Apple's Severance Acquisition: A Watershed Moment in Streaming Strategy

Back in 2022, hardly anyone predicted that a show about corporate workers having their memories surgically divided would become one of the most talked-about series on television. Yet Severance, the psychological thriller created by Dan Epler for Apple TV+, did exactly that. It captivated audiences with its haunting premise, stellar cast, and the kind of unsettling atmosphere that makes you question corporate culture itself.

Then, in early 2025, Apple announced something that shocked the entertainment industry: it had acquired all intellectual property rights and full production control of Severance from its original studio, Fifth Season, in a deal valued at just under $70 million. This wasn't just another acquisition. It was a pivotal moment that signaled Apple's willingness to invest heavily in its own content ecosystem, and it raised important questions about the future of streaming production, the economics of prestige television, and how tech companies are reshaping Hollywood.

The deal itself is elegant in its simplicity. Apple now owns everything—the show, its characters, its universe, all future seasons, potential spin-offs, prequels, and even international versions. Fifth Season remains as an executive producer, maintaining creative involvement while stepping back from the financial and operational burden. It's the kind of arrangement that benefits both parties: Apple gets full control over one of its biggest assets, and Fifth Season gets the backing it desperately needed to continue producing a series that had become increasingly expensive.

But here's where it gets interesting. This deal isn't happening in isolation. It reflects a larger strategic pivot across the entire streaming industry, one that's been building for years. Apple, Amazon, Netflix, and Disney have all begun to recognize that the economics of prestige television have fundamentally changed. Production costs are skyrocketing. Talent demands are increasing. Competition for eyeballs is fiercer than ever. In response, the streaming giants are making a calculated bet: vertical integration. Control your content from start to finish, and you control your destiny.

The Severance acquisition is Apple's most aggressive move yet in this direction. And understanding why this deal happened, what it means for Apple's streaming ambitions, and how it might reshape the entire entertainment landscape is critical for anyone paying attention to the future of media.

TL; DR

- Apple paid under $70 million for full IP rights and production control of Severance, taking over from Fifth Season

- The show is expected to run for four seasons with potential spin-offs, prequels, and international adaptations in development

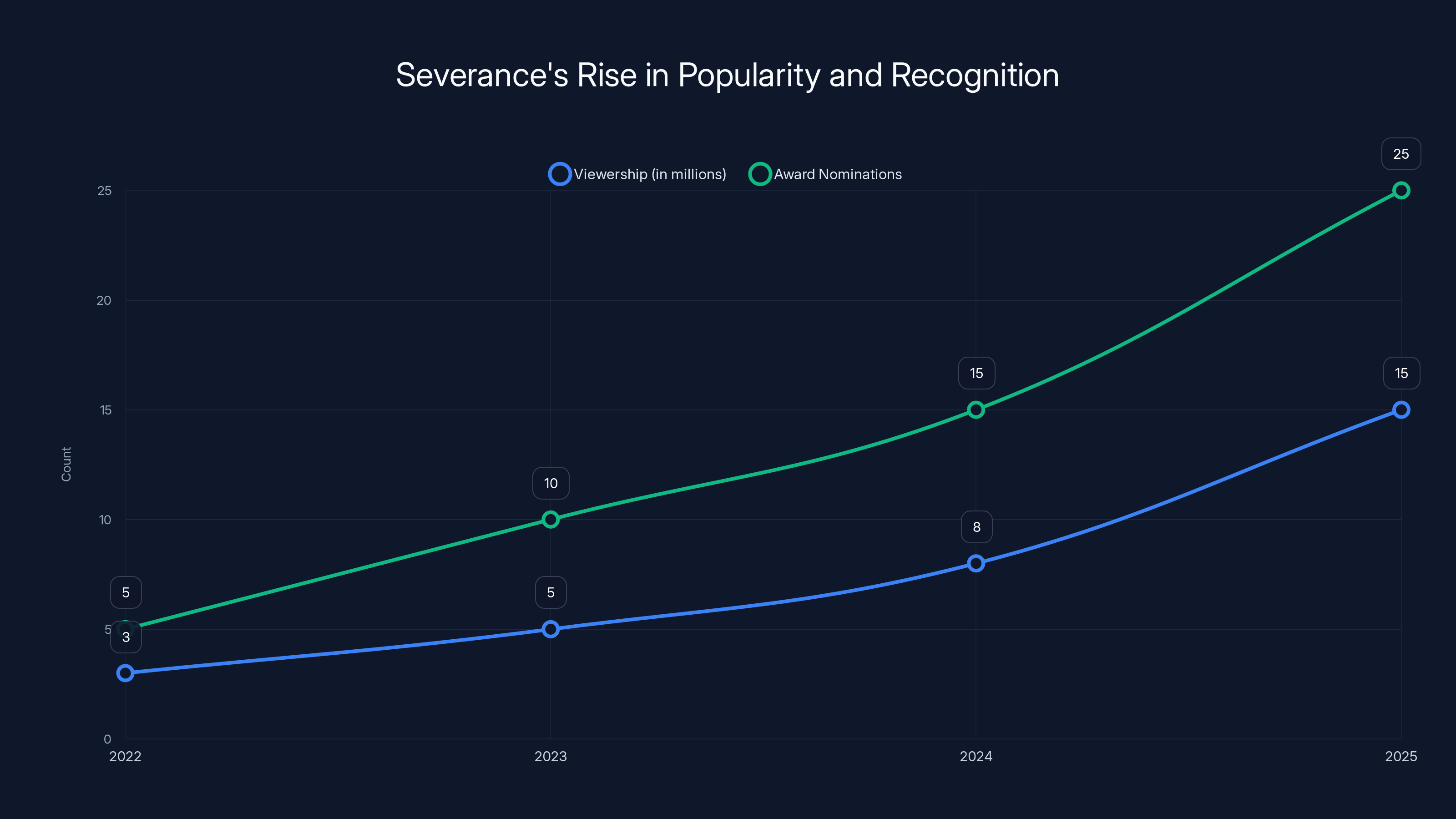

- Severance Season 2 was Apple's most-watched series and received the highest Emmy nominations of 2025, signaling massive audience engagement

