Samsung's Ballie Robot: Why Consumer Home Robots Keep Failing [2025]

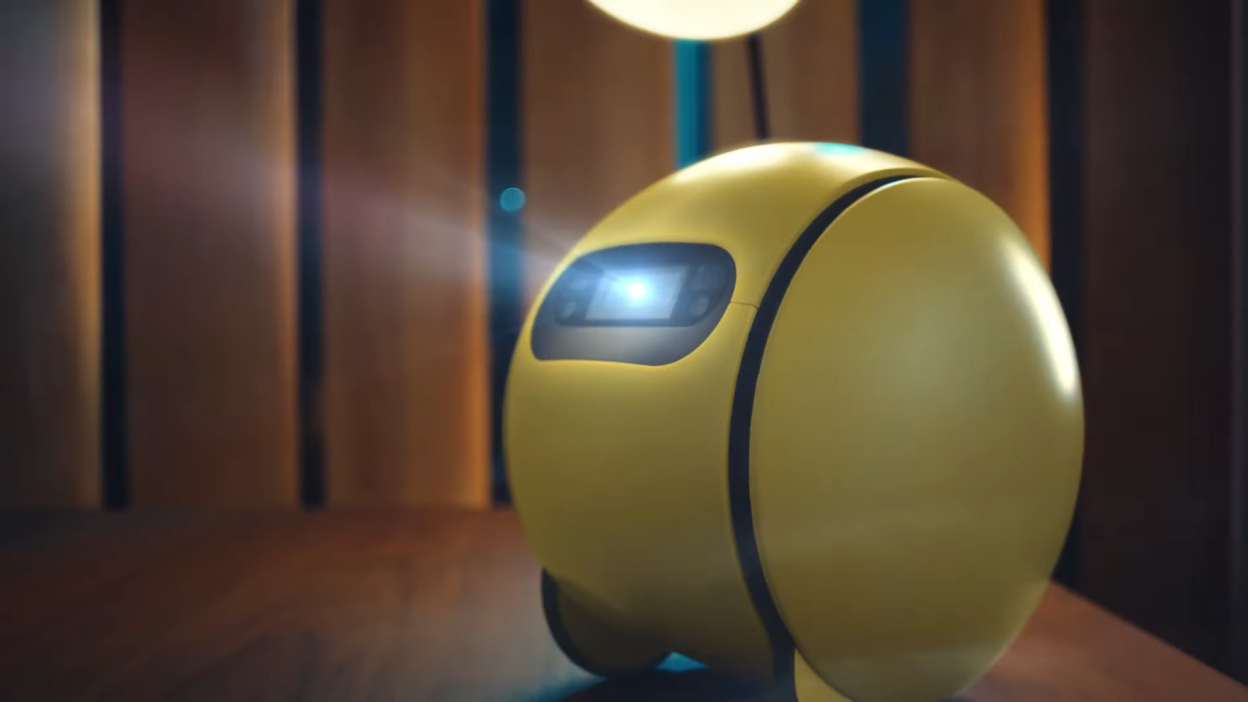

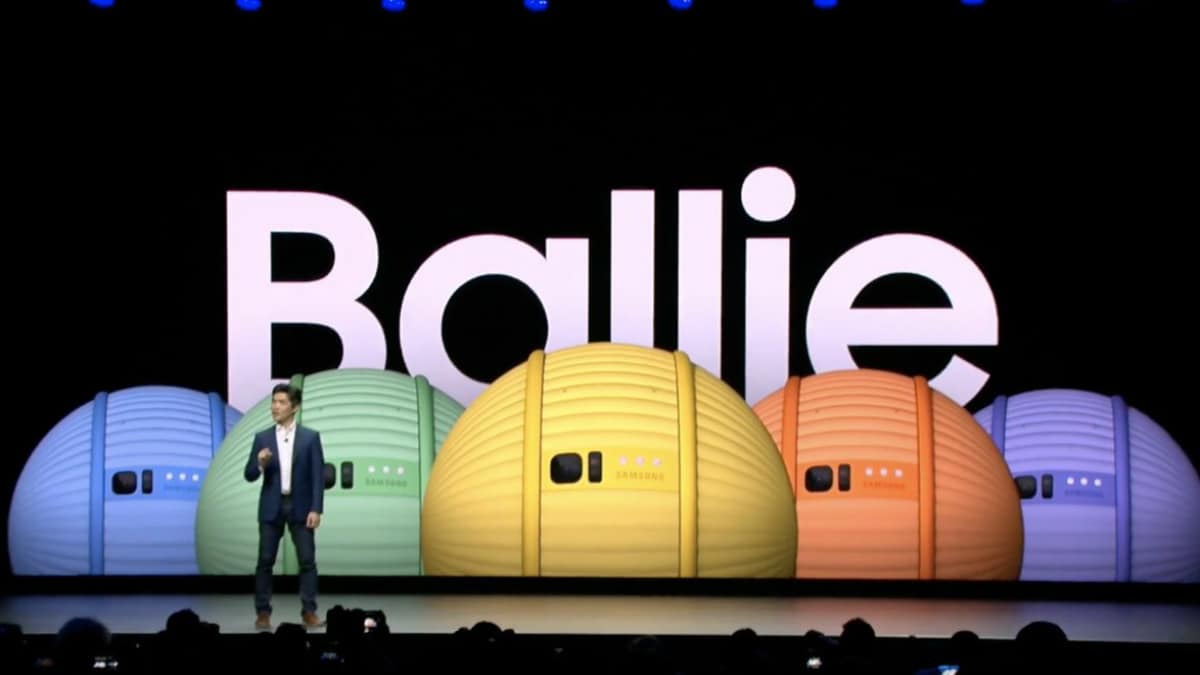

It's easy to get excited about a yellow sphere rolling around your living room. Samsung spent six years showing us Ballie, their autonomous home robot concept, at tech conferences and in marketing videos. The company promised facial recognition, smart home control, projector capabilities, and conversational AI. They said it was coming. They gave dates. They set up registration pages.

Then, quietly, Samsung told Bloomberg that Ballie was being "indefinitely shelved."

This isn't just another vaporware story. It's a window into why consumer home robots—one of tech's most hyped categories—keep failing to materialize despite billions in investment and decades of promises. We're going to dig into what happened with Ballie, why the home robot market remains broken, and what actually has to change before your home has a rolling robotic assistant.

The Six-Year Journey of a Robot That Never Shipped

Samsung's Ballie first rolled onto the stage in 2020, and honestly, it was one of the most compelling robotics demos of that year. The device was small enough to fit in your hand, powered by three wheels, and Samsung showed it following people using facial recognition. In videos, Ballie controlled smart vacuums, activated lights, and interacted with a smartphone. For a concept, it felt genuinely thought-through.

The 2024 refresh changed the design significantly. Samsung made Ballie larger, added a light ring, and showed off projector capabilities. According to their specs, it could project for two to three hours before needing a charge. Videos showed the robot sending directions to phones and making wine recommendations using conversational AI. This wasn't vaporware yet. This felt like a product inching toward reality.

By CES 2025, Samsung was giving limited demos and making concrete promises. A press release stated that Ballie would be available for purchase in the US and South Korea during summer 2025. They mentioned integration with Google Gemini for natural language processing. The company even created a registration website for early access, complete with a waitlist mechanism. Every signal pointed toward an actual consumer launch.

Except it never happened.

When 2026 arrived, so did the news: Ballie wasn't coming. Samsung repositioned the entire project as an "active innovation platform for internal use," according to a statement to Bloomberg. The device would inform how Samsung designs smart home experiences, but it wouldn't become a product you could buy.

This pattern—years of hype followed by quiet shelving—has become the dominant narrative of home robotics. It's not a failure of engineering. It's a failure of market fit, cost structure, and realistic expectations about what consumers actually need.

