Introduction: The Strategic Opportunity for One Plus in the Foldable Market

The foldable smartphone market has undergone a remarkable transformation since One Plus last explored this segment. What began as an experimental luxury category with prohibitive price points and questionable durability has matured into an increasingly mainstream technology segment driving significant growth for competitors. The market dynamics of 2026 present a uniquely favorable moment for One Plus to reclaim relevance in this space—not through desperation, but through carefully calculated strategic timing.

One Plus has traditionally positioned itself as a brand that combines flagship performance with reasonable pricing, creating a "flagship killer" ethos that resonated with tech-savvy consumers seeking value without compromise. The brand's philosophy emphasizes delivering cutting-edge technology at prices that undercut premium competitors while maintaining performance parity. However, the company has largely abstained from the foldable market in recent years, allowing competitors like Samsung, Google, and Xiaomi to establish dominance and refine their approaches through multiple generations.

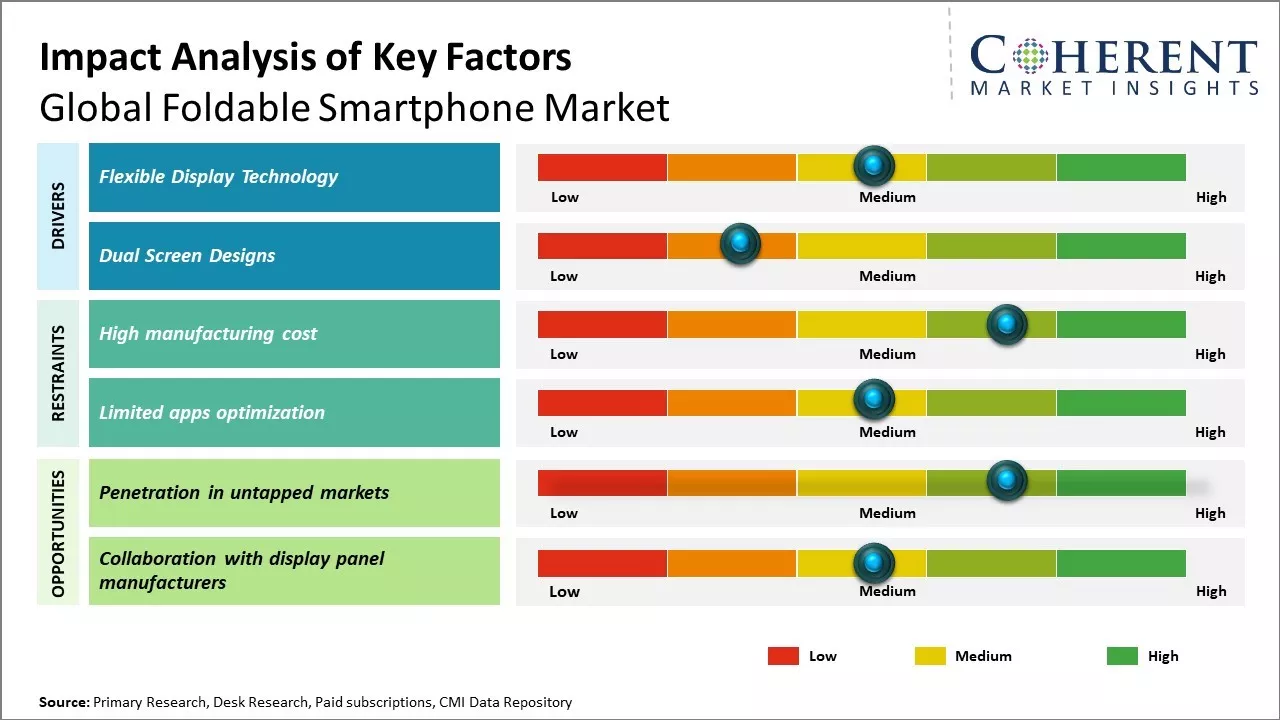

The case for One Plus entering the foldable market in 2026 rests on several interconnected factors: the maturation of foldable technology itself, the anticipated pricing corrections across the category, the completion of critical R&D cycles by competitors that One Plus can learn from, and the development of more reliable components and manufacturing processes that reduce production costs. Furthermore, 2026 marks a moment when consumer acceptance of foldables has reached a tipping point, with early adopter skepticism giving way to genuine mainstream interest.

This analysis examines why 2026 specifically represents an inflection point for One Plus's potential re-entry into foldables. We'll explore the current state of the foldable market, the technology maturation cycles that make this timing optimal, the competitive landscape One Plus would face, and the strategic positioning that would allow the brand to differentiate itself in an increasingly crowded segment. The question isn't whether One Plus can build a competitive foldable phone—the brand possesses the technical expertise and manufacturing capabilities. Rather, the question is whether the market timing creates conditions where such an entry would achieve meaningful commercial success and brand reinforcement.

