Harvey Acquires Hexus: Inside the Escalating Legal AI Arms Race

It's happening faster than anyone predicted. The legal technology industry, once a sleepy corner of enterprise software dominated by legacy players, has turned into a flat-out sprint for AI dominance. And the latest evidence? Harvey, the eight-billion-dollar legal AI powerhouse, just swallowed up Hexus, a startup that specializes in building tools for product demos, videos, and guides.

On the surface, this looks like a standard M&A play. Big company buys smaller company with complementary tech. Done. Next acquisition.

But dig deeper, and you're watching something more significant unfold. You're watching an industry recognize that AI isn't a nice-to-have feature anymore—it's the entire game. And the winners will be the companies that move fastest, integrate deepest, and own the most comprehensive solutions.

Harvey didn't become the fastest-funded legal tech company in history by accident. The company has raised

The acquisition of Hexus signals something crucial: Harvey isn't just building AI tools for lawyers anymore. It's building an entire ecosystem. And it's buying its way there fast.

Who Is Harvey? The Legal AI Company That Silicon Valley Can't Stop Funding

Harvey's origin story reads like a startup fever dream. Two people—Winston Weinberg, a first-year associate at O'Melveny & Myers, and Gabe Pereyra, a researcher from Google Deep Mind and Meta—sent a cold email to Sam Altman at Open AI on July 4, 2022.

They got a call that same morning.

