The Telly Story: From Bold Ambitions to Reality Check

When Telly emerged from stealth mode in 2023, it arrived with the kind of audacious promises that Silicon Valley loves to make. The startup's vision was elegantly simple: offer consumers a completely free television set in exchange for their engagement with advertisements displayed on a secondary screen. This wasn't just another streaming device or smart TV—it represented a fundamental reimagining of how media companies could monetize content consumption in American homes. The initial response from investors, consumers, and the tech press was overwhelmingly enthusiastic.

The company's leadership team, backed by notable venture capital firms and strategic investors, painted a picture of explosive growth and market transformation. Chief Strategy Officer Dallas Lawrence boldly declared to industry publications that shipping 500,000 units by the end of 2023 "wouldn't be a problem." This statement reflected not just confidence, but what appeared to be a well-developed operational plan supported by manufacturing partnerships and distribution networks. Within months, executives escalated these projections even further, suggesting that millions of additional units would flow into households throughout 2024.

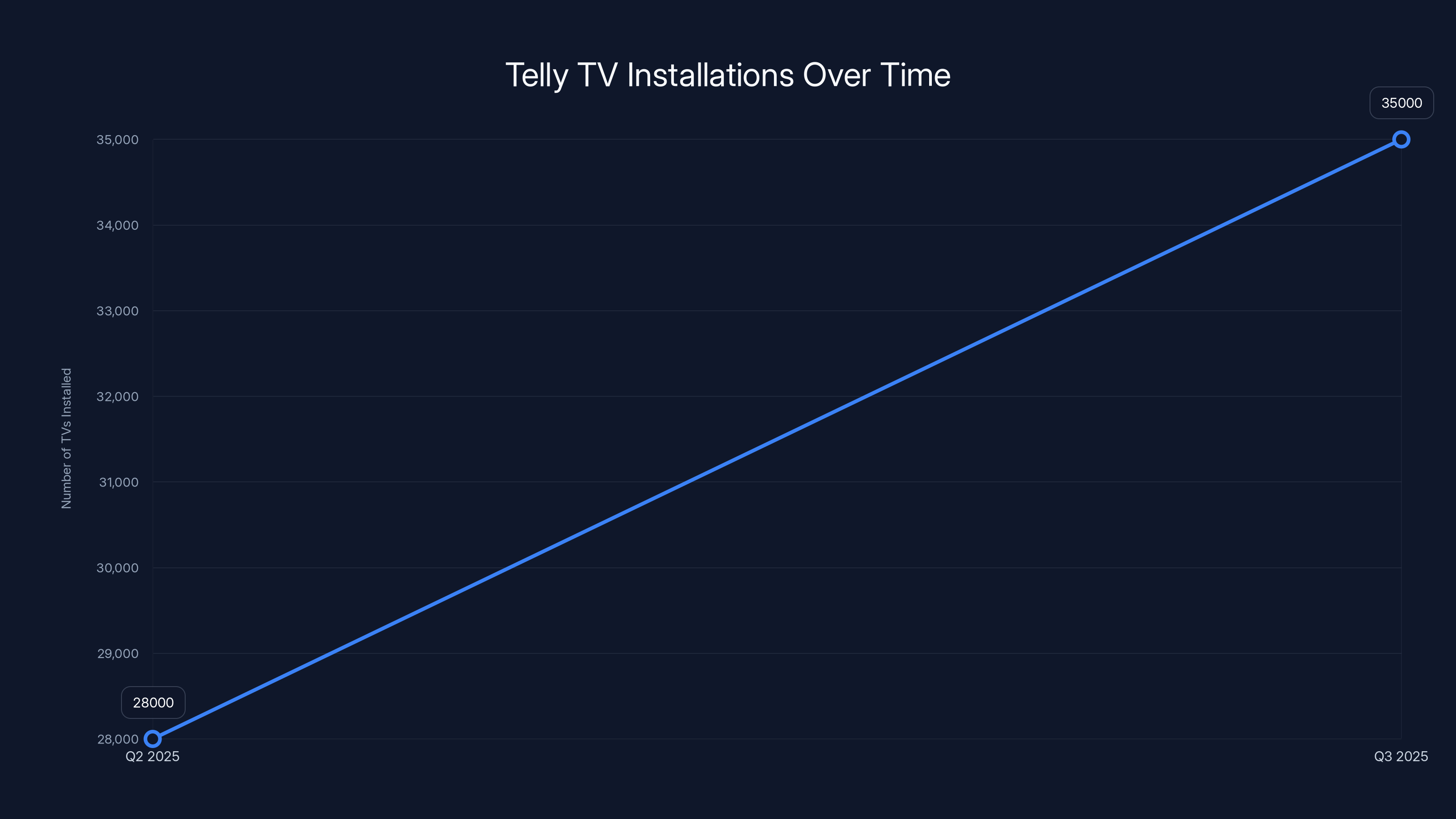

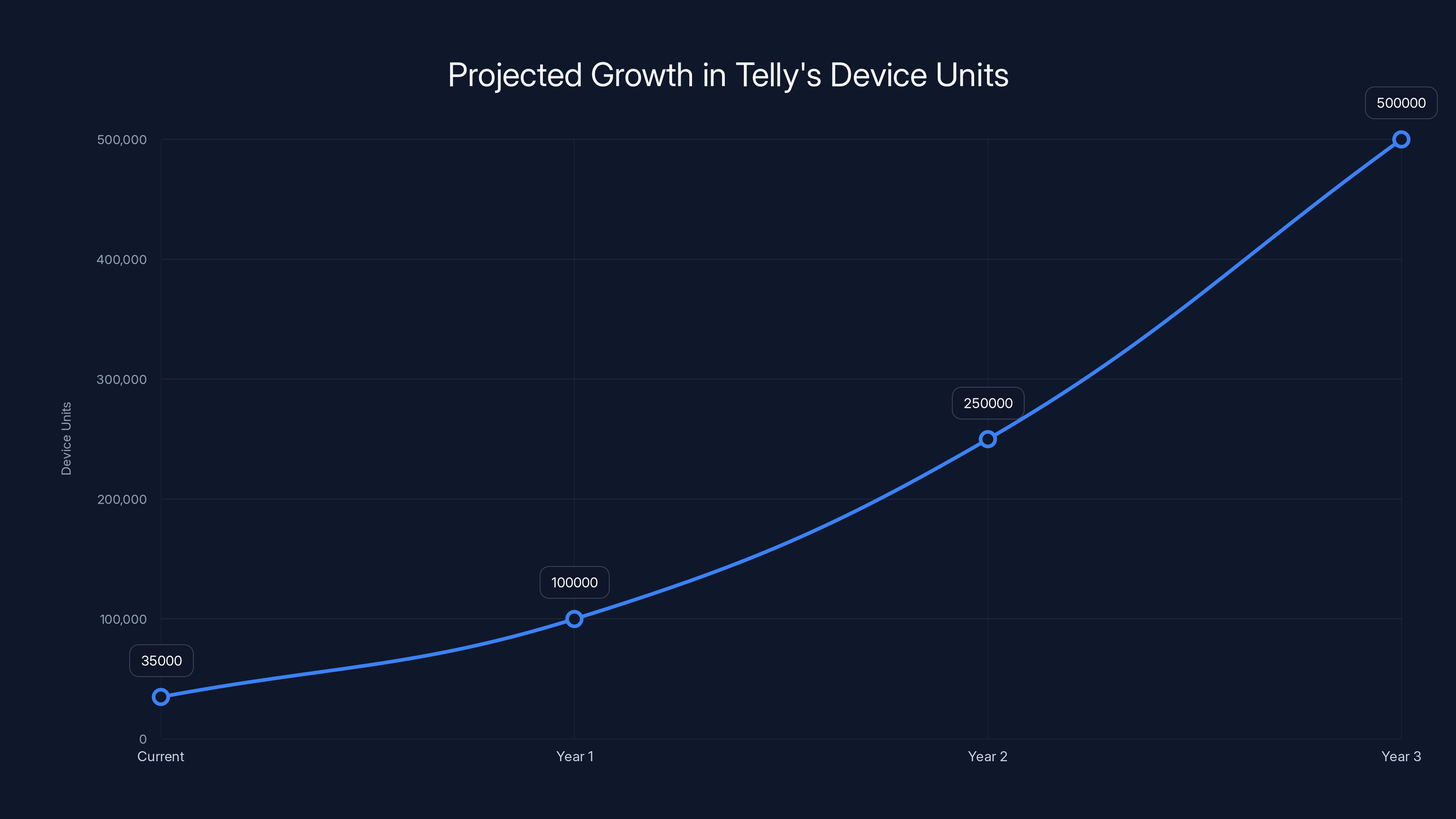

However, the gap between ambitious projections and operational reality has proven to be the defining story of Telly's first two years. By the fall of 2025—over two years after the company's initial launch—a confidential investor update revealed that Telly had managed to place just 35,000 television sets in consumers' homes. This number represents roughly 7% of the half-million units promised for 2023 alone. The revelation sparked important questions about the viability of the hardware-as-advertising-platform model, the challenges of manufacturing and logistics at scale, and whether even well-funded startups can overcome the inherent difficulties of producing physical goods.

