TikTok's Pine Drama App: The Micro-Drama Platform That's Learning From Quibi's Failures

Remember Quibi? That ambitious streaming service that launched with $1.75 billion in funding, promised to revolutionize mobile entertainment, and then spectacularly imploded after eight months? Yeah. TikTok just looked at that cautionary tale and basically said, "Hold my oolong tea."

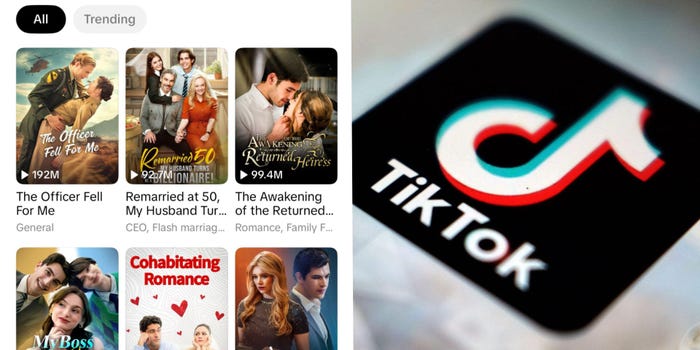

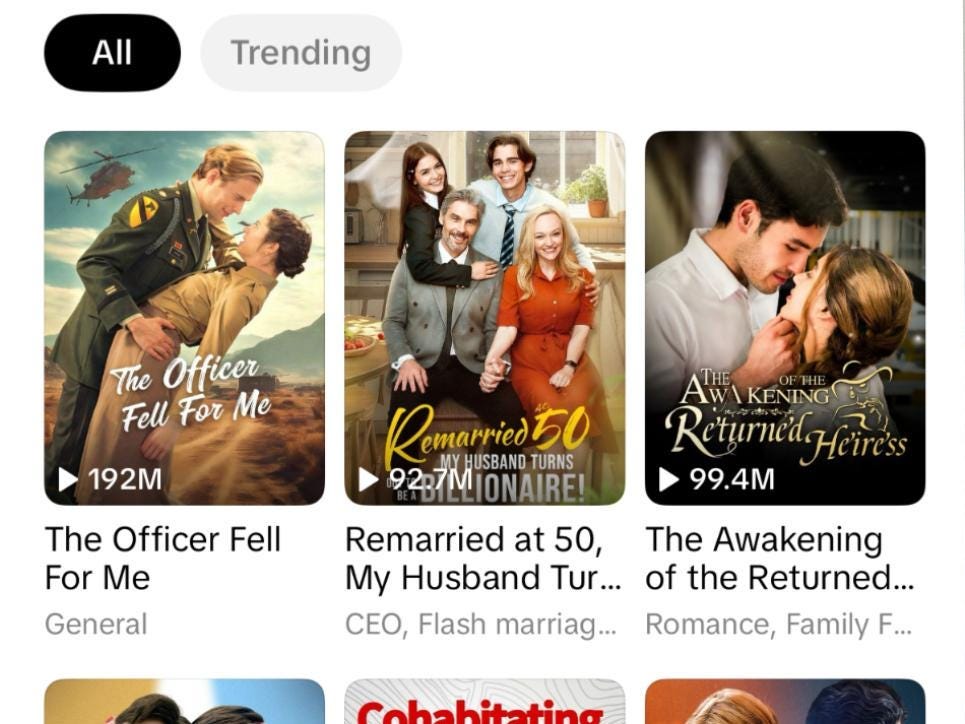

In early 2025, TikTok quietly rolled out Pine Drama, a new app that feels like someone took the core concept of Quibi, shrunk the episodes even further (we're talking 60 seconds per installment), cranked up the melodrama to soap opera levels, and slapped it onto TikTok's familiar scrolling interface. The app showcases micro dramas like The Officer Fell For Me and Married to My Past Life's Nemesis. These aren't Oscar-bait productions. They're deliberately corny, vertically shot serialized shows designed to keep you scrolling to the next cliffhanger in what amounts to the time it takes to brush your teeth.

But here's the interesting part: TikTok might actually be onto something that Quibi completely missed. Not because the content is better (it's intentionally campy), but because TikTok understands something fundamental about why short-form video actually works. They're not trying to replace television. They're building something adjacent to it, with distribution baked into the platform itself.

Let's unpack what Pine Drama is, why it exists, how it compares to previous attempts at this format, and whether TikTok has finally cracked the code on micro-drama monetization and engagement.

TL; DR

- Pine Drama is TikTok's dedicated micro-drama app: One-minute episodes, vertical video, cliffhangers designed to keep you scrolling through an entire season in 10–15 minutes.

- The format works because it respects attention spans: Unlike Quibi's ambitious 10-minute "chapters," Pine Drama assumes you'll watch multiple episodes in succession, not just one.

- It's free with no ads (for now): TikTok hasn't announced monetization, but competitors like Drama Box and Reel Short use a freemium model with paid premium content.

- This is TikTok's third attempt at serialized content: The company added a "Minis" section to the main app last year, but a dedicated app suggests they're betting bigger on this category.

- Success depends on discovery and habit formation: Quibi failed partly because it relied on traditional marketing. TikTok has built-in distribution through the For You algorithm.

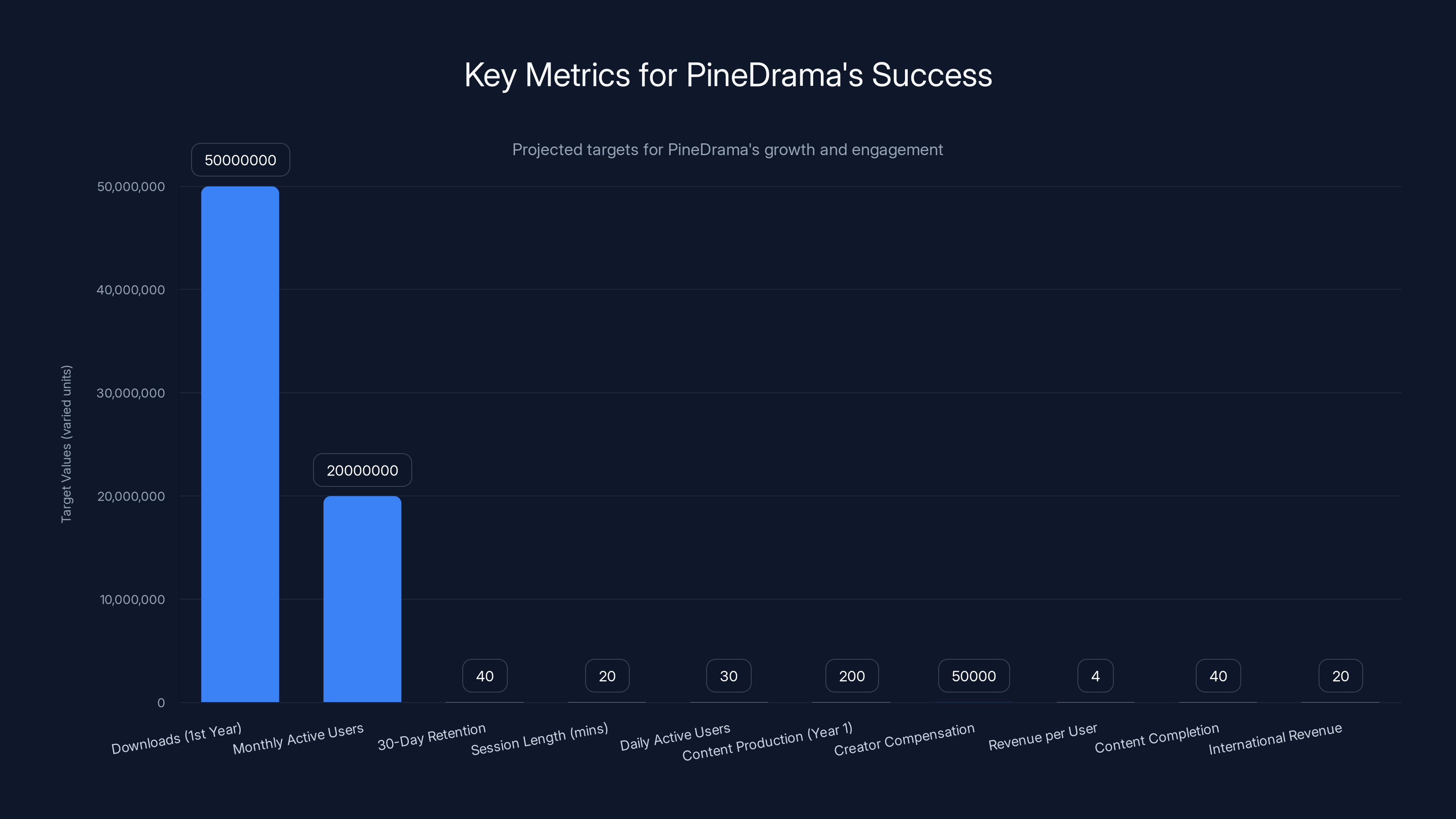

Key success metrics for PineDrama include reaching 50 million downloads in the first year, maintaining 40% retention, and generating $4 revenue per user. Estimated data based on industry benchmarks.

What Exactly Is Pine Drama? Understanding the App Architecture

Pine Drama isn't some completely new concept that TikTok invented in a lab. Micro dramas have been a thing in Asia for years, particularly in China and Korea, where apps like WeChat's mini-programs host thousands of serialized stories. What TikTok is doing is localizing and scaling this format for Western audiences who've grown up with TikTok's swipe-and-scroll interface.

