High on Life 2's Multi-Platform Strategy: Why Play Station Still Matters Most

When Squanch Games first launched the original High on Life back in December 2022, the decision seemed clear. The game would be an Xbox exclusive, landing on Xbox Series X, Xbox Series S, and Xbox One, plus PC via Game Pass. Play Station players waited. They waited through 2023 until July finally rolled around and the game arrived on PS4 and PS5.

Now, with High on Life 2 launching this week, the calculus has completely changed. CEO Mike Fridley didn't mince words in describing the decision to release simultaneously across Xbox and Play Station: it was "a no-brainer" according to TechRadar.

But here's what makes this pivot genuinely interesting—and what most gaming industry coverage misses. The shift isn't about abandoning Xbox or suddenly favoring Sony. It's about cold, hard data. It's about understanding where your players actually are, what they're willing to pay, and how to build a sustainable franchise in an increasingly crowded market.

The gaming industry is experiencing a fundamental shift in how exclusivity deals work. For years, platform holders like Microsoft used exclusivity windows as a way to drive console adoption and justify their subscription services. But the landscape has matured. Players own multiple platforms. Studios can't afford to leave money on the table for years waiting for exclusivity windows to expire.

What Fridley's comments reveal is something deeper than just business pragmatism. They expose how indie and mid-tier studios are increasingly making decisions based on actual player behavior data rather than the marketing promises platform holders make during deal negotiations.

Understanding the Original Exclusivity Deal's Impact

Let's rewind to 2022. Squanch Games, at that time, was a relatively young studio with something to prove. The original High on Life was their big swing—a colorful, comedy-focused first-person shooter with voice acting that wasn't trying to win universal acclaim so much as develop a passionate, engaged audience.

Microsoft's offer was substantial. Get your game on Game Pass day one. That means millions of potential players. That means visibility. That means you don't have to spend your entire marketing budget convincing strangers your game exists.

The trade-off was the exclusivity window. No Play Station. No Nintendo. Just Xbox and PC.

For a studio trying to establish itself, this made sense. The High on Life team could focus on a single build, optimize for Xbox hardware, and rely on Microsoft's marketing infrastructure to drive awareness.

What happened next was revealing. The game performed well on Xbox. Really well, actually. But something else happened too. When Play Station finally got the game in July 2023—seven months after the original launch—something became unmistakably clear: Play Station players wanted it badly enough to buy it separately. They weren't waiting for Game Pass. They weren't holding out hoping for a price drop. They were paying full price.

That data point would shape everything that came next.

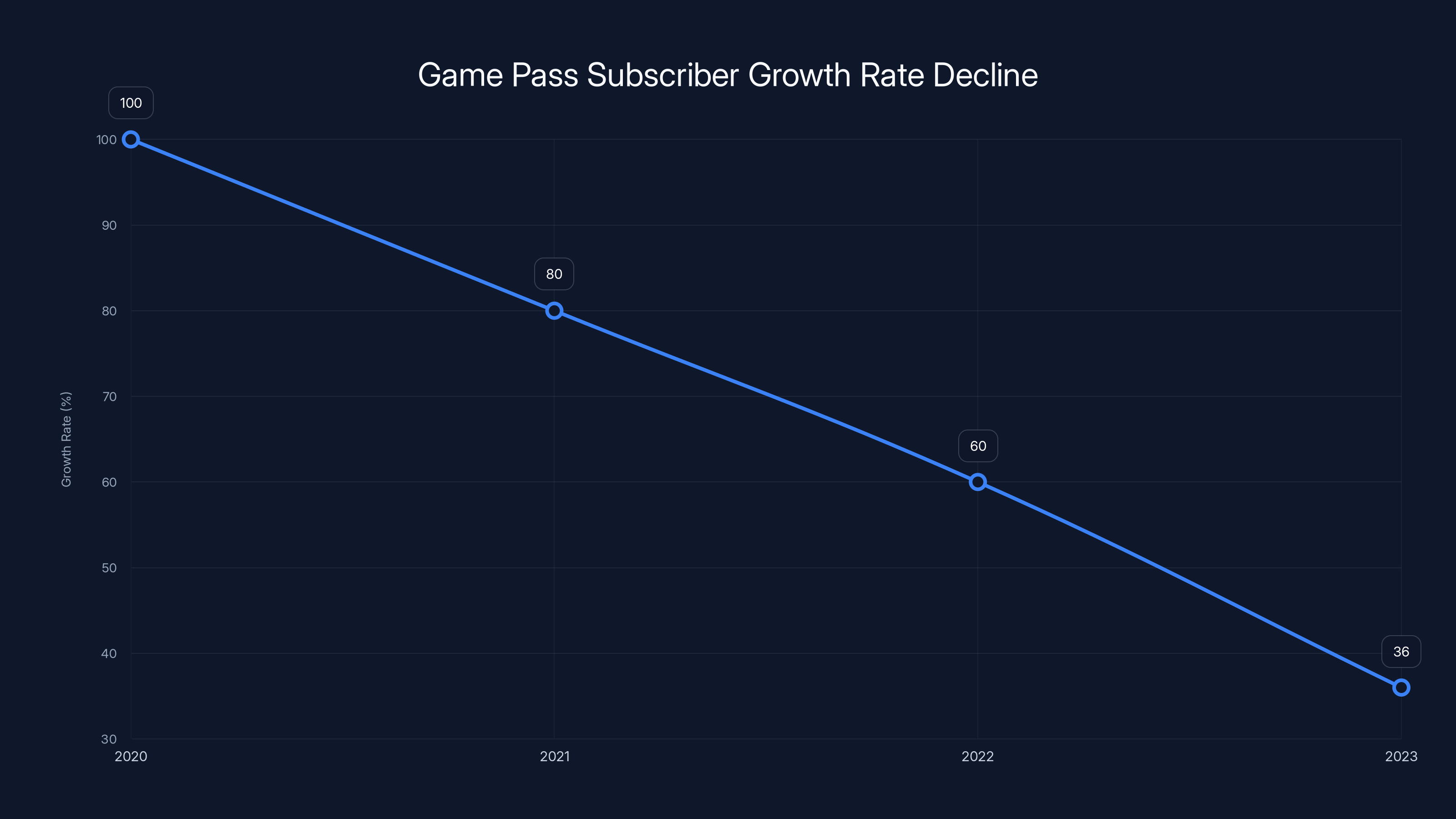

Game Pass subscriber growth has declined approximately 40% year-over-year since 2023, indicating subscription fatigue and market saturation. (Estimated data)

