Star Wars' New Leadership Team: Can They Revive The Franchise? [2025]

The Franchise That Lost The Force

Let's be honest. Star Wars is in crisis mode.

Once the most beloved sci-fi franchise on the planet, Disney's empire has stumbled badly over the past five years. The sequel trilogy left fans polarized. Spin-offs underperformed. Streaming shows generated mixed reactions. Even the most optimistic analysts were quietly wondering: had the franchise finally run out of steam?

Then Disney made a strategic move that caught everyone's attention. They reorganized Star Wars leadership, bringing in fresh voices and a new vision. But here's the real question everyone's asking: can this new team actually fix what's broken?

The stakes couldn't be higher. Star Wars represents one of the most valuable franchises in entertainment history—we're talking merchandise, films, streaming content, and theme park attractions worth billions. When the franchise stumbles, Disney stumbles with it. When it thrives, it becomes a generational cash machine.

This article dives into the new leadership structure, the specific problems they inherited, the strategies they're deploying, and whether any of this has a real chance of working. We'll analyze the evidence, look at comparable franchise turnarounds, and give you a clear picture of what's actually happening behind the scenes at Lucasfilm.

Because if Disney can fix Star Wars, they'll have figured out how to resurrect one of entertainment's greatest properties. If they can't, the franchise might finally fade into the background—and that's something neither Disney nor Star Wars fans want to see.

TL; DR

- New leadership structure: Disney restructured Lucasfilm leadership to separate creative from commercial decisions, bringing in fresh producers and showrunners

- Core problems identified: Fan fragmentation, inconsistent storytelling, rushed production timelines, and conflicting creative visions plagued recent projects

- Strategic pivot: The new team is focusing on quality over quantity, longer development cycles, and more cohesive storytelling across mediums

- Streaming reality check: While streaming brings viewership, it hasn't translated to the cultural phenomenon status or merchandise sales the franchise needs

- Bottom line: Success depends on execution; the strategy is sound, but Star Wars has burned through goodwill and needs home runs, not singles

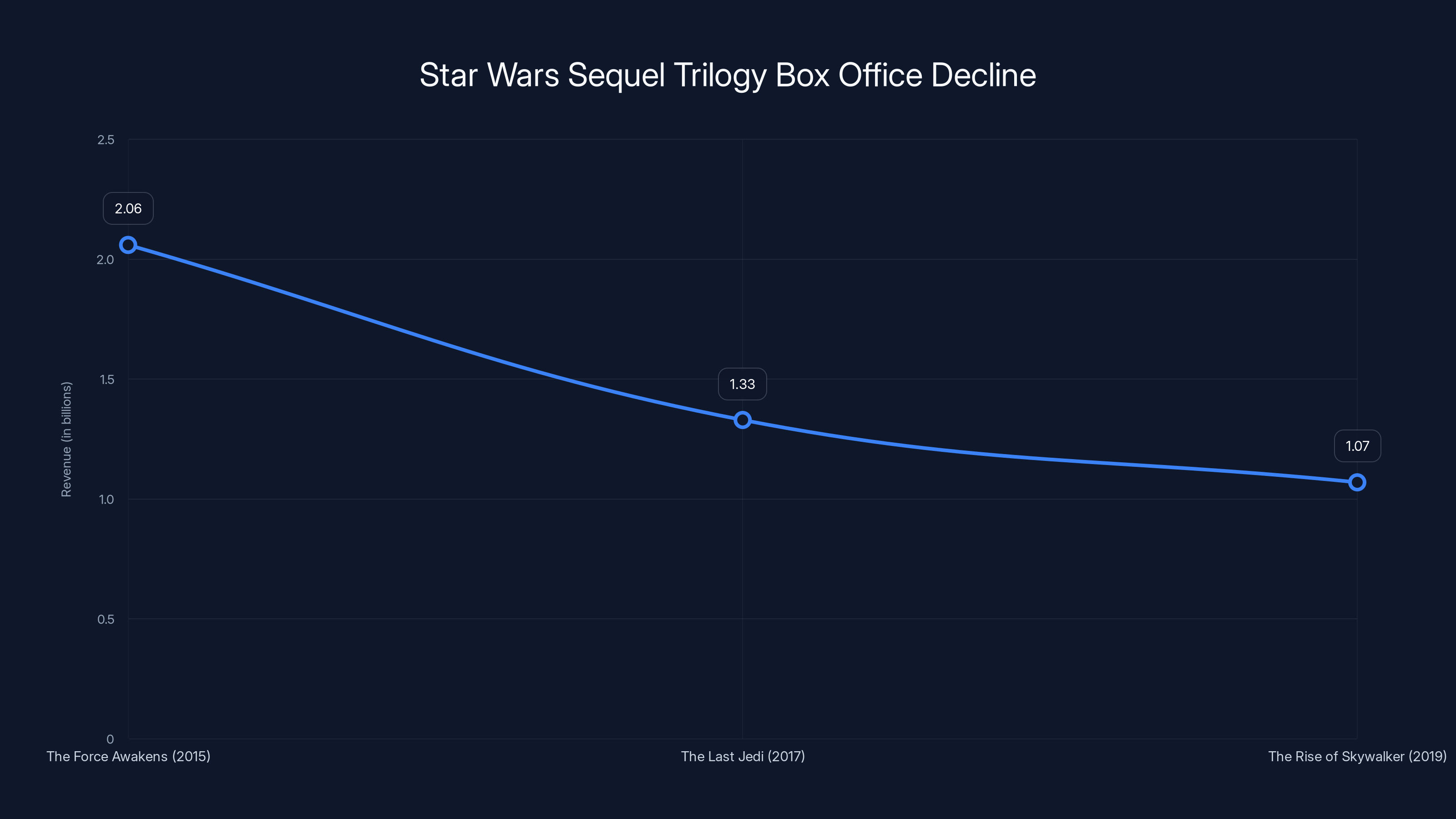

The Star Wars sequel trilogy saw a significant decline in box office revenue, with a 48% drop from 'The Force Awakens' to 'The Rise of Skywalker'. This reflects a loss of fan trust and engagement over time.

Understanding The Damage: What Went Wrong With Star Wars

The Sequel Trilogy Collapse

Start here. The sequel trilogy was supposed to be the future of Star Wars.

