Sony's TV Business Takeover by TCL: The Strategic Shift Reshaping the TV Industry [2025]

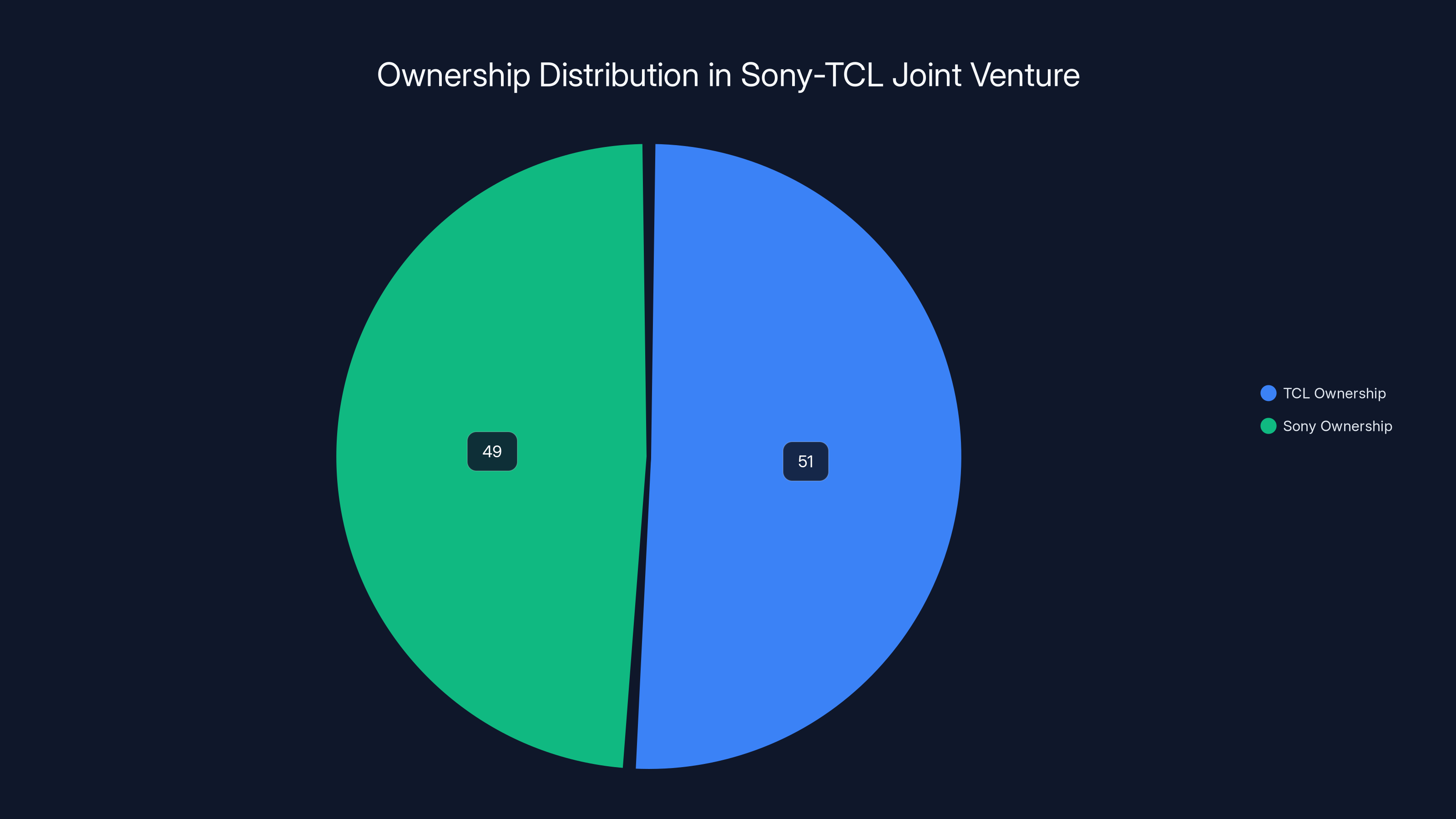

Sony just made a move that nobody saw coming. After decades of building one of the world's most respected TV brands, the Japanese electronics giant is handing control of its television business to TCL, the Chinese manufacturer that's quietly become a global force in the TV market. This isn't a complete acquisition. It's a joint venture where TCL gets 51 percent control and Sony keeps 49 percent, retaining the brand and maintaining a seat at the table. But make no mistake: this is a seismic shift in consumer electronics, as detailed in TipRanks.

When you hear "Sony TV," you think premium. You think picture quality that justifies the price. You think a brand that's spent decades building trust with consumers who care about image processing and audio excellence. TCL, on the other hand, built its reputation by doing the opposite. They innovated aggressively on display technology while keeping prices remarkably competitive. Most people know TCL as the company that makes solid TVs at Costco prices, not the company that charges for brand prestige, as noted by ZDNet.

Now imagine combining Sony's engineering expertise, their legendary image processing algorithms, and their premium brand cachet with TCL's ruthless supply chain efficiency, their advanced display technology, and their ability to manufacture at scale without breaking budgets. That's the bet both companies are making here. And it's a bet that could reshape what consumers expect from premium televisions in the next decade, as highlighted in The Verge.

This partnership signals something bigger than just business logistics. It shows that even iconic brands recognize they can't compete alone anymore. The TV market has fundamentally shifted. Margins are thinner. Display technology is commoditizing faster. And the companies that survive won't be the ones clinging to old models. They'll be the ones ruthlessly combining their strengths, as discussed in Financial Content.

Let's dig into what's actually happening here, why it matters, and what you should know if you're thinking about buying a TV in the next few years.

TL; DR

- The Deal: Sony is spinning off its TV business into a new joint venture with TCL, where TCL holds 51% control and Sony holds 49%, expected to launch in April 2027.

- What Changes: Future Sony Bravia TVs will be designed and manufactured through the partnership, combining Sony's image processing with TCL's display technology and cost efficiency.

- The Strategic Play: TCL gets access to Sony's premium brand reputation and engineering expertise, while Sony gets TCL's supply chain strength and display innovation.

- Timeline: Binding agreements targeted for end of March 2025, with regulatory approval required before April 2027 operational launch.

- Consumer Impact: Expect better-featured premium TVs at more accessible prices, but Sony's current premium positioning may shift toward more value-focused positioning.