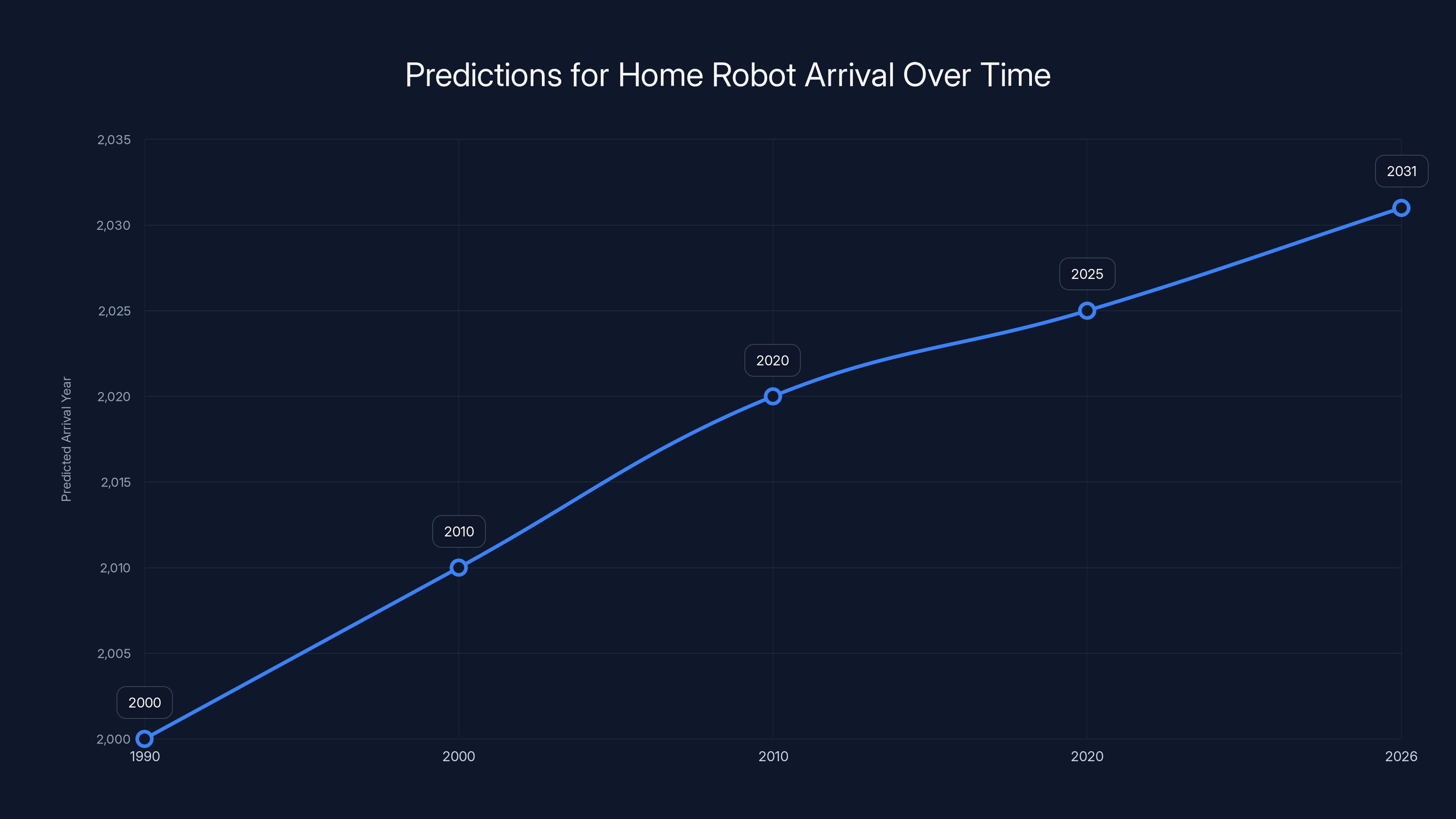

The timeline for the arrival of home robots has consistently been pushed back, with each decade seeing a new prediction extending further into the future. Estimated data.

Why Home Robots Keep Failing: The Economics Don't Work

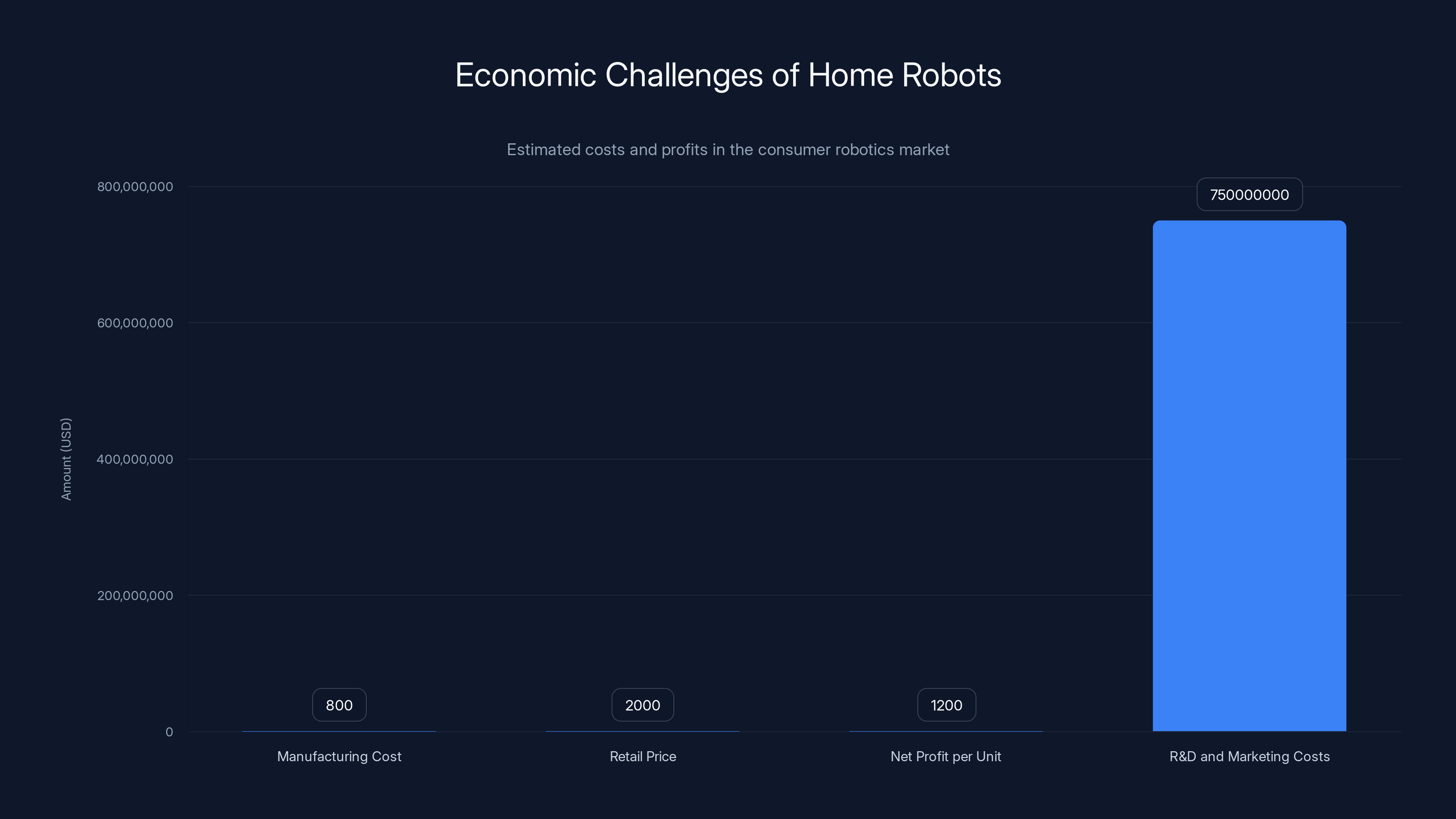

The Ballie situation exposes a fundamental problem that plagues the entire consumer robotics industry: the math doesn't add up.

