PayPal's CEO Transition: What Enrique Lores Brings to Digital Payments

When PayPal announced its leadership change in early February 2026, the financial world took notice. The company didn't just shuffle executives or promote from within. Instead, PayPal reached outside its ecosystem to recruit Enrique Lores, who spent six years steering Hewlett-Packard through a digital transformation. This move signals something deeper than a simple executive shuffle. It's a statement about where PayPal thinks digital payments are heading and what kind of leader the company needs to get there.

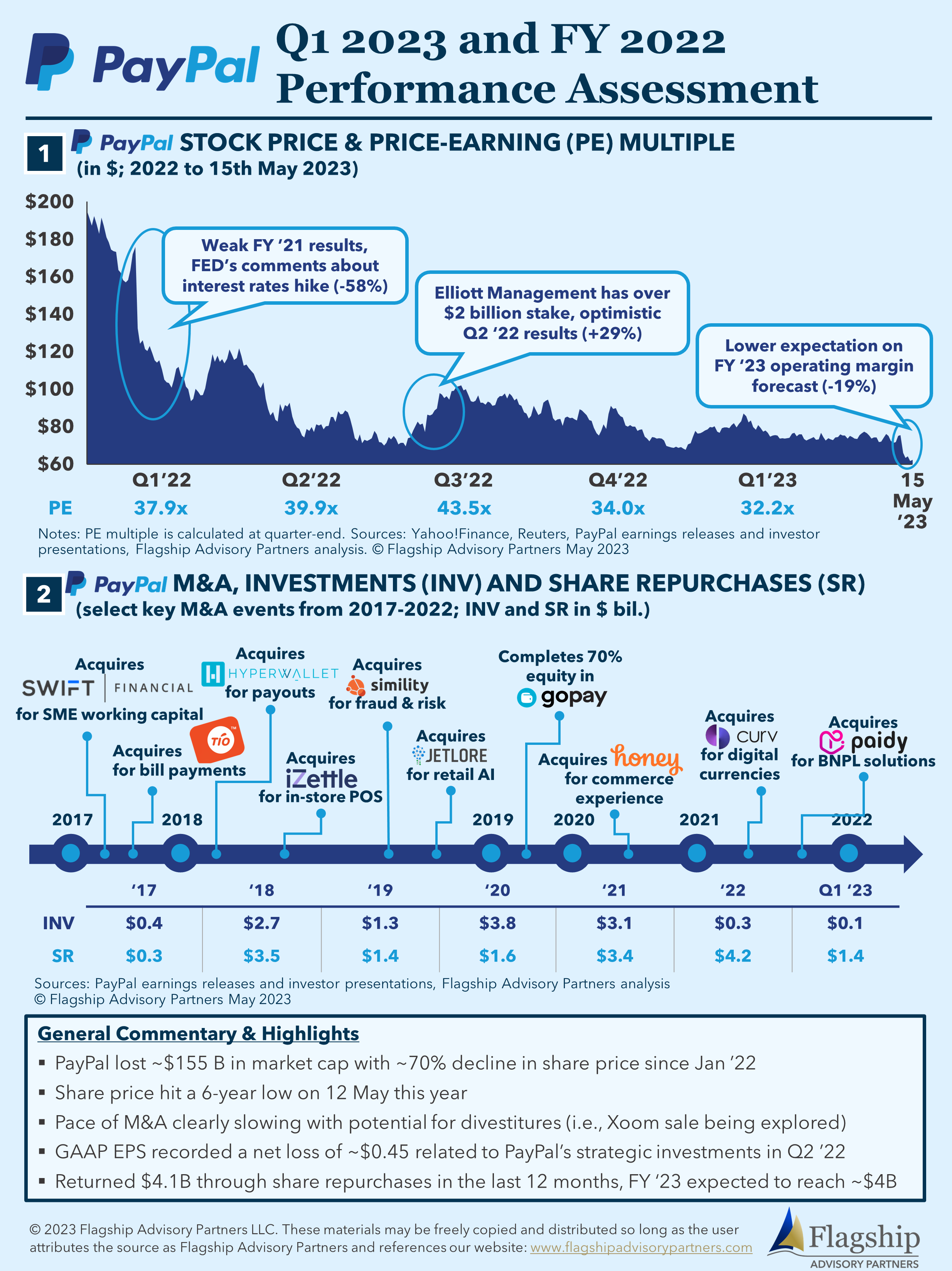

Lores isn't walking into a stable situation. PayPal's fourth-quarter earnings disappointed investors significantly. Revenue came in below expectations. Profit margins contracted. The company issued a profit forecast that suggested growth wouldn't materialize as Wall Street had anticipated. By the numbers, PayPal's stock dropped nearly 18% in premarket trading after the announcement. That kind of market reaction doesn't happen because shareholders like change for change's sake. It happens because the previous strategy wasn't working.

But here's what makes Lores interesting. He's not a fintech native. He came up through hardware and enterprise IT. At HP, he didn't revolutionize the printer industry. Instead, he streamlined operations, cut costs, pivoted the business model, and executed a relentless focus on what actually mattered. That operational discipline is exactly what the board apparently felt PayPal was missing.

The appointment also comes with immediate consequences. Alex Chriss, who took over as CEO in September 2023 from longtime chief Dan Schulman, is out. Jamie Miller, PayPal's CFO and COO, steps in as interim CEO until Lores officially joins the company. That transition period matters. It's a window where the board and interim leadership can prepare a roadmap, stabilize operations, and create a clear mandate for the incoming chief.

The real question isn't whether Lores can manage. It's what he'll actually change when he gets there. The payments landscape has shifted dramatically since Schulman's era. AI is reshaping commerce. Competitors multiply daily. Regulatory pressure mounts. And consumer behavior keeps evolving faster than most institutions can adapt. PayPal's board is betting that Lores has the operational chops and strategic vision to navigate this complexity.

The PayPal Leadership Crisis: Why Alex Chriss Lost the Board's Confidence

Alex Chriss had one job when he arrived at PayPal in September 2023: stabilize the company and prove that legacy fintech could compete with agile startups. He came from Intuit, where he'd learned the playbook of integrating acquisitions and building products customers actually wanted to use. On paper, it seemed like a solid fit.

In practice, it didn't work out that way.

