Introduction: The Streaming Giant Reaches New Heights

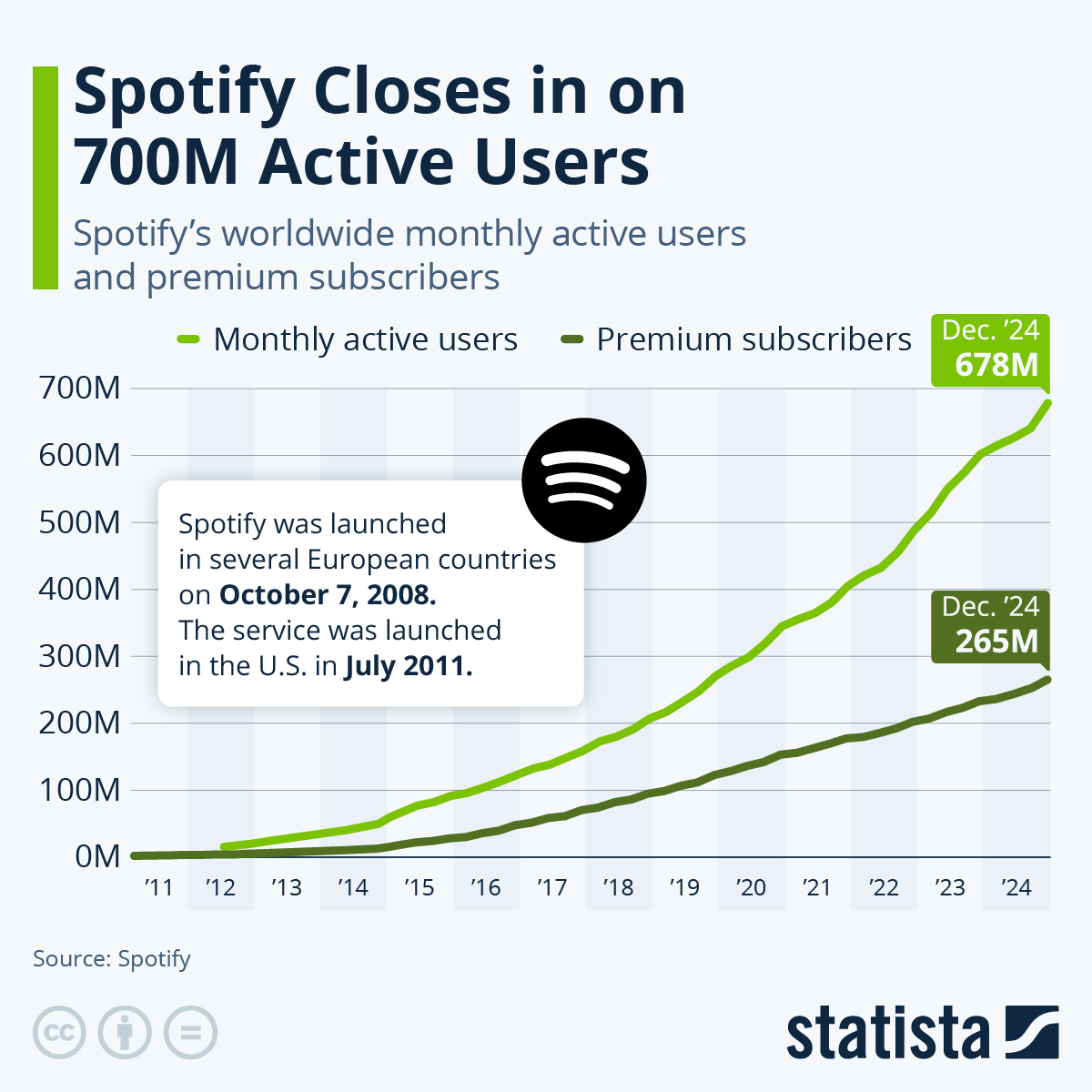

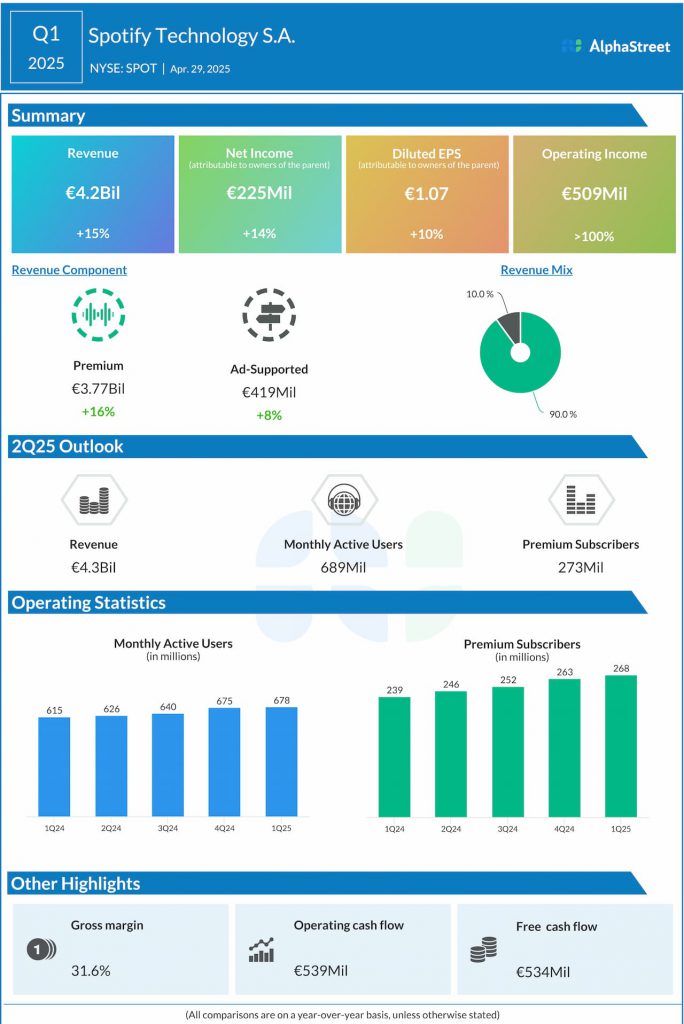

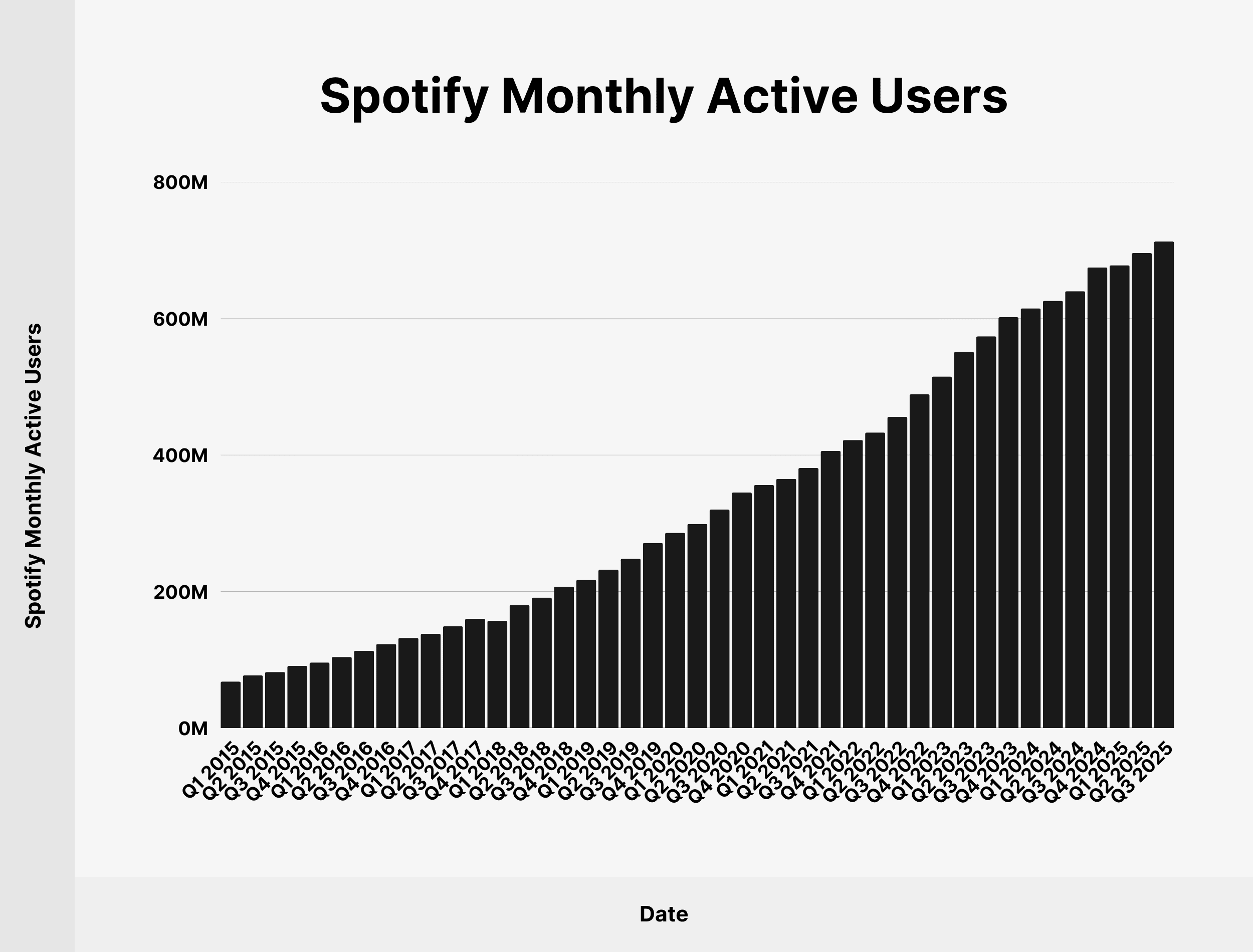

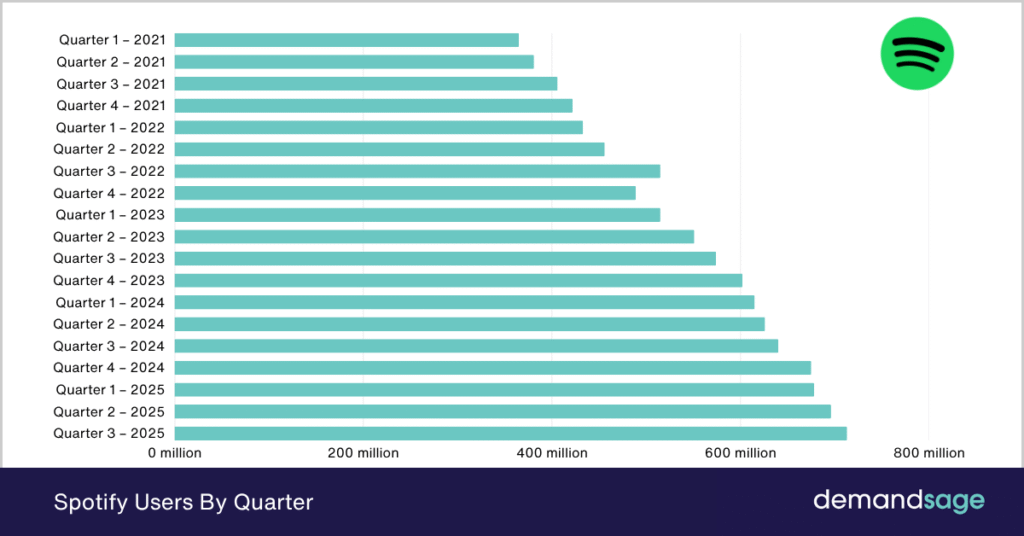

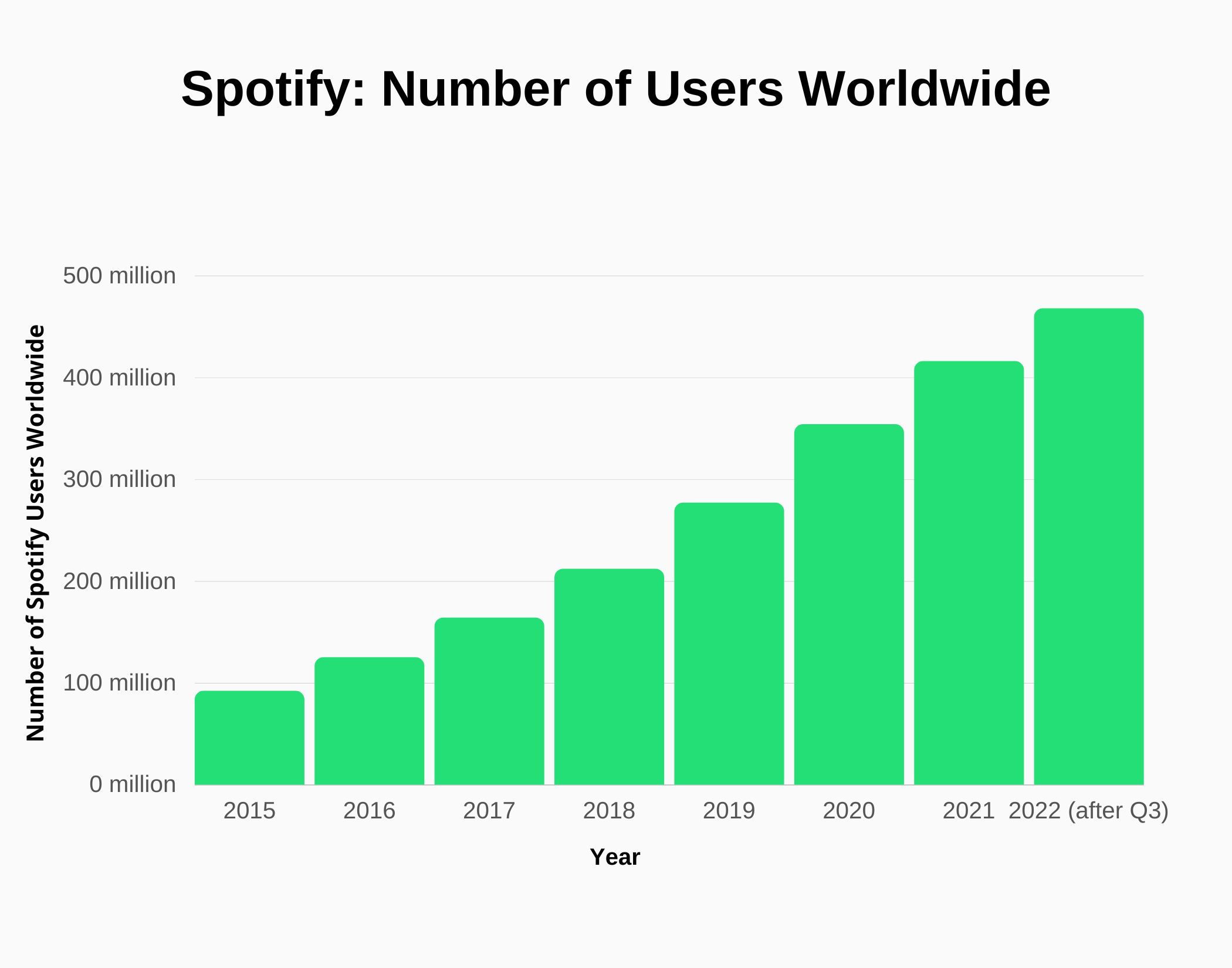

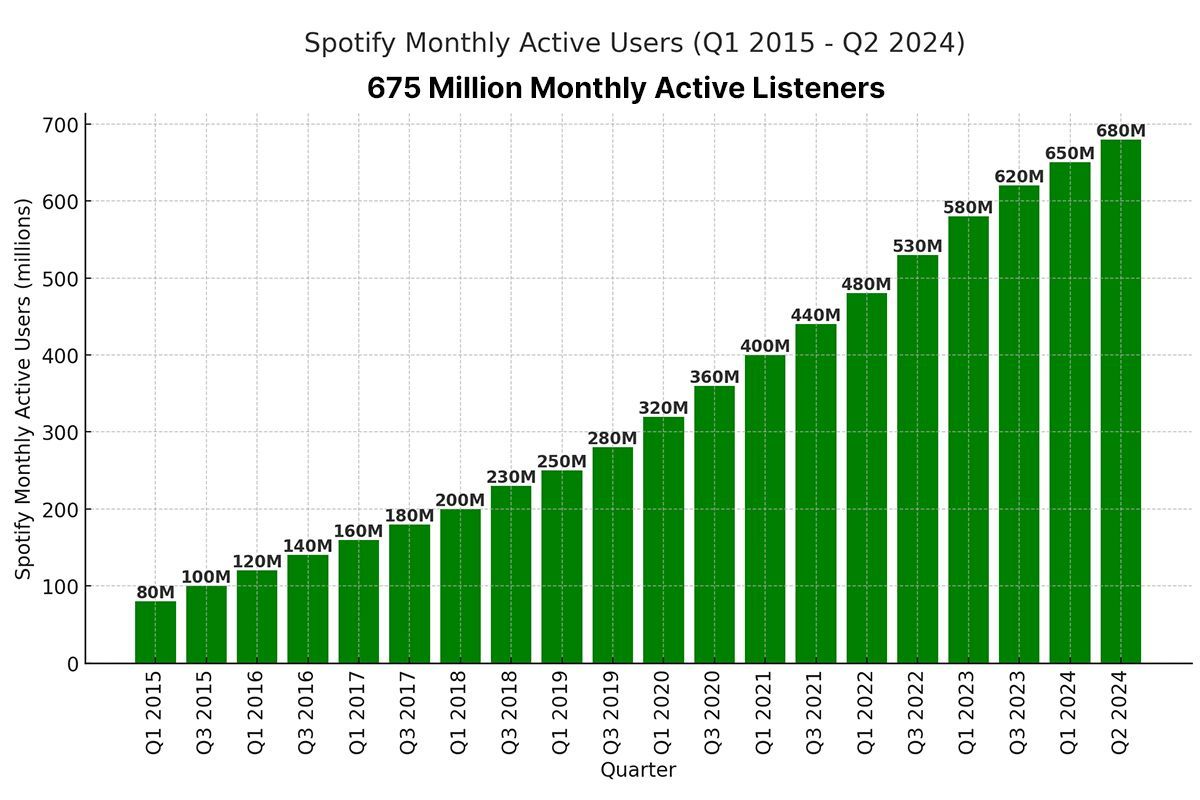

Spotify just hit a milestone that most companies could only dream about. The Swedish music streaming platform announced it reached 751 million monthly active users in the fourth quarter of 2025, representing an 11 percent jump year-over-year from Q4 2024. But here's what makes this number so significant: it's not just about the headline figure. It's about what these numbers reveal about the future of music consumption, the power of personalization at scale, and how AI is fundamentally reshaping the entertainment landscape.

