Asus Phones Are Officially Done. Here's What Happened

Last week, something quietly collapsed in the phone industry that most people didn't even notice. Asus chairman Jonney Shih announced the company is done making phones. No more Zenfone. No more ROG Phone. Just... silence.

For most consumers, that probably means nothing. But if you've followed the Android space for the last decade, you know Asus did something remarkable. They built phones that took actual risks. Tiny phones when everything else was getting bigger. Gaming phones when nobody else was taking mobile gaming seriously. They weren't always the best phones—honestly, they were often worse than the Samsung flagships sitting next to them. But they were interesting.

Now they're gone. And that matters more than you might think.

This isn't just about one company throwing in the towel. It's a symptom of something bigger happening in phones. The market is consolidating hard. Competition is dying. And what killed it wasn't a better product or a smarter strategy. It was economics.

Let me walk you through what happened, why it happened, and what it means for the phones you'll actually be able to buy in five years.

The Asus Story: From Outsider to Exit

Asus started in phones because they were already building everything else. They made laptops, tablets, routers, components. So around 2011, they figured: why not phones? It made sense on paper. You've got manufacturing expertise. You've got supply chain connections. You've got brand recognition in the tech world.

What they didn't have was a reason for people to buy an Asus phone instead of a Samsung or HTC.

For the first several years, they didn't have one. Their phones were technically solid but forgettable. The kind of thing that showed up on sale at Best Buy and you'd think, "Yeah, that's a phone." Nothing more.

Then something changed around 2020. Asus decided to stop competing on specs and start competing on personality. They launched the ROG Phone—a phone designed for gamers, with a side-mounted charging port so your hand wouldn't block it during gameplay. Active cooling. Absurdly high refresh rates. RGB lighting if that's your thing.

It was ridiculous. It was also brilliant.

Suddenly Asus had a lane. They weren't trying to beat the i Phone or the Galaxy S series at their own game. They were creating a different category entirely. A gaming phone for people who wanted actual performance and didn't care if it looked like a spaceship.

On the consumer side, they did something even bolder. In 2023, they released the Zenfone 10. This was a small phone. Genuinely small. 5.9 inches. In an era where every flagship was pushing 6.5 inches and up, where you basically needed two hands to use your phone, Asus made something that fit in one hand.

People loved it. Not enough people. But enough that you knew Asus understood something the rest of the industry didn't.

Why Phone Markets Get Brutal

Here's the economic reality nobody wants to talk about: smartphone margins are terrible if you're not Apple or Samsung.

Think about it. The bill of materials (the cost to actually make a phone) has stayed roughly flat for a decade while prices have stayed high. That sounds great for profit margins. Except it's not, because competition forces prices down. Every manufacturer is fighting over roughly the same component suppliers. Everyone's using the same processors (usually Qualcomm Snapdragon chips). Everyone's buying screens from the same panel makers.

The differentiation is getting harder to find. And the market is cruel to the player in fourth place trying to differentiate.

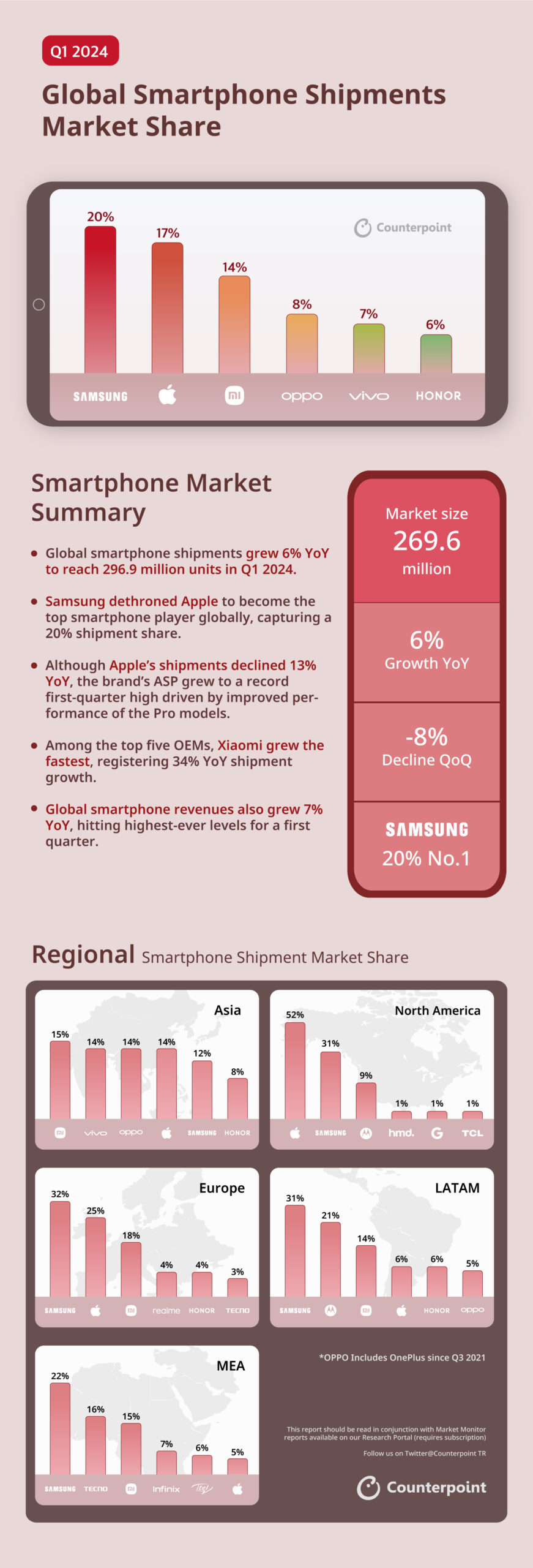

Let me put this in perspective. In 2024, the global smartphone market shipped around 1.2 billion phones. Here's how that broke down:

- Apple: roughly 23% market share

- Samsung: roughly 18% market share

- Xiaomi: roughly 13% market share

- Oppo: roughly 10% market share

- Everyone else: roughly 36% market share divided among dozens of companies

Notice anything? Apple and Samsung control 41% of the market. But here's the real kicker: they probably control 70% of the profit. Maybe more.

Why? Because they have pricing power. People will pay

That's a race to the bottom. And in a race to the bottom, you can't win by running harder. You can only win by running differently. Which is exactly what the ROG Phone tried to do.

The Zenfone 12 Ultra: Too Little, Too Late

Fast forward to 2025. Asus releases the Zenfone 12 Ultra. By all accounts, it's a fine phone. Good processor. Good display. Good camera. It doesn't come to the US, which is already a sign of how serious Asus is about competing.

Why doesn't it come to the US? Because the US is a phone graveyard for anyone who isn't Apple, Samsung, or maybe Google with their Pixel. The carriers control everything. Verizon, AT&T, and T-Mobile decide which phones get shelf space. And they'll give that space to brands that already own mind share.

Without carrier distribution, you're selling online only. That's possible—Google does it with the Pixel. But Google also makes the Android operating system itself, which gives them leverage and free marketing. Asus makes the phone. That's it.

So the Zenfone 12 Ultra exists mostly in markets outside the US. It's fine. Nobody's excited about it. Because "fine" isn't enough anymore. "Fine" just means you're slowly losing to competitors who are fine and bigger.

Meanwhile, the ROG Phone 9 FE released last year with a similar problem. The ROG Phone was Asus's differentiation story. But even that couldn't compete with the economics of being a smaller player in a mature market.

Gaming Phones as a Category: Dead or Dormant?

Let's talk about whether gaming phones even matter anymore.

The ROG Phone was born from a legitimate insight: some people care about performance while gaming on their phone and are willing to pay a premium for it. There was a real audience. Esports players. Mobile gamers who take it seriously. People who wanted specs that beat everything else.

But here's what happened. Flagships got so fast that the gap between a regular flagship and a gaming phone became irrelevant for most use cases. A Samsung Galaxy S25 Ultra runs pretty much any mobile game smoothly. The ROG Phone is faster, but not visibly. The difference is measured in frame-time consistency and refresh rate stability—things most people don't notice.

Plus, gaming phones are typically bulky and heavy because of all the cooling and components. That's a terrible value proposition in a market where phones are already the size of small tablets. People want them lighter and thinner, not heavier and thicker for gaming performance most won't notice.

The ROG Brand Lives, But Not in Phones

Here's the interesting part: Asus isn't abandoning gaming. They're just abandoning gaming phones.

Asus has the ROG brand in gaming laptops, where it's genuinely respected and commands premium pricing. Gaming laptops are actually a differentiated category. You need specific thermals, specific keyboards, specific displays. Gaming phone differentiation, as it turns out, is mostly marketing.

So Asus is doubling down where ROG actually matters. Gaming laptops, peripherals, components. They're exiting the phone business not because they failed at phones, but because they can make more money selling gaming laptops.

That's actually rational. It's also depressing if you liked having options in phones.

The Zenfone Legacy: What Gets Lost

Now let's talk about what dies with the Zenfone line.

The Zenfone, especially the Zenfone 10, represented something increasingly rare in phones: someone taking a different design philosophy seriously. Small size as a feature, not a bug. Premium build quality with a price that actually reflected the value. Software that didn't bloat the OS with unnecessary Asus apps.

When the Zenfone 10 came out, it got positive reviews. Not rave reviews. But genuine appreciation from people who wanted a small phone and thought Asus nailed it. The problem? Wanting a small phone in 2023 is a niche preference. A small but vocal niche. Not enough to drive unit sales for a company trying to be competitive.

So the Zenfone 11 and 12 came out. They were bigger. Closer to the standard 6.2-6.5 inch range everyone else was doing. Because Asus needed volume. And volume means following what works for the market leaders.

In trying to be competitive, they stopped being interesting. By the time Jonney Shih announced they were exiting, the Zenfone line had already lost the thing that made it worth paying attention to.

Market Consolidation: The Bigger Picture

Asus exiting phones is just the latest in a long trend. Over the last decade, dozens of phone makers have disappeared or exited the market:

- HTC went from being a legitimate competitor to essentially dead in phones by 2020

- Sony keeps making phones nobody knows about

- LG exited the market entirely in 2021

- Nokia's Android phones vanished years ago

- One Plus still exists but is now basically Oppo's sub-brand

- Motorola is surviving but as a budget brand mostly

The companies left in the game are: Apple, Samsung, Google, Xiaomi, Oppo/One Plus, Vivo, Realme, and a handful of regional players. That's it.

