The End of an Era: Sony's Historic Shift in Television Manufacturing

For nearly five decades, Sony has stood as one of the most prestigious names in television technology. The company that revolutionized home entertainment with the Trinitron—a cathode-ray tube technology that dominated living rooms throughout the 1980s and 1990s—announced in early 2026 that it would be entering into a joint venture with TCL, the Chinese television manufacturer. This partnership represents far more than a simple business agreement; it signals the conclusion of Sony's independent television manufacturing operations and marks a fundamental restructuring of how one of tech's most influential companies will approach the television market moving forward.

The announcement, while not entirely unexpected given industry trends, carries significant weight for understanding the modern consumer electronics landscape. Sony's television division has faced mounting pressures from aggressive pricing by Chinese manufacturers, stagnating TV market growth in developed nations, and the astronomical costs required to remain competitive in display panel manufacturing. While the company will continue to sell televisions bearing the Sony brand, the operational control and manufacturing responsibility will increasingly shift to TCL, a company that has quietly become one of the world's largest TV manufacturers by volume in recent years.

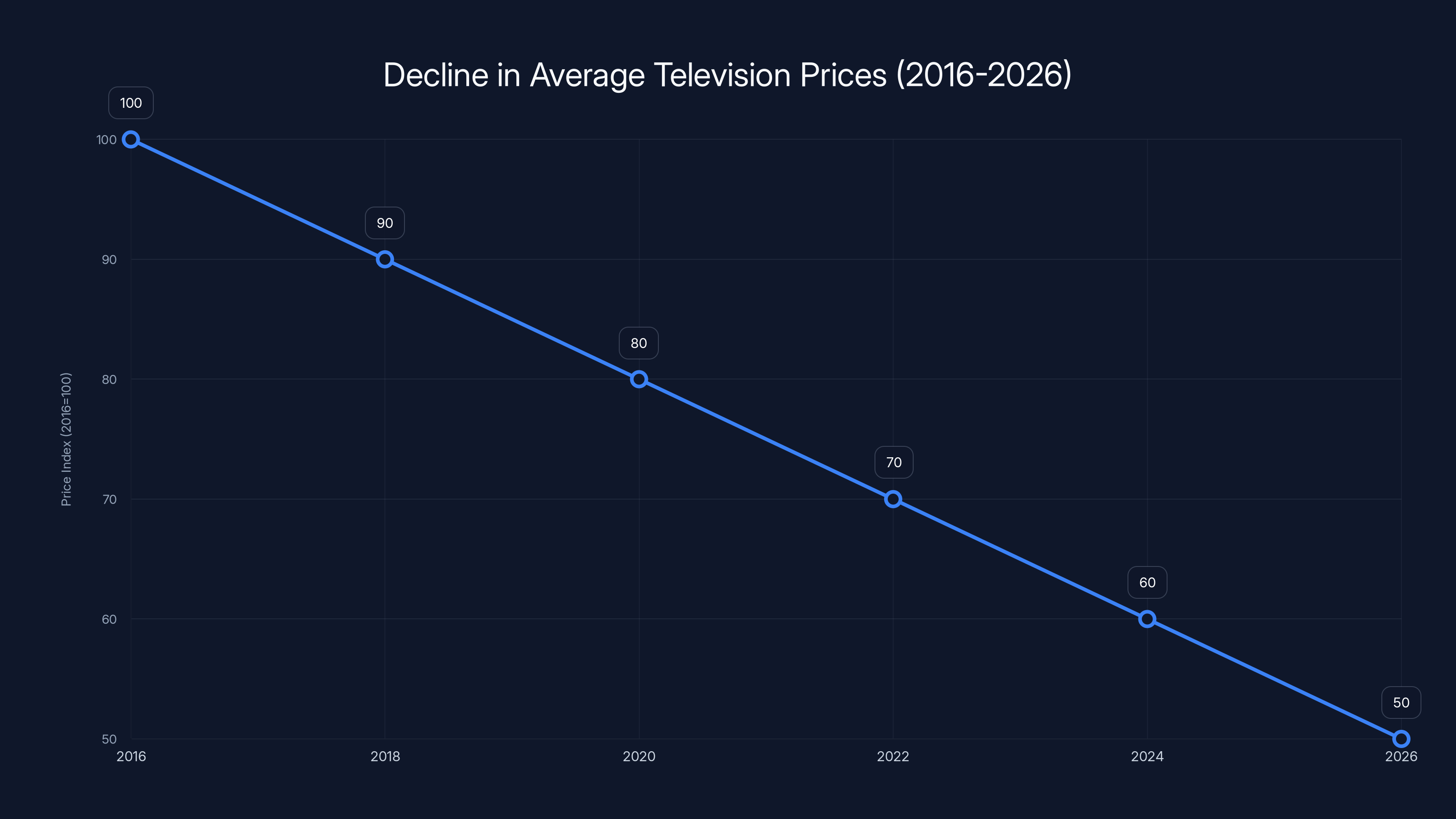

This transition reflects broader economic realities that have reshaped the consumer electronics industry over the past decade. The television market, once a source of significant profit margins for major manufacturers, has become increasingly commoditized. Average television prices have declined by approximately 40-50% in inflation-adjusted terms over the past ten years, while manufacturing capabilities have concentrated among a handful of companies with the scale and capital to compete. Sony, despite its brand prestige and engineering excellence, discovered that maintaining a completely independent television manufacturing operation no longer made financial sense given the competitive landscape and the capital investments required to compete in display panel technology.

Yet the story is more nuanced than simple decline. The partnership announcement comes at a moment when television technology itself is undergoing significant transformation. The shift toward 8K displays, the advancement of mini-LED and quantum-dot technologies, and the increasing integration of artificial intelligence and smart features into televisions have created new opportunities—but also new cost structures that independent manufacturers struggle to bear. Understanding this transition requires examining not just what's changing, but why these changes are occurring and what they mean for consumers navigating the television market in 2025 and beyond.

Understanding the Sony-TCL Joint Venture Structure

The Mechanics of the Partnership

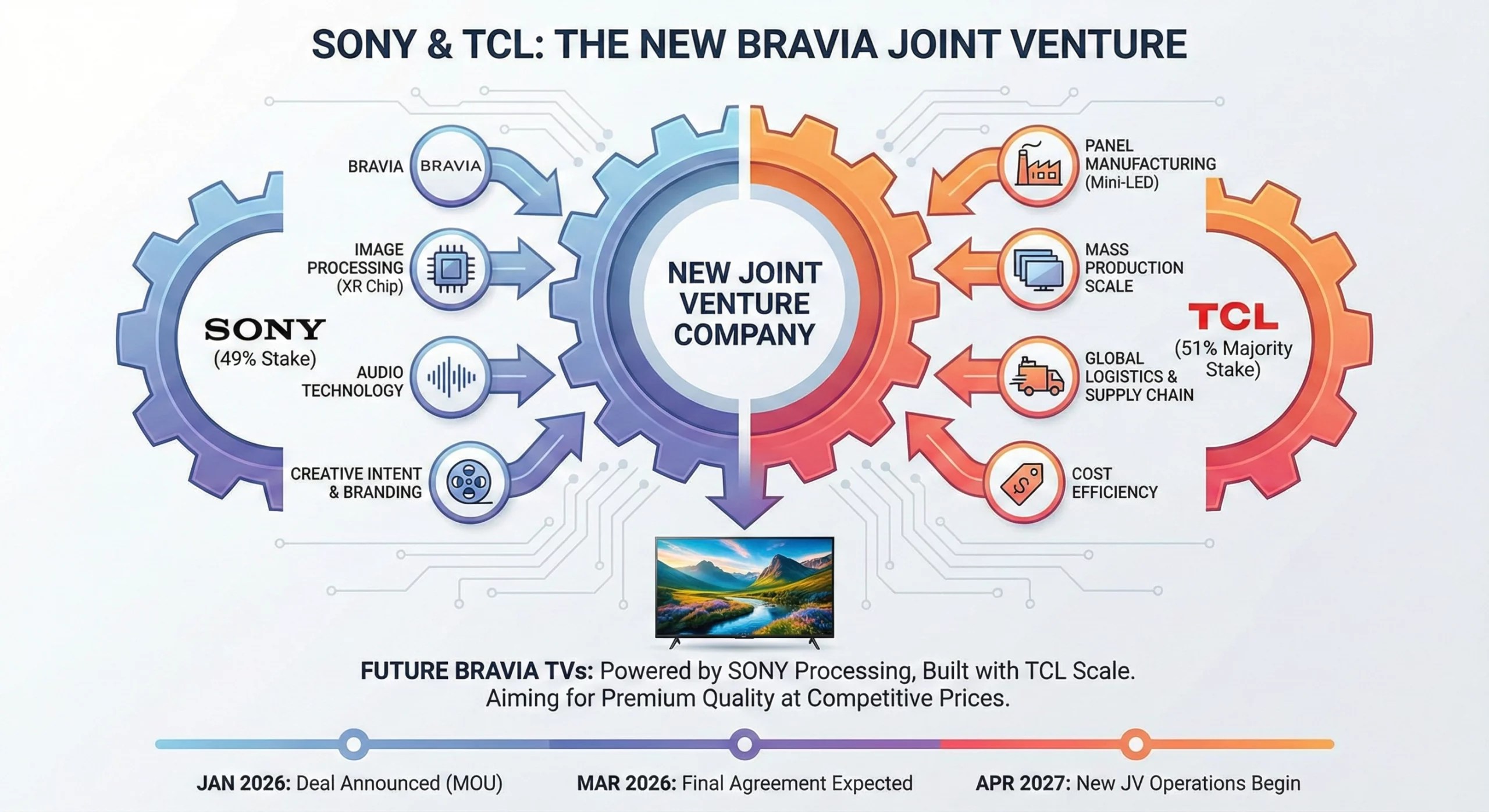

The joint venture between Sony and TCL represents a carefully structured collaboration designed to preserve Sony's brand equity while leveraging TCL's manufacturing prowess and supply chain efficiency. Under the agreement, both companies will maintain their brand identities, but manufacturing, procurement, and much of the product development infrastructure will operate under shared responsibility. This structure is critical to understand because it determines which aspects of Sony TVs will remain "Sony" in the traditional sense and which will increasingly reflect TCL's operational philosophy.