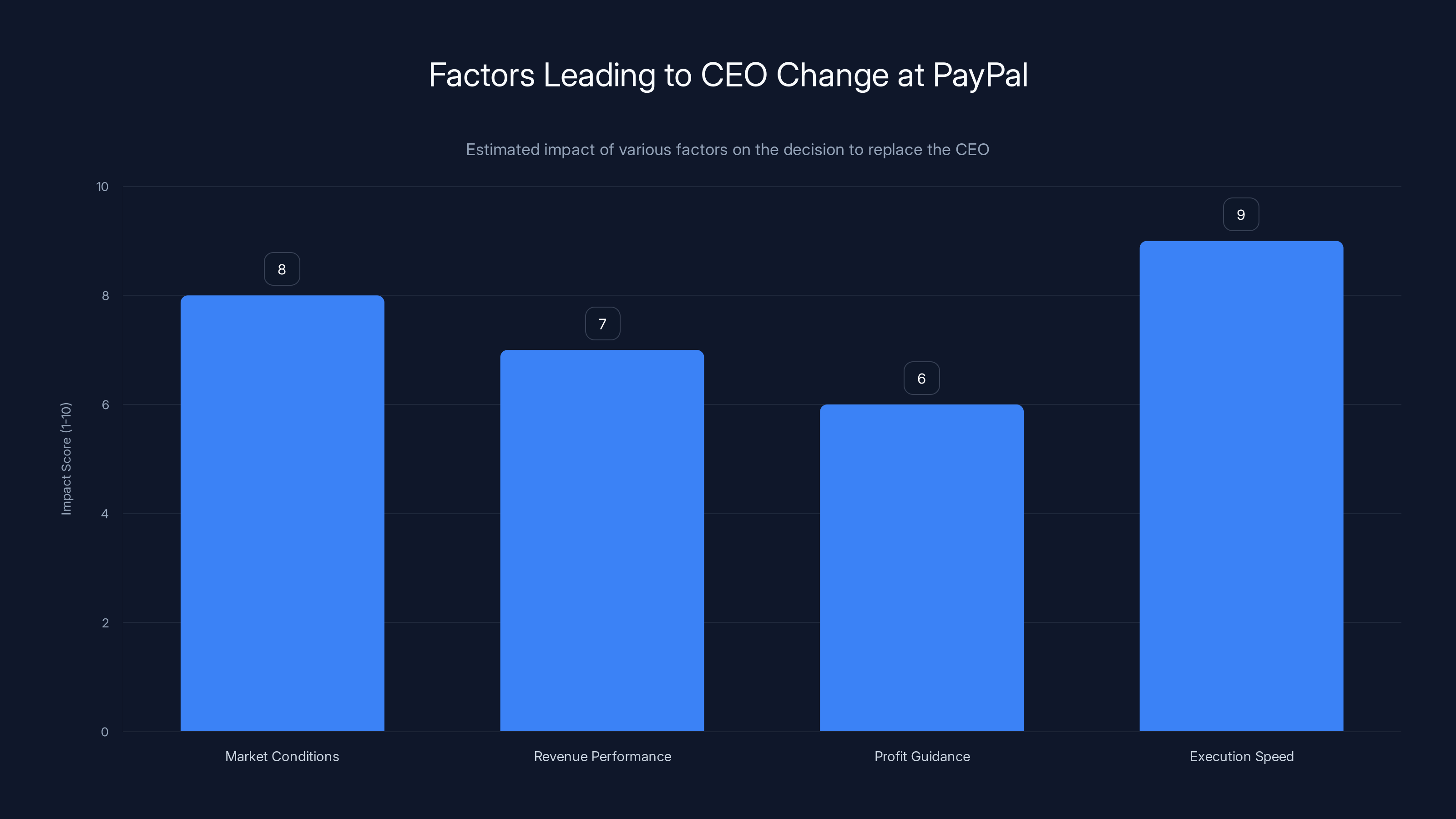

Chris had less than three years on the job before the board lost patience. That's not a long runway for any CEO, especially one inheriting a company with structural challenges. But the board's messaging was clear: the "pace of change and execution was not in line with expectations" given the market environment. Translation: we needed to move faster, and you weren't moving fast enough.

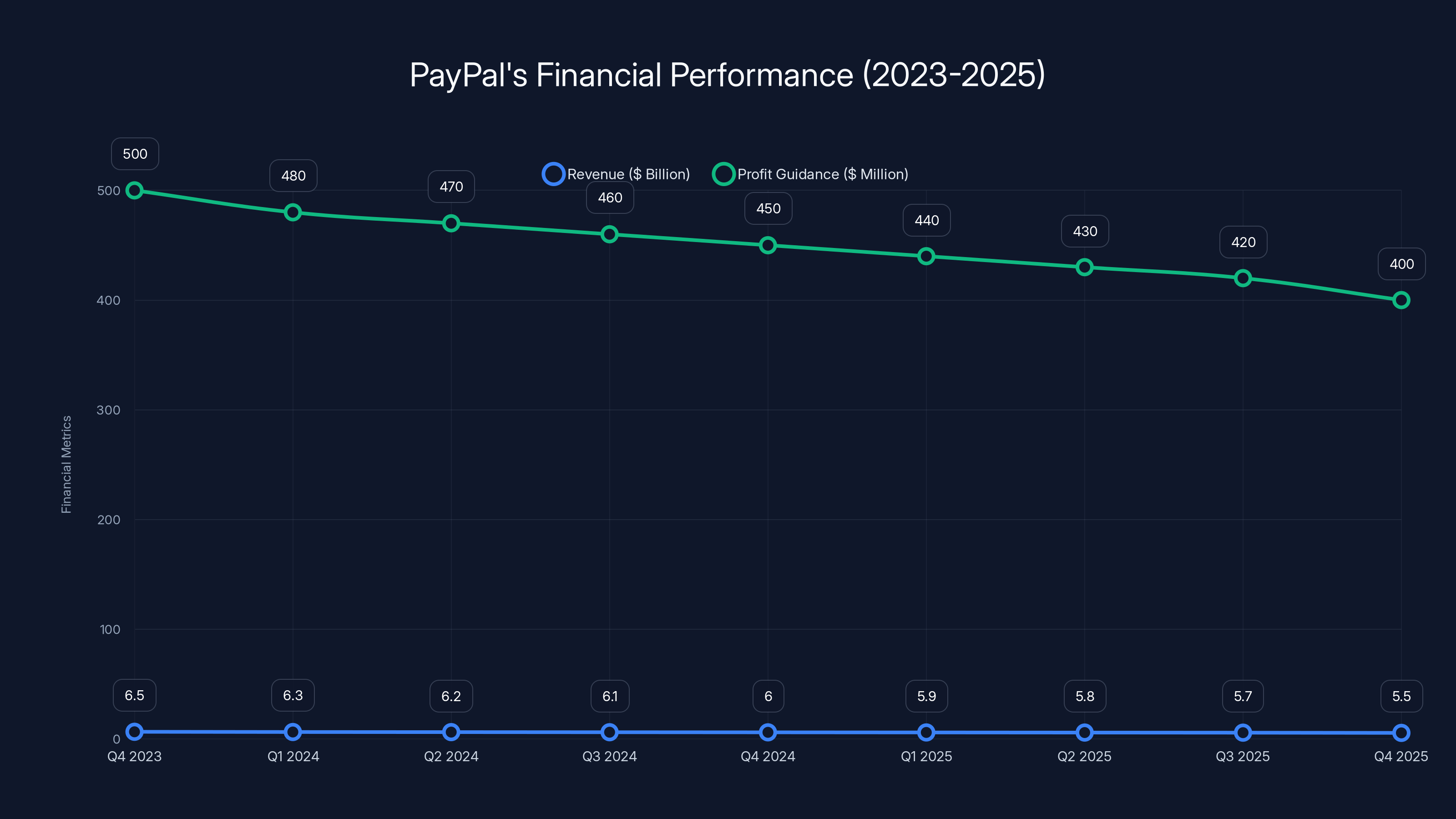

PayPal's Q4 2025 results tell the story better than any board memo. The company missed revenue targets. Profit guidance came in lower than consensus expectations. Consumer spending has weakened due to broader economic pressures. The labor market has softened. People are spending less. Companies are cutting costs. In that environment, a payment processor needs to show growth, not just stability. PayPal didn't show either.