Why is consolidation accelerating? Several reasons:

First, smartphone penetration is basically complete in developed markets. There's no more land grab. Everyone who wants a smartphone already has one. Growth is replacement only, and replacements happen every 4-5 years. That's a shrinking pie being divided among more players.

Second, economies of scale are ruthless in phones. If you want to make phones competitively, you need to sell tens of millions of units to absorb R&D costs and manufacturing complexity. Asus was probably selling a few million phones a year globally. Compare that to Apple's 200+ million i Phones annually. You can't compete on volume. And if you can't compete on volume, you can't absorb costs.

Third, distribution is controlled by gatekeepers. In the US, the carriers control everything. In Europe and Asia, you're competing against established brands with distribution relationships. As a new player or returning player, breaking in is nearly impossible.

Fourth, the technology innovation cycle has slowed dramatically. Phones are mature products now. The difference between a 2022 flagship and a 2025 flagship is measurable but not revolutionary. Processors are faster but not dramatically so. Cameras are better but in incremental ways. Batteries last longer but not dramatically longer. Without visible innovation, price becomes the main differentiator. And if price is the main differentiator, brand power and scale decide the winner.

What This Means for Consumers

Let's be blunt: fewer players in phones means fewer choices, less innovation, and probably higher prices long-term.

The consumer case for competition is straightforward. Competition forces innovation. It forces price discipline. It forces companies to actually care about what customers want instead of what Wall Street wants.

With fewer makers, the incentive structure changes. If you're Apple or Samsung or Google, you can experiment. You can take risks like making a small phone because you've got the scale and brand power to absorb it if it flops. You're Asus? You can't afford to risk it.

So the market tends toward sameness. Every flagship is roughly 6.3 inches with a 120 Hz display and a triple camera and runs 3-4 years of updates. There's no Zenfone 10. There's no ROG Phone being silly with active cooling. There's just... standard.

Prices stay high because there's less reason to compete on price. Samsung can charge $1,000 for a Galaxy S25 Ultra because what else are you going to buy that's in that category? Apple i Phone 16 Pro Max. Google Pixel 10 Pro. That's it. Three choices at the premium tier.

Meanwhile, the mid-range gets crushed. Xiaomi and Oppo dominate with decent specs at reasonable prices. But even that market is consolidating around standard designs and specs.

The Software Problem That Nobody Talks About

Here's something else that killed Asus and other mid-tier makers: software updates.

Android phones need regular software updates for security and features. Older versions of Android are actually dangerous to use—they have known security vulnerabilities. For a company like Google or Samsung, pushing out years of updates is expensive but doable at scale. You've got thousands of engineers. You can write update software that works across different hardware configurations.

For Asus? Every update means testing across hardware that's getting older and increasingly fragmented. Eventually, it becomes cheaper to just stop supporting a phone than to keep updating it.

Then there's the feature gap. Apple makes i Phones and controls i OS. They can push features to five-year-old i Phones because they control both hardware and software. Samsung and Google are close to that level. Asus just makes the phone. Google controls the operating system. They can't compete on software features because they're not allowed to.

This creates a vicious cycle. Consumers see i Phones getting 5+ years of updates and security patches. They see Samsung Galaxy phones getting 4+ years. Then they see an Asus phone getting 2-3 years. They rationally choose based on longevity. Asus can't fix this without Apple-level scale and control.

The Carrier Death Grip on Distribution

In the US, here's how phones get sold: through carriers. Verizon, AT&T, T-Mobile. They control shelf space in their stores. They control which phones are featured in advertising. They control carrier branding and bundled deals.

Carriers prefer carrying flagship phones because flagship buyers stay longer on their network and upgrade less frequently (better for carrier economics). Non-flagship phones are treated as throwaways to fill out the portfolio.

Asus never had carrier relationships like Samsung or Apple. Building those relationships takes years and requires you to already be winning. It's a catch-22. You need distribution to win. You need to already be winning to get distribution.

That's why Google had to spend billions acquiring Motorola just to have a phone manufacturing base with carrier relationships. That's why One Plus essentially became an Oppo subsidiary—they needed Oppo's distribution muscle.

Asus took a different approach. They tried to win through direct sales and online channels. And they did okay in that channel in some markets. But in the US and other key markets, that's not enough volume to sustain a phone business long-term.

"Indefinite Observation": Why Asus Left the Door Cracked Open

Notice that Jonney Shih didn't say "we're never making phones again." He said "indefinite observation." Meaning: we're done for now, but if the market changes, we might come back.

When should we expect Asus back in phones? Probably never, unless one of a few things happens:

One: A new phone form factor takes off. If foldables or rollables or some other new form factor becomes mainstream and represents 20%+ of the market, a company like Asus might re-enter with a product optimized for that form factor. The infrastructure, carrier relationships, and consumer mindshare would all reset somewhat.

