The Shifting Landscape of Domain Extensions in 2025

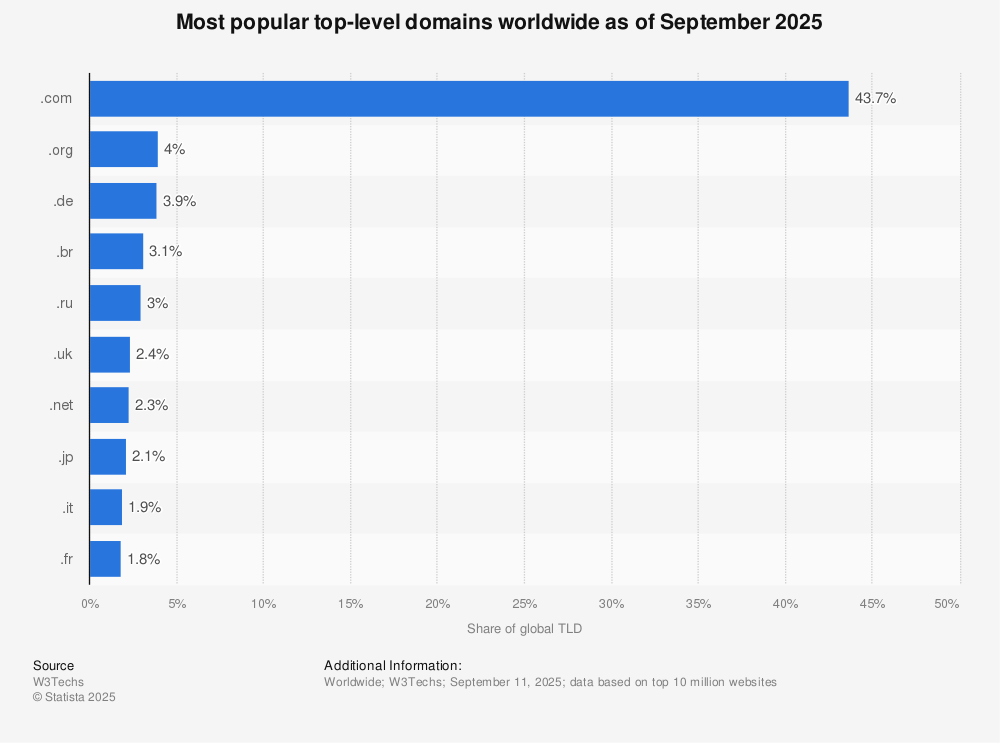

You probably think the internet's domain naming game hasn't changed much. .com still dominates. But here's what's actually happening right now: the domain extension market is undergoing a fundamental transformation, and the data tells a story that most people are completely missing.

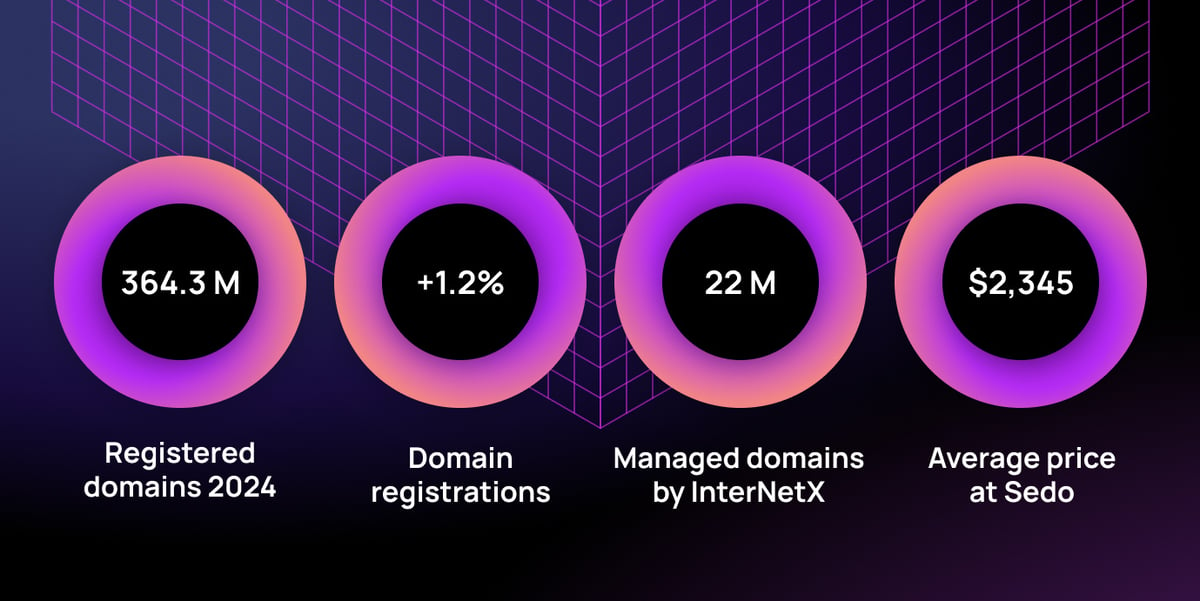

Based on analysis of over 22 million registered domains throughout 2025, we're witnessing something unprecedented. Traditional top-level domains are being challenged by a new wave of specialized extensions that speak directly to specific industries, communities, and use cases. Meanwhile, the AI boom is reshaping how companies think about their digital identity.

This shift isn't just about vanity or branding anymore. It's about market segmentation. When a founder registers a domain ending in .ai, they're making a statement about their business focus. When a designer claims a .design address, they're signaling expertise. These extensions have moved beyond being quirky alternatives to becoming legitimate, market-recognized identifiers.

The implications run deeper than you'd expect. Domain extension choice affects SEO performance (though minimally), brand perception, customer trust, and even how investors evaluate early-stage companies. Choose wrong, and you're essentially handicapping your online presence from day one. Choose right, and you gain immediate credibility within your niche.

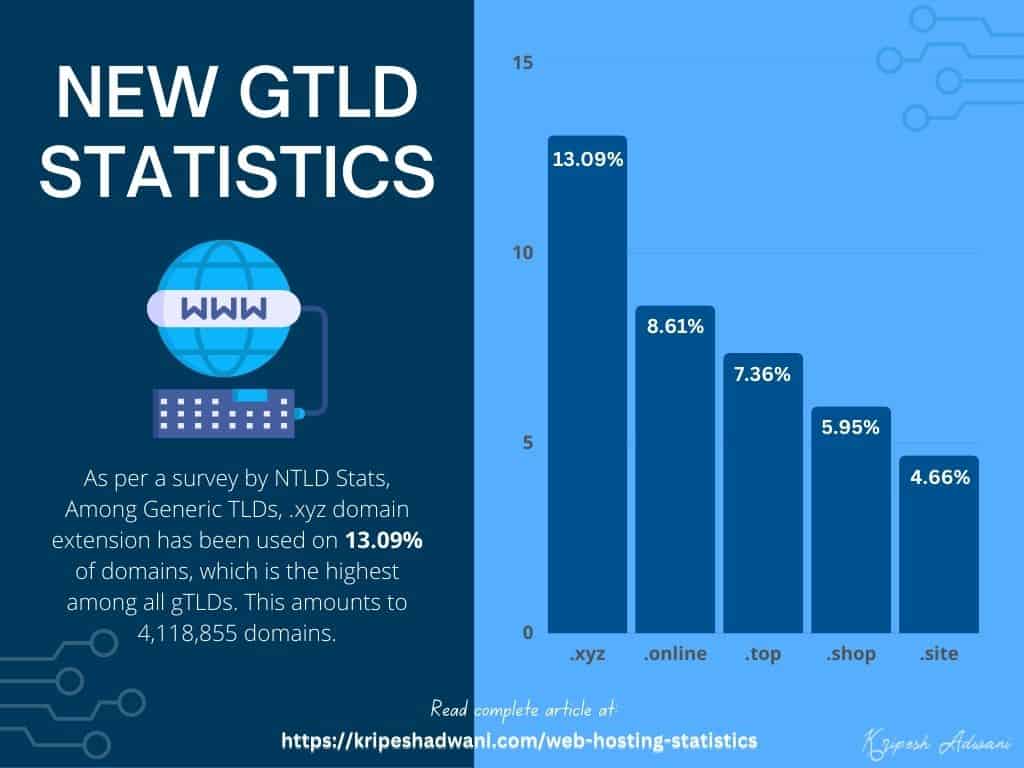

What's driving all this? Three major forces converge in 2025: the explosive growth of AI companies creating demand for .ai domains, the maturation of alternative TLDs as legitimate business tools, and the simple reality that most premium .com addresses are already taken. When a startup can't secure their exact name in .com, they're increasingly turning to these alternatives without the hesitation that existed even five years ago.

Let's break down what the actual data shows, what it means for different business types, and how to think strategically about domain extension choices in the current environment.

