Snap's Specs Subsidiary: The Bold AR Glasses Bet

Snap just made a move that feels both obvious and audacious at the same time. The company announced it's spinning off its augmented reality glasses division into a wholly-owned subsidiary called Specs Inc. On the surface, this looks like corporate restructuring theater—the kind of announcement that makes lawyers happy and everyone else confused.

But here's what's really happening: Snap is betting big on AR glasses, and it's willing to completely separate the hardware business from Snapchat to make that bet stick. The move signals something deeper about where the company thinks computing is headed, and it raises some genuinely interesting questions about whether AR glasses can ever escape the shadow of social media.

Let me walk you through why this matters, what Snap's actually trying to do, and whether this strategy has any real shot at working.

TL; DR

- Specs Inc. is a new subsidiary: Snap created a separate company for its AR glasses to enable investor partnerships and clearer business valuation, as reported by CNBC.

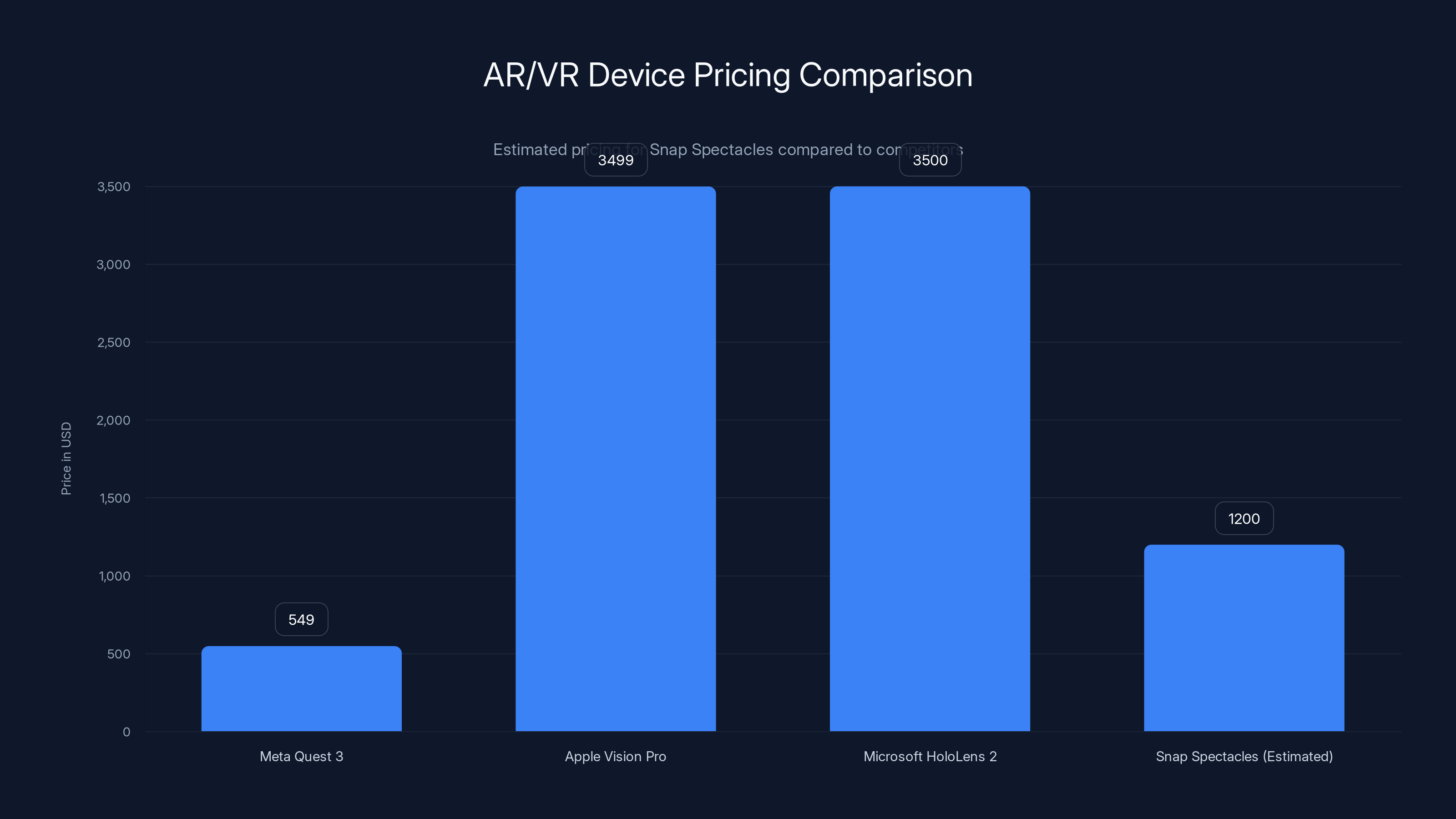

- Consumer launch is 2026: The first public Specs glasses will ship sometime next year, priced below Apple's $3,499 Vision Pro, according to Mashable.

- AI is the differentiator: Specs run an AI-first operating system called Snap OS 2.0, not traditional apps.

- The separation matters strategically: Distancing hardware from Snapchat's child safety baggage and social media criticism is deliberate, as detailed by WebProNews.

- Money talks: The move opens doors for minority investors and outside capital without diluting the parent company.

