This Week in Tech: Apple's AI Pin, Nex Phone's Triple OS, and the Sony-TCL Merger [2025]

There's this moment that happens every few months in tech where everything shifts underneath you. Not the giant "this changes everything" kind of shift. The smaller, stranger kind. The kind where you realize something you thought was settled is suddenly moving again.

This week felt like one of those moments.

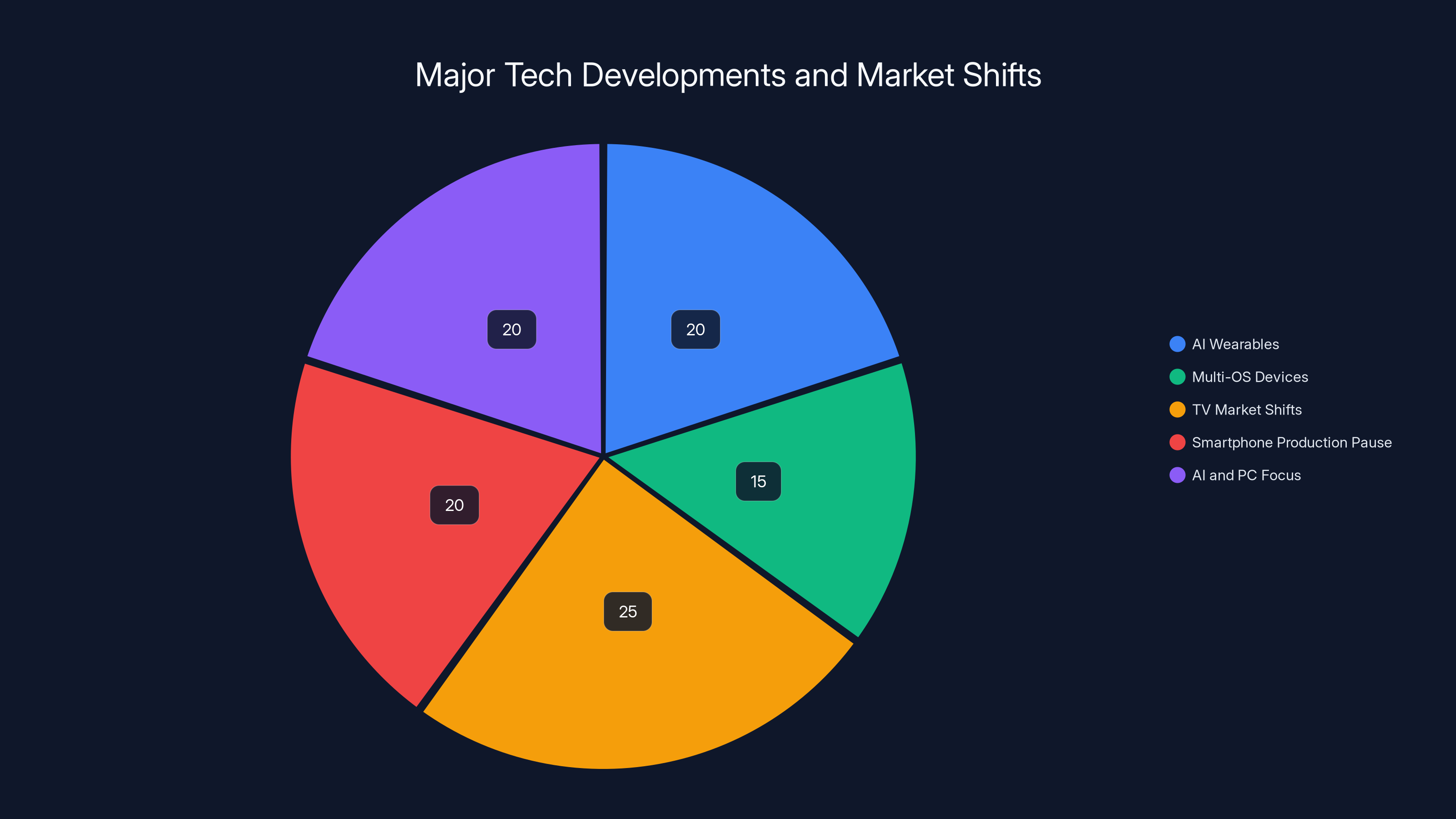

We're getting our first real look at what happens when established players genuinely get nervous. Apple is reportedly building a dedicated AI wearable after its AI rollout stumbled. Sony is handing over control of its TV business to a Chinese competitor. Asus is walking away from smartphones entirely. And a startup nobody's heard of just built a phone that can run Windows, Linux, and Android.

These aren't disconnected stories. They're symptoms of the same thing: the hardware industry is tired of the status quo and actively trying to break it.

Let's dig into what happened, what it means, and why you should care about any of it.

TL; DR

- Apple's developing an AI wearable with multiple cameras, microphones, and wireless charging, rumored for launch in 2027, powered by a revamped Siri experience built on Google's Gemini models