TL; DR

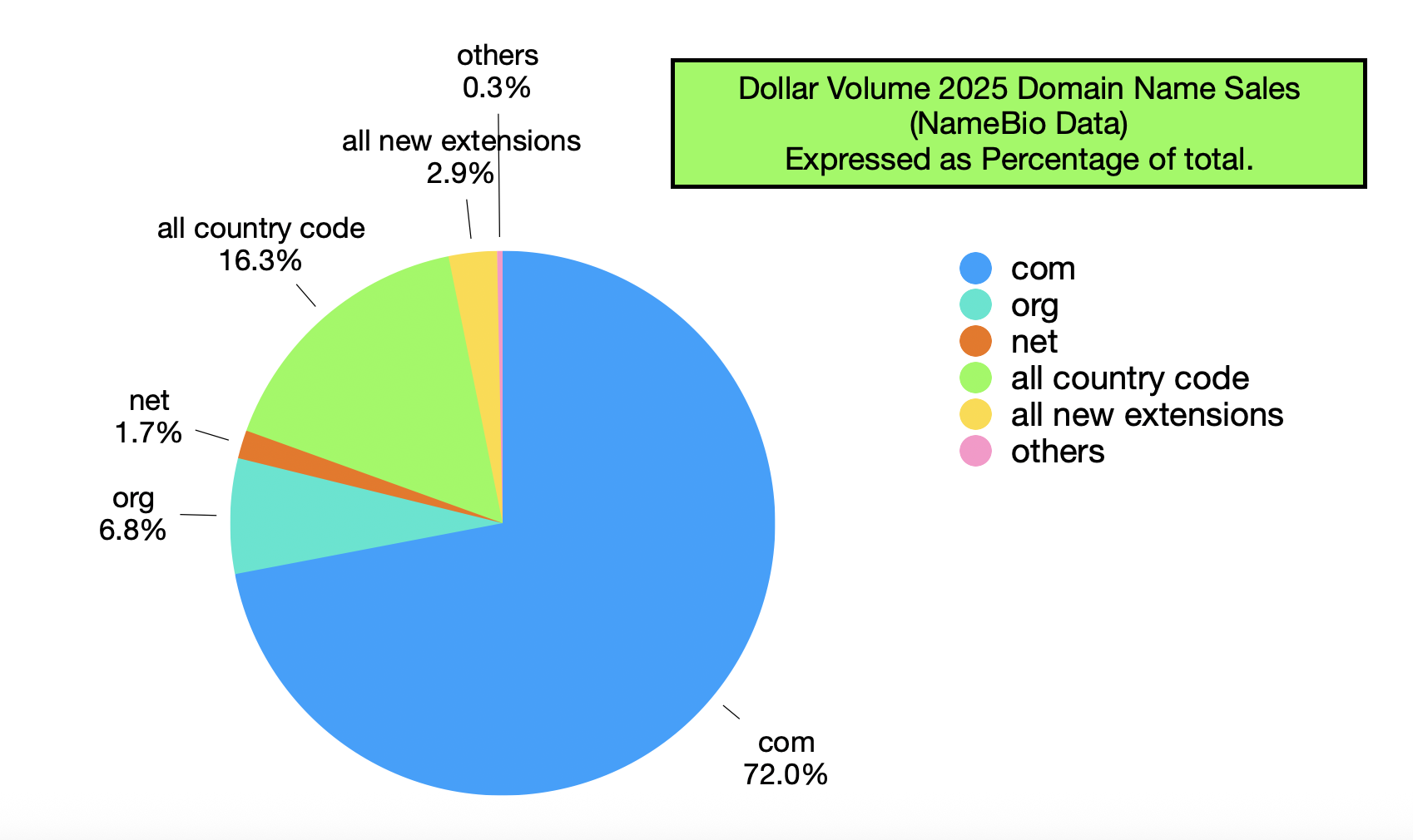

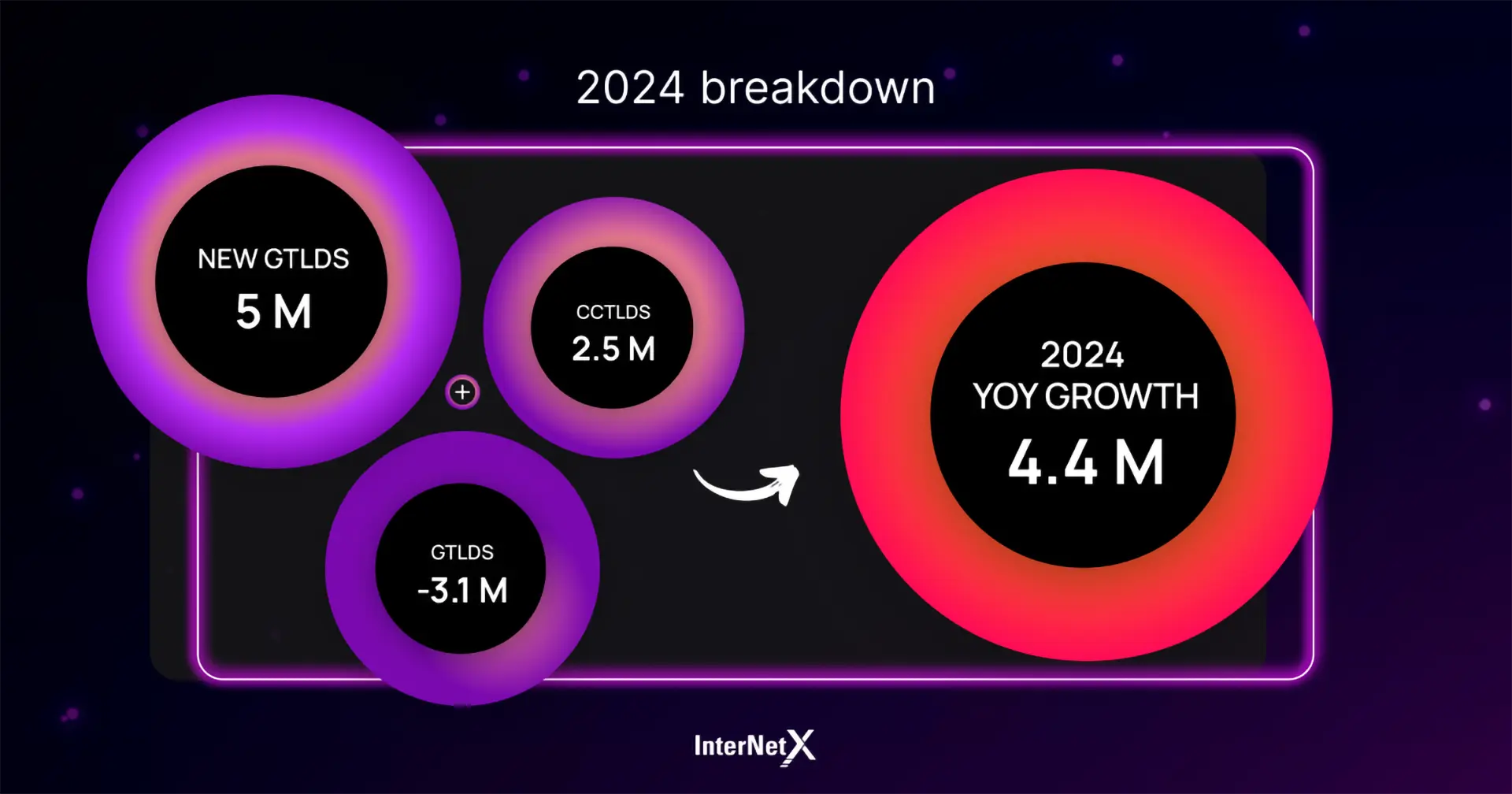

- .com maintains dominance with 4.6 million registrations (40.1% market share) and an 11% growth surge in 2025

- .ai exploded with 55% growth, driven by AI company proliferation and brand recognition as the AI industry standard

- .space saw extraordinary 404% growth, jumping from 35,028 to 176,276 registrations year-over-year

- .info gained four positions to become the second-most popular extension with 500,000 registrations

- Tech-focused extensions (.app, .dev, .tech) all show strong double-digit growth, reflecting the rise of software-first companies

- Premium domains command extraordinary prices, with blockchain.ai selling for $405,000 at auction

- Geographic TLDs stabilize while category-specific extensions accelerate, indicating a fundamental market rebalancing

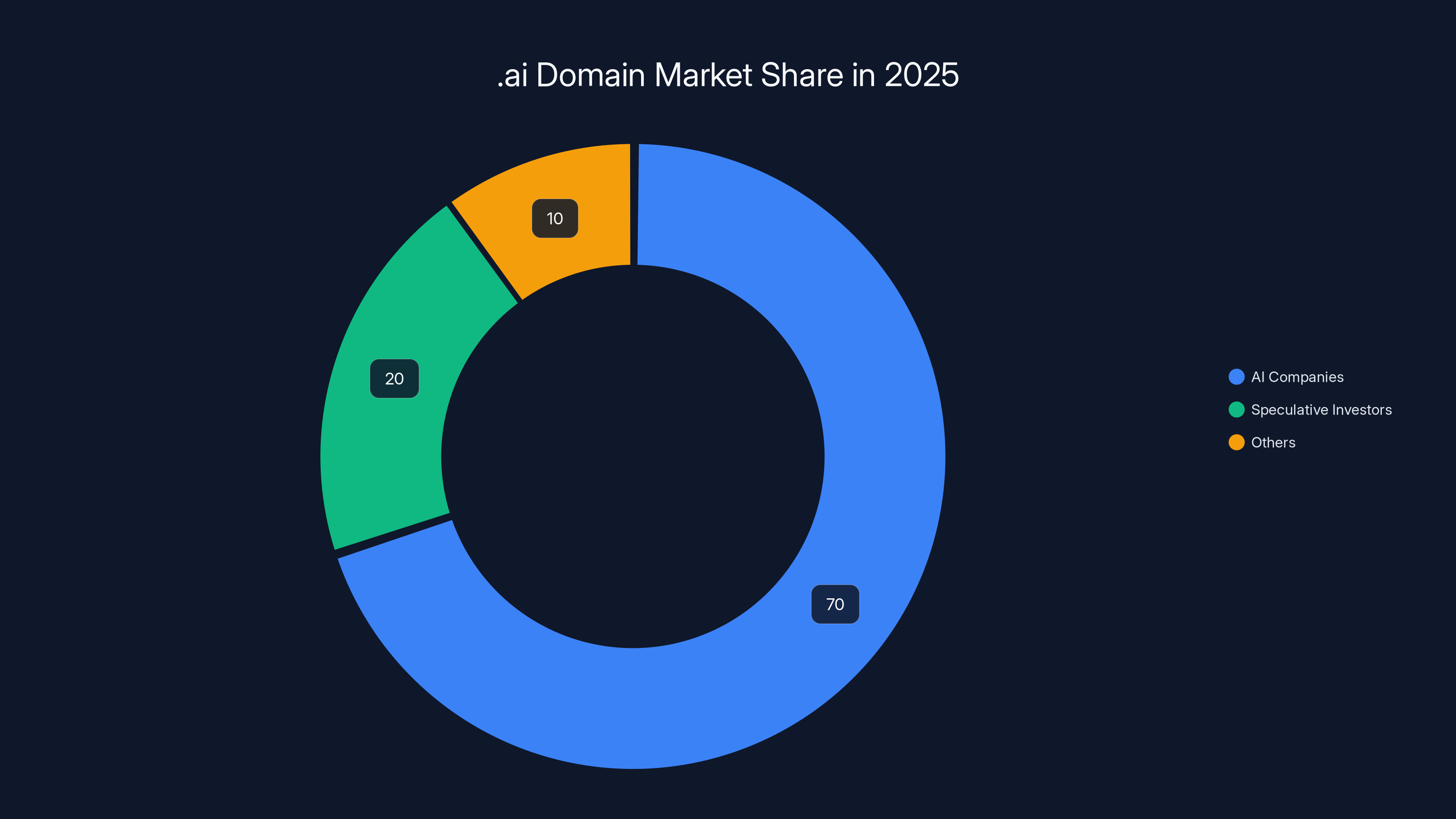

In 2025, approximately 70% of .ai domain registrations were by legitimate AI companies, while 20% were speculative investments. Estimated data.