Two: An existing category opens up. Right now, gaming phones are dying because flagships are fast enough for gaming. But what if something changes? What if there's a sudden demand for a specific type of phone (compact phones, low-cost high-performance phones, etc.) that the existing makers don't serve? That creates an opening.

Three: Asus acquires or partners with a phone company. Instead of building from scratch, Asus could acquire a struggling phone brand with existing relationships and manufacturing. This is more likely than returning to the market independently.

Four: Asus spins off or invests in a separate phone company. This would let them take the financial risk without threatening the core Asus business. It's how some companies return to markets they exited.

But honestly? All of these are low probability. The economics of phones aren't going to get better for mid-tier makers. The consolidation is structural, not cyclical.

Lessons for Other Phone Makers

Asus's exit is a warning sign. Specifically: if you're not Apple, Samsung, or Google, you need a differentiated strategy. You can't just make a phone and expect to compete.

Xiaomi survived by being cheaper without being cheap. You get a good product at a real discount relative to flagships. That works in price-sensitive markets.

Oppo (including One Plus) survived by being part of BBK Electronics, which owns multiple phone brands and can share costs and manufacturing across brands. They have scale.

Google survived by controlling Android and being able to market Pixel phones as the "real" Android experience. Plus they have the entire Google ecosystem (search, maps, Gmail, Drive, etc.) creating lock-in.

Samsung survived by being huge, by having massive brand power, and by making everything from chips to displays to phones. They can subsidize phones with margin from components.

Apple survived by being Apple. Premium pricing, vertical integration, ecosystem lock-in, and a brand that transcends technology.

What was Asus's strategy? Make good phones. Which isn't a strategy at all. It's a requirement just to participate. It's not a reason for someone to buy your phone instead of a Samsung or i Phone.

What About ROG Phone Fans?

For the people who actually bought ROG Phones, this sucks. You bought into a brand that promised premium gaming performance. And that brand is now gone.

Asus says they'll continue to support existing ROG Phone users with updates and software. But "support" in the phone industry means 2-3 more years of updates, then you're on your own.

If you own a ROG Phone 8 or ROG Phone 9, you're probably going to get updates through 2026 or 2027. After that, good luck. You'll be on a 4-5 year old OS version with security vulnerabilities and no new features.

The smart move? Probably sell it now while it still has resale value and move to a phone from a company that's committed to the market long-term.

The Narrowing of Android

Asus wasn't just making phones. They were making Android phones. They were demonstrating that you could build an interesting Android phone and sell it at a premium without being Samsung or Google.

With Asus gone, that option disappears. The premium Android phone category is now basically Samsung and Google. Xiaomi and Oppo do budget and mid-range better. But premium? It's Samsung and Google.

This has long-term implications for Android as an ecosystem. Android thrives on diversity. When it was competing with i OS, the idea was: Android supports innovation from multiple makers. You want a phone with a stylus? Samsung. You want a phone with a great camera and tight Google integration? Google. You want something different? HTC, Motorola, Sony, Asus, LG.

Now that list of differentiators is almost entirely gone. It's Samsung's way or Google's way at the premium tier.

That's healthier for Microsoft and other companies trying to build services on top of Android. Fewer variants means easier development. But it's worse for consumers who want choice.

Economic Reality: Why Companies Choose to Exit

Let's talk about the actual economics of making phones in 2025.

A typical smartphone manufacturer spends roughly 15-20% of revenue on R&D. That includes design, engineering, testing, and compliance across dozens of markets and regulatory environments. If Asus was selling phones with 30% margins (which is aggressive for a non-flagship maker), then R&D alone was eating half that margin.

Then there's marketing. Asus needs to tell people their phone exists. That's expensive. Samsung can spend $100 million on marketing because they're selling 100+ million phones. Asus selling 5-10 million phones? They can't outspend Samsung by a factor of 1/10th per phone. The economics don't work.

Then supply chain overhead. Manufacturing, logistics, customer service, warranty support, technical support. All per-unit costs that don't scale as well as you'd hope.

So here's what probably happened: Asus looked at the Zenfone business and realized that after R&D, marketing, and operations, they're making maybe 5-10% net margin. Compare that to their laptop business (probably 12-15% margin) or their component business (probably 20%+ margin). Why would they stay in phones?

The only reason to stay in phones is brand strategy—maintaining presence in a category for overall brand value. But Asus isn't Apple or Samsung. Asus makes laptops, routers, components. Phone presence isn't essential to brand strategy.

So they exited. Not because they failed. They exited because staying in phones made less economic sense than exiting.

The Dominance of Three Players

Let's do the math on what's left in premium phones:

Apple: 200+ million i Phones annually. Probably 60%+ of phone industry profit. The ecosystem lock-in is unmatched.

Samsung: 250+ million phones annually but declining. They're making money on flagships and cheaply on budget phones with minimal margin.

Google: 15-20 million Pixel phones annually but growing. They're positioning Pixels as the "premium Android" alternative to i Phone.

That's roughly it at the premium tier. Everyone else is fighting for mid-range and budget, where margins are thin and competition is brutal.

This three-player market is stable. Nobody's going to dethrone Apple or Samsung in premium phones. Google might grow Pixel market share, but that's coming from Samsung's pie, not creating new pie.

