PC Sales Downturn 2026: Why Memory Prices Are Skyrocketing

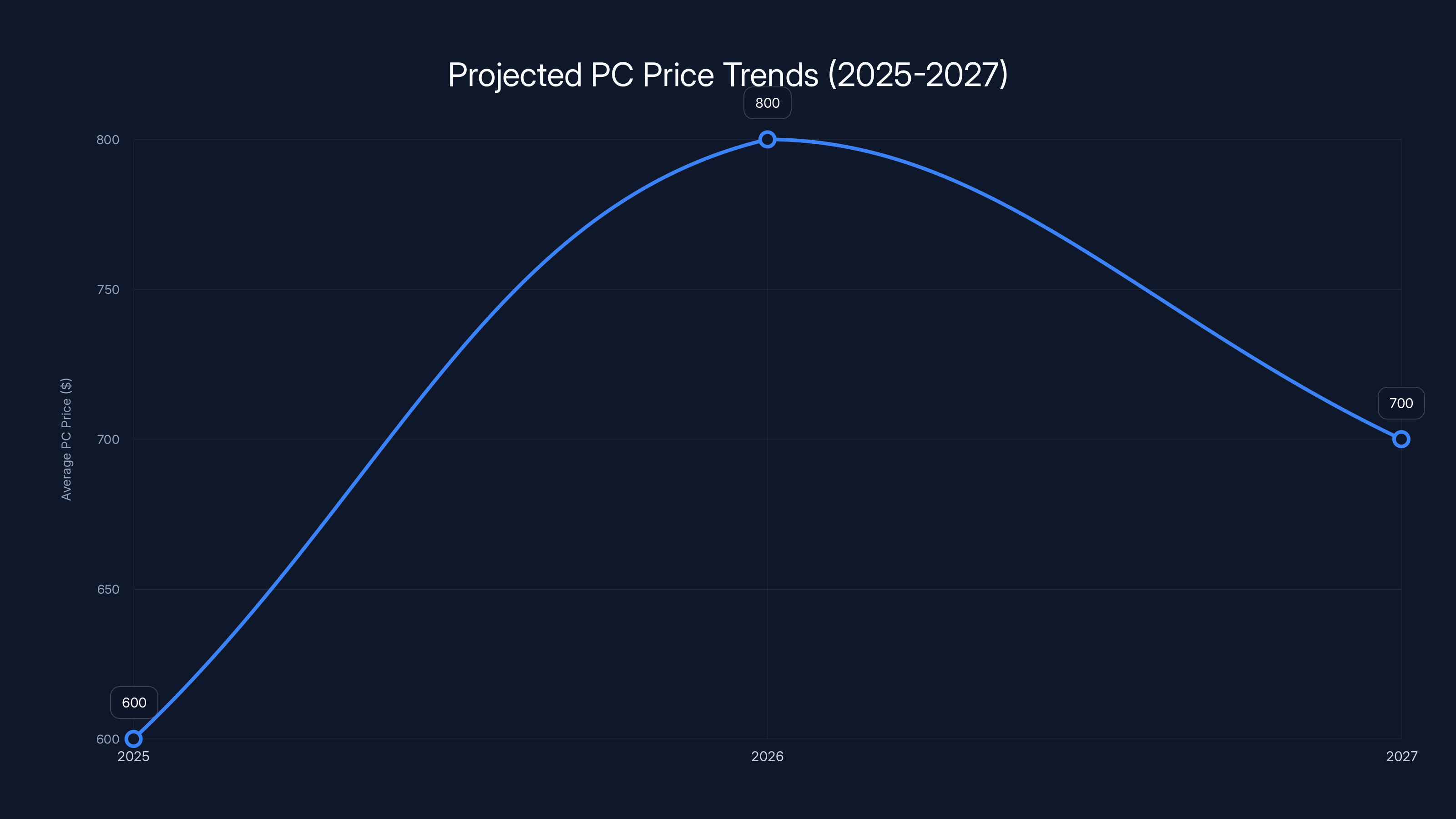

Something's brewing in the PC market, and it's not good news for your wallet. After a surprisingly healthy 2025 with 9.2% year-over-year growth, the PC industry is bracing for a rough ride ahead. The culprit? A perfect storm of memory shortages, rising component costs, and AI data centers hogging the expensive stuff.