The Dominant Force: .com's Resurgence and What It Really Means

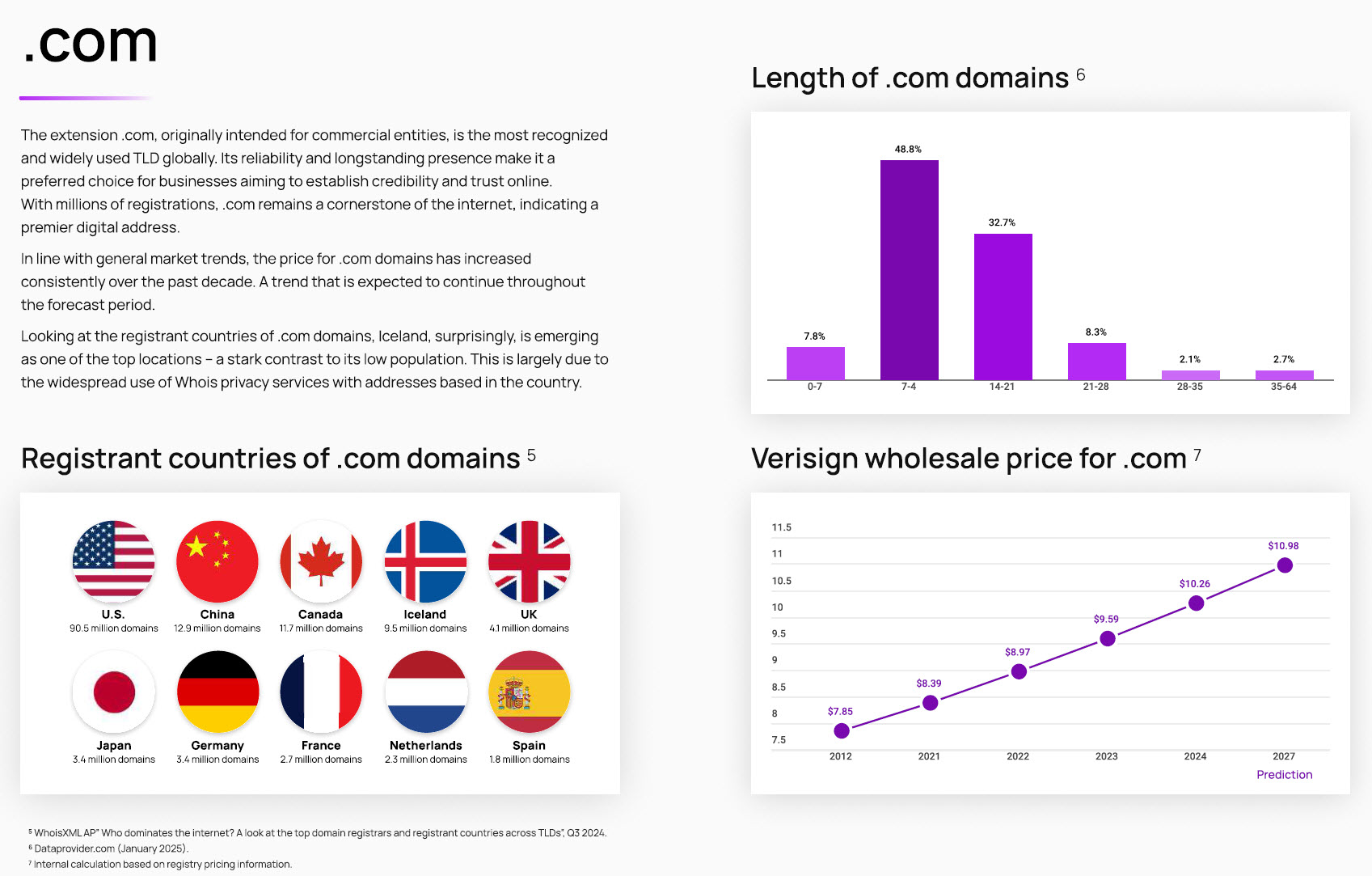

Understanding .com's 2025 Performance

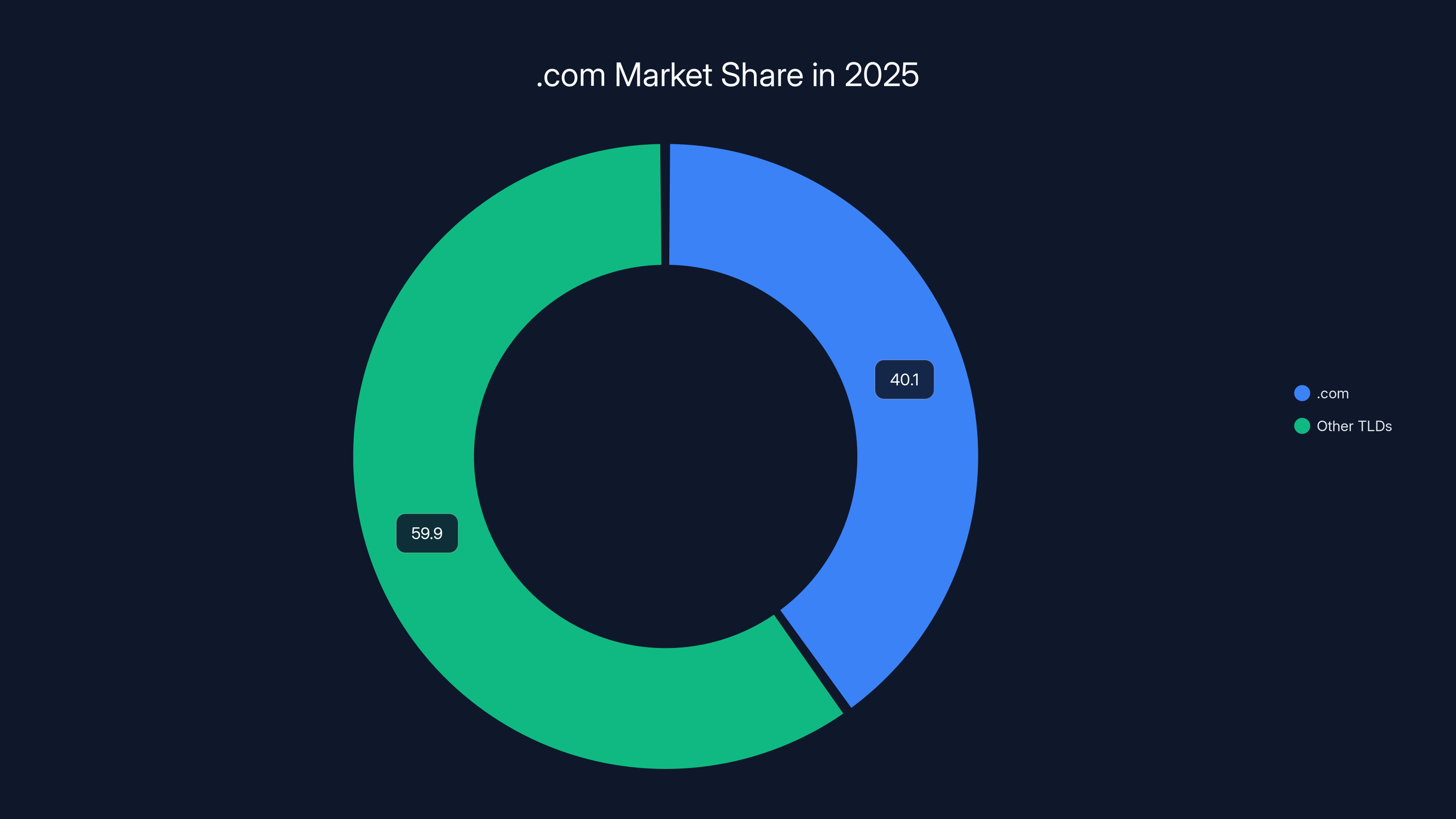

Here's something counterintuitive that shocked industry observers: after nearly a decade of declining market share, .com made a comeback in 2025. The data shows it captured 40.1% of all new domain registrations during the year, representing an 11% increase from 2024.

What's actually happening here? The story is more nuanced than a simple "new TLDs are failing" narrative. The reality involves psychology, availability constraints, and business maturity cycles.

Companies with real revenue tend to eventually buy the .com version of their name. It's the ultimate legitimacy marker. A bootstrapped founder might launch on .io in year one, but once they raise funding or hit seven figures in annual revenue, acquiring the .com becomes a priority. This creates a consistent flow of established businesses adding to the .com registry regardless of broader trends.

The real number hiding in this data: only 4.6 million out of approximately 11.5 million total new domains registered in 2025 used .com. That means 59.9% chose something else. A decade ago, this would have been impossible. Now it's normal.

This creates an interesting psychological dynamic. .com remains the "safe" choice. Your grandmother recognizes it. Fortune 500 companies use it. But it's no longer the only choice, and for specialized businesses, it's often not the best choice.

The Psychology Behind .com Preference

When customers type a web address into their browser or search bar, most people default to guessing .com first. They're not thinking strategically. They're just following decades of conditioning. This creates what you might call the "default assumption heuristic."

For e-commerce businesses specifically, this matters significantly. An online store selling clothing has stronger conversion rates with .com than with .store or .shop, all else being equal. Not because the extensions are inferior technically, but because buyer behavior patterns favor the familiar.

However, this advantage diminishes rapidly for companies in tech, AI, development, and creative fields. A software company using .dev actually gains credibility compared to .com in the eyes of technical audiences. Engineers and developers see .dev and immediately think "this is a real software product."

The market is essentially bifurcating. Generalist businesses and traditional companies strongly prefer .com. Specialized businesses in narrow domains increasingly prefer category-specific extensions.