The Telly situation illuminates several crucial business and operational realities that extend far beyond one company's challenges. It demonstrates the enormous gap between startup projections and execution timelines in the hardware space. It showcases the hidden costs and operational complexities of distributing physical products directly to consumers. Perhaps most significantly, it reveals important truths about how advertising-supported business models work when applied to expensive consumer hardware, and what revenue metrics actually matter when monetizing engaged users in their living rooms.

Understanding Telly's Core Value Proposition

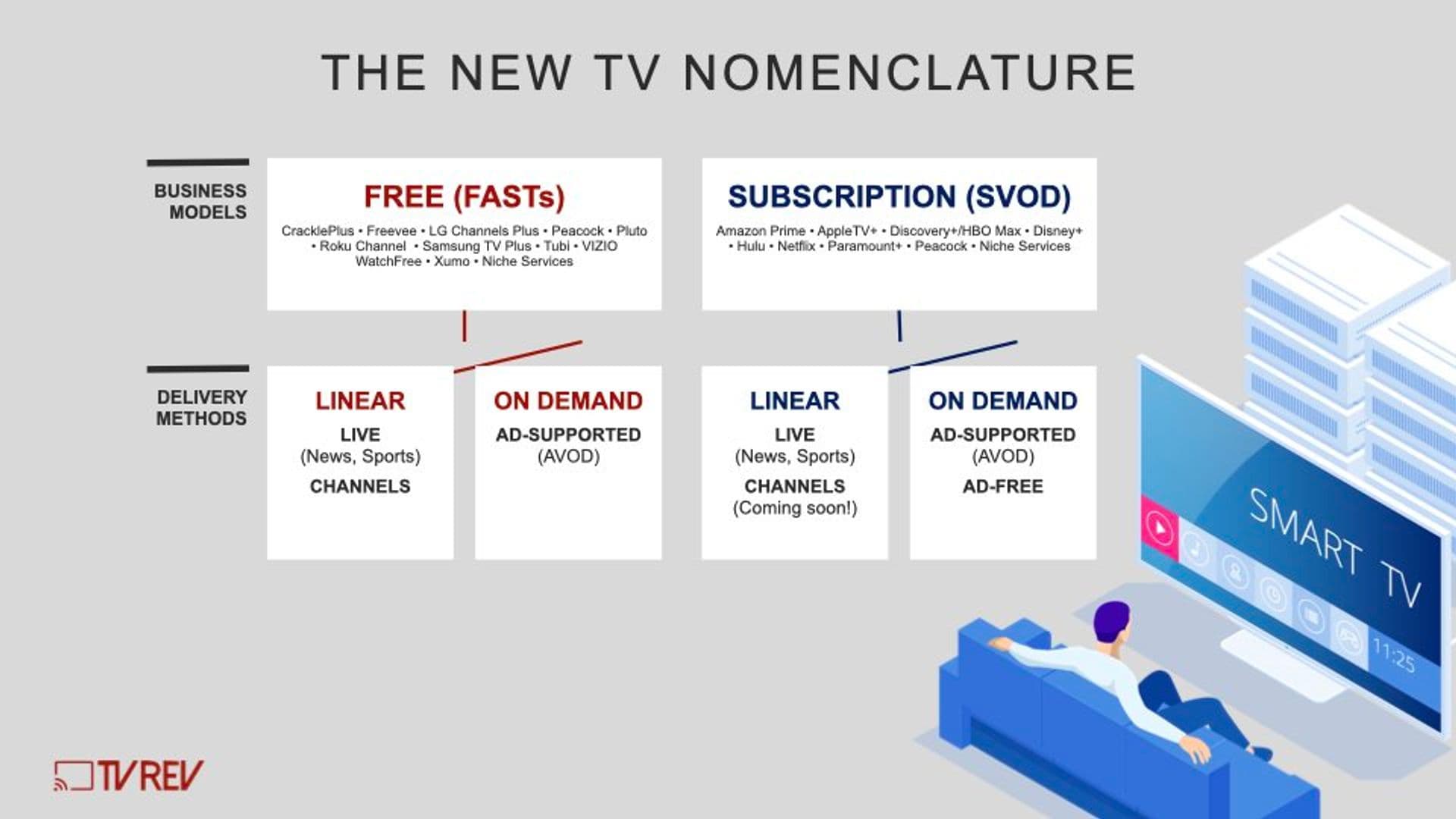

The Ad-Supported TV Model Explained

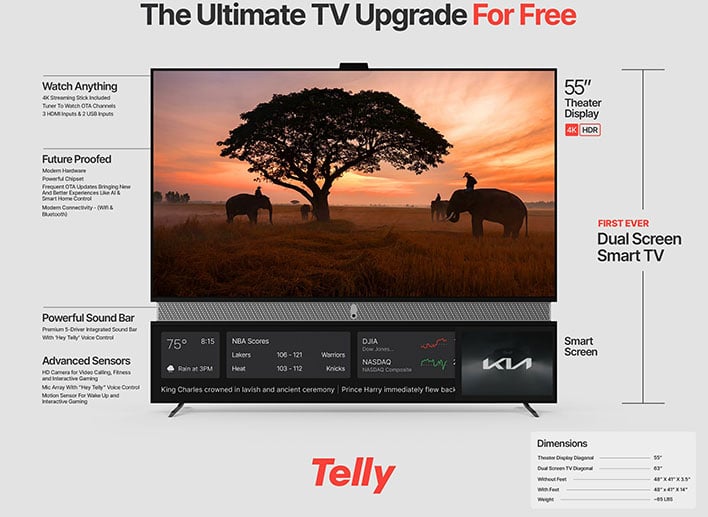

Telly's fundamental concept centers on creating an advertising-supported television experience that fundamentally differs from traditional smart TVs and streaming devices. Rather than requiring consumers to purchase a television outright—a capital expenditure that typically ranges from