TCL, founded in 1981 and headquartered in Huizhou, China, has evolved from a regional electronics manufacturer to a globally significant player in television production. The company currently ranks among the top three television manufacturers globally by unit volume, competing directly with Samsung and LG. Notably, TCL has developed considerable expertise in manufacturing efficient, feature-rich televisions at price points that have disrupted traditional market segments. The company operates massive manufacturing facilities in multiple countries, maintains sophisticated supply chain networks, and has invested heavily in display panel technology through partnerships and acquisitions.

Sony brings to the partnership something TCL cannot easily replicate: brand prestige, consumer loyalty, and a reputation for picture quality and reliability that commands premium pricing. Sony television owners tend to be repeat customers who value the engineering philosophy and attention to detail that has characterized the brand for decades. This brand value represents billions of dollars in goodwill—something a manufacturer cannot easily create through operational efficiency alone. The joint venture structure allows TCL to gain access to this brand value while Sony retains the ability to maintain premium positioning and command higher margins than TCL-branded alternatives.

Financial Rationale and Market Pressures

The financial pressures driving this partnership are worth examining in detail because they illuminate the state of the television manufacturing industry. Sony's television division has operated at razor-thin profit margins for over a decade, frequently breaking even or posting modest losses despite strong global brand recognition. Manufacturing competitiveness in televisions increasingly depends on absolute scale economies—the ability to source components in enormous volumes at the lowest possible unit costs. Sony, while enormous by any objective standard, lacks the sheer manufacturing volume that companies like TCL or Hisense bring to the market.

The display panel business illustrates this dynamic perfectly. Modern television panels—whether LCD, QLED, mini-LED, or OLED—require billions of dollars in manufacturing facility investments. Samsung maintains enormous display manufacturing capacity across multiple countries. LG operates significant OLED facilities. But Sony has never operated its own display panel manufacturing at meaningful scale. Instead, Sony purchases panels from external suppliers, which immediately puts them at a cost disadvantage compared to integrated manufacturers who amortize panel costs across their own products.

TCL, by contrast, has invested significantly in display panel manufacturing capabilities and maintains close relationships with panel suppliers. Through partnership with other manufacturers, TCL has structured supply arrangements that provide cost advantages of 5-15% on critical components compared to what smaller-volume purchasers can achieve. When multiplied across millions of televisions sold annually, these differences accumulate into massive competitive advantages or disadvantages. For Sony, competing independently against TCL-branded televisions manufactured by the same partner company at lower costs represented an increasingly unsustainable business model.

Additionally, the global television market has been essentially flat in unit volume growth for the past 15 years, with growth concentrated in emerging markets where price sensitivity is highest and brand loyalty is lowest. In developed markets like North America and Western Europe, television purchases have become replacement-driven, with consumers typically replacing working sets every 7-10 years. This replacement cycle, combined with improving television durability and reduced obsolescence pressures from non-functional improvements, means the television market no longer experiences the growth rates that could justify enormous R&D expenditures and manufacturing investments for any single manufacturer.

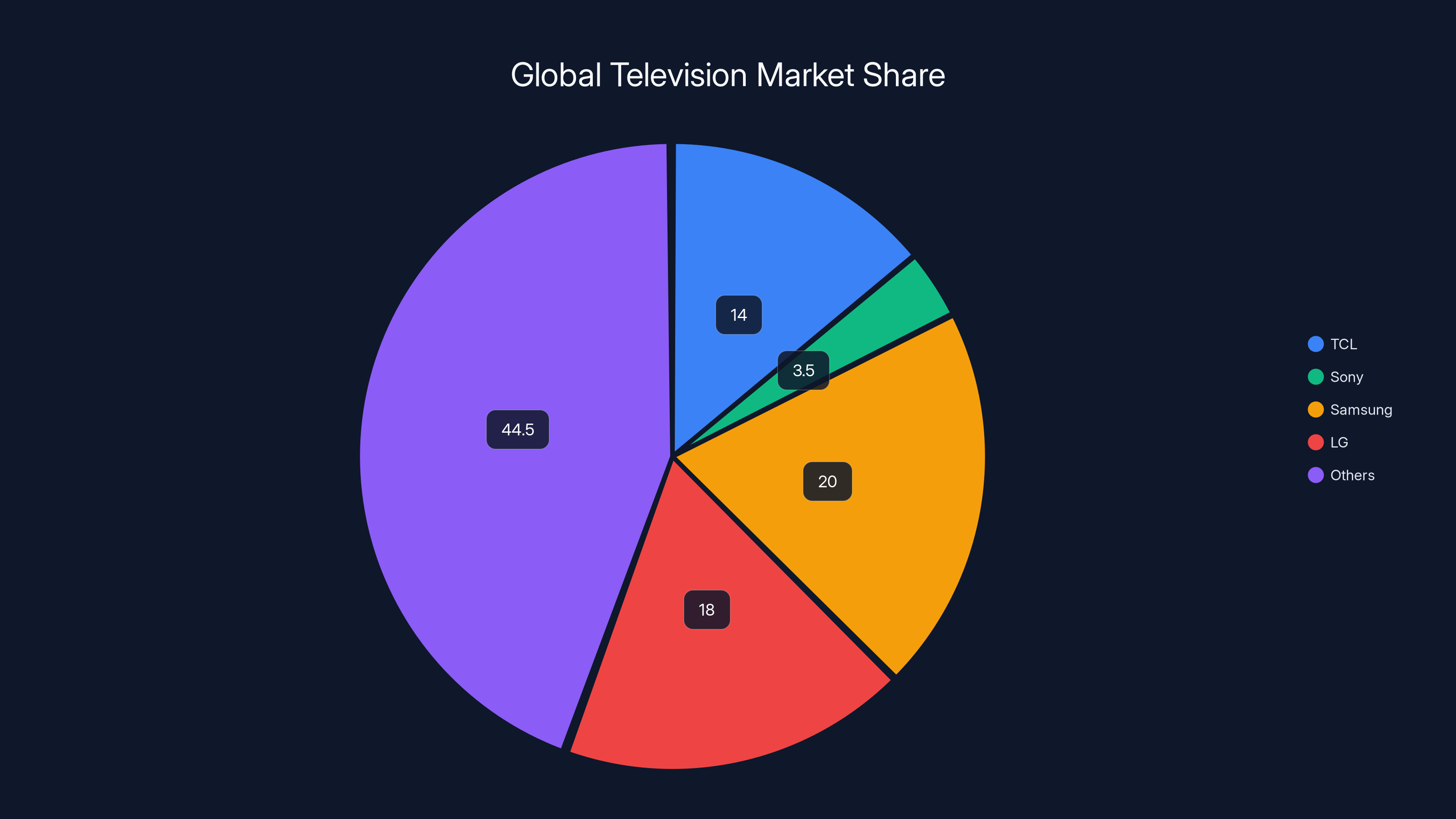

TCL holds a significant share of the global television market at approximately 14%, while Sony's share is around 3.5%. The partnership aims to leverage TCL's manufacturing strength to improve Sony's market position. (Estimated data)

Market Impact: What This Means for Television Competition

Competitive Landscape Transformation

The Sony-TCL partnership fundamentally alters the competitive dynamics of the global television market. Historically, the television market has consisted of relatively distinct competitor groups: premium brands like Sony, Samsung, and LG competing in high-margin segments; value brands like TCL, Hisense, and other Chinese manufacturers competing on price; and regional players occupying various niches. The partnership blurs these traditional boundaries by merging Sony's brand and positioning capabilities with TCL's operational efficiency.

For consumers, this creates an interesting dynamic. Sony-branded televisions will likely benefit from improved supply chain efficiency and reduced manufacturing costs, potentially translating to either better features at comparable prices or comparable features at lower prices than would otherwise be possible. A 55-inch Sony television released under the partnership might offer specifications that would have been prohibitively expensive under fully independent Sony manufacturing, or might achieve previous price points with enhanced capabilities.

However, this partnership also raises important questions about product differentiation. If Sony televisions are increasingly manufactured by the same facilities and using the same components as TCL televisions, what distinguishes them beyond branding and user interface? Historically, premium brands justified their pricing through superior engineering, better image processing, more refined designs, and enhanced reliability. These factors required R&D investment and quality control rigor that cost money. Under a joint venture structure, maintaining these differentiators becomes more challenging because the financial incentives point toward cost minimization and operational efficiency rather than premium differentiation.

Other television manufacturers are certainly aware of these dynamics. Samsung, which has maintained complete operational control over much of its television business and operates significant display manufacturing capacity, can emphasize its independent R&D and manufacturing control in marketing. LG similarly maintains independent operations, though it faces its own pressures and challenges. However, both Samsung and LG recognize that independent television manufacturing requires enormous capital investment and carries significant competitive risks. The Sony-TCL partnership may serve as a model—expect to see other announcements of strategic partnerships and joint ventures in the television industry over the coming years as manufacturers seek to share costs and risks while preserving brand equity.

Regional Market Implications

The partnership carries specific implications for different regional markets. In North America and Western Europe, where Sony brand recognition remains strong and consumers often associate Sony with premium quality, the partnership is unlikely to damage brand perception—provided that product quality and reliability remain consistent. Consumers don't typically know or care about manufacturing relationships; they care about picture quality, features, reliability, and value. If Sony televisions continue to perform well and offer compelling features, the partnership's existence remains largely irrelevant to purchase decisions.

In China and other emerging markets, where TCL maintains strong brand recognition and existing distribution networks, the partnership strengthens TCL's competitive position. TCL can now leverage any superior technologies or designs that emerge from Sony's engineering teams, potentially elevating its product offerings. Simultaneously, Sony gains access to TCL's distribution networks and manufacturing infrastructure in regions where establishing independent operations would be costly and challenging.