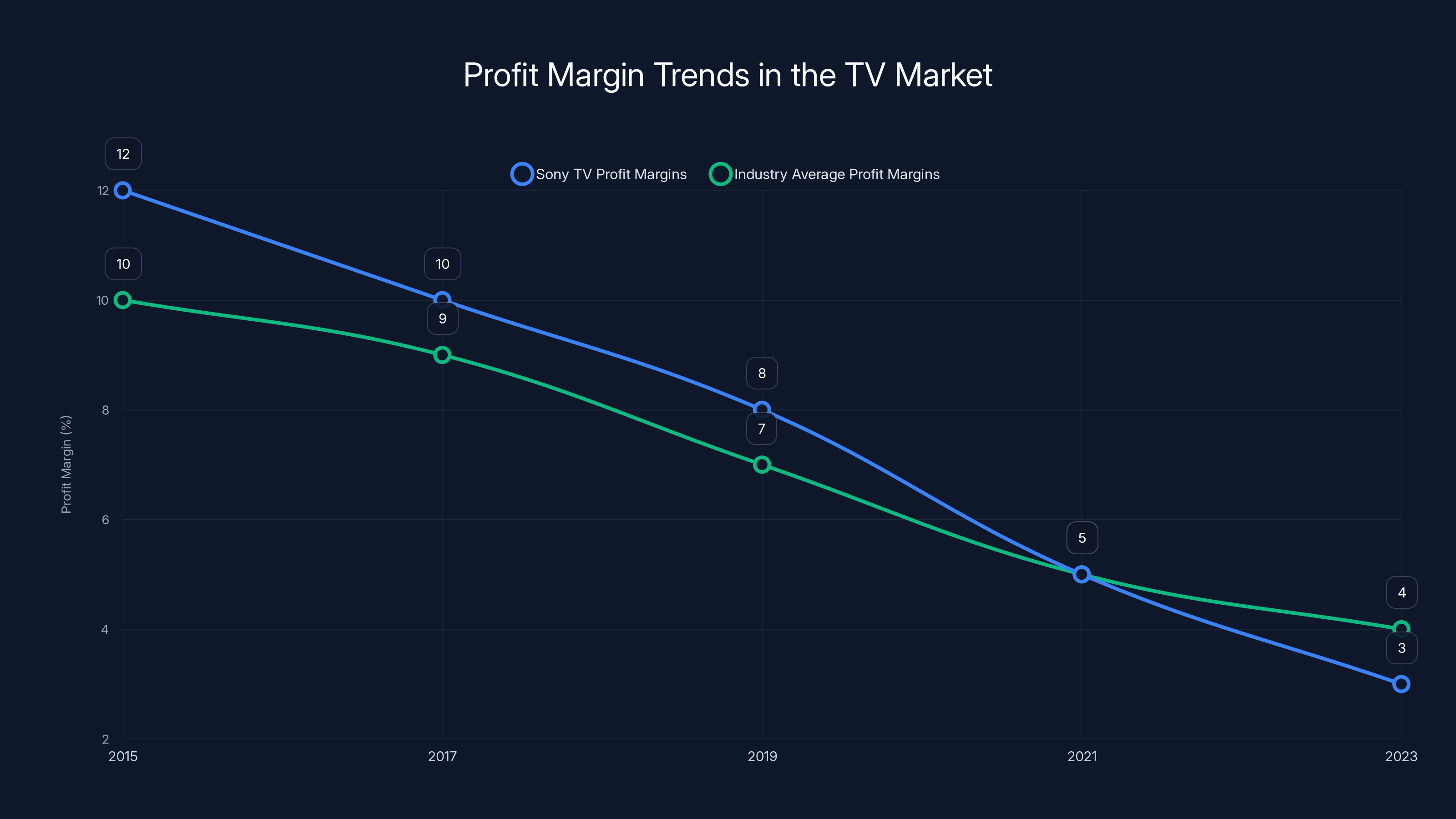

Sony's TV profit margins have declined from double digits in 2015 to low single digits in 2023, reflecting increased competition and market pressures. (Estimated data)

Why Sony Is Doing This (And Why It Matters More Than You Think)

Sony's TV business has been profitable, sure. But "profitable" and "strategically relevant" aren't the same thing. The TV market has been brutal for years. Profit margins have compressed from double digits to low single digits. Competition from Chinese manufacturers has intensified dramatically. And consumers increasingly view TVs as commodities, which means they shop on specs and price first, brand second.

Here's the financial reality: Sony's home entertainment division has been struggling to maintain pricing power. They can't charge premium prices the way they used to because consumers now know that a

Sony CEO Kimio Maki didn't randomly announce this partnership. The company had been studying the TV market for years and watching their position erode. They recognized a fundamental truth about manufacturing in 2025: you either have scale, or you have technology, or you have cost efficiency. Rarely do you have all three. TCL has two of those three at elite levels. Sony has expertise in the third but couldn't match TCL on scale or cost, as noted by CEPro.

The genius of this move is that it lets Sony exit the hardware manufacturing commodity game while staying in the premium brand game. They're not abandoning the TV business. They're restructuring it. Sony keeps their brand, keeps design influence, keeps engineering input, and keeps 49 percent of profits. What they lose is the operational headache of running a global manufacturing operation that's fighting against cost-cutting pressures every single quarter.

TCL gets something they've wanted for years: credibility in the premium segment. No amount of advertising spending gets you into the same category as Sony's brand heritage. But owning 51 percent of a company that sells TVs under the "Sony" and "Bravia" brands? That gets you there instantly. TCL chairperson DU Juan sees this clearly: they can now say "we build Sony televisions" and mean it literally, as discussed in RTINGS.

The deal also provides both companies with something increasingly valuable: optionality. A 51/49 split isn't a permanent arrangement. If the partnership works brilliantly, one company could eventually buy out the other. If it struggles, they can part ways without either company being ruined. It's a structured bet, not a winner-take-all gamble.