More specifically, PayPal's main revenue streams faced headwinds. Transaction volumes softened. Take rates (the percentage PayPal charges per transaction) came under pressure from competition and pricing wars. The platform's ability to drive incremental value for merchants and consumers stalled. From the board's perspective, Chriss had inherited a company in a critical inflection point and failed to capitalize on the opportunity.

Dan Schulman, Chriss' predecessor, had run PayPal for a decade. That's a long time in tech. It gave him the runway to build, iterate, and adapt. By contrast, the board apparently felt it couldn't afford to give Chriss that same patience. The competitive environment had accelerated. AI was becoming table stakes. Regulations were tightening. The board wanted someone who could move decisively, quickly, and with proven execution credentials.

This is where Enrique Lores enters the picture.

The board's decision to replace the CEO was heavily influenced by the need for faster execution and adapting to market conditions. Estimated data.

Who Is Enrique Lores? The HP Veteran's Track Record

Enrique Lores isn't famous outside tech and business circles, but his resume speaks volumes. He led HP through one of the more challenging transitions in enterprise technology. When Lores became CEO in 2019, HP was a sprawling conglomerate struggling with identity. The company had been split off from HP Enterprise years earlier. It owned everything from consumer printers to workstations to supplies divisions. None of it fit together neatly. Profit margins were thin. Growth was stalled. The narrative was that HP's best days were behind it.

Lores spent six years fixing that narrative. He didn't do it by inventing revolutionary products. Instead, he did it through operational discipline. He clarified the business model. He divested underperforming divisions. He automated supply chains. He improved manufacturing efficiency. He cut the right costs and invested in the right areas. By 2024, HP was more profitable, more focused, and more viable than it had been in years.

That playbook translates directly to what PayPal needs. PayPal isn't a hardware company. The operational challenges are different. But the core requirement is the same: clarify what the company actually does, focus on the most valuable business lines, improve execution, and eliminate waste.

Lores also brings something else to the table: deep experience with AI and automation. During his tenure at HP, he oversaw the company's pivot toward AI-driven business services, including the launch of HP AI+. He understands how to integrate artificial intelligence into operations, products, and business models. That experience is directly relevant to PayPal's challenge. The payments industry is being reshaped by AI right now.

In his statement about the appointment, Lores highlighted this explicitly: "The payments industry is changing faster than ever, driven by new technologies, evolving regulations, an increasingly competitive landscape, and the rapid acceleration of AI that is reshaping commerce daily." This isn't boilerplate CEO speak. It's a direct acknowledgment that AI is the central challenge PayPal faces.

Lores' tenure at HP also reveals something about his management style. He's methodical, data-driven, and focused on long-term value creation. He doesn't make dramatic announcements and then disappear. He shows up, digs into operations, makes structural changes, and follows through. That's the opposite of the kind of leadership that gets headlines but fails to deliver results.

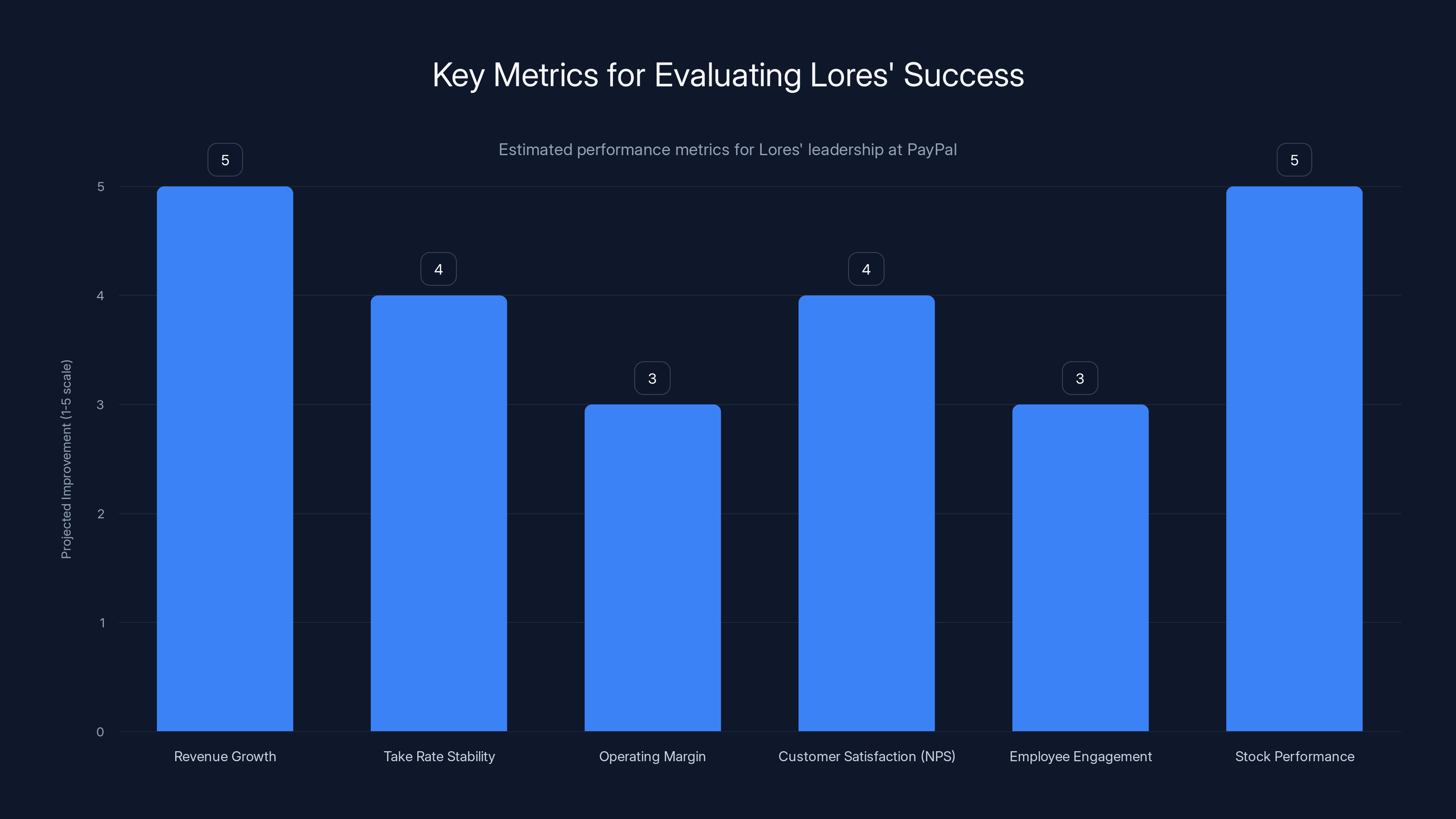

Estimated data suggests Lores' success will be measured by improvements across key metrics, with stock performance and revenue growth being critical areas.

The Broader Payment Industry Challenge: Why PayPal Needs a New Strategy

PayPal's troubles can't be blamed entirely on internal execution failures. The entire digital payment ecosystem is shifting, and companies that don't adapt will get left behind.

For years, PayPal dominated online payments. The company literally created the category as we know it. When someone bought something on eBay or established an online store, PayPal was the obvious choice for accepting payments. But that moat has eroded. Fast forward to 2026, and the competitive landscape looks completely different.