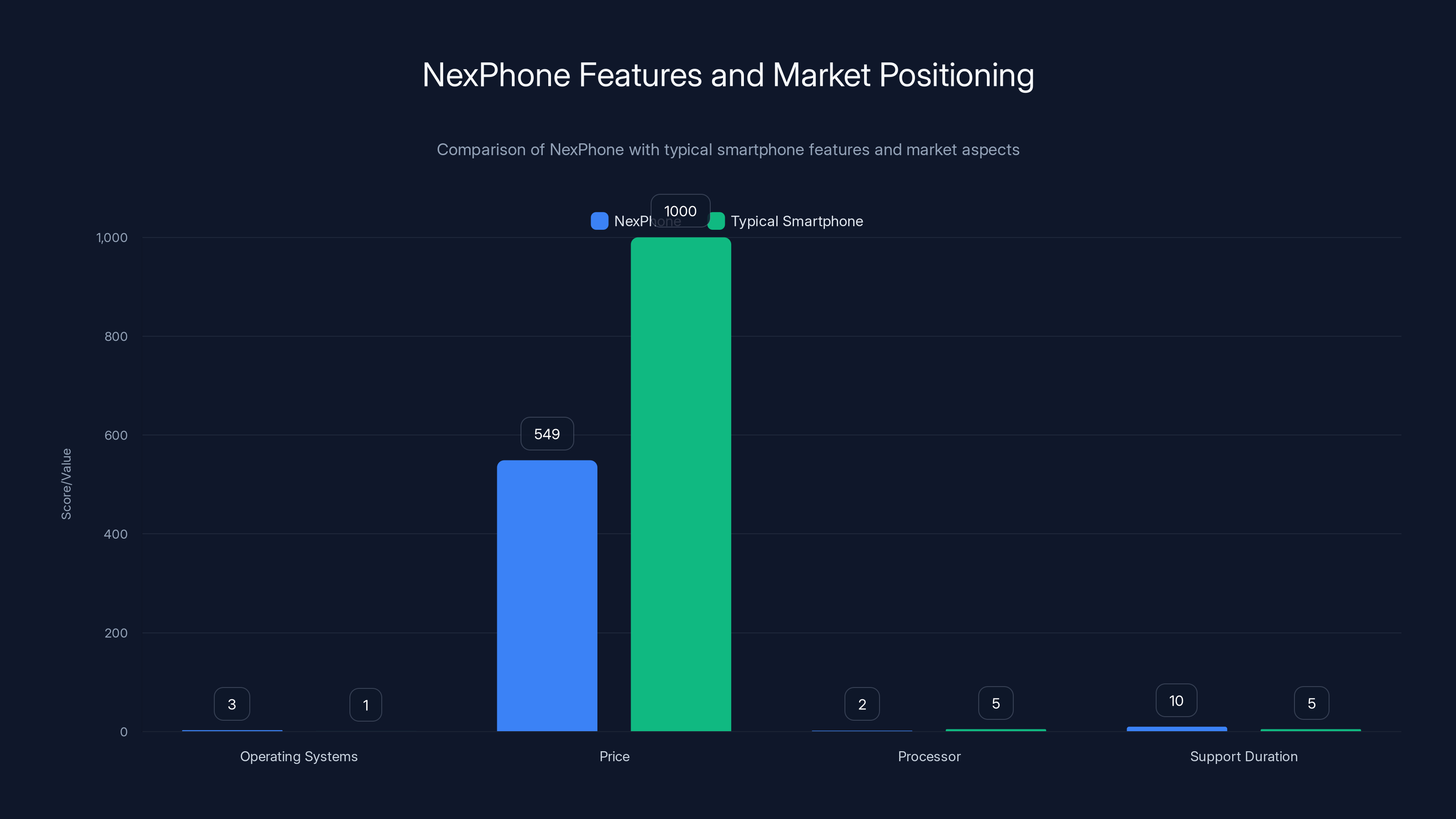

- The Nex Phone runs three operating systems (Android, Linux, Windows) on a single device with enterprise-grade support through 2036, costs $549, ships Q3 2026

- Sony is ceding TV control to TCL in a majority partnership that gives the Chinese manufacturer 51% control of Sony's Bravia brand and home entertainment business by April 2027

- Asus is pausing smartphone production after two decades in the mobile market, redirecting resources to PCs and AI-focused hardware like smart glasses and robotics

- The shift signals a reset in how tech companies think about hardware categories, AI integration, and global competition

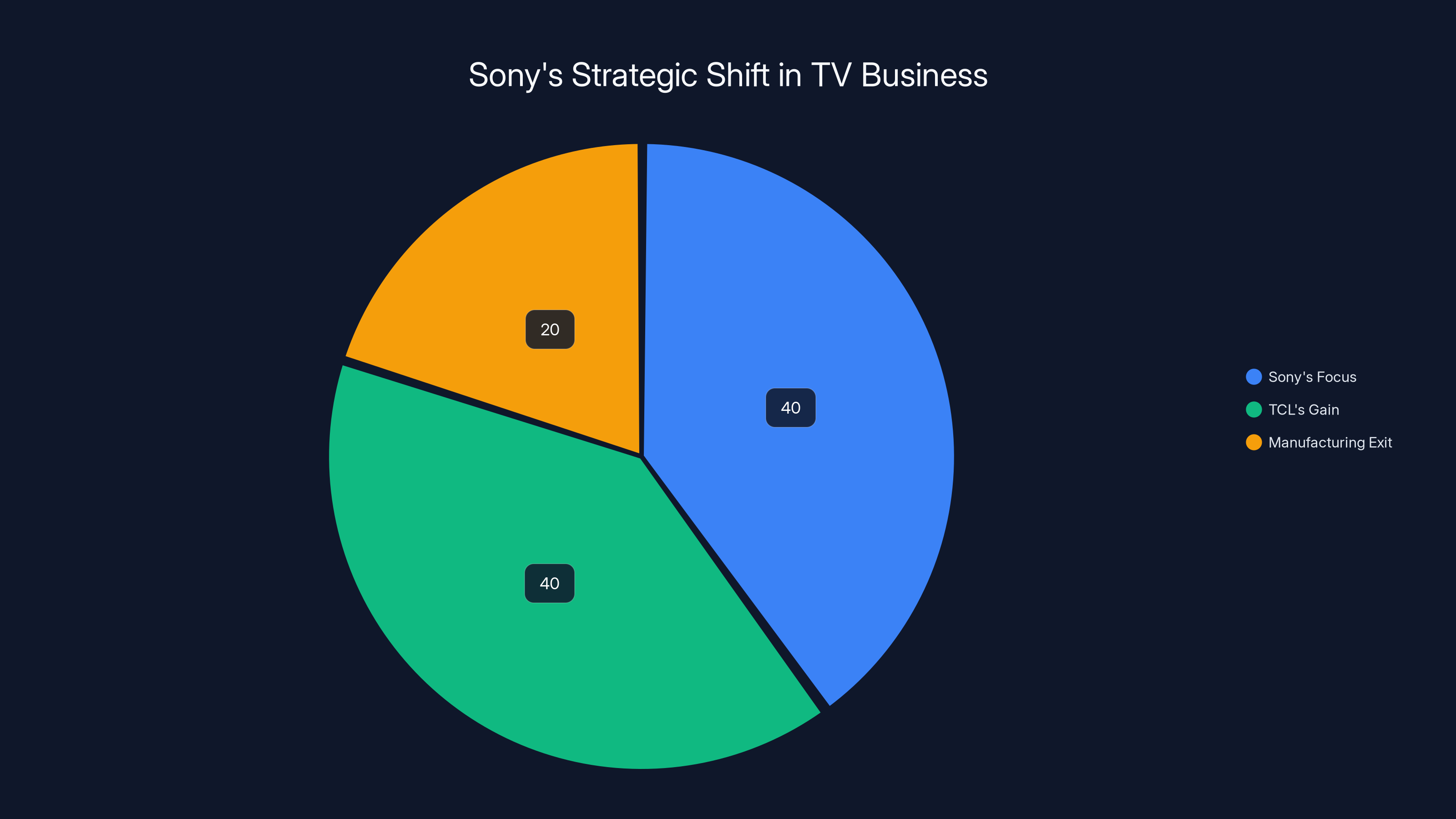

Sony's partnership with TCL allows Sony to focus 40% on content production, while TCL gains 40% in brand prestige and technology. Sony exits 20% from manufacturing.

