Mario Götze's Path from World Cup Champion to Venture Investor: How an Elite Athlete Built a Tech Portfolio Worth Millions [2025]

Most people remember Mario Götze for one perfect moment: July 13, 2014, a 113th-minute extra-time goal that gave Germany the FIFA World Cup championship. That shot changed his life forever. But if you've been following his career over the past few years, you've probably noticed something else. While still playing at the highest levels of professional soccer, Götze quietly built something equally impressive—a venture capital portfolio with over 70 companies, two of which became unicorns in 2025.

This isn't the typical "celebrity investor" story you might expect. Götze didn't just throw money at shiny startups or chase hype. Instead, he built something more deliberate: a personal investment vehicle called Companion M that applies the same discipline and strategic thinking to early-stage investing that made him a world-class athlete.

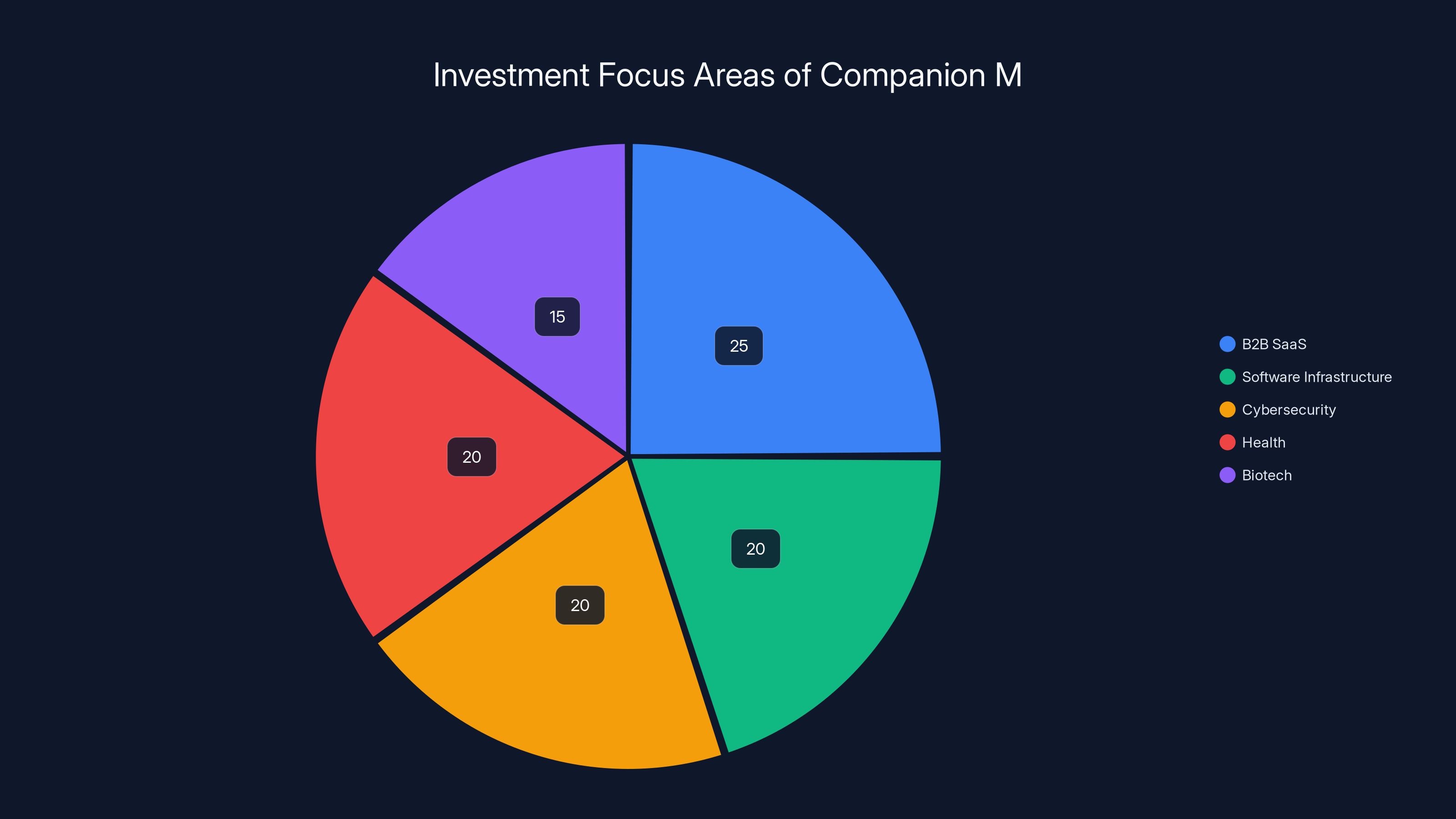

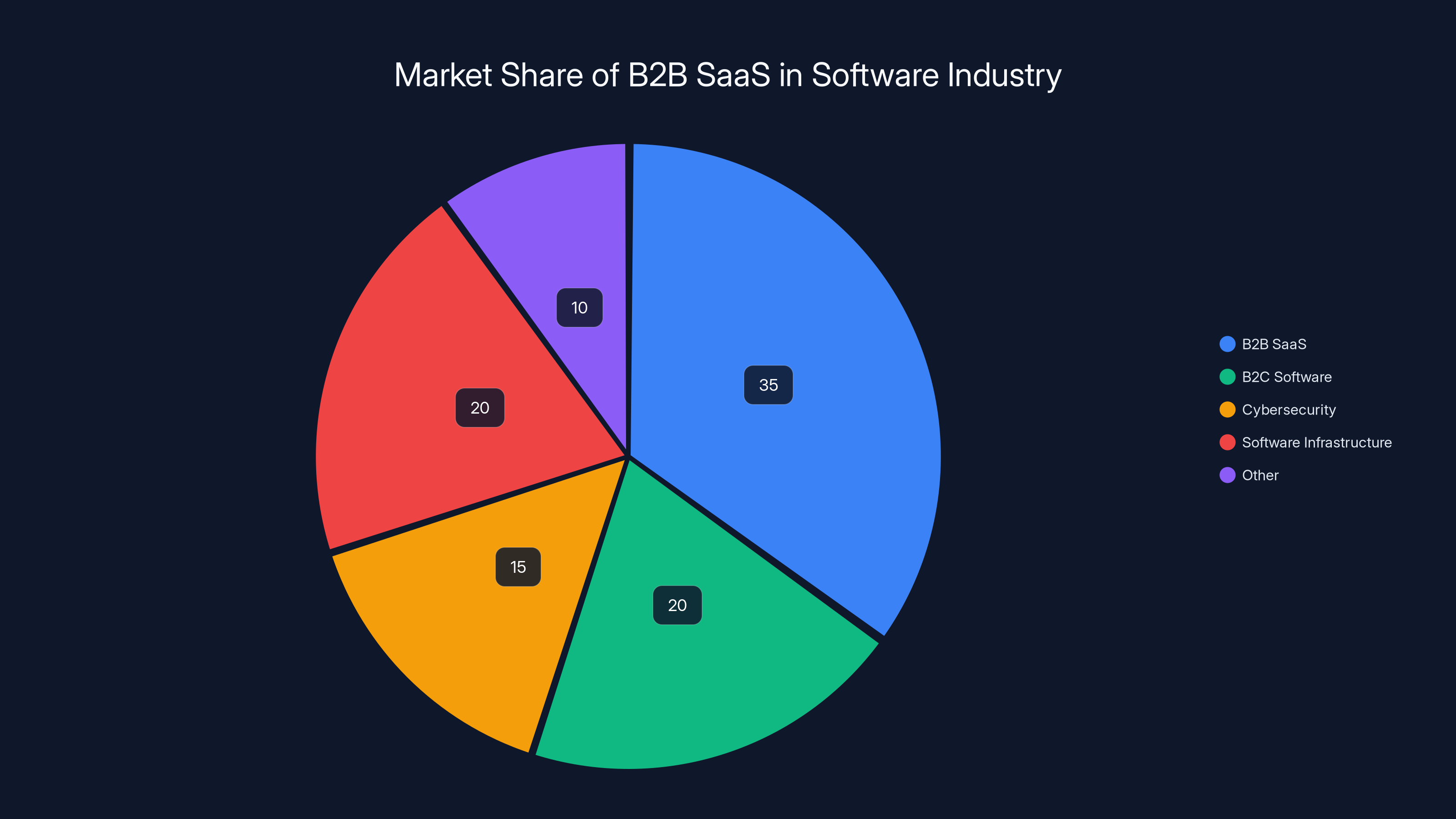

What makes his approach genuinely interesting is how unconventional it's been. While other athletes dabble in sports tech or lifestyle brands, Götze focused on B2B SaaS, software infrastructure, cybersecurity, and biotech. He invested in cannabis when European institutional investors wouldn't touch it. He backs venture firms on both sides of the Atlantic. And he's done all this while maintaining a professional soccer career, managing family life, and building something that could sustain him long after retirement.