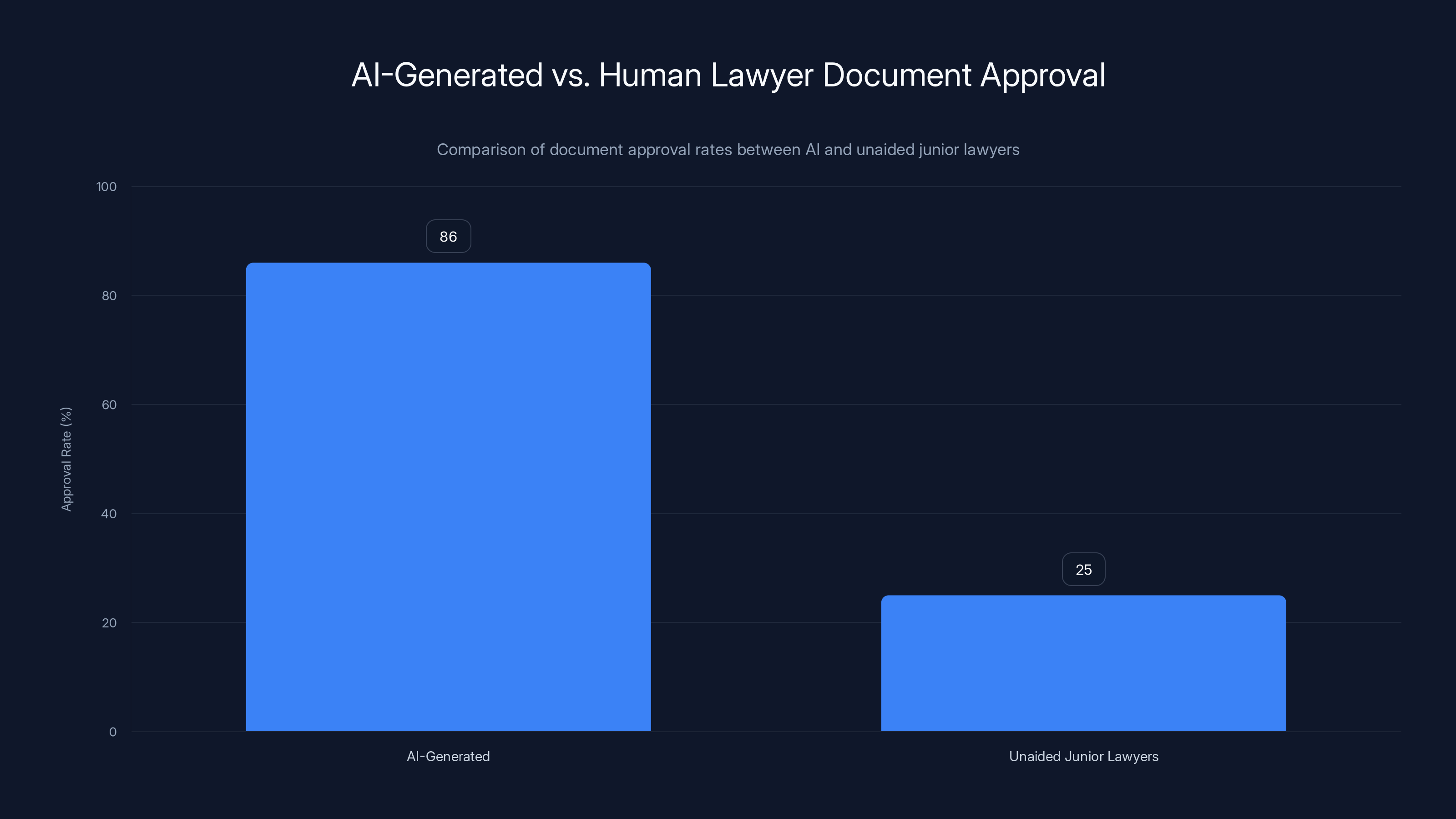

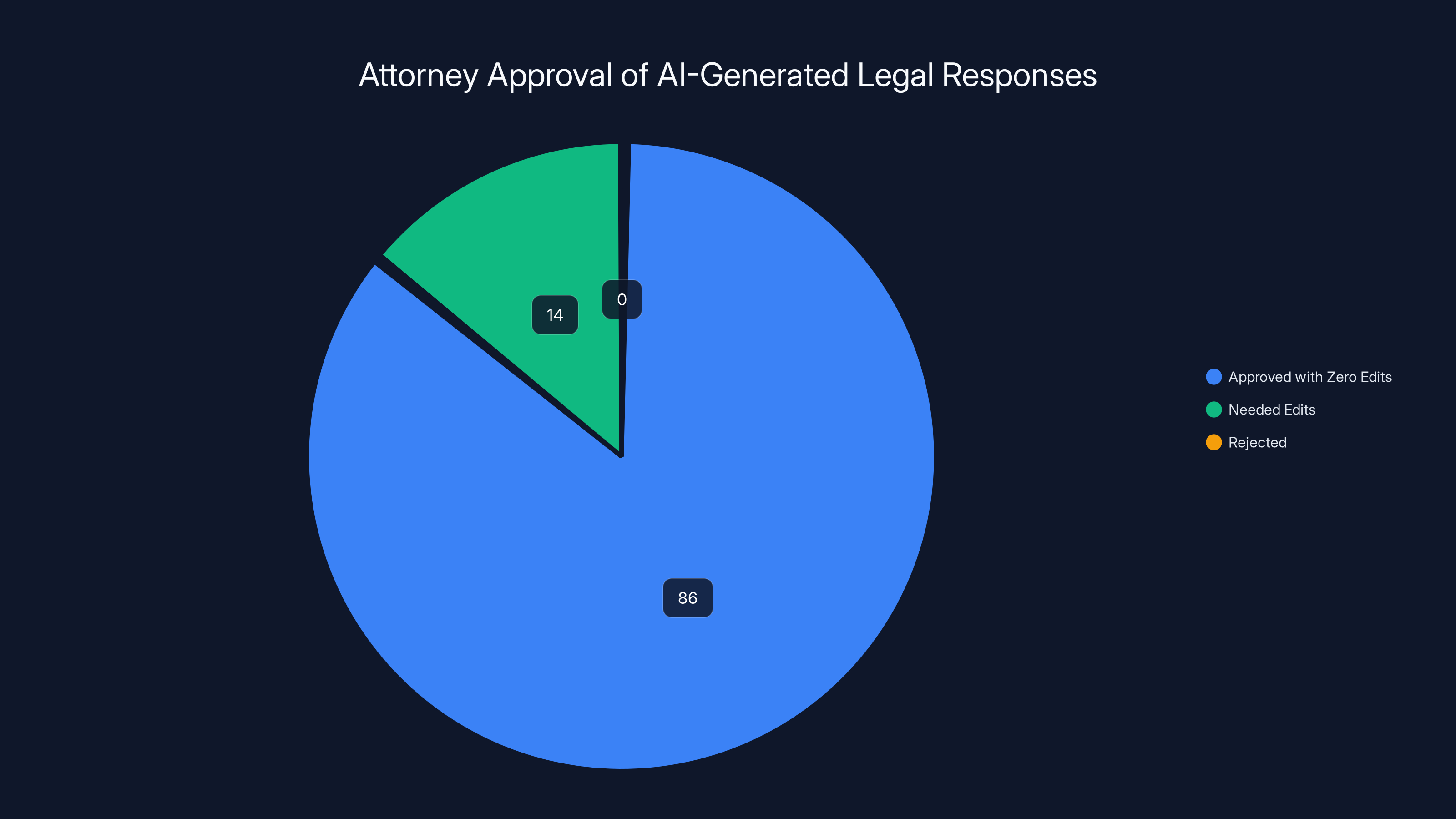

The pitch was deceptively simple. Weinberg and Pereyra had run an experiment with GPT-3 using landlord-tenant law questions pulled from Reddit. They showed the AI-generated answers to practicing attorneys. The result? Two out of three said they'd send 86 out of 100 responses with zero edits.

For an industry that charges

Within weeks, Harvey landed its first check from the Open AI Startup Fund, which remains the company's second-largest investor to this day. That early validation from Open AI itself—the company that literally created the AI revolution—gave Harvey unmatched credibility.

Fast-forward to late 2025. Harvey now claims more than 1,000 clients across 60 countries, including a majority of the top 10 U.S. law firms. That's not just adoption. That's market penetration that typically takes a decade to achieve.

The funding journey tells the story. Harvey started 2025 with a

That's not typical venture capital behavior. That's desperation to get in on something that's clearly working.

