Raspberry Pi Price Hikes: The RAM Crisis Explained [2025]

Last month, the tech community got some unwelcome news. Raspberry Pi, the beloved single-board computer that built its reputation on being affordable, announced its second price increase in just eight weeks. The move felt like a gut punch to hobbyists, educators, and professionals who've relied on these tiny machines for nearly everything from robotics projects to home automation to edge computing.

But here's the thing: it wasn't a surprise. Anyone paying attention to the semiconductor market saw this coming from a mile away. The culprit? A perfect storm of AI-fueled demand, supply chain bottlenecks, and a RAM shortage that shows no signs of slowing down anytime soon.

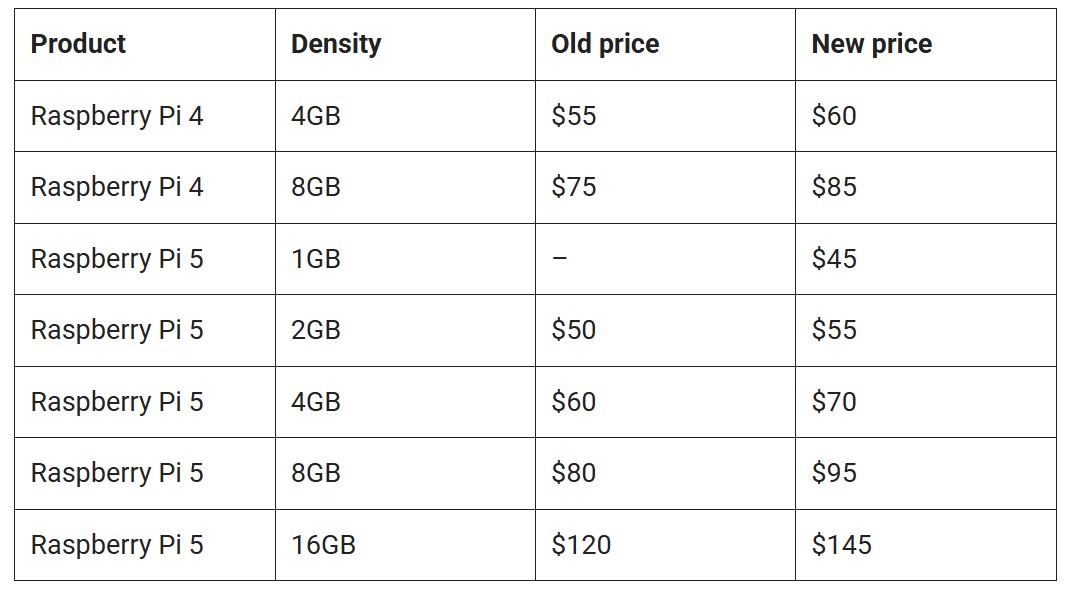

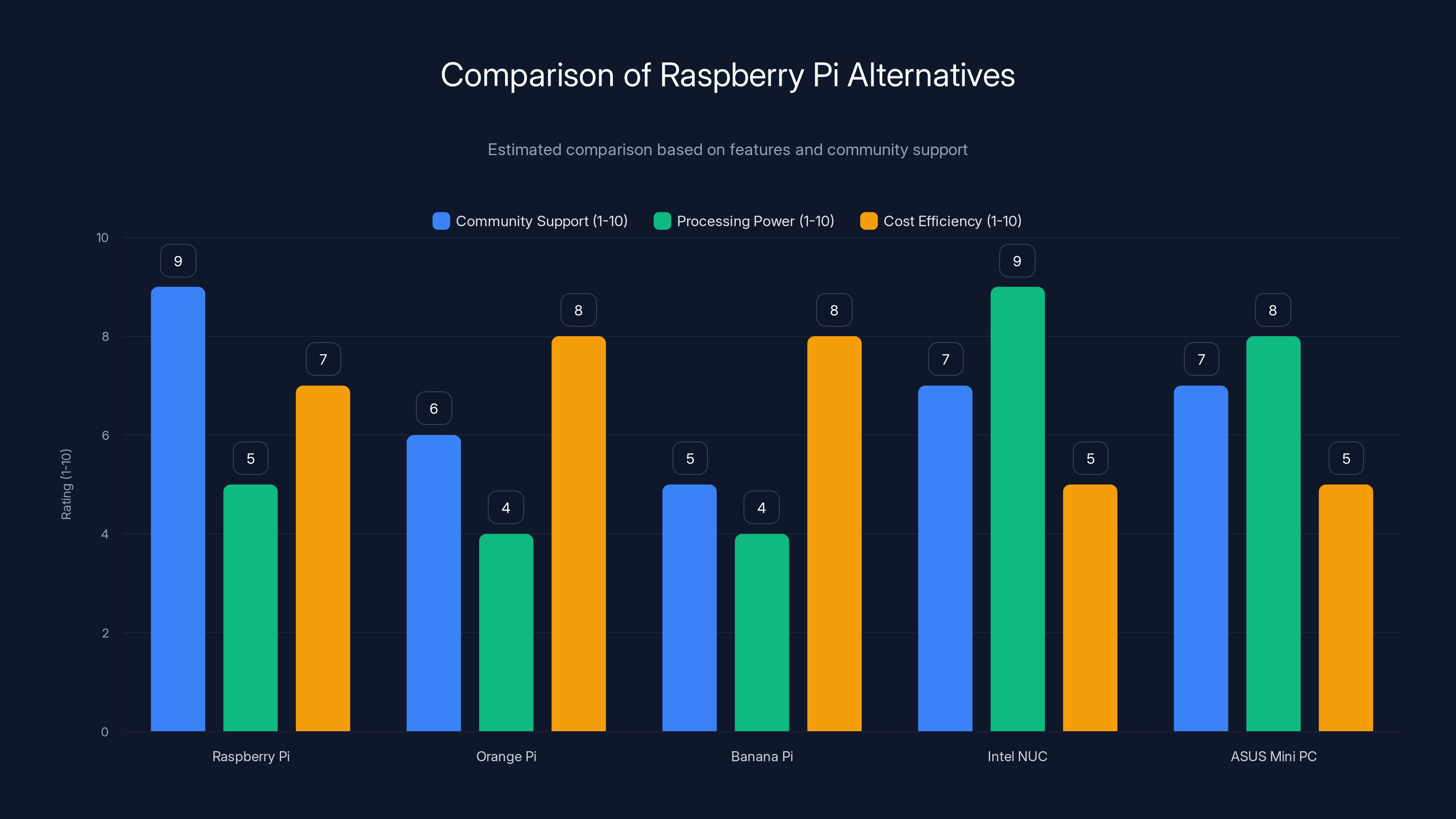

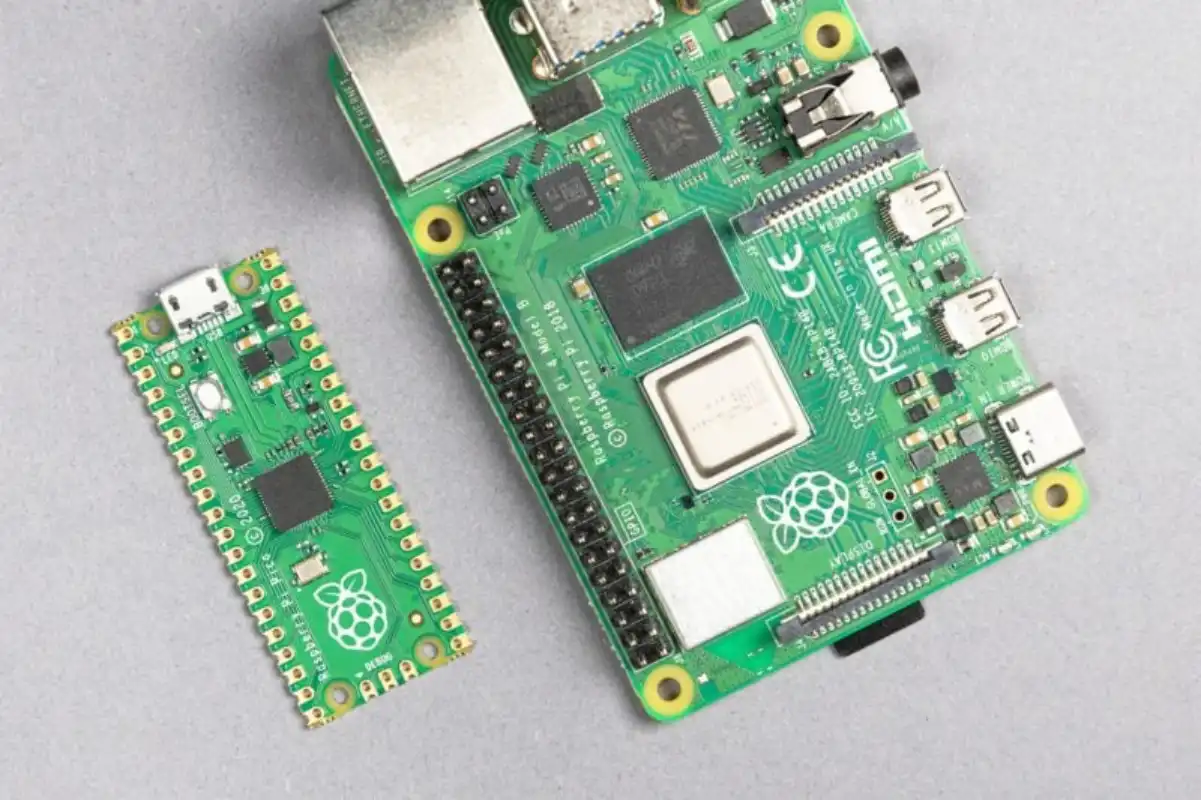

The price increases are aggressive. The 2GB models jumped

What's really fascinating is how selective these hikes have been. The 1GB models? They're staying at

The question everyone's asking isn't just "Why are prices going up?" It's "When will they come back down?" And that's where things get complicated.