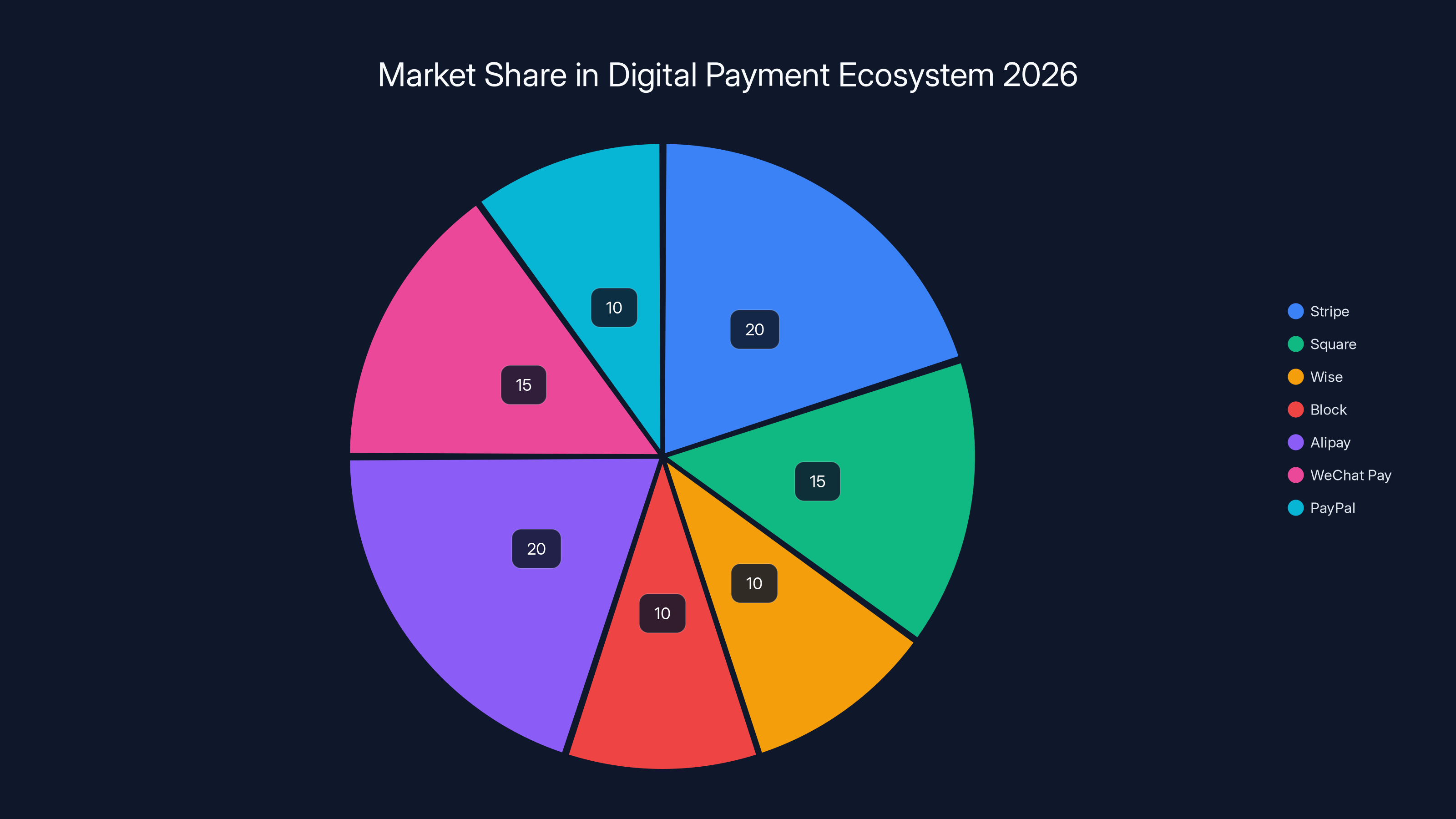

Stripe has built a technical platform so superior that it's become the default for developers. Square dominates physical point-of-sale transactions and has expanded into payments comprehensively. Wise (formerly TransferWise) owns cross-border payments. Block's ecosystem continues to expand. And international competitors like Alipay and WeChat Pay dominate their regions.

PayPal's response has been to diversify. The company owns Venmo, a peer-to-peer payment platform that's actually quite popular. It has payments processing for merchants. It operates Braintree, a payment gateway. It offers lending products through PayPal Working Capital. But none of these businesses feel cohesive. None feels like a clear winner. That's the strategic problem Lores inherits.

Moreover, the shift toward AI-native payment solutions is accelerating. AI can detect fraud better than humans. It can optimize pricing in real time. It can personalize the payment experience. It can route transactions more efficiently. AI can even predict customer behavior and suggest payment products proactively. Companies that integrate AI deeply into their payment infrastructure will have a massive advantage. Companies that bolt on AI as an afterthought will look dated.

PayPal has AI capabilities scattered across the organization, but there's no clear evidence that AI is embedded in the core infrastructure and customer experience the way it needs to be. That's another mandate Lores will inherit.

Then there's the regulatory environment. Payment processors operate in an increasingly complex regulatory landscape. Congress is scrutinizing fintech more closely. International regulators are tightening rules around data, fraud, and consumer protection. PayPal needs to navigate this complexity without sacrificing speed or customer experience. That requires clarity about which markets and products matter most and a willingness to exit or reshape products that don't meet regulatory or strategic criteria.

Jamie Miller's Interim Period: Bridging the Gap

When Enrique Lores joins PayPal, he'll be walking into a company that's already been prepped for change. That's the role of Jamie Miller, who moves from CFO and COO to interim CEO.

Miller has deep roots at PayPal. He's not an outsider trying to figure out the organization. He knows the numbers better than anyone. As CFO, he understands exactly where the profit leaks are. As COO, he understands where the operational inefficiencies live. That's powerful knowledge for an interim leader.

The board's choice to install Miller as interim CEO isn't accidental. It's strategic. Between now and when Lores officially takes over, Miller can stabilize the ship. He can communicate clearly to employees about the transition. He can engage with investors and analysts to reset expectations. He can begin taking actions that would be harder for an outsider to take immediately. When Lores arrives, he inherits an organization that's already in motion, not one that's standing still.

This is a page from the playbook that sophisticated boards use. Rather than create chaos with a leadership vacuum, you install a steady hand to maintain continuity. You give the new leader momentum rather than inertia. You ensure that critical decisions don't stall while you're waiting for the new CEO to onboard.

Miller will also be preparing the organization for the changes Lores is likely to bring. Lores' track record at HP suggests he'll want to immediately understand the cost structure, the revenue generation model, and the competitive positioning. He'll probably commission a comprehensive audit of operations. He might want to understand which business lines are truly profitable and which are carried by the others. He might want to see detailed metrics on customer acquisition costs, lifetime value, and churn. An interim CEO can prepare for all of that.

The transition period also buys time for the board to communicate to the market why this change was necessary and what to expect. A new CEO walking in with clearly articulated expectations and board alignment is far more effective than one arriving amid confusion and speculation.

PayPal's revenue and profit guidance consistently declined from Q4 2023 to Q4 2025, highlighting challenges in adapting to market pressures and competition. Estimated data.

The AI Imperative: Why Lores' Appointment Signals AI-First Strategy

Read Lores' statement about joining PayPal carefully. He explicitly mentions AI twice in just two sentences. That's not random. It's a signal about what he believes needs to happen.