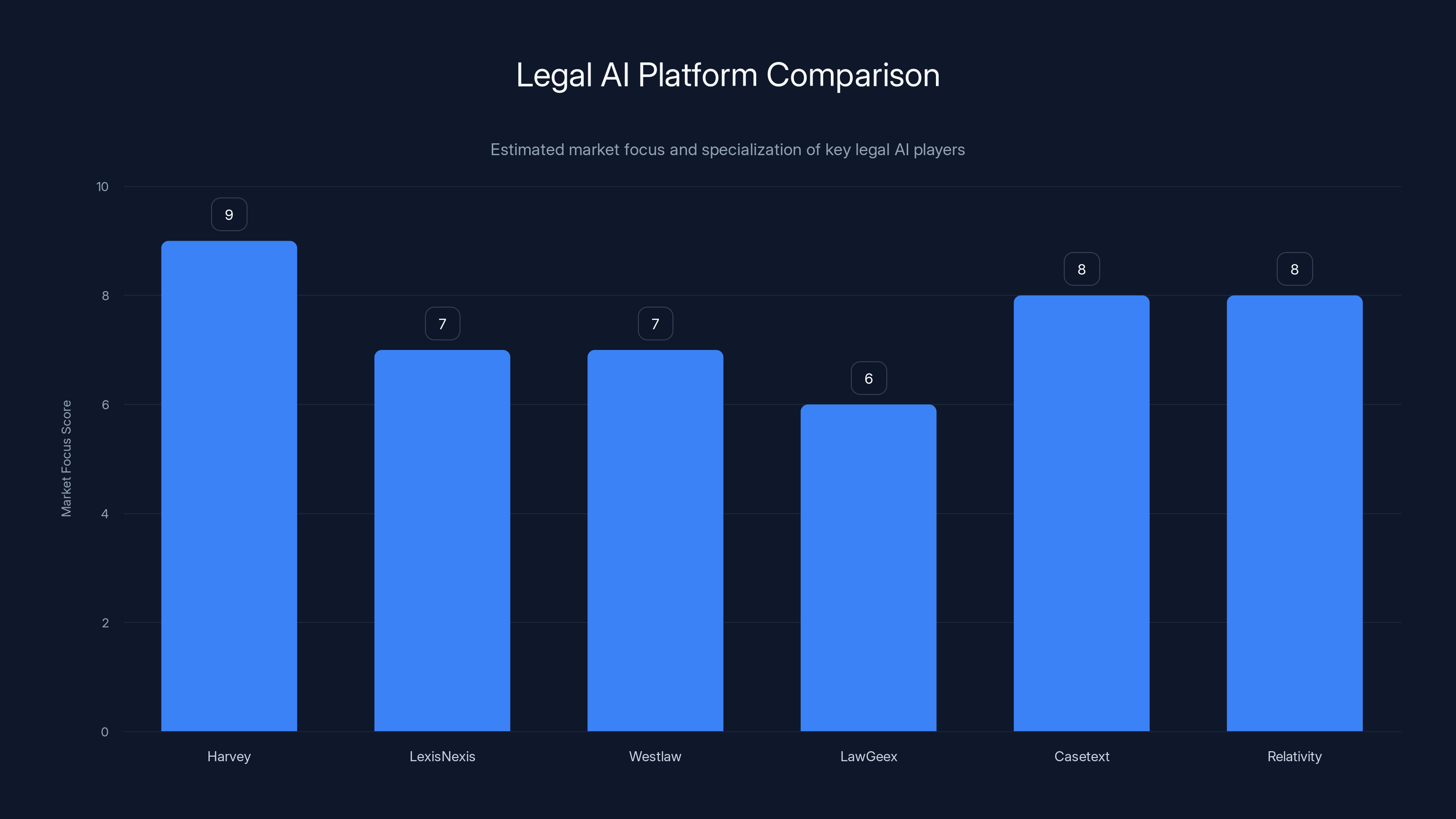

Harvey leads in ambition with a broad focus on becoming the legal AI operating system, while others specialize in specific areas like research and contract review. (Estimated data)

What Is Hexus? The Demo and Content Automation Play

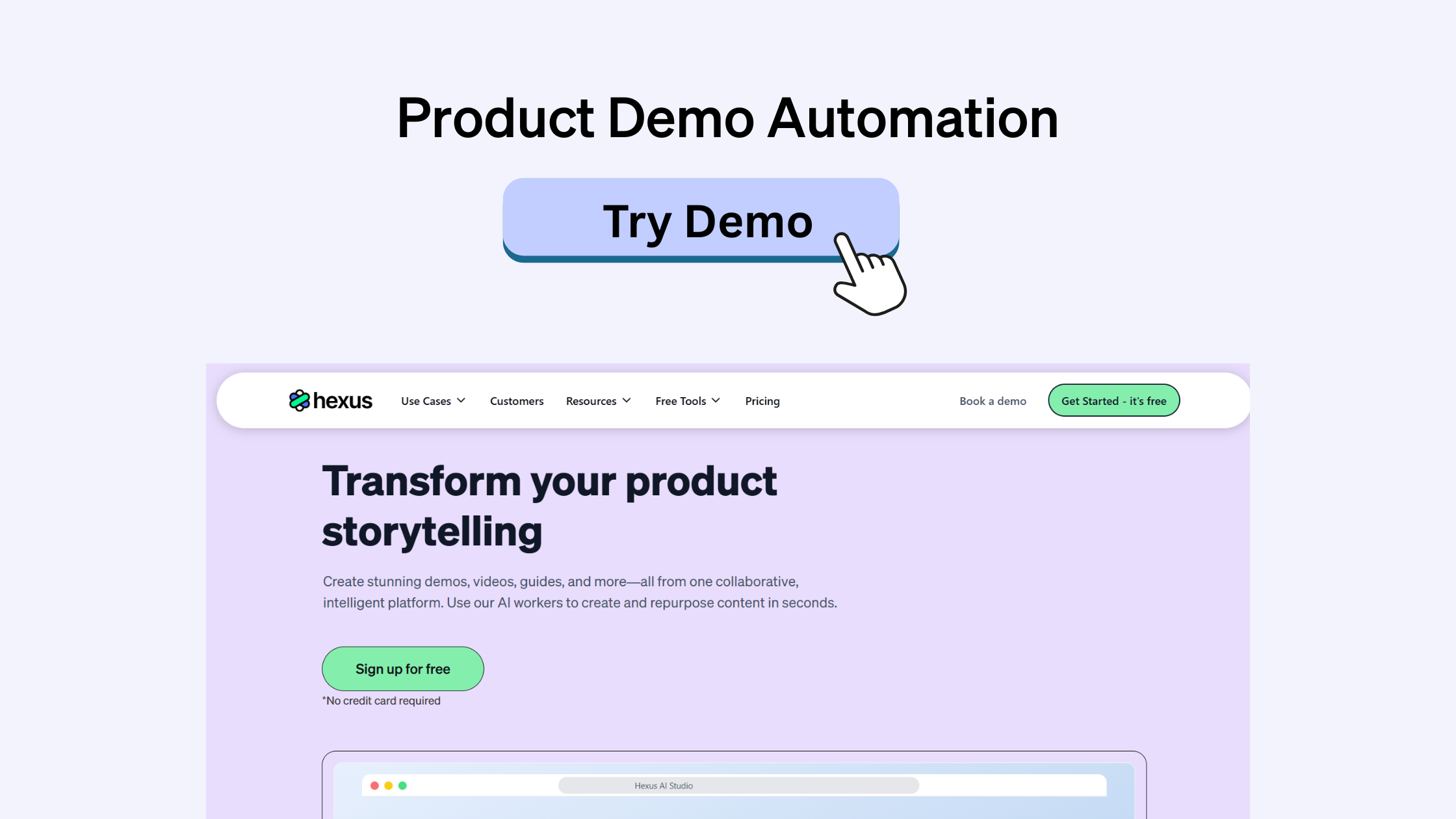

Hexus isn't a household name, but it's solving a real problem that touches millions of knowledge workers every day.

The company, founded by Sakshi Pratap, builds tools that automate the creation of product demos, instructional videos, and user guides. If you've ever spent two hours creating a step-by-step video walkthrough, or manually documenting a feature that someone else will need to know how to use, you know the pain Hexus targets.