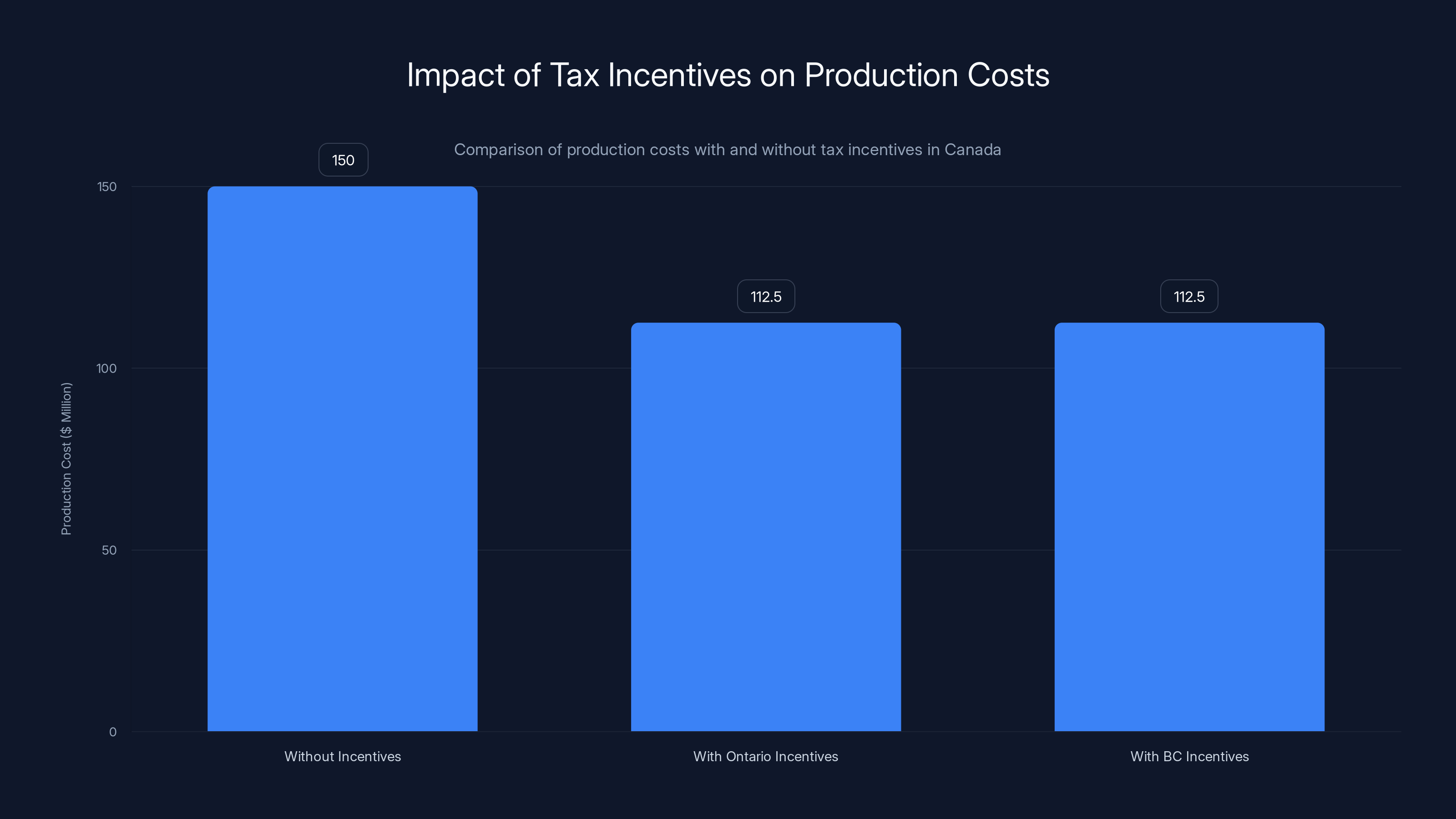

- Production costs exceeded Fifth Season's capacity, forcing the studio to consider relocating to Canada for tax incentives before Apple stepped in

- This deal mirrors Apple's strategy with Silo, reflecting a broader trend of streaming services acquiring full control over prestige content to maximize returns

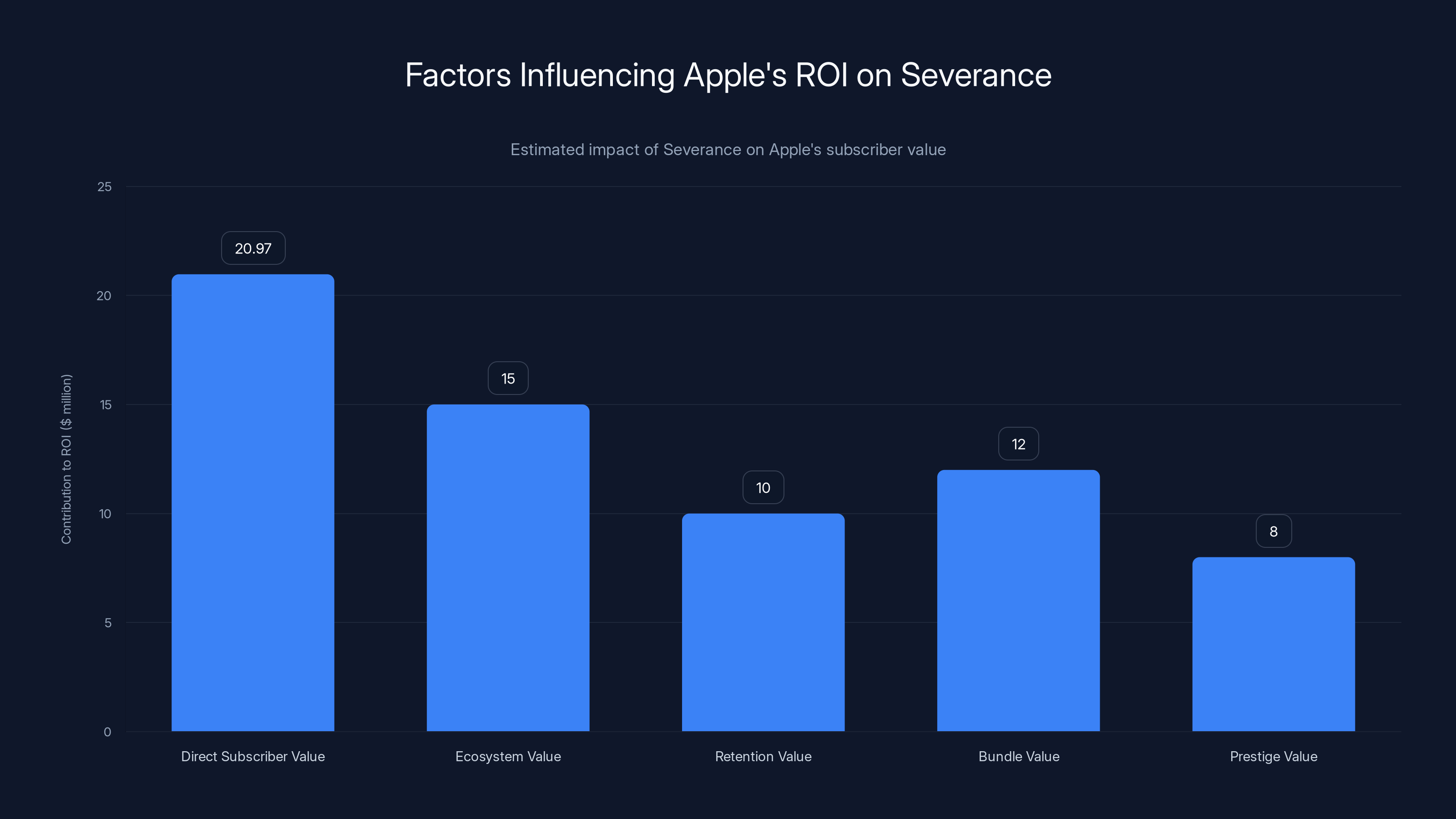

While direct subscriber value from Severance is estimated at

The Economics of Prestige Television: Why Severance Became Too Expensive

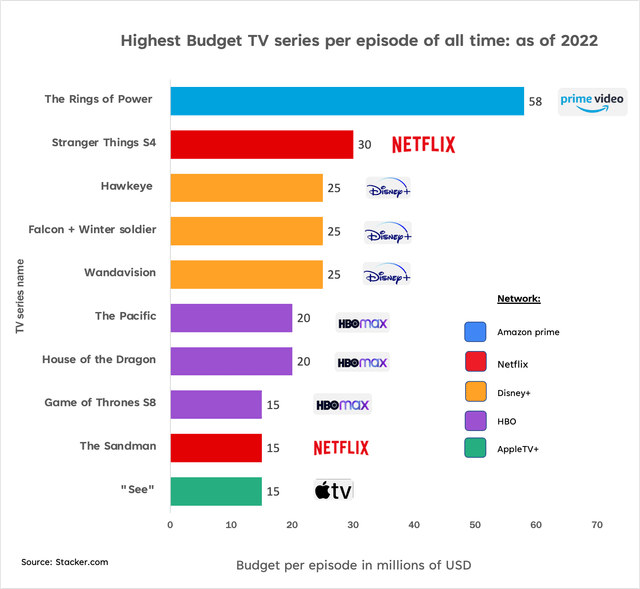

Producing a show like Severance isn't cheap. The series demands meticulous cinematography, complex narrative structures, high-end visual effects, and A-list talent. Season one cost approximately $15 million per episode to produce—a figure that's actually moderate for premium television, but still substantial when you're spreading it across ten episodes annually.

