How the PS5 Dominated Late 2025 Against Nintendo Switch 2

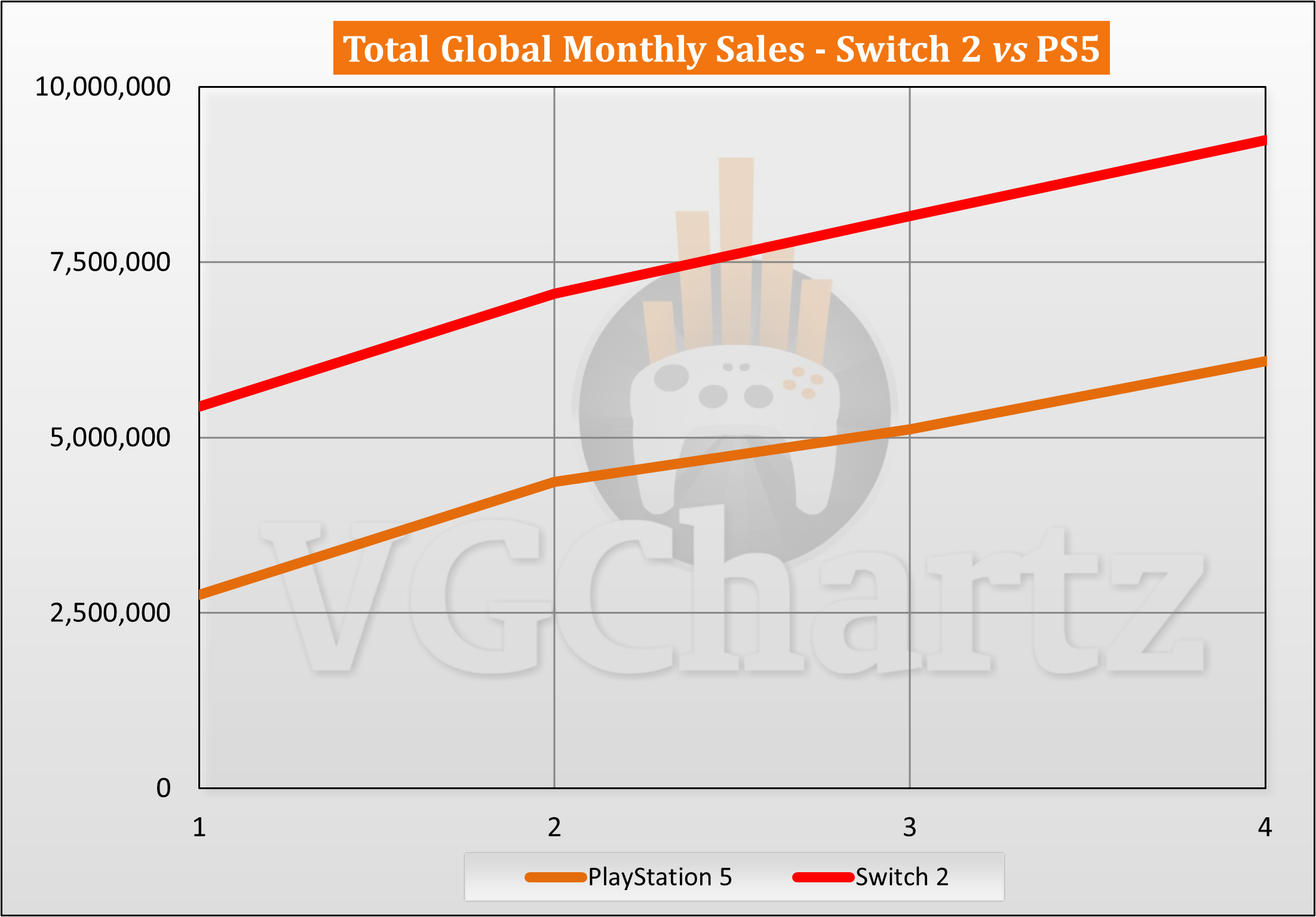

It's been five years since the PS5 launched, and frankly, people thought the console's sales momentum had peaked. But then something unexpected happened in late 2025. While the Nintendo Switch 2 was ramping up with its own impressive numbers, the aging PS5 managed to outsell it by an entire million units in just three months. That's not a typo. Over 8 million PS5 consoles moved during the October-December 2025 quarter, a feat that surprised pretty much everyone watching the console wars, as reported by TechRadar.

Sony's chief financial officer Lin Tao didn't mince words during the earnings webcast. He credited Ghost of Yotei, the highly anticipated sequel from Sucker Punch Productions, as a major driver. But it wasn't just one game. The combination of tentpole first-party releases, a robust live-service ecosystem with titles like Helldivers 2 and MLB The Show, and a massive installed base created the perfect storm for Q3 sales. That storm pushed the PS5 past the PS3's lifetime sales record and firmly positioned it as one of Play Station's strongest-performing consoles ever, according to Game Reactor.

What makes this story interesting isn't just the raw numbers. It's what these numbers reveal about console manufacturing, exclusive game launches, and how live-service games have fundamentally changed how hardware sells. The narrative around console cycles has shifted. It's no longer just about launch buzz or early adopter hype. It's about sustained engagement, software quality, and timing.

The PS5's Q3 performance also raises legitimate questions about Nintendo's strategy with the Switch 2. Here's a console that's newer, more powerful, and generates massive interest, yet it shipped 1 million fewer units in the same three-month window. What happened? Why did the PS5, a five-year-old console, outsell the industry's hottest new hardware?

That question sits at the heart of this analysis. We're going to dig into the numbers, the software strategy, the market conditions, and what it all means for the future of gaming hardware. Because this wasn't random. It was the result of deliberate choices, industry timing, and yes, a damn good game that people actually wanted to play.

TL; DR

- The Numbers: PS5 sold 8 million units in Q3 2025, outselling Nintendo Switch 2 by 1 million units