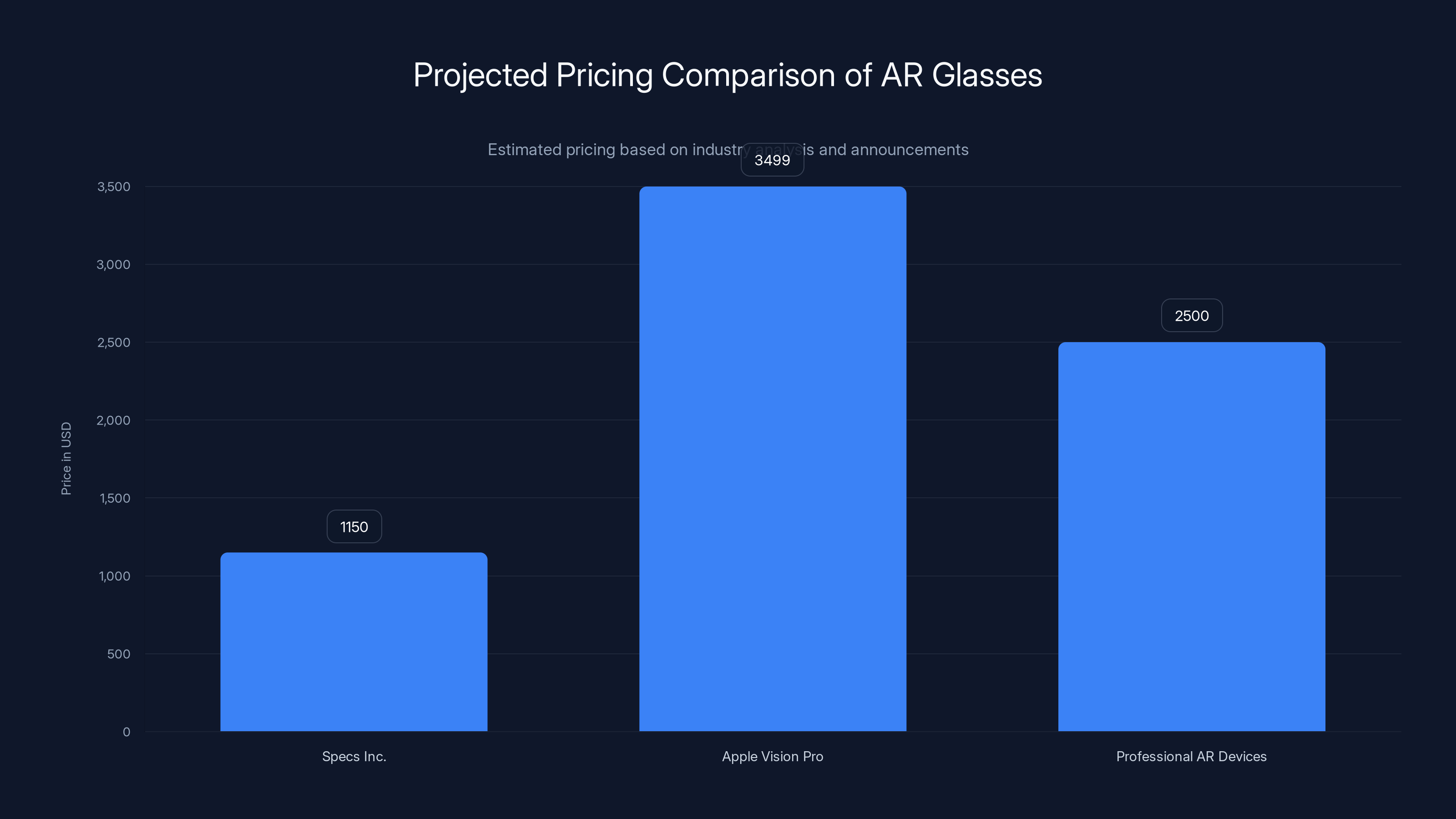

Specs Inc. glasses are projected to cost between

Why Snap Did This Right Now

Timing matters in tech. Snap's announcement comes at a moment when the AR glasses market is in a weird limbo state. Apple's Vision Pro launched to massive hype in 2024, then immediately encountered the hard reality of consumer adoption. Turns out people don't want a $3,500 headset strapped to their face.

Meanwhile, the rest of the industry watched and learned. Nobody wants to be Apple. Nobody wants to launch at premium pricing and watch the market collectively decide your product is too heavy, too expensive, and too dorky to actually use.

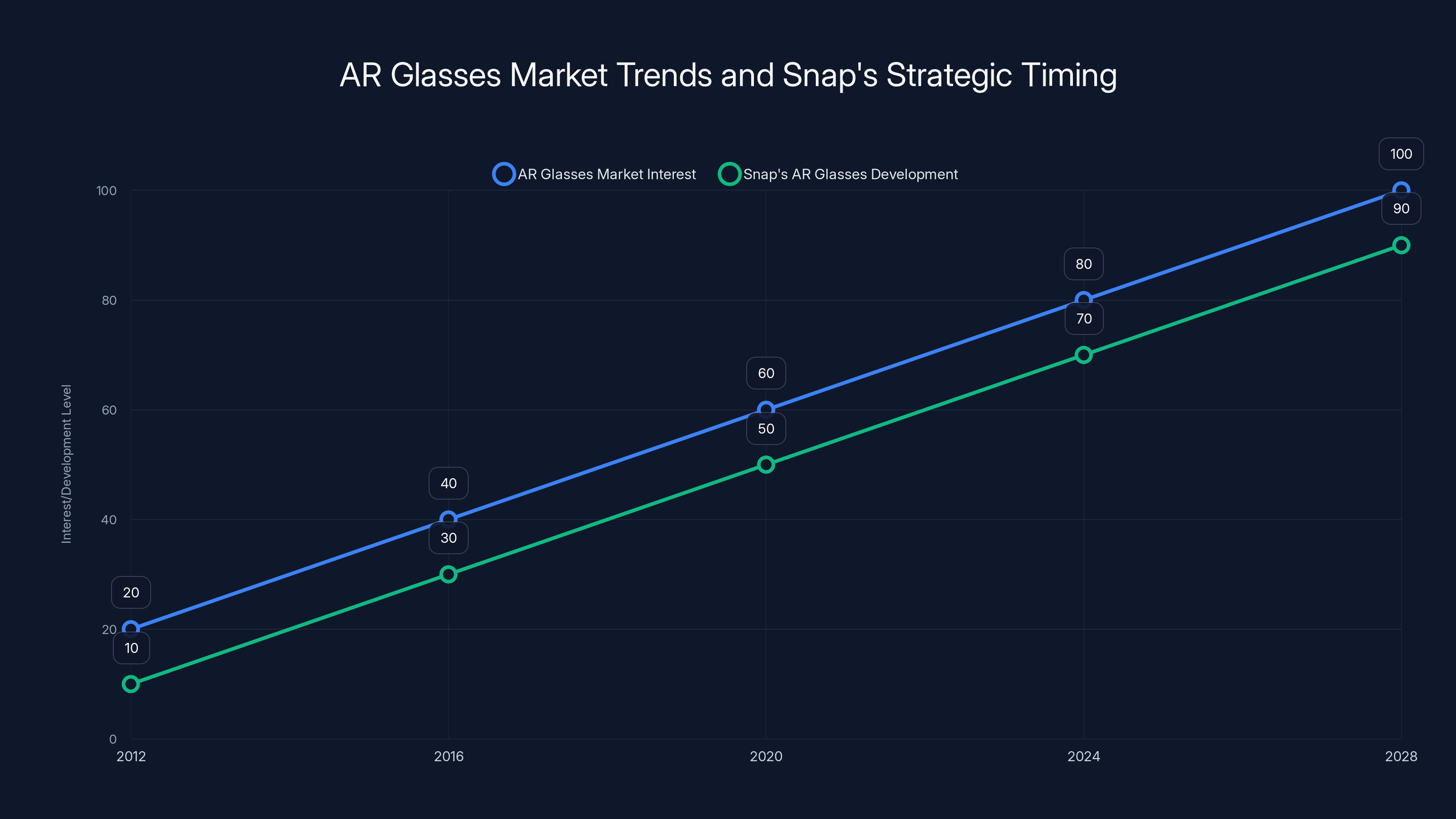

Snap's been making AR glasses since 2012 with Snapchat Spectacles. The company's on its fifth generation now, and they've had a decade of hardware iteration, user feedback, and actual people wearing the devices. That's not nothing. Apple had none of that runway.

But here's the constraint Snap kept running into: it's a Snapchat company. The entire market sees Snap through the lens of social media. Advertising. Privacy concerns. Child safety debates. Viral videos. That brand association creates friction when you're trying to sell people on a "new computing paradigm."

By creating Specs Inc. as a separate business, Snap basically said: let's try a different brand. Let's pitch investors on a pure hardware and OS play. Let's not have every glasses conversation immediately veer into "but what about Snapchat's moderation problems."

