The Porn Tax Wave: How Conservative Politics Are Reshaping Adult Content Regulation

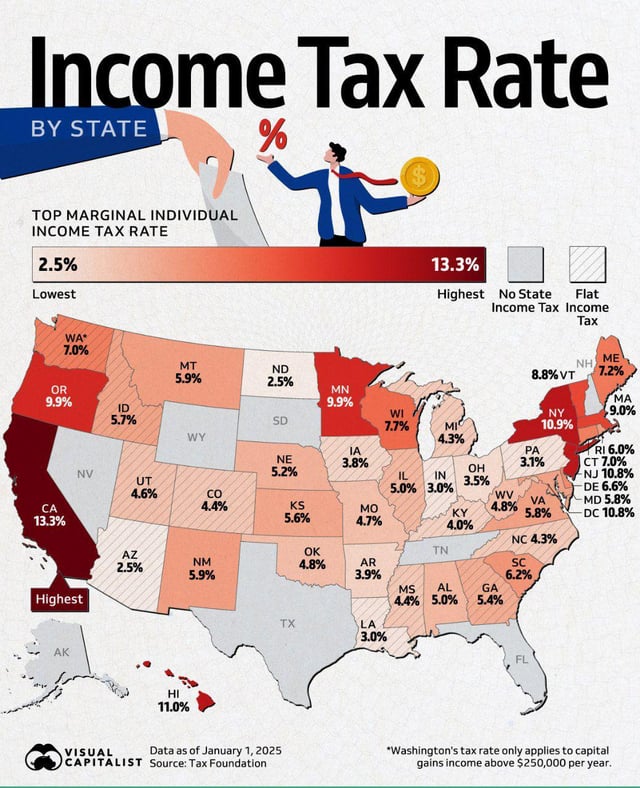

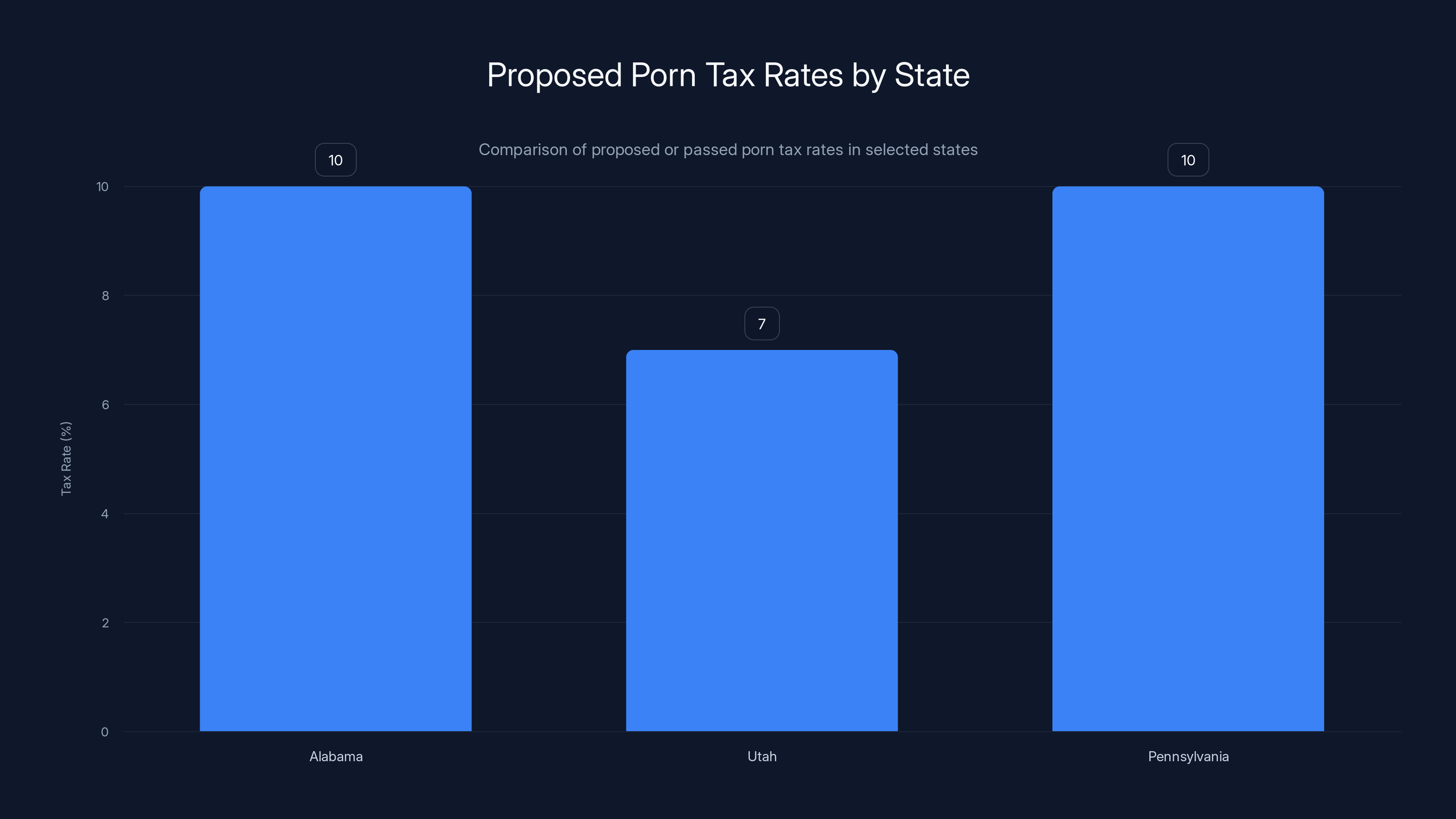

Something's been brewing in state legislatures across America, and it's not subtle. Conservative lawmakers are getting aggressive about regulating adult content, and they're not just focusing on age gates anymore. They're adding taxes. In 2024, Alabama became the first state to slap a 10 percent tax on pornography. Utah followed with a proposed 7 percent tax plus a $500 annual licensing fee. Pennsylvania is considering a 10 percent consumer tax on top of existing sales taxes. And this isn't some fringe movement—it's becoming a coordinated strategy among Republican-controlled legislatures.

But here's where it gets complicated. Legal experts, free speech advocates, and the adult industry itself are raising alarm bells. These aren't just regulatory moves. They're potentially unconstitutional attempts to price out protected speech through taxation. The Supreme Court has made clear that adults have a constitutional right to access pornography. Yet states are now trying to make that right expensive, if not prohibitively so.

The timing matters here. These efforts emerged during an era of heightened social conservatism, where politicians have become emboldened to regulate sexual expression in ways they might not have attempted a decade ago. Age verification became the opening salvo—states requiring ID uploads and identity verification to access adult sites. Now, with that precedent established, lawmakers are escalating to taxation. It's a masterclass in regulatory incrementalism, each step making the next one feel inevitable.

What's at stake goes beyond the adult industry. These porn tax battles are fundamentally about whether governments can use taxation as a weapon against unpopular but constitutionally protected speech. If states can tax pornography out of existence, what's stopping them from taxing other forms of speech they dislike? Comic books? Controversial political speech? Unpopular religious expression? The constitutional implications ripple far beyond adult content.

This article breaks down the porn tax movement, explains the constitutional arguments on both sides, examines how age verification laws created the political opening for taxation, and explores what comes next as more states eye similar legislation. The stakes are higher than most people realize.

