Pinterest's Bold Search Volume Claim Against Chat GPT Explained

When Pinterest CEO Bill Ready took the stage to discuss disappointing Q4 earnings, he reached for a surprising comparison. Pinterest, the digital pinboarding site most people associate with DIY projects and interior design inspiration, actually sees more search traffic than Chat GPT. On the surface, this sounds remarkable. But dig deeper, and you'll discover a comparison that's far more nuanced than the headline suggests.

Here's what happened: Pinterest missed Wall Street expectations on revenue (

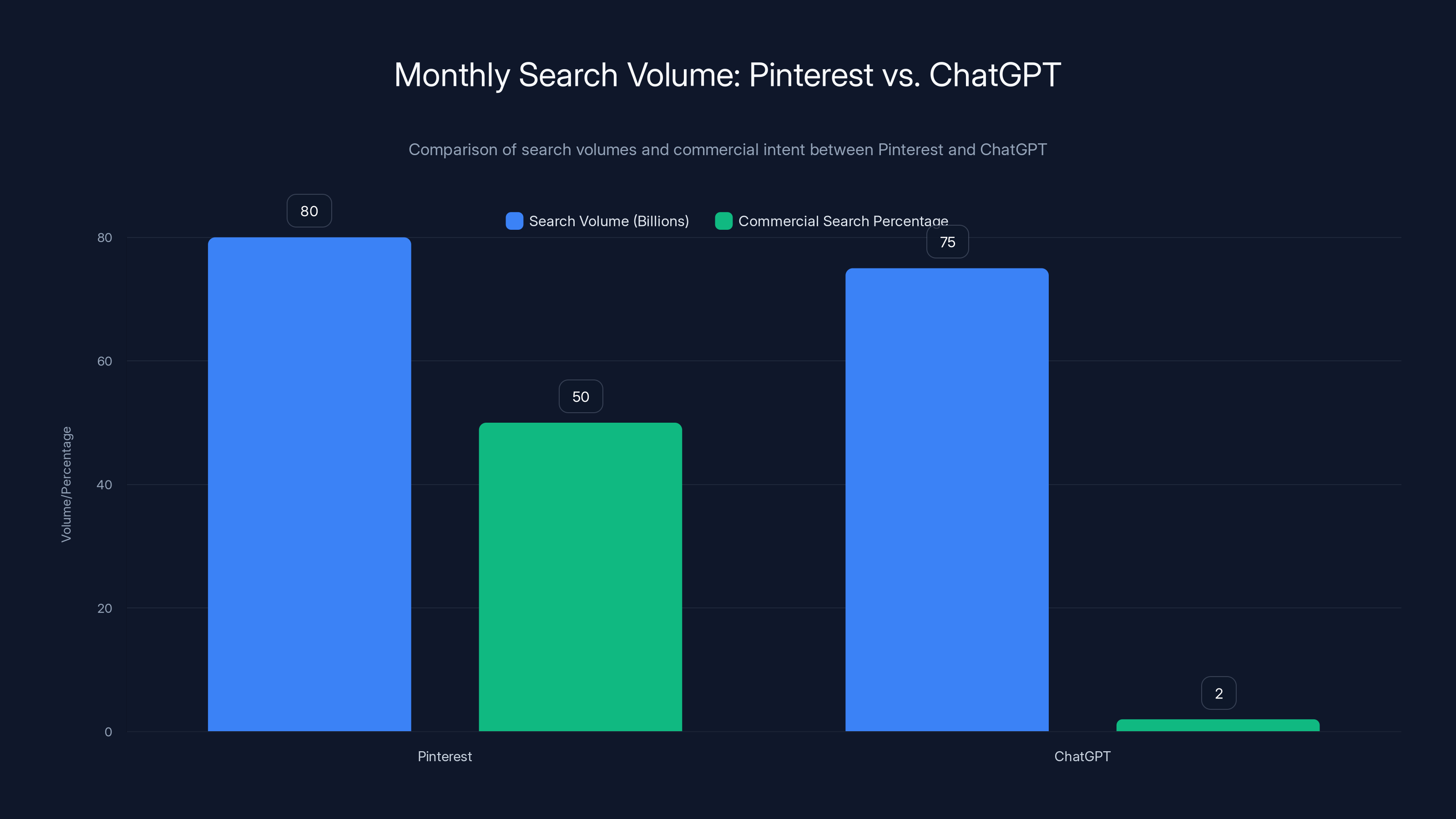

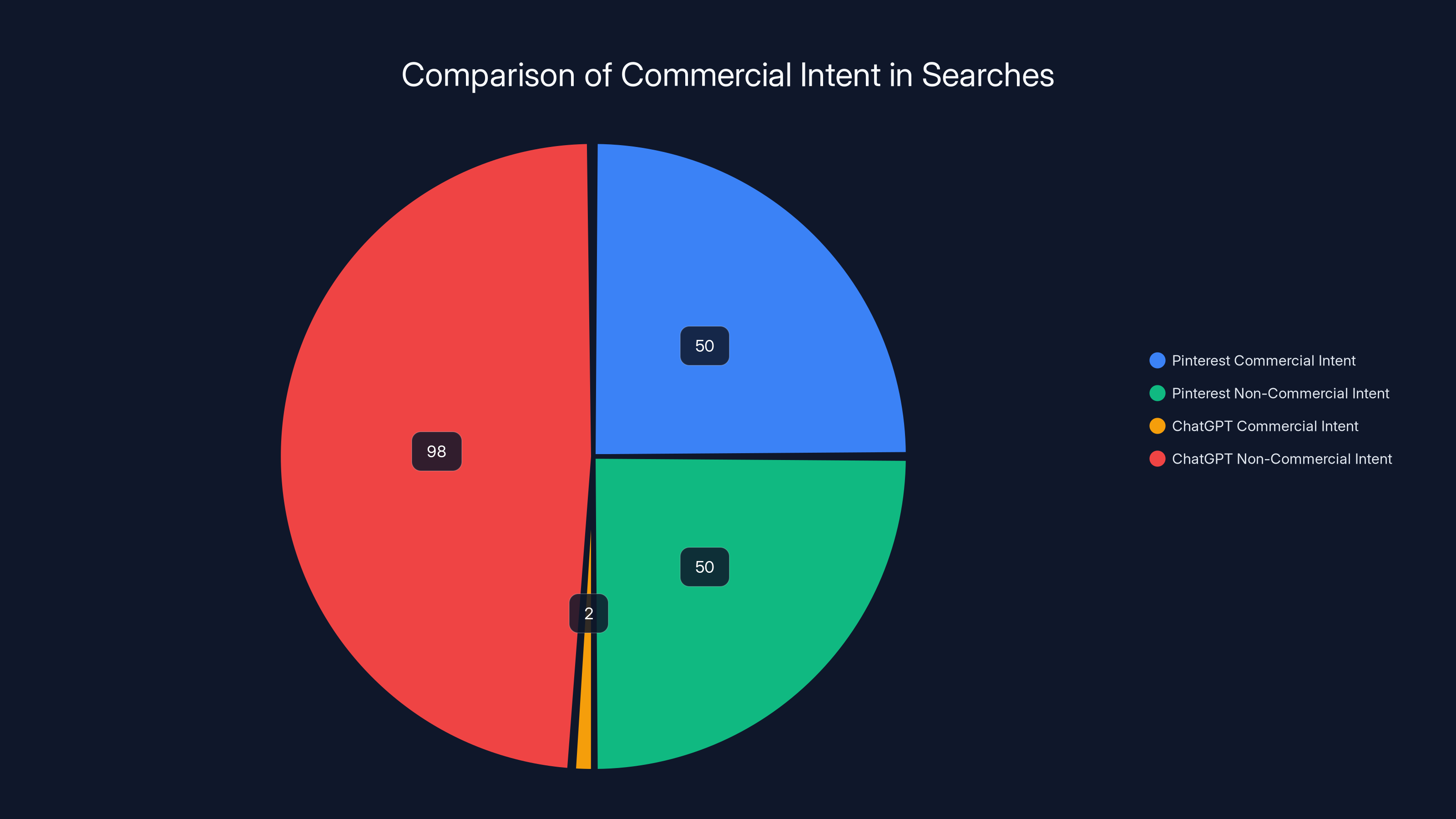

For context, Chat GPT receives roughly 2% commercial searches, Ready noted. This distinction matters enormously. It's not just about the raw numbers. It's about what users are actually trying to accomplish when they visit each platform.

So what's really going on here? Why did Ready make this comparison? And what does it reveal about the broader shift happening in digital platforms and search behavior?

The answer requires understanding how Pinterest works, what Chat GPT has become, and why comparing them might actually tell us something important about the future of search, commerce, and AI.

The Numbers Game: What 80 Billion Searches Really Means

Eighty billion monthly searches is genuinely massive. To put it in perspective, that's roughly 2.67 billion searches per day, or about 30,900 searches per second. That volume would place Pinterest in the top tier of search destinations globally, somewhere alongside Google's core search engine in terms of sheer query volume, according to DemandSage.

But here's the critical context that changes everything: Pinterest isn't a traditional search engine. Users don't go to Pinterest asking factual questions like "what is photosynthesis?" or "how many countries are in Africa?" They go to find inspiration, save ideas, and discover products they might buy.

A "search" on Pinterest might be someone typing "modern farmhouse kitchen designs" or "sustainable fashion brands." These are discovery-oriented searches with visual context and actionable intent. Compare that to Chat GPT searches, which often involve technical questions, writing assistance, coding help, or other knowledge-based queries.

The nature of these searches diverges fundamentally. Pinterest searches are inherently aspirational and visual. Chat GPT searches are information-seeking and text-driven. Ready's emphasis on commercial intent reveals why he made the comparison at all: Pinterest searches are valuable to advertisers because they signal genuine shopping interest, as highlighted by Business of Fashion.