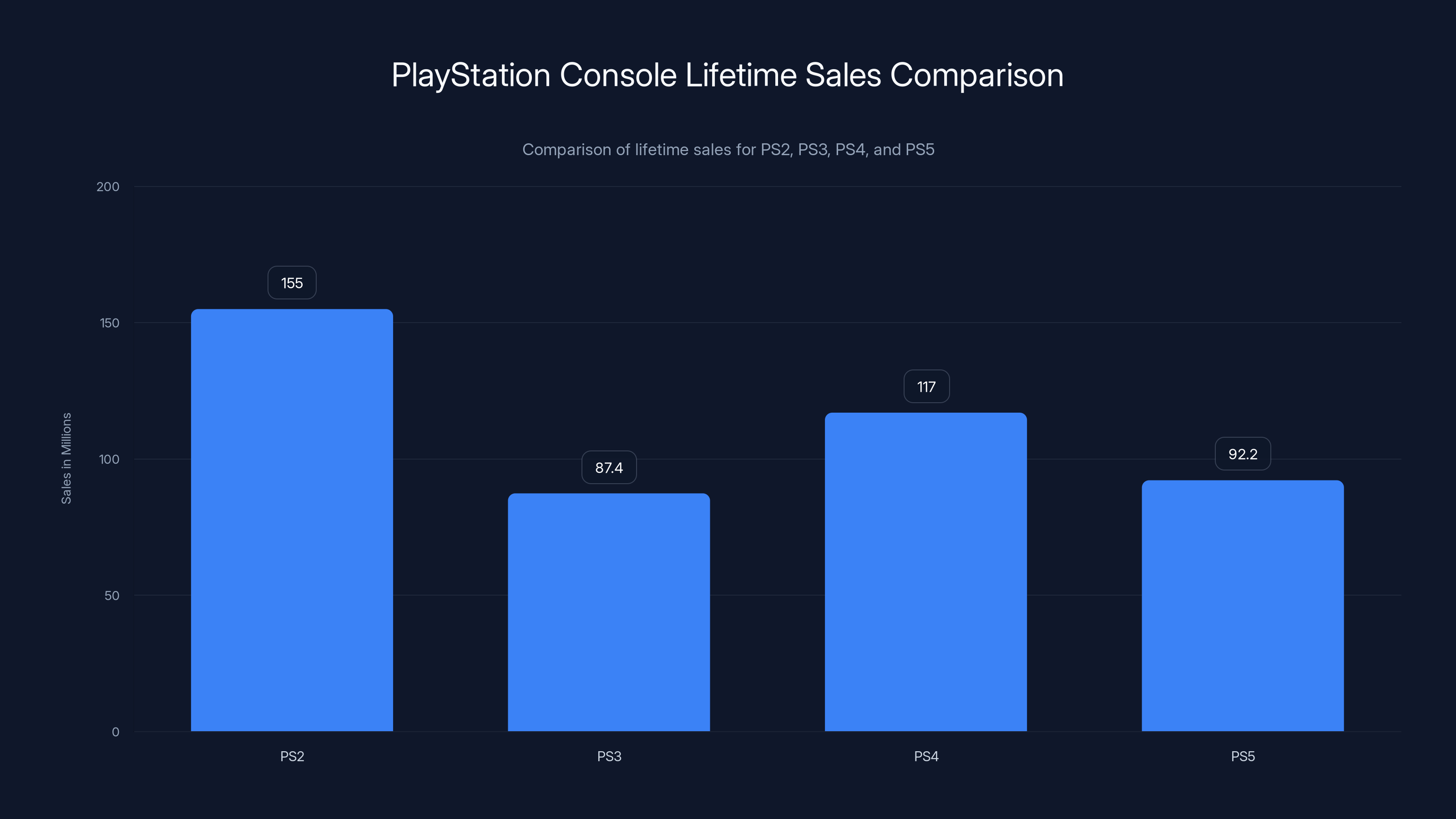

- Hardware Milestone: PS5 has now sold 92.2 million units cumulatively and officially outsold the PS3's 87.4 million lifetime sales

- Game Impact: Ghost of Yotei exceeded its predecessor's sales and drove significant Q3 revenue contribution

- Live-Service Foundation: Helldivers 2 and MLB The Show provided stable recurring revenue alongside new releases

- Bottom Line: Exclusive software remains the primary driver of console sales, even late in a hardware generation

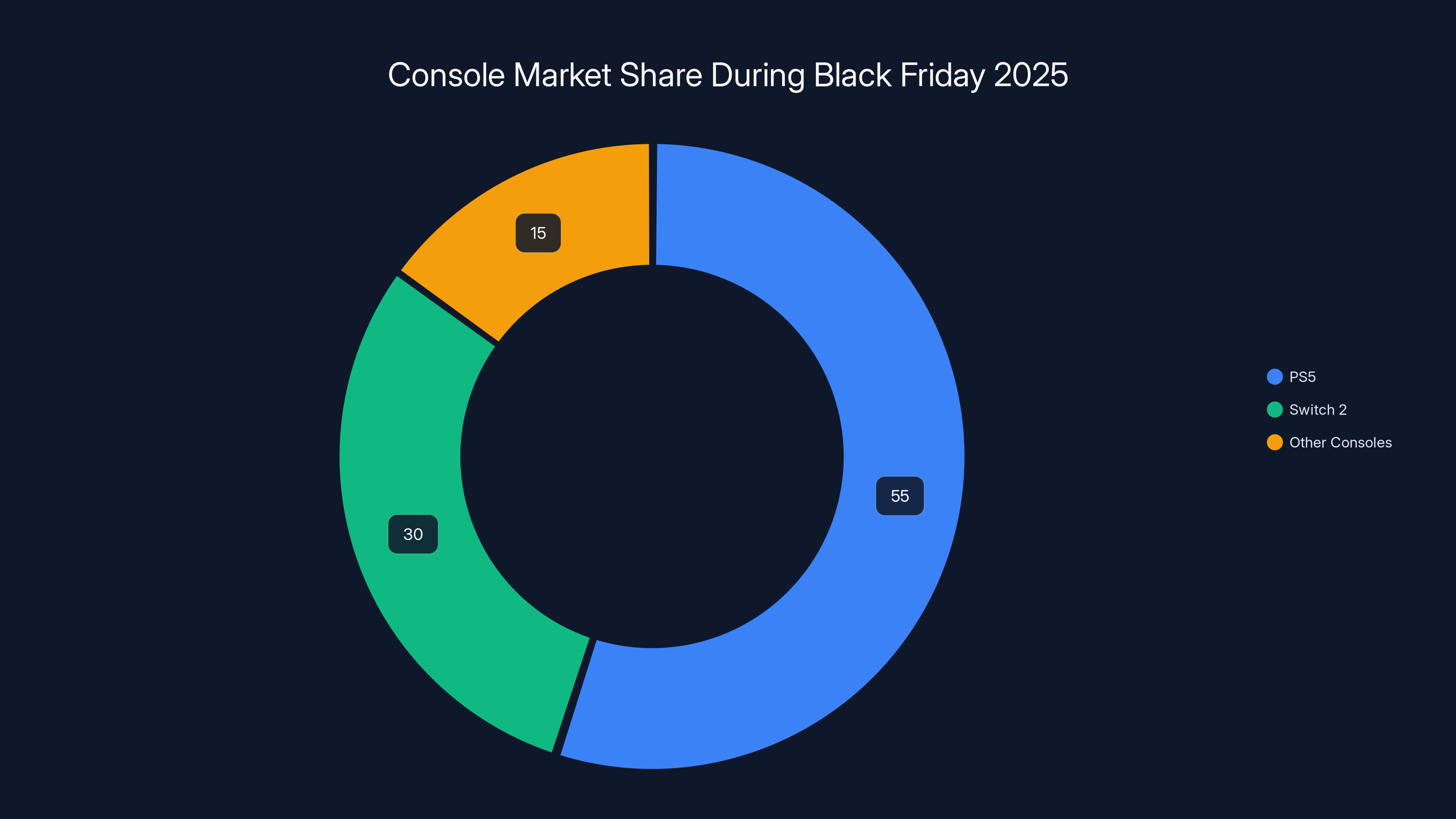

During Black Friday 2025, the PS5 dominated the console market with an estimated 55% share, driven by pricing, game availability, and inventory advantages. Estimated data.

