TikTok's U.S. Deal: The Complete Story You Need to Understand

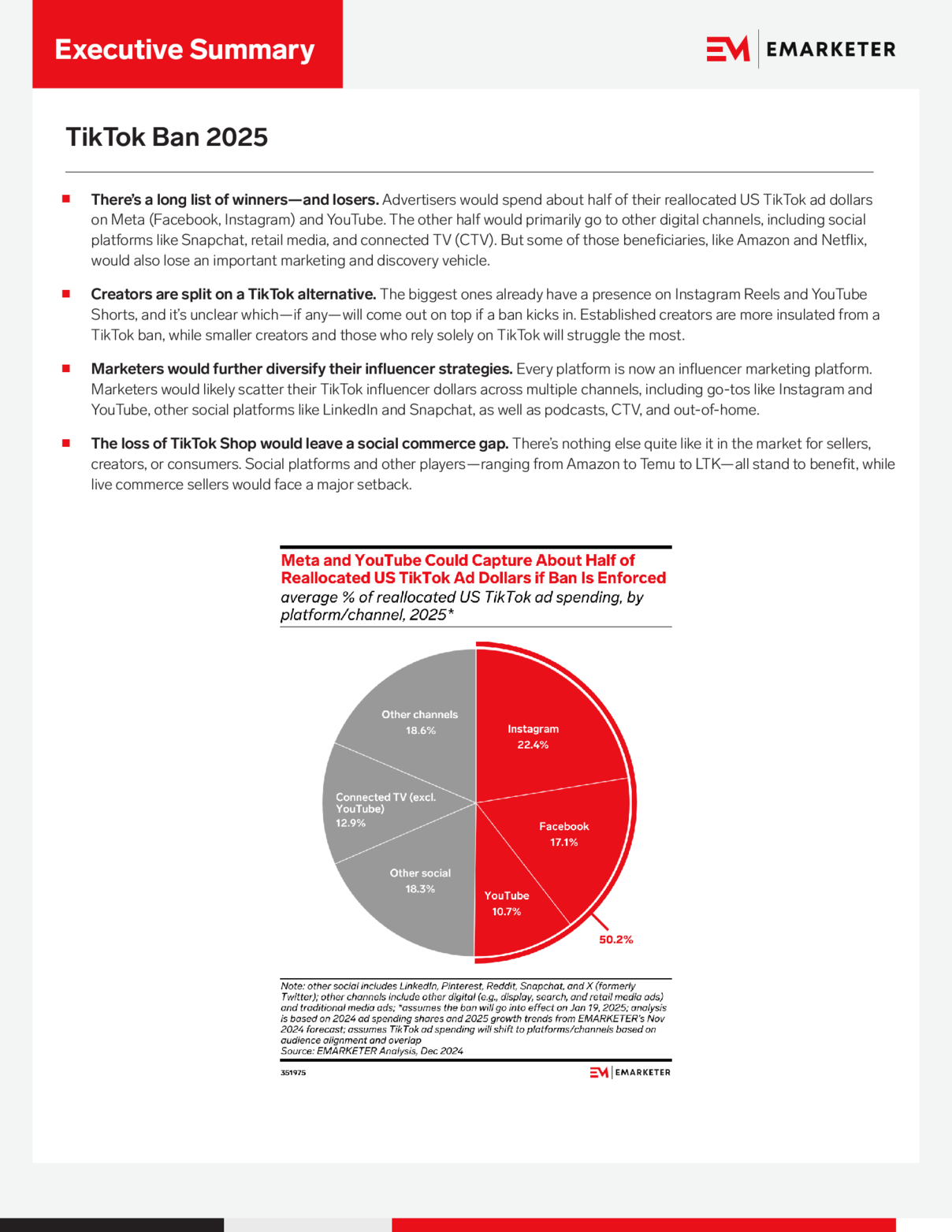

It's finally happening. After years of legal battles, executive orders, and enough drama to fill a streaming series, TikTok has signed a deal to restructure its U.S. operations. The app that over 170 million Americans use daily just got a new ownership structure, and honestly, most people have no idea what it actually means.

Let me break down what went down, who owns what now, and what changes (or doesn't change) for you as a user.

In December 2024, TikTok officially inked a deal with a consortium of American investors led by Oracle. This wasn't some handshake agreement either. We're talking about a formal restructuring of the entire U.S. entity, with new governance, new security arrangements, and new operational oversight. The deal was supposed to close in January 2026, and reports suggest it's moving forward as planned.