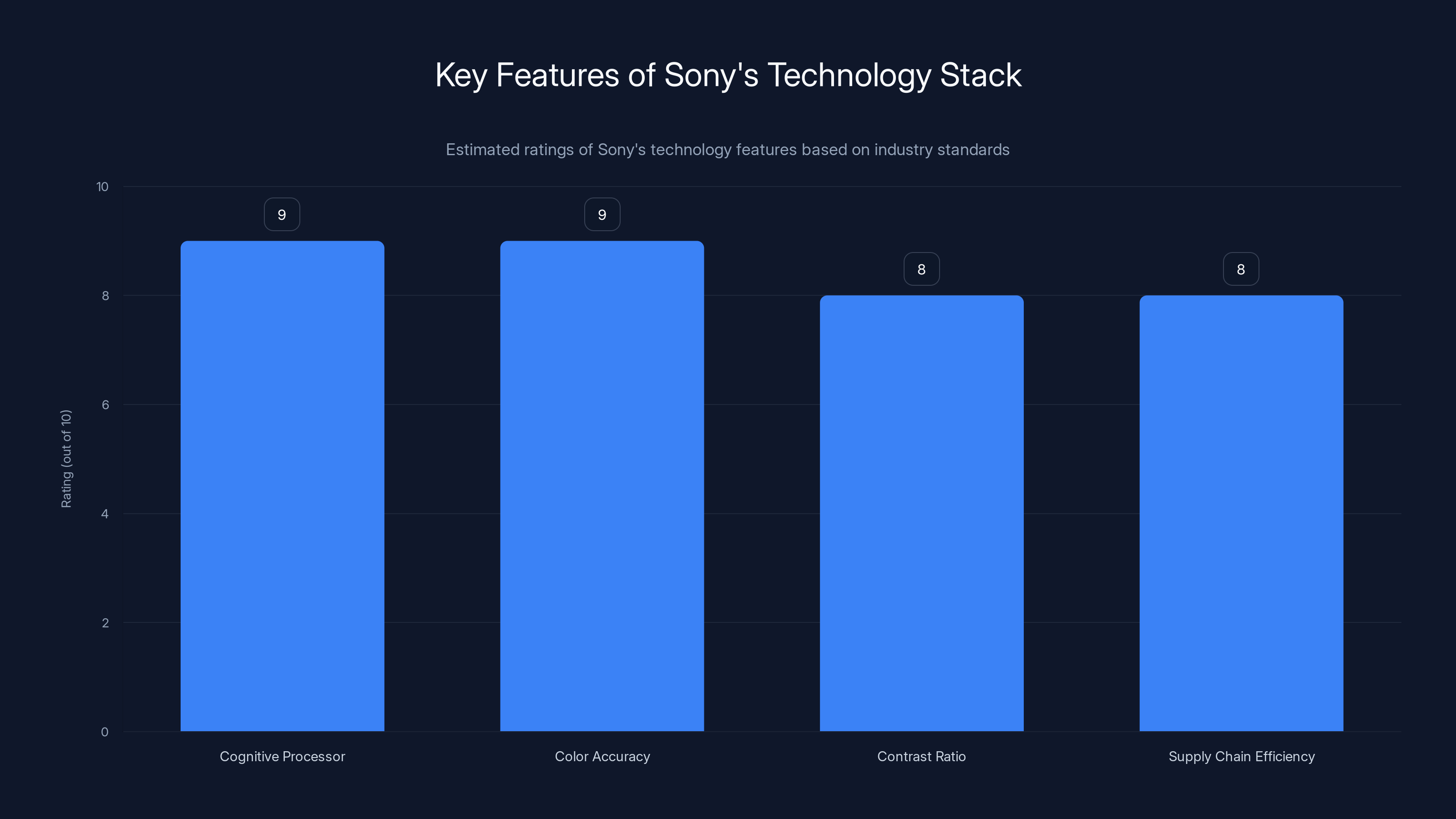

The Technology Stack: What Sony Brings to the Table

Sony's video processing engine is genuinely exceptional. They've spent 70 years building expertise in display technology, color science, and image optimization. That's not hyperbole. Their Cognitive Processor technology uses AI to analyze incoming video signals in real-time and make micro-adjustments to brightness, contrast, color saturation, and motion handling. Most people watching a Sony TV never consciously notice this processing happening. They just see a picture that looks slightly better than other TVs showing the same content, as explained by IndexBox.

What makes Sony's approach different is their obsession with reference standards. Professional video editors and cinematographers use Sony TVs in their workflows because Sony tunes their displays to match broadcast standards. When you're editing a movie, your monitor should show colors exactly as they'll appear in theaters. Sony's engineering team has spent decades building that trust with professionals, and that expertise flows down into their consumer TVs.

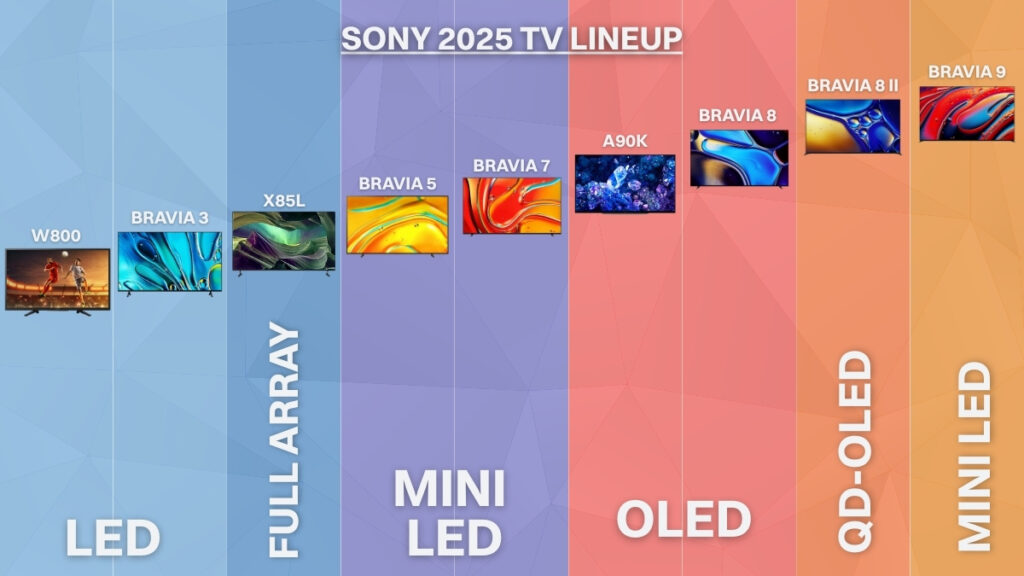

Bravia is their flagship brand, and it carries specific technology promises. High-end Bravia models include features like Full Array Local Dimming, which divides the backlight into hundreds or thousands of independently controllable zones. This creates deeper blacks and more impressive contrast ratios than standard LED TVs. When you're watching a dark scene in a movie, individual zones can go completely dark while bright areas stay bright. That's where premium picture quality lives, as noted by Mashable.

Sony also brings supply chain relationships that took decades to build. They've got established partnerships with component manufacturers, logistics providers, and retail distributors across every major market. Those relationships matter because they mean faster delivery times, better inventory management, and access to high-quality components before competitors can lock them up.

Then there's the brand value itself. Sony spends millions annually on marketing, sponsorships, and brand building. They've built consumer trust over 80 years in consumer electronics. That trust doesn't transfer automatically to other manufacturers. But when you own the Sony TV brand outright (49% of 51%), you inherit that trust. Consumers walking into retail stores will still see the Sony logo. That logo still means something.

The question that hangs over this is how much of Sony's premium positioning survives the partnership. If TCL's cost-cutting mentality dominates, we might see Sony Bravia TVs lose some of the engineering refinement that justified premium pricing. If Sony's influence stays strong, we could see TCL manufacturing processes that actually maintain Sony's quality standards while cutting costs. That's the tension at the heart of this deal.

