Introduction: When Politics Meets Physics

It's a strange moment in American energy policy. The Trump administration ordered a complete halt to five offshore wind projects totaling 6 gigawatts of capacity in December 2024, citing national security concerns about radar interference. Three federal judges, across three different courtrooms, essentially told the administration: nice try, but no. According to The New York Times, these legal setbacks are seen as a positive development for the offshore wind industry.

This isn't just about wind turbines spinning off the coast. It's about whether the government can unwind years of environmental review, engineering analysis, and multi-billion-dollar private investment with a single December memo. It's about whether a 90-day construction halt sticks when developers argue the reasoning is, as one judge noted, conspicuously lacking from the government's actual legal brief.

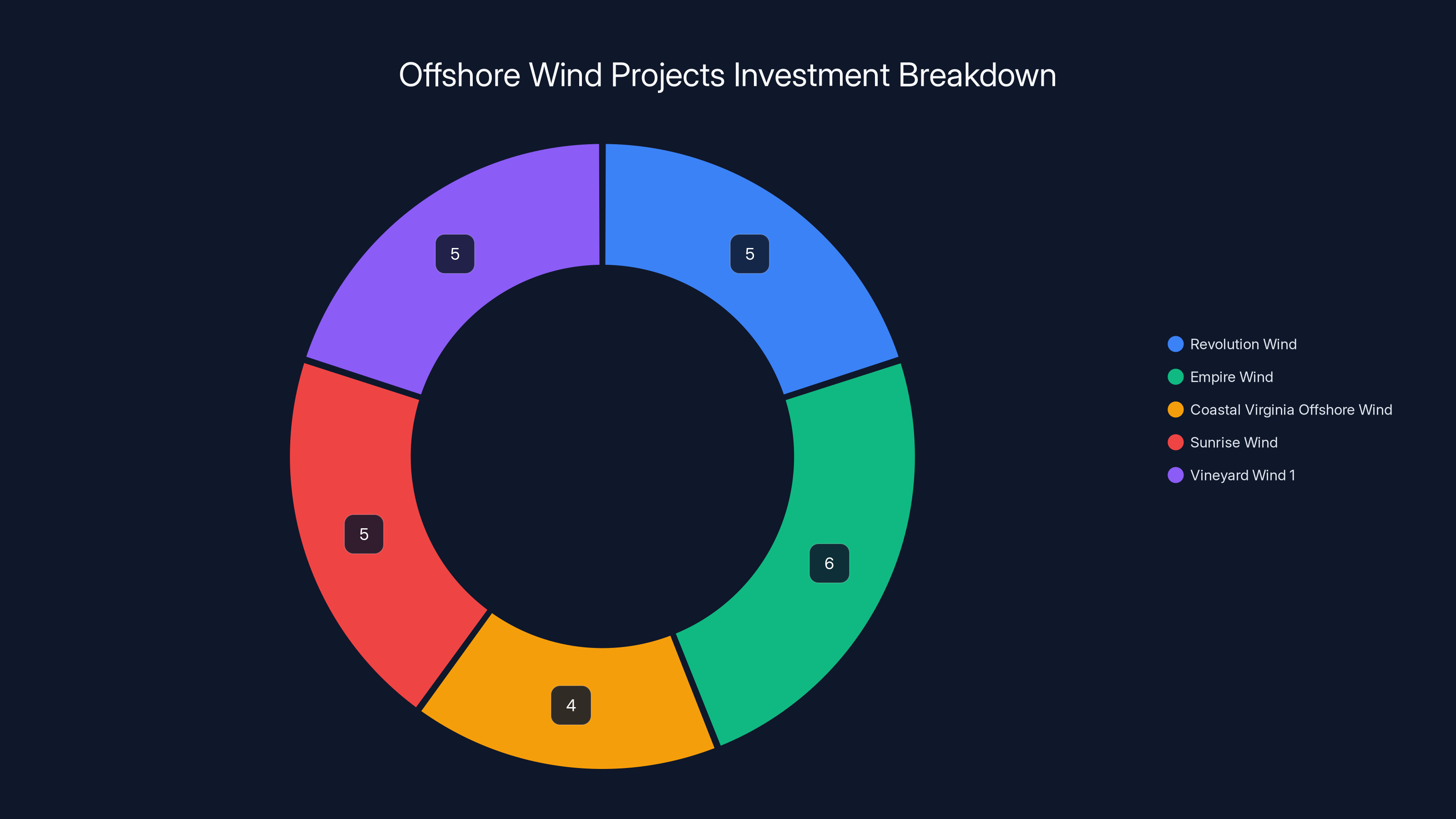

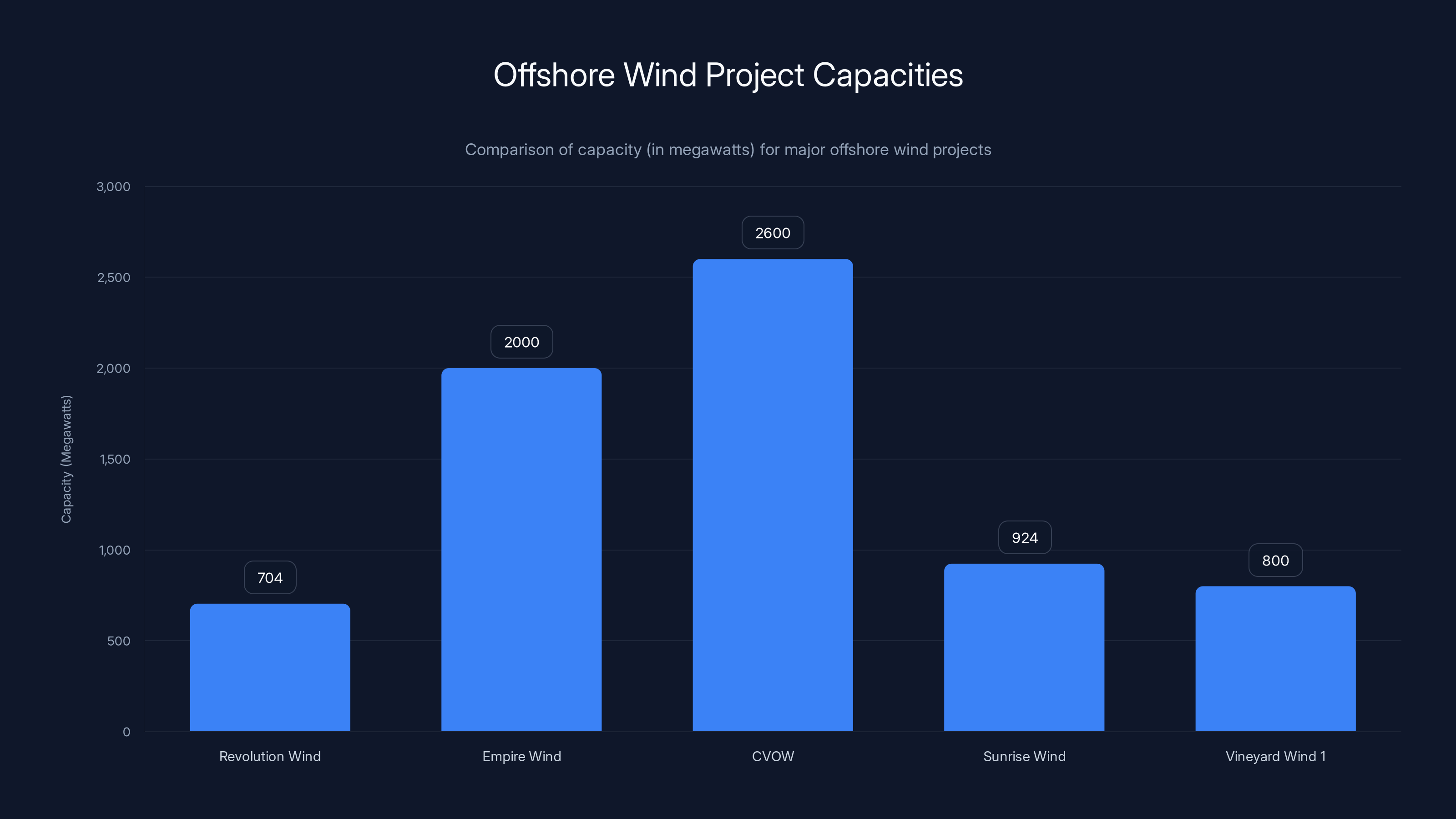

The legal victories matter because they create breathing room. Revolution Wind off Rhode Island, Empire Wind off New York, and Coastal Virginia Offshore Wind are now back to work. Two other projects, Sunrise Wind and Vineyard Wind 1, remain in legal limbo with hearings scheduled through February 2025. Combined, these projects represent roughly $25 billion in private investment and enough electricity generation to power millions of homes across some of America's most expensive electricity markets.