TL; DR

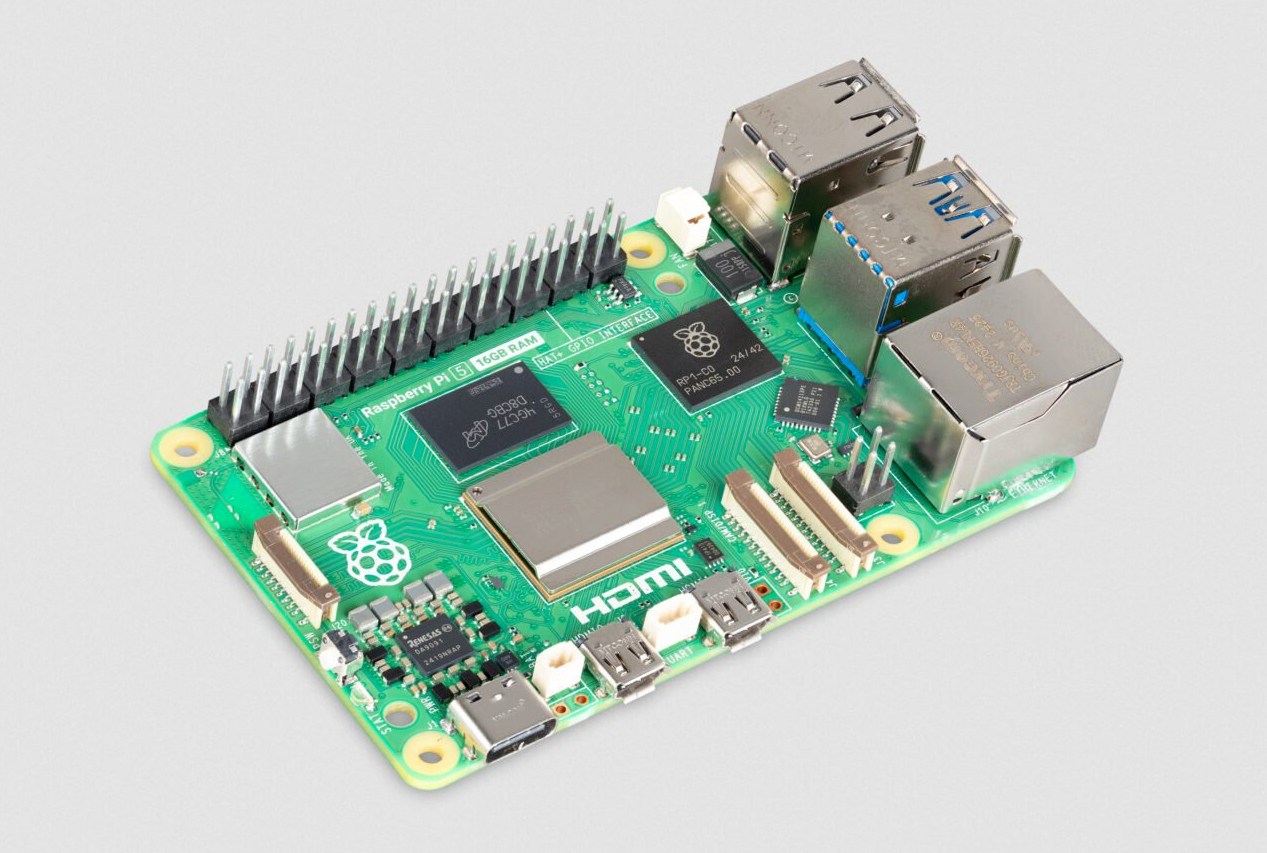

- Second hike in two months: Raspberry Pi 5 16GB model now costs 145 in December

- Selective price increases: Only models with 2GB or more LPDDR4 RAM affected; 1GB variants unchanged

- RAM shortage driving costs: AI boom and cryptocurrency mining competition created chip supply bottleneck

- Previous increases stacking: December hikes of 15 are now being added to February's60 jumps

- Broader implications: Other hardware manufacturers face similar pressures; price relief unlikely until mid-2026

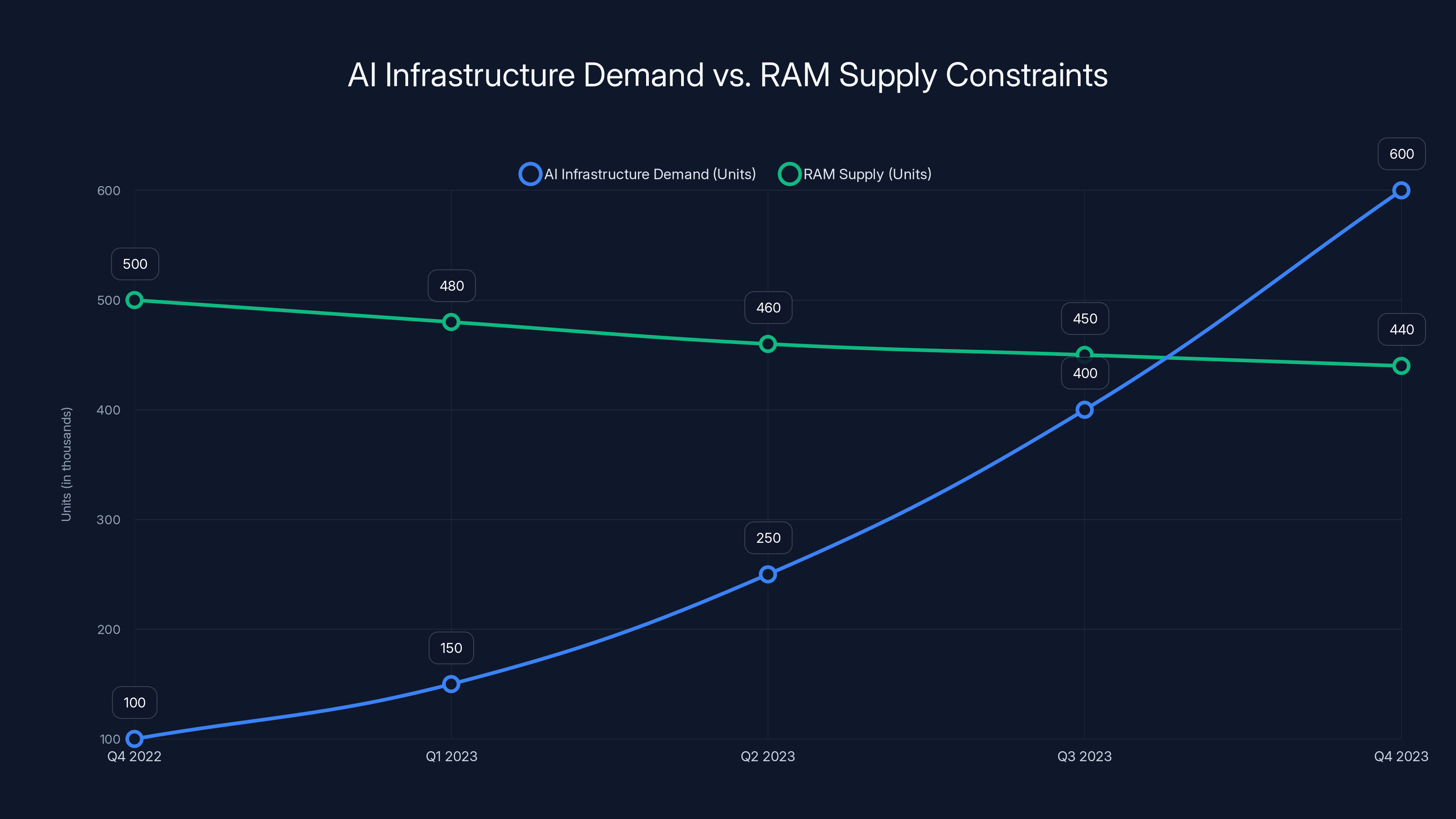

The demand for AI infrastructure has surged since late 2022, leading to a significant strain on RAM supply. Despite increasing demand, RAM supply has not kept pace, contributing to shortages and price hikes. Estimated data.