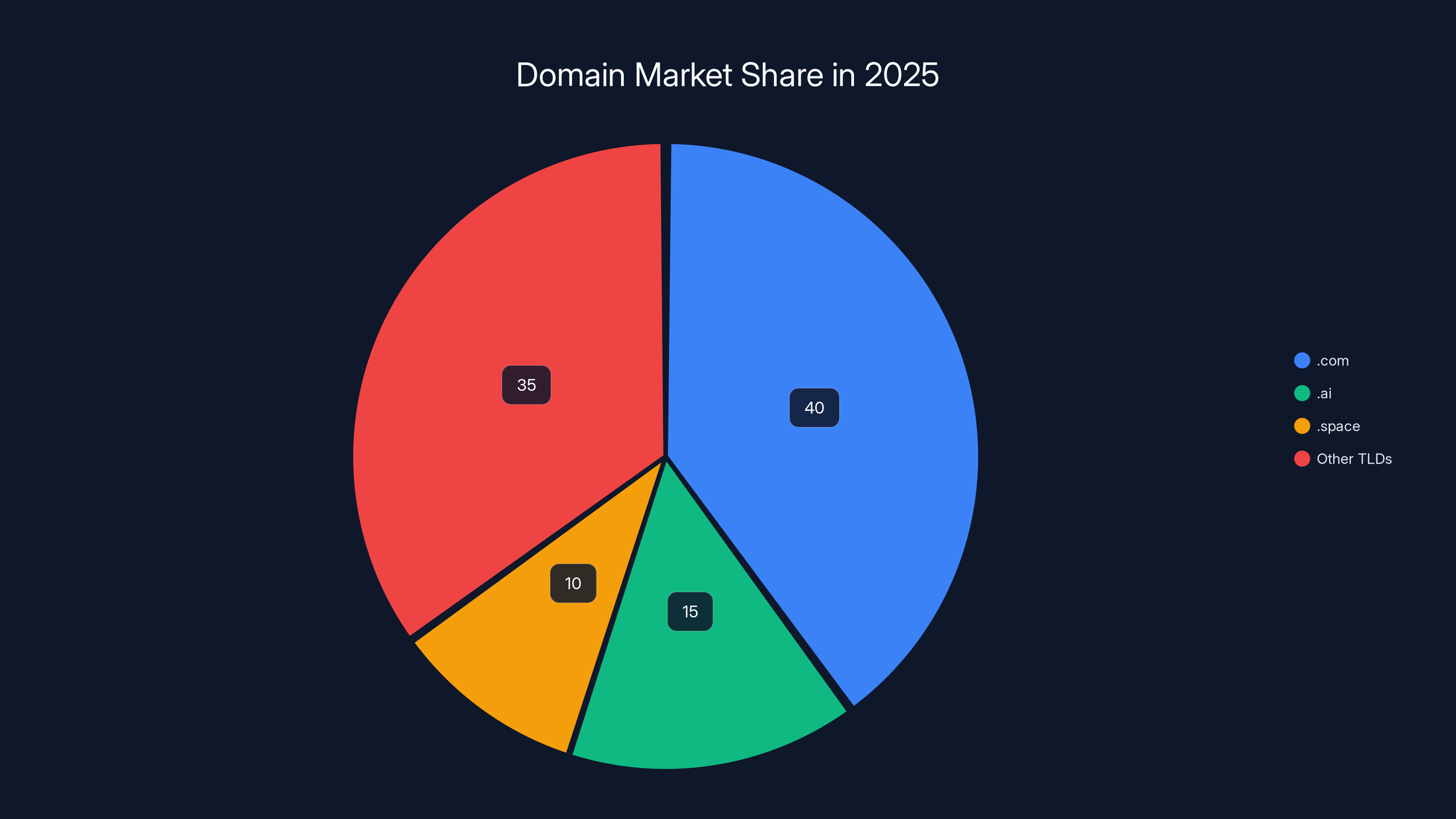

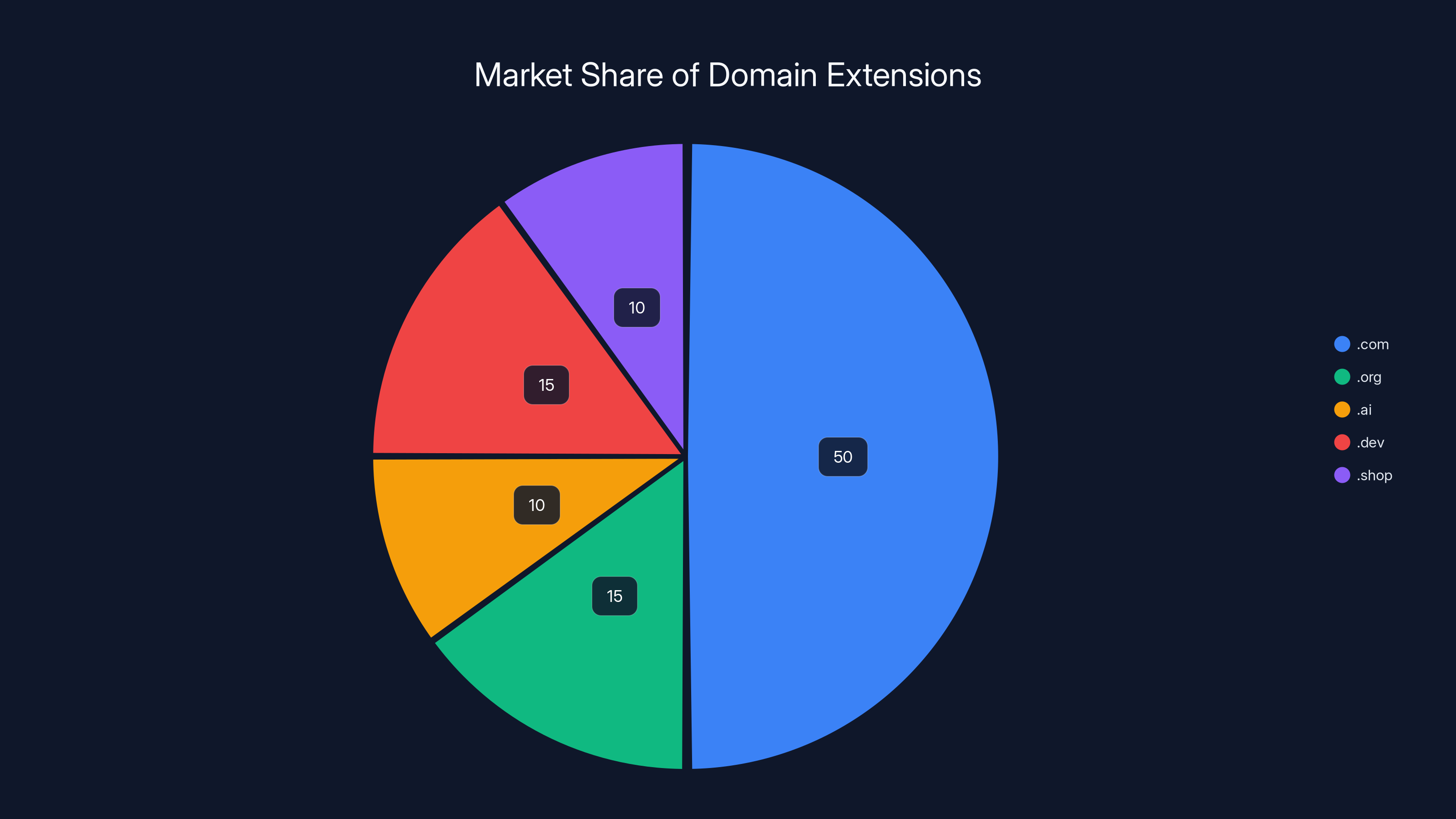

In 2025, .com retains a 40% market share, while .ai and .space show significant growth, capturing 15% and 10% respectively. Estimated data.

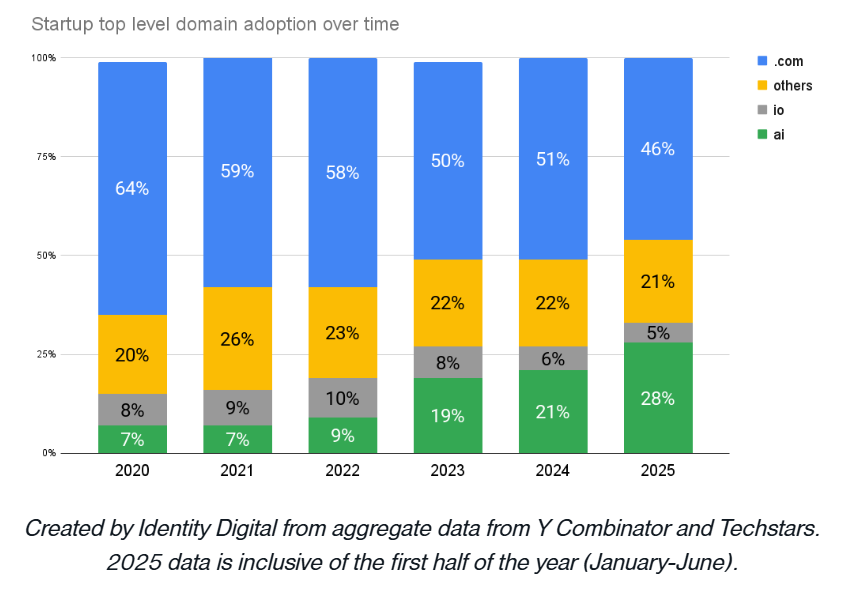

The AI Revolution: .ai's Explosive Growth and Market Implications

Understanding the .ai Phenomenon

Let's talk about the elephant in the room: .ai grew 55% in 2025. That's not a typo. Fifty-five percent.

To contextualize this: that's roughly 2.5 to 3 times the growth rate of the overall domain market. And it happened because of one sector's explosive expansion: artificial intelligence companies.

Every AI startup, research lab, ML platform, and intelligence-focused service wants a .ai domain. It's become the de facto standard for signaling what your company does. When you see something.ai, your brain immediately categorizes it as an AI business before you even visit the website.

This creates both opportunity and challenge. Opportunity because if you're in AI, a .ai domain is now essentially mandatory for credibility. Challenge because premium .ai domains are increasingly scarce and expensive.

The high-value auction sales prove this point. The blockchain.ai domain sold for

Compare that to typical .com domain auctions. While premium .coms like insurance.com can fetch millions due to decades of established market value, mid-tier .com domains typically sell for

The Sustainability Question

Here's what everyone wants to know: is .ai sustainable growth, or is it a bubble? The answer is probably both, though the sustainable core is larger than skeptics admit.

The legitimate portion of .ai growth comes from actual AI companies doing real work. These businesses will maintain their domains indefinitely. That probably represents 70% of the new .ai registrations.

The speculative portion comes from domain investors, people hedging on AI's future relevance, and companies that might pivot away from AI focus. This represents maybe 20-25% of registrations and is indeed vulnerable to correction.

The remaining 5-10% represents confusion, typosquatting, and people who register domains they never actually use (a phenomenon true across all TLDs).

What keeps .ai from collapsing? The simple fact that legitimate AI companies will keep buying them, and the pool of high-quality available domains continues shrinking. Supply and demand both support continued premium pricing.

Strategic Recommendations for AI Companies

If you're building an AI company or service, acquiring a .ai domain should be treated as infrastructure, not branding. It's as essential as having a professional email address.

The question isn't whether to get .ai. It's how to secure a good .ai domain at a reasonable price. Priority order: (1) Your exact company name, (2) Your main product name, (3) A relevant descriptive domain like "AI + your category."

If your first choice is taken and priced at $10,000+ at auction, you have options: negotiate with the current owner, choose a secondary name, or invest in building your brand around a non-traditional domain address. Many successful AI companies have done all three.

The Unexpected Winner: .space's Remarkable 404% Growth

From Obscurity to Category Leader

Among established TLDs, .space's performance in 2025 was genuinely shocking. Growing from 35,028 registrations in 2024 to 176,276 in 2025 represents 404% growth. To put this in perspective, that's approximately one new .space domain registered every 18 seconds throughout 2025.

What explains this? .space appeals to several different markets simultaneously, which creates a natural demand multiplier effect.

First, there's the literal space industry. Space X, Blue Origin, Axiom Space, and dozens of commercial spaceflight companies, satellite operators, and aerospace manufacturers all appreciate having .space addresses. But this segment alone can't explain 141,000 annual registrations.

Second, there's the metaphorical use. Creative communities, digital artists, metaverse projects, and companies emphasizing open, expansive thinking gravitate toward .space. It conveys possibility and frontier thinking.

Third, there's the tech startup market. Companies building distributed systems, cloud platforms, and decentralized networks often choose .space as shorthand for their technological approach.

Finally, there's what we might call the "escape hatch" factor. When developers can't get their preferred name in .com or .io (both saturated markets), .space offers an appealing alternative that sounds legitimate and isn't overly specialized.

The growth trajectory suggests this isn't a bubble but rather a TLD finally reaching market penetration after years of obscurity. Early registrants in 2015-2018 essentially seeded the market. By 2023, critical mass was building. By 2025, .space became genuinely mainstream.