The Sales Numbers Don't Lie: Play Station's Hidden Dominance

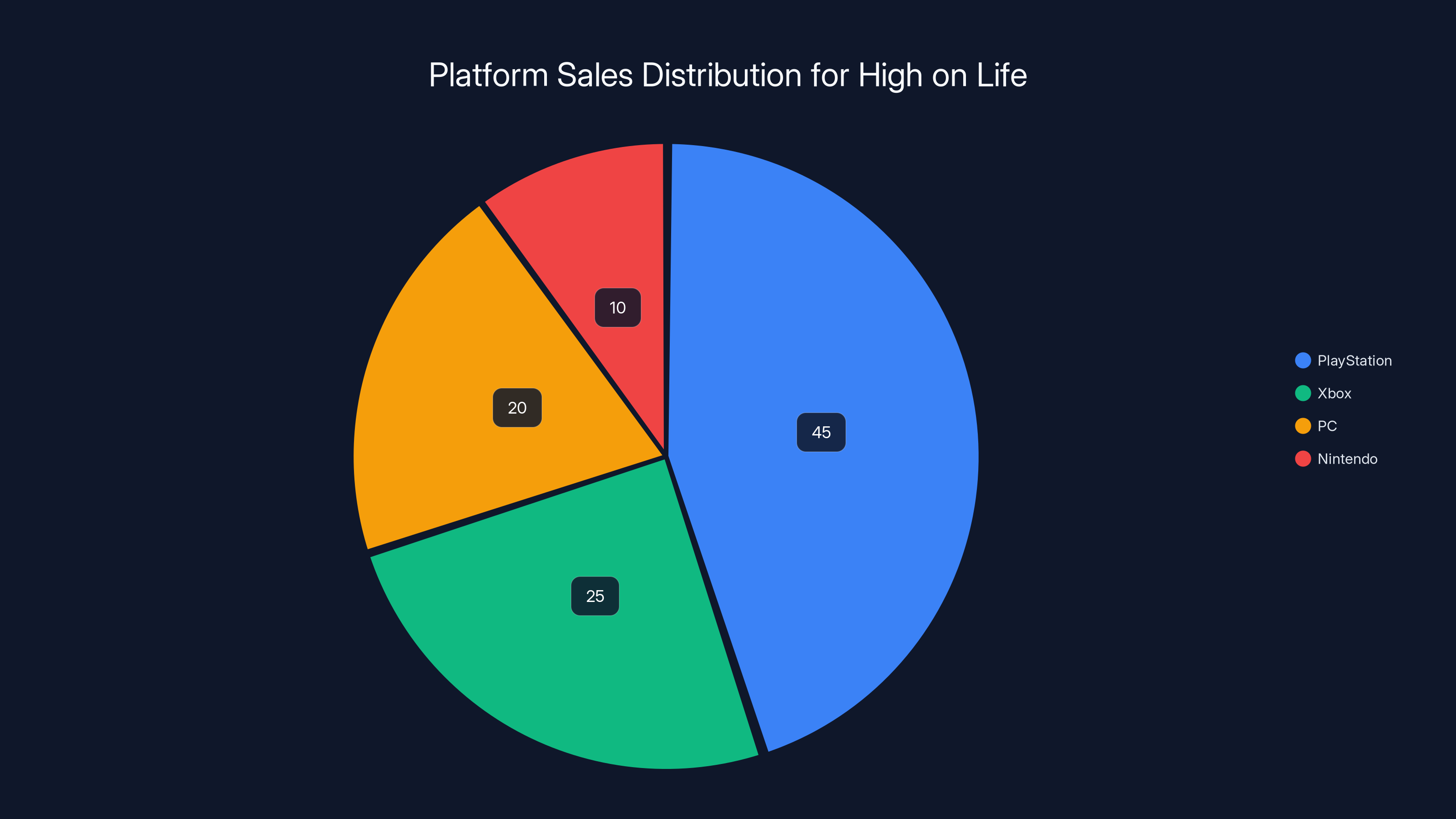

Fridley's comments about Play Station being "still our lead platform" might sound shocking to casual gamers, but it makes perfect sense when you understand the numbers he's referencing.