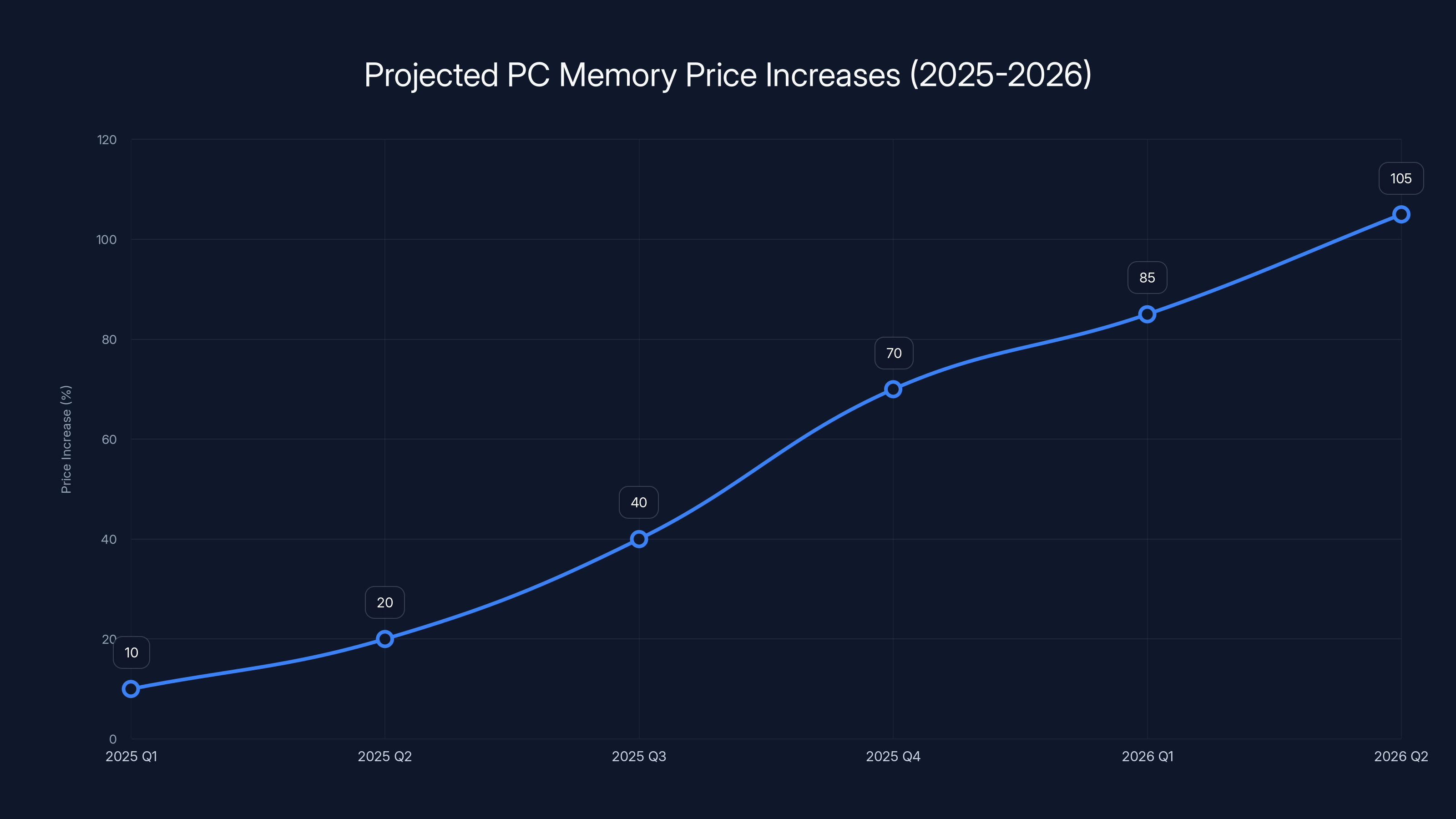

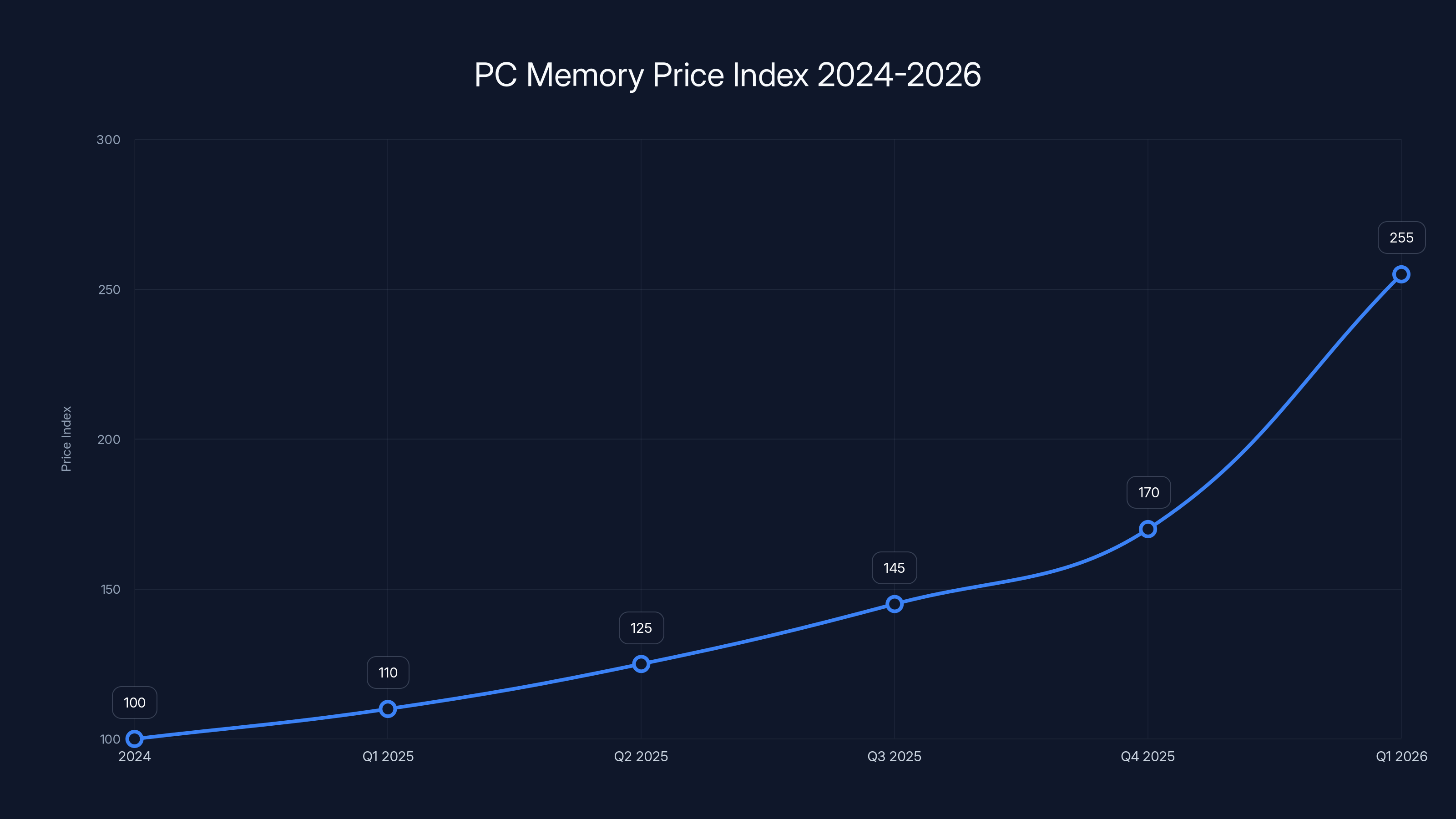

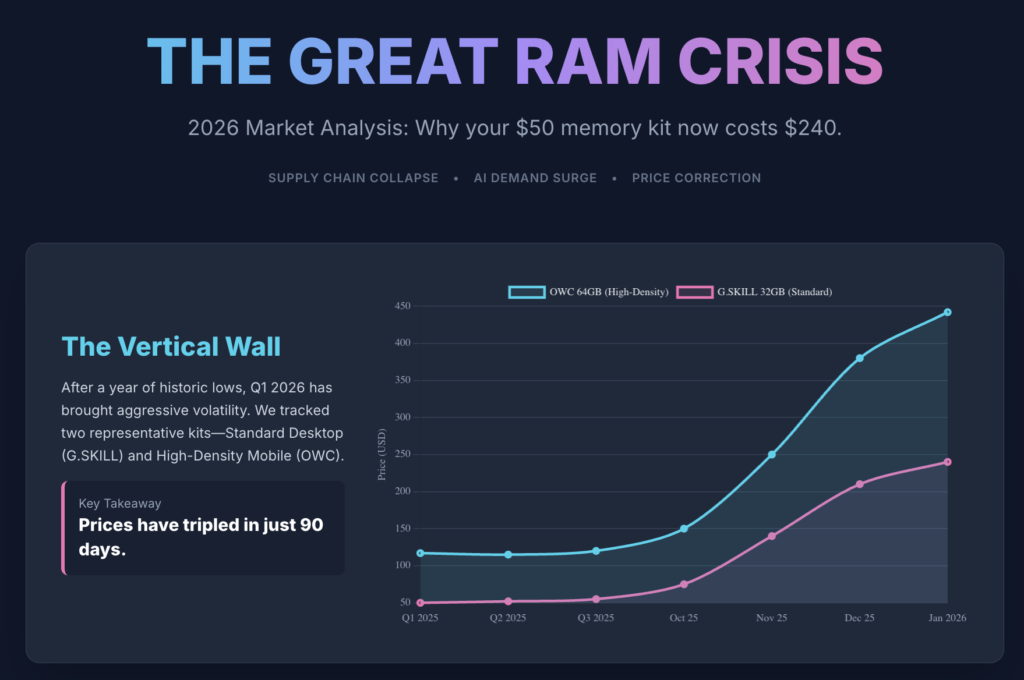

Here's what's happening: PC memory costs shot up 70% in 2025 alone, and analysts are predicting another 50% jump in early 2026. Meanwhile, SSD prices climbed 40%. When you combine those numbers, you're looking at a market where budget laptops become luxury items, and buying a PC right now might be the smartest thing you do all year.