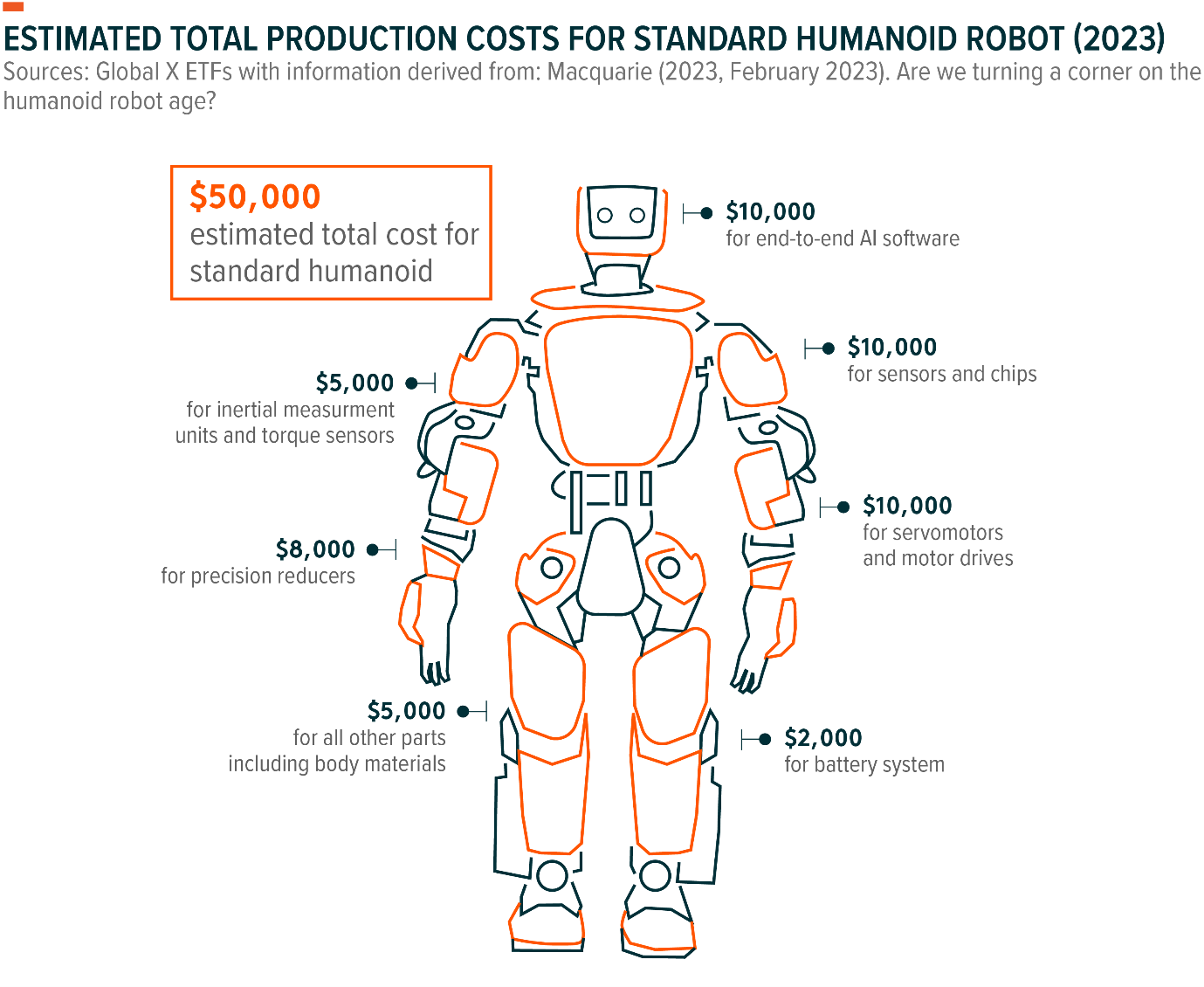

Building a consumer home robot that actually works costs somewhere between

Here's where it gets brutal: the addressable market for a $2,000+ home robot is limited. Not everyone wants one. Not everyone can afford one. And unlike a smartphone, where almost everyone needs communication and connectivity, a home robot is a nice-to-have. It's discretionary spending.

Let's do some rough math. Assume Samsung could capture 5% of US households—that's about 5.3 million units. If manufacturing costs are

Add in the fact that first-generation products always have issues—reliability problems, software bugs, incompatibilities with popular smart home platforms—and the risk profile becomes even worse. If Ballie launched and had widespread problems, Samsung wouldn't just lose money on the product. They'd damage their reputation across all their smart home offerings.

Samsung has the financial resources to absorb losses. But they don't have the motivation to. The company is already profitable. They already have thriving smart home businesses through their TVs, appliances, and mobile devices. Why risk that for a speculative robot project?

Compare this to iRobot, which built the Roomba empire on a single, focused problem: autonomous vacuum cleaning. That's a value proposition people understand and will pay for. Even then, iRobot struggled to expand beyond vacuuming. Their mop robots never achieved the same market penetration. Their home robot arms didn't gain traction.