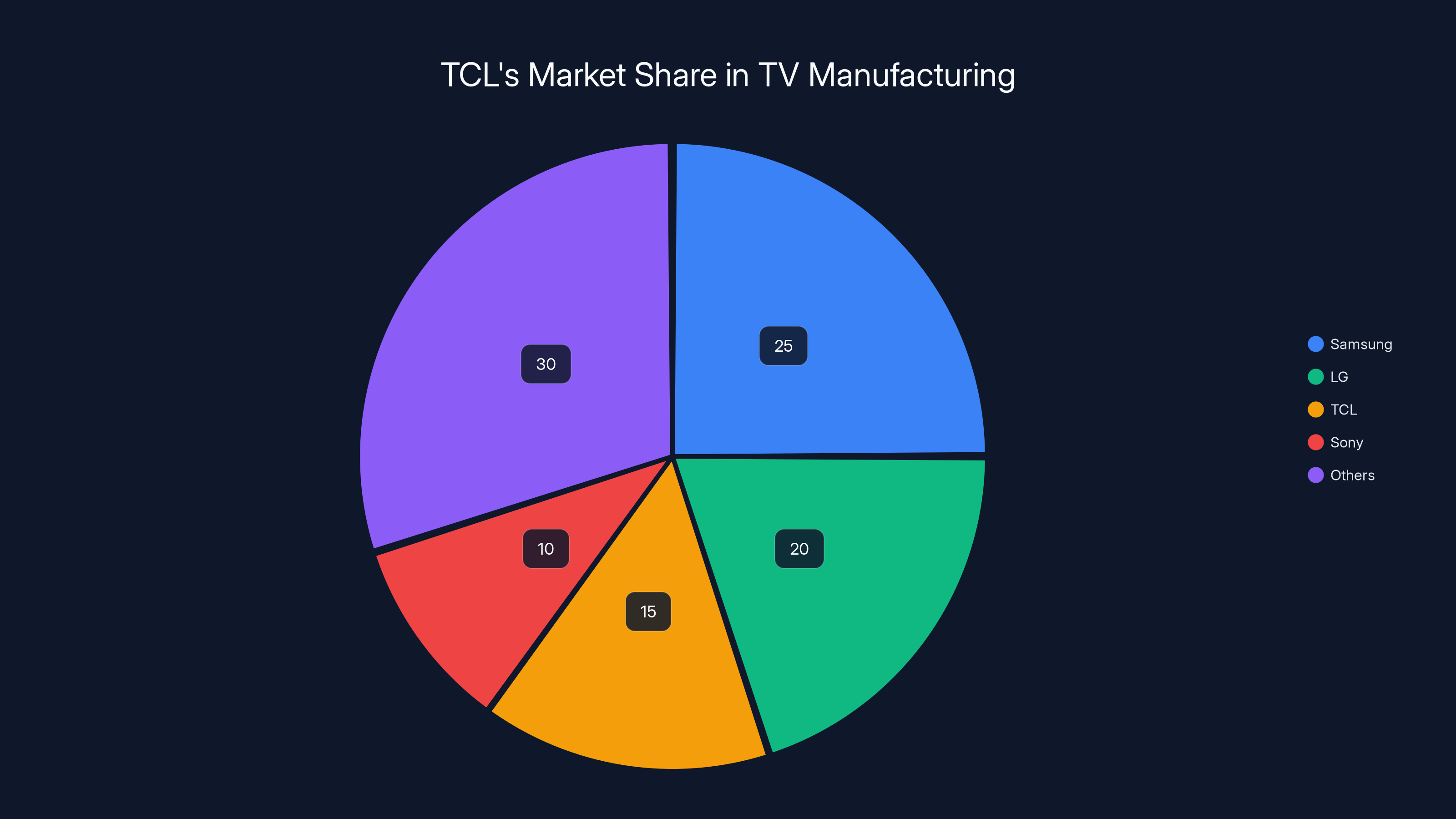

TCL is the third-largest TV manufacturer, capturing 15% of the market, thanks to vertical integration and cost efficiencies. Estimated data.

What TCL Brings: Scale, Display Innovation, and Manufacturing Ruthlessness

TCL is not some random Chinese manufacturer. They're the world's third-largest TV maker by volume, behind LG and Samsung. They ship more televisions annually than Sony ever has. And they do it while maintaining margins that make Sony look envious, as reported by The Verge.

How do they do it? First, vertical integration. TCL doesn't just assemble televisions. They manufacture their own display panels. That's enormous. Most TV manufacturers buy panels from specialists like LG Display, Samsung Display, or AU Optronics. Those companies add 20-30 percent to the final TV cost. TCL makes their own panels, which means they capture that entire margin internally. When you're operating at TCL's scale, that difference compounds to hundreds of millions in annual savings.

Second, they've invested heavily in display technology. TCL pioneered affordable QLED (Quantum Dot LED) technology years before other manufacturers brought it mainstream. They've invested in mini-LED backlighting, which is significantly cheaper than Full Array Local Dimming but still provides excellent contrast. They're now pushing hard into QD-Mini-LED, which combines quantum dots with mini-LED backlighting for premium picture quality at fraction of the premium price, as highlighted by The Verge.

Third, their cost efficiency is almost scary. TCL operates manufacturing facilities in multiple countries, continuously optimizes their supply chain, and negotiates volume discounts that most competitors can't match. When a component costs

There's also TCL's global market presence. They've spent a decade building distribution networks in North America, Europe, Asia, and emerging markets. They know how to sell cheap TVs at Costco. They know how to sell mid-range TVs at Best Buy. They've invested in understanding different regional preferences and consumer buying patterns. That knowledge is gold.

But here's the thing TCL has always lacked: premium brand perception. You can make the best TV in the world, but if consumers don't perceive it as premium, they won't pay premium prices. TCL's brand identity is "great value." They've leaned into that positioning, and it's made them incredibly successful at price points under $500. But they've hit a ceiling. Consumers don't naturally think of TCL when they want a luxury television.

This partnership solves that problem overnight. Suddenly TCL is involved in building Sony televisions. Their engineers are working on Bravia products. Their manufacturing is producing screens that carry the Sony logo. Over time, that creates a halo effect. TCL's separate brand gets upgraded perception. And TCL itself can charge more for its own branded TVs because consumers now know TCL builds "professional-grade" Sony TVs.

The Joint Venture Structure: Why 51/49 Matters

The split isn't random. Fifty-one percent gives TCL operational control. They can make the major strategic decisions without needing Sony approval on every business issue. But 49 percent gives Sony blocking power on existential decisions. Sony can't be completely overruled. That's how you structure a partnership where both parties have genuine skin in the game, as explained by The Verge.

What does "operational control" actually mean? TCL gets to hire the CEO. They decide which plants run production. They control the supply chain direction. They set manufacturing standards and cost targets. Those are the day-to-day decisions that determine whether the business succeeds or fails. Sony doesn't want that burden, so they're handing it off.

But Sony's 49 percent means they get board representation. They have input on major R&D investments. They can argue against decisions that compromise the Bravia brand. They have some veto power if TCL wants to cut corners in ways that damage Sony's reputation. That protection was non-negotiable for Sony.

The timeline is also interesting. They're targeting binding agreements by March 2025 and operational launch in April 2027. Two years feels like a long runway, but it's actually tight for a venture this complex. They need to:

- Integrate Sony's design teams with TCL's manufacturing operations

- Align product roadmaps (Sony's planned releases with TCL's production capabilities)

- Migrate manufacturing from Sony's facilities to TCL's optimized plants

- Restructure supply chains to capture TCL's cost advantages

- Retrain workforces and potentially consolidate redundant teams

- Navigate regulatory approvals across multiple countries

- Redesign products to maintain Sony's image quality while using TCL's components

Each of those is a project unto itself. Combining them into two years is genuinely ambitious.

The Global TV Market Context: Why Now?

The timing of this announcement isn't random either. The TV market in 2025 is experiencing specific pressures that make partnerships like this more attractive.

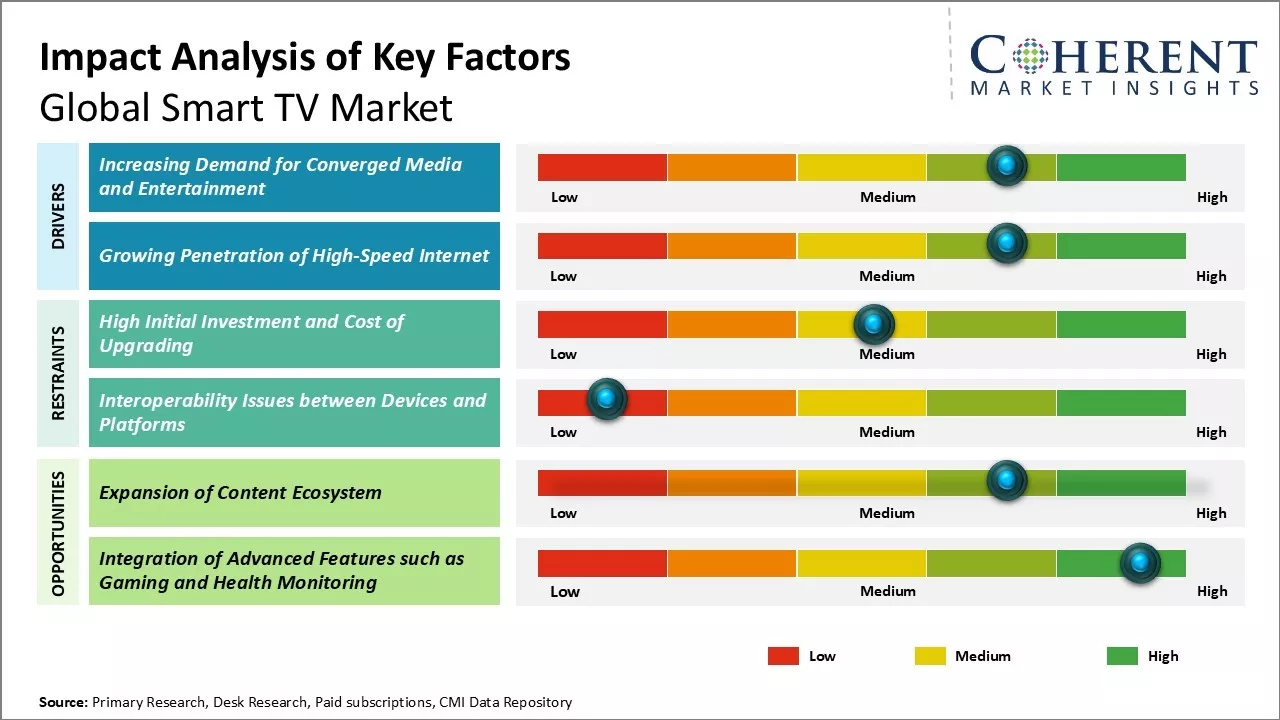

First, display technology itself is commoditizing. The jump from 1080p to 4K was genuinely impressive. But going from 4K to higher refresh rates or micro-dimming zones? That's incremental. Most consumers can't see the difference. This means manufacturers compete increasingly on price and less on innovation. When innovation advantage shrinks, manufacturing efficiency becomes your competitive advantage.