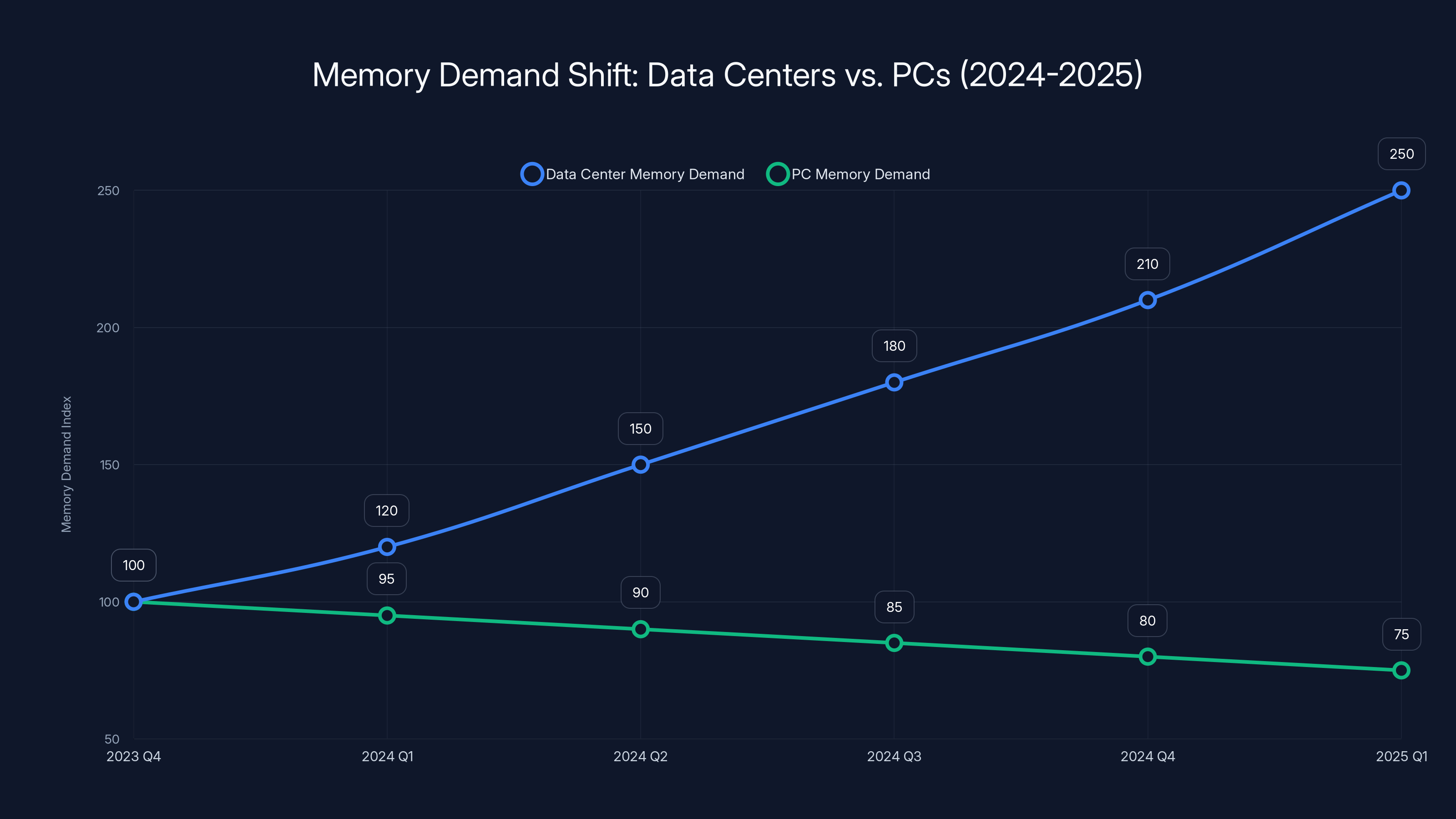

The issue traces back to a fundamental supply problem. Memory chip manufacturers, looking at where the real money is, have started prioritizing high-end server DRAM and HBM (high-bandwidth memory) destined for data centers. Meanwhile, everyday DDR memory that powers consumer PCs? It's getting squeezed. This isn't theoretical—major manufacturers like Dell and Lenovo are already warning customers about upcoming price increases.

What does this mean for you? If you've been thinking about upgrading your laptop or building a new PC, 2026 is shaping up to be the year everything gets more expensive. This guide breaks down exactly what's happening, why it matters, and what you should consider doing before prices spiral even further.

TL; DR

- Memory crisis is real: PC memory prices jumped 70% in 2025 with another 50% increase predicted for Q1 2026

- OEMs are cutting corners: Manufacturers will ship lower-tier configurations (less RAM, less storage) to protect margins

- Notebook shipments could drop 5-10%: Trendforce predicts between 5.4% and 10.1% decline in 2026 shipments

- Buy before it gets worse: Prices will likely stay elevated throughout 2026, making now the better time to upgrade

- Budget devices hit hardest: Entry-level PCs face the biggest price increases as manufacturers prioritize high-margin devices

PC memory prices are projected to increase significantly, with a 70% rise in 2025 and a further 50% increase expected in early 2026. Estimated data.

Why Memory Prices Exploded in 2025

Memory wasn't always this expensive. At the start of 2025, PC memory was reasonably priced and accessible. Then demand shifted dramatically, and supply couldn't keep up.

The fundamental problem comes down to economics. Memory chip manufacturers—the companies that make RAM and NAND flash—have capacity constraints. They can't just flip a switch and double production overnight. It takes months to ramp up manufacturing, and they need to invest billions in new fab capacity before they can make more chips.

So when demand surged, they had to make a choice: chase high-margin products or stick with bread-and-butter PC memory. The decision was obvious. Data center DRAM for AI infrastructure pays 2-3x more than consumer PC memory. HBM, which powers the most advanced AI chips, pays even more. From a pure profit perspective, why would anyone manufacture cheap DDR5 for laptops when they could make enterprise-grade memory for cloud providers?

This demand came from somewhere specific. The AI boom drove insane demand for data center infrastructure. Every major cloud provider, from Amazon Web Services to Microsoft Azure to Google Cloud, rushed to build out AI capacity. They needed tons of memory, and they weren't price-sensitive. If a company can rent out AI compute at premium rates, they'll happily pay premium prices for the hardware that powers it.

Meanwhile, consumer demand for PCs remained steady but not explosive. The market wasn't growing fast enough to justify major capital investments in production capacity. So manufacturers chose the path of least resistance: shift production to high-margin products and let PC memory prices rise naturally.

The 70% price increase wasn't some random spike. It was the inevitable result of supply and demand physics. When supply shrinks and demand stays constant, prices go up. When supply shrinks and demand grows, prices skyrocket.

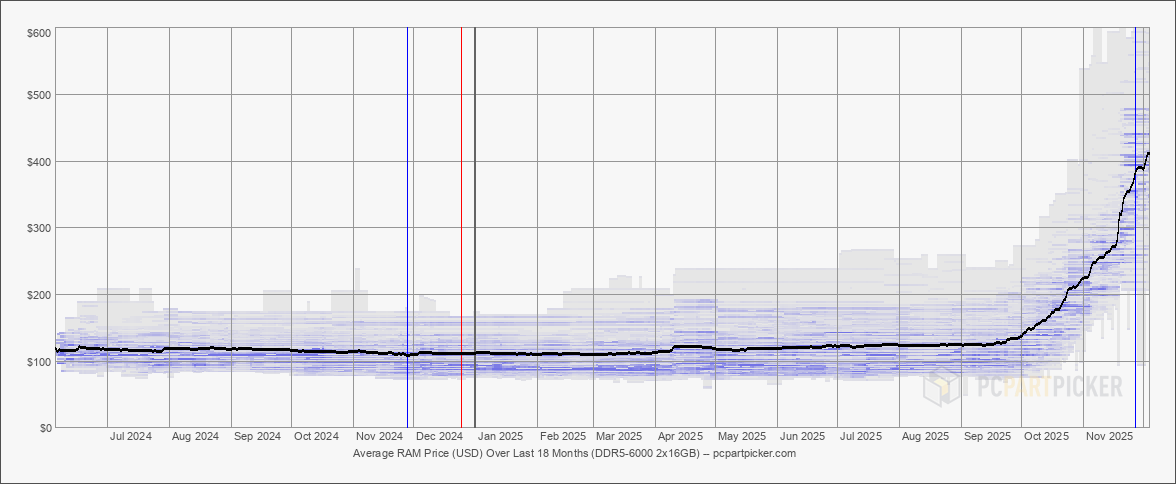

DDR5 memory prices surged 70% in 2025 and are projected to rise another 50% in Q1 2026, highlighting severe market revaluation. Estimated data for 2026.