Pratap's background is particularly relevant here. She's held engineering roles at Walmart, Oracle, and Google—three companies that have collectively trained some of the most rigorous engineering leaders in the world. That pedigree matters, especially when you're building tools for enterprise customers who expect reliability and quality.

Before being acquired by Harvey, Hexus had raised $1.6 million from Pear VC, Liquid 2 Ventures, and angel investors. That's a modest seed round by today's standards, which makes the acquisition interesting. Hexus wasn't a hyper-funded juggernaut. It was a focused, well-executed team solving a specific problem.

But here's the thing about content creation tools: they're not just valuable in isolation. They become exponentially more valuable when integrated into platforms with existing distribution and customer base.

For Harvey, acquiring Hexus isn't about getting a revenue stream from demo-making software. It's about getting a team that knows how to build fast, reliable content automation tools—and then directing that expertise toward the legal AI problem.

Pratap is now leading an engineering team focused on accelerating Harvey's offerings for in-house legal departments. That's the real prize. Her expertise building enterprise AI tools in adjacent problem spaces is getting repurposed toward Harvey's core mission.

The deal structure itself is telling. Pratap declined to reveal specific terms, but she confirmed the structure was "aligned around long-term team incentives." Translation: This wasn't a cash-out-and-bounce situation. This was a team agreeing to stay locked in for years, with their upside directly tied to Harvey's continued success.

The geographic split is also noteworthy. Hexus's San Francisco team has already joined Harvey. The India-based engineers will come onboard once Harvey establishes a Bangalore office. That's not just a logistical detail—it's strategic. Harvey is expanding infrastructure in major engineering hubs, signaling it's gearing up for accelerated hiring and development.

AI-generated responses have a significantly higher approval rate (86%) compared to unaided junior lawyers (estimated 25%), highlighting the efficiency and accuracy of AI in legal research.

The Competitive Landscape: Who Else Is Playing This Game?

Harvey isn't the only company chasing the legal AI dream, though its fundraising numbers might suggest otherwise.

Lexis Nexis and Westlaw, the two dominant legal research platforms for decades, have both launched AI-powered features. But they're incumbents playing defense, not insurgents playing offense. They have existing customer bases they can't disrupt too aggressively without cannibalizing their own business models.

Law Geex focuses on contract review automation—a narrower, more specialized use case than Harvey's broader legal AI platform. Casetext has built powerful legal research tools backed by AI. Relativity dominates e-discovery, a massive legal tech category.

But Harvey's ambition is broader. It's not trying to be the best contract review tool. It's not trying to be the best legal research platform. It's trying to be the operating system for legal work itself—the layer where AI touches every part of how lawyers work.

That's why acquisitions like Hexus matter. Each one is a building block. Demo creation tools. Video generation. Process automation. Knowledge management. Gradually, Harvey is assembling a full-stack legal AI platform that competitors can't easily replicate.

Consider the math. If Harvey truly can help lawyers produce attorney-ready work with minimal human review, the efficiency gains are extraordinary. A top law firm might spend

For Harvey, the TAM (total addressable market) is massive. There are roughly 1.3 million lawyers in the United States alone. Global legal services is a

Harvey's current valuation reflects investor belief that it can capture significant market share in that opportunity.

Why This Acquisition Matters: The Strategic Playbook

On the surface, Hexus seems like an odd fit for Harvey. Harvey is a legal AI platform. Hexus makes demo and video tools. They're different verticals.

But that's the wrong way to think about it.

Modern platform companies succeed by assembling capabilities in layers. Apple didn't just make phones—it bought Shazam, Beats, Intel's modem division, and hundreds of other companies to build out its ecosystem. Amazon started with books but acquired Whole Foods, MGM, and countless other businesses to build an empire. Microsoft has acquired over 300 companies this century.

The pattern is consistent: successful platforms don't win by being the best at one thing. They win by being the only place where you need to go to solve multiple problems.

For legal teams, that problem stack looks like this:

- Research and Drafting: Finding relevant cases, writing motions, contracts

- Document Review: Understanding contracts, spotting risks, extracting terms

- Due Diligence: Vetting companies, understanding legal exposure

- Training and Onboarding: Teaching new lawyers and paralegals firm processes

- Knowledge Management: Making institutional knowledge accessible

- Client Communication: Creating clear, persuasive documents for clients

Harvey has been crushing at 1-3. With Hexus's technology, it can extend into 4-6. Suddenly, Harvey isn't just a tool lawyers use to do their work faster. It's a platform that touches their entire workflow.

The economics of that expansion are attractive. Once you own the primary workflow tool, you can integrate adjacent services and capture margin on those integrations.

That's the math driving Harvey's acquisition strategy.

As Harvey consolidates its market position, pricing is projected to increase from

The Founder Playbook: Why Smart Founders Sell Early

Sakshi Pratap didn't need to sell Hexus. The company had raised $1.6 million and was presumably growing. She had options.

But there are compelling reasons why a founder with her background would choose to join Harvey as a leader rather than stay independent:

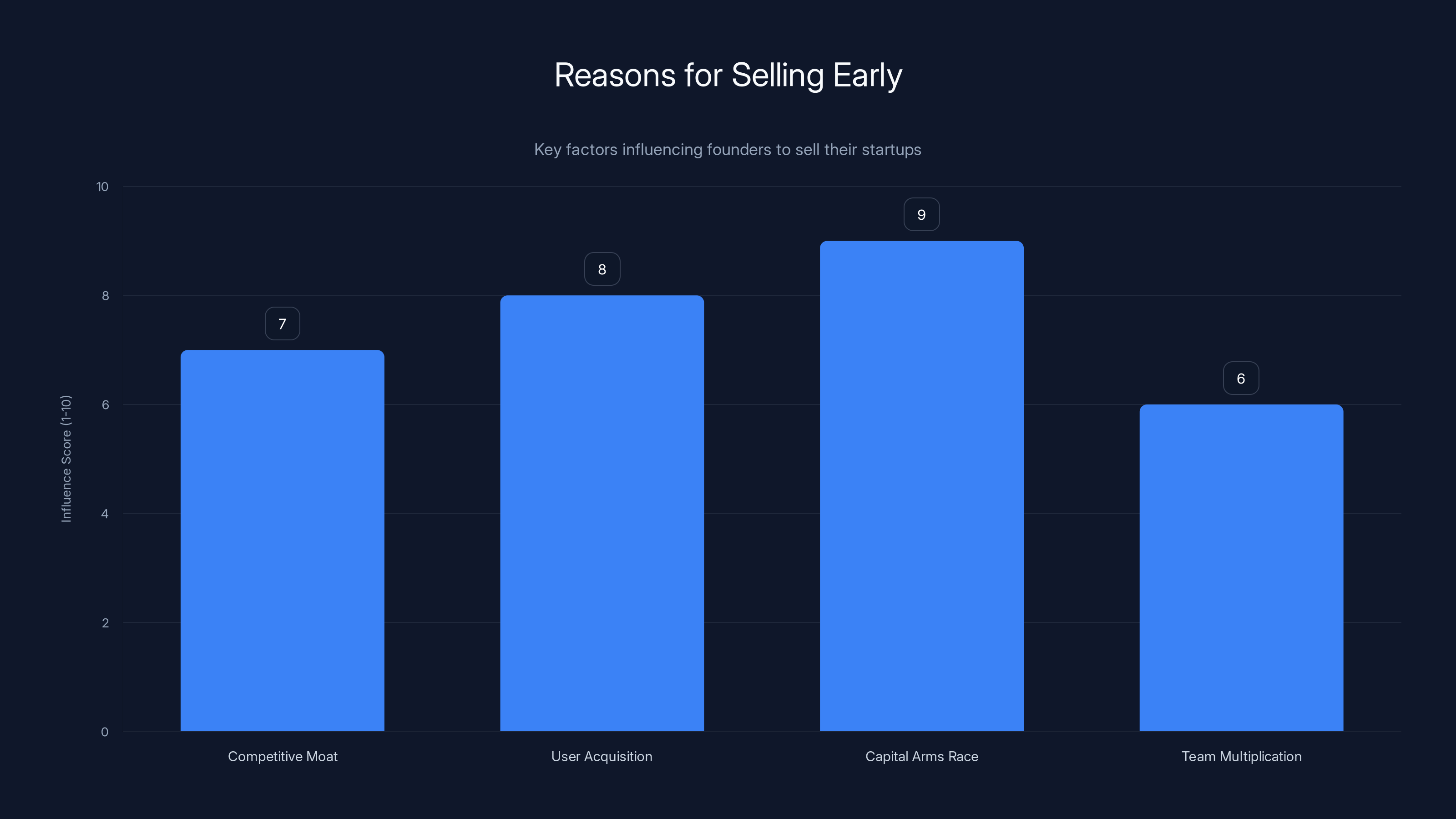

Firstly, the competitive moat is shrinking. As AI improves, building specialized tools gets harder. Open AI, Anthropic, and Google are releasing increasingly powerful models. That means the defensibility of any single-purpose AI tool decreases. But the defensibility of a full-stack platform increases.

Secondly, user acquisition is brutal. Selling to law firms is expensive, time-consuming, and relationship-driven. Harvey has already done that work. It has relationships with the top 10 U.S. law firms. That distribution advantage is worth more than any independent company can build in five years.

Thirdly, the capital arms race is real. Harvey raised

Finally, the team multiplication effect is powerful. Pratap gets to lead an engineering team at a company with unmatched resources and market position. That's career acceleration that would take a decade to achieve independently.

This is the new playbook in AI-powered software. Build something valuable. Get acquired by the company that can turn it into platform dominance. Become a leader inside the platform.

The founders who'll regret this decision are the ones betting they can compete with Harvey while building independently. History suggests those bets rarely work out.

The Economics of Legal AI: Where Does the Value Actually Come From?

Here's a question that matters: If Harvey's AI can produce attorney-ready legal work with 86% accuracy on the first try, why hasn't the legal industry's profit margins exploded?

The answer reveals something important about how disruption actually works in mature industries.

Firm economics work like this. A partner bills

But here's the catch: that equation only works if the associate is fully utilized and the client is willing to pay $500/hour. The moment you introduce AI that cuts the associate's work in half, several things happen simultaneously:

- Billing pressure: Clients expect rates to drop because less lawyer time is involved

- Volume pressure: Firms need more matters to keep associates busy

- Commoditization: Standardized legal work (contracts, simple motions, documents) becomes price-competitive

