Understanding the Sony-TCL Partnership: A Seismic Shift in Television Manufacturing

The television industry has experienced numerous partnerships and consolidations throughout its history, but few announcements carry the weight and strategic implications of the Sony-TCL memorandum of understanding. This potential collaboration represents one of the most significant developments in consumer electronics manufacturing in the past decade, signaling fundamental changes in how major television brands will compete, innovate, and deliver products to consumers worldwide.

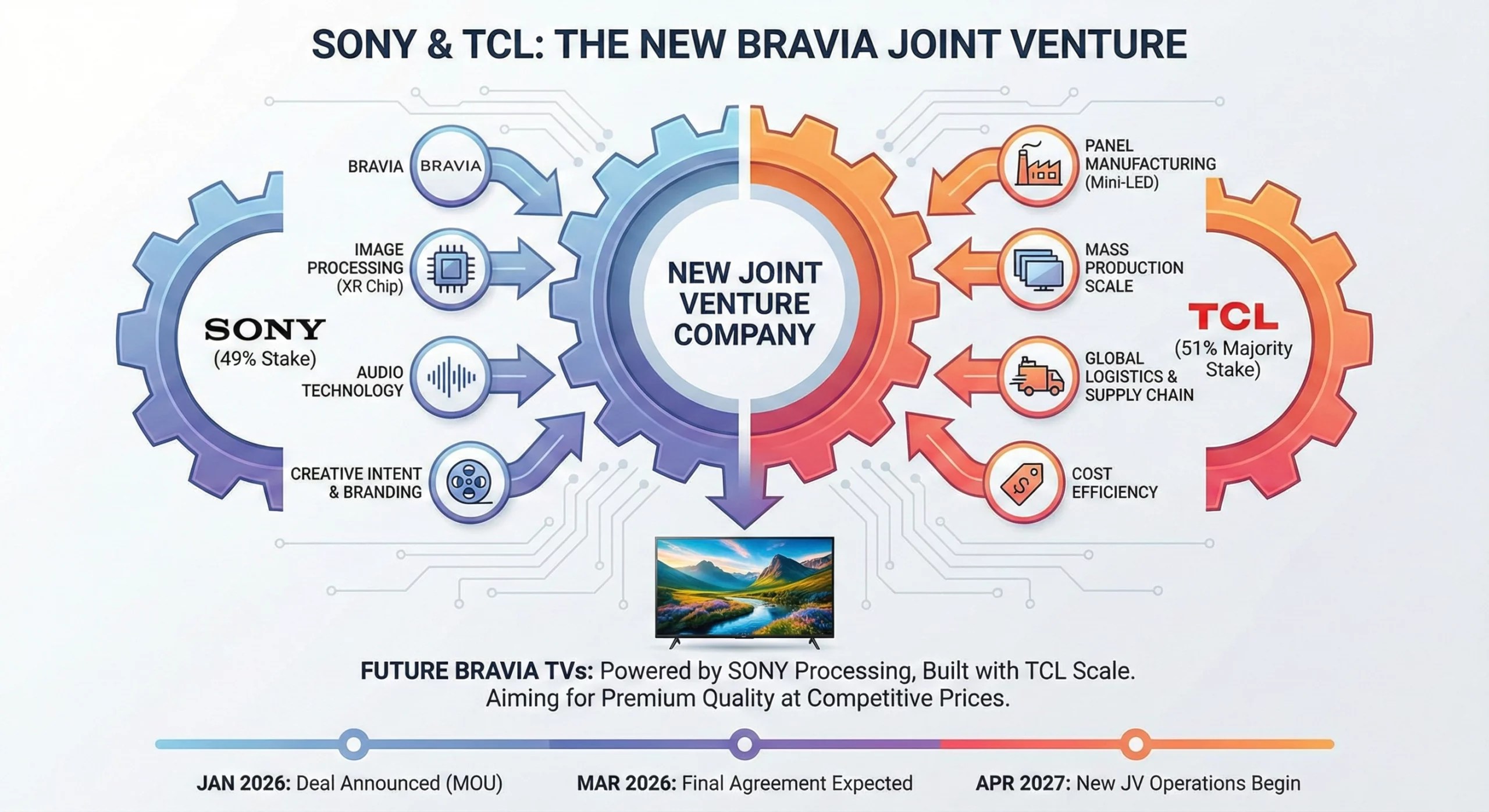

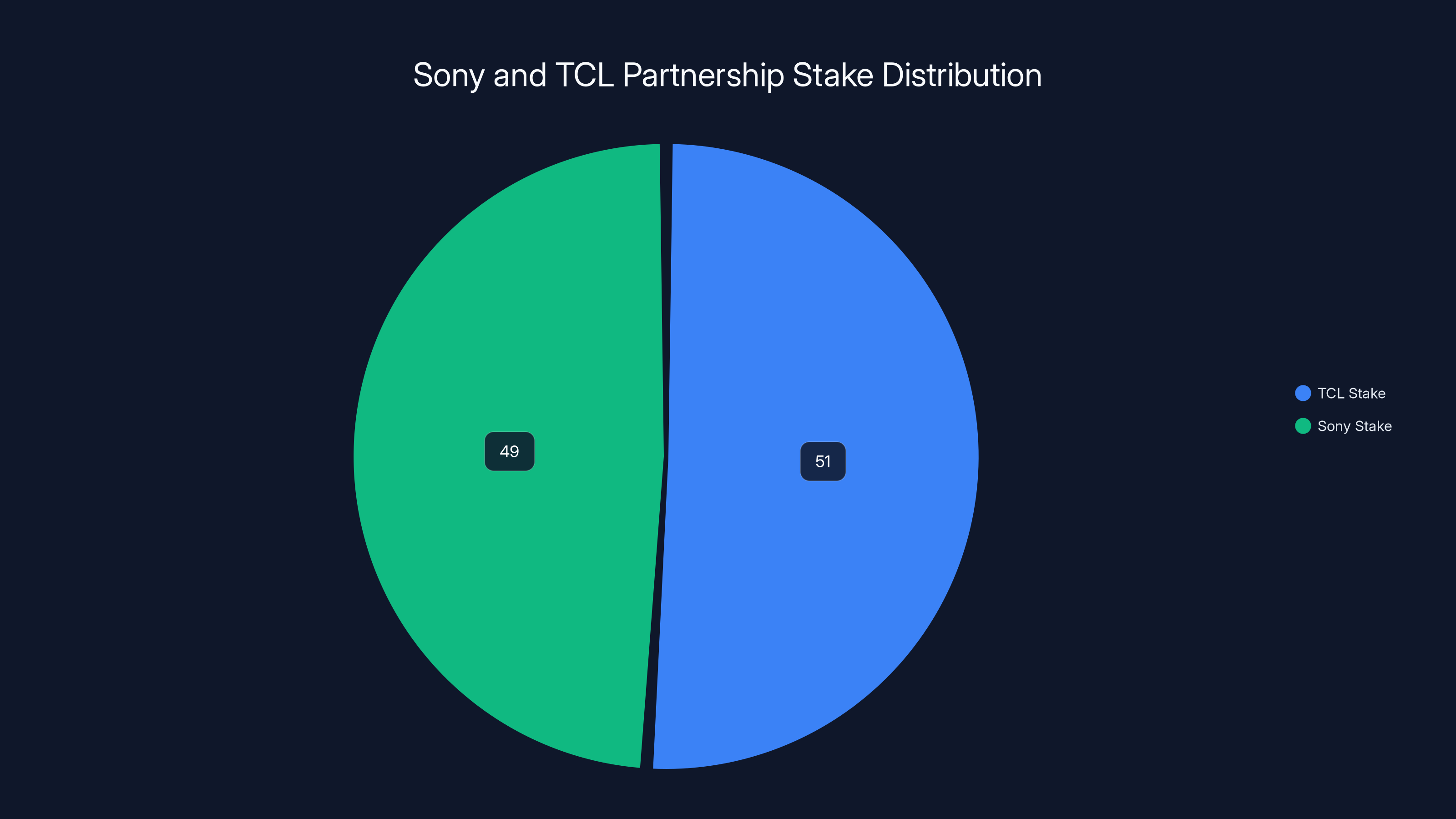

When Sony, one of the most recognizable and premium electronics brands globally, announced discussions with TCL, a company that has become synonymous with affordable, accessible televisions, industry observers immediately recognized the magnitude of this potential arrangement. The proposed structure—with TCL holding 51% ownership and Sony maintaining 49%—isn't simply another manufacturing partnership or outsourcing agreement. Instead, it represents a strategic pivot where two companies with fundamentally different market positioning, manufacturing philosophies, and geographic strengths are exploring a deeper integration that could reshape the entire television landscape.

What makes this partnership particularly fascinating is the timing and context. Sony has been grappling with maintaining its premium market position while facing relentless pressure from Chinese manufacturers offering superior value propositions. TCL, meanwhile, has rapidly ascended from a regional player to a global television powerhouse through aggressive innovation in display technologies, particularly in quantum dot and mini-LED developments. By combining Sony's brand prestige, design expertise, and software capabilities with TCL's manufacturing efficiency, supply chain dominance, and technological innovation, both companies stand to address each other's fundamental weaknesses.

However, the path from memorandum of understanding to an operational joint venture involves multiple hurdles that shouldn't be underestimated. Regulatory approval, particularly from Chinese government authorities who maintain significant oversight of foreign partnerships involving major manufacturing facilities, represents a critical checkpoint. The timeline—with potential binding agreements expected by March 2026 and full operational launch planned for April 2027—provides ample opportunity for market conditions, competitive dynamics, or strategic priorities to shift. Understanding both the compelling logic behind this partnership and the genuine uncertainties surrounding its execution is essential for anyone tracking the television industry's trajectory.

The Current State of Television Manufacturing and Industry Consolidation

Historical Context: How We Got Here

The global television manufacturing industry has undergone dramatic transformation over the past two decades. What was once dominated by Japanese manufacturers—Sony, Panasonic, Sharp—has progressively shifted toward South Korean companies like Samsung and LG, followed by explosive growth from Chinese manufacturers. This evolution reflects broader economic patterns where manufacturing advantages migrate toward regions with superior supply chain infrastructure, lower labor costs, and government support for strategic industries.

Sony's television division tells a particularly instructive story. Once synonymous with premium televisions and commanding significant market share globally, Sony gradually lost ground as it maintained premium pricing while competitors offered increasingly capable products at lower price points. By the early 2020s, Sony's TV division had become a relatively modest contributor to the company's overall revenue and profitability. Rather than aggressively investing in manufacturing infrastructure or competing on price in volume segments, Sony focused on premium positioning through technologies like Mini-LED and OLED, HDMI 2.1 support for gaming, and software integration with Play Station and other Sony entertainment services.

TCL's trajectory moved in the opposite direction. Beginning as a regional manufacturer, TCL invested heavily in display technology development, particularly through TCL China Star Optoelectronics Technology (CSOT), its wholly-owned subsidiary. CSOT evolved into one of the world's most significant LCD and LED panel manufacturers, supplying displays to numerous television brands globally while simultaneously supplying TCL's own television division. This vertical integration—where TCL controls the entire value chain from raw materials through panel manufacturing to finished products—provided unprecedented flexibility in implementing new technologies, controlling costs, and responding to market demands.