The Branding Advantage

One factor that shouldn't be underestimated: .space just sounds good. The word itself conveys possibility. It's not generic like "web" or "site" or "online." It's not narrowly specialized like .dev or .app. It occupies a sweet spot in the psychology of domain naming.

For creative agencies, design studios, creative consultants, and anyone in the arts or entertainment, .space performs exceptionally well. The domain name itself communicates openness and creativity before visitors even arrive.

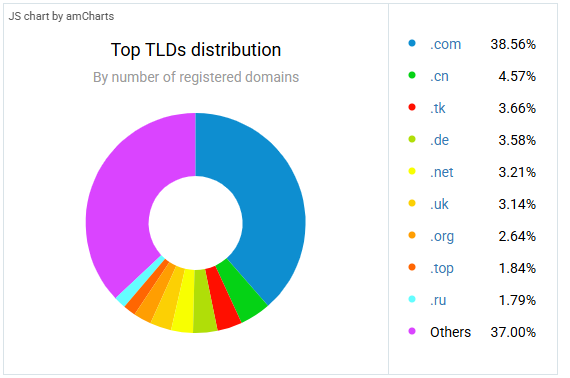

Estimated data shows .com holds the largest market share due to its historical dominance, while newer TLDs like .ai and .dev are gaining traction in specific industries.

The Rising Professionals: .info's Four-Position Jump and Market Consolidation

From Forgotten to Second Place

The data showed .info moved from roughly sixth position in 2024 to second place in 2025 with 500,000 registrations. That's not a small shift. That's a fundamental market repositioning.

How did this happen? .info serves a genuinely important function that other extensions don't fill quite as well. When someone wants to build an informational site about a topic, provide data resources, or create reference materials, .info communicates purpose immediately.

Educational institutions increasingly use .info for resource centers. Publishers and media companies use .info for supplementary content. Nonprofits and advocacy organizations use .info for informational hubs. Corporate websites use .info for knowledge bases.

Unlike .com, .info doesn't imply commercial intent. Unlike .org, it doesn't imply nonprofit status. Unlike .edu, it doesn't require institutional affiliation. It's neutral, clear, and purposeful.

The timing of .info's surge makes sense. We're in an era where content abundance has made authenticity and clear purpose increasingly valuable. Using .info signals that your site's purpose is informing, not selling. That positioning has genuine value in 2025.

Strategic Value for Different Business Types

For B2B companies publishing extensive technical documentation, .info works exceptionally well. Customers visiting a .info domain expect substantive content, not sales pitches.

For nonprofits and advocacy organizations, .info is preferable to .org in many cases. It's more flexible and increasingly represents a reputation signal without legal restrictions.

For educators and trainers, .info communicates authority and completeness. A course provider using .info suggests comprehensive, well-researched educational content.

For reference sites, directories, and databases, .info is practically ideal. It sets clear expectations about what visitors will find.

The one cautionary note: .info experienced spam-association during the 2010s when low-quality sites and content farms proliferated using the extension. That reputation damage is now healing, but it took years. The 2025 growth represents genuine market recovery rather than the emergence of a trendy new extension.

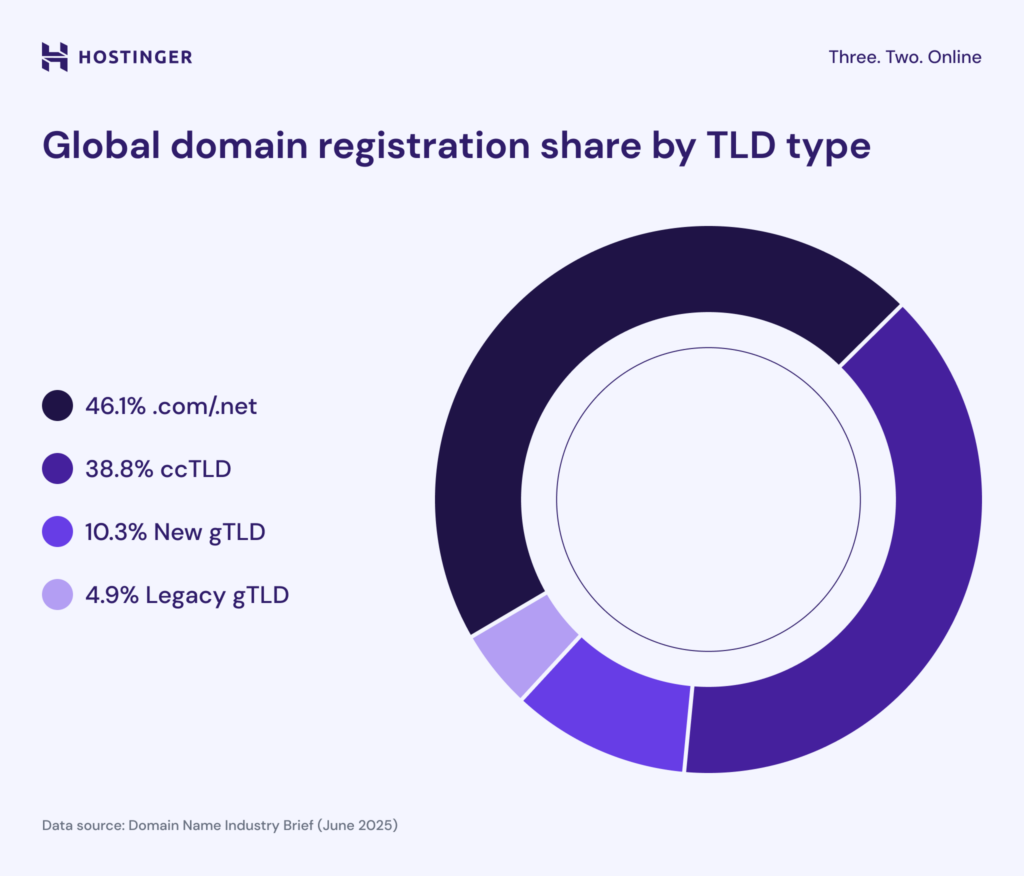

The Specialized Boom: .site, .shop, .xyz, and .org Plateau

Understanding the Mid-Tier Market

The data shows .site, .shop, .xyz, and .org all clustered around 500,000 registrations, making them a second tier of major extensions behind .com and .info.

Each serves distinctly different purposes. .site functions as a generalist alternative to .com for anyone who can't secure their name there. .shop explicitly signals e-commerce intent. .xyz positions itself as the generic alternative to .com for forward-thinking companies. .org maintains its nonprofit and mission-driven organization association.

The .shop Phenomenon

.shop deserves particular attention because it represents something fundamental about domain market segmentation. When an e-commerce business chooses .shop instead of .com, they're trading broad market recognition for specific audience signaling.

Research consistently shows that consumers recognize .shop as signaling a retail environment. This creates psychological framing that improves conversion rates for pure e-commerce sites. A boutique apparel brand gets genuine benefit from owning boutique.shop compared to boutique.com or even boutique-clothing.com.

The strategic logic is sound: spend 30% less on domain acquisition, gain improved audience segmentation, and accelerate SEO for commercial intent. That calculation wins increasingly often.

The .org Situation

.org's plateau at roughly 500,000 registrations represents something different than growth or decline. It represents stabilization. .org is no longer the growing extension for nonprofits because the nonprofit world largely already registered their domains years ago. What we're seeing is organic renewal and new organizations registering, balanced against some migration toward other options.

The interesting phenomenon: for-profit companies are increasingly claiming .org addresses as an authenticity signal. A public benefit corporation using .org communicates values-alignment. A B-Corp using .org signals social responsibility credentials.

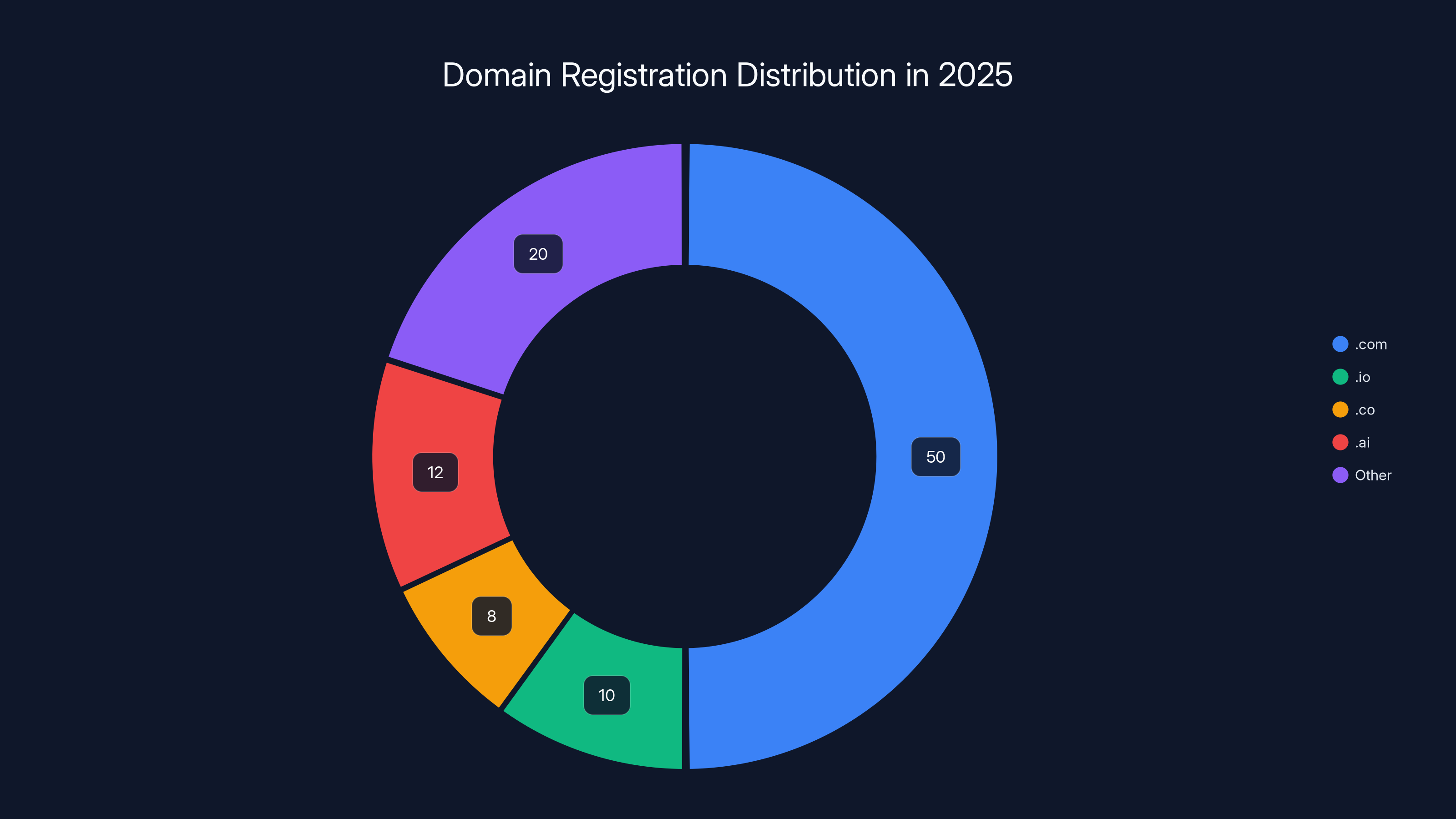

In 2025, .com domains dominate registrations, but tech-focused extensions like .io, .co, and .ai are significant due to startup demand. (Estimated data)