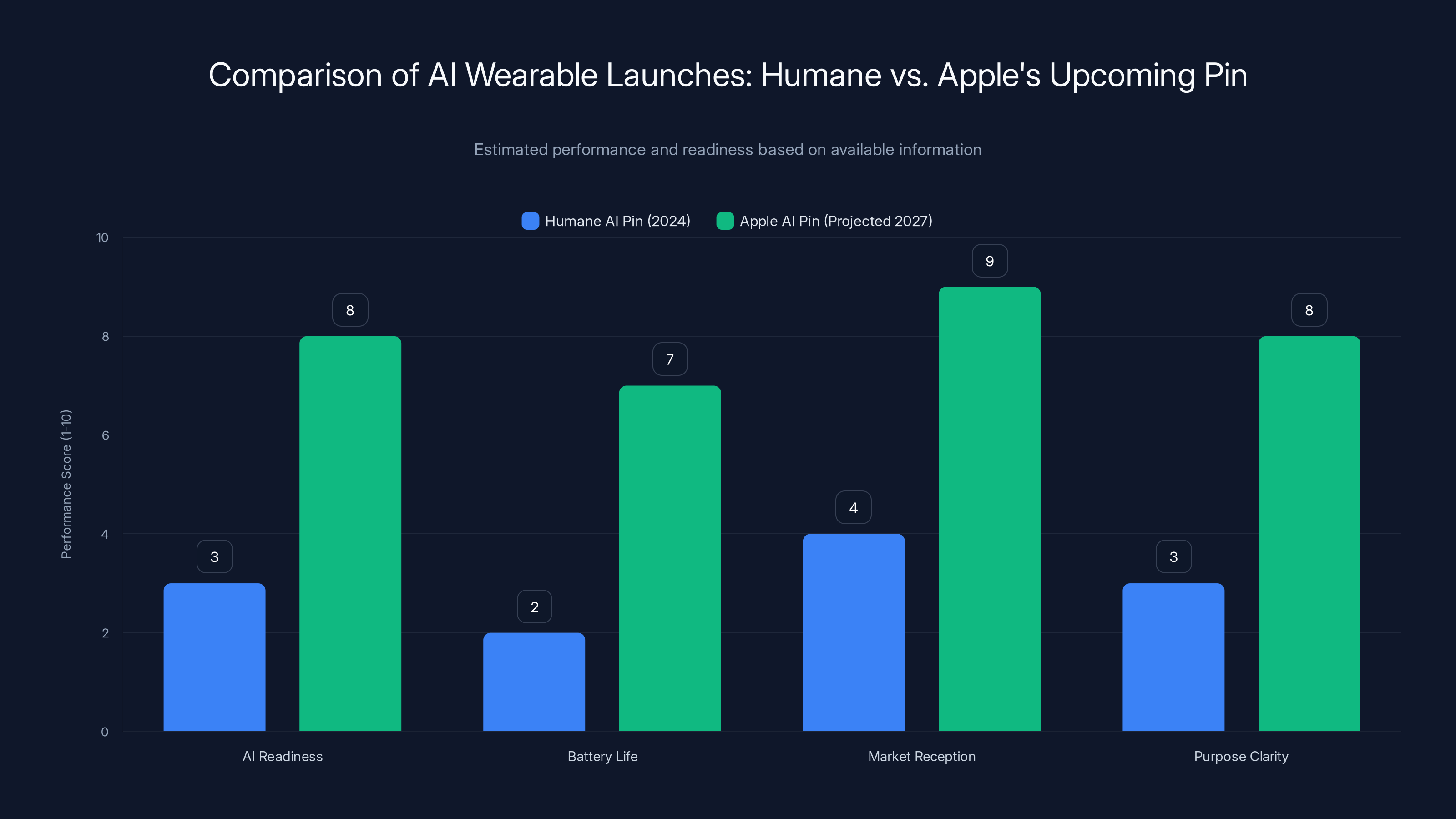

Apple's New AI Wearable: The Pin That Learned From Humane's Mistakes

Let's start with the story that's going to get the most attention: Apple is building a small wearable device the size of an Air Tag, and it's supposed to be one of the most consequential products the company releases in 2027.

Here's what we know. According to reporting from The Information, this device will have multiple cameras, a speaker, microphones, and wireless charging. It'll run on a new AI experience codenamed Campos—a complete reimagining of Siri as a conversational AI assistant, similar to Chat GPT. The device will supposedly debut alongside updates to i Phone, Mac, and i Pad that bake Campos into i OS 19, mac OS, and i Pad OS.

Now, if you're thinking, "Wait, didn't Humane already try this with the AI Pin?" you're exactly right. And you've identified the most important thing about this story.

Humane's AI Pin launched in 2024 to massive hype and exceptional skepticism. The company had raised over $220 million, hired legendary designers, and drummed up a media circus around the device. Reviews dropped, and the product crashed so hard it became a case study in what not to do. Battery life was abysmal. The AI wasn't ready. The use cases felt forced. Within months, the company was struggling to find buyers.

The AI Pin's fundamental problem wasn't that wearable AI hardware is bad. It was that Humane built the device before the AI experience was actually good enough to justify it. They released a pin looking for a purpose instead of building a pin around a purpose that already worked.

Apple's approach is the inverse. The company is betting that by the time the hardware ships in 2027, the Siri experience will be compelling enough to make the form factor make sense. That's a very different calculation.

Think about what this device actually needs to do. It needs to be your quick-access AI. Not your phone's AI—your own dedicated AI. Small enough to clip to your shirt. Smart enough to handle information capture (the cameras), voice interaction (the speaker and mics), and actual reasoning about what you're asking it.

The key detail buried in the rumors is that this Campos experience is being built with Google's Gemini models. Apple tried building its own generative AI stack for on-device processing and discovered what everyone else has learned: training and deploying world-class LLMs is phenomenally expensive and difficult. So they're doing what Google and Microsoft do: partnering with someone who already figured it out.

The Timing of Apple Intelligence Getting Its Act Together

Apple's broader AI story has been messy. The company launched Apple Intelligence with i Phone 16 and it landed with a thud. Features were delayed. Functionality was limited. The experience felt underbaked compared to what competitors were offering. And the rollout timeline—pushing major features into 2026—felt like an admission that Apple wasn't ready when it needed to be.

But here's what's actually happening underneath: Apple is learning in real time how to integrate AI into its ecosystem. The company's distribution advantage is insane. Over 2 billion active devices running i OS, mac OS, and i Pad OS. That's your install base. Every single one of those devices becomes smarter when Campos lands.

The wearable isn't competing with your i Phone. It's complementing it. It's the thing you wear when you don't want to pull your phone out. It's the device that's always listening, always ready, always aware of context.