The Manufacturing Advantage of Vertical Integration

Understanding TCL's competitive strength requires examining how vertical integration functions in display manufacturing. When a company like TCL manufactures its own panels, it gains several critical advantages that other manufacturers cannot easily replicate. Consider the implementation of quantum dot technology improvements. When TCL develops new quantum dots or color filters, it can implement these changes across its entire product line almost immediately. The company faces no need to negotiate with external panel suppliers, no requirement to wait for volume commitments from multiple customers, and no dependency on suppliers' investment priorities.

For contrast, consider Samsung or other manufacturers who must purchase panels from LG Display or other panel makers. When these suppliers introduce new technologies, adoption requires negotiation, volume commitments, and production coordination across multiple customers. A panel manufacturer considering a major production line modification must weigh the costs against benefits across their entire customer base, not merely one brand. This structural advantage has allowed TCL to implement technologies like mini-LED backlighting enhancements and advanced color management systems faster than competitors, translating to measurable quality improvements that reach consumers more rapidly.

The cost implications prove equally significant. TCL's control over panel production allows them to optimize manufacturing efficiency throughout the value chain. By coordinating panel production schedules with television assembly operations, managing raw material procurement directly, and eliminating middle-man markups, TCL achieves cost structures that companies dependent on external suppliers simply cannot match. This explains why TCL televisions often deliver comparable or superior specifications to competitors' offerings at substantially lower price points—not through sacrificing quality but through manufacturing efficiency.

Market Share Realities and Competitive Pressures

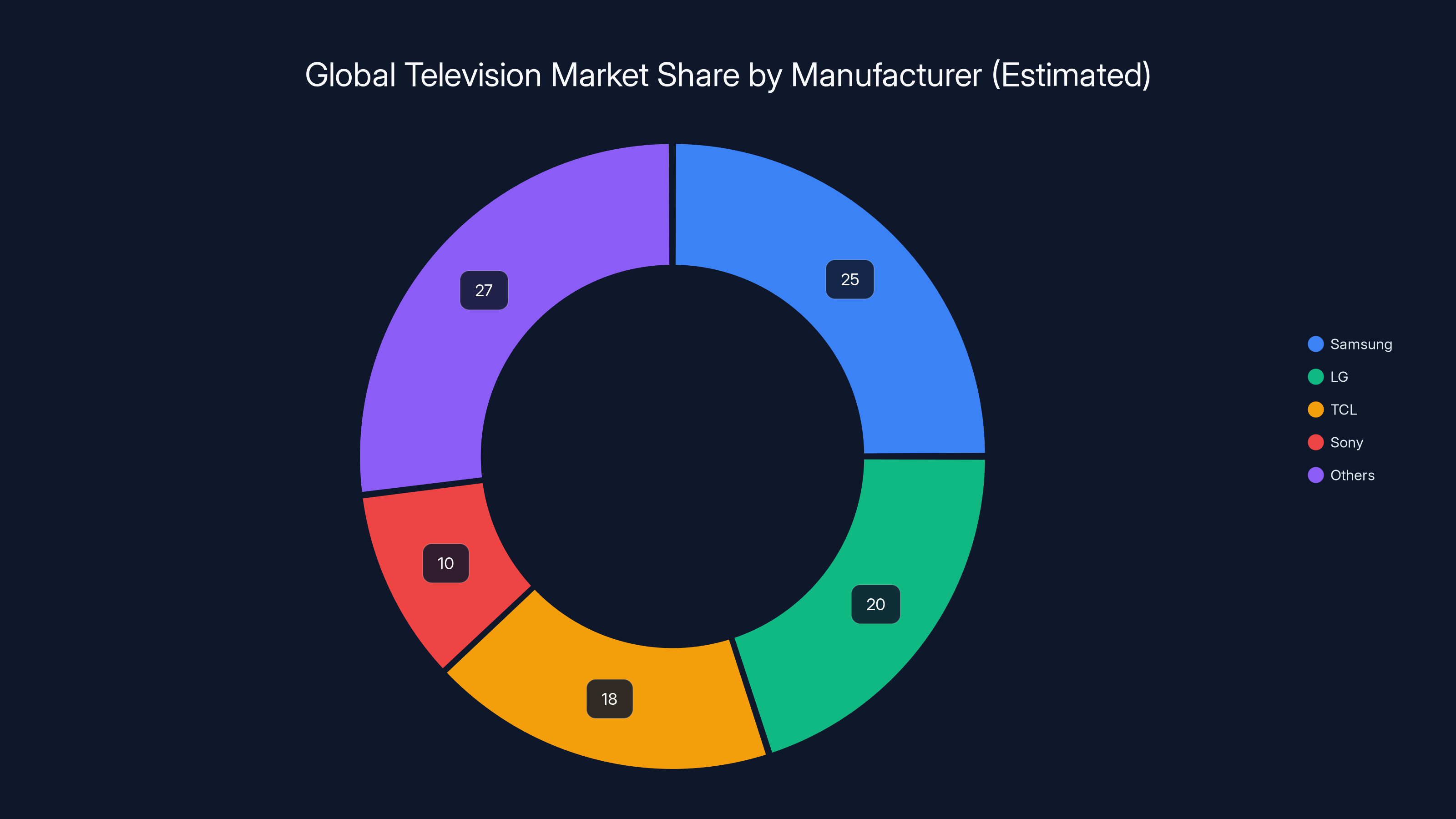

The contemporary television market distributes roughly as follows: Samsung and LG, both Korean conglomerates with extensive television operations, command approximately 20-25% of global market share each. TCL has captured roughly 10-12% global share, with significant strength in North America, Europe, and Asia. Sony maintains approximately 5-7% market share, predominantly in premium segments where consumers still associate the brand with superior quality and reliability. Other significant players include Hisense, Vizio (primarily North America), and numerous regional manufacturers.

This distribution reflects the harsh reality facing Sony. Despite strong brand recognition and heritage in electronics, Sony simply cannot compete with the volume-based economics of manufacturers like TCL and Samsung. A consumer purchasing a 65-inch 4K television for their living room has access to TCL models offering exceptional specifications at

