Nvidia's India AI Startup Strategy: Building Long-Term Demand

India's tech landscape is shifting, and Nvidia is betting billions that AI developers from Bangalore to Hyderabad will become the chipmaker's most important customers over the next decade. According to Nvidia's official blog, the company is not just selling GPUs to India anymore but is deeply investing in the startup ecosystem by funding accelerators, mentoring pre-seed founders, and building relationships with technical teams before their companies even exist legally.

This strategic move is driven by India's position as one of the world's fastest-growing developer markets, with a massive talent pool and an efficient cost structure. The regulatory environment is also becoming more favorable to deep tech, making it an attractive market for Nvidia. As noted by Al Jazeera, whoever captures India's AI founders early is poised to dominate the AI market later.

TL; DR

- Nvidia is investing early: Partnerships with seed-stage firms like Activate aim to reach founders before company formation.

- India's developer pool is booming: One of the world's fastest-growing concentrations of AI talent outside the U.S.

- The play is customer acquisition: Early relationships with startups mean sticky GPU adoption as those companies scale.

- Competition is fierce: OpenAI, Anthropic, Google, and others are making similar bets on Indian AI talent.

- Bottom line: This is a 10-year bet on India becoming the next major AI hub globally.

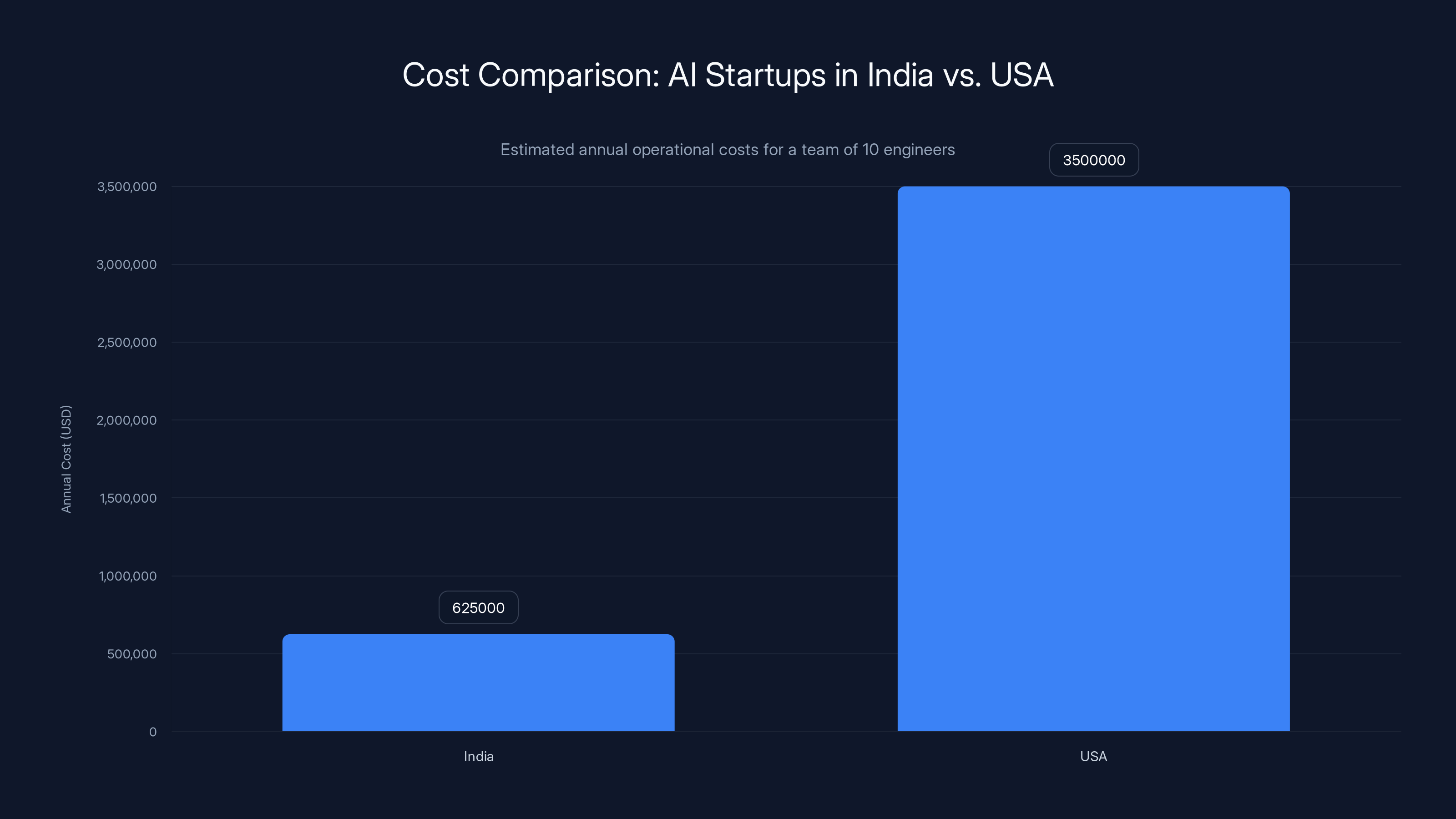

Starting an AI company in India costs approximately 60% to 70% less than in the USA, allowing Indian startups to operate longer and be more experimental. (Estimated data)

Why Nvidia Suddenly Cares About Indian Startups (A Lot)