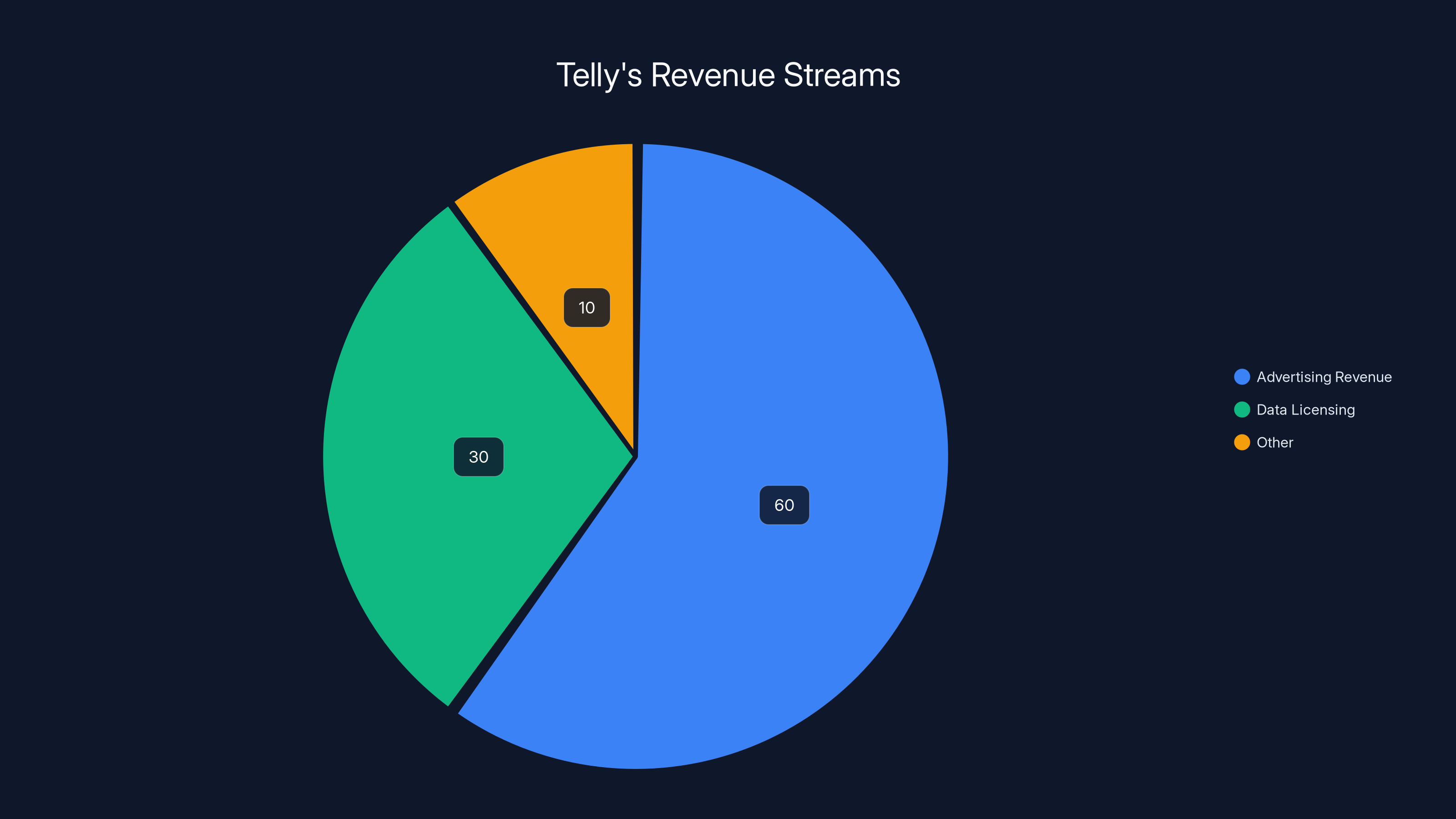

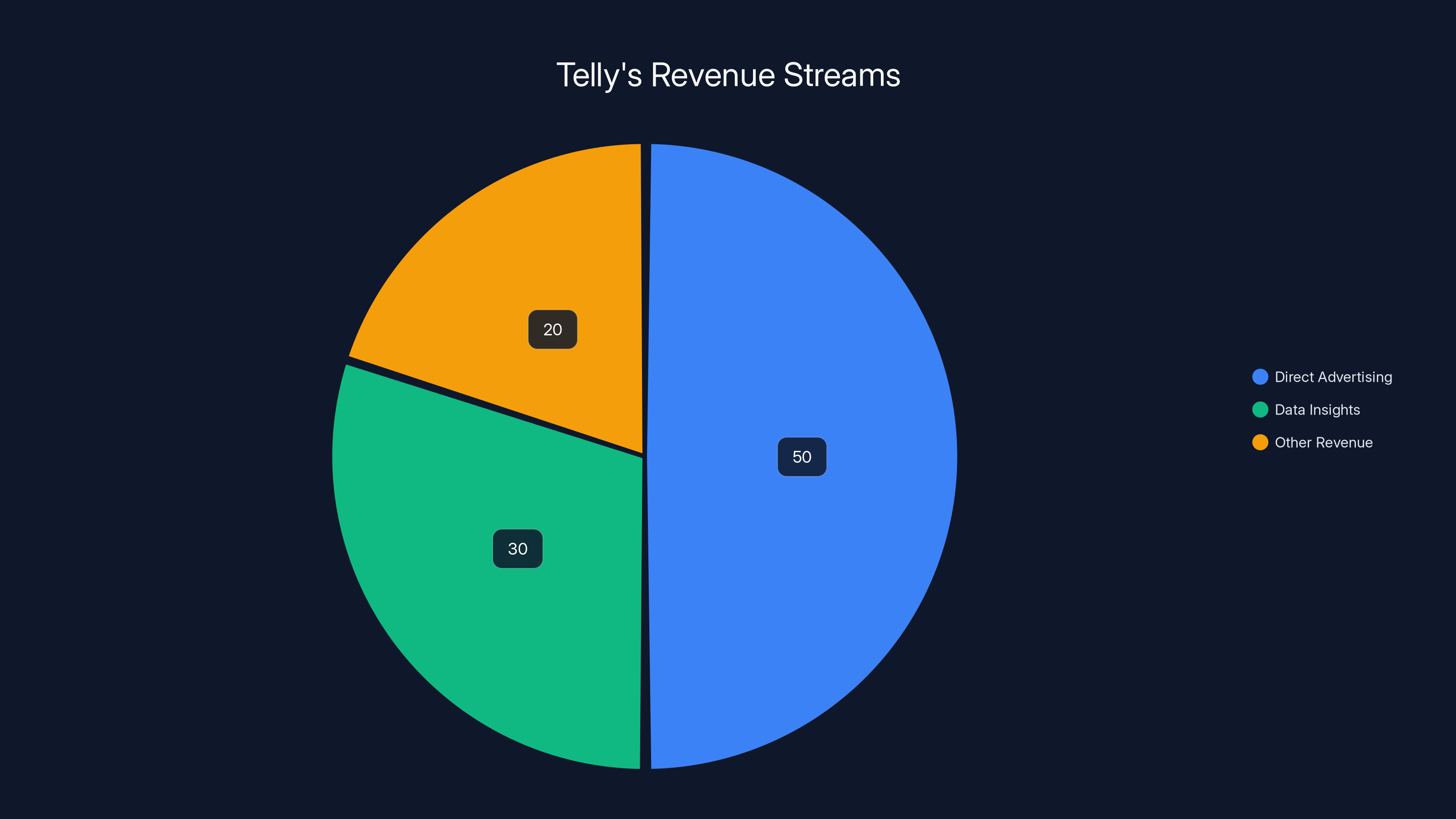

The company generates revenue through two interconnected revenue streams. First, advertisements displayed on the secondary screen beneath the main television provide direct advertising revenue from brands seeking to reach engaged audiences in the living room environment. Second, data collection and user engagement metrics create opportunities for data licensing and partnership agreements with content providers and advertisers who want insights into viewing patterns and user preferences. The model assumes that the lifetime value of advertising and data revenue from each television will substantially exceed the manufacturing, distribution, and support costs of the hardware itself.

Telly's secondary screen technology represents the company's primary innovation differentiator. This always-visible display—positioned below the main television's soundbar—constantly shows advertising content, sports scores, news headlines, weather information, and various widgets. Unlike banner ads on websites or pre-roll ads on streaming services, this screen remains persistently visible throughout the viewing experience, creating what media buyers call "continuous engagement opportunity." The company also integrated a voice assistant, built-in camera for video calls, and motion-sensor capabilities for interactive gaming experiences, creating multiple engagement touchpoints beyond passive advertising.

The 2023 Launch and Initial Reception

When Telly announced its consumer preorder program in mid-2023, the response exceeded the company's own expectations in some ways while falling short in others. The company reported receiving 250,000 preorders, suggesting that the concept had genuine consumer appeal. Many consumers saw the offer as a pragmatic solution to a real problem—the high upfront cost of television ownership—and appreciated not having to commit capital to new hardware. Tech enthusiasts and early adopters were intrigued by the novel approach to monetization and the opportunities for the secondary screen's interactive features.

This enthusiastic response validated the company's core hypothesis that consumers would accept advertising in exchange for hardware cost elimination. The preorder numbers also provided concrete evidence to present to investors and potential advertising partners, demonstrating that the addressable market existed and that consumers would actually engage with the offer. However, these preorder numbers would soon reveal themselves to be a misleading proxy for actual commercial viability—a common pattern in direct-to-consumer hardware ventures where enthusiasm for a novel concept significantly exceeds the market's actual purchasing intent when fulfillment becomes reality.