It's smart. Maybe not entirely fair—the glasses will ship with Snapchat integration—but strategically smart.

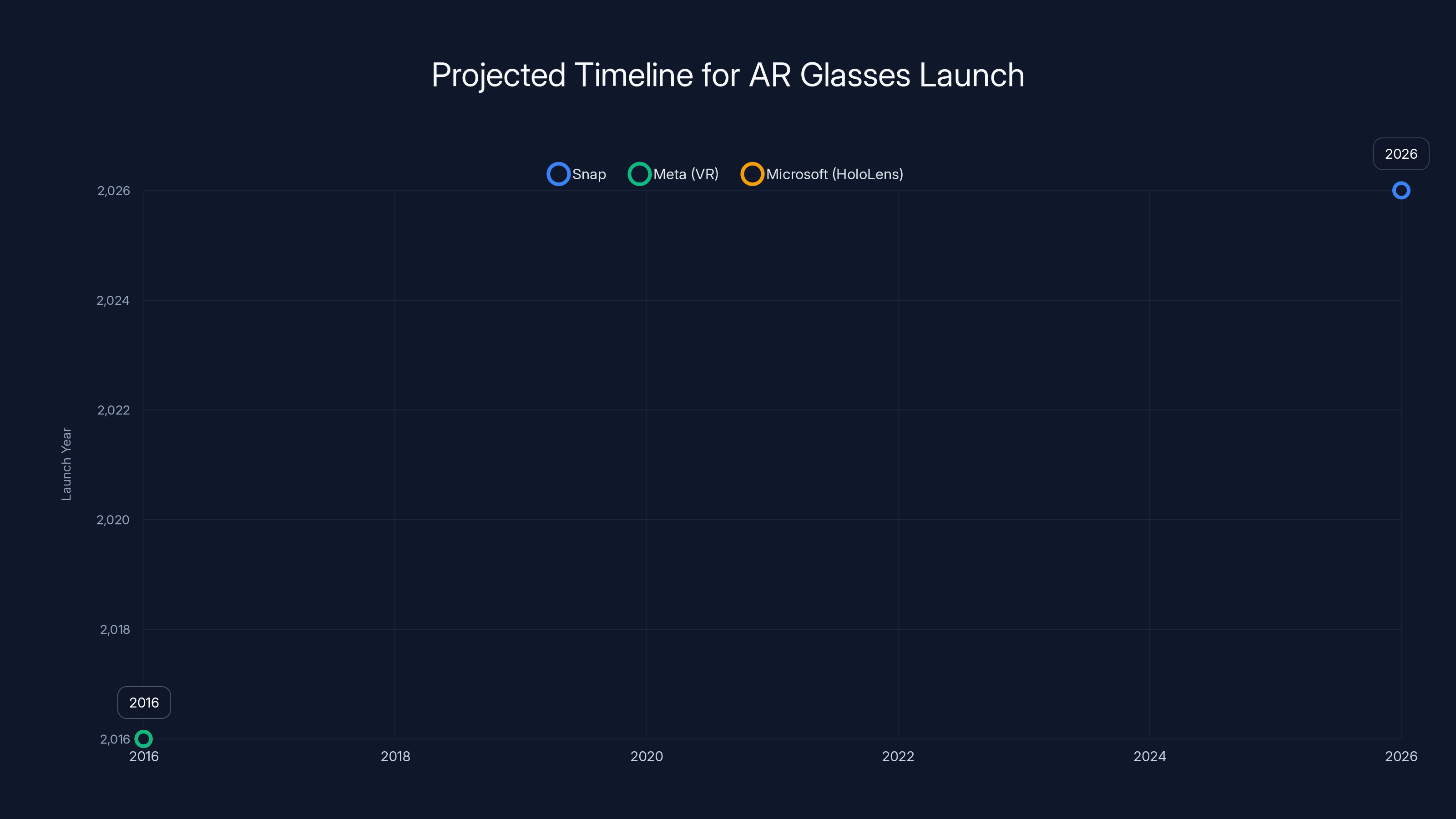

Snap's AR glasses are projected to launch in 2026, which is faster than Meta's and Microsoft's initial VR/AR product timelines. Estimated data.

The Subsidiary Structure Explained

Let's talk about what this actually means from a corporate structure perspective, because the details matter.

Specs Inc. remains a wholly-owned subsidiary of Snap. This isn't a spinoff where Snap shareholders automatically get Specs stock. It's not a separate company in the IPO sense. Think of it more like how Amazon created AWS as its own business unit, or how Google created Alphabet as the parent holding company.

The key phrase in Snap's announcement was "capital flexibility including the potential for minority investment." That's the real move here. By separating Specs into its own entity, Snap can:

Take external funding without diluting Snap shareholders. If a venture capital firm or strategic investor wants to put $500 million into Specs, that investment goes into Specs Inc., not Snap Inc. The parent company doesn't get diluted.

Establish a separate valuation. Right now, Snap's market cap is driven mostly by advertising revenue from Snapchat. The Specs business is invisible to investors—it's buried inside the parent company's losses. By making Specs a distinct subsidiary, analysts and investors can actually model the glasses business independently. That's powerful for fundraising.

