TikTok's US Entity Deal Explained: How ByteDance Avoided Ban [2025]

Introduction: The Deal That Ended Six Years of Political Uncertainty

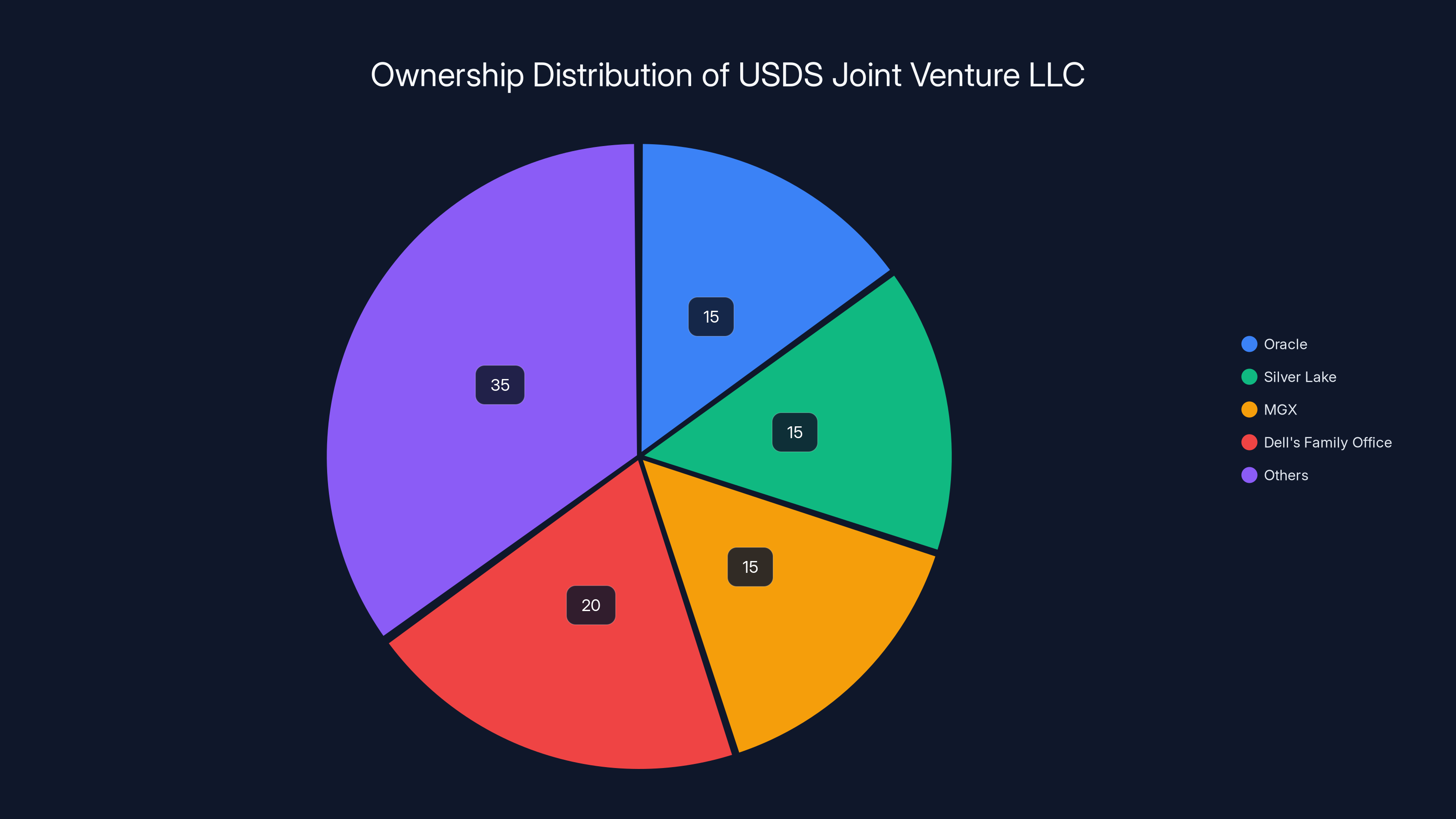

TikTok isn't going anywhere. After six years of regulatory threats, executive orders, failed negotiations, and legal showdowns, ByteDance finally closed the deal that keeps the app alive in America. On January 23, 2026, the company announced that ByteDance had signed a definitive agreement with a consortium of American investors to create USDS Joint Venture LLC (US Data Security). This new entity will operate TikTok independently from Chinese ownership, addressing national security concerns that launched the entire saga back in 2020.

But here's what matters: this wasn't a fire sale. This wasn't forced. And this wasn't a simple ownership transfer. This is a carefully constructed joint venture that keeps ByteDance's technology intact while placing operational control in American hands through corporate governance structures that essentially lock out Beijing from the algorithm.

Over 150 million Americans use TikTok monthly. For creators, it's a platform worth billions in economic activity. For advertisers, it's the most effective way to reach Gen Z. For ByteDance, it's the crown jewel of a company worth an estimated $268 billion. Losing it would've been catastrophic. The deal ensures nobody loses.

Let's break down what actually happened, who controls what, and why this matters way more than the headlines suggest.