Why the Hardware Is Actually Secondary Here

The camera suite, the wireless charging, the microphones—all of that matters less than you'd think. What matters is the AI experience that runs on the device.

This is the exact opposite lesson from Humane. Humane thought the form factor was the revolution. Apple knows the software is the revolution, and the hardware is just the delivery mechanism.

Imagine you're out on the street and see something you want to remember. You tap the device, it takes a photo, you describe what you're looking at, and Campos understands context and intent. That's a real use case. Humane couldn't do it reliably. Apple is betting by 2027 it can.

The Other AI Hardware Coming From Apple

The wearable pin isn't the only new hardware Apple is working on. Reports also mention smart glasses with AR capabilities, a dedicated smart home hub with a rotating display (which has been rumored for years), and Air Pods with enhanced sensors.

The pattern here is clear: Apple is trying to create an entire ecosystem of AI-powered hardware that talks to each other. The wearable handles quick interactions. The glasses handle spatial computing and information overlays. The home hub handles smart home automation. The Air Pods handle audio and biometric sensing.

That's not a product strategy. That's a platform strategy. And it's only possible because Apple controls both the software and hardware at every layer.

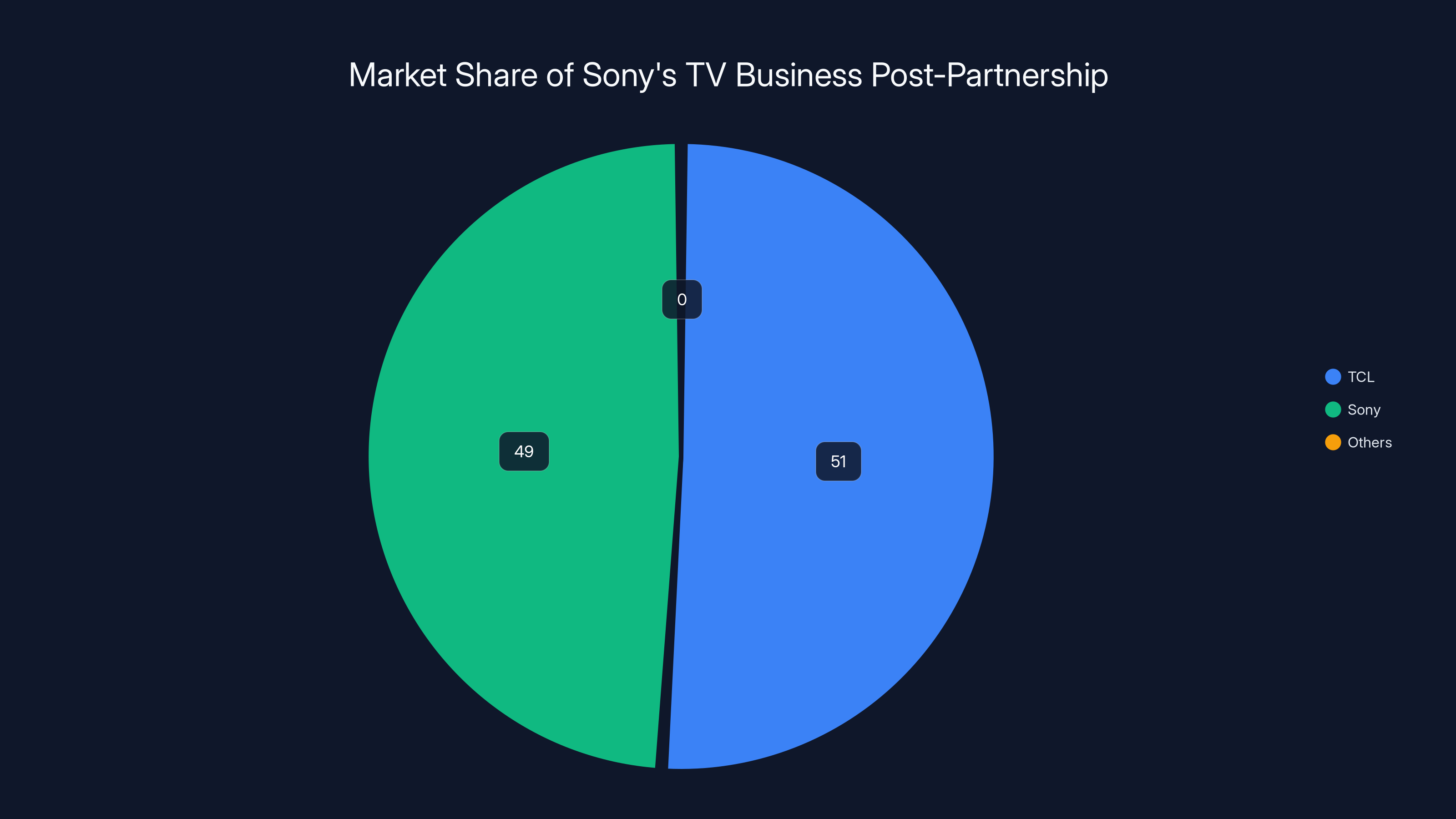

TCL now holds a majority control of 51% in Sony's TV business, marking a significant shift in the industry's power dynamics. Estimated data.

The Nex Phone: The Weird Outlier That Might Matter More Than You Think

If you missed the Nex Phone announcement, it's understandable. It came with minimal hype, no major press coverage, and the kind of technical specs that make normal people's eyes glaze over.

But this device is genuinely interesting because it does something phones aren't supposed to do: it runs multiple operating systems.

Let's be specific about what Nex Computer built. The Nex Phone can dual-boot between Android and Windows. When you boot into Android, you get a normal Android phone. When you boot into Windows, you get a custom mobile UI designed around phone-sized screens, and when you dock it into an external monitor, you get the full Windows 11 desktop.

There's also a Debian Linux environment you can launch as an app from Android.

Technically, this isn't revolutionary. Phones have been able to run multiple operating systems for years. What's different here is the execution. Nex Computer designed the experience to feel natural on mobile form factors while maintaining full compatibility with each operating system's capabilities.

Why This Matters More Than It Seems

The market for secondary phones is real but relatively small. People who want a backup device for work. People who need to test applications across multiple platforms. Developers who want a pocket-sized testing rig.

Nex Computer is targeting that market explicitly. The phone costs

The hardware itself isn't trying to compete with the latest Samsung Galaxy or i Phone. The processor is a Qualcomm QCM64490, not the top-tier flagship chip. But the company is promising support through 2036, which is a shocking long-term commitment in an industry where five years of updates is generous.

That long support window is actually the most interesting part. It signals that Nex Computer understands the value of stability over raw performance for this market segment.