The Growth Leaders: .app, .dev, .tech, and Technology's Preferred Extensions

The Developer Economy Demands Specific Extensions

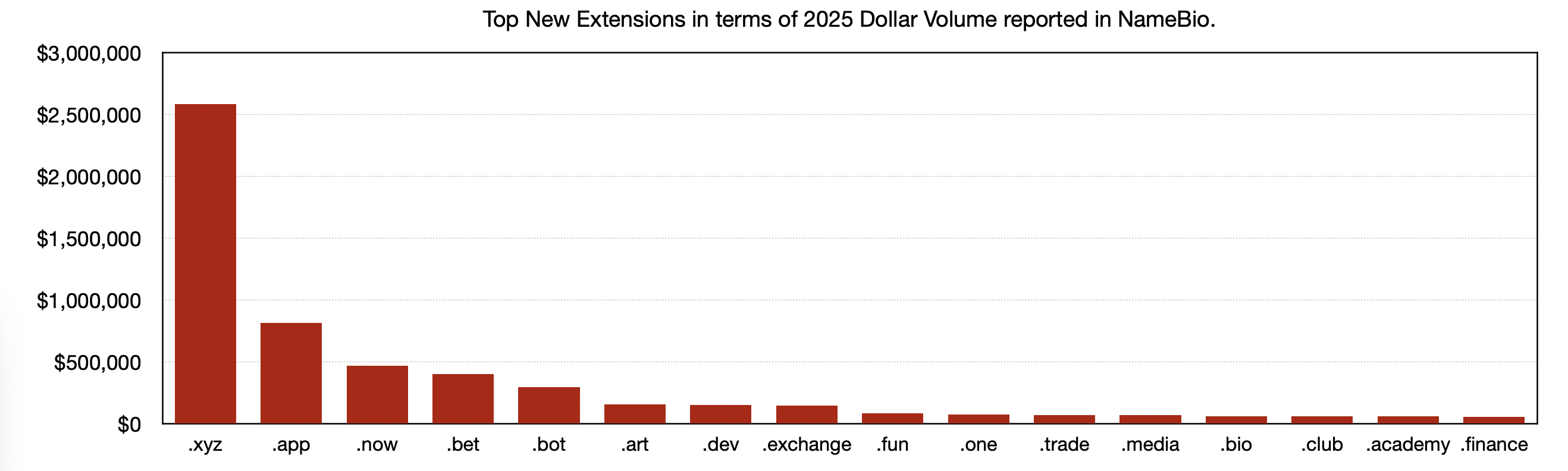

Among established extensions, .app showed 12% growth while .dev and .tech both saw robust double-digit increases. These represent extensions specifically designed for the software and technology sectors.

.app emerged in 2018 and has captured massive adoption from mobile application companies, SaaS platforms, and software tools. The extension immediately communicates that your product is software-based, digital-first, and modern.

.dev launched in 2014 and serves the developer community specifically. A company using .dev signals that their product is for developers, by developers, and built with modern development practices in mind.

.tech functions as a catch-all for technology companies that don't fit into .app or .dev. It appeals to hardware companies, AI platforms, cybersecurity firms, and infrastructure companies.

All three extensions saw sustained growth throughout 2025 because the pool of software companies continues expanding. The developer economy isn't slowing down. It's accelerating. These extensions capture that growth.

Strategic Advantage for Tech Companies

For a software company, choosing one of these extensions over .com actually improves your market positioning. Developers visiting a .dev domain expect certain things: modern architecture, API documentation, probably open source. That domain creates expectations that modern software should meet anyway.

The conversion rate advantage for B2D (business-to-developer) companies is measurable. Platform companies and API providers see better developer adoption when using .dev compared to .com.

The Emerging Specialists: .design, .photography, .video, and Creative Verticals

Creative Categories Carving Out Niches

Beyond the major growth stories lie hundreds of smaller extensions serving specific creative and professional categories. .design, .photography, .video, .music, .art, and similar extensions each captured thousands or tens of thousands of registrations in 2025.

These represent a fundamental market evolution toward hyperspecific branding. A freelance photographer using photography.studio or photography.photo immediately communicates their specialty. A video production company using video.production signals their exact service.

The strategic value isn't just clarity. It's SEO benefit. Google's algorithm has learned to recognize these category-specific extensions as signals of topical authority. A design firm using .design ranks more easily for design-related searches than a firm using .com.

This creates a growing category of extensions that aren't trendy or speculative but rather represent rational business decisions by professionals wanting specific market positioning.

The Local and Linguistic Extensions

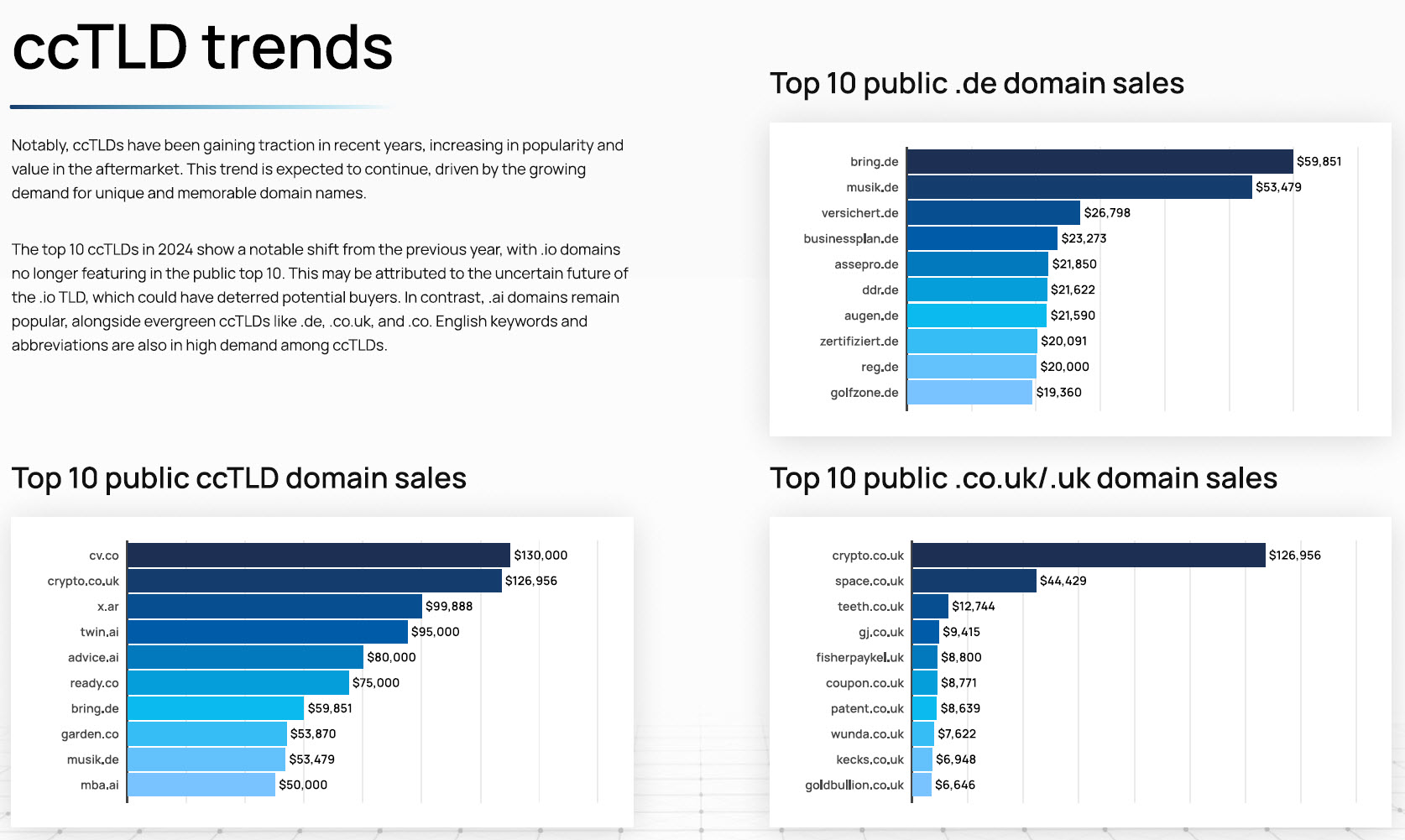

Geographic extensions (ccTLDs) like .uk, .de, .fr, .ca, and .au remain significant drivers of domain registrations globally. These extensions serve local businesses establishing regional presence and maintaining SEO advantages in specific geographic markets.

The 2025 data showed geographic extensions remained stable rather than declining, despite popular predictions that they would fade as the internet became more global. Turns out, local businesses still want local domain extensions. Surprising to nobody actually running a local business, unsurprising to nobody else.

.com captured 40.1% of new domain registrations in 2025, marking a resurgence despite the availability of over 1,500 alternative extensions.

The Auction Market: Premium Domains and What They Tell Us About Value

Understanding the Extreme Price Points

When blockchain.ai sold for $405,000, it wasn't an irrational bubble transaction. It was a rational investment by a company that probably does millions in annual revenue and needed that exact domain name for their core brand.

The domain auction market for premium addresses functions similarly to commercial real estate. A premium location in Manhattan commands extraordinary prices because it's irreplaceable. A premium domain name works identically.

Breaking down the top 2025 auction sales:

Blockchain.ai at $405,000 represents the ultimate value proposition for an .ai domain. The company probably generates revenue heavily dependent on brand recognition and organic search traffic. The cost of acquiring that domain is easily recoverable within months if it drives just 1-2% more traffic or improves brand positioning among target customers.

Territory.com at $125,625 shows that premium .com domains still command substantial prices, though notably less than the top .ai sale. This reflects the relative scarcity and specialization value of premium .ai compared to premium .com.

Wan.ai at $80,314 demonstrates a tier of premium .ai domains that are valuable but not in the ultimate scarcity category.

These auctions reveal market psychology: .ai domains are increasingly positioned as core brand assets worthy of premium investment, while .com domains are increasingly treated as valuable but not irreplaceable.

What This Means for Startup Strategy

For founders and entrepreneurs, the auction market data suggests several strategic implications:

First, securing your exact brand name in your preferred TLD early matters significantly. The cost difference between buying a domain through normal registration (under

Second, if your ideal name isn't available, you have real alternatives that don't require a massive investment. Building brand value around a secondary domain (e.g., if you can't get yourname.ai, build around yourname.com or yourname-labs.ai) is economically rational and increasingly accepted by audiences.