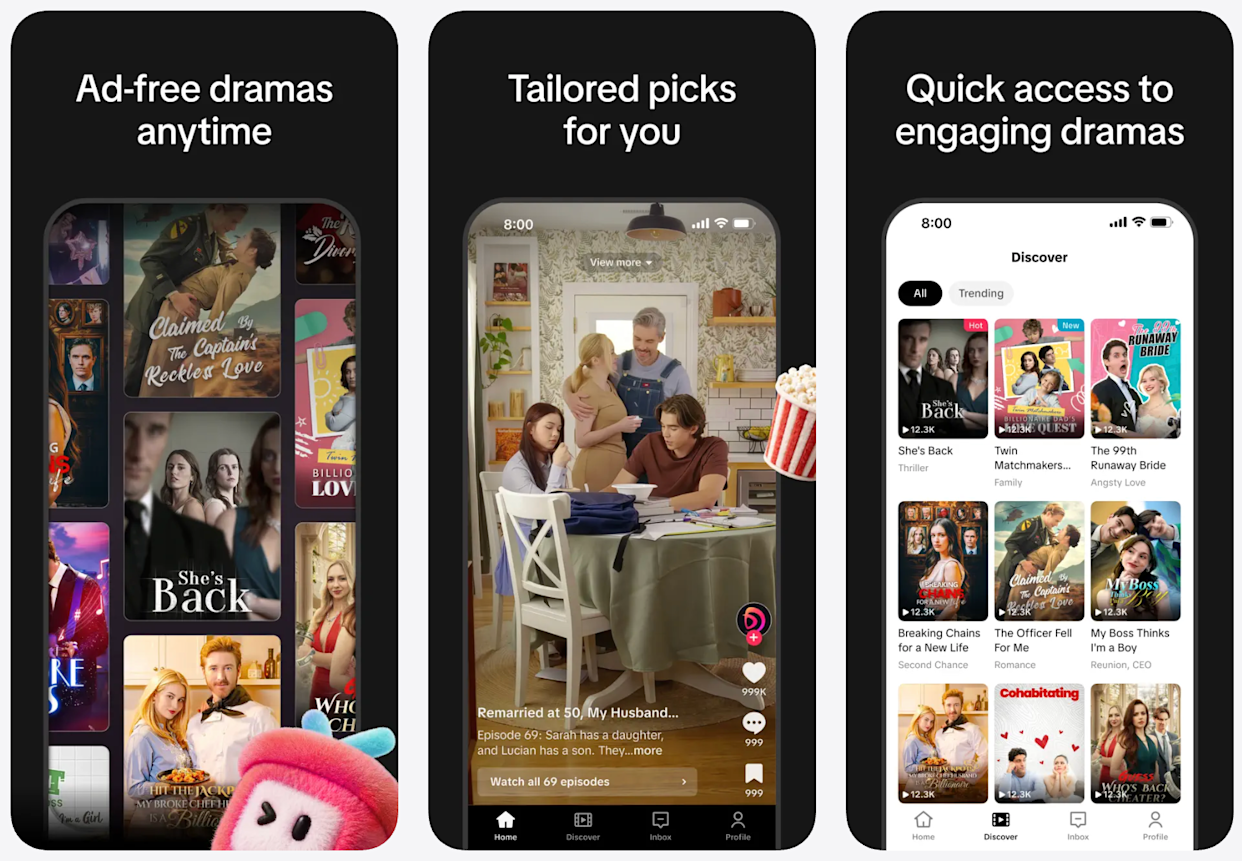

At its core, Pine Drama is a dedicated mobile app that looks almost identical to TikTok. You open it, you see a full-screen vertical video, and you swipe up to see the next episode. The primary difference is the content: instead of dance challenges and lip-sync videos, you're watching 60-second drama episodes with character names, plot arcs, and genuinely manufactured cliffhangers designed to make you immediately swipe to the next installment.

The app includes several standard social features that keep people engaged beyond just passive watching. There's a Discover tab where you can browse shows by genre or recommendation. You can save your favorite series to a personalized watchlist. You can react in real-time alongside other viewers, creating a pseudo-community experience similar to what you'd get on TikTok or X (formerly Twitter) during a live event. The interface is intentionally simple because TikTok knows that friction is the enemy of engagement.

Right now, the shows available range from romance plots to light drama to comedy scenarios. The production quality is deliberately modest. These aren't cinematic productions. The acting is often over-the-top. The dialogue occasionally cringes. And that's entirely intentional. The format is built for rapid consumption, not critical examination.

What's worth noting is that TikTok is testing this format separately from the main app. That's significant because it suggests the company is willing to experiment with different content categories in isolated environments. The Minis section in the main TikTok app got some engagement, but apparently not enough for TikTok to feel confident about dedicating a whole app to it. Now they're trying again with Pine Drama, but with a renewed focus on the drama angle specifically.

The episodes are optimized for binge-watching patterns. A single show might have anywhere from 20 to 100+ episodes, though each individual show's season arc typically plays out over about 20–30 installments. If you watch an episode per minute, you could theoretically consume an entire season in 30 minutes. This is deliberate. It's designed to lock you in.

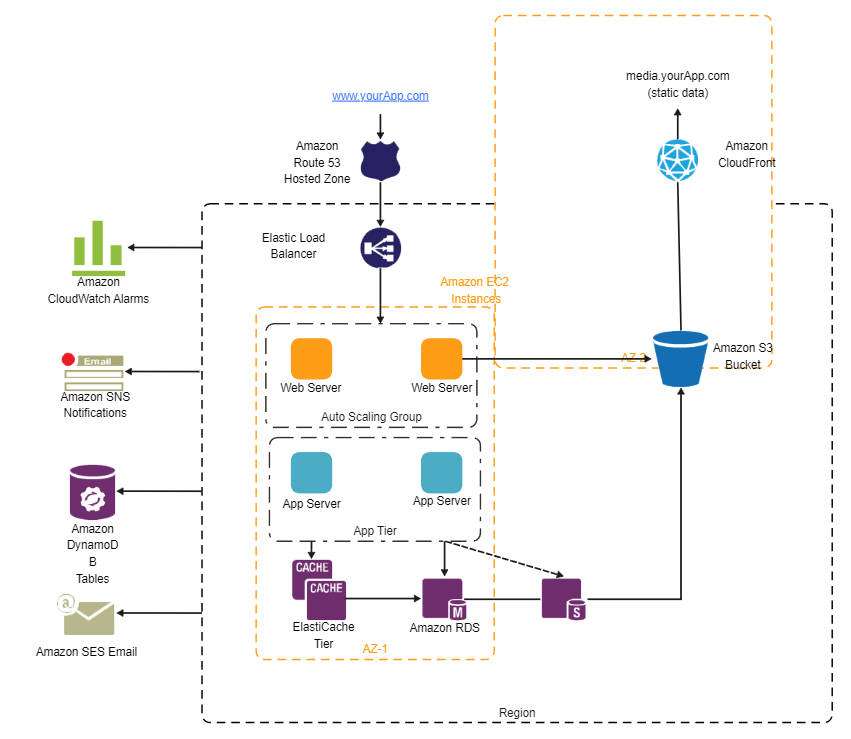

One critical feature that separates Pine Drama from competitors is its integration with TikTok's parent company's resources. TikTok has access to a massive content library through its ByteDance parent company, which also owns platforms like Douyin (the Chinese version of TikTok) and has produced micro-drama content for years. This means they're not starting from zero. They're taking a proven format and bringing it to scale in the US market.