TL; DR

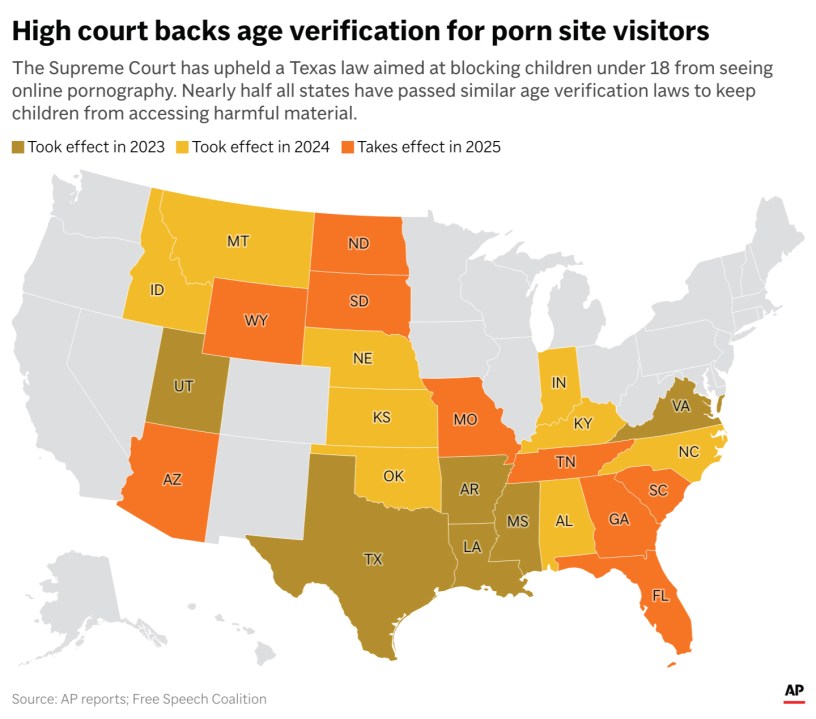

- Porn tax momentum is real: Alabama (10%), Utah (7%), and Pennsylvania (10%) have proposed or passed porn taxes, with 25 states already implementing age verification laws

- Constitutional experts say it's illegal: Tax on protected speech violates the First Amendment, according to Stanford law professor Evelyn Douek and free speech organizations

- The strategy is deliberate: Age verification laws preceded taxation, creating political momentum for increasingly restrictive regulations on adult content

- Sex workers pay the price: Creators and adult performers face the most direct economic impact, as platforms pass costs down to content producers

- The endgame is unclear: Legal challenges are coming, but the Supreme Court's recent tech regulation decisions suggest unpredictable outcomes

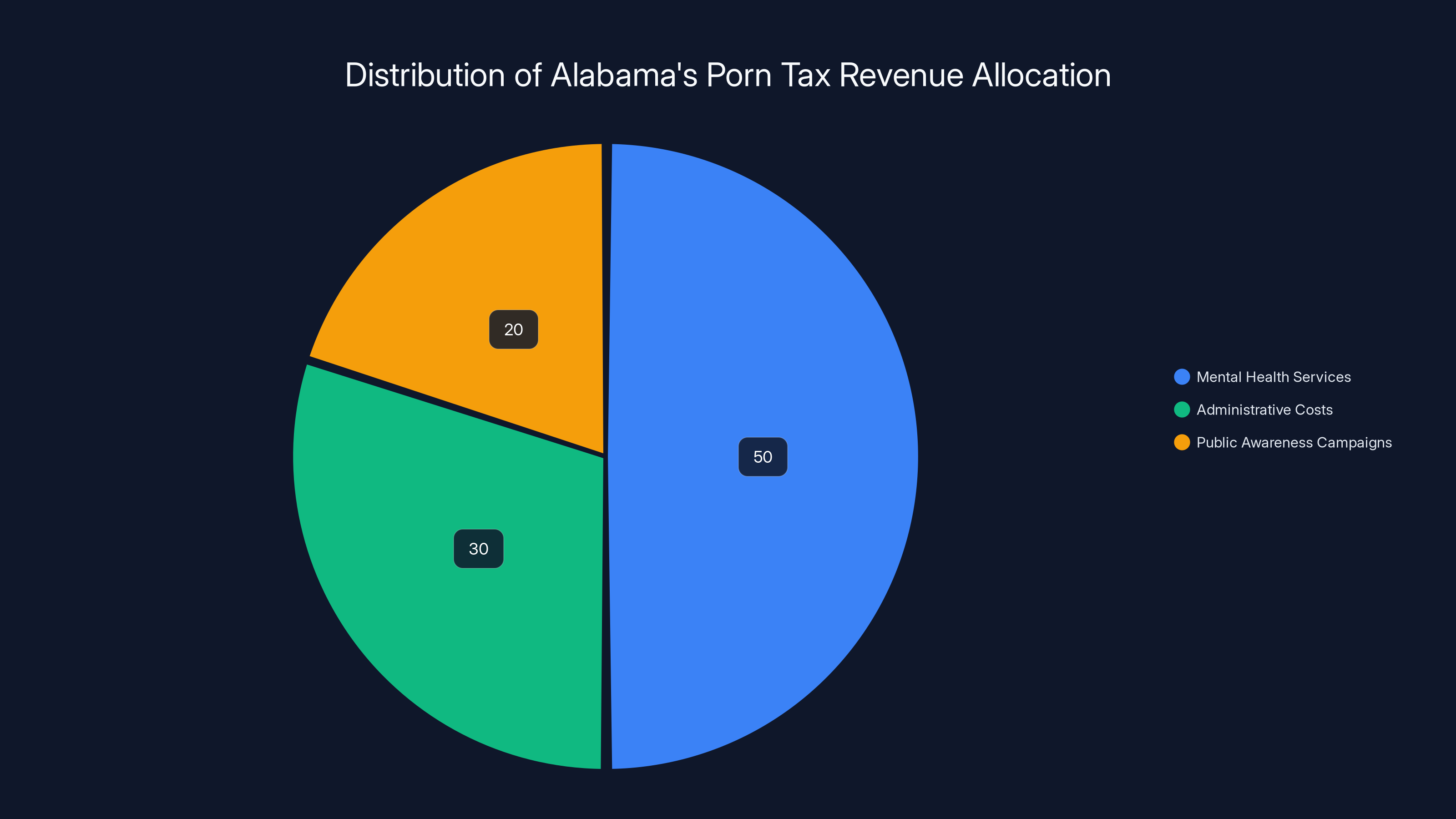

Alabama and Pennsylvania propose a 10% tax on adult content revenue, while Utah imposes a 7% tax. Estimated data.

Alabama's 10 Percent Porn Tax: The First Shot Fired

Alabama's porn tax wasn't some surprise legislative maneuver. It came after careful planning by conservative lawmakers who saw an opening. In 2024, the state enacted a 10 percent tax on all receipts from adult entertainment companies operating within Alabama's borders. The tax covers sales, distributions, memberships, subscriptions, and content deemed harmful to minors.

What made Alabama's move significant wasn't just that it happened first. It happened after the state had already implemented age verification requirements. That sequence matters. By establishing that adult sites had to verify ages of users, Alabama created the infrastructure and precedent for treating porn sites as regulated entities subject to taxation. It transformed adult content from an unrestricted industry into a heavily regulated one.

The political calculation was straightforward. Conservative lawmakers positioned the tax as funding for mental health services for teenagers. Alabama paired the tax with rhetoric about protecting youth, framing it as a public health measure rather than outright prohibition. This linguistic maneuver proved effective at building political support, even though the actual revenue generated has been modest.

But here's what's important: Alabama didn't face immediate legal challenges that stopped the tax from going into effect. That emboldened other states. When a state implements something and faces no immediate injunction, politicians in other states notice. They see a template that "works," and they copy it. Alabama essentially handed Utah, Pennsylvania, and other states a political roadmap.

The economic impact on Alabama's adult industry has been measurable but not catastrophic. Larger platforms like Pornhub blocked access to Alabama users entirely rather than pay the tax and navigate compliance. Smaller sites absorbed the cost or passed it to consumers. Content creators in Alabama faced pressure on earnings. The tax generated some revenue for the state, but far less than supporters predicted. Yet politically, Alabama achieved its real goal: it normalized porn taxation as a legitimate policy tool.