But here's what makes this story actually interesting: it's not really about whether you love or hate wind turbines. It's about grid infrastructure, power costs, manufacturing capacity, and whether decisions made in agency offices can survive judicial scrutiny when they contradict prior analysis. The administration's concern about radar interference is legitimate. The question is whether the solution required shutting down active construction sites that had already navigated this exact issue during permitting.

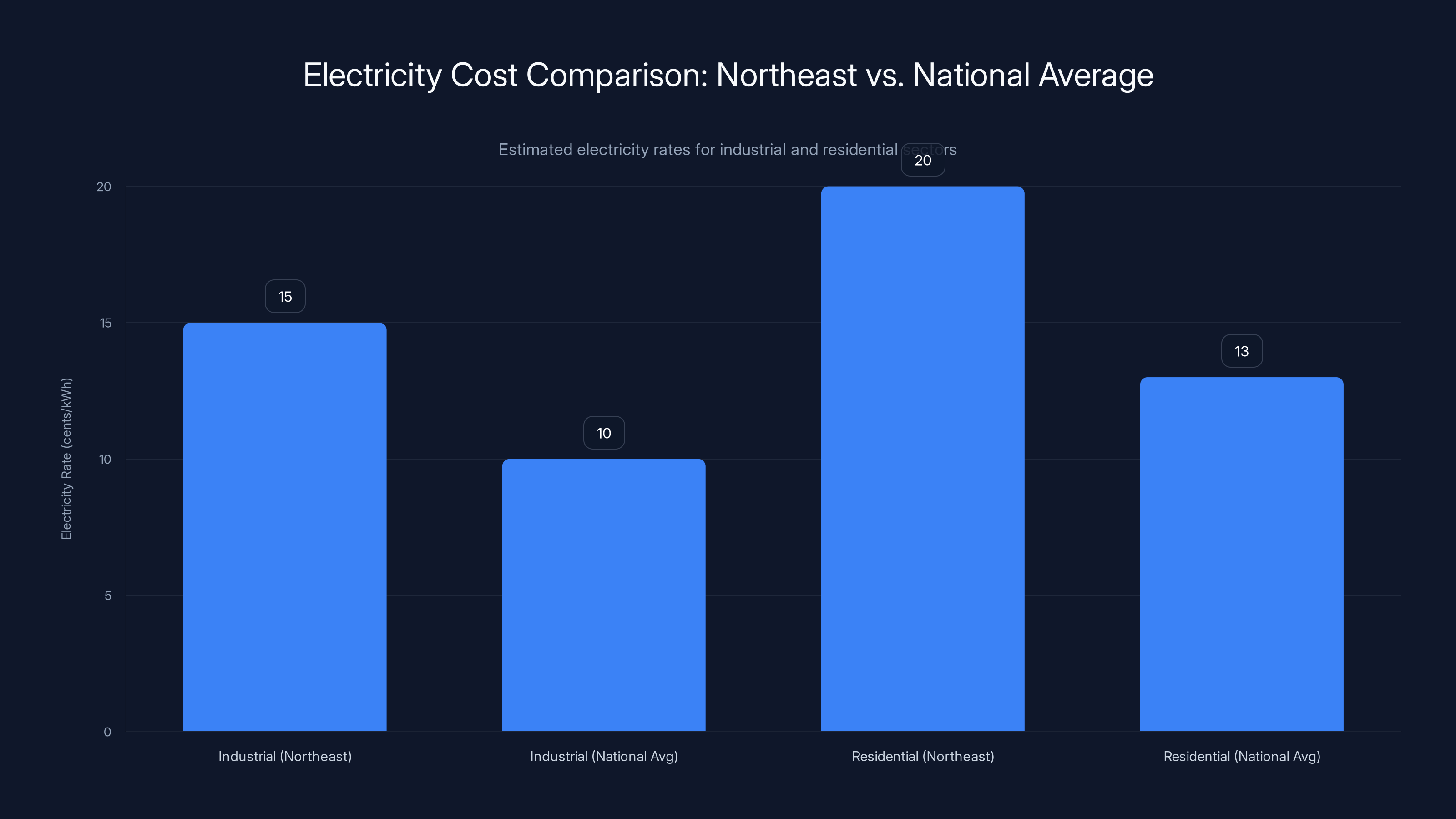

The East Coast needs this power. The Northeast currently pays some of the highest electricity rates in the nation. Data centers, hospitals, manufacturing facilities, and millions of residential customers are all facing rising energy costs. Offshore wind, as one of the cheapest forms of new generating capacity available today, represents a practical solution to a real problem. According to Brookfield's insights, offshore wind is crucial for meeting the region's energy demands.

Let's dig into what happened, why it happened, and what comes next for offshore wind development in America.

TL; DR

- Three judges blocked the Trump administration's offshore wind construction halt across three separate courtrooms in Virginia and Washington, DC, allowing work to resume on major East Coast projects

- Federal judges cited weak legal reasoning, noting the government's brief failed to address core arguments and lacked coherent national security justification for stopping construction

- $25 billion in private investment is now moving forward, with three projects resuming work and two others expected to prevail in February hearings