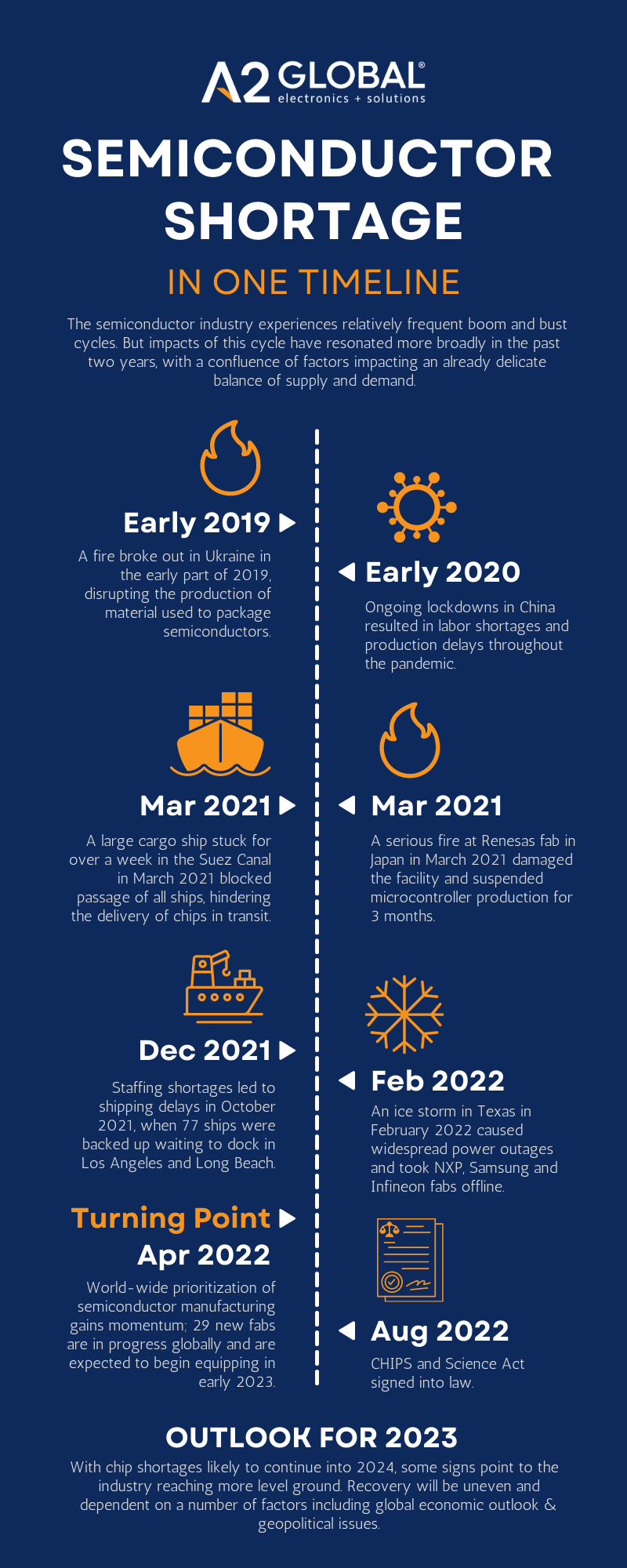

Understanding the Semiconductor Supply Chain Crisis

The Raspberry Pi price hike isn't happening in a vacuum. It's a symptom of something much larger that's been brewing since 2024. The semiconductor industry has been through multiple crises over the past few years. After the COVID-era shortages finally eased in 2023, everyone thought we'd see smooth sailing. Instead, we got something worse: selective, targeted shortages on specific chip types that are hardest to replace.

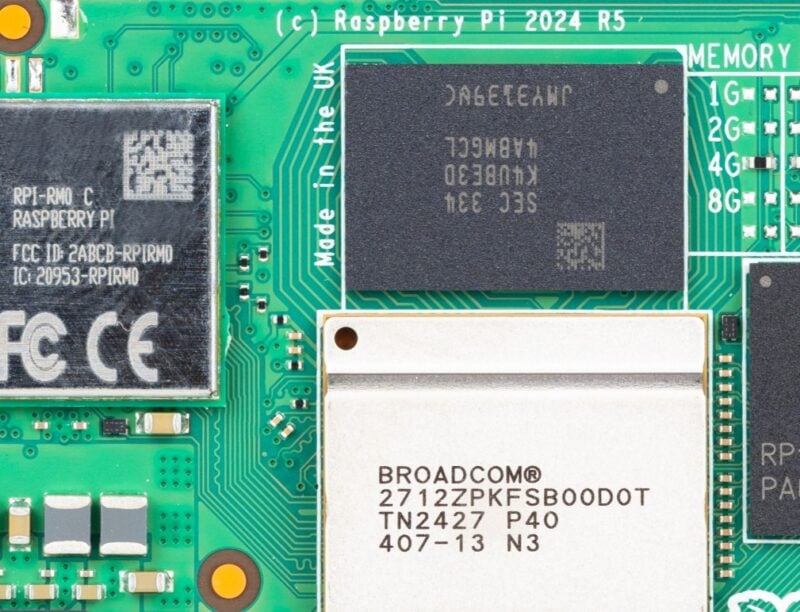

RAM, specifically LPDDR4 memory, has become the bottleneck of 2025. Why? Because it's needed everywhere. AI companies building data centers need tons of it. Consumer laptop manufacturers need it. Mobile phone makers need it. Gaming console developers need it. And now that AI models have become computationally intensive, the demand has basically exploded across the board.

The irony is that the semiconductor industry isn't short on capacity per se. TSMC and Samsung are manufacturing at near-maximum capacity. But they're optimizing for high-margin products. Producing LPDDR4 for single-board computers generating modest volumes doesn't make economic sense when you could be making the same chips for a Tesla AI accelerator or an enterprise GPU farm.

This is where market forces create painful realities. When demand exceeds supply and you can't just build more capacity overnight, manufacturers have to choose their customers. And larger, higher-margin clients win every time.

Raspberry Pi CEO Eben Upton's statement that the situation is "temporary" is technically true, but the timeline matters. When industry analysts talk about memory pricing returning to normal, they're generally looking at mid-2026 or later. That's nearly a year of elevated prices from the time the first hike was announced. For a company that built its entire brand around affordability, that's a serious challenge.

The Impact of AI-Driven Chip Demand

You can't understand the current RAM shortage without understanding the AI explosion. Since Chat GPT hit the market in late 2022, the demand for AI infrastructure has grown exponentially. Every major tech company—Google, Microsoft, Amazon, Meta, Apple—is racing to build out data centers specifically for AI workloads.

These data centers don't just need processors. They need massive amounts of RAM. We're talking about systems that might have 512GB, 1TB, or even more of memory. A single high-end AI server needs as much RAM as you'd find in an entire startup's rack of computers five years ago.

Nvidia's H100 and H200 GPUs, which are the workhorses of AI infrastructure, come paired with enormous memory configurations. The competition to secure these chips has become fierce. Cloud providers are willing to pay premium prices to get the silicon they need, and that drives up costs across the entire supply chain.

When Nvidia's demand increases, it puts pressure on memory manufacturers. When memory manufacturers are constrained, they have to allocate their output. Large orders from tech giants get priority. Orders from Raspberry Pi, which probably represents less than 0.1% of LPDDR4 demand, get pushed to the back of the queue.

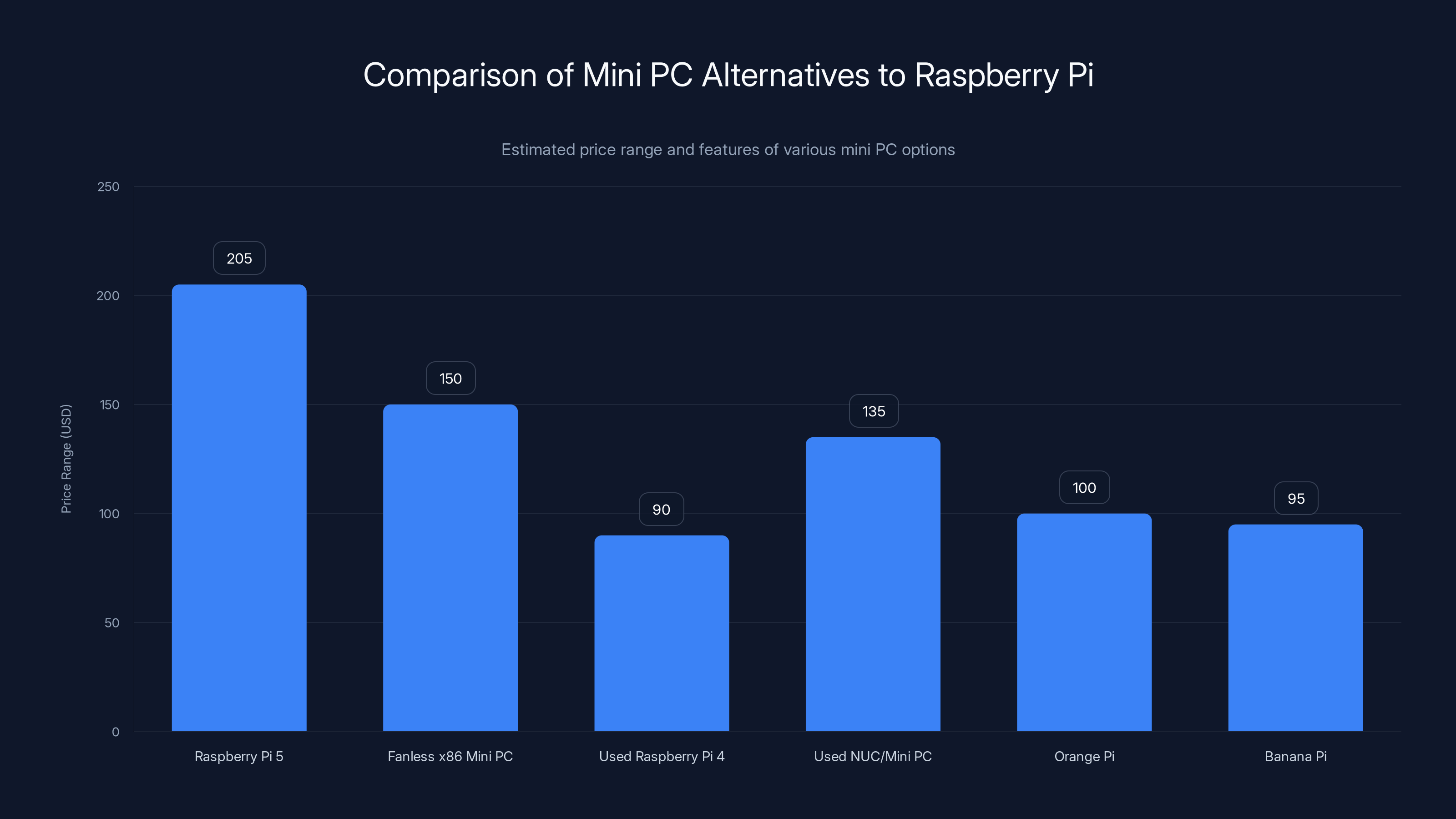

The domino effect is real. Raspberry Pi has to compete for chips at higher prices, so they raise their prices. Hardware enthusiasts and small businesses then have to decide whether a $205 Raspberry Pi 5 still makes sense for their project. Many decide it doesn't. They start looking at alternatives.