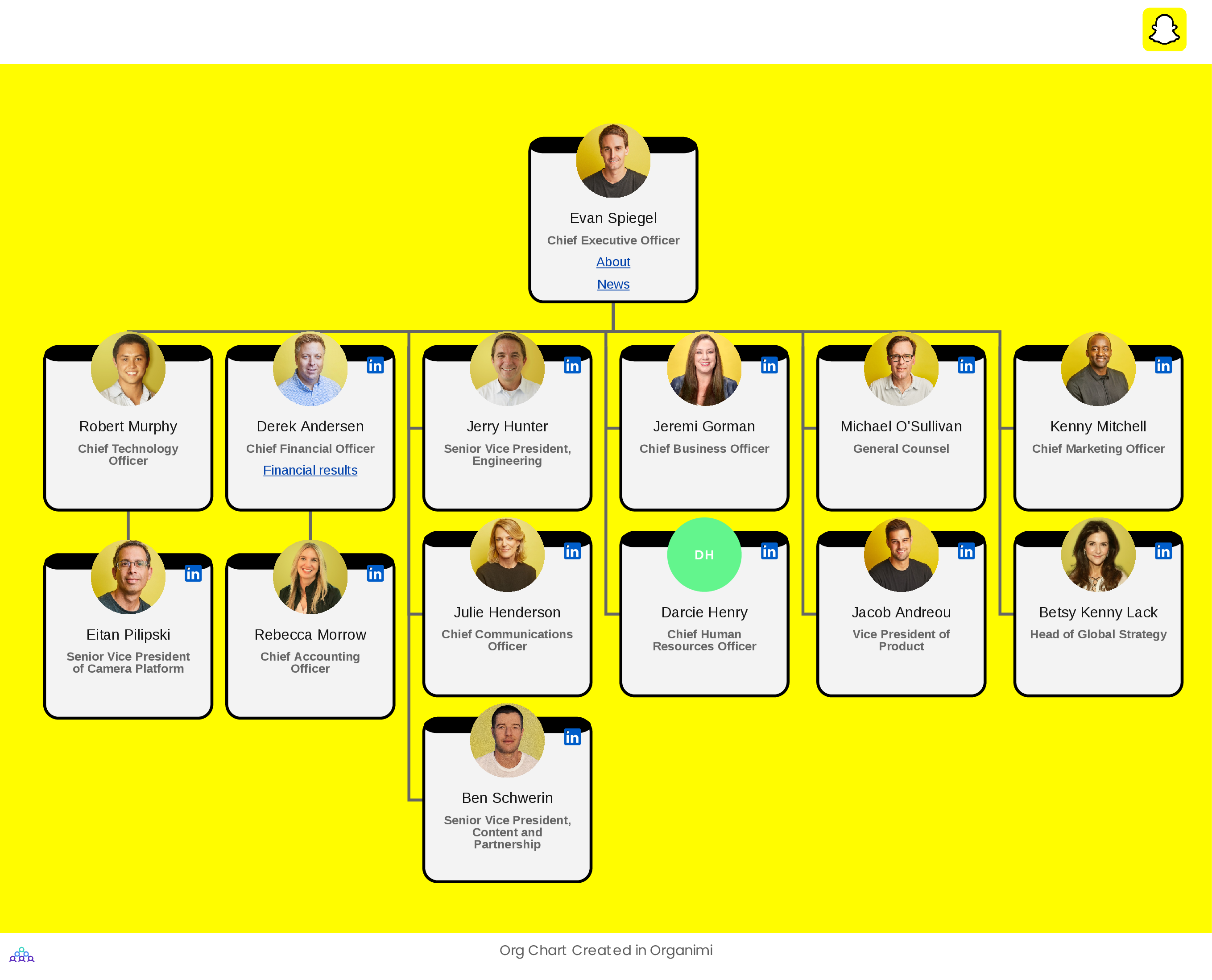

Create clearer accountability and incentives. Specs Inc. can have its own executive team, its own board, its own strategic direction. That separation often makes organizations move faster. No fighting over resources with the Snapchat team.

Shield the parent from hardware risk. Building glasses is risky. Manufacturing, supply chain, product-market fit, all of it is uncertain. By putting Specs in its own company, any catastrophic failure in hardware doesn't automatically tank Snap's core advertising business.

The structure also signals something to investors and partners: this isn't a side project. This is a bet-the-company initiative with its own capitalization.

The AI Operating System Angle

Here's what makes Specs different from every other AR glasses project: they're not trying to run traditional apps.

Snap showed a preview of this with Snap OS 2.0 on the fifth-generation developer Spectacles. The operating system is explicitly designed around an "Intelligence System" that understands context and acts on your behalf.

Instead of tapping icons and launching apps, the glasses are supposed to use AI to predict what you need and show you information proactively. You're walking down the street and the glasses know you're looking for a restaurant. Without you opening an app or typing a search, context appears. You're about to miss a meeting and the glasses remind you.

This is a fundamentally different computing model than iOS or Android. It's closer to how voice assistants work—you talk to them and they handle tasks—except visual and contextual instead of just voice-based.

Snap formalized this philosophy by partnering with Perplexity AI for $400 million in November. Perplexity is an AI search engine that returns answers with source citations, not just links. For AR glasses, that's actually perfect. You can show information and sources directly in the user's visual field.

The math here is interesting:

Traditional AR glasses app model:

- User opens app → Sees menu → Finds feature → Executes task → Result appears

- Friction points: 4-5 steps before useful information

Specs AI-first model:

- Context detected → AI predicts need → Information displayed automatically → User confirms or refines

- Friction points: 0-2 steps (mostly just confirmation)

Snap CEO Evan Spiegel actually said something bold about this: Specs will introduce "a new computing paradigm" to succeed the 1984 Macintosh. That's a bold claim. The Macintosh introduced graphical user interfaces. Spiegel's arguing that context-aware AI interfaces could be the next fundamental shift.

Is he right? That's debatable. But the philosophy matters because it's driving product development. Specs won't be iOS with AR filters slapped on top. It'll be purpose-built for a different interaction model.

Snap Spectacles are expected to be priced around $1,200, positioning them between consumer VR headsets and premium spatial computers. Estimated data based on industry trends.

Consumer Launch Timeline and Pricing Strategy

Snap confirmed that consumer Specs will launch sometime in 2026. No specific quarter, no specific month. Just "sometime this year." That's typical pre-launch vagueness, but it does tell us the hardware is real and coming.

Pricing is intentionally undefined, but Spiegel set a ceiling: it will cost less than the $3,499 Vision Pro.

That's smart positioning. Apple's price point became a punchline. Vision Pro was compared to a used car down payment. By saying Specs will be cheaper, Snap's already differentiated on price without committing to exact numbers.

Consider the context of AR/VR pricing:

Meta Quest 3:

Specs positioning themselves between consumer VR headsets and premium spatial computers actually makes sense. They're not trying to be a gaming device like Quest. They're not trying to be a premium all-in-one computing device like Vision Pro. They're positioning as the "smart assistant on your face" device.

That messaging works better at

The consumer launch also represents the first time Specs will be positioned primarily as a personal device rather than a developer tool. Previous generations sold mostly to developers and early adopters willing to pay premium prices for experimental hardware.

2026 is when Specs tries to become a mass-market device. That's a completely different game than developer hardware.

Distancing from Snapchat's Baggage

Let's be direct about something: Snapchat has baggage.

The platform has faced consistent criticism over child safety, with reports of minors being targeted by predators. Parents have concerns about screen time and social media addiction. Regulators have investigated the app's practices. None of this is unique to Snapchat—TikTok, Instagram, and YouTube all face the same criticism—but it's real and it sticks.

When you're trying to sell expensive new hardware to consumers, the last thing you want is constant comparisons to child safety failures. "Yes, these are great AR glasses. Also, here's an article about how the Snapchat app was used by predators."

The subsidiary structure solves for that rhetorically. Specs Inc. is a hardware company with its own brand. The PR story becomes "Snap's hardware division is launching AR glasses" instead of "Snapchat is making AR glasses." The distinction is subtle but powerful.

This is a playbook that's worked before. Microsoft did this with Xbox—created a separate brand that exists independently of Windows and Office. Sony did it with PlayStation, which lives in its own universe separate from Sony Electronics' other divisions.

Does the subsidiary actually isolate Specs from Snapchat's reputation? Not completely. The hardware will integrate with Snapchat. The parent company is still funding everything. But it creates enough separation for marketing purposes.

Investors and consumers have a cleaner story to work with. "We're investing in AR glasses" sounds better than "we're betting on a social media company's hardware play."

Is this entirely fair or honest? Not really. Specs will ship with Snapchat integration baked in. But corporations often do things that are strategically smart if not entirely transparent, and this is one of those moves.