The Current State of the Foldable Smartphone Market in 2025

Market Growth and Adoption Metrics

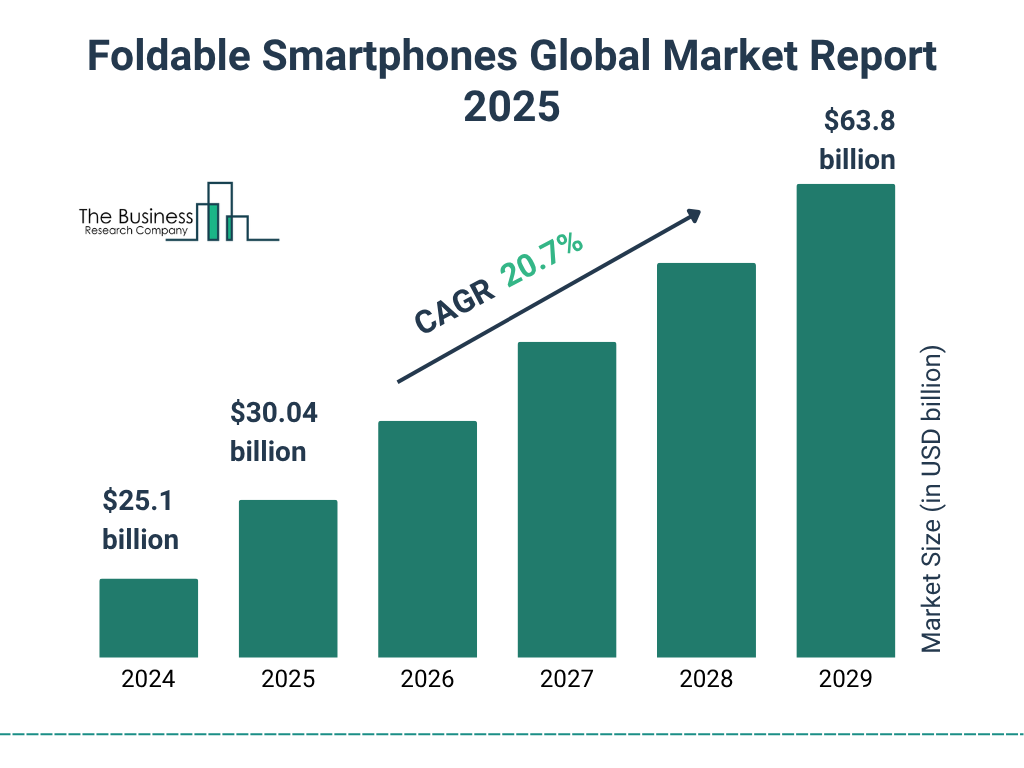

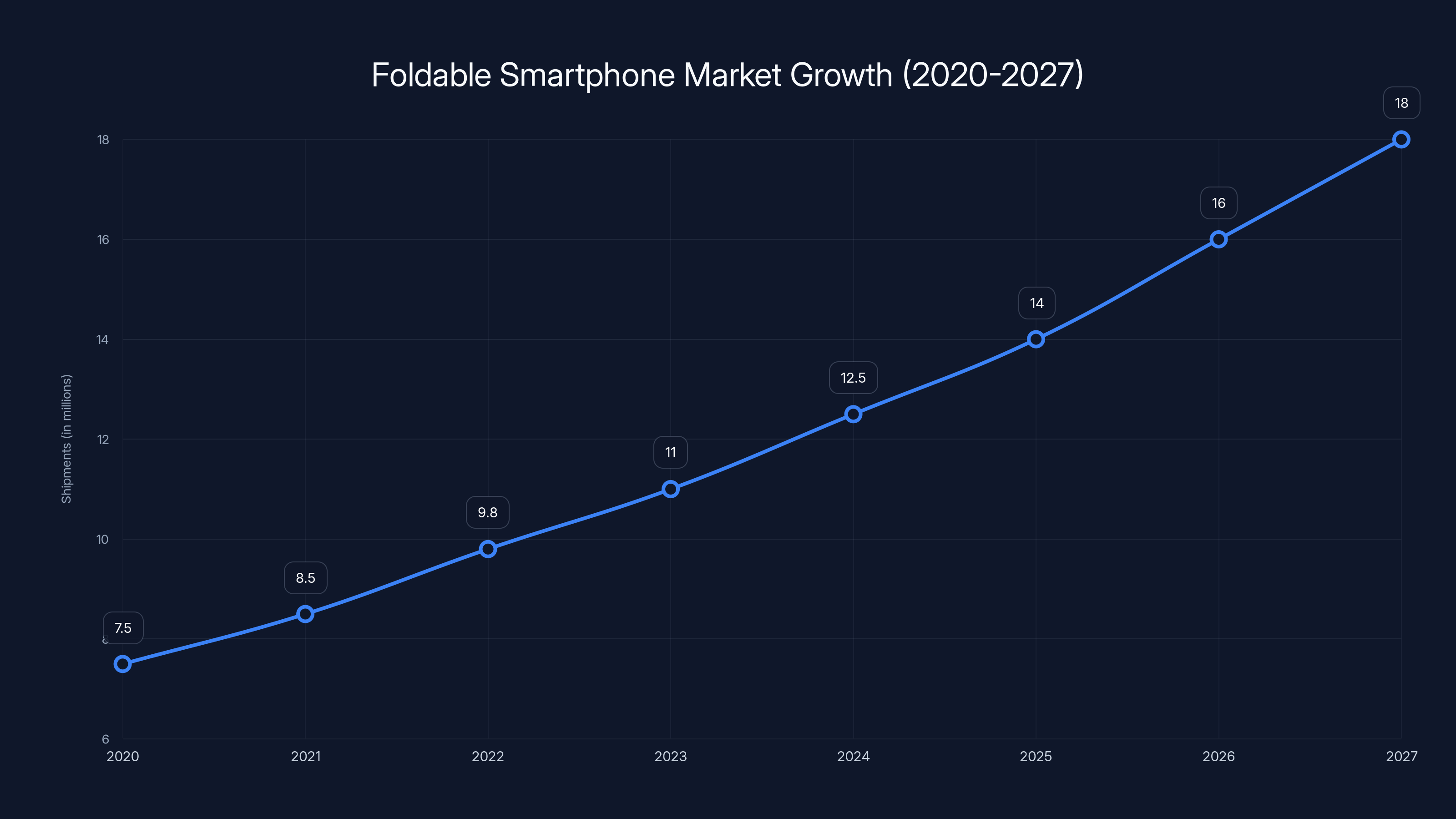

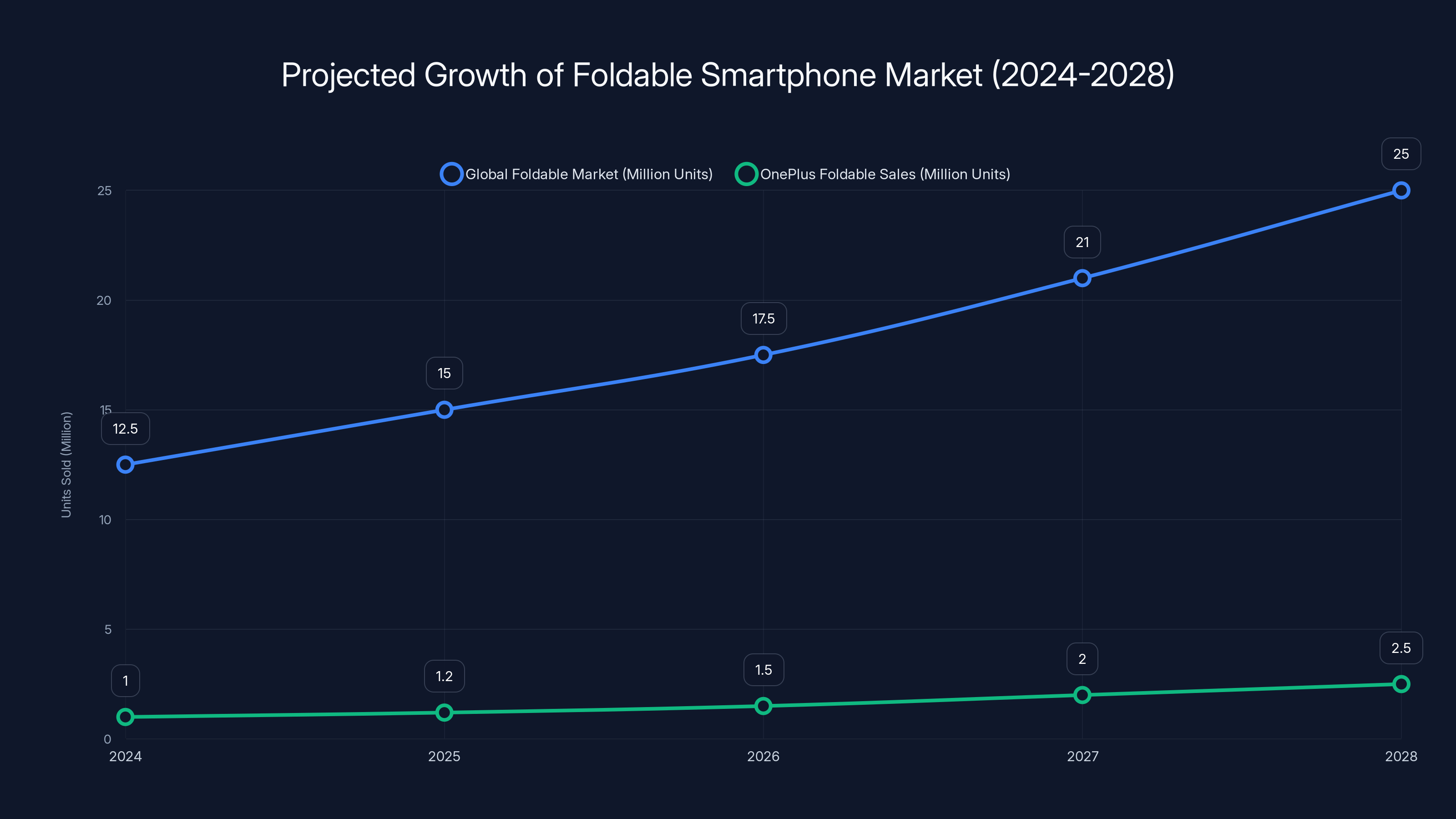

The foldable smartphone market has demonstrated resilience and growth that few predicted during the technology's early years. Industry analysts project that global foldable device shipments exceeded 12 million units in 2024, with expectations for continued double-digit annual growth through 2027. This represents a significant evolution from the roughly 7-8 million units shipped in 2020, indicating that foldables have transitioned from experimental gadgets to viable consumer products with genuine market demand. According to IDC, the market is poised for substantial growth.

Market penetration metrics reveal important insights about where foldables stand in the broader smartphone ecosystem. In major developed markets, foldables represent approximately 2-3% of premium smartphone sales, a seemingly modest figure that masks the category's strength among high-income consumers. Within the premium segment ($800 and above), foldables account for a much more substantial share of consumer interest and purchasing decisions. This concentration among premium buyers indicates that the market isn't yet mature enough to drive mass adoption, but the segment is sophisticated and growing.

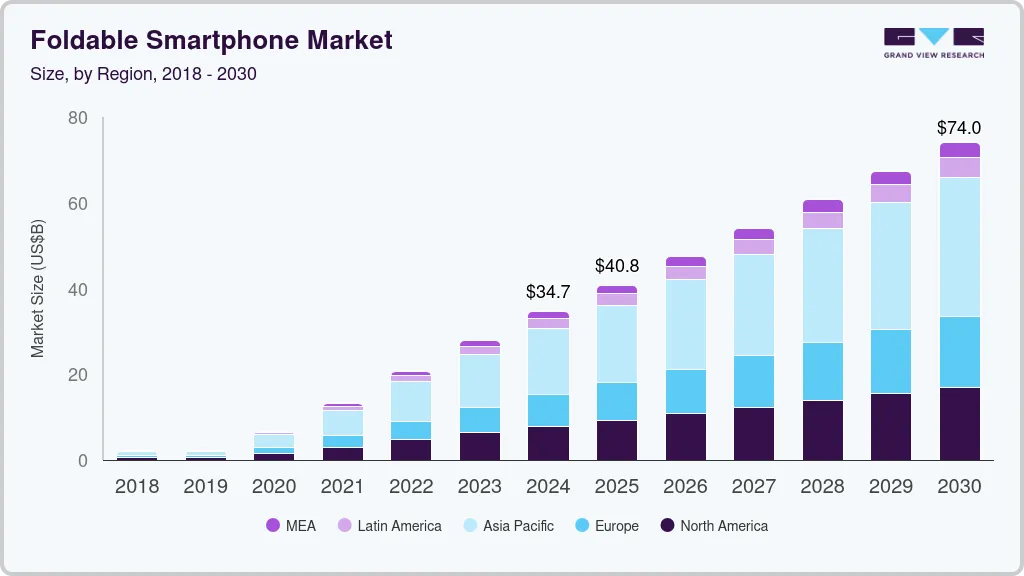

Regional variations tell particularly important stories about foldable adoption patterns. South Korea, where Samsung and other manufacturers maintain strong brand presence, sees foldable penetration rates exceeding 8% among premium smartphone buyers. China, driven by Xiaomi, Honor, and Oppo offerings, has become the world's largest foldable market by volume. Europe and North America lag behind these regions, though growth rates in Western markets accelerate as prices decline and awareness increases. This geographic variation suggests that regional differences in consumer preferences, brand loyalty, and pricing sensitivity still significantly influence foldable adoption.