In India, Southeast Asia, and other growth markets, the partnership's impact depends largely on how the two companies allocate their distinct brands. TCL might maintain its value positioning while Sony occupies premium segments, or the companies might segment by channel or region. These decisions will shape how consumers in these regions experience television purchasing options over the coming years.

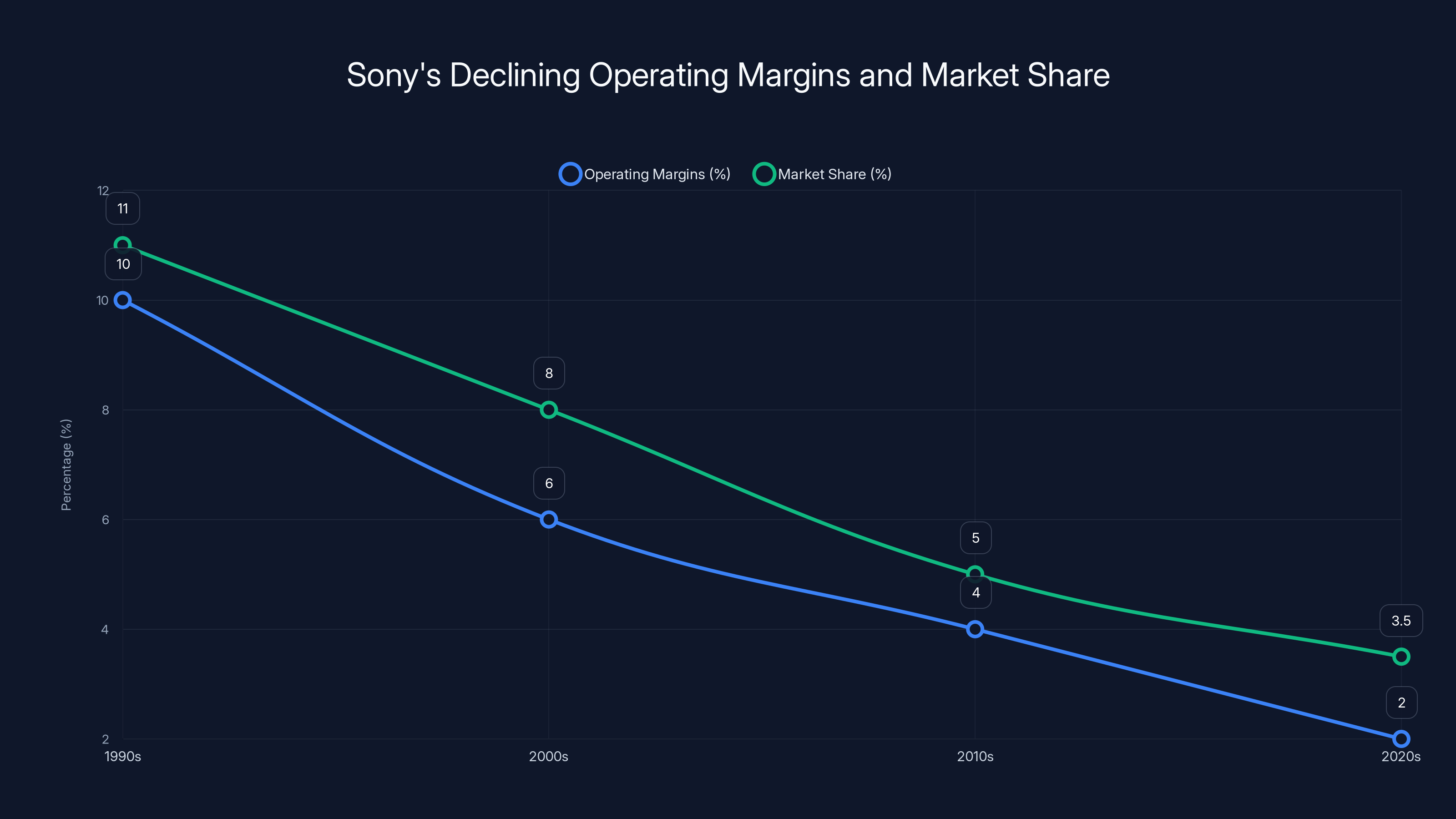

Sony's operating margins and market share both saw significant declines from the 1990s to the 2020s, illustrating the challenges faced in maintaining profitability and market position.

The Broader Context: Why Television Manufacturing Is Consolidating

The Technology Transition Challenge

Underlying the Sony-TCL partnership is a fundamental transformation in television technology that has challenged traditional manufacturers. For decades, television innovation followed relatively predictable trajectories: larger sizes, better resolution, improved color accuracy, more efficient power consumption, and gradually enhanced smart features. Manufacturers who could execute on these roadmaps effectively, control costs, and manage supply chains successfully prospered.

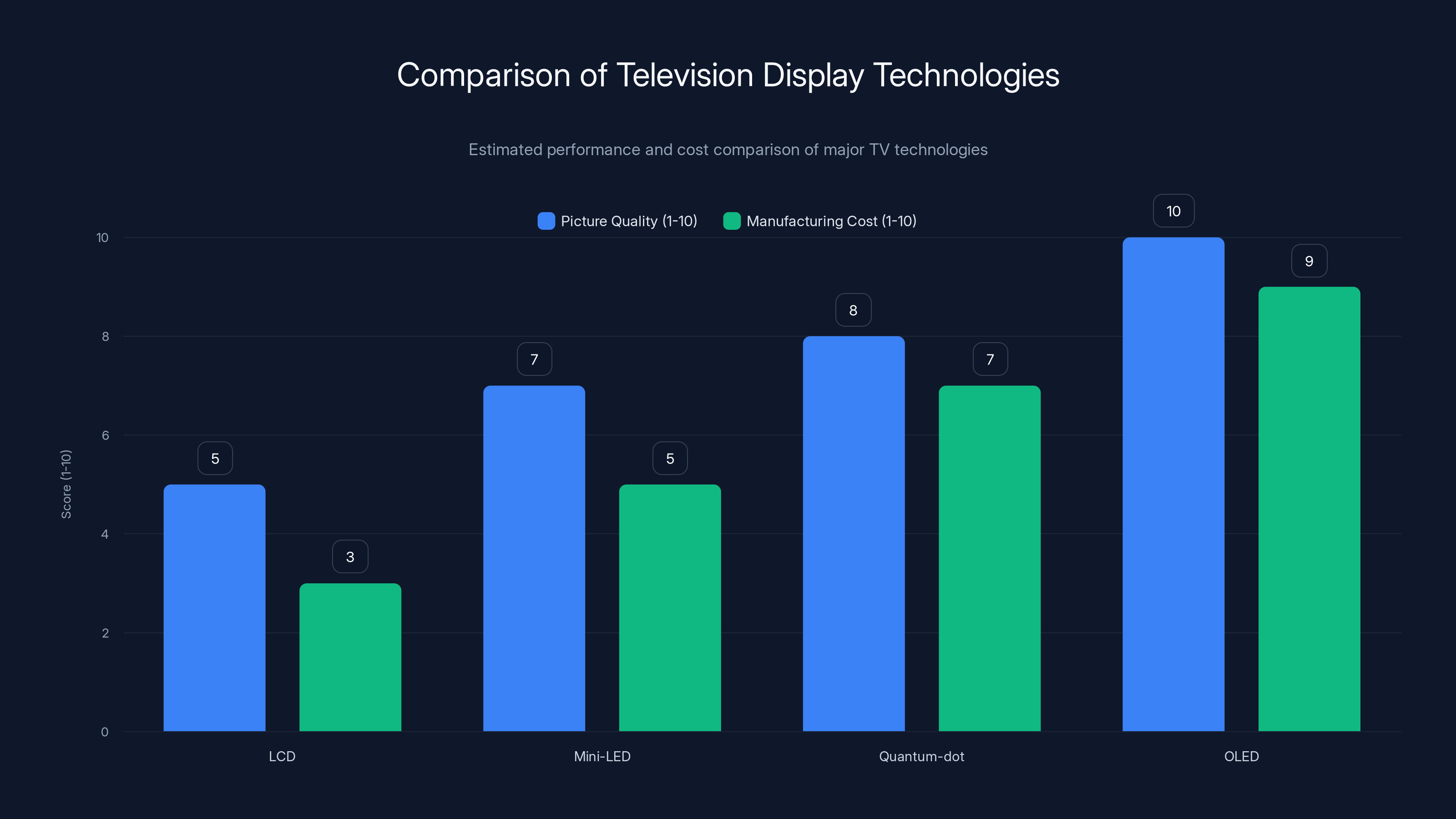

Over the past five years, this pattern has fractured. The shift from LCD to mini-LED, quantum-dot, and OLED technologies has created multiple competing technical standards, each requiring different manufacturing processes, component sourcing, and design approaches. There is no single "correct" direction that all manufacturers can collectively pursue. Instead, the market has fragmented into competing technology ecosystems, each with different cost structures, manufacturing requirements, and performance characteristics.

OLED displays, for instance, offer superior picture quality and contrast ratios but require completely different manufacturing processes than LCD-based technologies and command significantly higher prices at every screen size. Mini-LED represents a compromise approach, improving upon traditional LCD with better local dimming and contrast while remaining more affordable than OLED. Quantum-dot technology similarly addresses specific performance objectives while carrying its own cost and manufacturing implications. A manufacturer trying to serve multiple market segments and price points must now manage not just quality differentiation within a technology family, but fundamental technology choices that determine product positioning.

This complexity has raised the stakes of television manufacturing substantially. Companies must develop separate product lines optimized for each technology family, source components from different suppliers, and manage entirely different manufacturing processes. For a company like Sony with limited manufacturing volume compared to TCL or Samsung, managing this complexity independently becomes increasingly difficult. TCL, by contrast, has embraced this diversification and manufactures successful product lines across multiple technology categories.

The Display Panel Dominance Factor

The most critical underlying factor driving television industry consolidation is the economics of display panel manufacturing. Modern television displays are complex scientific instruments requiring enormous capital investments to produce. A cutting-edge LCD panel manufacturing facility costs billions of dollars to construct and operates at minimum efficient scale only when producing many millions of panels annually.