The Q3 2025 Sales Breakdown: PS5 vs Switch 2

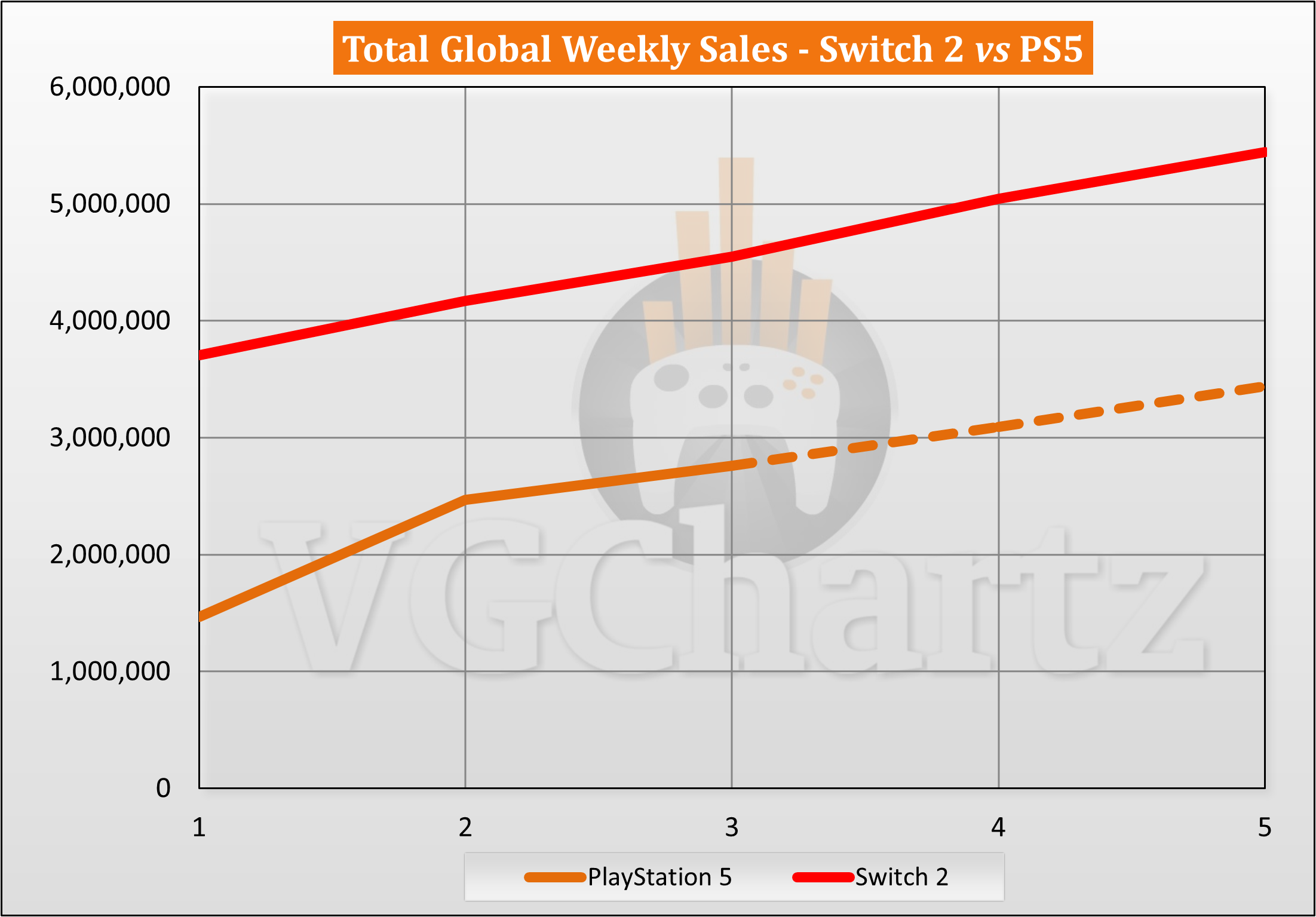

Let's start with the raw data because it's actually striking when you sit with it. During fiscal year 2025's third quarter (October 1 through December 31), Sony moved 8 million PS5 units globally. Nintendo's Switch 2, by contrast, hit 7 million units in the same period. A 1-million-unit gap might not sound enormous in the context of console gaming's 100-million+ install bases, but in a single three-month window, it's massive, as noted by IGN.

Here's what makes this remarkable: the PS5 launched in November 2020. The Nintendo Switch 2 is a brand-new console. Fresh. New hardware smell. The kind of hardware that typically dominates year-end sales windows. Yet the PS5, despite being half a decade old with a smaller original feature set than Switch 2, managed better numbers.

That said, context matters. Nintendo's own guidance to investors suggested that Western hardware sales for the Switch 2 fell short of internal expectations by year-end. That's CEO-speak for "we thought we'd sell more." The console wasn't struggling, exactly. Seven million units in three months is nothing to dismiss. But it underperformed relative to Nintendo's own projections, as reported by CNBC.

Sony, meanwhile, had a different problem. Q3 2025 sales were down 4% year-on-year compared to Q3 2024, when the PS5 shipped 9.5 million units. So while the PS5 outsold the Switch 2, it was actually selling fewer units than it had the previous year. The seasonality mattered. The 2024 Q3 period included the first real momentum from a refreshed PS5 slim model and that year's major game launches. By 2025, the console was moderating from those peaks.

But here's where operating income tells a better story than raw unit sales. Sony's gaming division operating income increased 19% year-on-year despite lower hardware units. That's because software revenue hit record highs. The PS5 install base, already over 84 million units by Q3, was spending more money on games, subscriptions, and add-ons than ever before. That's the shift happening in console gaming right now. Hardware is becoming almost secondary to software monetization, as highlighted by Engadget.

The global numbers also varied by region. Japan, which has traditionally favored Nintendo hardware, still had strong Switch 2 performance. But North America and Europe leaned heavily toward the PS5, particularly in October and November when Ghost of Yotei released. That geographic split explains why Sony's hardware sales were down year-over-year but operating income was up. They were shifting from high-volume, lower-margin hardware sales to higher-margin software and service revenue.

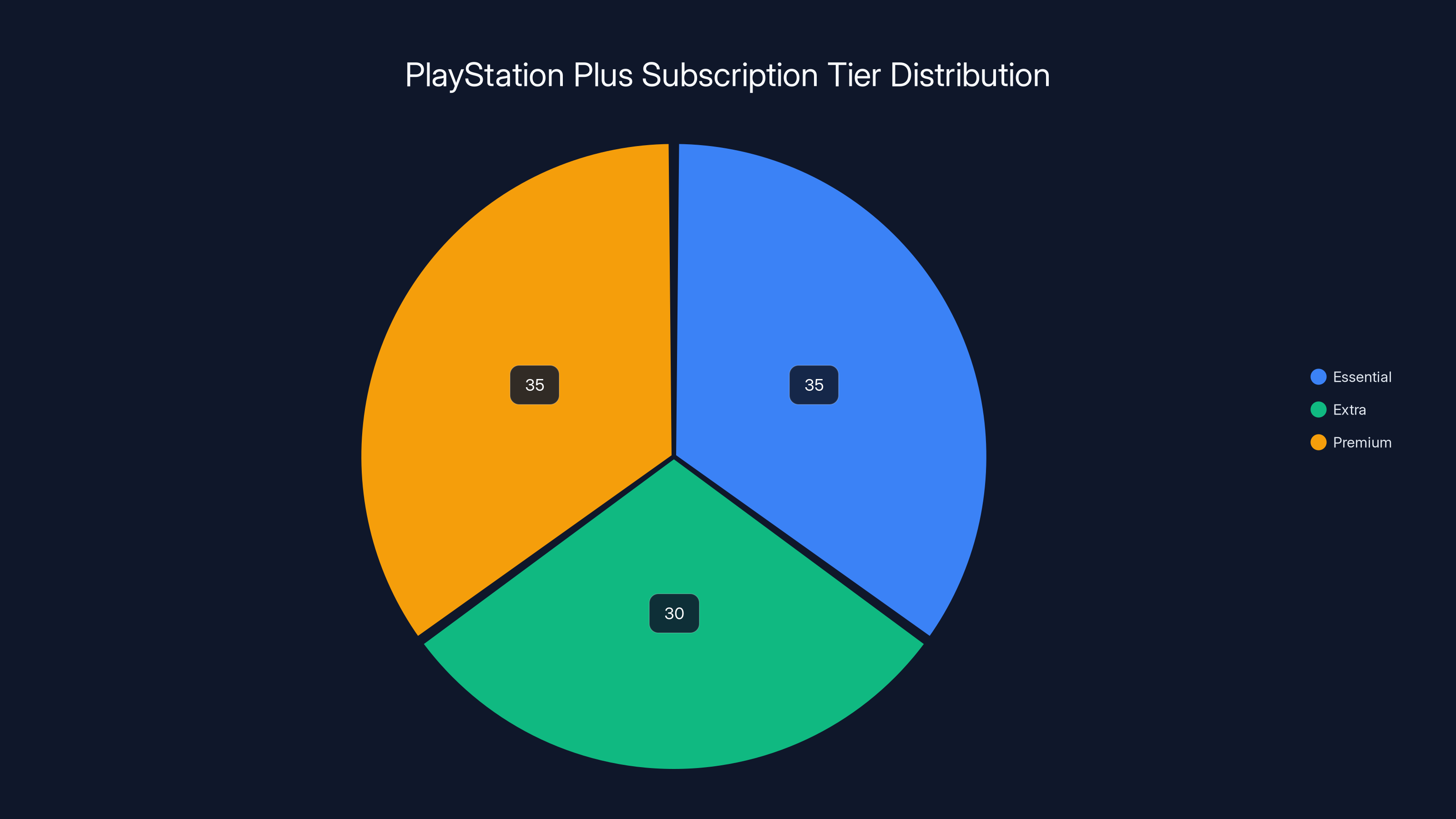

Estimated data shows a balanced distribution across PlayStation Plus tiers, with Premium and Essential tiers capturing the largest shares. Estimated data.

Ghost of Yotei: The Game That Outsold Its Predecessor

When Sucker Punch announced Ghost of Yotei in June 2024, the gaming world lost its mind. A direct sequel to 2020's Ghost of Tsushima, one of Play Station's best-reviewed games, was actually happening. And Sucker Punch, a Play Station first-party studio, was going to make it exclusive to PS5. Not "timed exclusive." Not "console exclusive with later PC ports." Exclusive. That decision alone told you something about how seriously Sony takes software-driven hardware sales.