Competitive Landscape Dominated by Samsung and Chinese Manufacturers

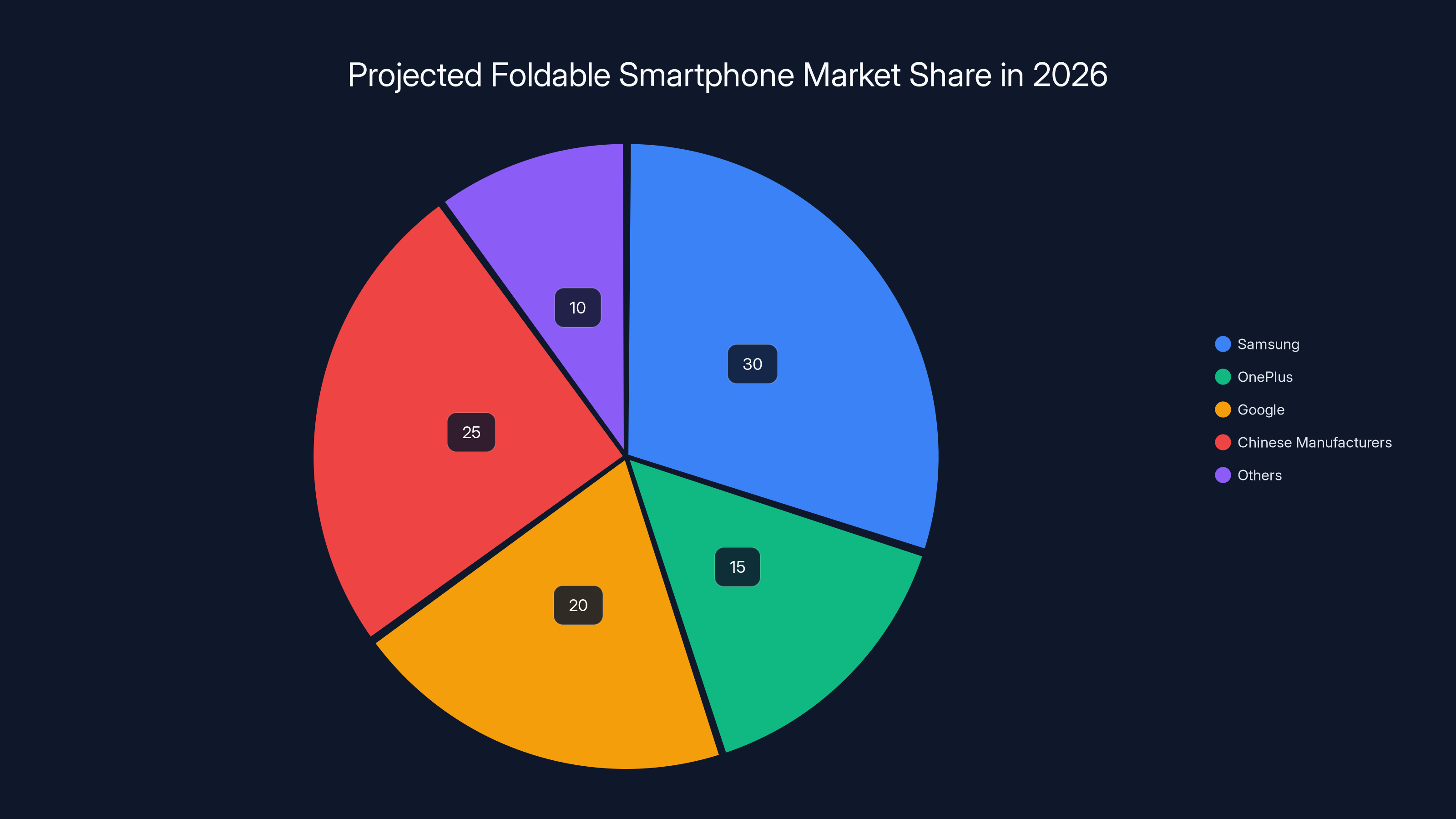

Samsung maintains a dominant position in the foldable market through its Galaxy Z Fold and Z Flip product lines, which have evolved substantially since their 2019 introduction. The South Korean manufacturer has shipped approximately 60% of all foldable devices sold globally, establishing an ecosystem of apps, accessories, and service provisions that create switching costs for consumers. Samsung's vertical integration—controlling display manufacturing, processor integration, and software optimization—provides significant advantages in cost reduction and performance optimization that competitors must match or exceed.

Chinese manufacturers, particularly Xiaomi, Oppo, and Honor, have emerged as formidable competitors with aggressive pricing and innovative form factors. Xiaomi's Mix Fold lineup offers substantial feature parity with Samsung offerings at 20-30% lower price points, making foldables more accessible to mainstream consumers. These manufacturers have also pursued different foldable approaches, experimenting with inward-folding versus outward-folding designs and varying crease visibility characteristics that appeal to different consumer preferences. The speed at which Chinese manufacturers iterate their foldable designs—often releasing new versions annually or bi-annually—demonstrates their commitment to this category and their ability to capture market share through rapid innovation cycles.

Google's entry into the foldable market with the Pixel 9 Pro Fold represents significant competitive validation of the category's future. Google's software expertise and AI integration capabilities create differentiation possibilities that go beyond hardware specifications. The search giant's approach emphasizes software experiences optimized for a larger, foldable screen format—multitasking, productivity features, and AI-powered tools that justify the foldable form factor on functional grounds rather than purely premium positioning.

Meanwhile, One Plus has remained largely absent from this segment, continuing to focus on conventional smartphone designs that emphasize flat displays and refined performance. This absence represents either strategic patience or missed opportunity, depending on perspective. The company last experimented with foldable-adjacent concepts through concept devices and partnerships, but never committed to a commercial product release.

Technology Maturation and Durability Improvements

One of the most significant developments in the foldable market between 2020 and 2025 has been the dramatic improvement in durability and reliability metrics. Early foldable devices, particularly first-generation models, suffered from well-documented durability issues: creases visible in bright light, fragile foldable screens prone to damage from dust and pressure, problematic hinge mechanisms that either exhibited excessive friction or inadequate retention force, and battery degradation in the flexible form factor.

The current generation of foldable devices demonstrates substantially improved durability across multiple dimensions. Display technology has evolved to reduce visible creasing through better substrate materials, improved pixel layouts, and refined manufacturing processes. Gorilla Glass Armor and equivalent protective technologies provide better scratch and damage resistance for both the foldable screen and the outer protective display. Hinge mechanisms have become increasingly sophisticated, with multiple engineering approaches proving effective at balancing durability with smooth operation over thousands of fold cycles.

Real-world durability data now supports claims that well-manufactured foldable devices can withstand extended use comparable to conventional flagship smartphones. Tear-down analyses and long-term use reports indicate that reliability issues, while still present, have become sufficiently rare that they no longer represent fundamental showstoppers to mass adoption. This represents a critical inflection point: foldables have transitioned from "experimental technology" to "proven reliability," a shift that removes psychological barriers to consumer adoption among mainstream buyers.

Battery technology specific to foldable applications has also matured significantly. Manufacturers have solved the technical challenges of integrating dual-cell battery configurations that power both sections of a foldable device, maintaining adequate capacity while managing thermal dynamics across the fold point. Energy density improvements in battery chemistry have enabled manufacturers to maintain or increase total battery capacity even as device volumes have decreased through improved manufacturing efficiency.

Foldable smartphone shipments are projected to grow from 7.5 million units in 2020 to 18 million units by 2027, indicating strong market adoption. (Estimated data)

Why 2026 Represents the Optimal Timing for One Plus Market Entry

The Cost Reduction Inflection Point

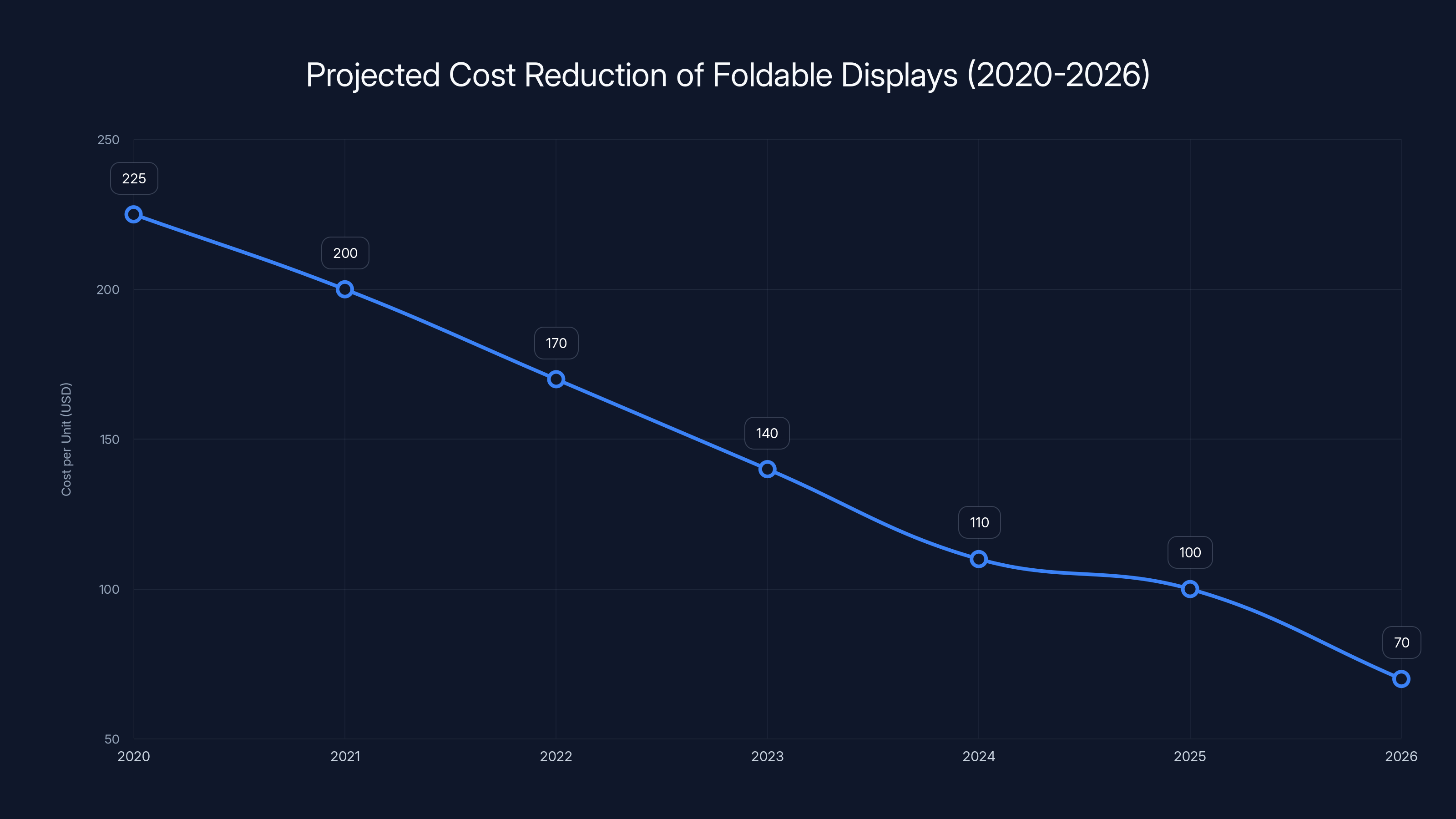

Foldable device manufacturing costs have been on a steep downward trajectory throughout the 2020-2025 period, and industry analysts project that 2026 marks a critical inflection point where component costs become substantially more favorable to manufacturers pursuing entry into this category. The foldable display, historically the single most expensive component in a foldable device, has seen per-unit costs decline from approximately

This cost reduction stems from multiple factors converging simultaneously. Production volume for foldable displays has increased sufficiently that manufacturers like Samsung Display (which supplies displays for most foldable devices), BOE, and Visionox have achieved economies of scale that materially reduce per-unit costs. Manufacturing yield rates—the percentage of displays that meet quality standards—have improved dramatically as manufacturers have refined processes and equipment, reducing waste and rework. Competition among foldable display suppliers has intensified, creating pricing pressure that advantages customers seeking new partnerships.