Second, the Chinese market is saturated. TCL has maxed out growth potential selling cheap TVs domestically. The only way to grow further is to either move upmarket (premium positioning) or expand internationally. This partnership does both. They get access to Sony's premium markets and retail channels.

Third, streaming has fragmented consumer preferences. A decade ago, everyone wanted big screens for watching cable or satellite TV. Now streaming has taken over, but there's no single technical spec that dominates anymore. Some people want perfect color accuracy for professional work. Others want fast motion handling for sports. Others want pure brightness for brightly lit living rooms. Manufacturers have to offer everything, which drives complexity and cost.

Fourth, geopolitical tensions are reshaping supply chains. Companies now prioritize having manufacturing in multiple countries to hedge against tariffs, export restrictions, or sanctions. TCL's multi-country manufacturing network directly addresses this risk. Sony gets instant geographic diversification.

Finally, AI and smart TV features are becoming table stakes. Every TV manufacturer now includes some form of AI upscaling, AI enhancement of older content, or AI-powered recommendations. Building this capability in-house is expensive. But TCL and Sony combined can share development costs while both brands benefit. That economics works better at their scale than it would for either company independently.

Sony's technology stack is highly rated for its Cognitive Processor and color accuracy, reflecting its expertise in display technology. (Estimated data)

What This Means for Sony Consumers Right Now

If you bought a Sony TV in 2024 or early 2025, nothing changes. You've got a warranty that's valid. Sony stands behind their existing products. The partnership doesn't retroactively make your TV worse or worse-supported.

But if you're thinking about buying a Sony TV in the next two years, here's what happens: the product roadmap is in flux. Sony's design team is integrating with TCL. Manufacturing plans are shifting. Some models might get delayed while they retool production. Sony will likely release fewer entirely new models and lean on refreshing existing designs with modest component upgrades.

This is actually common during major company restructurings. Expect 2025 and early 2026 to be somewhat conservative from Sony's TV lineup. They're managing the partnership transition while keeping the business running. That typically means playing it safe.

After April 2027, when the joint venture is fully operational, you'll start seeing different products. These will be genuinely new designs because they'll incorporate TCL's manufacturing innovations into Sony's engineering approach. That's where the real magic could happen. Imagine a

What This Means for TCL Consumers

TCL's existing TV lineup doesn't disappear. TCL will still make their own branded TVs at their price points. But the engineers working on TCL's premium models and the TCL engineers at the joint venture will share knowledge. If the joint venture develops a breakthrough in mini-LED backlighting for Sony TVs, that technology likely flows back into TCL's own products.

TCL also gains legitimacy. They can now point to Sony partnership as proof that their manufacturing and design is world-class. Their marketing will shift subtly from "great value" to "trusted by Sony." That matters for international expansion. In markets where brand reputation drives purchase decisions more than price, that halo effect is invaluable.

The risk for TCL is that they become the manufacturing arm while Sony gets disproportionate credit for the design and innovation. That's a classic joint venture dynamic. TCL could end up playing second fiddle in their own partnership. The 51 percent ownership makes that less likely, but it's still a risk that TCL management is presumably aware of and has mitigated in their agreements.

The Broader Industry Implications: What Other Manufacturers Are Watching

This deal is being studied intently by LG, Samsung, Hisense, and every other TV manufacturer watching their margins compress. The message is clear: if you don't have overwhelming advantages in technology or scale, you need a partner.

LG manufactures their own OLED panels, which gives them technology differentiation. Samsung has display panel manufacturing and extremely efficient operations. Hisense recently acquired Gorenje in Europe to gain regional distribution strength. But companies without multiple competitive advantages? They're increasingly vulnerable.

This partnership could accelerate consolidation in the TV industry. If TCL and Sony thrive together, expect more partnerships. We could see Samsung partnering with a Chinese manufacturer for LCD models while defending OLED premium products. We could see LG shifting more heavily toward OLED as their differentiator while partnering elsewhere for volume products.

The ultimate consolidation endgame would be 3-4 mega-manufacturers controlling 80 percent of the TV market. We're not there yet, but this Sony-TCL move accelerates the timeline.

