Nintendo Switch: The Console That Changed Gaming Forever [2025]

There's a moment that happens in gaming history every couple of decades when something shifts. Not a gradual evolution, but an actual, measurable change in how people think about what a console can be. The Nintendo Switch was that moment.

When Nintendo announced the hybrid console concept back in 2016, skeptics outnumbered believers. A device that could dock to a TV, work as a handheld, and split into separate controllers sounded like a gimmick. Companies had tried weird form factors before. Remember the Virtual Boy? Nobody wanted to remember the Virtual Boy.

But something different happened with the Switch. Instead of playing it safe with another traditional home console or incremental handheld upgrade, Nintendo took an actual risk. They bet that gamers wanted flexibility, that the lines between "home" and "portable" gaming were becoming meaningless, and that the right software library could make people forget about raw processing power entirely.

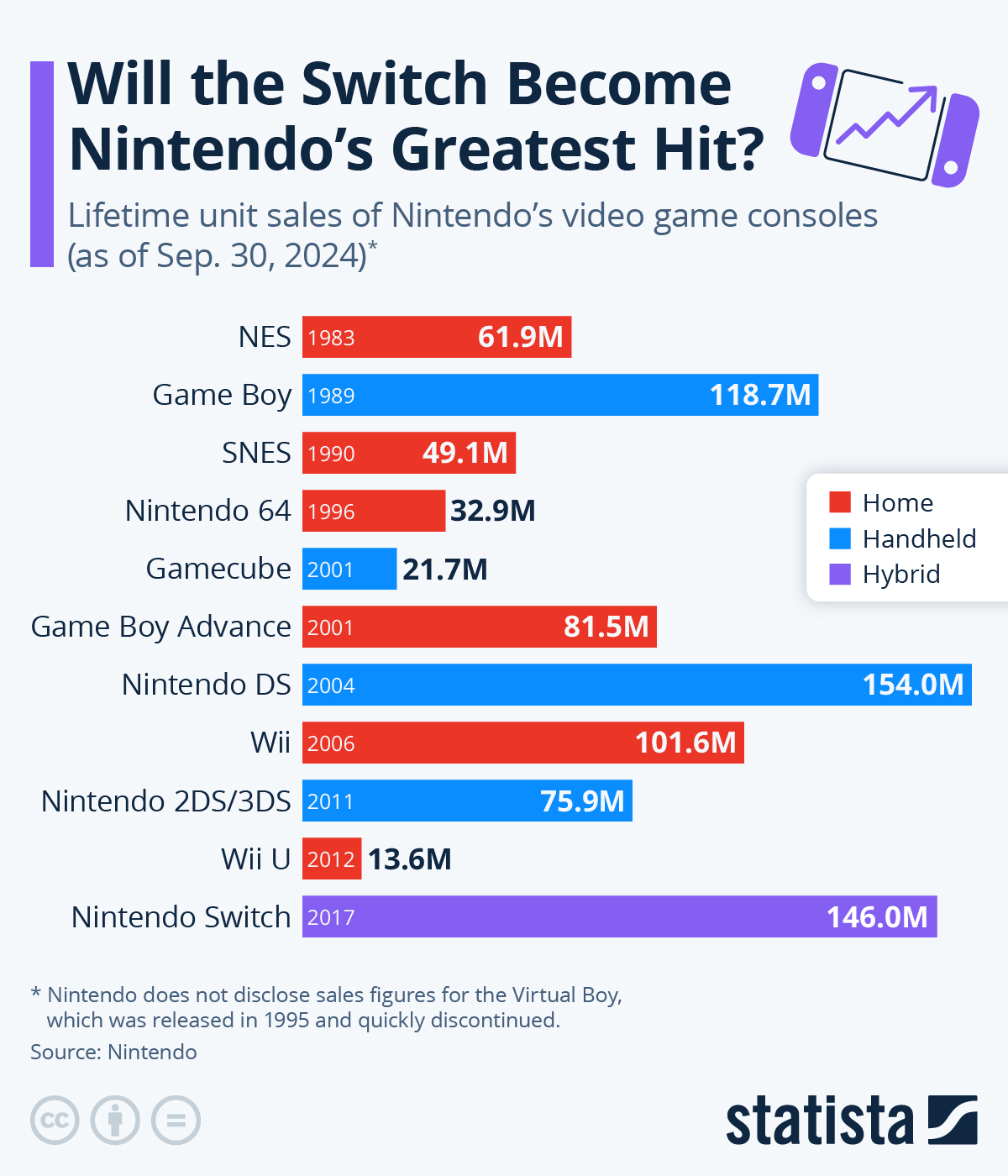

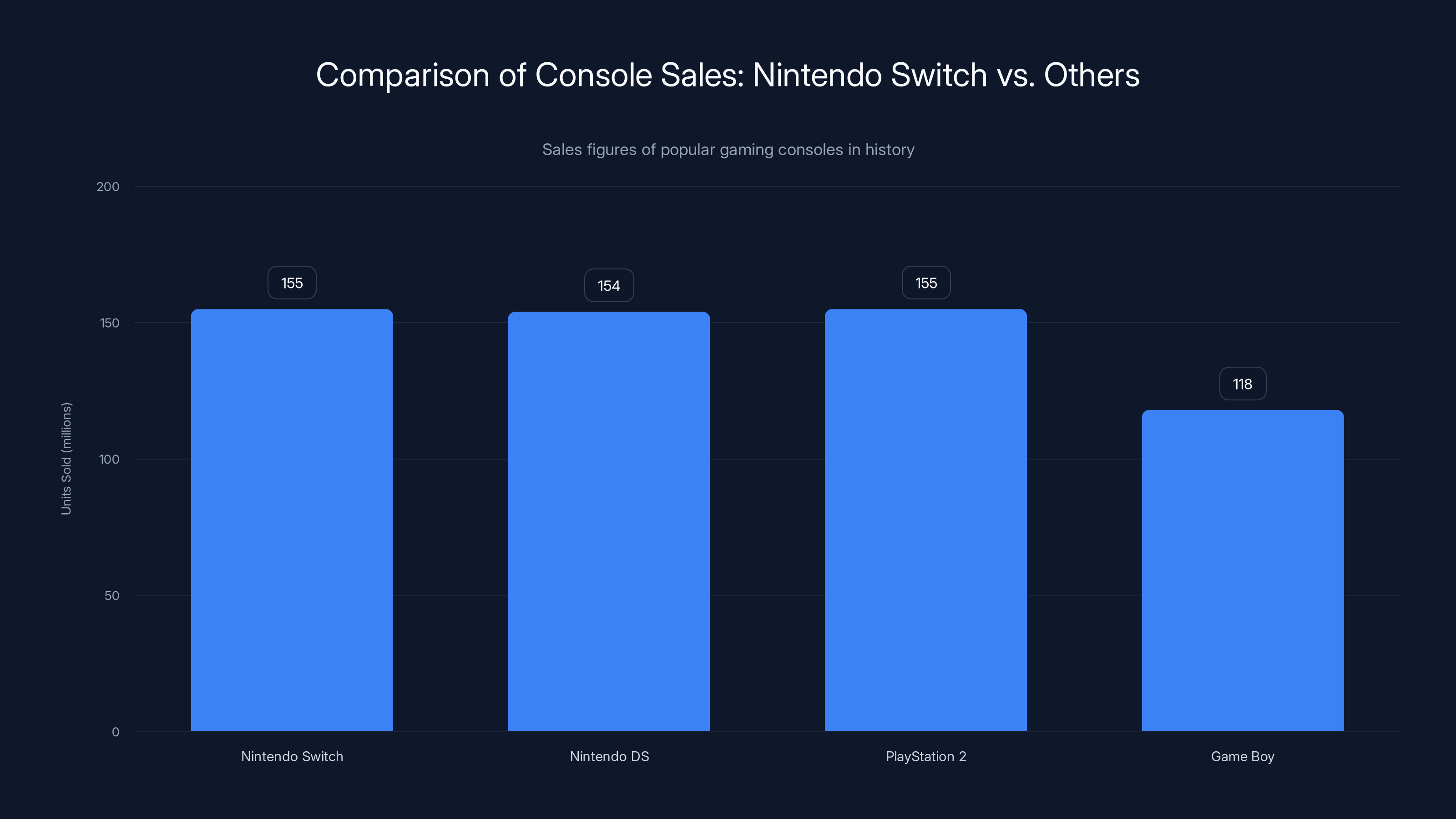