Meanwhile, you've got Xiaomi, Oppo, Vivo, Realme, and others fighting in the budget and mid-range tiers where most of the volume is but least of the profit.

What Could Have Saved Asus in Phones

Hypothetically, what would have needed to happen for Asus to survive?

Scenario One: They become the gaming phone company. Like really commit to it. Build partnerships with game studios. Sponsor esports tournaments. Make ROG Phone the default for mobile gaming. Execute that well for 5+ years. This would have required massive investment upfront with no guarantee of ROI.

Scenario Two: They own a specific market. Instead of trying to compete globally, Asus dominates Taiwan, Japan, or Southeast Asia. Sell there profitably and build from a strong regional base. This requires patience and long-term investment.

Scenario Three: They get acquired or merge. Asus merges with another phone maker and consolidates operations. Suddenly you have scale. This would have been difficult politically and probably would have triggered antitrust concerns.

Scenario Four: They license technology or designs to other makers. Instead of making the phone, Asus designs it and partners with a manufacturer or carrier. This is essentially what One Plus did.

Scenario Five: They nail something genuinely innovative. Not just small phones or gaming phones, but something that creates a new category. The problem? Innovation in phones requires massive R&D and carries massive risk.

None of these happened. So Asus exited.

The Future of Phones Without Asus

What does the market look like now?

Premium tier ($900+): Apple i Phone, Samsung Galaxy S, Google Pixel Pro. That's your choice. Three phones fundamentally. Each with variations (Plus, Ultra, etc.), but three makers.

Mid-range (

Budget tier (<$300): Xiaomi, Realme, Motorola, Samsung Galaxy A, others. High volume, low margin.

Plusses:

- Better quality control and software support at all tiers

- Less fragmentation for developers and consumers

- Easier for consumers to choose (fewer options)

Minuses:

- Less innovation from competitive pressure

- Higher prices because less competition

- Less variety in form factors and designs

- If one maker stumbles, there's no alternative

The minuses are structural. They get worse from here, not better.

Why Small Phone Fans Should Be Worried

Asus made small phones. Not many, but they did it seriously. The Zenfone 10 was genuinely small and genuinely good.

With Asus gone, small phones are almost entirely gone. Samsung makes the S24 FE which is smaller than the Ultra, but it's not truly small by pre-2015 standards. Apple makes the i Phone 16 (not Pro) which is the smallest option, but it's still 6.1 inches.

There's a growing movement of people who want smaller phones. They prefer one-handed operation. They prefer thinner bezels without bigger screens. They prefer phones that fit in pockets without a brick outline showing.

This audience is being completely ignored by the market. Samsung, Apple, and Google have decided small phones aren't profitable enough. They're optimizing for screen size because screen-on-time and camera quality correlate with big screens.

If the market consolidates further, small phones might disappear entirely. And the problem is, new players can't enter that market because the economics are even worse for small phones (less volume, niche audience).

Asus's Other Bet: The PC Market

Why is Asus exiting phones? Because they're doubling down on PCs.

The PC market is nothing like phones. It's huge, it's fragmented, and there's more money in it. Asus is one of the top PC makers globally. Gaming laptops under the ROG brand are genuinely respected. Budget laptops are fine. Business laptops (Vivobook) are competitive.

In PCs, you don't have the carrier gatekeepers. You don't have the same brand consolidation. You've got Lenovo, Dell, HP, Asus, Apple, and a bunch of others all competing effectively. The PC market is healthy and competitive.

For Asus, that's where they can make real money. ROG gaming laptops make decent margin. Business laptops make okay margin. Mobile workstations make great margin.

Contrast that with phones where you're fighting for 3-5% margin against massive competitors. The choice is obvious.

Timeline: When Did Asus Phones Get Doomed?

When exactly did this become inevitable?

Argument for 2018-2019: That's when the smartphone market peaked and started declining in developed markets. After that, it's just churn. Asus recognized the trend and decided not to fight a declining market against increasing competition.

Argument for 2021: That's when LG exited phones and the market really started consolidating. Asus saw the writing on the wall.

Argument for 2023: That's when the Zenfone 10 (their last truly differentiated product) came out and failed to move the needle. Asus realized they couldn't compete with differentiation alone.

Probably all three are factors. But the decision to exit wasn't made suddenly. It was inevitable from the moment Asus decided to compete in a market where they couldn't differentiate enough to justify the investment.

What Happens to Existing Asus Phone Users?

If you own an Asus phone right now, what happens?

Short term: Not much. Your phone still works. You'll get software updates for a couple more years. Security patches probably continue for another year or two after that.

Medium term (2-3 years): Updates get less frequent. Then they stop. You're running a 3-year-old version of Android.

Long term (4+ years): Your phone is effectively a brick for security purposes. It's still usable, but it's vulnerable to known exploits. You've got to switch to something else.

The wise move is probably upgrading sooner rather than later, before Asus phones become worthless on the second-hand market. In a year, Asus phone value is going to crater because the resale market knows the company's out of phones.

The Broader Trend: Everyone Exiting

Asus is just the latest. Who's next?