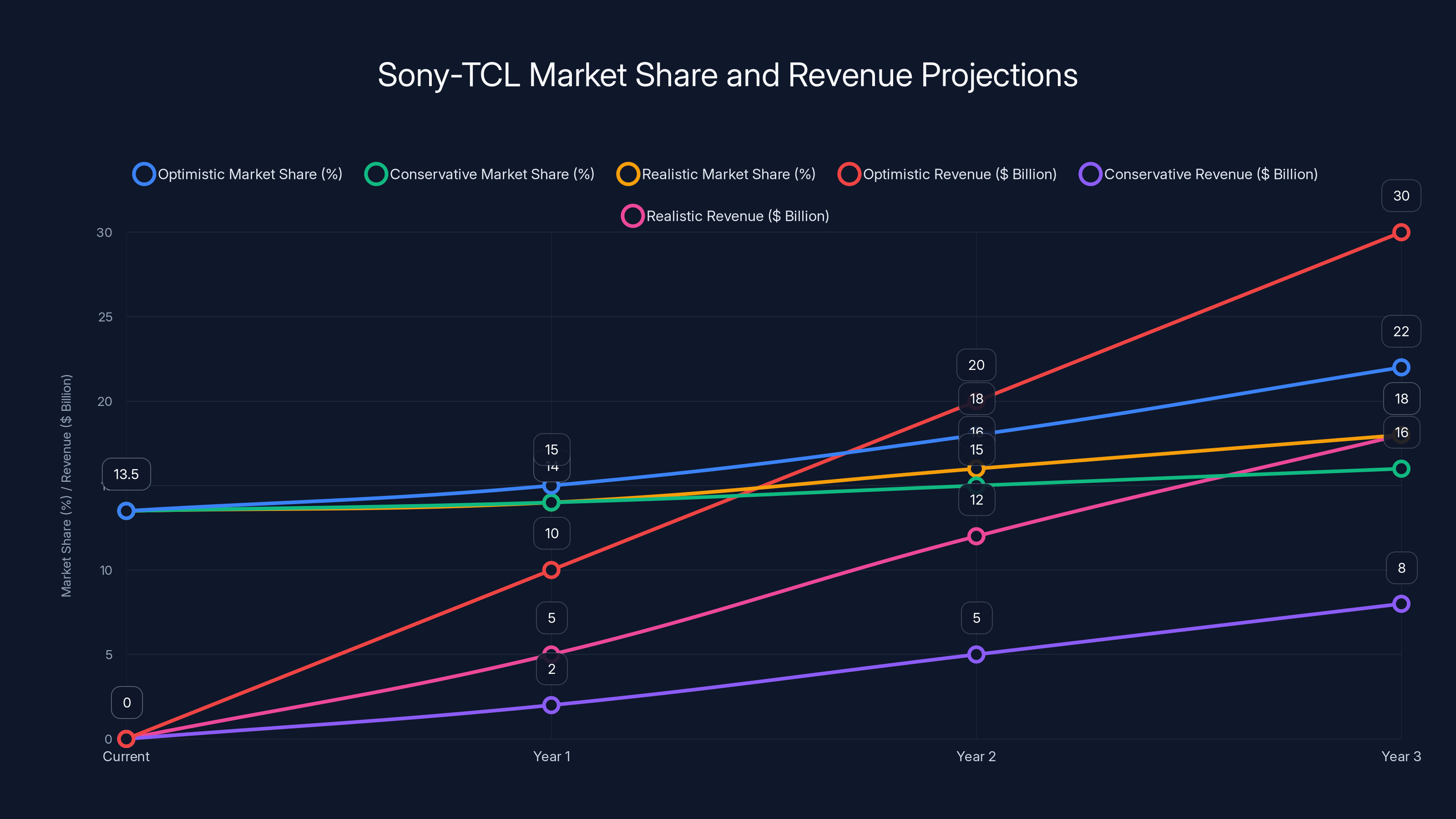

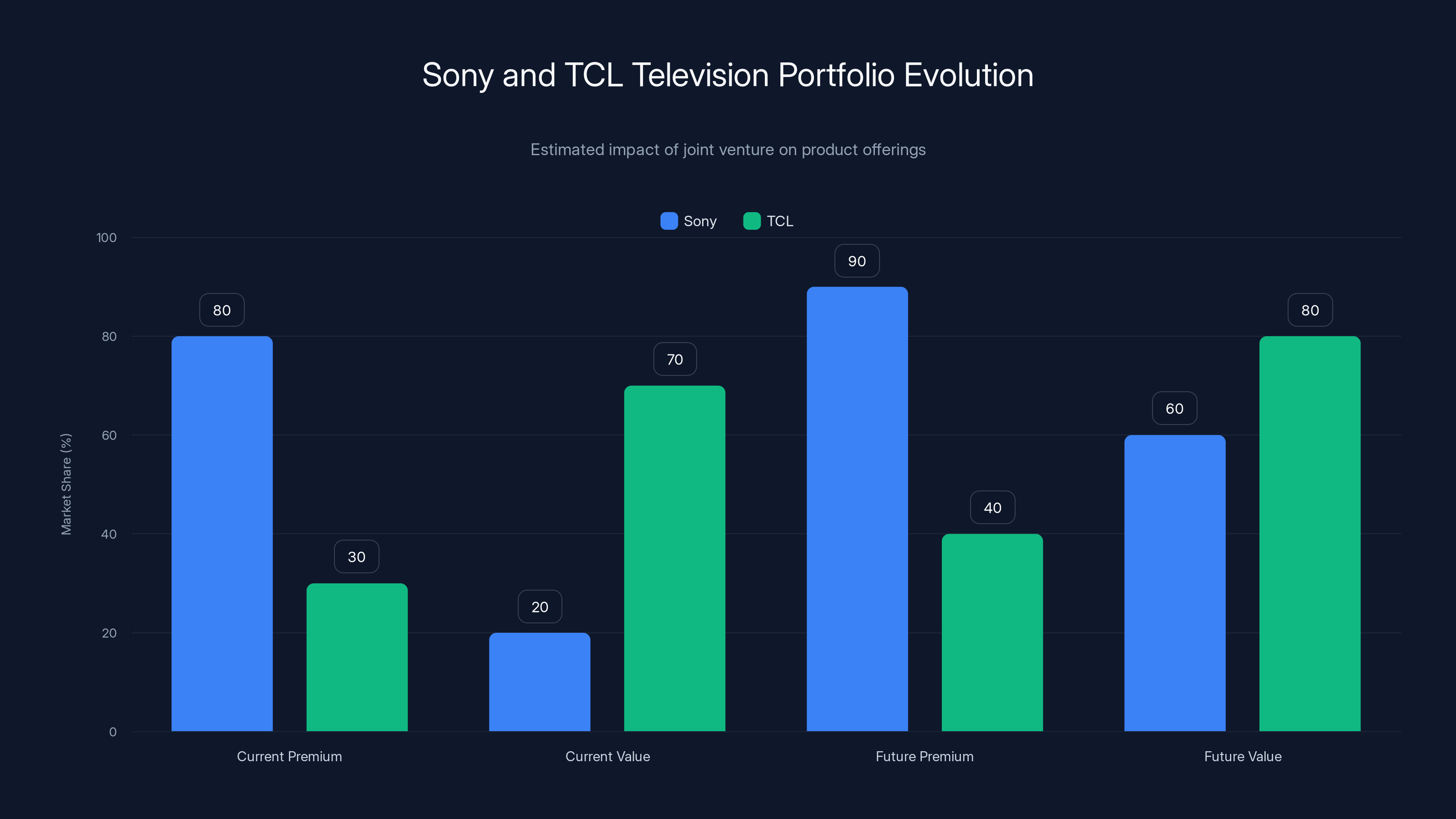

Projected market share and revenue growth for Sony-TCL over three years show potential gains in optimistic scenarios, with realistic expectations suggesting moderate growth. Estimated data.

Deep Dive: What Sony Gains From the Partnership

Access to Manufacturing Infrastructure and Supply Chain Dominance

From Sony's perspective, the partnership's most immediate and tangible benefit involves gaining access to TCL's manufacturing infrastructure without requiring massive capital investment. Building television manufacturing facilities involves extraordinary expense, ranging from $1-3 billion for modern, efficient operations capable of producing millions of units annually. Such investments require long payback periods and demand confidence in sustained demand, making them unreasonable for Sony given its current market position and capital allocation priorities.

By structuring the partnership with TCL holding 51% stake (providing operational control) while Sony maintains 49%, the arrangement allows Sony to benefit from manufacturing scale without shouldering the full burden of capital investment and operational management. TCL contributes its manufacturing facilities, supply chain relationships with panel manufacturers, logistics infrastructure, and operational expertise. Sony contributes its brand equity, design expertise, software capabilities, and market relationships—particularly with premium retailers and entertainment platforms.

This infrastructure access extends beyond mere assembly operations. TCL's relationships with panel suppliers like CSOT, LG Display, and Samsung Display provide Sony with negotiating leverage that independent operations cannot achieve. When TCL negotiates panel purchases, the volumes now represent not merely TCL's own needs but the combined demand of both companies. This increased leverage translates into better pricing, priority allocation during supply constraints, and influence over technology development roadmaps. For Sony, this proves transformative—suddenly, the company gains input into panel technology evolution without developing independent relationships with suppliers who may view them as relatively small customers.

Access to Cutting-Edge Display Technology Development

Beyond infrastructure, Sony gains access to TCL's sophisticated display technology development capabilities. CSOT operates one of the world's most advanced panel manufacturing and research facilities, with ongoing development in quantum dot technology, mini-LED backlighting, OLED panel manufacturing, and emerging technologies like QD-OLED (quantum dot OLED). By participating in this joint venture, Sony gains visibility into technology roadmaps and can influence development priorities toward products aligned with Sony's market positioning.

This proves particularly significant given Sony's historical strength in premium OLED and mini-LED television segments. Rather than relying on LG Display or Samsung Display for OLED panels—suppliers who also provide panels to Sony's direct competitors—Sony could potentially transition toward OLED panels sourced from TCL's facilities. This would represent a revolutionary change in the OLED supply landscape, which has remained relatively stable with LG Display dominating large television panels and Samsung Display providing smaller OLEDs primarily for other applications.

The partnership announcement specifically mentions that TCL is constructing new OLED production facilities, though the exact capabilities and timeline remain somewhat unclear. If these facilities achieve capability for large television-sized OLED panels competitive with LG Display in quality and cost structure, this would represent a seismic shift in the industry. Sony could potentially source OLED panels from a facility it partially owns rather than from competitors, while simultaneously benefiting from improved economics through TCL's manufacturing efficiency.

Simplified Product Development and Faster Market Cycles

Sony benefits significantly from gaining control over the complete manufacturing value chain. Historically, when Sony develops a new television technology or design concept, the company must work with external manufacturers to implement the design, negotiate manufacturing parameters, and manage quality assurance. Each iteration involves communication delays, coordination challenges, and compromises between Sony's ideals and manufacturing realities.

Within a joint venture with manufacturing partners, Sony gains the ability to implement design visions more directly. If Sony's engineering team develops an innovative approach to thermal management, backlight optimization, or image processing that requires manufacturing modifications, the company can now work directly with TCL's manufacturing teams rather than through external vendor negotiations. This tightens feedback loops, accelerates iteration cycles, and enables Sony to bring innovations to market faster than competitors constrained by external manufacturing partnerships.

Maintaining Competitive Market Position Without Crushing Capital Investment

Perhaps most fundamentally, the partnership allows Sony to maintain meaningful participation in a market where the company's historical approach—maintaining independent manufacturing or using carefully selected partners—had become economically untenable. The television business operates on thin margins in most segments, with only premium products commanding sufficient markups to fund continuous innovation and marketing. By gaining access to TCL's cost structure and manufacturing efficiency, Sony can potentially expand product offerings into volume segments while maintaining reasonable profitability, something that seemed impossible under previous arrangements.

This doesn't mean Sony will suddenly flood the market with ultra-low-cost televisions competing directly with entry-level TCL models. Instead, the partnership likely enables Sony to participate more meaningfully in mid-market segments—the 43-inch to 65-inch range where volumes prove most significant. Within these segments, Sony can potentially offer products combining reasonable pricing with the quality, design, and software integration that define Sony's positioning, capturing consumers who value the brand but cannot justify premium pricing.

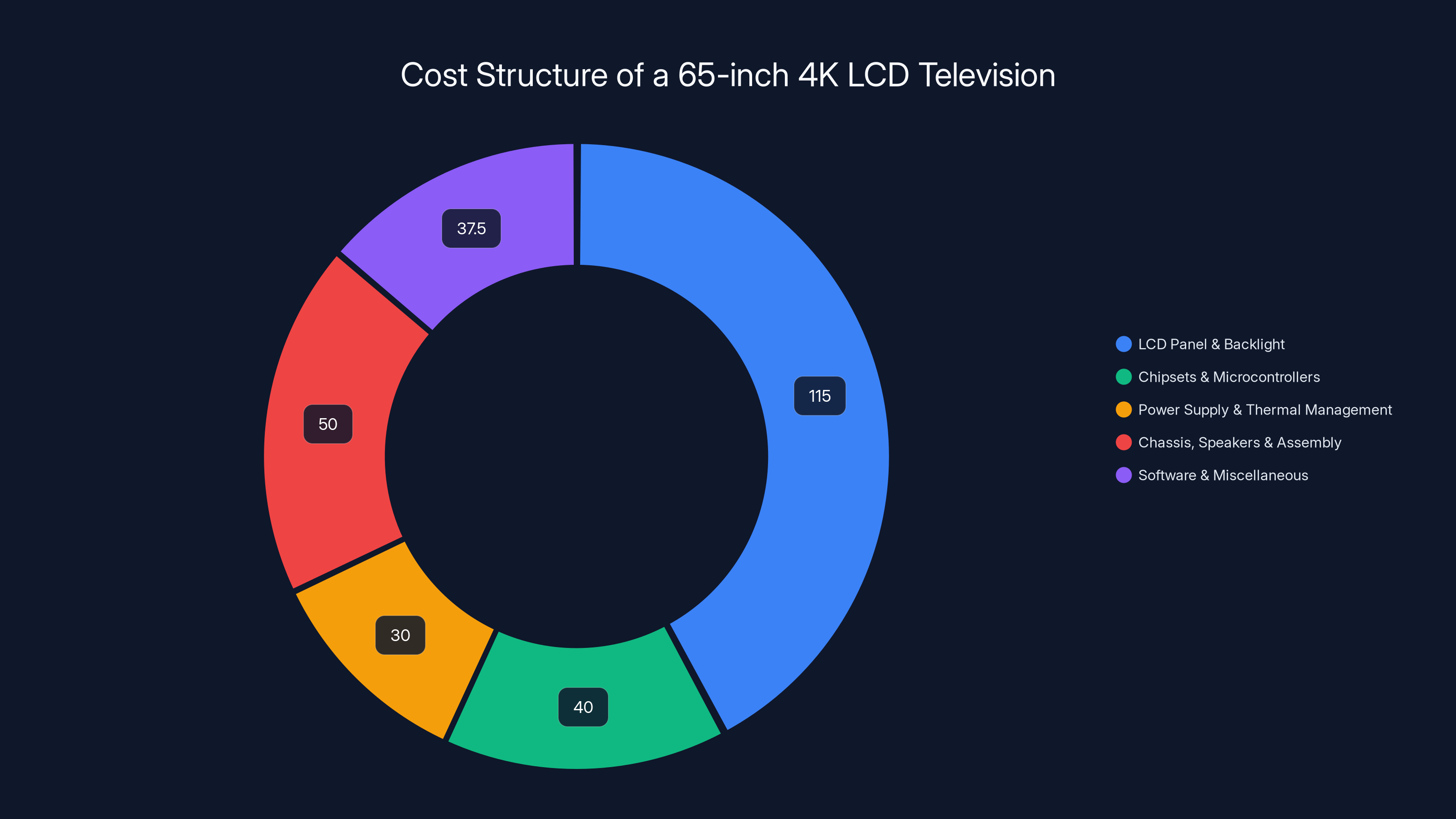

The LCD panel and backlight assembly are the largest cost components, comprising approximately 40-45% of total component costs. Estimated data based on typical cost ranges.

Comprehensive Analysis: What TCL Gains From This Partnership

Premium Brand Positioning and Market Segment Expansion

From TCL's perspective, the partnership addresses a fundamentally different challenge than that facing Sony. TCL has succeeded brilliantly in volume markets and mid-premium segments, but the company faces persistent challenges in the highest-premium market segments where brand prestige, heritage, and perceived quality drive purchasing decisions. While TCL produces exceptional televisions at all price points, consumer perception remains influenced by the company's history as an aggressive value player rather than a premium brand.