Beyond displays, other critical components have experienced similar cost reductions. Hinge mechanisms, once custom-engineered for each manufacturer with associated development and production costs, have become more standardized, enabling secondary suppliers to offer competitive alternatives to integrated hinge designs. Battery manufacturing processes optimized for foldable form factors have matured, reducing specialized production costs. Even software optimization, which Qualcomm and other chip manufacturers have integrated into their development platforms, has become more straightforward for new manufacturers to implement, reducing the R&D burden of foldable software optimization.

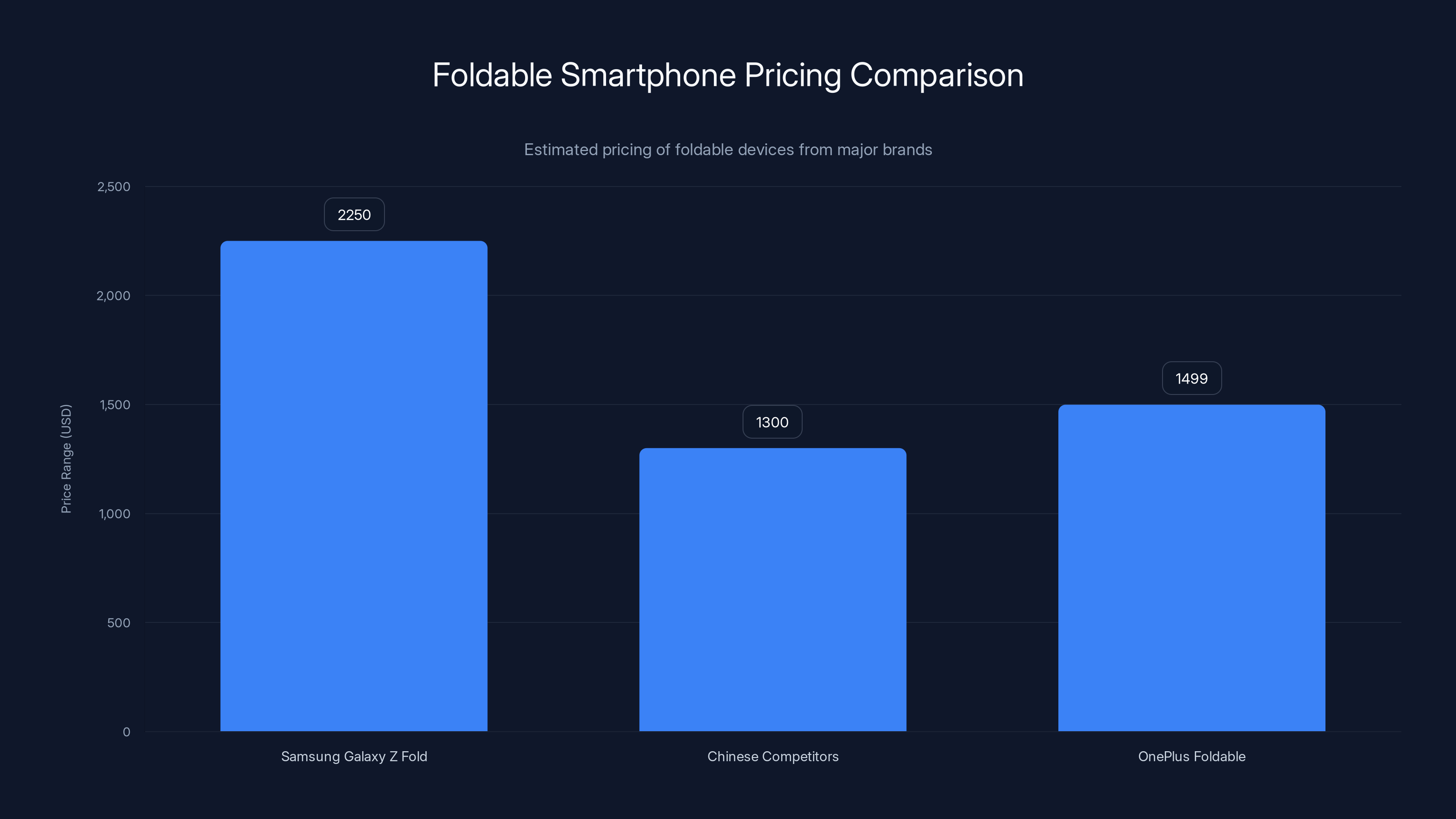

The cumulative effect of these cost reductions creates a window where a new entrant like One Plus could achieve competitive manufacturing costs similar to what Samsung and Chinese manufacturers currently enjoy, without requiring the multi-year R&D investment those companies made during foldable development's early phases. This timing advantage is substantial: One Plus could potentially enter the market with manufacturing costs supporting retail pricing $150-300 below what similarly-featured Samsung devices command, sufficient to establish compelling value positioning without compromising margins.

Market Maturation and Consumer Acceptance

Consumer perception of foldable smartphones has undergone a remarkable shift from 2020 to 2025. Early market research indicated that consumers viewed foldables as expensive novelties—impressive technology demonstrations with questionable practical advantages and genuine reliability concerns. Consumer surveys from 2021-2022 indicated that approximately 15-20% of smartphone users expressed interest in purchasing a foldable device, but the reasons for this interest often centered on premium status rather than functional advantages.

By 2025, consumer perception has shifted measurably toward pragmatism. Consumers increasingly appreciate foldables for genuine functionality: the ability to use larger screen real estate for productivity tasks, enhanced multitasking capabilities enabled by larger screens, and improved media consumption experiences. User reviews and long-term ownership data have become available, allowing potential buyers to make informed decisions based on actual use patterns rather than speculation. The psychological barriers that deterred mainstream adoption have diminished substantially.

This maturation of consumer perception is critical for a new entrant like One Plus. The company wouldn't need to educate consumers about the basic value proposition of foldable technology—that work has been done by earlier entrants. Instead, One Plus could focus on communicating specific value propositions: superior performance, refined design, competitive pricing, or unique software experiences. Market demand for foldables would exist independently of One Plus's entry, whereas in 2020, One Plus's introduction would have required substantial consumer education and demand creation.

Component Supply Chain Maturation and Availability

The foldable component supply chain has undergone significant maturation that benefits new entrants in 2026 more than would have been possible in prior years. When Samsung began manufacturing Galaxy Z Fold devices in 2019, the company maintained tight control over foldable display sourcing, creating supply bottlenecks that limited availability of critical components for competitors. Samsung Display's internal supply couldn't meet external demand, forcing competitors to negotiate with alternative suppliers like BOE and Visionox, often accepting less favorable terms due to limited alternatives.

By 2026, the foldable display supply chain has diversified substantially. Multiple suppliers operate at scale: Samsung Display, BOE, Visionox, and emerging suppliers from Taiwan and South Korea all produce foldable displays meeting comparable quality standards. This competitive supply ensures that a new entrant like One Plus could source displays at market rates without excessive premiums for new customer status or limited volumes. Supply commitments would reflect standard commercial terms rather than relationship-based scarcity dynamics that favored early entrants.

Hinge mechanisms, another critical foldable component, have similarly transitioned from custom-designed, manufacturer-specific solutions to increasingly standardized components available from specialized suppliers. Companies specializing in precision engineering for consumer electronics have developed hinge mechanisms that multiple manufacturers can implement, reducing the customization burden and costs associated with developing unique folding mechanisms.

Battery supply chains optimized for foldable applications have also matured, with multiple manufacturers capable of producing dual-cell configurations meeting the specific requirements of foldable devices. Thermal management materials, protective films, and protective glasses optimized for foldable applications are now available through standard component procurement channels rather than requiring custom development.

This supply chain maturation means that One Plus could achieve full production readiness for a foldable device more rapidly than competitors managed during their development phases, potentially reaching market within 18-24 months of committed development start, rather than the 3-4 year development cycles earlier entrants required.

OnePlus could position its foldable device at

Technical Innovation Opportunities for One Plus in the Foldable Space

Software Optimization and User Experience Differentiation

While competitors have devoted years to optimizing Android for foldable display configurations, significant opportunities remain for software differentiation that could define One Plus's competitive positioning. Oxygen OS, One Plus's custom Android variant, has traditionally emphasized clean interface design, responsive performance, and thoughtful feature implementation—qualities that align perfectly with foldable optimization needs.

The unique aspect of foldable software optimization lies not in basic functionality, which all manufacturers eventually achieve, but in the user experience philosophy embedded in the software. One Plus could differentiate through several approaches: seamless multitasking experiences specifically optimized for the foldable form factor, intelligent app-scaling that adapts UI layouts to maximize screen real estate usage, productivity features that exploit the larger screen for professional use cases, and gaming optimization that leverages the larger display for enhanced immersion.