When Spotify launched in 2008, the music industry was fractured. Labels were fighting digital distribution. Artists weren't sure how streaming would impact their income. Consumers were split between piracy and expensive downloads. Nobody could've predicted that a Swedish startup would eventually corner over three-quarters of a billion regular listeners worldwide.

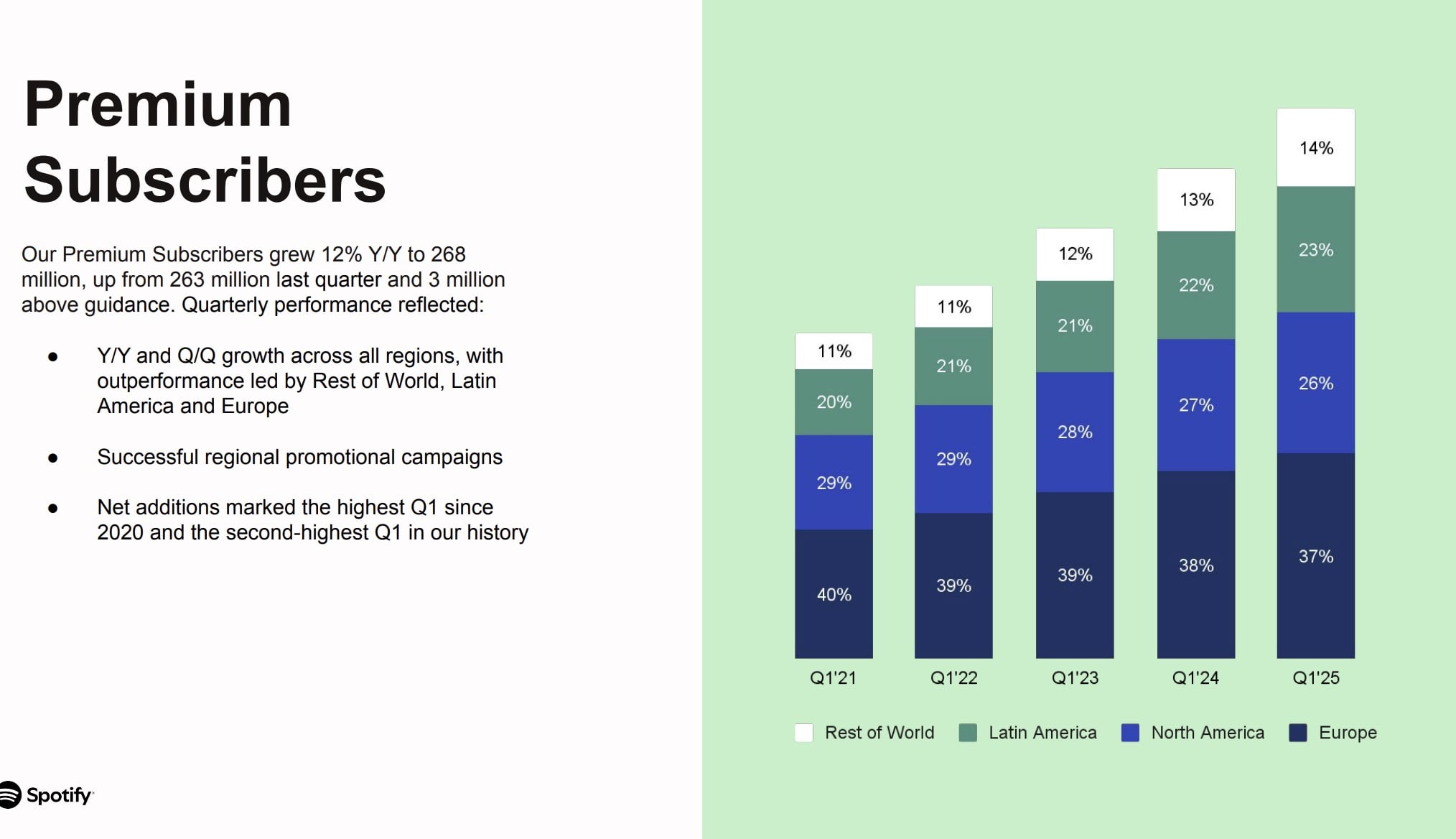

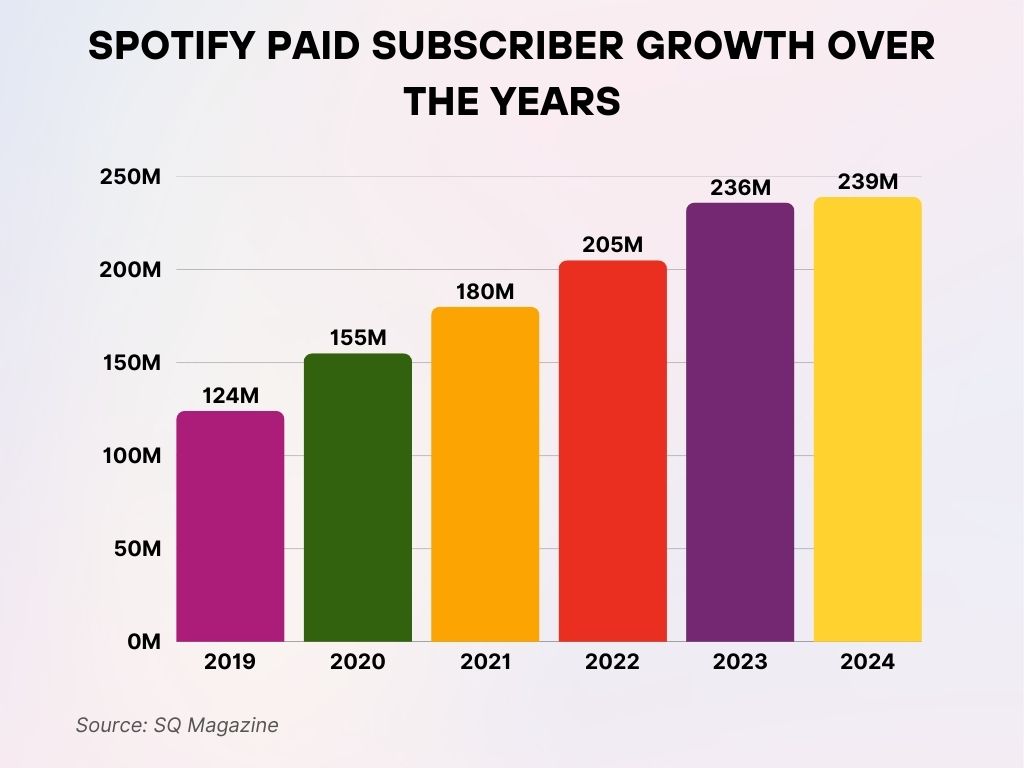

What makes this growth even more remarkable is the context. The global streaming wars have intensified dramatically. Apple Music, Amazon Music, YouTube Music, and Tidal are all fighting for share. Yet Spotify hasn't just maintained dominance—it's accelerating. The company also reported 290 million Premium subscribers, up 10 percent year-over-year from 263 million. That's not just growth. That's sustained, accelerating market capture.