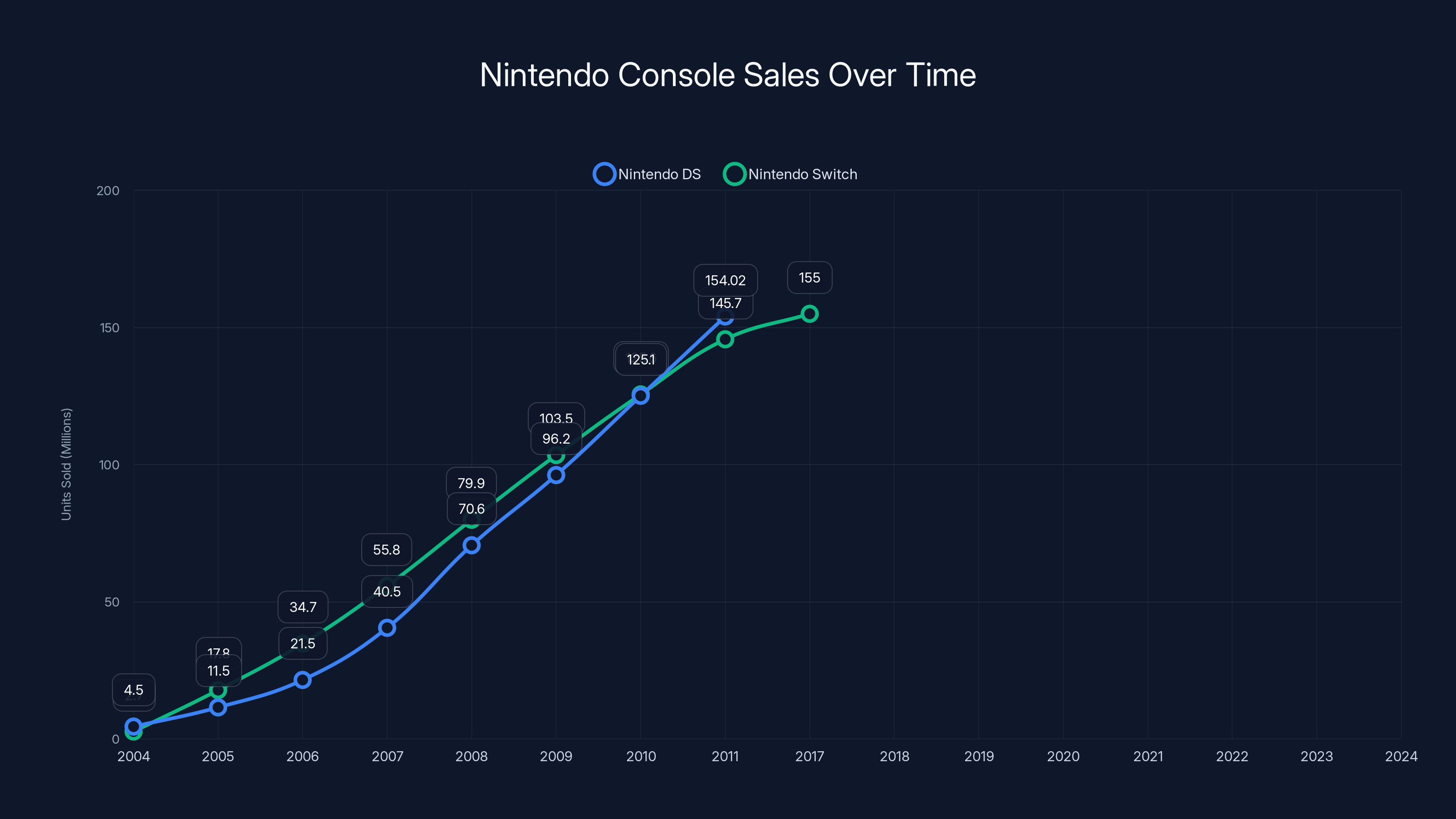

That bet just paid off in the most concrete way possible: the Switch has officially become Nintendo's best-selling console in company history, surpassing the Nintendo DS after nearly a decade in the market. With over 155 million units sold, the Switch isn't just a commercial success. It's a watershed moment that fundamentally reshaped how the entire industry thinks about console design.

TL; DR

- Historic Achievement: Nintendo Switch surpassed 155 million units sold, dethroning the DS as Nintendo's best-selling console ever

- Market Dominance: The Switch maintains strong sales momentum at 1.36 million units in Q3 alone, approaching its 10-year anniversary

- Design Innovation: The hybrid form factor proved skeptics wrong by prioritizing flexibility over raw processing power

- Software Strength: Iconic franchises like Mario, Zelda, and Pokemon drove adoption across casual and hardcore gamers

- Future Competition: PlayStation 2 remains the all-time best-selling console (over 155 million units), but Switch is closing in fast

