Right-to-Repair Battle: How the Repair Act Could Change Car Ownership

Your car knows everything about you. Every mile you drive, every hard brake you apply, every time you accelerate on the highway. Your vehicle collects this data constantly, streaming telemetry about your habits, location, speed, and even biometric information like how much you weigh. But here's the catch: you don't own that data. Your car's manufacturer does.

This isn't some dystopian hypothetical anymore. It's the reality of modern vehicles, and it's creating a massive rift between car owners and the manufacturers who built their vehicles. Every day, thousands of drivers face the same frustrating situation: their check engine light comes on, but they can't get the diagnostic information without paying their dealership exorbitant fees. They want to replace their own brake pads, but the car's security systems won't let them without manufacturer authorization. They're locked out of their own vehicles by digital gates designed to funnel repairs toward expensive dealership services.

The Repair Act, legislation introduced in early 2025 by Representatives Neal Dunn (Florida) and Marie Gluesenkamp Perez (Washington), represents the most significant push yet to break those digital locks. The bill would mandate that automakers share vehicle telemetry and diagnostic data with owners and independent repair shops, fundamentally reshaping how cars get fixed in America.

But the fight isn't simple. Automakers argue they're protecting intellectual property and vehicle security. Dealerships worry about losing lucrative service revenue. Some repair advocates, while supporting the bill overall, worry it could actually limit future repair legislation. Meanwhile, millions of drivers sit in the middle, frustrated that they can't fix the things they own.

TL; DR

- The Repair Act targets data access: Legislation would force automakers to share telemetry and diagnostic information with vehicle owners and independent repair shops