But here's what's critical to understand: production costs don't stay static. They increase every year. Talent becomes more expensive as the show's success attracts bigger names. Crew demands higher wages. Sets need to be maintained. Visual effects become more sophisticated. Locations need expanded security. What started as an ambitious but manageable budget slowly becomes a financial anchor.

By the time Season 2 rolled around, Fifth Season was facing a genuine dilemma. The studio couldn't absorb the escalating costs on its own. It had already approached Apple multiple times requesting financial advances to keep production moving forward. Even worse, the economics of New York-based production were becoming untenable. The studio was actively evaluating relocating the entire operation to Canada, where provincial and federal tax incentives could shave millions off the budget.

Let's think about what that would mean in practical terms. Severance has a specific identity tied to its New York setting. The austere corporate headquarters, the underground tunnels, the urban aesthetic—it's all woven into the show's DNA. Moving production to Canada would have required significant adaptation of locations, potentially damaging the show's distinctive visual signature.

This is where we see the real conflict. Fifth Season faced an impossible choice: either move production and risk damaging creative quality, or continue in New York and watch the budget spiral. There was no middle ground. The studio had built something culturally significant and commercially valuable, but it had outgrown the financial capacity of a traditional production company to sustain it.

Apple recognized this situation for what it was: an opportunity. The company has essentially unlimited capital. It can absorb cost overruns without blinking. More importantly, Apple views Severance not as a standalone series but as part of a broader content strategy to drive Apple TV+ subscriptions. Every dollar spent on Severance isn't just an investment in one show—it's an investment in the entire ecosystem.

That's fundamentally different from how a traditional studio like Fifth Season has to think about costs. A studio needs to produce multiple shows and spread risks across a portfolio. Apple can afford to go all-in on individual flagship titles if the strategic rationale makes sense.

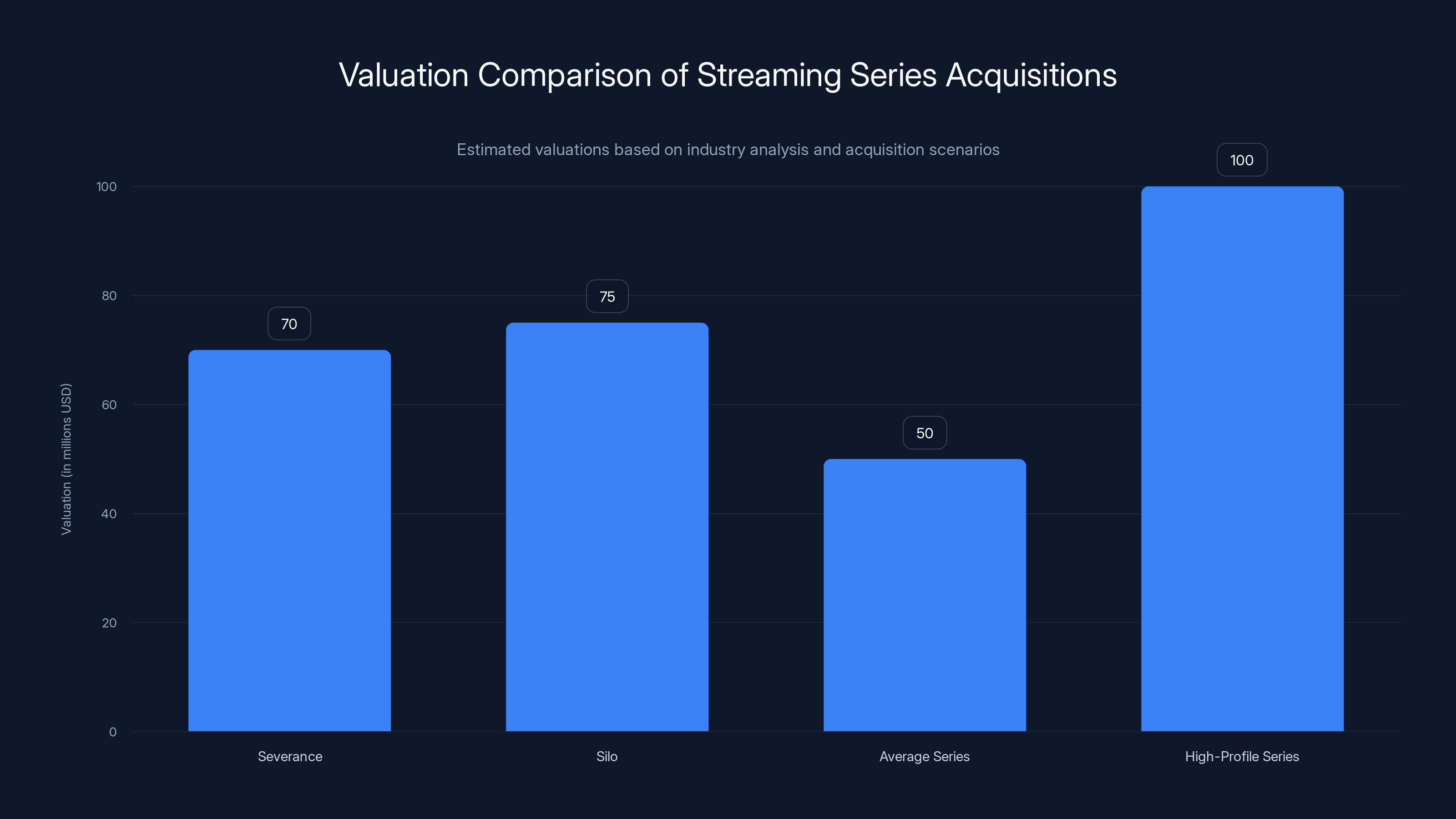

Severance's $70 million valuation is modest compared to high-profile series but higher than average acquisitions. Estimated data based on industry trends.

Understanding the $70 Million Valuation

On the surface, $70 million sounds like a lot of money. For most industries, it would be genuinely transformative capital. But in the context of streaming and entertainment M&A, it's actually quite modest.

To understand why, we need to think about what Apple is actually acquiring. It's not buying a completed asset with guaranteed returns. It's buying a franchise with uncertain future earning potential. The show has proven it can attract audiences—Season 2 was Apple's most-watched series at the time of its release. It has critical prestige—the series received a record number of Emmy nominations in 2025. But there's no guarantee that future seasons will perform at the same level, that spin-offs will succeed, or that international versions will drive subscriber growth.

So how do you value an asset like that? You work backward from the expected lifetime value of the show. Analysts would estimate how many subscribers Severance might drive over its complete run (assumed to be four seasons based on industry reporting), how much those subscribers are worth to Apple, and what the company's expected return on investment would be. You also factor in the prestige factor—a show like Severance enhances Apple's brand perception as a platform that produces serious, award-winning content.

The

Comparatively, when Apple acquired the rights to another prestige series, Silo, after its first season aired on Amazon, it likely paid a similar or higher price. Silo had proven less audience traction than Severance but still offered significant strategic value. The Severance deal appears to be in the right ballpark for a prestige show with demonstrated audience appeal.