Yet here's where the comparison becomes slippery. Chat GPT's 75 billion monthly searches might generate fewer direct purchase signals, but each query represents a moment of intense user engagement. Someone using Chat GPT to write code, debug problems, or research complex topics is spending significant time on the platform. The "value" of a Chat GPT search might be qualitatively different from a Pinterest search, even if the numerical volume appears comparable.

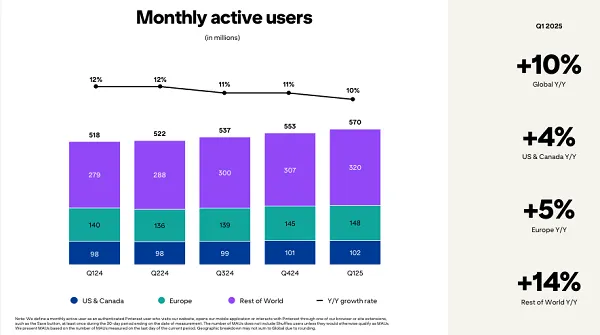

Why Monthly Active Users Grew While Revenue Missed

Here's the paradox that investors found troubling: Pinterest reported 619 million monthly active users, up 12% year-over-year. This beat Wall Street's forecast of 613 million users. User growth exceeded expectations. Revenue fell short. How does that happen?

The answer involves advertiser caution, macroeconomic headwinds, and shifting spending priorities. Ready attributed the shortfall to larger advertisers "pulling back on spend, particularly in Europe," as noted by Yahoo Finance. He also cited a new furniture tariff implemented in October that disrupted the home category specifically.

These weren't product failures. Pinterest's platform worked. More people were using it. The problem was on the monetization side. Advertisers weren't spending as aggressively despite having more eyeballs available.

This scenario reveals a tension that many platforms face: user growth and revenue growth are not always correlated. In fact, they can move in opposite directions. Pinterest attracted more users, but those users generated less advertising revenue. This might sound counterintuitive until you consider that marginal users often have lower conversion value, or that macroeconomic uncertainty makes advertisers conservative regardless of platform performance.

Looking ahead, Pinterest projected first-quarter 2026 sales between

What this reveals is that platform success requires alignment between three elements: user growth, engagement depth, and advertiser willingness to spend. Pinterest succeeded on the first two metrics. The third remained elusive.

The Pinterest User Profile: Why Visual Discovery Matters

To understand why Pinterest's search volume merits discussion despite lower revenue, you need to understand who uses the platform and why. Pinterest's user base skews heavily female (roughly 70% according to industry data), with concentrated strength among users interested in home design, fashion, food, crafts, and lifestyle content, as reported by Shopify.

This is a crucial demographic for certain advertisers. If you're selling interior design products, home decor, fashion items, or lifestyle goods, Pinterest users represent high-intent audiences. These people actively search for inspiration, save designs they love, and explore options before making purchases.

The platform's core mechanic is "pinning"—saving images and content to virtual boards organized by interest. This creates a personalized archive of inspirational content that guides real-world purchasing decisions. Someone saves 47 kitchen cabinet designs over several months, then eventually buys cabinets. That user's journey started with exploration on Pinterest.

Chat GPT, by contrast, has a radically different user profile. Early adoption skewed toward tech-savvy users, knowledge workers, students, and developers. The use cases included coding assistance, writing help, research, brainstorming, and problem-solving. These uses often produce immediate value but don't directly translate to shopping behavior.

Pinterest's 80 billion searches might include considerably more "shopping adjacent" queries than Chat GPT's 75 billion. Someone searching Pinterest for "bedroom design ideas under $5000" is further along the consideration journey than someone asking Chat GPT "explain neural networks."

This distinction matters for investors, advertisers, and anyone trying to understand where digital advertising dollars flow. Pinterest owns a channel with demonstrated shopping intent. Whether it can monetize that intent more effectively than competitors remains the essential question, as highlighted by Nasdaq.

The Competitive Landscape: Where Pinterest Sits

Pinterest occupies an interesting position in the digital ecosystem. It's not a traditional search engine like Google. It's not a social network like Facebook or Instagram, despite having social features. It's not an e-commerce platform like Amazon, despite driving shopping behavior.

Instead, Pinterest functions as a "visual discovery engine"—a platform where users explore ideas and aspirations, save them, and later convert those ideas into real-world purchases. This positioning gives Pinterest advantages and vulnerabilities in different markets.

Against Google, Pinterest wins on visual-first discovery and inspiration. Users searching Google for "kitchen ideas" might land on design blogs or product listings. Users searching Pinterest for the same query find thousands of curated, visually stunning examples organized by aesthetic and category. Google excels at answering questions. Pinterest excels at sparking desires, as noted by SQ Magazine.

Against Instagram, Pinterest competes on intentionality. Instagram users often passively scroll content feeds. Pinterest users actively search and save. This difference produces different advertiser dynamics. Instagram sells awareness and impulse. Pinterest sells consideration and intent.