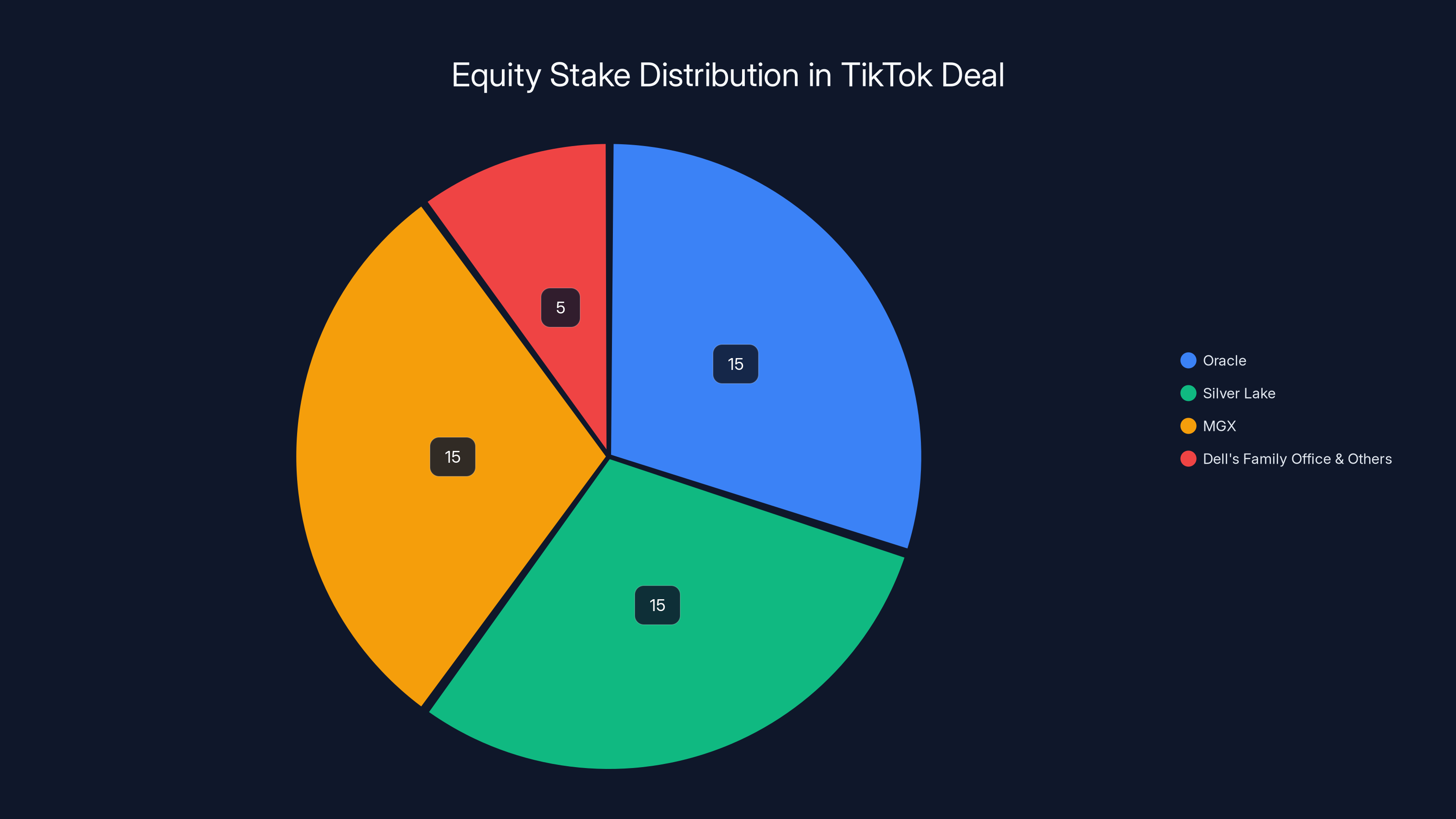

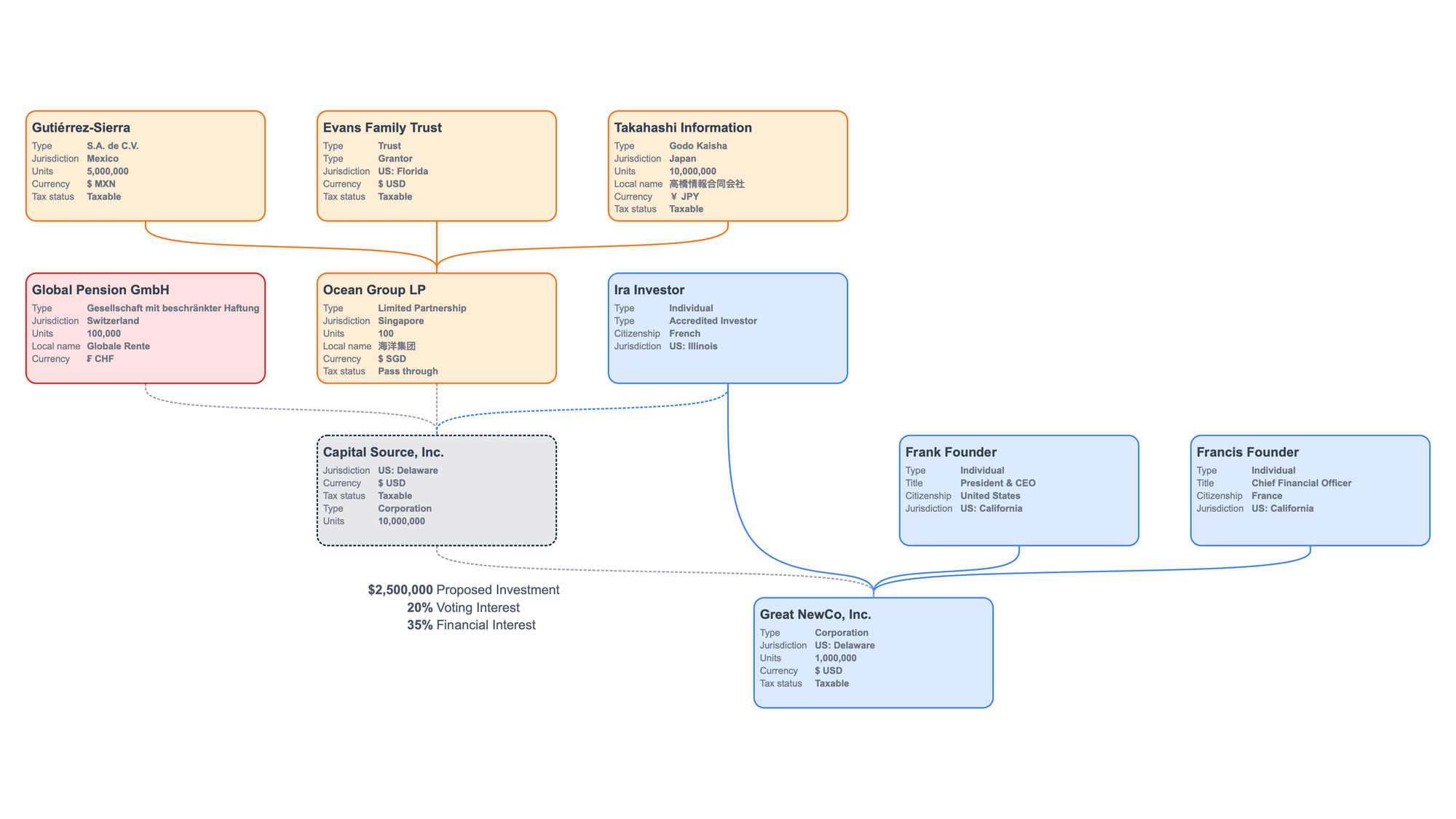

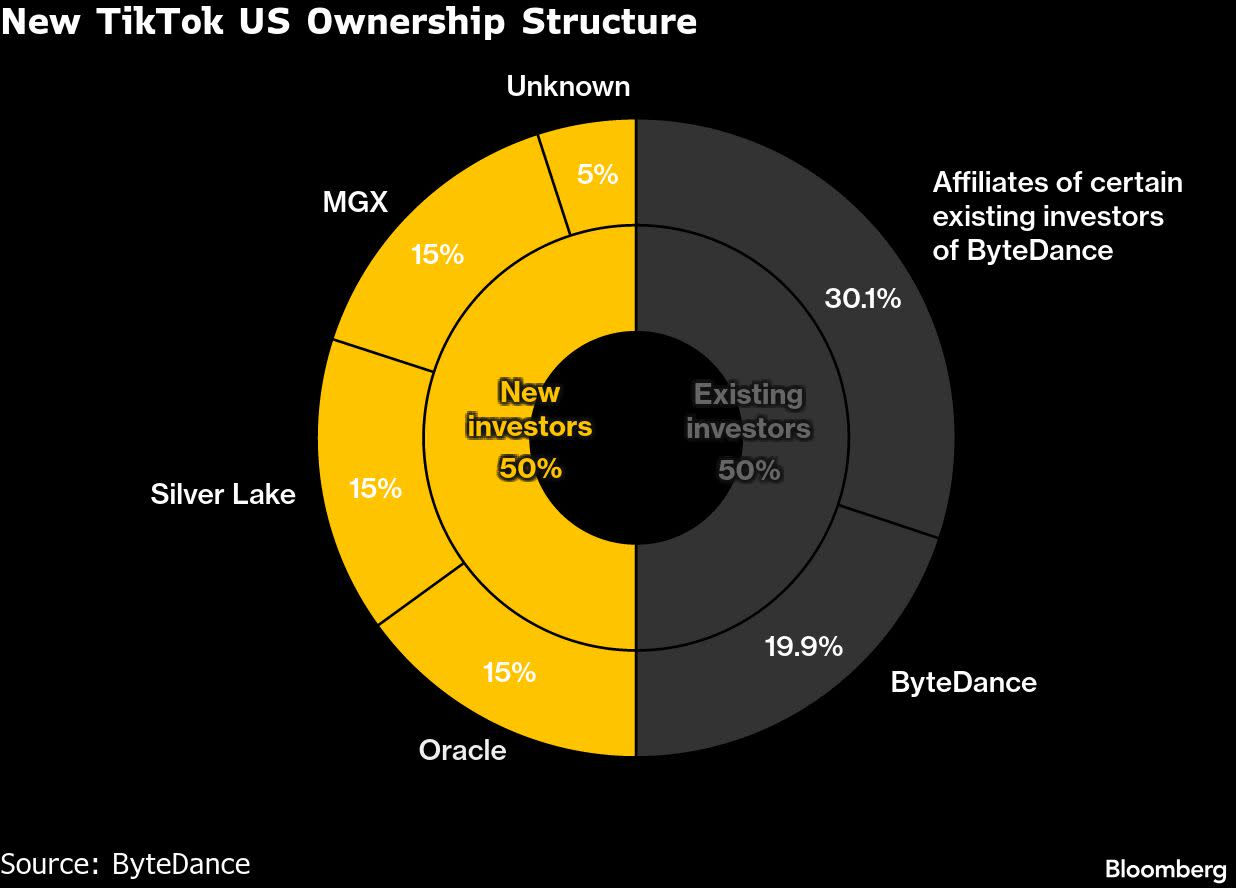

Oracle, Silver Lake, and MGX each hold a 15% stake in TikTok, highlighting their strategic and financial interests. Dell's family office and other investors hold smaller stakes, indicating diverse investment strategies. Estimated data.

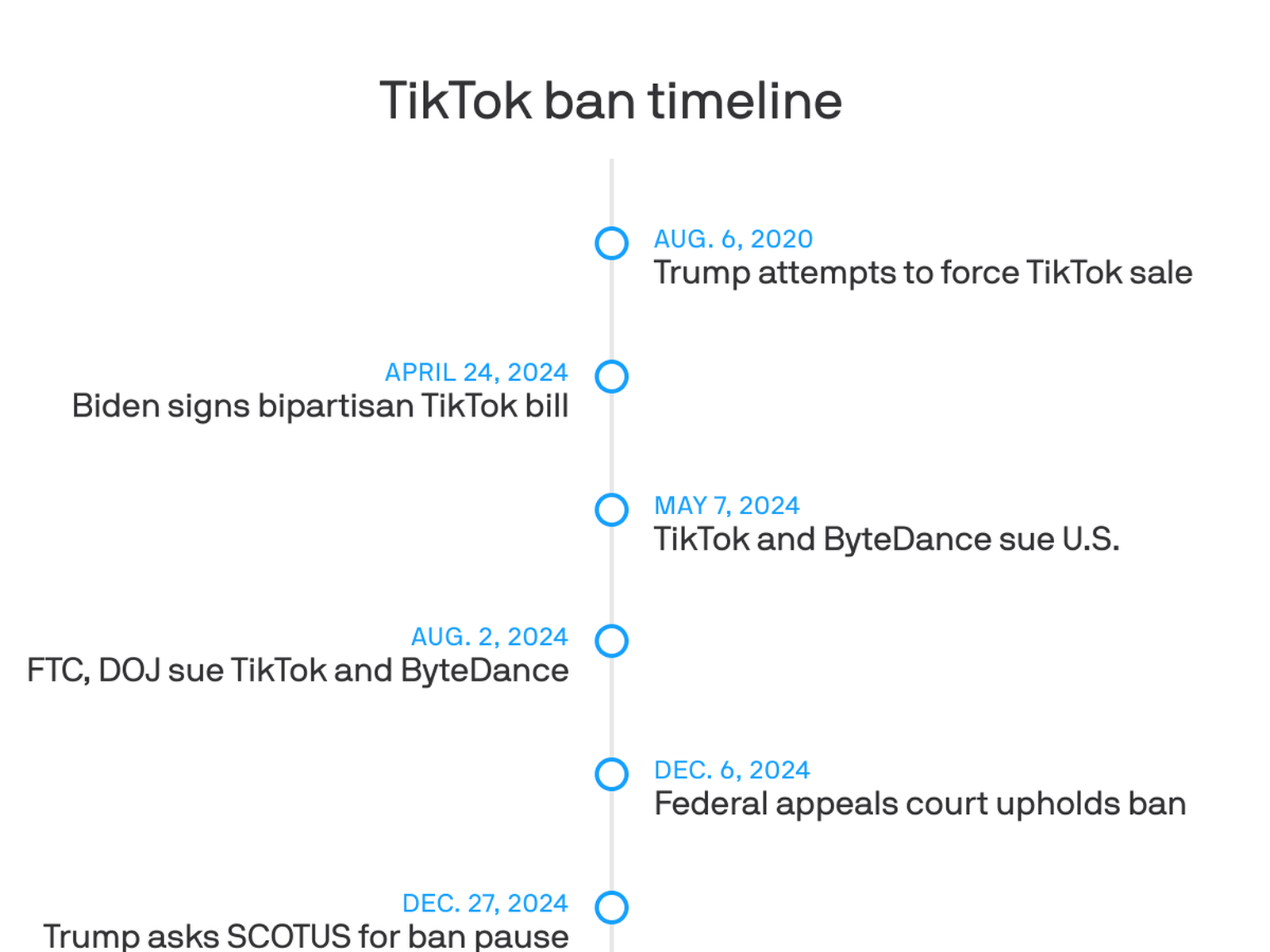

The Six-Year Saga: From Trump's Ban Attempt to Biden's Ultimatum

The TikTok story didn't start in January 2026. It didn't even start in 2024. The timeline stretches back to 2020, when President Donald Trump began aggressively pursuing restrictions on the app over national security concerns. Trump's initial Executive Order 13942, signed in August 2020, aimed to ban TikTok from operating in the US within 45 days unless it was sold to an American company. The rationale: Chinese law technically allows the government to demand data from any company operating within its borders. TikTok's algorithm, source code, and user data represented a potential national security vulnerability.

By November 2020, negotiations heated up. Microsoft explored buying TikTok. Oracle stepped in. WeChat faced parallel restrictions. But the deals collapsed repeatedly. Courts blocked enforcement. Presidential administrations changed. State governments proposed their own bans.

The uncertainty dragged on through 2021, 2022, 2023, 2024, and 2025. Every spring and fall, new legislation surfaced. ByteDance invested in American infrastructure. The company hired American executives. It promised American data independence. None of it was enough to kill the legislative push.

Then Trump returned to office in January 2025. On January 20, 2025, the Supreme Court upheld the Protecting Americans from Foreign Adversary Controlled Applications Act (PAFACA), essentially validating that Congress had the power to restrict or ban TikTok. The company had 75 days to divest.