Ghost of Yotei released October 16, 2025, perfectly positioned for the holiday shopping season. The game landed during the industry's most important quarter for retail foot traffic, gift purchasing, and casual consumer interest in gaming. It wasn't random timing. This was calculated, as highlighted by TechRadar.

Lin Tao stated explicitly: "Ghost of Yotei, a tentpole title we released in October, exceeded the sales of the previous title in the same period of time and significantly contributed to the financial results of the quarter." That's important language. "Exceeded the sales of the previous title in the same period." Ghost of Tsushima's October-December launch window generated strong numbers. Ghost of Yotei beat those numbers. In an industry where sequels sometimes cannibalize their predecessors' sales, that's remarkable.

The game sold over 3.3 million units in its first month, a figure that shocked even industry analysts. Ghost of Tsushima took several months to hit that number. Yotei compressed that timeline significantly. The sequel had several advantages: an established fanbase from Tsushima, extensive pre-release marketing, critical acclaim from early previews, and the sheer gravity of a Play Station exclusive landing right before the holidays.

But sales numbers don't tell the whole story. What mattered most was hardware attach rate. How many people buying a PS5 in October, November, and December also picked up Ghost of Yotei? That number was probably significant. Industry estimates suggest that software attach rates in the 0.7 to 0.9 range are common for tentpole titles around the holidays. Meaning 70-90% of new console buyers also grab the killer app.

The game's critical reception also mattered. Reviews consistently praised Yotei's narrative, combat refinements, and visual design. It wasn't a departure from Tsushima's formula, but rather a thoughtful evolution. That made it a safe bet for holiday shoppers. Parents buying consoles for kids, friends buying for gamers, casual fans returning to the franchise. Ghost of Yotei gave the PS5 a cultural moment right when it needed one most.

What's telling is how Sony's CFO specifically mentioned Yotei's contribution. In corporate earnings calls, executives generally avoid singling out individual games unless those games materially impacted results. The fact that Tao called it out suggests Ghost of Yotei's impact on Q3 was substantial enough to move the needle on Sony's overall financial guidance. They actually raised their FY25 sales forecast by 4% from the previous estimate, reaching 4,630 billion yen, as reported by WNHUB.

Play Station Plus and Live-Service Games: The Recurring Revenue Engine

Here's something Sony's CFO stressed that often gets overlooked in gaming discussions: "Play Station Plus significantly contributed to the results of the quarter as the shift to higher tiers of the service continued." That sentence deserves deeper examination because it represents a fundamental shift in how Play Station makes money.

Play Station Plus has evolved substantially since its 2010 launch. What started as a simple multiplayer subscription has become a three-tier service with Play Station Plus Essential, Play Station Plus Extra, and Play Station Plus Premium. Each tier offers different game catalogs, and Sony's been aggressively pushing players toward the higher tiers. Premium includes classic Play Station games, cloud gaming features, and early access to new releases.

The subscription service business is inherently more stable than selling individual games or hardware. Monthly recurring revenue is predictable. It compounds over time as more users join higher tiers. In Q3 2025, with the installed base approaching 85 million users, even modest tier migration creates enormous revenue increases.

But Play Station Plus depends on game quality to sustain user engagement. That's where live-service titles become essential. Games like Helldivers 2 and MLB The Show aren't blockbuster single-player experiences. They're designed to keep players coming back month after month. Helldivers 2, the top-down co-op shooter released in February 2024, became a surprise hit, attracting millions of players and maintaining consistent monthly active users through new content seasons and balance updates, as noted by Alinea Analytics.

MLB The Show, the baseball simulation franchise, has been subscription-included since 2021. It generates recurring revenue through card packs, cosmetics, and seasonal content. Players invest time and money into their teams, creating switching costs that lock them into Play Station's ecosystem.

Sony's CFO specifically mentioned these games contributing "stable recurring revenue." That language matters. Stable. Recurring. Predictable. In earnings calls, executives love predictable revenue because it reduces financial uncertainty. Live-service games provide that stability. Ghost of Yotei might drive hardware sales and big quarterly bumps, but Helldivers 2 and MLB The Show generate the foundation of Play Station's software revenue.

The shift toward higher Play Station Plus tiers is particularly important. Premium tiers cost more but offer better value propositions to players. Sony's pushing users to upgrade because the lifetime value of a Premium subscriber significantly exceeds an Essential tier subscriber. Over three years, a Premium subscriber might spend

The metrics back this up. Sony reported that monthly active users across Play Station reached a record high of 132 million accounts in December 2025, up 2% year-over-year. More users, more subscriptions, higher tier migration. It's a compounding growth engine. And that engine depends entirely on having enough good software to keep people playing.

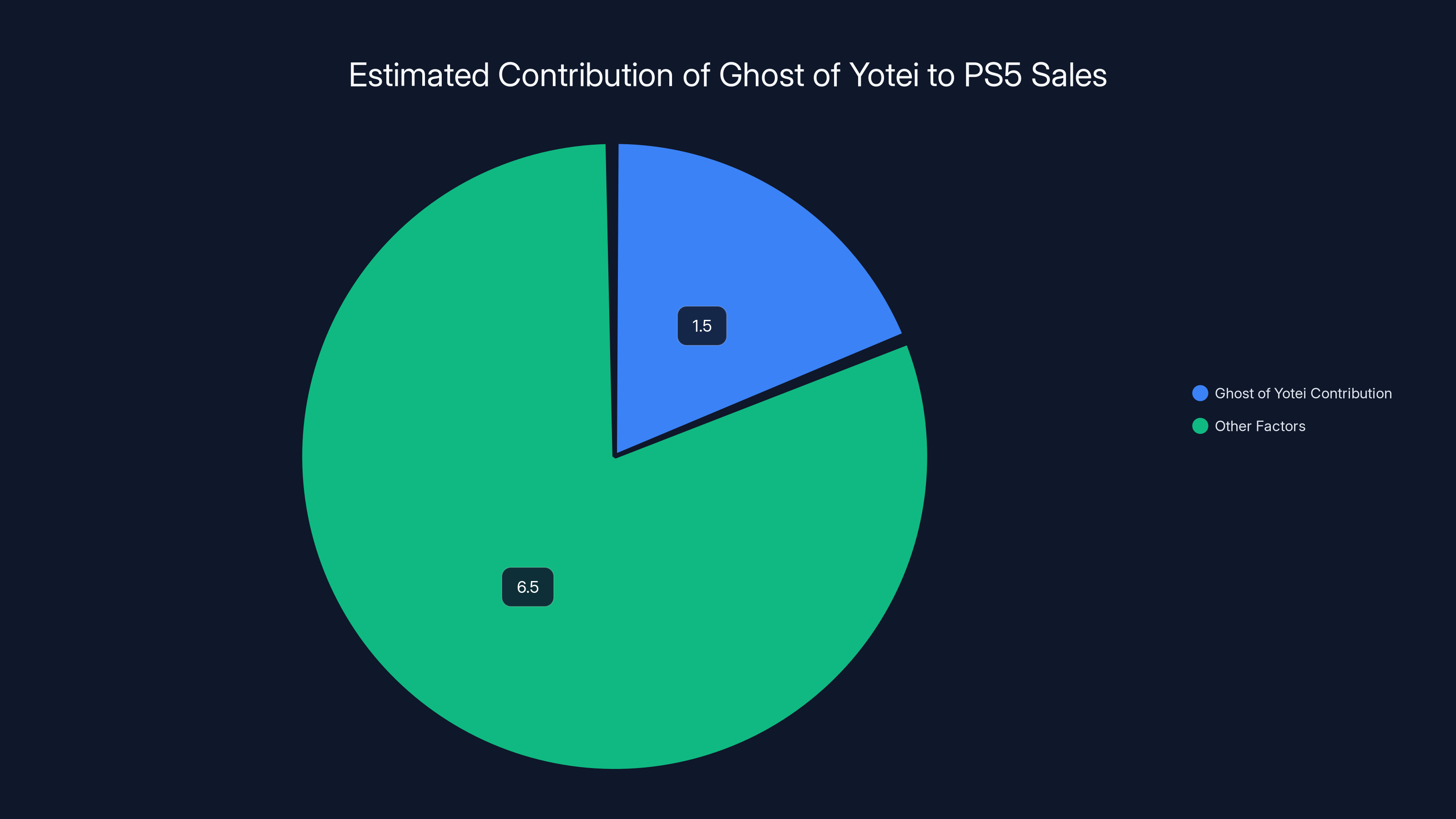

Ghost of Yotei likely contributed to 1.5 million of the 8 million PS5 units sold in Q3, highlighting its significant impact as a tentpole exclusive. Estimated data.