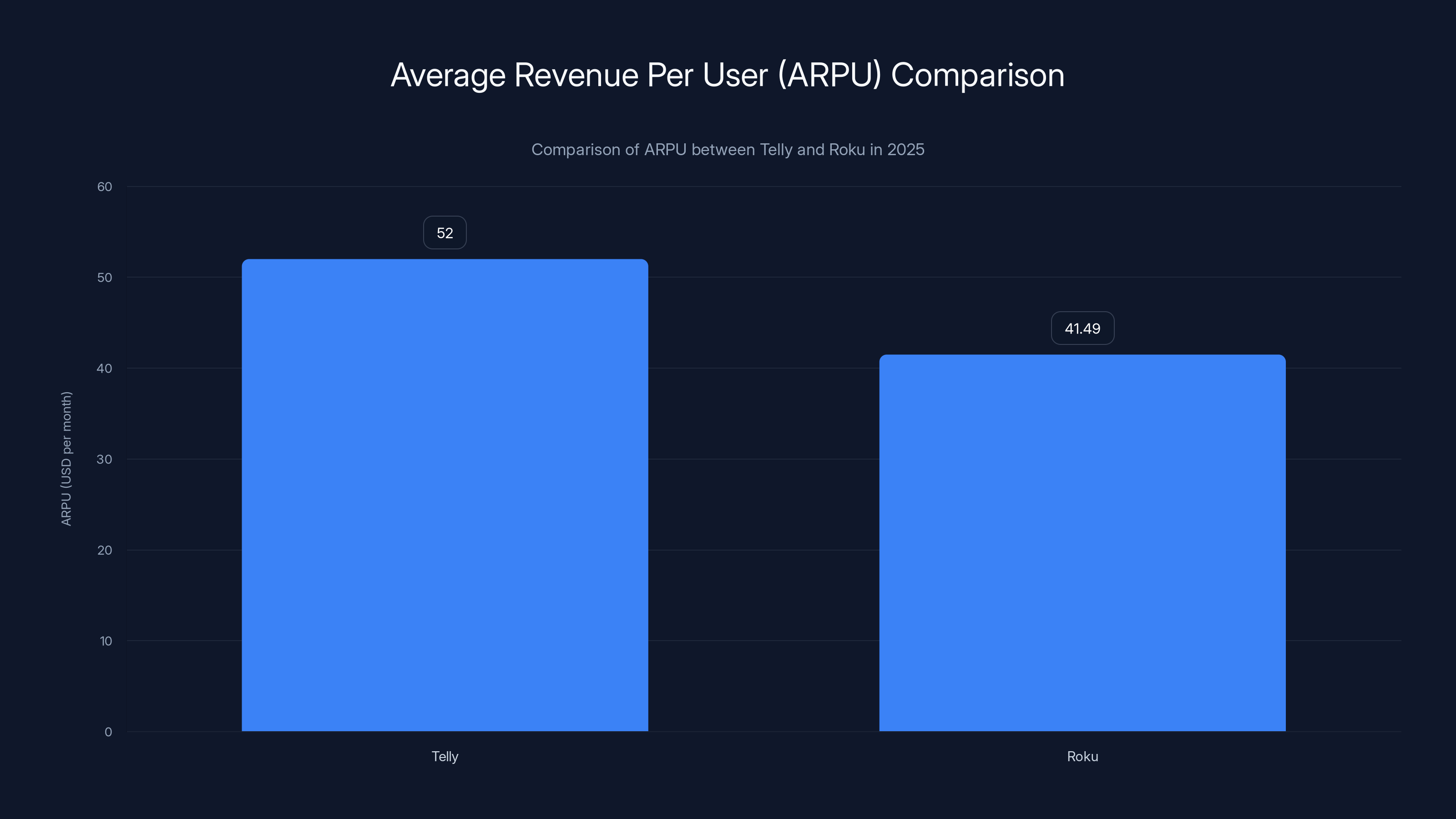

Telly's monthly ARPU of

The Manufacturing and Supply Chain Reality

Foxconn Partnership and Production Challenges

Telly's partnership with Foxconn, one of the world's largest electronics manufacturing companies, represented a significant validation of the company's technical feasibility. Foxconn's expertise in manufacturing consumer electronics at scale—developed through decades of producing iPhones, iPads, and other complex consumer devices—suggested that Telly had secured genuine manufacturing capability. However, the partnership also revealed the fundamental challenge facing any startup attempting to disrupt the hardware industry: manufacturing scale and inventory management are extraordinarily complex disciplines.

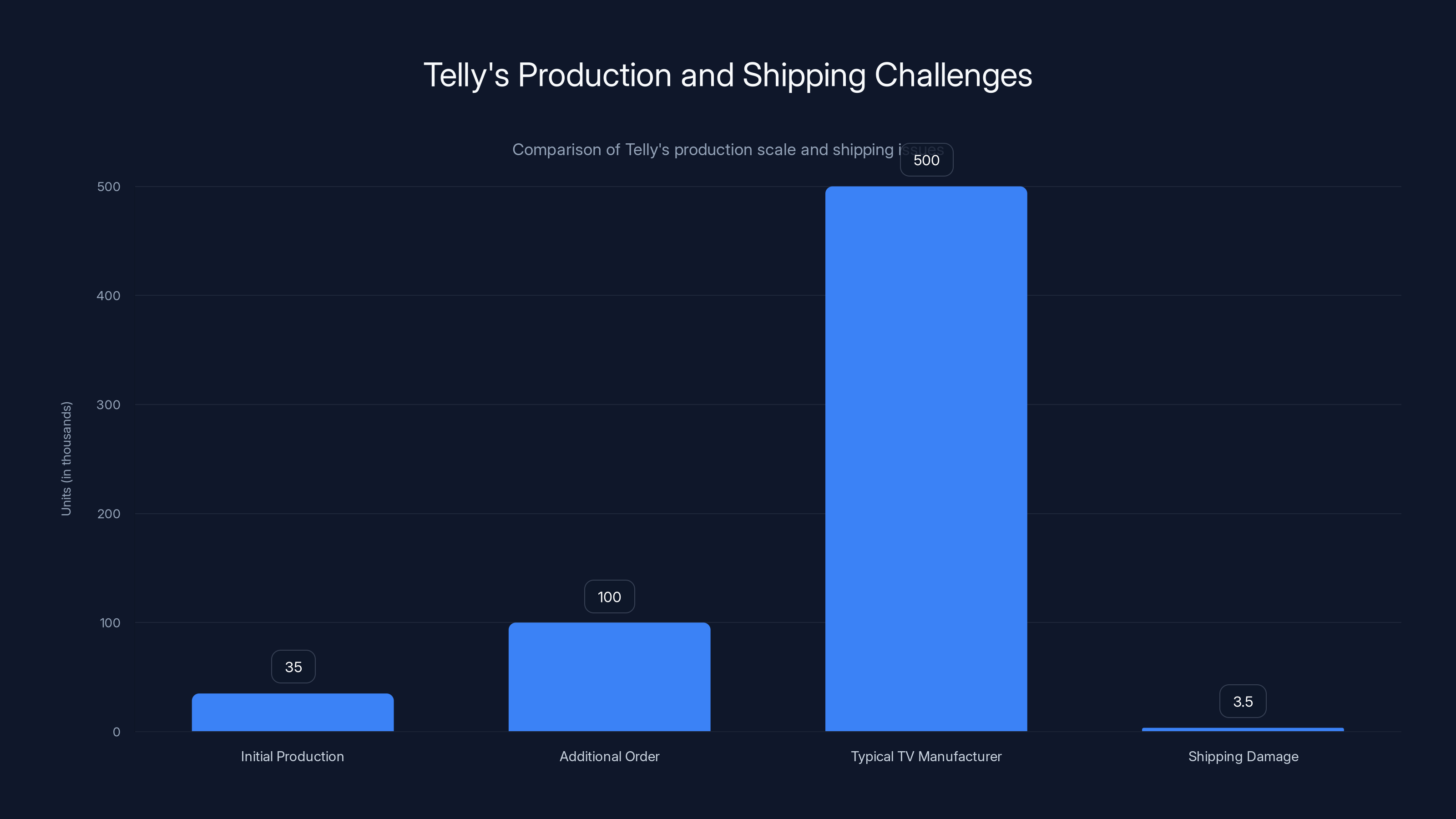

Producing 35,000 television units over approximately 18 months represents a relatively modest output by Foxconn standards. A factory producing iPhones might manufacture millions of units in the same timeframe. This mismatch between Telly's demand and Foxconn's optimization for massive-scale production creates inefficiencies at multiple levels. Setup costs per unit remain high when production volumes are low. Quality control processes designed for millions of units can be suboptimal for smaller quantities. Logistics coordination becomes more complex when dealing with smaller order volumes.