What This Actually Enables

Imagine you're a developer. You have a Nex Phone. You need to test your application on Android, Windows, and Linux. Instead of carrying three devices or maintaining three separate testing rigs, you have one device that gives you all three environments. That's not a huge productivity gain for most people, but for some, it's significant.

Or imagine you're doing field work where you need access to both mobile apps and desktop software. A single device that transitions smoothly between both is genuinely useful.

The phone also has practical specs: 12GB of RAM, 256GB of storage, a 6.58-inch 120 Hz display, a 64MP camera, wireless charging, and 5G support. These aren't cutting-edge by 2025 standards, but they're more than adequate for the use cases this device targets.

The Supply Chain Gamble

What's remarkable about the Nex Phone isn't that it exists. It's that Nex Computer managed to work with Qualcomm to get proper driver support for Windows on ARM. That's a technical achievement that most manufacturers wouldn't bother attempting.

The company's entire business model depends on filling a niche that the big manufacturers don't care about. Apple doesn't want you running Windows on an i Phone. Samsung doesn't want you running Windows on a Galaxy. Google doesn't want you running anything other than Android on a Pixel.

Nex Computer is explicitly offering all three.

The Parallel With Modular Hardware Trends

The Nex Phone exists in the same ecosystem as other weird, boundary-pushing hardware: Framework's modular laptops, Nothing's transparent phones, and USB-C standardization across devices. These aren't mainstream products. They're proof of concepts. They're signals that the mainstream market is getting bored with conformity.

Somebody will buy the Nex Phone and love it because it solves a real problem in their workflow. That's all it needs to do to succeed. It doesn't need to sell 50 million units. It just needs to prove the market exists.

Sony's Surrender: What Happens When an Industry Leader Steps Back

This is the story that caught everyone off guard. Sony and TCL announced a strategic partnership that would give TCL majority control (51%) of Sony's TV business.

Let me be direct: this is a surrender. A sophisticated one, but a surrender nonetheless.

Sony is handing over the Bravia brand—one of the most respected television names in the world—to a Chinese competitor that, by most Western market measures, hadn't even existed five years ago.

To understand why this matters, you need to understand what happened to the TV industry.

The Death of Premium TV Economics

Twenty years ago, Sony televisions were luxury goods. The company pioneered color technology, established quality benchmarks, and built a brand that was synonymous with image quality. People paid premium prices for Sony TVs because they were worth it.

Then commodity manufacturing happened.

Panel production became standardized. Chipsets commoditized. Manufacturing moved to low-cost regions. And suddenly, a

Sony's advantage eroded over a decade. The company tried to maintain margins by targeting the premium segment, but that strategy only works if the premium segment is large enough to sustain business.

It wasn't.

Why TCL Is Actually Perfect for Bravia

Here's what TCL understands that Sony has been slow to accept: the TV business is now about volume, operational efficiency, and global distribution. It's not about engineering excellence or innovation any more.

TCL has become a juggernaut precisely because it mastered those things. The company built vertical integration across panel manufacturing, component sourcing, and retail distribution. TCL doesn't just manufacture TVs. It controls significant portions of the supply chain.

Sony's approach has been different. The company wanted to focus on premium design and image processing while outsourcing manufacturing. That works when the gap between premium and standard is huge. It stops working when the gap narrows.

The partnership agreement says the new joint venture will "advance its business by leveraging Sony's high-quality picture and audio technology cultivated over the years." Translation: TCL will take Sony's engineering knowledge about image processing and audio quality, combine it with TCL's manufacturing efficiency and scale, and create premium TVs that are actually competitive on price.

The Timeline and What It Means

The deal is expected to be operational by April 2027, pending regulatory approval. That's less than 15 months away. This isn't some distant future event. This is happening.

What happens on the product side is straightforward. Bravia TVs will continue to exist. They'll probably be better than they would have been under Sony's solo direction because TCL's manufacturing expertise is genuinely impressive. But they'll also be more aggressive on pricing because TCL knows how to operate with tighter margins while maintaining profitability.

What happens on the corporate side is more interesting. Sony gets to exit a business that's been a drag on profitability and focus on content production (which is its actual strength through Play Station, music, and film). TCL gets a prestige brand and deeper integration into the premium TV segment.

The Broader Signal This Sends

This deal is a public admission that Western companies can no longer compete with Chinese manufacturers on manufacturing fundamentals. Sony isn't abandoning TV because it's tired. It's abandoning TV because it's lost the competitive war.

This matters for the entire hardware industry. If Sony—a company with enormous engineering talent, global brand recognition, and decades of TV expertise—can't compete, what chance do other companies have?

The answer is: the ones that focus on specialization rather than scale. Companies that make widgets nobody else wants to make. Products that serve niche segments with unique requirements.

The ones trying to compete on volume and efficiency will lose to TCL, Hisense, and other Chinese manufacturers who have a structural cost advantage.

Why Sony's Content Focus Makes Sense

Sony's actual strength isn't hardware manufacturing. It's content production and ecosystem integration. The company owns Play Station, an iconic gaming brand with hundreds of millions of players. It owns major music labels. It has a film studio.

By exiting TV manufacturing and focusing on content, Sony is moving toward a business model where it creates things people want to consume rather than manufacturing generic commodities.

That's a smarter long-term strategy than trying to compete with TCL on TV sales. But it's also a public acknowledgment that the hardware commodity game is over.

NexPhone supports multiple OS, is moderately priced, has a mid-range processor, and offers an exceptional 10-year support, highlighting its unique market positioning. Estimated data.