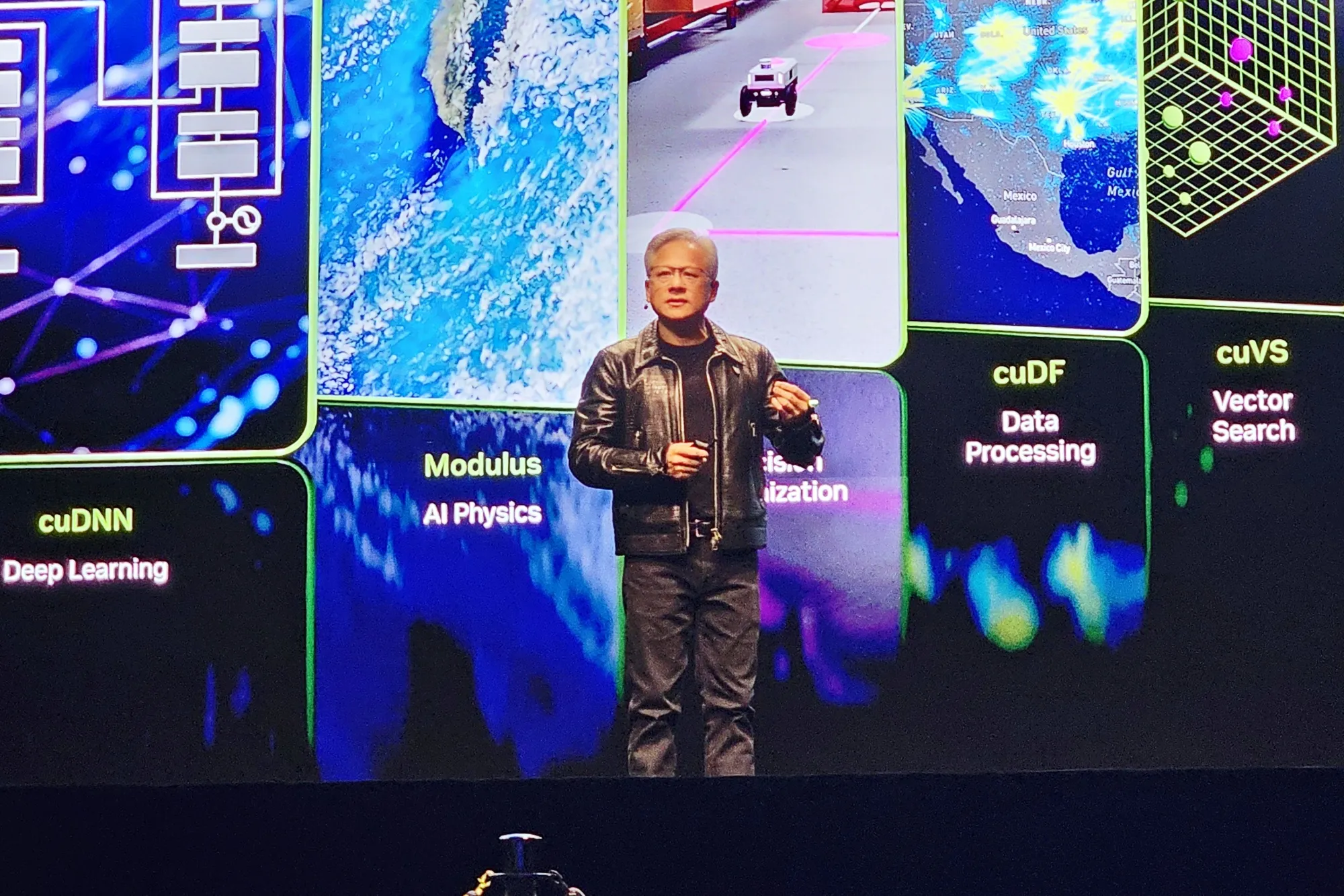

Nvidia's GPU business depends on demand from large enterprises, cloud providers, and increasingly, AI-native startups that are building the next generation of applications. The challenge is that by the time a startup is raising Series A or Series B, they've often already chosen their infrastructure and integrated with competitors' platforms, making switching costs high. However, if Nvidia can meet founders on Day 1—when they're still validating ideas in coffee shops and coworking spaces—something different happens. As described by TechCrunch, founders learn Nvidia's tools, understand its ecosystem, and build their entire technology stack around Nvidia's GPUs.

India's developer base is growing rapidly, with more than 5 million software developers as of 2025, and approximately 400,000 to 500,000 actively working on AI and machine learning projects. This is more AI developers than exist in most countries. Historically, Indian AI developers were trained on American infrastructure, but this is changing as India builds its own AI native company culture. Nvidia aims to ensure that the default tools for this new generation are theirs.

Nvidia's initiatives aim to reach over 10,000 early-stage founders in India, with significant funding and support. Estimated data.

The Activate Partnership: Nvidia's Earliest Intervention

Activate, the early-stage venture firm founded by Aakrit Vaish, represents Nvidia's most aggressive move into India's pre-seed ecosystem. Activate's business model is unconventional, practicing what Vaish calls "inception investing"—meeting technical teams and founders months before company formation. They help refine problems, connect founders with potential customers, and introduce them to other founders facing similar challenges.