- Talent drain: If associates are less busy, firms need fewer of them

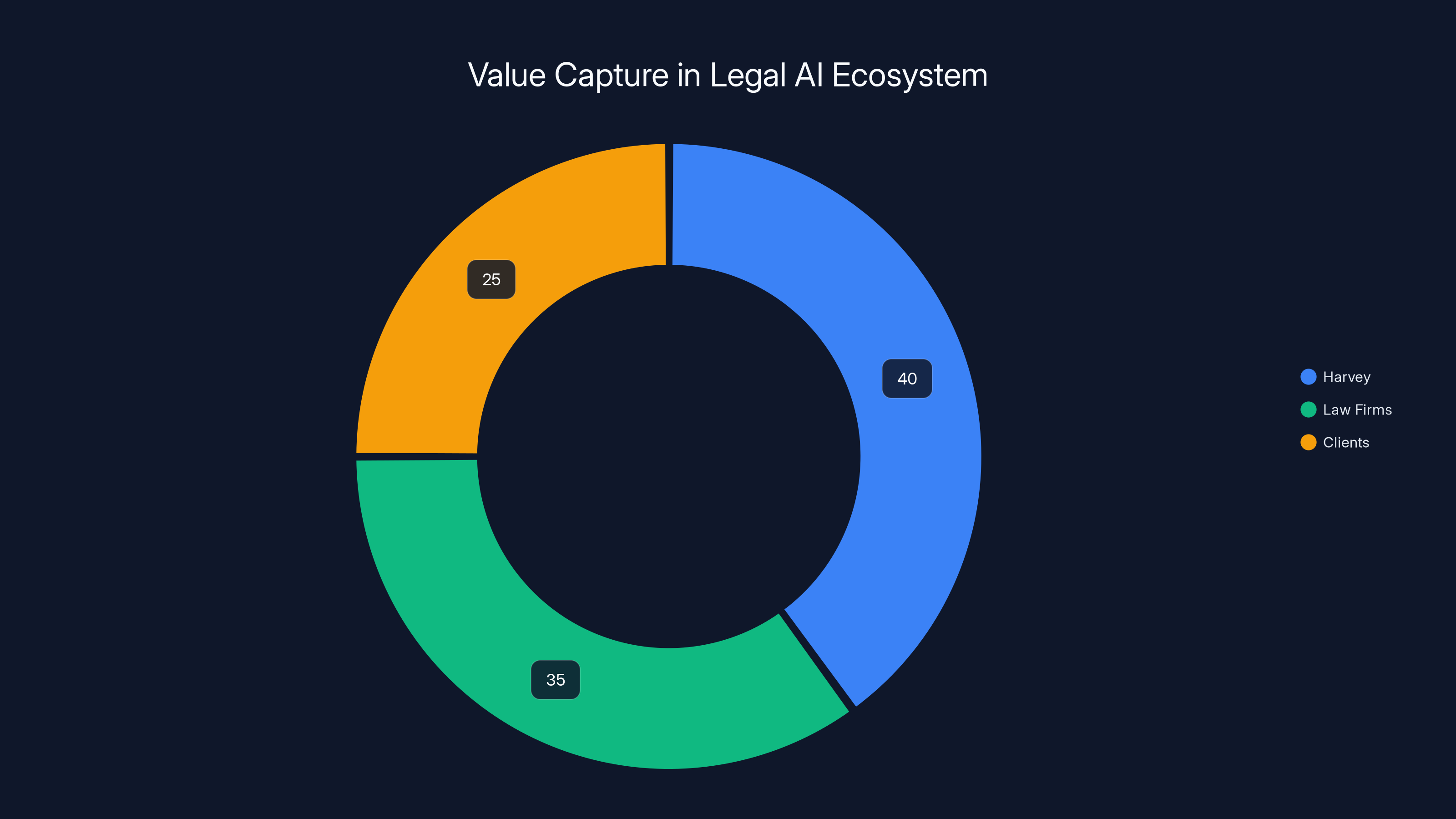

The value Harvey creates isn't captured entirely by law firms. It gets split between Harvey (through higher fees for its service), law firms (through higher margins and fewer headcount needs), and clients (through lower costs).

For Harvey, the play is to own enough of the legal workflow that it becomes essential infrastructure. If 50% of associate work flows through Harvey's AI, Harvey has enormous pricing power.

The value capture looks like:

| Entity | Value Capture | Mechanism |

|---|---|---|

| Harvey | Licensing + usage fees | Monthly subscriptions, per-matter fees, enterprise licensing |

| Law Firms | Efficiency gains + differentiation | Fewer associates needed, faster client work, higher partner leverage |

| Clients | Lower legal costs | Reduced lawyer hours per matter, faster turnarounds |

| Associates | Job displacement risk | Fewer roles, but higher-skill remaining roles |

This is why Harvey's aggressive acquisition and expansion strategy matters. The company is racing to become the default legal AI platform before competitive pressure forces pricing down.

Once you're the platform everyone uses, you can extract margin from every decision lawyers make. That's the endgame.

Estimated data shows that the capital arms race is the most influential factor for founders selling early, followed closely by user acquisition challenges.

The Talent Arbitrage: Why Geography Matters

One detail from the Hexus acquisition stands out: San Francisco team joins immediately, India-based engineers join once Harvey opens a Bangalore office.

This reveals something crucial about how modern software companies operate.

San Francisco engineering is expensive—

The real advantage is specialization. San Francisco is where product leaders, founders, and early-stage team members are concentrated. That's where Harvey can immediately integrate Hexus engineers into core product decisions. India is where you put the specialized execution teams—the folks who can crank on large engineering projects with architectural clarity and less need for real-time product decisions.

By expanding to Bangalore, Harvey isn't just accessing cheaper labor. It's accessing a proven engineering talent pool at scale. Infosys, Wipro, TCS, and dozens of other Indian software companies have trained hundreds of thousands of engineers in enterprise software development. That's why Google, Microsoft, Amazon, and Apple all operate massive engineering centers there.

Harvey opening a Bangalore office isn't a cost-cutting move. It's a scaling move. The company is saying: "We have product-market fit. We have funding. Now we need to scale engineering velocity dramatically. We'll do that partly in San Francisco (product and strategy) and partly in Bangalore (execution and scale)."

For Hexus engineers in India, this is a career acceleration opportunity. They get to work on a high-profile platform solving meaningful problems, with the backing of one of the best-funded companies in the world.

Competition and Consolidation: The Shape of Legal Tech's Future

Harvey's acquisition of Hexus is unlikely to be its last. Platform companies that want to own entire markets acquire constantly. That means the legal tech landscape is about to experience significant consolidation.

Who might Harvey acquire next?

Legal research tools: Companies like Casetext have built powerful case law databases. A fully integrated Harvey could own research, drafting, document review, and knowledge management.

e-Discovery tools: Relativity dominates large-scale litigation document review. If Harvey could integrate that, it could own the entire litigation workflow.

Contract management: Companies like Iconcur and Ebrevia manage contract repositories and workflows. That's a natural extension of Harvey's platform.

Legal project management: Tools like Integrify help law firms manage complex matters. Another natural add.

Each acquisition extends Harvey's reach into the legal workflow. Each one makes the platform stickier and more valuable.

For competitors, this creates a problem. They can't match Harvey's capital, user base, or talent acquisition rate. The faster Harvey consolidates the vertical, the harder it becomes for others to compete.

This is the classic startup playbook of the 2020s: win in your niche with venture capital velocity, then consolidate the adjacent niches before competitors have time to react.

In an experiment, 86% of AI-generated legal responses were approved by attorneys with zero edits, showcasing the potential of AI in legal services.

The Customer Impact: What Does This Mean for Law Firms?

Law firms using Harvey are asking a logical question: What does this acquisition mean for us?

Short answer: More capabilities, better integration, and likely higher pricing over time.

Longer answer requires understanding how platform consolidation works.

When Harvey integrates Hexus's demo and content creation tools, law firms get internal training capabilities they previously didn't have. New associates can watch AI-generated walkthroughs of complex processes. Client-facing materials can be generated faster. Firms can standardize their knowledge transfer.