Historically, several companies operated display panel manufacturing: Sony (through partnerships), Samsung, LG, and several others. Today, the landscape has consolidated dramatically. Samsung, LG, and BOE (a Chinese company) dominate global display panel production, collectively controlling roughly 80% of all LCD panel manufacturing capacity and over 90% of all OLED panel capacity globally. For any television manufacturer not vertically integrated into display panel production, costs are essentially set by these suppliers, who naturally prioritize their own television brands' profitability while selling to external customers on less favorable terms.

This creates a structural disadvantage for independent television manufacturers. Samsung televisions benefit from Samsung Display's production; LG televisions benefit from LG Display's production; but Sony televisions must source panels from competitors who have no incentive to provide particularly favorable pricing. Over time, this structural disadvantage compounds, making it increasingly difficult for independent television manufacturers to compete on price while maintaining profitability.

TCL has partially addressed this through partnerships with display manufacturers and through investment in its own panel production capabilities, but maintains more flexibility than Sony has enjoyed. By partnering with TCL, Sony gains access to TCL's more efficient supply arrangements and manufacturing partnerships. This represents a rational response to structural disadvantages in the modern television manufacturing environment.

Historical Context: Sony's Television Legacy and Dominance

The Trinitron Era and Premium Positioning

To understand the significance of the Sony-TCL partnership, we must examine Sony's extraordinary history in television manufacturing. Sony entered the television market in the late 1950s and spent the subsequent decades building a reputation for picture quality and reliability that became virtually synonymous with television excellence. The company's Trinitron technology, introduced in 1968, revolutionized cathode-ray tube displays through innovative electron gun design that delivered superior picture quality and brightness compared to competing technologies.

The Trinitron became the gold standard for television performance and commanded significant price premiums. Throughout the 1970s, 1980s, and 1990s, Trinitron televisions dominated premium market segments globally. Sony's brand became so associated with television quality that consumers frequently chose Sony not because of specific features or specifications, but because the brand represented a guarantee of reliable, high-quality performance. This brand equity translated into profit margins that were extraordinary by television industry standards—often double or triple the margins achieved by value-focused competitors.

This premium positioning persisted even after CRT technology became obsolete and the industry transitioned to flat-panel displays in the 2000s. Throughout the LCD transition, Sony maintained strong brand recognition and premium positioning. A Sony flat-panel television in 2005-2010 commanded price premiums of 15-25% compared to feature-identical models from less prestigious manufacturers. This premium reflected not just superior engineering, but also Sony's reputation for reliability, design quality, and customer support.

The Transition Challenges: Flat-Panel Era Pressures

However, the transition to flat-panel display technology created unexpected challenges for Sony's television business. Unlike CRT technology, where Sony's proprietary electron gun design provided genuine technical advantages, flat-panel displays were commodity components manufactured by specialized suppliers according to standardized specifications. A Sony-branded 40-inch LCD television and a TCL-branded 40-inch LCD television with identical specifications often used components sourced from the same suppliers and featured virtually identical technical performance.

This commoditization of the core display technology undermined Sony's traditional strategy of charging premiums through technical superiority. To maintain premium positioning, Sony had to shift emphasis toward areas like design, user interface, smart television features, and overall system integration. The company invested in superior image processing, advanced scaling algorithms, and sophisticated smart TV platforms designed to differentiate Sony televisions beyond the underlying commodity display panels.

These differentiation efforts required substantial R&D investment. Sony employed teams of engineers developing proprietary image processing algorithms and display optimization software. The company invested in superior industrial design, often featuring custom bezels, innovative stand designs, and refined aesthetic choices. These efforts did maintain Sony's premium positioning but came at significant cost that smaller-volume manufacturers could ill afford to match.

During the 2010s, however, the effectiveness of these premium differentiation strategies declined. Chinese manufacturers like TCL, Hisense, and Haier invested heavily in image processing technology, copied effective design approaches, and increasingly delivered feature parity with premium brands at significantly lower prices. Additionally, the rise of smart television features shifted competitive focus away from image quality engineering—the area where Sony's premium positioning was strongest—toward content aggregation, voice control integration, and ecosystem connectivity.

Smart television platforms have their own competitive dynamics. Samsung's Tizen platform, LG's Web OS, and others have developed sophisticated smart television experiences. Sony's Android TV platform, while functional, never achieved the same level of optimization or sophistication that Samsung and LG achieved with their proprietary systems. For consumers, the difference in smart television experience often outweighs image processing differences—particularly among younger demographics for whom content access and interface usability matter more than subtle picture quality improvements.

Estimated data shows a 40-50% decline in average television prices over the past decade, reflecting the commoditization of the market.

The Profitability Crisis: Why Sony Couldn't Remain Independent

Margin Compression and Market Share Erosion

The television business's transformation from a profit-generating powerhouse to a margin-compressed commodity market represents one of the technology industry's most dramatic business model collapses. In the 1990s, Sony's television division generated operating margins in the 8-12% range—excellent by any manufacturing standard. By the early 2020s, these margins had compressed to 1-3%, with many quarters seeing operational losses despite billions of dollars in television sales.

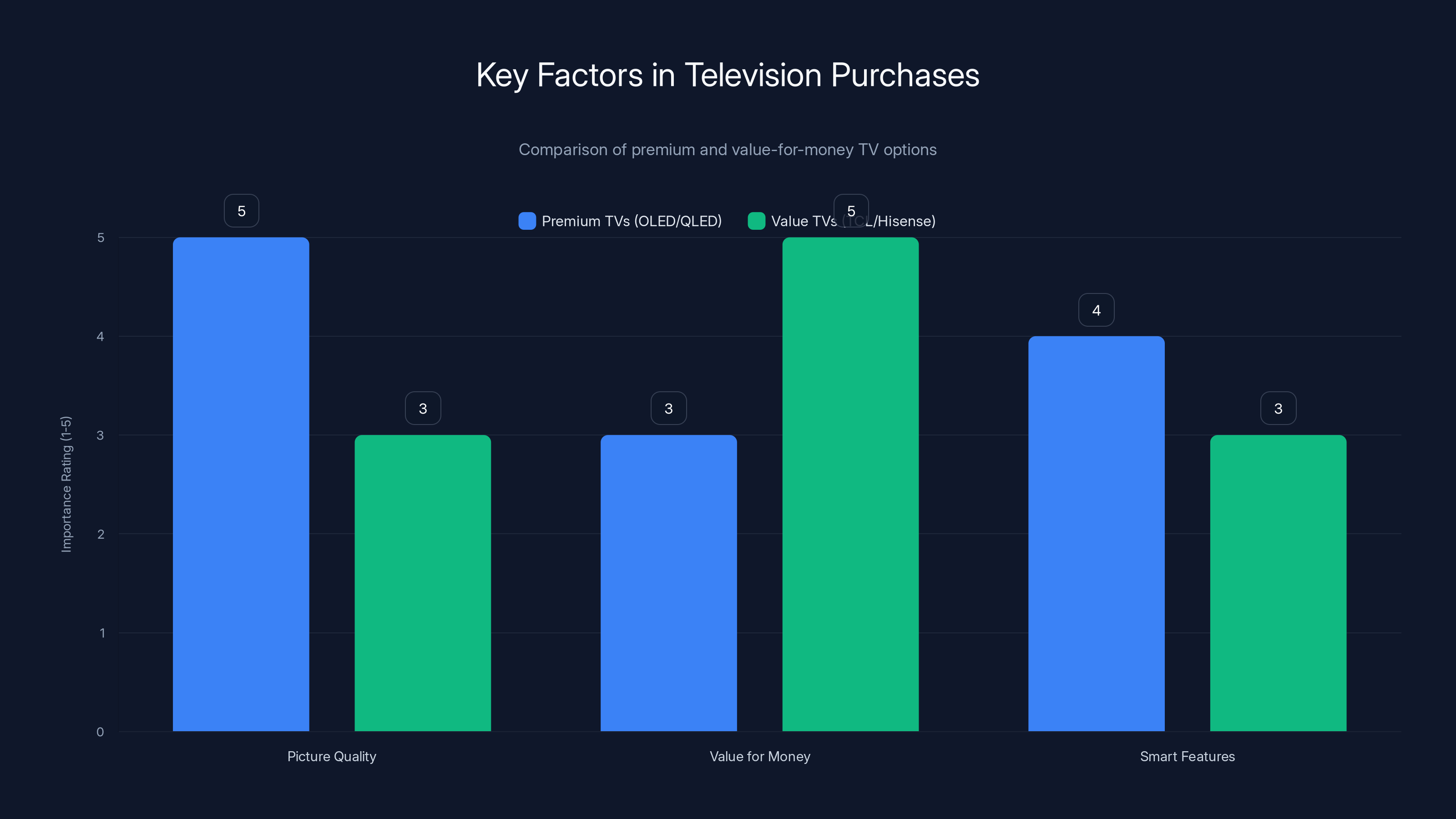

This margin compression occurred because consumer preference increasingly concentrated on price and basic feature adequacy rather than premium engineering and brand prestige. A consumer buying a television in 2023 faced a choice: pay a 25% premium for a Sony television with marginally superior image processing, or purchase an identically-sized TCL or Hisense television with 90% of the performance at 75% of the price. For most consumers, particularly price-sensitive segments that drove volume growth in emerging markets, the value proposition didn't justify the premium.

Simultaneously, Sony's market share in televisions declined steadily. In 2000, Sony held roughly 10-12% of global television market share. By 2020, this had declined to approximately 3-4%, with the company retaining meaningful share primarily in premium segments in developed markets. TCL, meanwhile, grew from negligible global presence in 2005 to commanding 12-15% of global market share by 2020, becoming one of the three largest television manufacturers globally.

This shift in relative competitive position made it increasingly difficult for Sony to justify investment in independent manufacturing infrastructure. Television manufacturing requires enormous capital expenditure—factories, equipment, supply chain management, quality control systems. These capital costs are fixed regardless of volume, making them devastatingly expensive for lower-volume manufacturers. Sony's declining market share meant these fixed costs were spread across fewer units, worsening unit economics and profitability.