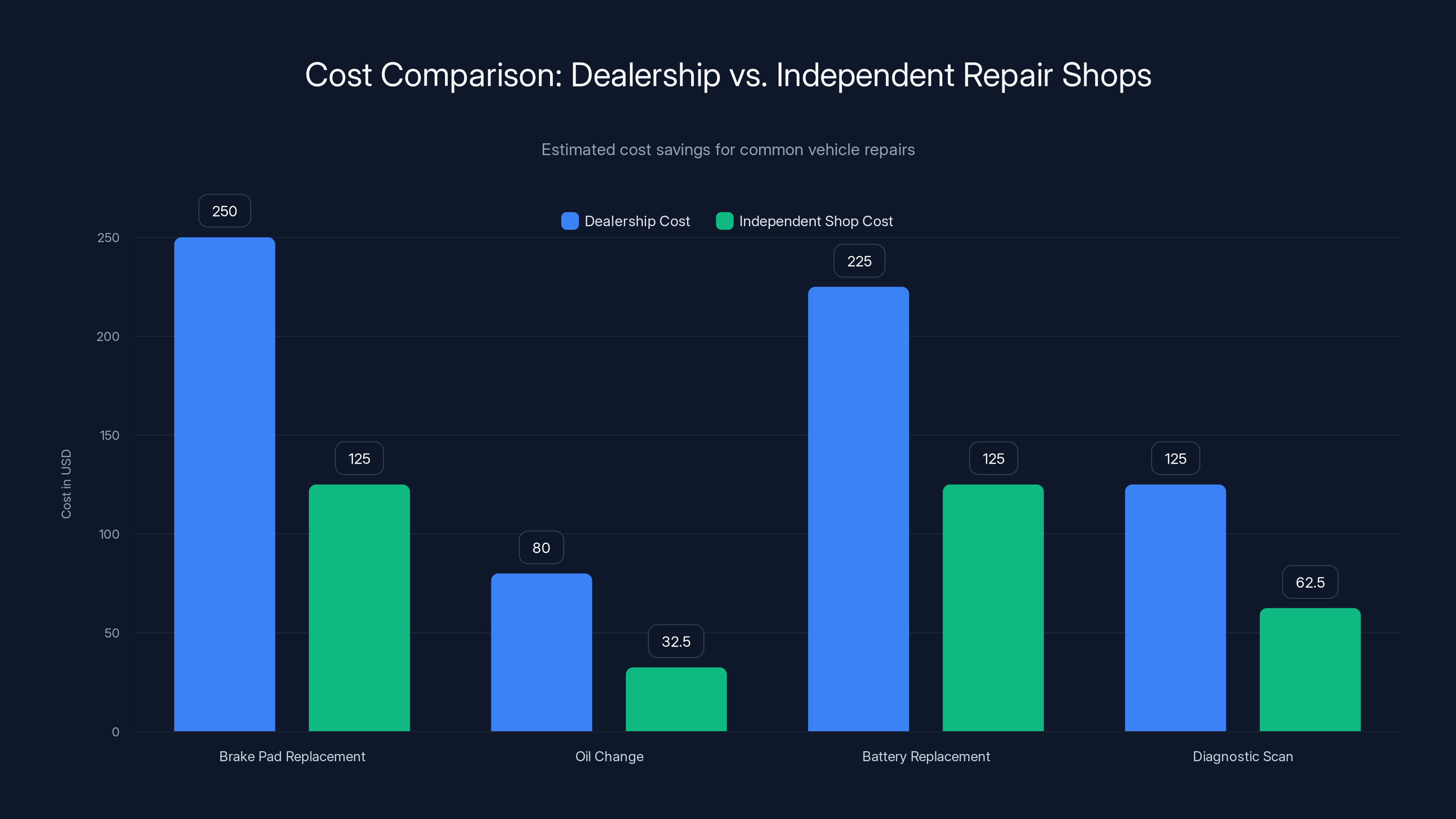

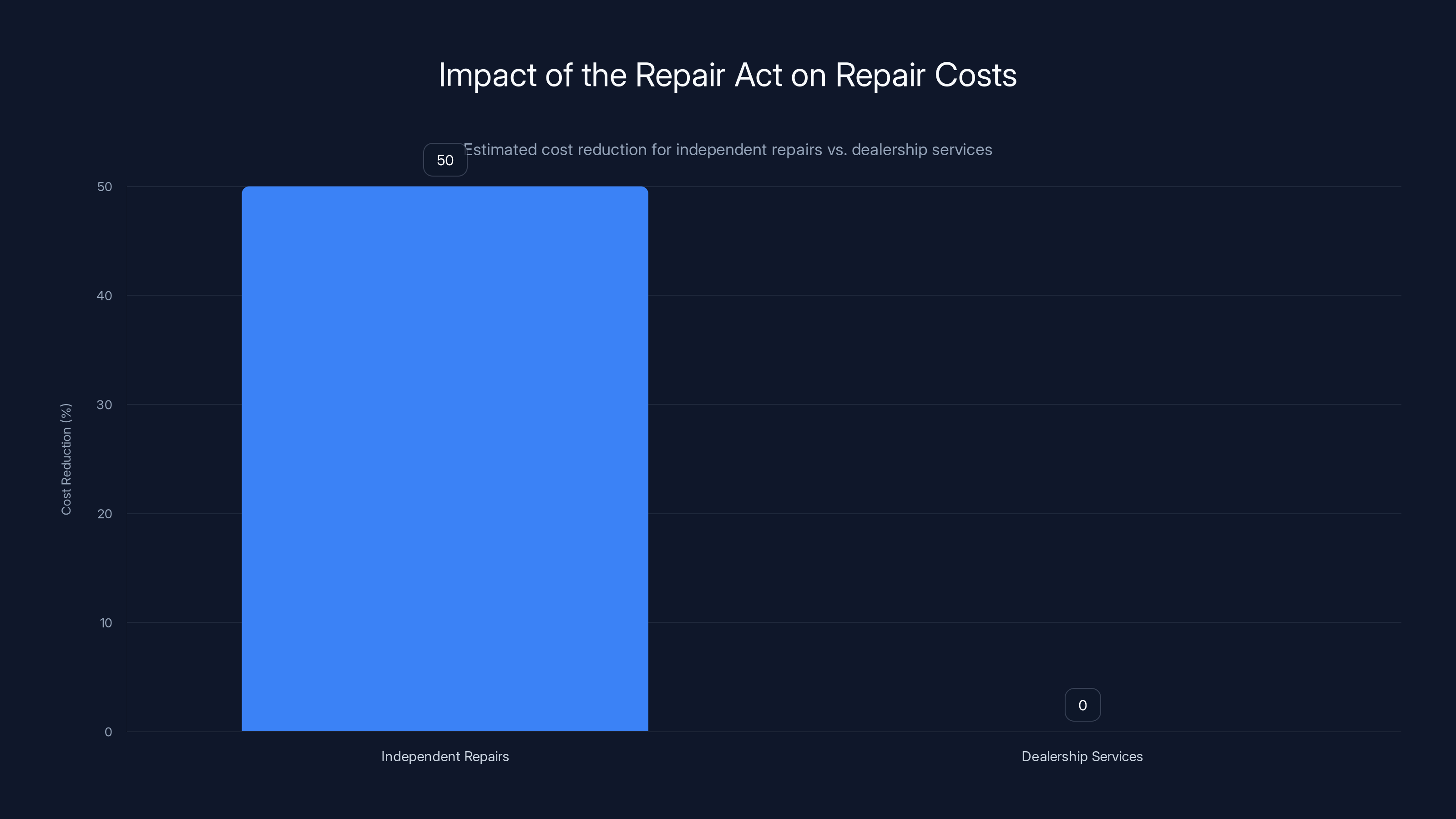

- This could save money: Independent repairs typically cost 40-60% less than dealership services, according to independent repair advocates

- Manufacturers are pushing back: The automotive industry argues the bill threatens intellectual property and vehicle security

- The preemption clause troubles advocates: One section could prevent states from passing stronger repair laws in the future

- The bill faces a long road: The legislation is expected to go through multiple rounds of revision before House and Senate votes later in 2025

Independent repair shops offer significant savings, charging 40-60% less than dealerships for common repairs. Estimated data based on industry benchmarks.

The Data Problem: Why Your Car's Information Belongs to the Manufacturer (Not You)

Modern vehicles are basically computers with wheels. A typical car manufactured in the last five years contains 100+ electronic control units. These aren't simple switches anymore; they're sophisticated microcomputers running proprietary software that monitors everything from engine performance to passenger comfort.

This technology generates enormous amounts of data. When your engine misfires, the system logs it. When your tire pressure drops, it's recorded. When you tap the brakes, acceleration patterns are captured. Every diagnostic code, every system status, every parameter measurement flows into the vehicle's central systems and often gets transmitted back to the manufacturer.

Manufacturers argue they need this data for legitimate reasons. Safety recalls require understanding how vehicles are performing in the field. Warranty claims depend on diagnostic information. Automakers claim they're using telemetry to improve design and catch defects faster.

But here's where it gets problematic. That same data infrastructure that enables safety improvements also enables manufacturers to lock consumers out of repairs. When you take your car to an independent shop, the technician can't read the full diagnostic data without manufacturer permission. This creates an artificial scarcity that drives customers toward dealerships.

Consider a practical example: your check engine light illuminates. An independent repair shop can see that some code has been triggered, but they can't access the complete telemetry about what your engine was doing when the problem occurred. Was it running too rich? Too lean? What was the fuel pressure at that exact moment? The dealership has access to all this information; the independent shop doesn't. This information asymmetry means independent technicians often have to charge diagnostic fees just to figure out what's wrong, driving up costs and time.

The Repair Act would fundamentally flip this script. Instead of manufacturers controlling access to diagnostic information, vehicle owners would get the keys to their own data. Independent repair shops would gain legitimate access to the information needed to diagnose and repair vehicles properly. This isn't about letting unauthorized people modify critical safety systems; it's about ensuring that the people who own vehicles can actually understand and maintain them.