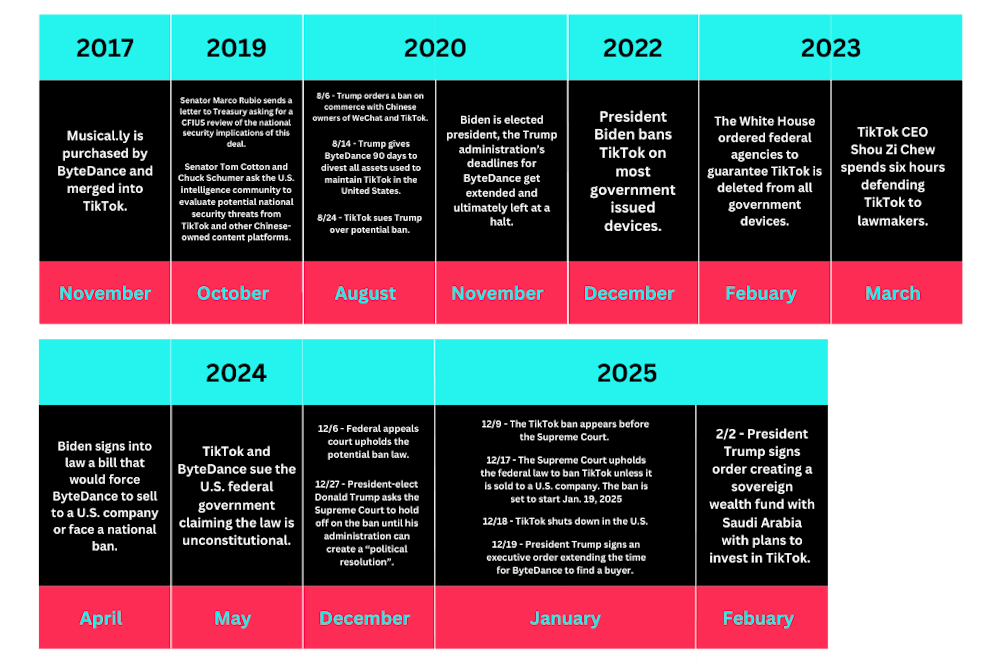

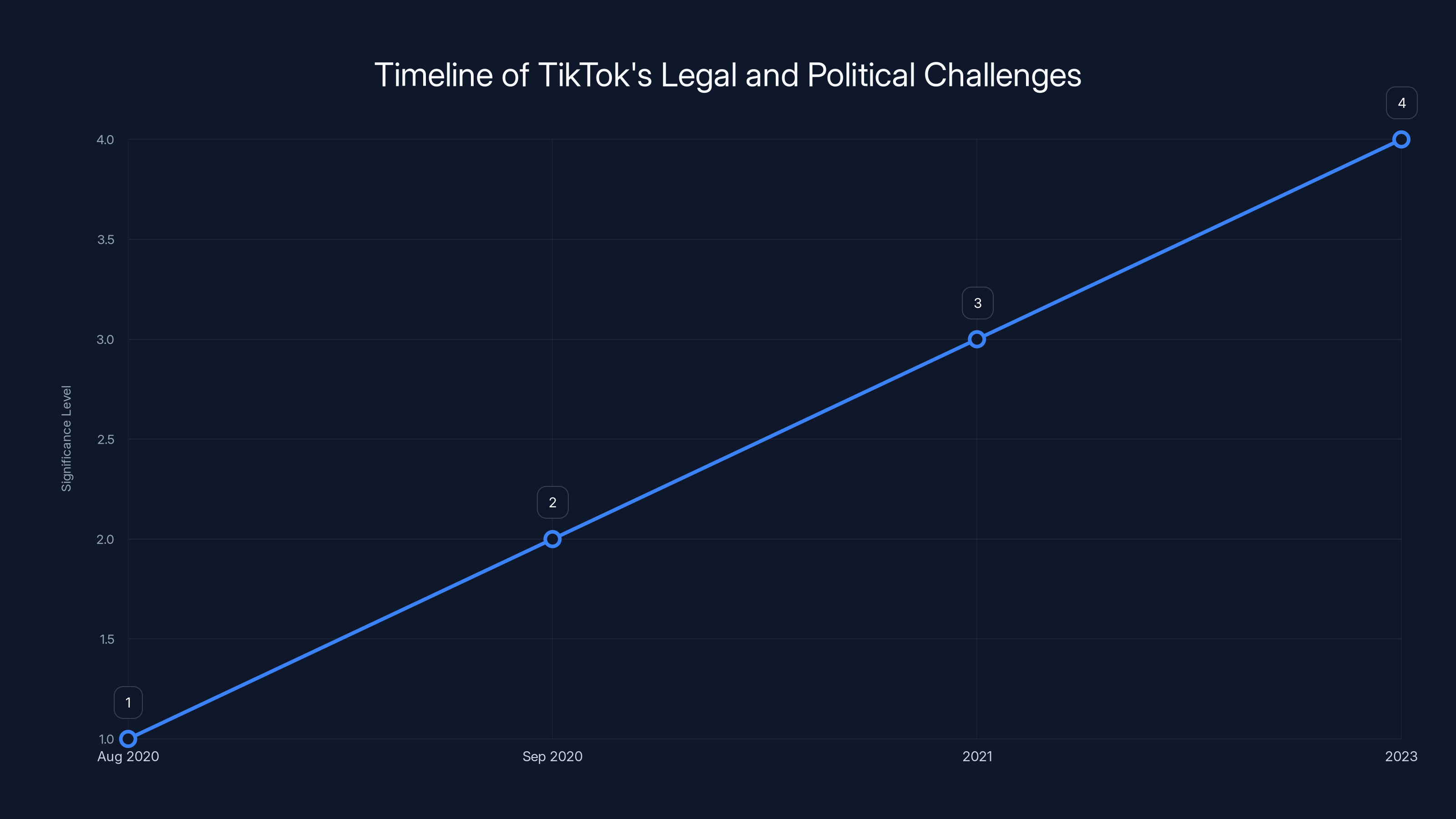

What makes this wild is that it represents the culmination of a four-year saga that started when Trump signed an executive order banning TikTok back in 2020. That first attempt didn't stick. Biden's administration took a different approach, passing legislation requiring TikTok to divest from ByteDance or face a ban. China's government then got involved, approving the deal with conditions. And then Trump returned to office with a completely different stance, suddenly pushing for a deal instead of an outright ban.

Now we're here. TikTok isn't being sold off entirely. Instead, the ownership structure is being split between American investors and ByteDance, with new oversight mechanisms that aim to address government concerns about national security.