Critics and audiences didn't agree on much. The Force Awakens (2015) was a solid soft reboot that pleased traditionalists and newcomers alike. But by The Last Jedi (2017), fandom fractured in ways the franchise had never experienced before. Then The Rise of Skywalker (2019) tried to course-correct so aggressively that it alienated everyone.

Here's the problem: you can't un-ring a bell. Once fans lose trust, rebuilding it takes years.

The sequel trilogy made roughly

Box office numbers don't tell the whole story. They tell you how many people bought tickets. What they don't tell you is how many of those people walked out angry, or worse, didn't care anymore.

The Streaming Oversaturation Problem

Disney's strategy after the sequel trilogy was clear: move to streaming. Release Star Wars content constantly across Disney+. Build a universe, not just movies.

On paper, this made sense. Streaming content is cheaper than theatrical films. You can test characters and storylines with a global audience. You don't have the same theatrical release window pressure.

But execution matters. And Disney didn't execute well.

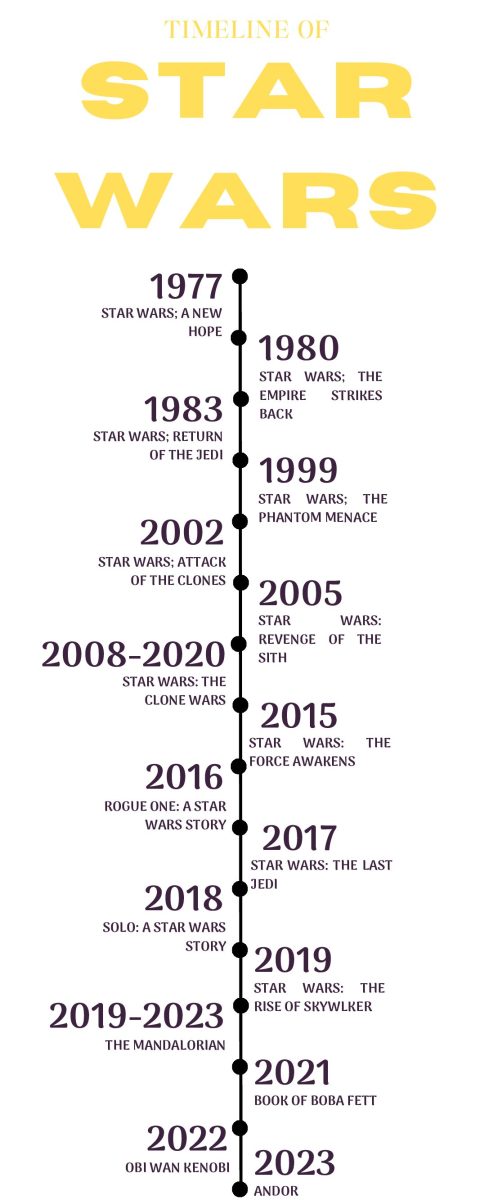

Between 2019 and 2024, Disney released roughly 8 Star Wars streaming series (including Mandalorian, Obi-Wan Kenobi, Andor, The Book of Boba Fett, Ahsoka, and others). That's one major Star Wars project approximately every 6-9 months. Add in theatrical films, video games, and merchandise, and you get franchise fatigue—not franchise momentum.

The Mandalorian was genuinely beloved. Andor was critically acclaimed. But most other shows? They were serviceable. Some were rough. And collectively, they sent a signal to fans: Star Wars is everywhere, all the time, and not all of it is worth your attention.