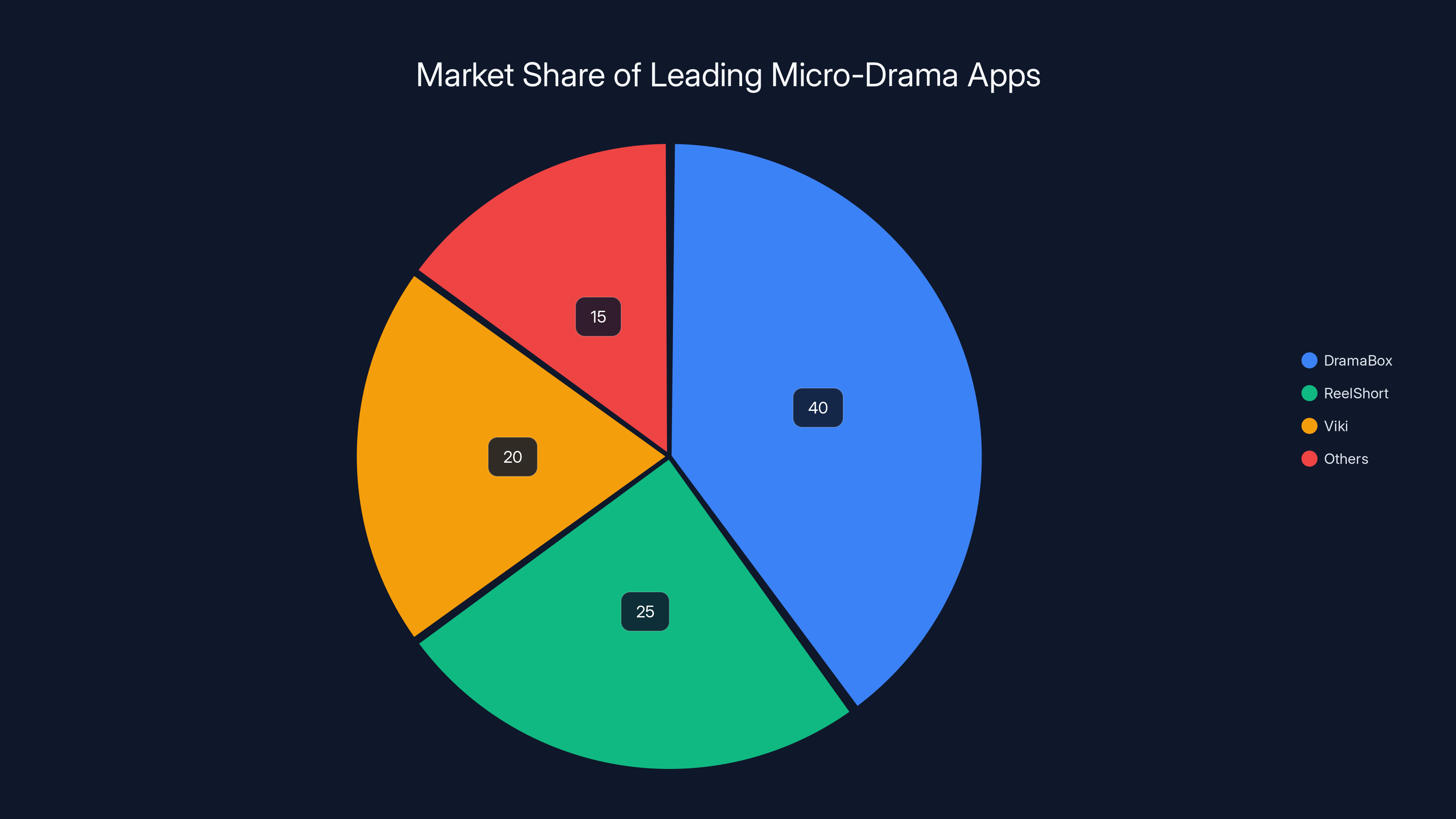

DramaBox leads the micro-drama market with an estimated 40% share, driven by high user retention and significant revenue generation. Estimated data.

Why Quibi Failed and What Pine Drama Is Doing Differently

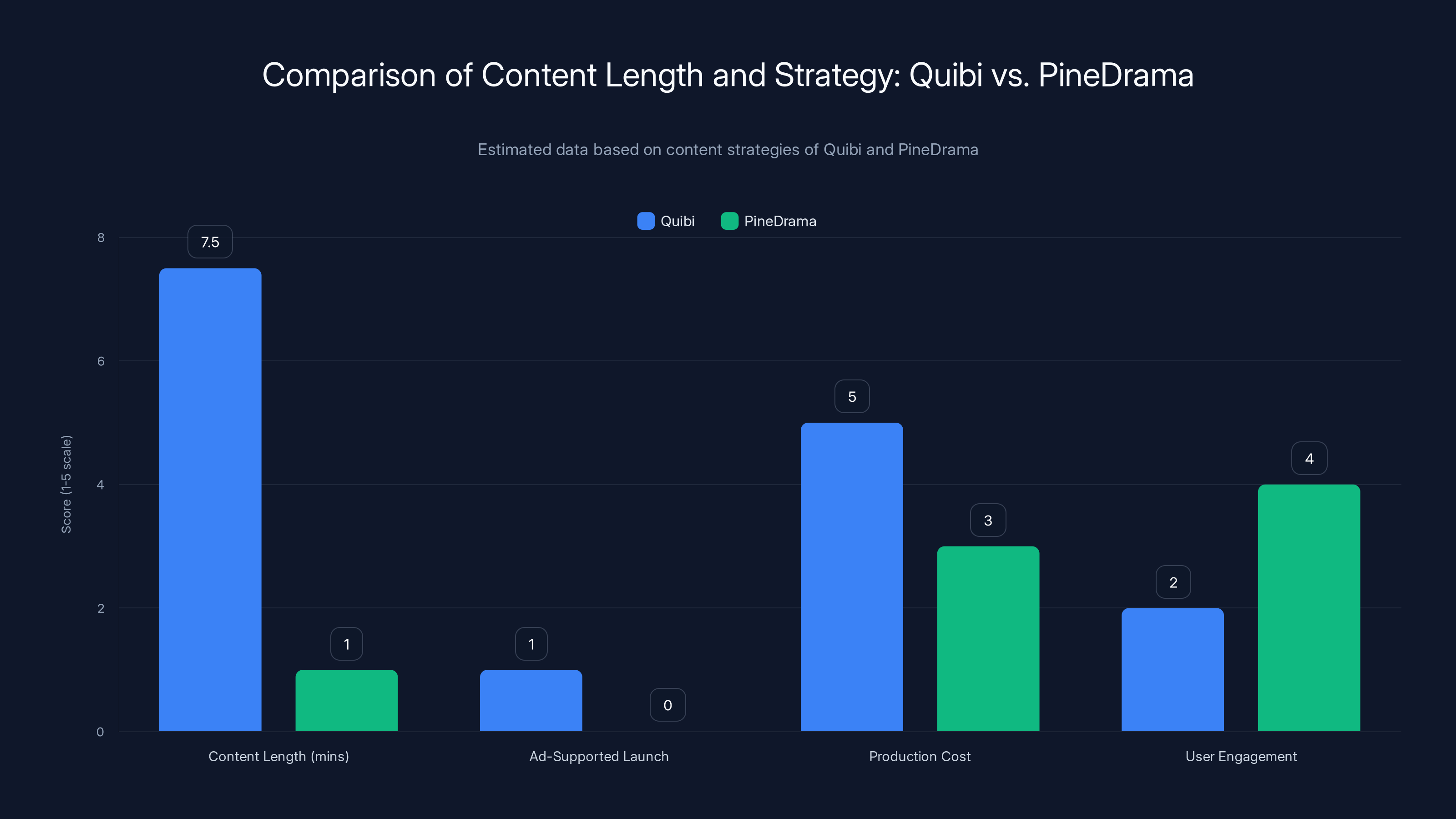

Quibi's collapse is worth understanding in detail because it's actually a masterclass in how to misread a market. The app launched in April 2020, right before lockdowns became universal. Jeffrey Katzenberg and Meg Whitman raised $1.75 billion based on a simple thesis: people want to watch premium content on their phones, and they want episodes that are short enough to consume during breaks.

The execution was catastrophically off. Quibi produced shows that were 5–10 minutes long. That sounds short until you realize that most people don't have uninterrupted 10-minute breaks during their day. They have 60-second breaks. They scroll TikTok for 15 minutes before bed. Quibi's format assumed you'd sit down and deliberately watch their content, which defeats the entire point of mobile-first entertainment.

Quibi also made the strategic mistake of being entirely ad-supported at launch (though they later introduced a subscription tier). For creators and platforms just starting out, advertising revenue doesn't materialize until you have massive scale. Quibi prioritized Hollywood-name talent and premium production values, which meant their content cost a fortune to produce. They couldn't afford to produce enough shows to keep users engaged long-term. After eight months, they'd burned through investor capital, couldn't secure sustainable revenue, and shut down.

The cultural moment was also wrong. Quibi launched during lockdowns, when people had plenty of time to watch longer content. The "short content for busy people" pitch made less sense when everyone was home. By the time lockdowns ended and the original pitch became relevant again, Quibi was already dead.

TikTok is approaching this differently on almost every dimension. First, Pine Drama content is genuinely one minute long, not 5–10 minutes. This is specifically designed for the way people actually use phones: in fragmented, interrupted sessions. One episode in the bathroom. One while you're waiting for your coffee. Three more before bed.

Second, Pine Drama's content strategy is completely different. Instead of licensing expensive scripted shows from major studios, TikTok is working with lower-cost production companies and independent creators who've already proven they can produce micro dramas at scale. This is similar to how TikTok succeeded in the first place: by democratizing content creation and making it accessible to creators with minimal budgets.

Third, monetization is completely different. Quibi tried to immediately monetize through ads and premium subscriptions. Pine Drama is launching ad-free with no clear monetization strategy. This is classic TikTok playbook: grow the user base first, establish the habit, then figure out monetization. It's what the company did with the main app, and it's what they're doing here.

Fourth, distribution is built into the platform. Quibi had to spend hundreds of millions on marketing and user acquisition. Pine Drama gets distribution through TikTok's existing ecosystem. If TikTok's For You algorithm decides your micro drama is worth watching, it can reach millions of users with minimal additional marketing spend. This is a massive competitive advantage that Quibi never had.

Morgan Stanley analysts noted that short-form video engagement has increased 65% year-over-year since 2021, particularly among users aged 13–24. That demographic naturally gravitates toward platforms with micro-content formats. Quibi tried to build an entire platform around a new format. TikTok is adding a new category to an existing platform with billions of users already accustomed to the interaction model.