Motorola is still making phones but as a budget brand mostly. They're owned by Lenovo, which has been slowly killing them for years. Could exit any time.

Sony still makes phones but nobody knows about them. They're probably next.

One Plus isn't really independent anymore (it's Oppo). If Oppo decides they don't need the brand anymore, One Plus dies.

What we're watching is the mobile phone industry consolidating into a few mega-companies and a few regional players. The middle class of phone makers is disappearing.

This is what consolidation looks like. It's not a sudden crash. It's the slow extinction of mid-tier competitors who can't generate enough margin to justify the investment.

Why This Matters Beyond Just Phones

Asus's phone exit matters because it's a case study in how markets consolidate when innovation slows and scales matter more than differentiation.

This isn't unique to phones. It's happening in cars (electric vehicles accelerating consolidation), social media (Twitter, Threads, Bluesky consolidating around few leaders), cloud computing (AWS, Azure, Google Cloud dominating), and basically every tech market that matured.

The pattern is:

- Young market with lots of players and high differentiation

- Market matures and differentiation becomes harder

- Economies of scale matter more than being different

- Smaller players can't generate enough margin to compete

- Consolidation accelerates

- You end up with 3-5 major players dominating

Phones are just a really visible example of this. And Asus is just one more casualty in a much broader trend.

TL; DR

- Asus exiting confirmed: Chairman Jonney Shih announced the company is ending the Zenfone and ROG Phone lines and entering "indefinite observation" of the market

- Economics are brutal: Smartphones have thin margins (3-5% for mid-tier makers) after accounting for R&D, marketing, and operations, making them unprofitable for all but the biggest players

- Market consolidation accelerating: Only Apple, Samsung, Google, Xiaomi, and a few others remain viable. HTC, LG, Sony, and now Asus have all exited in recent years

- Small phones and gaming phones disappearing: These were Asus's differentiation points, but both categories are dying as the market standardizes around flagship specs and form factors

- Consumers lose options: Fewer competitors means less innovation pressure, potentially higher prices, and standardized designs across the board—which is worse for everyone except the three market leaders

- Bottom Line: Asus phones never competed on sufficient scale or price, only on differentiation—and differentiation isn't enough to justify the investment in a mature, consolidated market