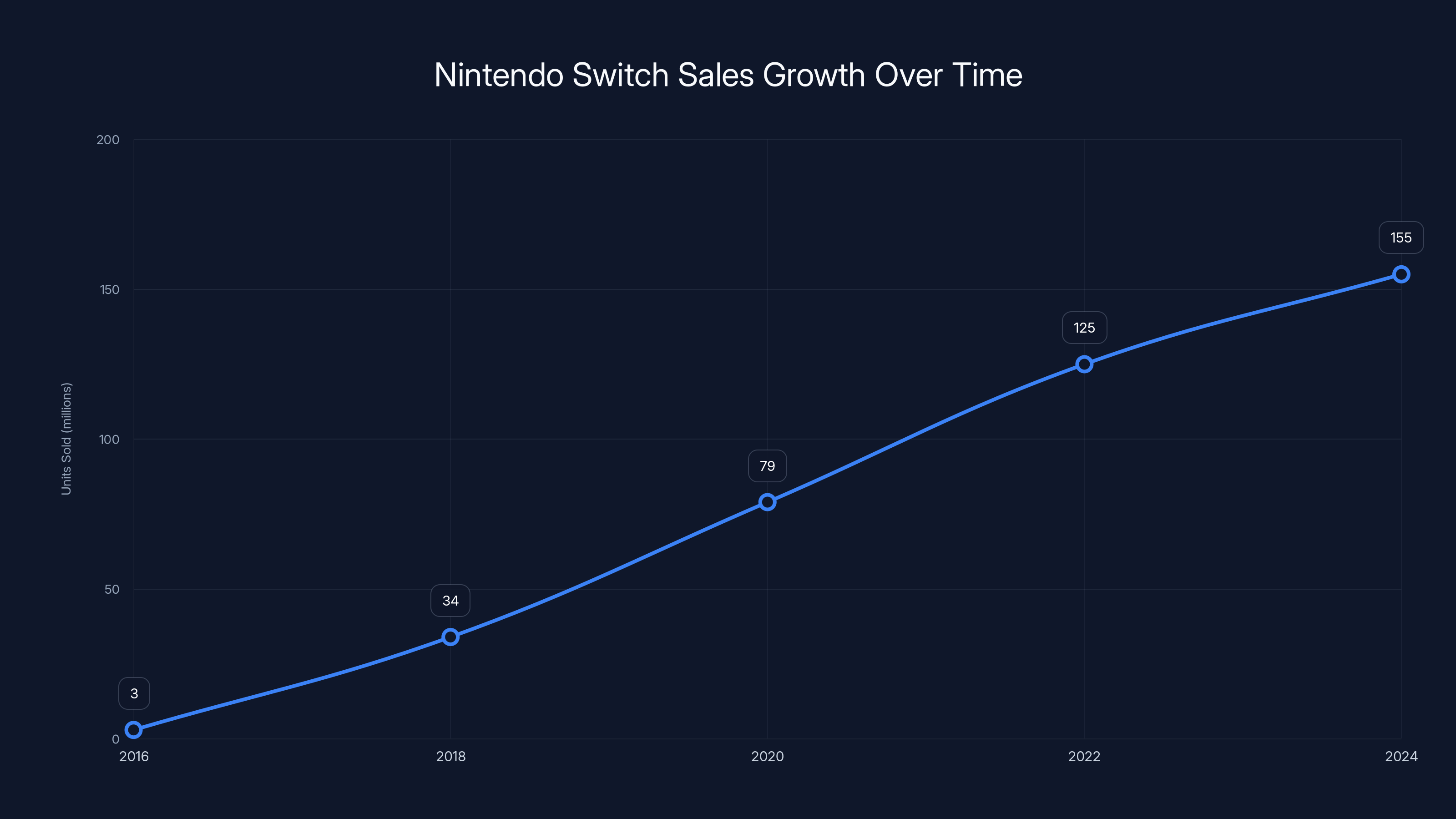

The Nintendo Switch's sales trajectory shows its rapid adoption and sustained popularity, approaching 155 million units by 2024. Estimated data.

The Numbers That Tell the Story: How 155 Million Units Happened

Numbers can feel abstract until you really sit with them. One hundred and fifty-five million units means if you lined up every Switch ever sold end-to-end, they'd stretch from New York to Los Angeles roughly 520 times.

But what makes this number genuinely remarkable isn't just its size. It's the speed and consistency with which Nintendo achieved it. The Nintendo DS dominated handheld gaming in the 2000s, selling 154.02 million units over a seven-year period (2004-2011). The Switch achieved essentially the same number in nearly a decade, all while operating in a completely different market category.

Consider the market context: when the Switch launched in March 2017, mobile gaming had fundamentally changed what handheld gaming meant. Smartphones had been decimating dedicated handheld sales for years. The Nintendo 3DS, the DS's spiritual successor, struggled to maintain relevance against iOS and Android devices that offered free-to-play experiences and instant access to millions of apps.

Into this environment, Nintendo introduced a device that cost

By Q3 of 2024 (the latest reported quarter before hitting this milestone), the Switch still shipped 1.36 million units. That's not a dying console coasting on legacy sales. That's a mature product that maintains relevance through sheer quality and library depth.

The Switch Lite, launched in 2019, brought the price down to $200 and created an entry point for budget-conscious buyers. The Switch OLED model, arriving in 2021, gave early adopters and enthusiasts a reason to upgrade with a vibrant display and better speakers. Each variant expanded the addressable market rather than cannibalizing existing sales.

The Nintendo Switch has sold 155 million units, surpassing the Nintendo DS and closely approaching the PlayStation 2's record, highlighting its significant impact in the gaming market.

The Hardware Innovation That Changed Everything

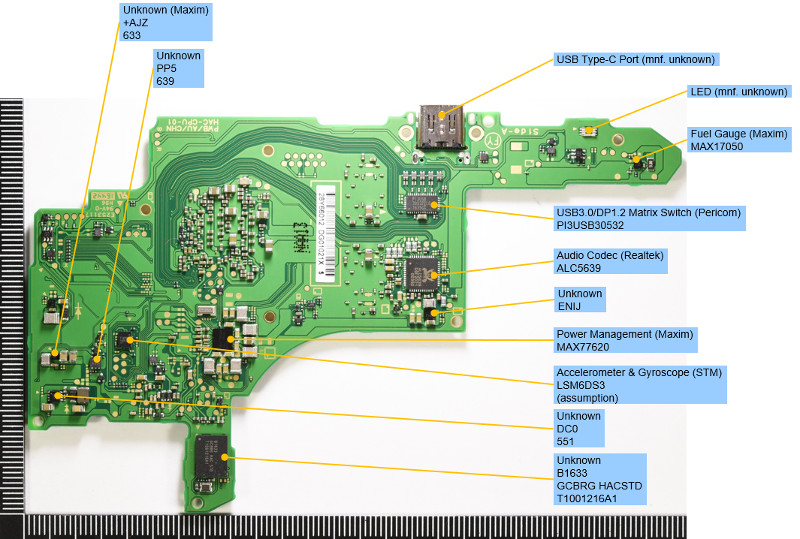

On paper, the Switch's specs look modest compared to contemporary consoles. The original Switch used an NVIDIA Tegra processor with 4GB of RAM. The PlayStation 4, which launched two years earlier, had 8GB of GDDR5 memory and significantly more raw GPU power. By pure technical specifications, the Switch wasn't the most powerful system on the market.

Yet this hardware philosophy became its greatest strength.

The genius of the Switch design lies in what engineers call "intentional constraint." By choosing a moderately-powered ARM-based processor instead of pursuing cutting-edge x86 architecture, Nintendo made several critical trade-offs that ultimately favored versatility.