TL; DR

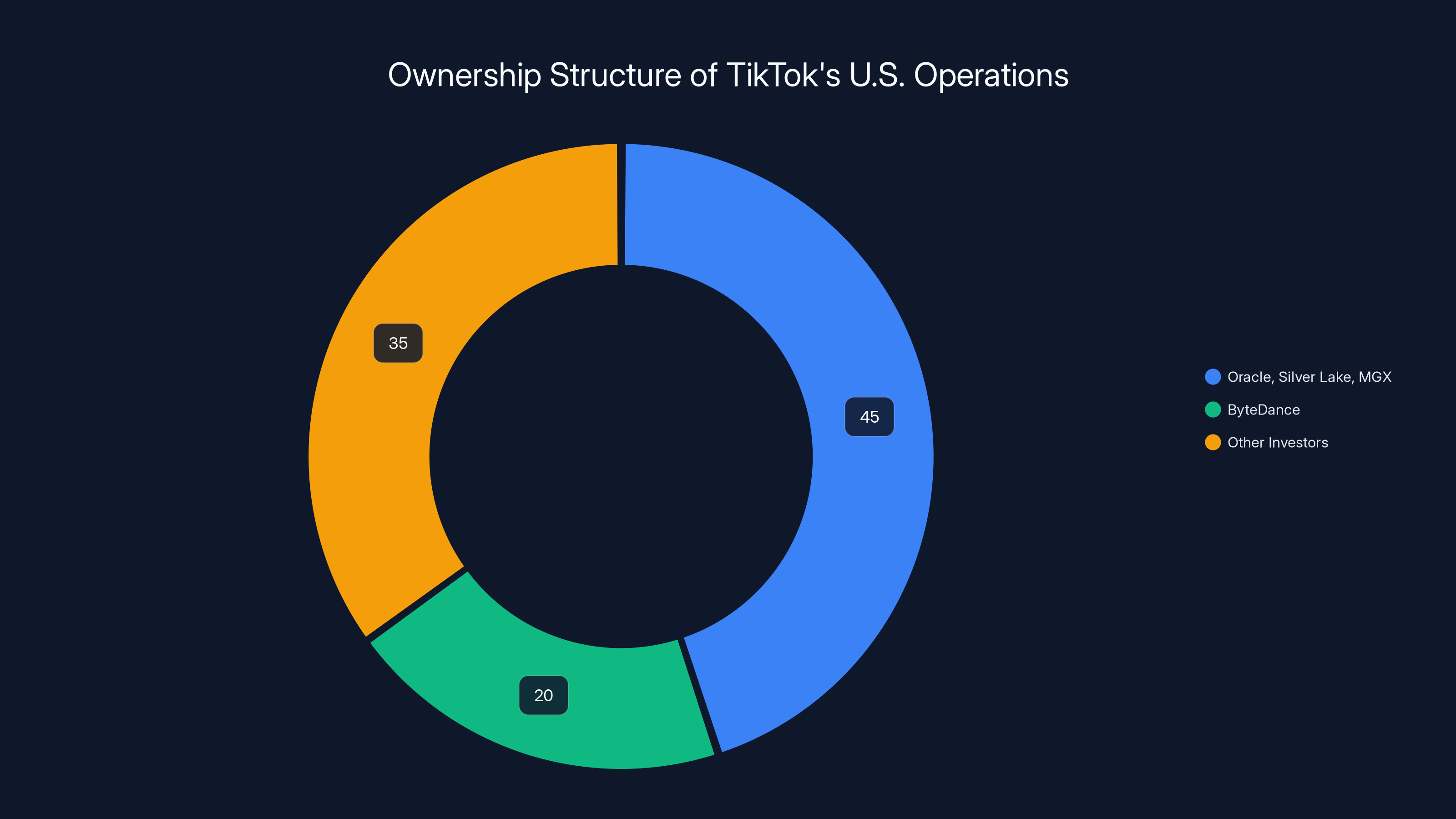

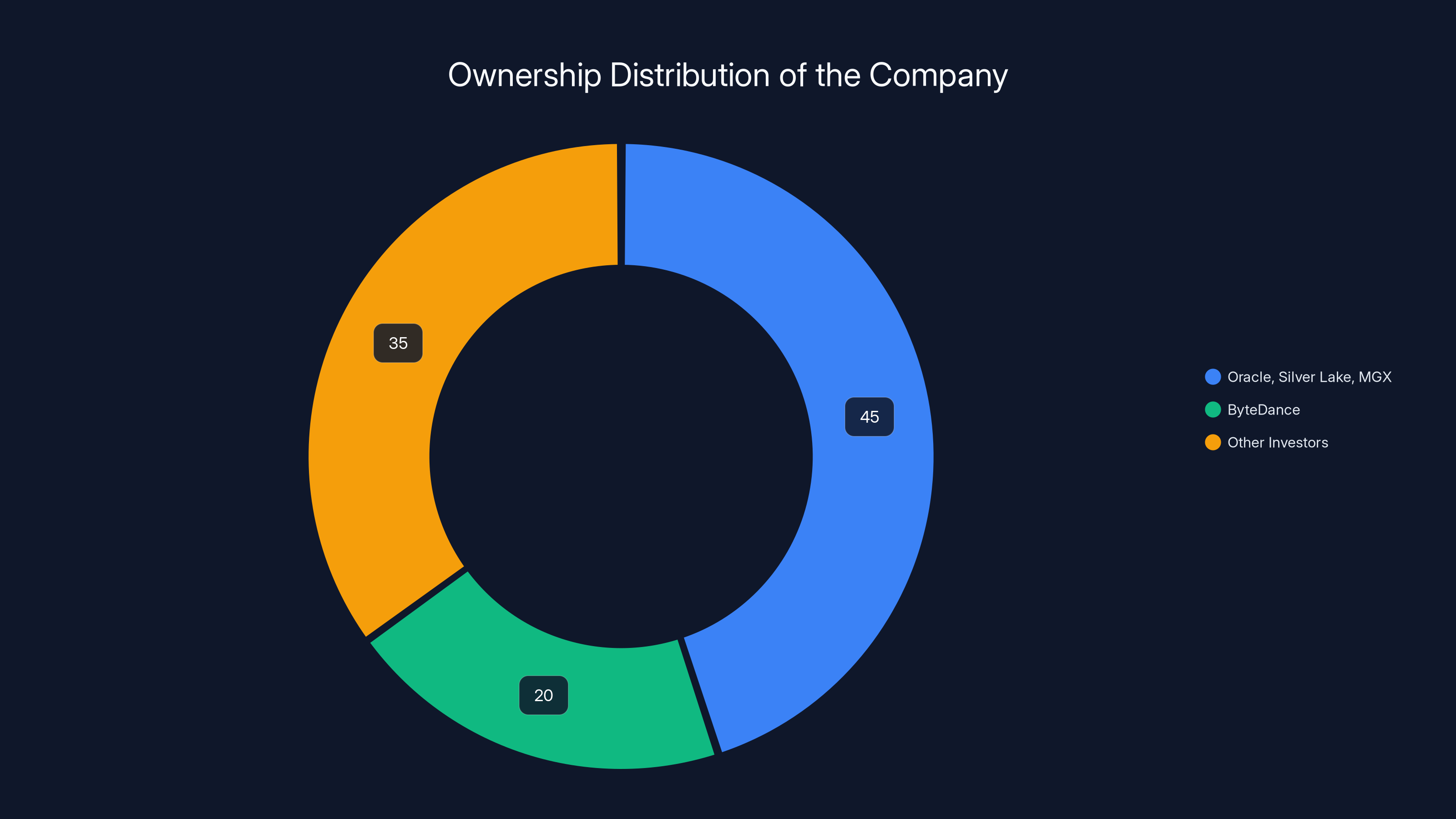

- The core deal: Oracle, Silver Lake, and MGX now control 45% of TikTok's U.S. operations, with ByteDance retaining roughly 20% and other investors holding stakes

- New governance: A joint venture called "TikTok USDS Joint Venture LLC" now oversees the platform's algorithm, user data, content moderation, and security

- Oracle's role: Acts as the "trusted security partner," auditing operations and ensuring data stored in the U.S. stays secure and separate from ByteDance

- What changes for users: Potentially nothing immediately, but the app might be discontinued in the U.S. and replaced with a new platform

- ByteDance's limits: Chinese parent company loses access to U.S. user data and cannot influence the U.S. algorithm