In 2025, as Götze enters his mid-30s and contemplates life after professional sports, his investment portfolio has become increasingly sophisticated. Two portfolio companies—Flatpay, a Danish fintech, and Parloa, a German AI startup—hit unicorn status. Several others raised significant follow-on funding rounds. Some have exited profitably. His limited partner positions in 20+ venture capital firms mean he's thinking like an institutional investor, not just an angel.

This is the story of how an athlete built a venture portfolio. But it's also a story about discipline, networks, and thinking differently. And it raises interesting questions about why so few athletes actually become exceptional investors, and what Götze has figured out that others haven't.

The Foundation: From Soccer Field to Investment Office

Götze's path to angel investing wasn't random, though it might appear that way on the surface. You can trace it back to his family background. His father, Jürgen, isn't a soccer coach or agent. He's a professor at the Department of Electrical Engineering and Information Technology at TU Dortmund University. That's a clue about how Götze thinks.

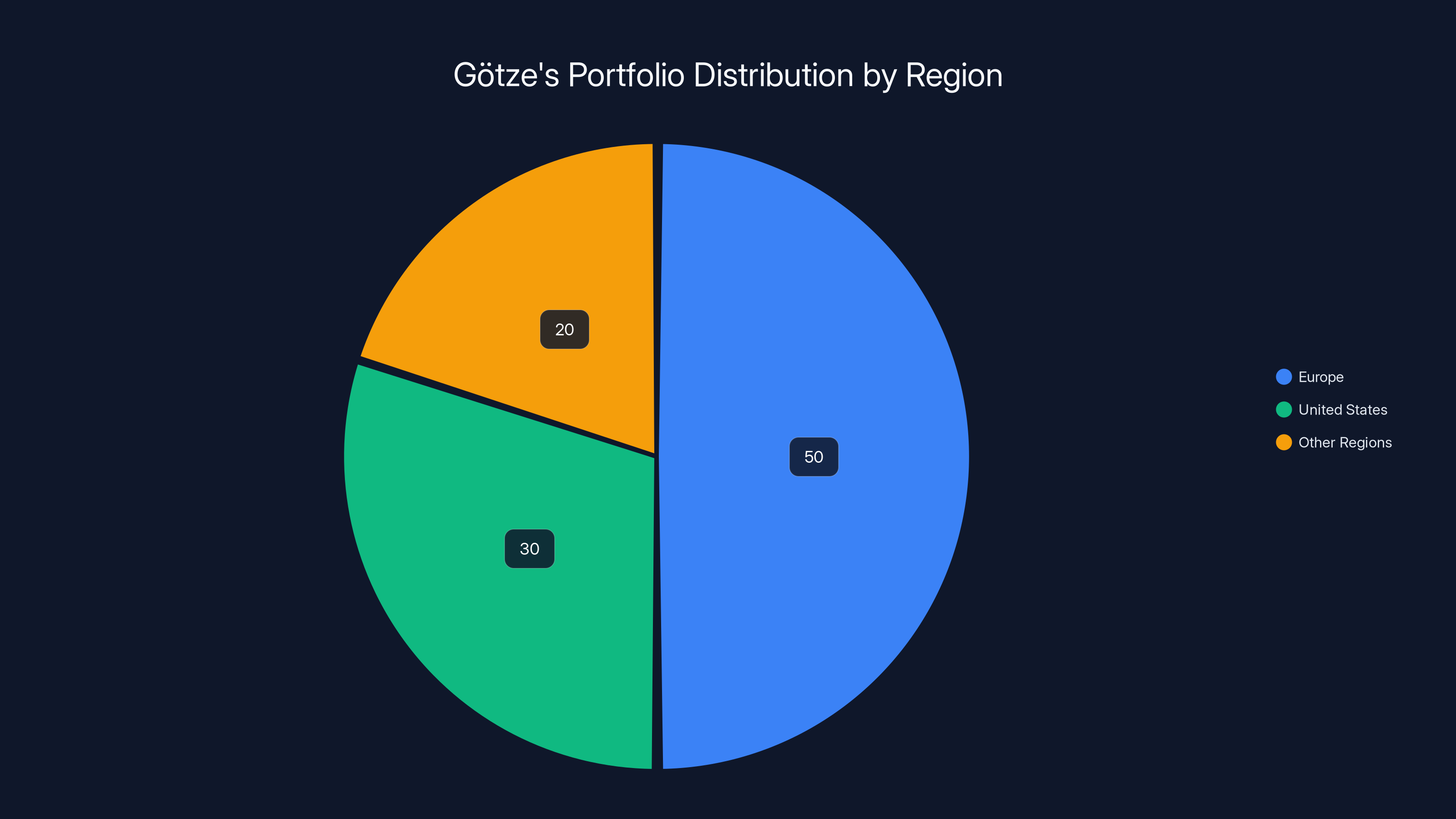

When Jürgen spent time at Rice University in Houston as a postdoctoral researcher, the family came along. For Götze, that exposure to the American research ecosystem left an impression. Years later, when he started thinking about where to invest, he split his focus between Europe and the United States intentionally. That's not accident—that's infrastructure.