The Global Micro-Drama Market: Who's Already Winning

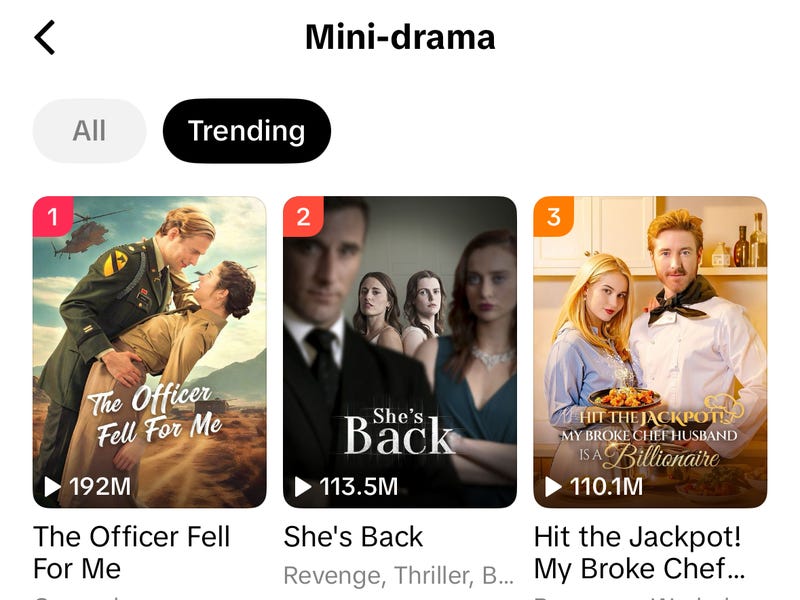

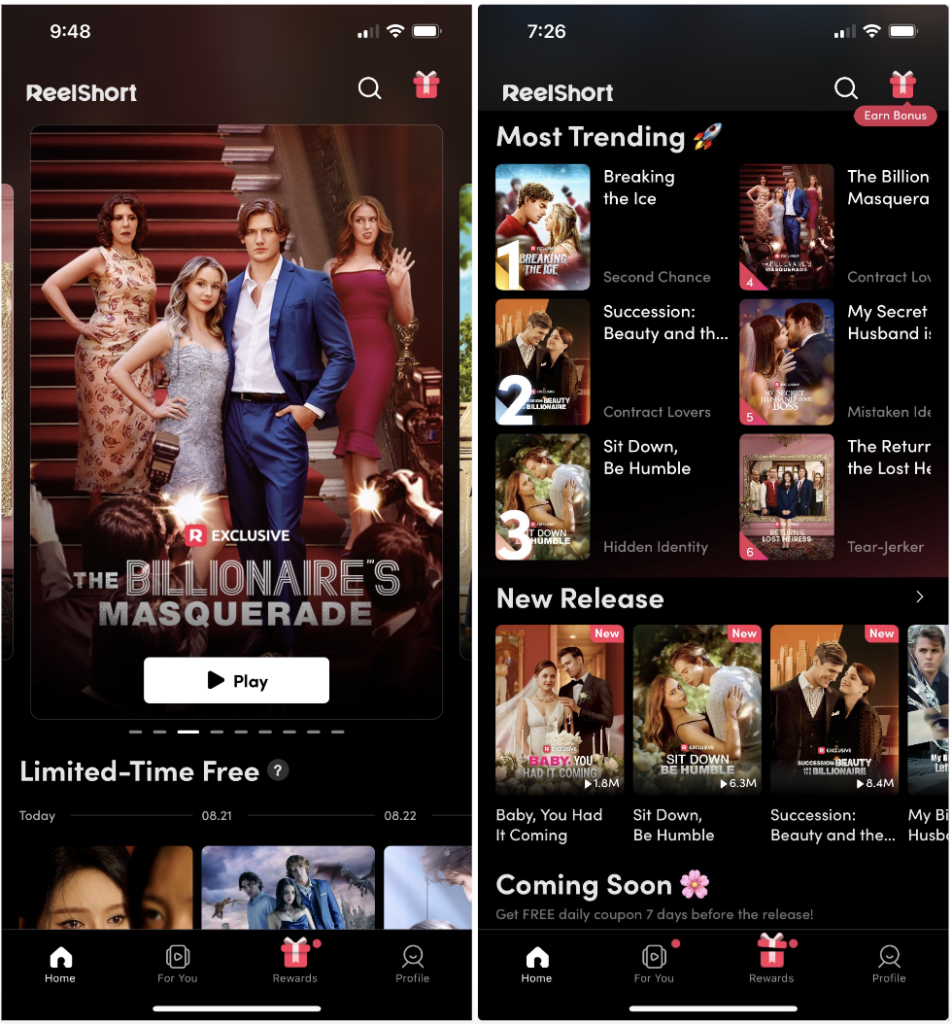

Pine Drama isn't entering a market that doesn't exist. Micro dramas are already generating significant revenue in Asia. Apps like Drama Box, Reel Short, and Viki have millions of users and are making real money through a combination of premium content, ad revenue, and subscription tiers.

Drama Box specifically has become one of the most downloaded entertainment apps globally in recent years. The app hosts micro dramas primarily from Asian production companies and has cracked something that Quibi never figured out: how to keep people watching continuously without forcing them to binge the entire season in one sitting. Each episode is specifically paced to be satisfying on its own while leaving just enough unresolved tension to make you tap "Next Episode" immediately.

Reel Short operates on a similar model but with more aggressive paywalls around premium content. The freemium structure gives you a few episodes per day for free, then requires you to either wait for a timer to reset or pay to unlock more. This creates artificial scarcity, which is incredibly effective at driving conversions. Studies on app monetization show that freemium models with time-based gates convert 4–7 times better than purely free or purely paid models.

Viki, which was originally a video translation crowdsourcing platform, evolved into a subscription service for Asian dramas and micro-dramas. They've been acquired by Rakuten and are now a significant player in the streaming space. Their success demonstrates that there's real willingness to pay for this content, particularly among viewers who've grown up consuming Korean, Chinese, and Thai dramas.

What's different about TikTok's entry into this space is the sheer distribution advantage. Drama Box, Reel Short, and Viki all grew through app store visibility and word-of-mouth marketing. TikTok has a built-in audience of over 1.5 billion users. Even if only 5% of TikTok's user base tries Pine Drama, that's 75 million potential users. That kind of scale changes everything about competitive dynamics.

The other advantage TikTok has is creator ecosystem integration. On Drama Box or Reel Short, creators upload their content and hope it gets discovered. On TikTok, creators already understand the algorithm, already have tools for editing and publishing, and already have communities of followers. The company can incentivize TikTok creators to produce micro-drama content for Pine Drama, essentially borrowing both talent and audience from the main platform.

PineDrama's strategy focuses on shorter content and user engagement, contrasting with Quibi's longer content and high production costs. Estimated data based on strategic differences.

The Science of Cliffhangers: Why Minute-Long Episodes Keep You Scrolling

There's actual neuroscience behind why cliffhangers work so effectively, and Pine Drama is leveraging this deliberately. When you're watching a narrative with unresolved tension, your brain is in what researchers call the "narrative completion" phase. Basically, your prefrontal cortex is engaged in trying to resolve the uncertainty, which feels rewarding when it finally does.

Zeigarnik effect, named after Soviet psychologist Bluma Zeigarnik, describes the phenomenon where people are more likely to remember interrupted tasks than completed ones. In the context of micro dramas, an episode that ends on a cliffhanger creates cognitive tension. Your brain wants to resolve it. The path of least resistance is to immediately watch the next episode.

This is why Pine Drama's one-minute format is actually genius. An hour-long episode with a cliffhanger ending might make you wait until tomorrow to find out what happens. You might even forget about the show. But a one-minute episode with a cliffhanger makes you swipe up immediately. Your brain wants closure right now, not in 24 hours. The cognitive friction is minimal. You're already holding your phone. The next episode is literally one swipe away.

Production companies creating for Pine Drama understand this instinctively. The last 5–10 seconds of every episode is a miniature climax. A surprise reveal. An unexpected complication. Something that forces an emotional reaction. Then the episode ends and you're presented with a choice: stop watching or keep going. But because the show literally just introduced new dramatic tension, stopping feels unsatisfying.

This is different from traditional television, where episodes typically resolve the main conflict before ending. A Good episode of a network drama resolves its A-plot and leaves its B-plot open. That's satisfying as a standalone unit. But micro-drama episodes intentionally don't resolve much. They're designed as connective tissue, not as individual stories.

The psychology of scroll engagement also matters. TikTok users have trained themselves to swipe when content isn't immediately engaging. But when you're in the middle of a serialized story, swiping up is almost automatic because you want to know what happens next. Content creators call this the "infinite scroll trap," and it's one of the most effective engagement mechanisms ever created.

But here's the thing: this level of engagement is a double-edged sword. It's great for session time and retention metrics. It's terrible for users who get lost in the app for three hours when they only meant to watch one episode. Regulatory bodies and parent groups are increasingly scrutinizing platforms that deliberately use psychological tricks to keep people glued to screens. Pine Drama could face pressure on this front, even if the content itself is harmless.