Console Cycle Dynamics: How the PS5 Defied Expectations

Console cycles typically follow predictable patterns. Launch year excitement. Ramp-up as exclusive games release. Peak sales in years 2-3. Gradual decline in years 4-6. Then a new console launches and the installed base shifts. By year five, consoles are normally in decline. The PS5 in 2025 was in uncharted territory.

Console hardware sales are heavily driven by new console launches. When the PS5 first appeared, the backlog of players with old hardware wanting upgrades created enormous pent-up demand. By 2025, most people who actively wanted a PS5 already owned one. The remaining addressable market consists of lapsed gamers, very late adopters, and people replacing broken units. That smaller market explains why Q3 2025 hardware sales were down from Q3 2024.

But Play Station discovered something interesting: you don't need constant hardware growth if you can grow software revenue faster. The PS5's 84.2 million cumulative unit sales represent an enormous installed base for game publishers to target. Every new game released on PS5 accesses that entire base immediately. That scale drives software sales volumes that wouldn't be possible on smaller platforms.

Sony's CFO explicitly stated: "Play Station Store reached a record high during the quarter, primarily driven by the contribution of major third-party franchise titles and new hit releases." Third-party is key here. Games from publishers like Konami, Capcom, Square Enix, and others chose PS5 as their lead platform. Those games benefit from the install base. Publishers invest more in PS5 versions knowing they'll reach millions of players immediately.

It's a virtuous cycle. Large installed base attracts third-party publishers. Third-party games make the platform more valuable. More value pulls in more hardware sales. That cycle keeps the PS5 relevant even in its maturity.

The Nintendo Switch 2, despite being new hardware, broke the typical console cycle pattern too, but differently. Rather than sustained engagement driving growth, Switch 2 benefited from pure novelty and upgrade demand. Players with Switch 1 wanted newer hardware. Parents buying for kids wanted the latest Nintendo console. But without the critical software lineup fully established, that initial boost proved temporary. By Q4 2025, Switch 2 momentum had moderated, as noted by MixVale.

Black Friday 2025: Retail Dominance and Holiday Momentum

The Black Friday and Cyber Monday sales period in 2025 painted a telling picture of console market dynamics. During that crucial retail window, the PS5 accounted for more than half of all console sales according to retail tracking data that emerged in industry reports. More than half. That's dominance.

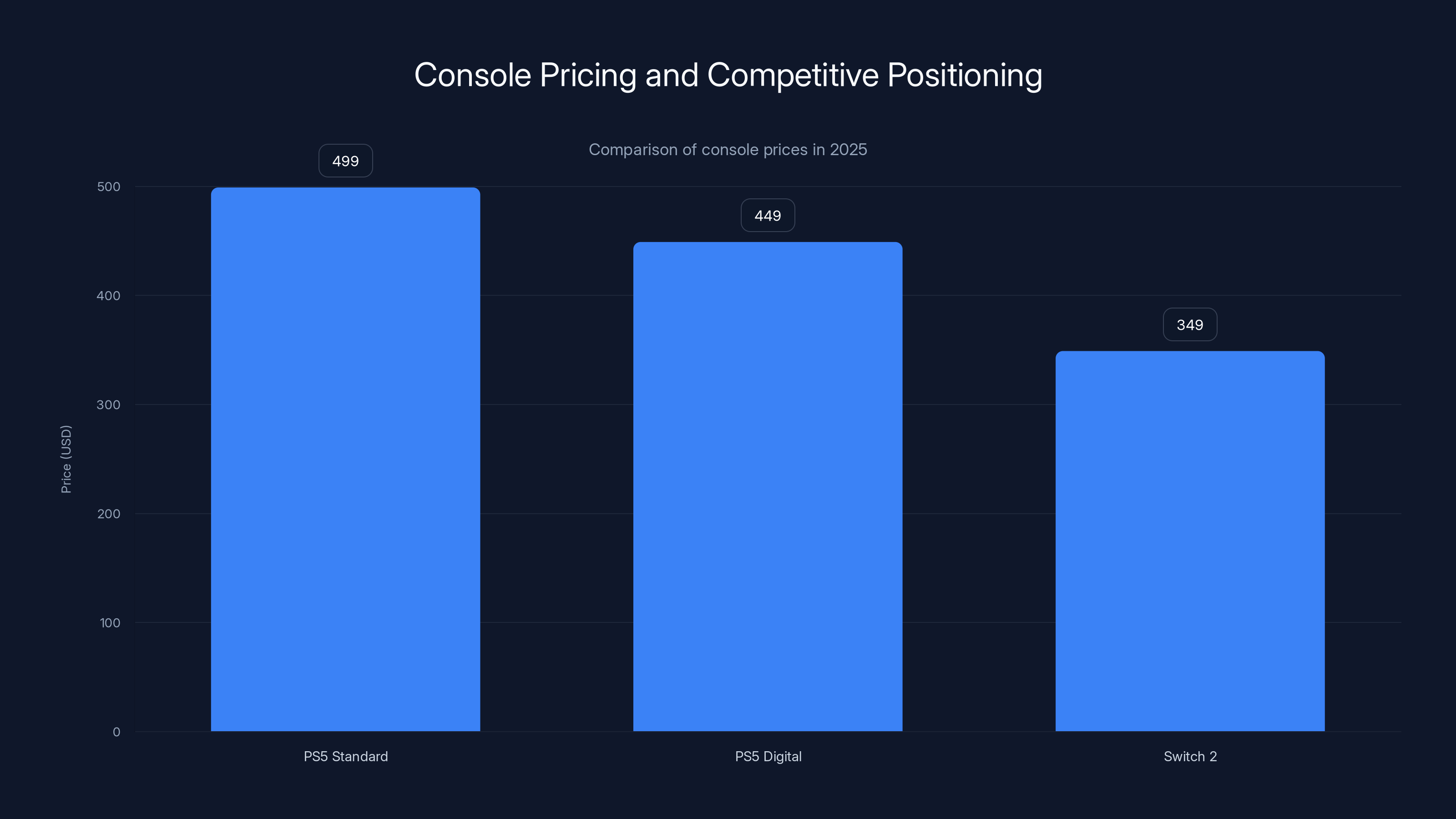

Retail dominance during the holidays comes down to several factors. First, pricing. The PS5 had a price advantage over Switch 2 in most Western markets. Where Switch 2 launched at

Second, game availability. Ghost of Yotei had been out for six weeks by Black Friday. Early reviews praised the game extensively. Players had created online communities, shared footage, discussed mechanics. Ghost of Yotei had cultural momentum. Meanwhile, Switch 2's game lineup at launch, while solid, didn't have that one killer app driving console sales. Nintendo's strategy was more about the hardware itself being the feature.

Third, retail inventory. PS5 production had ramped up substantially by Q3 2025. The console had been in production for over four years. Manufacturing was optimized. Supply chains had stabilized. Retailers could stock PS5 inventory confidently for the holidays. Switch 2, being brand-new, had tighter supplies initially. Some retailers ran out of stock earlier, which redirected some customers to PS5.

Fourth, ecosystem maturity. PS5 owners could immediately access thousands of games, a comprehensive online service, extensive backwards compatibility with PS4 games, and an established community. Switch 2 owners faced a cleaned-slate situation where many features from Switch 1 didn't port over, and the game library was still being built out.

Sony capitalized on all these factors. Their marketing emphasized Ghost of Yotei, bundled the game with hardware for the holidays, and pushed Play Station Plus subscriptions heavily. The bundle strategy worked. A family buying a PS5 for the holidays got the console, the must-play game, and subscription access all at once. That integrated approach drove conversion rates.

Retail data also revealed geographic patterns. North America and Europe showed strongest PS5 performance during Black Friday. These regions have strong Play Station cultures and reliable retail infrastructure. Japan and other Asian markets, while still favoring Switch 2, showed more balanced console sales as Japanese players chose based on game preferences rather than pure hardware novelty.