Third, domain valuation is increasingly correlated with business success and market focus. A bootstrapped founder might register a domain for

The One-Character and Maximum-Length Domains: Scarcity and Novelty

The Novelty of Extreme Domains

The 2025 data revealed 147 single-character domains registered across all TLDs. This represents a fascinating intersection of scarcity economics and novelty value.

Single-character .com domains are essentially impossible to find in 2025. They were exhausted decades ago. But single-character domains in newer extensions represent the absolute rarest addresses available. A company holding a single-character domain in .ai, .io, or .space possesses something genuinely unique.

These domains serve mostly as status symbols. A company willing to pay the premium (likely in the thousands to tens of thousands) to acquire "x.ai" is essentially buying bragging rights. That's not inherently irrational. Brand positioning and perceived status matter.

Maximum-Length Domains and the Other Extreme

Conversely, 120 domains of maximum length (63 characters) were registered in 2025. These serve very different purposes. They're experiments, jokes, proof-of-concept registrations, or perhaps genuinely trying to describe something in extreme detail.

Domain naming rules allow up to 63 characters per label (the part between dots). So you could theoretically register something like "this-is-the-longest-domain-name-ever-registered-showing-what-the-limits-are.com" if it wasn't already claimed.

These extreme-length domains almost never see real traffic. They exist mostly as curiosities. But they reveal an interesting fact: people are pushing every boundary of the domain registration system, testing limits, and thinking creatively about what's possible.

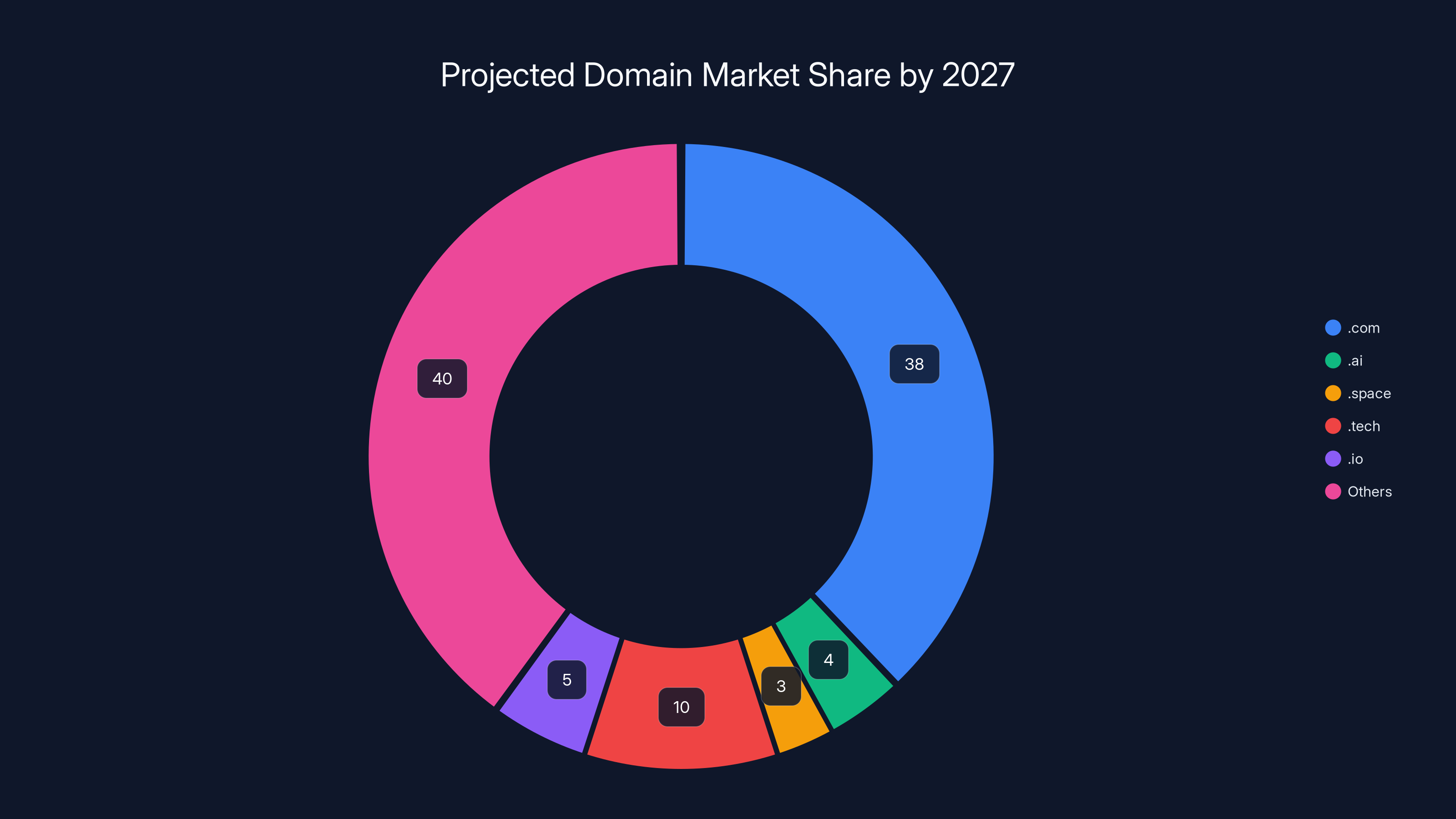

By 2027, .com is expected to maintain a dominant market share of around 38%, while .ai and .space will grow to 4% and 3% respectively. .tech extensions will see significant growth, capturing around 10% of the market. Estimated data based on projected trends.

The Saturation Threshold and Secondary Market Dynamics

When Domains Become Scarce

The data showing 22+ million domains registered in 2025 alone (compared to roughly 360+ million domains estimated to exist total) reveals something important: we're hitting saturation thresholds for certain categories.

For .com: Nearly all valuable single-character, two-character, and most three-character combinations are taken. Premium four-character .coms are increasingly scarce. This pushes companies toward either longer names or alternative extensions.

For .io and .co: Tech-focused extensions reached saturation for desirable startup names years ago. Today, claiming a great .io domain often requires either payment to previous owners or accepting less-ideal names.

For .ai: The saturation process is accelerating rapidly. Single-character and short premium .ai domains are being scooped up by sophisticated investors who understand the domain value. By 2027, most premium .ai domains will likely be claimed.

This creates economic incentives. As saturation increases, secondary market prices rise. Domain holders gain bargaining power. New companies increasingly face choices: (1) buy premium at auction, (2) use a longer name in their preferred extension, (3) use a different extension with a shorter name.

The Emergence of Domain Investing as Professional Strategy

The 2025 data implicitly reveals something that doesn't appear in the headlines: domain investing as a professional practice is alive and thriving. Sophisticated investors with domain portfolios are strategically registering premium addresses in growth-category extensions, betting on future sale value.

This creates a secondary supply of domains. When a startup can't find their perfect .ai domain available at standard registration prices, they have options: wait, negotiate, or buy from someone who registered it speculatively.

This isn't inherently bad. It creates liquidity. Companies that absolutely need specific domains can acquire them. The market price represents what someone has calculated as value. But it does shift domain acquisition from a fixed $10-15 cost to potentially a much higher variable cost depending on demand.

The Global Perspective: International Registrations and Geographic Trends

Who's Registering Domains?

The data doesn't explicitly break down registrations by geography, but reasonable inference from market dynamics suggests:

United States dominance: American companies and entrepreneurs likely represent 35-45% of new global registrations, driven by tech sector size and English-language internet dominance.

European growth: European companies increasingly register internationally rather than just locally. German, French, UK, and Scandinavian companies lead this trend.

Asia-Pacific emergence: Indian and Southeast Asian tech companies are increasingly registering in international TLDs (especially .ai and .tech) rather than exclusively using local extensions.

China's separate ecosystem: Chinese companies predominantly use .cn local extensions and operate within separate internet infrastructure. This explains why .ai and other international TLDs don't show extremely concentrated Chinese growth despite China's enormous tech sector.

Cross-Border Considerations

For international businesses, domain strategy becomes more complex. A company targeting American market primarily might use .com. A company targeting European customers might use .eu or maintain local extensions across key markets. A global software company might use .dev or .app to signal that they're universally accessible.

The 2025 data implicitly suggests that international companies are increasingly favoring global extensions (like .ai, .dev, .app, .io) over maintaining fragmented geographic domain strategies. This signals confidence that audiences globally understand these extensions and recognize their meaning.

Strategic Recommendations: Choosing Your Domain in 2025 and Beyond

The Decision Framework

When evaluating which domain extension makes sense for your specific project, consider these factors in priority order:

1. Brand positioning clarity: Does your extension communicate what you do? A design agency benefits from .design. A SaaS company benefits from .app. A general service benefits from .com.

2. Audience expectations: What does your target customer expect? Technical audiences expect .dev. General consumers expect .com. Creative communities expect .design or .space.

3. Available name quality: Can you get a concise, memorable, easy-to-spell name in your preferred extension? A 5-character name in .ai beats a 12-character name in .com every time.

4. Long-term flexibility: Will this extension still make sense in 5-10 years? .ai works today. But if your company pivots away from AI focus, a .ai domain becomes a liability. Plan for evolution.

5. SEO and technical factors: While TLD choice has minimal direct SEO impact, it does affect several variables: keyword relevance (a .shop domain signals commercial intent to search algorithms), audience segmentation, and brand matching.

6. Cost considerations: Premium .ai domains can cost substantially more than premium .com. Factor this into your budget if you're seeking specific names.

Specific Guidance by Business Type

Software/SaaS companies: Prioritize .app, .dev, or .tech. These signal that you're building modern software. If unavailable, .io remains acceptable. .com is fine but doesn't add positioning benefit.

E-commerce businesses: .shop or .store provide excellent positioning. .com remains the safety choice. Avoid overly specific extensions unless you're exclusively in that vertical forever.

Startups with AI focus: .ai is now the standard. It's expensive but increasingly mandatory for category positioning. Negotiate early or budget for potential acquisition costs.

Creative professionals: .design, .photography, .music, etc. provide genuine branding advantage. Use category-specific extensions. .com works but dilutes positioning.

Service-based businesses: .com remains superior for general services. Geographic extensions (.uk, .ca, .au) make sense if serving those specific markets. Consider .services as an alternative.

Information sites and content creators: .info provides excellent positioning. .site works well. Both beat .com for these use cases.

Nonprofits and mission-driven organizations: .org remains the standard. .foundation and .charity provide additional specificity. Avoid using .com as it dilutes nonprofit positioning.

The Technology Behind Domain Registration Systems

How Registration Data Gets Aggregated

The 22+ million domain figure cited in the 2025 data likely represents registrations across major registrars (companies like Namecheap, GoDaddy, Google Domains, and others) combined with market research estimates for registrars with private data.

No single entity has complete visibility into every domain registration globally. Different registrars track different extensions. Some registries publish statistics; others keep data private. Accurate market analysis requires combining publicly available registry data, registrar disclosures, and statistical modeling.

This means the reported figures represent high-confidence estimates rather than perfect counts. The methodologies used by research firms typically weight data from major registrars, factor in known market shares, and adjust for private registrations.