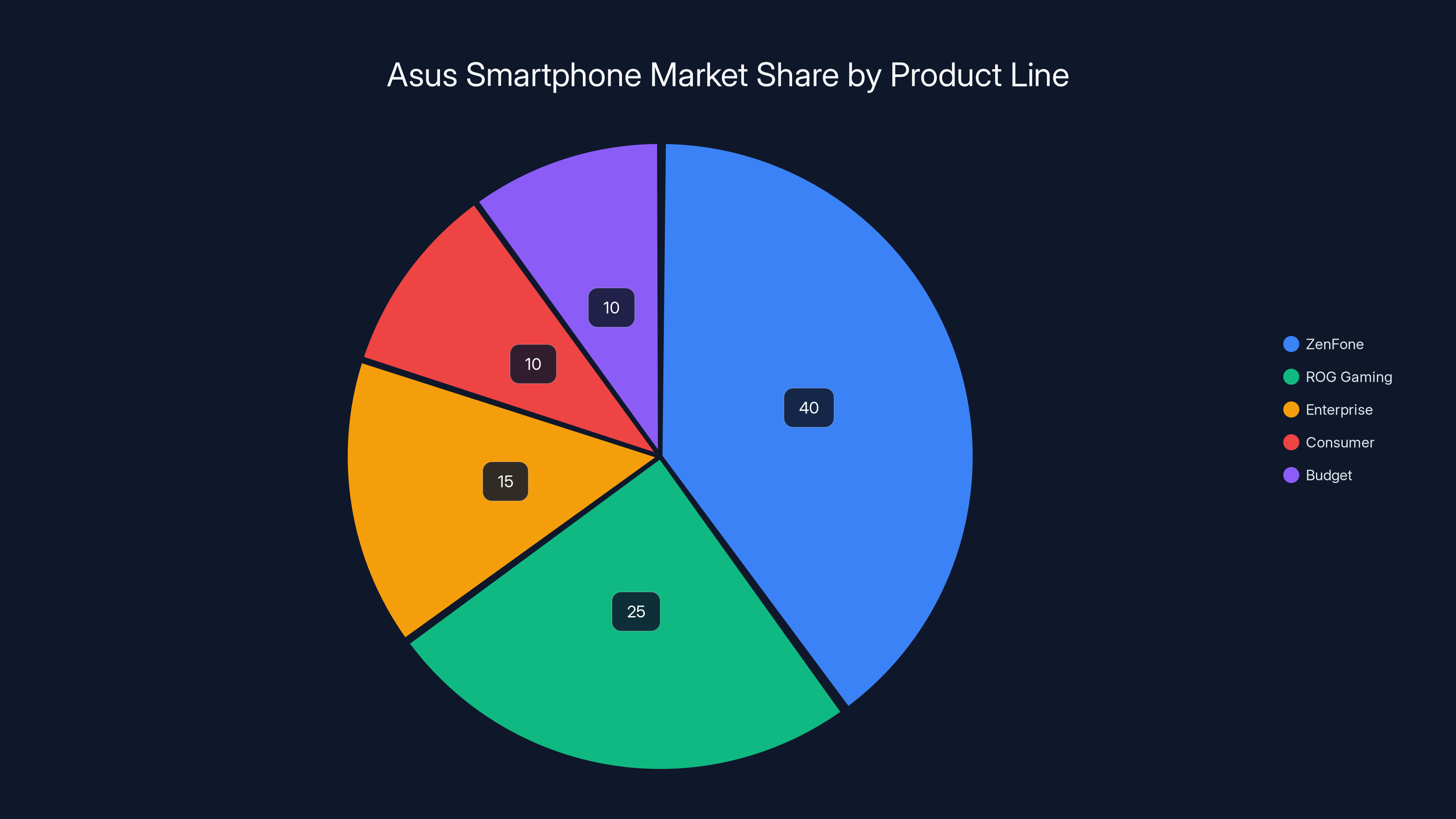

Asus Exits Smartphones: The End of a 20-Year Run

Asus has been making phones for two decades. The Zen Fone line. The ROG gaming phones. Enterprise devices. Consumer phones. Budget phones. Every category you can imagine.

This week, Asus chairman Jonney Shih announced the company is pausing smartphone production. There are no mobile launches planned for 2026. The company will continue supporting existing devices, but new handsets are off the table.

He called it a "temporary" pause, which is corporate speak for "probably permanent." When a company with 20 years of phone-making experience steps away, they're usually not coming back.

Why Asus Never Broke Through

Asus had all the ingredients for success in smartphones. Strong engineering. Good manufacturing relationships. Reasonable pricing. Decent design sense.

What Asus never had was a reason to exist as a phone company.

Zen Fones were "reliable" phones. That's not exciting. That's not why people buy phones. People buy phones because they want an i Phone, or they want a Galaxy, or they want something weird like a Nothing phone that breaks the mold.

Asus's Zen Fones were competent but invisible. Nobody thought "I wish my phone was more Asus."

The ROG gaming phones were more interesting. These were actually differentiated devices with cooling systems, high refresh rate displays, gaming-focused optimization. But gaming phone enthusiasts are a niche, and niche isn't enough to sustain a manufacturer at scale.

The Resource Reallocation Makes Sense

What makes this move strategically sensible is where Asus is redirecting resources. The company is focusing on PCs and AI-focused hardware like smart glasses and robotics.

Computers and laptops are still a core strength for Asus. The company has massive brand recognition and a loyal customer base in PC gaming and workstations. That's a business where Asus actually leads or competes closely with Lenovo, Dell, and HP.

Smart glasses and AI-focused hardware are emerging categories where nobody has locked down dominance yet. Asus has engineering talent and manufacturing expertise that could be competitive in those spaces.

Phones? Asus was never going to beat Apple, Samsung, and Google at phones. The barriers to entry are too high. The R&D costs are too expensive. The competition is too fierce.

Exiting makes sense from every angle.

What This Says About Phone Market Consolidation

We're living in a weird phase where the phone market is simultaneously fragmented and extremely consolidated. There are hundreds of phone manufacturers, but nine out of every ten phones sold are made by five companies: Apple, Samsung, Xiaomi, Oppo, and Vivo.

Asus tried to compete in that top tier and couldn't find a wedge. One Plus tried and ended up being acquired by Oppo. HTC tried and got crushed.

The phone business is dominated by companies with massive economies of scale, established retail distribution, and either a proprietary software ecosystem (Apple, Google) or Chinese conglomerate backing (Xiaomi, Oppo, Vivo).

If you're Asus, and you're an excellent computer company but not a mobile giant, there's no path to success in phones. You either need to compete on price (and lose money) or compete on innovation (and lose money against better-funded competitors).

Asus chose to compete where it can actually win.

The Supporting Cast Still Works

Asus isn't abandoning its ecosystem. The company still makes tablet components, still supplies chips to other manufacturers, still maintains strong relationships with the PC industry.

Exiting phones doesn't harm any of that. If anything, it focuses Asus's attention on the hardware categories where it can actually differentiate.

The Broader Pattern: Hardware Categories Are Resetting

Look at these four stories together and you see something interesting: the hardware industry is in the middle of a reset.

Apple is trying to define a new wearable category. Nex Computer is proving multi-OS devices can work. Sony is admitting it can't compete in legacy categories and is folding to a better operator. Asus is walking away from a market it can't win.

This is what happens when industries mature. The easy competition is over. The low-hanging fruit is gone. What remains is either radical innovation or decisive retreat.

Apple chose radical innovation with the wearable. Nex Computer chose specialization. Sony chose partnership. Asus chose retreat.

All four strategies might be right.

What This Means for Consumers

For you as someone buying hardware, this is actually good news mixed with realistic caution.

Good news: You're going to get more choice in certain categories. More wearables. More specialized devices. More niche hardware that serves specific use cases.

Realistic caution: You're also going to see winners and losers. Some of these bets won't work. Apple's wearable might not gain traction. The Nex Phone might remain a cult product. The Sony-TCL partnership might have rocky transitions.