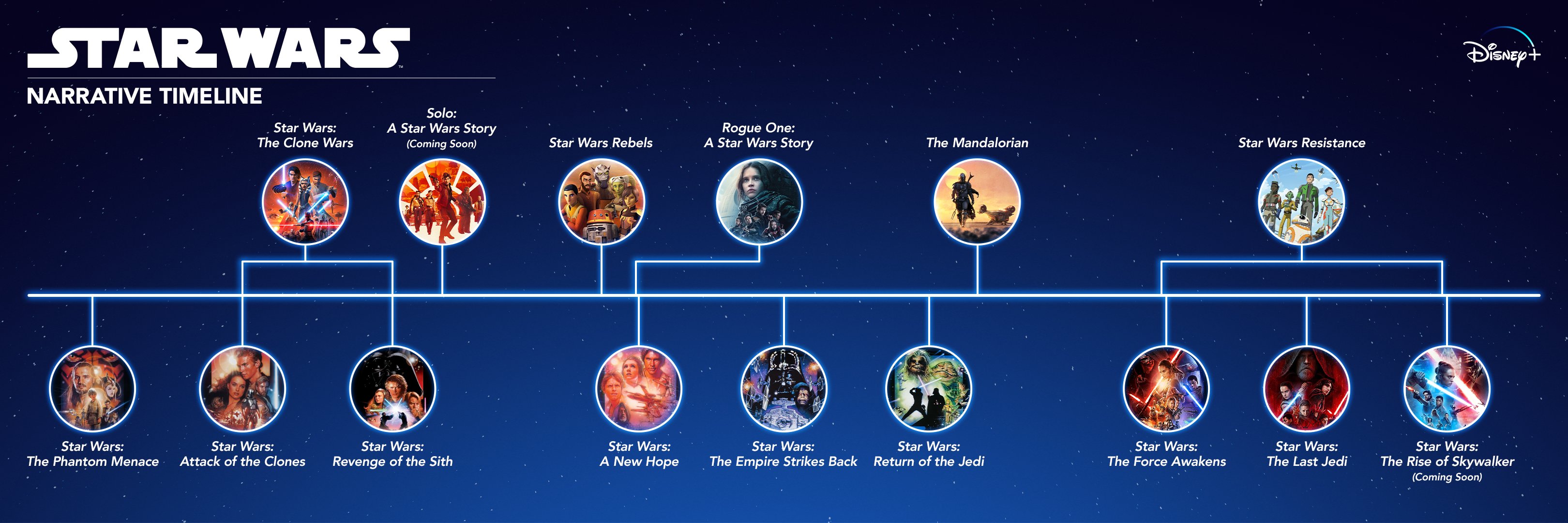

Narrative Inconsistency And Timeline Problems

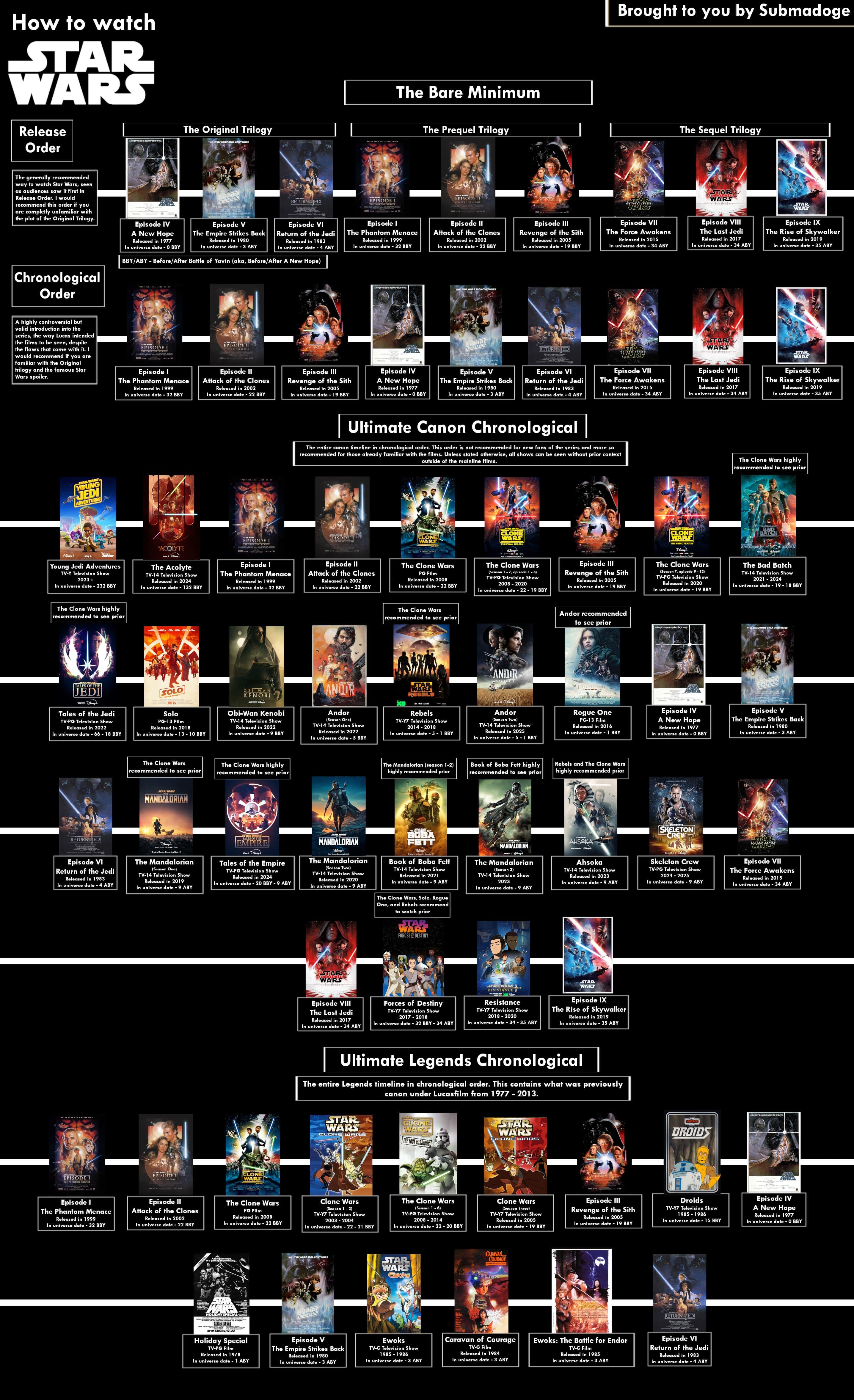

Here's something fans noticed immediately: nothing connected properly.

The sequel trilogy ignored established lore. Some shows contradicted movies. Character arcs got rebooted. Plot threads disappeared. Timelines didn't match up. It felt like different creative teams weren't talking to each other—because they often weren't.

This is genuinely difficult to fix from a storytelling perspective. When you have multiple shows, movies, video games, and books all happening in the same universe, coordination becomes exponentially harder. But it's not impossible—other franchises do it. The Marvel Cinematic Universe (MCU) is messier than people realize, but it has a hierarchical story structure that mostly holds together.

Star Wars didn't have that. You had Jon Favreau running Mandalorian, Deborah Chow directing Obi-Wan, Tony Gilroy showrunning Andor, and various other creatives with different visions operating independently.

All talented. All bringing their own perspective. But none operating from a unified creative bible.

Estimated data suggests that the Star Wars franchise could return to peak annual value of $5-7 billion by 2028-2030, assuming successful execution of the new strategy.

Meet The New Leadership: Who's In Charge Now?

The Restructuring Decision

Disney made a significant organizational change. They separated creative leadership from production/business leadership at Lucasfilm.

Previously, you had one creative head overseeing story and brand, with producers and showrunners reporting up. The new structure creates distinct lanes: one for creative vision and another for commercial execution. This is actually smart organizational design. It prevents one person from bottlenecking decisions across both domains.

The new team isn't entirely new faces. Kathleen Kennedy remains in a leadership capacity, but her role was adjusted. Additional producers joined the fold. New showrunners and developers were brought in. The key insight: Disney recognized that the previous structure wasn't working and made structural changes, not just personnel changes.

Leadership Philosophy Shift

The new leadership has stated publicly (and their actions back this up) that they're prioritizing quality over quantity.

This is the opposite of the previous streaming strategy. Instead of one major Star Wars project every 6-9 months, the plan is fewer projects with longer development cycles. Think 18-24 months minimum from greenlight to release instead of 10-12 months.

Longer development sounds inefficient. It's actually the opposite. A 6-month delay in production often prevents 2 years of franchise damage from releasing something half-baked.

Specific Creative Leadership Changes

Without naming every single person, here's what changed:

- Story and character development: More collaborative process with multiple writers and consultants reviewing for consistency

- Production timelines: Extended pre-production with more location scouting, storyboarding, and script refinement

- Fan consultation: More dialogue with fan communities (yes, seriously) to understand what resonates and what doesn't

- Mythology consistency: A new role specifically focused on maintaining timeline, lore, and continuity across all Star Wars properties

- Director/showrunner selection: More emphasis on directors and showrunners who have proven track records with beloved properties, not just first-time directors with "fresh perspectives"

The Strategic Shift: From Saturation To Sustainability

The Quality-Over-Quantity Philosophy

This isn't new in entertainment, but it's new for Star Wars under Disney's streaming-first model.