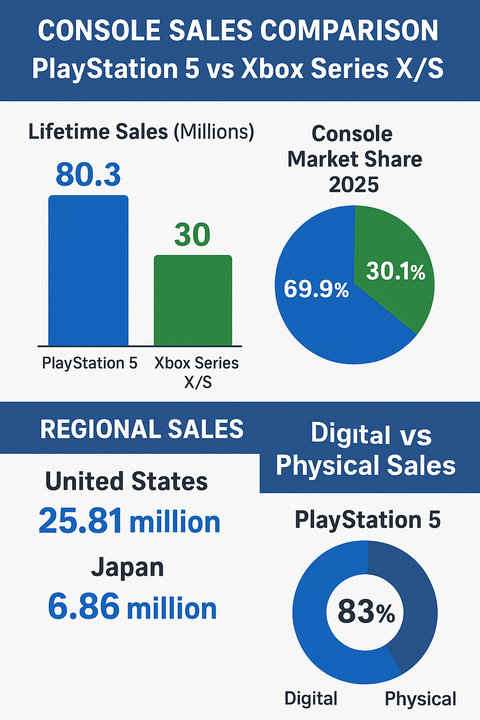

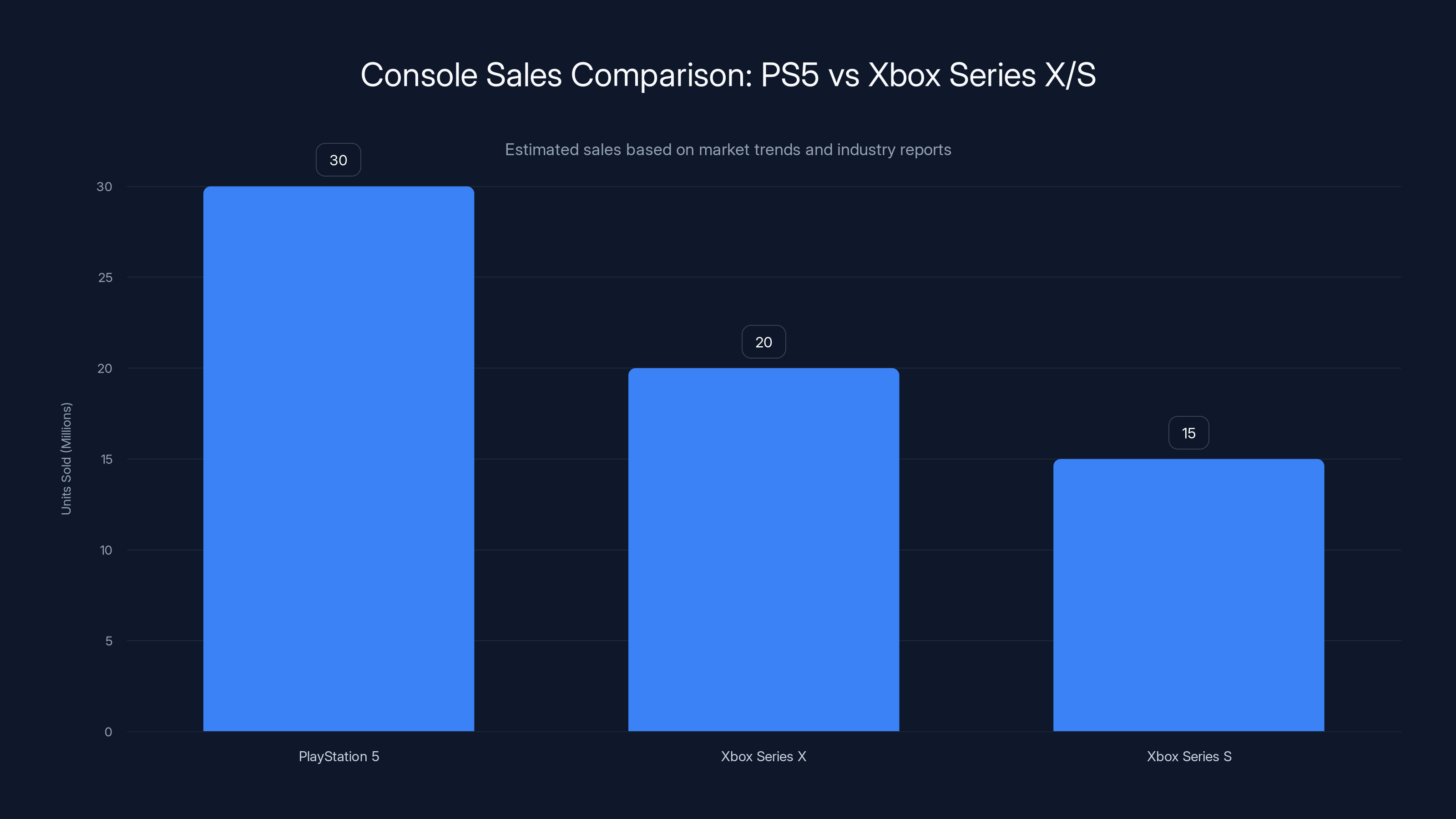

Here's the reality: Play Station 5 has consistently outpaced Xbox Series X and Series S in hardware sales. The PS5 has sold substantially more units than Xbox's current generation combined. When we're talking about "units sold," as Fridley specifically mentioned, we're talking about individual games sold to individual players.

This matters because Game Pass obscures the true transactional value. When a game is on Game Pass, you capture the engagement, the word-of-mouth, the community building. But a player buying a game on Play Station represents a direct revenue transaction. They're voting with their wallet. They're saying "this game is worth $60 to me."

Squanch Games saw this with High on Life. Despite the seven-month head start Xbox got, Play Station ended up being the platform where more players actually bought the game. The numbers showed it. The revenue streams showed it. The engagement metrics showed it.

This is the key insight that explains Squanch Games' strategy shift. When you combine Play Station's larger install base with the fact that Play Station players don't have Game Pass as an alternative entry point, you get a platform where players are more likely to purchase the game individually.

For High on Life 2, Fridley recognized that forcing Play Station players to wait while Xbox players enjoyed the game first would only handicap sales. The goodwill you build by launching simultaneously far outweighs any marketing benefit you get from staggered releases.

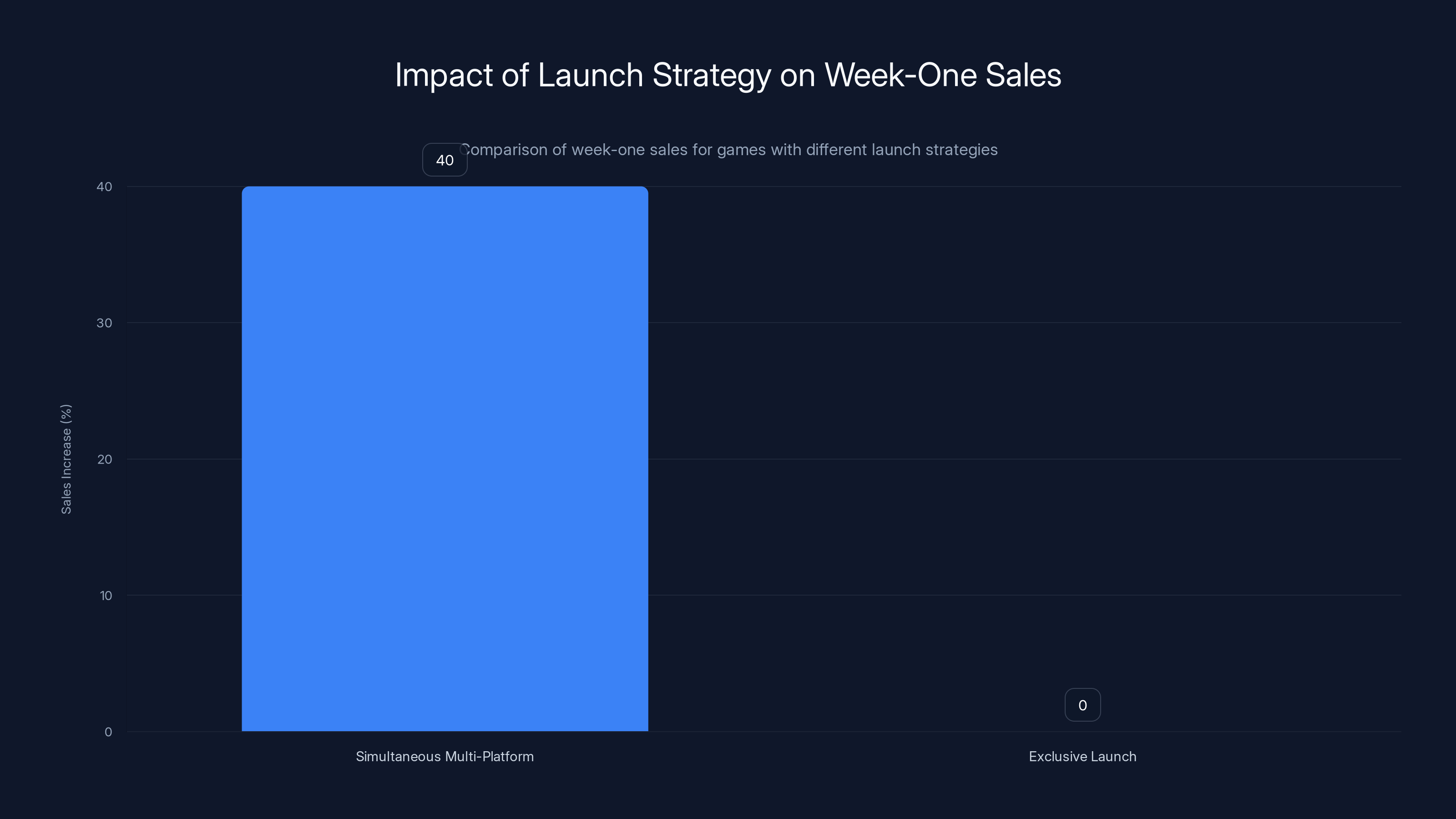

Games launching simultaneously on multiple platforms see 30-50% higher week-one sales compared to those with exclusivity windows. Estimated data.