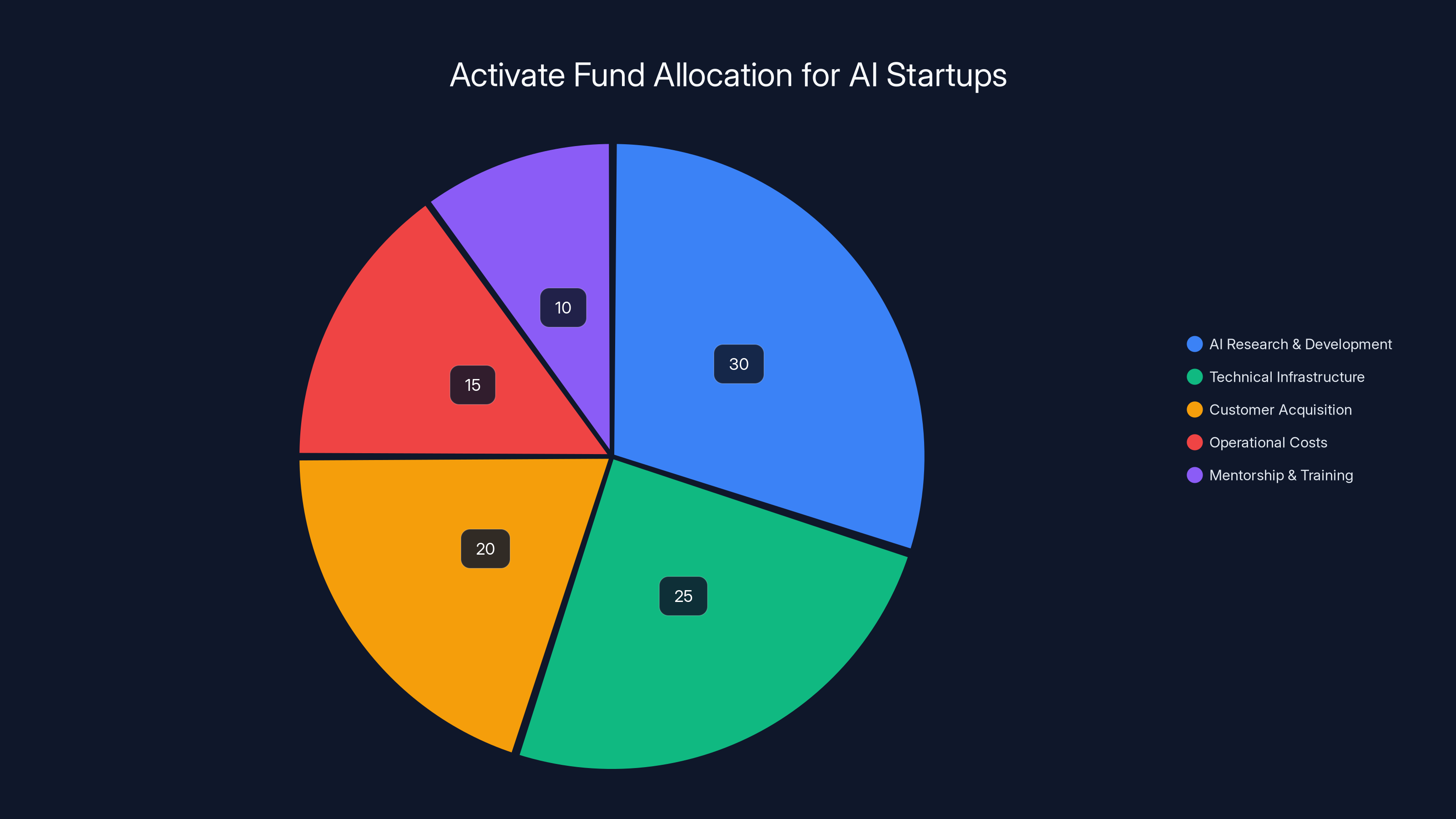

Activate's debut fund raised $75 million and plans to back 25 to 30 AI startups. The partnership with Nvidia is notable for providing Activate portfolio companies with direct access to Nvidia's engineering expertise and technical guidance. This is a competitive advantage for Activate, as portfolio companies can access world-class technical infrastructure and mentorship from Nvidia's engineers without paying premium consulting rates.

For Nvidia, the math is equally compelling. Activate's investor base includes prominent figures like venture capitalist Vinod Khosla and Perplexity co-founder Aravind Srinivas, giving portfolio companies significant credibility and network access. As reported by CNBC, Nvidia's historical engagement with Indian startups has been relatively light-touch, but this is changing with Activate providing the mechanism for deeper engagement.

Nvidia's Expanded India Footprint: A Layered Approach

The Activate partnership isn't Nvidia's only play in India. The company is running multiple, overlapping programs designed to reach different segments of India's startup ecosystem.