One specific area where One Plus could establish differentiation is in gesture-based navigation and control optimized for one-handed operation on a foldable device in both folded and unfolded states. The fold creates a natural transition point in the device's physical configuration; One Plus could implement gesture systems that intelligently adapt to whether the device is folded or unfolded, automatically adjusting navigation paradigms for optimal usability in each configuration.

Another opportunity lies in artificial intelligence integration tailored for foldable devices. One Plus could implement on-device AI capabilities that understand context based on device configuration: when unfolded and used as a tablet-like device, the AI-powered assistant could optimize for productivity and multi-window workflows; when folded and used as a phone, the AI could adapt to mobile-optimized, task-focused interactions. This contextual AI implementation would represent genuine differentiation unavailable in non-foldable devices.

Display Technology and Form Factor Innovation

While all foldable displays currently employ either inward-folding (Samsung Galaxy Z Fold style) or outward-folding (Samsung Galaxy Z Flip style) configurations, One Plus could explore alternative approaches that differentiate the device physically while improving user experience. One approach involves optimizing the crease visibility through advanced display technology: using micro-lens arrays, advanced pixel layouts, or light diffusion structures specifically designed to minimize crease perception without compromising overall display quality.

Another potential innovation area involves the aspect ratio and size optimization of both the primary display and the exterior display (when unfolded). Current foldable devices accept certain trade-offs in screen proportions to accommodate folding mechanisms; One Plus could pursue designs that optimize the screen experience in both folded and unfolded states, potentially through innovative hinge designs that allow different screen aspect ratio configurations.

One Plus could also differentiate through display brightness and color accuracy standards that exceed current competitors' specifications. The flexible display technology limitations that constrain current brightness levels (typically 1000-1500 nits peak brightness) could potentially be overcome through advanced backlight engineering or display substrate innovations. A foldable device with peak brightness exceeding 2000 nits would represent measurable improvement for outdoor usability and content visibility, differentiation that would be immediately apparent to consumers.

Hinge and Mechanical Engineering Innovation

The hinge mechanism represents one of the most critical and differentiated components in any foldable device, yet it's also an area where incremental innovation remains abundant. One Plus could pursue hinge designs that improve upon current implementations through multiple approaches: reducing visible hinge gap when the device is fully opened (current devices show small gaps; One Plus could pursue near-zero-gap designs), improving tactile feedback across the opening and closing motion, or implementing new mechanical approaches that reduce stress on the flexible display.

One specific innovation path involves variable resistance hinges that adjust resistance throughout the opening motion, providing optimal user feedback characteristics. Current hinges typically maintain relatively consistent resistance, which represents a compromise between different usage scenarios; One Plus could implement hinges that adjust resistance dynamically based on opening angle, providing light resistance at initial opening (for easy one-handed deployment) while maintaining stronger resistance at intermediate angles (for stability during use) and reduced resistance when fully opened (for natural flat placement).

Another hinge innovation involves implementing multiple mechanical stops or preferred positions that optimize for specific use cases. A foldable device that naturally wants to rest at specific angles (perhaps 90 degrees for hands-free viewing, or 140 degrees for tent-mode stability) would enable use cases that current foldables support less naturally. One Plus's engineering expertise could be particularly valuable here, as the company has historically emphasized mechanical refinement and attention to hardware details.

Performance and Thermal Management Advantages

Foldable devices inherently present thermal management challenges compared to conventional smartphones: the larger screen, often-larger battery capacity split across two locations, and the constrained thermal paths created by the folding mechanism all create conditions where heat dissipation becomes more challenging. One Plus could differentiate through superior thermal management, enabling sustained high performance even during extended gaming or intensive computational tasks.

Implementing advanced thermal materials, optimized internal layouts that improve heat dissipation from critical components, and intelligent thermal throttling algorithms that maintain performance longer while protecting components could all contribute to differentiation. One Plus's reputation for responsive performance would be strengthened if the company's foldable devices maintained performance advantages under sustained loads compared to competitors' offerings.

The larger screen and processing power required for complex applications running on foldable displays creates opportunities for processor-level optimization. One Plus could work closely with Qualcomm to implement optimizations specifically tailored for foldable use cases, enabling performance advantages or efficiency improvements that wouldn't be available through standard processor implementations.

Competitive Positioning Strategy for One Plus Foldables

Value Pricing as Core Differentiation

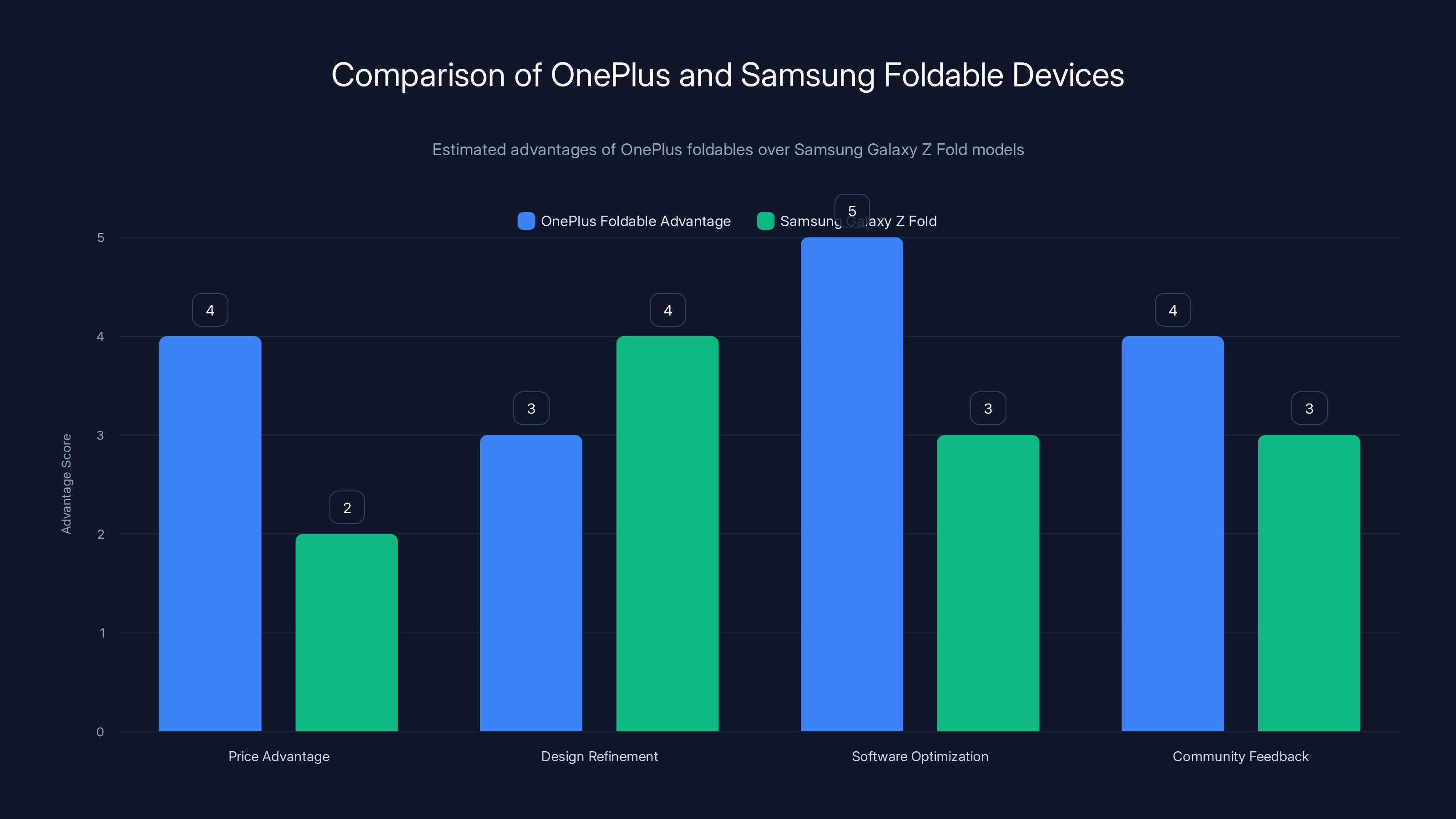

One Plus has built its brand identity around providing flagship technology at prices 15-30% below what premium competitors charge. This positioning created the "flagship killer" brand perception that drove early success for the company. However, in the conventional smartphone market, this differentiation has eroded as competitors have narrowed the price-performance gap through their own value-oriented offerings and as One Plus has gradually increased its pricing to premium levels.

The foldable market presents a unique opportunity for One Plus to re-establish its value differentiation positioning with particular force. Current foldable devices command significant premiums: Samsung Galaxy Z Fold devices retail for

The competitive advantage of value pricing in the foldable segment becomes even more pronounced when considering that consumers considering foldable purchase are already demonstrating premium device affinity (as evidenced by their consideration of devices in the $1,200+ price range). These consumers are often willing to accept slightly different form factor or feature compromises in exchange for measurably better value—precisely the audience that gravitates toward One Plus offerings.

One Plus could achieve this value positioning through several mechanisms: negotiating favorable component costs based on company size and volume commitments, implementing design efficiencies that reduce manufacturing complexity compared to competitors, or accepting lower profit margins on foldables to establish market presence and achieve volume scale. The company could even employ its traditional transparency and community engagement approach, explaining to consumers how One Plus achieves cost advantages that enable competitive pricing.

Design Philosophy and User-Centric Innovation

One Plus has historically differentiated through design refinement emphasizing ergonomic excellence, satisfying physical feedback, and attention to details that impact daily usability. These design priorities translate naturally to foldable devices, where the mechanical complexity and form factor changes create numerous opportunities for user experience optimization.

One Plus could position its foldable device around seamless integration of folding mechanics with overall industrial design, minimizing the visual and tactile evidence of the fold point, and creating devices that feel as polished and refined as One Plus's best conventional smartphone products. The company could emphasize the care taken in hinge mechanical refinement, the attention to minimizing display crease visibility, and the thoughtful integration of folding functionality into overall user experience.