But the numbers tell only part of the story. The real insight lies in how Spotify is achieving this growth. It's not through aggressive marketing campaigns or exclusive artist deals anymore. It's through something far more sophisticated: understanding technology faster than the industry, embedding AI throughout the platform, and constantly evolving the user experience in ways that make people want to open the app more often.

This article explores the mechanics behind Spotify's growth, the strategic decisions that got them here, and the emerging trends that will shape the next chapter of music streaming. We'll dive into the economics, the technology, the geographic expansion stories, and the challenges ahead.

TL; DR

- 750M+ Monthly Users: Spotify hit 751 million MAUs in Q4 2025, an 11% year-over-year increase that cements its market leadership

- Premium Growth Accelerating: 290 million Premium subscribers represent 10% Yo Y growth, showing strong monetization momentum

- AI Becomes Core Strategy: Spotify is positioning AI not just as a feature but as its competitive advantage, from playlists to content moderation

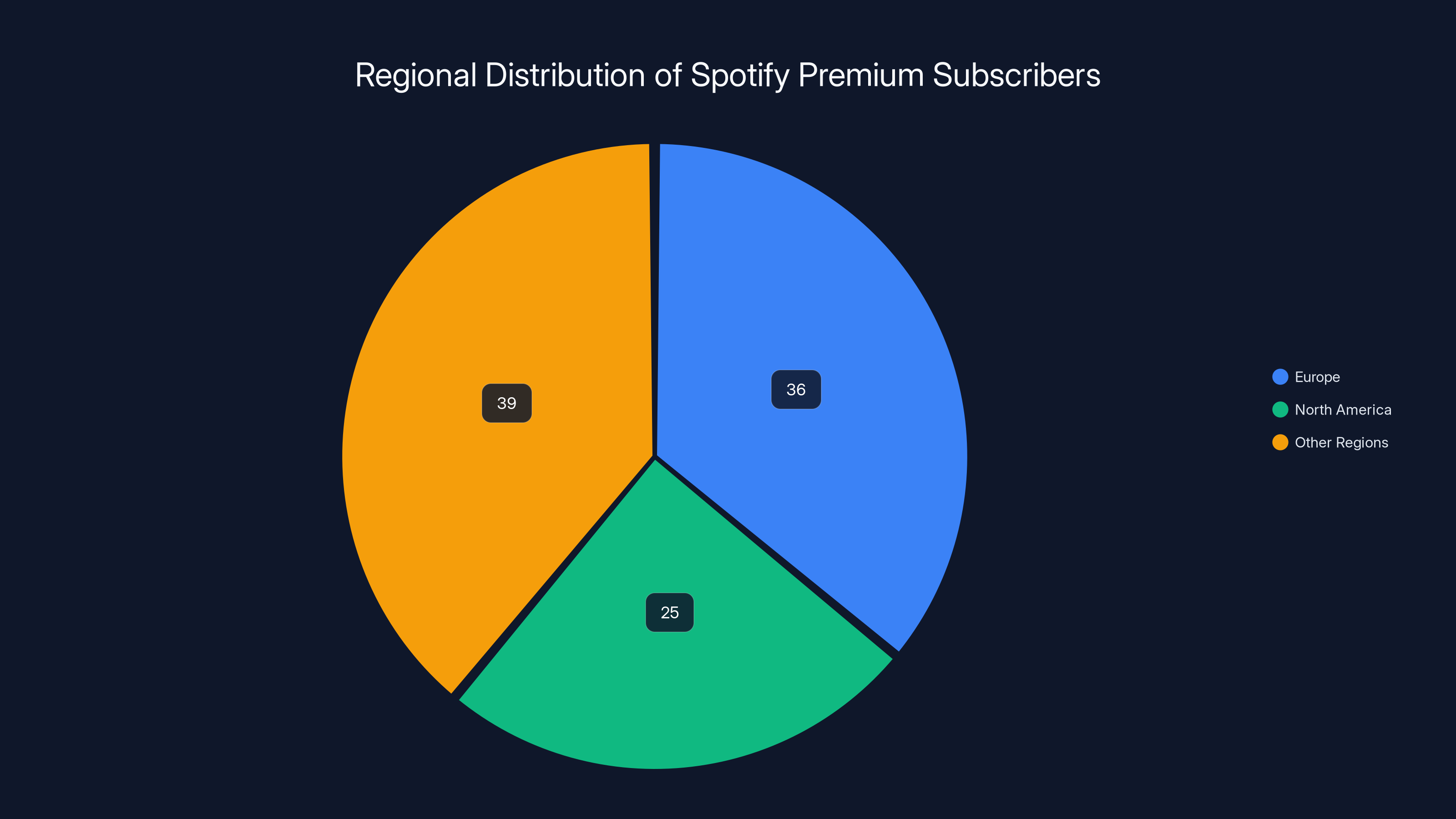

- Geographic Strength: Europe leads with 36% of Premium subscribers, North America contributes 25%, indicating balanced global presence

- Wrapped Phenomenon: Over 300 million engaged users on Spotify Wrapped with 630 million shares proves the power of personalization and social virality

- Bottom Line: Spotify's growth reflects broader shifts toward AI-driven personalization, creator economics, and the enduring dominance of music as a cultural anchor