But the willingness to try new things, to step back from failing categories, and to partner across traditional rivals—that's healthy.

The AI Acceleration

Everything in this story is accelerated by AI. Apple's wearable is built around an AI assistant. Nex Computer's multiple OS support is positioned as developer tooling for AI applications. TCL-Sony partnership is about bringing high-quality displays and audio to AI-powered content.

AI isn't just a software thing anymore. It's forcing hardware companies to rethink category definitions, supply chains, and competitive strategies.

The companies that understand this fastest will win. The ones that try to push old strategies into an AI-first world will lose.

Estimated data shows a balanced focus across AI wearables, multi-OS devices, and shifts in TV and smartphone markets, reflecting diverse strategic priorities in the tech industry.

What's Next: The 2026-2027 Hardware Outlook

If this week tells us anything, it's that the next 18 months are going to be chaotic and interesting.

Apple will detail Campos at its developer conference. We'll get real specs on the wearable. The company will probably announce other AI hardware. The question is whether the experience is actually compelling enough to justify the form factor.

The Nex Phone will actually ship. Reviews will come out. We'll find out whether multi-OS hardware is actually useful or just a clever engineering trick.

Sony's TV business will transition to TCL management. Bravia TVs will start shipping with TCL optimization. We'll see whether the marriage of Sony's technology and TCL's efficiency works.

Asus will double down on PCs and AI hardware. The company will probably announce smart glasses or robotics products that genuinely compete with market leaders.

This isn't the boring hardware cycle. This is the exciting one.

Key Themes Running Through Everything

Let's zoom out for a moment. Three major themes run through all of this.

Theme 1: Specialization Wins, Commoditization Loses

Companies trying to compete on volume and price in commodity categories are losing to Asian manufacturers who have structural cost advantages. Companies that specialize—Apple with premium design and ecosystem, Nex Computer with multi-OS compatibility, Asus with gaming and AI—are finding viable paths.

This matters for the entire tech industry. If you're going to compete on commodities, you need to be the low-cost provider. If you're not, you need to specialize.

Theme 2: AI Changes Category Definition

AI isn't just a feature you add to existing products. It's forcing companies to rethink what categories even are.

Apple's wearable is only interesting because AI makes it interesting. Without a compelling AI experience, it's just an Air Tag with cameras.

The Nex Phone is only interesting because developers need multi-OS access for AI development and testing.

TV technology is only competitive if it can process and display AI-generated content well.

AI is the category-defining force right now, not the other way around.

Theme 3: Global Manufacturing Realities Are Shifting Power

Sony ceding control to TCL signals that Western companies can no longer assume they have an advantage in hardware manufacturing.

This doesn't mean Western companies can't compete. It means they need to compete on software, services, design, and specialization, not on manufacturing capability or process improvements.

The companies that understand this fastest will thrive. The ones that cling to hardware manufacturing as a core advantage will struggle.

Apple's upcoming AI wearable is projected to outperform Humane's AI Pin in terms of AI readiness, battery life, market reception, and purpose clarity. Estimated data based on industry trends and Apple's strategic approach.

The Investment Perspective

If you're thinking about where to watch in the hardware space, here's what matters:

Apple's wearable execution will determine whether the company can maintain its hardware innovation lead in the AI era.

TCL's integration of Bravia technology will show whether Chinese manufacturers can successfully absorb Western technology and brand equity.

Nex Computer's Q3 2026 launch will prove whether there's a real market for specialized, multi-OS hardware.

Asus's pivot to AI hardware will show whether a PC company can transition into emerging categories.

Each of these is a signal about how the hardware industry is reorganizing itself around AI, specialization, and global competitive realities.

Pay attention to all four.

The Humanware Angle: What This Actually Means for People

Here's what I actually care about when I think about all this.

We've spent 15 years where the entire hardware industry acted like there were only three things that mattered: speed, size, and price. Phone companies optimized for speed. Laptop companies optimized for thinness. Everyone optimized for price.

That was boring. And it squeezed out the weird, interesting stuff.

Apple's wearable might be weird. The Nex Phone might be weird. But weird is where actual innovation happens.

Then the boring stuff that actually works—like TVs, like phones, like computers—those get better because companies are learning from the weird experiments.

Sony stepping back means Bravia TVs might actually get better because they're going to get the operational efficiency of a company that understands how to scale.

Asus focusing on gaming and AI means the enthusiast community is going to get more attention from a company that understands that market.

This week wasn't "tech is changing." This week was "tech is finally admitting what actually works and doubling down on it."

That's healthy.

ZenFone accounted for the largest share of Asus's smartphone sales, followed by ROG Gaming phones. Estimated data.

Looking Forward: What Matters in 2026

Mark three dates on your calendar.

June 2026: Apple's WWDC. This is where Campos and the wearable get detailed. Everything else is speculation until then.

Q3 2026: Nex Phone launch. We'll find out whether multi-OS hardware is actually useful or just a gimmick.

April 2027: Sony-TCL joint venture goes live. We'll see whether the partnership actually works or whether it's a messy transition.

These three events will tell you whether the signals from this week are real or just noise.

My guess? They're real. But execution is where these stories live or die.

FAQ

What is Apple's Campos wearable?

Campos is Apple's codename for a reimagined Siri experience that will power a new AI wearable device launching in 2027. The device will be about the size of an Air Tag, equipped with multiple cameras, microphones, a speaker, and wireless charging. It will give users a dedicated AI assistant for quick information capture and voice interaction, powered by Google's Gemini models and integrated across i Phone, Mac, and i Pad.

How does the Nex Phone's multi-OS system work?

The Nex Phone can dual-boot between Android and Windows, with Debian Linux available as a launchable app. When booted into Android, you get a standard Android experience. When booted into Windows, you get a custom mobile UI optimized for phone screens, and when docked to an external monitor, you get full Windows 11 desktop functionality. Each operating system has independent app ecosystems and storage, allowing developers and power users to test applications across platforms on a single device.

Why is Sony partnering with TCL instead of competing in TVs?

Sony's partnership cedes 51% majority control of its Bravia TV brand to TCL because the TV manufacturing business has become a low-margin commodity market where Chinese manufacturers have significant structural cost advantages. Rather than continue losing money competing on volume and manufacturing efficiency, Sony is exiting hardware manufacturing to focus on content production through Play Station, music, and film divisions. TCL gains a prestige brand and Sony's image processing technology, while Sony gains profitability and strategic focus.

What does Asus's exit from smartphones mean for existing phone owners?

Asus will continue supporting existing Zen Fone and ROG phone devices with security updates and bug fixes, but no new smartphone models will launch in 2026 or beyond. Existing devices will receive standard manufacturer support for 2-3 years following launch, but users shouldn't expect major OS upgrades beyond that timeline. The company is redirecting engineering talent to PC and AI-focused hardware instead.