Götze grew up in a household where technical innovation and intellectual rigor were valued alongside athletic excellence. His brothers all became soccer players, but they all had options. That kind of environment builds a different mindset. You don't default to doing the obvious thing because you've seen people choose different paths.

When Götze eventually started investing, he brought that framework with him. He wasn't trying to be a VC or build a fund—he was trying to be strategic about capital deployment. That distinction matters. Many celebrities become investors because it's the next status step. Götze became an investor because he already thought like one.

The actual vehicle—Companion M—launched with a specific structure. It's not a fund in the traditional sense. It's Götze's personal investment company, but it operates with a small team that supports him on angel investing, partnerships, and strategic positioning. Think of it as a one-person family office, but optimized for startup investing rather than wealth management.

That's an important distinction. Companion M isn't trying to manage assets for outside investors. It's not trying to hit fund return benchmarks. It's trying to deploy Götze's capital intelligently while supporting his personal brand and building optionality for his post-soccer life. That creates very different incentives than a traditional venture fund would.

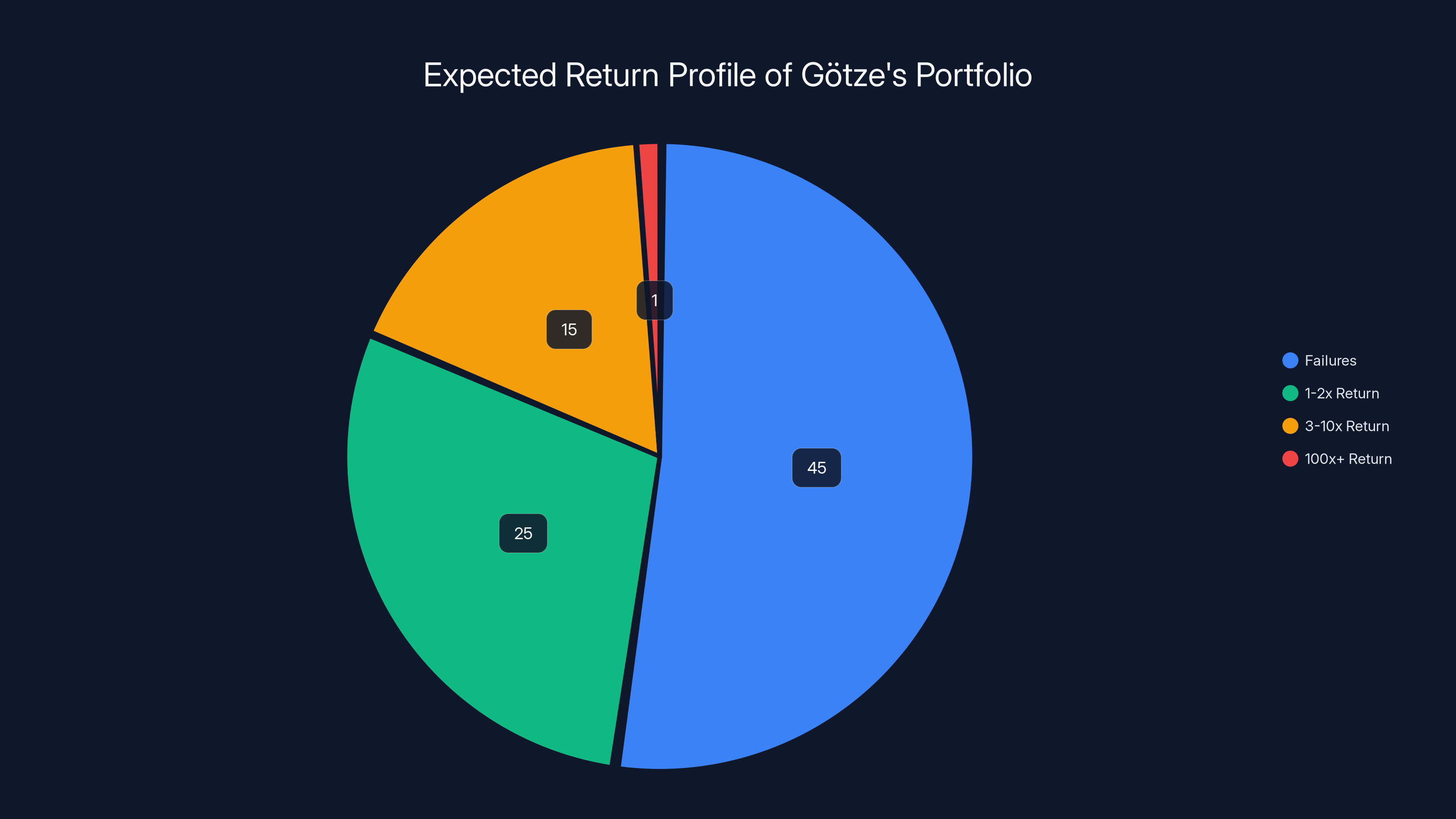

Götze's portfolio follows a typical early-stage investment distribution, where a small percentage of high-return investments (100x+) can significantly impact overall success.

Building the Investment Thesis: Focus Over Spray and Pray

One phrase keeps coming up in Götze's interviews about investing: "check all the boxes." When he talks about due diligence, he doesn't mean financial statements or market analysis. He means something more holistic.

"I only agree to invest if the startup and its founders check all the boxes," he told TechCrunch. That's vague on purpose, because the boxes are subjective. But it reveals something important about his investment philosophy: he's not trying to optimize for data points. He's trying to develop judgment.

Companion M's actual investment focus is disciplined. The primary areas are B2B SaaS, software infrastructure, cybersecurity, health, and biotech. Notice what's missing: sports tech, lifestyle brands, fitness apps, athlete nutrition. Those would be the obvious categories for a soccer player. Götze avoided them intentionally.

Why? Because he recognized early that having a personal connection to an industry doesn't make you a better investor in it. In fact, it often makes you worse. Your intuitions get clouded by familiarity. You think you understand the market better than you do. You miss obvious problems because you're too close.

Instead, Götze chose categories where he could be strategic without being emotional. B2B SaaS is scalable. Software infrastructure is resilient. Cybersecurity is necessary. Biotech and health align with his personal interest in human performance without being about sports directly.

The ticket size tells you something too. Companion M typically invests €25k to €50k (

That diversification is crucial. With 70 companies in the portfolio, even if 60 fail, two hit unicorn status, and the others produce modest exits, the math still works. Götze isn't trying to hit home runs on every single investment. He's trying to play a volume game with high conviction on thesis.

The network aspect matters too. Companion M focuses "on specific areas where we have built profound network and expertise." That phrase is doing a lot of work. It means Götze isn't just writing checks. He's making introductions. He's lending credibility. He's opening doors. That's why his brand matters—he's not just capital, he's connective tissue.

Companion M focuses on B2B SaaS, software infrastructure, and cybersecurity, avoiding more obvious sectors like sports tech. Estimated data based on described focus.