By partnering with Sony, TCL gains access to one of the world's most recognized premium technology brands. Within the joint venture structure, products can carry Sony branding in key markets where premium positioning matters most—particularly North America and Europe. This allows TCL to capture volume in premium segments without requiring decades of brand building independent of Sony. Consumers purchasing a Sony-branded television manufactured through the joint venture receive TCL's manufacturing excellence and technology innovation packaged within Sony's trusted brand identity.

This proves particularly valuable in retail environments where brand positioning drives purchasing decisions. When consumers browse a retailer's television section, they navigate based partly on specifications but substantially on brand associations and perceived value. A Sony television positioned as premium carries implicit quality signals that a TCL television—despite potentially superior specifications—cannot fully replicate given consumer brand perceptions. By having both Sony-branded and TCL-branded products emerging from the same manufacturing and technology development operations, the joint venture can serve multiple market segments simultaneously.

Access to Design Excellence and Market Insights

Beyond brand positioning, TCL gains access to Sony's design expertise, aesthetic sensibilities, and understanding of premium consumer preferences. TCL television designs have improved dramatically over recent years, but the company's design language remains oriented toward value propositions rather than premium market aspirations. Sony's industrial design teams bring decades of experience developing products for affluent consumers willing to pay premiums for thoughtful design, premium materials, and aesthetic coherence.

This design access extends to user interface design, remote control ergonomics, packaging presentation, and the overall unboxing and setup experience that premium consumers increasingly value. TCL can incorporate these design insights into its own product lines while maintaining independent brand identity, elevating the perceived quality and premium nature of TCL-branded products. This represents particularly significant value for TCL's expansion in European and North American markets where design-conscious consumers represent disproportionate purchasing power.

Sony's market insights regarding premium consumer preferences also prove valuable to TCL. Which features matter most to affluent consumers? How do installation preferences, gaming capabilities, and smart home integration influence purchasing decisions? What warranty and support models build consumer confidence? Sony's accumulated knowledge from decades serving these consumer segments provides TCL with insights that would otherwise require years of market observation and experimentation.

Strengthened Presence in Premium Markets and with Key Retail Partners

TCL's market penetration remains uneven geographically. The company commands strong positions in North America and developing markets but maintains less presence in certain premium markets and with specific retail partners who associate TCL with value rather than premium positioning. By leveraging Sony branding within the joint venture structure, TCL gains access to retail relationships, distribution channels, and consumer mindshare concentrated in premium segments.

Retailers like Best Buy, for instance, dedicate shelf space and promotional support to brands perceived as premium. By providing these retailers with Sony-branded products emerging from the joint venture manufacturing, TCL secures premium shelf positioning that would be unavailable to TCL-branded products competing directly against Samsung and LG. This retail positioning advantage translates into visibility, consumer awareness, and sales that would require substantially greater marketing investment to achieve independently.

Software and Smart TV Ecosystem Integration

TCL's smart television platforms have improved considerably, but the company historically relied on Google TV, Roku, or proprietary software developed in partnership with various companies. Sony, through its entertainment divisions (Play Station, movies, music), has developed sophisticated approaches to smart TV interfaces, content discovery, and entertainment ecosystem integration. By collaborating with Sony on software and smart features, TCL can elevate its television experience, offering consumers seamless integration with Play Station gaming, Sony Music services, and other entertainment properties.

This software integration particularly matters as consumer expectations increasingly involve seamless interaction between televisions, gaming consoles, streaming devices, and smart home systems. Sony's expertise in creating cohesive entertainment ecosystems across multiple devices and platforms provides TCL with capabilities that complement the company's hardware and manufacturing excellence. TCL consumers benefit from richer software experiences, while TCL benefits from software capabilities that would require substantial independent development investment.

Regulatory and Geographic Expansion Advantages

Finally, TCL benefits from Sony's established regulatory relationships, intellectual property portfolios, and geographic presence in markets where TCL faces barriers to expansion. While TCL has expanded globally, the company remains a relative newcomer in certain markets where established players enjoy regulatory relationships and consumer trust built over decades. Sony's brand recognition, established distribution channels, and relationships with government and retail partners facilitate market access for the joint venture that TCL could not achieve independently.

Sony's intellectual property portfolio also provides value, particularly in regions where patent enforcement proves important. By combining Sony's patent portfolio with TCL's manufacturing capabilities, the joint venture creates a more defensible competitive position against potential challenges from other manufacturers.

The Technology Roadmap: Where This Partnership Leads

Mini-LED and Quantum Dot Technology Evolution

The partnership will almost certainly accelerate innovation in mini-LED and quantum dot display technologies, areas where both companies maintain significant interest but diverging research priorities previously. Mini-LED technology—which uses hundreds or thousands of independent LED zones to provide backlighting control—represents a bridge between traditional edge-lit LED televisions and OLED panels. This technology proves particularly valuable for gaming and home theater applications where contrast and motion handling matter significantly.

TCL has invested heavily in mini-LED technology development, with its X-series televisions showcasing impressive implementations featuring thousands of dimming zones and sophisticated local dimming algorithms. Sony has similarly pursued mini-LED technology, particularly through its Master Series professional monitoring business and premium television offerings. By collaborating within the joint venture, these research efforts can consolidate toward unified technology roadmaps. Rather than competing to achieve marginally better local dimming algorithms or zone counts, the combined team can focus on breakthrough improvements—better color accuracy, reduced blooming artifacts, faster response times to content changes—that benefit consumers across both brand portfolios.

Quantum dot technology represents another domain where accelerated development is likely. Quantum dots—semiconductor nanocrystals with remarkable color generation properties—enable televisions to achieve wider color gamuts and more accurate color representation than traditional LED or fluorescent backlighting. CSOT has pioneered advanced quantum dot implementations, and the joint venture can accelerate adoption of these advances into Sony-branded products while simultaneously helping TCL-branded products evolve beyond basic quantum dot implementations toward more sophisticated applications.

OLED Panel Manufacturing and Supply Chain Transformation

Perhaps most significantly, the partnership creates potential for transformative change in OLED television supply chains. For over a decade, LG Display has essentially monopolized large OLED television panel manufacturing, supplying most television brands with OLED panels while simultaneously competing against those brands through LG's own television division. This creates inherent conflicts of interest—LG has limited incentive to aggressively reduce OLED panel prices or allocate priority to competitors over its own television business.

TCL's development of new OLED manufacturing capacity has the potential to disrupt this dynamic entirely. If CSOT facilities achieve capability for high-quality, large television-sized OLED panels at competitive cost structures, multiple outcomes become possible. Sony could source OLED panels from the joint venture rather than from LG Display, fundamentally changing the competitive dynamics of premium television manufacturing. Other manufacturers might negotiate for panel supplies from this new capacity, further reducing LG Display's monopolistic control.

Even if TCL's new OLED facilities cannot fully match LG Display's production capability or quality, simply having alternative OLED supply sources will pressure LG Display to maintain competitive pricing and improved service relationships. This represents a genuine benefit to consumers through eventual price reductions and improved product availability across premium OLED television categories.

Display Technology Timelines and Roadmaps

Based on current trajectory, the joint venture can be expected to pursue several technology pathways:

2026-2027: First Sony-branded products emerge from joint venture manufacturing, predominantly featuring mini-LED backlighting with advanced quantum dot implementations and Sony's premium software. TCL-branded products simultaneously benefit from improved manufacturing efficiency and software integration. Both product lines incorporate the latest generation of image processing algorithms developed collaboratively.

2027-2028: If OLED panel manufacturing facility development progresses as planned, first OLED products sourced from TCL's facilities reach market under both Sony and TCL branding. Initial volumes likely remain modest as production ramp-up occurs, but availability increases substantially as facility throughput expands.

2028-2029: The joint venture's product portfolio expands to include advanced Micro LED prototypes and next-generation quantum dot implementations. Gaming-focused models proliferate, leveraging Play Station integration for marketing and feature development.

2029 and beyond: The joint venture becomes a primary source of innovation in consumer television technology, potentially pioneering technologies like advanced holographic displays, AR integration, or revolutionary approaches to color gamut and contrast that current technologies cannot achieve.

Samsung and LG lead the global television market, with TCL rapidly increasing its share due to vertical integration and competitive pricing. Sony maintains a niche presence focusing on premium segments. (Estimated data)

Market Implications: How This Affects Competitors and Industry Dynamics

Pressure on Samsung's Television Division

Samsung faces the most immediate competitive pressure from this partnership. Samsung historically competed against both Sony and TCL—against Sony through premium positioning and against TCL through value propositions. The Sony-TCL partnership threatens to compress Samsung's competitive advantage in both dimensions. If the joint venture can deliver Sony-brand premium products at improved price points (through TCL manufacturing efficiency) while simultaneously elevating TCL-brand products through Sony design and software integration, Samsung's market position in both segments becomes more precarious.

Samsung's response options are limited. The company cannot easily merge its television division with competitors given antitrust considerations and brand positioning conflicts. Samsung could attempt to accelerate its own OLED panel production beyond current levels, potentially leveraging Samsung Display's advanced manufacturing capabilities. Samsung might also intensify vertical integration of television operations with Samsung Display, mirroring elements of the Sony-TCL partnership structure. Alternatively, Samsung could pursue acquisition or partnership with Chinese manufacturers, though any such arrangement would face considerably more regulatory scrutiny than Sony-TCL received.

Strategic Implications for LG Electronics and LG Display

LG Electronics, the television manufacturer, faces challenges similar to Samsung's. However, LG benefits from the unique advantage of controlling LG Display, its OLED panel manufacturing subsidiary. This vertical integration has historically insulated LG Electronics from OLED supply chain vulnerabilities that affect Samsung and Sony. The Sony-TCL partnership potentially undermines this advantage if TCL's new OLED facilities reach production parity with LG Display's capabilities.

LG Display faces more direct threats. The monopolistic position LG Display has enjoyed in large OLED television panels is fundamentally threatened by successful OLED panel development within the Sony-TCL joint venture. Even if TCL's facilities only capture 20-30% of new OLED television panel demand, this represents significant lost revenue and margin pressure for LG Display. The panel manufacturer may face pressure to reduce prices to maintain market share, directly impacting profitability.

LG Electronics and LG Display may accelerate collaboration on next-generation display technologies—micro LED, advanced OLED variants, or emerging technologies—to maintain competitive differentiation beyond mere OLED availability. The company might also pursue strategic partnerships or acquisitions to strengthen positioning against the consolidated Sony-TCL entity.

Impact on Independent Television Manufacturers

Smaller manufacturers like Vizio, Hisense, and regional players face a more complex scenario. These companies depend on panel suppliers like LG Display, Samsung Display, and CSOT for their manufacturing. As panel supply dynamics shift and new suppliers emerge from the joint venture, smaller manufacturers must navigate changing supplier relationships and potentially adjusted pricing.

Vizio, primarily focused on North American markets, might benefit from access to improved panel technologies emerging from the joint venture, assuming these become available through open market channels. However, Vizio also faces potential marginalization if the joint venture increasingly captures volume through Sony and TCL branding across multiple market segments. Vizio's survival strategy likely involves deepening partnerships with specific retailers, focusing on particular market segments, or pursuing strategic alliances that enhance positioning.

Hisense, a significant player in developing markets and increasingly in North America, might explore deeper partnerships with Chinese government entities or pursue mergers with other regional players to maintain scale against the consolidated Sony-TCL entity.