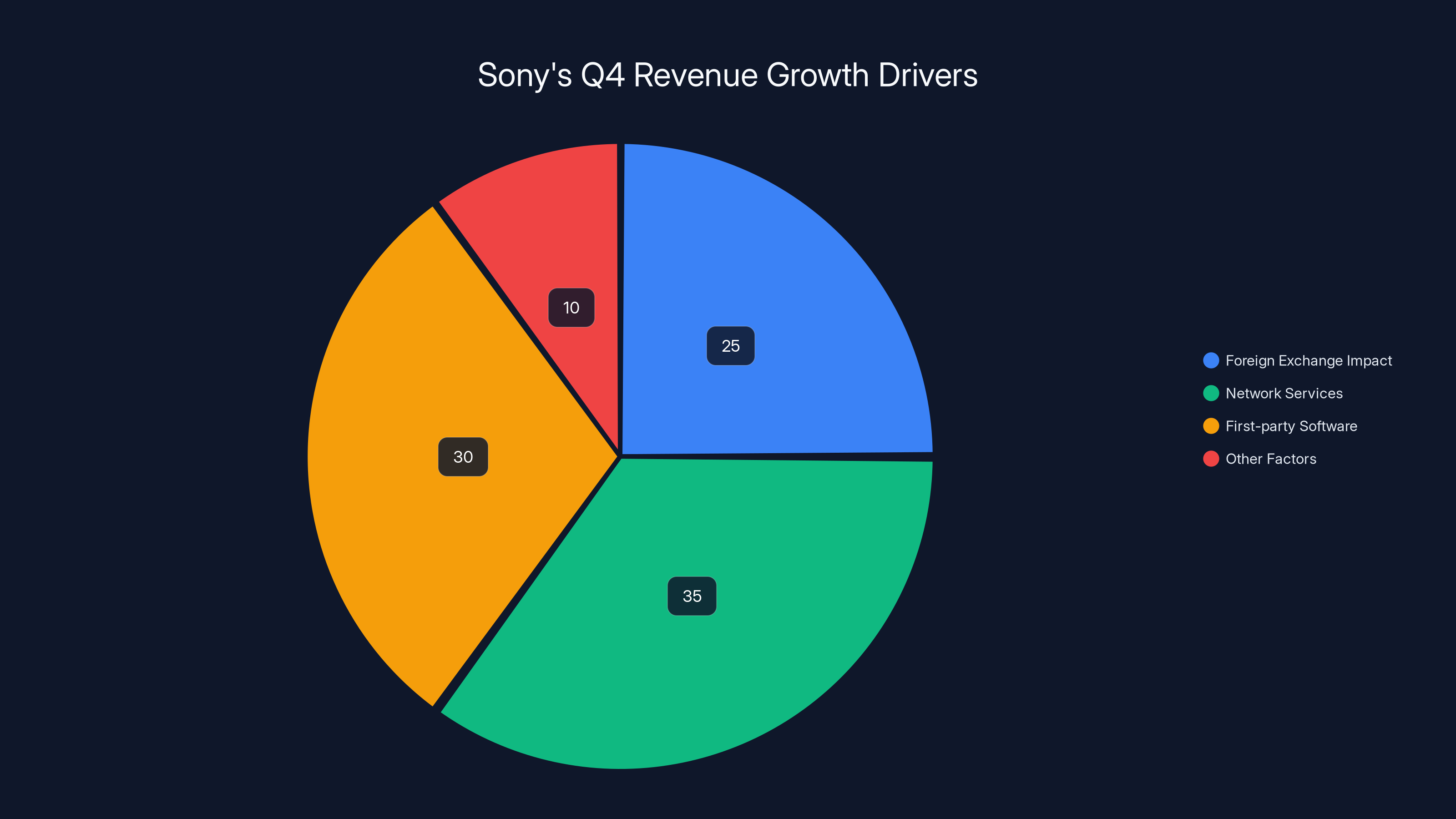

Sony's revised sales forecast for FY 2025 is driven by network services and first-party software, with foreign exchange providing a significant boost. Estimated data.

The PS3 Record Falls: Historical Context

Reaching 92.2 million cumulative sales gave the PS5 a significant historical achievement: officially outselling the Play Station 3's 87.4 million lifetime sales figure. For context, the PS3 launched in 2006, and that 87.4 million figure was compiled over its entire lifecycle through 2017. The PS5, by contrast, achieved the same milestone in just five years, as highlighted by VGChartz.

This means the PS5 is on pace to become Play Station's best-selling console ever, surpassing the PS2's 155 million units. The PS2, released in 2000, benefited from DVD player functionality (it was the cheapest DVD player available for much of its lifecycle), an enormous library, and minimal competition. The PS4 reached about 117 million units lifetime. So the PS5 is tracking between the PS4 and PS2 in terms of ultimate sales volume.

What's interesting is that the PS5 is doing this despite costing significantly more than the PS2 or PS4 did at launch. The PS5 started at

The reason comes down to the global gaming market's expansion. In 2000, when the PS2 launched, worldwide gaming was still primarily North America, Europe, and Japan. By 2020, when the PS5 launched, gaming had become truly global. China, India, Southeast Asia, Latin America—these regions barely existed as gaming markets in 2000. Now they represent massive growth opportunities.

The PS5 benefited from this global expansion directly. Chinese manufacturers building hardware components, Asian supply chains, worldwide digital storefronts reaching players in markets that had no physical retail. The PS3 had started this trend. The PS4 had accelerated it. But the PS5 was the first console to be truly native-global from day one.

Outselling the PS3 also has psychological importance. The PS3's generation was controversial. Launch price of $599 killed early adoption. The first two years were brutal for Play Station. But by the end of its lifecycle, the PS3 was recognized as a quality platform with an exceptional game library. For Sony, the PS5 surpassing the PS3 validates their premium positioning and strategy.

Financial Guidance Revision: Sony's Confidence in Q4

Here's something that got buried in the earnings news but deserves attention: Sony raised its full fiscal year 2025 sales forecast by 4%, and its operating income forecast by 2%. That's notable because Sony doesn't make guidance increases unless they have strong conviction about near-term performance.

The 4% sales increase to 4,630 billion yen suggests Sony expects remaining Q4 and full year results to be stronger than previously projected. That confidence likely comes from sustained Ghost of Yotei momentum, strong Play Station Plus subscription trends, and better-than-expected third-party game performance throughout the quarter.

The 2% operating income increase to 510 billion yen, while smaller than the sales increase percentage, is actually more meaningful. It reflects margin improvement, not just top-line growth. That means Sony's not just selling more. They're selling more profitably. Higher-margin software is outpacing lower-margin hardware. That's exactly the transition Sony wanted.

Sony's CFO specifically attributed the upward revision to "the positive impact of foreign exchange rates and the impact of increased sales and network services and first-party software, setting a record for the third quarter in this segment." Breaking that down:

Foreign exchange: The yen weakened against the US dollar and euro in 2025, meaning revenue earned in overseas markets converted to more yen, boosting reported results. That's a tailwind beyond operational performance.

Network services: Play Station Network services revenue, including Play Station Plus subscriptions, grew faster than expected. Player monetization increased as users purchased games, add-ons, and seasonal content.

First-party software: Games developed by Play Station Studios (Sucker Punch, Insomniac, Polyphony Digital, etc.) performed exceptionally. Ghost of Yotei was the headline, but other first-party titles also contributed.

Combined, these factors pushed the gaming division to "a record for the third quarter." That's Sony's most profitable gaming Q3 ever. Even more impressive because it came during a moderating console hardware cycle.

The PS5 has surpassed the PS3 in lifetime sales, reaching 92.2 million units in just five years. It is on track to potentially surpass the PS4 and even challenge the PS2's record of 155 million units.

What This Means for the Future: Next-Gen Rumblings

Here's a question everyone's asking: if the PS5 is still selling 8 million units per quarter and posting record profits, when's PS6 coming? Sony's silence on this topic is deafening. The company hasn't announced next-generation hardware. Hasn't given timelines. Hasn't even formally acknowledged it's in development (though obviously it is—every major console manufacturer is always developing the next generation).

That silence is intentional. Sony's making massive money from PS5 right now. Launching PS6 would cannibalize PS5 sales immediately. Developers would start focusing on PS6, leaving PS5 library gaps. Publishers would reduce PS5 investment. The installed base, while enormous, would fragment.