This design-focused positioning would differentiate One Plus from competitors emphasizing pure specifications or feature checklists. Consumers choosing One Plus foldables would be selecting devices optimized for the tactile experience of opening and closing the device, the satisfaction of the mechanical feedback, and the overall refinement of the hardware experience—attributes that premium consumer electronics enthusiasts highly value.

Software Ecosystem and Integration Strategy

One Plus could differentiate through software integration and ecosystem partnerships that enhance foldable usability in practical contexts. Working with productivity software developers (Microsoft Office, Google Workspace providers, design tools), the company could optimize and co-market applications that benefit from larger foldable screens. This would establish One Plus foldables as particularly strong devices for professional and productivity use cases—a differentiation increasingly valuable as remote work remains prevalent.

Integration with One Plus's existing ecosystem, particularly One Plus Buds, One Plus Watches, and One Plus Band devices, could be optimized for foldable form factors. The company could implement features where companion devices automatically adapt their functionality based on whether the primary One Plus foldable device is folded or unfolded, creating seamless ecosystem experiences unavailable to consumers of competitor devices.

Community-Driven Development and Transparency

One Plus has built brand loyalty through community engagement, regular communication with users, and transparency about development processes. The company publishes detailed specifications, explains design decisions, and solicits feedback from user communities in ways that larger competitors rarely emulate.

This community engagement approach could become a significant differentiator for One Plus foldables. The company could invite customers to provide input on development priorities, publish detailed engineering breakdowns explaining design choices, and implement community-suggested improvements in subsequent iterations. This transparency approach builds customer loyalty and creates communities of advocates who promote One Plus devices not because they're objectively superior, but because they feel genuine investment in and connection to the company's development process.

The cost of foldable displays is projected to decrease significantly by 2026, reaching an estimated $60-80 per unit, making it an optimal time for OnePlus to enter the market. Estimated data.

Market Entry Strategy and Product Positioning

Single Product vs. Multi-Product Line Approach

When One Plus enters the foldable market in 2026, the company must decide whether to pursue a single flagship foldable product or a multi-product line strategy similar to Samsung's Galaxy Z Fold and Z Flip approach. Each strategy presents distinct advantages and challenges.

A single-product strategy would emphasize focus, allowing One Plus to concentrate engineering resources on creating an exceptional device that clearly defines the One Plus foldable identity. The company could pursue an inward-folding design similar to Samsung's Galaxy Z Fold, which offers optimal screen experience and has proven consumer appeal. This approach would minimize development complexity, reduce manufacturing setup costs, and allow One Plus to achieve higher unit volumes within a single production line configuration, reducing per-unit costs through focused manufacturing.

Alternatively, One Plus could pursue a dual-product strategy offering both inward-folding (large screen) and outward-folding (compact) variants, matching Samsung's established portfolio approach. This would provide consumers with form factor options aligned to different use cases and preferences, potentially attracting broader market segments. However, dual-product development would increase engineering complexity, require separate manufacturing lines or substantial line reconfiguration between products, and demand larger component volume commitments to multiple suppliers.

Considering One Plus's traditional focus on delivering exceptional single products rather than complex product families, a single-product entry strategy aligns better with the company's historical approach. One Plus could establish market presence with an exceptional inward-folding device, then potentially expand to additional form factors in subsequent generations once manufacturing efficiency and market demand establish the commercial viability of expanded offerings.

Launch Timing and Market Rollout Strategy

One Plus could pursue a phased global launch strategy, beginning with the markets where foldable adoption is most established and demand is strongest: China, South Korea, and selective developed markets. This phased approach would enable the company to refine production processes, validate product quality, and address issues with limited scope before scaling to global availability. Launching simultaneously across all major markets creates supply chain risks and customer service challenges if issues emerge post-launch.

A mid-2026 launch window would position One Plus foldables to compete against the latest generation of competitor devices while allowing sufficient time for component procurement and manufacturing setup. This timing would also establish One Plus presence in the market before the anticipated refresh cycles for competitor devices in late 2026 and 2027.

Partnerships and Collaborations for Market Differentiation

One Plus could establish strategic partnerships with application developers, productivity software providers, and content creators to ensure that One Plus foldables offer optimized experiences for popular applications and use cases. A partnership with Google would be particularly valuable, enabling One Plus foldables to receive early access to Android optimization for foldable form factors and ensuring that One Plus devices benefit from Android development priorities that enhance foldable usability.

Partnerships with professional software developers—for video editing, design tools, productivity applications—could position One Plus foldables as particularly strong devices for creative professionals and content creators. One Plus could market foldables as devices purpose-built for professionals whose workflows benefit from larger screens and multitasking capabilities.

Potential Challenges and Risk Mitigation for One Plus Entry

Manufacturing and Quality Control Complexity

Foldable device manufacturing presents substantially greater complexity than conventional smartphone production. The precision required for hinge mechanisms, the specialized handling of flexible displays, and the quality control processes needed to identify defects in foldable screens all demand manufacturing expertise that One Plus would need to develop or acquire. Unlike specifications-based differentiation, manufacturing excellence in foldables directly impacts customer satisfaction and warranty costs.

One Plus could mitigate this risk through several approaches: partnering with experienced manufacturers who have already achieved foldable production expertise, investing in specialized manufacturing facilities or retooling existing facilities specifically for foldable production, or implementing extremely rigorous quality control processes that identify issues before devices reach consumers. The company could also establish conservative yield targets initially, accepting lower production efficiency in exchange for higher quality assurance, then improving efficiency as manufacturing expertise accumulates.

Consumer Acceptance and Early-Adopter Fatigue

While foldable market acceptance has improved significantly, certain consumer segments remain skeptical about foldable durability and practicality. One Plus entering as a new foldable manufacturer means the company lacks the established reliability reputation in the foldable category that Samsung has built through five generations of Galaxy Z devices. Early purchasers of One Plus foldables would be taking a relative risk compared to established competitors.

One Plus could address this through transparent communication about durability testing, third-party certification from recognized testing laboratories, extended warranty terms that demonstrate confidence in product reliability, and user review programs that establish long-term durability credentials. The company could also emphasize manufacturing partnerships with established producers of foldable components, ensuring consumers understand that One Plus devices incorporate proven technology rather than experimental approaches.

Competition and Market Saturation Risks

The foldable market will likely continue becoming more competitive through 2026-2028, with additional manufacturers entering and existing competitors releasing new generations. One Plus entering in 2026 means the company wouldn't establish first-mover advantage; instead, the company would be entering an increasingly crowded category where differentiation becomes more challenging as competitors converge on similar features and capabilities.

One Plus could mitigate this risk through emphasis on aspects where the company has historical strength: value pricing, design refinement, software optimization, and community engagement. Rather than competing on specifications or attempting to be first with features, One Plus could establish differentiation through overall experience quality and value proposition.

Supply Chain Disruption and Component Sourcing

Foldable component supply chains remain vulnerable to disruptions, as demonstrated by occasional supply constraints for foldable displays and specialized hinge components. One Plus entering the market creates additional demand for already-strained components, potentially leading to supply constraints or pricing pressures that affect manufacturing volumes and profitability.

One Plus could mitigate this through long-term contracts with multiple component suppliers, ensuring supply diversity and reducing dependence on single sources for critical components. The company could also maintain safety stock of critical long-lead components, accepting storage and capital costs in exchange for supply security that enables consistent production volumes.

OnePlus foldables are projected to offer significant price and software optimization advantages over Samsung, appealing to value-conscious consumers. (Estimated data)

Market Projections and Revenue Potential for One Plus Foldables

Market Size and Growth Projections Through 2028

The global foldable smartphone market is projected to grow from approximately 12-13 million units in 2024 to 20-25 million units by 2028, representing a compound annual growth rate of approximately 15-20%. This growth trajectory, while substantial, reflects a market that remains a small fraction of the overall smartphone market (which moves approximately 1.2 billion units annually). However, within the premium smartphone segment, foldables are projected to represent an increasingly significant share—potentially 8-12% of devices priced above $800 by 2028.

Assuming One Plus successfully establishes 8-12% market share in the foldable category, the company could achieve 1.5-2.5 million unit sales by 2028, generating $2-4 billion in revenue from foldables alone. This would represent meaningful contribution to One Plus's overall business, particularly considering that foldables command premium price points supporting higher revenue per unit than conventional smartphones.

Profitability and Margin Considerations

Foldable devices command premium price points ($1,200-2,500 depending on configuration), but they also entail higher manufacturing costs compared to conventional smartphones. The additional components (flexible display, precision hinge, specialized battery configuration), specialized manufacturing processes, and quality control requirements increase unit costs substantially.

Industry analysis suggests that well-manufactured foldable devices can achieve gross margins of 30-40%, comparable to premium non-foldable smartphones. One Plus, emphasizing value pricing, might accept margins in the 25-35% range to establish competitive positioning. This margin profile would be acceptable for profitability while supporting the company's value differentiation strategy.

Operating margins (accounting for R&D, marketing, and distribution costs) would likely be lower than gross margins suggest, particularly during the initial product generations when development and market establishment costs are highest. One Plus would likely see operating margins of 8-15% on foldable products during initial years, improving toward 15-25% as manufacturing efficiency increases and market position solidifies.

Return on Investment and Strategic Value Beyond Direct Profitability

From a purely financial perspective, One Plus foldables would likely be profitable and contribute meaningfully to company revenue. However, the strategic value extends beyond direct profitability calculations. Successful entry into the foldable market would reestablish One Plus as an innovator pursuing cutting-edge form factors, not merely a manufacturer of refined conventional devices. This would strengthen brand perception among technology enthusiasts and early adopters—audience segments that drive broader brand recognition and prestige.

Foldable products would also generate substantial media attention and reviews from technology publications worldwide, creating marketing value that would be difficult and expensive to achieve through paid advertising. Each foldable device review would position One Plus alongside Samsung, Google, and other premium manufacturers, elevating the company's competitive positioning within the broader technology landscape.