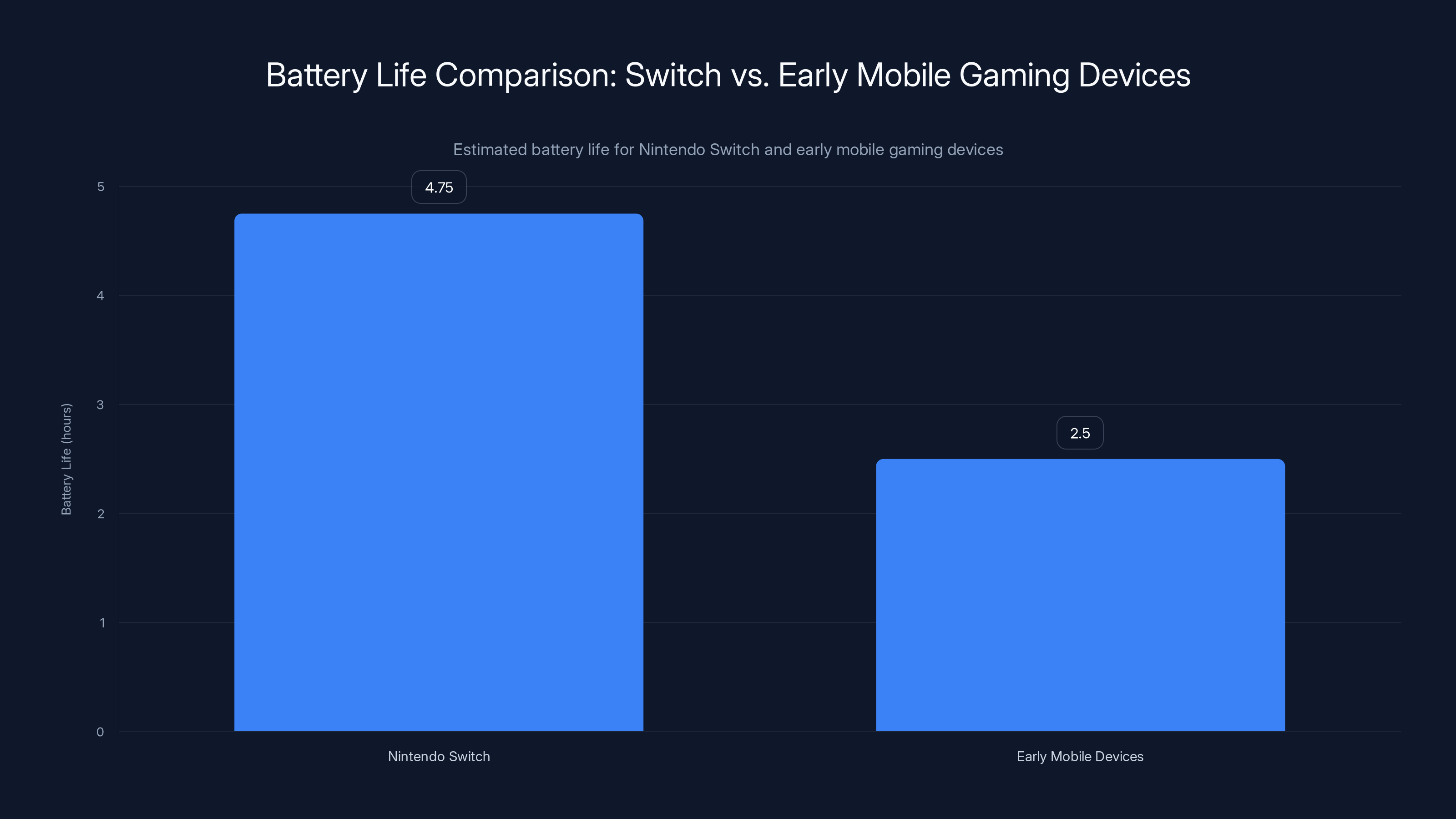

First, the ARM architecture enabled efficient power management. The Switch could run demanding games while consuming minimal battery, making true portable play viable. An NVIDIA engineer explained in interviews that the decision to use the Tegra chip meant developing a system that prioritized energy efficiency over peak performance. This trade-off meant longer battery life (3-6.5 hours depending on model and game) instead of the 2-3 hours typical of early mobile gaming devices.

Second, the dock-based approach solved a fundamental design challenge: creating a system that could seamlessly transition between TV-docked gameplay and handheld mode without compromising the experience in either context. The processing power remained constant, but the resolution could scale. Games could render at 1080p when docked (upscaling from internal resolution) and 720p in portable mode, with developers optimizing for visual quality rather than worrying about architectural limitations.

The removable Joy-Con controllers deserve special mention as an underrated innovation. Rather than being glorified grips, they're fully independent controllers with gyroscope, accelerometer, and haptic feedback. This meant:

- Two people could play multiplayer games immediately with one console

- Creative developers could design experiences leveraging motion controls (Mario Party's mini-games, Ring Fit Adventure's entire premise)

- Developers had a built-in accessibility option: games could support traditional controller configurations or split Joy-Con setups

- The modular design enabled hardware flexibility without redesigning the entire system

When the OLED model arrived in October 2021, Nintendo made surgical improvements rather than fundamental changes. The 7-inch AMOLED display provided better contrast and colors compared to the original's IPS panel. Enhanced audio through better speakers improved portable gaming. A wider kickstand solved a genuine ergonomic complaint from handheld enthusiasts. Improved LAN adapter support addressed network concerns.

None of these changes were revolutionary. All of them proved necessary based on years of player feedback.

Software Strategy: The Franchises That Sealed the Deal

Hardware without software is an expensive paperweight. Nintendo understood this lesson from the Virtual Boy's spectacular failure, and they arrived to the Switch's launch with a different playbook entirely.

The system launched in March 2017 with The Legend of Zelda: Breath of the Wild, a game that fundamentally reimagined open-world design. Rather than traditional level progression and scripted narrative beats, Breath of the Wild presented a world where player agency was paramount. You could approach challenges in virtually any order. You could tackle the final boss within 10 minutes of starting (though it wouldn't go well). Environmental interaction wasn't restricted to predetermined puzzle zones but integrated into the entire landscape.

Critically, this game worked beautifully on a portable device. Breath of the Wild's modular structure, where players could naturally pause and resume exploration, made it ideal for the Switch's portable form factor. You could play for 20 minutes on a bus, set it down for a meeting, and resume without losing context. Compare this to story-driven games with cinematic presentation that demand extended play sessions.

Within the launch window, Nintendo also released Mario Kart 8 Deluxe, which served a different but equally important purpose: accessibility. Mario Kart requires no learning curve. Anyone, regardless of gaming experience, can pick up a Joy-Con and understand racing fundamentals within seconds. The game's brilliant difficulty scaling means newcomers and competitive players both find appropriate challenges.

Over the following years, Nintendo maintained a software release cadence that felt deliberate and quality-focused:

- Super Mario Odyssey (October 2017): Reimagined 3D platforming with possession mechanics

- Mario Kart 8 Deluxe (April 2017): Multiplayer accessibility showcase

- The Legend of Zelda: Breath of the Wild (March 2017): Open-world blueprint

- Super Smash Bros. Ultimate (December 2018): Fighting game with 80+ characters, breaking traditional competitive expectations

- Animal Crossing: New Horizons (March 2020): Cozy game that became a pandemic comfort phenomenon

- Pokemon Sword and Shield (November 2019): Generational refresh of the franchise

- Ring Fit Adventure (October 2019): Fitness gaming that actually worked

- Monster Hunter: World Iceborne (October 2019): Demanding action game that proved the Switch could handle complex gameplay

This wasn't a "throw everything at the wall" strategy. Each major release served a specific market segment while reinforcing the Switch's versatility message: this platform serves competitive gamers, casual players, families, creative types, and people seeking relaxing experiences.

The Nintendo Switch reached 155 million units sold in nearly a decade, closely mirroring the Nintendo DS's trajectory over seven years. Estimated data for 2024.