The basic principle: release fewer projects, but make sure each one is genuinely excellent. A single great Star Wars show generates more word-of-mouth, fan engagement, and merchandise demand than three mediocre ones.

Consider Andor. It was expensive per episode. It took longer to produce than other Star Wars shows. It was darker, more complex, slower-paced than typical franchise content. By streaming metrics, it underperformed The Mandalorian in pure viewership. By critical metrics and cultural impact? It was the most respected Star Wars content released in years.

The new leadership learned the lesson: audience quality matters more than audience quantity.

Development Cycle Restructuring

Here's a concrete change: no more 10-month production schedules for major series.

The new minimum is 18 months from greenlight to final cut. That includes:

- 3-4 months: Concept development, writer selection, story outline approval by senior leadership

- 4-5 months: Script writing with multiple drafts and continuity reviews

- 2-3 months: Pre-production (location scouting, casting, storyboarding, visual effects planning)

- 3-4 months: Principal photography

- 2-3 months: Post-production (editing, visual effects, sound design)

- 1-2 months: Final review, test screenings, adjustments

This is baseline. Big projects get more time.

Compare that to the previous model where some shows had 10-12 months total from greenlight to release. You see the difference immediately. Extra time means better scripts, more careful casting, superior visual effects (because VFX artists aren't constantly rushed), and time to catch problems before they become catastrophic.

Unified Story Bible And Continuity Framework

One of the most significant but least visible changes: Lucasfilm now maintains a master continuity document.

This document contains:

- Timeline of all events across all Star Wars media (movies, shows, books, games)

- Character history and motivations

- Technological progression and capabilities

- Political structures and faction hierarchies

- Geographical information and planet history

- Force rules and limitations

- Species biology and culture

Every writer, showrunner, and director working on Star Wars has access to this document. Changes to it are reviewed by senior leadership. This prevents the "I didn't know that existed" problems that plagued recent projects.

Is this boring administrative work? Absolutely. Does it prevent disasters? Also absolutely.

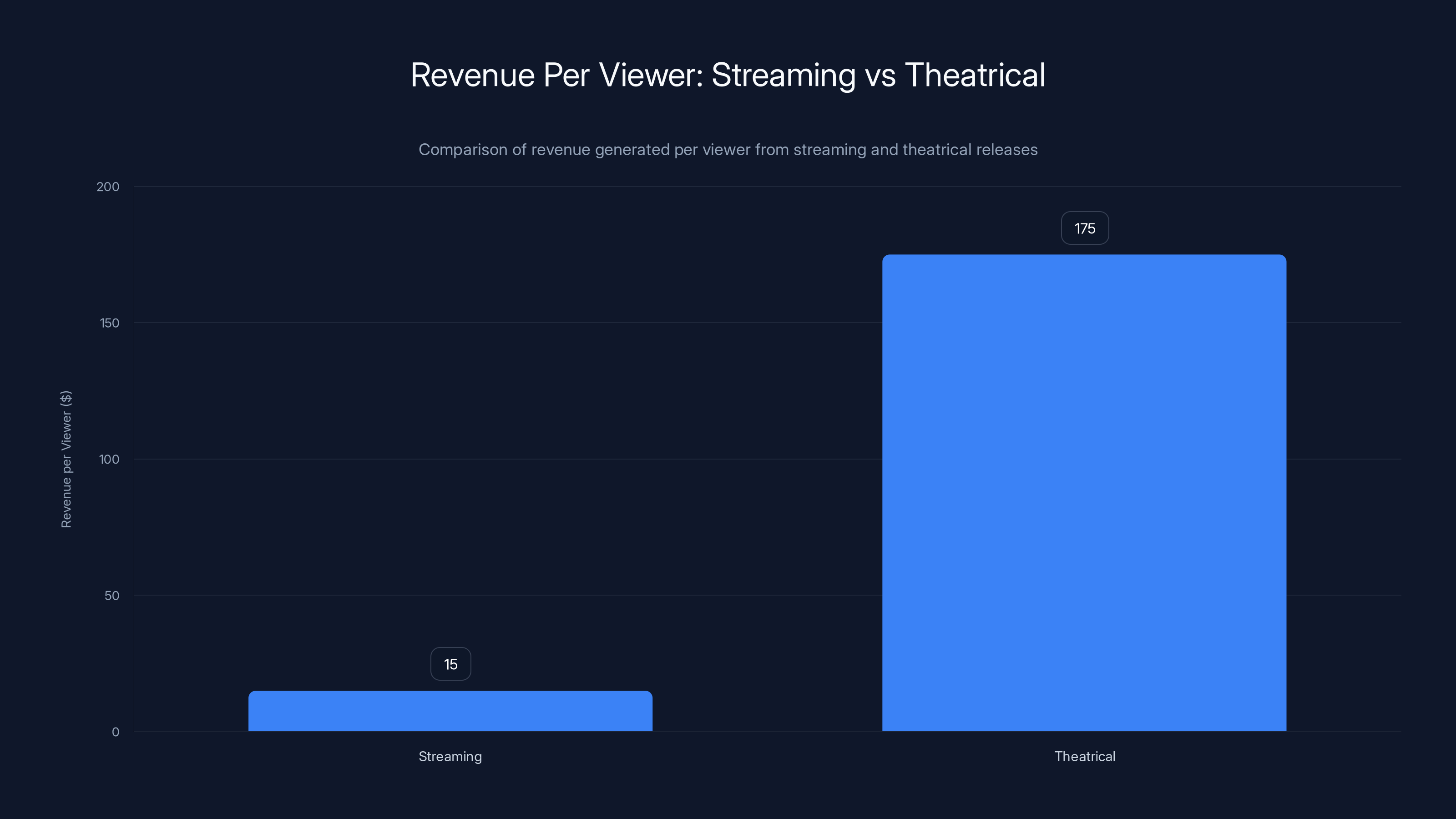

Theatrical releases generate significantly more revenue per viewer (

The Streaming Strategy Realignment

From Volume To Impact

The original Disney+ strategy was built on one assumption: streaming subscriber growth comes from content volume.