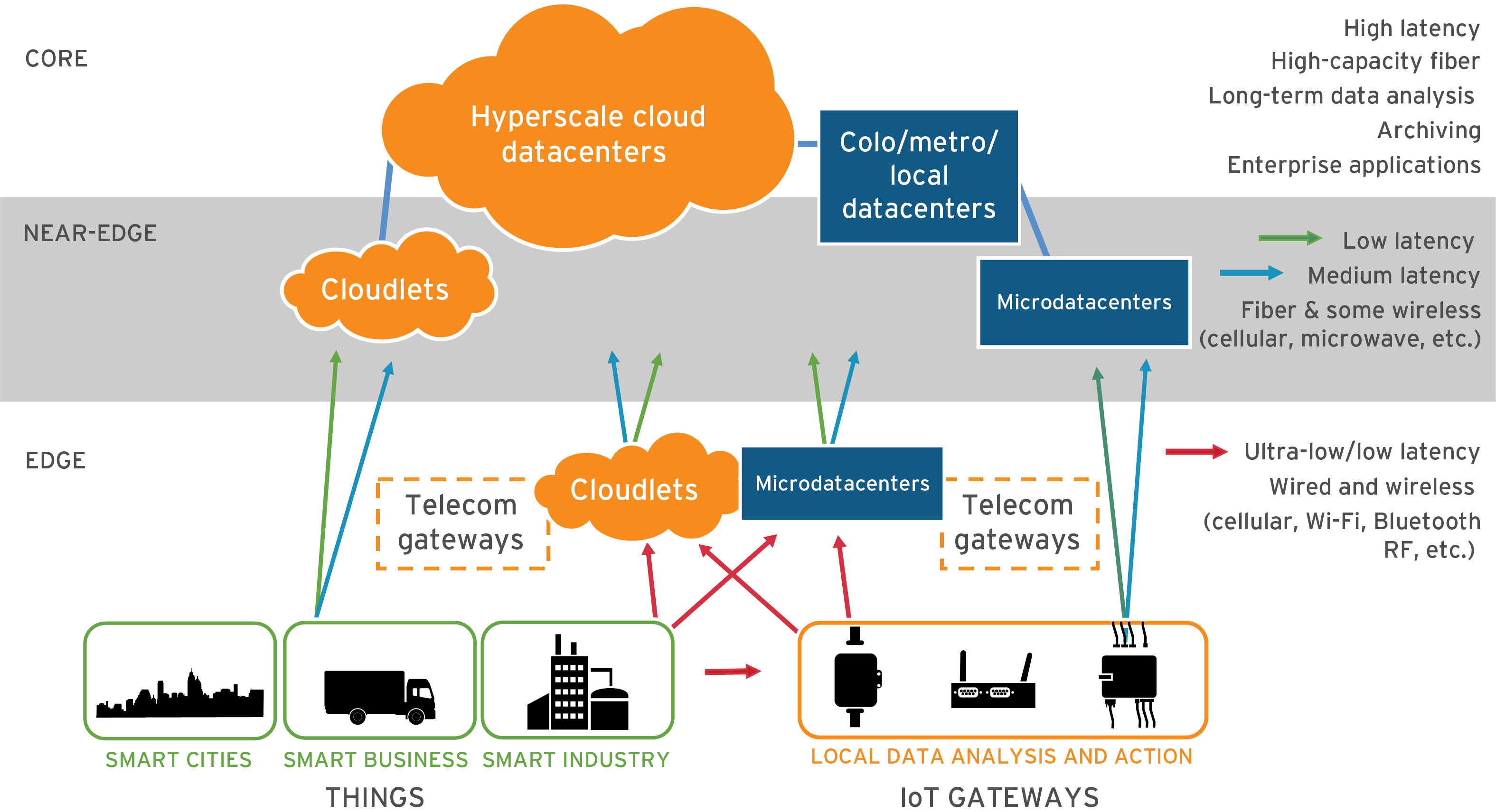

The Data Center Appetite That's Eating PC Supply

Data centers aren't new. Servers have existed for decades. But the intensity of current data center buildout is unprecedented. This isn't just Facebook adding servers. This is every major technology company simultaneously trying to secure cutting-edge AI infrastructure before their competitors do.

Consider what happened in 2024-2025: Open AI scaled Chat GPT, Microsoft invested $13 billion in Anthropic's infrastructure, Google pushed Gemini hard, Meta built new data centers for Llama, and smaller companies desperately tried to secure GPU and memory access for their own AI projects. The competition for manufacturing capacity became fierce.

Memory demand from data centers didn't just increase. It fundamentally changed. Traditional servers use standard DRAM in reasonable quantities. AI infrastructure needs memory in massive quantities, and increasingly needs specialized high-bandwidth memory that can feed data to GPUs fast enough to prevent bottlenecks.

HBM is the perfect example. It's exotic, expensive to manufacture, and absolutely essential for advanced AI chips. NVIDIA GPUs that power AI workloads need HBM to reach their full potential. Data centers will pay almost any price for it because the productivity gains justify the cost. A data center that runs AI workloads 5% faster can generate significantly more revenue.

Memory manufacturers noticed. They started redirecting production capacity toward HBM and high-end server DRAM. This left consumer DRAM production in a bind. Foundries that could've expanded PC memory production instead chose to make more profitable chips.

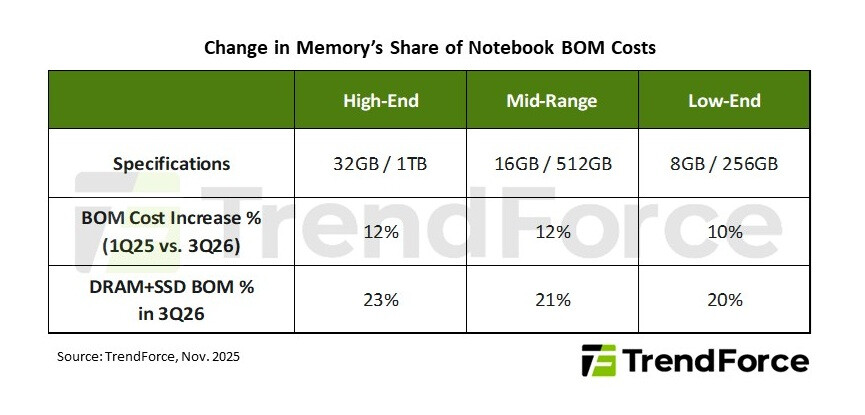

The cascade effect is obvious in hindsight. PC OEMs faced rising memory costs. They had two choices: raise prices or reduce specifications. Many chose to do both. Some models that shipped with 16GB of RAM last year are shipping with 8GB now—and costing more. It's a race to the bottom, except prices are going up.

PC Memory Costs: The Numbers Behind the Crisis

Let's get specific about what happened to pricing. These numbers matter because they show why the problem is severe and why predictions for 2026 are so dire.

Mainstream DDR5 memory (the standard for modern PCs) experienced a 70% price increase across all of 2025. That's not a small bump. That's not a seasonal fluctuation. That's a fundamental market revaluation.

To put 70% in perspective: if you could buy 32GB of DDR5 RAM for

Analysts at industry research firms predict an additional 50% increase in Q1 2026 alone. At that rate, that same 32GB kit would cost $204 before March ends. By summer 2026, mainstream estimates suggest prices could be up another 20-30% from Q1 levels.

SSD (solid-state drive) pricing tells a similar story. SSD costs rose 40% throughout 2025. A 1TB NVMe drive that cost

Why does this matter for the average person? Because storage and memory are the most expensive components in budget and mid-range PCs. They're not as flashy as a processor, but they're often 30-40% of the total component cost for a $500-1000 laptop.

When memory and storage both go up 50-70%, it forces OEMs into uncomfortable decisions. They can raise prices and risk losing customers. Or they can maintain price points while cutting specifications—shipping less RAM, less storage, or lower-quality components. Or they can take a hit to margins and absorb some costs.