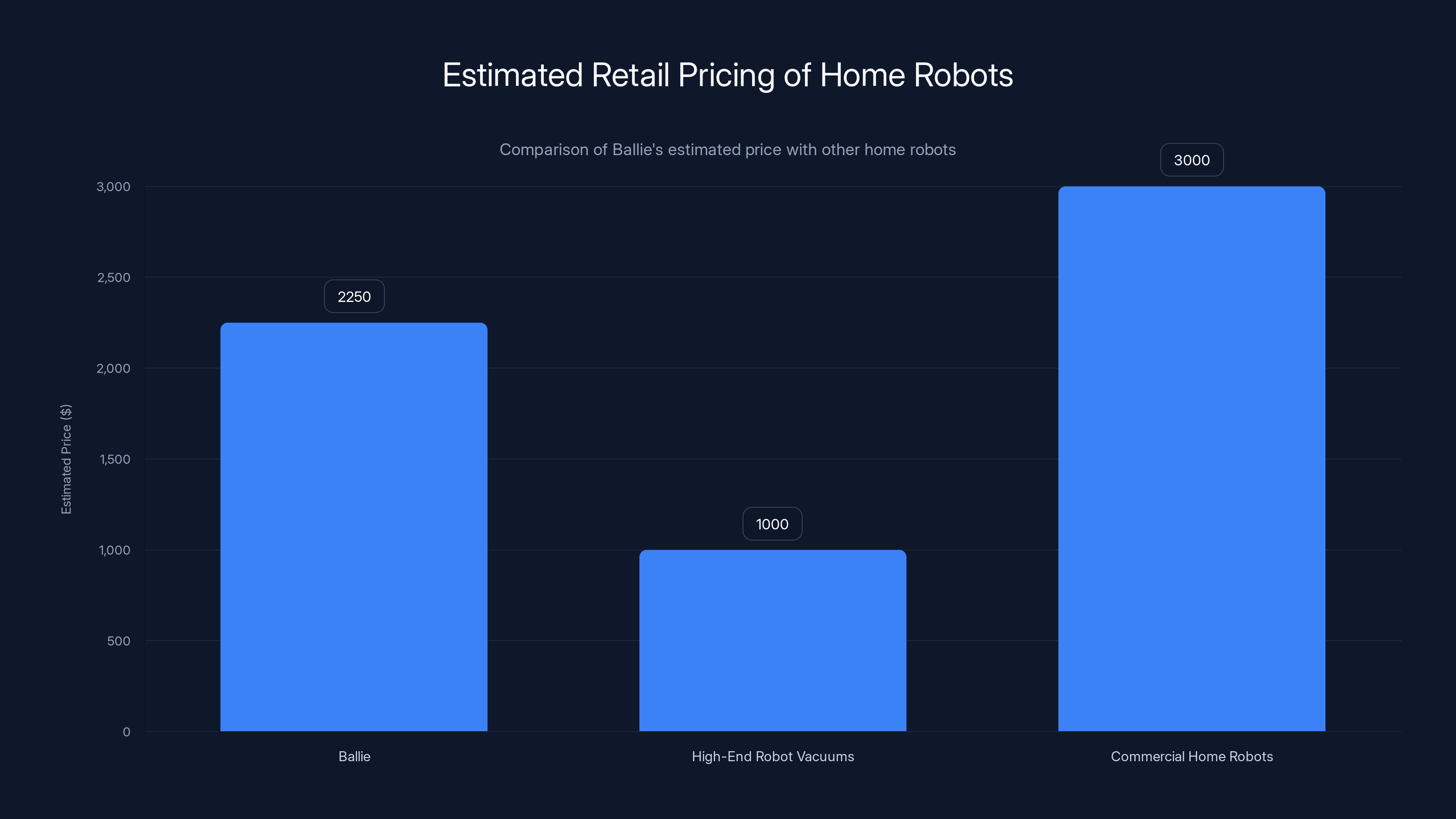

Ballie's estimated price range of

The Feature Problem: Does Anyone Actually Want This?

One overlooked aspect of Ballie's failure is the feature set itself. What, exactly, would Ballie do that justifies the cost?

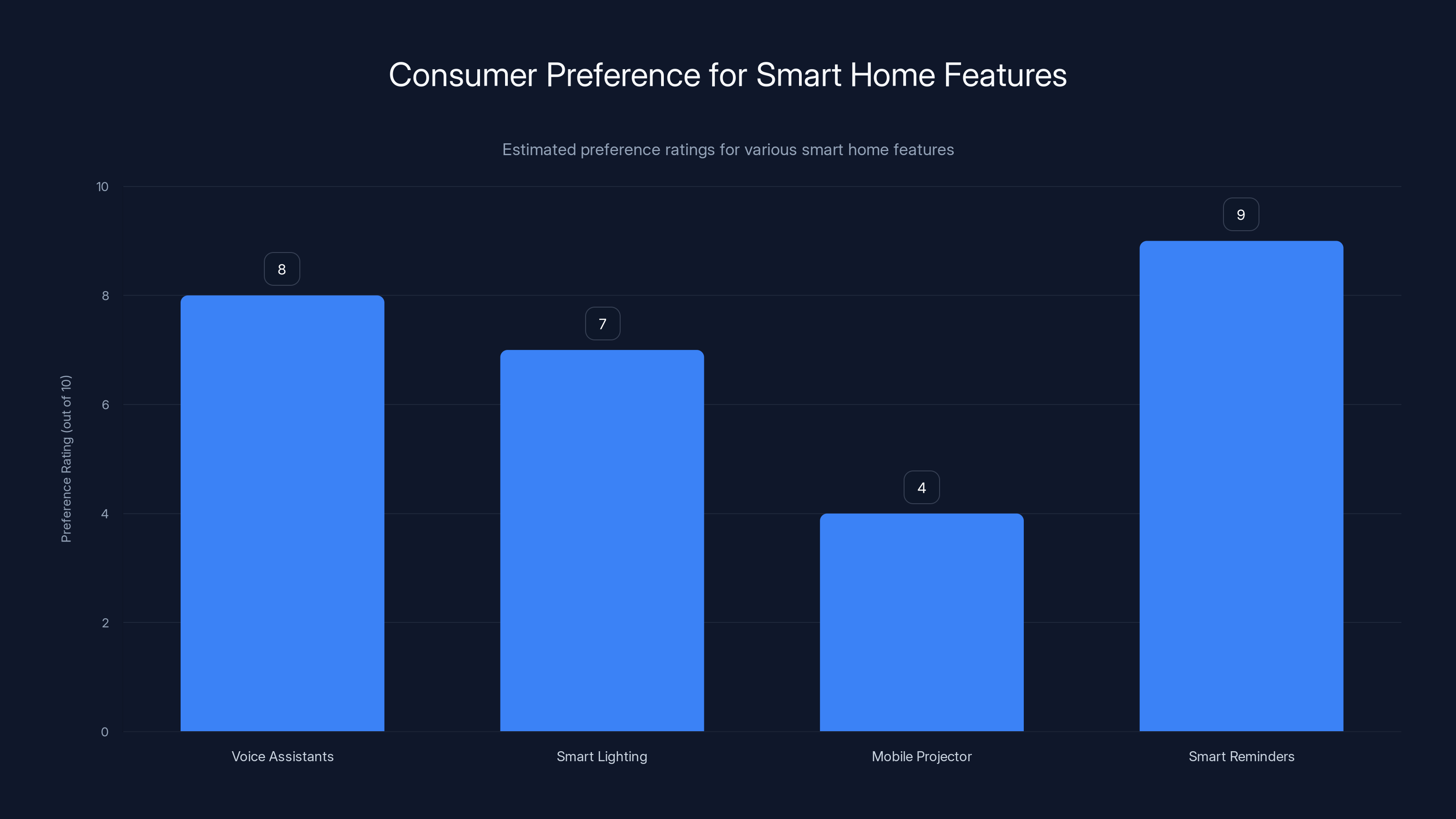

According to Samsung's marketing materials, Ballie would greet people at the door, adjust lighting, remind you of appointments, and make recommendations. It could project content. It could interact via voice.

Now think about your actual life. You adjust lighting with a phone, Alexa, or Google Home. You get reminders from your phone calendar or a smart speaker. You watch content on a TV or tablet. You already have voice assistants in your home—probably several.

What does Ballie add? Mobility? The robot can roll around, but for what purpose? To be present in different rooms? You already have multiple smart speakers. To follow you and be available? A phone does that, and you carry it everywhere.

The killer feature Samsung showed was projector capabilities. A rolling projector could theoretically be useful—project a recipe in your kitchen, display a map when you need directions, show a movie in any room. But you know what's cheaper and more reliable than a

This is the feature problem that most consumer home robots face: the features don't solve problems that people are actually struggling with. They solve hypothetical problems that sound cool at tech conferences but don't generate enough customer desire to overcome the high price tag and switching costs.

When Boston Dynamics created Spot—a four-legged robot capable of impressive athletic feats—nobody asked, "When can I buy one for my home?" People asked, "Can I buy one?" And the answer for consumer use was always no. Spot found niche applications in industrial inspection and research, but residential use never materialized.

The Reliability Challenge: Making Robots That Actually Work Every Day

Beyond cost and features, there's a serious engineering problem that companies rarely discuss publicly: making a robot that works reliably in unpredictable home environments is really, really hard.

Your home has stairs, different floor types, scattered objects, varying lighting conditions, obstacles in unexpected places, and an infinite variety of furniture configurations. A robot needs to navigate all of this safely, day after day, without breaking or causing damage.

This requires:

- Advanced computer vision to understand spatial layouts and detect obstacles

- Robust autonomous navigation that works in real-world conditions, not just controlled test environments

- Fail-safe mechanisms that prevent the robot from damaging itself or your home

- Software that improves over time as the robot encounters new scenarios

- Seamless integration with multiple smart home platforms and devices

- Continuous energy efficiency because charging a robot multiple times per day is annoying

Samsung spent six years testing Ballie internally. They likely discovered that one or more of these challenges was harder to solve at scale than initially expected. Maybe the navigation algorithm couldn't reliably handle the variability of real homes. Maybe battery life fell short of promises. Maybe integration with third-party smart home devices proved more complex than anticipated.