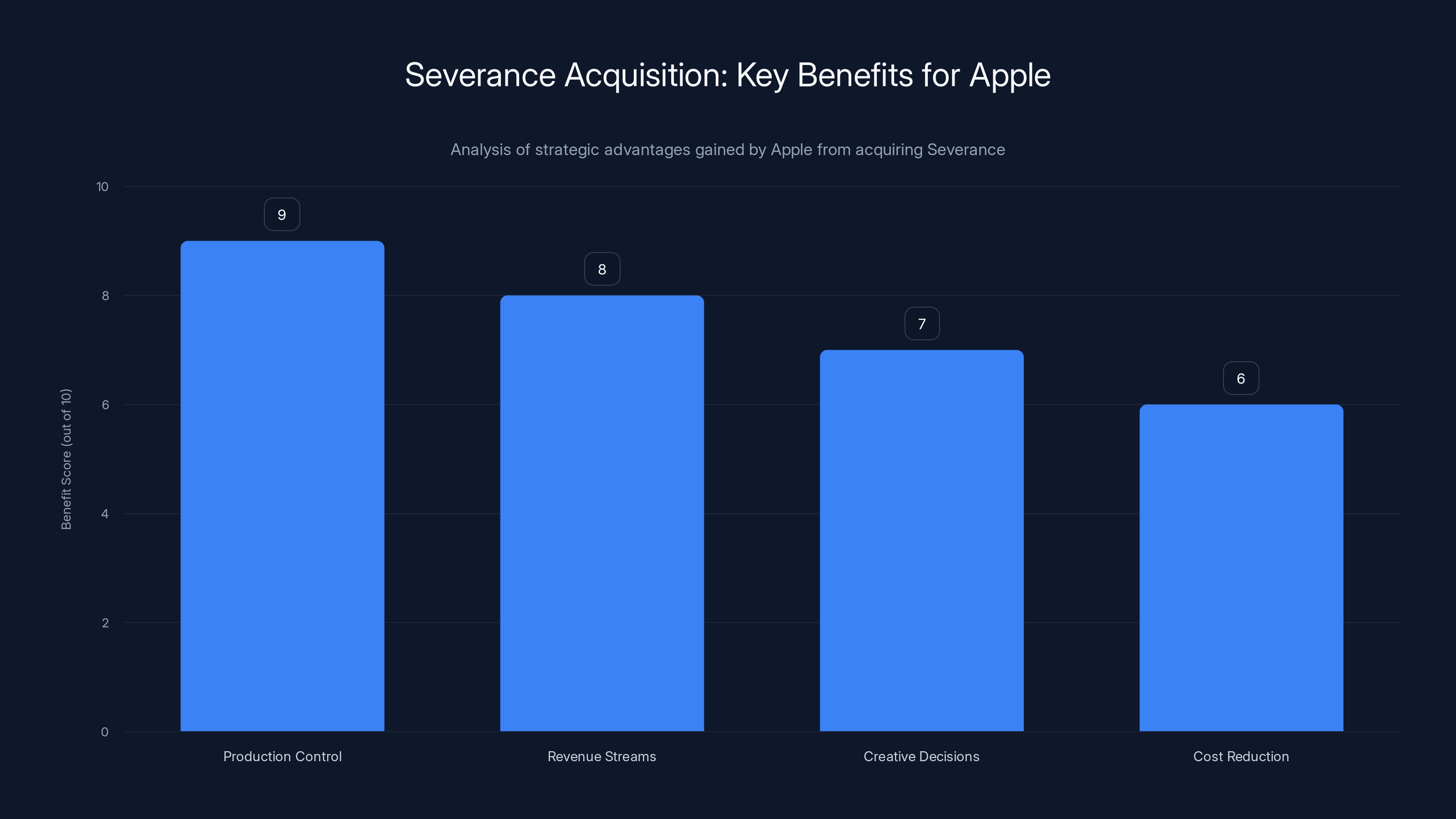

Why Apple's In-House Production Model Makes Strategic Sense

Apple's decision to bring Severance production in-house represents a deliberate strategic choice, not a temporary solution. The company has been building internal production capabilities for years, and this deal represents the culmination of that investment strategy.

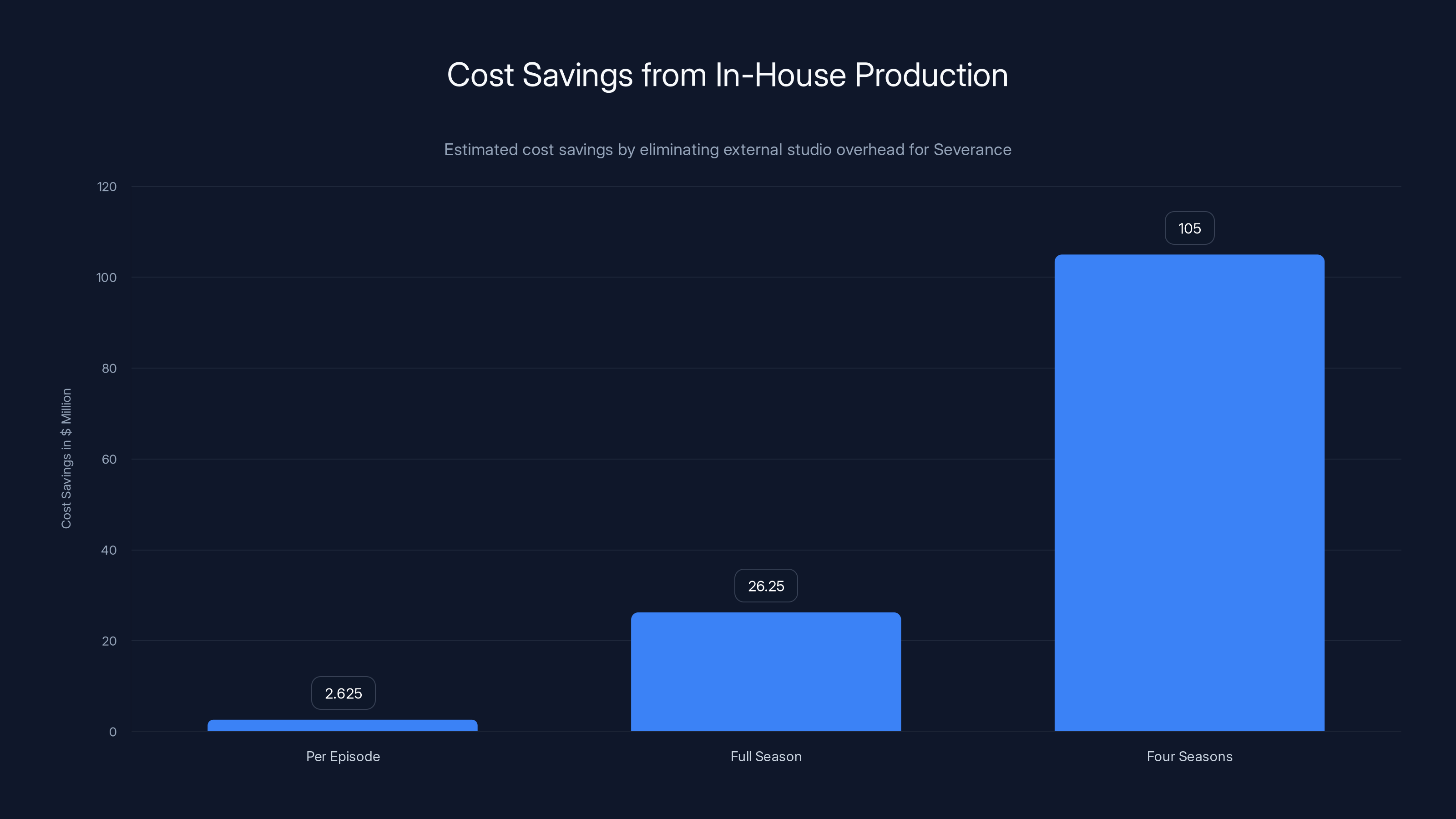

Here's the fundamental advantage of in-house production: margin control. When Apple produces a show through an external studio like Fifth Season, the company essentially rents the production infrastructure. The studio takes a percentage of the budget as overhead and profit. Apple covers all costs and keeps all the revenue generated by the show (subscriber value, licensing deals, merchandising). But the math still works out better if Apple can eliminate the middleman.