What's particularly brutal about this dynamic is that it's somewhat self-reinforcing. As prices go up, demand might drop. But reduced demand doesn't immediately free up supply for other manufacturers. The chips that would have gone to Raspberry Pi don't suddenly become available at lower prices. They might just get allocated to other high-demand products.

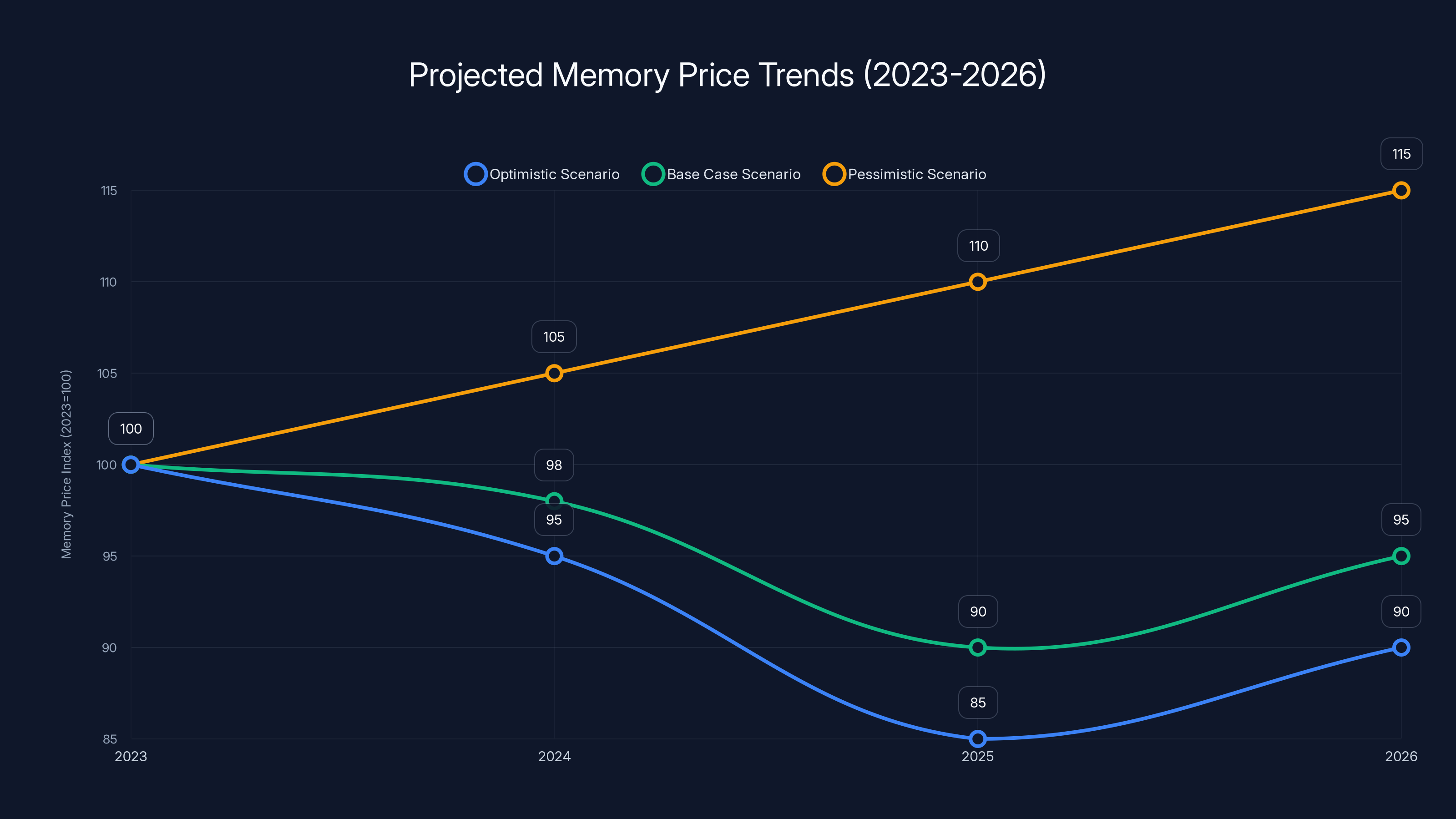

Projected memory prices under different scenarios show potential declines in the optimistic and base cases by 2026, while the pessimistic scenario suggests continued price elevation. Estimated data based on industry forecasts.

The December Price Hike That Started Everything

The February price increases that grabbed headlines weren't actually the first ones. Back in December 2024, Raspberry Pi had already raised prices across most Pi 4 and Pi 5 models by

But those December increases were significant because they signaled that the company expected supply issues to persist. When a hardware manufacturer raises prices in December, they're not doing it for seasonal reasons. They're doing it because they've been told by their suppliers that costs are going up and will stay elevated.

The October price adjustments that preceded the December hikes were even more narrow in scope—only affecting select models. This suggests Raspberry Pi was trying to be surgical about the increases at first, adjusting only where absolutely necessary. But as the months went on and supply forecasts worsened, the company had to expand the scope of the increases.

What's notable is how these increases are stacking. A customer looking at a Raspberry Pi 8GB model today has seen a cumulative price increase of around $45 from what it cost in September 2024. That's not from a single shock. It's from three separate price adjustments in six months.

This pattern tells us something important: the supply situation isn't stabilizing. If conditions were improving, you wouldn't see additional price hikes. You'd see stabilization or rollbacks. Instead, we're seeing acceleration.

Raspberry Pi's public stance is that these are temporary measures. Upton explicitly said the company intends to unwind the price increases once memory pricing comes down. But the company wouldn't have made these moves if the forecast looked rosier. The timing and magnitude of the increases suggest confidence that supply issues will persist at least through Q2 2025.

Why Higher RAM Variants Face Steeper Increases

One of the most interesting aspects of these price hikes is how dramatically they increase with memory capacity. The

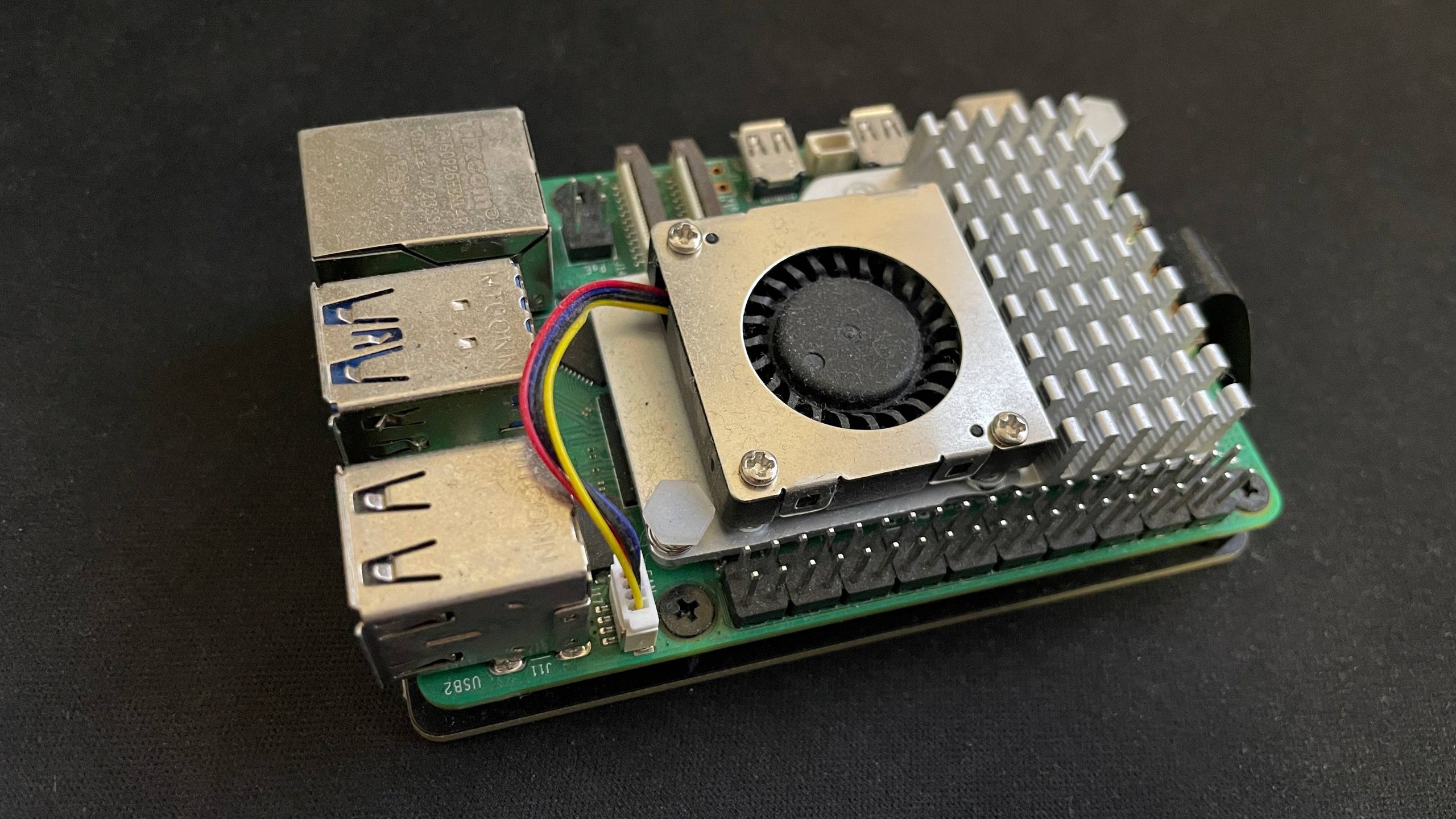

There's a clear economic logic here. Manufacturing costs don't scale linearly with RAM capacity. The fixed costs of making a board—the CPU, the cooling solution, the PCB, the connectors—are basically the same whether you're adding 2GB or 16GB of RAM. The variable cost is just the memory itself.