This was the moment. Not because Trump wanted to ban the app (he actually liked it), but because the legal framework was now ironclad. ByteDance had to act.

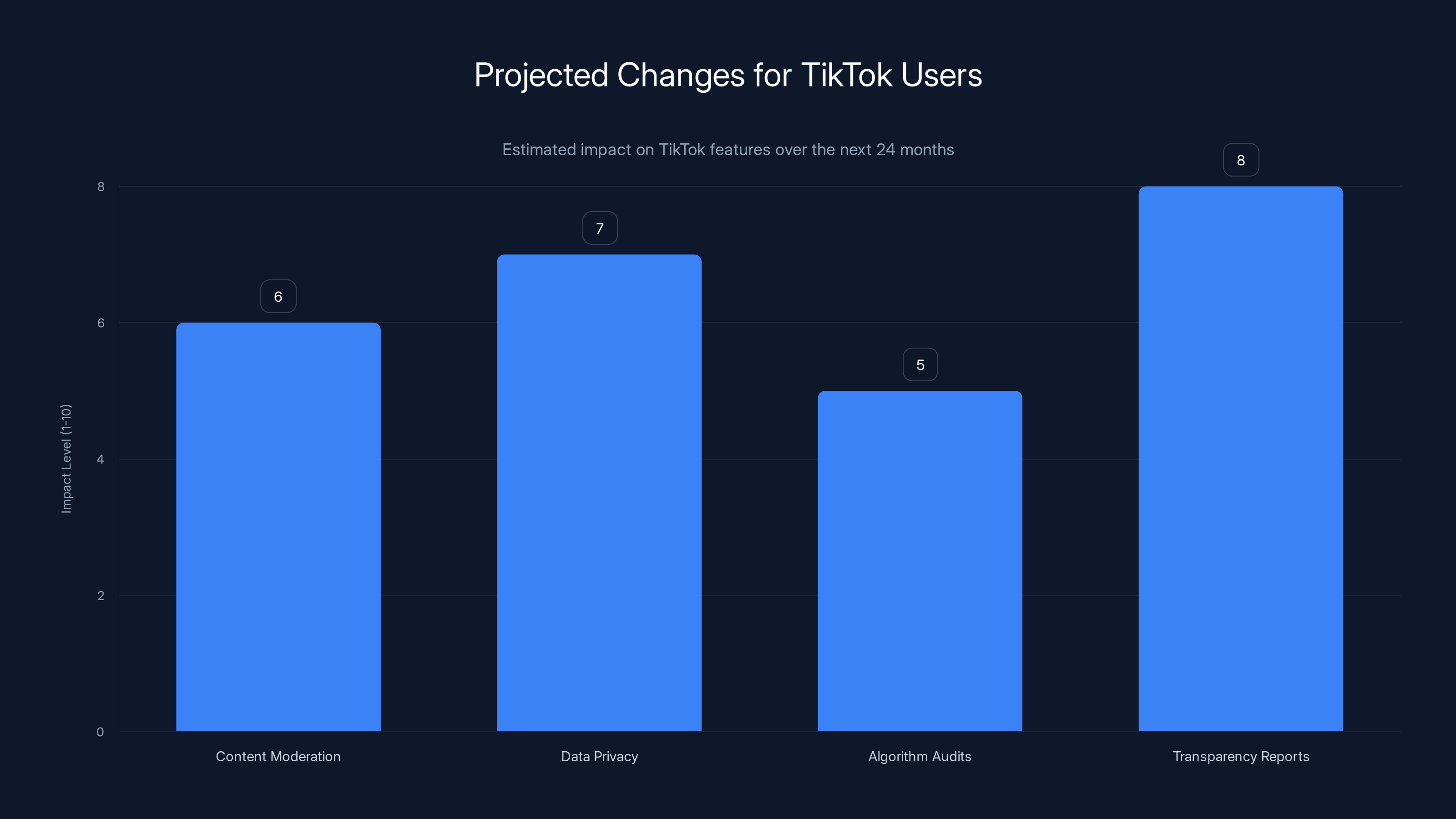

Estimated data suggests that transparency reports and data privacy changes will have the most significant impact on TikTok users over the next 24 months.

The New Structure: How USDS Joint Venture LLC Actually Works

The new entity is called USDS Joint Venture LLC, which stands for US Data Security. But it's not a traditional joint venture in the Silicon Valley sense. It's a governance structure designed to satisfy multiple stakeholders: Congress, national security officials, ByteDance, and American investors.

Here's the cap table:

- Oracle: 15% stake

- Silver Lake: 15% stake

- MGX (Abu Dhabi): 15% stake

- Dell's Family Office: Minority stake

- Other minority investors: Various stakes

- ByteDance: Retains technology and algorithmic IP through licensing agreement

The board of seven directors includes Adam Presser as CEO (formerly TikTok's head of operations and trust and safety), Shou Chew (TikTok's current CEO) as a director, and representatives from each major investor: Timothy Dattels (TPG Global), Mark Dooley (Susquehanna International Group), Egon Durban (Silver Lake co-CEO), Raul Fernandez (DXC Technology CEO), Kenneth Glueck (Oracle), and David Scott (MGX).

What this structure actually means: ByteDance loses operational control. The American-majority board can't be outvoted by ByteDance. The joint venture operates TikTok as an independent entity. ByteDance holds the algorithm license, but the Americans control deployment, data handling, and content moderation.

It's designed to be bulletproof against future political challenges. If Congress later demands proof that the algorithm isn't biased toward Chinese interests, the American board can audit it themselves. If senators worry about data exfiltration, the safeguards are embedded in the governance structure, not just promised in press releases.

National Security Safeguards: What Actually Changes for Users

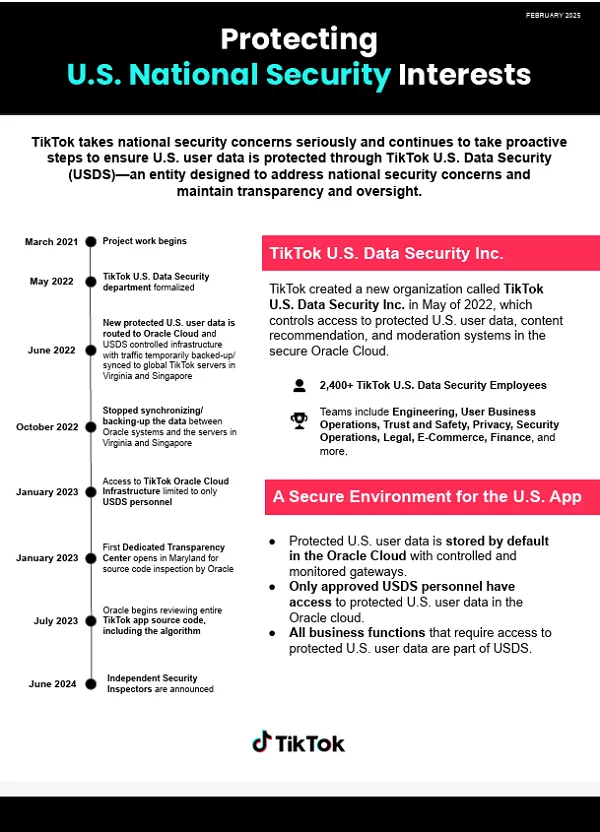

The deal includes specific safeguards that TikTok claims will "protect national security through comprehensive data protections, algorithm security, content moderation, and software assurances."