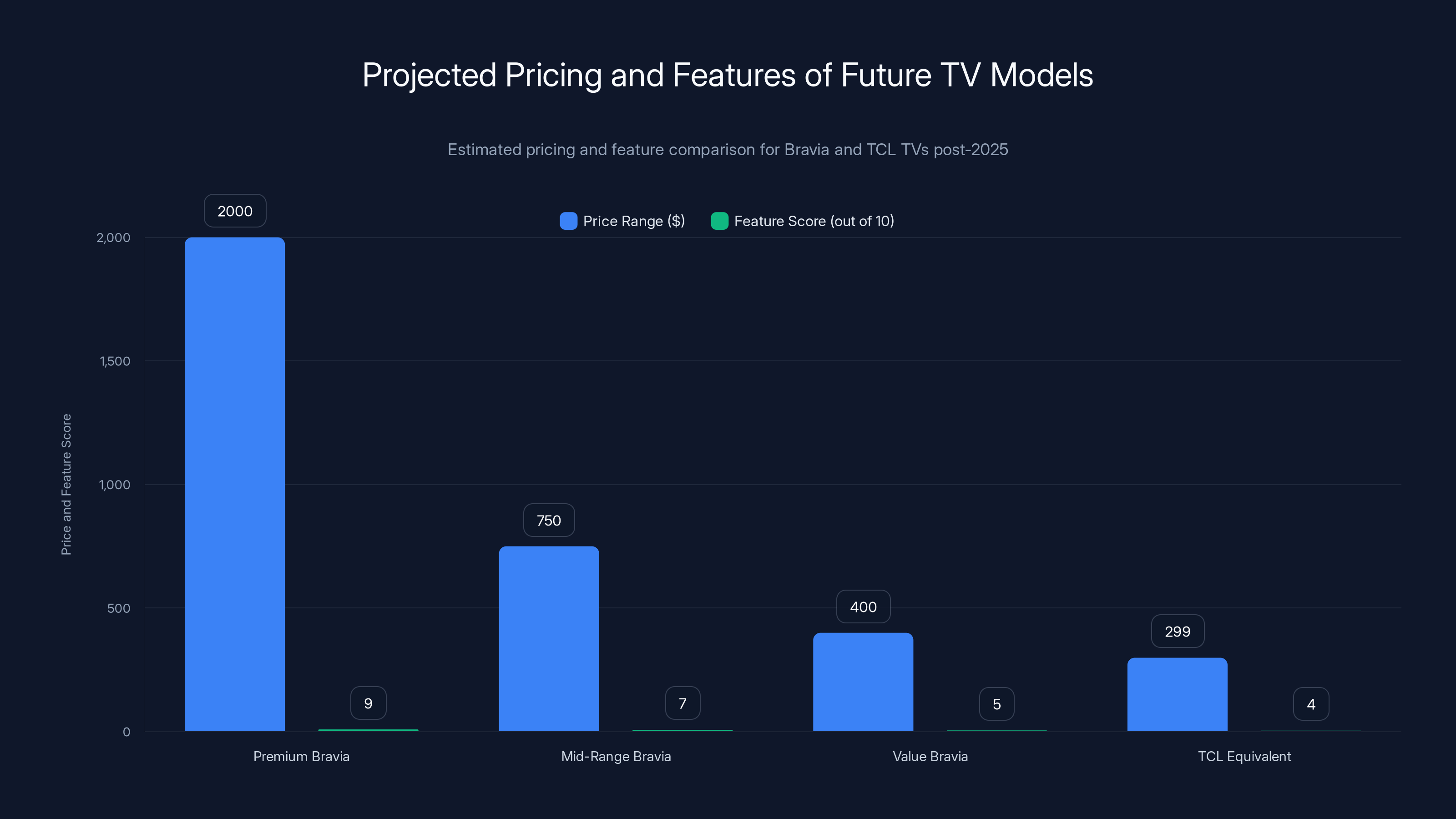

Estimated data shows Premium Bravia TVs will have the highest price and feature score, while TCL equivalents offer the lowest price with moderate features.

The Design and Engineering Reality: How This Actually Works

Here's what will probably happen on the engineering side over the next two years:

Phase 1 (2025-2026): Sony's design and engineering team in Japan continues designing TVs using their traditional approach. Meanwhile, TCL's design and manufacturing teams in China optimize production processes. Both teams get to know each other. Sony engineers visit TCL plants. TCL engineers work in Sony labs. Shared documentation gets created. Component specifications get aligned.

Phase 2 (2026-2027): Joint product roadmaps begin. Sony's next TV model is designed with input from TCL's manufacturing experts. TCL's engineers say "we can manufacture this design for 15 percent less cost if we adjust this component here." Sony's engineers respond "we can maintain our picture quality with that adjustment." Products start being co-designed.

Phase 3 (2027 onwards): Fully integrated product development. New Bravia TVs are conceived in collaboration from day one. TCL engineers are at the design table in Tokyo. Sony engineers are directing manufacturing in China. The product roadmap is unified.

What could go wrong? Cultural differences. TCL's "optimize for cost" mentality could clash with Sony's "prioritize quality" mindset. Engineers might argue constantly about specifications. TCL might push to cut features that Sony considers essential to brand positioning. Sony might resist manufacturing innovations that TCL considers critical for cost targets.

The leadership will need to navigate these tensions carefully. That's where the partnership succeeds or fails. Having executives from both companies committed to finding middle ground is essential.

Manufacturing and Supply Chain Reality

The joint venture will probably operate manufacturing in multiple regions:

Panel Manufacturing: TCL operates panel plants in China with massive economies of scale. Most joint venture TVs will use TCL panels. That's where the real cost advantage lives. Sony might fight for higher-grade panel specifications or additional quality control steps, but the fundamental sourcing comes from TCL.

Assembly: TCL has assembly plants in China, Vietnam, Mexico, and potentially Eastern Europe. The joint venture will leverage all of them. A TV sold in North America might be assembled in Mexico. A TV sold in Europe might be assembled in Poland or Czech Republic to minimize tariffs. A TV sold in India might be assembled in Vietnam. This geographic optimization is pure TCL expertise.

Component Sourcing: TCL has established relationships with component manufacturers in Asia who deliver at scale. Sony's premium component suppliers will gradually be evaluated. The joint venture will probably use a mix: TCL's high-volume, efficient suppliers for commodity parts, and Sony's specialists for audio systems and certain image processing chips.

Logistics: TCL's global logistics network handles the distribution. This is where the partnership captures huge efficiencies. Sony's existing retail partnerships work alongside TCL's proven distribution channels.

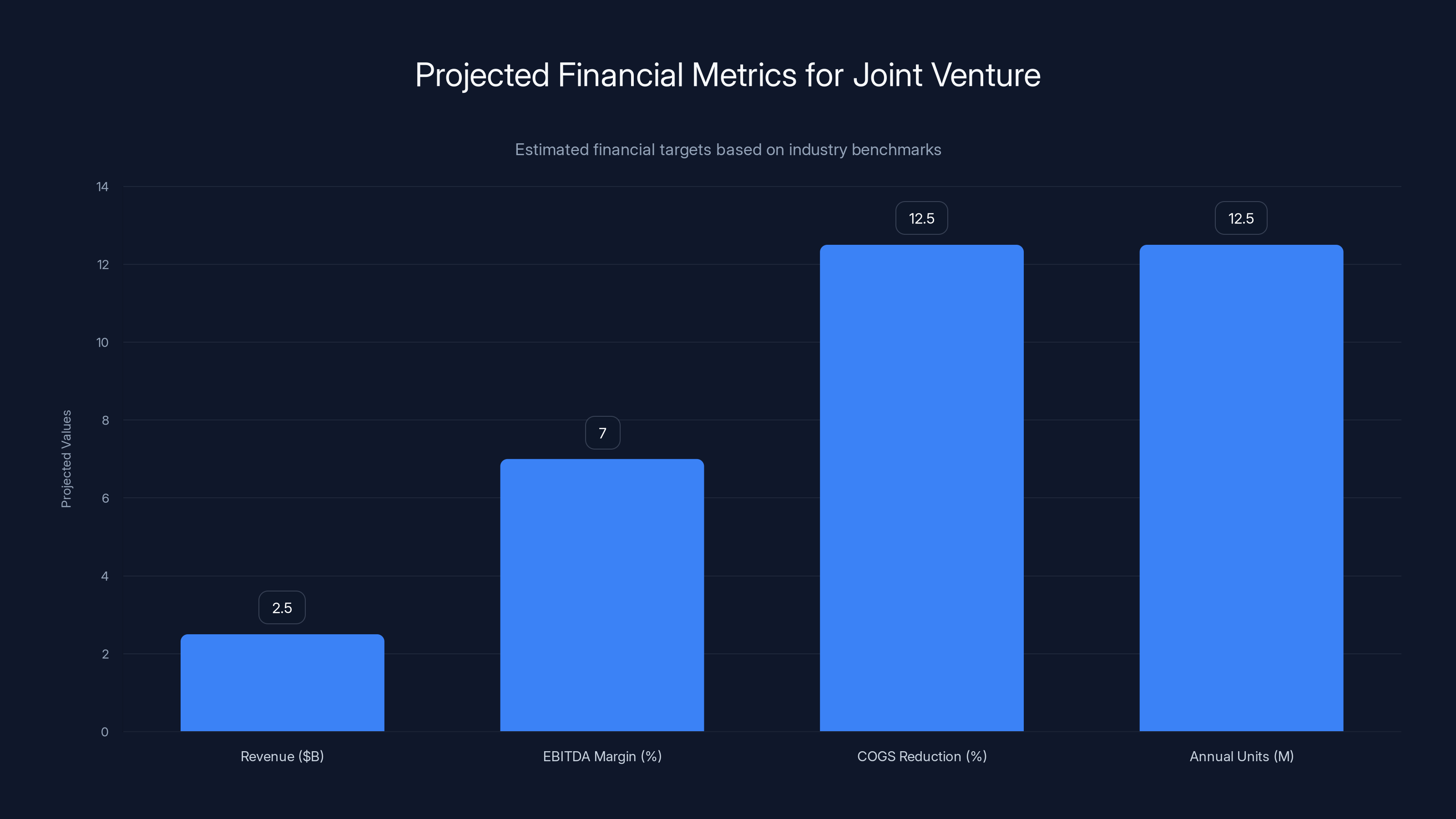

The Financial Projections: What Success Looks Like

Neither company released specific financial projections, but you can infer what they're hoping for:

Revenue: Joint venture probably projects $2-3 billion in annual revenue initially. That's roughly where Sony's TV business sits now, plus growth from new markets.