PayPal's opportunity isn't just to improve its current products. It's to rebuild its products around AI capabilities that competitors don't have yet. Imagine a PayPal checkout experience that uses AI to prevent fraud before it happens, that automatically suggests the optimal payment method for each customer, that personalizes the payment flow based on what's working best for that specific merchant.

Compare that to what most competitors offer today. Stripe's payments are excellent but still largely deterministic. Square's point-of-sale system is solid but hasn't been reimagined for AI. Wise's cross-border product is best-in-class but limited in scope. None of these platforms have deeply integrated AI in a way that creates a genuine customer advantage.

PayPal could own that space. But only if Lores prioritizes it. Only if he makes the hard decisions about what parts of the business to evolve and what parts to potentially divest. Only if he allocates resources to building AI-first products rather than bolting AI onto legacy systems.

Lores' appointment also suggests that the board believes PayPal needs a leader who understands how to integrate complex technology into consumer experiences. That's exactly what Lores had to do at HP. Enterprise printers and workstations aren't consumer products, but they require the same kind of thinking: how do you make technology that's good for the company also good for the customer?

The payments industry is at a moment where this question is critical. API standards are getting commoditized. Transaction processing is becoming cheaper and faster. The differentiation won't come from having better infrastructure. It'll come from having better AI, better user experience, better security, and deeper integration with customer workflows.

Lores seems to understand that. His track record suggests he'll invest accordingly.

PayPal's Business Model Under Pressure: Understanding the Q4 Failure

To understand why the board moved so decisively, it's important to understand exactly where PayPal's business model is breaking down.

PayPal makes money three main ways. First, it charges merchants a percentage of each transaction processed (the take rate). Second, it charges users fees for certain services like currency conversion or instant transfers. Third, it makes money on lending and financial services. Until recently, all three streams were growing. But Q4 2025 showed cracks in each.

Transaction volume growth slowed. That directly impacts revenue since most of PayPal's income comes from transaction fees. In a consumer spending environment that's cooling, fewer transactions means lower revenue. But that's just a volume problem. More concerning is what happened to take rates.

PayPal's take rate has been under pressure for years. As the market matures and new competitors enter, merchants have more options. They can use Stripe if they need a developer-friendly payment gateway. They can use Square if they need point-of-sale. They can negotiate directly with payment processors if they have volume. PayPal's pricing power has eroded.

The second revenue stream (service fees) also weakened. Users are choosing cheaper alternatives for international transfers. Competitors are offering faster settlement. PayPal's lending business, once promising, has stalled as credit conditions tightened.

Put it all together: slower transaction growth, lower take rates, weaker service fee momentum, and stalled lending. That's not a temporary problem. That's a structural issue with the business model.

Lores' job is to address that structure fundamentally. He can't just optimize the current model. He has to reimagine it. That might mean exiting some markets or products. It might mean doubling down on verticals where PayPal has unique advantages (like Venmo). It might mean radical simplification of the product portfolio. It might mean building new AI-powered services that command higher margins.

PayPal's stock dropped nearly 18% in premarket trading following the announcement of Enrique Lores as the new CEO, indicating investor concerns over the company's future strategy.

The Venmo Question: Profitability vs. User Growth

One of Lores' most critical decisions will be how to handle Venmo. PayPal paid $300 million for Venmo in 2013. It's since become one of the most popular peer-to-peer payment apps in the US, with tens of millions of users. But profitability has been elusive.

Venmo is useful for splitting rent and paying friends. It's not useful for businesses. It's not useful for large transactions. It's consumer-friendly but not particularly profitable per user. PayPal has tried various strategies to monetize Venmo more effectively, including pushing financial services and payment products to Venmo users. Success has been limited.

Lores inherits a decision: do you keep investing in Venmo hoping it eventually becomes a powerhouse financial app? Or do you monetize it more aggressively today, accepting that you might sacrifice growth for profitability? Or do you consider alternatives like a spinoff or partnership?

His track record at HP suggests he'd choose focus over sprawl. At HP, he was willing to divest businesses that didn't fit the core strategy or generate adequate returns. Venmo might be next on that list. Or it might be integrated more deeply into PayPal's merchant and lending services. Either way, expect Lores to clarify Venmo's strategic role quickly.

Merchant Services: Where PayPal Still Has Leverage

Despite the competitive challenges, PayPal still has something valuable: merchant relationships. Millions of merchants use PayPal for payments. That's actual, tangible value. Those relationships are also sticky because merchants invest in integrating PayPal into their checkout flows, financial reporting, and reconciliation processes.