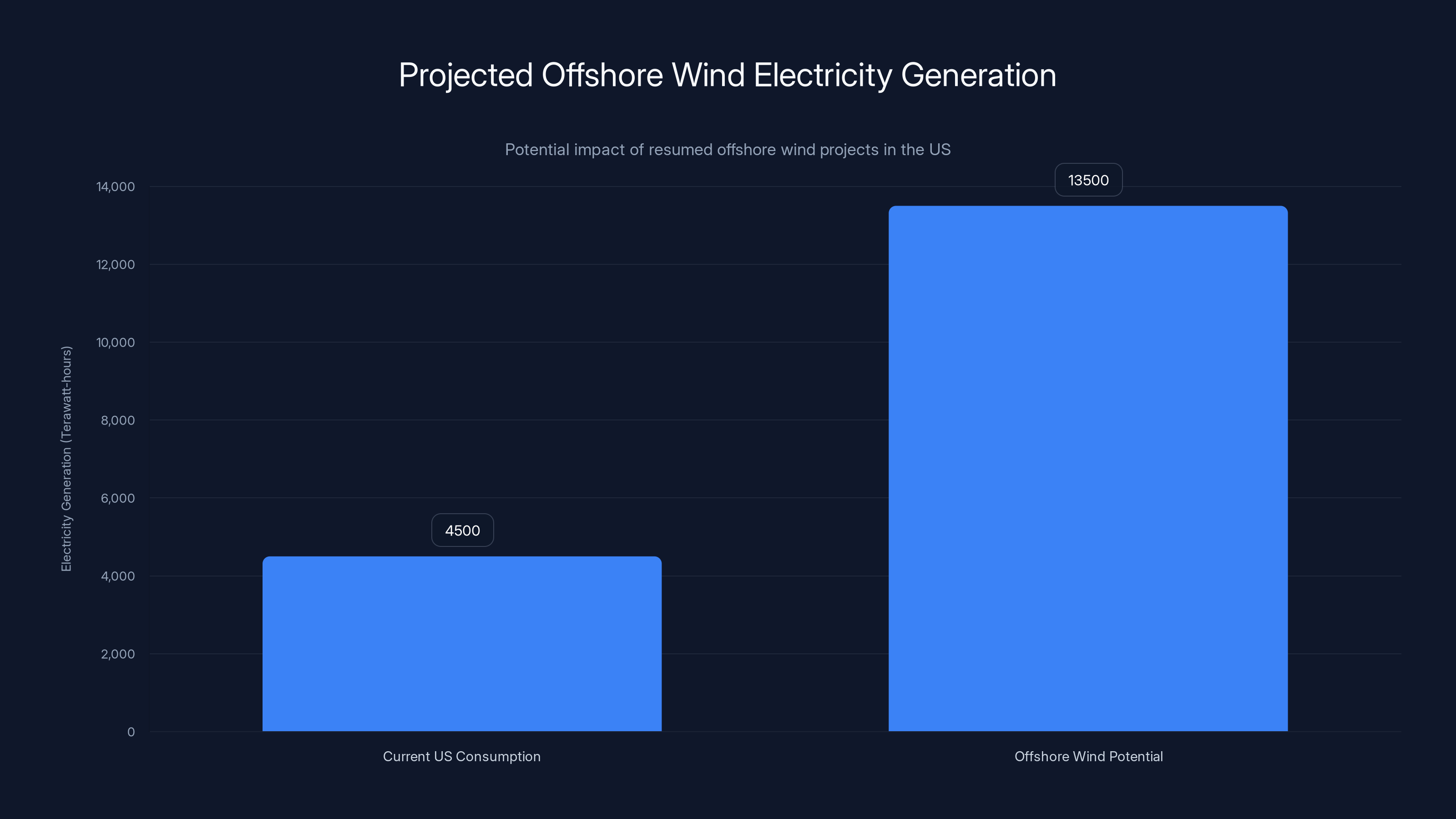

- Offshore wind could generate 13,500 terawatt-hours annually, more than three times current US electricity consumption

- The Northeast faces electricity costs 40-60% higher than national average, making cheap offshore wind deployment critical for economic competitiveness

Estimated investment distribution shows significant private investment in each project, totaling $25 billion. These projects are crucial for meeting energy demands in high-cost electricity markets. Estimated data.

The December Bombshell: How the Halt Happened

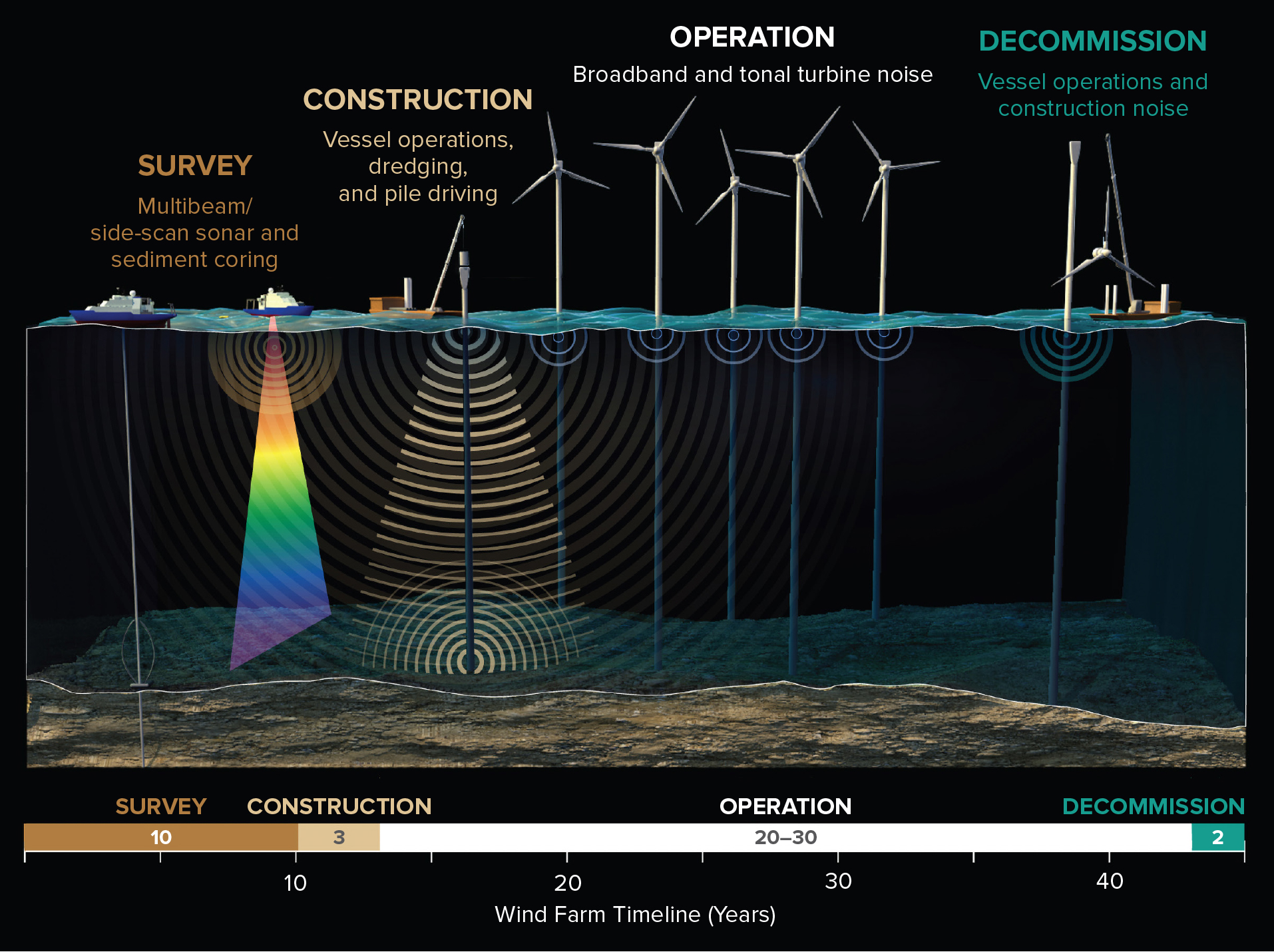

On December 19, 2024, just days before Christmas, the Trump administration's Department of the Interior issued an extraordinary order: all work on five offshore wind projects must stop immediately. The stated reason was national security. The government alleged that wind farms would interfere with military radar operations, creating blind spots in defense networks.

For context, this wasn't a hypothetical concern pulled from thin air. Radar systems genuinely can struggle with wind turbine signatures. The spinning blades create electromagnetic reflections that radar equipment interprets as targets or noise. It's a real technical problem that engineers have been grappling with for years across multiple continents.