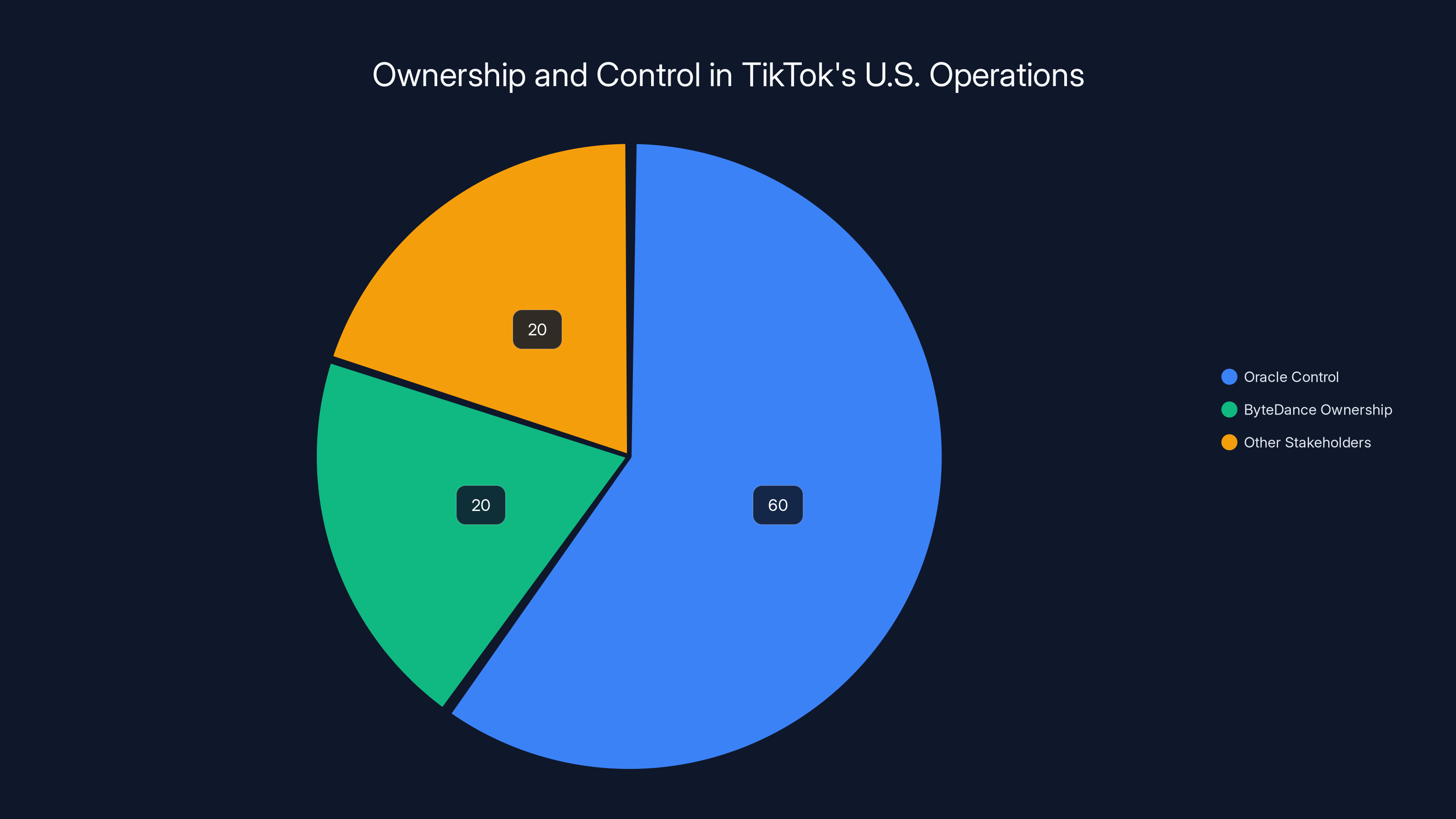

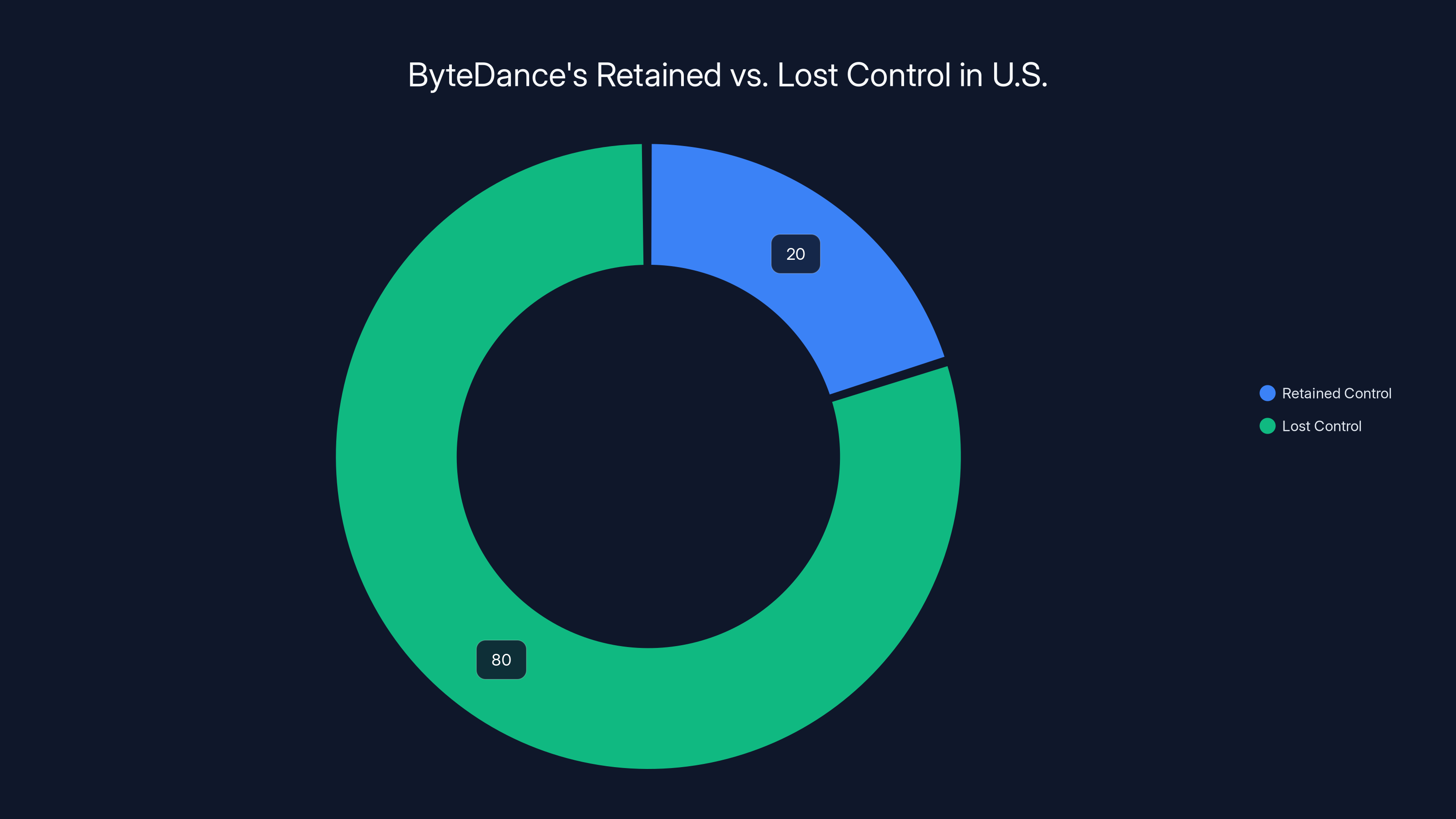

Estimated data shows Oracle controls 60% of TikTok's U.S. operations, while ByteDance retains a 20% ownership stake but loses operational control.

How We Got Here: The Four-Year Timeline

To understand why this deal matters, you need to know the messy history leading up to it. This isn't something that happened overnight. It's a saga spanning multiple presidencies, international diplomacy, and some genuinely confusing legal maneuvering.

The whole thing started in August 2020, when President Trump signed an executive order targeting transactions with ByteDance, TikTok's Chinese parent company. Trump's argument was straightforward: TikTok collects massive amounts of data on American users, and that data could end up in the hands of the Chinese government. National security threat, he said.