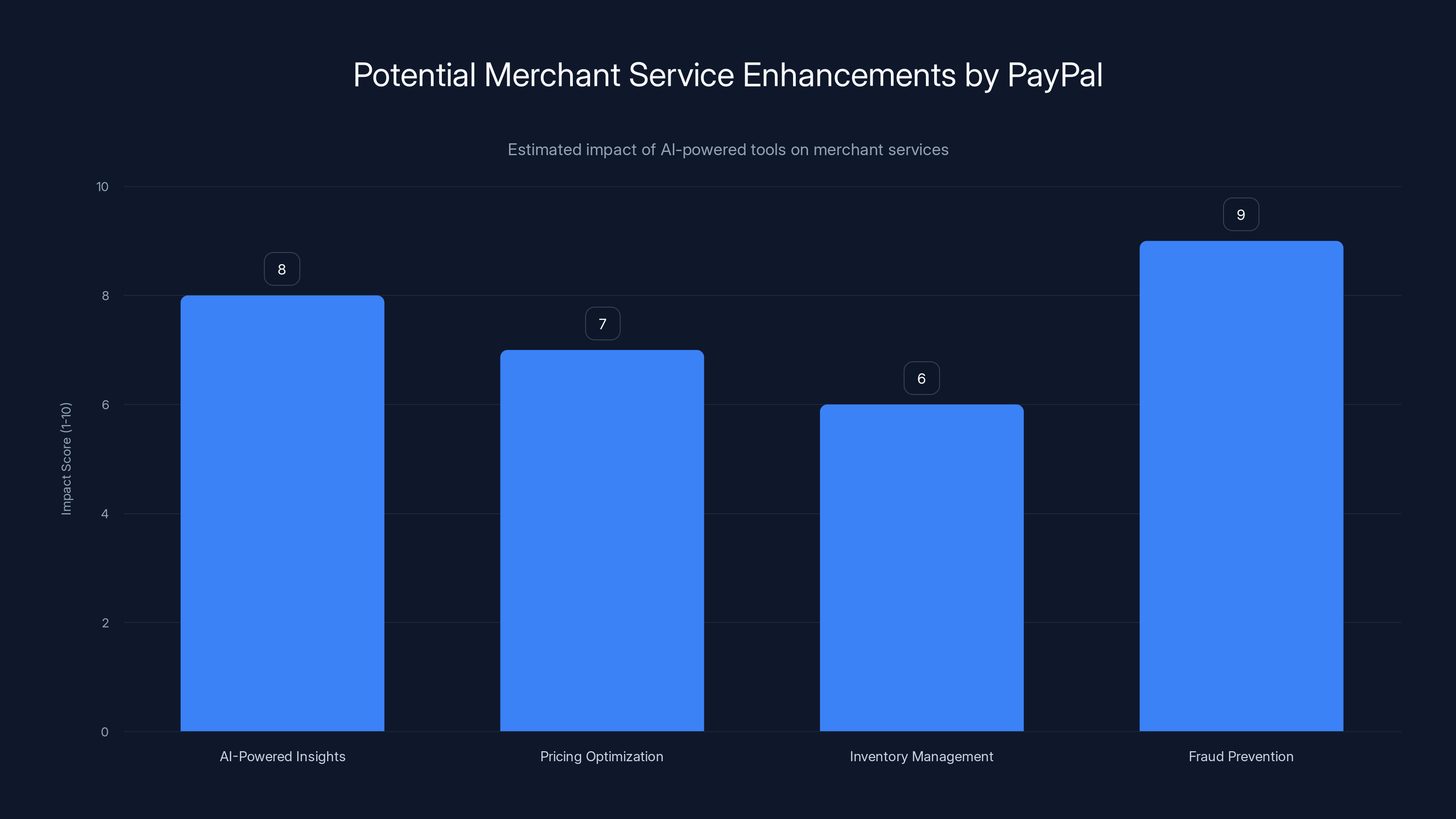

Lores' opportunity is to leverage those merchant relationships in new ways. Currently, PayPal offers payment processing, some lending, and basic reporting. But that's table stakes now. What if PayPal offered merchants AI-powered insights into their customer behavior? What if PayPal used AI to optimize pricing recommendations, inventory management, or fraud prevention? What if PayPal became the operating system for small business commerce rather than just the payment processor?

That's a plausible strategic direction for a company with Lores' background. At HP, he expanded beyond hardware into managed services and cloud offerings. He recognized that bundling hardware with services created better margins and stronger customer relationships. PayPal could do the same. Instead of being the payment processor, become the commerce platform. Instead of charging per transaction, charge for access to a suite of AI-powered business tools.

This strategy would directly address the take rate compression problem. Instead of trying to maintain percentage-based pricing on a commoditized service, PayPal shifts to SaaS-like pricing for valuable services. Instead of trying to compete on transaction speed or cost, PayPal competes on business insights and operational efficiency.

It's a fundamentally different business model. And it's probably the direction Lores is already thinking about.

Estimated data shows AI-powered fraud prevention as the most impactful enhancement for PayPal's merchant services.

International Expansion and Localization: The Untapped Opportunity

PayPal operates globally, but its international presence is fragmented and underexploited. In some regions, local competitors dominate because they understand local regulations, payment preferences, and customer behavior better. In other regions, PayPal has limited presence despite significant opportunity.

Lores' appointment might signal a renewed focus on international markets. During his tenure at HP, he led expansion into emerging markets and built regional organizations that could make local decisions quickly. That same approach could work for PayPal internationally.

Consider Asia. Alipay and WeChat Pay dominate. But there are massive opportunities in Southeast Asia, India, and other emerging markets where digital payment adoption is still growing. PayPal has a presence but hasn't won. A CEO with international expansion experience might change that.

Similarly, in Europe, Stripe has become dominant among developers and merchants. PayPal's presence is legacy. But there are still small merchants and consumers who use PayPal. Lores might invest in recapturing that market by building products specifically designed for European needs.

International expansion is also higher-margin than you might think. Once you've built the core infrastructure, expanding to a new country is primarily an engineering and regulatory problem, not a fundamental product problem. Lores' operational experience suggests he'd be efficient at that expansion.

The Regulatory Landscape: Navigating Compliance as a Competitive Advantage

PayPal operates in one of the most regulated industries possible. Payment processors are subject to regulations in dozens of countries, plus federal rules in the US covering everything from Know Your Customer (KYC) requirements to Anti-Money Laundering (AML) regulations to consumer protection laws.

For years, these regulations were a drag on competitiveness. Newer companies like Stripe were able to move faster because they started with compliance built in. PayPal had to retrofit compliance onto legacy systems. It was expensive and slow.

Lores' opportunity is to flip this script. Rather than viewing compliance as a cost center, view it as a moat. Smaller competitors might cut corners on compliance to move faster. Larger competitors might struggle with legacy compliance frameworks. PayPal could invest in next-generation compliance infrastructure that's both more effective and less costly.

This is exactly the kind of operational innovation that Lores brings from HP. At HP, compliance (safety, environmental, labor standards) was built into the product design and manufacturing process. It wasn't bolted on afterward. The same approach could work for payments compliance.

Moreover, as regulators tighten enforcement, this advantage becomes more valuable. Companies that can demonstrate best-in-class compliance will be trusted more by merchants, users, and regulators. That trust translates directly to competitive advantage.

Estimated data suggests that by 2026, Stripe and Alipay will lead the digital payment ecosystem, each holding 20% market share, while PayPal's share may drop to 10% due to increasing competition.

The Competitive Battlefield: How Lores Positions PayPal

Let's be clear about the competitive reality Lores walks into. PayPal is no longer the dominant player in digital payments. It's one of several well-funded, well-executed competitors fighting for different parts of the market.

Stripe owns developer payments. They've built such a superior developer experience that trying to compete directly is a losing proposition. Square owns point-of-sale and has expanded into payments comprehensively. Wise owns cross-border. Each competitor is stronger in their niche than PayPal is in its own.

PayPal's advantage is that it has some presence in all of these niches. It's not dominant anywhere, but it's not absent anywhere either. Lores could play this as a strength: build an integrated ecosystem where users and merchants can do everything they need with PayPal. You need to accept payments? PayPal. You need to send money internationally? PayPal. You need to lend money? PayPal.

But that strategy requires execution excellence and clear product vision. If PayPal tries to be everything to everyone, it'll be mediocre at everything. That's exactly the problem that led to Chriss' ouster.

Lores' challenge is to make hard decisions about which niches to own and which to exit or partner around. That's uncomfortable for a large company with legacy business lines. But it's necessary.

Employee Morale and Organizational Culture: Managing the Transition

Changing CEOs is disruptive. Employees get nervous. Is my job safe? What's the new strategy? Will the company be broken up? Will there be layoffs? These questions affect morale and retention.

Lores' appointment will inevitably raise these questions. He's an outsider. He doesn't have a track record at PayPal. Employees won't know what to expect. That creates uncertainty.

However, Lores' background might actually reassure employees in some ways. At HP, he was known as a stabilizing leader, not a chaotic one. He made difficult decisions, but he communicated them clearly and provided context. He wasn't an "fire and rebuild" CEO. He was a "clarify and optimize" CEO. That's probably better for employee morale than bringing in a turnaround specialist known for aggressive restructuring.

Still, expect some organizational changes in Lores' first 100 days. Probably a new strategy articulation. Likely some process improvements to make decision-making faster. Possibly some organizational simplification to reduce bureaucracy. But probably not mass layoffs immediately. Lores will likely want to understand the organization first before making big moves.

The board's use of Jamie Miller as interim CEO helps here. Miller has relationships with PayPal employees. He can explain to teams why Lores is the right choice without it feeling jarring.

Market Reaction and Investor Expectations: What Comes Next

PayPal's stock dropped 18% on the news of the leadership change. That's significant but not surprising given the disappointing earnings. Investors were already unhappy. The CEO change is both a reason for the decline and a potential catalyst for recovery.

Investors will be watching Lores carefully in his first 90 days. They'll want to see clear strategic communication. They'll want to see evidence of operational efficiency improvements. They'll want to see PayPal competing more aggressively in the market.

The stock decline actually creates an opportunity for PayPal. At a lower valuation, if the company executes well, there's upside for investors. Lores will inherit a company that's already priced for bad news. If he can deliver even modest improvements, the stock will respond positively.