Manufacturing Efficiency and Cost Structure Analysis

The Quantum Advantage: How Integration Drives Economics

The financial logic underlying the Sony-TCL partnership becomes apparent when examining television manufacturing cost structures. A typical 65-inch 4K LCD television involves approximately $250-350 in component costs distributed roughly as follows:

- LCD panel and backlight assembly: $100-130 (40-45% of component costs)

- Image processing chipsets and microcontrollers: $30-50

- Power supply and thermal management: $25-35

- Mechanical chassis, speakers, and assembly: $40-60

- Software licensing, firmware development, and miscellaneous components: $25-50

The panel represents the largest single cost component, making panel sourcing economics critical. A manufacturer independently sourcing panels from LG Display or Samsung Display faces wholesale panel pricing reflecting the panel manufacturer's overhead, profit margins, and risk allocation across a diverse customer base. By consolidating television manufacturing with panel manufacturing as the joint venture does, several cost reduction mechanisms activate:

Elimination of Panel Markup: When CSOT manufactures panels for consumption within the same organization, the panel division doesn't maintain independent profit margin requirements separate from overall joint venture profitability. This can reduce effective panel costs by 8-15%, depending on previous wholesale pricing.

Manufacturing Coordination Optimization: Matching panel production schedules precisely with television assembly reduces inventory carrying costs, obsolescence risk, and working capital requirements. Industry estimates suggest this coordination improvement saves 3-5% on total landed component costs through improved logistics efficiency.

Raw Material Procurement Leverage: Consolidated purchasing for both panel manufacturing and television assembly creates significantly larger procurement volumes for raw materials like phosphors, quantum dots, and specialty chemicals. This scale typically generates 4-8% savings on raw material costs.

Technological Implementation Efficiency: Implementing new technologies like improved quantum dots or advanced color filters requires manufacturing process modifications. Within an integrated operation, these modifications can be coordinated to minimize production disruption and maximize efficiency gains, reducing technology transition costs by an estimated 2-5% compared to independent manufacturers negotiating with external suppliers.

In aggregate, these factors can reduce effective component costs by 17-33% compared to manufacturers dependent on external panel supplies and lacking integration across the manufacturing value chain. On a

Competitive Cost Structure Comparisons

To contextualize this advantage, consider how different manufacturers achieve profitability:

Samsung: Operates vertically integrated television and display operations but lacks the manufacturing cost leadership that TCL possesses. Samsung's cost structure typically supports healthy margins in premium segments but places the company at disadvantage against TCL in volume segments. Samsung likely maintains component costs approximately 5-12% higher than equivalent TCL products due to historical manufacturing overhead and less aggressive process optimization.

LG: Similarly positioned to Samsung with vertical integration but historical cost structure disadvantages. LG's OLED television offerings benefit from direct panel sourcing but face competition from TCL's mini-LED alternatives that offer compelling value propositions at lower price points.

Sony (historically): Operating without significant manufacturing infrastructure, Sony relied on various contract manufacturers and panel suppliers, resulting in component costs likely 15-20% higher than TCL equivalents. This explains why Sony struggled to compete outside premium segments.

TCL: Maintains the lowest component costs among major manufacturers, typically delivering products at $20-40 lower component cost than competitors for equivalent specifications. This advantage translates into either exceptional value propositions for consumers or superior margins when pricing aligns with competitors.

Sony-TCL Joint Venture (projected): Combining Sony's design and brand advantages with TCL's manufacturing cost leadership could produce component costs approaching or achieving parity with TCL's existing cost structure while delivering Sony-branded positioning premium. This would be transformative for Sony's competitive dynamics.

The partnership structure gives TCL a 51% stake, providing operational control, while Sony holds a 49% stake, allowing it to benefit from TCL's manufacturing scale without full capital investment.

Geographic and Market Considerations

North American Market Dynamics

North America represents the world's largest television market by revenue, despite declining unit volumes as replacement cycles extend. Within this market, Sony historically maintained reasonable presence through premium positioning, though the company's share has eroded substantially over the past decade. TCL's presence in North America has surged, with aggressive retail partnerships at Best Buy, Costco, and other major retailers driving market penetration and awareness.

The joint venture likely enhances Sony's North American position through leveraging TCL's retail relationships and distribution infrastructure. Rather than attempting to rebuild Sony television presence independently through costly retail partnerships and advertising, the joint venture can provide Sony-branded products through existing TCL distribution channels. This represents a relatively quick path to renewed market presence.

For TCL, the partnership offers access to premium market segments and retail environments (particularly specialty audio/video retailers and luxury department stores) that historically viewed TCL as insufficiently premium for their brand positioning. By introducing Sony-branded products through these channels while simultaneously elevating TCL-brand perception, the joint venture gains leverage across market segments.

European Market Considerations

Europe presents a more fragmented television market with strong regional preferences and significant presence of local and regional brands. Sony maintains more robust presence in premium European markets than in North America, with particularly strong positioning in Germanic countries, Scandinavia, and Western Europe where premium brand positioning resonates more strongly than in value-oriented markets.

The joint venture will likely pursue a dual-brand strategy in Europe: utilizing Sony branding in premium segments and markets where brand heritage matters most, while leveraging TCL branding in value segments and markets prioritizing specification-to-price value. This market segmentation enables efficient geographic and demographic targeting.

European regulatory environments also matter significantly. EU regulations regarding energy efficiency, right-to-repair provisions, and electronic waste management impose requirements that larger manufacturers like the Sony-TCL joint venture can accommodate more easily than smaller manufacturers. These regulatory requirements may actually advantage the joint venture by creating higher compliance barriers that protect market share from smaller competitors lacking resources for full compliance.

Asian Market Dynamics

Asian markets present the most complex geography for the joint venture. China, where both Sony and TCL maintain significant operations, will be the joint venture's primary manufacturing base. The Chinese government maintains strategic interest in supporting domestic technology and manufacturing consolidation, potentially benefiting the joint venture through favorable regulatory treatment and government purchasing preferences.

Japan represents Sony's home market where the brand maintains enormous consumer affinity and brand prestige. The joint venture will leverage this for both Sony-branded and TCL-branded products sold through Japanese distribution channels. Japanese consumers' historical association of TCL with budget offerings may persist, but joint venture involvement provides opportunity to evolve TCL's brand perception within the Japanese market.

India and Southeast Asian markets represent growth opportunities where both Sony and TCL maintain interests. The joint venture can pursue aggressive positioning in these emerging markets where value propositions and design-forward products combined with TCL manufacturing efficiency create compelling offerings for consumers with rising but still-constrained purchasing power.

Regulatory, Legal, and Governance Framework

Chinese Government Considerations and Approvals

The partnership requires approval from Chinese regulatory authorities, specifically the Ministry of Commerce (MOFCOM), which oversees foreign investment and major business combination transactions. MOFCOM has generally been supportive of partnerships that consolidate manufacturing capability, develop advanced technology, and maintain employment within China. The Sony-TCL arrangement likely satisfies these criteria—the partnership consolidates television manufacturing operations, combines Sony's technology and design capabilities with TCL's manufacturing excellence, and maintains substantial employment and investment within China.

However, Chinese government authorities also monitor foreign ownership thresholds and strategic control of key industries. With TCL holding 51% stake and Sony holding 49%, the arrangement maintains Chinese majority ownership and control—a structure likely to receive regulatory favor. If the ownership structure had instead provided Sony majority control, regulatory approval would face substantially greater uncertainty.

Intellectual Property and Technology Sharing Frameworks

The partnership requires sophisticated legal frameworks governing intellectual property sharing, technology development, and commercialization rights. Sony and TCL will need to clarify which existing patents remain with their respective parent companies versus becoming joint venture assets, how newly developed technology will be allocated, and what restrictions (if any) apply to each company's use of technology outside the joint venture structure.

Historically, such technology-sharing arrangements balance competitive interests through various mechanisms: one company might retain exclusive rights to certain technology for specific geographic markets while the other retains rights in different regions; technology developed for premium products might be shared differently than technology for value products; software and algorithms might be treated differently than hardware inventions. The specific framework Sony and TCL adopt will significantly influence each company's strategic flexibility outside the joint venture.

Governance Structure and Decision-Making Authority

With TCL holding 51% stake and Sony 49%, TCL maintains formal operational control through majority board representation and voting authority on key decisions. However, important decisions likely require supermajority voting to protect minority shareholder interests. This governance structure means TCL can unilaterally make routine operational decisions while significant strategic matters require broader consensus.

Specific governance questions remain unresolved: Who appoints the joint venture CEO and executive leadership? How are disputes between the companies resolved? What supermajority thresholds apply to major capital investments, dividend distributions, or strategic direction changes? The resolution of these questions will substantially influence how effectively the partnership functions and whether governance disputes emerge.

Exit Mechanisms and Long-Term Stability

Memorandums of understanding typically include mechanisms for either company to exit the partnership under specific circumstances or after defined periods. Sony may have negotiated exit rights if certain financial targets aren't achieved within specified years, or if technological developments render the partnership less valuable. TCL may have rights to acquire Sony's stake if Sony determines television no longer aligns with strategic priorities.

The existence of such exit mechanisms, while potentially destabilizing, actually enhances partnership viability by reducing perceived lock-in risk and providing both parties with clear off-ramps if circumstances change dramatically. A partnership where neither company can exit would face greater governance challenges and potential disputes.

Estimated data shows Sony expanding into value segments while maintaining premium dominance, and TCL enhancing premium offerings through design and software improvements.

Product Strategy and Portfolio Implications

Sony-Branded Product Evolution

The joint venture will likely transform Sony's television portfolio significantly. Currently, Sony's television offerings remain limited and heavily concentrated in premium segments. By gaining access to TCL's manufacturing and cost structure, Sony can expand dramatically into volume segments while maintaining premium positioning in higher-end categories.

Expect Sony to introduce product lines at substantially lower price points than currently available—models in the $400-600 range for mid-size televisions, expanding Sony's presence in segments where the company has been nearly absent for years. These value-positioned Sony products will compete directly with Samsung's value offerings and higher-end TCL models, utilizing Sony's brand to command moderate premiums over equivalent TCL-branded products.

Simultaneously, Sony's premium offerings will likely benefit from improved technology, potentially incorporating OLED panels sourced from TCL facilities and advanced mini-LED implementations developed collaboratively. Gaming-focused products will likely expand substantially, leveraging Play Station 5 integration, high refresh rate support, and variable refresh rate technologies optimized for Play Station gaming.

TCL-Branded Product Enhancement

TCL's own product lines will benefit from design collaboration with Sony, elevated software capabilities, and potential access to Sony's entertainment ecosystem. TCL-branded products will likely develop a more premium aesthetic and user experience while maintaining the value positioning that defines TCL's market success. Consumers purchasing TCL televisions will encounter improved design language, more sophisticated software interfaces, and deeper entertainment integration—all elements that improve perceived value even if specifications and base pricing remain competitive.

TCL is also likely to expand into gaming-focused television segments, leveraging Play Station integration and advanced gaming features developed in collaboration with Sony. Currently, TCL positions gaming televisions as value alternatives, but partnership with Sony enables more sophisticated gaming-focused features that compete credibly with Samsung's premium gaming television offerings.