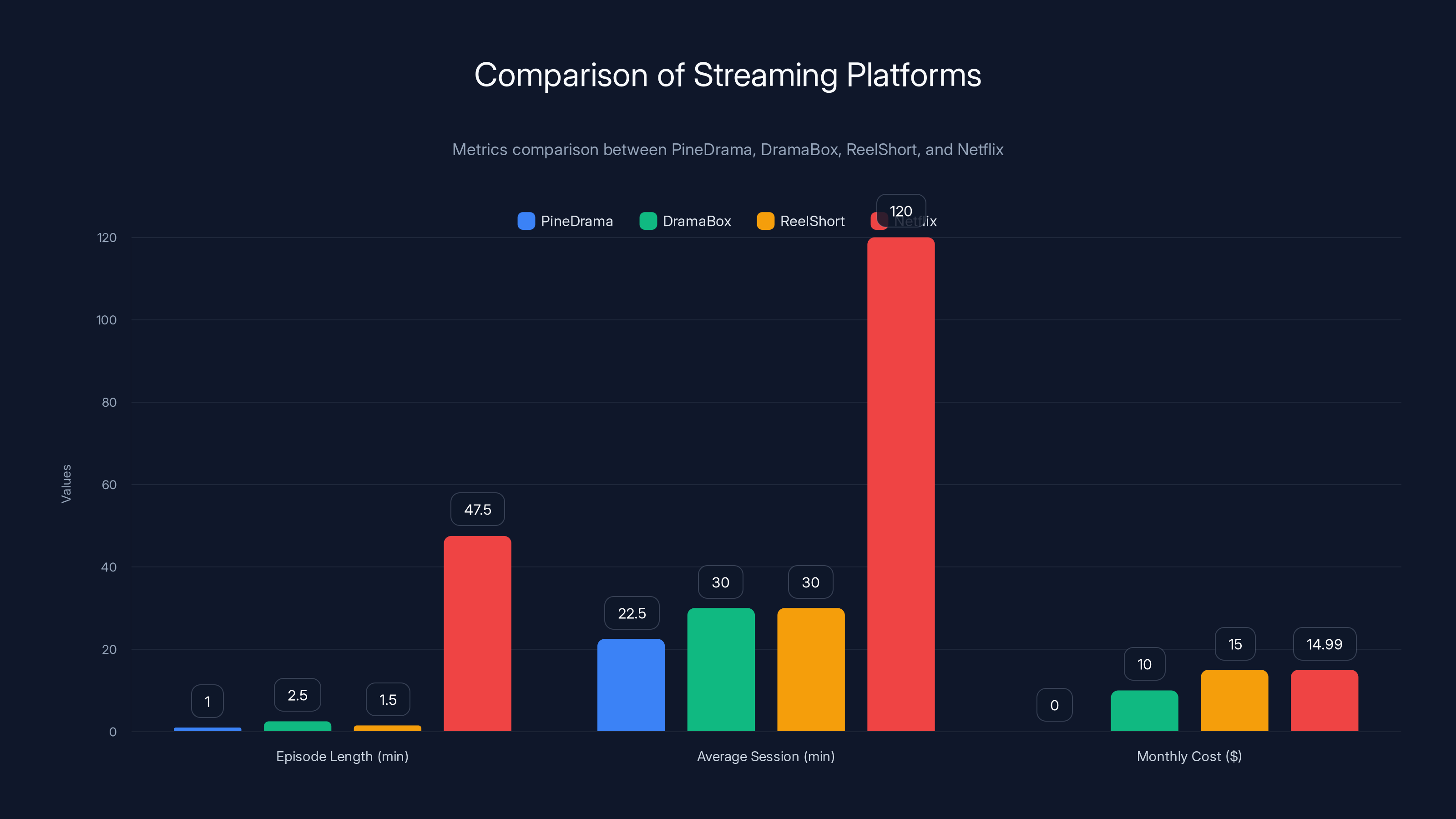

Comparison: Pine Drama vs. Drama Box vs. Reel Short vs. Traditional Streaming

To understand where Pine Drama fits in the landscape, it's worth comparing it directly to competitors using specific metrics:

| Metric | Pine Drama | Drama Box | Reel Short | Netflix |

|---|---|---|---|---|

| Episode Length | 1 minute | 2–3 minutes | 1–2 minutes | 35–60 minutes |

| Platform | Mobile app | Mobile app | Mobile app | All devices |

| Monetization | Ad-free (TBD) | Freemium + ads | Premium gates + ads | Subscription |

| Content Source | Asia + original | Primarily Asia | Primarily Asia | Global studios |

| Average Session | 15–30 min | 20–40 min | 20–40 min | 2+ hours |

| Target Audience | Gen Z + young millennials | Gen Z + millennials | Gen Z | All ages |

| Monthly Cost | Free | $5–15 | $10–20 | $6.99–22.99 |

| Engagement Model | Algorithm-driven | Algorithm + featured | Featured + premium | Browse-driven |

This table reveals something important: Pine Drama isn't trying to compete with Netflix on content quality or breadth. It's not trying to be a replacement for traditional streaming. It's competing for attention and session time in a completely different way.

Drama Box has been around since 2015 and has had time to build a library of hundreds of micro dramas. Reel Short is newer but has aggressive monetization that's already proven effective. Pine Drama is entering with less content but significantly more distribution potential.

What Pine Drama has that competitors don't is integration with TikTok's main platform. If TikTok decides to promote Pine Drama content within the main app's algorithm, that's essentially free marketing to over 1.5 billion users. No other micro-drama app has that advantage.

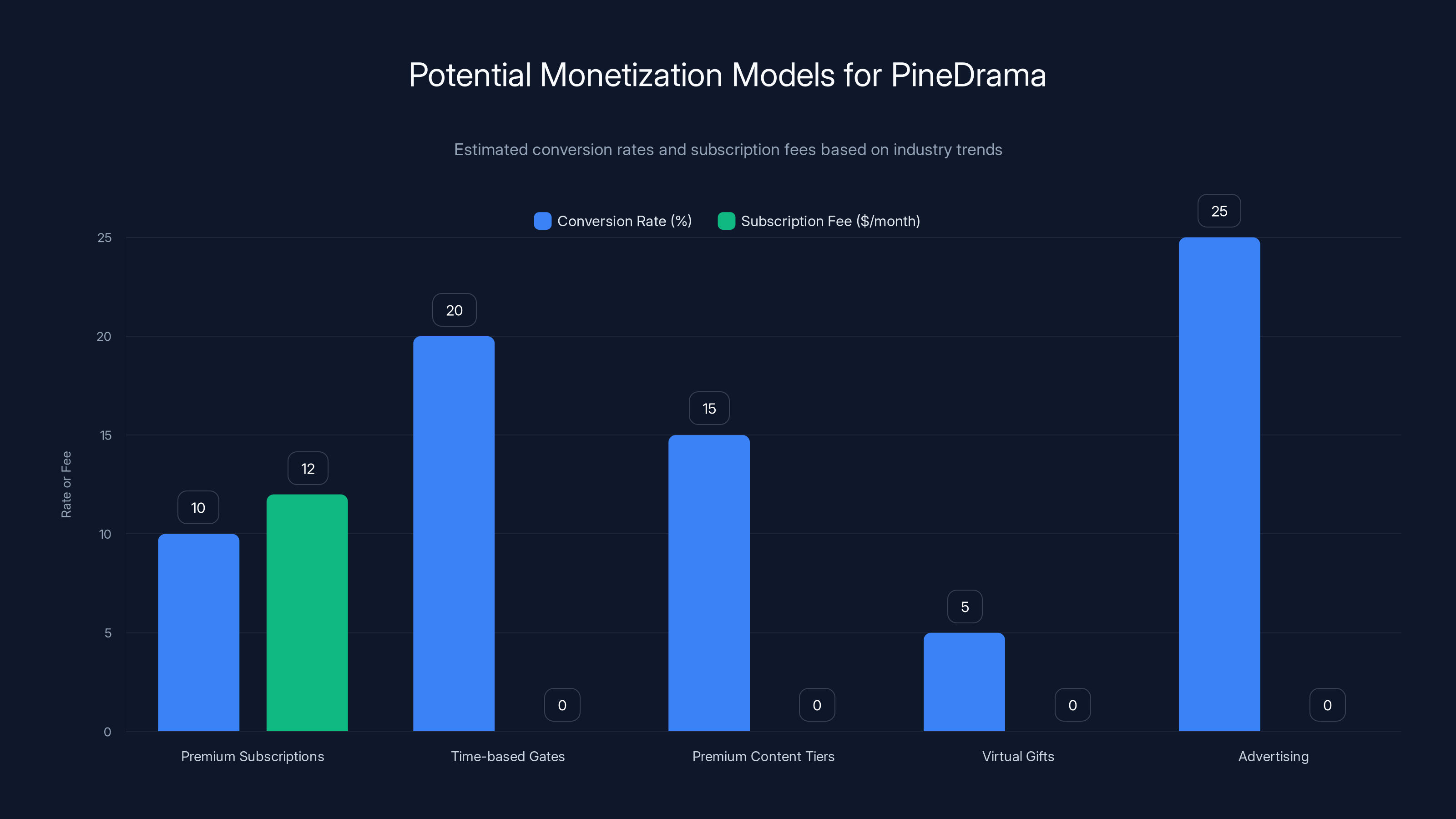

Estimated data shows that advertising and time-based gates could yield higher conversion rates, while premium subscriptions offer a steady revenue stream through monthly fees.

The Minis Strategy: Why TikTok Needs a Dedicated App

TikTok launched the "Minis" feature within the main TikTok app last year, which was supposed to be their answer to the micro-drama category. Minis are short-form mobile game content and serialized stories that live within the main TikTok ecosystem. It was a soft launch, no major marketing push, just a new section in the app's navigation menu.