By bringing production in-house, Apple can:

- Reduce overhead costs by leveraging existing infrastructure and personnel across multiple projects

- Maintain tighter creative control to ensure alignment with Apple's broader content strategy

- Capture all production value without sharing margins with external studios

- Accelerate decision-making by eliminating layers of studio approval and negotiation

- Scale efficiently by building production capacity that serves multiple shows

Let's think about this in concrete numbers. If Severance costs

Over the expected four-season run of Severance, that's potentially

But there's another dimension to this strategy that's even more important: control. By owning Severance outright, Apple controls the entire creative and commercial future of the property. The company can decide to extend the show beyond four seasons if it remains popular. It can greenlight spin-offs whenever it wants. It can license the show to international platforms if that makes strategic sense. It can create merchandise, video games, or other ancillary products. It can position Severance as the anchor for an entire fictional universe.

This is fundamentally different from the traditional studio model, where rights and creative control are fragmented across multiple parties. Each decision requires negotiation, compromise, and revenue sharing. Apple's acquisition eliminates all of that friction.

Apple's acquisition of Severance provides significant strategic benefits, particularly in production control and revenue stream management. Estimated data.

The Severance Phenomenon: Why This Show Matters

To truly understand why Apple was willing to pay $70 million for Severance, you need to understand what makes the show culturally significant in the first place.

Severance premiered on Apple TV+ in February 2022 to modest fanfare. It wasn't a guaranteed hit. The premise alone—a science fiction show about corporate workers who undergo a procedure to separate their work memories from their personal memories—was high-concept and potentially polarizing. It required viewers to engage with genuinely unsettling psychological themes while also following a complex mystery narrative.

But the show found its audience. Quickly. Critics praised it. Awards shows recognized it. Most importantly, viewers couldn't stop talking about it. The show tapped into something deeply resonant about contemporary work culture—the feeling of compartmentalization, the tension between professional identity and personal self, the dehumanizing aspects of corporate life.

By the time Season 2 arrived in 2025, Severance had become Apple's most-watched series at the time of its release. Not just most-watched among prestige dramas. Most-watched series period. That's a remarkable achievement, especially considering Apple's catalog includes shows with massive built-in fanbases and broader appeal.

The 2025 Emmy Awards further demonstrated the show's cultural footprint. Severance received the highest number of nominations of any series that year. We're talking about a show that earned recognition in acting categories, directing categories, writing categories, cinematography, production design, and more. That level of critical recognition signals that Severance has transcended the typical prestige TV bubble and become something more durable in the cultural conversation.

From Apple's perspective, this is exactly the type of show you want to own outright. Severance isn't just driving subscriptions today—it's establishing Apple as a platform for serious, ambitious, award-winning dramatic content. That positioning matters immensely in the competitive streaming landscape. It differentiates Apple TV+ from competitors and gives the platform a claim to cultural relevance beyond just having the most entertainment options.

Here's the thing that's easy to overlook: cultural impact has real commercial value. Severance makes Apple TV+ more prestigious. It makes the platform a destination for people who care about quality dramatic television. That prestige is worth real money when you're competing for subscriber attention in a crowded market.

The Four-Season Plan and the Art of Long-Form Storytelling

According to industry reporting, Apple and the creative team behind Severance are planning for the show to run for four seasons total. That's actually a significant statement about the future of the series and how Apple intends to manage it.

Four seasons is a sweet spot in modern television. It's long enough to develop complex characters and storylines in genuine depth. It's short enough that the show can maintain quality and audience engagement without overstaying its welcome. Think about the most celebrated prestige dramas of the last fifteen years—Breaking Bad (five seasons), The Sopranos (six seasons), Game of Thrones (eight seasons, though the final seasons proved controversial). Most of the shows we remember most fondly ran between four and six seasons.

Four seasons of Severance would give the creative team room to answer the fundamental mystery of the show—what exactly is the severance procedure and why does Lumon Industries' leadership believe it's necessary? It would allow for character development arcs that feel earned and complete. It would give the show time to explore the philosophical and ethical implications of its core premise without feeling rushed or leaving the audience frustrated.

From Apple's perspective, four seasons is also a manageable production timeline. The company is committing to approximately six to eight years of active production, which aligns with typical franchise planning. It's long enough to establish Severance as a cornerstone property of Apple TV+ but short enough that the company can plan for what comes next.

What's particularly interesting is the flexibility built into that four-season plan. Industry reports indicate that spin-offs, prequels, and even international versions are under consideration. This suggests that Apple and the creative team see Severance not as a standalone show but as the foundation for a larger fictional universe.

Imagine a Severance universe where you get:

- The main series exploring the core mystery across four seasons

- A prequel diving into how Lumon Industries developed the severance technology and why Mark Scout's predecessor disappeared

- Spin-off series focused on different departments within Lumon or other companies using severance technology

- International versions adapted for different countries with local casting and cultural context

That's potentially five to ten years of content development across multiple series. It's a long-term bet on a property that Apple clearly believes in strategically.

Tax incentives in Canada can reduce production costs by up to 25%, making high-budget projects more financially viable. Estimated data based on typical tax credit percentages.

The Emmy Recognition and Cultural Validation

The 2025 Emmy Awards proved something crucial: Severance had transcended the world of niche prestige television. The show's record-breaking nomination count wasn't just about the quality of individual episodes or performances. It was validation that Severance had earned a place in the broader cultural conversation about television excellence.

Emmys matter in ways that might not be immediately obvious to casual viewers. They drive: Advertising Situation, buzz, attracting A-list talent to future projects. They influence how critics and journalists cover a platform. They signal to international broadcasters and licensing partners that a show is premium content worth paying for. They give marketing departments ammunition to promote the platform to potential subscribers.

When Severance dominated the 2025 Emmy nominations, it did something specific for Apple: it positioned Apple TV+ as a platform that could compete with HBO, prestige cable networks, and other premium broadcasters for the industry's most respected awards. That's a huge deal. It means Apple isn't just another streaming service throwing money at content—it's a platform producing work that meets the highest standards of television craft.

From a subscriber acquisition perspective, that matters tremendously. Plenty of people who might not otherwise care about Emmy nominations will see that Severance is critically acclaimed and consider subscribing to Apple TV+ to watch it. Emmy prestige drives brand perception, which drives subscriber growth.

It's also worth noting that the Emmy recognition arrived after Season 2, which aired in 2025. The timing is crucial. Apple already owned the rights to future seasons by the time the Emmy nominations were announced. So Apple got all the benefit of the prestige without having to negotiate with Fifth Season about how to leverage the awards for marketing purposes. That's another advantage of full IP ownership—complete control over how the show is positioned in the market.

The Silo Precedent: Understanding Apple's Playbook

Apple's acquisition of Severance didn't happen in a vacuum. The company had already executed a similar strategy with another prestige science fiction series: Silo.