The Capital Investment Challenge

Maintaining competitiveness in modern television manufacturing requires continuous capital investment. Factories must be upgraded to accommodate new manufacturing processes. Supply chains must be constantly optimized and refined. New display technologies require extensive R&D and prototype manufacturing. Smart television platforms require ongoing software development and updates. Image processing algorithms require research teams and computational resources. A decade ago, Sony could justify these investments through strong profitability; by the early 2020s, this was no longer realistic.

Consider the mathematics of modern television manufacturing: a competitive 65-inch 4K television might cost

Apply this to Sony's declining global sales volume, and the profitability picture becomes grim. If Sony sells 2.5 million televisions annually (a rough estimate of recent years), the gross profit available to cover all overhead and R&D was insufficient to justify continued independent operation. By contrast, TCL sells 15+ million televisions annually, spreading overhead and R&D costs across a much larger base.

This creates what economists call a "structural disadvantage" that no amount of engineering excellence can overcome. It's a mathematics problem, not an execution problem. Sony could make the absolute best televisions in the world, but if the market doesn't value that excellence sufficiently to pay premium prices, the business becomes untenable.

What This Means for Sony Television Consumers

Product Continuity and Quality Assurance

For consumers who own Sony televisions or are considering purchasing them, the partnership raises legitimate questions about product continuity and quality standards. Will Sony televisions maintain their historical reputation for reliability and longevity? Will picture quality remain competitive with premium alternatives? These concerns are understandable, though the partnership structure provides some reassurance.

Sony has explicitly stated that the partnership will maintain independent product development and quality standards. Sony engineers will continue to develop image processing algorithms, optimize display settings, and architect product roadmaps. The partnership focuses on manufacturing operations, supply chain management, and cost optimization rather than product development decisions. This suggests that Sony televisions will continue to receive engineering attention and optimization effort, just in collaboration with TCL rather than independently.

Historically, successful brand partnerships in the electronics industry have maintained quality through continued brand focus and reputation protection. When Sony partnered with manufacturers in other product categories, the approach involved quality assurance and brand standards enforcement. There's no reason to expect this partnership to differ fundamentally. TCL has a strong incentive to maintain Sony brand quality because reputation damage would reduce the Sony brand's premium positioning, undermining the value of the partnership.

That said, consumers should monitor early product reviews carefully as new Sony models emerge under the partnership. The transition period will be critical for establishing whether the partnership delivers quality continuity or represents a beginning of gradual quality decline. Most evidence suggests the former is more likely, but vigilance is warranted.

Pricing Implications and Value Proposition

The partnership's most immediate impact for consumers may be pricing. As Sony gains access to TCL's more efficient supply chains and manufacturing processes, the company has opportunity to reduce retail prices while maintaining profitability, or maintain historical pricing while improving profitability. The likely reality is somewhere between these extremes.

Expect Sony televisions to become modestly more competitively priced within the premium segment, potentially eroding the traditional 15-25% price premium that Sony commanded. This could represent good news for consumers willing to purchase Sony televisions, as value improves. However, this pricing pressure might also reflect reduced engineering differentiation if TCL's operational influence extends into product development decisions.

Alternatively, some analysis suggests that Sony might use the partnership's cost advantages to invest more heavily in differentiation areas like design, interface refinement, and content integration partnerships. This would allow Sony to maintain premium positioning not through image quality engineering alone, but through overall user experience and lifestyle integration. For premium segment consumers, this might represent an acceptable evolution.

Long-Term Brand Trajectory

The longer-term question concerns Sony's brand trajectory. Will Sony remain a premium television brand, or will it gradually migrate toward the mid-premium segment as its competitive position stabilizes? Historical precedent suggests brands often undergo this kind of repositioning when manufacturing partners change. Some brands successfully maintain premium positioning through deliberate strategy and continued engineering focus; others gradually become indistinguishable from their manufacturing partners' own brands.

Sony's success likely depends on whether the company continues to maintain design and engineering autonomy. If Sony televisions remain distinctly engineered products with proprietary optimization, brand premium positioning can persist. If Sony increasingly relies on TCL's standard designs and engineering with only branding differentiation, the premium positioning will erode inexorably.

OLED technology leads in picture quality but also has the highest manufacturing cost. Mini-LED and Quantum-dot offer balanced alternatives. Estimated data based on typical industry evaluations.

The Broader Television Market and Consumer Alternatives

Premium Segment Dynamics

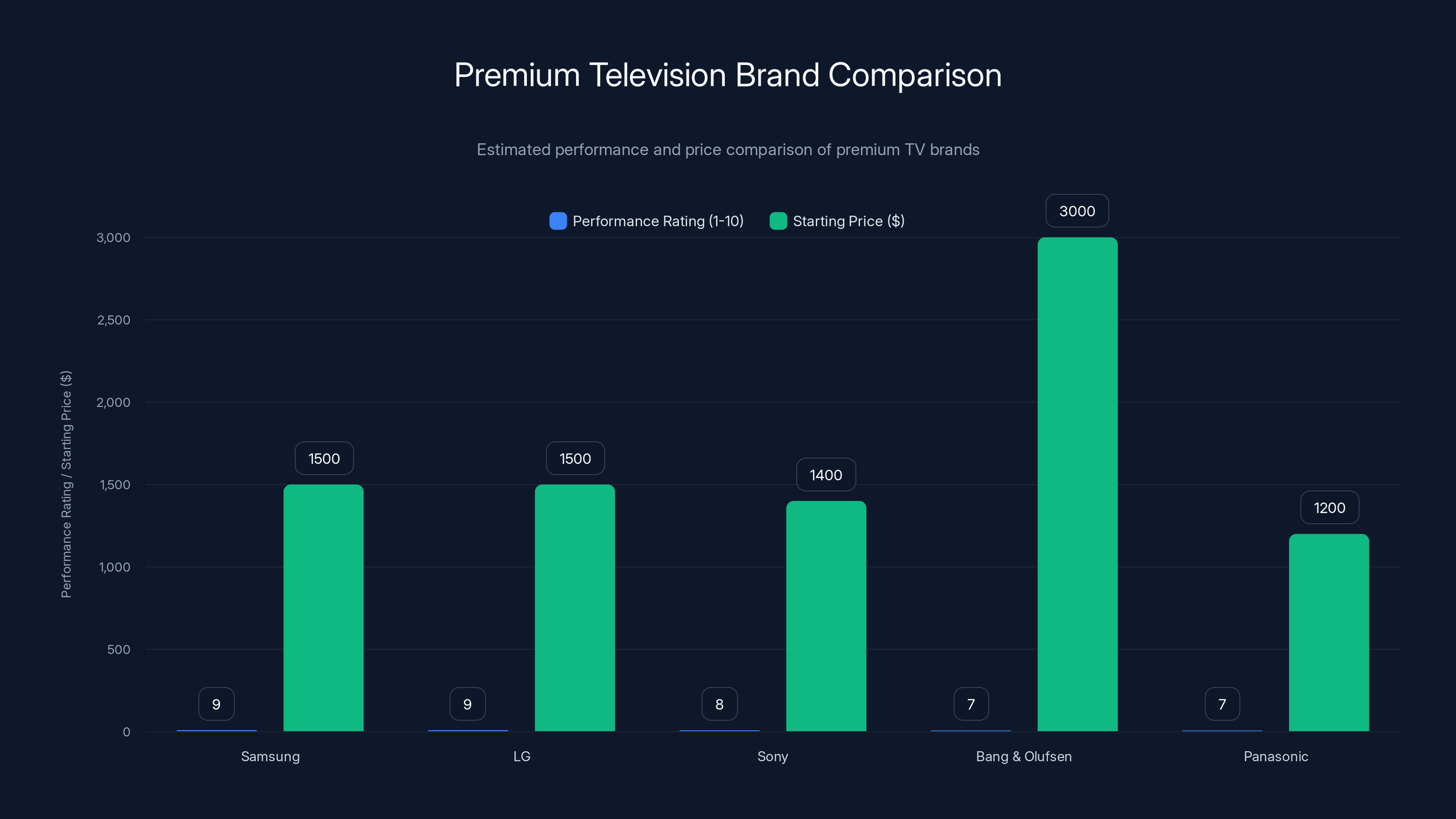

Outside of Sony, the premium television segment remains dominated by Samsung and LG, both of which maintain independent manufacturing operations and significant R&D investments. Samsung operates its own display facilities, develops proprietary Tizen platform software, and maintains extensive manufacturing infrastructure. LG similarly controls display manufacturing through LG Display and operates sophisticated OLED production facilities.

For consumers prioritizing premium television performance, Samsung and LG remain the primary independent manufacturers offering complete vertical integration. Samsung's QLED technology combines quantum-dot displays with proprietary image processing for strong performance at premium prices. LG's OLED televisions offer exceptional picture quality through self-emissive display technology, though at prices starting around $1,500-2,000 for 55-inch models. Both manufacturers command strong brand loyalty and customer satisfaction ratings.

Within the premium segment, consumers also encounter specialty manufacturers like Bang & Olufsen (targeting luxury design-conscious consumers), Panasonic (particularly strong in certain international markets), and various regional brands. These alternatives provide differentiation opportunities for consumers seeking specific attributes beyond Sony's traditional positioning.

Sony televisions, operating under the partnership, will likely position themselves as premium alternatives to Samsung and LG but potentially with slightly less engineering differentiation than historically. The value proposition may shift from "engineering excellence" toward "reliable premium brand with strong design and interface."

Mid-Premium and Mid-Range Market

Above TCL and Hisense but below Sony, Samsung, and LG, consumers find brands like Vizio, Insignia, and regional alternatives. These manufacturers typically offer acceptable picture quality at moderate prices, targeting value-conscious consumers who still want reliable products. The mid-range segment has become increasingly competitive as manufacturers have elevated overall quality standards and reduced the performance gap between mid-range and premium offerings.