The company's decision to order an additional 100,000 units from Foxconn in late 2025 signals confidence in eventual scaling, but also suggests that the company is still in early production phases. Most established television manufacturers operate with inventory turnover measured in weeks, shipping hundreds of thousands of units annually. Telly's production timeline indicates that even with major manufacturing partnership support, scaling from 35,000 to meaningful national distribution remains a multi-year undertaking.

The Shipping and Damage Crisis

One of the most revealing statistics from Telly's investor update was the disclosure that approximately 10% of units shipped via FedEx arrived at consumers' homes damaged. This represents an extraordinarily high damage rate that suggests fundamental problems with packaging, handling procedures, or the logistics partner's operational capability. For context, typical damage rates for electronics shipped via parcel carrier range from 1-3%, with well-optimized processes achieving rates below 1%. A 10% damage rate indicates that roughly one in ten customers received a broken television on arrival—a scenario that creates immediate negative sentiment and requires expensive replacement logistics.

The implications extend far beyond the simple replacement cost. Each damaged unit represents a failure point in the customer acquisition funnel. A consumer who receives a broken television has already experienced disappointment and inconvenience, creating a negative impression of the brand before any positive experiences with the product could develop. The replacement process requires additional shipping, extends the time until the customer receives a functioning device, and creates operational overhead for customer service teams. Some customers reported that replacement units also arrived damaged, compounding frustration and potentially leading to permanent customer loss.

Telly's shift to RXO, a logistics partner also used by Samsung for television delivery and installation, indicates a strategic decision to optimize for quality over cost. RXO's model typically includes delivery appointment scheduling and in-home setup verification, reducing damage rates and improving customer experience quality. This operational shift likely increased per-unit delivery costs but substantially decreased customer acquisition friction. The company's willingness to switch logistics partners demonstrates recognition that unit economics in the direct-to-consumer hardware space include significant customer service and replacement overhead that must be factored into profitability calculations.

Telly's TV installations grew from 28,000 in Q2 2025 to 35,000 in Q3 2025, reflecting a gradual increase despite initial projections of 500,000 by end of 2023.

Financial Realities and Unit Economics

Revenue Generation Per Device

Telly's disclosure that it generated

For comparison, Roku, one of the largest streaming device manufacturers and a heavily advertising-dependent platform, achieved average revenue per user of

This ARPU calculation illuminates the fundamental business model viability question: can the revenue per device justify the hardware costs? Contemporary television manufacturing costs for a 55-inch display-quality screen with integrated smart TV functionality, secondary display, voice assistant, and camera system likely exceed

Capital Requirements and Debt Financing

Telly's two recent debt funding rounds totaling

The debt financing approach suggests several important realities. First, the company has been unable to generate sufficient cash flow from operations to fund its growth trajectory. Second, the company has likely exhausted or heavily drawn upon its equity funding from venture capital investors, necessitating alternative capital sources. Third, debt holders have concluded that the business model has sufficient revenue visibility to justify lending $350 million, indicating confidence in the company's ability to service debt obligations through advertising revenue growth. However, debt obligations also create inflexibility—the company must hit revenue targets to service interest payments regardless of market conditions or strategic pivots.

This capital structure differs fundamentally from venture-backed startups that can sustain losses for extended periods while pursuing growth and market share. Telly must balance growth investment with profitability requirements to service $350 million in debt. This creates operational constraints that may limit the company's ability to sustain the aggressive growth investments that other well-funded startups could pursue.

The Gap Between Projections and Execution

From 500,000 Unit Projections to 35,000 Reality

The disparity between Telly's initial projections and actual results reveals profound misunderstandings about hardware manufacturing timelines, consumer demand translation, and operational scaling. When company executives told industry publications in May 2023 that shipping 500,000 units by year-end "wouldn't be a problem," they were presumably drawing upon manufacturing commitments from Foxconn and demand signals from preorder numbers. However, this projection failed to account for several critical variables that ultimately constrained actual production.

First, preorders don't automatically convert to fulfilled shipments at the stated timeline. Customers place preorders with expectations about delivery dates, but manufacturing delays, supply chain disruptions, and logistics constraints frequently extend these timelines. Between May 2023 (when the 500,000 unit projection was made) and the end of that year, supply chain circumstances changed significantly. Electronics manufacturers faced semiconductor availability fluctuations, shipping capacity constraints, and labor market challenges. A 500,000-unit order for a startup brand would necessarily be queued behind established manufacturers with existing relationships and larger volumes.

Second, the path from preorder to installed device involves numerous failure points where orders are abandoned. Some customers may have canceled preorders due to extended timelines. Others experienced financial changes during multi-month waits. Damage in shipment, as previously discussed, caused some customers to reject delivery or experience returns. Each of these failure points reduced the number of preorders that converted to active, functioning devices in homes.

Third, manufacturing capacity is constrained by equipment, labor, and logistics infrastructure. Even with Foxconn's capability, scaling from zero to 500,000 units annually requires significant manufacturing facility allocation, which competes with Foxconn's commitments to established customers. The company would have needed to negotiate specific production capacity allocation and likely pay premium pricing for rapid scaling, reducing unit economics or requiring higher capital investment.

Timeline Extensions and Recalibrated Expectations

By late 2025—approximately 2.5 years after the initial 500,000-unit projection—Telly had achieved roughly 35,000 units in people's homes. This represents a compound execution rate of approximately 1,400 units per month, dramatically below the rate required to hit original targets. The company's public statements evolved accordingly. Rather than doubling down on aggressive growth targets, Telly's leadership adopted a more measured tone while emphasizing the high quality of revenue generation from engaged users.

CEO Ilya Pozin acknowledged the complexity of hardware manufacturing in September 2024 podcast commentary, rejecting the narrative that "hardware is hard" while simultaneously acknowledging the challenges of scaling production. This rhetorical positioning attempts to distinguish between the fundamental possibility of hardware manufacturing (demonstrated by Apple, Google, and Tesla) and the specific operational challenges faced by Telly's execution. However, this distinction conflates different categories of challenges. Apple's massive manufacturing advantage derives from decades of optimization, massive order volumes that justify dedicated production lines, and extraordinary brand equity that enables component suppliers to allocate capacity priority. Telly faces none of these advantages.

Telly's primary revenue comes from advertising (60%) and data licensing (30%), with a smaller portion from other sources. Estimated data.

Market Positioning and Competitive Landscape

The Advertising-Supported Hardware Precedent

Telly's business model isn't entirely novel—it draws inspiration from several successful precedents in technology history, though none have been directly applied to televisions at scale. Amazon's subsidized Kindle device strategy offers one useful parallel. The company accepts minimal or negative margins on hardware in specific markets to drive ecosystem adoption and establish long-term customer relationships where higher-margin services (digital content sales, Prime membership) generate lifetime value far exceeding initial hardware investment.

Mobile phone manufacturers similarly subsidized handsets through carrier arrangements, with carriers absorbing hardware costs in exchange for long-term service commitments. This model proved extraordinarily successful in expanding smartphone adoption but operated within a framework where carriers had recurring subscription revenue (cellular service) to justify hardware subsidies.

Telly's unique challenge is that it lacks an analogous recurring revenue relationship beyond advertising. Consumers don't pay Telly a monthly subscription, and the company can't easily force customers to upgrade to new models as frequently as phone or computer manufacturers. This means the $22 million annual revenue must justify not just the cost of acquiring a customer (the hardware and distribution cost) but also account for a limited engagement lifecycle before the device becomes obsolete.

Competitive Alternatives in the Smart TV Market

Telly competes within a broader smart television ecosystem characterized by increasing advertising integration and data monetization. Traditional television manufacturers like Samsung, LG, and TCL have aggressively expanded advertising and content partnership features built into their smart TV platforms. These manufacturers charge customers for the hardware while simultaneously selling advertising access, creating dual revenue streams. Their competitive advantages include brand recognition, established retail distribution, and proprietary display technologies developed through decades of manufacturing.

Streaming device manufacturers like Roku, Amazon (Fire TV), and Google (Chromecast) have built massive advertising businesses around relatively inexpensive hardware that consumers own and control. These devices serve as gateways to streaming content but don't attempt to control the full television experience. They accept fragmentation across different manufacturers' hardware but gain reach through this distribution model.

For teams evaluating cost-effective alternatives to expensive smart TV hardware, platforms like Runable offer AI-powered automation capabilities that can streamline content creation and deployment workflows. While Runable operates in a different product category focused on workflow automation rather than consumer hardware, it represents the broader trend toward platforms that reduce operational friction and capital requirements through software-based solutions rather than hardware subsidies.