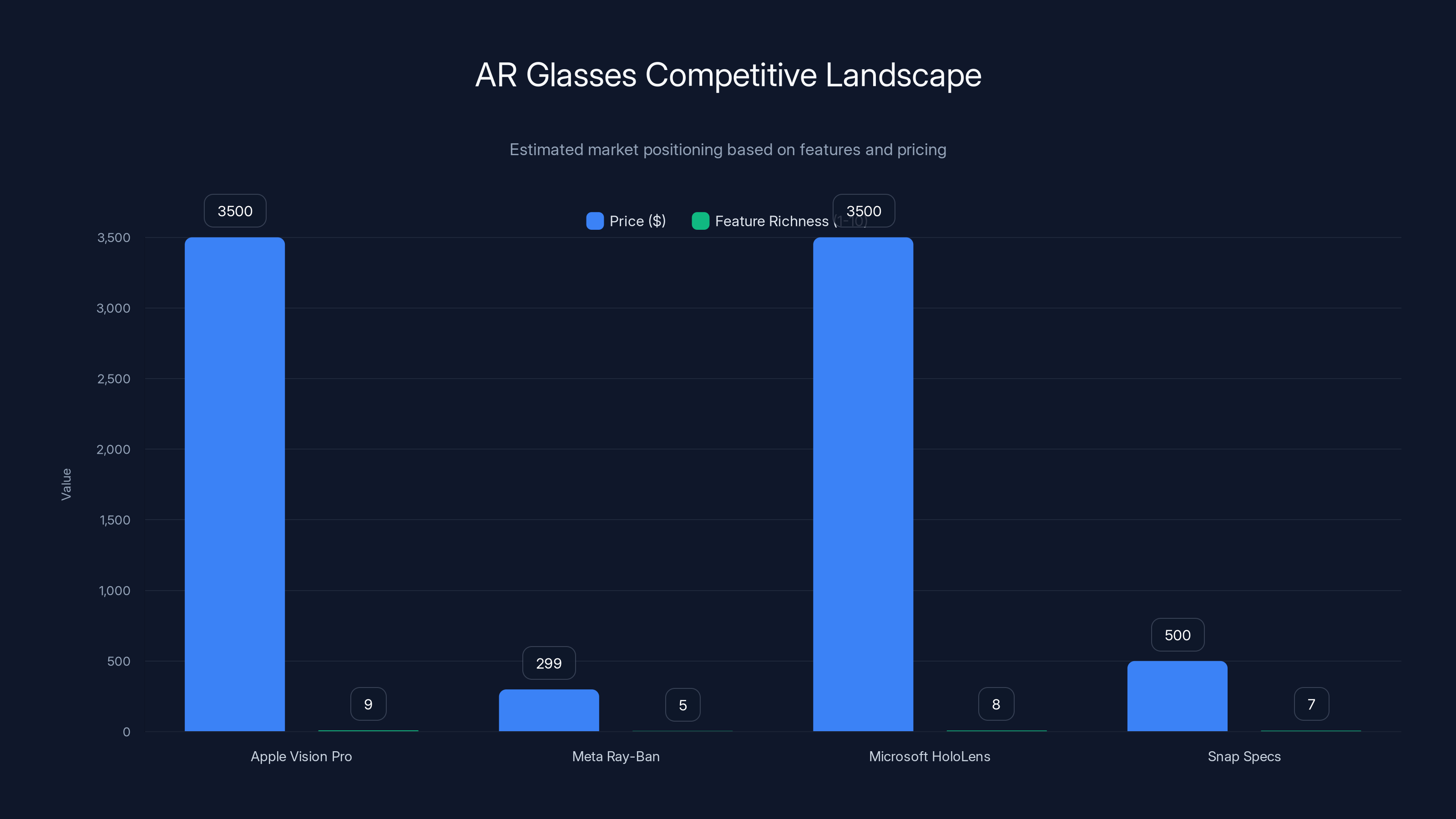

Apple Vision Pro is the most expensive and feature-rich, while Meta's Ray-Ban is the most affordable. Snap Specs aim for a balance between capability and cost. (Estimated data)

The Competitive Landscape for AR Glasses

Snap isn't launching in a vacuum. The AR glasses market is increasingly crowded, and every competitor has a different strategy.

Apple Vision Pro focuses on premium spatial computing and gaming. It's designed as a complete replacement for your laptop and monitor. The price reflects that positioning. Early sales have been underwhelming, which tells us the market doesn't yet want a $3,500 headset, but Apple's betting on future generations being cheaper and better, as noted by Virtual Reality News.

Meta's Ray-Ban smart glasses take a different approach: lightweight, affordable, focused on cameras and basic AI. They cost $299. The AI can describe what you're looking at, identify people, do real-time translation. It's not a computing device. It's a camera with AI. And it's gaining real adoption because it's genuinely useful and doesn't require you to wear a heavy visor.

Microsoft HoloLens remains enterprise-focused, selling to workers who need AR overlays in industrial or medical settings. Not a consumer play.

Samsung, Google, and Amazon are all reportedly working on AR glasses, but nothing's shipped yet.

Snap's positioning is interesting because it's trying to split the difference. More capable than Ray-Ban smart glasses (which are really just cameras with AI). Less expensive and less ambitious than Vision Pro. Actually wearable unlike some early prototypes that looked like something from a sci-fi movie.

The key competitive advantage Snap has is software and integration. They've been shipping AR experiences through Snapchat for over a decade. They know how to build effects, they have an ecosystem of creators, and they have tens of millions of active users who are already comfortable with AR as a feature.

When Specs ship, the glasses will be useful immediately because they'll have access to Snapchat's library of AR effects and integrations. That's not trivial. Meta is trying to build that ecosystem now with Ray-Ban. Apple is trying to build it with App Store. Snap already has it.