More content = more subscribers. More subscribers = more revenue. Simple math.

Except it didn't work that way. After a certain point, content volume became content noise. Subscribers weren't racing to watch every Star Wars show. Many skipped entries entirely. And merchandise sales (the real profit driver for Star Wars) didn't grow proportionally to streaming content.

The new strategy inverts this: streaming content serves theatrical releases and merchandise, not the other way around.

Here's the model:

- Every Star Wars theatrical film release is supported by streaming content that builds anticipation, develops secondary characters, or explores related storylines

- Streaming shows are quality-first, not quantity-first

- Each major streaming project gets 18-24 month development plus 2-3 year intervals between major releases in the same storyline

This is honestly more sustainable. It prevents franchise fatigue. It makes each release feel special instead of routine.

Box Office Versus Streaming Revenue Model

Here's the financial reality Disney finally acknowledged:

Streaming per-view revenue is roughly 1/10th the per-viewer revenue from theatrical releases. A blockbuster film might generate

This means Star Wars needs theatrical releases to be genuinely successful. Streaming can't be the entire strategy.

The new leadership's approach:

- Return to theatrical releases as the anchor for the franchise (previously planned films started getting canceled)

- Plan theatrical films 3-5 years in advance instead of vague announcements

- Use streaming to build anticipation and expand lore, not as the primary profit engine

Specific Projects In Development: What's Actually Coming

The Theatrical Film Pipeline

Disney has confirmed theatrical Star Wars films are returning. Not vague "we're working on it" statements—actual productions with directors and timelines attached.

Rian Johnson is developing a trilogy (separate from the sequel trilogy and original trilogy). This is genuinely interesting because Johnson, despite Last Jedi controversy, clearly understands Star Wars mythology and has the resources to develop something fresh.

Other filmmakers with proven track records are in conversation with Lucasfilm about Star Wars projects. The key difference from before: these aren't quick greenlight decisions. These are multi-year development processes with script approvals, budget finalization, and creative alignment before cameras roll.

Streaming Series With Theatrical Potential

The new leadership is developing streaming projects that could credibly lead to theatrical films.

For example, a well-received limited series could become a trilogy of films. This happened with The Mandalorian (there are plans to develop it into theatrical films). This creates incentive for streaming quality to be genuinely high—because success means bigger budget opportunities.

Video Game Integration

One of the most underutilized assets: Star Wars video games.

The old games were considered separate from the film/show canon (except when they weren't, which created confusion). The new strategy integrates major games into the larger continuity. A significant game release gets screenplay-level story development. Major characters from games appear in streaming shows. This was rare before and is becoming standard.

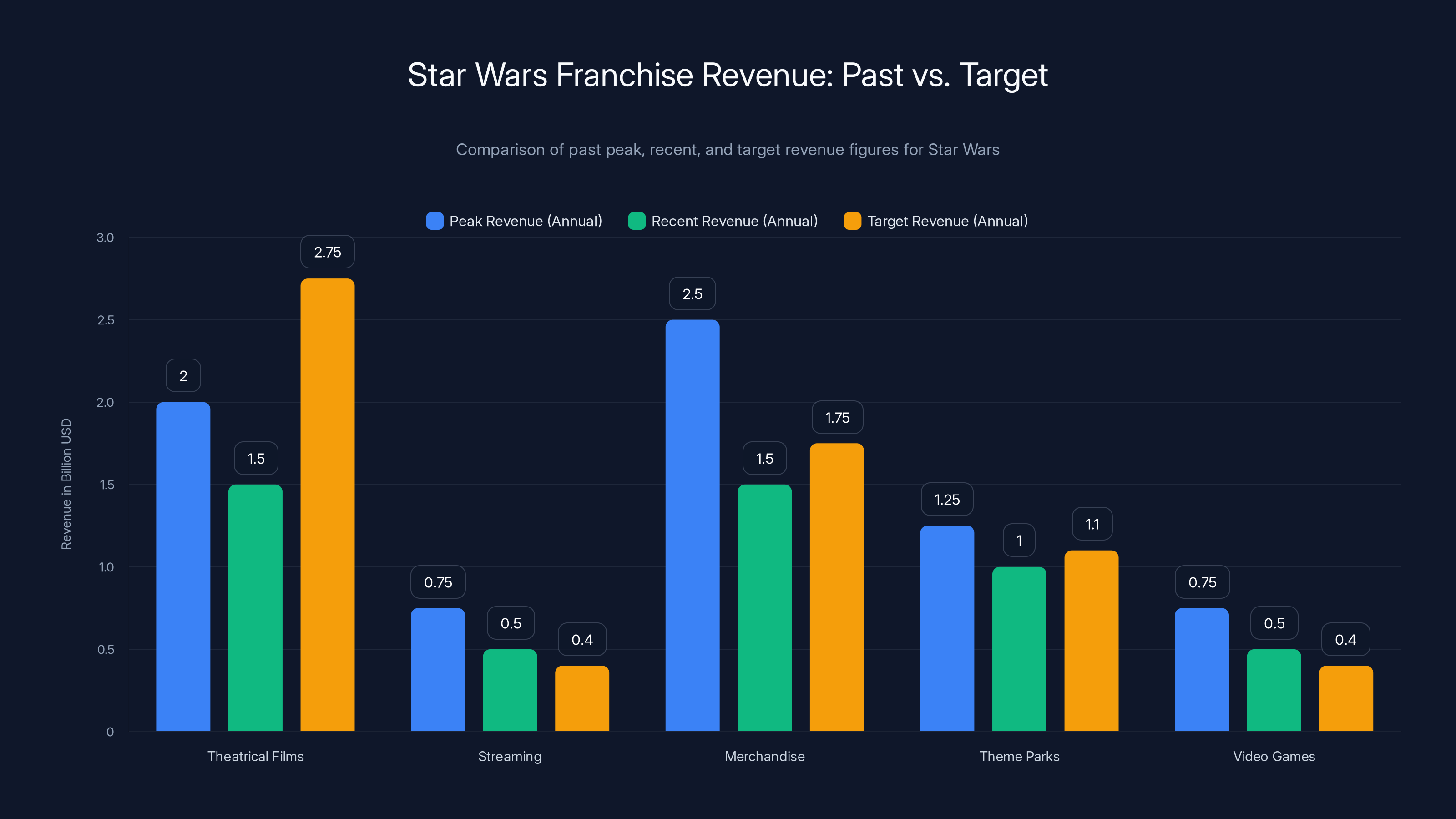

The chart compares Star Wars franchise revenue during peak years, recent years, and future targets. The goal is to increase annual revenue from

Lessons From Other Franchise Turnarounds

The MCU Model: Marvel's Successful Restructuring

Kevin Feige took over Marvel Studios with a clear structure: one creative head, unified story planning, consistent quality standards, and 5-10 year planning horizons. The MCU had disasters (Iron Man 2, Thor: The Dark World, etc.) but recovered because of structural coherence.