The Inception Program: Breadth and Scale

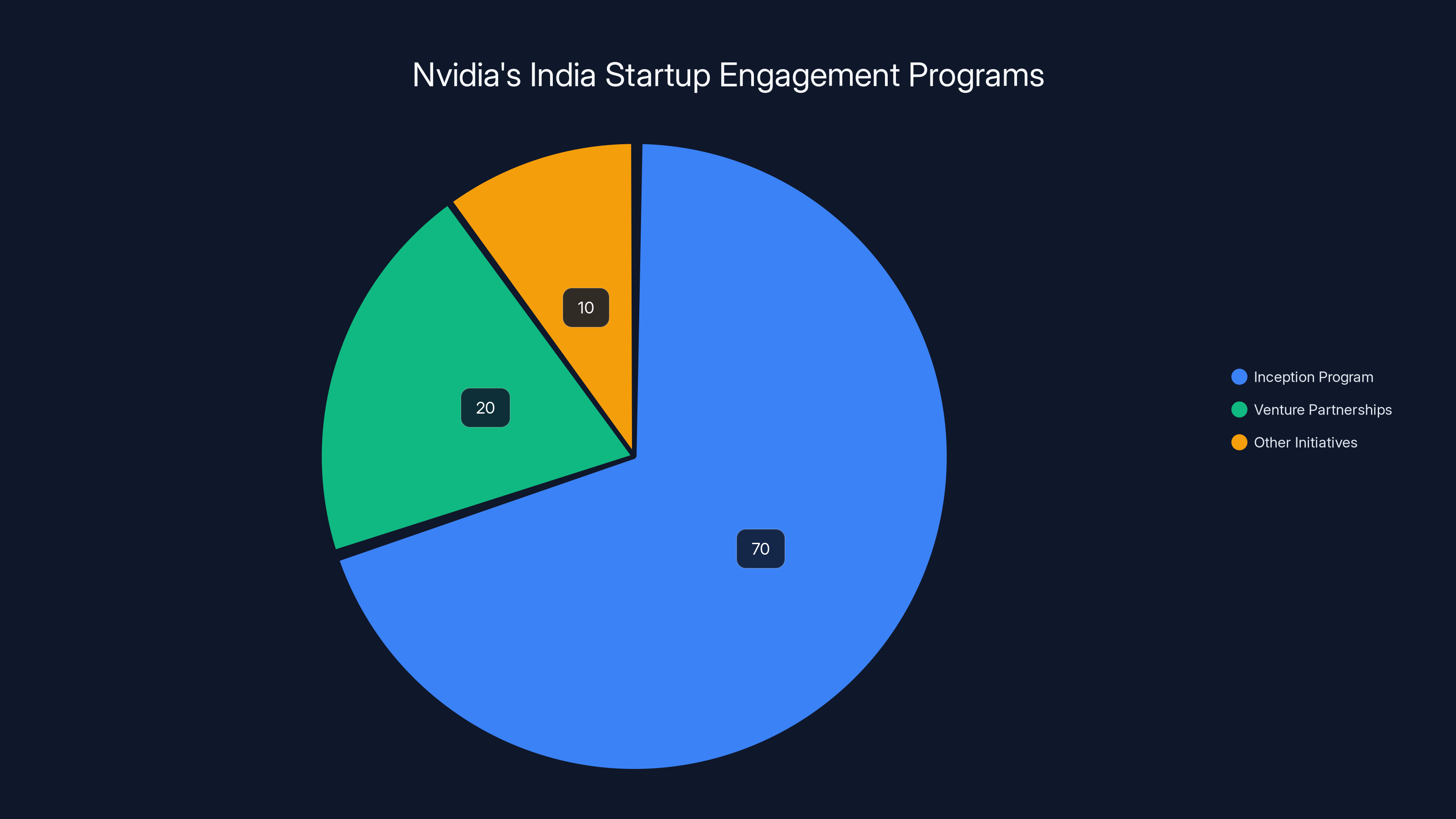

Nvidia's Inception program serves as the base layer of the strategy, providing startups with access to GPU credits, technical documentation, engineering support, and connections to the broader Nvidia ecosystem. With over 4,000 startups enrolled in the Inception program in India specifically, this is Nvidia's volume play. The company isn't picking winners at the Inception level but is casting a wide net, expecting that even if 95% of startups fail, the 5% that succeed and scale will drive massive demand for Nvidia infrastructure.

The Inception program is low-cost for Nvidia to operate at scale. Credits are allocated from compute they've already built, and the engineering team can support many startups simultaneously with asynchronous guidance. Nvidia started connecting its Inception program with other ecosystem players, introducing requirements for startups to work with incubators and accelerators, making the program more visible and accessible to founders in their earliest stages.

Venture Partnerships: Identifying the Best

Nvidia announced partnerships with multiple venture firms operating in India, including Accel, Peak XV, Z47, Elevation Capital, and Nexus Venture Partners. These partnerships serve a different purpose than Inception, as Nvidia is telling these VCs, "If you're looking at promising AI startups, let's talk. We can provide technical guidance and accelerate your portfolio company's product development." In return, Nvidia gets first look at the highest-potential AI companies being funded by India's best venture investors.

Accel is one of India's oldest and most successful venture firms, and Peak XV (formerly Sequoia India) is probably India's most prestigious venture firm. These partnerships mean Nvidia's engineers get introduced to the companies these firms are backing, often at the Series A or Series B stage, which is earlier than Nvidia typically engaged but later than Inception.

AI Grants India: Reaching the Earliest Founders

The third layer is perhaps the most interesting: AI Grants India. Co-founded by Vaibhav Domkundwar and Bhasker (Bosky) Kode, AI Grants India is explicitly designed to support early-stage founders. Nvidia is partnering with the organization to provide grants, mentorship, and technical resources to more than 10,000 early-stage founders over the next 12 months. This is Nvidia recognizing that its win rate on converting founders to long-term users is a function of how early it engages.

AI Grants India serves as the funnel top, reaching very early-stage founders and providing modest grants (typically

Estimated data shows that Nvidia's Inception Program forms the majority of its efforts in India, focusing on broad engagement with startups, while venture partnerships target high-potential AI companies.

The Deep Tech Alliance: Ecosystem Legitimacy

In November 2025, Nvidia joined the India Deep Tech Alliance, a consortium of American and Indian investors working to support emerging startups across deep tech domains. The consortium includes firms like Accel, Blume Ventures, Premji Invest, and Celesta Capital, representing billions of dollars in assets under management. By joining this alliance, Nvidia isn't leading but participating, signaling a commitment to the long-term development of India's deep tech ecosystem.

This move means Nvidia's engineers attend alliance meetings and provide technical guidance to startups backed by other investors in the consortium. Nvidia's resources are accessible not just to companies in its direct partnerships but to a broader cohort of deep tech startups. Nvidia's reputation becomes tied to the success of India's deep tech ecosystem, not just to its own business metrics.

Why India? The Market Dynamics Behind Nvidia's Focus

Nvidia's India strategy isn't random but responsive to specific market conditions that have aligned in India over the past 18 to 24 months.