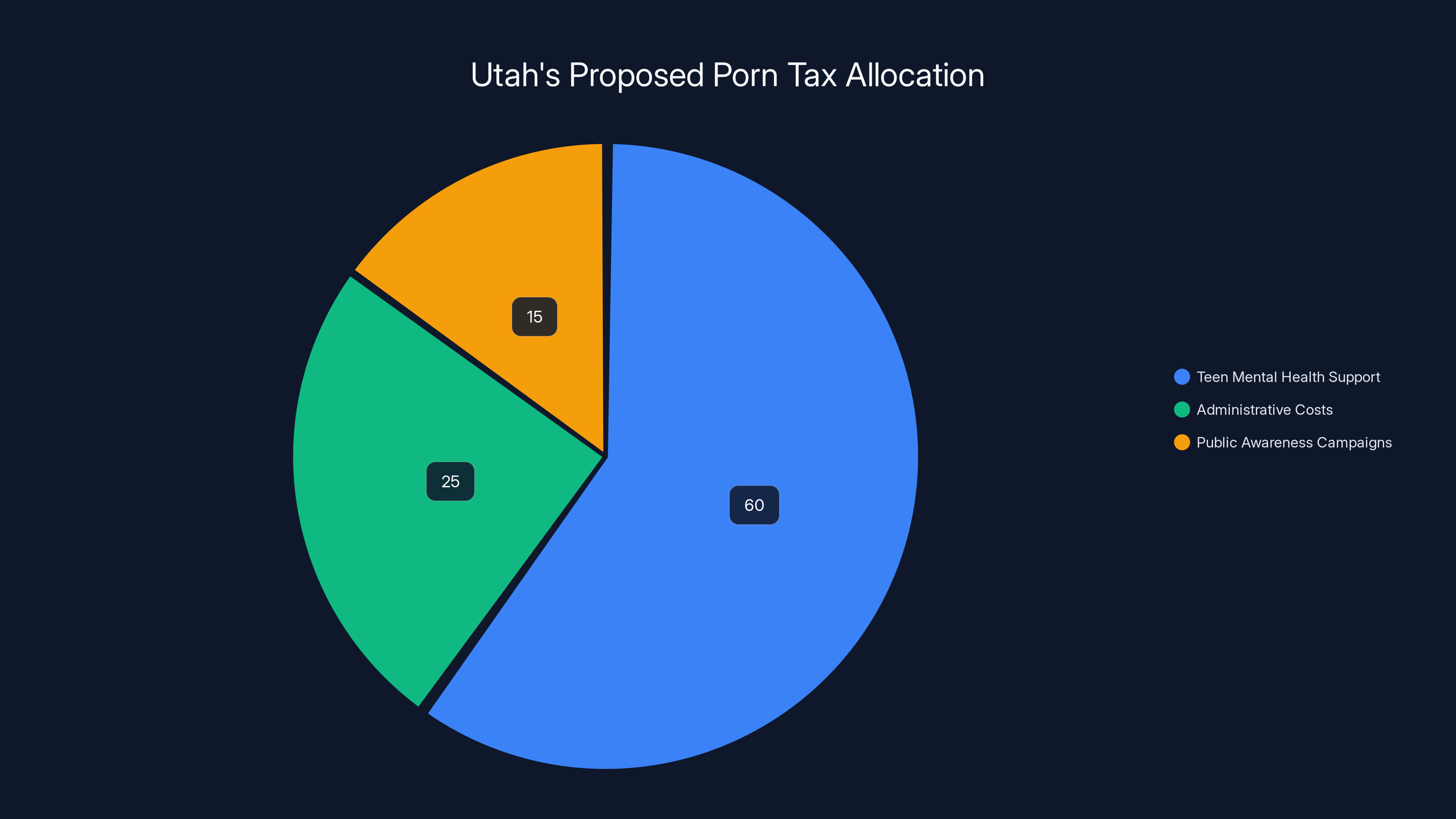

Utah's 7 Percent Tax and the "Porn Czar" Tradition

Utah's relationship with pornography regulation is uniquely intense. The state has been trying to eliminate porn for decades. Back in 2001, Utah created the nation's first "porn czar" position, officially titled the obscenity and pornography complaints ombudsman. Yes, that was a real government position. Someone got paid to handle porn complaints and coordinate obscenity enforcement. The position lasted until 2017, when it was quietly terminated.

In 2016, Utah's governor declared pornography a public health crisis. That declaration wasn't symbolic—it was the foundation for aggressive regulatory action. When state senator Calvin Musselman proposed the porn tax in 2024, he was building on decades of cultural consensus within Utah politics that porn constitutes a public health threat requiring state intervention.

Musselman's 7 percent tax proposal was paired with a $500 annual licensing fee for any adult site operating in Utah. The stated purpose was channeling revenue to the Department of Health and Human Services for teen mental health support. But the subtext was obvious: make porn expensive enough and platforms will leave the state.

What makes Utah's approach distinctive is how explicitly it connects taxation to public health ideology. The state hasn't hidden behind fiscal arguments. Instead, politicians openly state that taxing porn is part of a broader strategy to reduce its availability and normalize the view that porn constitutes a public health emergency. This ideology-forward approach differs from how other states have framed similar measures, but it's also more legally vulnerable because it reveals the actual intent behind the tax.

Utah's 16-state network of lawmakers who've declared porn a public health crisis provides political cover and coordination. These states share talking points, legislative language, and strategies. When one state passes a measure, it's quickly replicated across the network. This coordinated approach creates momentum that makes it harder for courts to dismiss porn taxes as isolated policy choices.

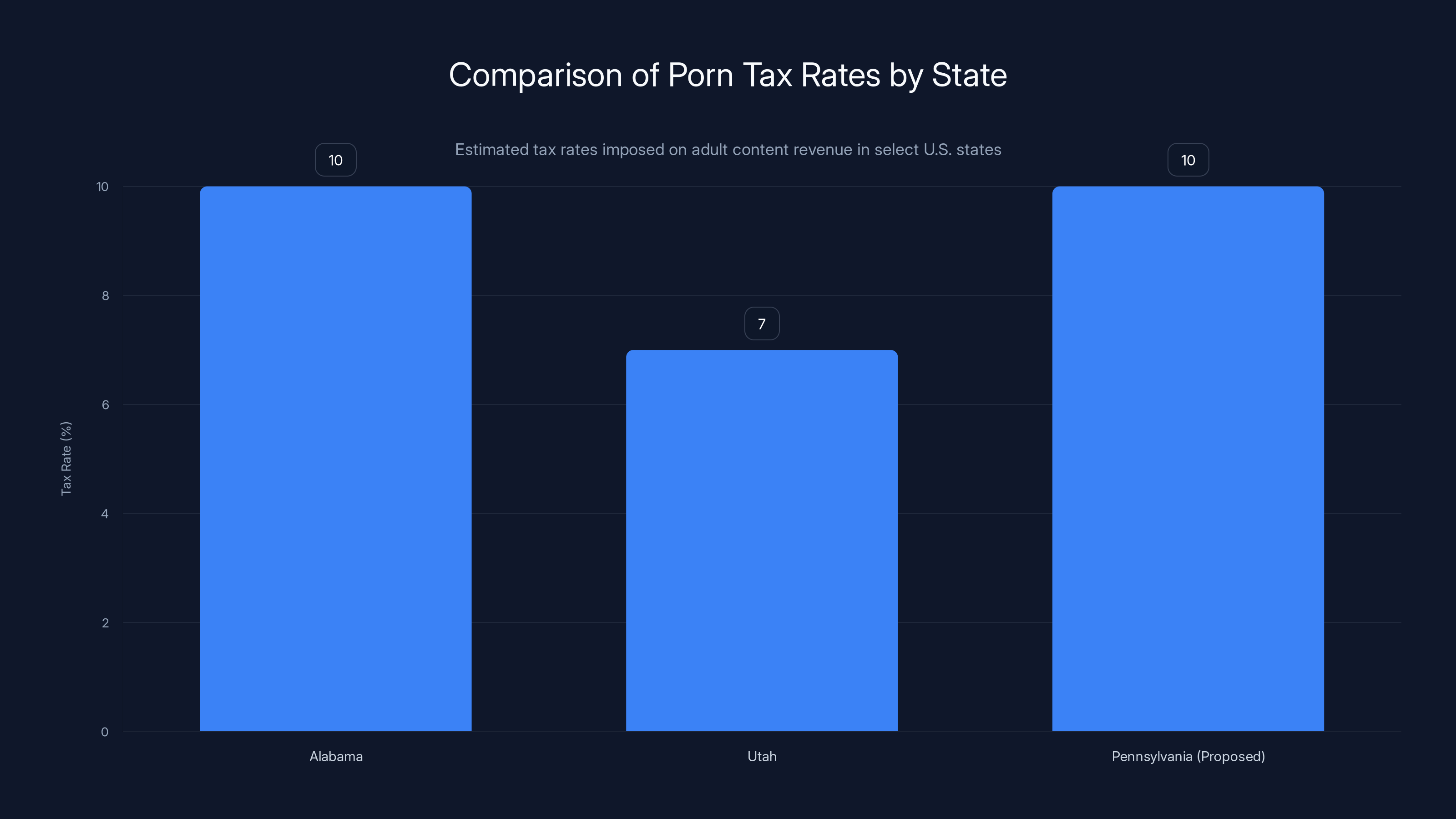

As of early 2025, 25 US states have enacted age verification laws, highlighting a significant regulatory trend. Estimated data.