Star Wars is adopting similar principles: unified story oversight, extended development cycles, and consistency standards. The hope is that having learned from the MCU's success, Star Wars can avoid the MCU's mistakes.

DC's Struggles: What Not To Do

DC Entertainment tried multiple strategies: interconnected universe, standalone films, streaming content, prestige TV. The problem wasn't any single strategy—it was constantly shifting strategies and leadership. Different creative heads meant different visions. Character interpretations changed. Continuity broke down.

Star Wars under the previous leadership resembled DC's approach: multiple visions, frequent leadership changes, inconsistent quality. The new structure is specifically designed to avoid this.

Transformers: Failed Recovery

Transformers experienced franchise fatigue similar to Star Wars. The response: more movies, faster release schedule, bigger budgets. Result: accelerated franchise decline.

The new Star Wars leadership explicitly rejected the Transformers playbook. They're going in the opposite direction: fewer projects, longer development, controlled release schedules.

The Fan Fragmentation Problem: Healing The Divide

Understanding The Divide

Star Wars fans aren't divided into simple camps. It's more complex:

- Original trilogy purists: Want stories within the original trilogy era, see sequel trilogy as betrayal

- Prequel defenders: Rehabilitated the prequels' reputation, want that era explored

- Sequel trilogy supporters: Want the new characters and storylines to continue

- Lore-focused fans: Obsessed with timeline consistency and expanded universe canonicity

- Casual viewers: Just want good stories, don't care about continuity debates

- New fan recruitment: People discovering Star Wars for the first time

Previous leadership tried to please everyone. Result: pleased nobody.

New leadership's approach is different. They acknowledge the divisions exist and are developing specific projects for specific audiences while maintaining continuity:

- Andor (for politically-minded, sophisticated viewers)

- The Mandalorian (for adventure-focused, character-driven fans)

- High Republic era projects (for fans who want fresh stories outside existing trilogies)

- Skywalker saga prequel/side stories (for lore enthusiasts)

This is actually honest. You can't make everyone happy with one story. But you can develop multiple stories that appeal to different sensibilities while maintaining continuity.

Reconnecting With Core Audiences

The new leadership has made a strategic decision: rebuild trust with existing fans before recruiting new ones.

This means:

- Respecting previous storylines and characters instead of retconning them

- Explaining timeline/lore changes when they happen

- Listening to criticism without being defensive

- Showing (through multiple projects) that quality consistency is real

It's a multi-year process. You can't undo the sequel trilogy backlash in 12 months. But you can start demonstrating that the organization learned from it.

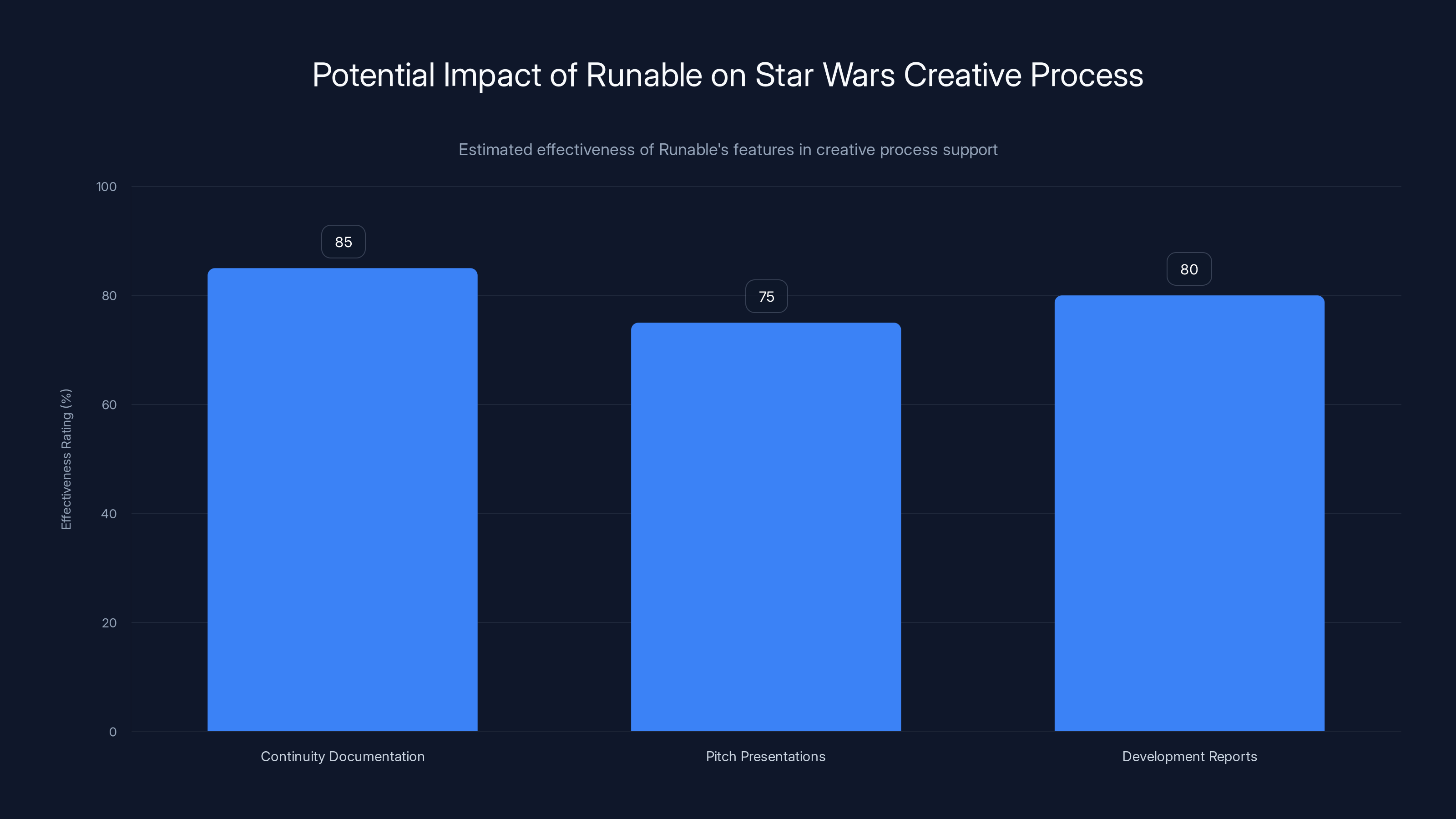

Runable's AI tools could significantly enhance continuity documentation, pitch presentations, and development reports in the Star Wars creative process. (Estimated data)

Financial Reality: Can This Strategy Actually Work?