When memory costs spike, it disproportionately affects the products with the most memory. A doubling in RAM chip costs means a small impact on the 1GB model but a massive impact on the 16GB model. If RAM cost goes from

But pricing isn't purely based on material costs. It's also based on demand elasticity and product positioning. Raspberry Pi could have spread the cost increases more evenly across all models. Instead, they've chosen to insulate the budget offerings while passing full costs to the premium segment.

This is smart strategy from a business perspective. The $35 Raspberry Pi 1GB is the gateway drug to the ecosystem. It's what gets used in schools, sold in bundles, becomes part of people's first projects. If that price point holds steady, the company preserves the entry-level appeal that's been core to Raspberry Pi's identity.

The 16GB model, by contrast, is targeting professionals and power users who are price-sensitive but not price-driven. These users have larger budgets. They're more willing to absorb cost increases because the cost of the hardware is a smaller percentage of their total project budget.

From a market perspective, Raspberry Pi is essentially saying: "We're maintaining affordability for beginners but accepting that enthusiasts will pay premium prices."

Historical Context: The 2022-2023 Shortage

This isn't Raspberry Pi's first rodeo with supply shortages. The COVID-era semiconductor crisis hit the company hard from 2020 through 2023. During that period, Raspberry Pi boards went from readily available to essentially impossible to find. Retailers couldn't stock them. Resellers bought them at list price and flipped them for two or three times the retail cost.

That shortage was different in character from what we're experiencing now. It was broader and more general—nearly all chips were affected. But it lasted years. Manufacturing capacity couldn't be brought online fast enough to meet demand, and every hardware company was competing for the same limited supply.

What happened back then was that users got creative. People started looking at alternatives. Thin client PCs that were being phased out of enterprise deployments were pressed into service. Old x 86-based mini computers became popular. Orange Pi and other Raspberry Pi clones gained traction. Some users just waited out the shortage.

When supply finally normalized in mid-2023, Raspberry Pi reasserted its dominance because it was still the best option for most use cases. The ecosystem had expanded. More software was available. More accessories existed. But some users had already moved on and never came back.

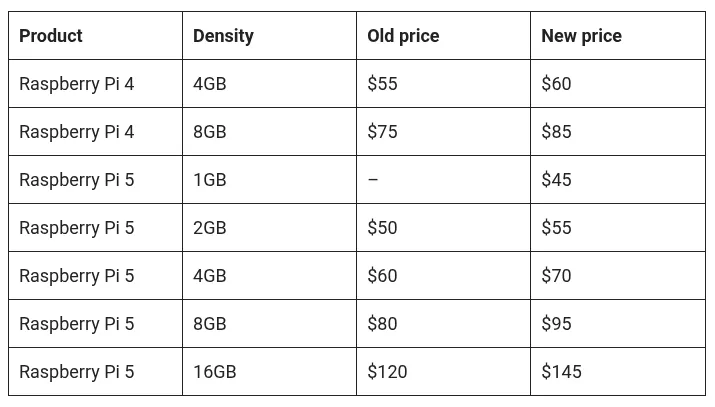

The current situation, while less severe, presents a similar risk. Users frustrated by $205 price tags might try a Banana Pi, an Orange Pi, or an x 86-based Intel NUC. They might discover these alternatives work fine for their needs and never return to Raspberry Pi.

Raspberry Pi's brand is built on being the affordable, accessible option. As prices climb, that differentiation erodes. The company clearly understands this risk—why else would Upton emphasize that price increases are temporary?

The difference is that this time around, supply constraints are more targeted and we have more visibility into recovery timelines. We know it's primarily a RAM issue. We know that major memory manufacturers have roadmaps for increased capacity. We have industry forecasts suggesting relief in the second half of 2025 or early 2026.

During the COVID shortage, nobody knew if or when things would get better. That uncertainty was part of what drove people to look for alternatives. This time, there's more confidence that the situation will resolve.

Raspberry Pi has the strongest community support, while x86-based mini PCs offer superior processing power. Orange Pi and Banana Pi are cost-effective alternatives. (Estimated data)

The Broader Hardware Ecosystem Impact

Raspberry Pi isn't alone in facing these pressures. The entire single-board computer market is being affected. Orange Pi, Banana Pi, Beagle Bone, and other manufacturers are all facing similar challenges. Some have already raised prices. Others are absorbing costs and sacrificing margin to remain competitive.

But the impact extends well beyond single-board computers. Any consumer electronics device that uses LPDDR4 memory is experiencing cost pressures. This includes laptops, tablets, game consoles, and smart home devices. The devices most likely to get hit early are those with the highest memory configurations.

The cascade effect is real. When memory costs rise, manufacturers have to decide between raising prices, reducing features, or cutting margin. Most choose a combination of all three. A laptop that might have come with 16GB at a certain price point last year might come with 12GB this year at the same price. A gaming device might drop its top-tier memory configuration entirely.

For companies like Dell, HP, and Lenovo, these challenges are manageable because they operate at massive scale and have long-term supply agreements locked in at fixed prices. They get protected. Companies like Raspberry Pi that operate on lower volumes and shorter supply commitments get exposed.

There's also a talent and services component to consider. Manufacturers with stronger relationships and higher purchasing volumes get first access to allocation. They get better pricing from suppliers. Smaller players get squeezed. This creates a consolidation pressure—the strong get stronger, the weak get weaker.

For the broader maker and hobbyist community, this matters because it affects the vitality of the ecosystem. When single-board computers get expensive, fewer people buy them. Fewer projects get built. Fewer libraries and tools get developed. The network effects that make these platforms valuable start to diminish.

Market Alternatives and Competition

The price increases open the door for competitors in ways that previous market conditions didn't. When Raspberry Pi was available at

The x 86-based mini PC market has evolved substantially in the last two years. You can find fanless x 86 mini computers for

Intel's NUC line (now discontinued) left a gap that companies like Lenovo, ASUS, and others have started filling with mini PC products. These aren't as low-power as a Raspberry Pi, but they're not expensive either. And unlike Raspberry Pi, they're not facing supply constraints because they're targeting a different market.

There's also the ecosystem argument to consider. A Raspberry Pi gets you access to vast software libraries, community support, and learning resources. An x 86-based mini PC gets you full Linux compatibility without compromise, but you lose some of the beginner-friendly aspects.

For developers, this fragmentation is annoying. For budget-conscious makers, it's an opportunity. Some users will absolutely migrate to alternatives. Others will stay loyal to Raspberry Pi despite the higher cost because the ecosystem value justifies the premium.

Orange Pi and Banana Pi have made serious improvements to their software support and ecosystem in recent years. They're no longer knockoffs—they're legitimate alternatives with their own strengths. Higher Raspberry Pi pricing makes these platforms more competitive.

The wildcard is used hardware. When new products get expensive, the used market becomes more attractive. A used Raspberry Pi 4 with 8GB might be available for