Pennsylvania's Double Tax Strategy: Layering Regulation

Pennsylvania's approach reveals how creative lawmakers have become at stacking regulations. The state already imposes a 6 percent sales and use tax on digital products, including adult content subscriptions. Rather than accepting this as sufficient taxation, Pennsylvania lawmakers proposed adding a 10 percent tax specifically on adult content platforms on top of the existing sales tax.

This layering strategy is legally significant. It means consumers buying adult content in Pennsylvania would face 16 percent total taxation (6 percent sales tax plus the proposed 10 percent adult content tax). That's substantially higher than taxation on comparable digital products. The differential treatment strengthens constitutional arguments that the tax singles out protected speech for discriminatory taxation.

The Pennsylvania proposal originated from two state senators who circulated a memo in October arguing that additional revenue should fund education and youth protection programs. The framing mimics Alabama and Utah, but the mechanism reveals something different. By proposing an additional tax on top of existing sales taxes, Pennsylvania lawmakers are arguing that adult content warrants special treatment beyond normal tax structures.

Two state senators authored the memo proposing the tax, indicating it has bipartisan consideration in Pennsylvania. That matters because it suggests adult content regulation is becoming a cross-party issue in some states, even as it remains primarily driven by conservative lawmakers. The convergence of political perspectives on porn regulation creates momentum that transcends normal partisan divides.

Pennsylvania's double-taxation approach might actually be the smartest strategy from a regulatory perspective, but it's also the most legally vulnerable. Courts will look at the differential treatment and ask why adult content deserves special taxation treatment beyond what applies to other digital products. Clear answers to that question are hard to articulate without revealing unconstitutional intent.

The Constitutional Crisis: Free Speech vs. Public Health Regulation

Evelyn Douek, an associate professor of law at Stanford Law School, pulls no punches about porn taxes. "This kind of porn tax is blatantly unconstitutional," she stated in expert analysis. Her reasoning is grounded in established First Amendment doctrine: the government cannot single out particular types of protected speech and tax them at higher rates purely because legislators dislike the content.

The constitutional framework here involves two key principles. First, the Supreme Court confirmed in Barnes v. Glen Theatre, Inc. and subsequent cases that adults have a constitutional right to access pornography. That right is firmly established, not something in dispute. Second, the First Amendment prohibits the government from singling out protected speech for discriminatory taxation based on content. Taxes must be applied equally across comparable categories or have compelling justifications beyond mere legislative disapproval.

Porn taxes fail this test on multiple levels. They apply specifically to adult content, not to comparable digital products like romance novels, medical content, or other material with sexual elements. The stated rationale—that porn harms youth—doesn't justify taxing it differently than other youth-harmful content because states don't tax violence, graphic content in other mediums, or other potentially youth-harmful material at different rates. The differential treatment reveals that the real motive is suppressing a disfavored type of speech.

Douek's analysis aligns with broader First Amendment doctrine developed over decades. In C-4 Total Energy Servs., Inc. v. Texas, the Supreme Court struck down discriminatory taxation of specific industries based on legislative preference. The Court held that the government cannot use taxation as a tool to suppress unpopular but protected economic activity. The logic applies directly to porn taxes, which explicitly target a disfavored industry.

The Free Speech Coalition, a trade association representing adult industry interests, has raised similar points. Their public policy director, Mike Stabile, framed it this way: "When we talk about free speech, we generally mean the freedom to speak, the ability to speak freely without government interference. But in this case, free also means not having to pay for the right to do so. A government tax on speech limits that right to those who can afford it."

Stabile's point cuts deeper than pure constitutional law. Even if courts eventually strike down porn taxes, the damage occurs during the lengthy litigation process. Creators lose income, platforms reduce service quality, and industry investment stops. The tax functions as an effective suppression mechanism even if it eventually gets struck down as unconstitutional. By the time courts rule, the regulatory goal—reducing porn availability—has already been achieved.

Age Verification Laws: The Regulatory Foundation

Before discussing porn taxes, understanding age verification laws is essential. These laws require pornography websites to verify that users are at least 18 years old before granting access. Verification methods range from uploading government-issued ID to using third-party age verification services to credit card verification. The logic seems straightforward: prevent minors from accessing adult content.

But here's the issue that creates the constitutional framework for porn taxes. Age verification laws require collecting and storing personal data about users accessing adult content. This creates privacy concerns that civil liberties organizations have documented extensively. Uploading your ID to a pornography site means that site possesses sensitive personal identification documents. If that site experiences a data breach, your government ID is in criminal hands.

As of early 2025, 25 US states have enacted age verification requirements in some form. Alabama and Utah passed these laws as precursors to implementing porn taxes. The sequence is significant. First, states require age verification, which establishes pornography sites as regulated entities with specific compliance obligations. Then, once the principle of regulation is established, taxation becomes the logical next step.

Critics argue this sequence reveals the actual goal behind age verification laws. They contend that age verification was never really about protecting children—it was about creating infrastructure for eliminating porn. Alex Kekesi, a spokesperson for Pornhub, expressed this concern when the platform blocked access in 23 states rather than implement verification systems: "Age restriction is a very complex subject that brings with it data privacy concerns and the potential for uneven and inconsistent application for different digital platforms."

In November 2024, Pornhub formally urged Google, Microsoft, and Apple to implement device-level age verification in their operating systems and app stores rather than forcing platforms to handle verification individually. The request was strategic—by pushing verification upstream to device manufacturers with serious security infrastructure, Pornhub sought to circumvent state-level requirements. The company recognized that platform-level verification creates privacy and compliance nightmares.

But here's what's revealing: a leaked video from 2024 featured Russell Vought, a Trump ally and Project 2025 coauthor, explicitly calling age verification laws a "back door" tactic to achieving a federal porn ban. His comment suggests that at least some conservative policy architects view age verification not as an end in itself, but as a stepping stone toward total prohibition. That framing matters for understanding the constitutional implications. If age verification is intentionally designed as a step toward banning porn entirely, the laws themselves become suspect under constitutional scrutiny.