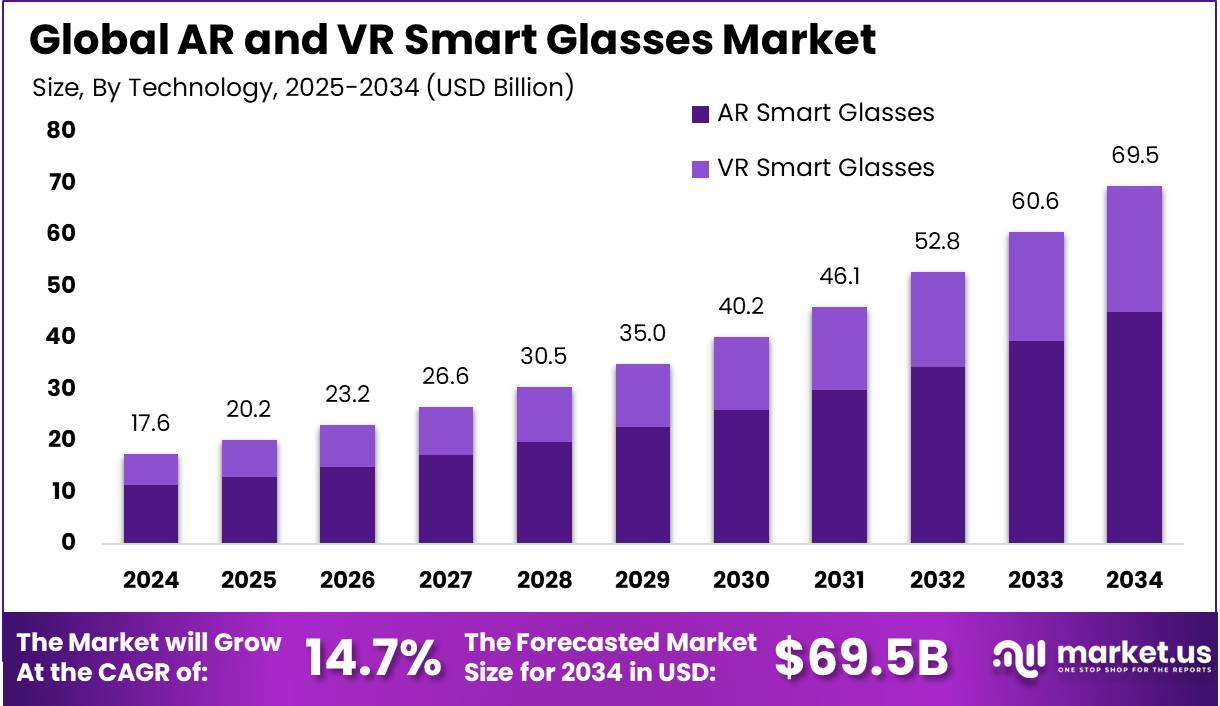

Estimated market sizes for AR glasses (2025-2030):

These are rough estimates, but the point is clear: there's room in the market for multiple players, but the timing has to be right and the product has to be genuinely useful.

How Specs' AI-First Approach Changes Everything

The traditional AR glasses pitch has always been: "Imagine having computer information overlaid on the real world." That's technically interesting but doesn't answer the human question: "Why would I actually wear this?"

Snap's answering that differently. Instead of asking "How do we overlay information?" they're asking "How do we make glasses that understand context and help you without you having to ask?"

That's a fundamentally different product.

Consider a scenario: You're at a coffee shop and a friend recommends the latte. With traditional AR glasses, you'd have to:

- Say "Show me reviews of this latte"

- Wait for the glasses to process the request

- Display reviews in your visual field

- You read the reviews

With Specs' approach, the flow would be:

- Friend mentions the latte

- Glasses detect the conversation and context (you're at a coffee shop, someone recommended a drink)

- Glasses proactively show you reviews, ratings, ingredients, or related recommendations

- You can acknowledge the information or ask for more details

One feels like you're commanding a computer. The other feels like the computer is helping you.

The technical challenge is that context understanding requires exceptional AI. The glasses need to understand what you're looking at, what you're hearing, who you're with, where you are, what time of day it is, and what your historical preferences are. Then synthesize all of that into a prediction about what you actually need.

Snap's betting that AI has gotten good enough to do this. And they might be right. Large language models and multimodal AI have improved drastically in the last 18 months. What seemed impossible two years ago is plausible now.

But here's the risk: if the AI gets it wrong too often, the glasses become annoying instead of helpful. Imagine walking down the street and your glasses keep suggesting irrelevant stuff. You'd take them off.

This is why the AI piece is so critical. Specs can't be good hardware with mediocre AI. The AI has to be genuinely useful or the entire concept falls apart.

Snap's strategic timing aligns with increasing market interest in AR glasses, leveraging a decade of development to capitalize on the growing trend. Estimated data.

The Developer Strategy for Specs Inc.

Snap hasn't abandoned the developer community with the shift to consumer glasses. In fact, making Specs Inc. a separate entity makes developer relations clearer.

Developers building for Specs need to understand an entirely different paradigm than app developers. There's no home screen. There's no file system. There's no traditional navigation structure.

Instead, developers are building "experiences" that integrate with the contextual AI layer. When a developer builds a restaurant experience, they're not creating an app that users launch and navigate. They're creating intelligence that the OS can activate contextually.

When you're near a restaurant and it's dinner time, the OS can activate that restaurant's experience automatically. You look at the menu written on a physical board, and overlays appear with ratings, ingredients, allergen information, or recommendations.

This is completely different from building a Snapchat lens (which is just effects) or building an iOS app (which is traditional software).

Snap has SDK tools and documentation for developers already. The question is whether developers will actually build for this platform. It's a chicken-and-egg problem: developers want users, and users want apps.

Snap's addressing this by having Snapchat integration baked in. Day one, Specs users will have access to Snapchat's effects library. That's millions of experiences immediately available.

As consumer adoption grows, more developers will build native Specs experiences. But that only happens if the glasses actually gain significant market share.

Manufacturing and Supply Chain Realities

Here's something people often gloss over when discussing new hardware: actually building it is hard.

AR glasses require:

- Custom display technology (not many manufacturers make AR-grade displays)

- Specialized lenses with optical properties not found in standard eyeglasses

- Multiple sensors (cameras, IMU, depth sensing, etc.)

- Processors powerful enough for AI inference but small enough to fit

- Batteries that last through a full day without weighing too much

- Assembly that maintains precision tolerances

- Quality control at scale

Snap has been iterating on hardware since 2012. That's real experience. But consumer volume manufacturing is different from developer kit production. Developer kits sell thousands of units. Consumer launches need hundreds of thousands.

Snap probably learned supply chain lessons from Spectacles generations 1-5. The company knows which manufacturers are reliable, which components work at scale, how to manage logistics.

But 2026 launch timelines are aggressive. If there's any manufacturing hiccup, the launch gets delayed. And hardware delays are expensive because you've already committed to marketing campaigns and retailer partnerships.

This is actually an advantage of the subsidiary structure: if manufacturing issues hit, Specs Inc. can operate independently without dragging down Snap's advertising business.