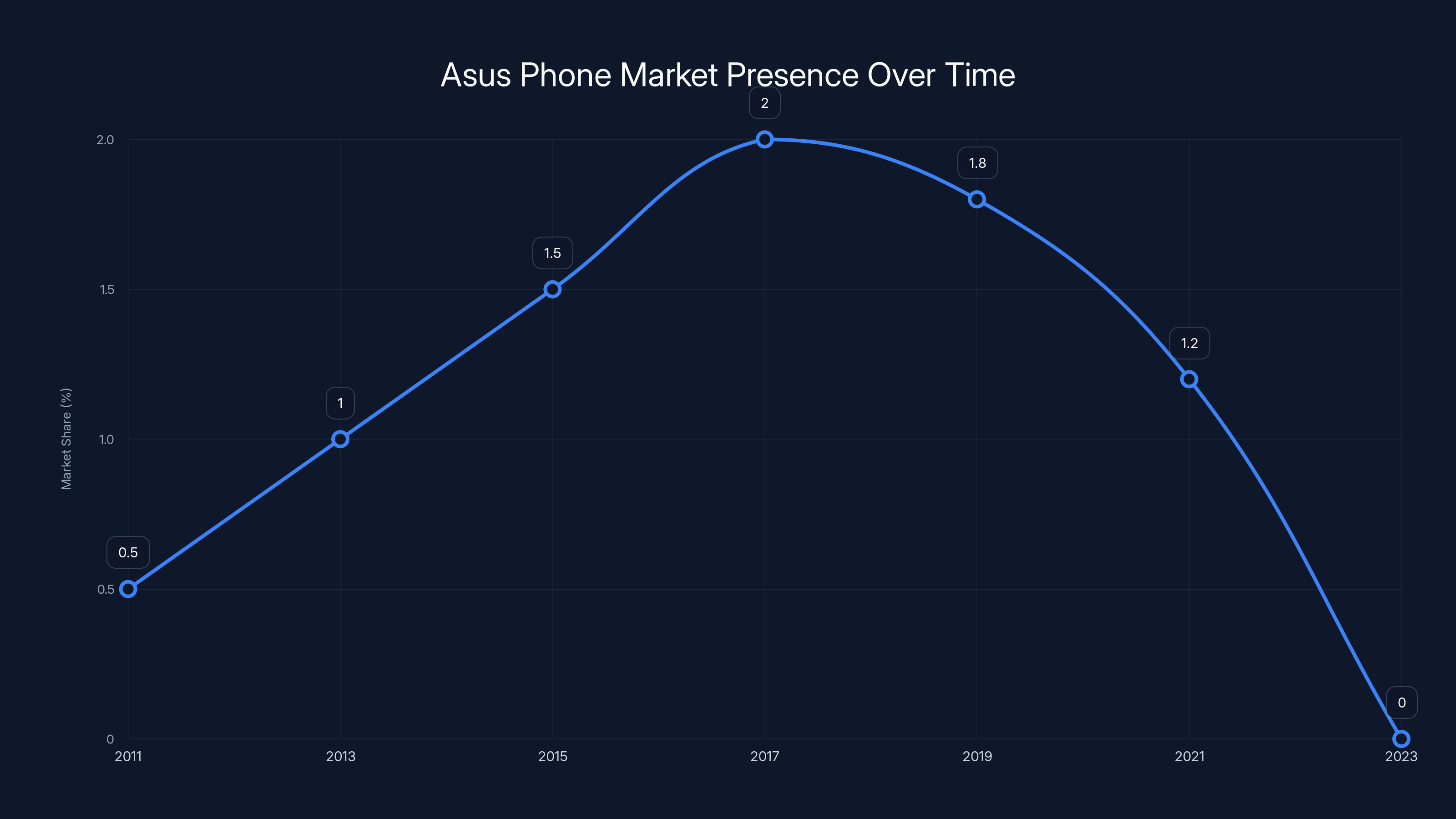

Asus entered the phone market in 2011, peaked around 2017, and exited in 2023 as market consolidation intensified. Estimated data.

FAQ

Why is Asus exiting the smartphone market?

Asus lacks the scale and pricing power to compete with Apple, Samsung, and Google, and smartphone margins are razor-thin after R&D and marketing costs. The company determined that its resources would be better allocated to higher-margin businesses like gaming laptops and PC components, where Asus has legitimate competitive advantages. The Zenfone and ROG Phone lines couldn't generate sufficient profit to justify ongoing investment in an increasingly competitive market.

What was special about Asus phones?

Asus's phones had two main selling points. The Zenfone line made genuinely small phones when everything else was getting bigger, with the Zenfone 10 being one of the last premium compact phones. The ROG Phone series was designed specifically for mobile gaming with active cooling, high refresh rates, and side-mounted charging to avoid hand obstruction during gameplay. Unfortunately, neither differentiation proved sufficient to create lasting market demand at profitable price points.

Will Asus make phones again?

Asus chairman Shih used the term "indefinite observation," suggesting they're not ruling out a return. However, re-entry would require either a major market shift (new form factor like foldables becoming mainstream), specific category opening up that existing makers ignore, or Asus acquiring an existing phone brand with distribution relationships. A true from-scratch re-entry is unlikely given how competitive and consolidated the market has become.

What happened to the ROG Phone gaming phone brand?

The ROG Phone line is being discontinued alongside the consumer Zenfone line. Asus will continue supporting existing ROG Phone users with software updates for a limited period. However, the brand is shifting focus to gaming laptops and components, where the ROG brand actually commands premium pricing and differentiation compared to competitors. Gaming phone differentiation (slightly faster performance and active cooling) proved insufficient compared to mainstream flagships.

How many Asus phones were sold annually?

Asus didn't publicly report phone sales figures, but industry estimates suggested they sold between 5-10 million phones annually—a tiny fraction of the 1.2 billion phones sold globally. For comparison, Apple sells 200+ million i Phones, Samsung sells 250+ million total phones, and Xiaomi sells 100+ million. This scale disadvantage meant Asus couldn't absorb R&D costs across enough units to remain competitive.

What does this mean for the Android smartphone market?

Asus's departure further consolidates Android premium phones to essentially Samsung and Google, with Xiaomi and Oppo dominating budget-mid-range. The "middle class" of phone makers that competed on differentiation is disappearing. This reduces consumer choice, likely increases prices long-term, and means less competitive pressure for innovation at the premium tier where phones are most profitable.

Should I be worried if I own an Asus phone?

You should plan ahead. Asus will likely provide software updates for 2-3 more years, but after that, security patches stop and your phone becomes increasingly vulnerable. Consider selling your Asus phone now while it still has resale value, before the market recognizes that Asus phones are no longer receiving support. Your phone will still function for basic tasks, but security concerns make upgrading advisable within the next 2-3 years.

Why can't mid-tier phone makers like Asus compete?

The smartphone market has consolidated because capital intensity, scale requirements, and brand power create massive advantages for established leaders. Carriers control distribution in key markets like the US. R&D costs don't scale linearly—Samsung and Apple spend billions but it's per-unit cost is lower than Asus's smaller spend. Without carrier relationships, brand recognition, or profit from other divisions, mid-tier makers get trapped with thin margins and high costs.