Margins: Target is probably 5-8 percent EBITDA margins. That would require about $100-240 million in annual operating profit. Right now Sony's TV business probably operates at 3-4 percent margins. TCL's premium offerings probably operate at 6-7 percent margins. The joint venture aims for the upper end through operational synergies.

Cost of Goods Sold (COGS): The partnership probably targets reducing COGS by 10-15 percent versus Sony's current baseline. If a

Scale: They're probably targeting 10-15 million units annually within 3-5 years. TCL currently ships roughly 16-17 million units across all brands. Sony's TV division is roughly 2-3 million units annually. The joint venture combining these is realistic.

Those financial targets matter because they determine whether the partnership is genuinely synergistic or just a cost-cutting exercise. If the only benefit is reducing costs while cutting corners, consumers will notice, and the premium brand gets damaged. If cost reduction comes from operational efficiency without compromising quality, it's genuinely win-win.

Estimated data suggests the joint venture aims for $2-3 billion in revenue, 5-8% EBITDA margins, a 10-15% reduction in COGS, and 10-15 million units annually. These targets indicate a focus on growth and efficiency.

Product Strategy: What Types of TVs Will Emerge

The joint venture will probably organize around market segments:

Premium Bravia (2025+ pricing $1,000-3,000): These will get the full Sony image processing treatment plus TCL's manufacturing efficiency. Expect Full Array Local Dimming, premium audio systems, and Sony's cognitive processors. These are the flagship products that define the brand. TCL's cost efficiency here means maintaining premium features while reducing prices 15-20 percent versus current Sony models.

Mid-Range Bravia (2025+ pricing $500-1,000): These will use TCL's QD-Mini-LED technology, some Sony image processing (maybe not the full suite), and genuine value-focused component selection. This is where the partnership delivers the most innovation for consumers. You'll get 90 percent of premium image quality at 50 percent of the premium price.

**Value Bravia (2025+ pricing under

TCL Branded Equivalents: TCL will continue selling TVs under the TCL brand at all price points. But these will benefit from shared R&D. A $299 TCL TV might incorporate technology developed through the Sony partnership. That helps both brands.

The Branding Question: How Will This Affect Brand Perception

Sony's brand is at stake. If Bravia TVs become synonymous with budget solutions within three years, Sony's premium positioning evaporates. That's the existential risk of this partnership.

How do they avoid this? By maintaining clear product differentiation. There will be expensive Bravia TVs that justify premium pricing through quality. There will be cheaper Bravia TVs that clearly target different customers. The Bravia brand needs to communicate "quality at every price point" rather than "formerly premium, now budget."

TCL faces the opposite challenge. They need to prove they can operate a premium brand without losing their cost discipline. If TCL gets complacent and starts making expensive mistakes, the partnership fails.

Both companies probably have marketing strategies already worked out for this. Expect Sony to emphasize "engineered by Sony" for the premium tier. Expect TCL to communicate their role in manufacturing excellence without claiming credit for design. Expect joint marketing that sells the collaboration itself as a benefit: "Sony's heritage plus TCL's innovation."

Regulatory and Geographic Considerations

This deal requires approval in multiple jurisdictions:

United States: The Committee on Foreign Investment in the United States (CFIUS) will review whether a Chinese company gaining 51 percent control of a TV business raises security concerns. This is probably the most significant regulatory hurdle. However, consumer electronics are generally less sensitive than semiconductors, networking equipment, or defense-related technology. CFIUS will likely approve this, but it won't be automatic.

European Union: EU competition authorities will review whether this concentration in the TV market creates unfair competitive dynamics. The analysis is probably straightforward: the combined entity's market share isn't so large that it raises competition concerns. Approval likely happens, but again, not automatic.

China: Chinese authorities need to approve Sony's foreign investment and potential capital flows. This is usually a formality for established companies like Sony, but China's regulatory environment changed significantly in 2024-2025. Approvals that would've been automatic five years ago now require more scrutiny.

Other Markets: Some markets require local partnerships for distribution or manufacturing. The joint venture team will need to navigate these on a case-by-case basis.

The regulatory timeline could stretch the April 2027 operational launch. If any major jurisdiction delays approval, the whole timeline shifts.

TCL holds a 51% stake, granting operational control, while Sony retains 49%, allowing strategic influence.

What Could Go Wrong: The Failure Scenarios

Scenario 1: Cultural Clash: Sony and TCL operate with fundamentally different philosophies. Sony prioritizes long-term brand building and incremental innovation. TCL prioritizes rapid cost optimization and market share growth. If executives can't bridge this gap, the partnership descends into constant compromise where neither company gets what they want.

Scenario 2: Brand Dilution: Bravia becomes associated with budget products. Premium consumers stop viewing Sony TVs as legitimate high-end options. The brand slowly deteriorates. Sony retains 49 percent of a declining asset.

Scenario 3: Integration Failure: The two companies can't actually integrate their operations. Designs stay siloed. Supply chains don't consolidate. Cost synergies never materialize. The venture ends up no more efficient than either company operating independently. Mutual frustration leads to breakup or buyout.

Scenario 4: Market Downturn: Global TV demand drops due to economic recession, overproduction, or consumer preference shifts toward projectors, micro LED, or new display technologies. The partnership launches into a declining market and becomes unprofitable. Both companies lose money.

Scenario 5: Geopolitical Tensions: US-China relations deteriorate further. Export restrictions, tariffs, or sanctions make the partnership economically unviable. Regulatory authorities block the venture. The deal never closes.

Each of these is a real possibility, not just hypothetical risk. Joint ventures between major companies fail surprisingly often because the surface-level financial logic doesn't account for operational reality.

What Success Actually Looks Like

The partnership succeeds if:

- Cost efficiency materializes: Manufacturing costs drop 10-15 percent without cutting quality corners.

- Products improve: Consumers get better-featured TVs at better prices compared to 2024 models.

- Brands coexist: Both Sony Bravia and TCL TVs maintain distinct positioning and appeal to different consumers.

- Market share stabilizes: The venture doesn't lose customers to competing brands; it grows through innovation rather than just reshuffling market share.

- Profitability improves: Joint venture achieves 6-8 percent EBITDA margins within three years, up from Sony's current 3-4 percent.

- International expansion accelerates: The partnership enables both brands to expand in markets where they weren't strong previously.

If the partnership hits these marks over five years, it's a genuine success. Both companies win. Consumers win. The TV industry gets more competitive and innovative.

The Competitive Response: What Samsung, LG, and Others Are Thinking

Samsung and LG are absolutely watching this. Samsung's TV division is profitable but facing similar margin compression. LG has already exited the LCD market and focuses almost entirely on premium OLED. They're positioned differently, but the strategic questions are identical: How do we compete against TCL's scale and cost efficiency while maintaining premium positioning?

Hisense is probably most threatened. They've built a respected mid-range brand, but they don't have Samsung's display panel manufacturing or LG's OLED technology leadership. The Sony-TCL partnership moves into Hisense's competitive sweet spot.

Expect this deal to trigger industry consolidation. We might see:

- Samsung partnering with another Chinese manufacturer for LCD volumes while defending OLED premium.

- LG accelerating OLED adoption as their primary differentiator.

- Hisense pursuing acquisitions to gain scale or technology.

- Smaller brands like Vizio or TCL's competitors in China facing acquisition pressure.