The Cannabis Investment: Strategic Bets and Market Tailwinds

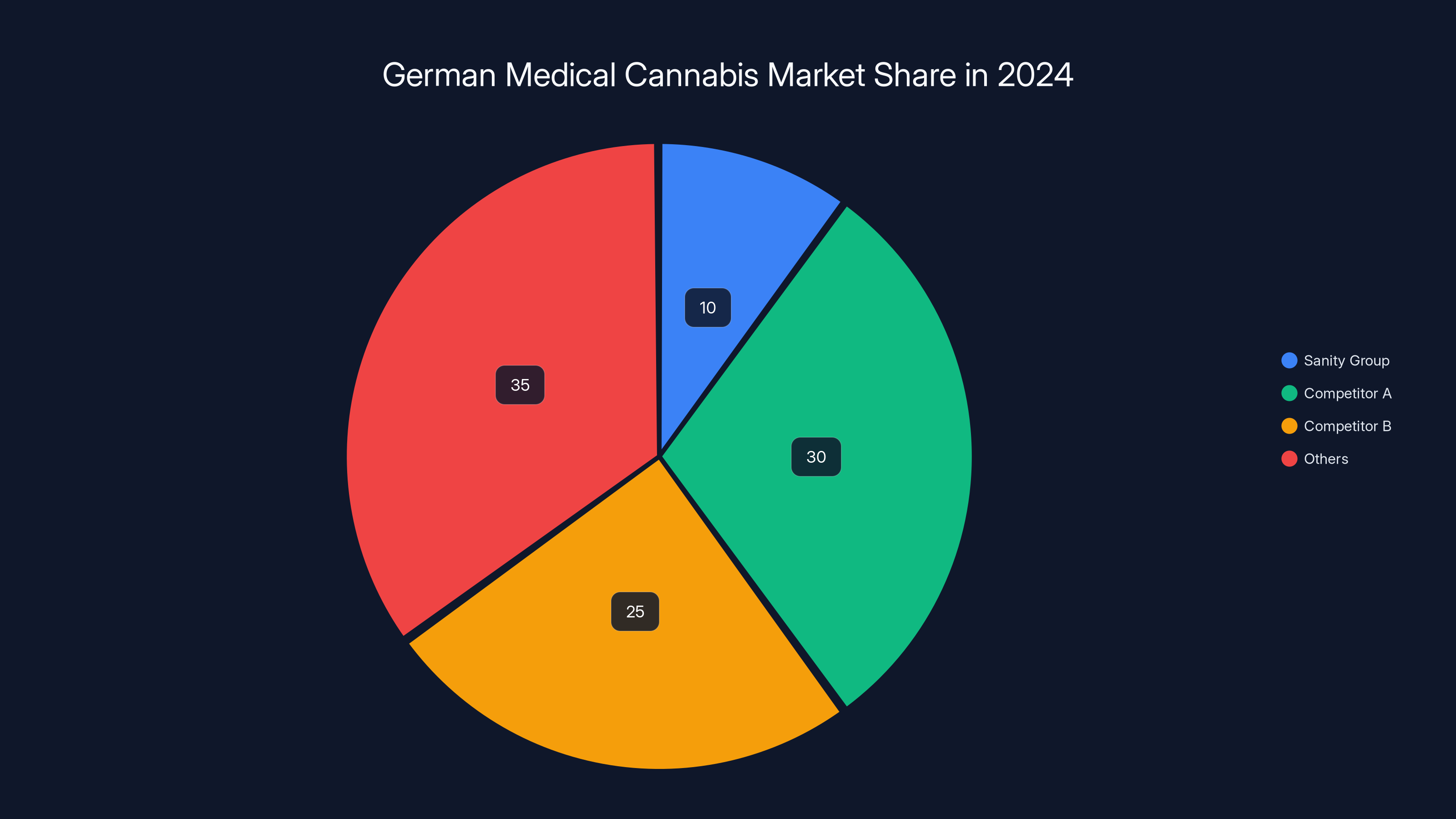

In 2020, when Götze invested in Sanity Group, a German cannabis startup, it made headlines. Not for the right reasons. European institutional investors were almost universally avoiding cannabis. The regulatory environment was uncertain. The stigma was real.

But Götze could see something others missed. Germany's cannabis laws were changing. The medical cannabis market was opening up. And unlike American investors, who had legal cannabis markets they could access, European institutional capital was sitting out an entire sector.

Sanity Group, by 2024, had captured approximately 10% of the German medical cannabis market. That's significant. And it happened because Götze was willing to bet on regulatory tailwinds when the consensus was skepticism.

There's a lesson embedded here about pattern recognition. The cannabis investment wasn't random. It fit the thesis (health/biotech), it was in a market where Götze had some advantage (German/European networks), and it depended on regulatory shifts that were actually happening.

Certainly, there's an irony: Götze can't use the product himself. Cannabis is banned for athletes in competition. At 33, still playing professionally at the highest level with Eintracht Frankfurt, he's operating under strict substance regulations. But that didn't stop him from investing in a market he understood intellectually.

That's another signal about how he thinks. He separates personal benefit from investment thesis. The cannabis bet isn't about lifestyle or personal use. It's about market opportunity and timing.

The cannabis play also tells you something about his willingness to be contrarian. When everyone else said no, Götze said yes. Not recklessly, but deliberately. That pattern—finding value where consensus is skeptical—shows up repeatedly in his portfolio.

Portfolio Deep Dive: The Companies and Returns

Götze's portfolio spans 70+ companies, but certain investments stand out. The two unicorns—Flatpay and Parloa—deserve specific attention.

Flatpay is a Danish fintech focused on flexible payment solutions. In a market flooded with fintech players, Flatpay found a differentiated position serving B2B customers with more sophisticated payment needs. The path from pre-seed investment to unicorn typically takes 5–7 years. That timeline suggests Götze was an early backer, possibly in 2019 or 2020.

Parloa is a German AI startup operating in conversational AI. This fits Götze's software infrastructure and AI thesis directly. Like Flatpay, hitting unicorn status in 2025 means the company achieved a $1 billion+ valuation. Both raises suggest real product-market fit and meaningful revenue traction.

Beyond the unicorns, Companion M has backed companies that went on to raise significant follow-on funding. Examples mentioned include Miami-based Arcee AI and Frankfurt-based Qualifyze. These are specialized plays in AI and professional services respectively. Having multiple companies graduate to larger rounds suggests Götze's selection process is working.

Ko Ro, a Berlin-based B2B marketplace for business supplies, represents a successful exit. Exits matter because they generate capital Götze can redeploy. More importantly, exits prove the thesis works. A company went from pre-seed to scale to acquisition or IPO. That's validation.

The geographic split—Europe and the United States—is deliberate. Götze has US investments (Arcee AI in Miami) and European ones (Qualifyze in Frankfurt, Sanity Group in Germany). That diversification reduces single-market risk and lets him exploit opportunities where he has networks.

What's missing from the portfolio tells you as much as what's there. No consumer social apps. No direct-to-consumer fitness or wellness. No sports tech, predictably. That discipline is rare. Most investors drift into noise. Götze holds the line.