Against emerging AI tools like Chat GPT or Perplexity, Pinterest occupies completely different territory. These tools answer questions and provide information. Pinterest provides inspiration and discovery. The comparison Ready made seems designed to position Pinterest as a "search destination" in broader competition with AI, but the platforms serve fundamentally different functions.

Yet this is precisely what makes the comparison worth examining. If AI-powered search increasingly dominates information lookup queries, what happens to traditional search volume? If users increasingly ask Chat GPT questions they once Googled, does that threaten Pinterest? Ready's comparison suggests he doesn't think so. His argument: Pinterest's searches serve a different purpose—commercial discovery rather than information retrieval.

Commercial Intent: The Hidden Metric in Ready's Argument

Ready's emphasis on commercial intent deserves careful attention. He stated that more than half of Pinterest's 80 billion monthly searches carry commercial intent, compared to approximately 2% of Chat GPT searches. This distinction is not trivial. It's the core of his argument for why Pinterest matters as a platform.

What qualifies as "commercial intent"? On Pinterest, it likely means searches for products, designs, or items users might purchase. A search for "sustainable leather backpacks" indicates commercial intent. So does "modern office desk design" or "affordable wedding dress styles." These searches signal that users are actively considering purchases, even if they haven't yet decided on a specific product.

Chat GPT's 2% commercial intent figure suggests that very few queries are directly shopping-related. Someone asking "how does photosynthesis work" isn't expressing commercial intent. Neither is "write a poem about autumn" or "debug this Python code." These are information, creative, and technical queries.

Commercial intent matters to advertisers because it correlates with conversion probability. An audience actively searching for products they might buy is more valuable than an audience passively consuming information. This is why Google's search advertising generates more revenue per query than many other advertising formats. Every search signal carries intent.

Pinterest's strength lies in capturing that moment of shopping intent before users transition to product research or purchase. An advertiser can reach Pinterest users when they're still in the inspiration phase, before they've committed to a specific product or brand. This is valuable real estate in the customer journey.

However, converting intent into actual purchases requires more than audience reach. It requires relevance, trust, and seamless paths to purchase. Ready mentioned Pinterest's partnership with Amazon as evidence that the platform was working to improve checkout flows. He suggested that users didn't yet want AI making purchases on their behalf, but that if they did, Pinterest would be prepared.

This hint at AI-powered shopping suggests Pinterest is thinking about its future in an AI-first world. Rather than compete head-to-head with Chat GPT on information delivery, Pinterest appears to be positioning itself as the discovery layer for visual, commercial AI experiences. Users might ask an AI chatbot "recommend office chairs under $300," and the AI might reference or redirect to Pinterest for visual options.

Whether that future materializes depends on whether major AI platforms choose to partner with Pinterest, and whether users actually want AI making shopping recommendations. These remain open questions.

The Furniture Tariff Problem and Category Vulnerability

Ready specifically blamed new furniture tariffs implemented in October for disrupting the home category, one of Pinterest's strongest verticals. This detail reveals an important weakness in the platform's monetization: it's vulnerable to macroeconomic factors affecting specific categories, as noted by Pinterest Newsroom.

Furniture is a high-ticket purchase category where Pinterest performs well. People search for furniture designs, save inspiration boards, and eventually buy. When tariff increases raise furniture costs and consumers become cautious, advertising spend in that category contracts. Pinterest feels the pain directly.

This category concentration represents a strategic vulnerability. If Pinterest's revenue depends heavily on home and design categories, then external shocks in those categories ripple through company finances. Compare this to Google, which spreads advertiser risk across millions of categories and search intents.

Pinterest's strengths in specific lifestyle and home verticals also represent its limitations. It's an excellent platform for certain advertisers and terrible for others. An e-commerce brand selling furniture has strong incentives to advertise on Pinterest. A B2B software company has little reason to be there.

The tariff impact also reveals something about advertiser sophistication. Ready suggested that larger advertisers were pulling back. This might indicate that established brands with significant budgets were recalibrating spending due to uncertainty. They weren't abandoning Pinterest permanently, but pausing investment while macroeconomic conditions stabilized. Smaller advertisers might continue spending, but they likely have smaller budgets.

User Growth Without Revenue Growth: A Familiar Pattern

The divergence between user growth (+12% year-over-year) and revenue growth (missing forecasts) follows a pattern seen in other social platforms during macro slowdowns. Snapchat experienced similar dynamics in 2017-2018. Twitter has cycled through similar periods. Even Facebook experienced revenue pressure despite user growth during certain quarters.

The pattern reveals that advertisers view platforms as discretionary spending during uncertainty. More users doesn't guarantee more revenue if advertisers are cautious. In fact, the marginal value of incremental users might be lower than existing users if they represent less engaged audiences or less valuable geographies.

Pinterest's growth of 619 million users represents geographic diversity. The company is growing in developed markets and emerging markets simultaneously. However, user value varies dramatically by region. A user in the United States represents higher advertising value than a user in a developing market, all else equal. If growth is concentrated in lower-value geographies, revenue growth might lag user growth.