In practice, this translates to:

Data Segregation: US user data—which includes your location, watch history, search queries, and behavioral patterns—gets stored on American servers operated by American companies, not ByteDance infrastructure in China. This isn't new; TikTok started this migration years ago. But now it's legally mandated and auditable.

Algorithm Transparency: The joint venture can examine and audit TikTok's recommendation algorithm independently. American security researchers can review how content gets promoted or suppressed. This addresses the core congressional concern: that ByteDance could be forced to manipulate the algorithm in ways that benefit China's geopolitical interests.

Content Moderation Governance: A majority-American board controls what content is allowed, when posts get flagged, and how appeals work. This prevents a scenario where Beijing could, in theory, pressure ByteDance to suppress content critical of the Chinese government.

Software Supply Chain Security: The joint venture will conduct security audits of TikTok's codebase. No components can be added without American oversight. This prevents backdoors or surveillance capabilities from being inserted.

None of these safeguards would've been implementable under ByteDance's previous structure. The joint venture isn't just about ownership percentages; it's about embedding American decision-making into TikTok's operations at the architectural level.

However, here's the honest reality: these safeguards depend on American regulators actually enforcing them. There's no international court that can verify compliance. It's trust-but-verify at scale, relying on occasional audits and Congressional oversight.

The USDS Joint Venture LLC is majority-owned by American investors, with Oracle, Silver Lake, and MGX each holding 15%, while Dell's family office and others hold the remaining stakes. Estimated data.

The Investor Consortium: Who Gets Rich (Or Doesn't)

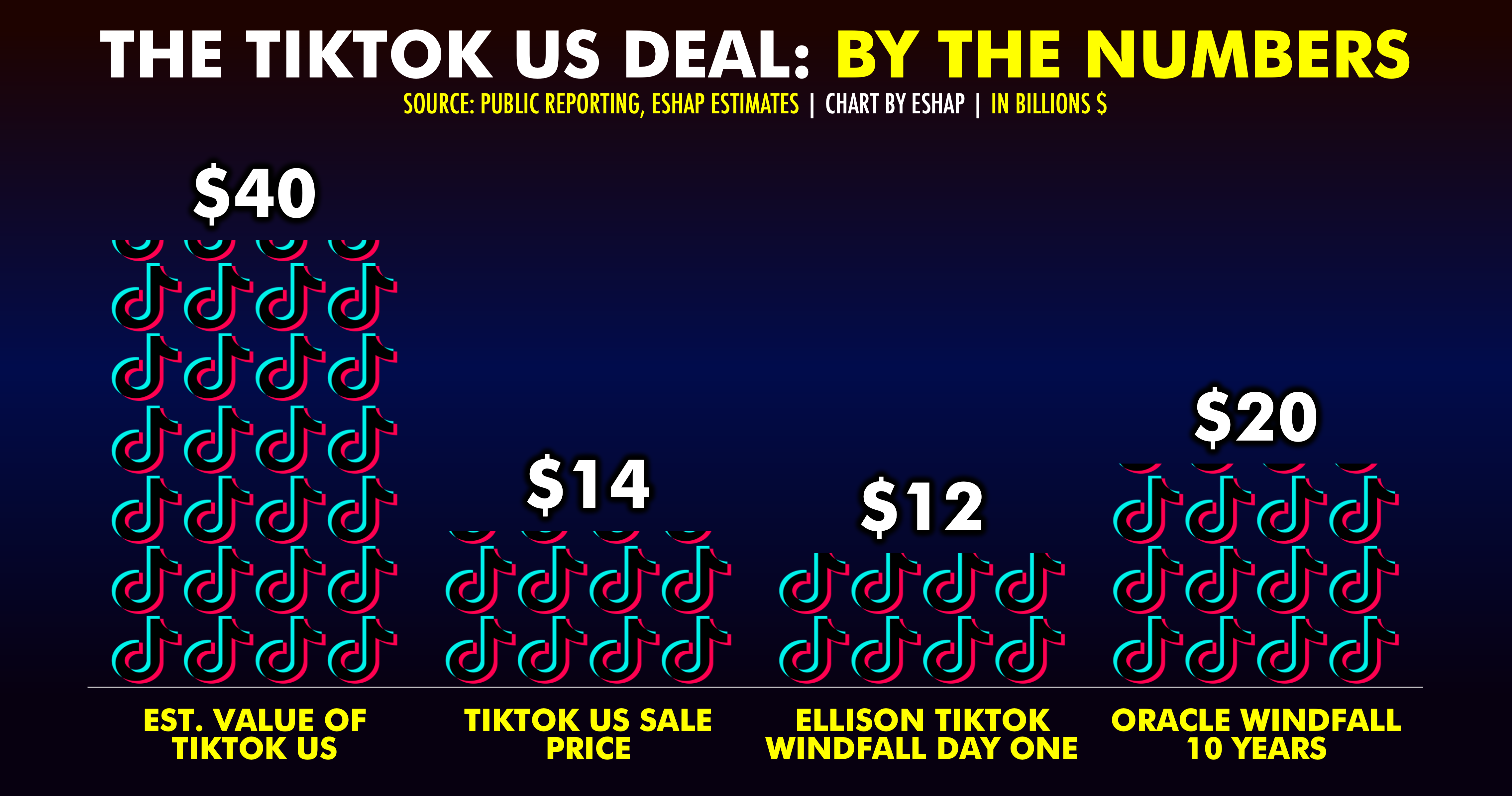

Let's talk money, because the investor breakdown reveals what actually went down here.

Oracle ($15 billion in annual revenue) becomes TikTok's cloud infrastructure provider and takes a 15% equity stake. For Oracle, this is partly strategic (cloud business growth) and partly patriotic (Larry Ellison has been vocal about security concerns). Oracle gets to audit the algorithm and manage American data servers. The company also gets a cut of any eventual public offering or acquisition.

Silver Lake (

MGX (Abu Dhabi's sovereign wealth fund) taking a 15% stake is the geopolitical wildcard. The UAE has positioned itself as a tech-friendly alternative to both US and Chinese dominance. MGX's investment signals international confidence in the deal while diversifying ByteDance's exposure from pure-China ownership.

Dell's family office and other minority investors make smaller bets, possibly with strategic angles (Dell could see cloud integration opportunities, for example).

The real winner is ByteDance, which retains its algorithm and technology IP through a licensing deal. It gets paid a fee for that license annually, ensuring a revenue stream from the joint venture's profitability. If TikTok generates $5 billion in US ad revenue, ByteDance takes a cut as the IP licensor.

The catch for ByteDance: it completely surrenders operational control and governance rights. The company can't influence algorithm changes, can't demand that content be suppressed, and can't extract US user data. It's monetization without influence, which is a remarkable concession.

Why This Deal Took So Long: The Sticking Points That Held Everything Up

ByteDance could've sold TikTok outright to Oracle in 2020. Why six years?

First, ByteDance didn't want to lose the app. TikTok's algorithm is ByteDance's crown jewel. The company created dozens of other products (Douyin in China, Hilo streaming, etc.), but TikTok's success demonstrated algorithmic expertise worth tens of billions. Selling TikTok entirely meant losing that IP and admitting defeat to American regulatory pressure.