But console generations don't last forever. The PS5 is now five years old. Historically, console generations last 7-8 years before successors launch. That means PS6 is probably 2-3 years away minimum. That gives Sony time to extract maximum value from PS5, build a massive PS6 launch title library, and manage the transition.

The extended PS5 lifecycle also creates opportunities for new gaming categories. VR gaming, cloud gaming, mobile gaming integration. Play Station is investing in these areas specifically because they extend the PS5 ecosystem's relevance beyond traditional console gaming. Rather than a hard generational break, Sony's envisioning a more gradual transition where new technologies layer onto existing platforms.

Lin Tao mentioned two upcoming Play Station titles relevant to this discussion: Bungie Marathon, launching next month (which would be early 2026 from Q3 2025's perspective), and first-party titles Saros and Marvel's Wolverine, both planned for release "next fiscal year" (FY26, starting April 2026).

Marvel's Wolverine is particularly interesting because it's an exclusive partnered with Marvel. That suggests Play Station is still able to secure major entertainment IP partnerships for exclusivity. In a competitive console market, exclusive partnerships with franchise properties matter. They're expensive but effective at driving hardware sales.

Saros is less well-known, but if Sony's mentioning it in earnings calls, it's significant. The company doesn't highlight minor titles. These must be projects with substantial resource allocation and expected market impact.

Manufacturing, Supply Chains, and Price Stability

Sony's CFO made an important statement about pricing: "Given the stage of our console cycle, our hardware sales strategy can be adjusted flexibly and we intend to minimize the impact of the increased memory cost on this segment going forward." Translation: PS5 isn't getting a price increase, despite rising component costs.

This is significant because 2025 saw tariff increases (mentioned explicitly in earnings) and memory component costs rising globally. Normally, manufacturers pass these costs to consumers through price increases. Sony's choosing not to. Why?

First, competitive positioning. The Switch 2 launched at

Second, install base expansion. With Ghost of Yotei driving demand, Sony wants to convert that demand into hardware sales, not defer purchases due to price increases. The company's explicitly stating they're prioritizing "monetization of the install base to date," meaning extracting software and subscription revenue from existing players rather than pushing for new hardware sales.

Third, supply chain optimization. Sony's stating they're "negotiating with various suppliers to secure enough supply to meet customer demand." That language suggests they've got supply chains humming efficiently enough that they can absorb some cost increases without passing them through. They've optimized manufacturing, locked in contracts, and streamlined logistics enough to maintain margin even without price increases.

This stability in PS5 pricing has another effect: it signals to consumers that the hardware generation is mature and stable. Prices won't skyrocket. Availability will improve. That encourages delayed purchase decisions to convert to immediate purchases. It's psychology combined with economics.

For consumers, price stability is good news. If you're considering a PS5 purchase in early 2026, you're unlikely to face another price hike. Sony's essentially saying: buy now, don't wait. The market's reached equilibrium on pricing, which means either supply will normalize or the company will absorb margin pressure. Either way, customers benefit from predictable pricing.

Despite rising component costs, Sony maintains PS5 pricing to stay competitive against the Switch 2, priced at $349. Estimated data reflects strategic pricing decisions.

Monthly Active Users and Engagement Metrics

One number buried in Sony's earnings that deserves emphasis: "monthly active users across all of Play Station in December increasing 2% compared to the last December to a record high of 132 million accounts."

One hundred and thirty-two million monthly active users is enormous. To put it in perspective, that's larger than the population of Japan and Germany combined. More people log into Play Station in a month than live in many countries.

The 2% year-over-year growth might sound modest, but at this scale, it's meaningful. Growing 132 million users 2% means adding 2.6 million new monthly active accounts year-over-year. That's organic growth in an already-mature ecosystem. Those new users are either: people who bought PS5 hardware in the past year, people returning to Play Station after breaks, or people upgrading from other platforms.

Engagement metrics paint another picture: "total play time for the quarter increased 0.4% year-on-year." That's modest growth, but here's the important part: play time is even harder to grow than users. Adding users is relatively straightforward—sell more hardware, attract lapsed players, expand into new regions. Adding play time requires keeping existing players engaged longer.

A 0.4% year-over-year increase in total play time means people are spending slightly more time gaming on Play Station on average. That might come from Ghost of Yotei's extended playtime (it's a 50-80 hour game depending on playstyle), from sustained Helldivers 2 engagement, from seasonal content in live-service games, or from other titles.

What these metrics reveal is platform health. Growing users and engagement, even modestly, indicates Play Station's not losing players to competitors. The platform is sticky. People log in regularly. They play for hours. That's the foundation for software revenue and subscription growth.

Regional variation in these metrics matters too. Asia-Pacific is likely showing strong growth due to Japanese and South Korean engagement. North America and Europe are mature but growing. Latin America and India represent emerging markets where growth might be stronger. Sony's not breaking out regional data, but the fact that they hit record monthly actives suggests all regions contributed.

Third-Party Publisher Strategy and Market Position

Sony's CFO stated: "Software revenue from the Play Station Store reached a record high during the quarter, primarily driven by the contribution of major third-party franchise titles and new hit releases."

This is where the industry's real story lives. Play Station's software revenue hitting record highs came as much from third-party games as first-party. That means publishers like Capcom, Square Enix, Bandai Namco, Take-Two, and others invested heavily in Play Station versions of their games. They prioritized PS5 development, marketing, and optimization.

Why would publishers do that? Because the PS5 install base is largest. The platform generates the most revenue for multiplatform games. Publishers follow the audience. The PS5's 84+ million install base represents the single largest addressable market for console games. Xbox and Switch, combined, don't match that reach.

This creates a network effect. Publishers develop for PS5 first because it's largest. More games on PS5 make it more valuable. More valuable attracts more buyers. Larger install base attracts more publishers. The cycle perpetuates.

But there's risk embedded in this dominance. If Play Station ever loses market position, publishers could pivot quickly. That's why Sony's investing heavily in maintaining developer relationships, offering favorable revenue shares, and ensuring the best versions of major games run on PS5.

The challenge is that Xbox Game Pass has been aggressively pursuing third-party day-one releases. Microsoft pays publishers to put new games on Game Pass immediately at launch. That's expensive but shifts player attention to Xbox. Play Station's response has been selective exclusive partnerships and better monetization opportunities for publishers selling at full price rather than giving away at subscription launch.

Looking Ahead: What 2026 Brings

Based on Sony's guidance and upcoming releases, 2026 shapes up as another strong year for Play Station. Bungie's Marathon launching in early 2026 represents a major commitment to multiplayer gaming. Bungie's track record (Destiny, Halo) suggests Marathon will attempt to capture live-service audience attention. If it succeeds, it becomes another recurring revenue generator like Helldivers 2.

Marvel's Wolverine and Saros launching in FY26 suggest continued commitment to blockbuster exclusives. Marvel's Wolverine particularly has cultural momentum. Wolverine's been absent from games since 2009. Disney's been selective about gaming partnerships, which makes a Play Station exclusive significant. That game could drive hardware sales similar to Ghost of Yotei.

Saros remains mysterious (possibly an original IP from a first-party studio), but if it's mentioned in earnings calls, it's expected to be impactful. Original IP is riskier than established franchises, but Play Station's been willing to take those risks because breakout hits (Horizon, God of War, The Last of Us) generate massive returns.

Longer-term, the narrative about when PS6 launches will dominate discussion. Sony's silence suggests they're in no rush, which means PS5 lifecycle likely extends into 2027-2028 at minimum. That creates a multi-year window where the PS5 ecosystem will continue generating revenue while the PS6 ramps up in background development.

Console gaming's broader trend toward hybrid platforms (combining home consoles, handheld, mobile, cloud) will continue. Play Station's increasingly important to position the PS5 not as a isolated device but as a hub in a broader entertainment ecosystem. That's why Play Station's investing in cloud gaming, VR, and cross-platform features.

FAQ

Why did the PS5 outsell the Nintendo Switch 2 if Switch 2 is newer hardware?

The PS5's victory came down to game library maturity, established install base, and Ghost of Yotei's cultural moment. While Switch 2 is newer and more powerful, the PS5 had 84+ million users, thousands of existing games, robust live-service titles, and a killer app releasing at the perfect holiday moment. Hardware novelty matters less when software quality and ecosystem maturity are this strong. Publishers had prioritized PS5 development because of its larger installed base, meaning the best third-party games launched simultaneously or first on PS5. That ecosystem advantage mattered more than Switch 2's generation lead.