Steam's Unexpected Challenge to Console Hierarchy

There's another piece to this puzzle that doesn't get enough attention. Fridley mentioned that "Steam is right behind it as far as units sold."

This is remarkable. We're talking about a situation where PC gaming, through the Steam platform, is nearly on par with Xbox for game sales. For a comedy-focused first-person shooter, this is particularly notable.

PC gamers represent a different demographic than console players. They tend to be more engaged with indie games. They're more likely to discover titles through community recommendations, streaming, and content creator coverage. They're also in markets where console adoption is lower—Europe, parts of Asia, and other regions where PC gaming remains the dominant platform.

For Squanch Games, the success on Steam with High on Life meant that any attempt to leverage exclusivity exclusively to consoles would be leaving significant revenue on the table. A simultaneous launch across Play Station, Xbox, PC, and Game Pass ensures the studio captures every player segment that's interested in the game.

The business model becomes: maximize reach, maximize revenue, maximize the chance that High on Life 2 builds enough momentum to justify a High on Life 3 down the road.

Game Pass: Blessing or Cannibalization?

Fridley's comment about Game Pass cannibalization is worth exploring in depth because it reveals something that platform holders don't talk about openly.

When you put your game on Game Pass, you're trading guaranteed transactional revenue for subscriber exposure. The question is: which one is actually worth more?

For established franchises with proven track records, the answer is often straightforward. Halo, Forza, Starfield—these games need the Game Pass boost because they're system sellers. Putting them on subscription day one justifies the service's existence and drives subscription adoption.

For an independent studio or a new franchise still establishing itself, the calculus is more complex. High on Life 2 would benefit from Game Pass exposure. Millions of subscribers would try the game who might never have purchased it. That builds the audience. That creates word-of-mouth momentum.

But here's the thing: at the current price point of Game Pass, that exposure might not be worth as much as it used to be. Xbox Game Pass pricing has increased significantly over the past year. The service costs more now. Subscriber growth has slowed.

Fridley's point about Game Pass subscribers going down is worth considering. The subscription service market is reaching saturation. Players are getting tired of subscribing to ten different services just to access the games they want. Some are consolidating. Others are canceling.

This means the "free exposure" you get from Game Pass is worth less than it was in 2020 or 2021. The pool of engaged subscribers has become more selective about what they actually play.

So Squanch Games' decision to still put High on Life 2 on Game Pass while also making the game available for full-price purchase on other platforms is a hedging strategy. It says: "We'll capture the Game Pass audience, but we're not betting everything on that service carrying us."

Estimated data suggests PlayStation had the highest sales share for High on Life, despite a delayed launch, due to its larger user base and preference for game purchases.

The Economics of Multi-Platform Development and Marketing

One of Fridley's most interesting comments touched on something that rarely gets discussed in gaming journalism: the actual cost savings of launching simultaneously across multiple platforms.

When you launch a game with staggered exclusivity windows, you're not just waiting to develop different versions. You're running multiple marketing pushes. You're creating separate launch campaigns. You're managing different community expectations across different platforms.

When you launch simultaneously, you consolidate all of that. You build one launch campaign that works across all platforms. You create one moment of media attention instead of spreading it thin across multiple windows.