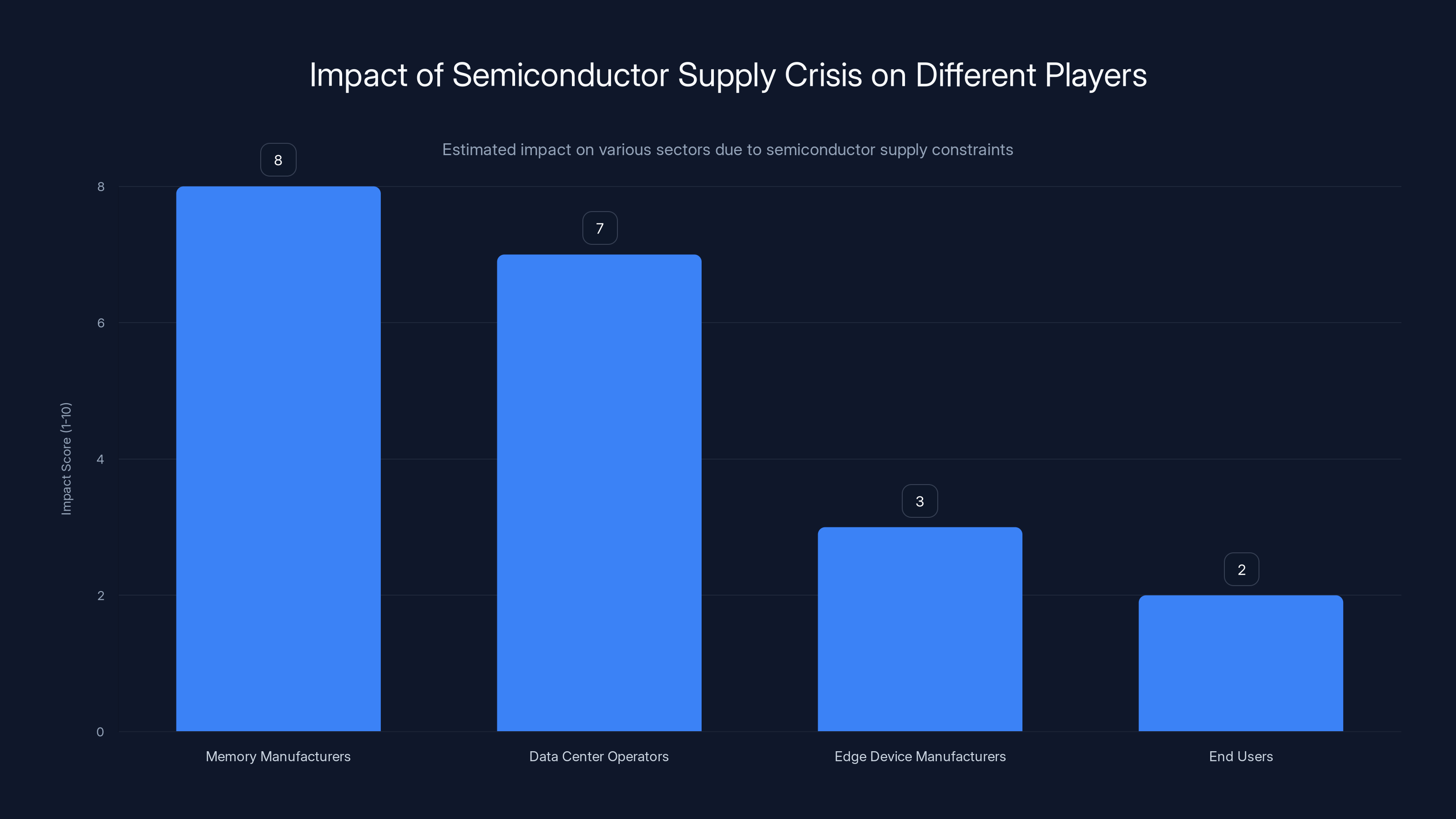

Supply Chain Economics: Who Benefits, Who Suffers

The semiconductor supply crisis creates winners and losers. This isn't a zero-sum game exactly, but it's close to one. When supply is constrained, certain players benefit while others get squeezed.

Memory manufacturers like SK Hynix, Micron Technology, and Samsung benefit directly. Constrained supply allows them to raise prices and improve margins. Their stock prices reflect this reality. From a shareholder perspective, a shortage is actually good news if your company is making the constrained products.

Data center operators like Google, Microsoft, and Amazon benefit from their scale and negotiating power. They can secure supply at reasonable prices because they're too important to their suppliers to alienate. They have long-term agreements and guaranteed volumes.

Edge device manufacturers like Raspberry Pi suffer. They can't get preferential treatment. They compete for allocation on the open market at whatever prices suppliers want to charge.

Users in the middle suffer most. They have to either pay higher prices or do without. For a professional using a Raspberry Pi as a key component in their business, the

This dynamic creates interesting strategic opportunities. Companies can position themselves as the affordable alternative to Raspberry Pi. They can market against the price increases. They can emphasize stability in their own pricing.

Raspberry Pi's strategy of absorbing costs on the 1GB model while passing full costs to higher-end models is economically rational but risky from a brand perspective. It signals that they're prioritizing margin on high-end products. It also confirms that the supply issue is real and persistent—otherwise, why wouldn't they try harder to absorb costs across the board?

Estimated data shows that while Raspberry Pi 5 is priced at $205, other alternatives like fanless x86 mini PCs and used options offer competitive pricing, making them attractive for budget-conscious users.

Long-Term Ecosystem Implications

Beyond the immediate impact of higher prices, there are structural implications for the Raspberry Pi ecosystem that deserve attention. When your core product's value proposition—affordability—gets undermined by supply constraints, users and developers start rethinking their architectural choices.

Consider a company building a product that uses Raspberry Pi boards. When a single unit costs

For educational institutions that buy Raspberry Pi boards in bulk, higher prices mean fewer units in the budget. A school district that could outfit 50 classroom projects with a $5,000 budget at old prices can now outfit maybe 20 projects. That's a massive reduction in market.

Open source communities that have built on top of Raspberry Pi—the software, the libraries, the tutorials, the hardware accessories—all benefit from a large installed base. As that installed base growth slows due to higher prices, the network effects that make the platform attractive start to fade.

This is why Upton's emphasis on the temporary nature of the increases is so important. If users believe prices will come back down, they're more likely to wait out the shortage and stick with Raspberry Pi. If they believe this is the new normal, they'll start migrating to alternatives.

The company's credibility on this point matters. If they bring prices back down meaningfully when supply improves, users will remember that commitment and stay loyal. If they use the supply excuse as cover for permanent price increases, they'll lose that trust.

Looking forward, there's also the question of how Raspberry Pi responds to these pressures long-term. Do they invest in vertical integration? Do they work with suppliers on guaranteed allocations? Do they diversify their memory suppliers to reduce vulnerability? Do they develop alternative designs that use different memory types that aren't in as short supply?

These are the kinds of strategic decisions that get made in response to supply chain shocks. They'll shape the platform for years to come.

When Will Prices Come Back Down?

Everyone wants to know the answer to this question, and the honest answer is: it depends on factors Raspberry Pi can't fully control. The company can't make LPDDR4 memory cost less. They can't create additional manufacturing capacity. They can only respond to market conditions as they evolve.

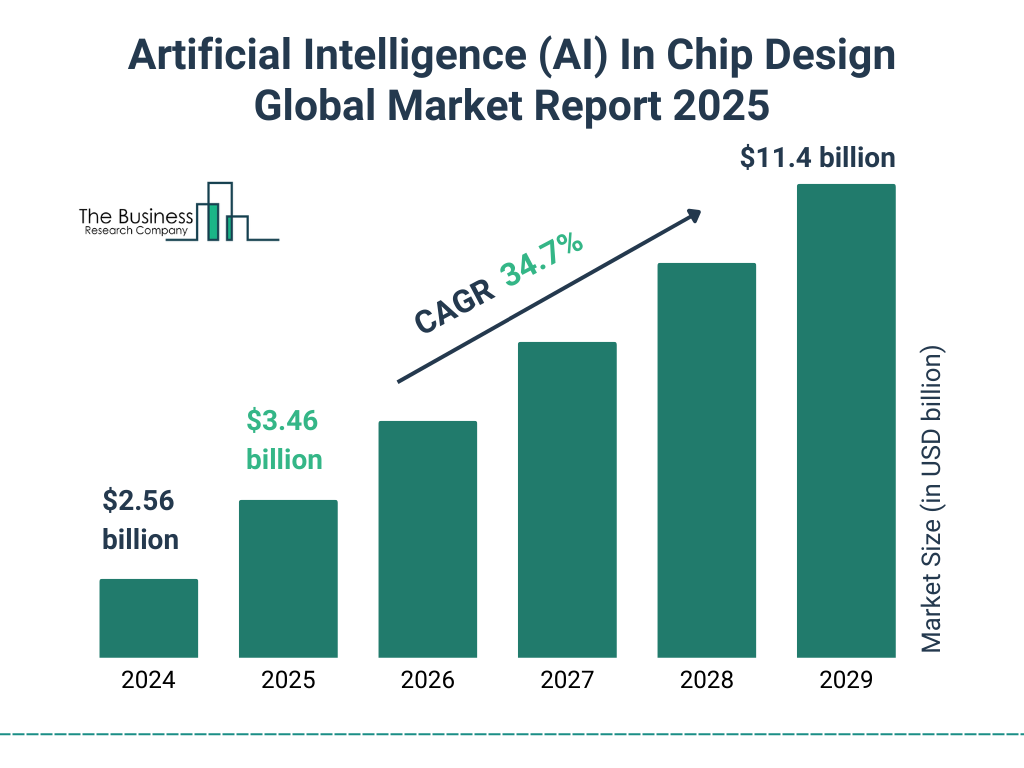

Industry forecasts, which are based on semiconductor manufacturing roadmaps and demand projections, generally point to relief starting in the second half of 2025, with more significant normalization in 2026. That's based on the assumption that AI infrastructure demand growth rates plateau and memory manufacturers bring online additional capacity.

But forecasts in the semiconductor industry are notoriously unreliable. They're based on assumptions about demand that can shift. If the AI boom continues accelerating, or if a new application emerges that drives even higher demand for memory, the shortage could persist longer.

Conversely, if there's a recession or technology shift that reduces AI infrastructure demand, supplies could normalize faster. A chip made for AI servers can be reallocated, but it takes time and involves costs to shift production.

What we can say with confidence is that memory prices won't come back to 2023 levels anytime soon. The semiconductor industry has fundamentally rebalanced toward higher-value applications. Margins on memory sold for AI infrastructure are fat. It's unlikely that suppliers will voluntarily reduce prices back to pre-shortage levels just because supply improves. They'll reduce prices to clear excess inventory and compete with each other, but probably not all the way back to the historical baseline.

Raspberry Pi's likely scenario is that prices come down gradually over the next 12-18 months. A

That would suggest that Raspberry Pi's post-crisis pricing might be permanently

What This Means for Hardware Businesses

For companies and individuals building products around Raspberry Pi, these price increases force important business decisions. If you're building a hardware product that uses Raspberry Pi as a component, you have several options:

First, you can pass the costs to your customers. This works if your customers are price-insensitive or if the increased component cost is a small percentage of your total product cost. If you're building a

Second, you can absorb the costs and accept lower margins. This is viable if you have good margins to begin with and you're willing to sacrifice some profit to maintain market share. It's not viable for businesses operating on thin margins.

Third, you can redesign your product to use lower-spec Raspberry Pi boards. Instead of requiring an 8GB model, can you make your software work with 4GB? Can you use multiple lower-spec boards instead of a single high-spec board? These kinds of optimizations are possible but require engineering effort.

Fourth, you can switch to a different platform entirely. This is the nuclear option because it means rebuilding your software stack, potentially redesigning hardware, and starting over with testing and validation. But for new products or companies that haven't built yet, it might be worth evaluating alternatives before committing to Raspberry Pi.