The timing, however, raised eyebrows. The projects had been under development for three to four years. Environmental impact assessments, radar compatibility studies, military reviews, and state permitting had all been completed. The government itself had approved these projects knowing about the radar concern. So why the sudden 90-day halt?

The administration's explanation centered on the premise that these projects hadn't adequately addressed radar mitigation. Never mind that radar experts had worked through mitigation strategies during the permitting process. The new administration saw an opportunity and took it.

Developers didn't sit around waiting for the holiday season to pass. Equinor (developing Empire Wind), Dominion Energy (Coastal Virginia Offshore Wind), and the Revolution Wind team filed lawsuits almost immediately. Their legal argument was straightforward: the government's order violated the Administrative Procedure Act because it was arbitrary and capricious, lacked adequate justification, and contradicted prior analysis the government had itself conducted.

What's striking is how quickly judges seemed to agree.

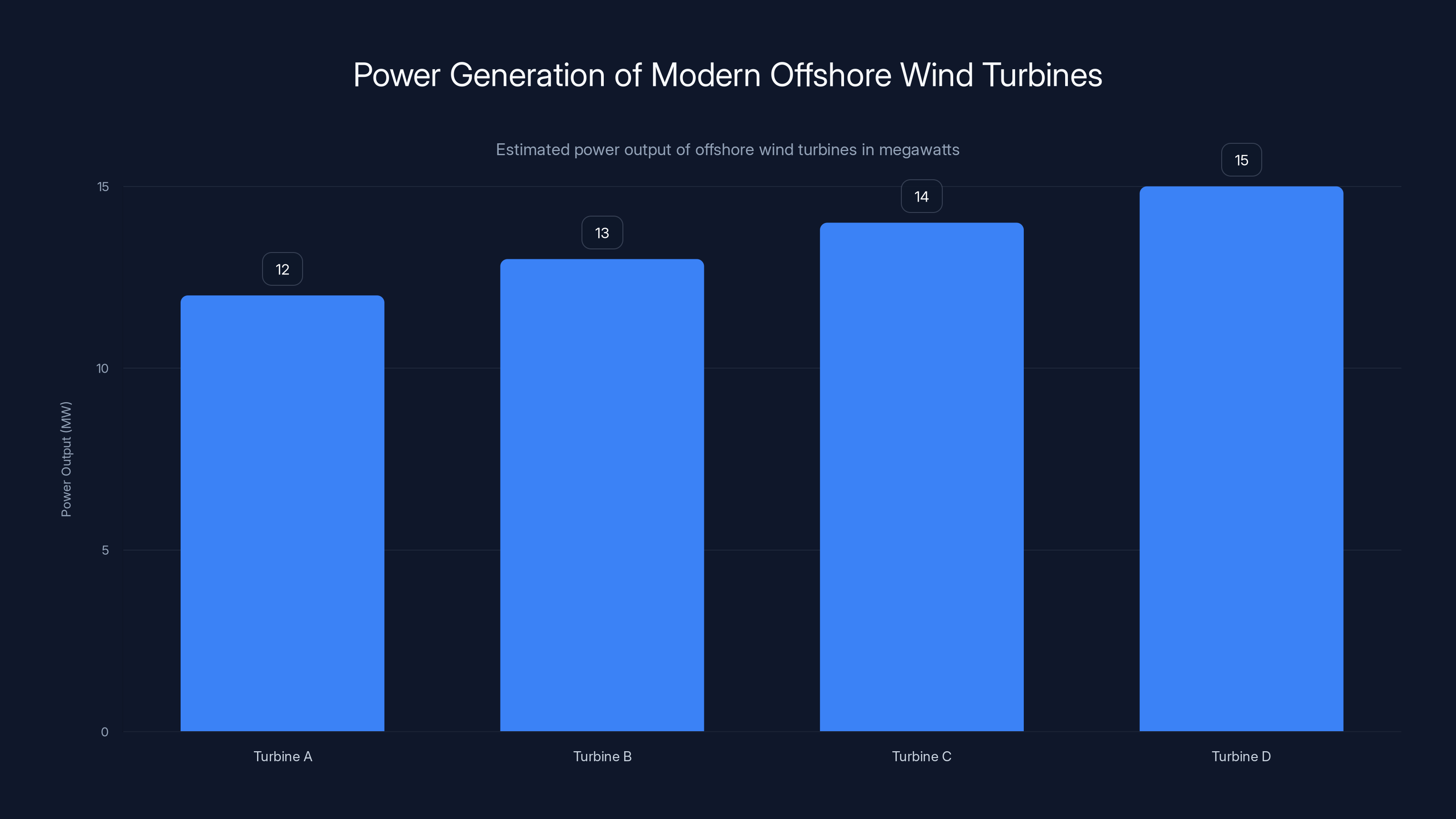

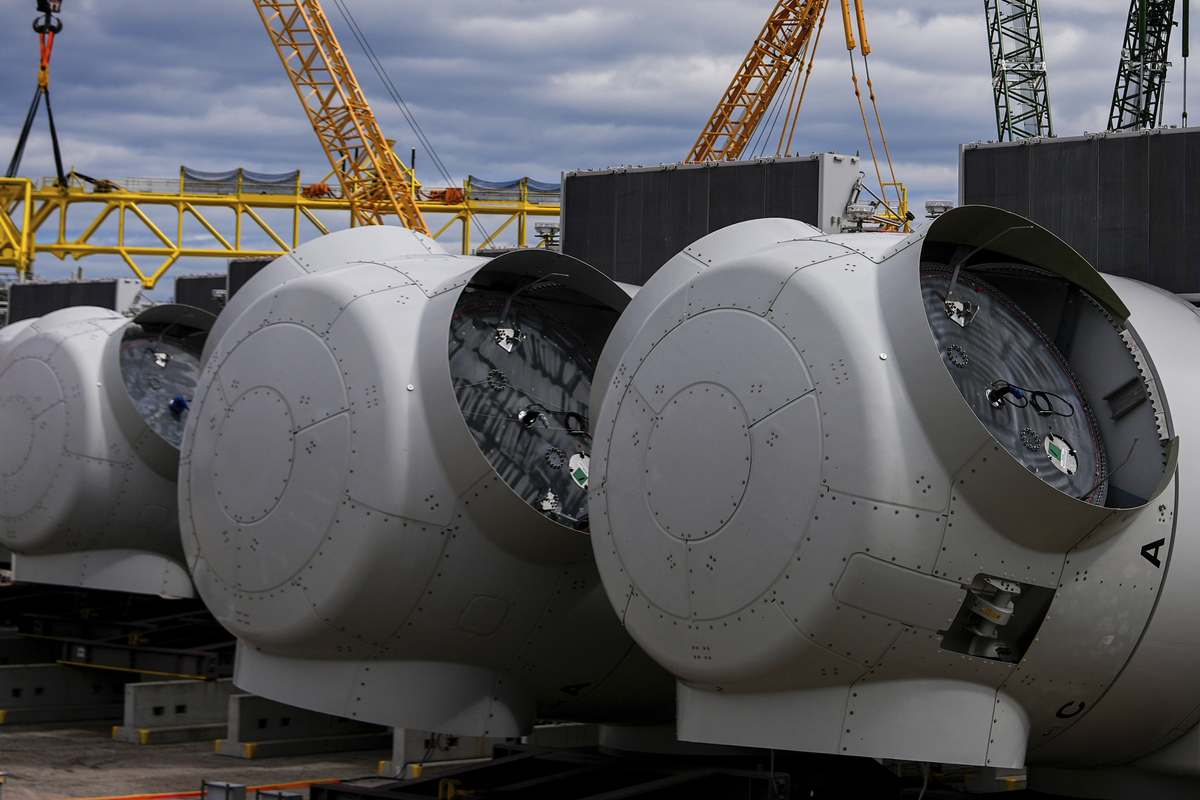

Modern offshore wind turbines can generate between 12 to 15 megawatts of power, showcasing significant energy production capabilities. Estimated data.