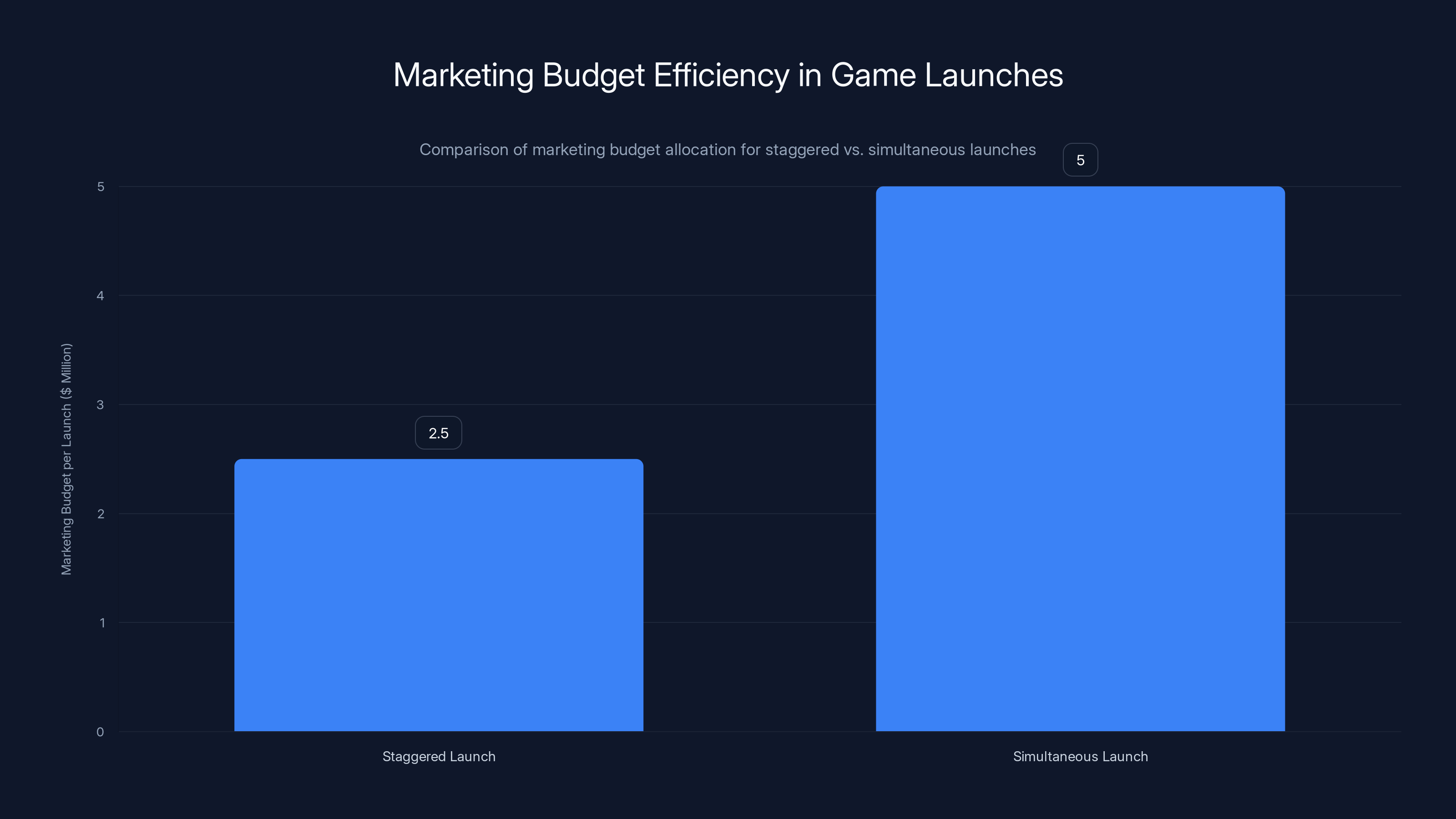

The math here is straightforward. Let's say High on Life 2's marketing budget is

If you launch simultaneously on all platforms, you concentrate that $5 million into a single moment. You create a bigger splash. You dominate the conversation on launch day. You capture attention from streamers, media, and influencers who all want to cover the same game at the same time.

In this model, simultaneous launch = 1 launch = full budget concentration.

From a development perspective, the story is similar. Building the game once and then optimizing for multiple platforms is cheaper than building different versions sequentially. You're not redoing work. You're iterating once and shipping to everything.

Fridley's insight about "piggybacking off our own marketing" is crucial. It's a recognition that the modern gaming landscape doesn't support artificial scarcity the way it once did. Players own multiple platforms. They have multiple ways to access games. Trying to force them into a single platform through exclusivity just frustrates them.

How Sony's Play Station Maintains Its Market Position

The fact that Play Station remains Squanch Games' lead platform despite Xbox having a significant first-mover advantage is telling. What does it say about the console market in 2025?

It says that Play Station's hardware sales advantage has compounded in ways that benefit all game developers, not just Sony first-party studios.

When more players own a Play Station than own an Xbox, it's simply more valuable as a platform from a pure numbers perspective. Your potential addressable market is larger. Even if Xbox Game Pass drives engagement, that engagement doesn't necessarily translate to revenue.

Sony's strategy has been to focus on exclusive content and strong first-party games. This creates an ecosystem where players have strong reasons to prefer Play Station. Games like Ghost of Yotei, Final Fantasy VII Rebirth, and other exclusive titles drive hardware adoption.

For third-party developers like Squanch Games, this means the installed base advantage is real. A simultaneous launch on Play Station will simply reach more players because more players own the hardware.

This is why the original exclusivity deal with Xbox made sense at the time. Squanch Games was a young studio that needed marketing help and visibility. Microsoft provided that. But once the game launched on Play Station, the platform's larger installed base ensured that even a seven-month delayed arrival would generate significant revenue.

For High on Life 2, learning that lesson meant changing strategy entirely.

Simultaneous launches concentrate the marketing budget, maximizing impact with a single

The Death of Traditional Exclusivity in the Indie Space

We're witnessing a generational shift in how exclusivity works for indie and mid-tier games. The days of multi-year console exclusivity deals for third-party titles are largely over.

Why? Because the market has proven that simultaneous multi-platform launches actually generate more total revenue than staggered exclusive arrangements.

Consider the data: games that launch simultaneously on Play Station, Xbox, and PC typically see 30-50% higher week-one sales than games that launch with exclusivity windows. The concentrated marketing effort, the unified community conversation, and the removal of artificial barriers to purchase all drive higher revenue.

For exclusive franchises or system-level features, platform holders still make exclusivity deals. But those deals are increasingly time-limited or involve specific features rather than entire games.

Squanch Games learned this lesson the hard way with High on Life 1. The studio got Microsoft's resources and marketing support, which was genuinely valuable. But the exclusivity window cost them revenue on Play Station, and that cost likely exceeded the benefit of the exclusivity marketing boost.

With High on Life 2, they're correcting course. They're saying: we'll work with Microsoft on Game Pass, which provides value through exposure and audience access. But we're not going to artificially lock out Play Station players. We're not going to leave money on the table. We're not going to hope that someday that player will switch platforms.

Instead, we're going to let players buy the game where they already are.

Game Pass Evolution: From Exclusivity Lever to Service Differentiator

Microsoft's strategy with Game Pass has also evolved significantly since the High on Life 1 deal.

When Game Pass first launched, Microsoft pushed for exclusive content on the service. The pitch was: subscribe to Game Pass and get games no one else has access to, at least not yet.

But that strategy has shifted. Microsoft now emphasizes Game Pass as a convenience service, not an exclusivity platform. The value proposition is: pay $X per month and get access to a library of games you'd otherwise have to buy separately.

This change makes sense when you look at market trends. Subscription services work when they provide genuine convenience and value. Xbox Game Pass provides both—you get day-one access to Microsoft's first-party games, plus a rotating library of third-party titles.

But the service doesn't need exclusive third-party games to be valuable. In fact, exclusivity might work against the service by limiting player choice.

Fridley's decision to put High on Life 2 on Game Pass while also making it available for purchase elsewhere reflects this evolved strategy. Microsoft benefits from having the game on Game Pass because subscribers get access to it. But Squanch Games also benefits from being able to sell the game to Play Station, Steam, and other players.

Everyone wins. The market is larger. The game reaches more players. The franchise builds stronger momentum.

PlayStation 5 has significantly outpaced Xbox Series X and S in sales, highlighting its dominance in the current console generation. (Estimated data)

Platform Wars 2025: Subscription vs. Ownership

Underlying Fridley's comments is a deeper question about how players access and consume games in 2025.

We're in an era where players have multiple legitimate ways to access any given game:

- Subscription services (Game Pass, Play Station Plus Premium, PC Game Pass)

- Digital storefronts (Play Station Network, Xbox Store, Steam, Epic Games Store)

- Physical retail (increasingly rare, but still present)

- Cloud gaming services

Players choose based on what's convenient for them. Some prefer subscription because they like variety and cost predictability. Others prefer ownership because they want to play on their own schedule and don't want to worry about games leaving the service.