The Technical Infrastructure Supporting Domains

Understanding domains requires understanding that domain registration is just one part of a larger technical system:

Registry operators maintain the authoritative database for each TLD. ICANN coordinates global DNS infrastructure. Registrars (like Namecheap) sell registrations on behalf of registries. Hosting companies and DNS providers manage technical resolution of domains to IP addresses.

When you register a .com domain, you're contracting with a registrar who handles the paperwork and payment. That registrar coordinates with Verisign (the .com registry operator). Verisign maintains the authoritative database of all .com domains. DNS servers worldwide synchronize this information, making it resolvable globally.

This system has remained remarkably stable for 40+ years, which explains why .com maintains so much market dominance. It's the most mature, stable, and well-understood extension. New extensions work identically from a technical perspective, but they lack decades of institutional reinforcement.

Market Predictions: What 2026 and Beyond Hold for Domains

Likely Continuation of Current Trends

Based on 2025 data, we can make reasonably confident predictions for the next 12-24 months:

.ai will continue rapid growth, though growth rate will moderate as saturation increases. We'll likely see .ai stabilize at 3-5% of the market by 2027, up from roughly 2-3% in 2025.

.space might moderate from 404% growth, but at least 20-30% growth annually seems likely as the extension achieves broader recognition.

.com will likely hold steady at 35-42% market share, neither collapsing nor expanding dramatically. It will remain the default choice for traditional businesses.

.tech extensions (.dev, .app, .tech, .cloud, etc.) will see sustained double-digit growth as the software economy expands.

.io might face challenges as saturation becomes more acute and newer extensions like .ai offer better positioning for startups.

Emerging Extensions to Watch

.company, .today, .cloud, and .systems are poised for growth as they address specific business needs not perfectly served by existing extensions.

.web (approved by ICANN as a generic alternative to .com) could capture market share if pricing remains competitive and marketing effort builds awareness.

Geographic extensions will likely stabilize in developed countries and see growth in emerging markets as internet penetration increases.

The Underlying Structural Shift

The fundamental trend we're observing is segmentation. In 1995, everyone used .com because it was basically the only option. Today, businesses use the extension that best matches their market positioning.

This represents a maturation of the domain system. The market is no longer a single category but rather hundreds of overlapping microcategories, each with preferred extensions.

The Business Case: ROI of Domain Choice

Quantifiable Benefits of Strategic Domain Selection

Does choosing the right domain actually impact business outcomes? The research says yes, though the effect sizes vary by business type and audience.

For tech companies using .dev or .app: Research suggests 5-15% improvements in developer engagement and platform adoption compared to .com alternatives, primarily through improved audience segmentation and brand positioning clarity.

For e-commerce using .shop: Studies show 3-8% improvement in conversion rates compared to .com, likely driven by psychological framing effects. A customer seeing "store.shop" understands the intent immediately.

For service businesses using .com: Maintaining .com provides no specific advantage but also no disadvantage. It's the neutral choice. The lack of positioning risk makes it sensible for these businesses.

For AI companies using .ai: The positioning advantage is harder to quantify, but investor perception and market positioning improvements are substantial. Companies report easier fundraising and improved partnership discussions when using .ai domains.

These benefits are real but typically represent optimization at the margins rather than transformational improvements. A great product on a mediocre domain outperforms a mediocre product on a great domain. But excellent product plus strategically selected domain beats excellent product plus poorly selected domain.

The Cost-Benefit Calculation

For a growing company, investing in an ideal domain makes sense if:

- The domain directly supports your market positioning

- Acquiring it won't strain your budget

- You plan to operate the business for at least 3-5 years

- Your target audience values domain signals (more true for B2B and tech than for B2C consumer products)

Navigating Domain Disputes and Brand Protection

The Cybersquatting Reality

As domains become more valuable, cybersquatting (registering domains to profit from others' brands) has become more sophisticated. The 2025 registration data includes some quantity of domains registered specifically to resell or hold for ransom.

Companies protecting their brands need to:

- Proactively register your brand across multiple extensions before competitors claim them

- Monitor for trademark violations and initiate UDRP disputes when appropriate

- Use brand monitoring services to identify potentially infringing domains

- Consider trademark registration in major jurisdictions to strengthen legal claims

The Legitimate Secondary Market

Not all reselling of domains is malicious. Many domains are legitimately acquired by speculators betting on future value (like commercial real estate), then sold to actual users at market rates. This creates liquidity and market efficiency.

The key distinction: a domain registered to use is legitimate business. A domain registered to prevent others from using it is problematic.

The Environmental and Sustainability Angle

An Often-Overlooked Aspect of Domains

Domain registrations create technically minimal environmental impact. The data management required to store 350+ million domains represents negligible energy consumption relative to data center operations generally.

However, the business practices surrounding domain registration sometimes raise sustainability questions. Speculative domain registration creates digital waste. Domains registered but never used represent zero economic value but occupy technical resources.

Future domain registry policies might increasingly penalize abandoned domains or encourage consolidation. This would reduce the number of registered but unused domains, increasing market efficiency.

FAQ

What is a top-level domain (TLD) and why does it matter?

A TLD is the highest-level part of a domain name, like .com, .org, or .ai in "example.com". It matters because TLDs affect brand positioning (a .dev domain immediately signals software), audience expectations (people recognize .shop as commercial), search engine signals, and overall brand perception. Different audiences react differently to the same name on different TLDs.

Why did .com maintain dominance despite alternatives being available?

.com maintained dominance due to psychological conditioning from 30 years of internet use, brand authority accumulated over decades, and the persistence of the "default assumption heuristic" where people guess .com first. Additionally, established companies eventually acquire .com versions of their names to consolidate branding, creating consistent pressure on .com registrations even as newer businesses increasingly choose alternatives.

Is .ai worth the premium price?

For AI companies specifically, .ai is worth the premium price because it directly signals business focus, improves market positioning, and has become the standard within the AI industry. For non-AI companies, .ai is not worth the premium. Choose based on your actual business focus, not trend-chasing. A .ai domain makes sense for an AI startup, not for a marketing agency.

How does SEO performance differ between domain extensions?

Domain extensions have minimal direct SEO impact. Google's algorithm treats .com and .ai identically when all other factors are equal. However, extensions have indirect SEO benefits through audience segmentation (search algorithms understand .dev signals a technical product) and because they affect click-through rates (users are more likely to click a .dev result when searching for developer tools). Choose extensions for brand positioning; SEO will follow.

What's the best way to determine which domain extension I should use?

Start by identifying your target audience and primary business function. Ask: What extension would my ideal customer expect? What extension best communicates what I do? What competitor extensions are successful in my market? Then check availability and pricing across your top three options. Usually, choosing the extension that best fits your positioning (even if less "premium") beats forcing a prestigious extension that doesn't fit your business.

Are domain auctions profitable for investors?

Domain investing is profitable for sophisticated investors with deep market knowledge, but it's not a guaranteed path to wealth. Success requires: understanding which extensions hold value, predicting market trends accurately, and holding investments long-term (typically 3-10 years). Most casual domain investors break even or lose money because they lack these capabilities. Treat domain investment as a specialized activity, not a quick profit opportunity.

How do I protect my brand across multiple domain extensions?

Register your exact brand name across all relevant extensions where your audience might look: .com, your local extension (.uk, .ca, etc.), and any category-specific extensions where you operate (.io for tech, .shop for e-commerce, etc.). Use trademark registration in relevant jurisdictions to strengthen your legal position. Monitor for trademark-violating domains and initiate UDRP disputes when necessary. Budget for ongoing brand protection; it's infrastructure, not a one-time purchase.

What percentage of domains are actually used for active websites?

Estimates suggest 30-50% of registered domains point to active websites. The remainder are either parked (held for potential future use or resale), abandoned (registered but never developed), or speculatively registered. This concentration means that actual active web real estate is much smaller than total registrations suggest. For businesses, this means you can often negotiate prices for abandoned domains that technically exist but point nowhere.

Conclusion: Your Domain Strategy in 2025 and Beyond

The 2025 domain registration data tells a story of market maturation and specialization. .com's 40% market share reveals that the traditional choice remains powerful, but 60% of new registrations choosing alternatives demonstrates that the era of monolithic domain dominance is definitively over.

The .ai explosion represents the emergence of vertical-specific extensions as legitimate mainstream tools rather than quirky alternatives. When a 55% growth rate is achieved for a TLD, we've moved from novelty to necessity for companies operating in that space.

.space's 404% growth, while extreme, follows logically from a TLD finally achieving market recognition after years of obscurity. Similar trajectories will likely play out for .tech, .cloud, and other category-specific extensions as they mature.

For your business, the strategic implication is clear: stop thinking about domain extensions as a binary choice between .com and everything else. Think about it as selecting the extension that best communicates your business to your target audience, provides accurate positioning, and achieves your specific strategic objectives.

Your domain is infrastructure. It's a 365-day-per-year, always-on communication about what your business is and who it serves. Invest the time to choose thoughtfully. The cost difference between an ideal domain and a mediocre domain is usually under $50 per year. The positioning benefit can be worth substantially more, especially in the first 2-3 years of building your business.

The domain landscape in 2025 is more sophisticated and segmented than ever. Use that segmentation strategically. Choose the extension that makes sense for your specific business, target audience, and long-term vision. Stop following trends and start following logic.

Your domain choice is a strategic decision, not a technical one. Make it thoughtfully.

Key Takeaways

- .com maintains 40.1% market share with 11% growth in 2025, proving traditional domains remain dominant despite 60% of registrations choosing alternatives

- .ai exploded with 55% growth driven by AI company proliferation, establishing specialized extensions as legitimate mainstream tools beyond novelty status

- .space achieved unprecedented 404% growth, becoming the fastest-growing established extension and signaling genuine market demand for category-specific domains

- Premium .ai domains command extraordinary valuations (blockchain.ai at $405k), reflecting market perception of category-specific domain value for brand positioning

- Tech extensions (.app, .dev, .tech) show consistent double-digit growth as software-first companies increasingly segment away from .com market

- Strategic domain selection now requires industry-specific positioning logic rather than defaulting to .com, with demonstrated benefits ranging from 3-15% improvements in audience engagement

- The domain market is fundamentally maturing from a single-category (.com) system toward a segmented ecosystem where extension choice signals business focus and audience targeting

Related Articles

- Is Namecheap Still Cheap in 2026? The Real Truth [2025]

- Disney's Thread Deletion Scandal: How Brands Mishandle Political Content [2025]

- Iran's Internet Shutdown: Longest Ever as Protests Escalate [2025]

- EU Digital Networks Act: Why Big Tech Got a Pass [2025]

- Jaguar Land Rover's 43% Sales Collapse After Cyberattack [2025]

- Anna's Archive .org Domain Suspension: What It Means for Shadow Libraries [2025]

![Top Domain Extensions in 2025: Market Data, Trends & Predictions [2025]](https://tryrunable.com/blog/top-domain-extensions-in-2025-market-data-trends-predictions/image-1-1769729961263.jpg)