The partnership positions Sony to compete more effectively in this mid-premium space—retaining premium branding while achieving more competitive pricing. For consumers in this segment, Sony becomes a more attractive option if pricing remains modest while quality standards persist. However, consumers in this segment might equally well consider alternatives from manufacturers like Vizio, which have developed strong mid-range offerings with competitive feature sets.

Value Segment and Budget Alternatives

TCL remains the dominant force in the value segment globally, though it faces competition from Hisense, Haier, and other Chinese manufacturers. In developed markets, Insignia (Best Buy's house brand), RCA, and others provide ultra-affordable options. For budget-conscious consumers, the partnership has minimal direct impact beyond the competition dynamics noted above.

The partnership does potentially affect how TCL positions its own brand versus the Sony brand it now helps manufacture. TCL might use the partnership as an opportunity to elevate its own brand positioning toward mid-premium segments, while Sony occupies premium segments. Alternatively, TCL might maintain its value positioning while Sony remains separate, allowing clear market segmentation. These strategic choices will unfold over several years as the partnership matures.

Alternative Solutions for Television Needs: What Consumers Should Consider

Evaluating Premium Television Options

For consumers considering a new television purchase, the partnership announcement doesn't necessarily necessitate changing purchasing considerations. The fundamental factors that should drive television purchases remain constant: screen size matching viewing distance, resolution appropriate for content consumption, panel technology suited to viewing conditions and content preferences, smart features alignment with existing ecosystems, and price-to-performance value.

Consumers prioritizing absolute picture quality should continue evaluating OLED technology from LG or Samsung's QN90/QN95 QLED lines, as these represent the current frontier of performance. These televisions offer superior contrast ratios (1,000,000:1 or greater for OLED versus 1,000:1 for QLED), exceptional color accuracy when properly calibrated, and minimal input lag for gaming. Prices are premium—$1,500-3,500 for 65-inch models—but performance justifies the investment for serious video enthusiasts.

Consumers prioritizing value-for-money should evaluate mid-range offerings from TCL, Hisense, Samsung's lower-tier lines, and others. Modern entry-premium televisions offer 4K resolution, HDR support, smart platform access, and acceptable color accuracy at prices under

Consumers prioritizing smart features and ecosystem integration should evaluate Android TV platforms, Samsung's Tizen, and LG's Web OS to determine which provides the best content access and user experience for their specific needs. This consideration often matters more than underlying display quality for households using televisions primarily for streaming content and casual viewing.

Strategic Recommendations for Different Consumer Types

For Existing Sony Television Owners: Continue maintaining your televisions with confidence. The partnership doesn't affect products already in the market, and Sony's service infrastructure and support commitments remain unchanged. If your current television still functions well, there's no compelling reason for immediate replacement.

For Consumers Considering Sony Purchase: Research and compare specific models carefully before and after the partnership's full implementation. Early partnership-era models may incorporate design and manufacturing innovations that represent genuine improvements. Alternatively, older Sony models produced under fully independent operations might represent better value if purchasing from existing inventory. Evaluate specific models' reviews and specifications rather than making brand-level purchasing decisions.

For Budget-Conscious Consumers: The partnership's primary impact is on mid-range pricing and feature availability. TCL, Hisense, and other value-brand alternatives likely remain the most cost-effective options for typical consumers. If Sony pricing becomes competitive in this segment while maintaining quality, Sony becomes a viable alternative—but not a necessary choice for budget-conscious purchases.

For Premium Enthusiasts: Samsung and LG's independent operations continue to offer the most extensive engineering differentiation and innovation investment. If premium picture quality and engineering excellence matter significantly, these brands likely remain superior choices to partnership-based Sony alternatives.

For Ecosystem-Integrated Consumers: Make purchasing decisions primarily based on smart platform preferences and content ecosystem alignment rather than underlying display technology. A television with your preferred smart platform and strong content integration will provide better ownership experience than a technically superior television with misaligned smart features.

Emerging Alternative Technologies and Approaches

Beyond traditional television manufacturers, consumers should consider emerging alternatives as television technology evolves:

Micro-LED Displays: Next-generation display technology offering OLED-like picture quality with superior brightness and durability. Limited availability currently, but potential to revolutionize premium segment within 5 years. Samsung and other manufacturers are investing heavily; expect commercial availability in premium segments by 2027-2028.

Laser Projection Systems: For consumers with appropriate room conditions and design flexibility, laser projectors offer exceptional screen sizes at reasonable prices. Brightness and contrast have improved dramatically, making these viable for rooms with modest light control. Price-to-screen-size ratio is superior to traditional televisions, though installation complexity is higher.

Modular and Flexible Displays: Emerging roll-up and foldable display technologies may eventually offer consumers unprecedented flexibility in television size and aspect ratio. These remain experimental, but represent potential future alternatives to rigid panel-based designs.

Gaming-Optimized Displays: For console and PC gamers, specialized gaming televisions from manufacturers like ASUS and other gaming-focused companies offer features optimized for gaming performance rather than general content viewing. These remain niche options but represent viable alternatives for specific use cases.

Premium TVs excel in picture quality, while value TVs offer better value for money. Smart features are comparable across both categories. Estimated data based on typical consumer priorities.

Industry Consolidation Trends and Future Implications

The Broader Consolidation Pattern

The Sony-TCL partnership exemplifies a broader consolidation pattern reshaping the consumer electronics manufacturing industry. Over the past 15 years, the number of significant independent television manufacturers has declined dramatically. Companies like Philips, Kodak, Panasonic (in many markets), and Sharp have exited or significantly reduced television manufacturing. Manufacturing control has consolidated to a smaller number of companies with sufficient scale to maintain competitive operations.

This consolidation trend likely accelerates. Within five years, expect to see additional announcements of partnerships, joint ventures, and brand transitions as remaining mid-sized manufacturers evaluate whether independent operations remain viable. Brands like Panasonic, Toshiba, and others in secondary positions face similar pressures to what Sony faced—sufficient brand value to merit continued operation, but insufficient volume to justify completely independent manufacturing.

The end state of this consolidation likely involves three to five manufacturing groups controlling 70-80% of global television production, with each group operating multiple brand labels spanning different price segments and regional markets. Sony-TCL partnership represents one model for achieving this consolidation; we may see others based on different strategic rationales.

Technology Investment Concentration

Consolidation has significant implications for innovation investment. Concentrated manufacturing means concentrated R&D investment. A handful of companies with sufficient scale can justify billion-dollar investments in next-generation display technology, advanced image processing, and smart television platform development. Smaller players, lacking independent manufacturing scale, must choose between licensing technology or collaborating with larger manufacturers.

This dynamic could accelerate innovation in some areas—concentrated resources can drive faster technology advancement—while slowing innovation in others. For instance, OLED and mini-LED technology development has concentrated at companies like Samsung, LG, and BOE, yielding rapid advancement. Conversely, smart television platform innovation may slow if fewer companies operate independent platforms, reducing competitive pressure and differentiation incentives.

Brand Portfolio Strategies

As manufacturing consolidation occurs, consolidated companies increasingly operate multiple brand labels targeting different segments and regions. TCL operates TCL-branded and non-branded products under the partnership while also owning brands acquired over the years. Samsung maintains Samsung, Tizen-based brands, and regional alternatives. This multi-brand portfolio strategy allows companies to compete across multiple price segments and market positions while centralizing manufacturing.

Consumers should understand that brand ownership and manufacturing relationships increasingly diverge from historical patterns. A television purchased under one brand might be manufactured by a completely different company. This isn't necessarily negative—manufacturing quality and brand standards enforcement matter—but it does mean historical brand-to-manufacturer associations have become less reliable guides to product quality and company identity.

Financial Market and Investor Perspectives

Market Reaction and Valuation Implications

The Sony-TCL partnership received cautious reception from financial markets and equity analysts. Sony's stock traded relatively flat on the announcement, suggesting investors viewed the partnership as logical recognition of existing challenges rather than a surprising or shocking development. Analyst commentary focused on the potential for improved profitability in Sony's television division through reduced manufacturing costs, though many noted uncertainty about the partnership's execution and long-term effectiveness.

TCL's perspective differs meaningfully. For TCL, gaining the ability to manufacture and distribute Sony-branded televisions represents an expansion of addressable market. TCL can capture manufacturing profit from Sony-branded products while retaining profit from TCL-branded alternatives, potentially improving overall profitability. Chinese market analysts viewed the partnership favorably as a vote of confidence in TCL's manufacturing capabilities and a validation of the company's growth trajectory.

Competitive Valuation Impacts

The partnership has subtle implications for competitive valuations. Samsung and LG face investor questions about whether they should maintain completely independent television operations or adopt similar partnership approaches. Both companies have significant display manufacturing assets and scale advantages that make independent operations more viable than Sony's situation allowed. However, investor enthusiasm for capital-intensive television manufacturing has waned, and partnerships or joint ventures might eventually become attractive even for these larger players.

Microsoft's television-related ventures and Amazon's strategic moves in content and display technology add complexity. Microsoft has explored television-adjacent markets like gaming consoles and cloud services. Amazon manufactures Fire TV platforms and content. Neither company has pursued direct television manufacturing, but both have explored implications of their technology competencies. The partnership structure might influence how these technology companies approach television-related opportunities in the future.

Samsung and LG lead in performance ratings and command premium prices. Sony offers competitive pricing with strong brand reliability. Estimated data.

Consumer Sentiment and Market Perception

Brand Perception Among Consumers

Preliminary consumer sentiment research on the partnership shows fascinating divergence. In developed markets like North America and Western Europe, most consumers were largely unaware of the partnership and showed minimal sentiment changes regarding Sony brand favorability. For consumers, "Sony television" remains a positioning concept independent of manufacturing relationships. If Sony televisions continue functioning reliably with strong features at reasonable prices, the partnership's existence matters little.

In China and Asia-Pacific regions, consumer perception tends more positive. TCL ownership and manufacturing association carries less stigma than some Western perceptions might suggest. TCL has successfully positioned itself as a serious technology company with strong R&D capabilities. Many Chinese consumers view the partnership as a positive development—evidence that TCL has achieved sufficient scale and credibility to partner with historically premium brands.