Regional and Market-Specific Product Variants

The joint venture will likely pursue careful market segmentation, with different product portfolios optimized for specific regions and customer demographics. North American consumers might see Sony-branded value models competing with Samsung directly, while European premium markets feature Sony-branded OLED offerings at aggressive pricing. Chinese markets might feature robust TCL-branded portfolios with Sony collaboration. Japanese markets could emphasize Sony-branded products leveraging the brand's heritage strength in the home market.

This sophisticated market segmentation allows the joint venture to capture share across market segments simultaneously while maintaining appropriate brand positioning in each territory. Rather than operating as a unified entity competing uniformly worldwide, the partnership acts more like a collection of complementary strategies designed for specific market conditions and consumer preferences.

Financial and Performance Projections

Revenue Scenarios and Market Share Predictions

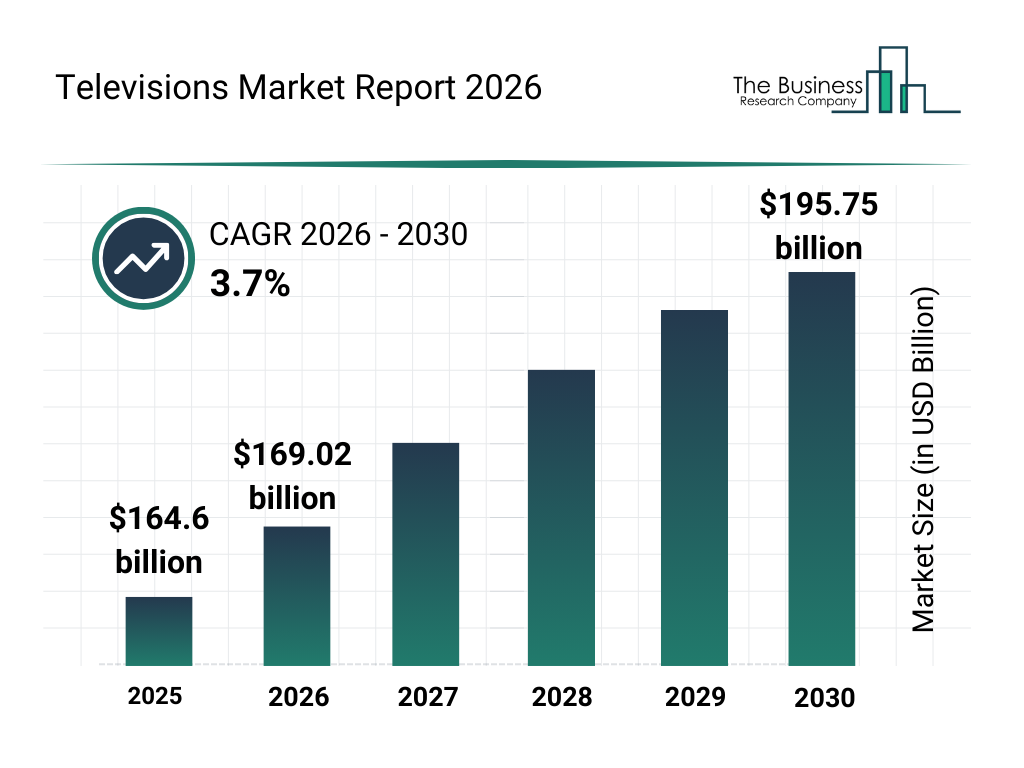

Analyzing potential financial outcomes requires modeling several variables: overall television market size and growth trajectory, competitive pricing dynamics, and the partnership's execution effectiveness. Current global television market volume totals approximately 200-220 million units annually with combined revenue of approximately $120-150 billion. This market has experienced slow-to-negative unit growth for nearly a decade as replacement cycles extend and consumer upgrade cycles lengthen.

Under optimistic scenarios where the joint venture captures market share from competitors through improved products and pricing, the combined Sony-TCL television operations could grow from current ~12-15% combined global share to 18-22% within three years. This would represent addition of 15-25 million units annually, translating to $15-30 billion in incremental revenue at average selling prices. However, such growth likely comes with margin pressure as the partnership captures share partly through improved pricing rather than pure margin expansion.

Under conservative scenarios where the partnership operates less effectively and primarily consolidates existing operations, growth remains modest—perhaps 2-4% annually reflecting overall market dynamics with slight share gains or slight share losses depending on execution quality. Revenue growth in this scenario might reach only $3-8 billion incremental over the partnership baseline.

Realistic scenarios likely fall between these extremes, with the partnership achieving approximately 12-18% combined global market share within 2-3 years and generating $8-18 billion in incremental revenue through combination of modest volume gains and margin optimization through manufacturing efficiency.

Profitability and Margin Structure Evolution

Manufacturing efficiency gains translate into improved profitability metrics. Current television manufacturer gross margins typically range from 18-28% depending on product category and positioning. Value products operate at the lower end (18-22%) while premium products sustain higher margins (25-30%).

The joint venture's manufacturing efficiency advantages could support expansion of gross margins by 200-400 basis points compared to competitors operating with less integrated manufacturing. This translates into either maintaining competitive pricing while improving profitability, or reducing pricing to capture market share while maintaining reasonable margins. The partnership likely pursues a hybrid strategy—improving margins in premium segments where brand positioning supports pricing power while moderately reducing pricing in value segments to capture share from competitors with less efficient cost structures.

Operating margins (after accounting for R&D, marketing, and administrative costs) could reach 6-10% for the combined entity compared to approximately 3-5% for comparable television manufacturers. This represents a substantial competitive advantage translating into improved financial sustainability and ability to invest in innovation.

Return on Investment Timeline

Sony's investment in the partnership involves no large upfront capital requirement beyond equity contribution to the joint venture entity. Instead, Sony contributes existing assets (brand, technology, intellectual property) in exchange for ownership stake. TCL provides manufacturing infrastructure, supply chain relationships, and operational expertise in exchange for its majority stake.

The partnership likely reaches profitability within the first 12-18 months of full operational implementation (expected mid-2027), with positive cash flow emerging soon thereafter. This relatively quick path to profitability reflects the consolidation of existing profitable operations rather than development of new technologies or market segments from zero. Both Sony's television operations and TCL's television operations currently generate positive cash flows, and consolidating these operations with improved efficiency should enhance rather than diminish profitability.

Sony's return on investment likely manifests through improved television division profitability within 2-3 years, potentially converting the division from modest profit or break-even into meaningful profit contributor to Sony's overall results. For TCL, returns manifest through enhanced brand value, access to premium market segments, and improved efficiency enabling higher margins.

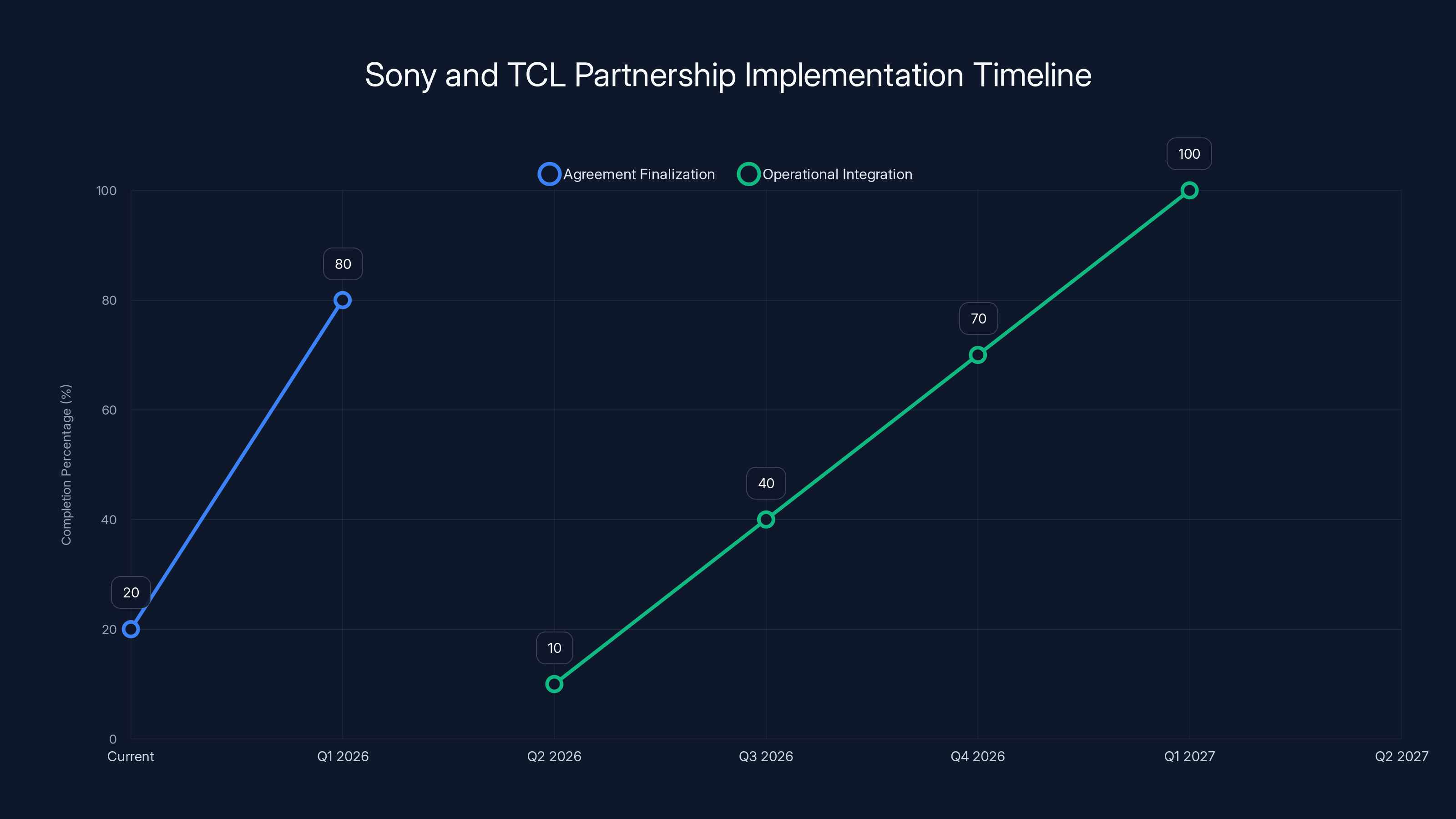

The timeline projects key phases of the Sony and TCL partnership, with agreement finalization expected by Q1 2026 and operational integration by Q1 2027. Estimated data.

Timeline and Implementation Roadmap

Phase 1: Agreement Finalization (Current through March 2026)

The memorandum of understanding transitions toward binding agreements. During this phase, Sony and TCL conduct detailed due diligence examining manufacturing facilities, supply chain relationships, intellectual property holdings, employee structures, and regulatory compliance. Both companies negotiate final terms governing ownership structure, board composition, governance procedures, and strategic direction.

Regulatory approvals are pursued from Chinese MOFCOM and potentially other regulatory authorities in jurisdictions where the partnership has significant presence. If significant regulatory challenges emerge, the partnership timeline could extend beyond March 2026 or be modified to address regulatory concerns. Assuming no major obstacles, binding agreements are likely finalized by late Q1 2026.

Phase 2: Operational Integration (April 2026 - March 2027)

Following binding agreement execution, the joint venture entity is formally established and Sony's television operations are transferred into the new entity. This phase involves integrating Sony's existing television division with TCL's television operations—combining design teams, aligning supply chains, consolidating manufacturing where appropriate, and establishing unified operational procedures.