Additionally, platform newness affects monetization. New users require onboarding, brand awareness, and demonstrated value before they become valuable advertising audiences. A platform with growing user base might actually experience temporarily declining average revenue per user as new, unmonetized users dilute the metric.

Looking forward, Pinterest's challenge is clear: convert new users into engaged, monetizable audiences. This requires time, content, and advertisers willing to experiment. During periods of advertiser caution, this conversion happens slowly.

Visual Search and AI: Pinterest's Strategic Positioning

Ready discussed visual search, discovery, and personalization as Pinterest's competitive advantages in an AI era. These features would help users complete "commercial journeys without typing in a single prompt." This phrasing deserves examination because it suggests Ready's thinking about how Pinterest stays relevant as AI reshapes search behavior.

Visual search technology allows users to upload an image and find similar products or inspiration. If you see a sweater you like on the street, you can photograph it and search Pinterest for similar items. This is fundamentally different from text-based search where you must articulate what you want.

For users, visual search is more efficient. For platforms, it's more valuable because it captures implicit preferences without explicit queries. Machine learning models trained on visual data can infer user taste, style, and preferences more accurately than text queries alone.

Ready's emphasis on helping users complete journeys without typing suggests he's concerned about user friction. As AI chatbots become better at understanding natural language queries, users might increasingly ask AI assistants for shopping recommendations rather than searching themselves. Pinterest's advantage is that visual inspiration requires less explicit articulation. You see something you like, save it, and explore similar items.

Personalization is the other lever Ready mentioned. Pinterest's algorithm shows each user different content based on their saved pins, search history, and engagement patterns. This personalization is valuable because it helps each user discover relevant products faster. Over thousands of interactions, the algorithm learns what each user wants to see, and shows them increasingly relevant content.

The combination of visual-first interface, personalization, and direct shopping integration (via Amazon partnership) represents Pinterest's strategy for remaining relevant alongside AI. Rather than compete with Chat GPT on text-based search, Pinterest will compete on visual discovery and shopping experience.

Whether this strategy succeeds depends on several factors: whether users continue preferring visual discovery to text-based AI recommendations, whether advertisers perceive sufficient ROI from Pinterest advertising, and whether the platform can maintain engagement as competitors (particularly Instagram) add similar visual discovery features.

The AI Shopping Question: Will Users Let Machines Buy?

Ready ventured into speculation about AI-powered shopping, suggesting that users don't yet want AI to make purchases on their behalf, but that Pinterest would be ready if they did. He claimed this would be "one of the easiest parts of the commercial journey to solve."

This statement reveals interesting assumptions about user behavior and AI adoption. Currently, shopping remains a fundamentally human decision. Even with all available information, users want to review options, compare prices, read reviews, and make their own choices. Trust in automation is lower for shopping decisions than for information-seeking tasks.

Consumers are comfortable asking Chat GPT technical questions. Asking it to make a $300 purchase on your behalf? That's a different trust relationship. You'd need to be extremely confident that the AI understood your preferences, budget, and values. Most users aren't there yet.

However, Ready's claim that this would be "easy to solve" is worth questioning. The technical implementation might be straightforward—connect user accounts, process transactions, manage logistics. But the trust problem isn't primarily technical. It's psychological.

That said, Ready might be onto something about future user behavior. As AI becomes more reliable and people develop longer histories of positive AI-assisted decisions, comfort with AI-mediated shopping might grow. Younger users with more AI exposure might have different comfort levels than older generations.

Pinterest's position in this potential future is interesting. Rather than recommend products directly (as Chat GPT might), Pinterest could function as the discovery and comparison layer. Users browse visual inspiration on Pinterest, AI assists with matching to products, and users complete purchases. Pinterest stays in the journey without making the final decision.

This represents a plausible future for the platform: not a direct competitor to Chat GPT, but a complementary tool in the AI-assisted shopping ecosystem.

Advertiser Behavior and Confidence Signals

Ready's comment about "larger advertisers pulling back on spend" deserves analysis because advertiser behavior often signals broader economic sentiment. When major advertisers reduce spending despite having access to larger audiences, it suggests something important is happening.

It could be macroeconomic caution—uncertainty about consumer demand leading to defensive marketing spending. It could be reallocation toward channels perceived as more efficient. Or it could be Amazon and other retail platforms competing for the same ad budgets, offering different targeting or attribution capabilities.

Pinterest's strong performance in home and lifestyle categories means it's especially vulnerable to pullbacks in discretionary spending. Furniture, home decor, fashion, and travel are among the first categories to see budget reductions during economic uncertainty. These aren't essentials. Advertising for essentials continues even during recessions.

Larger advertisers also have more sophisticated analytics and might be more likely to shift budgets toward platforms with clear ROI attribution. If Pinterest's attribution and conversion tracking is less sophisticated than competitors, larger advertisers with more rigorous ROI requirements might deprioritize it.

The forward guidance—suggesting conditions might worsen in Q1 2026—indicates Pinterest doesn't see immediate recovery signals from major advertisers. This suggests management is being cautious rather than bullish about near-term trends.