Analysts will be looking for evidence that Lores understands the business. His first earnings call will be critical. He'll need to articulate a vision for what PayPal could become that's compelling and credible. He'll need to provide enough detail to show he's done his homework. He'll need to set expectations that are achievable.

This is where Lores' track record at HP serves him well. He's been through earnings calls with analysts. He knows how to communicate complex operational changes in language that financial markets understand. He won't BS investors. He'll be straight about challenges and realistic about opportunities.

Strategic Priorities: What Lores Likely Does in Year One

Based on his track record and the statement he made upon appointment, here's probably what Lores will prioritize in his first year:

First, he'll conduct a strategic audit. He'll dig into every business line and ask fundamental questions: Is this profitable? Is it growing? Is it strategic? Does it align with our core mission? This isn't him second-guessing decisions. It's him building a fact base.

Second, he'll clarify the strategy. He'll decide which businesses matter most. He'll probably consolidate business lines that are redundant. He might exit or restructure businesses that don't meet the bar. He'll probably simplify the organizational structure to reduce decision-making friction.

Third, he'll invest in AI integration. He'll probably establish a dedicated AI team. He'll invest in building AI capabilities that are embedded in core products, not bolted on top. He'll probably articulate a clear vision for how AI creates customer value at PayPal.

Fourth, he'll address the take rate problem. He'll probably develop new revenue streams that aren't dependent on transaction percentages. This might be merchant services, SaaS-style products for small business, or financial services bundled with payment processing.

Fifth, he'll improve operational efficiency. He'll probably streamline costs where possible. He'll implement new metrics and accountability. He'll probably accelerate decision-making by reducing bureaucracy.

Finally, he'll communicate, communicate, communicate. He'll do investor meetings. He'll do employee town halls. He'll do media interviews. He'll articulate a compelling vision for where PayPal is headed. This matters because people need to understand why the company is changing.

The Fintech Ecosystem's Reaction: Implications for Competitors

PayPal's leadership change sends ripples through the entire fintech ecosystem. Competitors pay attention to moves like this. They're asking themselves: what does this mean for us?

Stripe probably isn't worried. Stripe is dominant in its niche (developer payments) and has a clear product vision. But Stripe might also see Lores' appointment as confirmation that the payments market is fragmenting further. Stripe wins in development. PayPal will probably focus elsewhere. The market is big enough for both.

Square might be more concerned. Square is also trying to be a comprehensive platform, like PayPal. If Lores successfully clarifies PayPal's strategy and builds focus, Square might feel competitive pressure. Or Square might realize that trying to be everything to everyone is a weak position and double down on point-of-sale, where it's strongest.

Wise is probably unconcerned. Wise owns cross-border payments. PayPal can't realistically compete there without spending billions and taking years. That niche is taken.

Smaller fintech companies are watching to see if PayPal becomes more aggressive on AI and innovation. If it does, that's competitive pressure. If it stays focused on optimization and margin improvement, that's an opportunity for nimble startups to build AI-first payment solutions.

Overall, Lores' appointment is a reminder that the fintech market is consolidating around specialists. Companies that focus on what they're best at will win. Companies that try to be everything will lose. That's a healthy market dynamic.

The Longer-term Vision: Where PayPal Could Be in Five Years

Lores has a five-year window to transform PayPal. That's a reasonable timeframe for meaningful change. Where could PayPal be in 2031 if Lores executes well?

Scenario one: PayPal becomes a focused B2B payments platform. It builds industry-specific solutions for e-commerce, marketplaces, and SaaS. It competes on integration, support, and AI-powered business intelligence rather than on transaction fees. It's less consumer-facing but more profitable per merchant. This is plausible given Lores' track record.

Scenario two: PayPal becomes a fintech operating system. It owns payments, lending, spending, and investing. It's a one-stop shop for business owners who need to manage money. It competes with Stripe's expanding platform on breadth and depth. This requires successful integration and clear product vision but is possible.

Scenario three: PayPal gets acquired by a tech giant. Apple, Amazon, or Google each has reasons to own payments infrastructure. If Lores stabilizes the company and improves profitability, PayPal becomes an attractive acquisition target. This is a real possibility in the fintech landscape.

Each scenario is plausible. Lores' job is to create clarity so that the organization and market understand which direction is most likely.

Challenges Lores Will Face: The Hard Truth About Turnarounds

Let's be honest: turning around a large company in a mature market is brutally difficult. Lores is walking into a company with legacy systems, entrenched organizational structures, and historical customer relationships that both enable and constrain strategy.

Challenge one: organizational inertia. Large organizations resist change. Employees have built careers on existing strategies. Reorganizing is disruptive. Even if a new strategy is better, getting buy-in takes time and political capital. Lores will need to spend considerable effort on organizational change management.

Challenge two: competitive commoditization. Payment processing is becoming a commodity. Margins are compressing. Building differentiation requires genuine innovation, not just operational efficiency. Lores can improve PayPal's cost structure, but that only buys time. Long-term success requires new products or services that competitors don't have.

Challenge three: regulation. The regulatory environment for payments is tightening globally. New rules about data privacy, fraud prevention, and consumer protection add complexity and cost. Lores will need to ensure PayPal complies with evolving regulations in dozens of jurisdictions. That's a management challenge that can't be solved through operational efficiency alone.

Challenge four: talent retention and recruitment. The CEO change might cause some talented people to leave. They might have believed in Chriss' vision and feel betrayed by the change. Or they might be concerned about uncertainty. Lores will need to move quickly to convince top talent that the company has a compelling future. That's particularly important in the engineering and product teams.

Challenge five: earnings expectations. Wall Street expects PayPal to return to growth. Lores will face pressure to show improvement quickly. But meaningful strategic change takes time. If he focuses too much on short-term earnings, he'll sacrifice long-term opportunity. If he focuses too much on long-term vision, Wall Street will punish the stock. Balancing this is hard.

Key Metrics Lores Will Own: What Success Looks Like

To evaluate Lores' performance, pay attention to these metrics:

Revenue growth. Can he stabilize revenue growth? This is table stakes. If revenue continues to decline, strategy doesn't matter.

Take rate stability. Can he stabilize or increase take rates despite competitive pressure? This is the core business metric. If take rates continue to decline, the business model is broken.

Operating margin. Can he improve profitability through operational efficiency? This shows management competence. Expect margin improvement of 100-300 basis points annually if he's executing well.

Customer satisfaction (NPS). Can he improve product quality and customer experience? Satisfied customers stick around. Dissatisfied ones leave. NPS is a leading indicator of future revenue.

Employee engagement. Can he maintain or improve employee morale despite organizational change? Burned-out employees produce bad products. Engaged employees produce great ones.

Stock performance. Can he drive stock appreciation? This is the ultimate measure of value creation. If PayPal stock outperforms the market and the payments industry, Lores is probably succeeding.

Conclusion: A Watershed Moment for PayPal

Enrique Lores' appointment as PayPal CEO marks a watershed moment for the company. The board decided that incremental improvement wasn't enough. It needed transformational change. It reached outside the fintech bubble to recruit someone with a track record of executing large-scale organizational change in a complex, regulated industry.

This decision makes sense. PayPal faces structural challenges that can't be solved by tweaking existing strategies. The payments landscape has fundamentally shifted. AI is reshaping what's possible. Competition is intense. Margins are compressing. The consumer spending environment is softening. In this environment, PayPal needs a leader who can make difficult decisions, execute them efficiently, and communicate them clearly.