Götze's portfolio is primarily focused on Europe (50%) and the United States (30%), with a smaller portion in other regions (20%). Estimated data based on described investments.

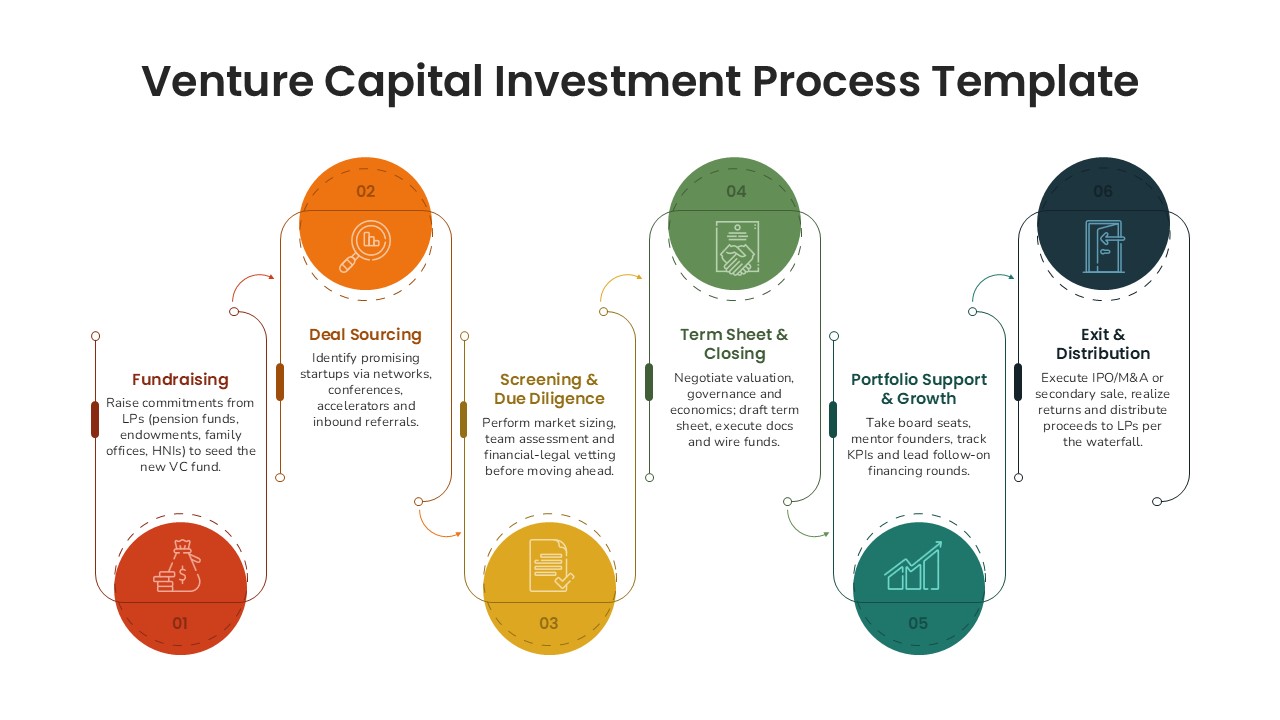

Limited Partner Strategy: Backing Venture Capital Firms

Here's where Götze's thinking expands beyond traditional angel investing. Companion M has taken limited partner positions in 20+ venture capital firms including 20VC, Cherry Ventures, EQT Ventures, Planet A, Merantix, Visionaries Club, and World Fund.

This is significant. It's different from angel investing. As an LP in venture funds, Götze isn't directly selecting companies. He's selecting investors. He's betting on their judgment and execution. That's a level of meta-investing that suggests real sophistication.

Why would Götze do this? Several reasons converge. First, diversification. With 20+ fund positions, he gains exposure to hundreds of companies across multiple geographies and sectors. One fund might focus on EU deep tech, another on US climate tech. Together, they create a diversified portfolio without requiring Götze to personally evaluate every company.

Second, it's a network play. By backing venture firms, Götze becomes a stakeholder in their success. Fund managers know they have a prominent investor in the cap table. That opens doors. When Götze later needs advice or introductions, those relationships are already established.

Third, it's preparing for what comes next. When Götze's professional soccer career ends, he envisions spending more time on his investment activities. By having LP positions in established firms, he'll already be embedded in the venture ecosystem. He won't be starting from scratch. He'll be moving from angel to institutional.

The specific funds tell a story too. 20VC focuses on seed and Series A companies, so that's direct access to companies at the stage Götze invests in. EQT Ventures is a substantial EU-focused firm, reinforcing his European presence. World Fund backs climate-tech startups, suggesting Götze cares about impact alongside returns. That's another signal: he's not purely financial. He's thinking about what he invests in.