Consumer Experience and Adoption Factors

The Secondary Screen Value Proposition

Telly's secondary screen represents both the company's primary innovation and a point of consumer uncertainty about long-term engagement. The always-visible advertising display theoretically provides higher engagement than banner ads or interstitial content on streaming services, but it also creates an unconventional user interface paradigm that consumers must adapt to. Unlike traditional television remotes or even smart TV interfaces, the secondary screen requires consumers to learn new interaction patterns and adjust expectations about information hierarchy.

The success of this design depends on whether Telly can populate the secondary screen with genuinely useful or entertaining content that feels complementary to the main television experience rather than distraction. Early adopter feedback from Reddit and technology forums suggests mixed results. Some users appreciate the sports scores and news ticker functionality during sporting events or news broadcasts. Others find the persistent advertising distracting or annoying, particularly when the secondary screen displays ads for products or services irrelevant to current content or personal interests.

This early feedback pattern resembles the initial consumer response to web advertising generally—novelty and mild interest from early adopters, followed by fatigue and banner blindness as advertising becomes ambient and expected. Telly faces the additional challenge that television watching is often a low-engagement activity where users prefer not to process additional information. Readers actively seek information from websites or social media, but television viewers frequently choose the medium specifically to reduce cognitive demands.

Adoption Curves and Churn Considerations

With only 35,000 devices in homes after two years, Telly remains in the early adoption phase of a hypothetical growth curve. The company has successfully attracted technology enthusiasts and early adopters willing to accept unconventional interfaces and experimental features in exchange for free premium hardware. This represents the first segment of any new technology adoption curve, typically comprising 2-3% of a potential market.

The next phase of adoption—early majority—requires broadening appeal beyond enthusiast audiences to mainstream consumers. This transition typically requires improvements in user experience, better content ecosystem integration, reduced friction in acquisition processes, and demonstrated reliability over time. Telly's experience with high shipping damage rates, logistics complications, and mixed consumer feedback suggests that the company is still addressing basic execution requirements before reaching early majority adoption.

Historical precedent suggests that consumer hardware adoption accelerates once a few key conditions are met: the value proposition becomes demonstrable through friend and family networks rather than requiring marketing explanation, the product category achieves cultural presence through media coverage and word-of-mouth, and perceived quality reaches a threshold where recommendations shift from "interesting experiment" to "actually good." Telly has achieved some elements of the first condition but hasn't yet generated the self-reinforcing adoption dynamics that characterize successful consumer hardware transitions.

Estimated data suggests that direct advertising accounts for 50% of Telly's revenue, while data insights contribute 30%, highlighting the importance of data monetization in their business model.

Operational and Logistical Complexity

Direct-to-Consumer Distribution Model Challenges

Telly's decision to bypass traditional retail channels and ship directly to consumers represents both a deliberate strategic choice and a source of significant operational complexity. The direct model theoretically maximizes margin by eliminating retailer markups and provides direct customer relationships that enable feedback and data collection. However, it also concentrates operational responsibility entirely on Telly's team and creates numerous failure points where execution problems directly impact customer experience.

Traditional television retailers manage incoming inventory, handle logistics coordination, manage returns, and provide local customer support. Manufacturers can focus on production and wholesale delivery without managing individual consumer transactions. Telly's direct model inverts this responsibility structure, requiring the company to manage every aspect of the consumer experience—packaging, logistics coordination, damage liability, returns processing, and customer support.

The initial 10% damage rate via FedEx represents one manifestation of this complexity. Retail-channel manufacturers ship larger consolidated shipments to distribution centers where professional handlers manage consolidation, staging, and local delivery coordination. Telly's model requires individual consumer addresses to be shipped directly from manufacturing facilities, often with imperfect packaging optimization. Each shipment becomes a separate logistics transaction requiring individual tracking, damage assessment, and potential replacement coordination.

Inventory Management and Demand Forecasting

Managing inventory for a startup hardware product with limited demand forecasting history represents a significant operational challenge. Too much inventory creates storage costs and obsolescence risk if product iterations or design changes become necessary. Too little inventory limits growth potential and frustrates consumers expecting rapid delivery. Traditional consumer electronics manufacturers have decades of demand forecasting data and sophisticated inventory management systems that optimize across multiple regional distribution centers.

Telly operates without this historical data and must make inventory decisions based on limited customer transaction history. The decision to order 100,000 additional units from Foxconn in late 2025 represents a significant bet on demand acceleration. If the company can successfully scale distribution and customer acquisition, this inventory becomes valuable capital deployed toward growth. If demand plateaus or declines, the company faces carrying costs and potential obsolescence as product iterations become necessary.

This inventory decision also reveals important information about the company's financial confidence and debt covenants. Ordering 100,000 units likely requires capital commitment or inventory financing arrangements. The company must believe revenue growth trajectories support this inventory investment to service debt obligations and maintain positive cash flow.

Advertising Ecosystem and Monetization

Building the Ad Marketplace

Telly's core revenue generation depends on building a functioning advertising marketplace where brands understand the value proposition and allocate media budgets to reach Telly's audience. This requires establishing several interconnected capabilities: audience measurement and verification, brand safety frameworks, ad targeting and optimization, and pricing models that align value with advertiser expectations.

With only 35,000 devices in homes, Telly operates at a scale where traditional advertising measurement methodologies—which typically require 100,000+ users to generate statistically reliable data—become problematic. Advertisers using traditional media buying frameworks expect geographic distribution, demographic targeting, and audience behavior data that becomes meaningful only at scale. Telly's small user base creates challenges in demonstrating value to mainstream brand advertisers accustomed to campaigns reaching millions of people.

The company has likely positioned itself with direct-response advertisers and performance-focused brands that accept smaller audiences if engagement metrics are sufficiently compelling. Direct-response advertising, often focused on product acquisition and immediate sales rather than brand awareness, typically accepts narrower audiences if cost-per-action metrics justify spending. Telly's ARPU of $52/month suggests that advertisers are finding sufficient value at current pricing to justify ongoing allocation.

Data and Insights Revenue Potential

Beyond direct advertising sales, Telly's revenue likely includes fees for data insights and audience characteristics that content providers, advertisers, and media planners value for campaign development and market research. The built-in camera and motion sensors enable behavioral data collection—viewing patterns, engagement with secondary screen content, interactive features utilization—that provides valuable information about television consumption habits. This data can command premium rates when aggregated and analyzed to identify consumption patterns, brand affinity, content preferences, and household characteristics.

The television consumption data market has proven valuable in other contexts. Nielsen, for decades the primary television measurement company, built a business worth billions by collecting and analyzing television viewing patterns. Streaming companies like Netflix, Amazon, and Disney collect similar data through their platforms. Telly's potential to build a new data platform on top of television consumption patterns represents a long-term business opportunity distinct from advertising.

However, data monetization requires scale to become meaningful. A few thousand households generate insufficient data volume for reliable pattern analysis. Scale to hundreds of thousands or millions of households transforms data from curiosity to actionable business intelligence. Telly currently operates in the range where data collection is feasible but data insights remain limited in scope and credibility.

Telly aims to scale from 35,000 to 500,000 units over three years, requiring significant manufacturing and distribution expansion. (Estimated data)

Technology and Product Innovation

Voice Assistant and Interactive Features

Telly's integration of voice assistant capabilities represents an attempt to create engagement beyond passive television watching. The voice interface theoretically enables consumers to control television functions, search for content, and interact with the secondary screen without traditional remote controls. Early smart speaker adoption demonstrated that voice interfaces can create new interaction paradigms, though smart TV voice integration has proven less transformative than standalone speakers like Amazon Echo or Google Home.

The built-in camera enables video calling functionality and motion-based gaming experiences. These features create differentiation compared to traditional smart TVs, but they also raise privacy concerns that may limit adoption. Cameras in living rooms represent significant privacy implications, and consumer hesitation about always-available cameras has slowed adoption of camera-equipped smart TVs despite potential benefits. Telly's marketing would need to substantially emphasize privacy protections and user control to overcome this adoption barrier.

Secondary Display Technology Advancement

The persistent secondary screen below the main television represents genuine technological innovation and manufacturing complexity. Integrating an additional display with independent content delivery, the main television interface, and advertising ecosystem requires sophisticated engineering across display technology, software integration, content delivery, and power management. The secondary screen must remain responsive and properly updated regardless of the main television's state, adding complexity to the overall system architecture.