Furthermore, the engineering expertise and manufacturing capabilities developed through foldable device production would create organizational competencies applicable to future innovation initiatives. The company would establish expertise in flexible display integration, advanced hinge engineering, and optimization of software for non-conventional form factors—capabilities valuable for foldables and potentially applicable to other innovative product categories.

Lessons from Competitor Foldable Development and Implementation

Samsung's Iterative Refinement Approach

Samsung's foldable development across five generations of Galaxy Z Fold and Z Flip devices provides valuable lessons about successful foldable market positioning. The company's strategy emphasizes iterative refinement rather than revolutionary changes, addressing customer pain points identified through previous generation usage. Each generation has brought measurable improvements: reduced crease visibility, improved durability, enhanced battery capacity, better software optimization, and refined design details.

This iterative approach suggests that One Plus shouldn't pursue a "perfect" first-generation device but should instead plan for multiple product generations with committed roadmaps for incremental improvement. Customers purchasing One Plus foldables would understand that performance and feature improvements would follow in subsequent years, similar to conventional smartphone product cycles.

Samsung's pricing strategy also provides insights: the company has consistently maintained premium pricing despite competitive entry from Chinese manufacturers, suggesting that brand perception and ecosystem investment support price maintenance. One Plus could similarly maintain prices across subsequent generations even as manufacturing costs decline, though the company's traditional value positioning suggests One Plus might pass more of cost savings to consumers through price reductions or feature additions.

Chinese Manufacturer Speed and Iteration

Chinese manufacturers' rapid foldable development cycles—often releasing new models annually or bi-annually—demonstrate that iteration speed can become a competitive advantage. Xiaomi, Oppo, and Honor have shown willingness to pursue experimental approaches, learn from market response, and refine designs quickly in response to customer feedback.

One Plus could adopt a similar rapid iteration approach, planning for annual product releases or significant updates rather than the traditional multi-year development cycles that dominated early foldable development. This would position One Plus as responsive to customer needs and market trends, potentially establishing the company as the "fast-follower" that identifies successful features from competitors and implements them more rapidly and with better execution.

Google's Software-First Approach

Google's entry into foldables emphasized software experience and AI integration optimized for larger foldable screens. Rather than pursuing display or hinge innovation, Google differentiated through software capabilities that justify the foldable form factor on functional rather than purely premium grounds. This approach resonates with productivity-focused consumers seeking practical advantages beyond larger screen real estate.

One Plus could emulate this software-focused differentiation, developing Oxygen OS features that provide clear advantages on foldable devices compared to conventional phones. Multitasking optimization, productivity integration, gesture systems optimized for folding mechanics, and AI features adapted for foldable context could all contribute to meaningful software differentiation.

The global foldable smartphone market is expected to grow significantly, with OnePlus potentially capturing 8-12% market share by 2028, translating to 1.5-2.5 million units. (Estimated data)

Industry Expert Perspectives on Foldable Market Evolution

Current Foldable Market Consensus

Industry analysts and technology experts widely acknowledge that foldables have transitioned from experimental niche products to legitimate mainstream premium devices. The consensus suggests that foldable market growth will accelerate substantially in 2026-2027 as manufacturing maturity increases and prices begin declining toward more accessible levels. Major analyst firms project foldables entering mass-market consideration phases by 2027-2028, when price points may reach

Experts emphasize that foldables have overcome fundamental skepticism regarding durability and practicality. The question is no longer "whether foldables are durable enough" but rather "which foldables offer the best balance of durability, performance, design, and value for specific use cases." This shift from fundamental viability questions to competitive differentiation questions represents a maturation milestone that benefits new entrants by reducing educational burden.

Predictions Regarding New Entrant Success Probability

Industry experts hold varying views about the feasibility of new entrant success in foldables. Some emphasize the substantial competitive moats Samsung has established through device generations, ecosystem development, and manufacturing expertise. Others point to the success of Chinese manufacturers in achieving significant market share despite Samsung's first-mover advantages, suggesting that adequate differentiation and execution can overcome established competition.

General consensus acknowledges that successful foldable entry requires sustained commitment, accepting losses or reduced profitability during market establishment, and demonstrating clear differentiation that justifies customer consideration of a newer brand. One Plus's strong brand reputation, customer loyalty among technology enthusiasts, and track record of delivering value could overcome the disadvantage of late entry.

2026 as an Inflection Point

Experts broadly acknowledge 2026 as a critical year for foldable market evolution. Manufacturing maturity reaches levels sufficient to support new entrants with reasonable cost structures and quality assurance. Market demand has established sufficient scale to reward multiple competitors rather than concentrating benefits among first-movers. Consumer acceptance has matured enough that marketing can emphasize practical advantages rather than experimental appeal.

Industry observers suggest that manufacturers waiting beyond 2026 to enter foldables risk entering a market where differentiation becomes increasingly difficult and customers have already formed strong brand preferences based on early experiences. Conversely, manufacturers entering before 2026 face higher manufacturing costs, more limited component sourcing options, and less mature supply chains that complicate production and increase risks.

Strategic Recommendations for One Plus Foldable Success

Pre-Launch Market Research and Positioning

Before committing to full-scale development, One Plus should conduct extensive market research to validate positioning and identify specific customer segments most likely to respond to One Plus foldables. This research should address: which form factor (inward-folding, outward-folding, or both) resonates strongest with target audiences; what price points optimize between competitive positioning and margin requirements; which specific features and capabilities most influence purchase decisions; how consumers perceive One Plus brand positioning relative to established foldable manufacturers.

This research would inform positioning strategy, ensuring that One Plus emphasizes differentiators aligned with customer priorities rather than focusing on features customers consider less important. The company should particularly investigate whether One Plus's historical value positioning remains appealing to foldable consumers (who tend to be more premium-focused than conventional smartphone buyers) or whether brand perception requires evolution toward more premium positioning to establish credibility in the foldable category.

Development Timeline and Milestone Planning

One Plus should establish a realistic development timeline targeting late 2025 or early 2026 product launch, allowing sufficient time for design, engineering, prototype validation, manufacturing setup, quality assurance, and inventory accumulation without extended delays. This timeline would position One Plus advantageously relative to competitor refresh cycles while providing adequate development duration to achieve manufacturing quality standards.

Key development milestones should include: component source identification and long-term contract negotiation (completed by early 2025); prototype development and internal validation (early 2025); design finalization and manufacturing process validation (mid-2025); quality assurance and durability testing (mid-late 2025); initial production and inventory accumulation (late 2025); regulatory certification and market launch (early-mid 2026).

One Plus should also establish contingency timelines acknowledging that foldable development often encounters unexpected challenges requiring extended problem-solving. Building flexibility into the schedule would reduce pressure to launch products before quality assurance is complete, a mistake that could damage brand perception irreparably.

Marketing and Brand Communication Strategy

One Plus should develop comprehensive marketing strategies positioned around core brand differentiation—value pricing, design refinement, software optimization, and community engagement. Marketing messaging should emphasize the practical advantages of One Plus foldables for specific use cases (productivity, content creation, professional use) rather than marketing foldables primarily on premium status grounds.

The company should leverage its community engagement strengths through transparent communication about development progress, engaging with user communities in feature prioritization, publishing detailed engineering explanations of design decisions, and inviting feedback throughout the development process. This community-driven marketing approach would differentiate One Plus from competitors emphasizing specification-focused advertising.

One Plus should also invest substantially in technology journalism relationships and reviewer programs, ensuring comprehensive coverage from major technology publications and influential independent reviewers. Foldable devices generate significant consumer interest and media attention; One Plus maximizing this attention through strategic journalist engagement would provide disproportionate marketing value relative to paid advertising investment.

Distribution and Availability Strategy

One Plus should establish broad distribution channels combining online direct sales (leveraging the company's e-commerce strength), major carrier partnerships for subsidized options, and selective retail partnerships in key markets. The company should prioritize early availability in markets with strong foldable adoption (China, South Korea, major developed markets) while potentially delaying less-mature markets where foldable demand remains limited.

Initial production volumes should target 500,000-1,000,000 units in the first year, sufficient to establish meaningful market presence while remaining achievable through limited production lines. This volume target would generate substantial revenue while avoiding overextension of manufacturing capabilities or inventory risk from demand forecasting errors.

After-Sales Service and Support Excellence

Foldable devices present unique service and support challenges compared to conventional smartphones. One Plus should establish comprehensive after-sales service programs including: specialized diagnostic tools for identifying foldable-specific issues, trained technician programs for hinge and flexible display service, transparent warranty terms clearly explaining coverage for normal wear and manufacturing defects, and rapid replacement programs ensuring that customers don't experience extended downtime from foldable device issues.

Given that early One Plus foldable purchasers would be making substantial investments ($1,400+) in devices from a company with limited foldable track record, exceptional after-sales service would differentiate One Plus meaningfully from competitors. Quick resolution of issues, hassle-free support experiences, and demonstrated commitment to customer satisfaction would build loyalty and generate positive word-of-mouth that drives broader adoption.

Estimated data suggests that by 2026, OnePlus could capture 15% of the foldable smartphone market, leveraging its brand reputation and value pricing to compete effectively against established players like Samsung and Google.

Conclusion: The Strategic Case for One Plus Foldable Entry in 2026

The argument for One Plus entering the foldable smartphone market in 2026 rests on multiple converging factors that create a uniquely favorable window for market entry. The technology underlying foldable devices has matured sufficiently to support reliable, durable products from new manufacturers. Component supply chains have evolved to enable new entrants to source critical materials on reasonable commercial terms without excessive premiums or supply constraints. Manufacturing processes and quality control approaches have stabilized, reducing the experimental nature of foldable production.

Moreover, consumer market conditions have fundamentally shifted since the foldable category's inception. Consumers no longer question whether foldables are durable enough or whether they offer practical advantages—these baseline questions have been answered affirmatively through years of real-world usage. Instead, consumers now evaluate foldables through the lens of normal product selection criteria: performance, design, software experience, value for money, and brand preference. This normalization of foldables eliminates the burden of category education that burdened earlier entrants.