Silo originally premiered on Amazon Prime Video, developed by Hugh Howey's bestselling novels. The show was well-received critically but didn't set the streaming world on fire in terms of viewership. When Amazon decided not to continue the series, Apple stepped in and acquired the rights after Season one aired. The company brought the show in-house and committed to multiple additional seasons.

That playbook—acquire a prestige show from another streaming service or studio, bring it in-house, commit to a multi-season run—is now clearly Apple's go-to strategy for building out its content library. It's actually quite clever.

Here's why the Silo model works:

-

Reduced development risk: The show has already proven itself with at least one season of production and audience reception. Apple isn't betting on untested creators or concepts.

-

Proven audience: Even if the show didn't set viewership records elsewhere, it has demonstrated appeal to at least a segment of viewers. Apple knows there's an audience to build from.

-

Cost leverage: By moving a show to its own in-house production infrastructure, Apple can often reduce per-episode costs while maintaining or improving quality.

-

Full IP control: Unlike deals where Apple co-produces with external studios, acquisition gives Apple complete ownership and control.

-

Prestige and differentiation: Acquiring shows that other platforms passed on or couldn't afford allows Apple to create a distinctive content library that includes both mainstream hits and prestige dramas.

The fact that Apple executed this strategy twice (Silo and now Severance) suggests it's not a one-off tactic but a core part of Apple TV+ content strategy. Expect to see Apple actively acquiring rights to prestige shows from other platforms and studios in the coming years.

By producing 'Severance' in-house, Apple can save approximately

Tax Incentives and the Geography of Production

One detail from the Severance acquisition story deserves deeper examination: Fifth Season's consideration of relocating production to Canada. That decision point reveals something important about how modern television economics work.

Canada, particularly Ontario and British Columbia, offer some of the most aggressive tax incentive packages in North America for film and television production. These include direct tax credits (typically 20-40% of qualified production spending), sales tax rebates, and in some cases, funding from provincial film agencies.

To understand the magnitude of these incentives, imagine Severance costs

But here's where the creative tradeoffs come in. Severance's New York setting isn't incidental. It's integral to the show's identity. The austere Lumon headquarters, the Manhattan streets, the urban environment—it's all woven into the visual language and storytelling. Moving production to Canada would have required significant location changes or extensive studio sets, both of which would alter the show's aesthetic and potentially compromise its distinctive look.

Fifth Season faced a genuine dilemma: save money by relocating, or maintain creative integrity by staying in New York. That's the kind of impossible choice that often signals a production is in trouble. Either path forward involves real costs—relocation cost in lost creative quality, staying cost in financial strain.

Apple's acquisition solved the dilemma by making the financial burden irrelevant. Apple can afford to keep Severance in New York because the company's cost structure is completely different from a traditional studio. Apple doesn't need to maximize margins on Severance—the show's strategic value to Apple TV+ justifies investment at almost any reasonable cost level.

This points to a broader shift in the entertainment industry. Tax incentives, which used to be a crucial factor in production location decisions, are becoming less important for well-capitalized streamers like Apple. The company can afford to keep shows where they need to be creatively, rather than chasing tax breaks. That's a significant competitive advantage over smaller production companies and studios.

What This Means for Creative Independence and Studio Economics

The Severance acquisition raises important questions about the future of independent production studios and creative talent in the streaming era.

Traditionally, studios like Fifth Season have provided a crucial service: they develop creative talent, secure financing for projects, manage production infrastructure, and navigate the complex economics of making television. Studios provide stability and resources that individual creators can't access on their own.

But as streaming platforms have accumulated capital and developed their own production capabilities, the value proposition of independent studios has shifted. Streamers no longer need studios to finance content—they can do it themselves. Streamers are building their own production infrastructure. Streamers are increasingly developing direct relationships with creators, bypassing studios entirely.

What we're seeing with the Severance deal is studios being forced to choose between two paths: either grow and consolidate into mega-companies (like the Paramount/CBS merger or the pending Warner Bros./Discovery consolidation), or sell their most valuable assets and IP to streamers.

Fifth Season chose the second path. The studio negotiated an excellent deal for Severance, which will provide capital and prestige value that can be invested into other projects. But the studio has effectively ceded control of its most successful property. That's a significant strategic concession.

For creative talent, this creates both opportunities and risks. On one hand, creators can potentially maintain more creative freedom by working directly with a streamer that owns their IP rather than a studio concerned with profit margins. On the other hand, creators lose the negotiating leverage that traditionally came from having multiple studios competing for their work.

In the Severance case, creator Dan Epler and the show's executive team presumably had significant input into the acquisition decision and the terms under which they'll continue producing the show. Their creative vision is likely to be preserved. But that's not guaranteed for every creator working under these new arrangements.

Severance's viewership and award nominations have grown significantly since its debut in 2022, peaking in 2025 with the highest Emmy nominations. Estimated data.

The Ripple Effects: What This Deal Signals to the Industry

When Apple acquires all IP rights to a show like Severance and commits to in-house production, it sends specific signals to other producers, studios, and talent.

First signal: Prestige content is worth real money. Apple paid $70 million for a property that was already mid-run. This tells studios that if they can produce critically acclaimed, award-winning content, they have leverage in negotiations with streamers. Prestige matters.

Second signal: Scale is essential. The reason Fifth Season couldn't sustain Severance alone was scale. A small studio can't spread costs across multiple productions the way Apple can. This pushes consolidation—smaller studios will increasingly need to merge or partner with larger companies to maintain viability.

Third signal: Streamer funding comes with control. When your primary financier is a tech company that owns your IP, that company gets to make strategic decisions about your show's future. This is structurally different from traditional television, where networks might finance multiple seasons but studios retained creative control. Streamers are now both financiers and creative controllers.

Fourth signal: International expansion matters. The fact that Apple is planning international versions of Severance tells studios that global reach has become a core part of streaming strategy. A show that only plays in English-speaking markets is leaving money on the table. This raises production complexity and costs, which pushes more creators toward partnership with well-capitalized streamers.

Fifth signal: Extended universes are the plan. Apple's plans for spin-offs, prequels, and other Severance-related projects tell creators that streamers increasingly think of individual shows as the foundation for larger franchises. This is more ambitious than traditional television planning, which usually focuses on sustaining a single series.

All of these signals point in the same direction: the future of premium television production will be dominated by a small number of mega-platforms (Apple, Amazon, Netflix, Disney+) that have the capital, infrastructure, and distribution reach to sustain high-budget productions while maintaining creative ambition.

The Subscriber Value Calculation: How Apple Views Severance's ROI

When Apple paid $70 million for Severance, the company was making a calculation about long-term subscriber value. It's worth thinking through that math, because it explains how streamers think about content investments.

Let's work through the logic:

Conservative scenario: Assume Severance drives 2 million new subscribers to Apple TV+ over its four-season run. Apple's ARPU (average revenue per user) is approximately $6.99 for the base tier subscription. If those subscribers remain for an average of 18 months (the time it takes to watch multiple seasons plus some additional engagement), the lifetime value is roughly:

Wait, that doesn't work. That calculation shows Severance generating less subscriber value than Apple paid for it. That seems like a bad investment.

But here's where the calculation gets more sophisticated. Apple doesn't view Severance in isolation. The company views it as part of a broader content strategy:

-

Ecosystem value: Severance isn't driving subscribers to watch Severance alone. It's driving subscribers to Apple TV+ because they want access to the full catalog. Those same subscribers will watch other shows, potentially including future Severance spin-offs. The lifetime value includes engagement with the entire platform.