Developer Population and Growth Rate

India has become one of the world's largest concentrations of software developers. Major tech companies have massive engineering operations in India, with companies like Google, Meta, Amazon, Microsoft, and Apple employing tens of thousands of Indian engineers. The more significant trend is that Indian engineers are increasingly starting their own companies and building their own products.

Cost Efficiency Without Talent Compromise

Starting an AI company in India costs 60% to 70% less than starting an equivalent company in the United States. This cost advantage is profound for early-stage startups, allowing Indian founders to run longer on limited capital, be more experimental, and afford to fail multiple times and keep iterating. For Nvidia, this matters because cost-efficient startups can adopt GPU infrastructure more easily.

Regulatory Environment

India's regulatory environment is rapidly becoming more accommodating to deep tech and AI companies. The government has signaled support for AI development, with tax incentives for tech startups and warming immigration policies for technical talent. This contrasts with some other markets imposing stricter regulations on AI development.

Untapped Market for AI Infrastructure

Most Indian companies building AI products are still relatively new to the space and haven't yet committed to Nvidia or chosen competing infrastructure. India represents a greenfield opportunity where infrastructure choices aren't yet locked in.

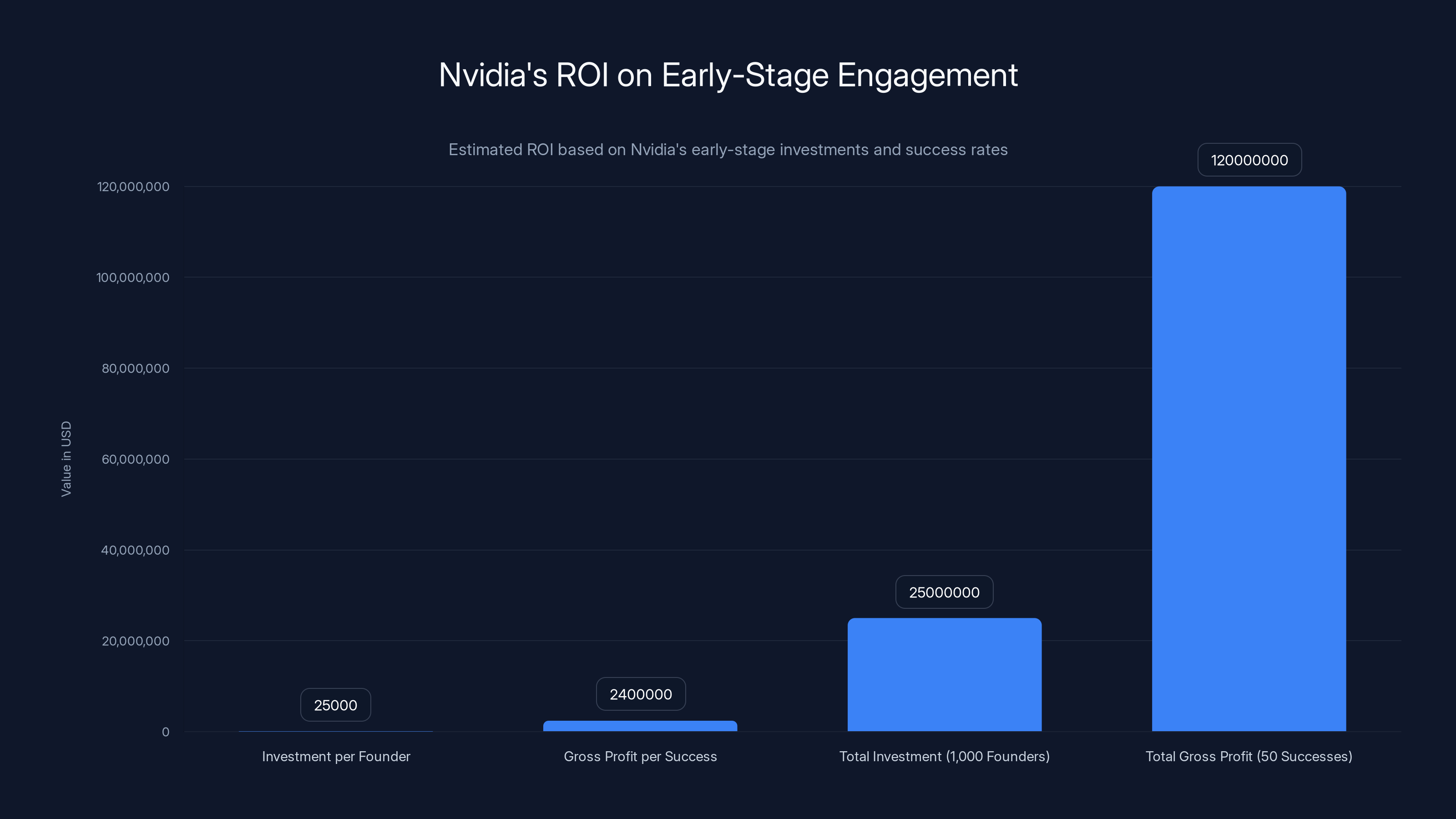

Despite a low success rate, Nvidia's early-stage investments can yield substantial returns, with potential gross profits far exceeding initial investments. Estimated data.

Competition: Why Every Major AI Company is Playing the Same Game

Nvidia isn't alone in this strategy. OpenAI, Anthropic, Google, and other major AI companies are making similar bets on India's ecosystem. OpenAI was present at India's AI Impact Summit, the same event where Nvidia's executives were engaging with founders and investors. Anthropic sent representatives, and Google has long maintained a significant presence in India.