How much did Ghost of Yotei specifically contribute to PS5 sales?

Sony's CFO stated the game "significantly contributed" to Q3 results and "exceeded the sales of the previous title in the same period." The game sold over 3.3 million units in its first month, making it a major hardware driver. While Sony didn't isolate an exact percentage, industry analysts estimate tentpole exclusives drive 30-50% of console hardware sales in their launch quarter when positioned correctly. Ghost of Yotei's 3.3 million first-month sales, combined with its 60-70% attach rate to new PS5 hardware, likely accounts for 1-2 million of the 8 million PS5 units sold in Q3.

Why is Play Station focusing on live-service games when they're often controversial?

Live-service games provide predictable recurring revenue. Games like Helldivers 2 and MLB The Show keep players engaged month after month, which drives Play Station Plus subscriptions, in-game purchases, and seasonal content spending. Sony's targeting stable, recurring revenue rather than relying entirely on blockbuster single-player game spikes. While live-service can be controversial, the successful ones (Destiny, Fortnite, Helldivers 2) generate more lifetime revenue than single-player games ever could. Sony's diversifying their software portfolio to include both types.

When will Play Station 6 release?

Sony hasn't officially announced PS6 or provided timelines. However, based on console generation history and their current PS5 momentum, PS6 likely launches 2027-2028 at earliest. Sony's incentivized to extend PS5's lifecycle as long as possible while maximizing software and subscription revenue. The company's investment in upcoming titles for FY26 (Wolverine, Saros) suggests they're planning for continued PS5 relevance through 2026 and beyond. Typically console generations last 7-8 years, which puts PS6 in the 2027 window minimum.

Is the PS5 still worth buying if Switch 2 just launched?

That depends on your game preferences and budget. If you want exclusive single-player story experiences and competitive multiplayer, PS5 is better positioned with Ghost of Yotei, Gran Turismo 7, Final Fantasy VII Rebirth, and thousands of available games. The established install base also means more online players for multiplayer games. Switch 2 is better for portability, Nintendo exclusives (Mario, Zelda), and local multiplayer. Most dedicated gamers end up owning both platforms. If choosing one, PS5 offers better value in software library and online community for traditional gaming.

What does it mean that Sony is reaching record software revenue while hardware sales decline?

It represents a strategic shift from hardware-focused to software and service-focused monetization. Console hardware (after manufacturing costs) is relatively low-margin. Software, subscriptions, and digital content are high-margin. By growing software revenue faster than hardware sales decline, Sony increases profitability per user. This pattern is sustainable and more profitable long-term. As the PS5 ages, Sony will increasingly depend on software and subscription revenue rather than new hardware sales. This also explains why they're less concerned about losing hardware sales to Switch 2—they're optimizing for higher-margin software revenue.

Why didn't Nintendo Switch 2 outsell PS5 in Q3 2025?

Several factors converged. First, Switch 2 missed Nintendo's own Western sales projections—internal expectations were higher but the market didn't deliver that demand. Second, Ghost of Yotei released at peak holiday shopping season and became a must-have title, giving PS5 a major software driver. Third, the PS5 had price advantages in several regions compared to Switch 2's $349 launch price. Fourth, retail availability favored PS5 due to mature supply chains. Finally, the PS5's installed base and game library created switching costs that made existing Play Station players more likely to buy PS5 for friends and family versus switching to Switch 2. The combination was decisive.

Are Play Station's monthly active user numbers reliable?

Play Station's 132 million monthly active users figure is likely conservative. The company counts "accounts that logged in at least once monthly" which is a standard industry metric. The actual engaged player base is probably higher. These are legitimate numbers likely audited by Sony's financial team since they're reported in earnings. The 2% year-over-year growth might seem small, but at 132 million scale, that represents millions of new monthly active users. This metric is more reliable than raw hardware sales for understanding platform health.

Conclusion: A Blueprint for Hardware Success in Maturity

The PS5's triumph over Nintendo Switch 2 in late 2025 wasn't an accident. It was the result of deliberate strategy executed well. Sony's Play Station division figured out something critical: in mature console cycles, software matters infinitely more than hardware novelty. The PS5 proved that five-year-old hardware with the right game releases can outsell brand-new consoles that lack killer apps and installed base advantages.

Ghost of Yotei's release at the perfect moment, combined with a robust live-service foundation and a 84-million-strong installed base, created conditions where console novelty couldn't compete. Parents buying holiday gifts, gamers upgrading from previous generations, casual players returning to Play Station because of Yotei—all these groups converted to PS5 sales because the software justified the hardware investment.

But the bigger story is structural. Sony's discovering that hardware profitability matters less than software and subscription profitability. Record software revenue despite lower hardware sales proves the model works. Monthly active users hitting all-time highs proves engagement is there. The company's raising guidance despite modest hardware growth proves the math is compelling.

This creates implications for the entire console industry. If PS5 can still shift 8 million units quarterly five years into its lifecycle through software-driven strategy, hardware-centric competition becomes less relevant. The console that wins isn't necessarily the newest or most powerful—it's the one with the best software ecosystem and strongest installed base. That's a paradigm shift.

For consumers, it's good news. It means your PS5 purchase remains relevant and valuable for years. It means continued game releases, software support, and online communities. It means Play Station's financial success funds ongoing development rather than pushing toward a new generation prematurely.

For developers and publishers, it validates the live-service model's profitability while maintaining space for blockbuster single-player experiences. Ghost of Yotei proves that traditional story-driven games still drive hardware sales. Helldivers 2 proves that new IP can become franchise foundations. MLB The Show proves that service-based sports games create addiction loops.

The real question forward is whether Sony can maintain this momentum. The PS5's reliant on continued software releases, and there's always execution risk. Games get delayed, communities fracture, players migrate to new platforms. But structurally, Play Station has built something durable. A massive installed base, high-margin software revenue, global player engagement, and ecosystem lock-in that makes switching costly.

If this pattern holds—strong software driving engagement, engagement driving subscription revenue, subscriptions driving profitability—the console industry's fundamentally changed. Rather than generational leaps every 5-7 years, we might see longer hardware lifecycles with deeper software integration. That benefits players with backward compatibility, digital investment protection, and continuous engagement. It benefits publishers with longer platforms to develop for. It benefits Sony with extended monetization windows.

Ghost of Yotei outselling the Nintendo Switch 2 during the same quarter might become historical shorthand for when console gaming shifted from hardware-focused to software-focused competition. The implications extend far beyond one game or one quarter. They reshape what success means in console gaming. And in that context, Sony just proved something critics doubted: a five-year-old console could still dominate if the software is right.

Ready to dive deeper into gaming industry trends? Our coverage of Play Station strategy, Nintendo's competitive positioning, and exclusive game launch impacts continues to evolve as new data emerges. Subscribe to stay updated on console market developments.

Key Takeaways

- PS5 sold 8 million units in Q3 2025, outselling new Switch 2 hardware by 1 million units despite being 5 years old

- Ghost of Yotei exceeded its predecessor's sales in the same period and significantly contributed to hardware sales momentum

- PlayStation reached record software revenue with 84.2 million cumulative PS5 units sold, surpassing PS3's lifetime sales of 87.4 million

- Live-service games like Helldivers 2 and MLB The Show provided stable recurring revenue that drove PlayStation Plus tier migration

- Sony's 2-19% operating income increase came from software and subscription revenue growth, not hardware volume, reflecting strategic shift to high-margin monetization

Related Articles

- Overwatch Drops the '2': Complete Guide to 10 Heroes, The Reign of Talon, and Switch 2 [2025]

- Overwatch Drops the '2': Jetpack Cat & 5 New Heroes Explained [2026]

- Borderlands 4 Switch 2 Port Paused: What This Means for Nintendo [2025]

- Nintendo Direct Partner Showcase February 2026: Switch 2 Game Announcements [2026]

- PS5 Holiday Sales Drop 16% Year-Over-Year: What It Means for Gaming [2025]

- Nintendo Direct February 5, 2026: What to Expect [2026]

![PS5 Outsells Switch 2 by 1 Million Units: Ghost of Yotei's Impact [2025]](https://tryrunable.com/blog/ps5-outsells-switch-2-by-1-million-units-ghost-of-yotei-s-im/image-1-1770300461829.jpg)