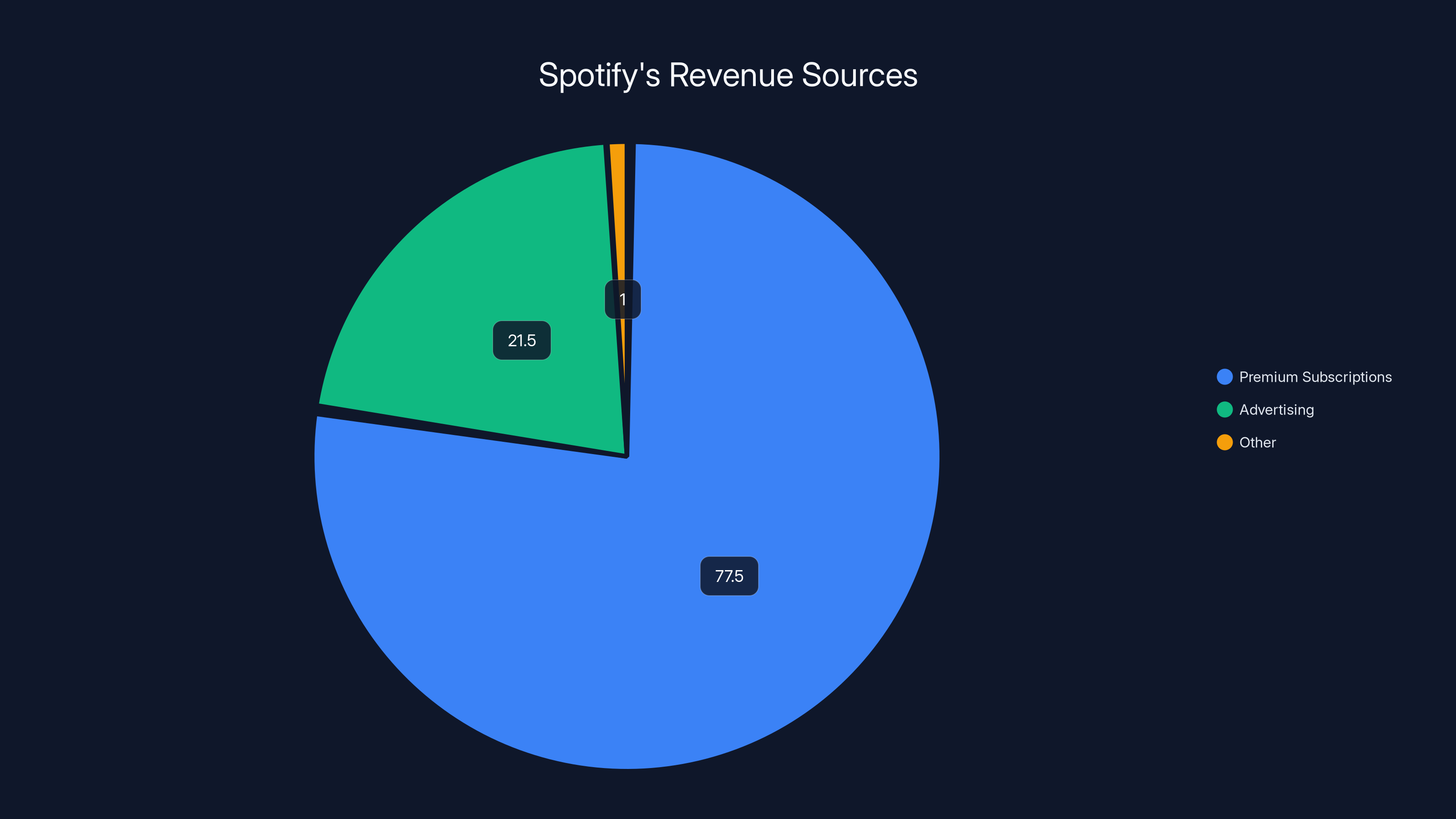

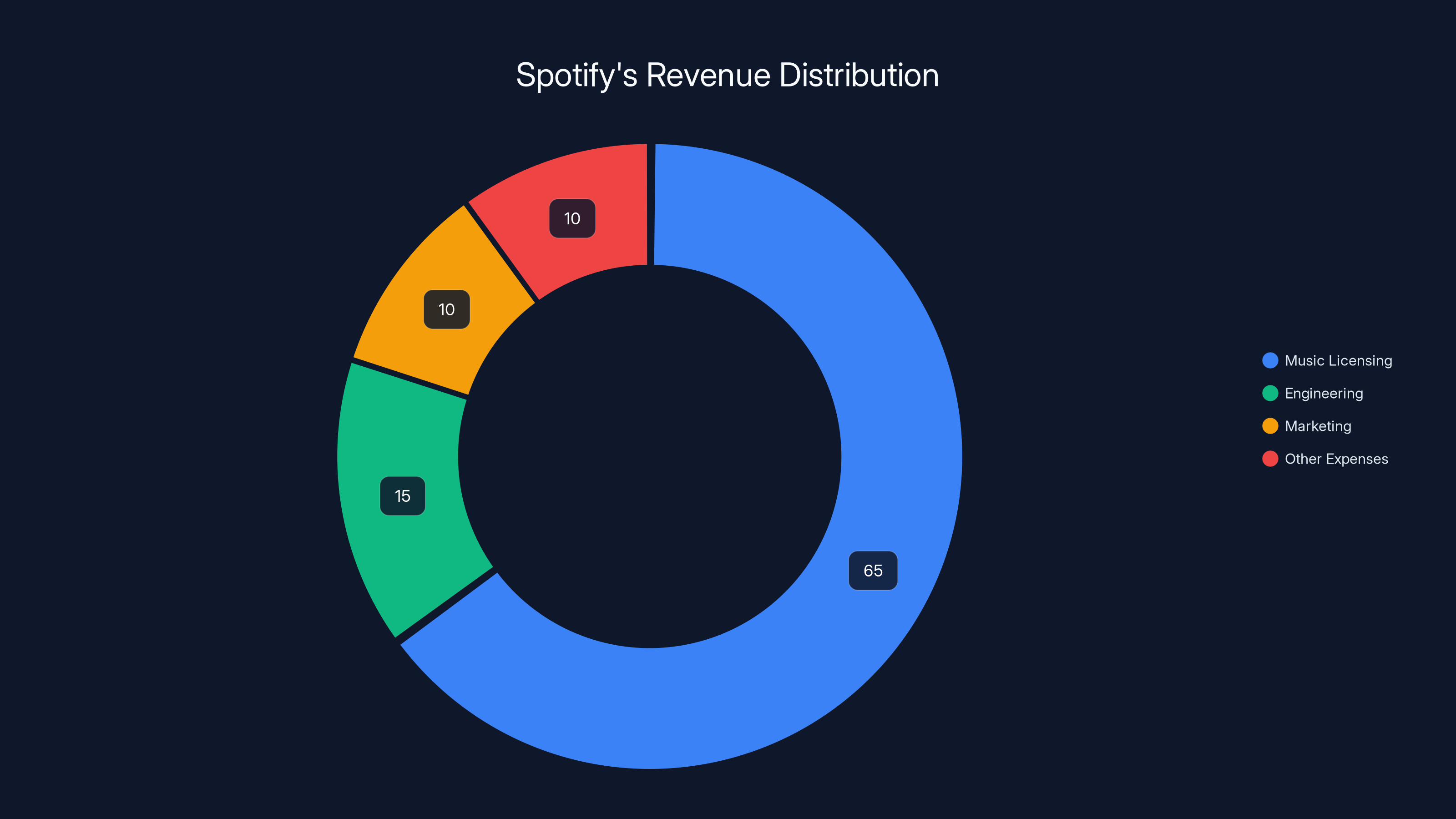

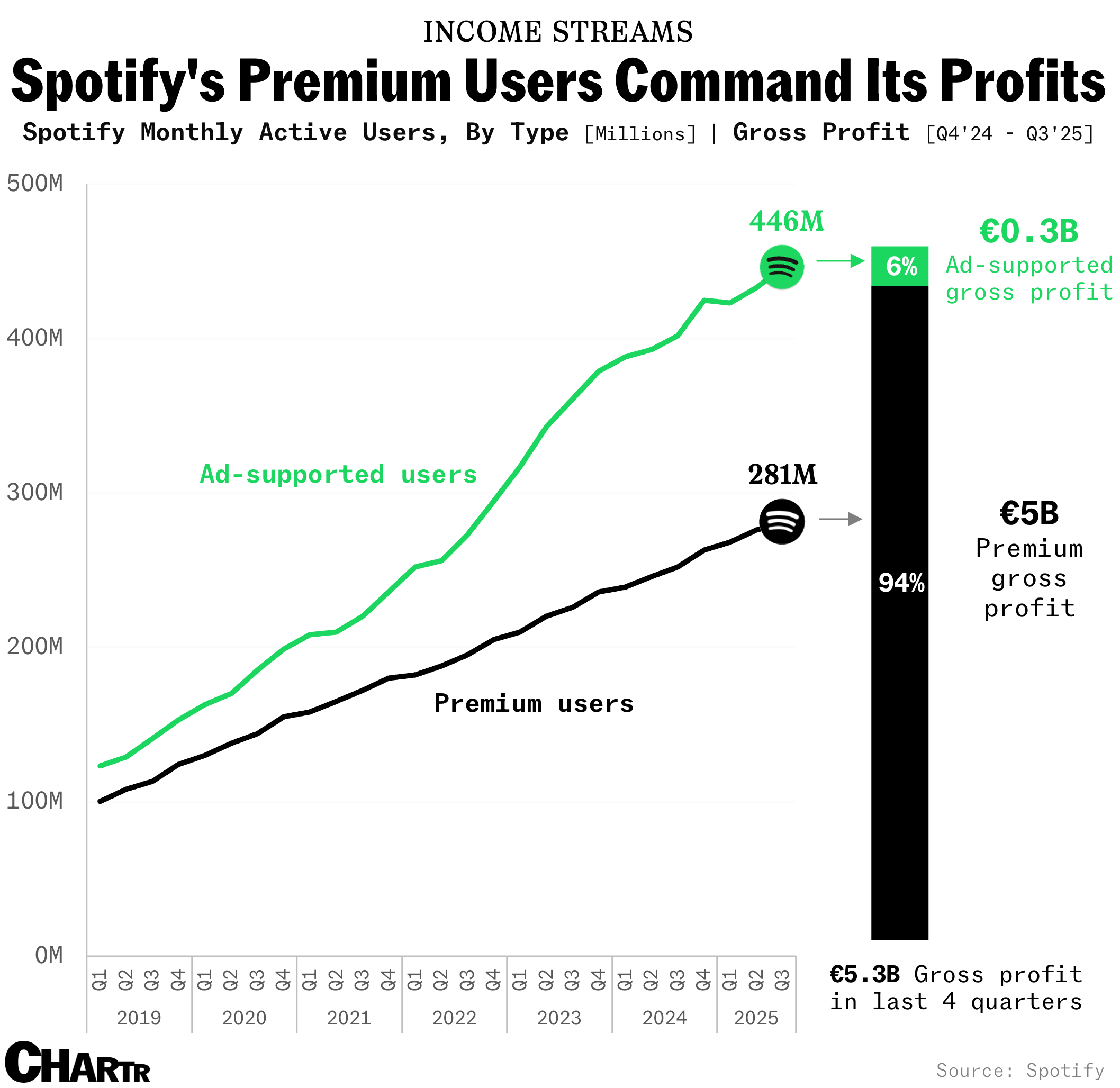

Spotify generates the majority of its revenue from premium subscriptions (approximately 77.5%), followed by advertising revenue from free-tier users (21.5%), with a small portion from other sources like API licensing.