Third-Party Developer Support: The Ecosystem That Matters

Nintendo systems have historically struggled with third-party developer commitment. The company's strong first-party lineup sometimes overshadowed third-party support, creating a perception that non-Nintendo games performed poorly on Nintendo hardware.

The Switch disrupted this pattern entirely.

Developers suddenly discovered that shipping games on the Switch meant accessing an entirely different market: commuters, parents, people who couldn't devote eight hours to a single gaming session. Games that struggled on traditional home consoles found massive audiences on Switch.

The Witcher 3: Wild Hunt represents the defining example. CD Projekt Red brought this graphically demanding RPG to the Switch through cloud rendering and aggressive optimization. Critics were skeptical that the game's complexity could translate to portable play. Players responded by making it one of the best-selling versions of the game across all platforms. The fact that you could play The Witcher 3 during a commute fundamentally changed how people thought about portable gaming.

Doom (2016) and Doom Eternal (2020) followed similar trajectories. Id Software's technologically demanding shooters seemed like questionable Switch ports. Yet they became hits because of a simple insight: people wanted to play these games in more contexts than traditional consoles allowed.

Indie developers particularly thrived on Switch. Games like Celeste, Hades, Hollow Knight, and Stardew Valley found passionate audiences partly because the platform's portability aligned with gameplay design. Celeste's tight controls and short difficulty spikes felt natural during short play sessions. Hades' roguelike structure, where runs lasted 30 minutes, was basically designed for portable play. Hollow Knight's exploration-based progression didn't require continuous story engagement.

This created a virtuous cycle: developers realized the Switch audience was hungry for varied experiences, so they invested in ports and original projects. Players discovered unexpected quality across multiple genres, which further justified developer investment.

The Virtual Boy Resurrection: Nostalgia Meets New Technology

In a move that seemed designed to prove Nintendo's confidence in the Switch ecosystem, the company announced the Virtual Boy as a Switch accessory. This required genuine guts.

The original Virtual Boy (1995) remains Nintendo's most infamous commercial failure. The monochrome red-and-black display was technically impressive for the era but severe enough to cause eyestrain and headaches in extended play. Nintendo shipped only 22 games in Japan and 14 in North America before abandoning the platform entirely. It never even launched in Europe or Australia.

For decades, the Virtual Boy became a punchline. Gaming historians cited it as evidence that even Nintendo couldn't always predict market demand. The system generated roughly 770,000 units sold during its lifespan, making it Nintendo's worst-performing console by an enormous margin.

So when Nintendo announced a Virtual Boy Switch accessory in 2024, the gaming community reacted with confusion, skepticism, and grudging curiosity.

The execution revealed Nintendo's nuanced understanding of their legacy. Rather than trying to make the Virtual Boy "good" or "modern," Nintendo leaned into its historical context. The accessory presents retro Virtual Boy games in their original monochrome form, exactly as they appeared 30 years ago. The physical design resurrects the original bipod stand (you must still lean into it rather than wearing it like a proper VR headset), maintaining the awkward ergonomics as part of the authentic experience.

This approach accomplishes several objectives simultaneously:

- Historical preservation: These games remain playable and accessible without emulation uncertainty

- Novelty appeal: Collectors and gaming historians get a legitimate way to experience Virtual Boy titles on modern hardware

- Affordable experimentation: At $100, the accessory isn't prohibitively expensive for casual curiosity

- Ecosystem expansion: It proves the Switch's flexibility as a platform that can accommodate niche use cases

Was the Virtual Boy accessory a commercial necessity? Absolutely not. The Switch doesn't need gimmicks at this sales level. Its existence signals something deeper: Nintendo's willingness to celebrate their history, even the embarrassing parts, if doing so creates value for players.

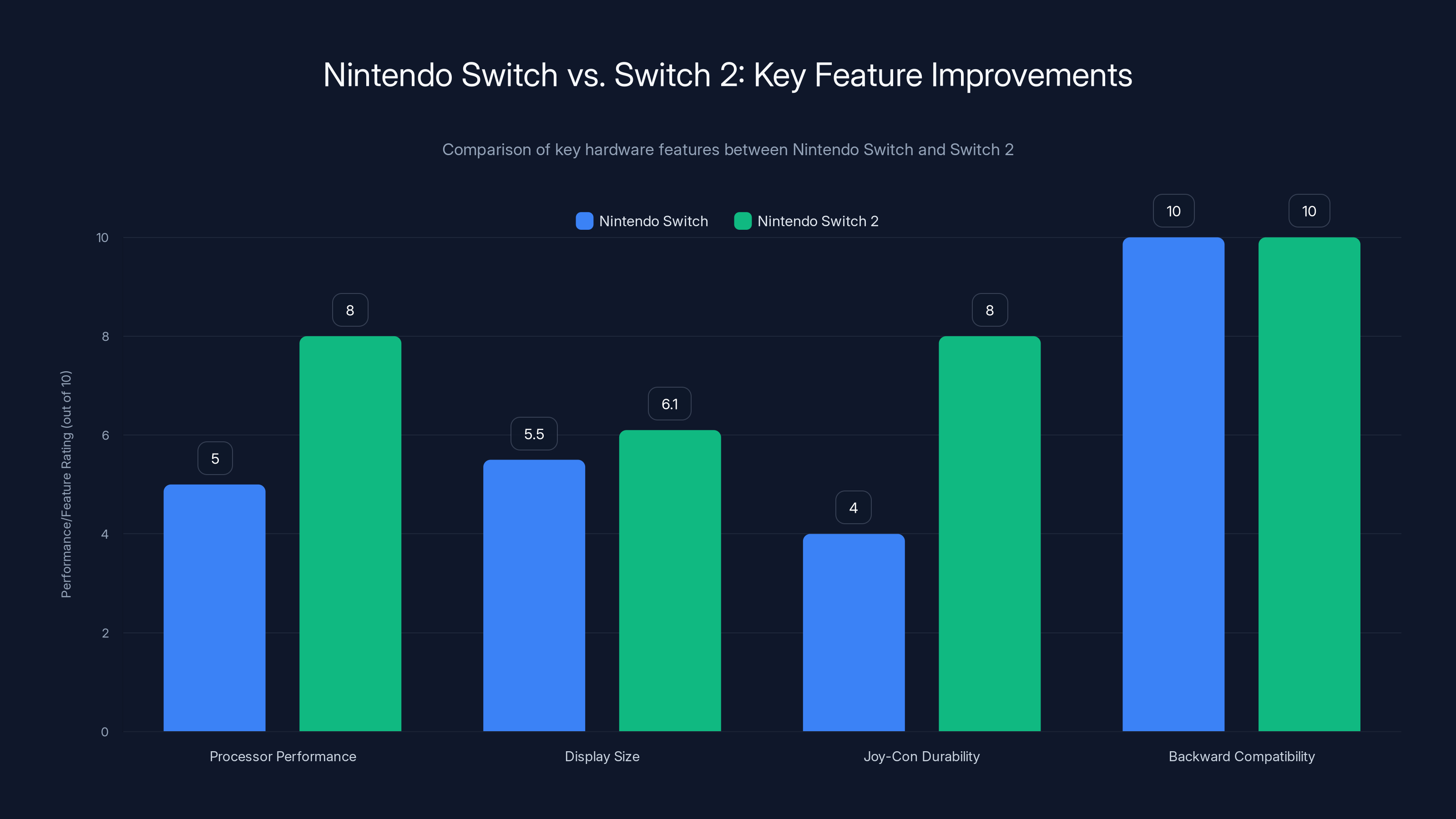

The Nintendo Switch 2 offers significant improvements in processor performance, display size, and Joy-Con durability, while maintaining full backward compatibility. Estimated data based on typical hardware upgrades.