A month later, Trump's administration ramped up the pressure, demanding that TikTok sell its U.S. operations to an American company. The leading contenders at that time included Microsoft, Oracle, and Walmart. Each had different visions for what TikTok could become under American ownership.

The Legal Battles That Stalled Everything

Here's where things got complicated. A federal judge temporarily blocked Trump's executive order, arguing that the ban likely violated free speech rights. TikTok kept operating. That decision frustrated Trump's team but gave TikTok breathing room.

Then came 2021. The Biden administration took office and initially continued some of Trump's concerns about TikTok, but they approached it differently. Instead of an outright ban, they initiated a security review process.

But in 2023, Congress got involved. The Senate and House passed legislation requiring TikTok to divest from ByteDance within a specific timeframe or face a ban from U.S. app stores. This was different from Trump's executive order because it came from Congress, making it much harder to challenge legally.

President Biden signed the bill into law, and suddenly, TikTok faced an actual deadline with teeth.

TikTok's Response and the Platform's Shutdown Moment

TikTok's response was aggressive litigation. The company sued the U.S. government, arguing that the law violated the First Amendment rights of American users and content creators. The company's argument was that it had already proven compliance with U.S. data regulations, and forcing divestment from ByteDance was a taking of property without due process.

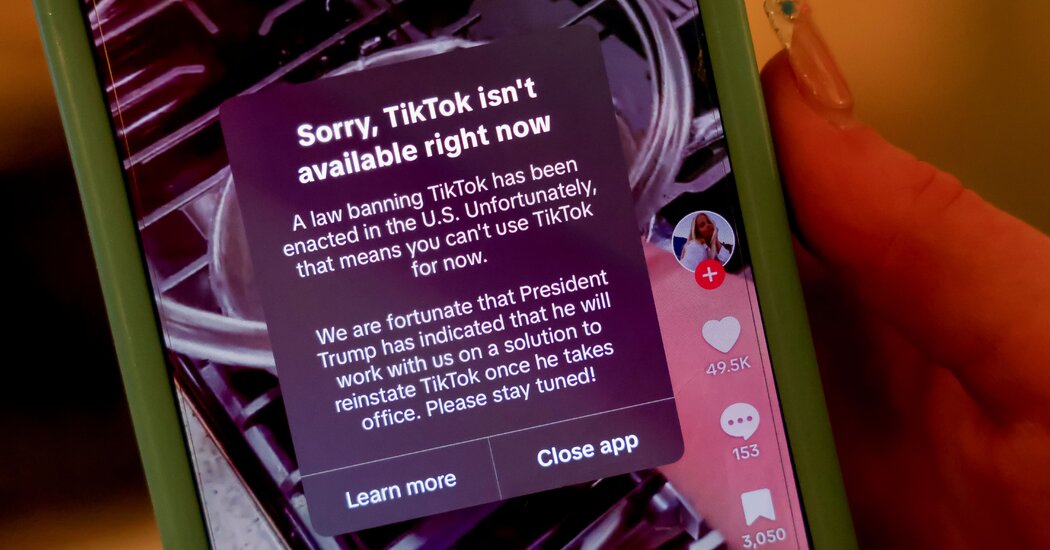

The legal arguments went back and forth. At one point, in January 2025, TikTok actually went dark in the U.S. The app shut down for roughly 12 hours, leaving millions of users staring at a message saying the service was unavailable. It was a dramatic move designed to highlight the impact of the law and galvanize public opinion.

Users could see the pressure mounting. News outlets ran stories about the possibility of TikTok disappearing. Content creators who rely on the platform for income were freaking out. The drama was real.

Then Trump took office for his second term, and things shifted again. Instead of pushing for a complete ban or forcing a traditional sale, Trump pursued a different structure: a joint venture where American investors would control significant portions while ByteDance maintained some stake.

The investor consortium of Oracle, Silver Lake, and MGX controls 45% of TikTok's U.S. operations, while ByteDance retains 20%. The remaining 35% is held by other investors.

The New Deal: Oracle, Silver Lake, and MGX Take Control

Let's talk specifics about what actually changed in the ownership structure. This is where the deal gets real.

According to documents reviewed by multiple outlets, the newly formed investor consortium consists of three main players: Oracle, the Silicon Valley software giant; Silver Lake, a major private equity firm; and MGX, an Abu Dhabi-based investment firm.

Together, these three entities will control 45% of TikTok's U.S. operations. ByteDance, the Chinese parent company, keeps approximately 20% of the U.S. business. The remaining stakes go to various other investors and parties involved in the negotiations.

The Valuation Numbers That Matter

Here's something crucial: TikTok's U.S. business is valued at roughly

For context, that

Oracle's Specific Role and Why It Matters

Oracle isn't just one investor among many. The company has a special role: "trusted security partner." This means Oracle is responsible for auditing TikTok's U.S. operations and ensuring compliance with something called the National Security Terms.

What are National Security Terms? They're essentially the technical and operational requirements that the U.S. government imposed on the deal. They ensure that user data stays on U.S. servers, that the algorithm running the "For You" page isn't controlled by ByteDance, and that Chinese government entities cannot access American user information.

Oracle already provided cloud services to TikTok before this deal, so the company has operational familiarity with the platform's infrastructure. Part of Oracle's new job is to replicate the TikTok algorithm into a U.S.-specific version that can be audited and controlled independently of the Chinese parent company. ByteDance would maintain ownership of the algorithm's intellectual property, but Oracle would essentially operate and retrain it for the American market.

This is technically complex. The algorithm that decides what videos show up in your For You feed is arguably TikTok's most valuable asset. Getting that right is crucial to maintaining the user experience.

Silver Lake's Stake and Investment Thesis

Silver Lake, founded by tech investors Roger McEachern and Glenn Hutchins, brings deep experience in tech infrastructure and scaling. The firm has invested in companies ranging from technology platforms to digital infrastructure projects. For this deal, Silver Lake's involvement signals a longer-term investment perspective focused on building sustainable operations under the new governance structure.

Private equity firms like Silver Lake typically see value in operational improvements and efficiency gains. In TikTok's case, that might mean optimizing the U.S. business for profitability while maintaining the user experience that drives engagement.

MGX's International Component

MGX is Abu Dhabi-based and represents international capital flowing into what will become a more globally compliant version of TikTok. This is less about U.S. politics and more about a Middle Eastern investment firm seeing value in a global social media platform that operates under Western regulatory oversight.

What ByteDance Loses and What It Keeps

This is crucial to understand: ByteDance isn't being shut out completely, but its control is significantly reduced.

What ByteDance keeps: The company retains approximately 20% of the U.S. entity and keeps ownership of the underlying algorithm's intellectual property. It also keeps the name "TikTok" and the brand. Even with reduced control, ByteDance benefits from the continued success of the U.S. platform.

What ByteDance loses: Access to U.S. user data. The company cannot see information about who watches what, when they watch, how long they engage, or any other behavioral data. This is massive because data is the lifeblood of modern social media platforms. Without access to that data, ByteDance loses visibility into what's working with American users.