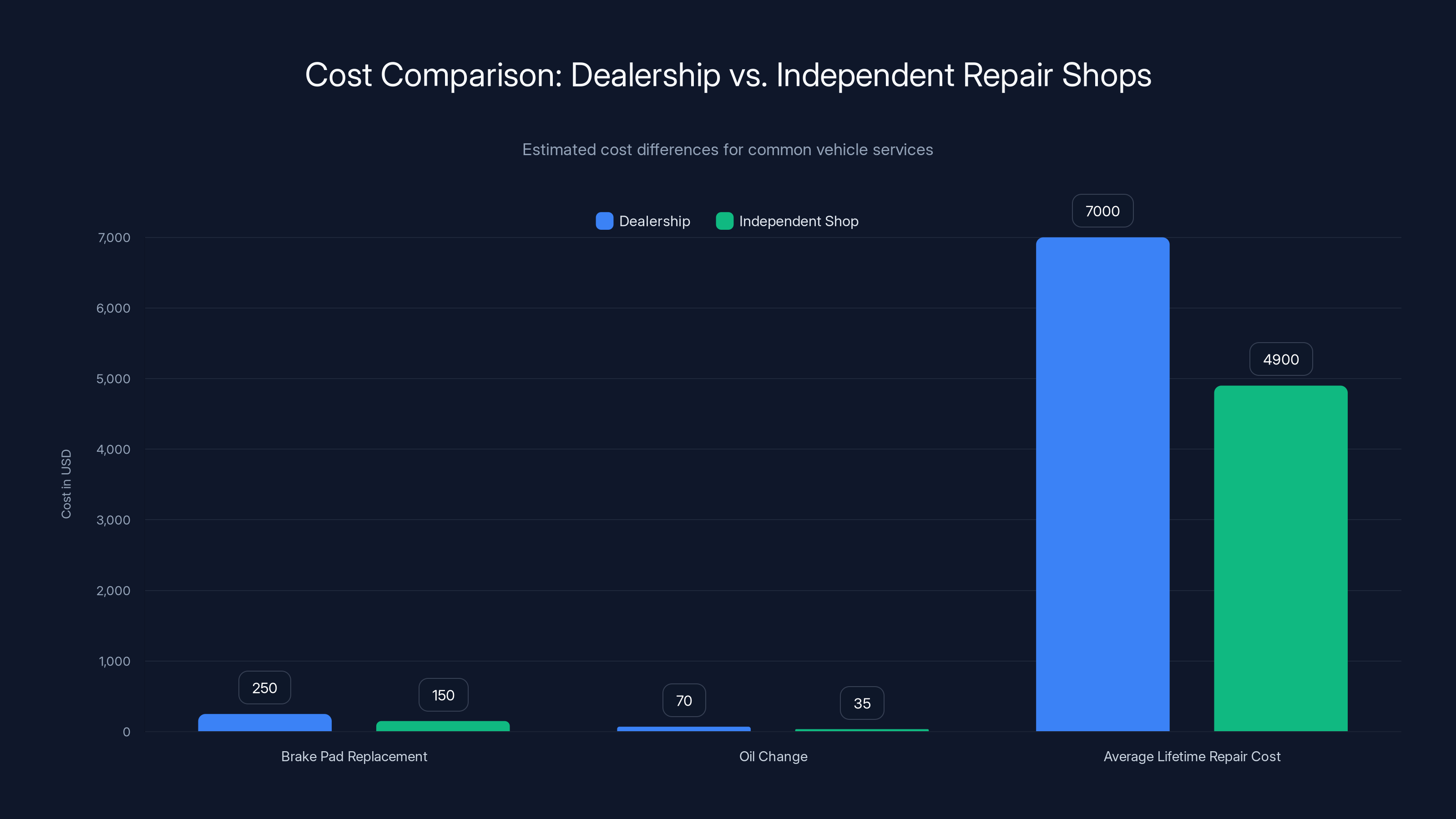

Dealerships charge significantly more than independent repair shops, with potential savings of up to 30% over a vehicle's lifetime. Estimated data based on typical service costs.

The Business Model Behind Dealership Repairs

To understand why manufacturers resist repair legislation, you need to understand how automotive dealerships make money. And the answer is surprisingly simple: they make most of their profit from service, not from selling vehicles.

When you buy a car, the dealer makes maybe 5-10% gross margin on the sale. But when you bring that car back for repairs, the margins skyrocket. Service departments operate at 30-50% gross margins, sometimes higher. For dealers, each customer becomes a recurring revenue stream that lasts for the lifetime of the vehicle. This is why your dealer is aggressively calling about your extended warranty and why they send you appointment reminders before your service intervals.

Manufacturers benefit from this arrangement too. When dealerships are profitable, they invest more in the dealership network. They buy more inventory. They market vehicles more aggressively. Manufacturers have essentially built their sales infrastructure around this service revenue model.

But here's what the data actually shows. Independent repair shops charge approximately 40-60% less than dealerships for the same work. A brake pad replacement that might cost

The gap exists for legitimate reasons. Dealerships have higher overhead. Their technicians are often more specialized. They stock more expensive OEM parts. But it also exists because consumers often have no choice. If your vehicle won't let an independent shop access diagnostic data, you're forced to either trust the dealership or go without repairs.

This business model has created a powerful opposition coalition. Dealership networks are politically connected. They donate to campaigns. They employ thousands of workers in every congressional district. When you're a representative, you notice when a major dealership in your district opposes legislation. That's a real constituency concern.

The Repair Act directly threatens this model. If independent shops can access diagnostic data, they become competitive alternatives to dealerships. Customers would make repair decisions based on price and convenience, not data access. This would likely force dealerships to compete on price and service quality rather than relying on information asymmetry.

What the Repair Act Actually Requires

The Repair Act isn't vague legislation. It contains specific, detailed requirements for what manufacturers must do. Understanding these requirements is crucial to assessing what the bill would actually change.

First and most importantly, the bill mandates that manufacturers provide vehicle owners and independent repair facilities with access to telemetry. But this isn't unlimited access to every piece of data the car collects. The bill specifically defines "repair data" as "diagnostic information, telemetry, repair procedures, calibration, and software updates necessary for the diagnosis, servicing, or repair of a motor vehicle."

Notice the limiting language. This isn't about giving third parties access to customer tracking data or proprietary autonomous vehicle algorithms. It's specifically about the information needed to perform repairs. A technician shouldn't need access to your vehicle's GPS location history to replace your spark plugs. They shouldn't need access to passenger biometric sensors to reprogram your transmission.

Second, the bill requires manufacturers to provide this data at a "fair and reasonable cost." This prevents manufacturers from technically complying with the law while charging prohibitive fees that make independent repair uneconomical. The legislation doesn't specify what "fair and reasonable" means, which will likely become a battleground for future regulatory guidance.

Third, the bill requires manufacturers to use the same diagnostic procedures and information that they provide to their own dealerships. This prevents manufacturers from creating two tiers of diagnostics: a comprehensive tier for dealerships and a limited tier for everyone else. Whatever your dealership technician can see, an independent shop should be able to see too.

Fourth, the bill includes a safety provision allowing manufacturers to restrict access to information related to autonomous driving systems, vehicle security, and cybersecurity. These are legitimate exceptions. You don't want unauthorized individuals reprogramming your vehicle's autonomous systems or modifying security protocols that protect you from remote hacking.

Fifth, the bill preempts state laws on these issues. This is the controversial part that we'll explore more deeply, but essentially it means that if the Repair Act passes at the federal level, states can't create stronger repair rights. They can only enforce the federal standard.

The Repair Act could reduce independent repair costs by 40-60% compared to dealership services. Estimated data.

The Preemption Problem: A Poison Pill for Future Advocates

Here's where the Repair Act gets complicated even for its supporters. The legislation includes preemption language that, while buried in the bill, could have massive implications for future repair legislation.

Preemption in federal law means that when Congress passes a law regulating a particular area, states can't pass laws that conflict with it. This makes sense in some contexts. You don't want 50 different vehicle safety standards. But preemption in the Repair Act context is more problematic.

The reason is that the right-to-repair landscape is constantly evolving. Manufacturers develop new locking mechanisms. Technology changes. Repair challenges shift. If the Repair Act locks in specific federal standards with preemption, it becomes much harder to strengthen those standards later.

Consider a hypothetical scenario five years from now. Manufacturers have found a clever new way to lock diagnostic data behind proprietary security measures that technically comply with the Repair Act but functionally prevent independent repair. Advocates want to pass a stronger state law that closes this loophole. Under the Repair Act as currently written, they can't. The federal law preempts their effort.