Each of these companies is trying to build relationships with India's AI developers before those developers are locked into competing platforms or dependencies. OpenAI wants developers building on top of ChatGPT and its API, Anthropic wants developers using Claude, and Google wants developers integrated with its cloud infrastructure and AI platforms.

This competition is actually good for Indian founders, as it means multiple major companies are fighting to provide resources, mentorship, and technical support. For Nvidia specifically, the competition adds urgency. If Nvidia doesn't reach founders early, OpenAI or Google might already have relationships in place.

The Economics of Early-Stage Engagement

Nvidia is willing to invest in ecosystem programs because the potential return on investment is substantial. Assume Nvidia engages with a founder in the pre-seed stage through AI Grants India, costing Nvidia

Over five years, that's

Switching GPU providers is non-trivial, as code needs to be optimized for different hardware, workflows need to be rewritten, and teams need to be retrained. A founder who learned Nvidia's tools on Day 1 faces much higher switching costs than a founder considering infrastructure options for the first time at Series B.

Estimated data shows a strategic allocation of Activate's $75 million fund, prioritizing AI R&D and technical infrastructure, leveraging Nvidia's expertise.

What Founders Actually Get Access To

When Nvidia talks about providing "technical expertise" and "engineering support," it means offering concrete resources such as GPU credits, engineering office hours, documentation and tutorials, access to Nvidia's developer community, networking events, introductions to venture capital, hardware partnerships, and research partnerships. Collectively, these resources significantly accelerate a startup's ability to build and iterate with AI.

A founder who would normally spend three months learning Nvidia's tools and optimizing code can do it in three weeks with engineering support, providing a 10-week acceleration advantage. Over the course of a startup's life, this compounds into significant product development advantages.

The Role of Venture Capital in Nvidia's Strategy

Nvidia's partnerships with venture firms are not trivial. Nvidia is explicitly telling venture capitalists, "If you want to invest in AI startups in India, we want to be part of that conversation." This creates an incentive structure for venture firms to include Nvidia in their due diligence processes on AI companies.

Here's what might happen in practice: A venture firm evaluates an AI startup for investment, reaches out to Nvidia for a technical assessment, and makes an investment partly informed by Nvidia's feedback. The startup is now aware that Nvidia thinks they're worth backing and is invested in their success.

From Nvidia's perspective, this is magical. They get visibility into interesting startups early, influence technical decisions, and the startup knows Nvidia believes in them. Venture firms benefit from free technical diligence, and startups benefit from validation and feedback from Nvidia.