The Comparison's Purpose: Framing the Narrative

Stepping back, why did Ready make the Chat GPT comparison in the first place? The most obvious answer is narrative management. Disappointing earnings are disappointing. Highlighting user growth (619 million, beating forecasts) is positive messaging, but it didn't offset revenue miss. Comparing search volume to Chat GPT shifts the conversation.

The comparison implicitly asks: "How valuable is Pinterest compared to other major tech platforms?" By claiming 80 billion searches monthly, Ready positions Pinterest as comparable to Chat GPT in traffic scale. By emphasizing commercial intent, he argues Pinterest's searches are actually more valuable because they signal purchasing behavior.

This is a clever reframe, but investors weren't entirely convinced, given the 20% stock drop. The market appears to value actual revenue and profitability over search volume comparisons. This suggests investors are skeptical of Pinterest's monetization potential regardless of traffic scale.

The comparison also hints at how Ready thinks about competitive threats. AI chatbots like Chat GPT represent a potential future where search behavior changes fundamentally. By comparing scale favorably and emphasizing functional differentiation (visual discovery vs. information retrieval), Ready is essentially saying Pinterest doesn't directly compete with Chat GPT. It serves different needs.

Whether this positioning reassures investors about the AI-era future remains to be seen. The stock's reaction suggests many investors remain unconvinced that Pinterest's search volume advantage translates to sustainable competitive advantage or profit growth.

Market Dynamics: How AI Search Affects Visual Discovery Platforms

The emergence of Chat GPT and other large language models has sparked broader questions about the future of search. If AI assistants can answer most questions better than traditional search engines, what happens to search advertising? How do platforms like Pinterest compete or complement this new paradigm?

Google faces existential pressure from AI search tools because it has built its business primarily on answering questions. If Chat GPT and similar tools supplant search queries Google would typically capture, Google's advertising model suffers.

Pinterest faces different dynamics. Its core value—visual inspiration and discovery—isn't directly threatened by text-based AI. If anything, AI integration could strengthen Pinterest. An AI could analyze saved pins, understand user preferences, and suggest new ideas aligned with those preferences.

However, competition for advertiser budgets is real and zero-sum. If AI platforms prove highly effective at shopping recommendations, advertisers might spend more there and less on Pinterest. The zero-sum game is advertiser budgets, not search volume.

For Pinterest to thrive alongside AI, it needs to either partner with major AI platforms (ensuring Pinterest recommendations appear in AI-mediated shopping) or develop its own AI capabilities sufficiently compelling that users and advertisers view Pinterest as essential.

Current evidence suggests Pinterest is attempting both. The platform has integrated shopping features, partnered with Amazon, and referenced its own AI capabilities around personalization and visual search. Whether these moves prove sufficient remains a medium-term question.

Revenue Model Challenges: Why Traffic Doesn't Equal Money

The core tension visible in Pinterest's earnings is a fundamental challenge in advertising-supported platforms: traffic and revenue don't automatically correlate. A platform can have enormous traffic and struggle to monetize it. Conversely, some platforms with smaller traffic generate impressive revenue.

Revenue depends on several factors: advertiser demand for access to your audience, pricing power per impression or click, conversion rates from advertising to sales, and overall advertiser budgets allocated to your platform.

Pinterest's challenge appears to be advertiser demand and pricing power. The platform has audience (619 million users, 80 billion searches). Advertisers seem willing to spend (otherwise Pinterest wouldn't have generated $1.32 billion in quarterly revenue). But either advertiser budgets are contracting, or advertisers are getting more selective about where they spend, or both.

The furniture tariff impact suggests supply-side factors matter. When product categories become less attractive to consumers due to price increases, advertising in those categories contracts naturally. This is a temporary factor that should reverse when tariffs change or consumer caution eases.

But if advertiser selectivity is increasing—if major advertisers are choosing to concentrate budgets on platforms with clearer ROI—that's a structural challenge. It suggests Pinterest needs to improve its measurement, attribution, and ROI demonstration to retain premium advertiser spending.

The path forward likely involves both tactics: improving short-term conditions (tariffs, macro recovery) and long-term capabilities (AI-assisted personalization, better attribution, stronger Amazon integration) that make Pinterest more compelling to sophisticated advertisers.

What This Means for Users, Advertisers, and the Industry

For Pinterest users, the earnings miss and stock decline are mostly irrelevant unless it triggers service deterioration. As long as Pinterest remains funded and operational, users continue to have a visual discovery tool with millions of ideas. The platform's core value proposition doesn't change based on quarterly performance.

For advertisers, the situation is more significant. Struggling growth raises questions about platform viability and feature velocity. Advertisers want to invest in platforms that are innovating and growing. A platform with declining revenue and cautious guidance might be perceived as less critical to overall marketing strategy.

For the broader industry, Pinterest's challenges highlight the difficulty of monetizing large audiences in certain categories. E-commerce, fashion, home, and lifestyle represent valuable customer segments, but they're also highly competitive. Pinterest must compete with Facebook, Instagram, Google, Amazon, and emerging platforms for advertiser budgets in these categories.