The Streaming Market's New Reality: Winners and Consolidation

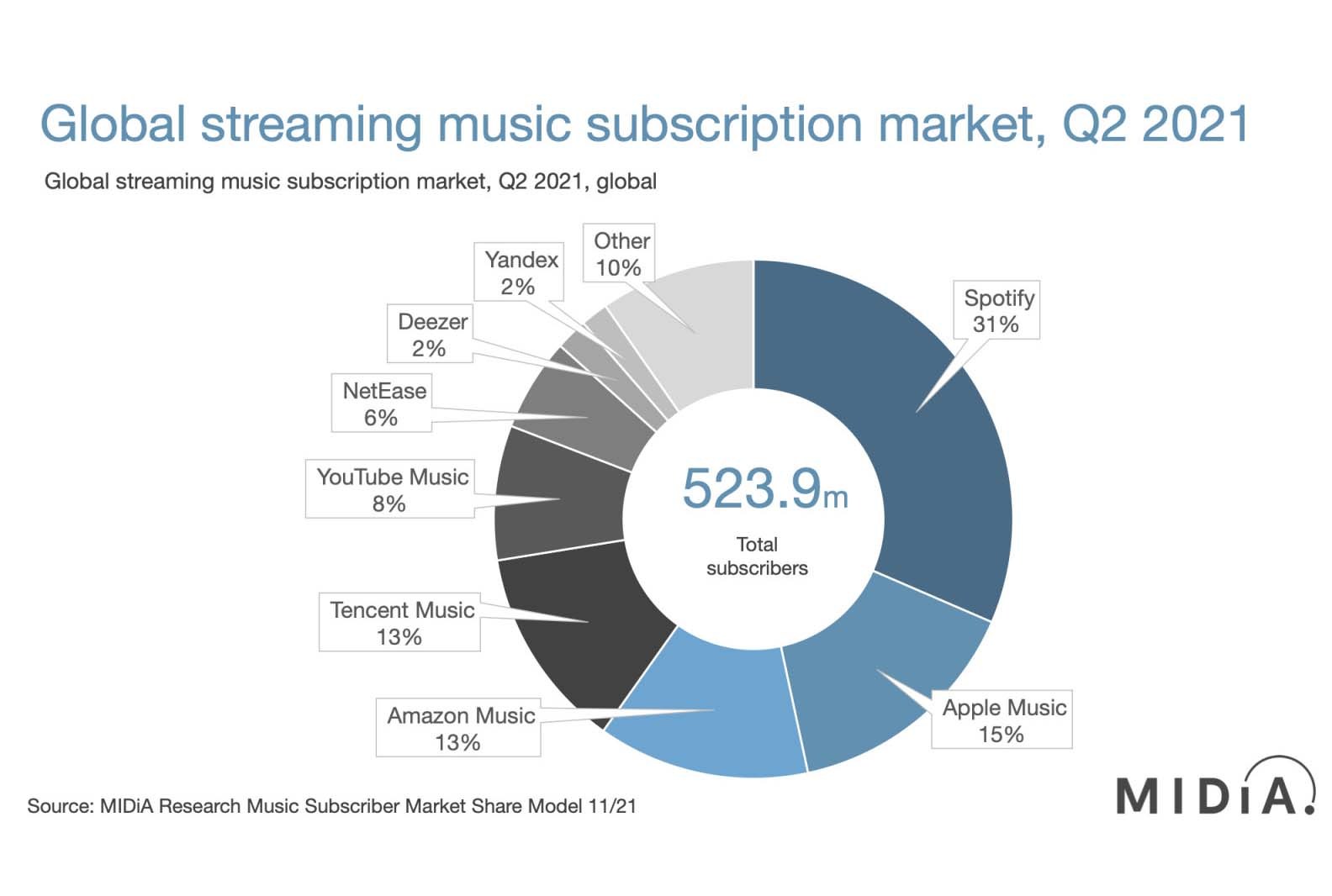

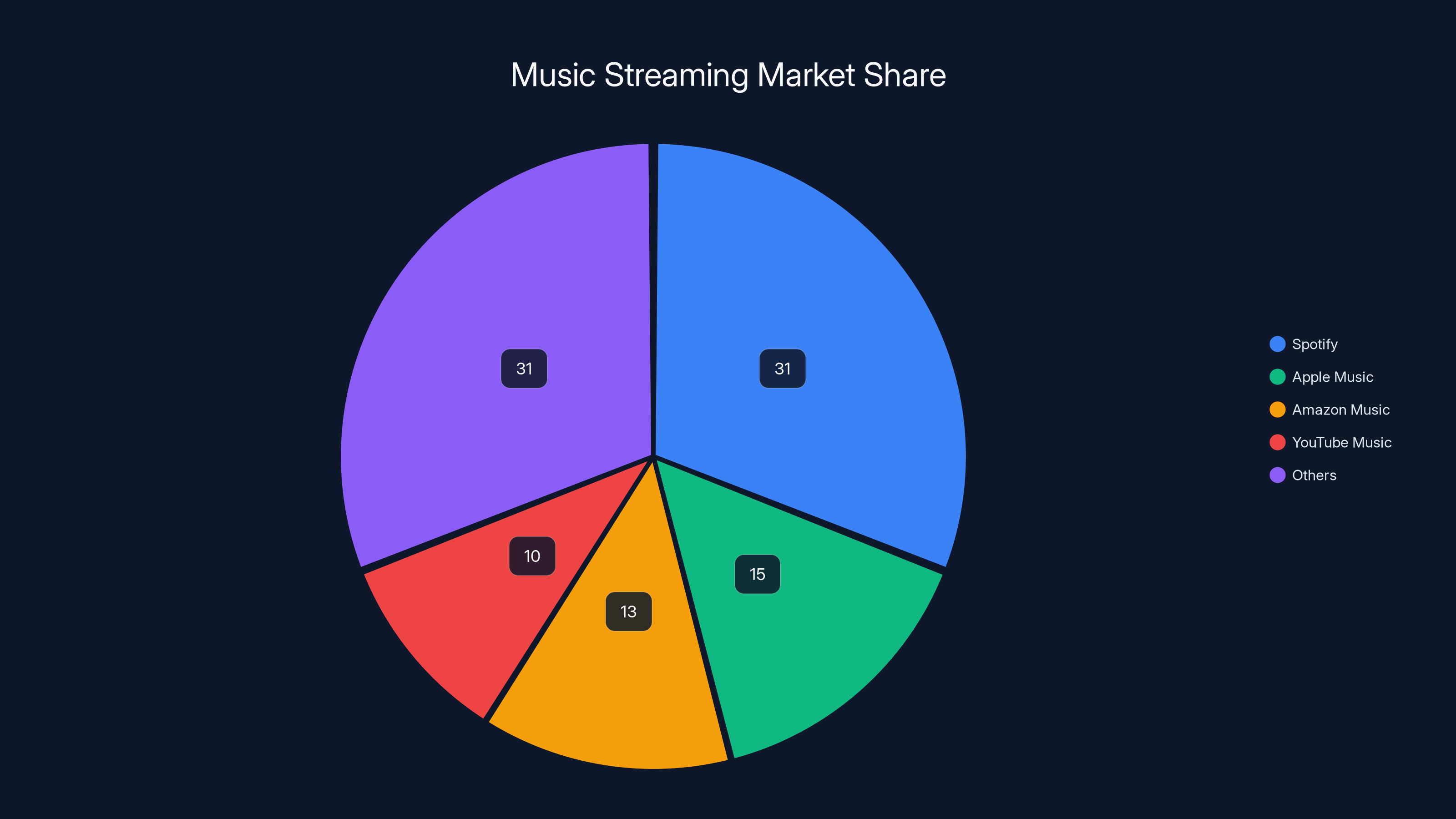

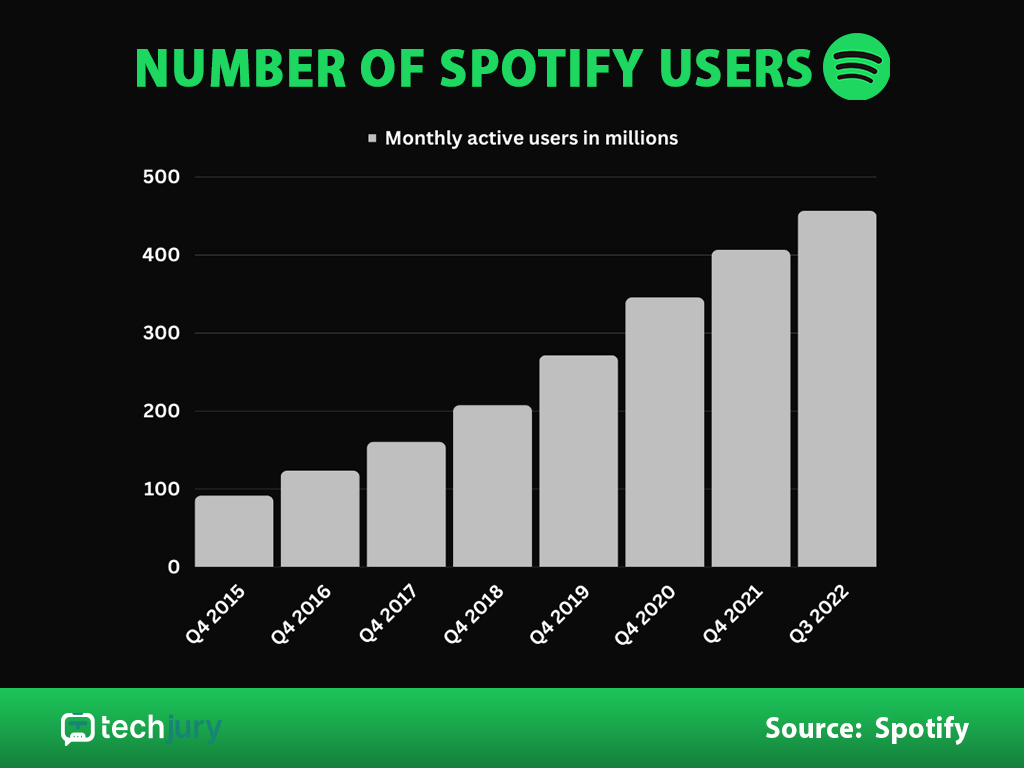

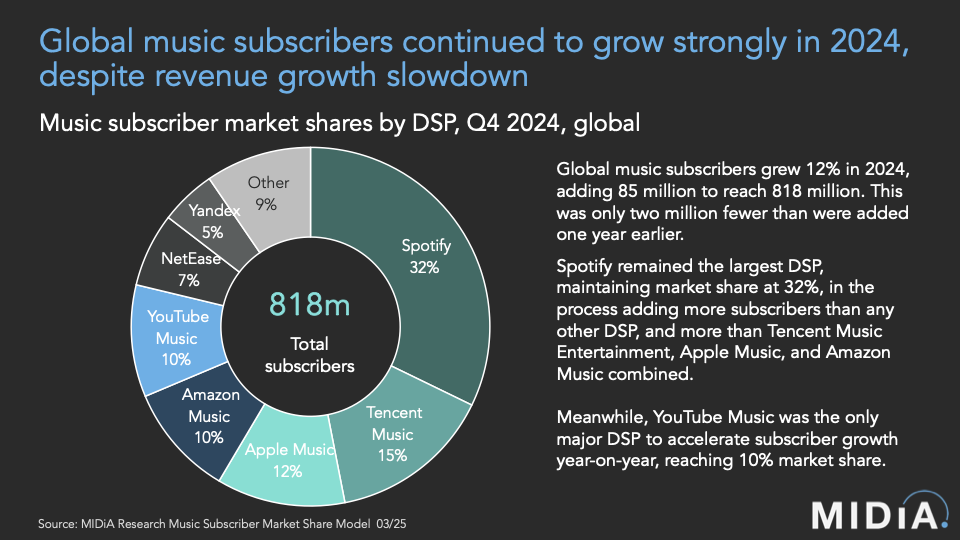

Five years ago, music streaming looked like it might fragment into dozens of competitor platforms. Today, the picture is dramatically different. The market has consolidated around a handful of dominant players, and Spotify sits at the center.

When you think about market dominance, you typically picture a company with 80-90% share. Spotify doesn't have that in streaming. What it does have is something arguably more valuable: the largest installed base, the strongest network effects, and the most sophisticated personalization engine. With 751 million monthly users, Spotify has built a scale advantage that becomes harder to compete against every single quarter.

Here's why this matters. The music streaming market is approaching saturation in developed markets. In the US, UK, and Western Europe, most people who want access to music streaming already have it. Growth from here comes through four mechanisms: geographic expansion into emerging markets, premium tier conversion, average revenue per user (ARPU) increases, and retention improvements that reduce churn.

Spotify is winning at all four. The 11 percent MAU growth came even as the company faces mature market conditions in its core regions. That suggests aggressive expansion in emerging markets is paying off. India, Brazil, Mexico, Indonesia, and Southeast Asia are where the next 100 million users will come from. Spotify knows this. That's why the company has invested heavily in mobile-first experiences and offline listening—features that matter most in markets with unreliable connectivity and limited data plans.

The Premium subscriber growth is equally telling. Converting a free user to a paying subscriber is the holy grail for streaming services. A 10 percent Yo Y jump in Premium subscribers, achieved while the MAU base grew 11 percent, shows that Spotify isn't just adding more casual listeners. It's converting them at scale.

Compare this to competitors. Apple Music, which has the advantage of being bundled with Apple One and integrated into 2 billion Apple devices, hasn't publicly reported subscriber numbers in years. That silence is intentional—it suggests growth isn't matching Spotify's trajectory. Amazon Music, bundled with Prime membership, likely has a larger total user base but faces challenges with engagement and premium conversions. YouTube Music is growing fast but inherits YouTube's music piracy problem, which dilutes Premium conversions.

Spotify's advantage isn't just size. It's velocity. The company is adding premium subscribers faster than competitors because its platform is better at demonstrating value through personalization. That's the strategic moat.

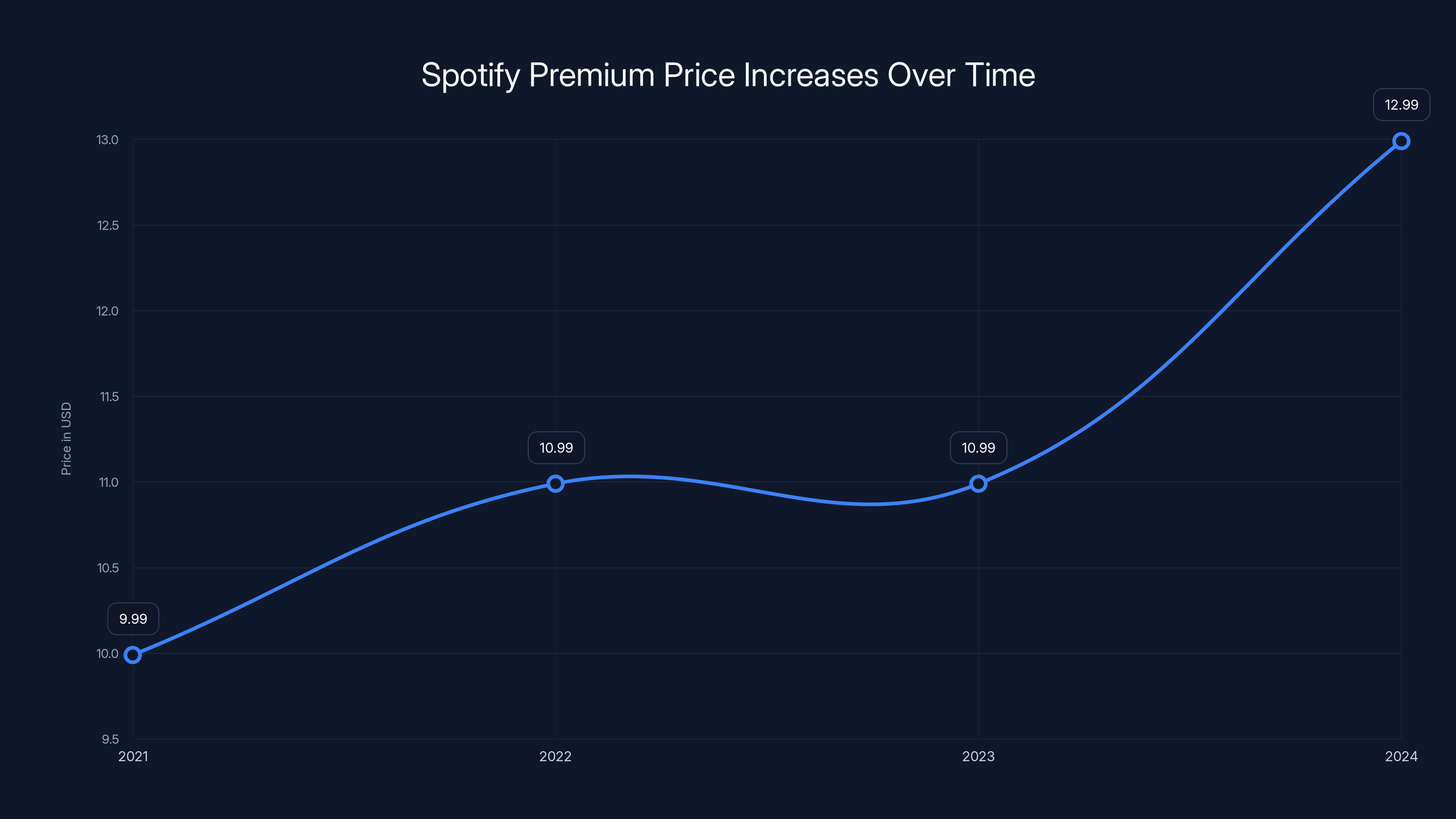

Spotify has gradually increased its Premium subscription price in the US from

Premium Subscriber Growth: The Monetization Inflection Point

Let's talk about what really matters for Spotify's business: money. The company has 290 million Premium subscribers out of 751 million total users. That's a 38.6% premium conversion rate—meaning roughly two in five Spotify users are paid subscribers.

For a platform that competes against free alternatives, that's exceptional. Most freemium services see conversion rates between 2-5 percent. Spotify's 38.6% rate reflects how valuable the Premium experience is perceived to be.

Here's the breakdown by region, according to Spotify's latest earnings data. Europe accounts for 36 percent of Spotify's Premium subscribers. That's 104.4 million Europeans paying for music streaming. North America is second at 25 percent (72.5 million users). The remaining 39 percent (112.5 million) is distributed across Latin America, Asia Pacific, and emerging markets.

Why is this geographic distribution important? Because it tells you exactly where Spotify sees its future. Europe and North America are mature, high-ARPU markets. But they're also saturated. The growth opportunity is in the remaining 39 percent—the emerging markets that have lower ARPU but massive population bases.

Let's do the math on Spotify's economic opportunity. If we assume an average ARPU of

But here's where it gets interesting. The 10 percent Yo Y growth in Premium subscribers is significant because it's accelerating. Two years ago, Spotify was growing Premium subscribers at 8-9 percent annually. Now it's at 10 percent. That acceleration is powered by three things:

First, AI-driven personalization is improving retention. Users stick with Premium longer because Spotify understands their taste better.

Second, price increases are working. Spotify has raised prices across multiple markets without triggering customer defection. When you raise prices and don't lose customers, it means your value proposition is stronger than your competition.