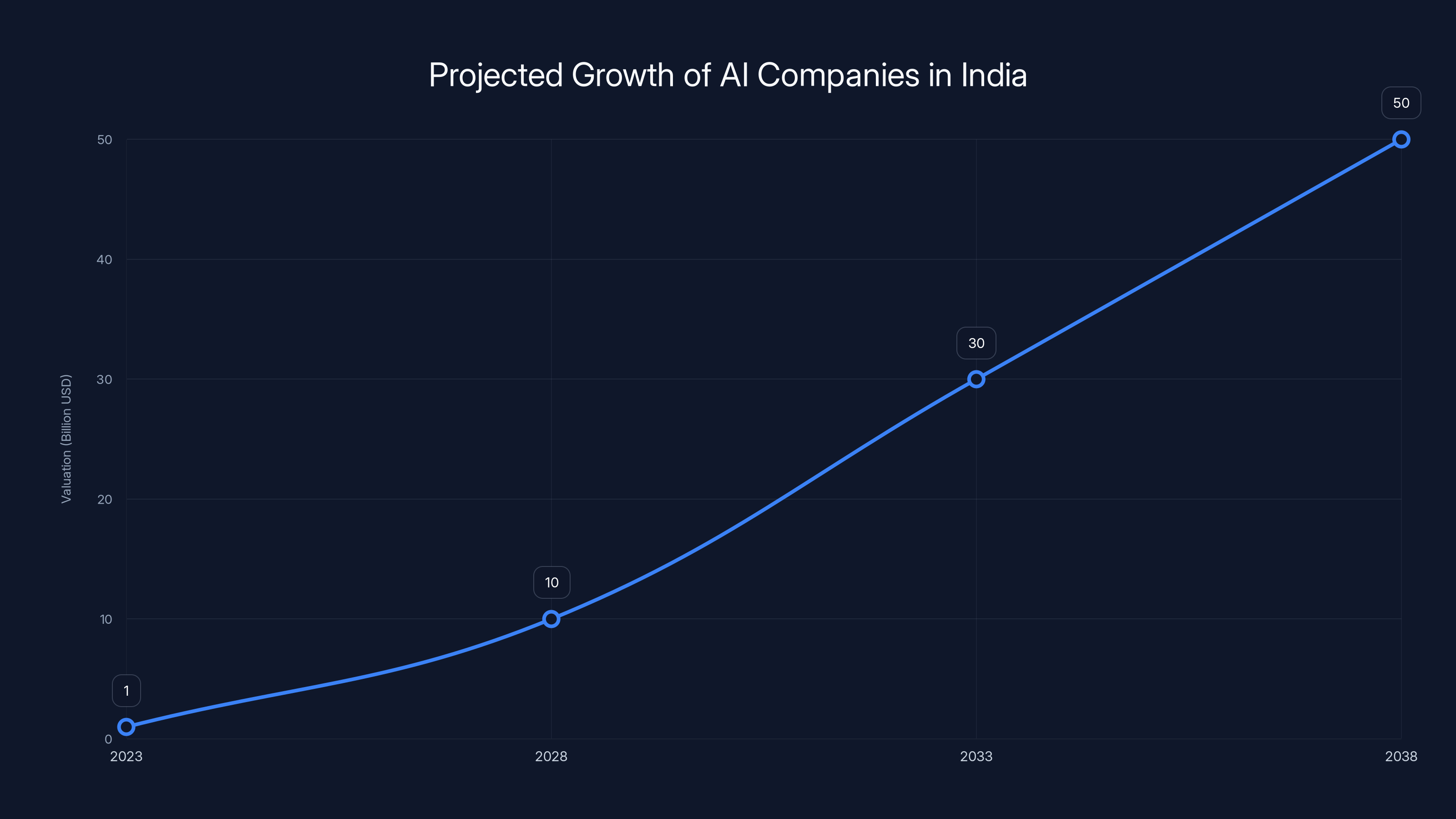

Estimated data shows potential growth of AI companies in India, influenced by Nvidia's ecosystem strategy. By 2038, a major AI company could reach a $50 billion valuation.

Challenges and Potential Friction Points

Nvidia's strategy is compelling but not without challenges. Running ecosystem programs at this scale is operationally complex, requiring consistent support quality and tracking outcomes. If poorly executed, programs become liabilities rather than assets. India's regulatory environment is generally supportive, but future regulations could create friction. Building relationships with thousands of founders is difficult, and managing expectations is critical.

As the AI industry matures, alternative hardware providers are emerging. AMD, Intel, and custom silicon makers are investing in AI hardware. If startups have good experiences with alternative hardware, Nvidia's early relationship advantages might erode over time. However, Nvidia's technological lead is substantial enough that this is a longer-term concern rather than an immediate threat.

What This Means for India's AI Ecosystem

Beyond Nvidia's strategic interests, this activity signals that India's AI opportunity is real and significant, attracting more venture capital to India. More capital flowing to Indian AI startups means more companies can be founded, more people can take risks on entrepreneurship, and more experiments can happen.

Historically, talented Indian engineers emigrated to the United States to build AI companies. That's still happening, but less so. When major tech companies provide resources, mentorship, and funding to Indian founders in India, it becomes more viable for talented engineers to stay and build locally. This is a significant long-term advantage for India, allowing the country to retain its technical talent.

As more resources flow into India's AI ecosystem, physical and digital clustering happens. Founders seek each other out, investors co-locate offices, and universities establish AI research centers. Clustering effects create knowledge spillovers, make talent recruitment easier, and create a cultural momentum around AI entrepreneurship.

One longer-term possibility is that India develops its own AI infrastructure companies that can compete with Nvidia. Historically, infrastructure innovation has been concentrated in the United States, but as India builds more AI companies and these companies face scaling challenges, some Indian entrepreneurs might decide to build infrastructure solutions. This could produce Indian competitors to Nvidia in areas like AI chip design, optimization, or platform development.

Timeline: What's Next for Nvidia in India

Based on Nvidia's announcement and historical patterns from similar initiatives, here's what to expect over the next 12 to 24 months:

Immediate (0 to 3 months):

- Activate fund launches its first cohort of 5 to 10 AI startups.

- AI Grants India begins disbursing grants to early-stage founders.

- Nvidia accelerates hiring in India to staff these programs.

Medium-term (3 to 9 months):

- Initial cohort of Activate companies reaches product-market validation stage.

- Several companies from Inception program announce funding rounds.

- Nvidia organizes India-specific developer events and conferences.

- Partnerships with venture firms begin producing visible collaborations.

Long-term (9 to 24 months):

- First companies from early-stage programs reach Series A and Series B funding rounds.

- Nvidia's engineer engagement begins translating into visible product improvements and adoptions.

- Ecosystem competitors (OpenAI, Google, Anthropic) demonstrate measurable outcomes from their own India programs.

- Discussion emerges about India's AI ecosystem maturity and whether it's producing globally competitive companies.

The success of this strategy will ultimately be measured by whether Indian AI companies founded with Nvidia's support go on to significant exits and create valuable businesses.

Lessons for Other Infrastructure Providers

Nvidia's India strategy is a masterclass in ecosystem engagement, but the lessons extend beyond Nvidia.

Engage Early and Often

The most valuable customer relationship is the one that begins before the customer has established competitive alternatives. Reaching founders before they've chosen infrastructure means your tools will be deeply embedded in the company's DNA.

Layer Your Approach

Nvidia isn't running a single program. It's running multiple overlapping programs: Inception for breadth, Activate for pre-seed depth, AI Grants India for earliest-stage founders, venture partnerships for scale-stage validation. This layering means Nvidia can reach a wide range of founder stages and needs.

Make Partnerships Part of Your Strategy

Nvidia isn't trying to do everything itself. It's partnering with accelerators, venture firms, nonprofits, and other ecosystem players. This allows Nvidia to extend its reach without proportionally increasing its overhead.

Track and Measure Outcomes

For these programs to be sustainable long-term, Nvidia will need to track outcomes. Which programs produce the most engaged founders? Which programs lead to the highest GPU adoption? Which partnerships are most productive? Without measurement, ecosystem programs become charity rather than strategic investments.

The Bigger Picture: Infrastructure Becomes Ecosystem

What we're witnessing with Nvidia's India strategy is a shift in how technology infrastructure companies compete. Ten years ago, tech infrastructure was a commodity market. You sold faster servers, cheaper compute, or more reliable services. Today, infrastructure competition is fundamentally about ecosystem control.

The company that owns the relationships with founders, investors, and developers becomes the default choice. The company that shapes how founders think about building wins long-term customer lock-in. Nvidia is winning this competition in the United States and is extending that victory to India.