Minis got some engagement, but apparently not enough for TikTok to feel like it was capturing the full opportunity. There are several reasons a dedicated app makes more strategic sense:

First, user segmentation. Minis in the main app are competing with every other type of content for attention. Your For You feed might show you a dance video, then a cooking tip, then a micro-drama episode, then a news clip. There's cognitive context-switching happening. With a dedicated app, users who download Pine Drama are explicitly choosing micro-drama content. No competing categories. That changes the engagement and retention dynamics significantly.

Second, monetization flexibility. The main TikTok app has ad products already optimized for certain types of engagement. Adding a completely different monetization model to the main app requires careful integration. A dedicated app gives TikTok freedom to experiment with different revenue streams—premium tiers, gift systems, ad formats—without affecting the main app's economics.

Third, content creator incentives. TikTok can offer creators different tools and compensation models for Pine Drama content versus main-app content. They can pay creators directly for micro-drama productions, run contests for new shows, and build a production ecosystem that's somewhat separate from the chaotic creator marketplace of main TikTok.

Fourth, international expansion. Different regions have different content preferences and regulations. A dedicated app makes it easier for TikTok to customize content libraries, monetization strategies, and user experiences by region. They could have different featured shows in different countries, different premium features, different community standards. The main TikTok app is harder to customize at that level without fragmenting the brand.

The Minis experiment was basically TikTok testing whether this category worked at all within their platform. Pine Drama represents them graduating from testing to scaling. It's the difference between adding a feature and building a full product.

Monetization Models: How TikTok Makes Money From Pine Drama

Pine Drama is currently free with no ads, which is the classic startup strategy: acquire users first, monetize later. But "later" is coming, and TikTok has several proven models to choose from.

Looking at Drama Box and Reel Short's approaches gives us hints about what might work. Both apps use a freemium model with some combination of the following revenue streams:

Premium subscriptions give unlimited ad-free watching and exclusive content. Drama Box charges

Time-based gates restrict how many episodes you can watch per day without paying. This creates artificial scarcity that drives conversion. A user can watch 2 episodes per day for free, then either wait 24 hours or pay to unlock more. It's not as intrusive as some freemium models, but it's effective. Users report 15–25% conversion rates when combined with compelling content.

Premium content tiers make certain shows exclusive to paying subscribers while keeping basic shows free. This is how Netflix operates, and Drama Box uses variants of this model. Some shows are available free with ads. Others are paid-only. This lets platforms optimize revenue while maintaining a free user base for engagement metrics and ad inventory.

Virtual gifts let viewers send gifts to creators during live streams or as appreciation for completed series. Creators earn a percentage of gift revenue. This is how livestream platforms make money and how TikTok creators already earn. It could translate to Pine Drama.

Advertising is the simplest model, but also the one that annoyed viewers most when Quibi tried it aggressively. Ads work better when they're between episodes rather than interrupting them. Pre-roll or post-roll ads (watching an ad to unlock the next episode) convert 20–30% better than mid-roll ads.

Branded content is increasingly important for streaming platforms. Imagine an episode of a micro-drama that takes place in a coffee shop that's clearly a Starbucks, or a character wearing a specific brand of clothing. Product placement is subtle in scripted content and generates revenue from brands. It's not intrusive but it's real money.

TikTok has also experimented with creator incentive funds. They could allocate a percentage of ad revenue (once ads launch) directly to creators who produce top-performing micro-drama content. This is how they've built the TikTok creator ecosystem, and it could work similarly for Pine Drama.

Most likely scenario: Pine Drama launches a freemium subscription ($9.99/month similar to TikTok+) within 12–18 months, adds ads to free content after about 6 months of user acquisition, and keeps most content free with premium tiers for exclusive shows. This is what's worked for every successful short-form content platform in the last five years.

PineDrama offers the shortest episode length and is free, targeting short, frequent user sessions. Netflix provides longer content and sessions at a higher cost.

Regulatory and Ethical Concerns: The Dark Side of Engagement-First Design

While we've been discussing Pine Drama's clever engagement mechanics, it's worth acknowledging the concerns that come with deliberately designing content to be as "sticky" as possible.

The European Union's Digital Services Act has strict requirements about design practices that use "dark patterns" to manipulate user behavior. Infinite scroll, autoplay, and cliffhanger narratives all fall into this category. Platforms operating in the EU need to disclose these engagement mechanisms and provide options to disable them. TikTok could face regulatory action if Pine Drama's design is deemed manipulative without proper disclosure.

Child safety is another concern. Micro-drama content, especially the romance-focused stuff, sometimes features themes that might not be appropriate for younger viewers. The content on Pine Drama needs age-appropriate classification. TikTok has sophisticated content moderation systems, but a dedicated app means they need separate moderation, age gating, and parental controls.

Screen time addiction is a cultural concern that's increasingly shaping regulation. Mental health organizations have warned about infinite-scroll design and its relationship to anxiety and depression, particularly in teenagers. A product literally designed to make you watch "just one more episode" by exploiting psychological completion-seeking behaviors is the kind of thing that draws scrutiny from parent groups and regulators.

TikTok is already under federal investigation in the US, and part of the concern relates to data privacy and the company's relationship with the Chinese government. If TikTok faces mandatory divesting or shutdown, Pine Drama goes with it. That's not a regulatory concern per se, but it's a strategic risk for users and advertisers.

On the positive side, TikTok has been more proactive about content moderation than many platforms. They have relationships with fact-checkers, they demonetize conspiracy content, and they remove content from creators who repeatedly violate terms. If Pine Drama becomes a significant platform for storytelling, TikTok will need to maintain those standards.

How Creators Are Already Using Micro-Drama Formats

Creators on TikTok and other platforms have been experimenting with serialized micro-drama narratives for years, even before Pine Drama existed. Understanding how they've approached it gives insight into what will probably be successful on the dedicated app.

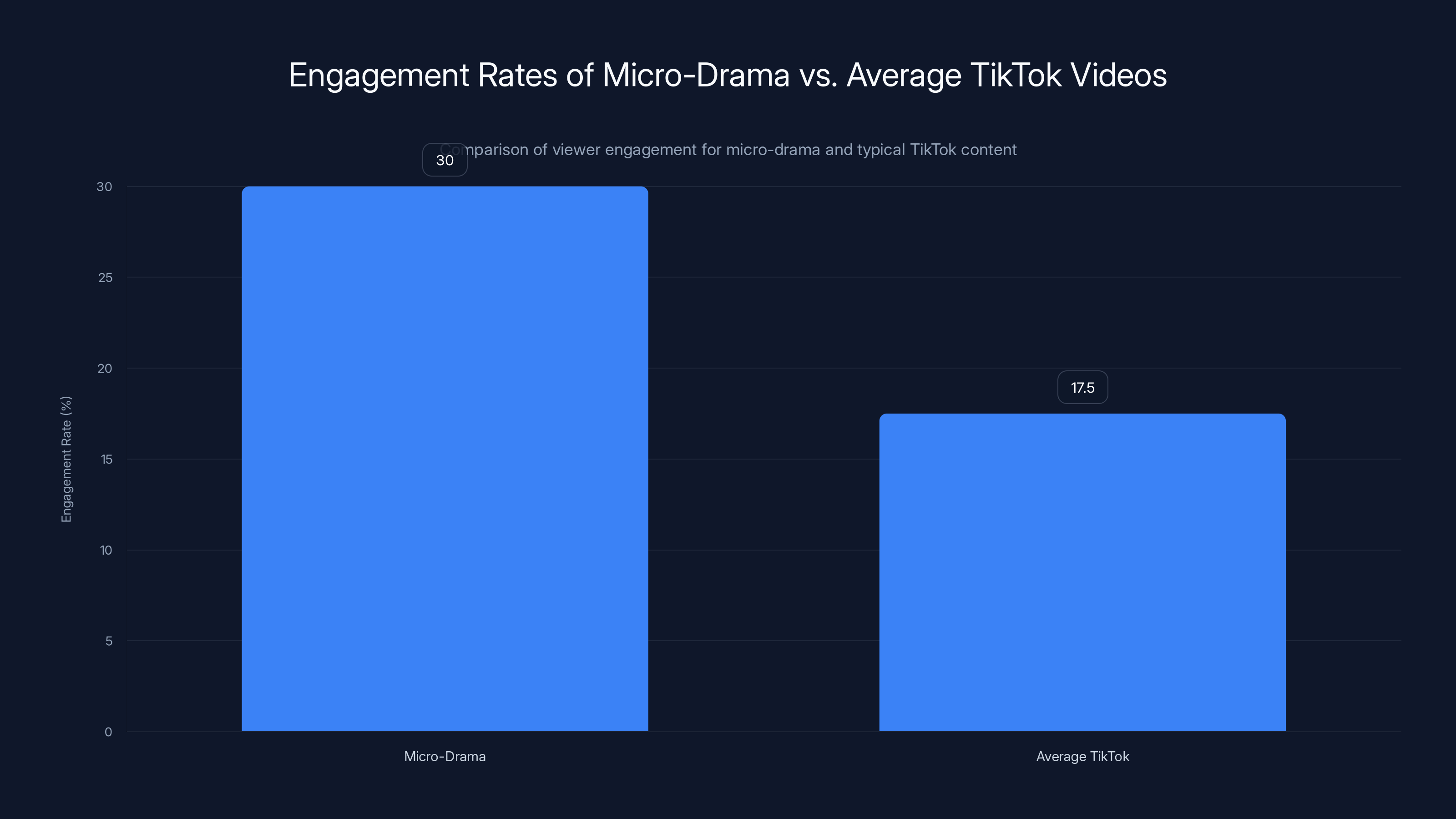

Independent creators have figured out that multi-part narratives consistently outperform standalone content. A creator posts a one-minute video with a cliffhanger, and 30% of viewers immediately check back for the next installment. That's higher engagement than average TikTok videos, which typically see 15–20% repeat-viewer engagement.