The Courtroom Reckoning: Three Judges, Three Similar Rulings

In three separate courtrooms across Virginia and Washington, DC, the Trump administration's lawyers faced skeptical judges. The exchanges revealed what would become the government's central problem: its brief simply didn't hold up to judicial scrutiny.

U. S. District Judge Carl Nichols, a Trump appointee, zeroed in on a critical weakness. He noted that the government's legal brief, which allegedly justified halting the Empire Wind project, didn't even mention the concept of "arbitrary and capricious" that Equinor had raised as the core legal claim. "Your brief doesn't even include the word arbitrary," Nichols said from the bench, according to reporting from the Boston Globe.

That's not a small oversight. When a defendant fails to directly address a plaintiff's primary legal argument, it signals weak preparation or, worse, a weak case. Judges interpret this as the government having nothing substantive to say in response.

Nichols also pushed the government on another point: why was construction being halted when the government's primary concern was about the operational phase of the wind farms? If radar interference happens when turbines are spinning, not when they're being built, why stop construction? The logic seemed disconnected.

U. S. District Judge Jamar Walker heard the Dominion Energy lawsuit regarding Coastal Virginia Offshore Wind and raised parallel concerns. Walker also questioned whether the Interior Department's order was overly broad. When viewed specifically in the context of the Virginia project, the government's national security justification seemed both vague and overbroad—applying equally broad restrictions to all projects regardless of their specific circumstances.

The message from the bench was consistent: the government needed to make better arguments, tie them more directly to the projects in question, and explain the disconnect between its stated concerns and its chosen remedy.

By mid-January 2025, preliminary rulings began allowing work to resume. The judges didn't issue final decisions—this litigation will continue through 2025. But they granted preliminary injunctions allowing construction to proceed while legal arguments continue. That's significant because it signals the judges believed the developers likely had a strong case on the merits.

The Radar Problem: Real Technical Issue, Questionable Solution

Let's be intellectually honest about something: the government's underlying concern isn't invented. Radar and wind turbines genuinely have compatibility issues.

Modern radar systems send out radio waves and measure reflections. They determine target location, speed, and characteristics based on how those waves bounce back. Wind turbine blades, especially large offshore turbines spinning at variable speeds, create complex reflection patterns that don't look like traditional targets but do create detectable signals.

For military radar networks, this is legitimately concerning. Degraded radar performance could theoretically create blind spots near offshore wind farms, which sit in areas that might overlap with naval operations or coastal defense networks.

But here's the thing: this problem has known solutions, and they were already implemented during the permitting process.

Radar Mitigation Strategies in Use:

First, wind farms can be sited to minimize overlap with critical radar coverage. The projects in question weren't randomly placed—the permitting process considered radar infrastructure and positioned farms in locations that minimize interference with existing military systems.

Second, radar equipment itself can be upgraded. Modern radar systems incorporate filters and signal processing algorithms specifically designed to identify and discard wind turbine signals. These aren't hypothetical—they're in operational use at wind farms in Denmark, Germany, and the UK. The technology works.

Third, operators can share real-time data with military agencies. Some wind farms already provide turbine location and operational data to defense departments, allowing military systems to account for wind farm presence in their signal processing.

The National Environmental Policy Act review that preceded project approval specifically examined radar compatibility. Experts concluded the risks were manageable through a combination of siting, equipment upgrades, and operational coordination. The government itself signed off on this analysis.

So the Trump administration faced a dilemma: how do you halt projects that had already cleared the radar compatibility bar? The answer was to essentially second-guess the prior analysis without providing new technical data contradicting it. The courts found this unconvincing.

Electricity rates in the Northeast are significantly higher than the national average, impacting industrial and residential sectors. Estimated data.

The Economics: Why Power Costs Matter More Than Wind Preferences

President Trump made his personal preference clear: "I'm not much of a windmill person," he told oil executives. That's honest. But policy shouldn't reduce to personal preference, and courts understood that.

The economic case for offshore wind in the Northeast is brutal in its clarity. The region faces chronic electricity supply constraints and among the highest power prices in the nation.

Northeast Electricity Market Realities:

The average industrial electricity rate in the Northeast currently runs 40 to 60 percent above the national average. Residential rates are similarly elevated. Why? Supply constraints combined with aging infrastructure and limited new capacity additions over the past 15 years.

Data centers, in particular, are sensitive to power costs. A 100-megawatt data center facility paying 50 percent premium prices over similar facilities in other regions represents millions of dollars in annual additional operating costs. That affects site selection, hiring, and regional economic development.

Manufacturing facilities face the same pressure. Companies choosing between locations weight electricity costs heavily. Expensive power in the Northeast pushes new industrial development to regions with cheaper, more abundant electricity.

Offshore wind directly addresses this. The levelized cost of electricity from new offshore wind projects averages

The six gigawatts that the Trump administration attempted to halt would eventually generate enough electricity to displace several billion dollars in annual fuel and operating costs across the Northeast's grid. That's not hypothetical benefit—that's direct consumer impact.

The Projects: What's Building, What's Delayed

Let's look at the specific projects that just resumed work.

Revolution Wind operates off Rhode Island and Connecticut. The project totals 704 megawatts of capacity. With preliminary injunctions allowing work to resume, the project is now back on schedule for delivering first power in 2026. The project will transmit power to a dedicated cable landing in Connecticut, connecting to regional grid infrastructure.

Empire Wind, developed by Equinor and the team that won the solicitation, operates off New York and will eventually total 2,000 megawatts across two phases. The first phase (Phase 1) of about 800 megawatts is the primary construction focus. This single project represents roughly $5 billion in capital investment and would make a material difference to New York's electricity supply.

Coastal Virginia Offshore Wind (CVOW), developed by Dominion Energy, represents 2,600 megawatts of capacity. The project is particularly significant because it sits in a region where electricity demand is growing and grid constraints are tightening. CVOW was already under active construction when the halt order arrived in December. The legal injunction allows Dominion to continue development.

Two other projects remain in procedural limbo:

Sunrise Wind, developed by Ørsted, totals 924 megawatts and operates off New York. Its preliminary injunction hearing was scheduled for February 2, 2025. Based on the pattern of the other three rulings, a similar decision allowing work to resume seems probable.

Vineyard Wind 1, the original offshore wind project approved during the Biden administration, totals 800 megawatts off Massachusetts. Its developers filed suit only after the other projects, so the legal process is further behind. Nonetheless, expectations are that this project, too, will eventually overcome the construction halt through litigation.

Combined, these five projects total approximately 12 gigawatts of capacity. For context, that's equivalent to the annual electricity output of roughly 12 large coal plants or a significant portion of the Northeast's total generating capacity.

Offshore wind has the potential to generate 13,500 terawatt-hours annually, over three times the current US electricity consumption. Estimated data highlights the significant impact of resumed projects.

Grid Infrastructure and Capacity: The Bigger Picture

Offshore wind doesn't exist in isolation. It connects to regional grid infrastructure, interacts with other generation sources, and affects how grid operators manage electricity supply and demand.