Balancing Acts: Professional Athlete and Active Investor

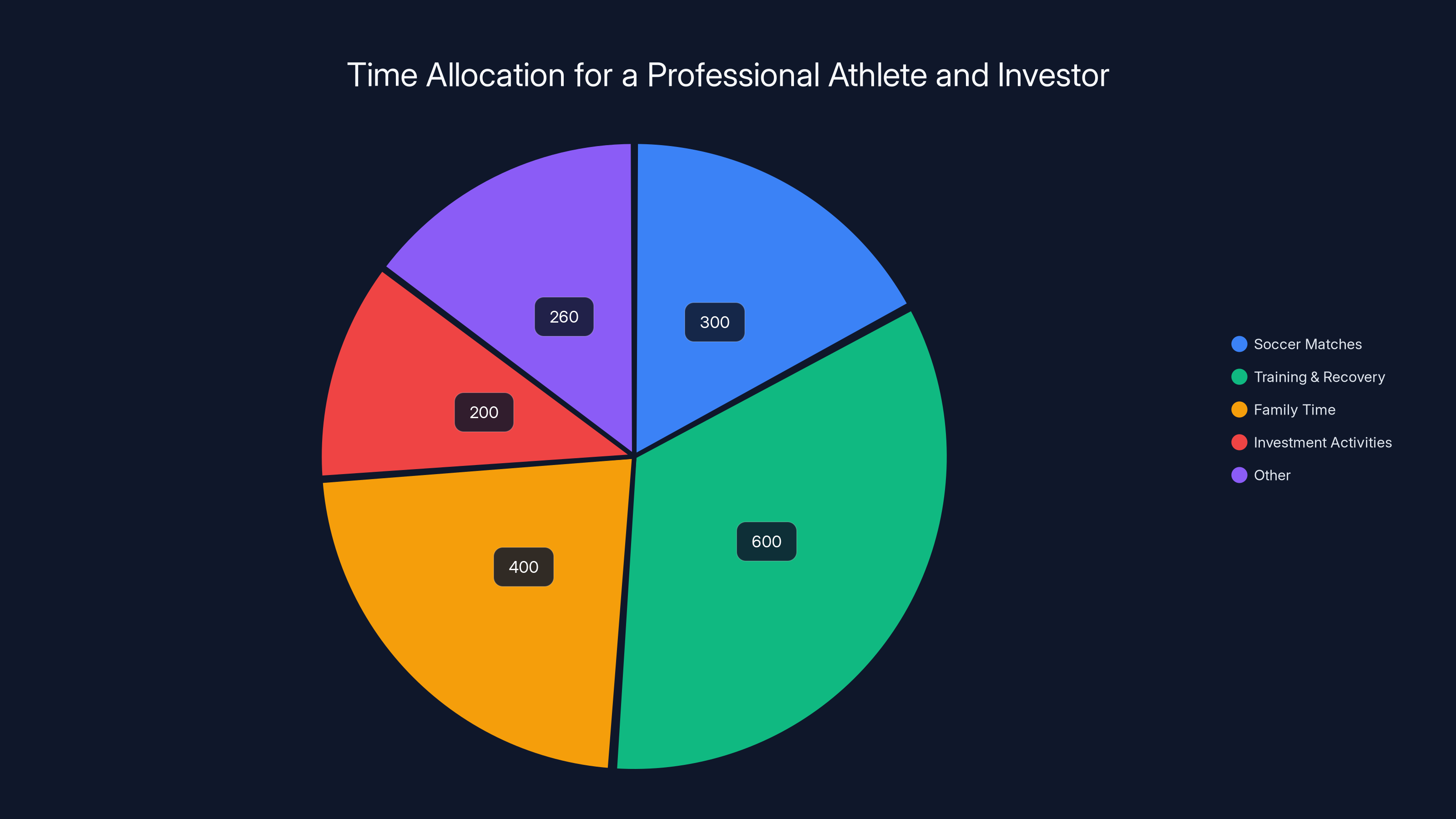

This is where the story gets real. Götze is 33 years old, still playing professional soccer at Eintracht Frankfurt, still performing at the highest level. He's also managing a family—two young daughters. And he's building an investment portfolio across two continents.

That's not three separate lives that magically coexist. That's one person trying to optimize against severe time constraints.

"I have to schedule calls before or after practices and align meetings with weeks when I don't have away games or play Champions League," Götze explained. That's not poetry. That's reality. Champions League games are midweek. Away games require travel. Pre-season training camps last weeks. There are injuries and recoveries. The calendar is brutal.

Many people would say that's too much. That he should pick one or the other. But Götze isn't optimizing for simplicity. He's optimizing for long-term optionality. He knows his professional career is finite. Soccer players don't play forever. But investors can invest forever.

So he's building optionality now, even though it's hard. Those calls before practice. Those meetings scheduled around Champions League. That infrastructure matters because it proves the thesis works at scale. He's not just interested in investing—he's actually doing it while managing one of the most demanding schedules in professional sports.

This is where being an athlete actually helps. Athletes understand constraint optimization. They're used to training windows, recovery protocols, game schedules. They think systematically about time. Götze probably approaches his calendar with more discipline than most VCs do.

There's also a branding element, though it's not cynical. When Revolut made Götze their first-ever brand ambassador for Germany, the fintech specifically cited his track record as an angel investor. That's unusual. Most athlete endorsements are about athletic performance, brand affinity, or reach. Revolut was endorsing his judgment.

That credibility matters for future opportunities. As Götze approaches the back end of his playing career, his brand is evolving. He's not just "the guy who scored in 2014." He's "the athlete-investor who picked Flatpay and Parloa." That narrative is more durable.

Sanity Group captured 10% of the German medical cannabis market in 2024, highlighting its strategic position in a growing sector. Estimated data.

The Competitor Class: Other Athletes in Venture

Götze isn't alone in this space, though he might be more disciplined than most. Cristiano Ronaldo and Kylian Mbappé also invest in startups. But there's a vast difference between having investments and having an investment practice.

Ronaldo's investments span a broader range: restaurants, a hotel chain, fitness apps, sports recovery brands. That's a lifestyle portfolio. It's entertaining, probably profitable, but it's not a thesis-driven investment strategy.

Mbappé's investments are similarly lifestyle-focused. Both athletes have celebrity and capital, but neither has built what Götze built: a systematic, thesis-driven approach that prioritizes regions and sectors over convenience.

In the United States, there's Kevin Durant. Durant invests actively and thoughtfully, backing companies like Whoop (wearable health tech), Duolingo (language learning), and others. He's thinking about his portfolio, not just taking every deal that crosses his desk.

But even Durant, with far more capital and opportunity than a European soccer player, doesn't maintain the discipline Götze does. He invests more broadly. Götze is pickier.

That's the real competitive advantage. Not that Götze has great judgment—lots of successful investors do. It's that he combined great judgment with extreme discipline about what he invests in. That combination is rare.

The Exit Strategy: Planning for What Comes Next

Götze is not hiding his intentions. "After my career ends, I plan to focus on my investment activities," he told Bloomberg. That's the plan. Professional soccer ends, investment career accelerates.

That's not a backup plan. That's an intentional transition. And it's why the LP positions in venture firms matter so much. They're the bridge. When his playing career ends, Götze won't be starting over. He'll have 70+ direct portfolio companies, positions in 20+ venture firms, and existing relationships with fund managers and founders across two continents.

That infrastructure is worth something tangible. Maybe it leads to him joining a venture firm as a partner. Maybe he raises his own fund. Maybe he stays independent but with more time to support his portfolio companies. The specific path is flexible. What's fixed is the foundation.

What Götze won't do—and he's explicit about this—is publish his "anti-portfolio." Those are the companies he passed on that later became huge successes. Everyone loves hearing those stories. They're humbling. They're educational.

But Götze sees through that. "There are plenty of new startups every year, and there will be some that you miss out on. But regretting past decisions leads to making uneducated or impulsive decisions in the future," he explained.

That's athlete psychology speaking. In soccer, you don't dwell on the shot you missed in the first half. You stay focused on the next opportunity. You make the best decision available with the information you have. You execute. You move on.

Applying that same mindset to investing is smart. It prevents the sunk-cost fallacy that destroys so many investment decisions. Götze will never say, "I should have backed Stripe" because that thinking would pull him away from evaluating current opportunities with clarity.

Estimated data shows Götze balancing his time across soccer, family, and investment activities, with roughly 300 hours annually for investment pursuits.

Sector Deep Dive: B2B SaaS and Why It Matters

B2B SaaS dominates Götze's thesis. That's not accidental. B2B SaaS is the most scalable software category. It's repeatable. It's rational. Customers buy it because it solves measurable problems and saves money.

B2C (business-to-consumer) software is riskier. It depends on adoption, habit formation, and preference. B2B SaaS is different. Build something that saves a customer $100k per year, and they'll pay for it. The economics are clean.

For an investor trying to reduce risk while maintaining upside, B2B SaaS is optimal. Add in software infrastructure and cybersecurity, and you're in categories where the TAM (total addressable market) is expanding faster than most markets. Companies need more security. Infrastructure needs to be more robust. Those are not fads.