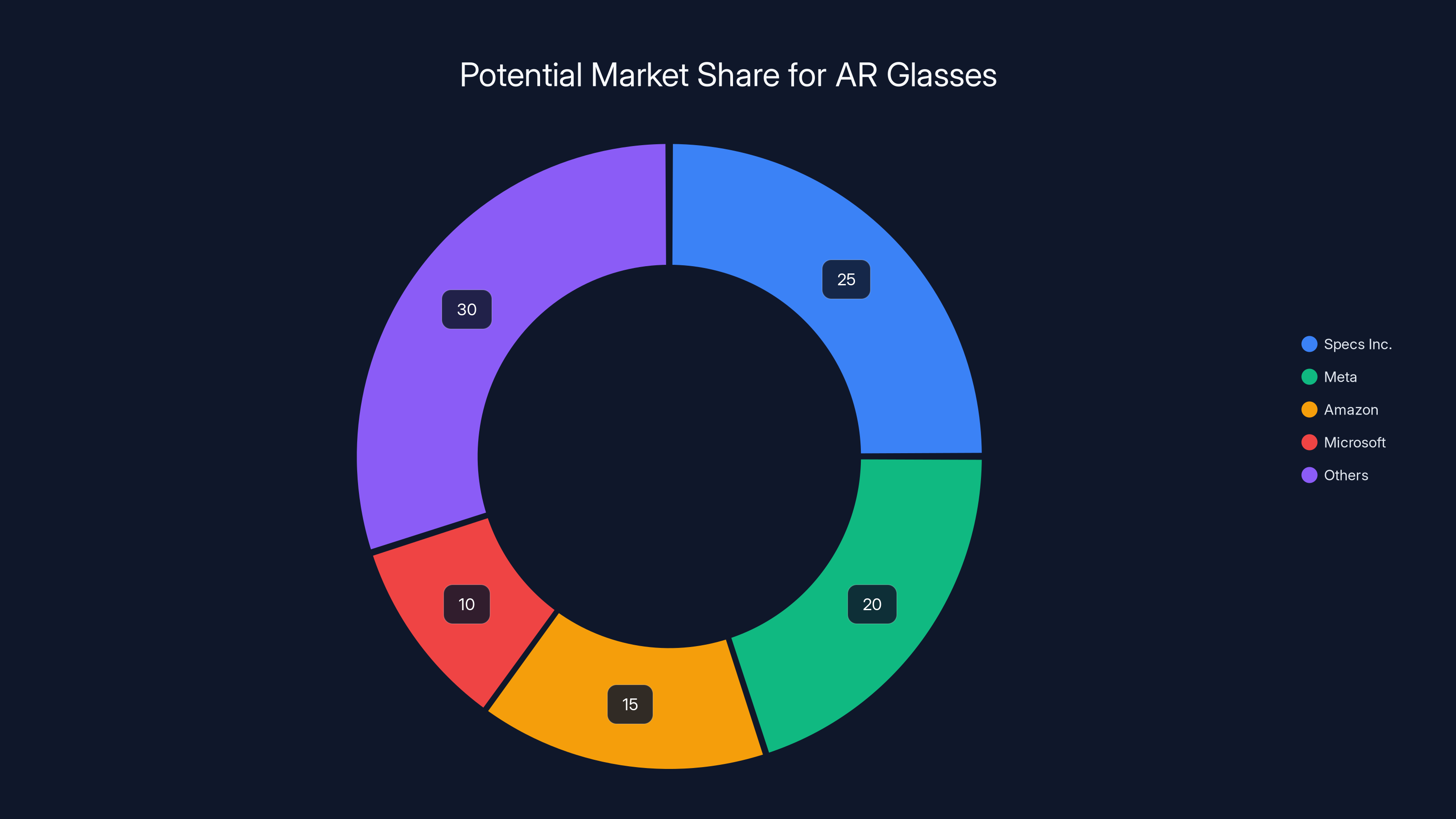

Specs Inc. could capture a significant portion of the AR glasses market, leveraging its first-mover advantage and established ecosystem. Estimated data.

Privacy and Data Concerns

Here's a conversation Snap hasn't fully grappled with publicly: wearable cameras collecting constant video and audio data create massive privacy implications.

Specs will have cameras pointed at the world around you. They'll have microphones recording conversations. They'll track your location via GPS. They'll monitor what you look at, how long you look at it, and who you're with.

All of that data trains the AI. The AI gets better when it learns from more of your behavior.

Snap says "protecting and respecting your privacy" is a design principle. But what does that actually mean?

Does it mean:

- Camera data never leaves the device?

- Audio recordings are deleted after processing?

- Location data isn't sold to third parties?

- Eye tracking data isn't shared with advertisers?

Snap hasn't specified. And frankly, the company's history with Snapchat privacy makes people skeptical. Snapchat has been caught retaining data longer than users expected, and sharing data with third parties in ways that weren't clearly disclosed.

Snap will need to be exceptionally transparent about Specs data handling if the company wants to avoid the backlash that HoloLens faced (privacy advocates worried about workplace surveillance) or the skepticism around Google Glass (people didn't want to be secretly recorded).

This is a genuine vulnerability for Specs. Earn trust or the product dies.

The Investment Thesis for Specs Inc.

Why would external investors put money into Specs Inc.? Let's look at the investment case.

TAM (Total Addressable Market): The potential market for AR glasses is massive. Billions of people wear glasses or use digital devices. If AR glasses become the dominant interface for computing, the market could be larger than smartphones.

First-mover advantage: Snap is one of the few companies with decade-long AR software and hardware experience plus an actual user ecosystem. Building AR glasses is hard. Building an AR platform and app ecosystem is harder. Snap has both.

Exit strategy: If Specs becomes a successful AR platform, the company could be acquired for billions by Meta, Amazon, or Microsoft. Or it could go public as an independent company.

Defensibility: AR glasses are hardware, which means they're harder to disrupt than software. If Specs gain market share and developers build on the platform, the switching costs for users get higher over time.

Diversification from advertising: Snap makes all its money from Snapchat ads. Hardware revenue would be new. Higher margins too (hardware companies can have 40-60% gross margins versus Snapchat's ~70% but much lower net margins).

The investment thesis is: "Early stage, high risk, huge market if it works."

That's exactly what venture capitalists pay attention to. And separating Specs into its own company makes the thesis much easier to model.

Lessons from Previous AR Glasses Failures

Let's learn from history here, because the graveyard of failed AR glasses projects is substantial.

Google Glass (2013): Looked ridiculous. Created privacy backlash (people thought they were being secretly recorded). Priced at $1,500. Developers didn't build apps. Died.

Thalmic Labs Myo (2013-2018): Armband that controlled computers via gestures. Cool concept. Turned out gesture control isn't actually how people want to interact with devices. Acquired and shut down.

Meta's failed AR glasses: Meta spent years developing Orion, an advanced AR device. Cancelled it because the technology wasn't ready and the consumer use case wasn't clear.

Snap's own first Spectacles (2014): Launched to massive hype. Sold way fewer units than expected. The problem: they only recorded Snapchat videos. Functionality was too narrow.

The pattern is clear: AR glasses need:

- Genuine functionality (not just a gimmick)

- Reasonable design (people will actually wear them)

- Ecosystem of software (apps/experiences that make them useful)

- Affordable pricing (relative to the value delivered)

- Solved core problems (why would you use this over your phone?)

Snap is addressing each of these more carefully than previous attempts. The glasses look more like normal eyeglasses. The AI integration actually solves real problems (you don't need to pull out your phone constantly). The pricing will be below $3,500. The ecosystem already exists through Snapchat.

But being better than failed predecessors isn't the same as being successful. You still need to win the market.

Enterprise Opportunities for Specs

While Snap is marketing Specs to consumers, there's a significant enterprise play lurking underneath.

AR glasses for enterprise use cases have been profitable for Microsoft (HoloLens) and other companies. Workers use AR glasses for:

Field service and repairs: Technicians wear AR glasses to see equipment specifications, repair procedures, and video calls with remote experts overlaid on the physical equipment they're working on.

Manufacturing: Assembly line workers see step-by-step instructions overlaid on products. Quality control is automated with computer vision.

Healthcare: Surgeons wear AR glasses during procedures to see patient imaging data, vitals, and guidance overlaid in their visual field.

Logistics: Warehouse workers see picking instructions and inventory levels overlaid directly on shelves.

Snap hasn't publicly emphasized enterprise use cases for Specs, but the company would be foolish not to pursue them. Enterprise customers pay more money, they buy in volume, and they have fewer privacy concerns (they know they're being tracked).

The subsidiary structure actually makes an enterprise play easier. Snap can create separate sales teams, separate pricing, separate support structures for Specs enterprise versus Specs consumer without confusing the two markets.

The Longer-Term Vision

What's Snap actually trying to build here?