Most manufacturers are doing some combination of all three.

Estimated data shows a sharp increase in data center memory demand from 2024 to 2025, while PC memory demand declines due to production shifts and rising costs.

How OEMs Are Responding: Margin Protection Over Specs

When component costs rise this fast, manufacturers have to make hard choices. The PC industry's response has been predictable but concerning.

The high-end strategy is straightforward. Premium laptops and workstations will continue to ship with full specs—16GB, 32GB, sometimes 64GB of RAM. These customers aren't price-sensitive. They need the performance, and they'll pay for it. Margins on these devices are healthy even with higher component costs.

The mid-tier compression is where things get weird. Devices that traditionally shipped with 16GB of RAM are now shipping with 8GB or 12GB. Devices with 512GB storage are dropping to 256GB. The price might stay the same, or even increase slightly. The justification? "Optimized configurations" and "sufficient for most users."

This isn't necessarily wrong—8GB is adequate for many tasks. But it's a step backward from what was standard a year ago. If your workflow involves heavy multitasking, video editing, or running virtual machines, 8GB becomes limiting fast.

Budget device casualties are the worst. Entry-level laptops, which are critical for students and small businesses, are being hit hardest. A

Manufacturers aren't being secretly evil about this. Ben Yeh, Principal Analyst at Omdia, explained the industry's thinking clearly: "Given tight 2026 supply, the industry is emphasizing high-end SKUs and leaner mid to low-tier configurations to protect margins."

Translate that into plain English: we're going to make expensive devices with fat margins and cheap devices with less stuff. The middle ground where the most customers actually shop is being abandoned.

Market Predictions: How Severe Will 2026 Get?

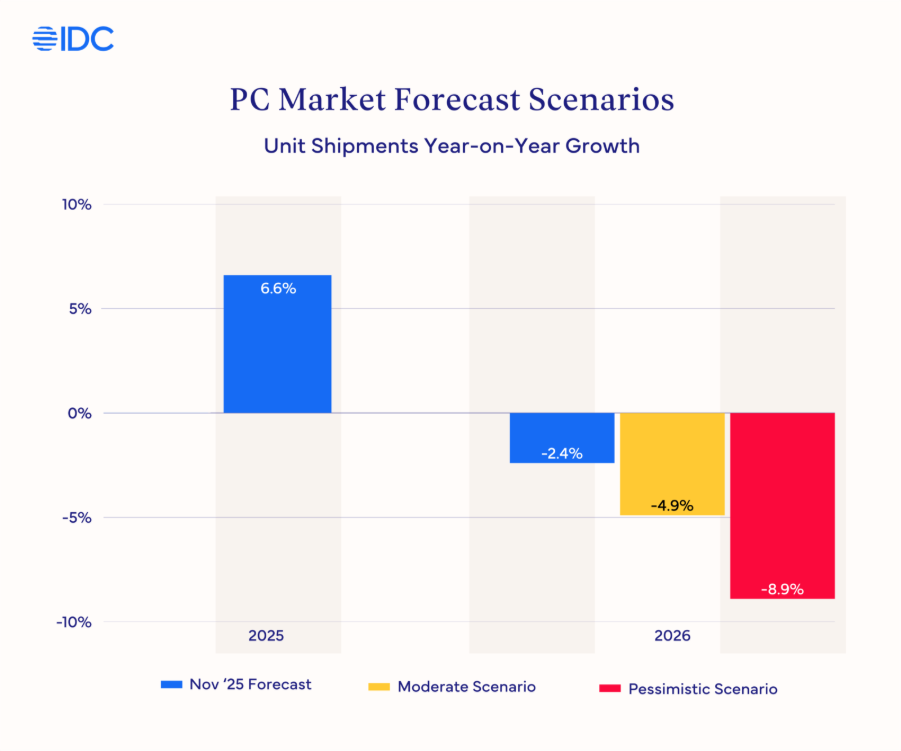

Industry analysts aren't pulling punches about 2026. The predictions range from concerning to alarming, depending on which firm you ask.

Omdia's outlook is cautious. They expect memory shortages to meaningfully impact PC sales in 2026. They're not predicting a market collapse, but they are predicting reduced shipment volumes and continued margin pressure on OEMs. Their primary concern is that the supply situation remains unpredictable—if data center demand stays as intense as 2024-2025, memory constraints could persist well into 2026.

Trendforce is more pessimistic. Their analysis predicts a 5.4% year-over-year decrease in global notebook shipments for 2026. That might sound small, but for an industry that was up 10%+ in 2025, a swing to negative is dramatic. Their worst-case scenario predicts a 10.1% decline if conditions worsen.

Notebooks matter because they dominate PC shipments. According to Omdia's data, notebooks account for roughly 79% of all PC shipments. Desktop computers are a shrinking portion of the market. So when notebook shipments decline, it drags down the entire PC market.

IDC's take is that the situation is extremely volatile. Jean Philippe Bouchard, Research VP at IDC, noted: "The PC market will be far different in 12 months given how quickly the memory situation is evolving." That's analyst-speak for "we have no idea exactly what will happen, but it's going to change fast."

IDC's predictions weren't as specific as Omdia or Trendforce, but their analysts warned of extreme volatility, lower average memory configurations, and continued price increases. The key phrase there is "extreme volatility." Market volatility makes planning impossible for consumers and retailers alike.

What do all these predictions have in common? Nobody thinks 2026 will be better than 2025. Nobody thinks prices will drop. Nobody thinks supply will ease significantly.

The optimistic view is that supply gradually improves throughout 2026, prices stop climbing by mid-year, and market conditions normalize by 2027. The pessimistic view is that data center demand stays crazy, memory shortages persist, and prices remain elevated through 2026 and into 2027.