We don't know the specific blocker, but there was definitely a blocker. When Samsung's spokesperson said Ballie "continues to inform how Samsung designs spatially aware, context-driven experiences," they were diplomatically saying, "We learned a lot, but the product isn't ready and may never be."

The reliability problem explains why most successful home robots have focused narrowly on one task. Roombas work because the problem is well-defined: move around the floor, suck up dust. Lawn mowers work because the environment is relatively predictable. But a general-purpose home robot that navigates complex indoor spaces, interacts with humans safely, and provides multiple services? That's a much harder problem.

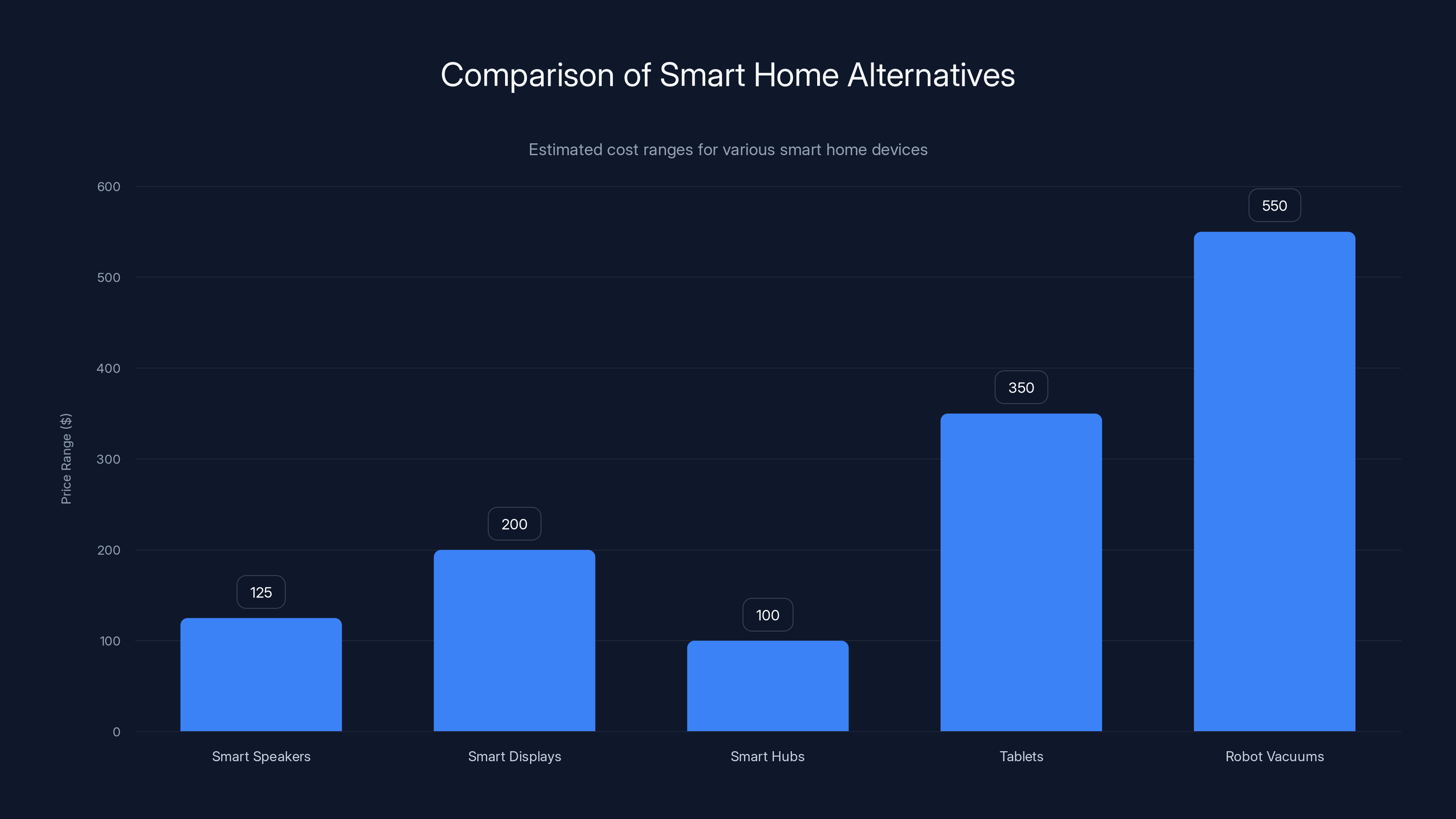

Smart home alternatives like speakers, displays, and hubs offer cost-effective solutions compared to complex robots like Ballie. Estimated data based on typical market prices.

The Market's Skepticism: When Promises Lost Credibility

Samsung's decision to shelve Ballie also reflects broader skepticism about home robotics promises. The industry has cried wolf too many times.

For decades, roboticists have promised that home robots were "just five years away." In 1990, researchers predicted home robots by 2000. In 2000, the prediction shifted to 2010. In 2010, it became 2020. We're now in 2026, and the predictions have become more cautious. Some optimists now say we're "five to ten years away" from truly capable home robots, which is basically admitting they have no idea.

This repeated failure to deliver has genuine consequences. Consumers have learned not to trust home robot announcements. Media coverage, which was breathless in 2020 when Ballie debuted, had become skeptical by 2025. Investors, who poured billions into robotics startups in the early 2020s, have become more selective about which companies get funded.

Boston Dynamics released emotionally compelling videos of Spot and Atlas doing impressive things. But those impressive things didn't translate into consumer products. The company eventually settled into industrial and research applications, which is actually appropriate given the capabilities and cost structure of their robots.

Brainly, a company that raised tens of millions for home robots, scaled back significantly. Most consumer robot startups haven't achieved meaningful market traction. The ventures that raised capital to build "the robot for everyone" discovered that "everyone" doesn't actually want a $2,000+ robot with limited practical utility.

What Actually Changed: Why 2026 Is Different From 2020

If Ballie was viable in 2020, why wasn't it viable in 2026? Several things shifted dramatically over that six-year period.

First, the AI landscape completely changed. In 2020, conversational AI was still relatively primitive. By 2025-2026, large language models became capable enough that consumers had access to sophisticated AI through Chat GPT, Claude, Gemini, and others. This meant that Ballie's AI capabilities—which would have been impressive in 2020—were now table stakes. Users expected better natural language understanding, more complex reasoning, and broader knowledge. Building a robot with competitive AI required significant resources and likely more computational power than Ballie's form factor could accommodate.

Second, smart home saturation changed priorities. In 2020, smart homes were still a growth market. Companies were racing to own the ecosystem. By 2025, the smart home market had matured. Most people with interest in smart home tech already had speakers, connected appliances, and integrations. The incremental value of adding another device was lower. Samsung already sold smart TVs, refrigerators, washers, and speakers. Adding a robot didn't meaningfully expand their market reach.

Third, supply chain and manufacturing realities shifted. Ballie is a complex electromechanical device. Building it in volume requires precision manufacturing. The supply chain constraints that dominated 2021-2023 had mostly resolved by 2025, but they had shifted priorities. Companies that were considering home robot investments may have realized that the same capital could be deployed more efficiently elsewhere.

Fourth, the autonomous driving experience taught hard lessons. We're now in 2026, and full self-driving remains a challenging problem for cars operating on predictable roads. This reality probably influenced Samsung's thinking about robots operating in unpredictable homes. If cars with billions in R&D still struggle with autonomous navigation, what makes us think a home robot will be easier?

The high manufacturing and R&D costs make profitability challenging for home robots, with significant investment required before seeing returns. Estimated data based on typical industry figures.