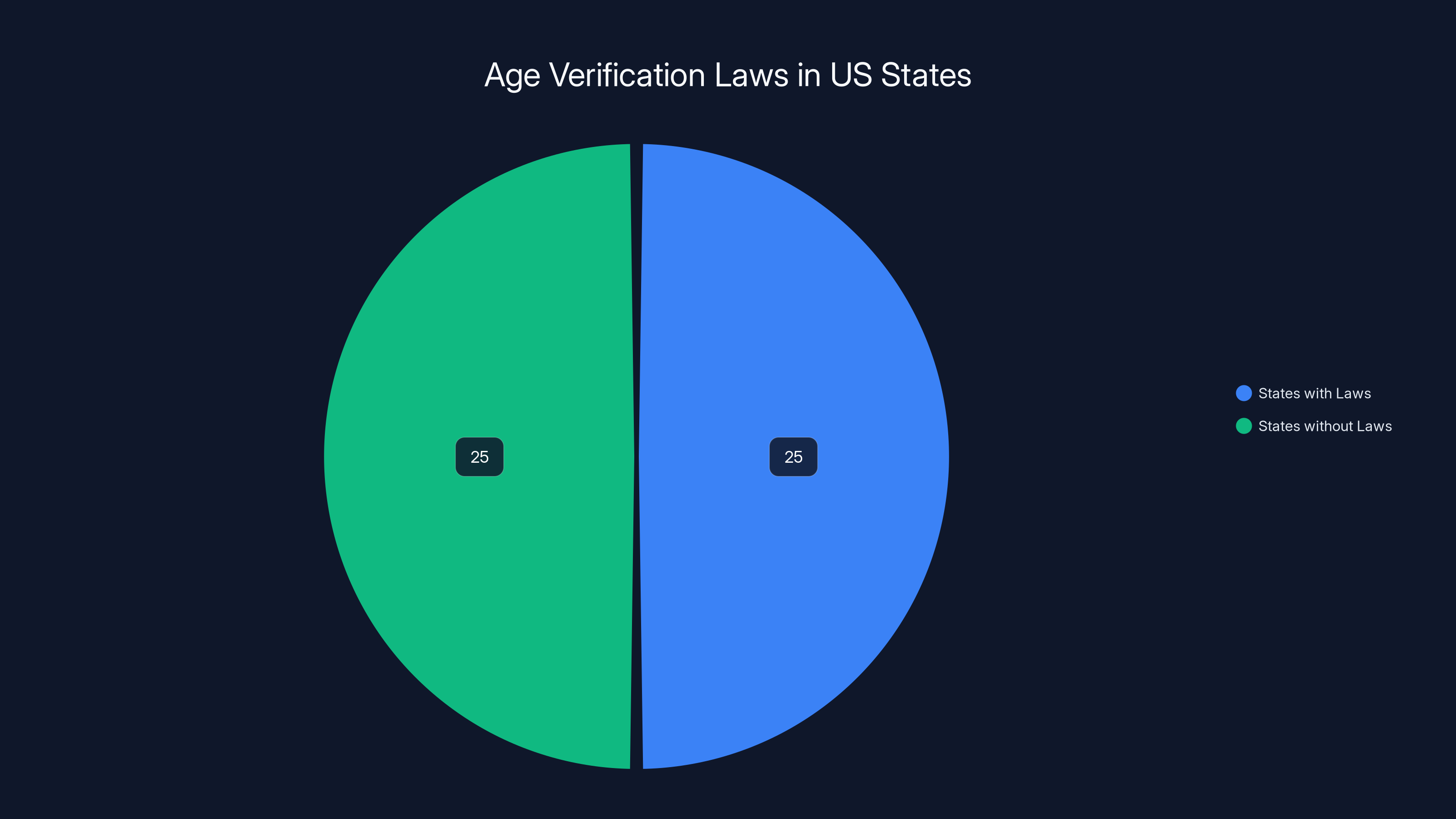

Estimated data shows a significant reduction in content creator earnings due to a 10% porn tax, highlighting the economic burden on creators.

The Data Privacy Nightmare: ID Verification and Personal Information

Age verification laws create a massive data privacy problem that rarely gets adequate attention. When pornography sites require users to upload government-issued ID, they're asking people to provide highly sensitive personal information to private companies with uneven security standards.

Consider what's involved. To verify your age, you might upload your driver's license, passport, or state ID. This document contains your name, address, date of birth, potentially your license number, and sometimes your social security number. Pornography sites are now required to store this information in databases. If that database gets breached—and databases get breached constantly—criminals possess your complete identity information.

The alternative that some sites offer is third-party age verification services that claim to verify age without storing the ID directly on the pornography site. But this creates different problems. You're trusting your ID information to a third-party verification company whose security you cannot audit. If that company's database gets breached, your information is still compromised. And now it's in the hands of a middleman with even less security resources than the porn site itself.

Credit card verification is the mildest option, but it eliminates all possibility of anonymity. Credit card transactions are traceable. A person using a credit card to access adult content creates a permanent financial record linking them to that activity. For people in certain professions, family situations, or circumstances where privacy is critical, this creates untenable conditions. A therapist, minister, social worker, or teacher might want to access adult content legally but cannot afford the privacy implications of their employers or colleagues discovering credit card records.

This privacy framework reveals why age verification was contentious from the outset. Civil liberties organizations argued that the privacy invasion required to implement age verification far exceeded the public benefit of age restriction. The analysis makes sense. Most minors access adult content through unregistered means anyway—VPNs, circumvention tools, and workarounds render age gates minimally effective at preventing youth access while substantially impairing privacy for adults.

Once states normalized the idea that pornography sites must implement these privacy-invasive verification systems, the logic of taxation became inevitable. If sites are already subject to extensive regulation and data requirements, additional taxation felt like a natural escalation. The regulatory framework created by age verification laws paved the way for porn taxes by establishing that porn sites aren't fully autonomous entities but regulated businesses subject to state oversight.

Content Creator Economics: Who Really Pays the Porn Tax

When policymakers discuss porn taxes, they focus on tax revenue, public health, and constitutional questions. What rarely enters the conversation is how these taxes affect actual content creators. The answer is brutal: creators bear nearly all the economic burden.

Here's the economics. A creator on Only Fans or similar platform typically receives 80 percent of subscription revenue, with the platform taking 20 percent. When a state imposes a porn tax, the platform doesn't absorb it—the tax is applied to gross receipts, not net creator payments. The platform calculates its tax obligation based on total revenue, then subtracts the platform's cut, and passes the tax burden to creators through reduced payouts or explicit tax deductions.

So a creator earning

Mike Stabile's point about taxation limiting free speech becomes concrete here. If a creator earns

For sex workers without platform intermediaries—independent contractors operating their own subscription services or selling content directly—the burden is even worse. They must understand complex tax law, file in multiple states, maintain records, and potentially pay accountants to handle compliance. A sex worker earning

Platforms like Only Fans officially state that creators are responsible for their own tax obligations. That's technically accurate but practically misleading. The creators have little ability to opt out or shop for better platforms. Only Fans has network effects that make it the dominant creator platform. A creator leaving Only Fans to avoid taxes loses access to their established audience and income stream. They're effectively trapped.

The Public Health Justification: Separating Rhetoric from Reality

Every porn tax proposal includes public health framing. Alabama, Utah, and Pennsylvania all claim the tax funds mental health services for teenagers. The reasoning is that pornography consumption harms teen mental health, therefore taxing porn is justified as a public health intervention. But this framing doesn't withstand scrutiny.

First, the causal link between porn consumption and teen mental health is weaker than tax proponents claim. Research shows correlation between pornography use and depression or anxiety, but establishing causation is much harder. Teenagers experiencing depression or anxiety might consume more pornography, or pornography might be one factor among dozens affecting mental health. Isolating porn's specific impact from social media, school stress, family dynamics, economic anxiety, and other factors is methodologically difficult.

Second, if the real concern is teen mental health, taxation is an absurdly indirect intervention. The tax might reduce porn availability, or it might not. Platforms might absorb the cost, pass it to consumers, or block the state entirely. Nothing about the tax mechanism directly addresses teen mental health. A direct intervention would be funding teen mental health services directly from general revenue, without requiring a porn tax to justify it.

The public health framing serves political purposes. It transforms what is functionally a speech-suppression tax into a protective health measure. That rhetorical shift makes it easier for legislators to justify the tax and harder for critics to oppose it. Opposing "teen mental health funding" sounds bad. Opposing a "porn tax" sounds supportable to conservative voters. So the public health framing is chosen precisely because it makes the tax politically defensible.

A 2022 report from Common Sense Media found that 73 percent of teenagers aged 13 to 17 have viewed adult content online. That prevalence suggests age verification laws are minimally effective at preventing youth access. If most teens access porn regardless of age gates, then taxation isn't addressing the actual problem. The laws exist not because they effectively protect youth, but because they signal commitment to combating porn as a moral issue.

Utah's declaration that pornography constitutes a public health crisis is particularly telling. The declaration wasn't based on a specific peer-reviewed study or public health analysis. It was a political statement by conservative lawmakers reflecting their moral concerns about sexual content. Transforming moral disapproval into "public health crisis" language provides cover for regulatory action that might otherwise seem like government morality enforcement.

The estimated allocation of Alabama's porn tax revenue shows a focus on mental health services, with 50% of funds directed there. Administrative costs and public awareness campaigns receive 30% and 20% respectively. Estimated data.

The First Amendment Doctrine: Protected Speech and Taxation

Understanding why porn taxes face constitutional problems requires understanding how courts analyze First Amendment issues. The relevant framework involves multiple layers of scrutiny depending on what kind of speech is involved and what government action is proposed.

Pornography is sexually explicit speech. The Supreme Court has confirmed in Barnes v. Glen Theatre and City of Erie v. Pap's A. M. that adults have a constitutional right to access pornography. The government cannot ban it entirely. But can the government regulate it? Yes, with limitations. States can impose age restrictions, prevent distribution to minors, and regulate the conditions of adult access. But regulations must be narrowly tailored to serve compelling interests and cannot eliminate the core activity entirely.

Taxation falls into a different category. When government taxes particular types of speech, courts apply what's sometimes called the "content-based taxation" doctrine. The question becomes whether the tax is applied equally across comparable categories or whether it singles out particular speech for discriminatory treatment. Discriminatory taxation based on content triggers heightened constitutional scrutiny.