Beyond data access, ByteDance loses influence over the algorithm that determines what content Americans see. While the company technically owns the algorithm's intellectual property, Oracle controls how it's implemented and modified in the U.S. market. This means decisions about content distribution, recommendation strategy, and feature development will be made by American-controlled entities, not by engineers in Beijing.

ByteDance also surrenders any ability to request that TikTok change moderation policies, content promotion strategies, or user data handling in ways that might benefit Chinese government interests or business objectives. The platform operates independently from Chinese governance.

The American consortium holds a controlling 45% stake, allowing them significant influence over company operations, while ByteDance retains a 20% stake, keeping them invested but non-controlling.

The New Governance Structure: How "TikTok USDS" Will Actually Work

To manage all of this, the investors created a new legal entity: the "TikTok USDS Joint Venture LLC." This isn't just a corporate name change. It represents a completely new operational and governance structure.

What USDS Is Responsible For

The TikTok USDS joint venture handles several critical functions:

Data Security and Storage: All U.S. user data must be stored on servers controlled by Oracle, located within the United States. This includes messages, watch history, engagement patterns, and any other information TikTok collects about users.

Algorithm Management: The team managing the For You page algorithm, feed ranking, and content recommendation systems operates independently from ByteDance. While ByteDance provides the underlying algorithm technology, Americans control how it's deployed and modified.

Content Moderation: The policies determining what content is allowed, what gets removed, and how creators are treated fall under USDS control. This includes decisions about misinformation, harmful content, and platform enforcement.

Software Assurance: Security testing and vulnerability assessments happen under the joint venture's oversight, ensuring the platform is protected against the kinds of data breaches or intrusions that could compromise user privacy.

Oracle's Auditing Authority

Oracle sits above the joint venture in some respects, acting as an external auditor. The company verifies compliance with National Security Terms and reports findings to relevant U.S. government agencies. This is the mechanism for ongoing oversight beyond the initial deal.

Think of Oracle as the referee ensuring both sides play by the agreed-upon rules. If ByteDance tried to exfiltrate data or gain unauthorized access to the algorithm, Oracle would theoretically catch it. If TikTok USDS failed to implement security measures properly, Oracle would flag the issues.

Of course, this model assumes Oracle is incentivized to catch problems rather than ignore them for business reasons. That's a risk baked into the deal's structure.

What This Means for American Users

This is the question everyone actually cares about: what changes in my TikTok experience?

The Immediate Impact: Probably Nothing

For the vast majority of users, the ownership restructuring doesn't immediately affect how TikTok works. You'll still scroll, still watch videos, still get recommendations. The feed algorithm isn't suddenly different. The app doesn't become slower or faster.

TikTok's infrastructure was already designed to serve content from U.S.-based servers to American users, so that didn't require massive overhauls. The content moderation policies weren't going to do a 180-degree flip overnight. Most operational systems can continue running under the new governance structure without disruption.

The Long-term Question: Platform Discontinuation

Here's where reports get murky and conflicting. According to reporting from various outlets, when the deal fully closes, the current TikTok app might be discontinued in the U.S. and replaced with a new platform. Users would be asked to transition to this new app, which would theoretically maintain similar functionality but operate under completely new technical infrastructure and governance.

The specifics of this new platform remain unclear. Would it have a different name? Different branding? Different features? Would your account transfer over seamlessly? These questions don't have clear answers yet.

This scenario makes sense from a technical and legal perspective. A fresh platform under new governance might reduce liability and simplify compliance. But from a user experience perspective, it's a significant disruption.

However, this is still speculative. The deal closed in early 2026, and how the parties actually implement the platform transition remains to be seen.

Data Privacy: The Real Change

The structural change that does matter for users is data handling. Under the new deal, your TikTok data stays in the U.S. and doesn't flow back to ByteDance or to Chinese servers. You'll never see this change, but it's significant.

This addresses the core security concern that drove the entire legislative push: preventing Chinese government access to American citizens' data. Whether you think that concern was overblown or legitimate, this deal ensures it's technically impossible for ByteDance to access U.S. user information.

Algorithm Transparency Questions

One benefit of the new structure is theoretical increased transparency about how the recommendation algorithm works. With Oracle and American entities overseeing the algorithm, there's at least a pathway for U.S. regulators and researchers to audit how content is being promoted.

Would this lead to actual transparency for users? That depends on whether the new governance structure chooses to provide it. But the technical structure now allows for government-mandated audits in ways it didn't before.

Estimated data suggests Europe is most likely to adopt U.S.-style regulatory changes for TikTok, while Asia, Latin America, and Africa show varying levels of interest.

Who Actually Owns What: The Detailed Breakdown

Let's get specific about the ownership percentages and what each party brings:

Oracle, Silver Lake, and MGX Combined: 45% controlling stake. This gives them Board representation, voting control, and operational authority over day-to-day decisions.

ByteDance: Approximately 20% stake, which is significant but non-controlling. ByteDance maintains some upside if the platform's value increases, but cannot dictate operational decisions.

Other Investors: The remaining 35% is distributed among various parties, potentially including the other investors mentioned in earlier negotiations (like Andreessen Horowitz in some earlier proposals), employees, and other financial backers.

The 45% stake for the American consortium is the crucial threshold. In corporate governance, holding 45% gives you effective control if other shareholders are fragmented. You can set strategy, hire and fire executives, and make major capital decisions.

ByteDance's 20% stake keeps them invested in success but prevents them from blocking major decisions. If they wanted to force a particular direction for the platform and the American investors disagreed, they'd lose that fight.

The Competition That Never Happened

Before the final deal was announced, multiple parties were competing for TikTok. Understanding who was in the running and why they dropped out tells you something about the difficulty of this situation.

Project Liberty and Frank McCourt

Frank McCourt, a real estate investor and tech entrepreneur, founded Project Liberty with the goal of creating a more user-centric internet. His group submitted a bid for TikTok that emphasized American ownership and user privacy.

The Project Liberty bid had support from some interesting names: Reddit co-founder Alexis Ohanian, investor Kevin O'Leary, and even Tim Berners-Lee, the inventor of the World Wide Web. That's a coalition of interesting minds.

Why didn't Project Liberty win? Likely because they couldn't match the financial backing and operational infrastructure that Oracle and Silver Lake brought. TikTok isn't just a social network; it's a complex technical platform requiring massive cloud infrastructure. Oracle already had that infrastructure in place.

Other Contenders

Earlier in the saga, Microsoft and Walmart were mentioned as potential buyers. Both ultimately stepped back, likely due to the political complexity and regulatory uncertainty surrounding the deal.

Microsoft would have integrated TikTok into its broader cloud and advertising ecosystem, but the company eventually concluded that the regulatory risk wasn't worth it.

Walmart had a different vision: leveraging TikTok's creator ecosystem for commerce and e-commerce integration. But again, the political headwinds proved too strong.

The fact that it came down to Oracle, Silver Lake, and MGX suggests that financial investors and companies with existing infrastructure partnerships with TikTok were more attractive than companies trying to buy the whole platform and integrate it elsewhere.