The Joy-Con Controller Dilemma: Hardware Success, Support Challenge

The Switch's biggest persistent criticism arrived paradoxically from its most innovative hardware element: the Joy-Con controllers.

The modular design that enabled handheld play, tabletop mode, and twin-controller multiplayer came with a significant flaw. The joysticks experienced drift—involuntary input where the analog stick registered movement despite resting neutral. Some units developed this issue within months of purchase.

Nintendo acknowledged the problem and eventually issued a recall, replacing controllers at no cost. Yet the issue persisted across multiple production runs. Players speculated about manufacturing tolerances, material choices, and design constraints. The reality appears more nuanced: the tight engineering required to fit full controls into small form factors left limited margin for error.

This created a fascinating dynamic. The same engineering tradeoffs that made the Switch's flexibility possible also constrained durability margins. The very design philosophy that made the console a success generated its most significant support issue.

Nintendo's response mixed transparency with pragmatism. They acknowledged the issue without defensive dismissals. They processed replacement requests rapidly. They eventually redesigned the controller with improved joystick mechanisms. Each Switch model revision incorporated hardware improvements addressing player feedback.

Yet the Joy-Con drift issue never fully disappeared, and continued reports suggest replacement controllers still experience occasional drift after extended use. This persistent issue teaches an important lesson about hardware engineering: designing for multiple use cases and maximum portability requires accepting certain reliability trade-offs.

The Nintendo Switch 2: What Comes After Perfection?

As the original Switch approached its decade milestone at 155 million units sold, Nintendo announced the successor: the Nintendo Switch 2.

This created a historically unusual situation. The original model maintains strong sales momentum even as its replacement begins shipping. Nintendo typically managed generational transitions by discontinuing earlier hardware, creating urgency to upgrade. With the Switch 2, Nintendo took a different approach: both systems remain available, targeting different market segments.

The Switch 2 incorporates meaningful hardware upgrades while maintaining backward compatibility with the entire existing Switch library. The processor delivers meaningfully better performance, enabling higher resolution and framerates in Switch games without requiring developer compromises. The redesigned Joy-Con controllers address long-standing durability complaints with improved joystick mechanisms.

The larger display in the standard model (6.1 inches compared to 5.5 inches on the original's docked experience) provides a more immersive portable experience without ballooning the overall size beyond reasonable portable limits.

Performance improvements don't revolutionize game design but enable cleaner implementations of existing concepts. Ports run at higher fidelity. Frame rate stability improves. Load times decrease. For players who experienced compromises on the original Switch hardware, the upgrade justifies the transition.

Yet the existence of both systems simultaneously raises interesting questions about hardware generational strategy. If the original Switch remains viable for another 2-3 years of strong sales, Nintendo maintains a lower-cost entry point while letting enthusiasts upgrade. If Switch 2 software development doesn't deliver exclusive experiences justifying the upgrade, the generational transition could feel muddled.

The Nintendo Switch offers an estimated battery life of 3-6.5 hours, averaging around 4.75 hours, compared to early mobile gaming devices which typically lasted 2-3 hours. Estimated data.

Market Positioning: How the Switch Conquered Multiple Audiences Simultaneously

Traditional console marketing divides the market into discrete segments: hardcore gamers wanting cutting-edge graphics, casual players seeking simple experiences, families seeking shared entertainment, and collectors pursuing comprehensive libraries.

The Switch succeeded by refusing to make compromises between these audiences. Rather than specializing in one segment, Nintendo created a platform that accommodated all of them simultaneously.

Hardcore players found complex experiences like Fire Emblem: Three Houses, Xenoblade Chronicles series, Bayonetta 2, and Monster Hunter titles. These games delivered gameplay depth rivaling dedicated console experiences. The portability became a feature rather than a concession: players could engage in 100+ hour RPGs during commutes, gradually progressing rather than requiring weekend marathons.

Casual players encountered Mario Party, Just Dance, and Wii Sports successors (through third parties) that required no prior gaming experience. The Joy-Con design meant multiplayer accessibility was built-in rather than requiring additional purchases.

Families discovered that the same hardware could deliver age-appropriate experiences across multiple title categories. Parents could play games their kids recommended. Siblings could enjoy different titles without requiring multiple consoles.

Collectors found Nintendo's own franchises alongside comprehensive third-party libraries. Unlike previous Nintendo systems that skewed heavily toward first-party games, the Switch attracted major AAA publisher support because the market opportunity aligned with publisher interests.

This positioning isn't accidental. It resulted from Nintendo's strategic focus on gameplay variety over technical specifications. By not pursuing the most advanced graphics rendering or processing power, Nintendo avoided the cost premium that characterized high-end gaming systems. Lower cost meant broader addressability. Broader addressability meant larger install base. Larger install base attracted more developers and more diverse software.

The virtuous cycle compounded over nine years.

The Joy-Con Form Factor: Engineering Flexibility at Scale

When Nintendo engineers initially proposed removing controllers entirely and making them separable, internal teams expressed skepticism. Traditional console wisdom held that separated controllers felt cheap and disconnected. Players expected integrated weight distribution and unified design language.

Nintendo tested the concept extensively. They discovered something unexpected: the separation didn't feel like a compromise but a feature. Two people could immediately play together. A single player could hold the device multiple ways depending on comfort, gaming style, and situation.

This flexibility drove Switch adoption in specific demographic groups that traditional console gaming hadn't reached as effectively. Parents could hand a Joy-Con to a child for simple games without requiring the child to understand complex controller layouts. Elderly players found that simplified Joy-Con experiences proved more accessible than traditional controllers with 15+ buttons.

The modular Joy-Con approach also enabled experimental gameplay that wouldn't function with traditional controllers. Games like 1-2-Switch proved this, enabling mini-games that leveraged motion controls, haptic feedback, and the controllers' independent functioning.

The Virtual Boy sold approximately 770,000 units, with 22 games released in Japan and 14 in North America, highlighting its limited market impact.

Regional Market Differences: How the Switch Conquered Global Gaming

Console penetration varies dramatically across regions based on gaming culture, internet infrastructure, hardware affordability, and localization efforts. The Switch's global success required understanding and addressing these regional nuances.

In Japan, the Switch resonated with multiple audience segments. Portable gaming had deep cultural roots through Game Boy success and extensive handheld gaming traditions. Japanese developers embraced the platform, delivering experiences ranging from traditional Nintendo franchises to creative indie titles. Pokemon integration meant the system captured established fandoms immediately.

In North America, the Switch disrupted established home console dominance. Players accustomed to PlayStation and Xbox ecosystems discovered that the Switch's portability offered something their existing systems couldn't match. Marketing emphasized flexibility rather than power, appealing to time-constrained players (working parents, commuters, students) rather than purely enthusiast gamers.

In Europe, the Switch faced slightly different dynamics. PC gaming maintains stronger presence than in North America. Yet the Switch's accessibility and Nintendo's franchise strength proved compelling. Regional localization in multiple languages broadened appeal beyond English-speaking markets.