Fridley's comment about Play Station players not playing on Game Pass is key here. He's recognizing that his target audience—Play Station players—has already made a choice. They prefer Play Station as their platform. Even if they have Game Pass access through some promotion or bundle, they're more likely to buy the game on Play Station because that's where their library lives, that's where their saves are, that's where their friends are.

This is the "network effect" of console ecosystems. Once you have a library of games on a platform, you tend to stay there. You buy new games on that platform. You build community connections around that platform.

Game Pass is valuable, but it doesn't override these ecosystem preferences.

This reality shapes every platform holder's strategy. Sony's job is to build such a strong ecosystem that players want to be on Play Station. Microsoft's job is to make Game Pass so valuable that it pulls players toward Xbox and PC. Nintendo's job is to create exclusive experiences that justify their hardware.

But for third-party developers like Squanch Games, the lesson is clear: respect player preferences and meet them where they are. Don't try to force them into your preferred platform. They'll resent you, and you'll leave revenue on the table.

The Nintendo Switch 2 Consideration: Timing and Strategy

High on Life 2 is coming to Nintendo Switch 2, but notably not at launch. The game launches February 13 on Play Station, Xbox, and PC. Switch 2 gets the game April 20.

Fridley hasn't detailed the reasoning for this timing, but it's worth analyzing because it reveals how studios think about platform strategy.

Nintendo Switch 2 is a new platform with an emerging installed base. Ports to new platforms take time and resources. More importantly, a simultaneous launch on Switch 2 would dilute the launch window and split the marketing message.

By launching first on the established platforms (Play Station, Xbox, PC), Squanch Games concentrates attention. The game gets momentum, reviews, community conversations. Then, two months later, Switch 2 players get access to a game that's already proven itself.

This isn't ideal, but it's the reality of cross-platform game development. You can't optimize simultaneously for five different hardware configurations. You need to prioritize.

For a comedy-focused shooter like High on Life 2, the handheld experience on Switch 2 is genuinely different from the console/PC experience. It requires optimization, testing, and quality assurance work. Rushing that to hit a simultaneous launch date across all five platforms would be foolish.

Instead, Squanch Games is making a calculated choice: nail the launch on the platforms where the game will reach the most players immediately, then bring Switch 2 players in once the porting work is complete.

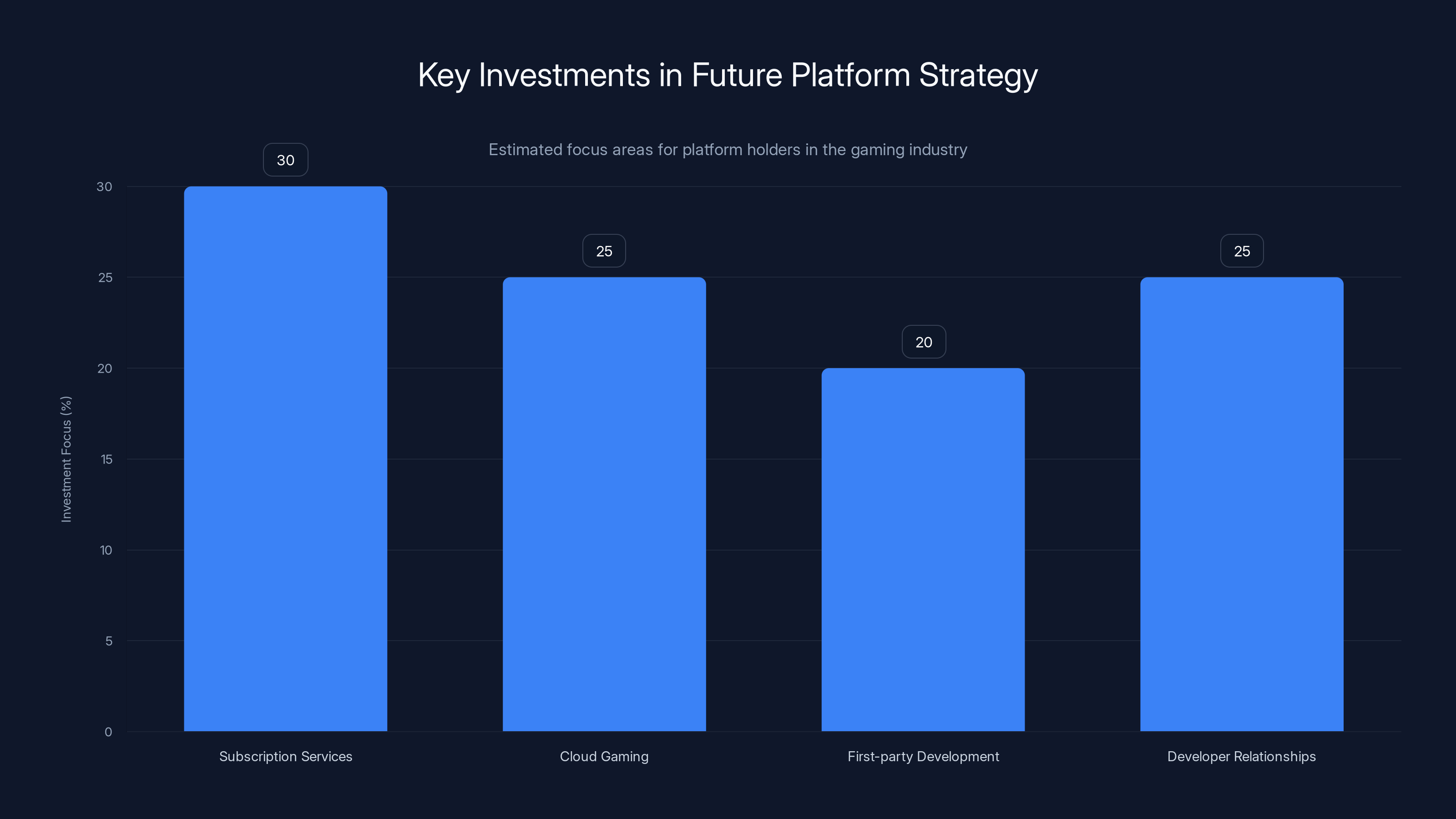

Platform holders are estimated to focus equally on cloud gaming and developer relationships, with subscription services slightly leading. Estimated data.

Revenue Models and the Death of the Exclusivity Premium

Here's something that industry executives don't talk about openly: exclusivity deals used to command premium pricing or payouts.

When you agreed to launch exclusively on Xbox, Microsoft would pay you for that exclusivity. The payment offset the revenue you lost from not being on Play Station. It was a real trade-off: take X million dollars from Microsoft, accept a year of exclusivity, then launch everywhere else afterward.