The Walking Robots Problem: Why Legs Aren't the Answer

Throughout Ballie's history, Samsung made a deliberate design choice: wheels instead of legs. This choice reveals something important about home robotics—the form factor problem.

Wheeled robots are simpler to engineer and more efficient for movement. But they struggle with stairs, rough terrain, and complex obstacles. Legged robots are more capable at navigation but far more complex mechanically and computationally. Boston Dynamics' Atlas, one of the most advanced humanoid robots ever built, costs millions of dollars per unit and can't yet do household chores reliably.

The ideal home robot would be humanoid—two arms, two legs, similar dimensions to humans so it could use existing infrastructure designed for human bodies. But humanoid robots that work reliably are probably ten years away minimum, and they'll be expensive for a long time.

Samsung could have designed Ballie with wheels (simple but limited), legs (complex and expensive), or kept it as a spherical platform (which has its own limitations). Whatever they chose, the design constrained what the robot could actually do in a real home.

This is why the most successful robots remain the simplest ones. A Roomba is a wheeled disc optimized for one task. It works because the task is well-matched to the form factor. Expanding that form factor to do more things simultaneously means accepting trade-offs that make the robot worse at each individual task.

The Software Integration Nightmare

One aspect of home robotics that rarely gets discussed is the software integration problem. For Ballie to be useful, it needed to integrate seamlessly with:

- Multiple smart home platforms (Google Home, Amazon Alexa, Apple Home Kit)

- Dozens of third-party smart devices (lights, locks, cameras, thermostats)

- Voice assistants from different manufacturers

- Mobile phone ecosystems (iOS and Android)

- Cloud services for processing and learning

- Proprietary Samsung services and devices

Each integration point introduces complexity, potential bugs, and support burden. If a software update from Amazon breaks Ballie's integration with Alexa, who's responsible? If a user has Home Kit devices but Samsung prioritizes Google Home, will they experience a degraded experience?

For a niche product like Ballie, maintaining compatibility across this landscape becomes extremely expensive. You need engineers dedicated to integration testing, customer support teams trained on all platforms, and the ability to respond quickly when third-party platforms change their APIs or behavior.

A profitable robot company would need either very high volume (to spread integration costs) or very high margins (to absorb integration complexity). Ballie couldn't achieve either.

Compare this to smartphones, which have two dominant platforms (iOS and Android) and a standardized set of features. Even with that simplicity, compatibility issues create major headaches. Now imagine doing it for a robot with less software standardization and more physical-world variability.

Estimated data suggests that traditional smart home features like voice assistants and reminders are preferred over novel features like mobile projectors.

The Privacy and Security Minefield

Ballie, as shown in Samsung's videos, uses facial recognition to identify people, monitors home activity, records audio for voice commands, and communicates with cloud services. These capabilities create enormous privacy and security responsibilities.

A home robot is literally watching your home. It sees when you wake up, when you go to bed, who visits, what you're doing. If that data is compromised or misused, it's a massive violation of privacy. If the robot is hacked, an attacker could see inside your home or even physically interact with other devices.

For a consumer product, this means Samsung would need to implement multiple layers of security, earn consumer trust, and maintain that security indefinitely. Any breach would create liability, bad publicity, and potential regulatory consequences.

Samsung built these risks into their privacy and security work—their statement mentioned "privacy-by-design" as one of the lessons Ballie informed. But managing these risks at scale requires resources and carries ongoing obligations. For a speculative robot product, it's an additional burden that makes financial projections even less attractive.

Other home robots faced similar challenges. Amazon's planned home robot generated significant privacy concerns even before it launched. Google and Apple have been cautious about home robots partly because of privacy complexity.

The Comparison with Smart Home Alternatives

When you actually look at the alternatives to Ballie, the appeal of an expensive, complex robot diminishes.

Smart speakers ($50-200) provide voice control and can integrate with numerous devices. They work reliably and have massive software support from Amazon, Google, and Apple. No moving parts, no complex navigation, no reliability concerns.

Smart displays ($100-300) add visual interaction to speakers. You can see information, control devices visually, and have more sophisticated interactions than voice alone.

Dedicated smart home hubs ($50-150) manage automations and device integrations without needing voice or display interaction.

Wall-mounted or desk tablets ($200-500) can run smart home control apps and display information persistently.

Robot vacuum cleaners ($300-800) do one job very well and have proven market demand.

For most people, some combination of these existing devices handles the use cases Samsung proposed for Ballie. The additions that Ballie would provide—mobility, physical presence, projector capability—are nice-to-have enhancements rather than solve-critical-problems features.

If you wanted to project content around your home, you could buy multiple smart projectors for less than Ballie's cost. If you wanted mobile voice control, your phone does that. If you wanted a physical presence for gesture recognition or physical interaction, the cost-benefit analysis didn't favor the robot.

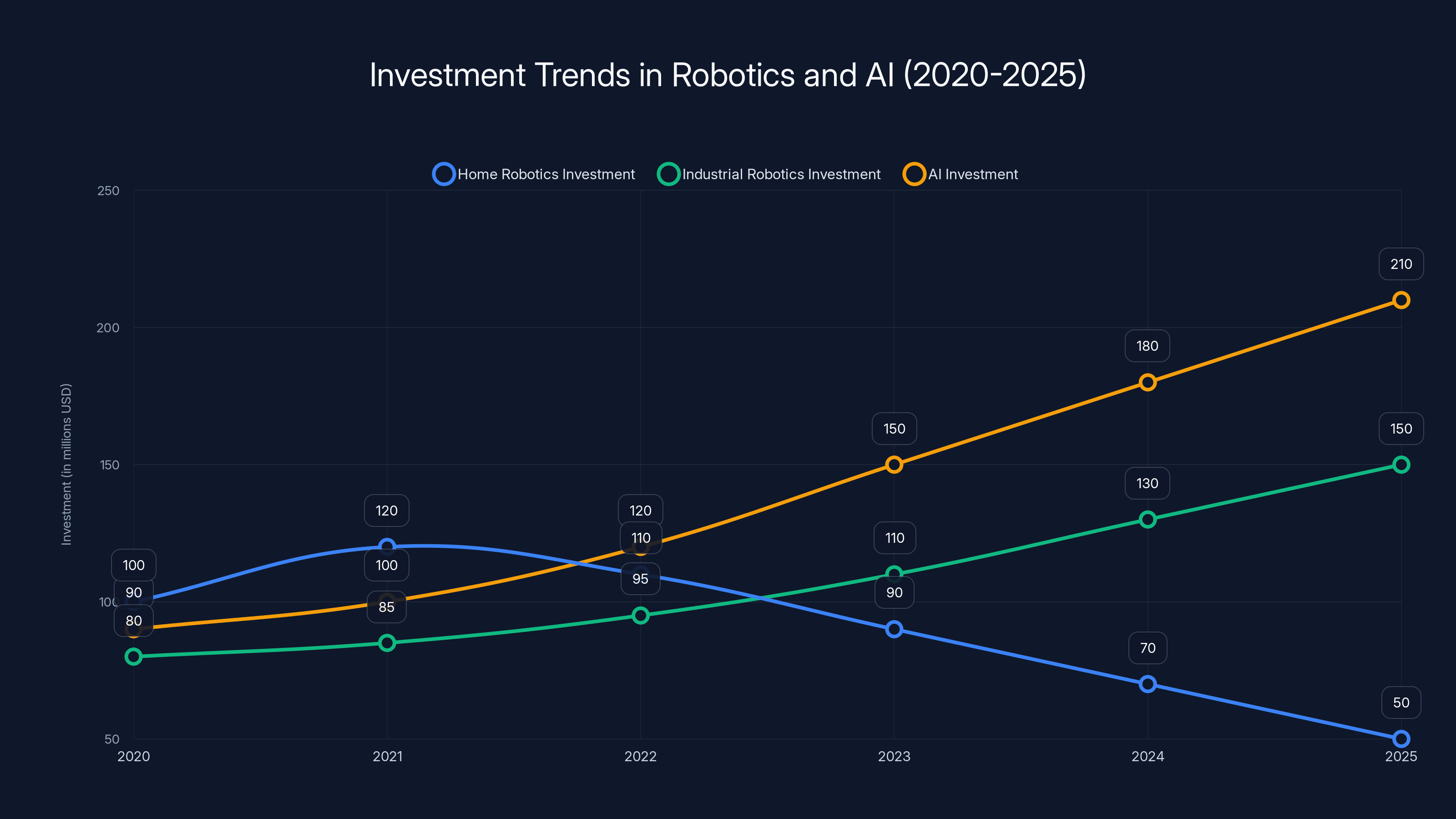

Estimated data shows a decline in home robotics investment from 2020 to 2025, while industrial robotics and AI investments increased, reflecting shifting priorities.