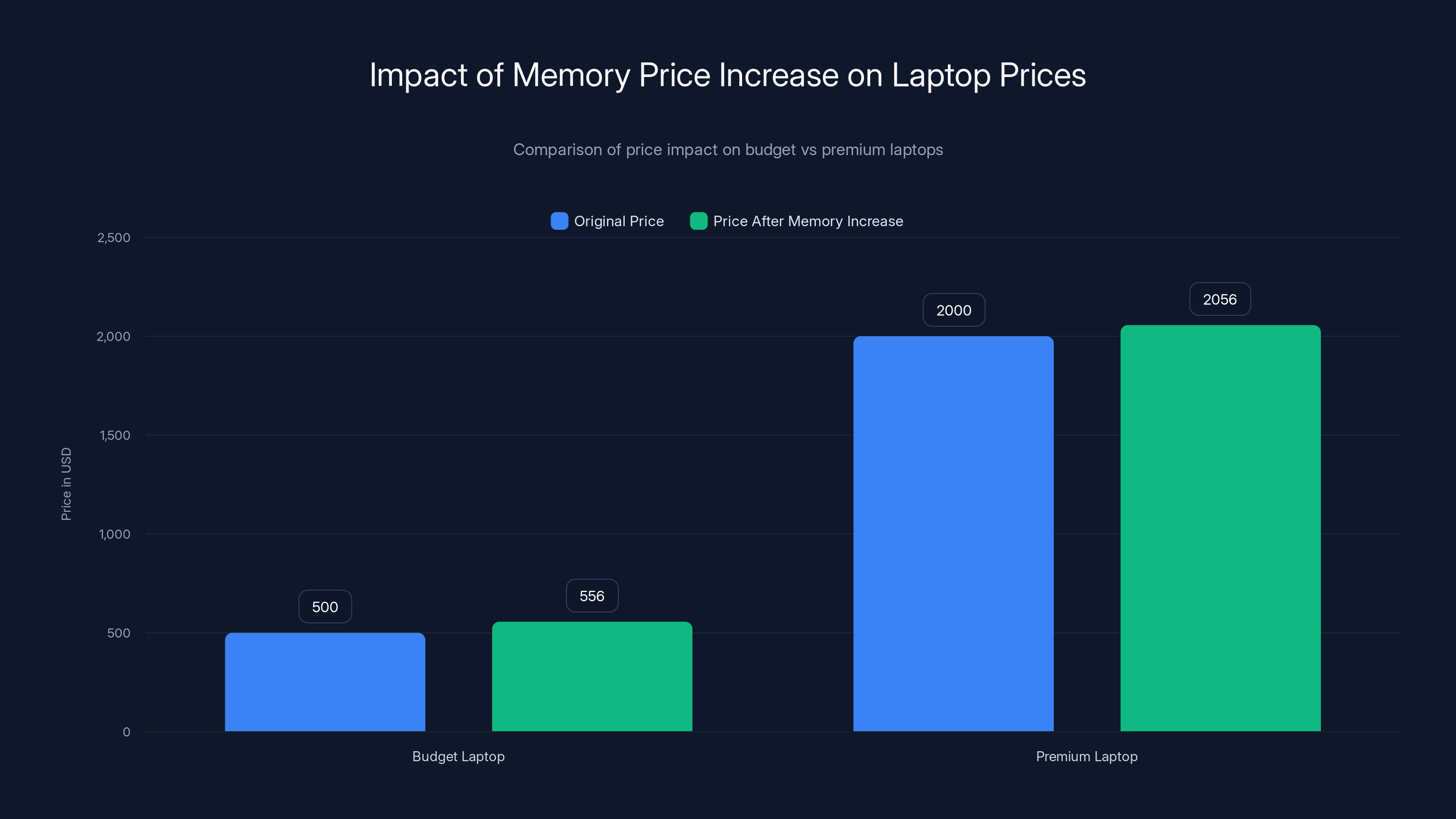

Estimated data shows that a 70% increase in memory prices results in a 5.6% price increase for budget laptops and a 2.8% increase for premium laptops. Budget devices are more sensitive to component cost increases.

Why Budget Devices Get Hit Hardest

There's a cruel math to how component cost increases distribute across the market. Budget devices suffer disproportionately.

Consider the cost breakdown of a $500 laptop:

- CPU: $80-100

- GPU/Graphics: $50-80

- Storage (256GB SSD): $30-40

- Memory (8GB DDR5): $35-45

- Display: $60-80

- Chassis, cooling, misc: $100-120

- Power supply, OS, other: $50-70

Memory is roughly 8% of the total cost. When memory prices go up 70%, that

Now consider a $2000 laptop:

- CPU: $250-350

- GPU/Graphics: $200-300

- Storage (1TB SSD): $80-120

- Memory (16GB DDR5): $70-90

- Display: $200-300

- Chassis, cooling, misc: $400-500

- Power supply, OS, other: $200-250

Memory is now about 4% of the total cost. A

The premium laptop can absorb the cost hit more easily. Its margins are bigger, and its customers are less price-sensitive. A

This explains why manufacturers are "emphasizing high-end SKUs." It's not malice. It's math. The high-end segment can tolerate price increases. The budget segment can't. So if you can only make a certain amount of expensive components, you prioritize building high-margin products.

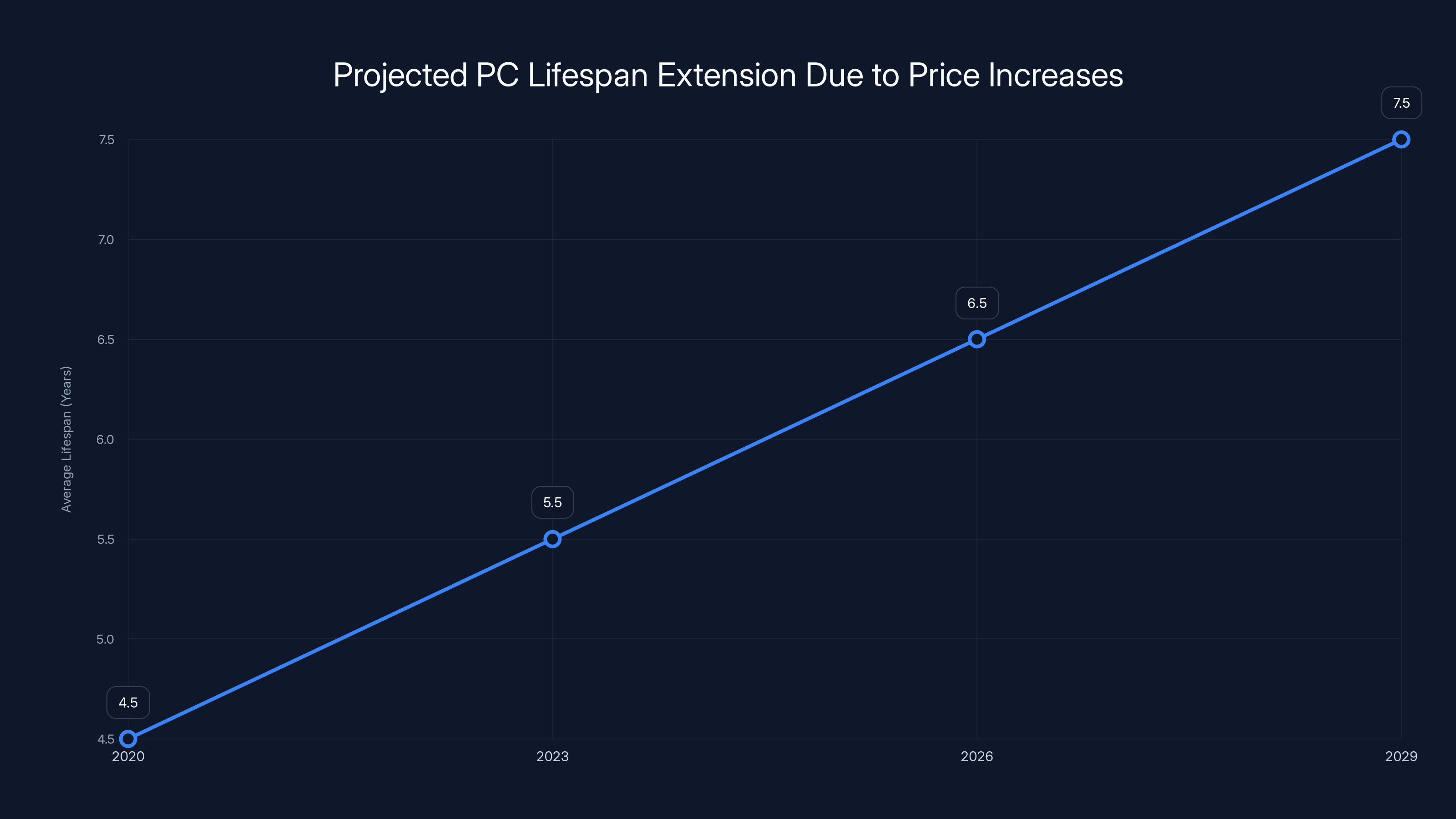

The casualties are students, developing countries, and anyone for whom a $500 laptop represents a significant purchase. Budget PC purchases will likely decline sharply in 2026 as prices rise. People will stretch the life of their existing devices rather than upgrade to something 20-30% more expensive.

Server Hardware Takes a Hit Too

PC pricing isn't the only concern. The same memory shortage pressures hitting consumer devices are affecting server hardware and enterprise infrastructure.

Server DRAM prices are climbing even faster than consumer memory. This creates a ripple effect through data centers and enterprise IT budgets. Companies that were planning to upgrade their infrastructure in 2026 now face 30-50% higher costs for memory-heavy systems.

This might seem unrelated to consumer PC prices, but it's not. When server costs spike, companies delay infrastructure upgrades. They squeeze existing hardware harder. This reduces demand for new servers, which reduces demand for manufacturing capacity, which theoretically should free up capacity for other products.