Key activities during this phase include: migrating Sony's television development efforts to work collaboratively with TCL's engineering teams; transitioning Sony's existing product lines to use panel supplies and components from TCL's suppliers; developing first generation of jointly-designed products; establishing governance procedures and decision-making processes; and preparing marketing and distribution strategies for the joint venture's products.

No significant new products are expected during this phase, though existing Sony and TCL television models continue production through current channels. By late 2026, the combined team achieves sufficient integration to begin development of first generation joint venture products.

Phase 3: Product Launch (April 2027 - December 2028)

Starting in mid-2027, first generation Sony and TCL products designed and manufactured through the joint venture reach consumers. Initial product launches focus on mid-premium and premium segments where both brands maintain presence and where quality and design differentiation matter most.

Sony-branded products launch with aggressive positioning emphasizing design quality, premium features, and Play Station integration. TCL-branded products simultaneously launch with enhanced design language, improved software, and features developed collaboratively with Sony. Pricing positioning reflects careful market segmentation with Sony products typically commanding 10-20% premiums over equivalent TCL models based on brand positioning and specific feature differentiation.

Over the course of 2027 and 2028, product portfolio expands into additional segments including value models and gaming-focused offerings. By end of 2028, the joint venture operates across most television market segments with competitive offerings. If OLED panel manufacturing reaches adequate production levels, first OLED products begin reaching market in late 2027 or early 2028.

Phase 4: Market Consolidation and Scaling (2029 and Beyond)

By 2029, the joint venture has established meaningful presence across market segments and geographic regions. Manufacturing efficiency improvements continue compounding through supply chain optimization and process improvements. New display technologies (advanced mini-LED, OLED from TCL facilities, experimental micro LED developments) begin reaching products.

During this phase, the partnership either achieves intended strategic objectives—stabilizing and growing both Sony and TCL television revenue while generating healthy returns—or faces reassessment regarding continuation. Market conditions, competitive responses from Samsung and LG, consumer acceptance, and regulatory environments will determine whether the partnership continues as structured or requires modification.

Competitive Response Scenarios and Industry Evolution

Samsung's Likely Countermeasures

Samsung will respond to the Sony-TCL partnership with strategic initiatives designed to protect market position. Most likely responses include:

Accelerated OLED Production: Samsung will likely invest in expanding Samsung Display's OLED manufacturing capability specifically for television panels, competing directly against TCL's emerging OLED capacity. This protects Samsung Electronics' access to OLED panels while pressuring TCL's OLED ambitions through scale and pricing.

Value Segment Aggression: Samsung may pursue more aggressive pricing and feature positioning in value television segments, defending against Sony-branded competition through advanced features at competitive pricing.

Vertical Integration Expansion: Samsung might pursue deeper integration between Samsung Electronics television operations and Samsung Display panel manufacturing, mirroring elements of the Sony-TCL partnership structure to improve cost competitiveness.

Strategic Partnerships: Samsung could pursue partnerships with Chinese manufacturers or acquisition of regional players to diversify manufacturing capability and geographic presence.

LG Electronics and LG Display Responses

LG will face pressure on multiple fronts but possesses unique advantages through LG Display's OLED capabilities:

OLED Market Expansion: LG will likely accelerate OLED television expansion, leveraging LG Display's monopolistic position to maintain supply while competitors await TCL's facilities to reach production readiness.

Premium Positioning Intensification: LG will emphasize premium design, software integration, and OLED-specific image quality advantages to reinforce premium market positioning against potential Sony-branded OLED competition.

Next-Generation Technology Acceleration: LG will pursue advanced display technologies like rollable OLED, transparent displays, or other innovations designed to maintain technology leadership perception.

Smaller Manufacturers' Positioning

Vizio, Hisense, and other smaller manufacturers must adapt to a landscape where two of their major competitors are consolidating manufacturing and technology capabilities:

Vizio likely pursues deeper relationships with specific retail partners (Costco, Walmart) and market segments (value, gaming) where the company maintains strength independent of manufacturing scale.

Hisense may pursue partnerships with other Chinese manufacturers or expand into adjacent categories (gaming monitors, commercial displays) to maintain scale and relevance.

Regional manufacturers will increasingly focus on specific geographic markets or customer segments where they maintain competitive advantages independent of global scale.

Risks and Challenges Facing the Partnership

Regulatory and Geopolitical Uncertainties

The partnership faces potential regulatory challenges despite favorable initial positioning. Trade tensions between China and Western countries could influence approval timelines or conditions. If geopolitical tensions escalate, Western governments might impose restrictions on partnerships involving Chinese manufacturers and strategic technology companies, potentially disrupting the arrangement.

Chinese government authorities might also impose conditions on the partnership—requirements for technology development to occur within China, restrictions on technology transfer outside China, or mandates regarding product sourcing and supply chain management. These conditions could fundamentally alter the partnership's economic logic and strategic value to both parties.

Execution and Integration Challenges

Merging two companies with different corporate cultures, manufacturing philosophies, and market strategies presents substantial execution challenges. Sony's heritage as a premium manufacturer built on careful engineering and design may clash with TCL's focus on manufacturing efficiency and rapid iteration. Integration of research and development teams, manufacturing operations, and decision-making processes could encounter friction that undermines partnership effectiveness.

Historically, technology partnerships between Japanese and Chinese companies have achieved mixed results. Cultural differences, language barriers, different regulatory environments, and divergent business practices have created integration challenges that sometimes prevent partnerships from achieving intended objectives. The Sony-TCL partnership will need exceptional management attention to overcome these integration challenges.

Supply Chain and Technology Risks

The partnership's success depends substantially on CSOT successfully developing OLED television panel manufacturing capability. If this technical development encounters unexpected challenges or requires more time than anticipated, the partnership's strategic value is substantially diminished. Similarly, disruptions to supply chains for critical components (specialty chemicals, advanced electronics, specialized materials) could undermine manufacturing efficiency improvements the partnership targets.

Technology advancement also presents risks—if competitors develop breakthrough display technologies that obsolete mini-LED or quantum dot approaches faster than anticipated, the partnership's technology roadmap requires urgent modification. The partnership is betting substantially on continued evolution of current display technologies (mini-LED, OLED) rather than revolutionary innovation that transforms the entire television display paradigm.

Market and Competitive Risks

The partnership's financial projections depend on maintaining consumer demand for televisions and capturing meaningful market share from competitors. If television demand declines more rapidly than anticipated due to changing consumer preferences (streaming sticks, mobile devices, content consumption patterns) or if competitors respond more effectively than expected, the partnership's revenue and profitability targets could be missed.

Competitors' strategic responses—particularly if Samsung or LG pursue aggressive innovation or pricing—could constrain the partnership's market share gains and margin expansion. If the partnership cannot achieve sufficient differentiation to justify pricing positioning and market share objectives, profitability targets become challenging to achieve.

Financial and Capital Allocation Risks

The partnership requires both companies to commit capital and management attention to achieve integration and launch new products. For Sony, this represents meaningful allocation of resources that might alternatively be deployed in higher-growth technology areas like AI, robotics, or other strategic priorities. If Sony determines television operations no longer align with corporate strategy, the partnership could be deprioritized or redirected.

For TCL, the partnership requires sharing manufacturing capacity and supply chains with Sony while maintaining TCL's independent television business expansion. This could create capacity constraints or competing priorities that undermine the partnership's effectiveness. If TCL faces capital constraints or changes strategic direction, partnership investment might be reduced.

The Broader Implications for Consumer Electronics Manufacturing

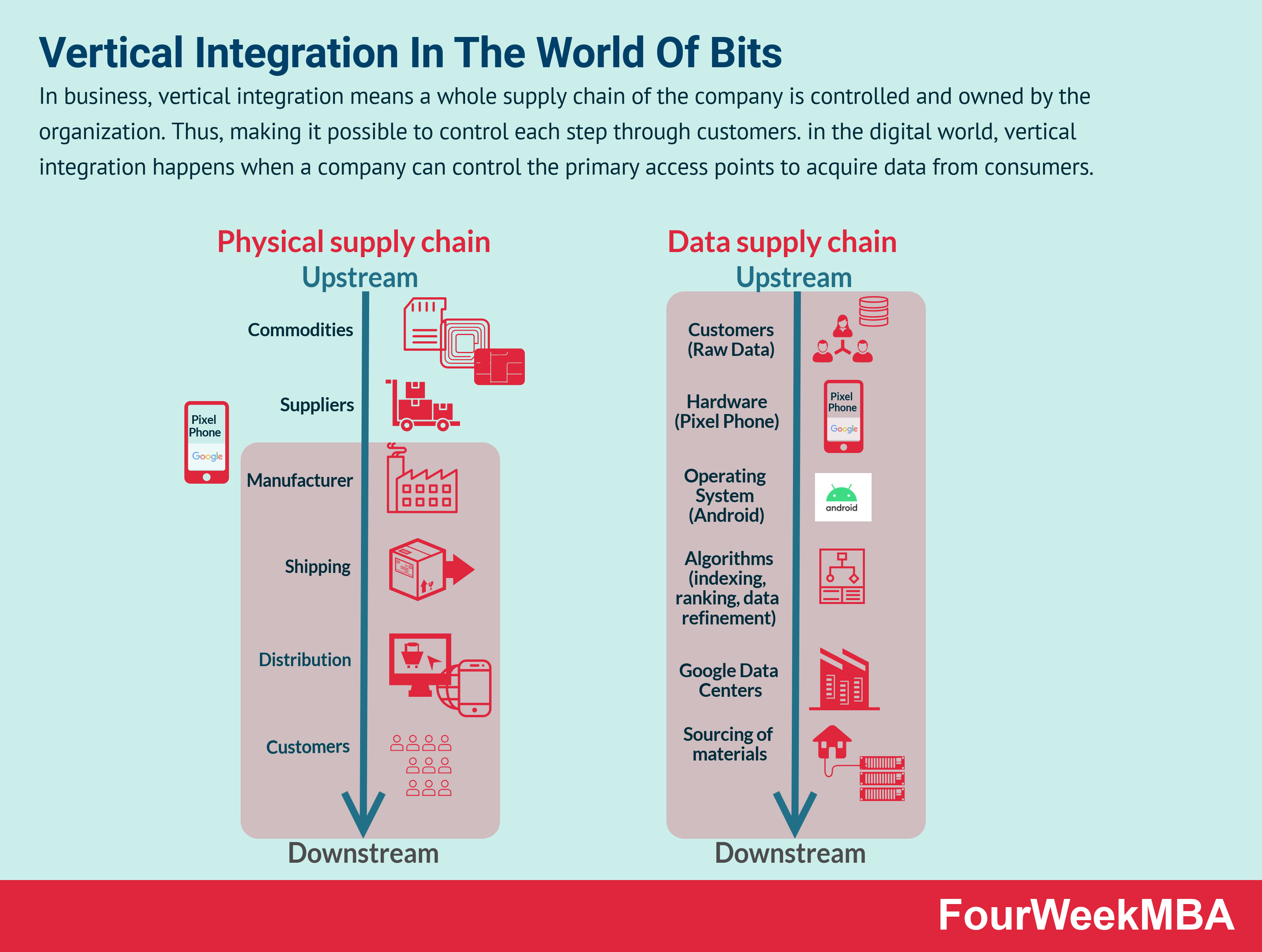

Vertical Integration Trend in Technology Manufacturing

The Sony-TCL partnership reflects a broader trend toward vertical integration in technology manufacturing. Companies increasingly recognize that controlling the entire value chain—from component manufacturing through final assembly to distribution and software—provides competitive advantages that distributed, outsourced models cannot replicate.