Lessons from Other Failed Home Robot Projects

Ballie isn't unique. It's part of a pattern of failed or stalled home robot projects.

Jibo was a social robot that raised millions in crowdfunding. The company promised an emotionally intelligent robot that would interact with families and become a household companion. The product launched to decent reviews but failed to find sufficient market traction. The company eventually shut down its service servers, rendering units non-functional. Users who paid $900+ for Jibo lost their investment.

Kuri was a cute wheeled robot designed for families. It had a friendly appearance, could navigate homes, and provided some interactive capabilities. Despite launch events and media coverage, Kuri never achieved meaningful sales. The company, Mayfield Robotics, was eventually shut down by its parent company Bosch.

Pepper was a humanoid robot marketed toward retail and service applications. Despite being one of the most advanced socially-interactive robots ever built, Pepper never became viable as a consumer product and its presence in retail declined significantly.

Amazon's Vesta home robot was canceled before meaningful consumer launch. The company spent years developing it, showed prototypes, then quietly shelved it.

The pattern across all these projects: years of development, enthusiastic announcements, and then either cancellation or marginal sales followed by eventual discontinuation.

The common denominator isn't bad engineering. It's the gap between what sounds compelling at a tech conference and what consumers will actually pay for and use consistently. That gap has proven larger and more persistent than companies anticipated.

The Economic Shift: When Investment Priorities Changed

In the early 2020s, robotics startups raised record funding. Investors believed that home robotics was the next big market. Companies attracted talent, launched development efforts, and published ambitious roadmaps.

But by 2024-2025, the mood shifted. The robotics startups that promised consumer products by 2025 mostly missed their timelines. The ones that achieved any traction did so in industrial or research applications, not consumer homes. Meanwhile, AI became the dominant technology narrative, pulling investment capital and engineering talent toward LLMs, diffusion models, and AI infrastructure.

For Samsung, which has internal innovation requirements and strong balance sheets, shelving Ballie became a rational decision. The company could continue learning from internal testing without the burden of bringing a consumer product to market that might not generate sufficient returns.

This shift in priorities reflects a market realization: home robotics as a consumer category isn't as urgent as previously believed. Other applications—industrial robotics, surgical robots, manufacturing automation—are advancing faster and generating more immediate returns.

What Would Make Home Robots Actually Viable?

For home robots to become a real consumer category rather than a perpetual "coming soon" concept, several things would need to change.

First, a compelling narrow-focus use case needs to achieve massive scale. This isn't a general-purpose robot. It's a robot that solves one clear problem better than alternatives. Roombas succeeded because they solved the specific problem of floor cleaning. A robot that excels at pet care, elder assistance, or specific household tasks could potentially succeed. But it needs to be significantly better at that task than existing solutions.

Second, manufacturing and cost structures need fundamental breakthroughs. At current cost structures, a reliable home robot that does multiple tasks costs

Third, the form factor needs to be definitively solved. Should it be wheeled? Legged? Humanoid? The optimal form factor depends on the specific use case, but right now we're still experimenting. Each form factor has fundamental trade-offs. Once we know what works best, manufacturing can optimize around it.

Fourth, software reliability needs to reach consumer-product levels. Current home robot software is still experimental. It crashes, loses connection, fails to understand commands, and requires frequent resets. Consumer products need near-perfect uptime. The gap between current capabilities and consumer expectations is wide.

Fifth, trust in robotics companies needs to rebuild. After years of overpromising and underdelivering, consumers are skeptical. If a company launches a home robot, it needs a track record of following through. Samsung's decision to shelve Ballie actually reinforces this problem—now when Samsung eventually claims to have a home robot ready, consumers will rightfully be skeptical.

The Role of Humanoid Robots in the Future

One possibility gaining traction is that consumer home robots might eventually come from humanoid robot companies rather than traditional consumer tech firms.

Companies like Tesla (with Optimus), Boston Dynamics, and various startups are developing humanoid robots with increasingly capable autonomous functionality. These robots are still far from consumer-ready, but the trajectory suggests that within 10-15 years, humanoid robots might be sophisticated enough for home use.

The advantage of humanoid form factors: humans built infrastructure for human-shaped bodies. Doors, stairs, light switches, and furniture are all designed for beings with our proportions. A humanoid robot could potentially use existing home infrastructure without requiring specialized modifications.

The disadvantage: humanoid robots are extraordinarily complex. Two-legged locomotion is mechanically and computationally harder than wheels. Arms need fine motor control for manipulation. The cost will remain very high for many years.

If humanoid robots do eventually work, they might bypass the entire category of "home robot" and become something more like household employees or assistants. But that's a future state we're probably at least a decade away from.

For now, the companies developing humanoid robots are appropriately cautious about consumer timelines. They're not promising home availability within years. They're saying decades, and honestly, that's probably more realistic.

The Regulatory and Insurance Questions Nobody Talks About

One understated issue with home robots is insurance and liability. If a robot malfunctions and causes damage—injuring someone, breaking property, or creating a safety hazard—who's liable?

For a traditional product, the manufacturer bears liability through product insurance. But a robot is more complex. If a robot crashes into someone and causes injury, is the manufacturer liable? The homeowner? The person who set up the robot incorrectly? The cloud service provider?

Insurance companies have been cautious about covering autonomous robots in homes. The risk profile is unclear. Home robot manufacturers would likely need product insurance, but insurers have limited experience underwriting these products.

This creates friction between launching a home robot and getting insurance companies to cover the potential liability. Samsung almost certainly explored this and discovered it was more complicated than anticipated.

As the robotics industry matures, insurance frameworks will develop. But for an early-stage consumer product, navigating insurance complexity is an additional barrier most companies underestimate.

Could Ballie Return? What Would It Take?

Samsung's statement that Ballie is an "active innovation platform" leaves open the possibility of eventual consumer release. But realistically, when and if Ballie returns to consumer consideration, the product would need to clear much higher bars.

It would need to demonstrate clear advantages over smart speakers and other alternatives—not hypothetical advantages, but real advantages that consumers would explicitly choose Ballie over existing solutions.

It would need solved-at-scale software and reliability that shows the device works consistently for months without issues in diverse home environments.

It would need a significantly lower price point—probably below $1,000—to be compelling to mainstream consumers.

It would need resolved privacy, security, and regulatory frameworks that make consumers and insurance companies comfortable with a monitoring device in their homes.

These are massive bars. Meeting them requires not just completing Ballie's development but also waiting for market conditions to shift. Samsung has decided that neither is likely soon, so Ballie remains on the shelf.

What This Means for Robotics Ambitions

The Ballie story is important because it reveals the reality of consumer robotics in the 2020s. Despite the hype, despite the investment, despite decades of research and development, the gap between impressive prototypes and viable consumer products remains enormous.