Take a simple example. If Pennsylvania imposed a 6 percent sales tax on all digital products but a 10 percent tax specifically on adult content, that differential treatment violates the First Amendment unless the state can demonstrate a compelling interest served by the discrimination. What compelling interest justifies taxing porn at 10 percent while romance novels are taxed at 6 percent? None that courts would likely accept, because both are protected speech.

The state might argue that porn harms youth and therefore warrants special taxation. But courts would push back: if the concern is youth harm, why doesn't the state tax violent video games, horror movies, or other youth-harmful content at different rates? The failure to apply consistent youth-protection taxation reveals that the actual motive is suppressing a particular type of protected speech, which the First Amendment prohibits.

This analysis traces to established Supreme Court precedent. In Police Department v. Mosicki, the Court held that government cannot use its taxing power to suppress protected speech. The tax must serve a legitimate revenue-raising purpose, not a content-suppression purpose. In porn tax cases, the suppression purpose is explicit. Supporters openly state they want to reduce porn availability through taxation. That candor about intent becomes evidence that the tax violates the First Amendment.

International Comparisons: How Other Countries Regulate Adult Content

Understanding porn taxes in the US requires context about how other democracies handle adult content regulation. The comparison reveals that porn taxes are globally unusual and often prove ineffective or face legal challenges.

The United Kingdom implemented age verification requirements for adult content in 2019 through the Online Safety Bill framework. The process has been contentious. Platforms including Pornhub blocked UK access entirely rather than implement verification systems. The UK approach is closer to what US states are pursuing, but it's faced similar problems. Neither age verification nor taxation has substantially reduced UK adult content consumption.

Germany has some of the world's most developed frameworks for balancing free speech with regulation of sexual content. The country permits porn but regulates distribution methods and age verification. However, Germany has not implemented taxation as a regulatory mechanism. The German approach focuses on preventing youth access through regulatory requirements rather than making porn expensive through taxation.

Canada's regulatory approach emphasizes gender and violence issues in pornography rather than broad suppression. Canadian provinces have not pursued pornography taxation. The focus is on preventing non-consensual content, violent content, and exploitative production rather than addressing consensual adult content generally.

In Australia, the regulatory approach has been increasingly restrictive, with proposals to implement age verification. However, Australian policy has not pursued pornography taxation. The framework focuses on registration and age verification requirements rather than financial burden.

The lack of international precedent for pornography taxation suggests that the US states pursuing this strategy are creating novel regulatory mechanisms without proven effectiveness. Other democracies have rejected porn taxation as a regulatory tool. That absence of international precedent weakens the policy case for porn taxes while also suggesting that courts evaluating constitutional questions might look to international practice as context.

The Enduring Role of Project 2025: Conservative Blueprint for Porn Regulation

Project 2025, the comprehensive policy framework developed by The Heritage Foundation and conservative allies for the incoming Trump administration, provides crucial context for understanding the current porn tax movement. The project's sexual ethics and pornography sections reveal that porn regulation is not an accidental state-level phenomenon but part of a coordinated national strategy.

Russell Vought, who led the Project 2025 planning process, was captured on video calling age verification laws a "back door" to federal pornography bans. That language reveals strategic thinking. Conservative policymakers view state-level age verification and taxation not as ends in themselves but as stepping stones toward more comprehensive porn prohibition. The sequence is deliberate: establish age verification in states, then add taxation, then pursue federal restrictions.

Project 2025 explicitly calls for federal coordination of pornography policy. The framework envisions using federal authority to restrict adult content in ways that states might not be able to implement independently. Federal taxonomy codes and regulations could define obscenity more broadly, restrict payment processor capabilities for adult sites, and coordinate law enforcement against pornography distribution.

The presence of Project 2025 coordination explains why porn taxes started emerging simultaneously across multiple states in 2024. These aren't independent regulatory decisions. They're part of a coordinated strategy with national political backing. States that implement porn taxes first gain political credit within conservative networks and help build the case for federal action.

This coordination has constitutional implications. If porn taxes are merely one component of a broader strategy to eliminate porn access entirely, courts evaluating the constitutionality of specific taxes might consider the broader suppression intent. The First Amendment prohibits laws that are facially neutral but designed with the intent of suppressing protected speech. Evidence of coordinated intent to eliminate porn could render individual porn taxes unconstitutional even if they might survive scrutiny in isolation.

Estimated data shows that the majority of the revenue from Utah's proposed 7% porn tax would be allocated to teen mental health support, with smaller portions for administrative costs and public awareness campaigns.

Sex Worker Safety and Economic Vulnerability

Another aspect of porn taxes rarely discussed is their impact on sex worker safety and economic vulnerability. Sex workers, including those creating content on platforms like Only Fans, already operate in precarious conditions. Porn taxes exacerbate those vulnerabilities.

First, the regulatory infrastructure required for age verification and tax compliance creates records that can be used against sex workers. If a platform maintains records of all creators' tax obligations in various states, that information becomes discoverable in criminal proceedings or civil litigation. A sex worker prosecuted in a jurisdiction that hasn't decriminalized sex work could find that their tax records become evidence used against them.

Second, reducing income through taxes makes sex workers more economically desperate. When creators can't sustain themselves through platform earnings, they may move toward more dangerous activities or relationships. Economic pressure from taxation can push people from relatively safer platform-based work toward street-based work or abusive relationships. The tax's indirect consequence is potentially increased vulnerability and danger.

Third, sex workers already face discrimination in banking and payment processing. Paypal, Stripe, and other major payment processors restrict or prohibit accounts for adult industry workers. Adding tax compliance complexity makes banking relationships more fraught. A sex worker trying to file taxes on platform earnings may find that their bank account gets frozen because the bank policy prohibits adult industry payments.

Mike Stabile's point about taxation limiting free speech also has safety dimensions. If creators cannot sustain themselves through legal platform-based work, they may engage in unregulated alternatives that expose them to greater exploitation and danger. The policy cascade started by porn taxes has foreseeable consequences for sex worker safety, even if those consequences aren't the stated intent.

Sex worker advocacy organizations have raised these concerns consistently, but their voices rarely factor into policy discussions. Porn tax supporters focus on public health and moral concerns while dismissing sex worker safety as irrelevant or outside the scope of policy consideration. Yet the practical impact on sex worker vulnerability is substantial and measurable.

Litigation Landscape: Where Porn Tax Cases Might Be Challenged

Several porn tax cases are likely to move through courts in coming years. Understanding the litigation landscape helps predict how these constitutional questions will be resolved.

The Free Speech Coalition, representing adult industry interests, has stated that they're prepared to challenge porn taxes in court. The organization has existing relationships with free speech and civil liberties attorneys experienced in defending adult content against government restrictions. These are sophisticated litigators who've fought obscenity prosecutions and defended adult industry interests for decades.

Initial challenges would likely come in federal district courts where the relevant taxes are implemented. A challenge to Alabama's porn tax would come in the Middle District or Northern District of Alabama. A challenge to Pennsylvania's proposed tax would come in a Pennsylvania federal district court. These cases would likely involve briefing by the Justice Department if they involve novel constitutional questions, and almost certainly involvement from civil liberties organizations like the American Civil Liberties Union.

The Supreme Court's recent decisions on content-based regulation of the internet provide some guidance about how it might approach porn taxes. In Texas v. Google, the Court addressed state regulatory power over digital platforms. The decision suggests the Court is skeptical of state attempts to regulate large technology companies, but it's unclear whether that skepticism extends to taxes versus outright regulations.

Most relevant might be the Supreme Court's decision in Reed v. Town of Gilbert, which established that content-based laws receive strict scrutiny under the First Amendment. If courts apply Reed's framework to porn taxes, the taxes would need to satisfy strict scrutiny by serving compelling state interests and being narrowly tailored. The porn tax framework likely fails this test because it's not narrowly tailored and the state interests (raising revenue, protecting youth health) could be served through means that don't single out protected speech.

However, courts might also consider whether taxation is a special category that receives different scrutiny than other speech regulations. The Supreme Court has historically deferred more to government taxation authority than to other regulatory mechanisms. That deference could theoretically extend to porn taxes, though the foundation for such deference is weaker when taxation is explicitly designed to suppress speech.