-

Retention value: A prestige show like Severance increases subscriber retention. Someone who's excited about a show is less likely to cancel their subscription. Reduced churn is worth real money in subscription economics.

-

Bundle value: Many Apple TV+ subscribers access the service through larger Apple bundles (Apple One, which also includes music, cloud storage, etc.). A show like Severance increases the perceived value of the entire bundle, reducing overall churn.

-

Prestige value: The Emmy nominations and critical acclaim associated with Severance increase Apple's brand perception. That's worth real money in marketing value—it allows Apple to market the platform as a home for premium content, which affects acquisition costs across the entire subscriber base.

-

Ancillary revenue: Apple could potentially generate additional revenue through merchandise, video game adaptations, licensing deals, and other ancillary products based on the Severance IP.

When you factor in all of these dimensions, the $70 million acquisition price starts to look more reasonable. The company isn't expecting Severance alone to justify the investment through direct subscriber acquisition. Instead, Severance is one component of Apple TV+ strategy, working in concert with dozens of other shows to build a compelling platform.

Streaming Economics: The Race for Scale and Differentiation

The Severance acquisition can't be understood without understanding the broader dynamics of streaming economics, which have fundamentally shifted over the past five years.

In the early days of streaming, the economics were relatively simple: acquire as many subscribers as possible, grow the user base, eventually reach profitability. Netflix pioneered this model, spending massive amounts on original content to drive subscriber growth. Other streamers followed the same playbook.

But something changed around 2022-2023. The low-hanging fruit of subscriber growth was exhausted. Market saturation set in. Growth rates slowed. Streaming services began losing subscribers for the first time. Investors and analysts started demanding profitability rather than growth metrics.

In response, streaming services have shifted strategy. They're now optimizing for:

- Profitability per subscriber: Rather than maximizing subscriber growth, services are trying to maximize the revenue extracted from each subscriber

- Content efficiency: Rather than producing dozens of new shows per year, services are being more selective, focusing on shows that drive real engagement and retention

- Pricing power: Services are increasing subscription prices, adding ad-supported tiers, and exploring other monetization strategies

- Subscriber retention: Rather than assuming subscribers stay indefinitely, services are now managing churn actively and investing in content that reduces it

Severance fits perfectly into this new streaming economic model. The show is high-quality, prestige content that drives subscriber retention and engagement. It's not a low-cost show, but it generates more value per subscriber than something produced on a lower budget.

Apple's acquisition also reflects this shift. The company isn't just buying a show—it's buying a franchise that can generate revenue streams across multiple dimensions: subscribers, advertising (if Apple adopts an ad-supported tier), merchandise, licensing, international versions, and ancillary products.

This is fundamentally different from how traditional television networks used to think about content. Networks would produce shows to sell advertising time. The content itself was a vehicle for ads. Streaming services, by contrast, produce content as the actual product. The business model has flipped.

That shift changes everything about how services evaluate and invest in content.

The Future of Severance: What the Four-Season Plan Might Look Like

Based on industry reporting and the patterns established by other prestige dramas, we can make some educated guesses about how Apple and the creative team might structure Severance across four seasons.

Season 1 established the world, the mystery, and the main characters. It asked the fundamental question: what is severance, and why would anyone submit to this procedure?

Season 2 deepened the mystery. It introduced complications, raised the stakes, and began providing hints about the larger conspiracy behind Lumon Industries.

Season 3 (speculative) would likely accelerate toward revelation. The show would begin answering key questions about Lumon's origins, the true purpose of severance technology, and Mark Scout's connection to the conspiracy. This is typically when prestige dramas provide major revelations that shift the entire context of the story.

Season 4 would presumably provide resolution. The final season would wrap up character arcs, provide the ultimate revelation about severance and Lumon, and bring the overarching narrative to a satisfying conclusion. Season 4 would be the show's chance to answer everything while maintaining dramatic tension and emotional impact.

That four-season arc would give the show approximately eight to ten years to tell its complete story (assuming roughly two years between seasons for production). That's a reasonable timeline for a high-budget prestige drama.

As for spin-offs and prequels, we can imagine several possibilities:

-

A Lumon Industries origin story showing how the company developed severance technology and why the leadership believed it was necessary. This could explore the character of the previous Severance worker whose disappearance Mark is investigating.

-

A spin-off following a different character or department within Lumon. Imagine a series focused entirely on the operations team or the security division.

-

A prequel exploring the development of severance technology before Lumon began using it commercially. This could feature entirely different characters and settings.

-

International versions that transplant the Severance concept to other countries and corporate cultures. A Severance version set in Japan or Germany could explore how different cultures respond to the same technology.

Apple isn't planning these projects right now (as far as public reporting indicates), but the fact that the company is leaving room for them signals genuine confidence in the IP's long-term commercial potential.

What This Means for Fifth Season and Independent Studios

The Severance deal represents both a success and a strategic adjustment for Fifth Season.

On one hand, the studio negotiated an excellent agreement. It retains executive producer status, which means creative involvement and ongoing revenue participation. The $70 million price tag signals that Lumon Industries' leadership recognized Fifth Season as a valuable creative partner and compensated the studio accordingly.

But on the other hand, Fifth Season has effectively stepped back from being the primary creative driver of its most successful property. The studio is no longer in control of Severance's direction. Apple makes the strategic decisions about how many seasons the show runs, where it produces, and how to develop the IP across spin-offs and other projects.

For Fifth Season's future, this creates both opportunities and constraints. The capital from the Severance sale can be invested into new projects and new creative ventures. The studio can explore original concepts without worrying about Severance's escalating costs. In that sense, the deal is liberating.

But the deal also demonstrates that Fifth Season has hit a ceiling as an independent studio. The company can't produce shows at Severance's scale without partnering with a better-capitalized entity. That's not a failure—it's simply the economic reality of modern prestige television production. Studios like Fifth Season now operate in a different context than they did ten years ago.

This likely accelerates a broader industry trend: consolidation and partnership between independent studios and mega-platforms. The golden age of truly independent studios producing major network programming may be coming to an end. In the future, studios will either:

- Merge with larger companies (creating mega-studios with multiple revenue streams)

- Partner with streamers on favorable terms (like Fifth Season with Apple)

- Specialize in niche content where scale isn't required

Fifth Season appears to have chosen option 2, which is probably the right choice for a studio that's produced one massive hit but doesn't have the financial resources to sustain it independently.

The Competitive Response: What Netflix, Disney, and Amazon Might Do

When one streaming giant makes a bold strategic move, competitors often respond. Apple's Severance acquisition will likely trigger moves from Netflix, Disney+, and Amazon Prime Video.

Netflix has already been moving in this direction, acquiring underlying IP and increasing investment in prestige drama. Expect Netflix to accelerate acquisition of prestige properties from other platforms or studios.

Disney+ has significant resources and owns Star Wars and Marvel universes, but the company might look to acquire prestige drama properties outside its traditional franchises. Disney's acquisition of FX and expansion of Hulu suggest the company is trying to build a broader content portfolio.

Amazon Prime Video has tried the prestige drama approach with shows like The Boys and Rings of Power. Amazon might accelerate investment in that space, potentially looking to acquire IP from struggling studios or other platforms.

The likely result: more acquisition deals like Severance. More consolidation of IP around a few mega-platforms. More studios selling off their most valuable properties to streamers. More in-house production control by major streamers.

The streaming landscape in 2026-2027 will look quite different from 2022-2023, and the Severance deal represents one of the major inflection points in that transition.

Investment Implications: What Wall Street Should Be Watching

For investors tracking Apple, the Severance acquisition signals several things worth noting.