Based on everything the company has said and done, here's the vision: AR glasses become the dominant computing platform. Not for games or entertainment primarily, but for everyday information access.

Instead of pulling out your phone to check the time, get directions, check messages, or search for information, your glasses proactively provide that information contextually. Your phone becomes a secondary device.

If that happens, whoever controls the AR glasses platform controls a fundamental interface to the internet. That's worth billions.

Snap is betting it can be that company. And by separating Specs into its own subsidiary, the company is signaling that this isn't a side project—it's a core bet on the future of computing.

It's audacious. It's risky. Plenty of things could go wrong. But the strategic logic is sound, and the execution so far has been more thoughtful than most AR hardware companies manage.

The next phase is consumer launch in 2026. That's when we actually find out whether people want to wear AR glasses, whether the AI integration works as promised, and whether Snap can build an ecosystem that rivals Apple and Meta.

Until then, the subsidiary announcement is a signal: Snap is all in on this bet.

Key Takeaways

Snap's decision to create Specs Inc. as a separate subsidiary tells us several things:

First, the company is serious about AR glasses. This isn't a side project that might get cancelled if advertising dips. It's a fundamental bet on the future.

Second, Snap recognizes that the Snapchat brand creates friction when pitching new products to investors and consumers. The subsidiary lets them build something new without inheriting that baggage.

Third, the AI-first philosophy is core to differentiation. Specs aren't trying to be the most powerful spatial computer or the coolest gaming device. They're trying to be an intelligent assistant you wear on your face.

Fourth, the pricing strategy is realistic. Under $3,500 puts Specs in a market segment where they can actually win without pretending to compete with Apple.

Fifth, the timeline is accelerating. 2026 is sooner than most expected. Snap is moving faster than Meta moved on VR headsets or Microsoft moved on HoloLens.

The risk, of course, is execution. Great strategy doesn't guarantee great products. But Snap has institutional knowledge about AR that most competitors lack, and they're deploying it thoughtfully.

Watch 2026 closely. If Specs launch with a compelling AI experience and reasonable pricing, the AR glasses market might finally stop being a perpetual promise and become an actual thing people use.

FAQ

What exactly is Specs Inc. and how does it differ from Snap?

Specs Inc. is a wholly-owned subsidiary of Snap dedicated to developing and launching AR glasses. Unlike Snap's main business (Snapchat advertising), Specs Inc. operates as a separate company focused purely on hardware and AR software. This structure allows Specs to attract minority investors, establish its own valuation for fundraising, and operate independently with its own executive team and strategic direction.

When will Specs consumer glasses actually launch?

Snap confirmed consumer Specs glasses will launch sometime in 2026, though the company hasn't announced a specific quarter or month. This represents the first major consumer release of Specs hardware after years of developer previews. The company has been iterating on Spectacles hardware since 2012, so the consumer version will benefit from over a decade of development experience.

How much will Specs glasses cost?

Snap hasn't announced exact pricing, but CEO Evan Spiegel confirmed Specs will cost less than Apple's

What makes Specs' AI approach different from other AR glasses?

Instead of relying on traditional apps and manual navigation, Specs use an AI-first operating system called Snap OS 2.0 that understands context and proactively delivers information. The glasses can detect what you're looking at, who you're with, where you are, and what your preferences are, then automatically surface relevant information without requiring you to open apps or issue commands. This represents a shift from command-based computing to context-aware assistance.

How does the Perplexity partnership improve Specs?

Snap's $400 million investment in Perplexity AI ensures that Specs glasses have access to advanced AI search and answer capabilities. Perplexity specializes in answering questions with source citations rather than just links, which translates well to AR displays where showing information alongside sources directly in the user's visual field is valuable. This partnership provides the intelligence backbone for Specs' contextual AI system.

Why did Snap separate Specs into its own company?

Creating Specs Inc. as a subsidiary accomplishes several strategic goals: it attracts investors interested in pure AR hardware plays without Snapchat's social media baggage, establishes a separate valuation for clearer financial modeling, enables minority investments without diluting Snap's parent shareholders, creates distinct brand positioning separate from Snapchat's privacy concerns, and allows the team to operate with focused strategy and incentives. The move also signals that AR glasses are a core company bet, not a side project.

Will Specs work with Snapchat or other apps?

Specs will integrate deeply with Snapchat, including access to millions of AR effects and experiences created for the Snapchat platform. The glasses will also support third-party developer experiences built specifically for the Specs ecosystem. Rather than running traditional mobile apps, Specs prioritize contextual AI integrations where developers create intelligence layers that activate based on user context rather than explicit app launches.

How does Specs compare to Apple Vision Pro and Meta Ray-Ban glasses?

Vision Pro is a premium all-in-one spatial computer priced at

What privacy concerns do Specs raise?

Specs will continuously record video and audio from your surroundings, track your location, monitor your eye gaze, and collect behavioral data to train the contextual AI. Snap claims privacy protection is a core design principle but hasn't detailed exactly how data will be handled, whether recordings are stored, how long they're retained, or which third parties might access information. These details will be critical given Snapchat's past privacy controversies and public skepticism about wearable cameras.

What's the enterprise potential for Specs?

Beyond consumer markets, Specs have significant enterprise applications in field service, manufacturing, healthcare, and logistics. Technicians, surgeons, factory workers, and warehouse staff can all benefit from AR overlays showing instructions, data, and remote guidance. Snap could develop separate enterprise pricing and support structures through Specs Inc., similar to how Microsoft monetizes HoloLens differently than consumer products.

How realistic is Snap's "new computing paradigm" claim?

Snap's assertion that Specs could rival the Macintosh as a computing shift is ambitious but not baseless. Context-aware AI interfaces could genuinely change how people access information compared to traditional app-based computing. However, this requires the AI to be exceptionally accurate, the hardware to be genuinely wearable, and the ecosystem to provide real value. Past AR glasses have failed despite good intentions, so execution matters more than vision.

Snap's restructuring of its smart glasses business into Specs Inc. represents one of the most significant bets any company has made on augmented reality since Apple's Vision Pro. By creating a separate entity with its own funding mechanisms and brand positioning, Snap is signaling that AR glasses aren't an experimental side project but a fundamental part of the company's future.

The real test comes in 2026 when these glasses actually ship to consumers. Until then, the strategy is sound, the technology roadmap is credible, and the market timing might finally be right for wearable AR to break through from promise to reality.

Related Articles

- Best Fitness Trackers & Watches [2026]: Complete Buyer's Guide

- 7 Biggest Tech Stories This Week: LG OLED TVs, Whoop Fitness Trackers [2025]

- This Week in Tech: Apple's AI Pin, NexPhone's Triple OS, and the Sony-TCL Merger [2025]

- Solos Sues Meta Over Ray-Ban Smart Glasses Patents [2025]

- Fix Garmin Accidental Calls in Shower: Complete Guide [2025]

- Apple's AI Pin: What We Know About the Wearable Device [2025]

![Snap's Specs Subsidiary: The Bold AR Glasses Bet [2025]](https://tryrunable.com/blog/snap-s-specs-subsidiary-the-bold-ar-glasses-bet-2025/image-1-1769611213484.jpg)