Successful micro-drama creators follow a specific formula: introduce characters and conflict in 15 seconds, develop tension for 30 seconds, then end with an unexpected twist or revelation that makes you want the next episode. The best creators can do this repeatedly across 30–50 episodes without the quality degrading noticeably.

Production costs are lower than traditional TV but higher than typical TikTok creators' budgets. Successful micro-drama creators usually employ 2–3 actors, have a simple set (a bedroom, a living room, an office), and shoot in a specific visual style that's consistent across all episodes. Equipment costs run

Creators are already building audiences. Some have millions of followers across platforms by creating serialized drama content. The apps like Drama Box actively recruit creators, sometimes offering upfront payments for original series. TikTok will likely do similar recruitment, offering creator funds or upfront payments to bring proven talent to Pine Drama.

Micro-drama formats achieve a 30% viewer engagement rate, significantly higher than the 15-20% typical for average TikTok videos. Estimated data based on typical engagement rates.

The Attention Economy: Is There Room for Another Platform?

One of the fundamental questions about Pine Drama is whether the attention economy has room for another platform, even if it's distributed by TikTok.

The average person spends about 6–7 hours per day consuming digital media. Of that, maybe 1–2 hours is dedicated short-form video. TikTok already captures about 95 minutes per day of that time from its users. YouTube Short, Instagram Reels, and other platforms split the remainder. Adding Pine Drama is essentially asking users to carve out additional time from somewhere.

But here's what TikTok might be realizing: not everyone who uses TikTok is interested in the same content. Someone interested in micro-drama content might be spending 30 minutes per day on TikTok looking for drama content, then leaving when the algorithm doesn't serve it. That user isn't necessarily spending more time on TikTok. They're using it less efficiently. Pine Drama captures that user's full attention for 30 minutes instead of split attention.

It's also a strategic move for TikTok to diversify its content categories. The company is increasingly getting pushback on privacy concerns, cultural impact, and regulatory issues. Having multiple apps gives them flexibility. If TikTok faces regulation that requires removing certain features, they can keep those features in Pine Drama or vice versa. It's like a insurance strategy for product development.

The competitive threat to traditional social media is also real. Instagram and Snapchat have copied TikTok's Reels and Stories features, but they haven't built dedicated products for specific content categories. TikTok is getting ahead of that by building category-specific apps. YouTube Shorts is on YouTube. Instagram Reels is on Instagram. But TikTok gets to have TikTok, Pine Drama, and whatever comes next.

Content Trends: What Actually Succeeds in Micro Drama

Based on what's working in Drama Box, Reel Short, and Asian micro-drama platforms, certain content categories consistently outperform others.

Romance dramas are the clear winner. They account for approximately 40–50% of views across micro-drama platforms. The reason is straightforward: romance content involves emotional investment and relationship tension, which is naturally built for cliffhangers. "Will they end up together?" is a question that drives entire seasons.

Reincarnation dramas are surprisingly popular, particularly in Asian markets. The premise usually involves a character remembering their past life and having to reconcile it with their current relationships. It's a format that allows for endless plot complications and explains away character knowledge that wouldn't otherwise be justified.

Fantasy and supernatural drama is the third major category. These shows get 25–30% of overall views. The appeal is similar to romance: you're investing in a relationship or a character journey that involves inherent uncertainty.

Comedy drama is underrated and harder to execute. It accounts for maybe 10% of views, but when it works, it has incredibly high rewatch rates. The challenge is that comedy is culturally specific and doesn't translate as well across regions or demographic groups.

Action drama exists but is less common. The format doesn't lend itself well to action sequences, so most "action" micro-dramas are actually romance or thriller dramas with action elements.

Thriller and mystery drama make up about 5% of content. They're effective at driving cliffhangers but harder to sustain over 30 episodes because mystery-solving has a natural conclusion point. Once you've revealed the twist, what's the continued tension?

Successful creators diversify their content across these categories, sometimes mixing them (romance + mystery, for example). They also recognize that what works in one region might not work in another. A romance drama that's incredibly successful in Southeast Asia might not resonate with US audiences. This is where Pine Drama's connection to TikTok's regional algorithms is valuable. They can test content in specific regions and scale what works.

Advertising and Sponsorship Opportunities on Pine Drama

Once Pine Drama launches monetization, advertising becomes a significant revenue stream. But the format presents unique opportunities and challenges compared to traditional platforms.

Micro-drama episodes have natural pause points where ads fit. You could run a 15-second pre-roll ad before an episode starts, a 6-second mid-roll ad if there's a natural scene break, and a 15-second post-roll ad after the episode ends. Based on Drama Box's model, this generates roughly

Brand placement within content is more subtle. A character in a drama uses a specific phone. They wear branded clothes. They drink from a branded bottle. This generates sponsorship deals directly between brands and production companies, similar to traditional TV product placement. An individual episode sponsorship might generate

Live streaming during micro-drama premieres or fan events creates real-time advertising opportunities. Brands can sponsor specific episodes, sponsor creators directly, or run ads during livestreams. This is proven to drive engagement and conversion.

Creator-specific sponsorships work differently than traditional ads. A creator with a popular micro-drama series might receive sponsorship deals directly from brands that want exposure to that creator's audience. This could be clothing brands, beauty brands, even VPN or productivity apps.

Affiliates and influencer marketing tie into Pine Drama's growth strategy. TikTok creators with existing audiences could promote specific shows or encourage followers to download the app. These partnerships drive user acquisition and are typically cheaper than traditional advertising.

The Global Expansion Playbook: What Other Markets Look Like

TikTok has already tested micro-drama content in international markets through Douyin (its Chinese app) and various regional versions. Understanding what worked internationally provides hints about what Pine Drama will prioritize globally.

In Southeast Asia (Thailand, Vietnam, Philippines, Indonesia), micro-drama consumption is exceptionally high. Users spend more time on these apps than on the main TikTok app. This is because short-form serialized drama aligns with cultural storytelling traditions and consumption patterns. Pine Drama will almost certainly launch heavily in these regions with heavy content investment and localized production partnerships.

In India, TikTok faced bans but competitors like Moj and Josh operate successfully. Micro-drama content in India tends toward romance and family drama. If TikTok can operate again (or rebrand), Pine Drama could capture significant market share by investing in Hindi and regional language content.

In Latin America, TikTok is hugely popular, but local creators have primarily focused on music, dance, and comedy. Serialized drama content is less established, which could be an opportunity for Pine Drama to build the category from scratch. Early-mover advantage is significant in untapped markets.

In Europe, regulatory hurdles are more significant. The Digital Services Act requires transparency about engagement mechanics. Pine Drama would need to clearly disclose its design patterns and offer user controls. This makes European expansion slower but also creates opportunities for TikTok to position itself as more transparent than competitors.

In the Middle East and North Africa, culturally appropriate content is essential. Micro-drama content needs to align with regional values and sensibilities. TikTok has experience here from its main app, but Pine Drama would need specific content partnerships and local producers.

Competitive Responses: How YouTube, Instagram, and Others Are Reacting

TikTok's Pine Drama launch is forcing competitors to think about whether they need a dedicated micro-drama product too.

YouTube Shorts is the most obvious competitor, but YouTube's model is fundamentally different. Shorts are 15–60 seconds of largely unscripted, single-creator content. They're not designed for serialization in the same way Pine Drama is. YouTube would need to fundamentally change Shorts to compete directly, which seems unlikely.

Instagram Reels is similar to YouTube Shorts. It's designed for discovery and creator visibility, not for narrative serialization. Instagram could theoretically add a "Collections" feature that groups Reels into serialized series, but that would be playing catch-up to Pine Drama's established approach.

Snapchat has more room to maneuver. Snapchat's shows have always been designed for serialized viewing, and the platform has invested in content partnerships. They could develop a micro-drama app similar to Pine Drama, but they'd be starting from behind with less user distribution advantage.

Netflix's response is uncertain. Netflix could theoretically create a mobile-focused micro-drama app, but it would require them to change their monetization model (Netflix's premium subscription model doesn't fit with free, ad-supported, volume-based engagement). Netflix could also acquire proven micro-drama creators and produce for them, similar to what they've done with stand-up comedy specials.

Independent micro-drama platforms like Drama Box and Reel Short will continue growing, particularly in regions where they have network effects already established. But TikTok's entry brings mainstream awareness to the format that helps everyone in the category. Drama Box saw a 40% increase in downloads after Quibi launched, for example, because Quibi's marketing made people aware the format existed.

What Success Looks Like: Metrics and Milestones

How will we actually know if Pine Drama succeeds or fails? Here are the metrics that matter.

Downloads and active users: 10 million downloads in the first 3 months would be good. 50 million in the first year would be exceptional. Monthly active users need to reach at least 15–20 million to be sustainable long-term.

Retention rates: 30-day retention should be 40%+ (meaning 40% of users who download the app are still using it after 30 days). This is higher than average apps but normal for successful social platforms.

Session length and daily active usage: If users are spending 20+ minutes per session on average, that's successful. If daily active users (people who open the app at least once per day) are 30%+ of monthly active users, that's healthy engagement.