Over time, this secondary display technology could evolve into genuinely valuable consumer experiences. Imagine the secondary screen displaying contextual information about television programs—cast information during movies, statistics and real-time data during sports broadcasts, recipe ingredients during cooking shows. However, current implementations appear focused primarily on advertising with some widget content, limiting perceived consumer value.

Market Forces and Industry Dynamics

The Broader Smart TV Evolution

Telly enters a television market characterized by commoditization and shrinking profit margins. The primary television manufacturers—Samsung, LG, TCL, Hisense, and others—compete primarily on price and feature parity. Profit margins have compressed as consumers increasingly view televisions as commodity items with limited differentiation. This commoditization created the opportunity for Telly's ad-supported model—if manufacturers are struggling to maintain profitability through hardware sales alone, advertising-supported models become more attractive.

Simultaneously, television content has shifted substantially toward streaming delivery, reducing the importance of the television device's built-in tuner or content curation functions. Smart TV software has become increasingly standardized, with most television manufacturers running variants of Android TV, Google TV, or proprietary systems based on similar underlying technology. This standardization reduces the manufacturer's ability to create distinctive experiences and increases competition on price and screen quality alone.

Telly's arrival during this period of commoditization is opportune—the company avoids competing in a race-to-the-bottom price environment that favors scale and manufacturing efficiency. By inverting the unit economics (negative hardware margin offset by high advertising revenue), Telly attempts to escape the commoditization trap. However, this also limits the company's potential market size to consumers willing to accept advertising in exchange for hardware cost elimination.

Shifting Consumer Preferences and Ad Fatigue

Consumer response to advertising has shifted dramatically in recent years, with growing adoption of ad-blocking technologies, subscription services explicitly advertising "ad-free" experiences, and documented fatigue with programmatic advertising across digital platforms. This broader trend creates headwinds for Telly's model, which depends on consumer tolerance for persistent, inescapable advertising.

Telly's advantage compared to web advertising or streaming ads is the captive nature of the television environment—consumers can't simply install ad blockers on their television hardware or easily skip advertisements as they can with streaming services. However, this advantage is also a disadvantage from the user experience perspective. Consumers who explicitly choose advertising-supported models (like free streaming services with ads) have made a conscious trade-off calculation. Consumers who receive free televisions in exchange for advertising haven't necessarily accepted this bargain as readily, and may experience advertiser fatigue over time as the novelty of free hardware fades.

Telly's initial production of 35,000 units is modest compared to typical manufacturers. An additional order of 100,000 units shows growth potential, but 10% shipping damage rate highlights logistical challenges.

The Path Forward and Scaling Challenges

Required Growth Trajectories and Market Expansion

For Telly to achieve meaningful commercial success, the company must scale dramatically from 35,000 units to hundreds of thousands or millions of active devices. This scale expansion requires solving three interconnected problems simultaneously: manufacturing and supply chain capacity, customer acquisition at scale, and monetization efficiency maintenance.

Manufacturing scale to 500,000+ units annually would require dedicated production line capacity allocation from Foxconn. This commitment typically comes after demonstrated demand signals and prepayment commitments, which Telly may be creating through its additional 100,000-unit order. However, transitioning from 35,000 to 500,000 units annually requires not just increasing manufacturing but also establishing regional distribution capabilities, supply chain redundancy, and quality control scaling.

Customer acquisition at scale requires the company to expand beyond enthusiast early adopters to mainstream consumers. This necessitates presence in retail channels (contrary to the direct model), advertising campaigns that create awareness among non-technical audiences, and partnerships with internet service providers, cable companies, or other distribution channels with direct consumer relationships. Each of these channels represents negotiations with established partners who will demand favorable terms and margins.

Monetization efficiency maintenance means that as the company grows, ARPU must remain near current levels ($52/month) or increase. If the company achieves scale through lower-quality audience segments with reduced advertising engagement or demographic characteristics less valuable to advertisers, ARPU will decline. Maintaining or improving ARPU at scale requires continuing to attract higher-value audience segments or developing more sophisticated data and insights products.

Profitability and Unit Economics at Scale

Even at current ARPU levels, Telly's path to profitability requires achieving certain scale thresholds and controlling operational costs. At

At 35,000 devices, the company generates approximately

At 200,000 devices (roughly 2x current), assuming similar ARPU and contribution margins, the company would generate

Investor Perspective and Capital Dynamics

Risk Assessment and Return Scenarios

Telly's investors face a challenging risk-return calculation. The company's initial equity investors likely invested at valuations based on aggressive growth projections. If initial investors valued the company at

The

For venture investors holding equity, the path to acceptable returns requires either achieving profitability and eventual exit through acquisition by a larger media or technology company, or achieving sufficient scale that the business can be sold to strategic buyers at valuations representing acceptable multiples of current revenue. A 5x revenue multiple (

Exit Scenarios and Strategic Acquisition Potential

Telly's potential acquirers might include traditional television manufacturers seeking to establish advertising platforms (Samsung, LG, TCL), streaming companies wanting television hardware integration (Amazon, Netflix, Disney), technology companies expanding advertising businesses (Google, Meta), or media companies seeking advertising inventory (Comcast, Charter, traditional broadcasters). Each category of acquirer would value Telly differently based on strategic fit and potential synergies.

A consumer electronics manufacturer acquiring Telly could integrate the advertising platform into millions of existing devices, dramatically scaling monetization. A streaming company could combine Telly's hardware with content offerings to create a more integrated ecosystem. An advertising company could leverage Telly's household engagement for broader advertising portfolio enhancement. Each acquisition scenario would justify different valuations and terms.

However, acquisition probability at meaningful valuation requires Telly to demonstrate significantly higher scale, more predictable unit economics, and lower execution risk than the company currently demonstrates. At 35,000 units with acknowledged scaling challenges, Telly remains too small and uncertain for most strategic acquirers to justify premium acquisition prices.

Lessons and Broader Implications

Hardware as a Capital-Intensive Business Model

Telly's experience reinforces fundamental lessons about hardware businesses that entrepreneurs and investors frequently underestimate. Even with significant capital backing, manufacturing partnerships with sophisticated suppliers like Foxconn, and a functioning business model that generates meaningful ARPU, scaling hardware to national or global distribution requires years of execution and massive capital deployment.

The gap between Telly's projections and actual results reflects not management incompetence but rather the enormous complexity of hardware manufacturing, logistics, quality control, and customer acquisition at scale. Every successful hardware company—Apple, Samsung, Dell, Tesla—required years to achieve meaningful production scale. Telly's 35,000 units after two years, while disappointing against initial projections, isn't dramatically off the pace of other hardware startups in their early phases.

The critical difference is that venture capital and debt markets have become less tolerant of extended time-to-profitability than in earlier eras. Companies that require 5-10 years to reach meaningful profitability and break-even scale increasingly face investor pressure to demonstrate results within 2-3 year timeframes. Telly's trajectory illustrates this tension between hardware business fundamentals and modern capital market expectations.

The Economics of Free Hardware Distribution

Telly's model demonstrates both the appeal and limitations of offering hardware for free in exchange for advertising engagement or data. The appeal is undeniable—consumers clearly value free premium hardware even when it includes advertising. The limitations reveal themselves in the difficulty of building sustainable business models on advertising alone, without underlying recurring revenue like cellular service or subscription fees.

Future companies pursuing similar hardware-as-ad-platform models might learn from Telly's experience that dual monetization (advertising plus subscription or service fees) may be necessary to achieve break-even at reasonable scale. Alternatively, companies might pursue narrower target markets or specific use cases where advertising or data monetization aligns more naturally with consumer preferences and usage patterns.

FAQ

What is Telly's business model exactly?

Telly offers free television sets to consumers in exchange for exposure to advertisements displayed on a secondary screen beneath the main TV. The company generates revenue through advertising sales on this persistent display and through data insights about viewing patterns and consumer preferences. Consumers receive high-quality hardware without upfront payment, while Telly monetizes the advertising space and user engagement data collected from millions of households.

How many Telly TVs are actually in homes right now?

As of Q3 2025, Telly had placed approximately 35,000 television sets in consumers' homes. This number increased from 28,000 in the previous quarter, indicating gradual growth but substantially below the company's initial projections of 500,000 units by the end of 2023. The relatively modest installation base reflects manufacturing scaling challenges, logistics complications, and the time required to achieve consumer hardware distribution at meaningful scale.

Why did Telly miss its initial projections so dramatically?