Second, Chinese law technically restricts it. Exporting advanced AI algorithms is controlled under China's national security framework. ByteDance can't freely transfer TikTok to American ownership without Beijing's approval. The joint venture structure solves this: ByteDance isn't selling the algorithm; it's licensing it to an independent entity. Subtle but legally significant distinction.

Third, the valuations didn't align. In 2020, ByteDance valued TikTok at around $50-75 billion. American buyers (Microsoft, Oracle) offered far less. By 2025, even though the regulatory pressure intensified, ByteDance still held out for a better deal. The joint venture with Oracle, Silver Lake, and MGX essentially values TikTok at a higher implied valuation through equity stakes and licensing fees than a straight acquisition would've brought.

Fourth, every new Congress brought new demands. In 2021, the concern was algorithm transparency. In 2022, it was data localization. In 2023, it was content moderation. In 2024, it was national security audits. Each congressional session added requirements. ByteDance kept negotiating to find a structure that satisfied all of them simultaneously.

Fifth, Trump's return changed the calculus entirely. Trump actually likes TikTok and uses the platform to reach voters. He wasn't pushing for divestment for personal reasons. But Congress forced his hand. The Supreme Court ruling in January 2025 removed all ambiguity. ByteDance had 75 days and no escape route.

The joint venture structure was the compromise that finally worked: ByteDance keeps the technology, Americans get operational control, investors get financial upside, and Congress gets governance safeguards.

The new USDS Joint Venture LLC gives American investors significant control, addressing national security concerns while maintaining ByteDance's technological influence. Estimated data.

Trump's Role: From Ban Advocate to Deal Cheerleader

Here's one of the most surprising elements: President Trump celebrated the deal on Truth Social immediately. "The app will now be owned by a group of Great American Patriots and Investors, the Biggest in the World, and will be an important Voice," Trump posted.

This represents a complete reversal from 2020, when Trump aggressively pursued TikTok's ban. What changed?

First, Trump discovered TikTok's political utility. The platform proved essential for reaching younger voters. Trump's campaign accounts accumulated tens of millions of followers. The algorithm favored his content because it gets engagement. Banning TikTok would've reduced his reach.

Second, the joint venture satisfied the national security requirements that even Trump's own officials demanded. If Oracle, Silver Lake, and MGX are controlling TikTok's operations, there's no credible national security argument anymore. Congress can't claim Chinese control exists when Americans literally run the company.

Third, Trump's second term has a pro-business, anti-regulation orientation. Instead of being the "ban guy," Trump became the "dealmaker guy" who solved the TikTok problem in a way that preserved the platform. This is better politics than outright bans, which would've angered Gen Z voters.

Trump's endorsement matters because it removes the partisan element from the deal. This isn't a Democratic solution or a Republican solution; it's a Trump-approved business solution that Congress will likely support.

The Congressional Response: Why Lawmakers Might Actually Approve This

The joint venture isn't final until Congress and the SEC approve it. But there are strong reasons lawmakers will likely support it:

National Security Box Checked: The deal addresses every congressional concern raised since 2020. Data localization, algorithm transparency, American board control, security audits—all of it's in the structure.

American Jobs Preserved: TikTok employs thousands of Americans directly and supports hundreds of thousands of content creators. The joint venture keeps those jobs intact while proving that Chinese ownership poses a problem.

Economic Upside: Oracle, Silver Lake, and MGX are respectable American and international companies. Congress won't worry about the deal collapsing or being exploited.

Bipartisan Support: Senator Marco Rubio (Republican) has been aggressive about China tech restrictions, but he's likely to support this deal because it actually limits Chinese control. Democratic senators concerned about data privacy get the same assurances. This isn't partisan; it's consensus.

No Precedent for Rejection: Congress has never rejected a divestment deal that actually addressed its stated concerns. Approving this sets a precedent for future tech disputes: divest operational control, keep American security, allow business to continue.

The only scenario where Congress blocks this is if political winds shift dramatically or if investigative reporting reveals some hidden aspect of the deal. But based on the structure, that's unlikely.

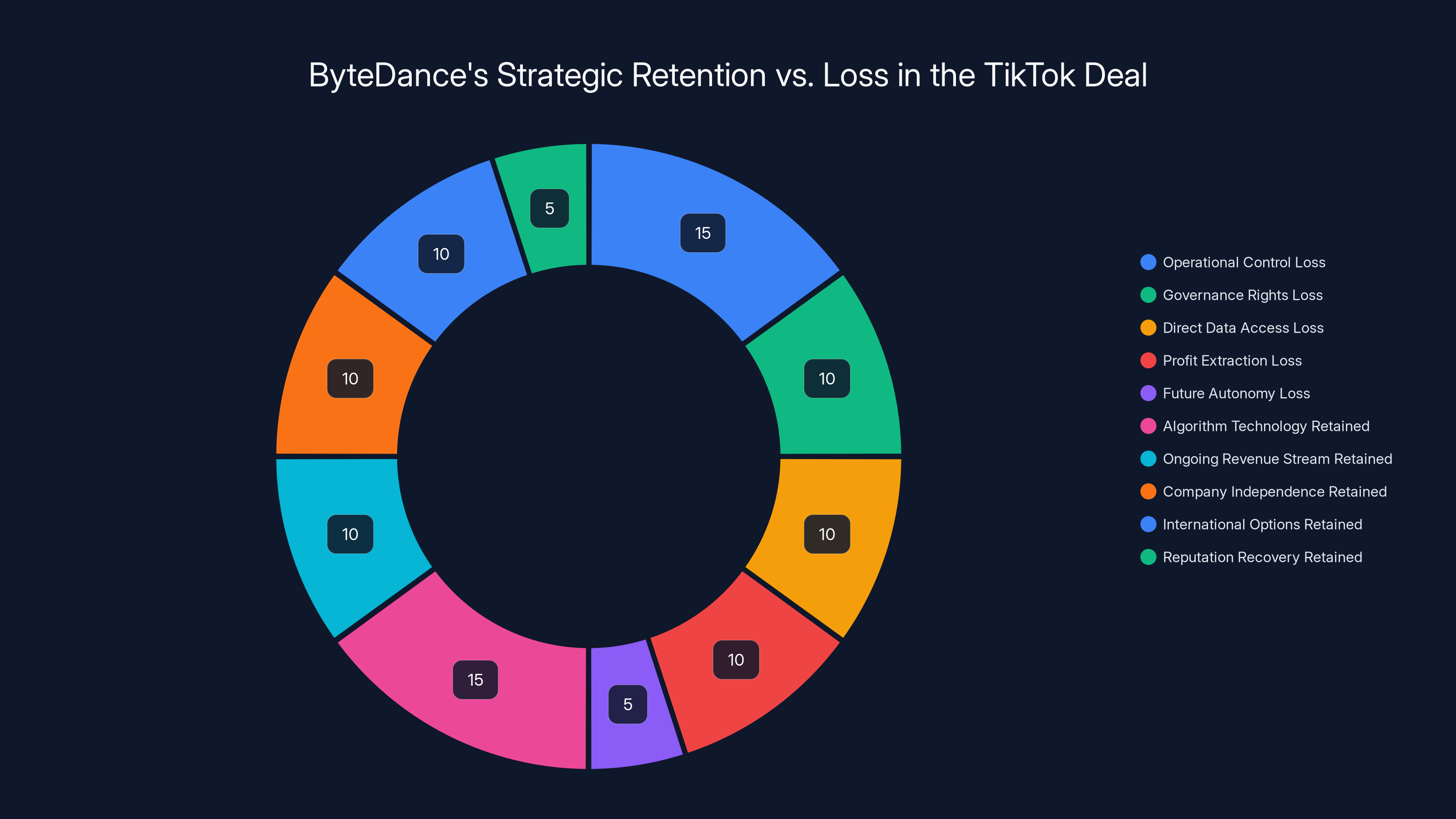

ByteDance strategically retains key assets like algorithm technology and revenue streams while conceding operational control and governance rights in the US. Estimated data.