The AI angle adds another competitive dimension. If AI assistants become primary shopping interfaces, platforms optimized for discovery (like Pinterest) need to either integrate with those assistants or develop equally compelling alternatives.

Ready's comparison to Chat GPT is ultimately a statement about Pinterest's place in this evolving landscape. The platform isn't trying to be a general-purpose AI assistant or information engine. It's positioning itself as the specialized visual discovery layer for shopping and inspiration. Whether that positioning proves durable depends on how the broader AI and e-commerce landscape evolves.

The Bottom Line: Search Volume Isn't a Proxy for Platform Value

Pinterest's claim that it sees 80 billion searches monthly—more than Chat GPT's 75 billion—is technically impressive and strategically meaningful. It demonstrates that a significant portion of internet users rely on Pinterest for discovery and inspiration. It confirms that Pinterest is indeed a "major search destination."

However, the comparison also masks fundamental differences in platform function, user intent, and monetization dynamics. Chat GPT searches are primarily informational. Pinterest searches are primarily aspirational and commercial. One isn't "better" than the other. They're different.

The real story isn't the search volume comparison. It's that Pinterest, despite having a growing user base and leading search volume in its category, is struggling to convert those assets into strong revenue growth. That's the challenge investors are reacting to.

Pinterest's path forward involves deepening AI integration, improving attribution and ROI clarity for advertisers, and positioning itself as a complementary partner to emerging AI-driven shopping experiences rather than a direct competitor. Ready's statements suggest the company understands this positioning. Whether execution delivers remains to be seen.

For now, Pinterest trades on hope about future monetization and uncertainty about AI-era dynamics. The search volume comparison is relevant context, but it's not the decisive factor. Earnings, growth, and profitability are.

Pinterest claims 80 billion monthly searches, surpassing ChatGPT's 75 billion. Notably, over 50% of Pinterest's searches have commercial intent, compared to only 2% for ChatGPT.

FAQ

What does Pinterest's search volume claim actually mean?

Pinterest's claim that it sees 80 billion monthly searches refers to queries conducted on the platform where users type terms to discover content. This is genuinely massive volume, positioning Pinterest among the world's largest search destinations. However, these searches are fundamentally different from Chat GPT searches because they focus on visual discovery and inspiration rather than information retrieval. A Pinterest "search" for "modern kitchen design" is an aspirational query, while a Chat GPT search for "how does an oven work" is informational. Understanding this distinction reveals that the raw numbers, while impressive, don't directly compare platform importance or value.

Why did Pinterest's user growth not translate to revenue growth?

Pinterest reported 619 million monthly active users, up 12% year-over-year, yet missed revenue forecasts. This occurs because new user growth often brings lower monetization value than established users, and macroeconomic conditions matter enormously. The furniture tariff cited by management specifically hurt Pinterest's strong home design category, causing advertiser pullback. Additionally, larger advertisers were reportedly reducing spend despite larger audiences, suggesting advertiser caution during uncertain economic conditions rather than platform failure. When advertisers are conservative, they allocate budgets defensively, regardless of available audience size.

How important is commercial intent for platform monetization?

Commercial intent is extraordinarily important because it directly correlates with advertiser value and conversion likelihood. Pinterest's emphasis that over 50% of its searches carry commercial intent is strategically significant because it distinguishes its audience from Chat GPT's, where only roughly 2% of searches are shopping-related. An audience actively considering purchases is more valuable to advertisers than an audience seeking information. However, converting intent into actual conversions requires strong checkout flows, product relevance, and trust—not just audience size. This is why Pinterest emphasizes features like its Amazon partnership and improved checkout experiences.

What threat does AI search pose to Pinterest's business model?

AI search tools like Chat GPT pose both threats and opportunities for Pinterest. The threat is competition for advertiser budgets and potential shifts in shopping behavior toward AI-mediated recommendations. However, Pinterest's visual-first, discovery-oriented interface serves different user needs than text-based AI assistants. The actual risk is less about being "replaced" and more about being deprioritized if AI platforms prove highly effective at shopping recommendations. Pinterest's strategy appears to be positioning itself as a complementary discovery layer rather than direct competitor. Success depends on whether users continue preferring visual inspiration to AI-powered shopping suggestions, and whether the platform can integrate AI features effectively.

Is a platform's search volume a good indicator of its financial health?

Search volume alone is a poor indicator of financial health. Massive traffic and poor monetization can coexist, as Pinterest's situation demonstrates. A platform's financial health depends on advertiser demand, pricing power, conversion efficiency, and overall budget allocation to that platform. Pinterest has search volume but faced advertiser caution and macroeconomic headwinds that depressed revenue. Conversely, platforms with lower traffic but highly targeted, valuable audiences can generate more revenue per search. Investors care about revenue, profitability, and growth trajectory—not just raw traffic. This is why Pinterest's stock dropped despite impressive search volume numbers.