That's also why the Arcee AI and other AI startup positions make sense. When AI becomes a B2B SaaS tool—infrastructure for building AI applications—the dynamics become more rational. You're not betting on consumer adoption of Chat GPT competitors. You're betting on tools that help companies build their own AI applications.

That's a thesis you can execute consistently. Götze can find companies working on that problem, evaluate their founders, and deploy capital knowing the market dynamics are real, not speculative.

Biotech and Health: An Athlete's Edge

The health and biotech focus deserves separate attention because it's where Götze might actually have some advantage. He's not a biotech expert, but he knows human performance from the inside.

That matters for understanding which biotech companies are solving real problems versus ones chasing hype. An investor without athletic background might fund a supplement company that promises performance gains. Götze probably wouldn't, because he knows what actually works and what doesn't.

The cannabis investment fits here too. It's biotech/health, but it also required understanding an emerging market. Götze had the networks to understand German regulation. He understood the opportunity. That knowledge gap—between European investors and the market—created alpha.

Other health and biotech companies in Götze's portfolio likely benefit from similar thinking. He's not trying to be a biotech VC. He's trying to find founders solving legitimate health problems with scientific backing. That's a constraint that filters out a lot of noise.

B2B SaaS commands a significant portion of the software market, estimated at 35%, due to its scalability and economic rationality. Estimated data.

The Math: How His Portfolio Returns Work

With 70 companies in the portfolio, the expected return distribution looks something like this:

Assuming €30k average ticket size across 70 companies equals €2.1 million deployed capital.

Typical early-stage portfolio outcomes:

- 40–50% of companies fail completely (return: 0x)

- 20–30% return 1–2x (modest exits or downrounds)

- 10–20% return 3–10x (good outcomes)

- 5–10% return 10x+ (breakouts)

- 1–2% return 100x+ (unicorns or greater)

With two unicorns, Götze has already exceeded median early-stage returns. A 1 billion dollar valuation on an initial €25k–€50k investment returns 20,000x–40,000x. Just one unicorn generates more value than the entire rest of the portfolio needs to produce for him to break even.

But valuations aren't returns. Return = exit proceeds divided by invested capital. If Flatpay and Parloa remain private or go public at lower valuations, the 20,000x doesn't materialize. Still, even halving those numbers gives you 10,000x, which is generational wealth on a single investment.

The math explains why Götze's strategy works. With enough data points and low enough ticket sizes, you can afford to wait for a few great outcomes. You don't need 50% winners. You need two 50x outcomes out of 70 companies. That's achievable.

Lessons: What Götze Got Right

Several things stand out about how Götze built this:

Thesis first, opportunities second. He decided what he'd invest in before he started investing. That kept him disciplined. When sports tech opportunities came along, he said no. When cannabis came along (health/biotech thesis), he said yes.

Geographic diversification. Europe and the US. That reduces single-market risk and forces him to build networks in multiple places.

Low enough tickets to diversify. €25k–€50k meant he could back 70 companies without excessive concentration risk. That wasn't luck. That was design.

Small team support. He didn't try to do everything himself. Companion M has a team. That's how he balanced professional soccer and investing.

LP positions, not just angel rounds. This was the forward-thinking move. It embedded him in the venture ecosystem for the long term.

Conviction without ego. He's willing to bet on things others avoid (cannabis) but not so confident he overcommits. €25k–€50k is bold, not reckless.

The Risks: What Could Go Wrong

No story is without tension. Götze's setup has vulnerabilities.

Portfolio concentration in high-failure sectors. Even with 70 companies, early-stage startups fail at high rates. If macro conditions deteriorate, many of these companies could hit fundraising walls simultaneously.

Founder quality variation. Götze meets many founders. His judgment is good, but judgment is still subjective. Bad founder-market fit exists. Some picks will be worse than expected.

Regulatory risks. Sanity Group and biotech positions depend on favorable regulatory environments. Germany's cannabis laws could shift. FDA approval timelines could extend.

Opportunity cost. The time Götze spends on investing is time he's not spending on other things. With limited playing career remaining, is that trade worth it? Only he can answer.

Concentration in emerging tech. B2B SaaS, AI, biotech are all growth-stage bets. They're exposed to capital markets and appetite for risk. A recession hits and these categories suffer first.

These aren't necessarily disqualifying. They're just part of the risk profile. Götze knows this. He's built the portfolio anyway.

Timeline: From First Investment to Where He Is Now

The actual chronology isn't perfectly clear, but we can reconstruct it:

2020 or earlier: Early angel investments, including Sanity Group (cannabis).

2020–2022: Scaling to dozens of investments, beginning to take LP positions in venture firms.

2023–2024: Portfolio matures, Flatpay and Parloa raise later rounds and approach unicorn status.

2025: Flatpay and Parloa both hit unicorn valuations. Götze is now managing a multi-company, multi-stage portfolio.

That timeline suggests the portfolio has been building for about 5 years. Five years is still early days, but it's long enough to see meaningful patterns. Two unicorns in 70 companies in 5 years is a strong track record.

Looking Ahead: The Next 5 Years

What happens next depends partly on Götze's playing career. He's 33. Professional soccer typically ends in the mid-30s, sometimes pushing to 35–36 if you're still performing at high levels.

Assuming Götze plays 3–5 more years, the investment portfolio will continue to scale. More follow-on funding rounds. More exits. More portfolio companies raising Series A and beyond.

The LP positions in venture firms will mature too. Capital allocated to those firms in 2020–2022 is coming due for return in 2025–2027. Götze will see his first major venture fund exits. That'll test whether his fund selection skills are as good as his company selection skills.

Post-playing career, you can expect Götze to move into institutional venture space. Whether that's as a partner at an existing firm, as a founder of his own fund, or as a full-time operating advisor to portfolio companies isn't certain. But something will shift. The balance between soccer and investing won't be possible anymore. One will dominate.

Given how seriously he's taken the investment infrastructure, investing will likely dominate.

The Bigger Picture: Why This Matters

Götze's example is useful for two audiences.

For other athletes: It shows that you can build a real venture portfolio without waiting until retirement. You can do this concurrently. It requires discipline and good support structure, but it's possible. It also shows that being an athlete doesn't make you a worse investor—it might even help because you think in terms of constraints, execution, and long-term planning.

For non-athletes thinking about angel investing: It shows how thesis matters more than deal flow. It shows how geographic diversification reduces risk. It shows how low ticket sizes and high company counts let you win the portfolio math game rather than trying to be right on every single investment.

Most importantly, it shows that systematic investing beats opportunistic investing. Götze didn't just say yes to interesting pitches. He built a framework, then used that framework to filter opportunities. The framework did most of the work.

FAQ

What makes Mario Götze's investment approach different from other athlete-investors?

Götze focuses on B2B SaaS, software infrastructure, and biotech rather than lifestyle or sports-adjacent sectors. He established a clear investment thesis before deploying capital, takes disciplined €25k–€50k positions across 70+ companies for portfolio diversification, and supports his investments through a team at Companion M rather than simply writing checks. This systematic approach has generated two unicorns (Flatpay and Parloa) in five years, outperforming most early-stage portfolios.