The Impact on TikTok Users: What Actually Changes

Here's the honest truth: for daily users, almost nothing changes immediately.

You still get the same app. The algorithm still works the same way. Your For You Page still recommends videos based on your watch history and engagement. Creators still earn money through TikTok Shop, Super Likes, and creator funds.

What changes gradually:

Content Moderation: Decisions about what's allowed shift from ByteDance offices in Beijing to a board with American representation. This might mean subtle differences in how political content, gambling content, or other sensitive categories are handled.

Data Privacy: Over the next 12-24 months, US user data fully migrates to American servers. This doesn't improve privacy necessarily (US data laws aren't stronger than China's), but it does prevent China from legally demanding data under Chinese law.

Algorithm Audits: Security researchers and Congressional staff will occasionally audit how recommendations work. You might see slightly less "viral" content in some categories as the algorithm becomes more transparent.

Transparency Reports: The joint venture will likely publish quarterly or annual transparency reports about content moderation, data handling, and algorithm changes. This creates accountability that didn't exist before.

For creators, the economics stay largely the same. Advertising rates, revenue splits, and creator fund payments shouldn't change materially. If anything, American investors might allocate more resources to creator support and monetization options.

For advertisers, the deal is excellent news. The platform's legitimacy increases dramatically. Brands that avoid TikTok due to China ownership concerns can now advertise without that risk. This could increase ad spend, improve pricing, and make TikTok more lucrative for creators.

What ByteDance Loses vs. What It Keeps

This is a critical distinction because it determines whether ByteDance actually lost the TikTok fight.

ByteDance Loses:

- Operational control of TikTok (the joint venture's board runs the company)

- Governance rights (can't influence algorithm or content decisions)

- Direct data access (US user data stays on American servers)

- The ability to extract profits freely (licensing fees go to ByteDance, but operational profits fund the venture)

- Future autonomy (if the joint venture wants to change direction, it needs board consensus, not ByteDance approval)

ByteDance Keeps:

- The algorithm technology (through licensing agreement, not loss of IP)

- Ongoing revenue stream (licensing fees from TikTok's US profitability)

- The company's independence (ByteDance isn't acquired or forced to sell)

- International options (TikTok operates in dozens of countries; this deal only affects the US)

- Reputation recovery (ByteDance is no longer the villain blocking national security)

This is why calling it a "loss" for ByteDance is incomplete. The company sacrificed American control but kept the technology that makes TikTok work. It's a strategic retreat that preserves assets while accepting operational losses.

For some context: ByteDance is valued at

The International Implications: Why Other Countries Are Watching

This deal doesn't just affect TikTok. It creates a blueprint for every other country considering restrictions on Chinese tech platforms.

The EU is monitoring closely. The bloc has been aggressive about regulating TikTok under its Digital Services Act, but an outright ban was never politically feasible. The American joint venture model gives Brussels an alternative: demand European board representation, European data localization, and European algorithm audits, but allow the platform to continue operating.

The UK has discussed TikTok restrictions. The joint venture structure could satisfy British national security concerns without losing access to a platform that's central to British digital culture.

Canada has explored banning TikTok or forcing divestment. The American deal shows that operational control, not ownership, is what matters for national security. Canada could demand Canadian board seats and server localization as an alternative to ban.

India already banned TikTok in 2020, long before this American deal. But the joint venture model could inform how India might handle future Chinese tech platforms—not through absolute bans, but through governance structures that embed Indian oversight.

The precedent: governance-based restrictions are more politically viable and technically feasible than ownership-based bans. Countries don't have to lose platforms; they have to gain influence over how those platforms operate.

For ByteDance, this sets a template for negotiating similar deals with other countries. The joint venture isn't unique to America; it's a model that could work in Europe, Asia, and beyond.

The Long-Term Question: Will This Deal Actually Survive?

Seven years from now, will this joint venture still exist, or will geopolitical winds shift again?

Honestly, the deal is solid, but it depends on three factors:

First: Congressional Stability: If Congress remains bipartisan on China tech restrictions, the deal holds. If the committee that oversees it changes or loses interest, there could be new demands. The current structure is designed to be future-proof against reasonable demands, but not against totally new requirements.

Second: ByteDance's Behavior: If ByteDance tries to secretly extract data, influence the algorithm remotely, or violate the licensing agreement, Congress will use it as justification to push for complete divestment. The joint venture works only if ByteDance honors its side of the deal.

Third: TikTok's Financial Performance: If the app stagnates, loses users, or becomes less profitable, investors might push for changes. The joint venture only works if TikTok remains valuable enough to justify Oracle, Silver Lake, and MGX's continued involvement.

Assuming normal circumstances, the deal should hold for 5-10 years. After that, the joint venture might go public (IPO), get acquired by another American tech company, or remain private indefinitely. But the core structure—American control of US operations—is unlikely to change.

The Unspoken Winners and Losers

Winners:

- TikTok creators: The platform stabilizes, ad revenue likely increases, and they keep their livelihoods

- Oracle: Gets algorithm intelligence, cloud business growth, and potential equity upside

- Silver Lake: Invests in one of the world's most profitable social platforms at a discount

- Advertisers: Access to 150 million US users without China ownership concerns

- Congress: Passes the national security buck to American companies to enforce

Losers:

- Microsoft: In 2020, seemed poised to acquire TikTok; now it's off the table

- Other Chinese tech companies: The deal sets precedent for restrictions on ByteDance, Alibaba, Tencent, and others

- Data privacy advocates: US data is on American servers now, but Americans aren't better at privacy than ByteDance was

- Geopolitical hardliners: Wanted an outright ban; got a compromise instead

What This Means for Tech Policy Going Forward

The TikTok deal isn't just about one app. It fundamentally shifts how America thinks about foreign tech companies:

From Ownership to Control: Regulators now understand that who owns the company matters less than who controls the operations. This opens paths for Chinese tech companies to stay in the US through operational restructuring rather than forced sales.

From Bans to Governance: Congress proved that governance-based solutions (board seats, algorithm audits, data localization) can satisfy national security concerns. This is better policy than outright bans, which destroy value and harm consumers.

From Distrust to Verification: The joint venture model embeds ongoing oversight into corporate structure. This is harder to enforce than a simple ban, but it's more sophisticated and ultimately more effective.

From Partisan to Pragmatic: Both Democrats and Republicans supported this deal because it addresses real security concerns while preserving a valuable platform. That's the template for future tech disputes.

Other American tech companies are watching too. If China decides to restrict Meta, Google, or Apple in retaliation, the joint venture model might be offered as an alternative. The TikTok deal could normalize foreign governance requirements for American tech abroad.