What would need to change for Pinterest to improve its financial performance?

Pinterest needs several factors to improve: first, macroeconomic conditions stabilizing so advertisers resume spending (especially in furniture and home categories), second, strong performance from AI-powered personalization and visual search features that increase advertiser ROI, third, better attribution and measurement that justify advertiser spending to sophisticated brands, and fourth, successful integration with shopping platforms that makes the path from inspiration to purchase seamless. The company also benefits from avoiding category concentration risk by expanding advertiser offerings beyond home and lifestyle. Ready's comments suggest management is working on most of these levers, but success requires both favorable external conditions and strong execution on product development.

How does Pinterest's strategy differ from Chat GPT's approach to commerce?

Pinterest's strategy is to remain the visual discovery layer that helps users find inspiration and explore options before purchase. It's not trying to close transactions or provide product recommendations directly. Chat GPT's emerging e-commerce strategy, by contrast, focuses on AI-assisted recommendations and potentially transaction facilitation. Pinterest would complement Chat GPT by providing visual options that an AI could reference. Rather than compete directly, Pinterest's positioning suggests it sees potential partnership with AI platforms rather than zero-sum competition. This differentiation is crucial to how the company is thinking about its future in an AI-dominated search and shopping landscape.

Why is the furniture tariff specifically damaging to Pinterest?

The furniture tariff implemented in October raises prices for furniture imports, making furniture less attractive to price-sensitive consumers. Since furniture is a high-value category where Pinterest performs exceptionally well (lots of users search for design inspiration before purchasing), a tariff-driven price increase directly reduces advertiser spend in that category. Consumers postpone furniture purchases, retailers reduce inventory investment, and advertising budgets contract accordingly. Pinterest's strength in lifestyle and home categories, while normally an advantage, becomes a vulnerability during shocks affecting those specific categories. This illustrates why platform concentration in particular categories represents strategic risk, even when those categories are highly profitable.

Pinterest has a higher percentage of searches with commercial intent (50%) compared to ChatGPT (2%), highlighting its value to advertisers. Estimated data.

Conclusion and Strategic Implications

Pinterest's comparison of its 80 billion monthly searches to Chat GPT's 75 billion reveals something important about how platforms position themselves in competitive markets. The comparison is technically accurate but strategically incomplete, masking fundamental differences in user intent and monetization potential.

The real story underneath the earnings miss is that Pinterest maintains a massive, growing user base with genuine commercial value, but is struggling to convert those assets into strong revenue growth due to advertiser caution, macroeconomic factors, and category-specific headwinds. The company's path forward requires both patience for external conditions to improve and excellence in execution on AI-powered features that increase advertiser ROI.

For investors, the question is whether Pinterest can remain a "must-have" advertising platform as the landscape evolves, or whether it gradually becomes one option among many for certain categories. For advertisers, the question is whether Pinterest's unique audience and visual-first interface justify continued investment, or whether alternative channels offer better ROI. For users, the platform remains valuable as a discovery tool regardless of quarterly earnings.

Ready's confidence that Pinterest would be ready if AI-mediated shopping became dominant is probably justified from a technical standpoint. The harder question is whether being ready is sufficient if users and advertisers have already moved elsewhere. The gap between technical capability and market adoption determines whether Pinterest's future proves as positive as management suggests.

The next few quarters will be revealing. If advertiser spend rebounds and Pinterest's category exposure recovers, the stock's decline becomes a buying opportunity. If advertiser caution persists or spreads beyond home categories, the company faces genuine headwinds. The search volume comparison is less important than the revenue trajectory.

Key Takeaways

- Pinterest's 80 billion monthly searches claim is accurate but masks fundamental differences in user intent and platform function compared to ChatGPT's 75 billion.

- Over 50% of Pinterest searches carry commercial intent versus only 2% of ChatGPT searches, representing the platform's primary strategic advantage with advertisers.

- User growth (619 million, up 12% YoY) failed to translate to revenue growth due to advertiser caution, macroeconomic factors, and furniture tariff impacts in key categories.

- Pinterest's strength in home design, fashion, and lifestyle categories creates vulnerability to category-specific economic shocks that reduce advertiser spending.

- Platform success requires alignment between user growth, engagement depth, and advertiser willingness to spend—Pinterest achieved the first two but struggled with the third.

Related Articles

- ChatGPT Ads 2025: Complete Guide to OpenAI's Advertising Strategy

- OpenAI's ChatGPT Ads: What It Means for AI's Future [2025]

- Coupang Data Breach: U.S. Investors Sue South Korea Over Regulatory Discrimination

- Claude's Free Tier Gets Major Upgrade as OpenAI Adds Ads [2025]

- TikTok's Local Feed Feature: Everything You Need to Know [2025]

- ChatGPT's Deep Research Tool: Document Viewer & Report Features [2025]

![Pinterest vs ChatGPT: Search Volume Claims Explained [2025]](https://tryrunable.com/blog/pinterest-vs-chatgpt-search-volume-claims-explained-2025/image-1-1770939373520.jpg)