That's valuable. But it's also lock-in. The more integrated Harvey becomes, the harder it is to leave. Switching costs increase. Dependency deepens.

Eventually, Harvey will optimize for revenue extraction. That doesn't mean charging exorbitant fees immediately. It means gradually moving from penetration pricing (low initial cost) to value-based pricing (pricing based on the value delivered).

If Harvey can save a law firm

For now, Harvey faces pressure from Lexis Nexis, Westlaw, and specialized competitors. So it needs to be aggressive on pricing to build market share.

But as Harvey consolidates, competitive pressure should decrease. When that happens, pricing power increases.

This is the venture-backed software playbook: Race to dominance with low prices and rapid feature expansion. Once dominant, optimize for profitability.

The Broader Implications: What This Means for the AI Industry

Harvey's aggressive expansion strategy—$760 million raised in 2025, multiple acquisitions, rapid hiring—signals something important about the AI market: We're past the proving phase. We're in the consolidation phase.

The early question was: Can AI actually do useful work in professional services? Harvey answered that decisively. Lawyers are using it. Firms are paying for it. It's adding real value.

Now the question is different: Who will own the AI-powered future of legal services?

That's a winner-take-most game. The platform that owns research, drafting, document review, knowledge management, client communication, and internal training will have unmatched defensibility and pricing power.

Harvey is moving faster than anyone else to own that platform.

This has ripple effects across AI:

-

Vertical integration accelerates: General-purpose AI companies (Open AI, Anthropic, Google) will see vertical application companies (Harvey, etc.) build increasingly specialized solutions on top of them. This is healthy competition.

-

M&A in AI accelerates: Well-funded AI companies will acquire smaller, specialized competitors to build out platforms. This consolidates the market faster.

-

Pricing pressure on foundational models: As vertical application companies consolidate, they gain bargaining power with foundational model providers. Expect pricing to come down.

-

Differentiation becomes harder: If every legal AI tool is built on GPT-4 or Claude, differentiation comes from integration, UX, and customer success. Not raw model quality.

These are the dynamics Harvey is betting on. The company is positioning itself as the platform that wins in the legal category—not through better AI (Harvey uses the same models as everyone else), but through better integration and deeper understanding of legal workflows.

Estimated data shows Harvey capturing 40% of the value through licensing and fees, law firms capturing 35% via efficiency gains, and clients benefiting from 25% in cost reductions.

The Hexus Founders' Next Move: What Happens to Sakshi Pratap?

One question worth asking: What's next for Sakshi Pratap after leading an engineering team at Harvey?

If Harvey's trajectory continues—multiple exits to major law firms, international expansion, potential IPO or acquisition by a larger company—Pratap is in an excellent position. She'll have built a major product at a valuable company, acquired expertise in legal tech, and built relationships across the industry.

Historically, founders who've successfully built products inside larger companies go one of two directions:

- They climb the ladder: Becoming a VP, SVP, or eventually Chief Product Officer

- They go back to founding: Using their expertise and network to start a new company

Given Pratap's background and the speed of tech industry moves, she could do either. If legal AI becomes as big as it's positioned to be, there will be adjacent opportunities worth billions. Pratap will have the expertise to spot and exploit them.

For now, her play is clearly to build inside Harvey. That's the right call in a consolidation environment. Consolidation rewards being part of the consolidating platform, not fighting it.

The next founder who builds a tools company in legal tech will need to decide early: Do I try to compete with an increasingly integrated Harvey? Or do I build something complementary and sell to them?

Historically, sell looks smarter every time.

The State of Legal Tech: Before and After Harvey

Harvey isn't just another software company. It's changing the shape of an entire industry.

Before Harvey, legal tech was fragmented. You had legal research tools (Lexis Nexis, Westlaw), contract management (Docu Sign), e-discovery (Relativity), and specialized tools for specific practice areas. Lawyers bounced between systems.

After Harvey (or at least the direction Harvey is pushing), you have integrated AI platforms that own entire workflows. One system for research, drafting, review, and knowledge management. Less switching. More efficiency.

The transition from the fragmented model to the platform model is what we're watching in real-time.

Industries don't like this transition. Fragmentation is comfortable. Everyone knows their niche. But consolidation is inevitable when better technology makes it possible. The question isn't whether it will happen. It's how fast and who wins.

Harvey's fundraising and acquisition velocity suggest it's trying to win very fast.

What Could Go Wrong? The Risks Harvey Faces

For all Harvey's success, significant risks remain.

Regulatory risk: The legal profession is heavily regulated. Unauthorized practice of law exists. There's a real question whether AI-generated legal advice requires human lawyer review before being delivered to clients. If regulators impose strict requirements, Harvey's efficiency advantage shrinks.

Competitive response: Lexis Nexis and Westlaw won't sit idle. They have customer relationships with every law firm on the planet. If they integrate AI features effectively, they become serious competitors.

AI commoditization: If foundational models become commodities (which is happening), Harvey's moat narrows. Any competitor can build similar AI capabilities on top of GPT-4 or Claude. Differentiation then depends on product, design, and customer relationships.

Customer concentration risk: Harvey claims the top 10 U.S. law firms use its platform. That's good for revenue concentration and brand. It's bad for risk diversification. If those firms become unhappy, Harvey's revenue takes a hit.

Talent scaling challenge: The legal industry is conservative. Deploying capital fast requires people who understand both tech and law. Those people are rare. Harvey will face hiring constraints as it scales.

Acquisition integration risk: The Hexus acquisition is the first of likely many. Integration is hard. Acquisitions that looked good on paper often underperform. As Harvey does more acquisitions, execution risk increases.

None of these risks are showstoppers. But they're worth monitoring if you're thinking about Harvey as an investment or a customer.

The Funding Question: Is Harvey Overvalued?

Harvey reached an

To answer it, consider the math:

If Harvey can take 1% of the

That actually seems conservative. The company has product-market fit with major customers. It's the clear market leader in legal AI. It's expanding into adjacent areas. All of that supports a high valuation.