In 15 years, when a major AI company founded in Bangalore is valued at $50 billion, there's a good chance that company was reached by Nvidia when it was just an idea in a founder's head and that founder never seriously considered alternative infrastructure. That's the prize Nvidia is really playing for.

Conclusion: Why This Moment Matters

Nvidia's increased focus on India's AI startup ecosystem isn't just a regional expansion. It's a statement about where the next wave of AI innovation is coming from. For 30 years, the United States has been the epicenter of technology entrepreneurship and innovation. That remains true, but the distribution is shifting.

India is becoming a major source of AI talent, entrepreneurship, and innovation. The country has the developer population, the cost structure, and increasingly, the ecosystem support and venture capital to build world-class AI companies. Nvidia is positioning itself to capture that opportunity by reaching founders early, providing meaningful technical support, and integrating itself into India's investment ecosystem.

This is a 10 to 20-year bet. Nvidia is willing to invest significant resources today to win customer relationships that will generate value for decades. The strategy is working, and similar moves by OpenAI, Anthropic, and Google suggest the entire industry recognizes the same opportunity.

For India's founders and investors, this is excellent timing. The global focus on India's AI opportunity is creating a wealth of resources, mentorship, and funding that didn't exist a few years ago. The infrastructure wars are no longer just about chips. They're about ecosystems, relationships, and the power to shape how the next generation of builders think about technology.

Nvidia understands this and is positioning accordingly.

FAQ

What is Nvidia's early-stage investment strategy in India?

Nvidia has announced multiple initiatives targeting Indian AI startups at different lifecycle stages: the Activate partnership for pre-seed and inception-stage companies, the AI Grants India program for earliest-stage founders, partnerships with major venture firms like Accel and Peak XV, and participation in the India Deep Tech Alliance. Together, these initiatives aim to reach over 10,000 early-stage founders over the next year while providing direct access to Nvidia's engineering expertise and GPU infrastructure.

Why is India strategically important for Nvidia's long-term business?

India has become one of the world's fastest-growing concentrations of AI developers and entrepreneurs, with over 400,000 engineers actively working on AI projects. The cost structure for starting AI companies is 60-70% lower than in the United States, allowing founders to remain independent longer. Most critically, Indian founders haven't yet locked into competing infrastructure choices, making this an opportunity for Nvidia to shape long-term customer relationships early.

How does the Activate partnership work for Indian AI startups?

Activate practices "inception investing," engaging with technical teams months before company formation. The $75 million fund plans to back 25-30 AI startups while providing portfolio companies direct access to Nvidia's engineering expertise. Activate's investor network includes prominent figures like Vinod Khosla and Perplexity co-founder Aravind Srinivas, giving portfolio companies significant credibility and network access.

What benefits do startups get from Nvidia's ecosystem programs?

Startups in Nvidia's programs receive GPU compute credits (typically

How does Nvidia's strategy compare to OpenAI and Google's India initiatives?

OpenAI, Anthropic, and Google are all making similar bets on India's AI ecosystem, each trying to build relationships with founders early and establish their platforms as default infrastructure choices. The competition is actually beneficial for Indian founders, as it increases the total supply of ecosystem support, mentorship, and resources available in the market.

What is the expected timeline for seeing results from Nvidia's India programs?

Initially (0-3 months), Activate's first cohort will launch and AI Grants India will begin disbursing grants. Medium-term (3-9 months), funded companies should reach product-market validation and funding round announcements. Long-term (9-24 months), companies should begin Series A and Series B funding, and measurable GPU adoption across portfolio companies should become visible.

How does this strategy affect India's broader AI ecosystem development?

Nvidia's and other major companies' investments in India's AI ecosystem increase the ecosystem's legitimacy, attract additional venture capital, improve talent retention by making it viable for engineers to build locally, create geographic clustering effects, and potentially spur development of Indian competitors to global infrastructure providers.

What is the ROI calculation for Nvidia on these early-stage ecosystem programs?

Even assuming a 5-10% success rate among founders Nvidia reaches, the math is compelling. A

Ready to explore how AI infrastructure decisions shape startup trajectories? Runable helps teams automate their most time-consuming development workflows with AI-powered agents, allowing you to focus on infrastructure strategy and product building instead of repetitive tasks. Start free today.

Related Topics to Explore

- India's AI Startup Landscape: Understanding the developer population growth, funding trends, and emerging company categories driving India's AI ecosystem

- Infrastructure Lock-in in AI: How early technology choices cascade through a startup's lifecycle and why infrastructure decisions matter more than most founders realize

- Global Tech Competition: The broader competitive dynamics between the U.S., India, and China in AI development and infrastructure

- Venture Ecosystem Development: Best practices for ecosystem programs, measuring program effectiveness, and creating sustainable support structures

- AI Chip Competition: The emerging landscape of GPU alternatives and custom silicon for AI workloads

Key Takeaways

- Nvidia is investing in India's pre-seed and inception-stage startups through multiple coordinated programs, not just serving mature companies.

- The strategy aims to lock in long-term infrastructure choices by reaching founders before competitive alternatives are established.

- India's 400,000+ AI developers and 60-70% lower startup costs make it an increasingly attractive market compared to the United States.

- Ventures like Activate, AI Grants India, and partnerships with top VCs create a multi-layered approach reaching different founder segments.

- Even with 5-10% success rates, the ROI on early-stage founder engagement is substantial when accounting for GPU consumption over decades.

![Nvidia's India AI Startup Strategy: Building Long-Term Demand [2025]](https://tryrunable.com/blog/nvidia-s-india-ai-startup-strategy-building-long-term-demand/image-1-1771549559839.jpg)