Interestingly, research suggests consumers purchasing televisions prioritize current model specifications and reviews over brand history or manufacturing relationships. A consumer reading reviews of a 2026 Sony 55-inch model will evaluate that specific television's features and performance rather than making brand-level decisions based on manufacturing change. This tendency actually benefits Sony—the partnership can be largely transparent to ordinary consumers making purchasing decisions based on specific models and specifications.

Generational Differences in Brand Loyalty

The partnership may have differential impacts across generational segments. Older consumers with long histories of Sony television ownership express higher concern about partnership implications. These consumers developed brand loyalty through positive ownership experiences and show greater skepticism about manufacturing changes affecting quality. Younger consumers, with less historical brand investment and greater willingness to consider Chinese manufacturers, express minimal concern about the partnership and are more likely to evaluate purchase decisions on current specifications and price rather than brand legacy.

Over time, this generational dynamic means Sony's premium brand positioning may naturally erode as older generations age out and younger demographics approach television purchasing decisions. The partnership accelerates this natural transition, but doesn't create it independently.

The Competitive Landscape for Smart Television Platforms

Platform Wars and Content Integration

An underappreciated aspect of television competition concerns smart platform differentiation. The actual display panel—the physical monitor—has become increasingly commoditized. The differentiation that matters to many consumers involves the television's user interface, content aggregation, voice assistant integration, and overall system experience. This is where Samsung's Tizen, LG's Web OS, and Sony's Android TV compete.

Sony's Android TV platform, while functional, has historically lagged behind proprietary systems developed by Samsung and LG. Android TV provides access to Google ecosystem services and integrates with Android devices, which appeals to some consumers but creates less differentiation than competitors' proprietary systems. The partnership with TCL doesn't directly address this platform disadvantage, though TCL's operational efficiency might allow Sony to invest more heavily in platform optimization.

Streaming Content Aggregation represents another competitive battleground. Modern televisions function increasingly as content hubs, and consumers expect seamless access to Netflix, Disney+, Amazon Prime, You Tube, and other services. Television platforms increasingly compete on how elegantly they integrate these services and personalize content discovery. Proprietary smart platforms like Tizen and Web OS have advantages in optimization and refinement compared to generic Android TV implementations.

The partnership has potential to advantage Sony through TCL's content relationships and distribution partnerships in Asia-Pacific markets. TCL has negotiated favorable content partnerships with streaming services and has optimized its platform experience through substantial user base and market feedback. Leveraging this expertise could improve Sony's Android TV experience.

Voice Assistant Integration

Voice control through Alexa, Google Assistant, and other AI assistants has become standard smart television features. Consumers increasingly expect to control televisions through voice commands, and platform choice affects voice integration depth and functionality. Samsung's proprietary system, LG's Web OS, and others have developed sophisticated voice integration. Sony's Android TV benefits from Google Assistant integration but might lack the proprietary optimization that Samsung and LG have developed.

The partnership could address this through TCL's accumulated experience with voice integration optimization. As smart televisions become increasingly central to smart home ecosystems, voice control quality becomes more important to consumer satisfaction and purchase decisions.

Supply Chain Implications and Component Sourcing

Display Panel Supply Relationships

The partnership immediately affects Sony's display panel sourcing. Sony has historically relied on purchasing panels from suppliers including Samsung Display, LG Display, BOE, and others. The partnership with TCL provides access to TCL's panel sourcing arrangements, which likely include favorable pricing from BOE (a major panel supplier in which TCL has close relationships) and potentially preferential allocation from other suppliers.

This supply chain advantage could be significant. Display panel costs represent 40-50% of total television manufacturing cost for mid-range products, and favorable sourcing could translate to $20-40 per television in cost advantages depending on volume and negotiation terms. Multiplied across millions of units, this represents billions of dollars in potential value.

However, this also creates competitive risks. If Sony's panel sourcing improves dramatically through the partnership, Samsung and LG face potential sourcing disadvantages unless they secure advantageous arrangements. This might drive negotiations between major television manufacturers and panel suppliers, potentially creating shifts in relative competitive positions.

Component and Semiconductor Sourcing

Televisions incorporate numerous components beyond display panels: processing chips, memory, power supplies, and various specialized integrated circuits. The partnership provides access to TCL's component sourcing relationships and volume-based supplier negotiations. TCL's enormous purchasing volume allows leverage in negotiations that Sony couldn't exercise independently.

This benefit extends beyond direct cost advantages to include supply reliability and allocation priority during component shortages. TCL's suppliers, accustomed to working with TCL's massive volumes, likely provide preferential treatment and supply priority. Sony gains access to these relationships through the partnership.

Future Television Technology and Innovation Roadmap

Near-Term Technology Evolution (2025-2028)

Over the next three years, expect television technology to evolve along established trajectories. OLED technology will continue improving, with brighter, more affordable models reaching broader market segments. Mini-LED technology will mature and penetrate deeper into mid-range segments. Quantum-dot and other hybrid technologies will continue refined development. These transitions represent evolutionary advancement within established technology families rather than revolutionary new approaches.

Resolution improvements beyond 4K will expand slowly. 8K television technology exists but faces obstacles: minimal 8K content availability, substantial cost premiums, and limited consumer perception of value improvement. Expect gradual 8K adoption primarily in ultra-premium segments through 2028, with broader market penetration unlikely in this timeframe.

Smart features will continue integration and refinement. AI-powered upscaling, which uses machine learning to improve picture quality of lower-resolution content, will advance and become increasingly standard. AI-powered content recommendations will improve as algorithms refine. Voice control and ecosystem integration will deepen as smart home technology adoption accelerates.

Medium-Term Innovation (2028-2033)

Beyond three years, more speculative innovations become likely: Micro-LED technology, which potentially offers OLED quality with superior durability and brightness, is approaching commercial viability for premium segments. Several manufacturers have demonstrated functional micro-LED displays; Samsung, Apple, and others have indicated intent to commercialize products within this timeframe. Micro-LED represents a potentially transformative technology offering performance advantages across multiple dimensions compared to OLED.

Flexible and rollable display technology, currently experimental, might achieve commercial viability. Samsung has demonstrated rollable display concepts and indicated development timelines. If these technologies achieve manufacturability and cost-effectiveness, they could enable new television form factors and use cases. Such innovations would likely command enormous price premiums initially, targeting only luxury and early-adopter segments before broader market diffusion.

Augmented reality and spatial computing integration in televisions might evolve from concept to implemented feature. Television screens, which increasingly function as home entertainment hubs, could incorporate depth sensing and spatial computing to enable new interactive experiences. This represents speculative innovation but aligns with broader industry trends toward mixed reality experiences.

Regulatory and Trade Considerations

Global Trade Dynamics

The Sony-TCL partnership occurs against complex global trade dynamics. US-China trade tensions, supply chain reshoring efforts, and regional trade policies create context for strategic decisions about manufacturing locations and sourcing. TCL, as a Chinese company, faces import tariffs and regulatory scrutiny in developed markets. Sony, as a Japanese company, maintains more favorable trade positions in many developed markets.

The partnership's structure—with Sony maintaining brand and design while TCL handles manufacturing—potentially allows Sony to navigate trade policy uncertainties. If TCL manufacturing becomes politically disadvantageous in specific markets, Sony could potentially shift production to other locations while maintaining supply relationships. This flexibility provides strategic advantages compared to completely independent operations.

Regulatory Compliance and Environmental Standards

Television manufacturing involves significant environmental and regulatory compliance requirements. EU energy efficiency standards, US EPA requirements, and various national regulations impose increasing compliance costs. Consolidated manufacturing under TCL's infrastructure allows centralized compliance management and optimization compared to independent manufacturing operations.

TCL has invested in manufacturing facilities meeting increasingly stringent environmental standards. These investments provide compliance infrastructure that benefits all products manufactured under the arrangement, including Sony-branded televisions. This consolidation can actually reduce per-unit compliance costs compared to independent manufacturing.

The Broader Question: What This Means for Technology Industry Structure

The Specialization and Consolidation Paradox

The Sony-TCL partnership illustrates a fascinating paradox in modern technology industry structure. Technology has become simultaneously more specialized and more consolidated. Specialized knowledge and expertise have become concentrated in companies with sufficient scale to justify R&D investment. Manufacturing has consolidated among companies with optimal scale for operations. But brand and market positioning remain distributed across numerous companies.

This creates a structure where technology companies increasingly specialize in specific domains—Samsung in displays and semiconductors, Apple in design and software integration, Microsoft in software platforms—while relying on partners for other competencies. Companies can no longer maintain complete vertical integration across all areas of complex products. Instead, they specialize in domain expertise while collaborating with partners in other areas.

Television manufacturing exemplifies this evolution. Sony specializes in brand positioning, design, and software integration while partnering with TCL for manufacturing operations. This allows Sony to compete in premium segments through brand value and design excellence while avoiding capital-intensive manufacturing investments. TCL specializes in manufacturing efficiency and supply chain optimization while leveraging Sony's brand for market access.

This structure has both advantages and disadvantages. Specialization can drive excellence in specific areas but reduces companies' ability to control entire product ecosystems. For consumers, it means competitive dynamics are increasingly determined by partnership structures and supply chain relationships rather than single-company capabilities.

Implications for Consumer Choice and Innovation

Industry consolidation and specialization have implications for consumer choice and innovation. On one hand, consolidated manufacturing can drive cost reductions that benefit consumers through improved price-to-performance. On the other hand, reduced manufacturer competition can reduce innovation pressure and differentiation opportunities.

In televisions specifically, consolidation has reduced the number of competitive platforms and manufacturing approaches. Most televisions increasingly converge toward similar architectures—LCD or OLED panels, standard processors, Android TV or proprietary platforms. This convergence reduces consumer choice in fundamental television characteristics while improving availability of specific features.