But valuation isn't destiny. Execution is. Harvey needs to:

- Continue winning customers: Keep landing marquee law firms

- Expand use cases: Move beyond research and drafting into other parts of legal work

- Integrate acquisitions successfully: Hexus needs to add real value

- Maintain product quality: AI legal advice that's wrong is liability risk

- Navigate regulatory questions: Make sure its product doesn't violate UPL (Unauthorized Practice of Law) rules

Do all of that, and $8 billion looks cheap. Do even two of them wrong, and valuation compresses.

This is the venture capital game in 2025: Back companies with strong products and proven unit economics. Price them aggressively. Scale them fast. Hope the business model holds up at scale.

Harvey is winning that game right now.

FAQ

What exactly did Harvey acquire when it bought Hexus?

Harvey acquired Hexus's team (San Francisco immediately, India-based engineers once a Bangalore office opens), their technology for creating product demos and instructional videos, and their expertise in enterprise AI tool building. The acquisition was structured to keep the team locked in with long-term incentives rather than a cash-out scenario, suggesting Harvey is betting on the team's ability to accelerate product development for in-house legal departments.

How does Harvey's legal AI actually work, and why is it more accurate than traditional legal research?

Harvey's platform uses large language models (particularly GPT-4) trained on legal documents, case law, and statutes. When lawyers ask questions or need documents drafted, the AI generates responses by pattern-matching against its training data. The accuracy advantage comes from AI's ability to instantly synthesize thousands of documents and identify relevant patterns, whereas human lawyers must manually search. In Harvey's early experiments, lawyers said they'd send 86 out of 100 AI-generated responses with zero edits, compared to maybe 20-30 for unaided junior lawyers.

Why is consolidation happening so fast in legal tech, and what happens to smaller competitors?

Consolidation accelerates when one player (Harvey) gets a capital advantage ($760 million raised in 2025 alone) and proves a business model works. Smaller competitors face a choice: compete independently (very hard against well-funded platforms) or get acquired by Harvey or a similar player. Most choose acquisition because the independent path becomes increasingly risky. Consolidation benefits users through better integration but eventually gives the consolidator pricing power. Smaller competitors that stay independent face margin pressure and reduced customer acquisition.

How much will law firms have to pay for Harvey's platform after it achieves market dominance?

Price typically follows a predictable arc: penetration pricing to gain share, then value-based pricing once dominant. Right now, Harvey likely prices aggressively to outcompete Lexis Nexis and Westlaw. Once it captures 50%+ of major law firms, it can shift to pricing based on value delivered. If Harvey saves a firm

What's the regulatory risk with AI-generated legal advice, and could it shut down Harvey?

Every state has Unauthorized Practice of Law (UPL) rules that prohibit non-lawyers from giving legal advice. The legal question is whether AI-generated advice, reviewed by a lawyer, constitutes the lawyer giving advice (allowed) or the AI giving advice (potentially problematic). Most legal scholars believe lawyer-reviewed AI output is fine, but this hasn't been fully tested in court. A future court ruling could restrict how AI is used. However, complete shutdown is unlikely because all the major law firms already use AI tools. Regulators would face pressure to accommodate rather than prohibit.

How does Harvey's acquisition of Hexus help it compete against Lexis Nexis and Westlaw?

Direct competition on legal research would be hard (those companies have 100+ year head starts). Instead, Harvey is building a full-stack platform where legal professionals stay inside Harvey's ecosystem for research, drafting, document review, and now knowledge management and training. Hexus's demo and video tools let Harvey create better internal training, making lawyers more productive on its platform. This increases switching costs and makes Harvey stickier. It's not about out-researching Westlaw. It's about being the platform lawyers don't want to leave.

Is Harvey's $8 billion valuation justified?

Possibly, depending on execution. If Harvey captures 1% of the

The Bottom Line: Why This Acquisition Signals Where Legal Tech Is Heading

Harvey's acquisition of Hexus isn't a one-off deal. It's a signal.

The signal says: The legal tech industry is consolidating around AI-powered platforms, and the race to own that platform is on.

For law firms, this means better tools and deeper integration, but eventually higher prices and less choice.

For founders building legal tech, this means the window for independent success is closing. The smart play is to build something valuable, get acquired by a consolidating platform, and execute from inside.

For investors, this means concentrated bets are starting to pay off. Harvey is executing at an extraordinary pace, and it's far ahead of competitors. That's rare, and it's valuable.

For the legal profession itself, this means transformation is coming whether it's ready or not. AI is going to reshape how legal work happens, who does it, and how much it costs. The firms that adopt fastest and build their operations around AI will have structural advantages over those that don't.

Hexus, once an independent startup trying to carve out a niche in demo creation, is now part of something much larger. Its team gets to work on platform-scale problems with platform-scale resources. That's a better outcome than staying small and independent in an increasingly consolidated market.

This is how industries transform: not gradually, but suddenly. And when they do, everyone asks why they didn't see it coming.

Harvey sees it coming. That's why it's moving so fast.

Key Takeaways

- Harvey reached 760M in 2025, signaling investor confidence in legal AI as a category

- The Hexus acquisition extends Harvey's platform from legal research and drafting into knowledge management and internal training

- Legal tech consolidation is accelerating around platform players, making it harder for single-purpose tools to compete independently

- Harvey now claims 1,000+ clients across 60 countries, including a majority of top 10 U.S. law firms, giving it massive distribution advantage

- Aggressive M&A strategy suggests Harvey expects to capture significant market share in the $800B+ global legal services market

Related Articles

- LiveKit Hits $1B Valuation: Voice AI Infrastructure Boom [2026]

- Vimeo Layoffs After Bending Spoons Acquisition: What Happened [2025]

- How Davos Became Silicon Valley's Mountain Summit [2025]

- Meta Pauses Teen AI Characters: What's Changing in 2025

- Why AI Agents Keep Failing: The Math Problem Nobody Wants to Discuss [2025]

- TechCrunch Disrupt 2026: Save $680 + 50% Off +1 Tickets [2026]

![Harvey Acquires Hexus: Legal AI Race Escalates [2025]](https://tryrunable.com/blog/harvey-acquires-hexus-legal-ai-race-escalates-2025/image-1-1769233015196.png)