How does Companion M actually structure its investments?

Companion M operates as Götze's personal investment vehicle with a small supporting team. The vehicle splits capital across direct early-stage company investments (typically pre-seed and seed rounds), limited partner positions in 20+ venture capital firms, and strategic partnerships. The relatively small ticket sizes (

Why did Götze invest in cannabis when most European VCs avoided it?

Götze recognized that Germany's cannabis laws were liberalizing before the broader institutional market did. His health and biotech investment thesis aligned with the opportunity. By 2024, his investment in Sanity Group had positioned the company to capture approximately 10% of the German medical cannabis market. This exemplifies his willingness to invest against consensus when the underlying thesis is sound, combined with conviction in regulatory tailwinds.

What is the expected return profile of Götze's portfolio structure?

With a typical early-stage distribution where 40–50% of companies fail, 20–30% return 1–2x, 10–20% return 3–10x, and 1–2% return 100x+, even one or two unicorn successes can justify the entire portfolio. Götze's two unicorns alone generate exceptional returns on €2.1 million of total capital deployed, making portfolio success highly likely even if 60+ companies generate no return.

How does Götze balance professional soccer with active angel investing?

Götze schedules calls before or after training sessions and coordinates investment meetings around match schedules and Champions League commitments. This constraint-based approach reflects his athletic background, where optimizing limited time windows is fundamental. The combination of a dedicated Companion M team and his systematic investment thesis means he isn't constantly evaluating new opportunities—he's executing a predetermined framework, which reduces time requirements significantly.

What are Götze's plans after his professional soccer career ends?

Götze explicitly stated that upon retirement, he plans to "focus on my investment activities." His LP positions in 20+ venture capital firms position him to transition into institutional investing. Whether through joining an existing venture firm as a partner, raising his own fund, or serving as an operating advisor to portfolio companies remains open, but the infrastructure is already in place for a full-time investment career.

How does geographic diversification (Europe and US) benefit Götze's portfolio?

Splitting investments across the Atlantic reduces single-market risk and exploits regional information advantages. Götze's family background (exposure to Rice University in Texas) gave him familiarity with American venture ecosystems. His German and European networks provide insider access to European opportunities. This dual-geography approach means he can find and evaluate deals in markets where he actually has networks and context, rather than trying to be broadly global.

What role do Götze's LP positions in venture firms play in his overall strategy?

LP positions in firms like 20VC, EQT Ventures, Cherry Ventures, and others provide diversification across hundreds of companies without requiring Götze to personally evaluate each one. More strategically, they embed him in the venture ecosystem and create relationships with fund managers he can collaborate with later. These positions also reduce single-company risk while maintaining upside exposure to emerging categories and geographies he might not cover with direct angel investments.

Why hasn't Götze published his anti-portfolio of deals he passed on?

Götze explicitly rejected this idea because regretting past decisions leads to worse future investing. His athlete's mindset focuses on optimizing the next decision, not dwelling on previous ones. This prevents the sunk-cost fallacy and emotional reasoning that derails many investors. The philosophy is fundamentally different from how celebrity investors often approach sharing "lessons learned."

What can non-athletes learn from Götze's investment strategy?

The core lessons are thesis-first investing (decide what you'll invest in before evaluating deals), consistent ticket sizing (€25k–€50k across many companies reduces concentration risk), geographic diversification, systematic process over deal flow, and thinking about post-investment support (via team or LP positions). Most importantly, Götze's example shows that success in angel investing comes from discipline and framework, not from getting lucky on a single company. The portfolio math does the work if you build the right structure.

Conclusion: The Athlete Who Thinks Like a Venture Capitalist

Mario Götze's World Cup goal in 2014 was the moment that changed his life. But the decades that follow might be changed even more by the portfolio he's quietly built in parallel.

What's interesting about Götze's story isn't that he became an angel investor. Plenty of famous people do that. What's interesting is how intentionally he built the structure. He didn't wait until his playing career was over. He didn't just chase deals. He didn't try to be an expert in sectors where he had personal interest (sports tech, fitness).

Instead, he thought like a systems engineer. His father's background in electrical engineering clearly rubbed off. He designed an investment process. He selected categories where he could have disproportionate insight. He diversified. He scaled to 70 companies across two continents while still performing at the highest level of professional sports.

Two of those companies became unicorns in 2025. Others are raising larger rounds. Some have exited. The portfolio is generating real returns.

But maybe the more valuable thing is that Götze has built optionality for the next 30 years of his life. Professional soccer has a finite horizon. Investing doesn't. By starting now, building the infrastructure now, developing the networks now, Götze has set himself up to move fluidly from athlete to investor-as-career.

That transition is harder than most people realize. You lose the structure of professional sports. You lose the feedback loops that tell you daily whether you performed well. You lose the peer community. Many athletes struggle with that transition. Götze seems to be building intentionally to avoid that struggle.

The portfolio itself—70 companies, two unicorns, positions in 20+ venture firms—is impressive. But the real achievement is the process. Götze has proven he can build a systematic investment practice that generates exceptional returns while maintaining a world-class athletic career.

When he retires from soccer, that process becomes even more powerful. He won't be squeezing calls around training schedules. He'll have full attention to allocate. And he'll have years of pattern recognition and network building already complete.

The next decade of Götze's life could generate far more impact than the 2014 World Cup goal. The goal was about one moment of excellence. The investment career is about decades of disciplined compounding.

For anyone paying attention to how elite athletes build alternative careers, or how systematic investing actually works in practice, Götze's path is instructive. He's written a playbook that combines athletic discipline with venture thinking. That's rare. It's probably going to work.

One more thing: that athlete's mindset about not dwelling on missed opportunities? That's genuinely excellent advice for investing. The best decision you can make today is better than regretting the decision you made three years ago. Götze understands that better than most. That alone might make him a better investor than people with a lot more time to focus on venture.

The World Cup trophy sits on a shelf somewhere. The real trophy might be the portfolio he builds over the next 30 years.

Key Takeaways

- Götze's investment vehicle (Companion M) manages 70+ companies with disciplined €25k–€50k ticket sizes, generating two unicorns by 2025—Flatpay and Parloa

- His thesis focuses on B2B SaaS, software infrastructure, cybersecurity, and biotech, deliberately avoiding sports-adjacent sectors despite his athlete status

- Two-continent geographic diversification (Europe and US) combined with LP positions in 20+ venture firms creates institutional-grade portfolio structure

- Athletic mindset translates directly to investment discipline—constraint optimization, avoiding sunk-cost fallacies, and systematic decision-making beat opportunistic deal chasing

- Götze explicitly plans to transition into full-time investing post-playing career, using existing portfolio infrastructure and VC relationships as the foundation for institutional investing

![Mario Götze's Path from World Cup Champion to Venture Investor [2025]](https://tryrunable.com/blog/mario-g-tze-s-path-from-world-cup-champion-to-venture-invest/image-1-1767724818382.jpg)