The TV industry in 2030 could look fundamentally different from 2025, with this Sony-TCL partnership as the catalyst.

Timeline and What to Watch

March 2025: Binding agreements should be finalized. Watch for any delays. If regulatory issues emerge or either company gets cold feet, this is when it becomes apparent.

Through 2025: Regulatory approvals progress. CFIUS, EU competition authorities, and Chinese regulators review the deal. Expect quarterly press releases announcing approval progress.

2026: Real integration begins. You'll see joint R&D announcements. Teams get reorganized. Supply chain consolidation starts. First products designed collaboratively are conceived.

Late 2026-Early 2027: Product roadmap changes become apparent. Rumor sites start speculating about new Bravia models that look different from traditional Sony designs. Manufacturing locations shift.

April 2027: Joint venture officially becomes operational. The first products entirely designed under the partnership framework start production.

2027-2028: New Bravia and TCL models launch incorporating partnership innovations. Consumers start noticing the results.

The Consumer Question: Should You Buy a Sony TV Now or Wait

If you genuinely need a TV right now, go ahead and buy. A 2025 Sony Bravia TV is still a quality product. Nothing changes retroactively.

If you can wait until late 2026 or 2027, you probably should. That's when the partnership delivers products that actually benefit from the collaboration. Mid-range Bravia models should be substantially better value at that point.

If you were considering waiting for TCL instead of Sony, consider this: TCL might actually become a better value play themselves by incorporating Sony partnership innovations into their own brand.

The fundamental question is whether you value immediate gratification or whether you're willing to wait for better options. If you wait, you're betting that the partnership succeeds and actually delivers benefits to consumers. Based on the financial incentives involved, that's a reasonable bet.

Conclusion: The Future of Premium Television

This Sony-TCL partnership represents a fundamental shift in how the TV industry will operate. The era of single manufacturers trying to dominate all segments is ending. The future belongs to companies smart enough to combine their strengths.

Sony is trading operational control for financial upside and brand preservation. They're admitting they can't compete with TCL's manufacturing advantage alone, so they're joining TCL rather than fighting them. That's strategic clarity from a company that could've stubbornly defended their independence and slowly declined.

TCL is trading premium brand perception and engineering expertise for growth capital and market expansion. They're leveraging their operational excellence to enter segments they couldn't dominate with their own brand alone. That's smart strategic sequencing.

For consumers, the partnership could be genuinely transformative. Imagine premium Sony picture quality combined with TCL's manufacturing efficiency. That's not pipe dream. That's what the financial incentives are aligned to create.

The next few years will determine whether this becomes a template for the industry or an outlier. If it succeeds, expect more partnerships. If it struggles, expect the companies to retreat and competitors to avoid similar arrangements. Either way, the TV business as we know it is changing. This partnership is the signal flare that change is already underway.

Watch this space. April 2027 will tell you whether the bet worked.

FAQ

What is the Sony-TCL joint venture?

The Sony-TCL joint venture is a new company where TCL owns 51 percent and Sony owns 49 percent, combining Sony's home entertainment business with TCL's manufacturing and display technology expertise. The venture will design, manufacture, and sell television and audio equipment under the Sony and Bravia brand names, expected to launch in April 2027 following regulatory approvals and finalized agreements by March 2025.

How does the joint venture affect current Sony TV owners?

Current Sony TV owners experience no immediate changes. Warranties remain valid, customer support continues, and existing products maintain their specifications. The partnership primarily affects future product development and manufacturing processes, with new jointly-designed products becoming available after April 2027.

Why is TCL taking control with 51 percent ownership?

TCL's 51 percent stake gives them operational control of day-to-day business decisions including manufacturing, supply chain, and production planning. This reflects TCL's manufacturing expertise and scale efficiency advantages, while Sony's 49 percent stake provides blocking power on major strategic decisions affecting the brand.

What will change about Sony Bravia TV features and pricing?

Future Sony Bravia TVs will likely feature improved value propositions combining Sony's image processing excellence with TCL's manufacturing cost efficiency. Expect similar feature sets at lower prices, or enhanced features at comparable prices. Premium models maintain Sony's quality standards while mid-range and value-tier products become more accessible with shared research and development.

Will TCL's own branded TVs be affected by this partnership?

TCL will continue selling televisions under the TCL brand, and these products will benefit from shared research and development with the joint venture. Knowledge transfer from Sony-Bravia product development likely flows into TCL's own product line, potentially improving features and quality across TCL's entire range.

When will the new joint venture products actually be available?

The joint venture officially launches in April 2027 after regulatory approvals. Initial products designed collaboratively will begin manufacturing in late 2027 with retail availability in 2028. Current Sony TV models continue production through the transition period with new products phasing in gradually.

What regulatory approvals are required for this partnership?

The deal requires approval from the US Committee on Foreign Investment in the United States (CFIUS), European Union competition authorities, Chinese regulatory bodies, and potentially other markets where Sony and TCL operate. The companies are targeting final binding agreements by March 2025, with all approvals expected by April 2027.

How will Sony maintain premium brand positioning in this partnership?

Sony's 49 percent ownership provides input on major strategic decisions protecting the Bravia brand. Premium-tier televisions will maintain Sony's engineering standards, image processing technology, and quality specifications. The partnership targets efficiency in manufacturing and supply chain, not compromises in product quality.

Could this partnership fail or dissolve?

Joint ventures carry inherent risks including cultural misalignment, integration challenges, market downturns, regulatory issues, or geopolitical tensions. However, both companies' financial incentives strongly align toward success, and the structured 51/49 ownership allows either company to eventually acquire the other's stake if circumstances warrant.

Should I wait to buy a Sony TV until after the partnership launches?

If you need a television immediately, current Sony models remain quality products. If you can wait until 2027-2028, the partnership should deliver televisions with better value propositions combining Sony's technology with TCL's efficiency. The optimal choice depends on your timeline and current needs versus patience for potential improved future options.

Related articles on consumer electronics partnerships, television technology evolution, and manufacturing strategy will appear below this content based on topic relevance.

Key Takeaways

- Sony's TV division is shifting to a new joint venture where TCL controls 51% and Sony holds 49%, launching April 2027 after regulatory approvals by March 2025.

- The partnership combines Sony's premium image processing and brand value with TCL's manufacturing efficiency, vertical integration, and cost advantages estimated at 15-25%.

- Manufacturing costs will likely drop 10-15% through TCL's operational expertise, potentially enabling better features at lower prices or similar features at significant discounts.

- Future Bravia TVs will use TCL's display panels and assembly, Sony's cognitive processors and image tuning, targeting $100-240M in annual EBITDA versus Sony's current 3-4% margins.

- The partnership signals accelerating industry consolidation; competitors like Samsung and LG may pursue similar partnerships to compete against TCL's scale and cost advantages.

- Consumers should expect 2025-2026 product delays as teams integrate, with genuinely improved products emerging 2027-2028 combining both companies' strengths.

- Premium positioning might temporarily soften as more affordable Bravia options launch, but flagship models maintain engineering standards and quality specifications.

Related Articles

- NanoLED TVs Could Revolutionize Your Screen by 2029 [2025]

- Why Apple's Move Away From Titanium Was a Design Mistake [2025]

- Asus Phone Exit: Why the Zenfone Era is Ending [2025]

- Best Buy Winter Sale 2025: Top 10 Tech Deals Worth Buying [2025]

- Best Gear & Tech Releases This Week [2025]

- Retro Portable Music Player Design Concept [2025]

![Sony's TV Business Takeover: Why TCL's Partnership Changes Everything [2025]](https://tryrunable.com/blog/sony-s-tv-business-takeover-why-tcl-s-partnership-changes-ev/image-1-1768907360513.jpg)