Lores appears to be that leader. His track record at HP shows he can stabilize struggling companies, improve operations, and position them for future growth. His appointment signals that the board believes PayPal's future is bright if leadership and strategy are right.

But signals don't equal success. Lores inherits a company with real problems and limited time to solve them. He needs to move fast without breaking things. He needs to innovate while optimizing. He needs to improve short-term earnings while positioning for long-term growth. He needs to navigate regulatory complexity, competitive pressure, and organizational inertia. He needs to recruit and retain top talent while maintaining investor confidence.

If he pulls it off, PayPal could be substantially stronger in three to five years. The company could reclaim competitive ground. It could build new revenue streams less dependent on transaction fees. It could become a center of AI innovation in payments. It could actually fulfill the potential that PayPal investors have hoped for.

But if he fails, PayPal could gradually fade into irrelevance, becoming a legacy player that once mattered but eventually got passed by. That's the stakes. That's why the board moved decisively. That's why Lores' appointment matters to everyone watching the fintech industry.

Watch his first 90 days closely. That's when you'll see what he actually believes and where PayPal is really headed.

FAQ

Why did PayPal's board replace Alex Chriss so quickly?

Alex Chriss had been CEO for less than three years. The board felt his pace of execution wasn't matching the speed of market change. Q4 2025 earnings disappointed investors significantly, with lower-than-expected revenue, profit, and profit guidance. The board signaled that PayPal's "pace of change and execution was not in line with the Board's expectations" given broader market trends. In a fast-moving industry like payments, even 18-24 months of underperformance can trigger CEO changes, especially when market conditions are shifting rapidly.

What is Enrique Lores' background, and why is he qualified for PayPal?

Enrique Lores spent six years as President and CEO of Hewlett-Packard, overseeing a major digital transformation of the company. He streamlined operations, improved profitability, divested underperforming divisions, and positioned HP for growth in AI-driven services. While Lores isn't a fintech native, his experience navigating complex organizations, executing operational improvements, and integrating AI into business models directly applies to PayPal's challenges. The board valued his track record of delivery over fintech domain expertise.

Who is Jamie Miller, and what is his role during the transition?

Jamie Miller is PayPal's CFO and COO. He serves as interim CEO from the announcement date until Lores officially joins the company. Miller brings deep knowledge of PayPal's financial performance, cost structure, and operations. Having an internal executive serve as interim CEO provides organizational continuity, maintains investor confidence, and allows time for the organization to prepare for Lores' arrival. Miller will likely stabilize the company and prepare the roadmap for incoming leadership.

What are PayPal's main business challenges right now?

PayPal faces multiple headwinds: slower transaction volume growth due to consumer spending softness, declining take rates (transaction fees) from intensifying competition, weaker service fee momentum, and stalled lending business growth. Revenue missed expectations in Q4 2025, and profit guidance was disappointing. The fundamental challenge is that PayPal's existing revenue streams are under pressure, and the company hasn't successfully built new, higher-margin revenue sources to offset the decline. This structural problem requires strategic change, not just operational improvement.

Why did PayPal's stock drop 18% after the leadership announcement?

The stock decline reflects two factors. First, disappointing Q4 earnings and weak guidance already had investors unhappy. Second, CEO transitions create uncertainty about future strategy. Markets dislike uncertainty. However, the 18% decline also creates opportunity. At lower prices, if Lores executes well, there's upside potential for investors. The board's decisive action (hiring an external CEO with a strong track record) should provide some reassurance that leadership understands the magnitude of the challenges and is serious about addressing them.

What role will AI play in Lores' strategy for PayPal?

Lores explicitly mentioned AI twice in his initial statement about the appointment, signaling it's a central strategic priority. The payments industry is rapidly being reshaped by AI for fraud prevention, customer personalization, pricing optimization, and transaction routing. PayPal needs to embed AI deeply into its core infrastructure and products to compete effectively. Rather than viewing AI as an add-on feature, Lores will likely prioritize building AI-native products that competitors can't easily replicate. This is a significant departure from PayPal's current approach.

How might Lores' appointment affect PayPal's different business units (Venmo, Braintree, etc.)?

Expect Lores to conduct a comprehensive strategic review of all business units. Venmo is popular but unprofitable. Braintree is solid but faces competition from Stripe. Lending has stalled. Lores will likely decide which units are truly strategic and deserve investment, which should be optimized for profitability, and which might be restructured or divested. His track record at HP suggests he's comfortable making difficult decisions about which parts of a business to keep and which to exit if they don't meet strategic or financial criteria.

What is the competitive threat from companies like Stripe, Square, and Wise?

Stripe dominates developer payments through superior developer experience. Square owns point-of-sale and is expanding into payments comprehensively. Wise dominates cross-border payments through technology and focus. PayPal competes in all these areas but is dominant nowhere. Lores will need to decide whether to compete more aggressively in specific niches or to build an integrated ecosystem where customers can use PayPal for multiple needs. Either strategy requires clear focus and excellent execution.

How long will it take for Lores to show meaningful results?

Expect meaningful strategic announcements within 90 days. Operational improvements and organizational changes should be visible within 6 months. Meaningful impact on revenue and profitability will likely take 12-18 months, as new products, services, and organizational changes take time to drive results. Stock market reaction will probably be volatile in the near term, based on commentary and guidance, before settling based on actual business results. Investors should monitor quarterly earnings calls and strategic updates for evidence of execution.

Why does PayPal's leadership change matter to the broader fintech ecosystem?

PayPal's choices about strategy, investment, and focus will influence competitive dynamics across the entire payments industry. If Lores successfully rebuilds PayPal as a focused competitor, it validates that strategy over breadth. If PayPal struggles, it might signal that legacy fintech companies can't adapt fast enough. Competitors will watch closely to understand which markets PayPal is prioritizing and which it's conceding. This shapes where startups and competitors choose to invest.

Key Takeaways

- PayPal's board replaced CEO Alex Chriss with HP veteran Enrique Lores due to execution pace misalignment with market conditions and disappointing Q4 earnings.

- Lores brings proven operational expertise in streamlining complex organizations and integrating AI, directly addressing PayPal's core strategic challenges.

- PayPal faces structural revenue pressures including declining transaction volumes, compressed take rates, and emerging competitive threats from specialized fintech players.

- AI integration will be central to Lores' strategy, with opportunities to differentiate in fraud prevention, customer personalization, and merchant services.

- The payments industry is fragmenting around specialists (Stripe for developers, Square for POS, Wise for cross-border), forcing PayPal to clarify strategic focus.

Related Articles

- Enterprise AI Race: Multi-Model Strategy Reshapes Competition [2025]

- Why Businesses Fail at AI: The Data Gap Behind the Divide [2025]

- Prediction Markets Like Kalshi: What's Really at Stake [2025]

- SME AI Adoption: US-UK Gap & Global Trends 2025

- Apple's Patreon Subscription Billing Mandate: What Creators Need to Know [2025]

- Microsoft Q2 2026 Earnings: Cloud Dominance, Gaming Struggles [2025]

![PayPal's Enrique Lores Appointment: A Strategic Overhaul in Digital Payments [2025]](https://tryrunable.com/blog/paypal-s-enrique-lores-appointment-a-strategic-overhaul-in-d/image-1-1770129554479.jpg)