Kyle Wiens, the CEO of iFixit (a major right-to-repair advocacy organization), has publicly called this preemption language a "poison pill." Wiens supports passing the Repair Act overall because he believes the immediate benefit of forcing manufacturers to share data outweighs the long-term risk. But he acknowledges that the lack of flexibility could be problematic.

"Right to repair is a kind of a cat-and-mouse game," Wiens has explained. "Manufacturers come up with new ways of locking things down, and then we have to wrangle enough public support and outcry to push back and stop them. And then they come up with something else. There needs to be some break on the power of these monopolies."

The preemption clause essentially removes that flexibility. Once the federal law is set, advocates would need to go back through Congress to update it, which is exponentially harder than updating a state law.

Repair advocates expected that the Repair Act would be amended during the legislative process to remove or weaken the preemption language. The bill has already gone through House subcommittee hearings, and preemption is likely to become a negotiation point as the legislation moves forward.

How Manufacturers Are Fighting Back

The automotive industry has mounted a sophisticated opposition campaign against the Repair Act. This isn't just dealership associations objecting; it's the entire manufacturing establishment, from General Motors to Toyota to foreign manufacturers.

Their core argument centers on three claims: intellectual property protection, cybersecurity, and consumer choice. Let's examine each.

The Intellectual Property Argument: Manufacturers claim that requiring them to share diagnostic data means surrendering proprietary information about how their vehicles work. They argue that this data represents years of research and development investment and that sharing it with competitors (like parts manufacturers) amounts to forced technology transfer.

This argument has some merit, but it's also overstated. Diagnostic data doesn't necessarily reveal how a vehicle's engine works or what proprietary algorithms control its performance. It's information about what happened, not necessarily information about how the system was designed. There's a meaningful difference between "your oxygen sensor is reading 0.85 volts" (diagnostic data) and "we achieve optimal combustion through this proprietary fuel injection algorithm" (proprietary information).

The Cybersecurity Argument: Manufacturers claim that opening up diagnostic access creates security vulnerabilities. If independent shops can access vehicle systems remotely, couldn't hackers do the same? What if someone uses the diagnostic protocols to reprogram your vehicle's safety-critical systems?

This concern is more substantial. Vehicle cybersecurity is genuinely important. A hacked car could have its brakes disabled or steering system compromised. However, the Repair Act includes specific carve-outs for autonomous systems and security-related information. It's not asking manufacturers to throw open every system indiscriminately.

The Consumer Choice Argument: Hilary Cain, Senior Vice President of Policy at the Alliance for Automotive Innovation (the industry trade group), testified that "vehicle owners should be able to get their vehicles fixed anywhere they want," and that "automakers already provide independent repairs with all the information, instruction, tools, and codes necessary to properly and safely fix a vehicle."

This is the most misleading claim. While it's technically true that manufacturers have some programs providing information to independent shops, these programs are voluntary, controlled by manufacturers, and incomplete. The burden is on independent shops to apply for access and meet manufacturer requirements. The Repair Act would make this access mandatory and standardized.

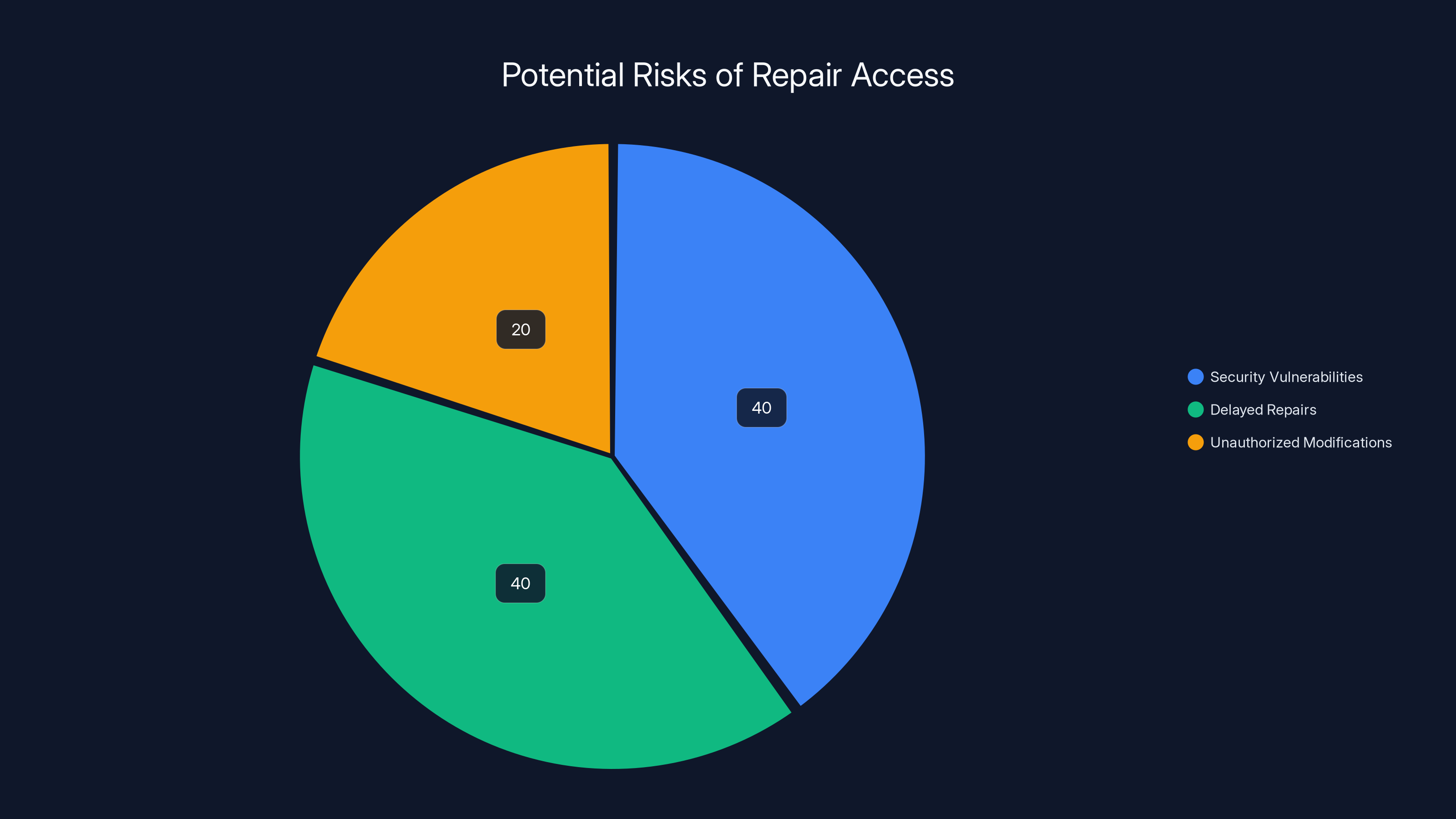

Estimated data shows that security vulnerabilities and delayed repairs are equally concerning at 40% each, while unauthorized modifications are less of a concern at 20%.