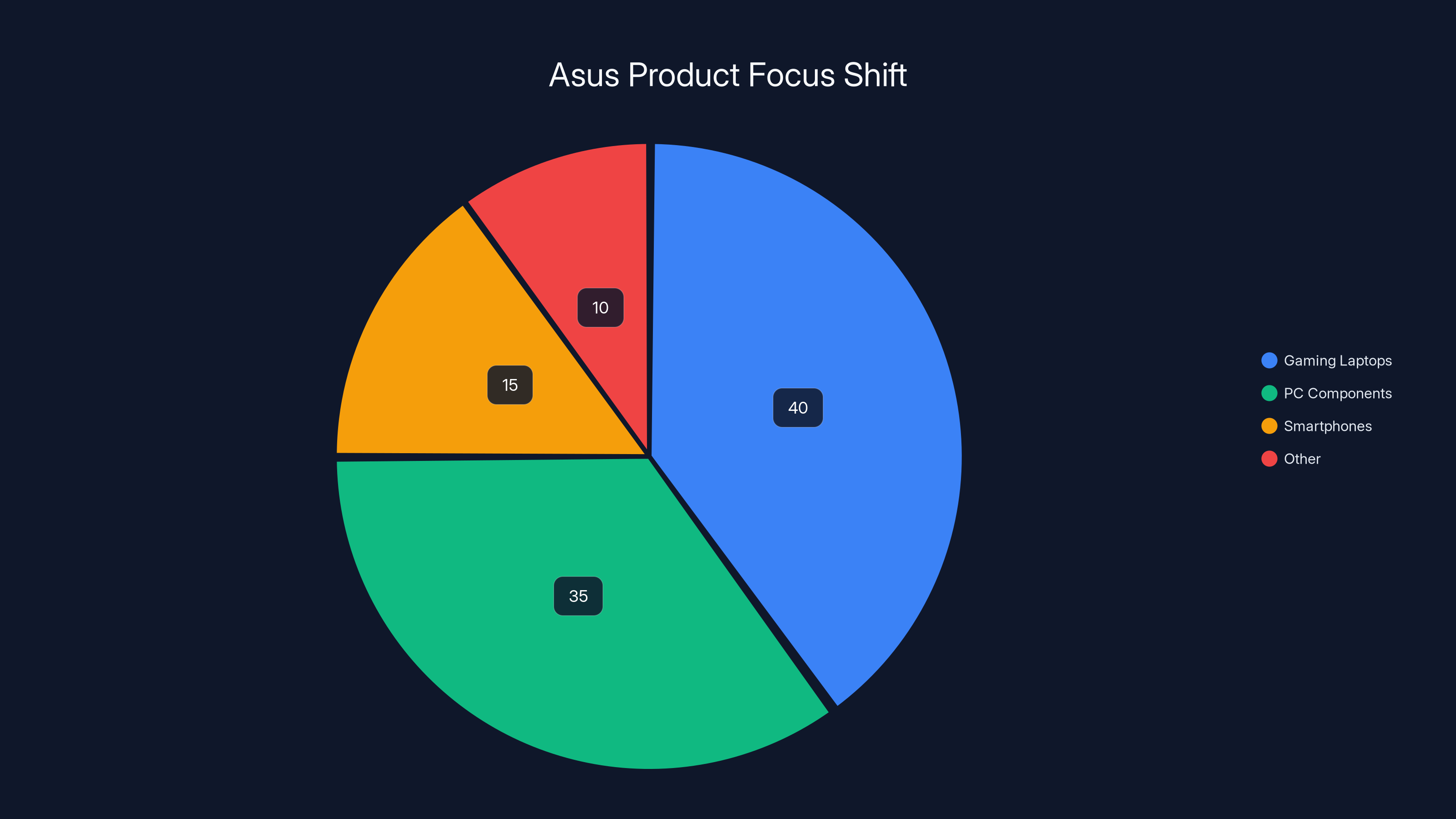

Estimated data shows Asus reallocating focus towards gaming laptops and PC components, with reduced emphasis on smartphones.

The Consolidation Continues

Asus's departure is merely one chapter in the broader story of smartphone market consolidation. What we're watching is the maturation of a product category. Maturity means margins compress. Compressed margins mean only the biggest players survive. And only the biggest players can afford to invest in genuine innovation.

The market isn't getting worse for consumers because one company left. It's getting worse because consolidation is structural. And Asus's exit is predictive of what's coming: a phone market dominated by three or four global players, with regional alternatives in specific geographies.

That's not necessarily bad economically—consolidation creates efficiency. But it's bad for innovation, consumer choice, and the competitive dynamics that drove phones to get better for the last 15 years.

Asus understood this. They looked at the board, looked at the economics, and made a rational decision: there's no profit in being the fourth-best phone maker in a market controlled by three. So they exited to focus on markets where they can actually win.

That's the sound of an industry maturing.

Key Takeaways

- Asus officially exits smartphone market, ending Zenfone and ROG Phone lines due to unsustainable economics

- Smartphone profit margins for mid-tier makers are 3-5% after R&D and marketing, insufficient to justify investment

- Market consolidation leaves only Apple, Samsung, and Google as viable premium phone makers globally

- Small phones and gaming phones as differentiation categories are dying due to commoditization of specs

- Consumers face reduced choice, less innovation pressure, and likely higher prices as competition decreases

Related Articles

- Best Buy Winter Sale 2025: Top 10 Tech Deals Worth Buying [2025]

- Best Gear & Tech Releases This Week [2025]

- Retro Portable Music Player Design Concept [2025]

- Dreame's Risky Product Expansion Strategy: From Vacuums to Everything [2025]

- NanoLED TVs Could Revolutionize Your Screen by 2029 [2025]

- The End of Cheap Phones: Why Prices Are Rising 30% in 2025

![Asus Phone Exit: Why the Zenfone Era is Ending [2025]](https://tryrunable.com/blog/asus-phone-exit-why-the-zenfone-era-is-ending-2025/image-1-1768833371014.jpg)