But in reality, the freed capacity doesn't automatically redirect to consumer PC memory. Fabs are optimized for specific product types. A line producing server DRAM can't instantly switch to producing consumer DDR5. It's not a faucet you can turn on and off.

So the server hardware crunch doesn't help consumer PC pricing. If anything, it extends the supply crisis because data centers needing to upgrade infrastructure will accept higher prices before they'll wait for capacity to appear.

As PC prices rise, the average lifespan of PCs is projected to extend from 4.5 years in 2020 to 7.5 years by 2029. (Estimated data)

Storage Isn't Safe Either: The SSD Problem

While memory gets the most attention, storage costs are a parallel crisis. SSDs rose 40% in 2025 and face similar pressures in 2026.

Unlike memory, SSD supply doesn't have the same data center bottleneck. There's no equivalent to HBM for storage. Data centers don't need exotic NVMe SSDs the way they need exotic memory.

SSD prices are rising for different reasons. The NAND flash market has cyclical supply patterns, and the industry is emerging from an oversupply period that artificially depressed prices in 2023-2024. Manufacturers reduced production capacity to avoid another glut. Now demand is picking up, and supply hasn't caught up.

Add input cost inflation, manufacturing complexity, and the usual supply chain disruptions, and you get a situation where SSDs are more expensive and less available throughout 2026.

For consumers, this doubles the pain. It's not just memory that's expensive—it's also storage. A laptop with 8GB RAM (down from 16GB) and 256GB SSD (down from 512GB) is both more expensive and less capable than what was standard two years ago.

The Ripple Effect: What Happens When PCs Get More Expensive?

When PC prices rise significantly, it doesn't just mean people pay more. It fundamentally changes market behavior.

Upgrade cycles extend. People hold onto devices longer rather than upgrade to new models at higher prices. Average PC lifespan has been creeping up from 4-5 years to 5-6 years. In a downturn where new PCs get expensive, it could stretch to 7+ years. That's fewer replacement sales for manufacturers.

Trade-down behavior emerges. Customers who would've bought a

Segment consolidation happens. The middle market gets squeezed. Instead of seeing a healthy mix of budget, mainstream, and premium devices, the market fragments. People either buy cheap budget devices or save up for premium models. The mainstream segment shrinks.

Alternatives get explored. Tablets become more attractive substitutes for light computing tasks. Phones handle more productivity work. Cloud-based computing (Chromebooks or remote access) becomes more appealing. Used and refurbished PCs capture a bigger portion of demand.

Business purchasing decisions change. Small businesses and enterprises delay upgrades. They extend maintenance on existing hardware. They move to subscription-based cloud services instead of buying new devices. They spend more on managed services and less on hardware.

All of these effects show up in lower PC shipment numbers. Trendforce's prediction of a 5-10% decline makes sense when you account for all these behavioral changes.

Estimated data suggests a 20-30% price increase in 2026 due to memory demand, with potential stabilization by 2027.

What About Refurbished and Used PCs?

One interesting dynamic to watch in 2026 is the used PC market. When new devices become expensive, used devices become more attractive.

Refurbished laptops that might've sold for

For consumers, this isn't necessarily bad news. Used and refurbished devices often offer better value than new devices during price spikes. A three-year-old Mac Book Pro with 16GB RAM and a 512GB SSD might actually be cheaper than a new budget Windows laptop with 8GB RAM and 256GB SSD.

Refurbished devices also have another advantage: they're released from inventory that already exists. They don't depend on manufacturing new components. If memory is in short supply, it doesn't affect used device pricing.

The downside is limited selection and no warranty. You're buying someone else's problem. But for price-sensitive buyers, it's increasingly an appealing option.

Making the Business Case for PC Upgrades Now

If you're running a business or managing IT infrastructure, the current situation creates an interesting decision point. Should you upgrade now or wait?

The math is becoming clear: upgrade now. Here's why.

If you're going to buy 50 laptops at some point, you can either:

Option A: Buy now (late 2025)

- 50 laptops at 50,000

- Specs: 16GB RAM, 512GB SSD

- Total cost: $50,000

Option B: Wait until mid-2026

- 50 laptops at 57,500 (accounting for 15% price increase)

- Specs: 12GB RAM, 256GB SSD (reduced configuration)

- Total cost: $57,500

You pay more money and get less computer. Option A is clearly better.

This logic applies to individuals too, especially for people who were already considering an upgrade. Delaying a purchase that was planned for 2026 to happen in late 2025 could save 10-15% of the purchase price while actually getting better specs.

The only scenario where waiting makes sense is if you have very specific needs that might be addressed by new technology coming in 2026. But even then, you'd want to evaluate whether the new tech is worth 15-20% more money.

Should You Buy Components Separately?

Another strategy worth considering is building your own PC or buying a barebones system and upgrading components separately.

Historically, this approach saves money when component prices are volatile. You buy the case, power supply, and motherboard, then source memory and storage from the cheapest available supplier.

In the current environment, this could work, but with caveats.

Advantages:

- You can source memory from multiple suppliers, maybe catching sales

- You avoid OEM markups on high-cost components

- You can mix and match components to optimize cost-per-performance

Disadvantages:

- Memory prices are rising across all suppliers. There's no discount warehouse with cheap RAM

- You lose warranty coverage from major manufacturers

- Building your own PC requires technical knowledge

- You don't get manufacturer optimization and QA testing

- Small volume builders can't negotiate component pricing the way Dell and Lenovo can

For most people, buying pre-built is still the path of least resistance. But if you're technically comfortable and patient about sourcing components, you might find small cost savings.

The Industry's Role and Responsibility

It's worth noting that memory manufacturers aren't acting illegally or unethically. They're responding to market signals and maximizing profit, which is what publicly traded companies do.

But this situation highlights a tension in how the computer industry works. When data center demand spikes due to AI infrastructure buildout, consumer market gets squeezed. There's no mechanism forcing manufacturers to balance supply across segments fairly.

Manufacturers could proactively invest in expanded capacity for consumer memory. But why would they? Consumer memory has thin margins. Data center memory pays better. Unless governments regulate the market or create incentives for capacity expansion in consumer-oriented production, manufacturers will continue prioritizing high-margin segments.

This isn't a new problem. It's the story of every commodity good. When supply is constrained, high-margin applications get prioritized. It's basic economics.

For consumers, the only real leverage is through purchasing power. If enough people delay PC purchases, OEMs might lobby manufacturers to invest in consumer memory capacity. But that would require coordination that doesn't really happen.

2027 and Beyond: When Does It Get Better?

The hopeful question: when does this end?

Honestly, it depends on several variables beyond anyone's full control.

If data center demand moderates: Memory manufacturers will gradually shift capacity back toward consumer products. Prices could stabilize by late 2026 and potentially start declining in 2027. This is the optimistic scenario.

If data center demand stays intense: Expect tight supply and elevated prices through all of 2026 and into 2027. This would be painful but not unprecedented.

If manufacturing capacity expands: New fab capacity coming online in 2026-2027 (Samsung, SK Hynix, Intel, and others have announced investments) could eventually ease shortages. But "coming online" typically means 18-24 months from fab completion to meaningful production.

If AI infrastructure buildout slows: Less demand from data centers immediately reduces competition for memory. This could happen if companies pause AI infrastructure spending, hit diminishing returns on AI spending, or consolidation reduces the number of companies building data centers.

The most likely scenario? Supply tightness eases gradually through 2026, prices stabilize by mid-to-late 2026, and meaningful price decreases begin in 2027 as new manufacturing capacity ramps up.

That's not a guarantee, just the historical pattern for commodity computing components during tight supply cycles.

Making Your 2026 PC Decision: A Framework

Here's a practical decision framework for the next 12 months:

If you were planning to upgrade in 2025: Buy now. Prices are already elevated, and they'll only get worse. Getting better specs today is worth it.