First, Apple is serious about Apple TV+ as a core business. The company is willing to make significant capital investments in content, which contradicts any narrative that Apple views streaming as secondary to its core hardware business. A $70 million acquisition (plus ongoing production costs) signals genuine commitment.

Second, Apple is optimizing for long-term subscriber value and retention rather than short-term churn reduction. The company is making bets that will take years to fully pay off. That's a longer time horizon than some competitors are taking.

Third, Apple is positioning itself to capture more revenue per subscriber through prestige content that supports premium pricing. Apple TV+ prices are higher than some competitors specifically because the platform offers prestige content like Severance. That pricing power is worth real money.

Fourth, Apple is building moats around its content library through IP ownership. By owning Severance outright, Apple prevents competitors from acquiring the property or creating competing versions. That's a long-term competitive advantage.

For Apple shareholders, these are all positive signals. The company is demonstrating strategic discipline in content investment and building defensible competitive advantages in streaming.

FAQ

Why did Apple acquire Severance instead of just continuing to finance it?

Apple acquired Severance because the show's production costs had become unsustainable for Fifth Season to handle independently. By owning the IP outright, Apple gains complete control over the show's production, strategic direction, and all future revenue streams. This vertical integration allows Apple to reduce overhead costs, make faster creative decisions, and maximize the long-term value of what has become one of the platform's marquee properties.

What does the $70 million price tag include?

The $70 million figure covers Apple's acquisition of all intellectual property rights to Severance, full production control, and the ability to greenlight future seasons, spin-offs, prequels, and international versions. Fifth Season remains as an executive producer, maintaining some creative involvement while stepping back from the financial and operational burden. The price doesn't include ongoing production budgets for future seasons, which Apple will fund separately.

How many more seasons of Severance can we expect?

Based on industry reporting, Severance is planned for four seasons total, which would give the creative team sufficient time to develop character arcs and answer the show's central mysteries without overstaying its welcome. Beyond those four seasons, Apple is also considering spin-offs, prequels, and international versions that could extend the Severance universe significantly.

Why would Fifth Season agree to sell if Severance is so successful?

Fifth Season made a strategic calculation that the escalating production costs of Severance had exceeded what the studio could sustainably afford. The studio had already requested multiple financial advances from Apple and was considering relocating production to Canada to access tax incentives. By selling to Apple, Fifth Season secured capital it could reinvest into other projects while maintaining some creative involvement through executive producer status.

Is this deal similar to what happened with other shows?

Yes. Apple executed a similar strategy with Silo, acquiring the series from Amazon after its first season and bringing it in-house for continued production. This approach is becoming standard for Apple TV+ and other streamers as they increasingly move toward vertical integration of prestige content.

What advantages does in-house production give Apple?

In-house production gives Apple several advantages: reduced overhead costs by leveraging existing infrastructure, tighter creative control to ensure alignment with broader platform strategy, elimination of studio profit margins, faster decision-making, and the ability to efficiently scale production across multiple shows simultaneously. These advantages compound significantly over time.

Will the show's quality be affected by the change in production?

While any major production change carries some risk, there's no inherent reason why Apple's in-house production would negatively impact quality. Creator Dan Epler and the existing production team are expected to continue their roles. Apple's primary goal is maintaining the show's quality and distinctiveness, as these factors directly affect subscriber value. The company has strong financial incentives to preserve what makes Severance successful.

What does this mean for the future of independent studios?

The Severance deal suggests that the era of truly independent studios producing major prestige content may be coming to an end. Studios like Fifth Season now face pressure to either consolidate with larger companies, partner with well-capitalized streamers, or specialize in niche content where scale requirements are lower. This represents a significant structural shift in entertainment industry economics.

Could international versions of Severance feel different from the original?

Yes, and intentionally so. International versions would likely feature local casting, adapted cultural contexts, and storylines tailored to specific markets while maintaining the core Severance concept. This approach has been successful for other prestige shows and allows streaming services to expand their addressable market while respecting regional preferences and viewing habits.

What does this acquisition mean for Apple TV+ subscribers?

For subscribers, the Severance acquisition means continued production of the show at the quality level fans expect, with full creative independence for the show's creator team. It also means Apple is confident enough in the property to plan four seasons and potential spin-offs, rather than canceling the show due to budget constraints as has happened with other prestige series on different platforms.

The Severance Acquisition as an Industry Inflection Point

When historians look back at the streaming era, they'll likely identify a few crucial moments when the industry fundamentally shifted. The introduction of subscription streaming itself was one inflection point. The rise of ad-supported tiers was another. The explosion in original content spending was a third.

Apple's $70 million acquisition of Severance will probably be identified as another such moment: the point when streaming giants began aggressively consolidating IP ownership and moving toward vertical integration of production.

This deal signals the maturation of the streaming industry. The wild experimentation phase is ending. The race for scale through content volume is giving way to optimization for profitability and subscriber retention. And in that new competitive environment, controlling your own IP matters tremendously.

For Apple, the Severance deal represents a clear statement: we're serious about Apple TV+ as a strategic business priority. We're willing to make large capital investments. We're building long-term competitive advantages through IP ownership. We believe in the power of prestige content to drive subscriber value.

For the entertainment industry more broadly, the deal signals that independent studios need to either consolidate or partner with better-capitalized entities to remain viable at the prestige tier. Fifth Season's agreement to sell wasn't a failure—it was a rational response to economic realities that now govern prestige television production.

For viewers, the deal means Severance will continue production at the quality level fans expect, with the full creative vision of the show's creators realized across four seasons. That's ultimately what matters. In a fragmented, chaotic media landscape, a streaming service investing $70 million to ensure a prestige drama stays in production under the same creative team is genuinely good news for everyone who cares about quality television.

The question now is what comes next. Will other streamers follow Apple's playbook? Almost certainly. Will we see more independent studios selling to mega-platforms? Absolutely. Will the entertainment industry continue consolidating around a few major players? All evidence suggests yes.

But that's a story for another day. For now, what matters is that Severance will continue. Mark Scout's nightmare will go on. Lumon Industries' mysteries will deepen. And Apple TV+ will have cemented its position as home to some of the most ambitious, prestige-tier dramatic television being produced anywhere.

That's worth something. Maybe not $70 million worth. But something.

Key Takeaways

- Apple paid under $70 million for complete IP ownership and production control of Severance, signaling serious long-term commitment to the platform

- Fifth Season's inability to sustain production costs forced the studio to seek partnership with a better-capitalized streamer, reflecting changing entertainment economics

- Severance Season 2 became Apple's most-watched series with record Emmy nominations, demonstrating the show's cultural impact and justifying Apple's investment

- The acquisition mirrors Apple's strategy with Silo, establishing a pattern of acquiring prestige properties from other platforms to consolidate IP ownership

- Vertical integration allows Apple to reduce overhead, maintain creative control, and maximize long-term franchise value across spin-offs and international versions

Related Articles

- Apple's Severance Acquisition: Vertical Integration Strategy [2025]

- Netflix's Warner Bros. Acquisition: The $82.7B Megadeal Explained [2025]

- YouTube TV Custom Bundles: Breaking Streaming Costs Down [2025]

- HBO Max UK Launch Date, Pricing & How It Compares to Netflix [2025]

- HBO Max UK Launch 2025: Everything You Need to Know [2025]

- Live Nation's Monopoly Trial: Inside the DOJ's Internal Battle [2025]

![Apple Acquires Severance: What This $70M Deal Means for Streaming [2025]](https://tryrunable.com/blog/apple-acquires-severance-what-this-70m-deal-means-for-stream/image-1-1770912612085.jpg)