The litigation timeline matters for practical effects. If cases take three to five years to reach final resolution, the tax's economic impact persists throughout that period. Creators suffer income reduction for years while the case is litigated. The platform's market position changes. Regulatory precedents shift. By the time a court rules the tax unconstitutional, the damage has been done.

The Political Momentum Problem: How Regulatory Cascades Work

Understanding why porn taxes are proliferating requires understanding how regulatory momentum works. When one state implements a novel policy, it creates several cascading effects.

First, it demonstrates feasibility. Other legislators see that a state successfully implemented the policy without immediate legal injunction, creating the impression that the policy works. That impression matters more than whether the policy actually works or is ultimately constitutional. If Alabama's tax isn't immediately blocked by courts, other states view it as a viable model to replicate.

Second, it creates competitive pressure. Politicians in states that haven't implemented porn taxes face pressure from conservative base voters asking why their state is "soft on porn" when Alabama and Utah have taxed it. That political pressure drives adoption. Legislators who fail to pursue porn taxes face primary challenges from more conservative candidates.

Third, it establishes normalized language and frameworks. Once Alabama discusses porn taxation using public health language, other states adopt the same language. The framework spreads. Within a few years, what seemed like a radical regulatory approach becomes normal political discourse. That normalization makes it easier for more states to implement variations.

Fourth, it creates coordination opportunities. States that implement porn taxes can share information about compliance mechanisms, revenue collection, and legal strategies. The coordination creates a network of states with shared interests in defending porn taxes against legal challenges.

The result is momentum that becomes self-reinforcing. Each state that implements a porn tax makes it more likely that others will follow. The regulatory cascade reaches a tipping point where porn taxation becomes the default policy position among conservative legislators. That momentum is powerful and difficult to reverse, even if courts eventually strike down individual taxes.

It's worth noting that this regulatory momentum works regardless of whether the taxes are ultimately constitutional. The process of litigation delays, compliance costs, and market disruption occurs during the years before courts rule on constitutionality. The political goal of reducing porn availability is partially achieved through the regulatory process itself, independent of the ultimate legal outcome.

Alabama and Pennsylvania propose a 10% porn tax, while Utah suggests a 7% rate. These states are part of a broader trend with 25 states implementing age verification laws, indicating a move towards more restrictive regulations.

What's Next: Escalation to Federal Regulation

The trajectory from age verification to taxation to broader federal regulation is becoming clearer. If porn taxes succeed in multiple states without being struck down immediately, the next escalation is almost certainly federal regulation.

A federal pornography regulatory framework could include several components. Federal tax on adult content distributed to US customers. Federal registration requirements for pornography producers. Federal coordination of payment processor restrictions on adult industry accounts. Federal definitions of obscenity that are broader than current Supreme Court standards. Potential federal prosecution of pornography distribution across state lines.

Project 2025 explicitly envisions this federal role. The framework calls for the Justice Department to prioritize pornography enforcement, federal tax coordination on adult content, and federal legislation establishing stronger obscenity definitions. That blueprint suggests that if Republican administrations regain full control of federal government, comprehensive federal porn regulation will be pursued.

The challenge federal regulators would face is the same constitutional problem that state-level regulators face: the Supreme Court has confirmed that adults have a constitutional right to access pornography. A federal prohibition would face immediate constitutional challenges. That's where the regulatory cascade becomes strategically important. If states have already implemented age verification, taxation, and other restrictions, a federal framework can build on that existing infrastructure.

Federal regulation might focus on restricting who can access pornography at the infrastructure level. If payment processors cannot legally process porn payments, if internet service providers must implement age verification at the network level, if credit card companies cannot process transactions for adult sites, the practical effect is porn prohibition without explicit federal prohibition. The government achieves the suppression goal through regulation of supporting infrastructure.

That approach would almost certainly face constitutional challenges, but the litigation timeline matters. During the years of litigation, the infrastructure restrictions would remain in place, substantially reducing porn availability and creator income. The regulatory goal would be partially achieved even if courts eventually strike down the specific restrictions.

Unsolved Technical Problems: Why Age Verification Doesn't Work

Underlying all pornography regulation discussions is a fundamental technical reality that regulators often ignore: age verification on the scale required is essentially impossible without privacy invasion or trivial circumvention.

Government ID-based verification creates the privacy nightmare discussed earlier. But it also has minimal effectiveness. A teenager can simply upload an older sibling's or parent's ID. The site operator has no practical way to verify that the person uploading the ID is actually the person whose ID it is. Video verification systems that require a real-time face-match face spoofing risks. Blockchain-based age tokens that verify age without collecting ID information face adoption and compatibility challenges.

Credit card verification is more effective at age gating but eliminates privacy entirely. Teens with access to parents' credit cards can still access adult sites. VPN usage defeats geographic blocking. Circumvention tools proliferate faster than regulators can address them. The technical cat-and-mouse game between platforms implementing age gates and users finding workarounds never reaches equilibrium.

This technical reality means that age verification laws are theater more than substance. They create compliance burdens on platforms and invasions of privacy for users without substantially preventing minor access. Teens determined to access adult content find ways around the systems. Yet the regulatory infrastructure persists because the political goal isn't really preventing minor access—it's creating mechanisms for more aggressive regulation.

Understanding this technical reality is crucial for evaluating porn tax arguments. Supporters claim that taxes are necessary to address harm to minors. But if age verification systems don't effectively prevent minor access, then taxation based on protecting minors from something they can access anyway is pretextual. The real motivation is suppressing consensual adult access, which the First Amendment prohibits.

Platforms have invested significant resources in age verification technology, only to find that determined users defeat the systems with trivial workarounds. That learned experience explains why platforms like Pornhub have concluded that platform-level age verification is ineffective compared to device-level verification. Yet states continue requiring platform-level verification, suggesting they're not actually focused on preventing minor access.

The First Amendment in the Age of Moral Regulation

Porn taxes reveal something deeper about contemporary First Amendment jurisprudence. Governments are learning how to regulate speech through tools that aren't explicitly content restrictions but function as effective speech suppression. Taxation is one such tool. Regulatory burden is another. Payment processor restrictions are a third.

These mechanisms work because they're indirect. Courts are more skeptical of laws that explicitly say "you cannot speak" than laws that say "you must pay tax on your speech" or "you must meet these regulatory requirements to speak." Yet the practical effect is the same: the speech becomes more expensive, more burdensome, more risky. Eventually, it becomes economically impossible to engage in the speech.

This regulatory pattern raises deep constitutional questions about whether the First Amendment protects only the right to speak or also the right to speak without extraordinary financial burden. If a government can tax protected speech at 10 percent while not taxing comparable speech, has it effectively suppressed that speech? The constitutional framework developed in the 20th century assumed government would regulate speech directly. It provides less guidance when government regulates speech indirectly through taxes, regulatory burden, and infrastructure restrictions.

Even if porn taxes are ultimately struck down by courts, they demonstrate that governments are becoming more sophisticated about speech regulation. Future regulations will likely be even more carefully crafted to survive constitutional scrutiny while achieving the practical goal of speech suppression. Understanding porn taxes is thus relevant to broader conversations about free speech in the 21st century.

Porn taxes also reveal partisan realignment on free speech issues. Historically, opposition to speech restrictions has been bipartisan. But porn regulation has become almost entirely partisan, with Democrats more protective of adult content rights and Republicans more supportive of regulation. That partisan divide suggests that free speech as a constitutional principle is less important to both parties than advancing their specific ideological goals.

The Creator Economy Impact: Beyond Adult Content

What happens to pornography regulation eventually affects broader creator economy issues. Platforms like You Tube, Tik Tok, Patreon, and Only Fans all operate in the same regulatory and economic ecosystem. Restrictions on one category of creators have spillover effects on all creators.

If states successfully implement porn taxes and the precedent holds, it creates a template for taxing other categories of creator content. What prevents a state from imposing a 10 percent tax on violent video game streaming content? Or conspiracy theory content? Or political content from disfavored politicians? Once taxation becomes an accepted regulatory tool for speech the government dislikes, the precedent extends far beyond adult content.

Creators in all categories have shared interests in preventing porn taxes from surviving constitutional scrutiny. A creator on You Tube making educational content about climate change has interest in preventing governments from establishing taxation authority over disfavored speech categories. A podcaster discussing controversial politics has interest in preventing taxation of political speech.