The Mid-Atlantic grid operator (PJM Interconnection) has recently faced criticism for rising electricity prices in its territory. Wholesale power prices have ticked up over the past two years, driven by a combination of factors: aging coal plant retirements, natural gas price volatility, weather-driven demand spikes, and transmission constraints.

Offshore wind introduces new generation in a region that needs it. The farms connect to undersea cables that land on shore and integrate with existing transmission networks. From an operational perspective, they behave similarly to onshore wind: variable generation dependent on meteorological conditions but with good predictability over 6 to 48-hour horizons.

Grid operators use forecasting, energy storage, and demand management to balance variable generation. The scale of offshore wind being added to the Northeast doesn't overwhelm these systems—it actually makes the grid more robust by diversifying generation sources and reducing dependence on natural gas price fluctuations.

The Grid Integration Reality:

The Northeast grid wasn't built for this much variable generation. But it's not a hard constraint. Germany's grid currently handles over 60 percent variable renewable generation on an annual basis, with peak periods reaching 80 to 90 percent. Denmark's grid handles over 80 percent wind generation. Modern grids can manage significant variable generation through a combination of forecasting, energy storage, and operational flexibility.

The United States has the advantage of a much larger and more diverse generating fleet than Denmark or Germany. Adding 12 gigawatts of offshore wind is material but not transformative from a grid operations perspective. The Northeast has sufficient transmission, generation diversity, and operational sophistication to absorb this capacity.

National Security: Separating Real Concerns From Political Cover

The national security argument deserves more charitable analysis than it's sometimes given. Protecting military capabilities is a legitimate government interest.

But separating legitimate security concerns from political rhetorical cover is important. Here's the test: if the concern were genuinely critical, how was it acceptable during years of permitting and analysis that preceded these approvals? Why didn't the prior administration identify it as disqualifying? Why didn't military leadership raise it as blocking the projects?

The record shows military agencies were consulted during permitting. Their feedback was incorporated. The government approved the projects understanding the radar issue and accepting the mitigation strategies proposed by developers and regulators.

A new administration disagreeing with a policy decision is entirely legitimate. But courts require that agencies provide rational explanation for reversing prior decisions. The Trump administration didn't do this clearly enough for the judges to find persuasive.

One way to think about it: if national security concerns about radar were truly disqualifying, the government could have raised them years earlier. The fact that they became urgent only after a new administration took power invites skepticism about whether national security is actually the primary motivator.

This doesn't mean security concerns are invented. It means they need to be evaluated against the standard they were evaluated at during the prior process. If the threshold changed, the government needs to explain why and provide evidence the change is warranted.

The courts found the government's explanation insufficient. That's their role in the system.

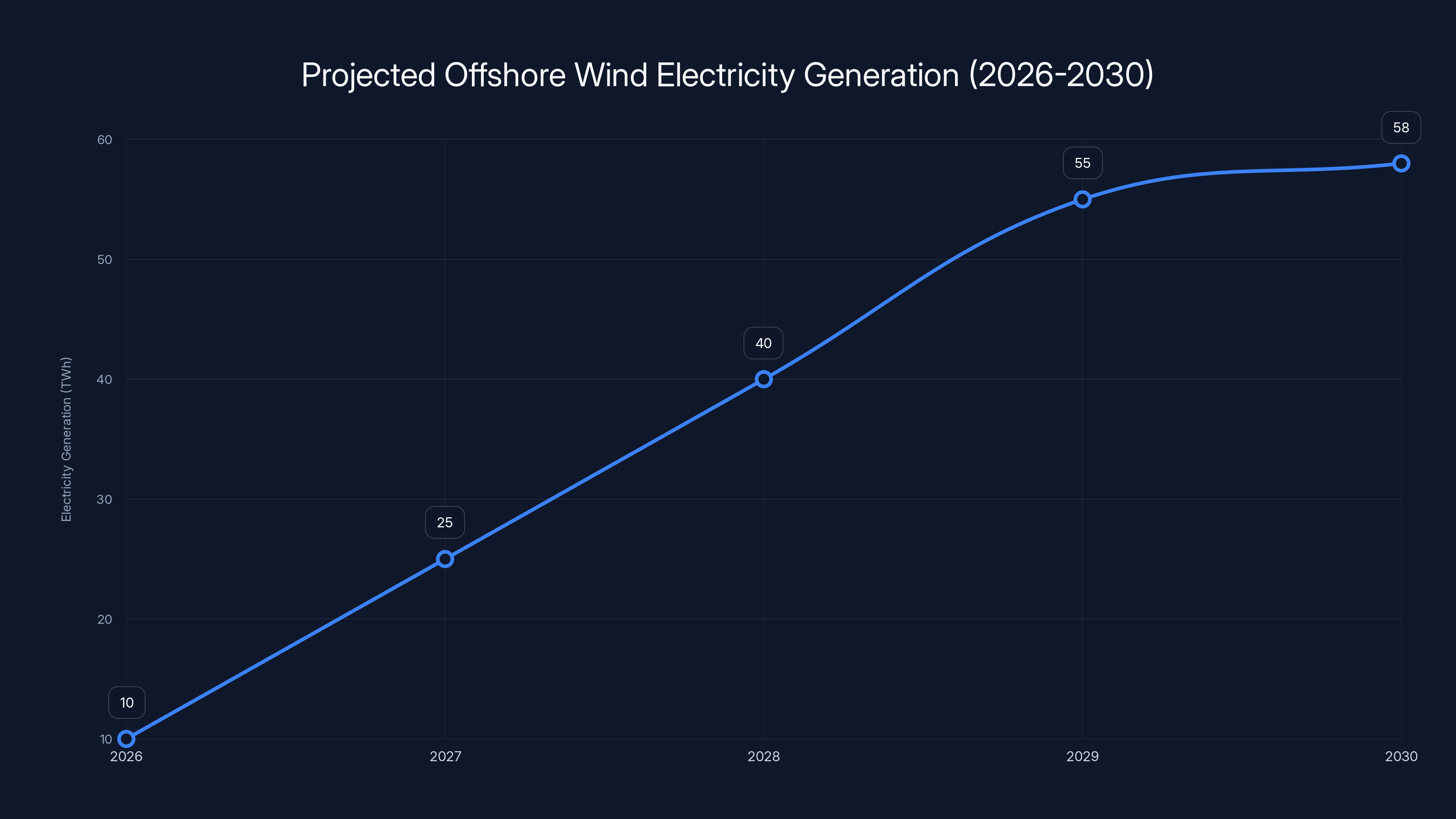

Estimated data shows offshore wind could generate up to 58 TWh by 2030, contributing significantly to the Northeast's electricity supply.

The Precedent: What These Rulings Mean for Future Projects

These judicial victories do important work beyond these five specific projects. They establish precedent about how courts will treat regulatory reversals on major infrastructure.

The core principle is straightforward: agencies can change policy decisions, but they need to follow procedures and provide rational justification. This isn't anti-business; it's pro-rule-of-law. It prevents any administration from unilaterally reversing multi-billion-dollar private investments through bureaucratic memo.

The rulings signal to future project developers that if they've gone through proper permitting, gotten approvals, and begun construction based on valid permits, subsequent administrations can't easily halt work through vague claims without substantive justification.

That's good news for offshore wind projects under development. But it's also good news for any major infrastructure investment that faces regulatory uncertainty.