The Hearing: When Advocates Met Opposition Face-to-Face

On a Tuesday in early 2025, the US House Committee on Energy and Commerce held a subcommittee hearing specifically focused on motor vehicle repair legislation. The hearing was titled "Examining Legislative Options to Strengthen Motor Vehicle Safety, Ensure Consumer Choice and Affordability, and Cement US Automotive Leadership," which, despite its verbose framing, essentially came down to: should the government force manufacturers to let people repair their own cars?

The hearing brought together representatives from the industry, repair advocates, consumer groups, and manufacturers. It was contentious.

Nathan Proctor from PIRG (Public Interest Research Group) testified in favor of the Repair Act. Proctor explained that manufacturers use information asymmetry as a business strategy: "Automakers are trying to use the kind of marketing advantage of exclusive access to this data to push you to go to the dealership where they know what triggered this information. Repair would actually be quicker, cheaper, more convenient if this information was more widely distributed, but it's not."

Bill Hanvey, CEO of the Auto Care Association (which represents independent repair shops), provided perhaps the most cutting testimony. He described modern vehicles as "essentially computers on wheels that produce data that manufacturers then gate off to block consumers from accessing." Then he made a statement that captured the core issue: "Make no mistake about it, automakers unilaterally control the data, not the owner of the vehicle. It may be your car, but currently it is the manufacturer's data to do with whatever they choose."

Hanvey's testimony highlighted something important that often gets lost in technical discussions about repair access. Fundamentally, this is about ownership. If you own something, you should be able to understand and maintain it. The fact that modern cars have become so software-dependent shouldn't change that basic principle.

Justin Rzepka from the CAR Coalition (Car Access Rights Coalition) pushed back against manufacturer claims about intellectual property, explaining: "The Repair Act is specifically about repair, maintenance, calibration, and diagnostic information. That's all that the bill is asking for. This has nothing to do with proprietary software. This has nothing to do with intellectual property. This is about information that you generate as a car owner."

On the opposition side, manufacturers presented their arguments about security, IP protection, and the claim that they already provide adequate access. Interestingly, manufacturers couldn't point to comprehensive data about how many independent shops currently have adequate access, how much that access costs, or how quickly manufacturers respond to access requests.

What struck many observers about the hearing was how it revealed the fundamental positions on both sides. Manufacturers essentially argued: "We're providing access, it's working fine, and if you force us to share more data, it will break our business model and create security risks."

Repair advocates essentially argued: "Your business model is built on locking consumers out of repairs, and the data asymmetry is forcing people to pay unnecessarily high prices. The government should mandate that this stop."

There's something almost refreshing about how clearly both sides presented their actual stakes in the fight.

The Financial Impact: How Much Could the Repair Act Save Consumers?

One of the most compelling arguments for the Repair Act is economic. If the legislation succeeds in opening up competition for repairs, consumer costs could drop significantly.

The data here isn't perfectly clean because repair costs vary wildly by vehicle, location, and specific repair type. But industry research provides some useful benchmarks.

Independent repair shops typically charge 40-60% less than dealerships for the same work. Some specific examples illustrate this:

- Brake pad replacement: dealership 100-150

- Oil change and filter: dealership 25-40

- Battery replacement: dealership 100-150

- Diagnostic scan: dealership 50-75

For more complex repairs where diagnostic information becomes critical, the gap is often even larger. A transmission issue that a dealership might charge

The average car owner spends roughly

Of course, not every repair would shift to independent shops. Manufacturers would still perform warranty work. Some consumers prefer dealerships for peace of mind. But even if the Repair Act results in 10-15% of repair spending shifting from dealerships to independent shops, that's meaningful consumer savings.

The economic argument is powerful because it's concrete. This isn't about some abstract principle of "right to repair." It's about real money that real families could save on vehicle maintenance.

For manufacturers and dealerships, the economic calculation goes in the opposite direction. If repair spending shifts from dealerships to independent shops, manufacturer service revenue decreases. This doesn't just affect dealership profits; it affects the financial model that manufacturers use to plan their dealership networks.

Some economists have argued that this competitive pressure would actually benefit consumers overall by forcing dealerships to improve service quality and reduce prices. Others argue that the disruption to dealership networks could have broader economic impacts through job losses and reduced investment in service infrastructure.