This broader creator economy interest explains why civil liberties organizations beyond the adult industry are concerned about porn taxes. Porn taxes are test cases for whether governments can use taxation to regulate speech. If porn taxes succeed, they establish precedent for much broader regulatory use of taxation. The First Amendment implications are massive.

Platform economics also connect pornography regulation to broader creator economy issues. Platforms rely on legal certainty about the content they can host and the taxes they must pay. Uncertainty about porn taxes creates platform vulnerability. A platform that processes billions in creator payments becomes liable for complex tax obligations in multiple jurisdictions. That liability discourages platform investment and innovation.

Smaller platforms serving niche creator communities are particularly vulnerable. Only Fans has the resources to handle complex tax compliance across multiple jurisdictions. A startup platform serving independent creators might find that multi-state porn tax compliance is prohibitively expensive. The result is consolidation—only the largest platforms can afford the regulatory burden. That consolidation has broader consequences for creator choice and platform competition.

FAQ

What is a porn tax?

A porn tax is a state or local government tax imposed specifically on revenue from pornography or adult content platforms. These taxes are typically imposed as a percentage of total receipts from subscriptions, sales, or performances of sexually explicit material. Alabama's 10 percent porn tax, Utah's 7 percent tax, and Pennsylvania's proposed 10 percent consumer tax are examples of how different states structure these taxes, which are justified by supporters as funding mental health services or protecting youth from harm.

Why do conservative lawmakers support porn taxes?

Conservative lawmakers support porn taxes as part of a broader strategy to reduce pornography availability and normalize the view that pornography constitutes a public health threat. These lawmakers contend that pornography harms teens and contributes to sexual dysfunction, addiction, and exploitation. By implementing age verification laws and then adding taxation, they create escalating restrictions on adult content. The public health framing provides political justification for what are fundamentally efforts to suppress sexual expression based on moral disapproval.

Are porn taxes constitutional?

Constitutional law experts including Stanford Law School professor Evelyn Douek argue that porn taxes are unconstitutional because they single out protected speech for discriminatory taxation based on content. The First Amendment prohibits government from using taxation as a tool to suppress disfavored speech. While courts have yet to definitively rule on porn taxes, legal challenges are being prepared by free speech organizations and the adult industry, and litigation is expected to reach federal courts within the next few years.

How do porn taxes affect content creators?

Porn taxes directly reduce creator income by taxing gross receipts before creator payments are calculated. A creator earning

What is age verification and why is it controversial?

Age verification requires pornography sites to confirm that users are 18 or older before granting access, typically through ID verification, third-party verification services, or credit card verification. It's controversial because collecting government ID information for age verification creates significant privacy risks if databases are breached, it eliminates anonymity when credit card verification is used, and it has minimal effectiveness at preventing determined minors from accessing adult content through VPNs and other workarounds.

What does Project 2025 say about pornography regulation?

Project 2025, the comprehensive policy framework developed by conservative organizations for the incoming Trump administration, explicitly calls for expanded federal pornography regulation including federal taxes on adult content, broader obscenity definitions, and federal law enforcement focus on pornography distribution. The framework treats state-level porn taxes and age verification laws as stepping stones toward a comprehensive federal pornography regulatory regime that would substantially restrict legal adult content access.

How many states have implemented age verification laws?

As of 2025, approximately 25 US states have enacted some form of age verification requirement for pornography websites. These requirements vary from state to state, with some requiring government ID verification and others allowing alternative verification methods like credit card confirmation. The 25-state adoption reflects the rapid spread of age verification policy among conservative state legislatures over the past few years.

What happens if porn taxes are struck down by courts?

If courts strike down porn taxes as unconstitutional, the immediate effect would be that states would be required to refund taxes collected and cease enforcement of the tax laws. However, the litigation process typically takes several years, during which the tax remains in effect and reduces creator income. Even with an eventual legal victory against the tax, creators suffer years of income reduction. The regulatory momentum created by porn taxes often inspires even more restrictive future legislation from states seeking workarounds.

What are the privacy concerns with age verification?

Age verification systems that require uploading government-issued ID create databases containing sensitive personal information including names, addresses, and identification numbers. These databases represent valuable targets for cybercriminals. If breached, users' complete identity information is compromised. Credit card verification alternatives eliminate anonymity by creating permanent financial records of adult content purchases. These privacy invasions are imposed even though age verification systems have proven minimally effective at preventing minor access to adult content.

How do platforms respond to porn taxes?

Large platforms like Pornhub have responded to porn tax requirements and age verification mandates by simply blocking access to users in affected states rather than implementing compliance systems. This block-rather-than-comply approach reflects platform decisions that compliance costs exceed market value in those jurisdictions. Platforms have advocated for device-level age verification in operating systems rather than platform-level verification, arguing that centralized verification is more privacy-protective and effective than platform-specific systems.

What is the future of porn regulation in the US?

If current trends continue, more states will implement porn taxes and age verification laws throughout 2025 and beyond. Federal regulation is likely if Republicans maintain control of Congress and the presidency, with Project 2025 providing the blueprint for comprehensive federal pornography taxation, registration, and enforcement requirements. Litigation challenging porn taxes will move through federal courts, potentially reaching the Supreme Court within five to seven years. The outcome will have implications far beyond pornography, establishing precedents for whether governments can use taxation to suppress other categories of protected speech.

The Constitutional Reckoning Ahead: What Comes Next

The porn tax movement represents a watershed moment for free speech rights in the United States. What happens with Alabama's tax, Utah's proposed tax, and Pennsylvania's double-taxation scheme will establish precedents that extend far beyond adult content regulation. If these taxes survive constitutional scrutiny, governments will have established a powerful new tool for suppressing disfavored speech through taxation. If courts strike them down, the precedent limits government taxation authority over any protected speech.

But there's a darker possibility: courts might avoid the question entirely. They might dismiss cases on jurisdictional grounds, rule narrowly on technical grounds, or send cases back for additional factual development. The legal question could fester for years without definitive resolution. During that period, the taxes remain in effect, creators suffer income reduction, and the regulatory goal of reducing porn availability is partially achieved regardless of the ultimate legal outcome.

What's certain is that porn taxes will not resolve the underlying tensions. Conservative politicians will push for more aggressive regulation if taxes survive. Free speech advocates and the adult industry will litigate fiercely if that regulation expands. The cultural conflict around sexual expression and government authority will intensify rather than abate.

For content creators across all categories, the porn tax developments matter because they establish whether governments can use taxation as a speech regulation tool. For civil liberties organizations, they represent a critical First Amendment battleground. For the adult industry, they pose existential threat to business models. For policymakers, they offer a template for regulating other speech categories through indirect means.

The next few years will determine whether porn taxes represent a successful new regulatory model or a cautionary tale about constitutional limitations on government power. Either way, the implications extend far beyond adult content into fundamental questions about free speech, taxation, and government authority in the 21st century.

Key Takeaways

- Alabama's 10% porn tax and similar proposals in Utah and Pennsylvania represent coordinated conservative strategy to regulate adult content through taxation rather than direct prohibition

- Constitutional law experts argue porn taxes violate the First Amendment by singling out protected speech for discriminatory taxation based on content and viewpoint

- Age verification laws preceded porn taxes, establishing regulatory infrastructure that enabled taxation—suggesting age verification was always a stepping stone toward broader restrictions

- Content creators bear the economic burden of porn taxes as platforms deduct tax obligations from creator earnings, reducing income and requiring expensive multi-state tax compliance

- Project 2025 reveals that porn taxes are part of a larger strategy toward comprehensive federal pornography regulation, with state-level taxes serving as precedents for federal restrictions

Related Articles

- TikTok's 2026 World Cup Live Deal: What It Means for Sports Broadcasting [2025]

- 2025 Social Media Predictions Reviewed: What Actually Happened [2026]

- How to Create an Influencer Media Kit That Lands Deals [2025]

- Instagram's AI Media Crisis: Why Fingerprinting Real Content Matters [2025]

- TechCrunch Disrupt 2026: Top Media & Entertainment Startups [2025]

- Surveillance Goes Both Ways: How Citizens Are Recording Police [2025]

![Porn Taxes and Age Verification Laws: The Constitutional Crisis [2025]](https://tryrunable.com/blog/porn-taxes-and-age-verification-laws-the-constitutional-cris/image-1-1767962354580.jpg)