What This Means for Pipeline Projects:

The principle cuts both directions. Environmental groups might worry these rulings strengthen precedent for continuing oil and gas pipeline projects that face legal challenges from new administrations. The procedural principle is the same: if a project was properly permitted and approvals were valid, subsequent administrations can't easily reverse course without clear legal and factual justification.

That's probably the right outcome. Infrastructure projects require certainty. If any new administration can halt work through bureaucratic action, no major project survives long enough to break ground. The economy needs infrastructure stability even when political preferences change.

The Electricity Supply Outlook: 2026-2030

If the current trajectory holds and all five projects eventually resume work through litigation, the Northeast will add 12 gigawatts of offshore wind generating capacity between 2026 and 2029. Here's what that means for electricity supply:

Generation Potential:

With a typical capacity factor of 45 to 55 percent in Atlantic waters, 12 gigawatts would generate approximately 47 to 58 terawatt-hours of electricity annually. Current Northeast electricity consumption is roughly 400 terawatt-hours annually. So offshore wind represents 12 to 15 percent new generation supply.

That's not trivial. It's the equivalent of taking five to seven large coal plants completely offline. For electricity costs, it creates downward pressure on wholesale prices, which eventually flows through to consumer electricity rates.

Timing Matters:

The first projects (Revolution Wind, Empire Wind Phase 1) should deliver electricity in 2026 to 2027. That timing is fortunate because electricity demand in the Northeast continues growing. Data centers, manufacturing, and residential demand are all rising. New supply hitting the market when demand is growing means the offshore wind capacity actually displaces expensive generation that would otherwise be needed.

Grid Dynamics:

The offshore wind capacity is also geographically advantageous. Wind farms off the coast can transmit power to major load centers (New York City, Boston, Philadelphia) relatively efficiently. The location reduces transmission losses compared to far-distance generation like western wind or southwestern solar.

The Coastal Virginia Offshore Wind (CVOW) project has the highest capacity at 2,600 MW, while Revolution Wind has the lowest at 704 MW. These projects collectively contribute significantly to the regional electricity supply.

Broader Implications: Energy Independence and Manufacturing

The Trump administration's stated priority is energy independence. Ironically, killing offshore wind projects contradicts that goal. Electricity independence, just like energy independence, requires diversified generation sources.

The U. S. currently imports manufactured wind turbines and components from Denmark, Germany, China, and Japan. Developing a robust offshore wind industry would eventually support domestic manufacturing. The supply chain for offshore wind—specialized vessels, installation equipment, turbines, subsea cabling—represents a manufacturing opportunity that the U. S. currently exports.

Europe has been building offshore wind industry for 20 years. The continent now has specialized construction vessels, turbine manufacturers, installation expertise, and supply chain infrastructure. America is just beginning to develop equivalent capabilities.

Killing offshore wind projects delays that development. It keeps the U. S. dependent on imports for the generation technology that's increasingly powering global electricity systems.

That's a strategic economy argument that transcends climate policy. Even if you're skeptical about renewable energy policy, the industrial policy case for developing domestic offshore wind manufacturing capability is sound.

The Path Forward: 2025 Legal Timeline

The litigation won't conclude in early 2025. These preliminary injunctions allow work to continue, but the underlying lawsuits will proceed through the federal court system over months.

Expected Timeline:

Sunrise Wind has a hearing scheduled for February 2, 2025. Based on the pattern of other rulings, a similar preliminary injunction is likely.

Vineyard Wind's case will follow, with briefs filed over February and March 2025. Oral arguments probably in April or May 2025.

On the merits, the government could appeal rulings, potentially taking cases to the Circuit Court level. That adds months or years to the process.

Meanwhile, developers have already incurred costs from the December halt. Idle equipment, suspended contracts with suppliers and installation crews, and financing costs for delayed projects all add up. Once construction resumes, developers will push to accelerate timelines to recover these losses.

What Happens If the Supreme Court Gets Involved:

If the Trump administration continues fighting, eventually cases could reach the Supreme Court. But Supreme Court involvement is unlikely because the issues are relatively straightforward applications of Administrative Procedure Act standards. The courts have consistently found that agencies need solid justification for reversing prior decisions. That's not a novel legal question.

More likely, the government will eventually decide the litigation isn't worth the resources and allow these projects to continue. Alternatively, it could pursue legislative solutions, trying to get Congress to ban offshore wind through statute rather than regulatory action. But that's also unlikely given Congress's partisan split and the fact that offshore wind has support from some Republicans, particularly in coastal states.

The Bigger Energy Question: What Comes After Coal

The offshore wind legal victories matter because they represent one answer to a fundamental energy infrastructure question: what replaces coal generation as coal plants retire?

Coal has powered American electricity for 150 years. But coal plants are aging. Roughly 40 percent of the U. S. coal fleet is over 40 years old. These plants are retiring faster than new generation replaces them, creating supply gaps.

The options for replacement generation are: natural gas, nuclear, renewables (wind and solar), and energy storage. Each has trade-offs.

Natural gas is cheap, flexible, and quick to build. But it's susceptible to price spikes and maintains fuel cost volatility that coal plants reduced. Natural gas also has carbon emissions, though roughly 40 percent lower than coal.

Nuclear is reliable, low-carbon, and efficient. But it's expensive, slow to build, and faces regulatory and public acceptance challenges. The U. S. is building new nuclear, but deployment is measured in decades for new plants.

Renewables (wind and solar) are cheap, increasingly reliable through storage and grid management, and have minimal operational fuel costs. But they're variable and require infrastructure investment in transmission and storage.

Energy storage (batteries, pumped hydro, thermal storage) is growing rapidly and becoming cheaper. But it's still expensive relative to wind and solar generation.

The practical answer for most of the country is a mix of all of these. The Northeast, specifically, benefits from offshore wind because it combines generation close to major load centers, relatively high capacity factors, low operational costs, and the ability to be deployed relatively quickly compared to nuclear.

What Developers Learned From This Fight

For the offshore wind developers who won these legal battles, several lessons emerge.

First, solid permitting and environmental review matters. The projects survived legal challenge partly because they had gone through comprehensive review and the government had found them acceptable. Shortcuts in permitting would have given the government more ammunition.

Second, having credible legal representation and willingness to litigate is essential. These developers had the resources to immediately retain top law firms and file lawsuits. Smaller projects or developers without capital reserves might not have this option.

Third, timing and momentum matter. Getting preliminary injunctions allowing work to resume early in the process was crucial. Months of delay while litigation proceeded would have been devastating. Early wins signal to the judge that the case has merit.

Fourth, judicial deference to agency expertise is real but not unlimited. If the government's reasoning had been more sophisticated and the procedural record stronger, courts might have sided differently. Weak lawyering and vague reasoning don't survive judicial review.

These lessons will shape how future infrastructure projects approach permitting, litigation strategy, and government relations.

Conclusion: Rule of Law in Infrastructure Policy

The offshore wind legal victories ultimately aren't about wind turbines, national security concerns, or even climate policy. They're about rule of law and how American infrastructure policy actually functions when billions of dollars and years of development meet political transition.

The Trump administration has legitimate authority to set policy direction. It can prefer fossil fuels to renewables. It can prioritize energy independence differently than a prior administration. But it can't do these things through executive action that ignores statutory requirements and procedural safeguards.

The courts' role is to ensure that when agencies act, they follow the law and provide reasoned justification. That's exactly what happened here. The judges found the government's reasoning insufficient and allowed construction to proceed.

For the Northeast's electricity system, this is genuinely good news. Cheap, reliable new generation capacity is being deployed at a time when the region needs it. Electricity costs should moderate as new supply hits the market. Manufacturing, data centers, and residents all benefit from lower power costs.