The timeline highlights significant events from Trump's executive order in 2020 to Biden's legislative actions in 2023, showcasing the evolving legal and political landscape for TikTok in the U.S. (Estimated data)

National Security Considerations and Why They Matter

The entire reason this deal happened is because the U.S. government views TikTok as a national security concern. Understanding that concern is crucial to understanding the deal's structure.

The Data Collection Argument

TikTok collects significant data on its users: watch history, engagement patterns, device information, location data (if you enable it), and metadata about your interactions. That's not unusual for social media platforms. Facebook and YouTube collect similar data.

The concern is specific to TikTok being owned by a Chinese company. The worry goes: if the Chinese government demands access to that data under Chinese national security laws, ByteDance might have to comply. China's national security framework doesn't have the same privacy protections that American law provides.

By separating TikTok's U.S. operations from ByteDance, the government removes the pathway for Chinese authorities to legally demand that data.

The Algorithm Concern

Beyond data, there's concern about the algorithm itself. TikTok's algorithm is remarkably effective at determining what content keeps users engaged. In theory, if a foreign government controlled that algorithm, it could weaponize the platform to spread propaganda, suppress certain viewpoints, or promote content that serves foreign policy objectives.

This concern is less about current capabilities and more about potential future scenarios. The deal addresses it by moving algorithm control to American entities.

The Geopolitical Context

It's worth noting that the concern about TikTok isn't unique to the Trump administration or even to the United States. Multiple countries have restricted or considered restricting TikTok access. The underlying worry that social media platforms controlled by foreign governments can be weaponized is shared across democracies.

Whether you think the specific TikTok concerns are overblown or justified, the structural reality is that government concerns about social media platforms owned by foreign entities are unlikely to go away.

What Happens to Content Creators and the Influencer Economy

TikTok creators represent a massive economic ecosystem. Hundreds of thousands of people earn income through the platform. What does this deal mean for them?

Creator Fund and Revenue Sharing

The deal doesn't automatically change how the Creator Fund works or how creators earn money on TikTok. Assuming the platform continues operating, creator payments should continue roughly as they are today.

However, if TikTok is replaced with a new platform (as some reports suggest), there would be a transition period. The new platform would need to implement its own creator revenue-sharing mechanisms, which might be different from the current system.

Verification and Creator Tools

Under the new American-controlled governance, there might be changes to creator tools and verification processes. The American investors might accelerate rollouts of creator-focused features that ByteDance was slower to implement.

There's also potential for creator-focused partnerships. If the new owners want to grow the platform's appeal to a broader set of creators, they might invest in better analytics, better monetization tools, or better integration with other platforms.

Long-term Platform Stability

From a creator's perspective, the deal provides some relief about long-term stability. If TikTok had actually been banned, the entire creator economy would have collapsed. By restructuring ownership instead of banning the platform, creators can have more confidence that their income stream will continue.

ByteDance retains 20% control over TikTok's U.S. entity, while losing 80% control, including data access and algorithm implementation. Estimated data.

The International Angle: How This Deal Affects Global TikTok

One question that doesn't get as much attention: what happens to TikTok outside the U.S.?

The deal specifically restructures U.S. operations. It doesn't affect TikTok in Europe, Asia, Latin America, or anywhere else. ByteDance's global TikTok business continues operating independently from the U.S. joint venture.

However, there are ripple effects. If the U.S. deal proves successful and stable, it might become a template for other countries considering similar regulatory demands. Europe, particularly, has been pushing for stronger regulatory oversight of TikTok operations, and they might use the U.S. model as a reference.

Conversely, if the new U.S. structure creates operational difficulties or reduces the platform's competitiveness, that could embolden countries considering outright bans.

For ByteDance, the U.S. restructuring reduces the company's leverage in other markets. The company can't credibly argue that it's impossible to separate data or operate under foreign government oversight. It's now doing exactly that in the U.S., which strengthens the hand of regulators in other countries.

The Political Reality: Why Trump Shifted on TikTok

One of the more puzzling aspects of this saga is Trump's shift from "ban TikTok" to "restructure TikTok through a deal." Understanding that shift provides context for the deal's structure.

During his first term, Trump viewed TikTok as a national security threat and pushed for an outright ban. By his second term, he was pursuing a structured deal instead. What changed?

Several factors likely contributed:

Political Costs: A TikTok ban would alienate millions of young voters who use the platform daily. The political cost of directly banning it proved higher than the political benefit of appearing tough on China.

Economic Interests: By his second term, Trump had relationships with some of the investors involved in the deal. A structured acquisition preserves the business and keeps it operating, which has political and economic benefits.

Precedent Concerns: Forcing divestment of a U.S. business because of foreign ownership is a radical use of government power. By pursuing a deal-based restructuring instead, Trump avoided setting a precedent that could invite retaliation against American companies abroad.

China Relations: Trump has expressed interest in developing a productive relationship with China during his second term. A complete TikTok ban might have been seen as unnecessarily antagonistic, whereas a deal that addresses specific concerns without destroying the business is less confrontational.

Risk Factors: What Could Still Go Wrong

Despite the deal being signed, several risks remain:

Oracle's Track Record on Security

Oracle's role as the "trusted security partner" is crucial to the deal's credibility. But Oracle is a for-profit company with business incentives that might conflict with perfect security. If there were a choice between inconveniencing the platform with additional security measures versus maintaining operational efficiency, which would Oracle choose?

Ongoing Legal Challenges

While the deal was structured to address government concerns, lawsuits could still challenge various aspects. ByteDance might argue that the structure violates property rights. Civil liberties groups might argue that it still doesn't adequately protect privacy. The legal landscape could shift.

Implementation Complexity

Separating the U.S. TikTok from the global TikTok while maintaining platform functionality is technically difficult. Data flows, algorithm updates, and feature rollouts need to work across this new boundary. Implementation mistakes could degrade the user experience or create security vulnerabilities.

Geopolitical Escalation

If U.S.-China relations deteriorate, the assumption that ByteDance will cooperate with the new structure could break down. China's government might block certain operations, or ByteDance might face pressure that makes cooperation difficult.

Valuation and Profit Realities

The deal assumes TikTok's U.S. business is worth $14 billion. If that turns out to be overvalued and the platform doesn't generate expected returns, investor enthusiasm could wane, potentially leading to changes in strategy or investment.

Parallels to Other Tech Regulatory Structures

This deal isn't unique in creating new governance structures for foreign-owned tech platforms operating in the U.S. There are similar models worth considering:

The Chinese Internet Companies Model

Foreign companies operating in China often need to work with Chinese partners or government-approved entities. Companies like Apple, Google, and Microsoft operate in China through structured arrangements that address government concerns.

The TikTok deal essentially reverses this model: a Chinese company operating in America through a structured arrangement with American partners and oversight.

European Data Residency Models

Europe has pushed for data residency requirements where company data must be stored within European servers. The TikTok deal implements a similar principle for U.S. data.