Many companies are probably pursuing some combination of these strategies. Startups building the next generation of products are likely looking seriously at alternatives. Established products that are already built around Raspberry Pi are probably absorbing costs and passing some through to customers.

This is how supply shocks reshape industries. They force companies to question assumptions and make strategic changes that wouldn't have happened otherwise. Some of those changes stick around even after the supply situation normalizes.

Higher RAM variants face steeper price increases due to non-linear scaling of manufacturing costs and strategic pricing. Estimated data based on typical market trends.

Educational Impact and Implications

Raspberry Pi has been transformative in computer science education. Thousands of schools have integrated Raspberry Pi into their curricula. It's affordable, it's capable, it's physically small enough that every student can have their own board. The ecosystem has grown to support education with curriculum materials, lesson plans, and pre-built projects.

Price increases directly threaten this educational momentum. Schools operate on fixed budgets. When component costs rise, something has to give. Either fewer students get boards, or schools reduce the number of projects, or they delay purchases hoping prices come down.

Educators have already reported concerns about the impact of earlier price increases. If prices climb to $205 for the top-end model, you'll definitely see schools making different choices. Some will stick with older Pi 3 and Pi 4 models that haven't increased in price. Others might switch to alternatives. Some might reduce the scope of their programs.

Over time, this matters for the technology pipeline. Fewer young people getting hands-on experience with real hardware and real computing means fewer people entering tech careers. It shifts who has access to technical education toward families that can afford expensive hardware.

Raspberry Pi's foundation has a mission around education and democratizing access to technology. The price increases put pressure on that mission. While the company might justify the increases as necessary for survival during supply constraints, the educational impact is real and concerning.

This is an area where Raspberry Pi might consider premium support or educational bundles at discounted prices, even if it hurts margins. Protecting the educational market is protecting the long-term health of the ecosystem.

Expert Perspectives and Industry Reaction

Hardware manufacturers and industry analysts have been watching this situation closely. The reaction has been mixed. Some see it as justified given supply constraints. Others see it as a warning sign about the broader state of the semiconductor industry.

Venture capitalists investing in hardware startups are noting that component costs are becoming unpredictable. Supply chains that seemed stable are proving fragile. This is pushing some investment toward software solutions and away from hardware—why build a hardware business if your components might become unavailable or unaffordably expensive?

Developers and makers have been more openly critical. Online communities are discussing whether they should pivot to alternatives. Some are sharing strategies for making their projects work with less capable hardware. Others are stockpiling older Raspberry Pi boards before prices increase further.

The semiconductor industry itself is being forced to confront questions about allocation and priorities. Right now, AI is winning the allocation battle because it represents the highest margin and highest growth. But this is unsustainable long-term if it completely freezes out other markets. Eventually, the market rebalances.

What industry observers are watching for is whether this shortage leads to genuine supply chain changes. Will companies invest in diversifying suppliers? Will they build more resilient supply chains? Will they demand longer-term supply agreements? Or will they just wait out the shortage and go back to the status quo?

Historically, industries don't change their supply chain practices until they get hit repeatedly. One shortage induces some caution. Two or three shortages in a row drives real structural change. We're still in the "one shock" phase where people are reacting but not necessarily overhauling their entire approach.

The Cryptocurrency Mining Factor

It's worth noting that part of the memory and chip demand crunch isn't just AI. Cryptocurrency mining has also been a factor, though it gets less attention than AI. GPU and ASIC mining for proof-of-work cryptocurrencies requires enormous amounts of compute power.

While crypto mining has been less dominant than it was in 2021-2022, it's still a non-trivial portion of semiconductor demand. Miners competing with AI data centers for chips drives prices up across the board.

This matters for the Raspberry Pi situation because it means some of the supply crunch might ease sooner than others suggest. If crypto mining becomes less profitable and miners reduce their hardware purchases, that could free up supply capacity. It's an additional variable beyond just AI demand.

The interaction between these different demand sources is complex. A change in Bitcoin prices affects mining profitability, which affects chip demand. A breakthrough in AI efficiency affects how many chips are needed per inference. A recession affects everything. Multiple factors are in play simultaneously.

Memory manufacturers and data center operators benefit from semiconductor supply constraints, while edge device manufacturers and end users suffer. Estimated data.

Strategic Lessons for Hardware Companies

The Raspberry Pi situation offers important lessons for any company building hardware products. First, supply chain resilience matters more than it used to. Operating with just-in-time inventory worked fine when supply was stable and predictable. It doesn't work when supply is volatile.

Second, diversification of suppliers is a real value creator. Companies that depend on a single supplier or a single source for critical components are fragile. Building redundancy costs money upfront but pays dividends when crisis hits.

Third, flexibility in design is an asset. Products that can function with multiple different components or memory configurations are more resilient than products that require a specific component. This applies to Raspberry Pi as much as it does to any other manufacturer.

Fourth, communication with customers matters. Transparency about supply issues and price increases, paired with clear timelines for resolution, maintains trust. Customers can tolerate price increases more easily than they can tolerate uncertainty.

Fifth, protecting the entry-level market is strategic, not just altruistic. The

These lessons will shape how hardware companies operate for the next several years. The companies that adapt fastest will have competitive advantages. Those that don't will find themselves disadvantaged when the next crisis hits.

Timeline Projections and Scenarios

Based on available information about semiconductor manufacturing capacity, memory demand from AI and other sources, and industry forecasts, we can sketch out a few potential scenarios for how this unfolds.

Optimistic Scenario: Memory manufacturers bring additional capacity online faster than expected. AI demand growth slows. By mid-2025, supply starts improving noticeably. Prices begin coming down in Q3-Q4 2025. By early 2026, prices are close to pre-crisis levels, though perhaps

Base Case Scenario: Supply improvements happen gradually. Memory prices decline slowly through 2025. By late 2025, prices have come down 20-30% from peak levels but haven't returned to historical norms. Raspberry Pi gradually unwinds price increases, with the majority coming off by mid-2026 but some becoming permanent. Memory remains moderately elevated compared to 2023.

Pessimistic Scenario: AI demand continues accelerating beyond expectations. A new application or use case emerges that drives memory demand even higher. Supply chain issues persist or even worsen through 2026. Prices remain elevated. Raspberry Pi's price reductions are minimal. The company accepts that margins on higher-end products will remain strong and pricing will stay elevated to reflect this.

Each scenario has different implications for the Raspberry Pi ecosystem and for users. The optimistic scenario is what Upton is betting on. The base case is what most industry analysts expect. The pessimistic scenario is a tail risk but possible.

Uncertainty around which scenario plays out is itself a cost. Companies can't plan with confidence. Customers can't make confident purchasing decisions. This uncertainty persists until supply conditions clearly stabilize.

What Users Should Do Now

For different types of users, the price increases call for different responses. It's not a one-size-fits-all situation.

For hobbyists and experimenters: The 1GB boards remain at their original $35 price point. They're actually still a bargain. Most hobbyist projects—media servers, home automation, retro gaming emulation—work fine on 1GB. Unless you specifically need more RAM, buy the 1GB model and pocket the savings. The performance difference for most use cases is minimal.

For students and educators: If you're buying boards for educational purposes, look into whether your institution has educational pricing or bulk discount programs. Reach out to Raspberry Pi directly about educational bundles. Some manufacturers offer academic discounts. Don't assume the list price is the only price available.

For businesses using Raspberry Pi: If you're building products around these boards, this is the moment to seriously evaluate alternatives. Get quotes for Orange Pi, Banana Pi, and x 86-based solutions. Do a real cost-benefit analysis. The answer might still be Raspberry Pi, but you should make that decision with eyes wide open to the full cost picture.

For companies with existing Raspberry Pi deployments: If you've already built products on Raspberry Pi, you're mostly locked in. You'll have to absorb or pass through the cost increases. Focus on lobbying Raspberry Pi for reasonable timelines on price rollbacks and on optimizing your designs to work with lower-spec boards if possible.

For anyone building for the long term: If you're making infrastructure decisions that will last 5+ years, Raspberry Pi is still a good choice. The ecosystem value justifies premium pricing. But prices should come down from where they are now. Build that assumption into your budgets.

For those who can wait: If you're not in a hurry, waiting 6-12 months for prices to come down is a viable strategy. The downside is that you delay your project. The upside is you save real money. For non-time-critical projects, this math often works out.

Future of Single-Board Computers

The Raspberry Pi price crisis raises broader questions about the future of single-board computers as a category. For over a decade, Raspberry Pi has defined this market and has been essentially unchallenged at the price-performance-ecosystem sweet spot.

Now, that position is being tested. Competitors are improving. Alternative platforms are becoming more viable. The COVID shortage and now the AI-era shortage have both created gaps where alternatives can gain traction.

Looking forward, the SBC market will probably evolve in a few directions simultaneously. You'll see continued dominance of Raspberry Pi in the education and hobbyist spaces because of ecosystem effects, but with eroded pricing power. You'll see growth in alternatives for specific use cases—industrial temperature ranges, extended warranties, specific performance characteristics.

You'll also see more fragmentation at the very high end. Applications that need 16GB or 32GB of RAM aren't going to use Raspberry Pi at

In the Io T space, you'll see more purpose-built solutions rather than Raspberry Pi adaptations. Companies will build exactly what they need rather than trying to force a general-purpose SBC to fit their specific requirements.

And you'll probably see some consolidation. As Raspberry Pi raises prices and solidifies its premium position, and as alternatives improve, the market space for cheap low-end boards shrinks. That means fewer competitors and fewer options.

The net effect is an ecosystem that remains vibrant but increasingly stratified. Raspberry Pi stays on top for general purpose use. Specialized solutions proliferate for specific use cases. The middle becomes squeezed.