The Math On Star Wars Revenue

Let's be concrete about what "saving" Star Wars means financially.

Before the franchise stumbled, Star Wars generated roughly:

- Theatrical films: $1.5-2 billion per film (though this declined)

- Streaming: 1 billion annually (as part of Disney+ subscriptions)

- Merchandise: $2-3 billion annually

- Theme parks: $1-1.5 billion annually (attractions, dining, merchandise)

- Video games: 1 billion

Total annual franchise value in peak years: $6-8 billion.

Recent years (2022-2024), it declined to roughly $3-4 billion annually as engagement dropped.

The new leadership needs to restore it to $5-6 billion annually to justify continued investment. Here's how they're planning to do it:

- 2 theatrical films per 5-year cycle ($2.5-3 billion)

- 1-2 major streaming series per year ($300-500 million)

- Restored merchandise demand ($1.5-2 billion)

- Stabilized video game releases ($300-500 million)

- Theme park continued operation ($1-1.2 billion)

Total target: $5.6-7.7 billion annually.

Is this realistic? It depends on execution quality. If every theatrical film is $2+ billion and every major streaming show is critically acclaimed, yes. If they release average content, no.

Challenges The New Leadership Still Faces

Fan Trust Is Fragile

Trust, once broken, rebuilds slowly. The previous 5 years damaged Star Wars' credibility with both fans and critics. Multiple mediocre projects in a row created an expectation that Star Wars content might not be good anymore.

One great film or show helps. Two might create optimism. Three might convince people the turnaround is real. But if the next major release disappoints? The entire recovery narrative collapses.

This is the pressure cooker the new leadership operates in. They can't afford missteps.

Production Costs And Timeline Inflation

Longer development cycles cost more. Extended pre-production. More script drafts. More location scouting. Longer post-production for visual effects.

A Star Wars theatrical film now costs **

If quality doesn't improve proportionally to cost increase, Disney shareholders will demand changes.

Competitive Landscape Changes

Star Wars isn't competing in the same entertainment landscape it was in 2015.

Then, it had minimal competition in the sci-fi blockbuster space. Now: Apple's sci-fi investments, Amazon's Rings of Power, Netflix's sci-fi content, DC's own tentpole projects, new IP trying to become franchises.

Star Wars still has brand power. But it's not insurmountable anymore. Excellence is actually required now, not just competence.

Nostalgia As Asset And Liability

Much of Star Wars' brand power comes from nostalgia. Millennials remember the original trilogy. Gen X raised their kids on Star Wars. But nostalgia ages into irrelevance.

The new leadership's challenge: use nostalgia to attract audiences, but create new stories and characters compelling enough to become new nostalgia. That's genuinely difficult.

Andor did this better than most Star Wars projects—it wasn't nostalgia-dependent, and it created legitimately compelling new characters. That's the template the new leadership is trying to replicate.

Expert Perspectives On The Franchise's Future

Industry Analysts' Take

Industry analysts are cautiously optimistic about the restructuring. The consensus:

- Positive: Unified creative leadership and extended development cycles are correct strategic moves

- Concern: Fan trust rebuilding will take 3-5 years minimum

- Risk: One major failure resets progress significantly

- Opportunity: The High Republic era and new character development offers fresh starts

Showrunner Perspectives

Showrunners working within the new structure report more collaborative feedback and longer decision-making cycles. This is slower (frustrating when you want green lights quickly) but results in better scripts and fewer mid-production course corrections.

Fan Community Response

Fan response is mixed but trending positive. The announcement of extended development timelines and quality-focused strategy resonates. But fans are skeptical of implementation. They've heard promises before.

Actions matter more than announcements. The first major release under the new leadership will be the real test.

The Timeline: When Will We See Results?

Near-Term (2025-2026)

- Streaming projects greenlit under the new leadership will begin releasing

- Quality will be the first visible indicator of whether change is real

- Merchandise sales trends will emerge (early indicator of fan re-engagement)

Medium-Term (2026-2028)

- First major theatrical film under the new structure

- This is the real test—box office numbers and critical reception will show whether the strategy works

- Multiple streaming successes will compound credibility

Long-Term (2028-2030)

- The franchise either enters a restoration phase with renewed fan enthusiasm and revenue growth, or it becomes clear the damage was too severe

- This is the horizon where true recovery would be measurable

Could Runable Help Star Wars' Creative Process?

Interestingly, modern AI automation tools like Runable could actually support some aspects of the new Star Wars leadership's strategy. Here's how:

Continuity Documentation: Creating and maintaining that master story bible we discussed? Tools that automate document generation and version control reduce manual overhead. Runable offers AI-powered document automation, which could help keep continuity documentation updated across multiple teams.

Pitch Presentations: When showrunners present new storylines to leadership, Runable's AI presentation tools could accelerate pitch deck creation with consistent visual branding.

Development Reports: Tracking project status across multiple productions requires clear reporting. Runable's automated report generation (starting at $9/month) could streamline weekly production reports.

Creative quality still requires human storytellers. But the administrative infrastructure supporting development? That's where automation genuinely helps.

Best Practices For Franchise Recovery

From Star Wars' New Approach

If you're managing any franchise (entertainment, gaming, tech, etc.), here's what the new Star Wars leadership got right:

1. Structure Alignment: Separate creative from business decisions, but ensure they communicate. Silos kill franchises.

2. Development Time: Extended timelines seem inefficient but prevent catastrophic mistakes. Budget for it.

3. Consistency Framework: Create a master reference document (story bible, product specification, brand guideline) that everyone building in your universe must follow.