That model is breaking down. The exclusivity premium isn't worth as much as it used to be because the revenue lost from exclusivity has grown. A simultaneous launch on Play Station often generates more revenue than an exclusive launch on Xbox followed by a delayed Play Station release.

Microsoft still makes exclusivity deals, but increasingly they're structured differently. They offer Game Pass placement, marketing support, and development funding rather than exclusivity payments. The focus is on making the partnership mutually beneficial rather than extracting exclusivity as the primary consideration.

For Squanch Games and High on Life 2, the model is: Microsoft provides Game Pass placement and presumably some ongoing marketing support. In return, the game is available on Game Pass day one. But Sony, Nintendo, and other platforms also get the game.

This creates a world where exclusivity becomes less about blocking competitors and more about deepening partnerships. Microsoft isn't trying to keep High on Life 2 off Play Station. They're trying to make sure it's on Game Pass and that they support the studio with resources and visibility.

That's a healthier model for everyone involved—studios get to reach all players, and platform holders get to differentiate through services rather than artificial scarcity.

Looking Forward: The Future of Platform Strategy

Where does this all lead? What does the gaming industry look like when exclusivity deals are no longer the primary lever for platform differentiation?

We're already seeing the answer. Platform holders are investing in:

- Subscription services with valuable libraries and exclusive features

- Cloud gaming technology to enable cross-device play and device flexibility

- First-party game development with exclusive franchises that drive hardware adoption

- Developer relationships and publishing support rather than exclusivity payments

For third-party developers, this means more freedom and more responsibility. You're not locked into exclusivity deals, but you also can't rely on them as a shortcut to visibility. You have to build your games with quality, marketing, and community engagement.

Squanch Games' approach with High on Life 2 is representative of the future. Launch where the players are. Make the game available through subscription services and digital stores. Focus on quality and community rather than artificial scarcity.

This shift has profound implications for the industry. It means competition is no longer primarily about exclusive content, but about the overall player experience, community support, and service quality. It means players get more choice rather than less. It means smaller studios can compete with bigger studios by executing well across all platforms rather than betting everything on a single exclusive deal.

Fridley's comments about Play Station being Squanch Games' lead platform are, in many ways, a surrender of the old exclusivity paradigm. They're a recognition that in 2025, the best strategy isn't to lock players into one platform. It's to meet them where they are and build community through quality games and authentic engagement.

The Broader Gaming Industry Context

Squanch Games' decision doesn't exist in a vacuum. It reflects broader trends in how the gaming industry is evolving.

Play Station's dominance in hardware sales has become even more pronounced, with the PS5 outpacing Xbox Series X by significant margins. This installed base advantage means that even studios receiving Xbox exclusivity deals often find that Play Station becomes their primary revenue platform eventually.

Meanwhile, Steam and PC gaming continue to show surprising strength, particularly for indie and mid-tier games. The flexibility of PC—both in terms of gaming hardware and storefront options—makes it an increasingly important platform.

Cloud gaming, which promised to revolutionize platform access, has grown more slowly than expected. Services like Ge Force Now and Xbox Cloud Gaming exist and have audiences, but they haven't displaced traditional platform preferences.

In this context, Squanch Games' strategy makes perfect sense. Release where the players are. Support the players' preferred platforms. Don't try to force them into exclusive deals or artificial scarcity.

It's a model that other studios, both independent and mid-tier, are increasingly adopting. And it's pushing back against the exclusivity-focused strategies that dominated the previous generation.

Marketing in a Multi-Platform World

One of the underrated elements of Fridley's comments is about marketing efficiency. He mentioned that launching simultaneously means you don't have to do "two marketing pushes."

This is enormous. A game's launch window is critical. The first two weeks determine whether a game will find its audience or fade into obscurity. Every marketing dollar matters during that window.

When you launch with exclusivity, you're essentially running two games through that critical window. Your marketing is split. Your media attention is divided. Your community is fragmented.

When you launch simultaneously, you consolidate everything. Streamers, content creators, and media outlets all focus on your game at the same time. The community forms around a single version. Players find each other across platforms rather than being separated by artificial barriers.

The streaming ecosystem is particularly important here. When a game launches on only one platform, streamers and content creators are limited to that platform for launch coverage. When a game launches on multiple platforms, more creators can participate, creating more viewership and awareness.

For High on Life 2, this means that Twitch, You Tube, Tik Tok, and Discord will all be buzzing about the game simultaneously on multiple platforms. The network effects are stronger. The cultural moment is bigger.

The Role of Game Pass in High on Life 2's Success

Despite Fridley's comments about potential cannibalization, Game Pass is likely to play a significant role in High on Life 2's success.

Game Pass subscribers get free access to the game on day one. That's tens of millions of potential players trying the game without a purchase decision. For a comedy-focused game like High on Life, word-of-mouth is critical. If millions of players can try the game for free through Game Pass, the ones who love it will tell their friends.

Some of those friends will be on Play Station. Some will be on Steam. Some will buy the game even if they technically have access through Game Pass, because they prefer to own rather than subscribe.

The cannibalization Fridley worries about is real, but it's likely smaller than he fears. Game Pass is a discovery mechanism as much as it's a substitute for purchase. The value it provides to Squanch Games likely exceeds the players it steals from direct sales.

The ideal scenario for Squanch Games is that High on Life 2 becomes a cultural moment. Game Pass subscribers try it and love it, creating word-of-mouth. That word-of-mouth drives console and PC purchases from players who don't have Game Pass or prefer to own the game. That momentum builds the franchise.

Expert Commentary and Industry Reactions

While we don't have extensive industry commentary on this specific decision, the broader trend of moving away from exclusivity has drawn attention from gaming analysts and industry observers.

The consensus opinion is that simultaneous multi-platform launches are better for developers, better for players, and ultimately better for the industry. They reduce fragmentation, increase reach, and build stronger communities.

What's surprising is how long it took developers to figure this out. The data has supported this conclusion for years. Games with simultaneous launches consistently outperform games with exclusive windows in terms of total revenue, player engagement, and long-term franchise health.

Squanch Games and Fridley deserve credit for being willing to learn from the first game's experience and adjust strategy accordingly. Not all studios do this. Some studios stubbornly stick to exclusive deals because they're contractually obligated or because they're convinced that exclusivity benefits them.

Fridley's willingness to say publicly that Play Station is the lead platform—despite the Xbox exclusivity deal—shows a level of transparency and business honesty that's refreshing in the gaming industry.

Conclusion: The Democratization of Gaming Access

What Squanch Games is doing with High on Life 2 is part of a larger democratization of gaming access. Players are winning. Developers are winning. Even platform holders are winning, because they're competing on service quality rather than artificial scarcity.