Security Review Precedents

The Committee on Foreign Investment in the United States (CFIUS) regularly reviews foreign investments in U.S. companies for national security concerns. The TikTok deal represents a more activist use of that power, essentially restructuring a business rather than just approving or blocking an acquisition.

What Experts and Industry Observers Are Saying

There's no consensus on whether this deal is good or bad. Perspectives vary:

National Security Hawks: Some argue the deal doesn't go far enough, that ByteDance retaining any stake is problematic, and that user data needs even more stringent protection.

Civil Liberties Advocates: Some worry that the deal legitimizes the precedent of forcing companies to restructure based on their foreign ownership, potentially setting a dangerous precedent for other platforms.

Investors: Most see this as a good outcome because it preserves the platform's value while addressing government concerns. The investors who won the deal are betting on TikTok's continued success.

ByteDance: The company's public statements suggest they're accepting the deal as better than a complete ban, even though it reduces their control and access to data.

Users: Polling suggests most users are just relieved the platform will continue operating, regardless of ownership structure.

FAQ

What exactly did Oracle agree to do in this deal?

Oracle is serving as the "trusted security partner" responsible for auditing TikTok's U.S. operations and ensuring compliance with government-mandated National Security Terms. This includes managing user data stored on Oracle's U.S. servers, overseeing algorithm implementations to prevent ByteDance control, and conducting regular security assessments. Oracle will replicate and retrain TikTok's algorithm for the U.S. market while ensuring ByteDance cannot access American user information or influence content distribution decisions.

Will TikTok users need to migrate to a completely new app?

Reports from Bloomberg and other outlets suggest that when the deal fully closes, the current TikTok app may be discontinued and replaced with a new platform. However, specific details remain unclear, including whether this new platform will maintain feature parity with current TikTok, how accounts will transfer, or whether it will even be called "TikTok." The transition timeline and implementation details should become clearer as the joint venture begins operations.

How much does ByteDance retain in the new structure?

ByteDance retains approximately 20% ownership stake in TikTok's U.S. operations and maintains intellectual property ownership of the underlying algorithm technology. However, the company loses control over how that algorithm is implemented, loses access to U.S. user data entirely, and cannot influence moderation policies or content distribution decisions. Essentially, ByteDance profits if the platform succeeds but cannot direct its strategy.

Is my data safe from the Chinese government now?

Under the new structure, your TikTok data is stored on Oracle-controlled servers within the United States and is legally prohibited from being shared with ByteDance. This means the Chinese government cannot demand that data through ByteDance, as they theoretically could under Chinese national security laws when the company was wholly foreign-owned. However, complete safety is never guaranteed—the structure reduces but doesn't eliminate security risks.

Could the deal still fall apart?

While the deal has been signed and was scheduled to close in early 2026, several risks remain. Legal challenges from ByteDance or civil liberties groups could complicate things. Implementation difficulties in separating the U.S. operations could create operational challenges. Shifts in U.S.-China relations could also create unexpected obstacles. However, both the U.S. government and the investor consortium have strong incentives to make the deal work.

What happens to TikTok creators under the new ownership?

Creator revenue-sharing mechanisms like the Creator Fund should theoretically continue operating under the new structure, assuming the platform maintains operational continuity. However, if the current app is discontinued in favor of a new platform, there would be a transition period where creators need to understand the new revenue-sharing model. The new American-controlled ownership might also introduce different tools and policies for creators, potentially improving analytics and monetization options.

Does this deal set a precedent for other foreign-owned apps?

Potentially, yes. By forcing TikTok to restructure rather than outright banning it, the U.S. government demonstrated that it can impose governance changes on foreign-owned tech platforms based on national security concerns. This could create templates that other countries use when dealing with platforms like TikTok, and it might prompt the U.S. government to apply similar logic to other foreign-owned social media or technology companies in the future.

How does this affect TikTok's global operations outside the U.S.?

The deal only restructures U.S. operations. TikTok continues operating globally under ByteDance's control in all other markets. However, the U.S. deal may embolden other countries' regulators to pursue similar structures, and it reduces ByteDance's ability to argue that separating operations is impossible. The deal could therefore have indirect effects on TikTok's regulatory situation elsewhere.

What's the relationship between Oracle, Silver Lake, and MGX in managing the platform?

All three entities hold parts of the 45% controlling stake and sit on the board of TikTok USDS Joint Venture LLC, but Oracle has a special auditing role beyond its equity stake. The three firms will collectively make strategic decisions about the platform's direction, but specific operational divisions of labor and decision-making authority aren't entirely clear from public disclosures. In practice, this likely means one or two of the firms take the lead on operations while others provide financial and strategic oversight.

Looking Forward: What Happens Next

This deal represents a significant shift in how the U.S. government approaches foreign-owned tech platforms. Instead of banning them outright, it's pursuing structural solutions that preserve the business while addressing specific concerns.

Whether this model works—whether Oracle can genuinely audit and control the platform, whether users maintain confidence in the new structure, whether the platform's operational experience remains intact—will determine whether this becomes a template for future foreign tech acquisitions or a one-off solution.

For TikTok users, the pragmatic reality is that the platform will likely continue operating in the U.S. That was the best-case scenario a year ago. The ownership restructuring is a cost of that continued operation, and for most users, the experience will remain largely unchanged.

For ByteDance, the deal is a loss of control and access but better than a complete ban. The company profits if the platform succeeds while others make strategic decisions.

For the American investors—Oracle, Silver Lake, and MGX—the deal is a bet that TikTok's U.S. business remains valuable and defensible under new governance. If they're right, they'll generate strong returns. If they're wrong about the platform's appeal or about their ability to operate it effectively, they'll face losses.

The next chapter of this story will play out as the joint venture begins operations and users see whether the transition to new governance creates any disruptions. Until then, TikTok remains a fascinating case study in how geopolitics, regulation, and business intersect in the modern digital economy.

Key Takeaways

- Oracle, Silver Lake, and MGX now control 45% of TikTok's U.S. operations, with ByteDance retaining about 20% but losing all control and data access

- The new joint venture structure ensures U.S. user data stays on American servers and ByteDance cannot influence the recommendation algorithm

- The current TikTok app may be discontinued and replaced with a new platform when the deal fully closes

- This deal represents a shift from outright bans to structured government-approved restructuring of foreign-owned tech platforms

- For most users, the experience should remain unchanged, though the ownership restructuring addresses government national security concerns

Related Articles

- UK Social Media Ban for Under-16s: What You Need to Know [2025]

- Under Armour 72M Record Data Breach: What Happened [2025]

- Meta's Aggressive Legal Defense in Child Safety Trial [2025]

- UK VPN Ban Explained: Government's Online Safety Plan [2025]

- Snapchat's New Parental Controls: Screen Time Monitoring for Teens [2025]

- FTC's Meta Antitrust Appeal: What's at Stake in 2025

![The TikTok U.S. Deal Explained: What Happens Now [2025]](https://tryrunable.com/blog/the-tiktok-u-s-deal-explained-what-happens-now-2025/image-1-1769098181503.jpg)