In emerging markets, the Switch's relative affordability (especially the Lite model at $200) provided an entry point to console gaming for players in regions where dedicated gaming hardware represents significant discretionary spending. The lack of requirement for constant internet connectivity proved particularly valuable in regions with variable internet availability.

The Software Library: Quantity, Quality, and the Long Tail

With over 5,000 games available (including digital releases), the Switch maintains perhaps the most diverse software library of any console in gaming history. This quantity masks an important quality distribution story.

Early Switch libraries prominently featured Nintendo's own franchises: Mario, Zelda, Pokemon, Splatoon, and various series launched through the first 12-18 months. These games established the platform's credibility and drove hardware adoption.

As the install base grew, developer support intensified. Major publishers rushed to bring their popular franchises to the portable platform. Indies discovered an audience hungry for varied experiences. Japanese developers particularly embraced the system, flooding the eShop with everything from high-quality ports to experimental projects.

This created a "Long Tail" phenomenon where not just blockbuster games drive sales, but thousands of smaller titles collectively represent significant ecosystem value. A player might spend

The eShop's recommendation algorithm evolved to surface relevant games, though Nintendo's curation never matched competitors like Steam's algorithmic sophistication. Physical game sales for popular titles remained important, distinguishing Switch success from digital-only competitors.

Looking Ahead: Can the Switch 2 Repeat This Success?

The original Switch achieved something historically rare: a console that maintained relevance and sales strength throughout its entire lifecycle. Most systems experience peak sales 2-3 years after launch, then gradual decline as player interest wanes.

The Switch peaked later, maintained higher baseline sales for longer, and entered its final phase still shipping 1.36 million units quarterly. This pattern suggests exceptional market positioning and software support.

The Switch 2 faces an unusual challenge: it must justify upgrading from a system that remains viable and beloved. Backward compatibility helps by ensuring existing libraries remain valuable. Hardware improvements matter less when the previous generation still functions perfectly.

Success for Switch 2 likely depends on exclusive software that genuinely justifies upgrading rather than marginal performance improvements. Players maintaining original Switch systems need compelling reasons to purchase new hardware. The installed base is large enough that many players won't feel urgency to transition for years.

Nintendo's approach of maintaining both systems simultaneously suggests confidence in the approach. Rather than forcing generational turnover, they're letting the market naturally migrate as players recognize value in upgrading.

The Numbers That Matter: Financial Impact and Market Influence

Beyond unit sales, the Switch's financial impact shaped Nintendo's business trajectory dramatically. Console hardware typically generates modest margins, with revenue concentrated in software sales and services.

Switch software sales exceeded all previous Nintendo generation records. With an average attach rate of 9+ games per console (compared to 6-7 for previous generations), players invested heavily in software ecosystems. This created recurring revenue through digital purchases, Nintendo Switch Online subscriptions, and continued software sales.

The platform's longevity extended the profitable period compared to typical console cycles. Rather than 5-7 year relevance windows, the Switch remained a primary revenue driver for 9+ years. This extended profitability window exceeded even PlayStation 2's commercial trajectory proportionally.

Competitors watched closely. Microsoft's embrace of Game Pass represented a direct response to Switch's model, recognizing that subscription services could compete against individual game purchases. Sony's PlayStation 5 acknowledged that exclusive franchises and rapid software release cadences mattered as much as technical specifications.

The Competitive Landscape: PlayStation 2 Still Reigns, But Switch Approaches

The PlayStation 2 holds the all-time best-selling console record at approximately 155+ million units. Notice the parallel: the Switch has essentially matched that number despite a different market era, different competitive environment, and different hardware positioning.

The PS2's dominance derived from DVD drive adoption, strong Japanese support, and comprehensive third-party backing across all genres. It dominated for two consecutive console generations worth of software support (2000-2005 approximately), a rare achievement.

The Switch approaches this milestone from a fundamentally different angle: portability, flexibility, and market diversification. The systems serve different purposes (living room entertainment vs. comprehensive gaming across contexts), yet both achieved unprecedented market penetration.

Other historical best-sellers included the original Wii (82+ million), Game Boy/Game Boy Color (118+ million), and PlayStation 1 (102+ million). The Switch's achievement ranks among the highest in gaming history, making it objectively one of the most successful consumer electronics products ever created.

That achievement becomes even more remarkable considering the skepticism surrounding its announcement, the technical limitations compared to contemporaries, and the unproven hybrid market.

The Unexpected Aftermath: What Happens to Joy-Con Sales Now?

A question that emerged from the milestone announcement deserves consideration: with 155 million Switch systems sold, how many Joy-Con replacement controllers have sold?

Joy-Con controllers retail for approximately

This underscores an important business reality about console platforms: hardware sales represent the gateway to ecosystem revenue. Accessories, software, and services generate the genuine margin. The Switch's success in driving software and accessory sales exceeded even Nintendo's projections, explaining the extended profitability window.

The Lessons That Shaped an Industry

Gamers and industry observers have spent the past decade analyzing Switch's success, searching for replicable insights. Several principles emerged:

Flexibility beats absolute power: The Switch proved that hardware versatility could outweigh technical specification advantages. Players valued the ability to game across contexts more than pixels-per-second performance.

Software ecosystem matters more than hardware: The launch window included Breath of the Wild, immediately establishing credibility. Strong software support maintained momentum throughout the lifecycle. Hardware matters only as a delivery mechanism for great software.

Market segmentation enables growth: By refusing to specialize in enthusiast gamers exclusively, the Switch accessed casual, family, and mainstream audiences simultaneously. Each segment reinforced the others.

Design for actual use cases: The detachable Joy-Cons addressed real ergonomic needs rather than pursuing theoretical ideals. The kickstand solved actual portability problems. Every design decision traced back to how humans actually use gaming devices.

Longevity through sustained support: Nintendo and third-party developers maintained software releases across nine years. Rather than abandoning the platform two years in, they recognized the installed base's ongoing importance.

FAQ

Why did the Nintendo Switch become so much more successful than previous Nintendo consoles?

The Switch succeeded because it solved a real market need that competitors didn't address: the desire to play console-quality games in portable contexts. By positioning flexibility as a primary feature rather than a gimmick, Nintendo appealed to audiences that traditional home consoles couldn't reach, including time-constrained players, commuters, and families seeking flexible gaming options. The combination of strong software lineup (Zelda, Mario, Pokemon) with proven third-party support created the ecosystem depth necessary for sustained sales momentum.

How does the Switch's 155 million units sold compare to other gaming platforms in history?

The Switch's achievement ranks among the highest in consumer electronics history. It surpassed Nintendo's own previous record-holder (the Nintendo DS at 154 million units) and approaches the PlayStation 2's all-time record (155+ million units). Considering the different market era, competitive environment, and hardware positioning, the Switch's performance represents one of the most remarkable commercial achievements in gaming, comparable only to Game Boy's dominance in the 1980s-1990s handheld market.

What role did third-party developer support play in the Switch's success?

Third-party support proved essential beyond Nintendo's first-party franchises. When major publishers discovered that games like The Witcher 3 and Doom could successfully transition to the Switch and find passionate audiences, developer investment increased dramatically. Indie developers particularly thrived, with games like Celeste, Hades, and Stardew Valley finding mainstream success partly due to the platform's portable nature aligning with their gameplay design. This diverse software ecosystem attracted players who might skip a console lacking variety.