Content production volume: At least 200 original shows in year one, expanding to 500+ by year two. This requires a robust creator ecosystem and sufficient funding.

Creator compensation and satisfaction: For success, creators need to earn

Revenue per user: Once monetization launches, the platform needs to generate

Content completion rates: If 40%+ of users who watch the first episode of a series watch it to completion, that's successful engagement.

International expansion: Successful global expansion requires at least 20% of revenue or user base coming from international markets within two years.

Failing on most of these metrics is what would signal that Pine Drama is struggling. The worst-case scenario would be Pine Drama dying quietly in 18 months because user growth plateaued and creators migrated to more stable platforms. The most likely scenario is that it survives, grows, but never matches TikTok's overall scale (because it's a category app, not a general social platform).

The Future of Serialized Mobile Content: Predictions and Possibilities

Assuming Pine Drama succeeds and becomes a meaningful part of TikTok's ecosystem, what does the future of serialized mobile content look like?

First, the category will grow significantly. Drama Box and Reel Short have already proven there's a market worth billions of dollars annually. With TikTok's distribution, that market could explode to $10+ billion globally over the next five years.

Second, production quality will improve. Initial micro-drama content is deliberately low-cost and campy. As the category matures and production budgets increase, you'll see higher production values, better acting, and more sophisticated narratives. This will attract different demographic groups than the current core audience.

Third, traditional entertainment companies will become more involved. Netflix, Disney, and other studios could produce micro-drama content as an extension strategy. Instead of 5-minute YouTube videos, they could produce serialized mobile dramas tied to existing franchises or new original content.

Fourth, live streaming and interactive elements will play a bigger role. Imagine watching a micro-drama where you vote on what happens next, or where creators do live reactions to viewer engagement. This gamification element would increase engagement and provide new monetization opportunities.

Fifth, AI-generated content will inevitably arrive. This is contentious, but the incentives are obvious: if you can generate a 30-episode micro-drama series with AI for

Sixth, regulation will catch up. The dark-pattern design of infinite-scroll micro-drama platforms will face regulatory scrutiny in the EU, UK, and increasingly in North America. Platforms will need to offer opt-in recommendations, time-spent warnings, and parental controls. This will reduce engagement slightly but create more sustainable, legally defensible products.

Conclusion: Learning From Quibi and Building Something That Lasts

TikTok's Pine Drama is not the first company to bet on short-form serialized video. Quibi spent billions and failed spectacularly. But Pine Drama has advantages that Quibi never possessed, and more importantly, it's addressing the market in a way that respects how people actually consume mobile content.

Quibi made the mistake of thinking premium content and brand recognition were enough. They built a beautiful product for an imaginary user who had 10-minute breaks between activities and preferred to sit down and focus on their phone. That user doesn't exist in large numbers.

Pine Drama gets it differently. One-minute episodes are designed for interrupted consumption patterns. Cliffhangers are engineered to create psychological completion-seeking. The platform integrates with TikTok's existing algorithm and creator ecosystem, eliminating the need to rebuild distribution from scratch. Monetization is deferred until the user base is established, avoiding Quibi's trap of needing revenue immediately.

That doesn't guarantee success. Product-market fit is always uncertain. User acquisition could plateau. Creators could find the compensation insufficient. Regulatory pressure could constrain the platform's growth. International expansion could stumble in specific markets.

But the structural advantages are real. TikTok's distribution is a moat that Quibi and every other competing micro-drama platform lacks. The company's experience with mobile-first content, creator incentives, and algorithmic recommendation systems positions them better than any competitor to scale this format.

Pine Drama likely won't replace traditional streaming or TikTok itself. It's a category app, competing for attention specifically against other micro-drama platforms and against the drama content on TikTok's main app. But within that category, it's positioned to be dominant.

The micro-drama market is growing globally, and TikTok is making a calculated bet that they can own a significant portion of it. They're learning from Quibi's failures, positioning the product in a way that aligns with user behavior rather than fighting against it, and leveraging their existing ecosystem to drive adoption.

In two years, we'll know if this succeeds. If Pine Drama reaches 50 million monthly active users with healthy retention and engagement metrics, TikTok will have cracked a new category. If it plateaus at 5–10 million users and becomes a niche product, it'll be filed away as an interesting experiment that didn't scale.

Either way, Pine Drama signals that short-form serialized video is here to stay. The form factor has proven successful in Asia. Distribution through TikTok's platform makes it viable in the West. And the psychology of cliffhangers ensures that once people start watching, stopping feels wrong.

The real question isn't whether micro-drama succeeds as a format. It already has. The question is whether TikTok can own enough of it to make the investment worthwhile. Based on their advantages, I'd bet they can.

FAQ

What is Pine Drama?

Pine Drama is TikTok's dedicated app for watching serialized micro-drama series in one-minute episodes. The app functions similarly to TikTok's main interface but focuses exclusively on short-form drama content with cliffhangers designed to keep viewers scrolling through entire seasons.

How does Pine Drama differ from Quibi?

Pine Drama learns from Quibi's failures by using one-minute episodes instead of 5–10 minute ones, launching without mandatory monetization, leveraging TikTok's existing distribution infrastructure, and aligning with actual mobile consumption patterns rather than aspirational ones. Quibi failed partly because longer episodes didn't fit interrupted mobile use.

Can I watch Pine Drama outside of TikTok's ecosystem?

Pine Drama is a standalone app, separate from the main TikTok application. However, you don't need a TikTok account to use it. Like TikTok, Pine Drama is available on iOS and Android as a dedicated mobile app through standard app stores.

What kind of content is available on Pine Drama?

Content focuses on serialized dramas, primarily romance, reincarnation, and fantasy genres. Shows feature character-driven storytelling with cliffhangers that encourage binge-watching. Production quality is typically modest, with soap opera-style acting and deliberately campy narratives, though this varies by show.

Is Pine Drama free or does it cost money?

Currently, Pine Drama is completely free with no advertisements. However, TikTok has not announced a permanent monetization strategy. The app will likely introduce some combination of paid subscriptions, premium content tiers, or advertisements within 12–18 months based on similar platforms' approaches.

How does Pine Drama's monetization compare to competitors like Drama Box and Reel Short?

Pine Drama is currently free, while Drama Box and Reel Short use freemium models with

Who creates content for Pine Drama?

Content comes from independent production companies and creators specializing in micro-drama format, primarily studios that have experience producing for Asian micro-drama platforms. TikTok is actively recruiting creators and offering incentives for original series, similar to their creator fund model on the main app.

Will my data on Pine Drama be handled differently than on TikTok?

Pine Drama is owned and operated by TikTok, so data handling practices are likely similar to the main app. This includes TikTok's privacy policy and data collection practices. Users concerned about data privacy should review TikTok's privacy documentation before downloading Pine Drama.

Can I download episodes of Pine Drama to watch offline?

Currently, Pine Drama requires an internet connection to watch content, similar to the main TikTok app. There's no announced feature for downloading episodes for offline viewing, though this could change as the platform evolves.

Is Pine Drama available internationally or only in the United States?

Pine Drama has been rolled out in multiple markets, but availability varies by region and app store. The app is most widely available in regions where TikTok has strong user bases, with particular focus on Southeast Asia. Expansion to Europe and other regions may face regulatory delays related to data privacy and design practices.

What happens if I finish all episodes of a show I'm watching?

Most shows have 20–100+ episodes, so it takes significant time to exhaust all available content. Once you've watched all released episodes, you'll either have to wait for new episodes to be produced (similar to traditional TV) or start watching a different show. Some shows conclude while others are renewed for multiple seasons.

How is Pine Drama moderated for inappropriate content?

TikTok operates content moderation teams that apply similar standards to Pine Drama as they do the main app. Shows are categorized for age appropriateness, and TikTok has systems for removing content that violates community guidelines. However, the app's community standards for dramatic content may differ from the main TikTok app due to the serialized narrative focus.

Key Takeaways

- PineDrama uses one-minute episodes instead of Quibi's 10-minute format, respecting how people actually consume mobile content in interrupted sessions.

- TikTok's 1.5 billion user base and algorithmic distribution system give PineDrama an unprecedented advantage over independent micro-drama platforms like DramaBox and ReelShort.

- Micro-drama content thrives on romance narratives (45% of viewership) because relationship tension naturally sustains cliffhanger-driven storytelling.

- The Zeigarnik effect—people's desire to complete interrupted tasks—is deliberately exploited through ending every episode with unresolved tension that makes viewers immediately swipe to the next one.

- Quibi failed partly because it tried to monetize immediately and built for aspirational mobile use; PineDrama is deferring monetization until user base is established, learning from that failure.

Related Articles

- TikTok's 2026 World Cup Live Deal: What It Means for Sports Broadcasting [2025]

- Disney Plus Vertical Video: The TikTok-Like Future of Streaming [2025]

- Best Amazon Prime Shows to Watch Right Now [2025]

- Netflix's $82B Warner Bros Deal: What It Means for Movie Theaters [2025]

- Netflix and Sony Streaming Deal: 5 Must-Watch Movies [2025]

- Higgsfield's $1.3B Valuation: Inside the AI Video Revolution [2025]

![TikTok's PineDrama App: The Micro-Drama Platform That's Learning From Quibi's Failures [2025]](https://tryrunable.com/blog/tiktok-s-pinedrama-app-the-micro-drama-platform-that-s-learn/image-1-1768676855612.png)