Why is the Nex Phone only $549 when it has multiple operating systems?

The Nex Phone is affordable because it targets developers and power users, not mainstream consumers, and uses a mid-range Qualcomm processor rather than flagship-tier silicon. Nex Computer makes money through volume in a niche market rather than premium pricing. The long-term support commitment through 2036 actually signals that the company is optimizing for reliability and software support rather than cutting-edge hardware performance.

When will Apple's AI wearable actually launch?

Apple's AI wearable is rumored for 2027 launch, which means details will likely be announced at WWDC in June 2026. The device depends heavily on the Campos Siri experience being fully developed and reliable first, so Apple is prioritizing software quality over hardware release speed. This is different from Humane's strategy and reflects lessons learned from the AI Pin's failed launch.

How will the Sony-TCL partnership affect TV pricing and quality?

The partnership is expected to result in premium Bravia TVs that maintain Sony's image processing and audio quality while benefiting from TCL's manufacturing efficiency. This typically means competitive pricing relative to similarly-specced premium TVs, with improved production efficiency that may reduce component costs. The joint venture becomes operational in April 2027, so meaningful product changes will come after that date.

Is the Nex Phone available to buy now?

The Nex Phone is available for pre-order with a

What makes Apple's AI wearable different from Humane's AI Pin?

Apple is building the wearable around an AI experience (Campos based on Google's Gemini) that's already proven in other contexts, then designing hardware to deliver that experience. Humane built the hardware first and tried to figure out the software afterward. Apple's approach prioritizes software quality over form factor novelty, and the company is leveraging its massive ecosystem advantage to integrate the device across i Phone, Mac, and i Pad.

Will the Nex Phone actually ship on time?

Nex Computer has been building lapdocks and related hardware for over a decade, so the company has proven manufacturing and supply chain execution. The Q3 2026 timeline is feasible but ambitious. First-generation shipments sometimes face delays, so realistic expectations should include potential 2-4 week delays beyond the Q3 target date.

The Real Story Behind the Headlines

When you step back and look at these stories as a pattern rather than isolated news items, something becomes clear: the hardware industry is admitting that the world it built over the last 15 years isn't working anymore.

Apple's building an AI wearable because phones aren't evolving fast enough and competitors are catching up.

Sony's stepping back from TVs because it can't compete with Chinese manufacturers on the fundamental business model.

Asus is exiting phones because there's no viable path for a non-vertical-integrated player to compete.

Nex Computer is succeeding with the Nex Phone because it's filling a gap that nobody else cares about.

These aren't four random tech stories. They're symptoms of an industry in transition. The old playbook doesn't work anymore. Companies are figuring out new playbooks.

Some of them will work. Some won't. That's how innovation happens.

But the companies that move fastest, specialize most ruthlessly, and understand that the hardware game is now about software and ecosystem rather than manufacturing excellence will be the ones that matter in five years.

Watch this space. 2026 and 2027 are going to tell us a lot about which bets were right.

Key Takeaways for Tech Observers

-

Apple's moving beyond phones: The wearable pin signals that Apple sees the next category as AI-first devices, not smartphone extensions. The company is betting that dedicated AI hardware becomes as essential as phones.

-

Multi-OS hardware is viable for specialists: The Nex Phone proves there's actual demand for cross-platform testing and development devices. This opens opportunities for niche manufacturers.

-

Western companies can't compete on manufacturing alone: Sony's exit from TV manufacturing signals a fundamental shift in competitive advantage. Design, software, and brand matter more than manufacturing excellence.

-

Specialization beats generalization: Asus succeeds in gaming because it focuses there. It fails in phones because it tried to be everything. The lesson applies across hardware categories.

-

AI changes what hardware categories mean: Everything in this week's news is accelerated by AI. The wearable exists because of AI. The multi-OS phone exists because of AI development needs. Displays matter because of AI content.

-

The next phase of hardware innovation will be weird before it's mainstream: Apple's wearable and Nex Computer's phone seem strange now. They'll feel normal if they gain traction.

What to Watch in 2026

If you care about hardware and want to understand where the industry is headed, these are the inflection points:

Q1 2026: Analyst reports on TV demand and market share shifts post-Sony-TCL announcement.

Q2 2026: WWDC announcements on Campos, the wearable, and Apple's broader AI hardware strategy.

Q3 2026: Nex Phone launch and early reviews. First indication of whether multi-OS phones have real-world viability.

Q4 2026: Holiday buying season shows whether consumers care about the new wearable category or whether it's developer-focused only.

Q1 2027: Sony-TCL transition becomes visible in new product announcements and market positioning.

These checkpoints will tell you whether this week's stories are the start of something real or just temporary noise.

My bet? They're real. But I've been wrong before.

Final Thoughts

Tech moves so fast that we often miss the patterns underneath the noise. We see Apple announce something. Sony makes a deal. Asus exits a market. Nex Computer launches a weird product.

Each story makes sense individually. Together, they tell a bigger story about an industry reorganizing itself around AI, global competition, and the reality that most companies can't be good at everything.

The next few years will reward the companies that pick a wedge, go deep, and stop trying to compete everywhere.

It'll punish the companies that try to maintain legacy advantages in categories where those advantages don't matter anymore.

That's the pattern. Watch for it.

Related Insights for Your Reading List

If this week in tech interests you, you might also care about how Apple's broader AI strategy is developing, what the modular hardware movement means for consumer choice, and how Meta's and Google's wearable ambitions are competing with Apple's vision.

You should also track how the Chinese hardware manufacturers are moving upstream into premium categories and what that means for Western brands.

And keep an eye on what happens with vertical integration in hardware. TCL controls supply chains. Apple controls software and hardware. Google is trying to own the stack. Whoever figures out the right level of integration wins.

That's the real game. Everything else is noise.

Related Articles

- 7 Biggest Tech Stories This Week: LG OLED Breakthrough & More [2025]

- Harvey Acquires Hexus: Legal AI Race Escalates [2025]

- Solos Sues Meta Over Ray-Ban Smart Glasses Patents [2025]

- Trump Phone T1 Ultra: Everything We Know [2025]

- Sony TCL TV Partnership 2025: What It Means for Consumers & Industry

- Best Buy Presidents' Day Sale: 50+ Deals on TVs, Laptops & Appliances [2025]

![This Week in Tech: Apple's AI Pin, NexPhone's Triple OS, and the Sony-TCL Merger [2025]](https://tryrunable.com/blog/this-week-in-tech-apple-s-ai-pin-nexphone-s-triple-os-and-th/image-1-1769254602266.png)