Why did Nintendo decide to release the Switch in multiple hardware versions instead of a single model?

Nintendo's multi-model strategy accomplished several objectives simultaneously. The Switch Lite (

What made the Joy-Con controller design innovative despite its notorious drift problems?

The Joy-Con's modular design enabled capabilities no previous controller architecture could match: dual handheld use simultaneously, tabletop play mode, and integrated motion controls in each half. This flexibility supported gameplay experiences ranging from multiplayer Mario Kart to gyro-aiming in Splatoon. The drift issue represented an engineering trade-off inherent to fitting full control systems into small detachable form factors. While Nintendo eventually addressed it through replacements and redesigned controller mechanisms, the original innovation remains sound despite the durability challenges that emerged.

How did the Switch maintain strong sales momentum even as it approached its 10-year anniversary?

The Switch's continued sales strength derived from several factors working in concert: sustained software releases from Nintendo and third parties, the eventual Switch OLED refresh offering tangible upgrades, competitive pricing enabling adoption among younger players discovering the platform for the first time, and the ecosystem's demonstrated value through years of successful games. Additionally, the system's portability addressed use cases competitors couldn't match, creating a durable competitive advantage that didn't diminish with age. Hardware that remains useful doesn't become obsolete simply because newer systems exist.

What role did Nintendo's intellectual property franchises play in the Switch's success?

Nintendo's franchises (Mario, Zelda, Pokemon, Donkey Kong, Kirby, Splatoon) provided immediate credibility and installed base anchors. Zelda: Breath of the Wild launched alongside hardware, immediately justifying purchase for franchise enthusiasts. Subsequent releases maintained momentum: Super Mario Odyssey showcased innovative design, Animal Crossing provided pandemic-era comfort, and Pokemon Sword/Shield captured generational fans. However, the reliance on owned franchises was balanced by diverse third-party support, preventing the overspecialization that characterized previous Nintendo platforms. The franchises opened doors; third-party software kept players engaged.

What can the Switch 2 learn from the original system's success to ensure it achieves similar longevity?

The Switch 2 should prioritize software diversity and sustained release cadence over hardware specification bragging rights. Backward compatibility ensures existing libraries retain value, but exclusive experiences will drive upgrade urgency. Maintaining price competitiveness compared to the original Switch (rather than charging premium prices) broadens adoption. Supporting multiple play modes and contexts should remain core to design philosophy. Most importantly, Nintendo should avoid abandoning the original Switch prematurely; the successful simultaneous hardware strategy suggests confidence that both systems can profitably coexist during transition periods.

How did the Switch's portability change how game developers approach design and optimization?

Portability fundamentally shifted developer thinking about play session length, pause-and-resume functionality, and context-aware difficulty. Games designed around 30-60 minute sessions (roguelikes, turn-based titles, puzzle games) thrived on Switch, while cinematic games requiring sustained engagement struggled. Developers learned that consistent frame rates mattered less than stability within compromised specifications. UI/UX received increased attention since portable play involves more context switching and interruptions than living room gaming. This shift influenced even non-Switch development, as developers recognized that accommodating varied play contexts improved overall experience quality.

What unexpected audiences did the Switch reach that previous Nintendo systems didn't capture as effectively?

The Switch succeeded beyond Nintendo's traditional audience by appealing to time-constrained adults, casual gamers who'd abandoned consoles for mobile, and people seeking flexible entertainment options. Working professionals who couldn't dedicate evening gaming sessions discovered that commute gaming became viable. Parents recognized the platform's family-friendly potential and built-in multiplayer. Older players found that simpler Switch titles (like Animal Crossing) offered engagement without overwhelming complexity. This expansion beyond "core gamers" created a virtuous cycle where broader appeal justified developer investment in diverse software, which attracted even broader audiences.

Conclusion: The Console That Redefined Gaming's Future

When Nintendo announced the Switch in 2016, the conversation centered on technical specifications, processing power comparisons, and whether the hybrid concept would prove viable. The company's bold bet—that flexibility and gameplay quality mattered more than raw performance—faced skepticism from fans accustomed to power-driven generational leaps.

Nine years later, the data is unambiguous: Nintendo was right. The Switch's 155 million units sold represent far more than a commercial victory. They represent a fundamental shift in how the gaming industry thinks about hardware, software, and market positioning.

The console proved that great games transcend technical limitations. That flexibility creates value competitors can't replicate. That diverse software ecosystems attract broader audiences than specialized libraries. That sometimes, the least obvious design choice (a hybrid handheld-home console from a traditionally conservative manufacturer) generates the most transformative results.

The Switch is approaching the PlayStation 2's all-time sales record with a completely different market positioning, business model, and design philosophy. That achievement suggests the console captured something fundamental about how humans want to play games in the modern era.

As the Switch 2 begins its lifecycle and the original system approaches retirement, the legacy is cemented. The Switch didn't just become Nintendo's most popular console. It became one of the most successful consumer electronics products in history and proved that thinking differently about established categories can reshape entire industries.

For players discovering the Switch today, the nine-year library represents unparalleled value. For developers, the proven market validated creating diverse experiences across skill levels and play contexts. For the gaming industry broadly, the Switch provided a blueprint proving that innovation in form factor and software strategy can outperform incremental hardware specification improvements.

That's the real story behind 155 million units: not raw sales numbers, but how gaming's most iconic company took a risk, executed flawlessly, and fundamentally changed what gaming consoles could be.

Try Runable to create AI-powered presentations and documents about gaming industry trends in minutes. Analyze console market data, generate industry reports, and create investor presentations with AI automation starting at $9/month.

Key Takeaways

- The Nintendo Switch surpassed 155 million units sold, dethroning the Nintendo DS as Nintendo's best-selling console and rivaling the PlayStation 2 as gaming's most commercially successful platform

- Hybrid design prioritizing flexibility over raw processing power proved more valuable than traditional power-focused generational competition strategies

- Strong software ecosystem with Nintendo franchises (Zelda, Mario, Pokemon) combined with comprehensive third-party support created unprecedented market breadth across casual, family, and hardcore audiences

- Modular Joy-Con controllers enabled multiplayer accessibility and experimental gameplay design despite documented durability challenges that affected user satisfaction

- Extended 9-year product lifespan with sustained software releases proved superior to traditional console cycles, maintaining strong quarterly sales momentum even approaching generation transitions

Related Articles

- Nintendo Switch 2 Review: Why You Should Buy Now Before Price Hikes [2025]

- Nintendo Switch 2 2026 Game Lineup: What's Actually Coming [2025]

- PS5 Outsells Switch 2 by 1 Million Units: Ghost of Yotei's Impact [2025]

- Assassin's Creed League Canceled: What Happened to the AC Multiplayer Game [2025]

- GameSir Super Nova Controller: Full Customization Guide [2025]

- Sony's Live Service Strategy: Horizon Hunters Gathering Changes Everything [2025]

![Nintendo Switch: The Console That Changed Gaming Forever [2025]](https://tryrunable.com/blog/nintendo-switch-the-console-that-changed-gaming-forever-2025/image-1-1770381518197.jpg)