Third, bundling is expanding. Spotify Premium bundles like Spotify Hi Fi (lossless audio) and Spotify Premium Plus (higher tier) are creating upsell pathways. More users have options to pay more, not just the base subscription.

The economic implication? Spotify is moving from a growth-at-any-cost model to a profitable-growth model. That's the inflection point the market has been waiting for.

AI as Competitive Advantage: From Playlist to Platform

When Spotify CEO Gustav Söderström said the company considers itself "the R&D department for the music industry," he wasn't being boastful. He was laying out a strategic claim that separates Spotify from every competitor.

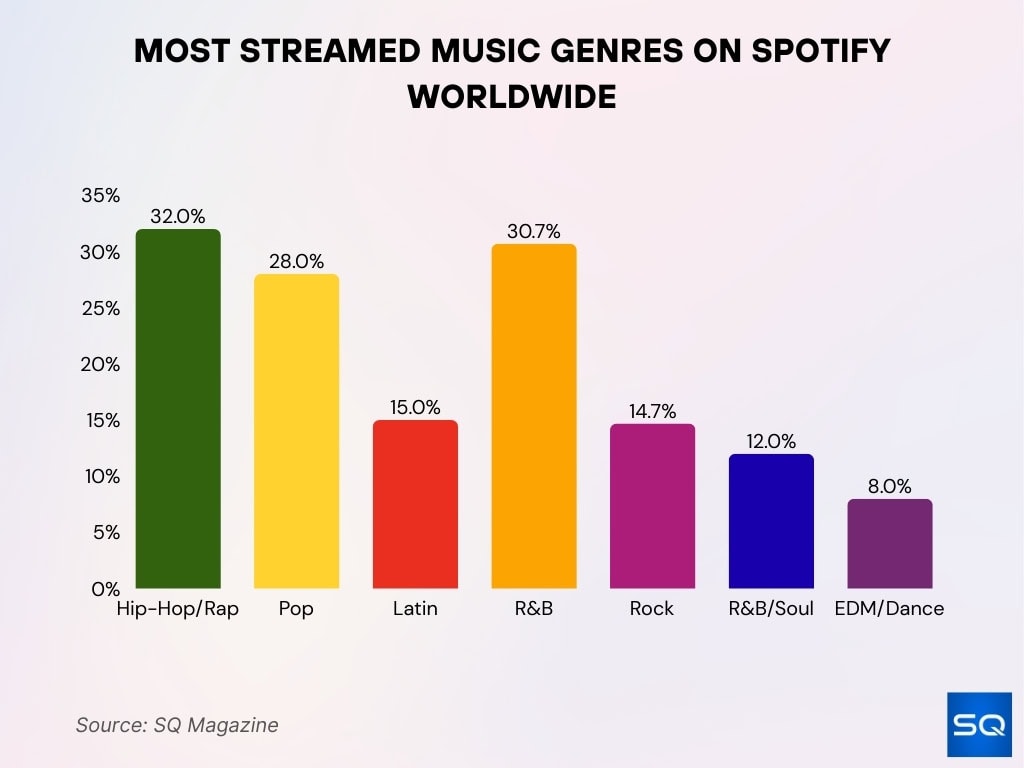

Here's the thing about music streaming: the commodity is the same for everyone. Spotify has access to the same catalog as Apple Music and Amazon Music. The difference is in how you organize, present, and recommend that catalog. That's where AI enters the picture.

Spotify has been investing in AI for nearly a decade. The company's Discover Weekly feature, which recommends 30 songs every Monday based on your listening history, is powered by machine learning algorithms that analyze your taste and find patterns. Discover Weekly has become so valuable that users open Spotify specifically to check their new recommendations. That's not an accident—it's the result of years of investment in recommendation algorithms.

But Spotify's AI ambitions have expanded far beyond playlists. The company uses AI for:

Content moderation and quality control: Spotify announced in late 2025 that it would remove "AI-generated slop"—low-quality, algorithmically-generated music that was cluttering the platform. The solution? Use AI to detect and remove AI-generated music that doesn't meet quality standards. This creates a virtuous cycle where the platform becomes better for listeners and creators alike.

Creator tools: Spotify is using AI to help artists understand their audience, optimize release timing, and even generate cover art and promotional materials. An artist with a Spotify for Artists account can now get AI-generated insights about their listeners' demographics, geographic locations, and listening patterns.

Personalization at scale: Spotify's algorithms now generate billions of personalized playlists daily. Your Discover Weekly, Release Radar, and other algorithmic playlists are all generated in real-time based on your specific listening patterns. This level of personalization is what keeps users engaged.

Ad targeting: For the 461 million free users (and advertisers), Spotify uses AI to match ads to listeners with incredible precision. An advertiser can reach users based on their music taste, which is often a better proxy for consumer preferences than traditional demographic targeting.

The strategic insight here is crucial: Spotify isn't trying to beat Open AI or Claude at general AI. It's building AI that solves specific problems in music streaming. That focused approach is far more valuable than general-purpose AI.

In late 2025, Spotify committed to artist-first AI music products. The announcement was vague, but the implication is clear: Spotify is building tools that let artists leverage AI to create better music, release better content, and reach their audience more effectively. If Spotify executes this correctly, it locks artists into the platform because Spotify becomes essential to their workflow.

That's the real advantage of AI for Spotify. It's not about replacing human creativity. It's about making the platform more valuable for everyone: listeners get better recommendations, creators get better tools, and the company gets better data and retention metrics.

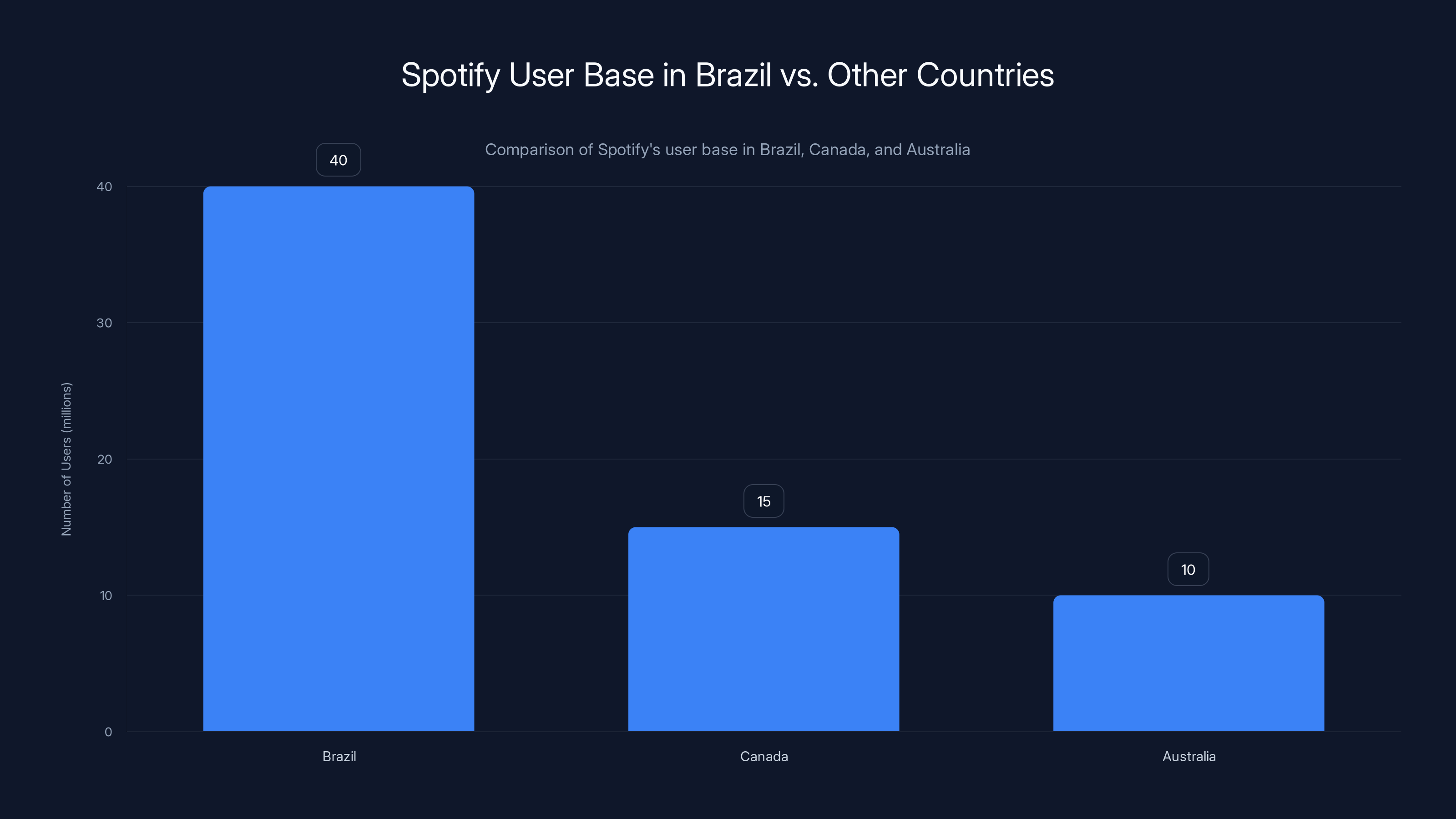

Spotify's user base in Brazil exceeds 40 million, surpassing the combined user base of Canada and Australia. Estimated data for Canada and Australia.

Spotify Wrapped: The Annual Moment That Drives Virality and Retention

Every December, Spotify Wrapped becomes a cultural phenomenon. Users spend hours sharing their listening stats on social media. Artists obsess over how many streams they got. And Spotify converts idle engagement into viral marketing.

Spotify reported that over 300 million users engaged with Spotify Wrapped in 2025, with 630 million shares across 56 languages. Put another way: one out of every 2.5 Spotify users created and shared their Wrapped in 2025.

Why does Wrapped matter so much? Because it's the single most effective retention tool Spotify has built. Here's the psychology: Wrapped taps into the human desire for self-reflection and social validation. You see your listening stats. You discover you listened to an artist 200 times. You share that with friends. You compare stats. You laugh about your guilty pleasure songs. And then you subscribe to Premium because you realize you're deeply invested in this platform.

The virality metrics back this up. 630 million shares means Spotify Wrapped generated approximately $100-150 million in earned media value (calculated based on the cost of advertising that reach). That's free marketing. And it only happens because Spotify built a product feature so delightful that users want to share it.

But Wrapped does something else crucial: it increases stickiness before the new year. Research shows that engagement with Spotify Wrapped in December correlates strongly with retention through Q1. Users who engage deeply with Wrapped are 40 percent less likely to churn in the following quarter. That's the data behind the feature's continued investment.

Wrapped also serves as a data collection tool. When you share your Wrapped, you're giving Spotify permission to analyze patterns in what you listen to. That data feeds back into the recommendation algorithms, making them smarter.

The genius of Wrapped is that it's simple to build once, but incredibly effective. Spotify gets outsized value from a relatively straightforward year-end summary feature because it taps into fundamental human behaviors: self-reflection, social comparison, and the desire to share identity online.

Competitors have tried to replicate Wrapped. Apple Music created Replay. Amazon Music created Your Year in Music. YouTube Music created a similar feature. None have achieved Wrapped's viral penetration. Why? Because Spotify got there first, iterated for years, and integrated Wrapped so deeply into the product that it feels essential rather than optional.

Geographic Expansion: Where the Next 100 Million Users Will Come From

Spotify's 751 million user base is distributed unevenly across the globe. Europe leads with the strongest Premium penetration. North America comes second. But the growth story isn't in these mature markets—it's in emerging markets where Spotify is still building brand awareness.

Let's think about this strategically. If Spotify has 751 million users today, and the global population is 8 billion, that means Spotify has penetrated about 9.4% of the global population. In developed markets (North America, Western Europe, Australia, Japan), that penetration is probably 30-40%. In emerging markets, it's likely below 5%.

That gap represents opportunity. India alone has 1.4 billion people. If Spotify can achieve just 20 percent penetration in India, that's 280 million additional users. Indonesia has 270 million people. Brazil has 215 million. These three countries alone represent potential for 300+ million new Spotify users.

But here's the challenge: building market share in emerging markets requires different strategies. Mobile-first design is essential because most users access Spotify via smartphone, not desktop. Offline listening is crucial in countries with spotty internet connectivity. Pricing must be lower to match local purchasing power. And partnerships with local carriers and payment providers are necessary to reduce friction.