Apple pioneered this model with proprietary chip design and selective manufacturing partnerships. Tesla vertically integrated battery production to ensure supply reliability and cost competitiveness. Samsung has historically maintained deep vertical integration across display panels, memory chips, and consumer electronics. The Sony-TCL partnership represents another manifestation of this trend—combining Sony's design and brand advantages with TCL's manufacturing integration to achieve competitive benefits neither company could replicate independently.

This trend likely accelerates as technology companies increasingly recognize the strategic value of controlling critical supply chains and manufacturing processes. Smaller manufacturers lacking resources for complete vertical integration will face growing pressure to consolidate or form partnerships to maintain competitiveness against larger, vertically integrated competitors.

Global Manufacturing and Supply Chain Implications

The partnership signals confidence in China's continued role as the global center for consumer electronics manufacturing. Despite geopolitical tensions and discussions of supply chain diversification, Sony's partnership with TCL—and location of primary manufacturing in China—reflects recognition that China possesses unmatched manufacturing infrastructure, supply chains, and technical expertise that justify continued concentration of production in China.

This challenges narratives about supply chain diversification and production returning to developed countries. While some manufacturing may disperse to other countries for specific products or segments, the fundamental manufacturing center of gravity remains in Asia, particularly China, where decades of investment have created infrastructure and expertise that competitors find difficult to replicate elsewhere.

The partnership also demonstrates that companies competing globally continue seeking cost leadership through manufacturing efficiency and vertical integration. The emphasis on controlling the value chain to achieve cost advantages suggests that price competition will intensify in consumer electronics rather than moderating through quality differentiation or niche positioning.

Future of Consumer Electronics Partnerships

The Sony-TCL model—combining one company's premium brand and design capabilities with another's manufacturing efficiency and supply chain expertise—likely becomes more common across consumer electronics. We might see similar partnerships in smartphone manufacturing, wearable devices, or other categories where manufacturing efficiency and brand positioning matter critically.

Future partnerships will likely involve combinations of: premium brands seeking manufacturing efficiency, manufacturing specialists seeking brand prestige, technology leaders seeking commercialization capability, and geographic players seeking global reach. The specific combination of complementary capabilities will vary, but the fundamental logic of combining different competitive strengths through partnership remains robust.

FAQ

What is the Sony-TCL partnership?

The Sony-TCL partnership is a proposed joint venture where Sony and TCL would establish a new company to consolidate television manufacturing and product development operations. With TCL holding 51% ownership and Sony maintaining 49%, the arrangement combines Sony's premium brand, design expertise, and software capabilities with TCL's manufacturing efficiency, supply chain mastery, and display technology innovation. The partnership is structured as a memorandum of understanding with binding agreements targeted for completion by March 2026 and full operational launch expected for April 2027.

How does the Sony-TCL partnership work structurally?

The partnership operates as a joint venture entity controlled by both parent companies with TCL maintaining operational control through majority ownership (51%) while Sony retains meaningful influence through its 49% stake. TCL contributes manufacturing facilities, supply chain relationships, and production expertise while Sony contributes its television division, intellectual property, design teams, and brand equity. The joint venture operates as a consolidated television manufacturer serving global markets under both Sony and TCL branding, with shared research and development, coordinated supply chains, and unified manufacturing operations achieving cost efficiencies neither company could achieve independently.

What are the main benefits of this partnership for Sony?

Sony benefits from the partnership through multiple mechanisms: access to TCL's manufacturing infrastructure without requiring massive independent capital investment, integration into TCL's supply chains that provide improved leverage with panel suppliers like LG Display and Samsung Display, access to CSOT's display technology development including emerging OLED panel manufacturing, faster product development cycles through direct control of manufacturing operations, and improved cost structure enabling expansion into volume market segments previously inaccessible due to pricing constraints. These advantages allow Sony to maintain meaningful television market presence while avoiding the substantial capital investment and operational overhead that independent manufacturing would require.

What are the main benefits of this partnership for TCL?

TCL benefits from access to Sony's premium brand positioning and design expertise, enabling the company to expand into premium market segments where TCL-branded products face perception challenges despite excellent specifications and value. The partnership provides software and entertainment ecosystem integration capabilities through Sony's Play Station division and other entertainment properties, geographic market access particularly in premium segments where Sony maintains established relationships, and design collaboration that elevates TCL-branded product aesthetics and perceived quality. These benefits allow TCL to expand beyond value positioning into premium segments while maintaining the efficiency advantages that define TCL's competitive strength.

Will this partnership affect television prices and availability?

The partnership likely produces positive effects on consumer television pricing and availability. Manufacturing efficiencies achieved through vertical integration should eventually translate into improved value propositions for consumers—either through lower pricing for comparable specifications or improved features at existing price points. Improved availability of OLED televisions could occur if TCL's new panel manufacturing facility successfully produces large television-sized OLED panels, breaking LG Display's monopolistic supply position and increasing competition in the OLED segment. However, these benefits likely emerge gradually over 2027-2029 as the partnership launches new products and manufacturing efficiencies materialize, with consumer impact limited in the near term.

How does this partnership affect Samsung and LG?

Samsung and LG face increased competitive pressure from the Sony-TCL partnership, which consolidates two major competitors' manufacturing and technology capabilities. Samsung's position is particularly threatened in both premium segments (where it competes with Sony) and value segments (where it competes with TCL). LG faces potential disruption of its OLED panel supply monopoly if TCL's emerging OLED manufacturing facilities successfully produce large television panels at competitive cost and quality. Both Samsung and LG will likely respond through accelerated innovation, strategic partnerships, or manufacturing investment to maintain competitive positioning against the consolidated Sony-TCL entity.

What regulatory approvals are required for this partnership?

The partnership requires approval from Chinese regulatory authorities, specifically the Ministry of Commerce (MOFCOM), which oversees foreign investment and major business combinations. Because TCL maintains Chinese majority ownership (51%) and the partnership consolidates manufacturing within China while maintaining employment, regulatory approval is likely but not guaranteed. The partnership might face scrutiny in other jurisdictions regarding foreign investment, technology transfer, or competitive implications, though the primary regulatory hurdle is Chinese government approval. The memorandum of understanding targets binding agreement completion by March 2026, suggesting regulatory approval timelines align with this target.

When will Sony-branded products from the partnership reach consumers?

First generation Sony and TCL products designed and manufactured through the joint venture are expected to reach consumers in mid-2027, approximately 12 months after the joint venture achieves full operational status in April 2027. Initial product launches will focus on premium and mid-premium segments where both brands maintain presence, with subsequent expansion into value segments and gaming-focused products through 2028. Full portfolio transition to joint venture products and manufacturing will occur gradually through 2028-2029, with older products using previous manufacturing partners transitioning to new supply chains.

What display technologies will the partnership pursue?

The partnership will accelerate development of current display technologies including mini-LED with advanced quantum dots, OLED panels from TCL's emerging manufacturing facilities, and advanced color management systems. Beyond current technologies, the partnership likely pursues experimental micro LED development, advanced refresh rate and motion handling technologies, and gaming-specific features leveraging Play Station integration. The partnership's technology roadmap emphasizes continuous evolution of proven display technologies (mini-LED, OLED) rather than revolutionary approaches, reflecting confidence in these technologies' continued market relevance through the 2030s.

Could this partnership be abandoned or modified?

Yes, the partnership could be abandoned or substantially modified if regulatory obstacles prove insurmountable, if financial or market conditions change dramatically, or if strategic priorities at either company shift. The memorandum of understanding provides both companies with flexibility to reassess the arrangement before binding agreements are finalized. Even after binding agreement execution, exit mechanisms likely exist allowing either company to modify or exit the partnership under specific circumstances. However, assuming current market conditions persist and no major regulatory obstacles emerge, the partnership is expected to proceed toward full implementation as outlined.

How does this partnership impact competition and consumer choice?

The partnership consolidates two previously independent competitors, likely reducing consumer choice in some dimensions while expanding it in others. The combination of Sony and TCL reduces the number of major independent manufacturers competing globally, potentially limiting consumer options for independent brands positioned between premium (Samsung, LG) and ultra-value segments. However, the partnership may expand consumer choice through improved Sony-branded offerings at lower price points, elevated TCL-branded products at premium positioning, and potential OLED television availability improvements if TCL's panel manufacturing succeeds. The net effect on consumer competition and choice remains uncertain and depends on execution success and competitive responses from Samsung and LG.

Conclusion: Navigating Television's Consolidating Landscape

The Sony-TCL partnership represents one of consumer electronics manufacturing's most significant developments in recent years, with implications extending far beyond the television industry itself. By bringing together Sony's heritage brand, design expertise, and premium market positioning with TCL's revolutionary manufacturing efficiency, supply chain mastery, and display technology innovation, the partnership creates a new entity positioned to compete credibly across television market segments globally.

For Sony, the partnership represents an elegant solution to a fundamental challenge: how to maintain meaningful presence in a market where the company's historical premium positioning could no longer compete against value-focused manufacturers offering exceptional specifications at aggressive pricing. Rather than attempting to rebuild independent manufacturing capability or engage in prolonged decline in television market share, Sony has chosen to leverage partnership with a manufacturing specialist to maintain relevance while accessing efficiency gains necessary for profitability in volume segments.

For TCL, the partnership provides access to brand prestige and premium market segments that the company has struggled to penetrate despite exceptional product quality and aggressive innovation. By leveraging Sony's design heritage and brand equity, TCL can expand beyond value positioning into premium segments where consumer perceptions and brand associations drive purchasing decisions as much as specifications and pricing.

The partnership's success hinges on several critical factors. Regulatory approvals must proceed smoothly, particularly from Chinese authorities whose support is essential but not guaranteed. Operational integration of two companies with different cultures and philosophies must overcome execution challenges that have derailed previous technology partnerships. Manufacturing efficiencies must materialize as projected, delivering cost advantages that translate into either improved profitability or aggressive competitive pricing. CSOT's OLED panel manufacturing development must reach production readiness for large television-sized panels, creating genuine alternative to LG Display's current dominance.

If these factors align favorably, the partnership becomes transformative for global television manufacturing. The consolidation of Sony and TCL under a unified ownership structure, combined with vertical integration of manufacturing, creates a competitor positioned to challenge Samsung and LG globally across multiple market segments simultaneously. The partnership could accelerate technology evolution, improve manufacturing efficiency across the industry through competitive pressure, and create new product categories that leverage combined capabilities neither company could achieve independently.

If execution falters—whether through regulatory obstacles, integration challenges, or market factors—the partnership could stall or be abandoned, leaving the television industry landscape relatively unchanged from current positioning. However, even partial success would represent meaningful market disruption, elevating Sony's television presence while improving TCL's premium market penetration.

For consumers, the partnership's ultimate impact remains to be determined. Best case scenarios involve improved value propositions, expanded OLED television availability, and accelerated innovation in display technology and software integration. Worst case involves reduced competition, moderately higher pricing, and consolidation of the market around three or four major players. Most likely outcomes fall between these extremes—gradual market consolidation, selective price improvements in specific segments, and incremental technology evolution rather than revolutionary innovation.