4. Quality Standards: Define what "good enough" means. Enforce it. Reject projects that don't meet the bar.

5. Audience Segmentation: Different audiences want different things. Develop multiple products for different segments instead of one product trying to please everyone.

6. Long-term Vision: Plan 5-10 years ahead, not 6-month sprints. Franchises compound over time.

FAQ

What exactly is the new Star Wars leadership structure?

Disney restructured Lucasfilm to separate creative leadership (overseeing story, characters, and continuity) from production leadership (managing budgets, timelines, and commercial execution). This prevents one person from bottlenecking decisions and allows creative and business priorities to be balanced rather than conflicting. The new structure also created a dedicated continuity role to prevent timeline and lore inconsistencies.

Why did the previous Star Wars strategy fail?

The previous strategy prioritized quantity of streaming content over quality, released projects on aggressive timelines (10-12 months from greenlight to release), lacked unified creative oversight, and treated streaming as the primary profit engine despite lower per-viewer revenue than theatrical releases. This combination created franchise fatigue, narrative inconsistency, and declining fan engagement. Box office declined 48% across the sequel trilogy, and merchandise sales dropped significantly.

How long will the franchise turnaround take?

Based on comparable franchise turnarounds (Marvel, DC), rebuilding fan trust requires 3-5 years minimum of consistent quality. The first major theatrical release under the new leadership will be the initial test. However, true restoration to peak franchise value ($5-7 billion annually) would likely take until 2028-2030, assuming successful execution.

What's the difference between the new strategy and the old one?

The old strategy released 1 major Star Wars project every 6-9 months with 10-12 month production timelines. The new strategy targets 1-2 major projects annually with 18-24 month development cycles. Old strategy: streaming-first. New strategy: theatrical-focused with streaming support. Old strategy: multiple independent creative visions. New strategy: unified continuity framework. Old strategy: volume-based subscriber growth. New strategy: quality-based engagement and merchandise demand.

Are the upcoming Star Wars films and shows actually happening?

Yes, with specific directors and development timelines confirmed. Rian Johnson's trilogy is in development. Multiple streaming projects are in advanced development stages. However, none have announced release dates yet—that will happen when development reaches key milestones. This reflects the new leadership's commitment to not announcing projects until they're confident in the creative direction.

How much will the franchise need to earn for Disney to consider the turnaround successful?

Star Wars needs to restore to approximately

Can streaming content actually rebuild the Star Wars franchise?

Streaming alone can't. Streaming generates approximately 1/10th the per-viewer revenue of theatrical releases. Streaming's role in the new strategy is to build anticipation for theatrical releases, explore secondary characters and storylines, and maintain fan engagement between films. Major franchise recovery comes from blockbuster theatrical films performing well ($1.5-2 billion per film) combined with renewed merchandise demand. Streaming content must be excellent, but theatrical content is the primary engine.

What happens if the next Star Wars theatrical film underperforms?

It would significantly damage the turnaround narrative and likely trigger another strategic restructuring. One critical or box office failure isn't catastrophic (Marvel had Dark World). But two consecutive failures would signal the structural changes aren't working and would prompt Disney leadership to reconsider the entire approach. This is why the pressure on the first theatrical release is so significant—it determines whether fans believe the recovery is real.

Conclusion: The Franchise At An Inflection Point

Star Wars exists at a genuine crossroads. The franchise that once seemed unstoppable has stumbled badly enough that its future is actually uncertain. That's not dramatic exaggeration—it's financial reality. Franchise value dropped 50%. Fan engagement fractured. Merchandise sales declined. These aren't small problems.

But here's the thing: the new leadership's strategy actually addresses the root problems. Unified creative oversight prevents narrative inconsistency. Extended development cycles prevent rushed releases. Quality standards prevent mediocre projects diluting the brand. Theatrical focus returns to the revenue model that actually works.

Is the strategy guaranteed to work? No. Implementation matters enormously. One mediocre film could reset everything.

But the strategy is sound. And for the first time in years, there's genuine organizational alignment behind it.

The real test comes 2026-2028 when the first theatrical films and major streaming projects under the new leadership release. If those succeed, we'll see franchise recovery. If they don't, Star Wars might finally become what seemed unthinkable five years ago: a legacy franchise rather than a cultural phenomenon.

The Force might not be with the franchise anymore. But the new leadership has a credible plan to bring it back. Whether they can execute? That's the question everyone's asking, and it won't be answered until we see the actual content.

For now, cautious optimism is warranted. The structure is right. The strategy is right. The timeline is realistic. Execution is the variable, and we'll know within 18-24 months whether the new leadership team can actually save the Star Wars empire.

One thing's certain: the franchise will never be resurrected by streaming content alone or by quantity-over-quality thinking. The new leadership understands this. Whether they can actually deliver on it determines everything.

Key Takeaways

- Disney restructured Lucasfilm leadership, separating creative decisions from production/business decisions to prevent bottlenecks and improve strategic alignment

- Previous streaming-first strategy created franchise fatigue with 8 major shows in 5 years; new approach targets 1-2 quality projects annually with 18-24 month development cycles

- Box office declined 48% across sequel trilogy and merchandise sales dropped significantly, but strategic changes address root causes rather than symptoms

- Franchise recovery requires restoring revenue from current 5-6 billion annually, achievable through theatrical focus and renewed fan engagement

- Success depends entirely on execution quality starting 2026-2028 when first theatrical films and major streaming projects under new leadership release

Related Articles

- Kathleen Kennedy Steps Down from Lucasfilm: What It Means for Star Wars [2025]

- Dave Filoni Takes Over Lucasfilm: What It Means for Star Wars [2025]

- 2026 BAFTA Film Awards Longlist: What Netflix's Absence Reveals [2025]

- Warner Bros. Discovery Rejects Paramount Skydance Bid: Why Netflix Won [2025]

- Why Stranger Things Finale in Theaters Proved Streaming's Missing Piece [2025]

- Craig Brewer's Next Hip-Hop Film: What Snoop Dogg Revealed [2025]

![Star Wars' New Leadership Team: Can They Revive The Franchise? [2025]](https://tryrunable.com/blog/star-wars-new-leadership-team-can-they-revive-the-franchise-/image-1-1768563391678.png)