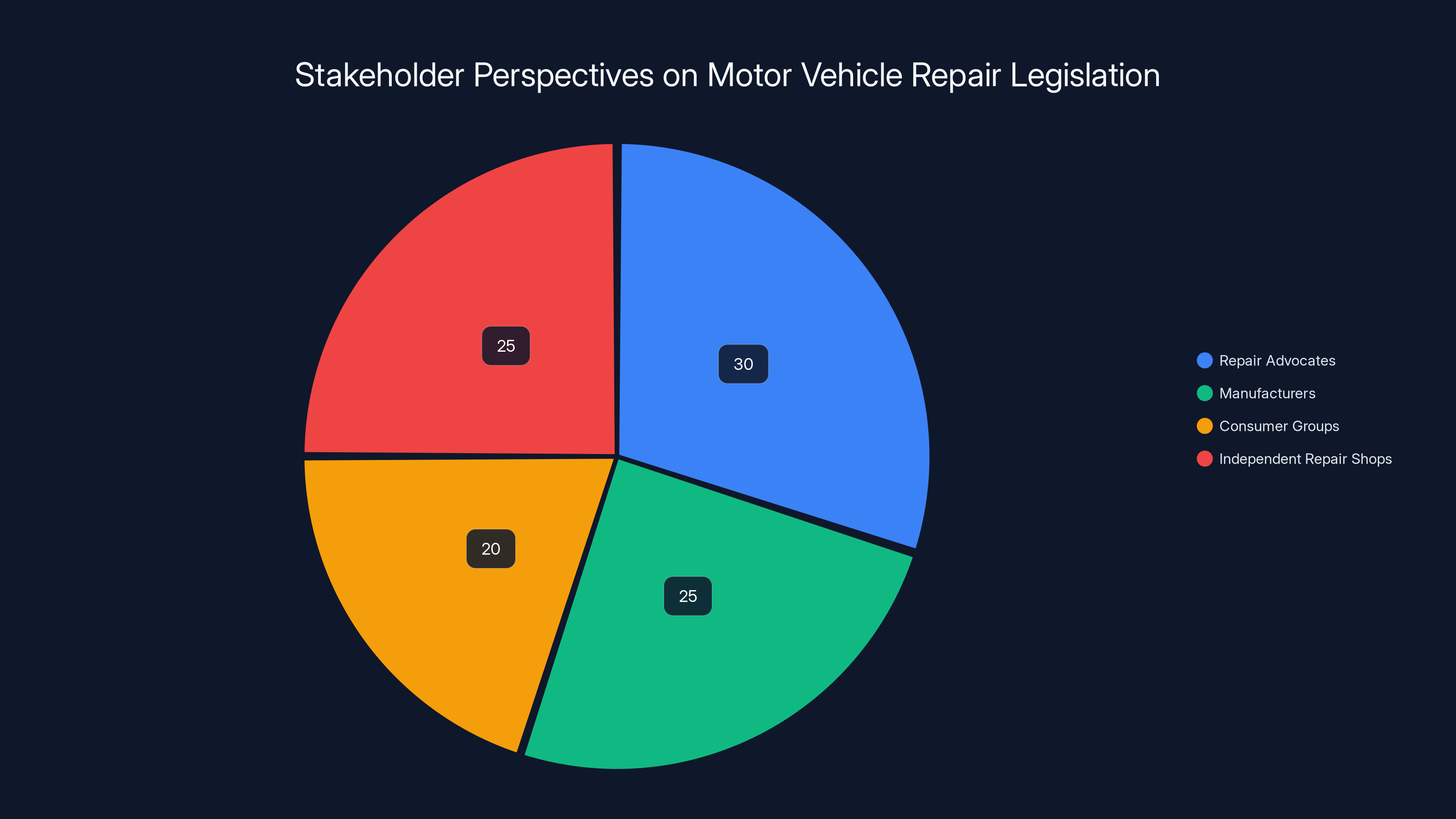

Estimated data shows a balanced distribution of perspectives, with repair advocates and independent repair shops strongly supporting the Repair Act, while manufacturers are more resistant.

The Safety Argument: Does Repair Access Create Risks?

Manufacturers consistently raise safety concerns about opening up diagnostic access. The argument goes: if independent shops and unauthorized individuals can access vehicle systems, safety could be compromised.

This concern deserves serious examination because it's not purely a negotiating tactic. Vehicle safety genuinely is important. A car with compromised brakes or failed safety systems becomes a danger.

However, the safety argument requires unpacking into two separate questions: first, would the Repair Act as written create actual safety risks? Second, should safety concerns prevent manufacturers from sharing diagnostic data?

On the first question, the Repair Act includes specific safety carve-outs. Autonomous driving systems, cybersecurity protocols, and safety-critical control systems would be exempted from the data-sharing requirement. A technician wouldn't get access to reprogram your vehicle's stability control or to modify autonomous system algorithms. They'd get access to the diagnostic information needed to understand what's wrong with existing systems, not to redesign those systems.

This distinction matters. Accessing diagnostic data ("your ABS system is reporting error code X") is different from accessing the ability to reprogram systems ("I'm going to rewrite your ABS algorithm"). The Repair Act is asking for the former, not the latter.

On the second question: should safety concerns prevent data sharing? This requires balancing two competing risks. There's the risk that opening up diagnostic access could create security vulnerabilities. But there's also the risk that forcing consumers to use dealership service (due to data access restrictions) creates safety risks through delayed repairs.

Consider a practical example. Your ABS warning light comes on. You want to fix it, but your independent repair shop can't access the diagnostic information. You can't afford the dealership's $150 diagnostic fee on top of repair costs, so you drive around for months with a compromised ABS system. That's a real safety risk.

Manufacturers haven't provided data demonstrating that opening up diagnostic access creates net safety increases. They've provided concerns about hypothetical scenarios. Meanwhile, repair advocates have documented real safety problems caused by delayed repairs due to access restrictions.

Global Perspective: How Other Countries Handle Right-to-Repair

The United States isn't the only country grappling with these issues. Other nations have already implemented repair legislation, providing useful lessons about what works and what doesn't.

The European Union has gone further than the proposed US Repair Act. EU regulations already require manufacturers to provide technical documentation and repair information to independent repair shops for certain categories of vehicles. These regulations specifically cover information necessary for repair and maintenance.

The Australian Competition and Consumer Commission released a comprehensive report recommending mandatory repair access similar to what the Repair Act proposes. Their findings were based on extensive stakeholder interviews and economic analysis.

Canada has also been exploring right-to-repair legislation, with consumer advocates pushing for standards similar to the EU model.

These international examples provide data about real-world implementation. The EU experience shows that mandatory repair access doesn't create the cybersecurity catastrophes that manufacturers predicted. Independent shops in Europe have access to diagnostic information, and vehicle hacking rates aren't higher in EU countries than in the US.

This international context matters because it demonstrates that the Repair Act isn't a radical experiment. It's bringing US law into alignment with standards that other developed democracies have already implemented successfully.