For the broader energy policy question, offshore wind demonstrates that renewable generation can achieve scale in America. It's not just theoretical anymore. It's real capacity, real investment, real electricity.

That doesn't mean offshore wind is the only answer. Natural gas, nuclear, onshore wind, solar, and storage all have roles. But the legal victories clear the path for offshore wind to play its part in powering the American economy.

The litigation will continue through 2025 and possibly beyond. But barring an unlikely Supreme Court intervention, these projects will get built. By 2028 or 2029, when the first turbines spin offshore, the infrastructure investment and electricity generation will be real. The courts made sure of that.

FAQ

What are offshore wind farms and how do they generate electricity?

Offshore wind farms are clusters of wind turbines positioned in ocean waters, typically 5 to 50 miles from shore. Each turbine stands 200 to 260 feet tall above water and uses rotating blades to capture wind energy. The spinning blades turn a shaft connected to a generator that converts mechanical rotation into electrical current. That electricity travels through undersea cables to shore-based connection points that feed power into the regional electrical grid. Modern offshore turbines can generate 12 to 15 megawatts of power each.

Why does the Trump administration claim offshore wind interferes with radar?

Radar systems work by transmitting radio waves and measuring the reflections that bounce back from objects. The reflected signals tell operators where targets are located and how fast they're moving. Wind turbine blades, particularly large offshore turbines spinning at variable speeds, create complex electromagnetic reflections that radar systems interpret as noise or spurious signals. When radar systems can't distinguish wind farm reflections from actual targets, they experience reduced detection capability in the offshore area. Military radar networks that monitor coastal waters and naval operations could theoretically experience coverage gaps near offshore wind farms, though mitigation strategies can minimize this effect.

What mitigation strategies address the radar compatibility problem?

Engineers and military agencies have developed several solutions. First, wind farms can be sited to minimize overlap with critical military radar coverage areas. The permitting process for these projects specifically considered radar infrastructure and positioned farms accordingly. Second, radar equipment can be upgraded with modern signal processing filters designed to identify and discard wind turbine signatures while preserving military target detection. These upgraded systems are in operational use at wind farms in Denmark, Germany, and the UK. Third, wind farm operators can provide real-time data to military agencies about turbine locations and operational status, allowing military radar systems to account for wind farm presence. The combination of these strategies has proven effective in other countries.

How much would offshore wind reduce electricity costs in the Northeast?

The Northeast currently has the highest electricity rates in the nation, 40 to 60 percent above the national average for both industrial and residential customers. Adding 12 gigawatts of offshore wind capacity at an operational cost of

What is the significance of the "arbitrary and capricious" legal standard the judges mentioned?

Arbitrary and capricious is the legal standard courts use under the Administrative Procedure Act to review whether agency decisions are rational and properly justified. When a judge says an action is "arbitrary and capricious," they mean the agency didn't follow required procedures, didn't consider relevant factors, acted without explanation, or acted irrationally. In the offshore wind cases, judges found the Trump administration's decision to halt construction didn't adequately explain why the radar concern, which had been evaluated during permitting, suddenly required halting active construction. The government needed to show its reasoning was rational and properly connected to the facts in the record. The government's brief apparently fell short by not even addressing the core legal argument raised by the developers.

Could these court rulings affect other infrastructure projects?

Yes, the rulings establish procedural precedent applicable to any major infrastructure project. The core principle is that agencies can change policy decisions, but they must follow legal procedures and provide rational justification. This cuts both directions: environmental groups' efforts to halt oil and gas pipelines face the same legal standards. If a project was properly permitted under prior administrations and approvals were legally valid, subsequent administrations can't easily halt work through vague or unexplained executive action. The courts have basically said: if you want to reverse a prior decision, provide clear legal reasoning and factual justification. This standard applies across all infrastructure sectors.

How long will these projects take to generate electricity?

The timing varies by project. Revolution Wind is expected to deliver first power in 2026. Empire Wind Phase 1 is targeted for late 2026 or 2027. Coastal Virginia Offshore Wind was already under active construction when the halt order arrived, so it should return to its original timeline of 2027 to 2028. Sunrise Wind and Vineyard Wind 1 are further behind but expected to achieve completion by 2028 or 2029 if litigation proceeds as expected. The December halt delayed projects by several months, but the preliminary injunctions allowing construction to resume suggest most projects will meet revised timelines between 2026 and 2029.

What does 12 gigawatts of offshore wind capacity mean for American electricity generation?

Twelve gigawatts is a significant but not overwhelming addition to U. S. generating capacity. To put it in perspective, that's roughly equivalent to the capacity of 12 large coal plants or about 3 to 5 percent of total U. S. installed electricity generation capacity. With typical offshore capacity factors, 12 gigawatts would generate approximately 47 to 58 terawatt-hours annually, which is 12 to 15 percent of Northeast regional consumption. For the grid operator managing these projects, it's material but manageable. Germany's grid handles over 60 percent variable renewable generation; Denmark handles over 80 percent wind generation. The U. S. has a larger, more diverse grid than both countries, so integrating 12 gigawatts of variable generation is technically and operationally feasible.

Why does the U. S. import offshore wind turbines and components?

The U. S. offshore wind industry is nascent. Europe, particularly Denmark and Germany, has been developing offshore wind for two decades. That experience, investment, and specialization created manufacturing capacity for offshore turbines, specialized installation vessels, and subsea cable systems. American companies are beginning to manufacture these components, but the industry hasn't achieved the scale and efficiency of European manufacturers. Building out the U. S. offshore wind industry would eventually support domestic manufacturing for turbines, foundations, cables, and installation equipment. That represents not just energy independence but industrial capacity and economic benefit. Killing offshore wind projects delays that capability development and keeps the U. S. dependent on imported equipment.

Key Takeaways

- Federal judges across three courtrooms found the Trump administration's offshore wind construction halt lacked adequate legal justification and violated Administrative Procedure Act standards

- Preliminary injunctions allowing work to resume on Revolution Wind, Empire Wind, and Coastal Virginia Offshore Wind represent $25 billion in private investment and future electricity generation

- The Northeast faces electricity costs 40 to 60 percent above the national average, making cheap offshore wind deployment economically critical for the region

- Offshore wind could generate 13,500 terawatt-hours annually—more than three times current U. S. electricity consumption—if developed to full potential

- These rulings establish procedural precedent that agencies need rational justification and proper procedures to reverse major infrastructure decisions

- Radar compatibility concerns are real but solvable through siting, equipment upgrades, and operational coordination—solutions already proven in other countries

- The U. S. offshore wind industry is building manufacturing capacity and supply chain; killing projects delays industrial development and energy independence

- Litigation will continue through 2025, but the preliminary injunctions signal the developers likely prevail on legal merits

Related Articles

- Trump's Offshore Wind Pause Faces Legal Challenge: Data Center Power Demand Crisis [2025]

- Trump and Governors Push Tech Giants to Fund Power Plants for AI [2025]

- Offshore Wind Developers Sue Trump: $25B Legal Showdown [2025]

- Microsoft's Community-First Data Centers: Who Really Pays for AI Infrastructure [2025]

- Microsoft's $0 Power Cost Pledge: What It Means for AI Infrastructure [2025]

- Anker's Home Battery System vs Tesla Powerwall [2025]

![Offshore Wind Legal Victories: Why Trump's Setbacks Matter [2025]](https://tryrunable.com/blog/offshore-wind-legal-victories-why-trump-s-setbacks-matter-20/image-1-1768673159556.jpg)