If you were planning to upgrade in mid-2026: Consider moving the purchase to late 2025 if possible. You'll beat the worst of the price increases and get better specs.

If you were planning to upgrade late 2026 or 2027: Wait if you can. Your current device should be fine for another year. If it starts failing, buy used/refurbished as a stopgap.

If you're a business upgrading infrastructure: Accelerate purchases to Q4 2025 if budgets allow. The cost of delaying until 2026 will likely outweigh any capability gains from newer models.

If you're price-sensitive: Watch the refurbished and used markets. They'll become more attractive as new prices climb. High-quality used devices from reputable sellers offer better value propositions in 2026.

If you're building a custom PC: Source components in the next 8-12 weeks before additional price increases hit.

The Bigger Picture: Semiconductors and Market Cycles

This situation is a microcosm of how the semiconductor industry actually works. Supply and demand create price cycles. When supply is constrained, manufacturers optimize for profit rather than market balance.

We saw this with GPUs during the 2020-2021 crypto boom. Gamers couldn't find graphics cards because miners bought everything. We're seeing it now with memory and data center demand.

The lesson: in technology markets, supply constraints create opportunity for some players and suffering for others. Early adopters benefit. Late arrivals get squeezed. There's no fairness mechanism, just market dynamics.

For consumers, the practical takeaway is straightforward: when you know supply is tight and prices are rising, buy sooner rather than later. Wait for better pricing only works when supply is abundant and prices are falling.

FAQ

Why are PC memory prices increasing so much in 2026?

PC memory prices are rising because memory manufacturers have shifted production capacity toward higher-margin products like data center DRAM and HBM (high-bandwidth memory) for AI infrastructure. These products pay 2-3x more than consumer DDR memory, so from a profit perspective, manufacturers prioritize them. Meanwhile, supply of mainstream PC memory has tightened significantly, causing prices to spike. The 70% increase in 2025 resulted from this supply-demand mismatch, and further 50% increases are predicted for early 2026.

Will 2026 be a bad year for PC buyers?

Yes, 2026 is likely to be a challenging year for PC buyers. Prices will be higher, and specifications may be lower (less RAM, less storage in devices at the same price point). The question is one of degree. Budget and mid-tier devices face the worst pressures, while premium devices can better absorb cost increases. For most consumers, 2025 or late 2025 is a better time to buy than 2026. The PC market is expected to decline 5-10% in shipment volume, reflecting reduced purchasing due to higher prices.

Should I wait to buy a PC in 2026?

Generally, no. Waiting typically means paying more and getting less. If you're already considering a PC upgrade, doing it before prices climb further makes financial sense. The only exception is if you have very specific needs that newer 2026 models will address better than current devices. But even then, evaluate whether the new features justify the 15-20% price premium. For most users, a slightly older device bought at a lower price is better than a newer device at a much higher price.

Are used and refurbished PCs a good alternative in 2026?

Yes, the used and refurbished market becomes increasingly attractive when new PC prices spike. A well-maintained three-year-old laptop might offer better value than a new budget model, especially since used devices don't suffer from specification reductions caused by rising component costs. The downside is limited selection, no warranty, and potential hidden issues. Buy from reputable refurbished retailers with good return policies, and you can find genuine value.

How much should I expect PC prices to increase?

Expect 15-30% price increases for budget and mid-tier devices by mid-2026. Premium devices will see smaller percentage increases (5-15%) because they started at higher prices and have bigger margins to absorb cost increases. These aren't uniform increases—memory costs alone could account for 5-10% of the total increase, while OEMs also pass along rising storage and manufacturing costs. Some manufacturers will choose margin over volume and increase prices more. Others will cut specifications instead.

Will SSD prices also increase in 2026?

Yes, SSD prices are rising alongside memory prices, though for slightly different reasons. Storage drove a 40% increase in 2025 and faces similar pressures in 2026. NAND flash is transitioning out of an oversupply period, manufacturers reduced capacity to avoid gluts, and demand is picking up faster than supply. Additionally, input costs and manufacturing complexity continue rising. Combined with memory increases, storage cost hikes further pressure overall PC pricing.

Is it worth building my own PC to save money?

Building your own PC might yield small savings (5-10%) if you source components strategically and avoid OEM markups. However, memory price volatility means there's no discount warehouse with cheap RAM right now—prices are high everywhere. Building also requires technical knowledge, voids warranties from major manufacturers, and means you lose OEM optimization and quality assurance. For most people, buying pre-built remains the better choice, despite higher costs. The savings from DIY building are too small to justify the complexity and risk.

What does this mean for gaming laptops?

Gaming laptops face the same memory and storage pressures as other devices, but the impact is different. Gaming laptops already include more RAM and storage than mainstream devices, so they absorb component cost increases more easily as percentage of total cost. However, expect base models to start at higher price points and include fewer upgrades. Manufacturers might offer more gaming laptops with discrete GPUs as a high-margin category where they can absorb costs, while mainstream gaming options get squeezed.

When will PC prices stabilize?

PC prices will likely stabilize by mid-to-late 2026 as data center memory demand moderates and new manufacturing capacity comes online. Samsung, SK Hynix, Intel, and others are investing in expanded fab capacity that should produce meaningful volume by 2026-2027. If these capacity expansions happen on schedule, supply tightness eases through 2026, prices stop climbing by mid-year, and potential price decreases could begin in 2027. However, this timeline assumes data center demand moderates and manufacturing capacity ramps successfully.

Conclusion: The PC Market's Inflection Point

We're at an inflection point in the PC market. 2025 was the last good year for prices and availability. 2026 will be the year consequences arrive. By 2027, hopefully, things normalize again.

The core issue is straightforward: data centers need memory more than PC makers do, and they're willing to pay more for it. Supply is constrained. Manufacturers optimize for profit. Consumers get squeezed. It's not malicious, it's just economics.

For you as a consumer, the implications are clear:

If you've been considering a PC upgrade, the time to act is now. Waiting for 2026 doesn't make sense. Prices will be higher. Specs will be lower. You'll have fewer good options.

If you must buy in 2026, budget 20-30% more than 2025 prices. Don't be surprised when a laptop that would've cost

The refurbished and used markets will become much more attractive. Quality used devices offer genuine value when new prices spike.

Upgrade cycles will lengthen. People will hold devices longer rather than replace them at inflated prices. This is bad for PC manufacturers but reasonable for consumers.

By 2027, things should stabilize. New manufacturing capacity comes online, data center demand may moderate, and prices should stop climbing.

The PC industry went through price spikes before. It'll happen again. The industry always adapts, supply eventually catches up, and prices normalize. The question for you is whether you want to go through 2026 with an old computer or take action now.

Most people should choose to act now.

Visit industry tracking sites like Statista and Mercury Research to watch memory prices and PC shipment trends throughout 2026. Set up price alerts on PCs you're interested in. Check refurbished inventory regularly. And if you see a good deal on a device you actually need, pull the trigger before it gets worse.

The PC market in 2026 will be different. Being proactive now means being prepared for it.

Key Takeaways

- PC memory prices surged 70% in 2025 with another 50% increase predicted for Q1 2026 as data centers consume high-margin components

- Global PC shipments are forecast to decline 5-10% in 2026 due to rising costs and reduced consumer purchasing power

- Budget and mid-tier laptops face the steepest price increases and specification cuts, while premium devices better absorb cost pressures

- Used and refurbished PCs become increasingly attractive alternatives when new device prices spike significantly

- Buying a PC upgrade before late 2025 saves 15-20% compared to waiting until 2026 while maintaining better specifications

![PC Sales Downturn 2026: Why Memory Prices Are Skyrocketing [2025]](https://tryrunable.com/blog/pc-sales-downturn-2026-why-memory-prices-are-skyrocketing-20/image-1-1768331472455.jpg)