Competitively, the foldable market has matured from a Samsung-dominated segment to a genuinely multi-player competitive landscape with successful entries from Chinese manufacturers and new entrants like Google. The presence of multiple competitors demonstrates that the market rewards differentiation and value rather than concentrating benefits among early movers. One Plus's strengths—brand reputation among technology enthusiasts, manufacturing competence, commitment to value pricing, and user-centric design philosophy—position the company well to compete effectively against established foldable manufacturers.

From a financial perspective, entering the foldable market would generate meaningful revenue and profit contributions while remaining achievable within One Plus's manufacturing and R&D capabilities. The market size (projected 20-25 million units by 2028) is sufficiently large to support multiple competitors pursuing different strategic positioning. One Plus capturing 8-12% market share would translate to 1.5-2.5 million unit sales and $2-4 billion in annual revenue by 2028—a substantial achievement that would transform One Plus's portfolio balance.

Beyond direct financial returns, foldable entry would strengthen One Plus brand perception, demonstrating the company's commitment to innovation and advanced technology. The marketing value generated through foldable product announcements, media reviews, and consumer interest would enhance One Plus brand positioning in ways that conventional smartphone product refreshes cannot achieve. The engineering expertise developed through foldable manufacture would create organizational capabilities applicable to future innovation initiatives.

However, success is not guaranteed. One Plus would face intense competition from established foldable manufacturers with greater experience and established user bases. The company would need to execute flawlessly on product design, manufacturing quality, software optimization, and customer service. Manufacturing complexity requires investment in specialized expertise and facilities. Market acceptance is not assured, even among One Plus's existing customer base.

Yet these challenges, while substantial, are surmountable through disciplined execution, sustained commitment, and the strategic advantages that 2026 market conditions provide. Waiting beyond 2026 risks allowing competitive positions to calcify further, as Samsung, Chinese manufacturers, and potentially other entrants strengthen foldable market presence. Waiting also means missing the cost reduction inflection point and supply chain maturation advantages that 2026 presents.

For One Plus, 2026 represents the optimal moment to reassert the company's innovation credentials through foldable market entry. The timing aligns with One Plus's traditional philosophy of delivering cutting-edge technology at compelling value. The market conditions support new entrant success for well-executed competitors. The competitive landscape has matured sufficiently that differentiation opportunities exist for companies offering genuine improvements over established competitors.

The strategic question is not whether One Plus can successfully enter the foldable market—the company clearly possesses the capabilities required. Rather, the question is whether One Plus's leadership recognizes the strategic moment and commits to the sustained effort required to establish credible foldable product lines. For a company that built its brand through bold decisions and commitment to innovation, entering the foldable market in 2026 would represent alignment between strategic opportunity and organizational capability. For competitors and consumers, One Plus foldable devices would represent meaningful additional choice in a category increasingly defining the premium smartphone market.

The case for 2026 as the perfect year for One Plus foldable entry is compelling. The technology is ready. The market is ready. The competitive landscape provides opportunity. The strategic timing is optimal. All that remains is for One Plus to make the commitment and execute the plan.

FAQ

What specific advantages would One Plus foldable devices offer compared to Samsung Galaxy Z Fold models?

One Plus foldables would differentiate primarily through value pricing (potentially $300-500 lower than comparable Samsung devices), refined design emphasizing hinge smoothness and display crease minimization, optimized Oxygen OS software tailored for foldable form factors with enhanced multitasking and productivity features, and community-driven development prioritizing customer feedback over specifications. While Samsung foldables offer established reliability and ecosystem maturity, One Plus would appeal to value-conscious customers willing to accept newer manufacturer status in exchange for better price-to-feature ratios and thoughtful software optimization.

Why would 2026 specifically represent better timing for One Plus entry than earlier years like 2024 or 2025?

Foldable component costs, particularly flexible displays and hinge mechanisms, have experienced dramatic reduction through 2025 with projections for continued decline into 2026, enabling One Plus to achieve manufacturing cost parity with established competitors without years of R&D investment. Supply chain maturation allows multiple component sources, reducing One Plus's dependence on relationship-based procurement and enabling competitive cost negotiations. Consumer acceptance has matured beyond early-adopter skepticism, eliminating the substantial educational burden earlier entrants faced. Manufacturing processes and quality control approaches have stabilized through generations of competitor refinement, reducing the experimental nature of foldable production. Combined, these factors create conditions optimal for new market entry, whereas earlier timing would have encountered higher costs, limited component sourcing, uncertain consumer acceptance, and less mature manufacturing processes.

What manufacturing challenges would One Plus need to overcome for successful foldable production?

One Plus would need to develop expertise in flexible display handling and quality control (identifying defects in foldable screens before customer delivery), precision hinge mechanism manufacturing (ensuring smooth opening/closing mechanics and durability across hundreds of thousands of cycles), integration of dual-cell battery configurations, and software optimization accounting for device configuration changes. The company would likely address these through partnerships with experienced foldable component manufacturers, investment in specialized manufacturing equipment and training, and implementation of rigorous quality assurance protocols. Initial production would emphasize quality over volume, accepting manufacturing efficiency reductions in exchange for high reliability that establishes consumer confidence in One Plus foldable durability.

How would One Plus differentiate foldable software experiences from competitors?

One Plus could implement context-aware AI that adapts interface behavior based on whether the device is folded or unfolded, sophisticated multitasking optimization enabling seamless app switching and split-screen workflows optimized for larger foldable screens, gesture systems specifically designed for one-handed operation in both folded and unfolded configurations, productivity integration with professional software (Microsoft Office, Google Workspace, design tools), and ecosystem integration with One Plus companion devices (Buds, Watches) that automatically adapt functionality based on device configuration. This software differentiation would position One Plus foldables as particularly strong for productivity and professional use cases, appealing to customers whose workflows benefit from larger screen real estate.

What would be realistic pricing expectations for One Plus foldable devices?

One Plus would likely position inward-folding foldables at

Would One Plus foldables cannibalize sales of conventional One Plus flagship phones?

Some cannibalization would be inevitable, as customers with sufficient budgets for $1,400+ devices might choose foldables over conventional flagship phones. However, foldable and conventional flagship segments appeal to partially different customer needs: foldables emphasize larger screen real estate and premium novelty, while conventional flagships emphasize ergonomic practicality for daily use and refined performance. One Plus could mitigate cannibalization through positioning foldables for specific use cases (productivity, content creation) while maintaining conventional flagships as superior for conventional smartphone usage patterns. The overall effect would likely be positive for One Plus, as foldables would open pricing segments and customer segments that conventional phones alone couldn't penetrate, while conventional flagships would retain customers prioritizing everyday practicality over larger screens.

How would One Plus establish supply chain security for critical foldable components?

One Plus would pursue long-term contracts with multiple foldable display suppliers (Samsung Display, BOE, Visionox), ensuring supply diversity and reducing single-source dependence. The company would maintain strategic inventory of long-lead components, accepting capital and storage costs in exchange for supply security enabling consistent production volumes. One Plus would work closely with hinge mechanism specialists and battery manufacturers to ensure supply reliability. The company would also establish relationships with component backup suppliers, creating fallback options if primary suppliers experienced disruptions. By committing to multi-year volume commitments with multiple suppliers, One Plus would secure favorable pricing and supply priority, mitigating risks of component constraints that could limit production volumes.

What timeline would be realistic for One Plus foldable development and launch?

Assuming One Plus committed to foldable development in early 2025, realistic timeline would target late 2025 or early 2026 product announcement with subsequent market availability. Compressed timeline compared to early foldable development (Samsung's first Galaxy Z Fold development required 3+ years) would be achievable because One Plus could learn from competitors' design approaches, source proven components rather than developing custom parts, and optimize software using established Android foldable optimization approaches. Development would include prototype design and validation (early 2025), manufacturing process optimization (mid-2025), quality assurance and durability testing (mid-late 2025), and production ramp (late 2025-early 2026). This timeline would position One Plus advantageously relative to competitor refresh cycles while allowing adequate development duration to achieve quality standards.

Would One Plus face intellectual property or patent challenges from foldable development?

Foldable technology incorporates numerous patented designs, particularly regarding hinge mechanisms, flexible display protection, and thermal management approaches. One Plus would likely need to negotiate licensing agreements with Samsung and other patent holders, or develop alternative approaches avoiding patented innovations. However, the foldable market maturity means that many fundamental patents have transitioned from active development phases into licensing arrangements, suggesting that patent-holder licensing (rather than litigation) would be the standard approach. One Plus's established relationships with component suppliers and industry partnerships would facilitate identifying viable technology approaches that respect existing intellectual property while enabling competitive products. Patent challenges would increase development complexity and cost, but would not represent insurmountable obstacles preventing market entry.

Key Takeaways

- 2026 represents a strategic inflection point where foldable technology maturity, component cost reductions, and supply chain evolution favor new market entrants like OnePlus

- Current foldable market dominated by Samsung and Chinese manufacturers has matured beyond early-adopter phase, enabling new competitors to compete on differentiation rather than category education

- OnePlus could differentiate through value pricing (300-500 discount vs Samsung), refined design emphasizing hinge mechanics, and software optimization for productivity use cases

- Manufacturing complexity of foldables presents challenges but manageable for OnePlus through component partnerships, specialized manufacturing investment, and rigorous quality assurance protocols

- Market projections suggest foldable devices reaching 20-25 million unit sales by 2028, sufficient to support OnePlus achieving 8-12% market share and $2-4 billion annual revenue from foldables alone

- Success requires sustained multi-year commitment, acceptance of initial margin compression, and development of manufacturing expertise in flexible displays, hinge mechanisms, and thermal management

- OnePlus entry would provide meaningful brand benefits beyond direct profitability, strengthening perception as innovation leader and creating valuable organizational competencies for future products