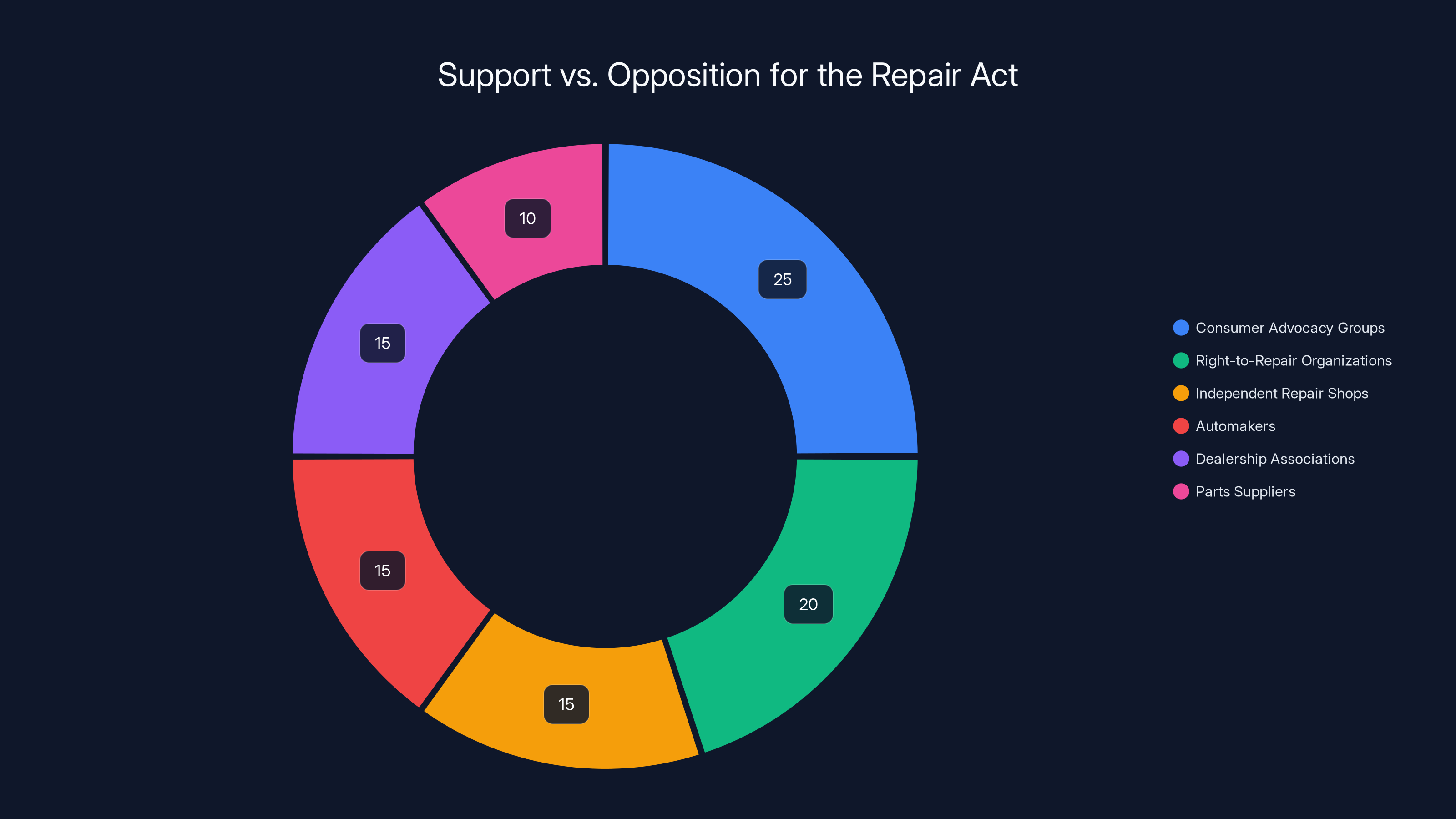

Estimated data shows consumer advocacy groups and right-to-repair organizations as major supporters, while automakers and dealership associations are key opponents. Estimated data.

The Political Landscape: Who's Pushing the Bill, Who's Opposing It

Understanding the political dynamics behind the Repair Act reveals why this legislation has become increasingly contentious despite enjoying broad consumer support.

Supporting the legislation: consumer advocacy groups (PIRG, Consumers Union), right-to-repair organizations (iFixit, Repair Association), independent repair shops (represented by Auto Care Association), vehicle parts suppliers, and small business organizations that benefit from competitive repair markets.

Opposing the legislation: automakers (domestic and foreign), dealership associations, and some parts suppliers who benefit from manufacturers' exclusive relationships.

Politically, the bill has bipartisan sponsorship, which is relatively unusual for tech-related legislation. Representatives Dunn (R-FL) and Gluesenkamp Perez (D-WA) have attracted co-sponsors from both parties.

Gluesenkamp Perez is particularly interesting because she comes from a conservative political background but represents a district with strong support for right-to-repair principles. She's been vocal about how repair access relates to consumer freedom and property rights, framing it in terms that resonate with conservative values.

The opposition is more concentrated but more powerful. Dealership associations have deep political relationships in every congressional district. Manufacturers employ hundreds of thousands of people. The lobbying resources arrayed against the Repair Act are substantial.

This creates an interesting political math. Consumer advocates have broad public support (polls consistently show 70%+ of Americans favor right-to-repair legislation). Repair shops have local political relationships in every district. But manufacturers have concentrated lobbying power and campaign contributions.

The bill is expected to go through multiple rounds of negotiations. Some provisions will likely change. The preemption language will probably become a major negotiation point. The specific definition of "repair data" might be refined.

Likely Outcomes and Timeline

The Repair Act was expected to proceed through the legislative process in 2025, but legislative timelines are notoriously unpredictable. Here's what typically happens:

First, the bill gets refined in committee based on feedback from stakeholders. This is where manufacturers' concerns might result in modifications. Maybe the definition of what data must be shared gets narrowed. Maybe safety carve-outs get expanded. Maybe the enforcement mechanisms get specified more clearly.

Second, the bill would go through full House committee markup. This is where amendments can be proposed and voted on. The preemption language is likely to face amendment attempts here.

Third, the bill would go to a House floor vote. Given bipartisan sponsorship and broad public support, passage seems likely, though the margin might depend on how much the bill got modified in earlier stages.

Fourth, the bill would need to go through the Senate, which typically means it starts fresh in Senate committee. The Senate process might result in further modifications.

Fifth, if the House and Senate pass different versions, they need to be reconciled in conference committee.

Finally, if a final bill emerges and passes both chambers, it goes to the President for signature. The administration's position on repair legislation will matter here.

Historically, right-to-repair bills have struggled to advance at the federal level despite passing or coming close in several states. This current iteration has better momentum due to broader consumer awareness of repair issues and more sophisticated legislative drafting.

Realistic outcomes probably look like: the Repair Act passes in some form, but perhaps with modifications that narrow its scope or specify implementation details more precisely. Alternatively, if the bill stalls in Congress, individual states might pass stronger repair legislation, which would create a patchwork of state-level requirements that manufacturers would need to comply with.

The Bigger Picture: Right-to-Repair Beyond Cars

While this article focuses on vehicles, the right-to-repair movement extends far beyond cars. It includes phones, computers, agricultural equipment, medical devices, and consumer electronics.

Apple has been particularly contentious in right-to-repair debates. The company restricts access to replacement parts for iPhones, MacBooks, and other devices. When you need a repair, you either go to Apple or to unofficial repair shops that might void your warranty.

John Deere has created massive problems for farmers by restricting repair access on agricultural equipment. Farmers can't fix their own tractors; they have to use authorized John Deere service centers. This has created bizarre situations where farmers are exploring circumventing manufacturer restrictions just to fix equipment they own.

Medical device manufacturers have been criticized for preventing hospitals from servicing equipment, creating dependency on expensive service contracts.

Consumer electronics manufacturers have followed similar patterns. They make devices increasingly difficult to repair, restrict parts availability, and lock consumers into manufacturer-approved repair channels.

The Repair Act is specifically about vehicles, but its success could inspire similar legislation for other product categories. Conversely, if manufacturers successfully defeat the Repair Act through lobbying, it might embolden manufacturers in other industries to resist repair legislation.

So the stakes in the Repair Act fight extend beyond automotive repair. This is about establishing a principle: manufacturers can't use artificial digital restrictions to prevent consumers from maintaining products they own.

What You Should Do Now

If you care about repair access, several actions could influence the outcome:

Support repair advocacy organizations. Groups like iFixit, the Repair Association, and PIRG are actively lobbying for right-to-repair legislation. Contributing to these organizations amplifies their voice in the political process.

Contact your representatives. Tell your House member and Senators that you support right-to-repair legislation. Legislative offices track constituent communications and count them in their voting decisions.

Consider independent repair shops. When you need vehicle service, getting quotes from independent shops demonstrates the economic demand for competitive repair access. This creates real business incentives for supporting right-to-repair legislation.

Follow legislative progress. Legislative websites publish bill text, hearing transcripts, and voting records. Following this process keeps you informed about where the Repair Act stands.