FAQ

What exactly is the USDS Joint Venture LLC?

The USDS Joint Venture LLC is an independent American company created to operate TikTok in the United States. ByteDance owns the algorithm technology but licenses it to the joint venture, which is controlled by a board of American and international investors. The structure separates ByteDance's ownership from operational control, addressing national security concerns while allowing TikTok to continue operating in America.

How much of TikTok does ByteDance still own?

ByteDance retains the algorithm technology and receives ongoing licensing fees from TikTok's US profitability, but it does not directly own the joint venture's equity. The joint venture itself is majority-owned by American investors: Oracle (15%), Silver Lake (15%), MGX (15%), Dell's family office, and others hold the remaining stakes. ByteDance's control is through technology licensing, not ownership percentage.

When did this deal finalize, and what was the deadline?

The deal was finalized on January 23, 2026. The Supreme Court had upheld the 2020 divestment law on January 20, 2025, giving TikTok 75 days to divest or face a shutdown. The joint venture structure satisfies the legal requirements by placing operational control in American hands while preserving ByteDance's technology IP through a licensing agreement.

Will this deal actually improve data privacy for TikTok users?

The deal doesn't improve data privacy standards, but it changes where US user data is stored. All user information now stays on American servers operated by Oracle, preventing China from legally demanding it under Chinese law. This addresses the national security vector of data exfiltration, though data protection laws (GDPR, CCPA, etc.) still apply the same way they did before.

Could Congress demand further changes or restrictions after approving this deal?

Yes, Congress could theoretically demand additional safeguards if national security concerns persist. However, the joint venture is structured to accommodate new requirements without forcing a complete restructuring. Congress could demand additional algorithm audits, more frequent security reviews, or expanded board representation, and the joint venture could adapt. An outright rejection would require evidence of major security breaches or ByteDance violations of the agreement.

What happens if the joint venture becomes unprofitable or unstable?

If the venture struggles financially, the investor consortium (Oracle, Silver Lake, MGX) could restructure operations, seek new investors, or eventually attempt a sale to another American company. Congress would need to approve any major changes to the ownership or governance structure. The worst-case scenario would be forced divestment again, but that's unlikely unless TikTok loses massive user numbers or revenue.

How does Adam Presser's role as CEO affect decision-making?

Adam Presser, as the joint venture's CEO, executes decisions made by the board of directors. He handles day-to-day operations, hiring, product development, and legal compliance. However, major strategic decisions (algorithm changes, data policies, expansion plans) go to the board, where Americans have a clear majority. This structure prevents any single person from making unilateral decisions that compromise national security safeguards.

Could China legally force ByteDance to take back control of TikTok through legislation?

Chinese law doesn't extend jurisdiction over American corporations, so China cannot legally force ByteDance to take back control of a joint venture registered and operating in the US. ByteDance could theoretically attempt to acquire the venture back, but Congress would block any such transaction. The joint venture structure is deliberately designed to be irreversible without American government approval.

What does this deal mean for TikTok's algorithm and recommendation system?

The algorithm stays the same for users, but it's now subject to American audits and oversight. The joint venture can audit how the algorithm recommends content, flag potential biases, and require transparency reports. However, the core recommendation engine itself—TikTok's technical advantage—remains ByteDance's IP. The company can still use the same algorithm in Douyin (its Chinese app) and potentially license it to other platforms.

Will TikTok go public after this deal?

That's a future decision for the joint venture's board. An IPO is possible in 5-10 years if the company continues growing profitably. Public listing would make the governance structure even more transparent (SEC disclosure requirements) and could provide investors with a liquidity event. However, the joint venture could also remain private indefinitely or get acquired by another American tech company.

Conclusion: The Template for Tech Geopolitics

The TikTok deal is over, but its implications are just beginning.

For six years, this saga dragged through American politics like a never-ending legal battle. Every president, every Congress, every season brought new threats and new negotiations. ByteDance had to make a choice: lose America entirely or surrender operational control while keeping the technology.

The joint venture wasn't ByteDance's ideal outcome. The company would've preferred to operate TikTok independently. But it's infinitely better than an outright ban, which would've cost the company $50+ billion and set a precedent for restrictions on its other products globally.

The deal works because all stakeholders get something:

Congress gets to declare victory on national security. Chinese control is replaced with American governance. The algorithm is auditable. Data stays local. Mission accomplished, politically.

ByteDance keeps its most valuable asset: the recommendation engine. The company still generates revenue from TikTok's profitability. It maintains the technology that built its reputation. It's a strategic retreat, not total surrender.

American investors get access to one of the world's most profitable social platforms. Oracle gains algorithmic intelligence and cloud business. Silver Lake gets equity upside. MGX diversifies geopolitically. Everyone wins financially.

TikTok users keep their app. Creators keep their income. The platform continues evolving. The experience barely changes because the underlying technology is the same.

The real significance is the precedent. This deal proves that governance-based restrictions are more viable than ownership-based bans. It shows that tech geopolitics has matured past "ban everything Chinese" into more sophisticated control mechanisms. It demonstrates that American regulation can preserve platforms while addressing legitimate security concerns.

Other countries will copy this model. Other Chinese companies will face similar pressures and discover that the joint venture structure offers an escape route. Other tech disputes will be resolved through governance rather than destruction.

We've moved from an era where countries either allowed or banned foreign tech. Now we're in an era where countries demand control. That's more sophisticated. More complex. More expensive to enforce. But ultimately more durable than the alternative.

The six-year TikTok saga ends here. But the template for tech geopolitics just started.

The app survives. The company adapts. America gets security. China loses control but keeps profit. Everyone moves forward. That's the deal.

Now we wait to see if Congress approves it. Based on everything we know, they will. TikTok isn't going anywhere.

Key Takeaways

- ByteDance finalized a joint venture deal on January 23, 2026, creating USDS Joint Venture LLC with Oracle (15%), Silver Lake (15%), and MGX (15%) as majority investors, addressing six years of national security concerns

- Adam Presser became CEO of the new entity while Shou Chew serves as a director on a seven-member board that places American decision-making power over TikTok's operations, algorithm, and content moderation

- ByteDance retains algorithm technology through a licensing agreement but loses operational control, meaning it receives ongoing revenue from US profitability without governance influence

- The deal embeds multiple national security safeguards: US data localization on Oracle servers, algorithm transparency with American audits, content moderation governance controlled by the board, and software supply chain security

- The joint venture structure sets a template for future tech geopolitics, proving that governance-based restrictions are more viable and politically acceptable than outright bans across multiple countries and industries

Related Articles

- TikTok US Deal Finalized: 5 Critical Things You Need to Know [2025]

- TikTok's US Deal Finalized: What the ByteDance Divestment Means [2025]

- The TikTok U.S. Deal Explained: What Happens Now [2025]

- DOGE Social Security Data Misuse: What Happened & Why It Matters [2025]

- TikTok's PineDrama App: The Micro-Drama Platform That's Learning From Quibi's Failures [2025]

- The Fake War on Protein: Politics, Masculinity & Nutrition [2025]

![TikTok's US Entity Deal Explained: How ByteDance Avoided Ban [2025]](https://tryrunable.com/blog/tiktok-s-us-entity-deal-explained-how-bytedance-avoided-ban-/image-1-1769184618402.jpg)