This doesn't mean consumer home robots will never happen. It means they're probably further away than we'd like, they'll be more expensive initially than we'd prefer, and the first successful ones will likely be much more specialized than the general-purpose robots companies keep promising.

For companies like Samsung, it means making hard choices about where to invest resources. A speculative home robot competes for capital against more reliable businesses. When the math doesn't work, shelving is the rational decision.

For consumers, it means tempering expectations about home robotics timelines. When someone announces a home robot is coming to market within a year or two, healthy skepticism is warranted. The history of this category suggests announcements are optimistic and timelines always slip.

For robotics researchers and companies building toward this future, Ballie's shelving is actually useful information. It shows that interesting technology and heavy investment aren't sufficient. Market fit, cost structure, reliability, and consumer demand all need to align. That alignment is rarer than technology alone.

The Broader Picture: Why Home Robotics Matters

Despite Ballie's failure to ship, the underlying ambition—making robots useful in everyday life—remains important. Aging populations need assistance. Labor shortages create demand for automation. Repetitive household tasks are genuinely unpleasant.

If home robots eventually work, they'll create real value. But that's a big "if," and the timeline is longer than any company currently claims.

The Ballie story is really a story about the gap between technological possibility and commercial viability. Engineering can create robots that do impressive things. But creating a robot that millions of people will buy, maintain, trust with their home, and use for years is a different challenge entirely.

Until that challenge gets solved, home robots will remain the future perpetually arriving tomorrow.

TL; DR

- Samsung shelved Ballie indefinitely after six years of development, repositioning it as an internal innovation platform rather than consumer product

- The economics of home robots don't work at scale, requiring $2,000+ retail prices for products with limited consumer demand

- Consumers already have better alternatives for the use cases Ballie proposed—smart speakers, displays, and dedicated single-purpose robots solve those problems at lower cost

- Home robot reliability remains unsolved at scale, requiring autonomous navigation and seamless third-party integration across complex home environments

- Market skepticism has grown, as decades of promises failed to materialize—home robots remain perpetually "coming soon"

- Industrial robotics is advancing much faster than consumer home robotics, pulling investment and talent toward more immediately viable applications

- Privacy, security, and insurance frameworks for home monitoring robots are still underdeveloped

- Future home robots will likely be narrow-focus devices solving one specific problem exceptionally well, not general-purpose assistants

FAQ

What exactly is Ballie?

Ballie is Samsung's autonomous home robot concept that was announced in 2020 and repeatedly demoed at tech conferences through 2025. The device is a yellow sphere approximately the size of a basketball that moves on three wheels and can perform tasks like facial recognition, smart home control, projections, and voice interaction. Samsung spent six years developing and testing Ballie internally but ultimately decided not to release it to consumers, shelving the project indefinitely in early 2026.

Why did Samsung cancel Ballie's consumer release?

Samsung never officially stated the specific reasons, but the most likely factors include unfavorable cost-to-market dynamics (development and manufacturing costs too high relative to addressable market), inability to achieve desired reliability standards in real-world home environments, feature set that didn't sufficiently differentiate from existing smart home solutions, and changing business priorities toward more profitable product categories. The company's statement that Ballie "continues to inform how Samsung designs spatially aware, context-driven experiences" suggests they learned from development but determined the product wasn't ready or desirable enough for consumer market release.

How much would Ballie have cost?

Samsung never released an official price, but industry analysts estimated retail pricing between

What are the main barriers preventing home robots from becoming mainstream consumer products?

Home robots face multiple interconnected challenges: unfavorable cost structures requiring $1,500+ prices for limited addressable markets, complex autonomous navigation in unpredictable home environments, difficulty justifying capabilities over cheaper existing alternatives (smart speakers, displays, vacuums), software reliability far below consumer product standards, privacy and security concerns with home monitoring devices, insurance and liability frameworks still underdeveloped, complex third-party smart home platform integrations, and two decades of unfulfilled promises creating consumer skepticism about robotics timelines.

Has Ballie been completely abandoned or could it return?

Samsung indicated Ballie would continue as an internal innovation platform, leaving open the possibility of eventual consumer release. However, for Ballie to re-emerge as a consumer product, it would need to demonstrate compelling advantages over existing alternatives, achieve consumer-grade software reliability across diverse home types, reduce pricing substantially below $1,500, and operate within resolved privacy and regulatory frameworks. Given current market conditions and Samsung's business priorities, consumer availability remains unlikely within the foreseeable future.

What's the difference between Ballie and other failed home robots like Jibo or Kuri?

All three projects shared similar patterns: years of development, enthusiastic announcements, and then either cancellation (Jibo, Kuri) or indefinite delay (Ballie). The core difference is that Ballie never launched to consumers, so Samsung avoided the additional reputational damage of a failed consumer product. Jibo and Kuri both experienced customer disappointment when services shut down or sales failed to justify ongoing development. In retrospect, all three projects underestimated the gap between impressive prototypes and commercially viable consumer products.

Are there any successful home robot categories?

Yes, but only in narrow, well-defined niches. Robot vacuum cleaners have achieved mainstream adoption because they solve a specific problem (floor cleaning) at an acceptable price point ($300-1,200) with proven utility. Robot lawn mowers occupy a similar position for outdoor yard maintenance. Beyond these single-purpose robots, general-purpose home robots remain largely unsuccessful in the consumer market, with most companies either pivoting to industrial applications or discontinuing their programs entirely.

When will general-purpose home robots actually become available to consumers?

Based on current technological progress and historical patterns, realistic timelines for general-purpose home robots are likely 10-20+ years away, not the 3-5 year timelines that companies frequently promise. Near-term developments might include improved robot vacuum capabilities, specialized robots for specific tasks (pet care, yard maintenance), and potentially humanoid robots in industrial settings. Consumer general-purpose home robots requiring reliable autonomous navigation, seamless smart home integration, and trusted operation remain in early research phases despite the hype.

What companies are still working on consumer home robots?

Most traditional consumer technology companies (Apple, Google, Amazon) have shelved or severely reduced consumer home robot programs. Humanoid robot companies like Tesla, Boston Dynamics, and various startups continue development, but they're explicitly not targeting consumer launch timelines in the near term. The few companies still pursuing consumer home robots are primarily startups with venture funding, though their progress toward commercial viability remains slower than investors anticipated when funding these companies in 2021-2023.

Key Takeaways

- Samsung shelved Ballie indefinitely after six years of development, revealing structural problems preventing home robots from becoming mainstream consumer products

- Home robot economics are fundamentally broken: 1,500-3,000+ retail pricing for products with limited addressable market

- Consumers have better, cheaper alternatives for everything Ballie promised—smart speakers (100-300), and single-purpose robots ($300-1,200)

- Autonomous navigation, software reliability, and third-party smart home integration remain unsolved at the scale required for consumer products

- Two decades of overpromised robotics timelines destroyed consumer trust—home robots remain perpetually 'coming soon' but never arriving

Related Articles

- Home Robots in 2026: Why Specialized Bots Beat the Robot Butler Dream [2026]

- Why Samsung's Ballie Robot is Probably Never Coming Out [2026]

- LG's CLOiD Robot: Why Home Automation Still Isn't Ready [2025]

- Skylight Calendar 2: The AI-Powered Family Organization System [2025]

- The 7 Weirdest Gadgets at CES 2026: Musical Popsicles to AI Headphones [2025]

- Switchbot's Onero H1 Laundry Robot: The Future of Home Automation [2025]

![Samsung's Ballie Robot: Why Consumer Home Robots Keep Failing [2025]](https://tryrunable.com/blog/samsung-s-ballie-robot-why-consumer-home-robots-keep-failing/image-1-1767827310394.jpg)