Engage in discussions. Share information about right-to-repair issues with friends, family, and colleagues. Public opinion matters, and if manufacturers sense that consumers prioritize repair access, it influences their political calculations.

FAQ

What is the Repair Act and what does it require?

The Repair Act is federal legislation introduced in 2025 by Representatives Neal Dunn and Marie Gluesenkamp Perez that would mandate manufacturers provide vehicle owners and independent repair shops with access to vehicle telemetry, diagnostic information, and repair procedures. The law would specifically require manufacturers to share the same repair information with independent shops that they provide to their own dealerships, at fair and reasonable costs.

How would the Repair Act change the cost of vehicle repairs?

Repair advocates estimate that mandatory repair access could reduce vehicle repair costs by 40-60% for independent repairs compared to dealership services. If consumers shifted even 10-15% of repair spending from dealerships to independent shops, this could save consumers approximately $1 billion annually across the US vehicle fleet. Lower diagnostic fees and competitive pricing would be the primary drivers of savings.

Why do manufacturers oppose the Repair Act?

Manufacturers oppose the legislation based on three main arguments: intellectual property concerns about sharing proprietary vehicle information, cybersecurity risks from opening up diagnostic access, and business model impacts from losing service revenue. Dealerships particularly oppose the bill because their profit margins depend on repair work, and competition from independent shops could reduce their service revenue by an estimated 15-30%.

What is the preemption clause and why do advocates worry about it?

The preemption clause prevents states from passing repair legislation stronger than the federal Repair Act. This concerns advocates because they argue right-to-repair is an evolving fight where manufacturers constantly develop new locking mechanisms. Preemption locks the current standard in place federally, making it harder to strengthen requirements when manufacturers find new ways to restrict access. Several right-to-repair advocates, including iFixit CEO Kyle Wiens, have called this language a "poison pill" that should be removed.

Does the Repair Act include carve-outs for safety-critical systems?

Yes. The Repair Act specifically exempts autonomous driving systems, vehicle cybersecurity protocols, and safety-critical control systems from mandatory data sharing. The legislation focuses on diagnostic and repair information needed for maintenance and repairs, not access to reprogram safety systems. This balances consumer repair rights with legitimate manufacturer concerns about vehicle security.

How does the Repair Act compare to right-to-repair legislation in other countries?

The Repair Act is broadly similar to repair access regulations already implemented in the European Union, which require manufacturers to provide technical documentation and repair information to independent shops. Australia and Canada have also recommended similar requirements. European data shows that mandatory repair access hasn't created the cybersecurity problems manufacturers predicted, and independent shops in EU countries have access to diagnostic information without safety catastrophes.

What's the timeline for the Repair Act becoming law?

The bill was expected to proceed through congressional committees in 2025 with potential House and Senate votes later in the year. However, legislative timelines are unpredictable. The bill will likely be modified through committee hearings and amendments, particularly regarding the preemption language. Realistic outcomes include the bill passing in modified form, stalling in Congress, or sparking alternative state-level legislation.

How would manufacturers comply with the Repair Act's requirements?

Manufacturers would need to establish standardized procedures for providing diagnostic data, repair procedures, and calibration information to vehicle owners and independent repair shops. They would likely create digital platforms or APIs for accessing this information, similar to systems that some manufacturers already use for dealerships. Implementation would require manufacturers to change their current data governance practices but wouldn't necessarily require wholesale system redesigns.

Could the Repair Act impact vehicle cybersecurity?

Right-to-repair advocates argue that opening up diagnostic access wouldn't significantly impact cybersecurity because the bill specifically exempts security-critical systems and autonomous driving systems. Manufacturers argue that diagnostic access could create vulnerabilities, though they haven't provided data supporting this claim. International experience from the EU suggests that diagnostic access alone doesn't create measurable cybersecurity degradation when properly implemented with appropriate access controls.

How would the Repair Act affect vehicle warranties?

The Repair Act itself doesn't explicitly address warranty provisions, which could become a contentious issue during implementation. Manufacturers currently use warranty restrictions to discourage independent repairs. The legislation might require clarification about whether using independent repair shops voids warranties, particularly for repairs using non-OEM parts. This issue will likely be addressed through regulatory guidance after the bill passes.

What happens if the Repair Act passes but manufacturers don't fully comply?

The legislation would likely include enforcement mechanisms, though the current bill doesn't specify these in detail. Enforcement could occur through the FTC, state attorneys general, or potentially through private lawsuits by consumers or repair shops. Similar legislation in the EU has enforcement procedures involving manufacturer notifications and potential penalties. The specific enforcement mechanisms will probably be clarified through regulatory guidance after the bill passes.

The Future of Vehicle Ownership

The Repair Act represents a pivotal moment in how we think about product ownership in the digital age. Vehicles have become so intertwined with software and data that traditional concepts of ownership have become strained.

When you buy a car, what exactly are you buying? Legally, you own the physical vehicle. But increasingly, you don't own the software running the vehicle. You don't control the data the vehicle generates. You can't access the diagnostic information about your own machine without manufacturer permission.

This tension between legal ownership and practical control defines the modern right-to-repair debate. The Repair Act is an attempt to realign practical control with legal ownership, ensuring that the people who own vehicles can actually maintain them.

The outcome of this legislative fight will send signals far beyond automotive repair. If manufacturers successfully defeat the Repair Act through lobbying and political pressure, it demonstrates that they can maintain control over repair access despite consumer demand for change. If the Repair Act passes, it establishes that consumers' right to repair products they own takes precedence over manufacturers' desire to control repair channels.

This principle will likely spread to other industries. If vehicle owners gain repair access through legislation, consumers in other sectors will demand similar access for phones, computers, farm equipment, and medical devices. Manufacturers across industries are watching this fight carefully.

The political fight over the Repair Act isn't ultimately about vehicles at all. It's about the fundamental question of what ownership means when products are controlled by software. That's a question that will define technology policy for decades to come.

Key Takeaways

- The Repair Act mandates manufacturers share vehicle diagnostic data with owners and independent repair shops, breaking manufacturer monopolies on repair information

- Independent repairs could save consumers 40-60% compared to dealerships, potentially saving $1-4 billion annually if competitive repair access increases

- Manufacturers oppose the legislation citing intellectual property protection and cybersecurity concerns, though international experience shows these risks can be managed

- The preemption clause preventing states from passing stronger repair laws troubles advocates who worry about future flexibility as technology evolves

- Bipartisan congressional sponsors support the legislation, which faces opposition from dealership networks and manufacturer lobbying despite 80%+ public support for right-to-repair principles

![Right-to-Repair Battle: How the Repair Act Could Change Car Ownership [2025]](https://tryrunable.com/blog/right-to-repair-battle-how-the-repair-act-could-change-car-o/image-1-1768349212081.jpg)