Several factors contributed to Telly's projection shortfalls. Manufacturing scale from zero to 500,000 units annually is extraordinarily complex, even with established suppliers like Foxconn. Approximately 10% of units shipped via the initial logistics partner arrived damaged, requiring costly replacements and extending customer acquisition timelines. The direct-to-consumer distribution model, while offering margin benefits, created operational complexity that traditional retail channels handle more efficiently. Consumer preorders didn't convert to fulfillment at expected rates due to delivery delays, financial circumstances changes, and product quality concerns.

How much money does each Telly TV make per month?

Based on Telly's Q3 2025 disclosures, each television generates approximately

What is the damage rate problem with Telly TVs?

Telly initially shipped televisions via FedEx with a 10% damage rate—approximately one in ten units arrived broken or defective. This extraordinarily high damage rate reflected packaging inadequacies and logistics handling problems. The company subsequently switched to RXO, a logistics partner also used by Samsung for TV delivery and installation. This new partnership includes delivery appointment coordination and in-home installation verification, significantly reducing damage rates and improving customer experience quality. The initial damage crisis created substantial customer service overhead and negative brand sentiment among early adopters.

Is Telly still manufacturing TVs and expanding?

Yes, Telly continues manufacturing and distributing televisions. In late 2025, the company ordered an additional 100,000 units from manufacturing partner Foxconn, suggesting confidence in demand acceleration and plans for continued scaling. The company also raised $350 million in debt financing to support manufacturing, inventory, distribution, and corporate operations. These signals indicate that despite falling short of initial projections, the company continues pursuing growth and hasn't abandoned its core business model.

What makes Telly different from other smart TVs or streaming devices?

Telly's primary differentiator is the always-visible secondary screen displaying persistent advertising alongside widgets, sports scores, and interactive content. This creates higher advertising engagement compared to traditional streaming ads or smart TV interfaces. The device also includes built-in voice assistant, camera for video calling and motion gaming, and integrated smart TV functionality. However, these features are present in competitive offerings from Samsung, LG, Amazon, and Google, making Telly's core distinction really the free-with-advertising model rather than specific technical capabilities.

Could Telly's model work at massive scale profitably?

At current ARPU levels ($52 monthly), Telly's model could theoretically work profitably at scale, assuming the company reaches 500,000+ devices while maintaining similar per-device economics. However, achieving and maintaining this ARPU at scale requires the company to attract higher-value audience segments, continue building the advertising marketplace, and prevent ARPU erosion that typically accompanies scale in advertising businesses. The company would need to achieve profitability within 8-12 months per device to offset manufacturing and distribution costs before accounting for corporate overhead. Reaching break-even on a corporate basis requires 5-10x current scale under most financial projections.

How does Telly compare to free streaming services with ads?

Telly's model differs fundamentally from ad-supported streaming services like Peacock, Netflix with ads, or Pluto TV. Streaming services generate advertising revenue from content viewers but require consumers to already own television hardware. Telly subsidizes the hardware itself and creates a persistent advertising platform beyond streaming content. This approach generates higher ARPU (

What are alternatives to Telly for budget-conscious consumers?

Consumers seeking budget television options have several alternatives to Telly. Traditional refurbished TVs from manufacturers like Samsung, LG, and TCL offer steep discounts compared to new units. Basic streaming devices like Roku, Fire TV, and Chromecast cost $30-100 and work with existing televisions. Some regional manufacturers offer affordable new TVs at competitive price points. Existing smart TV platforms already include advertising and content partnerships without requiring additional hardware. For teams and businesses requiring automation and content creation tools, platforms like Runable offer cost-effective alternatives to expensive enterprise software, representing a different approach to cost reduction through software efficiency rather than ad-supported hardware.

Will Telly ever achieve the scale it originally projected?

Reaching 500,000 TVs annually would require the company to increase production roughly 15x current rates while maintaining ARPU and managing profitability. This is theoretically possible but would require several years of consistent execution improvements, successful customer acquisition campaigns, and likely expansion into retail channels beyond direct-to-consumer distribution. The company's recent debt financing and additional Foxconn orders suggest management believes significant scaling is achievable, but the timeline likely extends to 2026-2027 rather than the 2023-2024 projections made at launch. Telly faces more fundamental uncertainty about whether the market will ever reach half-million-unit annual demand at profitable economics.

Conclusion: Hardware Disruption Meets Reality

Telly's journey from ambitious startup with bold growth projections to a company with 35,000 installed devices represents an instructive case study in the challenges of hardware innovation and the gap between venture capital ambitions and operational execution. The company arrived with a compelling value proposition—premium television hardware for free in exchange for advertising engagement. The market's initial response suggested genuine consumer interest, with 250,000 preorders demonstrating that the concept resonated beyond tech enthusiast circles.

However, the intervening two years exposed the profound complexity of hardware businesses that entrepreneurs and investors frequently underestimate. Manufacturing scaling, logistics optimization, quality control, customer acquisition, and operational efficiency all present challenges that interact with each other in ways that make aggregate complexity substantially exceed the sum of individual problems. What appears straightforward in product concept and investor presentations reveals itself to be extraordinarily intricate in execution.

Telly's $52 monthly ARPU demonstrates that the core business model functions and generates meaningful revenue. The company has proven that consumers will engage with secondary screen advertising at rates that justify advertising investment, and that persistent advertising displays create engagement opportunities distinct from traditional streaming ad models. These validations suggest that the company's fundamental hypothesis—that advertising-supported television can be a viable business model—isn't wrong in principle.

The company's challenges aren't failures of business model logic but failures of execution speed and operational excellence. Had Telly achieved 100,000 devices by the end of 2024, the narrative would be entirely different. The company would be positioned for scaling with demonstrated manufacturing capability, proven unit economics, and clear path to profitability. Instead, the extended timeline to achieve results raises investor questions about management execution capability and market viability.

Looking forward, Telly faces critical inflection points. The 100,000-unit Foxconn order and $350 million debt financing suggest the company intends to pursue aggressive growth scaling. Success in this endeavor would validate the business model and demonstrate that patient capital and extended timelines can eventually prove hardware disruption concepts viable. Failure to achieve meaningful scaling from this capital base would indicate that the model's limitations outweigh its opportunities.

For broader technology and investment communities, Telly's experience reinforces several important lessons. First, hardware businesses require substantially longer timelines to achieve meaningful scale than software or services businesses, and investor expectations for rapid growth must be recalibrated accordingly. Second, manufacturing partnerships with sophisticated suppliers like Foxconn are necessary but insufficient to solve hardware scaling challenges—the company must also develop capabilities in logistics, quality control, customer acquisition, and operational excellence. Third, business models that depend on monetizing free hardware through advertising face ongoing challenges in consumer acceptance and preference shifts that make long-term revenue sustainability uncertain.

Telly remains an important experiment in television industry disruption and advertising-supported hardware business models. Whether the company successfully scales to meaningful national distribution, achieves profitability at scale, and becomes a durable competitor in the television market remains an open question. The answer will reveal important lessons about whether hardware disruption remains viable in an era of software-dominated technology markets and changing consumer preferences around advertising.

Key Takeaways

- Telly achieved only 35,000 installed devices by Q3 2025, far below the 500,000 units promised for 2023, revealing hardware scaling complexity

- Each Telly TV generates approximately 41.49 but still requiring 8-12 months to offset hardware costs

- 10% shipping damage rate forced the company to switch logistics partners from FedEx to RXO, illustrating direct-to-consumer model challenges

- Telly raised $350 million in debt financing to fund continued manufacturing and distribution, indicating profitability remains years away

- The company's $22 million annual revenue proves the advertising-supported TV model works in principle but scaling requires managing interconnected manufacturing, logistics, customer acquisition, and monetization challenges

- Telly's experience demonstrates that venture capital projections for hardware businesses frequently underestimate timelines and complexity compared to software-based startups

- Alternative platforms pursuing different cost-reduction models provide lessons in how operational efficiency can compete with hardware subsidies as value propositions

Related Articles

- Roku Streaming Stick Free HDMI Extender: Hidden Feature Guide [2025]

- OpenEvidence's $12B Valuation: Why AI Medical Data Matters [2026]

- Luminar's Collapse: Inside Austin Russell's Bankruptcy Battle [2025]

- Emergent Raises $70M Series B: Inside the AI Vibe-Coding Boom [2025]

- Sony TVs Made by TCL: What This Partnership Means for TV Quality [2025]

- Sony's TV Business Takeover: Why TCL's Partnership Changes Everything [2025]