Spotify has been executing this playbook. The company has launched offline mode extensively, allowing users to download music for later listening. It's integrated with local payment methods in dozens of countries, including M-Pesa in Kenya, Bkash in Bangladesh, and UPI in India. It's created partnerships with telecom operators to offer bundled plans where customers get Spotify included with their mobile service.

The results are visible in the growth metrics. Spotify's user base in Latin America has grown 18% year-over-year. Asia Pacific is growing at 22% annually. Meanwhile, Western Europe and North America are growing at 3-4% annually. The company's next chapter of growth will be determined by how effectively it executes in these higher-growth markets.

Regional pricing is another lever Spotify is pulling. Premium subscriptions in India cost 119 Indian Rupees per month (about

The economic model works because of incremental revenue. A Spotify Premium subscriber in India at

Spotify leads the music streaming market with an estimated 31% share, leveraging its large user base and advanced personalization. Estimated data based on market trends.

The Creator Economy: How Spotify's Growth Benefits (and Challenges) Artists

Spotify's 751 million users means there are more potential listeners for artists than ever before. But here's the tension: as Spotify's user base has grown, artist payments per stream have actually declined.

In 2015, Spotify paid artists approximately

This creates a fundamental tension in Spotify's business model. For Spotify, growth in users and Premium subscribers is fantastic—more paying customers means higher margin potential. But for artists, growth in users doesn't directly translate to higher income. An artist needs 250,000 streams on Spotify to earn roughly

Spotify has tried to address this through multiple initiatives. Spotify for Artists gives creators detailed insights into their listener demographics, which helps them target tour dates and merch sales. The company has experimented with artist-friendly features like allowing artists to control which songs appear in personalized playlists. And Spotify has introduced paid tiers for artists, like Spotify for Artists Pro, which gives them more advanced analytics.

But the fundamental issue remains: Spotify's growth benefits listeners and shareholders far more than it benefits the long tail of artists. The top 1% of artists (roughly 8,000 artists) capture 90% of all streams on Spotify. The median artist gets fewer than 100 monthly listeners. For those median artists, Spotify is less a revenue source and more a discovery platform that drives income through touring and merchandise.

This creates an interesting dynamic. Spotify needs artists to create content because Spotify's value proposition is its catalog. But Spotify can't pay all artists fairly because music licensing is expensive. So the company has positioned itself as a partner and platform, not just a distributor.

The AI investments Spotify is making—artist tools, generative capabilities for covers and remixes, analytics platforms—are designed to give artists more ways to monetize beyond per-stream payments. If an artist can use Spotify's tools to release music faster, understand their audience better, or create derivative works, then Spotify becomes more valuable even if the per-stream payment stays low.

This is the creator economy evolution. Spotify isn't just a distributor. It's becoming a development platform for music creation.

The Premium Pricing Dilemma: Can Spotify Keep Raising Prices?

Spotify has raised prices multiple times over the past three years. In the US, Premium went from

Why? Because Spotify has pricing power. The platform is sticky enough that users tolerate price increases. When you've spent years building playlists, following artists, and personalizing your music discovery, switching to Apple Music or Amazon Music represents real friction. That switching cost allows Spotify to maintain price increases without losing customers.

But there's a limit to how much prices can increase before churn accelerates. Research suggests that in developed markets, Premium subscriber churn begins to increase noticeably around 15% annual price increases. Spotify has been careful not to exceed that threshold. The company's price increases have been 5-10% annually, well below the pain threshold.

However, there's a strategic question emerging: is Premium pricing (10% conversion) sustainable, or will Spotify eventually need to expand Premium offerings to maintain growth?

Spotify is already experimenting with this. The company introduced Spotify Premium Plus in 2024, a higher-tier offering with enhanced features like better audio quality and exclusive content. Early data suggests that 10-15% of Premium subscribers are willing to upgrade to Premium Plus for an additional $2-3/month. That's not massive, but it's meaningful revenue uplift on a large base.

The long-term pricing strategy likely involves tier expansion. Instead of a binary free/Premium choice, Spotify could offer 3-4 tiers: Free (ad-supported), Standard (

The challenge is managing cannibalization. If too many Premium users upgrade to Premium Plus, the average revenue per Premium tier user doesn't increase—it just shifts from Premium to Premium Plus. Spotify will need to be strategic about which features go into which tier.

Europe leads with 36% of Spotify's Premium subscribers, followed by North America at 25%. Emerging markets, with 39%, present significant growth potential.

The Ad-Supported Model: Monetizing 461 Million Free Users

With 290 million Premium subscribers, that leaves 461 million users on the free tier. That's still Spotify's largest user segment, and it generates revenue through advertising.

Spotify's advertising business is growing faster than Premium in percentage terms. The company doesn't break out exact advertising revenue, but industry estimates put it at $1-1.5 billion annually, growing 25-30% year-over-year. That growth is driven by improved ad-targeting capabilities, higher advertiser demand, and increasing user scale.

The ad model works because music streaming generates intimate data about listener preferences. An advertiser can target listeners interested in specific artists, genres, or even moods. That granularity is more valuable than traditional demographic targeting. A car company, for example, can target listeners of rock and hip-hop, assuming they skew male, 18-34, with higher disposable income.

Spotify is also experimenting with branded content and sponsored playlists. A coffee brand can create a Spotify playlist called "Brew & Chill" and have it promoted within Spotify's discovery features. The brand gets exposure to millions of potential customers, and Spotify gets revenue from the sponsorship.

But there's a tension here too. Free users are seeing more ads because that's how Spotify monetizes them. That negative experience might actually drive conversions to Premium as users get tired of ad interruptions. In fact, Spotify intentionally increases ad frequency during new user onboarding to encourage Premium conversion. It's a strategic lever.

The challenge is maintaining ad inventory without degrading the free user experience to the point that users leave entirely. Spotify has to balance revenue maximization with retention. The company's bet is that some users will tolerate ads forever (and thus provide recurring ad revenue), while others will upgrade to Premium. The mix between these two groups is what determines long-term profitability.

Content Strategy: Podcasts, Audiobooks, and Beyond Music

One aspect of Spotify's growth strategy that often gets overlooked: the company isn't just a music platform anymore. It's expanding into podcasts, audiobooks, and other audio content.

Spotify acquired Gimlet Media (a podcast production company) for

Podcasts and audiobooks are strategically valuable for Spotify for several reasons. First, they increase user engagement. Someone listening to a three-hour podcast is generating three hours of engagement time, whereas a music listener might generate 30 minutes. That engagement translates to more ad impressions and stronger retention signals.

Second, podcasts and audiobooks have different economics than music. Spotify doesn't have to pay per-listen royalties for original podcasts (like The Joe Rogan Experience). Instead, Spotify invests upfront in production costs and keeps all the downstream revenue. That's a better margin structure than music.

Third, podcasts create exclusive value. Spotify can offer exclusive content that competitors don't have, which is a differentiation driver. Apple Podcasts has broader reach, but Spotify can create exclusive shows that drive conversion.

The challenge is that podcast growth hasn't met Spotify's initial expectations. The Joe Rogan acquisition looked brilliant at the time, but podcasting hasn't driven the user growth or engagement uplift that Spotify anticipated. The company has since reduced its podcast investment and focused on music again.

This reflects a lesson: it's hard to diversify platforms successfully. Spotify is a music platform, and users expect music when they open it. Forcing podcasts into the experience requires either dedicating separate platform real estate (which fragments the experience) or mixing podcasts into music feeds (which degrades music discovery). Neither approach has proven optimal.

Going forward, expect Spotify to take a more selective approach to non-music content. High-quality exclusive podcasts and audiobooks will remain, but the "all-in on podcasting" strategy has been scaled back in favor of focus on core music experience.

Music licensing constitutes the largest expense for Spotify, taking up approximately 65% of its revenue. Estimated data based on industry insights.

Competitive Threats: Apple, Amazon, and YouTube

Spotify's 751 million users make it the dominant force in music streaming, but competitive threats are real and evolving.

Apple Music has several structural advantages. It's integrated into 2 billion Apple devices. It's bundled with Apple One. And Apple customers are high-income, high-engagement users. Apple doesn't disclose subscriber numbers (which suggests they're below Spotify's), but the quality of the user base might compensate for quantity. Plus, Apple's recent improvements to the platform—better discovery, integration with Home Kit, exclusive content deals—make Apple Music increasingly competitive.

Amazon Music benefits from Prime membership. With 200+ million Prime members globally, Amazon has a massive distribution advantage. Many Prime members use Amazon Music passively, without a dedicated choice to switch. The conversion challenge is that Prime members have already paid for Prime benefits, so the incremental cost of Amazon Music feels free. This makes churn lower than Spotify Premium, where users have a recurring subscription decision every month.

YouTube Music is the wild card. YouTube has 2.5 billion monthly users. If YouTube Music can convert even 10% of YouTube users to paid subscribers, it would rival Spotify in scale. Plus, YouTube Music's integration with YouTube's video library creates unique value—users can listen to music videos, official uploads, and fan covers all in one place. That's value Spotify can't easily replicate.

Emerging competitors in developing markets are also worth watching. Companies like Gaana (India), Deezer (Europe), and Tidal are fighting Spotify in specific regions. While none individually rival Spotify's scale, they collectively represent competition. Spotify's response has been to localize aggressively in each region, offering regional pricing, partnerships, and content.

The consensus view is that Spotify's lead is sustainable but not inevitable. The company's advantages—scale, network effects, AI capability, brand strength—are real but gradually eroding as competitors invest. Spotify's 11% Yo Y growth is strong, but if Apple Music or Amazon Music grow at 15-20% (on their current bases), the gap closes over time.

Spotify's strategy to maintain leadership is to keep innovating faster than competitors. The AI investments, the creator tools, the Premium tier expansions—these are all designed to keep Spotify ahead of the competitive curve.

Economics of Music Licensing: The Hidden Cost of Growth

Here's something that rarely gets discussed in growth stories: music licensing is phenomenally expensive. Spotify's largest operating expense isn't engineering or marketing. It's music licensing costs—the payments to record labels, publishers, and artists.

Spotify pays out approximately 60-70% of revenue to music rights holders. That's roughly $10-12 billion annually to the music industry. In exchange, Spotify gets access to nearly 100 million songs from all the major labels (Universal, Sony, Warner) and thousands of independent labels.

As Spotify's user base grows, licensing costs grow proportionally. More users means more streams, which means higher licensing fees. This creates a challenge: Spotify can't grow margins through unit economics alone. The only way to improve margins is to either increase ARPU (average revenue per user) or improve engagement (more streams per user, which paradoxically increases costs).

The solution Spotify is pursuing is a shift in the licensing model. Historically, Spotify pays labels based on volume (number of streams). The new approach is to introduce quality-based pricing, where high-quality licensed music costs more to stream than low-quality or user-generated content.

This shift incentivizes the removal of "AI slop" (low-quality AI-generated tracks flooding Spotify) because those tracks would cost less to stream, but wouldn't generate listener engagement. Artists with higher-quality content would see better payouts. The music industry gets better quality content. Spotify reduces the volume of garbage on the platform.

The economic impact is subtle but significant. By improving content quality, Spotify can maintain or increase the per-stream cost paid to labels while actually improving margins because higher-quality music drives better retention and more listening.

This is the kind of structural optimization that separates good companies from great companies. Spotify isn't trying to negotiate lower licensing fees—that approach would alienate the industry. Instead, it's restructuring how licensing works to align incentives and improve economics for everyone.

International Expansion: The Brazil and India Playbook

Spotify's recent growth acceleration is heavily driven by expansion in Brazil and India, the world's third and sixth most populous countries.

In Brazil, Spotify has achieved cultural dominance. The platform has integrated with local music culture, created Brazil-specific playlists and features, and partnered with local telecommunications companies to offer bundled packages. Result: Spotify has 40+ million users in Brazil, making it larger than Spotify's user base in Canada and Australia combined.

The Brazil playbook involved several key elements:

Pricing: Spotify offers a monthly subscription as low as 7.99 Brazilian Reais (roughly $1.60), making it accessible to middle-class Brazilians. This prices below other entertainment subscriptions (like Netflix) while still generating meaningful revenue.

Localization: Spotify created Brazil-specific content, playlists (like "Sertanejo Nacional"), and partnerships with Brazilian artists. This made Spotify feel like a platform built for Brazilians, not a foreign product.

Distribution partnerships: Spotify partnered with TIM, Vivo, and other carriers to offer bundled plans. A mobile customer could get Spotify Premium included in their wireless plan, reducing churn and increasing adoption.