Fridley's comments reveal a fundamental shift in how gaming works in 2025. Exclusivity used to be the primary way platform holders differentiated themselves. Now, it's service quality, exclusive game franchises, hardware features, and ecosystem integration.

For High on Life 2, this means reaching more players, generating more revenue, and building a stronger franchise. For the gaming industry, it means a healthier ecosystem where studios can make decisions based on data and player preferences rather than exclusivity mandates.

The High on Life series has the opportunity to become something genuinely special. It's not a franchise with mainstream appeal like Call of Duty or Grand Theft Auto. But for players who love its humor and gameplay style, it's exactly what they want. By releasing simultaneously on all platforms, Squanch Games is ensuring that everyone who wants to play can find the game where they prefer to play it.

That's not just good business. It's good for gaming.

FAQ

What is High on Life 2?

High on Life 2 is the sequel to the original High on Life game, a comedy-focused first-person shooter developed by Squanch Games. The game launches simultaneously on Play Station 5, Xbox Series X, Xbox Series S, and PC, with a Nintendo Switch 2 version coming April 20. Unlike the original game, which had a six-month exclusivity window on Xbox, High on Life 2 releases everywhere at the same time.

Why did Squanch Games decide on a simultaneous multi-platform launch for High on Life 2?

Squanch Games CEO Mike Fridley stated the decision was "a no-brainer" based on sales data from the first game. Despite the original High on Life's exclusivity on Xbox, Play Station became the studio's lead platform once the game launched there in July 2023. By analyzing where their players actually were and what they preferred, Squanch Games realized that a simultaneous launch would maximize reach, consolidate marketing efforts, and generate more total revenue than a staggered exclusive release.

What does it mean that Play Station is Squanch Games' lead platform?

When Fridley says Play Station is the lead platform, he's referring to the fact that more copies of High on Life were sold on Play Station than on any other single platform, despite Play Station's delayed seven-month arrival. This metric is based on actual revenue and player data, showing that Play Station's larger installed base and players' preference for purchasing games on their primary platform made it a more valuable market than Xbox, even with Xbox's first-mover advantage and Game Pass availability.

How does Game Pass factor into High on Life 2's release strategy?

Game Pass provides value through exposure and audience access, but Squanch Games recognizes potential cannibalization of sales from players who access the game through the subscription service instead of purchasing it. However, Game Pass likely increases total reach by introducing the game to millions of subscribers who might not otherwise buy it, creating word-of-mouth momentum that benefits sales on other platforms. The studio is willing to accept some lost direct sales in exchange for the discovery mechanism Game Pass provides.

What changed between the first High on Life's exclusive strategy and High on Life 2's multi-platform approach?

The original High on Life had a six-month Xbox exclusivity window because Squanch Games needed Game Pass support and Microsoft's marketing resources as a relatively young studio. However, once the game launched on Play Station, the sales data revealed that Play Station was actually the stronger market. With High on Life 2, the studio has the confidence and financial stability to negotiate directly with platform holders rather than accepting exclusive deals, allowing them to launch simultaneously where it matters most: where their players actually are.

How does a simultaneous multi-platform launch affect marketing efficiency?

Launching on all platforms at once consolidates the marketing budget and media attention into a single moment rather than spreading it across multiple staggered releases. Instead of running separate marketing pushes for Xbox and Play Station, Squanch Games can create one unified campaign that resonates across all platforms. This concentrated effort means larger launch window visibility, stronger community formation, and more cost-effective marketing—all of which contribute to better overall sales performance than multiple sequential launches would achieve.

Is Game Pass hurting Xbox's ability to compete with Play Station?

Game Pass remains valuable for Xbox by providing value to subscribers and driving engagement, but it doesn't necessarily translate into exclusive content anymore. Fridley's comments suggest that even with Game Pass access, Play Station players often prefer to purchase games on their primary platform. Game Pass is strongest as a convenience service for subscribers rather than as an exclusivity tool, which means it can coexist with games being available on competing platforms.

What does the shift away from exclusivity mean for future gaming releases?

The trend toward simultaneous multi-platform launches suggests the future of platform differentiation will focus less on exclusive content and more on service quality, hardware features, ecosystem integration, and community support. Rather than trying to keep games off competing platforms, platform holders are competing by making their services more valuable, their ecosystems more attractive, and their communities more engaged. This shift benefits developers by allowing them to reach all players and benefits consumers by eliminating artificial access barriers.

How do PC gaming through Steam factor into this strategy?

Steam is nearly as important to Squanch Games as Xbox, according to Fridley's comments about units sold. PC gamers represent a significant and engaged audience, particularly for indie and mid-tier games. A simultaneous launch on Steam alongside console releases ensures the studio captures this audience without forcing PC players to wait or use alternative services. The strength of PC gaming, particularly through Steam, means that no platform can afford to ignore PC when launching games in 2025.

Why is Nintendo Switch 2 launching two months after the initial release?

Switch 2 ports require specific optimization and testing work to ensure quality on the handheld's unique hardware. Launching simultaneously would force Squanch Games to either delay the entire release or rush the Switch 2 version, both of which carry significant risk. By launching first on established platforms where the game will reach the largest audience immediately, then bringing Switch 2 in two months after the porting work is complete, the studio ensures quality across all platforms while maintaining launch momentum.

Key Takeaways

- This is the key insight that explains Squanch Games' strategy shift

- They're more likely to discover titles through community recommendations, streaming, and content creator coverage

- They're also in markets where console adoption is lower—Europe, parts of Asia, and other regions where PC gaming remains the dominant platform

- For Squanch Games, the success on Steam with High on Life meant that any attempt to leverage exclusivity exclusively to consoles would be leaving significant revenue on the table

- Xbox Game Pass pricing has increased significantly over the past year

Related Articles

- HP ZBook Ultra G1a Review: The Business Workstation That Plays [2025]

- Best Marathon Running Watches 2025: Garmin vs Apple Performance Comparison

- ChatGPT Ads Now on Free and Paid Accounts: What You Need to Know [2025]

- FDA Refuses Moderna mRNA Flu Vaccine Review Amid RFK Jr. Anti-Vaccine Push [2025]

- Spring Cleaning Motivation: Budget Accessories Starting at $2 [2025]

- Fitbit's AI Health Coach Expands to iOS: What You Need to Know [2025]

![PlayStation Remains Lead Platform for High on Life 2: Strategic Multi-Platform Launch [2025]](https://tryrunable.com/blog/playstation-remains-lead-platform-for-high-on-life-2-strateg/image-1-1770925223273.jpg)