However, specialization has enabled deep expertise development. Samsung's display technology, LG's OLED innovation, and others' specialized competencies have driven substantial technological advancement in specific domains. The partnership structure allows these specialized competencies to be leveraged more broadly. Sony benefits from access to TCL's manufacturing expertise; TCL benefits from access to Sony's brand value. Both consumers and the participating companies benefit from this specialization-enabled exchange.

Planning Your Television Purchase in the Partnership Era

Decision Framework for Television Shoppers

Given the partnership landscape, how should consumers approach television purchases? Start by defining your core usage patterns and priorities. Are you primarily watching streaming content, cable television, gaming, or a mix? Do you have specific room conditions, viewing distances, or light control capabilities? These factors matter far more to satisfaction than brand loyalty or manufacturing relationships.

Second, determine your technology preferences. OLED offers superior picture quality but commands premium prices and has burn-in risks for fixed-image content. QLED and mini-LED offer strong performance at moderate prices with more durability. Standard LCD provides adequate performance at budget prices. Your preference here drives significant portion of purchasing decision.

Third, evaluate feature requirements and smart platform preferences. Do you need specific streaming services pre-installed or optimized? Do you prefer Google Assistant, Alexa, or proprietary voice systems? Is gaming performance important, and if so, do you need specific gaming features? These considerations often matter as much as underlying display quality to consumer satisfaction.

Fourth, compare specific models and reviews rather than making brand-level decisions. A 2026 Sony model should be evaluated against specific Samsung, LG, and TCL competitors of similar size and price point. Read professional reviews and user feedback about specific models. Check specifications including refresh rate, local dimming capability, brightness, color accuracy, and smart platform functionality.

Finally, consider warranty and support infrastructure. Sony maintains service infrastructure and warranty support that provides peace of mind for premium purchases. TCL and other value brands have developed adequate support systems, though perhaps less extensive than premium manufacturers. Factor service availability into purchasing decisions, particularly for expensive purchases.

Conclusion: The Sony-TCL Partnership and the Television Industry's Future

The Sony-TCL partnership represents far more than a simple business arrangement between two companies. It exemplifies the profound transformation reshaping consumer electronics manufacturing in the 21st century. The era of complete vertical integration, where single companies controlled all aspects of product development, manufacturing, and distribution, has given way to specialized, partnership-based models where companies concentrate on domain expertise while collaborating extensively with others.

For Sony, the partnership represents recognition that independent television manufacturing no longer offered a viable path forward given competitive pressures, capital requirements, and margin compression in the television market. Rather than accepting slow decline through continued independent operation, Sony chose strategic partnership that preserves brand equity and design excellence while accessing manufacturing efficiency through collaboration. This decision reflects rational business strategy in an industry where competitive dynamics have fundamentally shifted.

For consumers, the partnership's implications remain largely positive. Sony televisions will likely improve in value proposition as manufacturing cost advantages enable either better features at comparable prices or comparable features at lower prices. The partnership doesn't change the fundamental characteristics that made Sony a desirable brand—design quality, reliability, premium positioning—even as operational details shift.

The broader television industry is unlikely to remain unchanged by this partnership. Other manufacturers facing similar pressures will evaluate whether similar partnerships or consolidation strategies make sense for their operations. Over the next five to ten years, expect additional announcements of partnerships, brand transitions, and manufacturing consolidations as the industry adjusts to contemporary competitive realities.

For consumers making television purchasing decisions today, the partnership announcement shouldn't dramatically alter evaluation criteria. Continue prioritizing your specific needs, usage patterns, and technology preferences. Compare specific models against direct competitors across price ranges. Evaluate smart platform features and content integration alongside display technology. Research specific models' reviews and reliability ratings. Make decisions based on comprehensive product evaluation rather than brand history or manufacturing relationships.

The television industry's future will feature continued innovation in display technology, smart features, and content integration. Consumer expectations for value continue rising. Competitive dynamics will remain intense as manufacturers vie for market share in gradually shrinking markets. The Sony-TCL partnership positions both companies to compete effectively in this environment while maintaining distinct brand positioning. For Sony, this partnership represents not an ending but a transformation—the end of the independent era, but potentially the beginning of a renewed competitive chapter through strategic collaboration.

FAQ

What is the Sony-TCL television joint venture?

The Sony-TCL joint venture is a strategic partnership between Sony and TCL, a Chinese television manufacturer, designed to consolidate television manufacturing operations while maintaining distinct Sony and TCL brand identities. Under the arrangement, TCL provides manufacturing, supply chain, and operational expertise while Sony maintains brand positioning, design oversight, and product engineering focus. The partnership allows both companies to compete more effectively in a competitive, margin-compressed television market.

Why did Sony decide to partner with TCL instead of continuing independent television manufacturing?

Sony faced structural disadvantages in independent television manufacturing, including declining market share (3-4% global versus historical 10-12%), razor-thin profitability margins (1-3% operating margins), and capital-intensive requirements for competing in display panel and manufacturing technology. Meanwhile, TCL grew to command 12-15% global market share through operational efficiency and manufacturing excellence. Partnership allows Sony to access TCL's cost advantages and manufacturing scale while preserving brand premium positioning, solving profitability challenges that independent operation could not address.

Will Sony televisions maintain quality and reliability standards after the partnership?

Sony has explicitly committed to maintaining independent product development, quality standards, and engineering oversight under the partnership structure. Manufacturing operations will shift to TCL, but quality assurance, image processing optimization, design, and brand standards remain Sony responsibilities. Historical precedent suggests successful brand partnerships maintain quality through continued brand focus and reputation protection. However, consumers should monitor early models' professional reviews to confirm quality continuity during the transition period.

How will the partnership affect Sony television pricing and availability?

The partnership likely enables Sony to offer more competitive pricing within the premium segment by leveraging TCL's manufacturing efficiency and supply chain advantages. Consumers may see either improved features at comparable prices or comparable features at modestly lower prices as Sony gains access to cost-optimized manufacturing. Availability shouldn't be negatively impacted; if anything, the partnership may expand distribution through TCL's established networks in growth markets.

Should existing Sony television owners be concerned about warranty and support?

Existing Sony televisions purchased before the partnership announcement are completely unaffected. Sony's warranty obligations, service infrastructure, and support commitments for products already sold remain unchanged. The partnership affects future manufacturing of new models but does not alter support for current products. Consumers should maintain normal maintenance practices and contact Sony support through established channels for any warranty claims or technical issues.

What alternatives should consumers consider if they want completely independent television manufacturers?

Samsung and LG remain the primary manufacturers maintaining complete independent television operations with vertical integration into display manufacturing. Both companies operate proprietary smart platforms, control significant manufacturing infrastructure, and maintain extensive R&D investment in display technology and optimization. For consumers prioritizing completely independent manufacturing and engineering control, Samsung and LG represent the primary alternatives. Both offer competitive products across multiple price segments and maintain established brand loyalty and quality reputation.

How does the Sony-TCL partnership compare to other television manufacturers' approaches?

Samsung and LG maintain fully independent operations, controlling manufacturing and display technology development. Panasonic and others have previously exited television manufacturing or significantly reduced operations. The Sony-TCL partnership represents one model for consolidation—maintaining brand identity while partnering for manufacturing—that other mid-sized manufacturers might eventually adopt. Expect similar partnerships and consolidations in coming years as manufacturing economics continue favoring consolidated operations over completely independent production.

What is the impact on consumers comparing Sony televisions to TCL models?

With shared manufacturing infrastructure, Sony and TCL televisions will increasingly share common base components and manufacturing processes. The primary differentiation will involve branding, design, image processing optimization, smart platform implementation, and positioning strategies. Consumers should evaluate specific models directly against each other based on specifications, reviews, and features rather than assuming significant technical differentiation. Sony models will command price premiums reflecting brand positioning, design, and smart feature implementation rather than fundamentally different underlying technology.

When will the partnership's effects be visible to consumers in new television models?

Early partnership-era models were likely in development pipelines at announcement time and will reach market through 2026 and beyond. The first clearly partnership-developed models should appear in new product lines released during 2026-2027. Consumers can identify partnership-era models by checking manufacturing labels and release dates. Early models may represent transition between independent Sony manufacturing and full partnership integration, making detailed review evaluation particularly important during initial years.

How does the partnership affect display technology choices like OLED, QLED, and mini-LED?

The partnership doesn't eliminate Sony's access to any display technology category. Sony will continue offering OLED, quantum-dot, and mini-LED models as appropriate for market segments and pricing. TCL's panel sourcing relationships and manufacturing expertise may influence technology choices and pricing strategies. For instance, Sony might introduce mini-LED models more aggressively if TCL's manufacturing partners offer favorable mini-LED production costs, while maintaining OLED in premium segments. The partnership enables technology choices based on cost-effectiveness rather than vertical integration limitations.

Key Takeaways

- Sony-TCL partnership represents end of independent Sony television manufacturing era due to margin compression and manufacturing scale disadvantages

- Television market consolidation reflects structural economics where display panel sourcing and manufacturing scale determine competitive viability

- Consumers should evaluate televisions based on specific model specifications and reviews rather than brand loyalty or manufacturing relationships

- Samsung and LG remain primary manufacturers maintaining complete independent operations, offering alternatives to partnership-based approaches

- Partnership enables Sony to leverage TCL's manufacturing efficiency while maintaining premium brand positioning and design differentiation

- Display technology choices (OLED, QLED, mini-LED) matter more to consumer satisfaction than manufacturing structure or corporate ownership

- Television industry likely experiences continued consolidation with additional partnerships as other mid-sized manufacturers evaluate independent viability

- Smart platform features and content integration increasingly compete equally with underlying display quality in consumer satisfaction metrics

Related Articles

- Sony TVs Made by TCL: What This Partnership Means for TV Quality [2025]

- Sony's TV Business Takeover: Why TCL's Partnership Changes Everything [2025]

- Best Buy Presidents' Day Sale: 50+ Deals on TVs, Laptops & Appliances [2025]

- FiiO Retro Headphones: Vintage Design Meets Modern Audio [2025]

- Telly's Free TV Strategy: Why 35,000 Units Matter in 2025

- OLED vs Mini-LED TV Battle 2025: LG's Brighter & Cheaper Panels