Payment options: Spotify integrated with local payment methods and even allowed prepaid phone credit to be used for subscriptions.

The result: Spotify went from virtually unknown in Brazil to dominant in a seven-year period. The same playbook is being executed in India, where Spotify is competing aggressively with Gaana, Jio Saavn, and YouTube Music.

In India, Spotify's strategy includes:

Ultra-low pricing: Spotify Premium costs 119 Indian Rupees per month ($1.43), one of the lowest globally.

Offline mode: Given India's inconsistent internet connectivity, offline listening is essential. Spotify allows users to download unlimited songs for offline playback, something competitors also offer but Spotify has optimized heavily.

Mobile app focus: Spotify's Indian app is optimized for phones with 4GB RAM and 2G/3G connections, recognizing that many Indians use older devices.

Cricket marketing: Spotify became the official audio sponsor of Indian Premier League cricket matches, gaining association with India's biggest sports property.

India represents a 300+ million potential user opportunity for Spotify. If Spotify can achieve 25% penetration in India (comparable to penetration in developed markets), that's 75+ million new users. At current growth rates, India could add 30+ million users to Spotify by 2027.

The Role of Data and Personalization in Retention

Spotify's real competitive advantage isn't the music catalog—all major platforms have similar library breadth. The advantage is personalization and the data infrastructure that powers it.

Every action you take on Spotify—every song you pause, every artist you follow, every playlist you create—generates data. Spotify ingests billions of data points daily and uses machine learning to model your music preferences at a granular level.

This data infrastructure enables features like Discover Weekly, which has become the single most important user engagement driver on the platform. Users open Spotify specifically because they know Monday's Discover Weekly will have personalized recommendations. That anticipation is powerful.

The retention benefit of personalization is measurable. Spotify's data shows that users who engage with personalized features (Discover Weekly, Release Radar, Daily Mixes) have 30-40% lower churn than users who don't engage with these features. That's massive—it means personalization directly translates to longer subscription lifespans.

Competitors have tried to replicate this. Apple Music has personalized playlists. YouTube Music has algorithmic recommendations. But none have matched Spotify's sophistication because Spotify has been optimizing personalization for longer and with more data.

The challenge is data privacy. As regulators tighten data privacy regulations (GDPR in Europe, proposed regulations in the US), Spotify's ability to collect and use personalization data might be constrained. The company is monitoring this closely and investing in privacy-preserving machine learning approaches that can deliver personalization without requiring as much raw user data.

The Challenge of Discovery and Curation in a 100 Million Song Library

With 100 million+ songs available on Spotify, the paradox is that users are overwhelmed by choice. How do you find music worth listening to in an 100-million-song library?

This is the core challenge of scale in music streaming. Spotify's algorithms try to solve this through discovery features, but human curation is also essential. Spotify employs thousands of human music experts who manually curate playlists, write playlist descriptions, and make editorial decisions about which music gets promoted.

The mix of algorithmic and human curation is what separates Spotify from YouTube Music or Apple Music. Spotify's human curators have deep music knowledge and understand regional preferences in ways algorithms alone can't capture.

But scale is a challenge. Spotify can't employ curators in every country who understand local music deeply. Instead, the company uses a hub model: employ expert curators in key markets (US, UK, Brazil, India, Sweden) and then have those curators' work distributed globally via algorithms.

This is also where AI enters the picture. Machine learning can help curators scale their knowledge by identifying similar songs, artists, and moods, then automating the creation of playlists based on those patterns. A human curator might manually create 10 playlists per week, but with AI assistance, they could oversee creation of 100+ playlists per week.

Regulatory Headwinds: Policy Changes Affecting Streaming Economics

Spotify's growth is occurring against a backdrop of increasing regulatory scrutiny. Several policy changes are potentially impactful:

EU Regulation: Europe's Digital Markets Act potentially designates Spotify as a "gatekeeper" platform, which could impose new obligations around interoperability and data sharing.

Music licensing reform: Multiple governments are revisiting how music licensing is regulated, potentially changing how much Spotify must pay for music.

Data privacy: GDPR and other regulations limit how much user data Spotify can collect and use for personalization.

Antitrust: Apple's bundling of Apple Music with other services is under antitrust review in multiple jurisdictions.

These regulatory changes create both risks and opportunities. A risk: if licensing costs increase due to regulatory action, Spotify's margins compress. An opportunity: if Spotify is designated as a "gatekeeper" in the EU, that status actually reinforces its market position and makes it harder for competitors to challenge.

Spotify's regulatory strategy is to be proactive. The company has been transparent with regulators, funded music industry research, and argued for balanced approaches to regulation that maintain innovation incentives.

Future Outlook: Where Is Streaming Going?

What's next for music streaming? Several trends are emerging:

Spatial audio and lossless: Spotify has been slow to adopt spatial audio (available on Apple Music) and lossless audio quality (available on Tidal). Expect Spotify to eventually offer these as Premium Plus features, though the competitive advantage might be limited since most listeners use compressed audio via earbuds.

Creator monetization tools: Spotify will likely expand tools that let artists monetize beyond streaming, including direct sales, tips, and merchandise integrated into the platform.

Podcast integration: Spotify will continue to produce high-quality exclusive podcasts, but the all-in strategy has been scaled back. Expect selective investments rather than broad expansion.

Global payment infrastructure: Spotify will continue to invest in local payment methods and partnerships to expand into developing markets. This is where the next 300 million users will come from.

AI-powered tools: From playlist generation to artist tools to discovery recommendations, AI will become increasingly embedded in every part of Spotify's product.

The 750 million user milestone is remarkable, but it's perhaps more interesting as a foundation for what comes next. Spotify's challenge over the next 5 years is not adding the next 100 million users (that's relatively straightforward—just keep executing the emerging market playbook). The challenge is maintaining engagement and Premium conversion rates while the platform matures.

Spotify's ability to do that depends on its ability to innovate faster than competitors, maintain a superior experience, and keep finding new ways to deliver value to users and creators. The next chapter of Spotify's story will be determined by how well the company executes on those fronts.

FAQ

What are Spotify's main revenue sources?

Spotify generates revenue primarily from two sources: Premium subscription fees (roughly 75-80% of revenue) and advertising from free-tier users (roughly 20-25% of revenue). Premium subscribers pay monthly fees ranging from

How does Spotify's personalization algorithm work?

Spotify uses machine learning algorithms that analyze billions of data points about your listening habits, including the songs you complete, the songs you skip, the playlists you create, the artists you follow, and the time of day you listen to specific genres. The system then identifies patterns in your taste and recommends songs, artists, and playlists it predicts you'll enjoy. Features like Discover Weekly use collaborative filtering (comparing your taste to similar users' tastes) and content-based filtering (analyzing audio features of songs you like) to generate personalized recommendations.

Why are Spotify's per-stream payouts declining if the user base is growing?

While Spotify's user base has grown substantially, the per-stream payout to artists has declined because Spotify pays out approximately 60-70% of its revenue to music rights holders as fixed costs. As the user base grows without proportional revenue growth (due to lower pricing in emerging markets and competitive pressure), the per-stream payout actually decreases mathematically. Additionally, the increased volume of music on Spotify means payments are spread across more tracks, further reducing per-stream rates for individual artists.

How does Spotify compete against Apple Music and Amazon Music?

Spotify's competitive advantages include its large user base and network effects, superior personalization algorithms developed over years of optimization, the cultural moment of Spotify Wrapped, and brand recognition among music listeners. Apple Music benefits from integration with Apple devices and the Apple One bundle, while Amazon Music benefits from Amazon Prime membership. YouTube Music has the advantage of YouTube's 2.5 billion user base. Spotify maintains leadership through continuous innovation in AI, creator tools, and international localization, but the competitive gap is narrowing as competitors invest in their platforms.

What is Spotify's average revenue per user and how is it changing?

Spotify's average revenue per user (ARPU) varies significantly by region, ranging from roughly

How does Spotify maintain user retention and prevent churn?

Spotify reduces churn through personalization (Discover Weekly and Release Radar engagement significantly reduce churn), social features (sharing playlists and Spotify Wrapped with friends creates network effects), exclusive content (podcasts and artist partnerships), and habit formation (the app becomes part of users' daily routines). The company also strategically times price increases to minimize churn and offers multiple tier options so users can find a price point that matches their willingness to pay. Data shows users with high engagement with personalized features have 30-40% lower churn than less-engaged users.

What is Spotify's strategy for competing in emerging markets?

Spotify's emerging market strategy includes ultra-low pricing (as little as $1-2/month in countries like India and Pakistan), mobile-first app design optimized for older devices and slow internet, offline listening functionality, local payment method integration (M-Pesa, UPI, etc.), partnerships with telecommunications carriers for bundled plans, and deep localization including country-specific playlists and partnerships with local artists. This playbook has worked exceptionally well in Brazil and is being deployed in India, Indonesia, and Southeast Asia as the next frontier for growth.

Will Spotify ever offer lossless audio quality?

Spotify has been slow to adopt lossless audio, which is available on Tidal and Apple Music. The company's reasoning is that most listeners use compressed audio through earbuds or phone speakers, where the quality difference isn't perceptible. Spotify may eventually offer lossless as a Premium Plus tier feature to compete with Apple Music, but it's not a current priority. The company's focus remains on discovery, personalization, and engagement rather than audio quality as a differentiation lever.

Conclusion: The Streaming Giant's Next Chapter

Spotify hitting 751 million monthly active users is a milestone worth celebrating, but it's perhaps more meaningful as a marker of how far music streaming has come and how much further it can go. When Spotify launched in 2008, the music industry was fragmented and skeptical about streaming's potential. Today, streaming is the dominant way people consume music globally, and Spotify is the dominant platform in that ecosystem.

But growth of 11% year-over-year, while strong, also signals that Spotify is moving into a different phase. The easy growth—signing up new users in developed markets—has largely happened. The next frontier is deeper penetration in emerging markets, higher Premium conversion rates, and improved monetization per user. Those metrics don't generate the same excitement as doubling user counts, but they're arguably more important for long-term sustainability.

The strategic decisions Spotify is making—investing heavily in AI, building creator tools, carefully managing content quality, expanding internationally—suggest the company understands this inflection point. Spotify isn't trying to chase every new trend. It's focused on deepening its moat through technology and user experience.

The competitive environment is intensifying. Apple Music, Amazon Music, YouTube Music, and regional competitors like Gaana and Tidal are all fighting for market share. Spotify's lead is sustainable but not insurmountable. The next five years will determine whether Spotify can maintain its position as the default music streaming platform globally or whether it becomes one of several equally viable options.

What's clear is that the music streaming market itself isn't going anywhere. Music is a fundamental part of human culture and a reliable driver of engagement. Spotify's ability to remain the platform where most people listen to music will depend on its continued innovation, its execution in emerging markets, and its ability to deliver personalized, high-quality experiences at scale.

The 750 million user milestone is impressive. But the real test of Spotify's leadership will be what happens next: whether the company can add the next 300-500 million users while maintaining profitability and user satisfaction. If Spotify executes on that challenge, the next milestone won't just be a number—it'll be a confirmation of Spotify's dominance for another decade.

Key Takeaways

- Spotify hit 751 million monthly active users in Q4 2025, an 11% year-over-year increase, cementing dominance in music streaming

- Premium subscribers grew to 290 million (10% YoY), generating 75-80% of revenue and demonstrating strong monetization momentum

- AI-driven personalization, particularly Discover Weekly and algorithmic playlists, directly reduce churn by 30-40% among engaged users

- Emerging markets in Latin America and Asia Pacific are growing at 20-30% annually, dwarfing 3-4% growth in developed markets

- Spotify Wrapped generated 630 million social shares across 56 languages, serving as the platform's most powerful retention and virality driver

- Regional pricing strategies (India at 12.99/month) enable global penetration while preserving profitability in developed markets

Related Articles

- YouTube's AI Playlist Generator Explained [2025]

- YouTube Music Lyrics Behind Paywall: What It Means for Subscribers [2025]

- YouTube TV Custom Bundles: Breaking Streaming Costs Down [2025]

- YouTube TV Custom Channel Packages & Pricing Guide [2025]

- HBO Max UK & Ireland Launch [2025]: Complete Guide & Pricing

- HBO Max UK Launch Date, Pricing & How It Compares to Netflix [2025]

![Spotify Hits 750M Users: Growth Drivers Behind the Numbers [2025]](https://tryrunable.com/blog/spotify-hits-750m-users-growth-drivers-behind-the-numbers-20/image-1-1770729006448.jpg)