Preparing for Future Supply Disruptions

What's becoming clear is that semiconductor supply disruptions are going to be a feature of the landscape, not a bug. Climate change, geopolitical tensions, concentrated manufacturing in Taiwan and South Korea, growing demand from AI and other emerging applications—all of these factors suggest supply volatility will persist.

This means companies and users should be planning for future disruptions. Build supply chain resilience into your planning. Develop relationships with multiple suppliers if possible. Design products that can adapt to component availability changes. Maintain strategic inventory of critical components.

For Raspberry Pi specifically, the company should be looking at how to build more resilience into its supply chain. That might mean working directly with memory manufacturers on long-term agreements. It might mean developing variants that use different memory types. It might mean building some manufacturing redundancy.

For the broader tech ecosystem, this situation demonstrates the risk of depending too heavily on components made in concentrated geographies by a limited number of manufacturers. There's a strategic national security angle to this as well—countries and companies should want to avoid complete dependence on Taiwan-based manufacturers for critical components.

Long-term, we might see more regional manufacturing. We might see more vertical integration. We might see more investment in domestic semiconductor capacity. These changes won't solve supply disruptions entirely, but they can make them less severe.

For now, users and businesses should adjust their expectations. Supply disruptions are going to happen. Prices will rise periodically. The best you can do is plan for it, communicate about it, and maintain flexibility in your designs and purchasing strategies.

FAQ

Why is Raspberry Pi raising prices if it's temporary?

Raspberry Pi is raising prices because its suppliers—the memory manufacturers—have increased their costs due to global demand for RAM driven by AI infrastructure expansion. The company has no choice but to either increase prices or stop selling boards at a loss. The price increases are necessary because the underlying material costs have permanently increased in the short term. Upton's statement that the increases are temporary refers to the expectation that memory prices will eventually decline as supply normalizes, allowing Raspberry Pi to lower prices back down. However, this process is expected to take 12-18 months minimum.

Should I buy a Raspberry Pi now or wait for prices to drop?

If you need a Raspberry Pi for a time-sensitive project, buy now. The delayed cost of waiting might exceed the cost savings from a future price reduction. If you're not in a hurry and can wait 6-12 months, waiting is financially smarter. For educational purposes, contact Raspberry Pi Foundation about educational discounts and bulk pricing before making a decision. If you're building a business around Raspberry Pi, evaluate alternatives now to make an informed decision. The 1GB models remain at original pricing, so if those meet your needs, that's a reasonable option regardless of timeline.

Are there good alternatives to Raspberry Pi?

Yes, alternatives include Orange Pi, Banana Pi, and x 86-based mini PCs like Intel NUCs or ASUS mini computers. Each has different strengths. Orange Pi and Banana Pi offer similar ecosystems to Raspberry Pi with lower prices but smaller communities. x 86-based mini PCs offer more processing power and don't have supply constraints, but consume more power and are less beginner-friendly. Older, used hardware is also becoming more competitive. The right choice depends on your specific needs, budget, and timeline.

How long will supply issues persist?

Industry forecasts suggest meaningful relief starting in mid-2025, with significant normalization by 2026. However, forecasts in the semiconductor industry are frequently wrong. Factors that could extend the shortage include continued acceleration of AI infrastructure demand, emergence of new applications requiring memory chips, or supply chain disruptions from geopolitical events. Conversely, a recession could reduce demand faster than expected. Plan for 12-18 months of elevated pricing to be conservative.

Are other hardware companies raising prices?

Yes, manufacturers of laptops, tablets, gaming consoles, and other devices using LPDDR4 memory are facing similar pressures. However, larger companies with significant purchasing power—like Apple, Dell, and Microsoft—are better insulated because they have long-term supply agreements at locked-in prices. Smaller manufacturers and those dependent on spot market pricing for components are more exposed and are more likely to raise prices or reduce features.

Will Raspberry Pi actually lower prices when supply improves?

Upton has committed to unwinding price increases once memory pricing comes down, but there's no guarantee that all increases will be reversed. It's more likely that prices will come down partially from current levels but remain somewhat elevated compared to 2023 pricing. The company has found that premium-spec models can command higher prices, and shareholders probably won't be thrilled if the company voluntarily reduces prices below what customers are willing to pay. Monitor for price reduction announcements—if they happen as soon as supply improves, Upton's commitment is credible. If not, expect some price increases to become permanent.

What can I do with a lower-spec Raspberry Pi?

Most single-board computer projects work fine with 1GB or 2GB of RAM. Media servers, Io T applications, home automation hubs, retro gaming emulation, network monitoring, and simple web servers all run well on lower-spec boards. The only applications that really need 8GB+ are those running computationally intensive tasks like large language models, complex video processing, or running multiple memory-hungry applications simultaneously. For the average maker project, a 1GB Pi 5 at $45 is still an excellent value.

How does this affect future Pi releases?

It's unclear whether Raspberry Pi will release new models while supply constraints persist. The company is focused on managing current product lines and pricing rather than introducing new SKUs that would compete for limited memory supplies. Once supply normalizes, expect new models that take advantage of next-generation chips. The price situation is unlikely to affect the company's long-term product roadmap, but it might delay new releases by 6-12 months.

Can Raspberry Pi switch to a different memory type to avoid shortages?

Technically possible but not practical for existing products. Different memory types have different performance characteristics, power consumption profiles, and compatibility with the existing CPU. A redesign would take significant engineering effort and time. New products could be designed around alternative memory, but existing lines would need to stay as-is. This might be something Raspberry Pi considers for future generations if memory supply remains a persistent problem.

Will this crisis change how companies approach supply chains?

Almost certainly. Companies are learning that just-in-time inventory is fragile when supply is unpredictable. Expect more companies to build strategic inventory, diversify suppliers, design for component flexibility, and negotiate longer-term supply contracts. These practices have costs, but the cost of supply disruptions is higher. The semiconductor industry as a whole will likely see more investment in capacity and more regional manufacturing to reduce geographic concentration.

Conclusion

Raspberry Pi's second price increase in two months is the inevitable result of global supply constraints driven by explosive demand for memory chips from AI infrastructure, cryptocurrency mining, and broad consumer electronics demand. The decision to raise prices on higher-capacity models more aggressively than lower-capacity models reflects economic reality—memory represents a bigger percentage of product cost for high-spec models, and the company's ability to absorb costs is limited.

What makes this situation significant is what it reveals about the semiconductor industry's new structure. AI has become the dominant demand driver. Companies and applications that need cutting-edge silicon have pricing power. Companies that need standard commodity chips find themselves squeezed.

For Raspberry Pi, the immediate impact is manageable. The company remains viable. Prices are elevated but not catastrophic. The ecosystem is strong enough to weather some price increases. Users have alternatives but nothing that matches Raspberry Pi's combination of price, performance, and community.

But the longer-term implications matter more. If prices stay elevated beyond mid-2026, users will migrate to alternatives. The ecosystem will fragment. Raspberry Pi's identity as the affordable option will erode. The company will become a premium product for professionals rather than the gateway drug to hardware that it's always been.

Upton's commitment to bringing prices back down is credible, but only if it's backed by action. The company must prioritize the entry-level market and work to restore original pricing as soon as supply permits. Maintaining the

For users, the message is clear. If you need a Raspberry Pi for something time-critical, buy now or accept the higher cost. If you can wait, prices should moderate within a year. If you're evaluating alternatives, now is the time to seriously consider Orange Pi, x 86-based mini PCs, or other options. The competitive landscape is shifting, and you should make decisions with eyes open to the full picture.

The semiconductor industry's supply constraints will ease eventually. Supply chains will stabilize. Prices will come down. But the structural shifts driving demand for high-end silicon are here to stay. The next crisis probably isn't far off. Building resilience now is the smart play.

For Raspberry Pi specifically, the company has the resources, the ecosystem, and the brand loyalty to survive this crisis and emerge intact. But it will require careful navigation. Maintain affordability where possible. Be transparent about timelines. Deliver on commitments to reduce prices. Invest in supply chain resilience for the future. Do these things, and Raspberry Pi will still be the board of choice for makers and tinkerers a decade from now. Fail on any of these counts, and the company might find itself displaced by competitors that learned lessons from Raspberry Pi's vulnerability.

Key Takeaways

- Raspberry Pi raised prices on higher-capacity models by 60 in February 2025, just two months after December increases, bringing the 16GB model to $205

- Global memory shortage driven by AI infrastructure demand is the primary cause—AI data centers now consume 15%+ of all high-performance RAM production

- Only models with 2GB or more LPDDR4 RAM are affected; 1GB variants remain at original 45 pricing to protect the entry-level market

- Industry forecasts predict memory supply normalization starting mid-2025 with significant relief by 2026, but complete price recovery unlikely within 12-18 months

- Competitors like Orange Pi and x86 mini PCs are becoming viable alternatives, threatening Raspberry Pi's market dominance if price increases become permanent

Related Articles

- Raspberry Pi Price Increases 2025: Impact of Global Memory Shortage

- DDR5 Memory Theft Crisis: Why Thieves Are Smashing Gaming PCs [2025]

- China Approves Nvidia H200 Imports: What It Means for AI [2025]

- AI Infrastructure Boom: Why Semiconductor Demand Keeps Accelerating [2025]

- GPU Memory Crisis: Why Graphics Card Makers Face Potential Collapse [2025]

- Samsung RAM Prices Doubled: What's Causing the Memory Crisis [2025]

![Raspberry Pi Price Hikes: The RAM Crisis Explained [2025]](https://tryrunable.com/blog/raspberry-pi-price-hikes-the-ram-crisis-explained-2025/image-1-1770062852979.jpg)