Why Online Car Buying Still Isn't Happening [2025]

You'd think by now we'd be buying cars the way we buy everything else. Click a few buttons, enter your credit card info, and boom—your new ride shows up in the driveway. But here's the thing: that's not happening. Not even close.

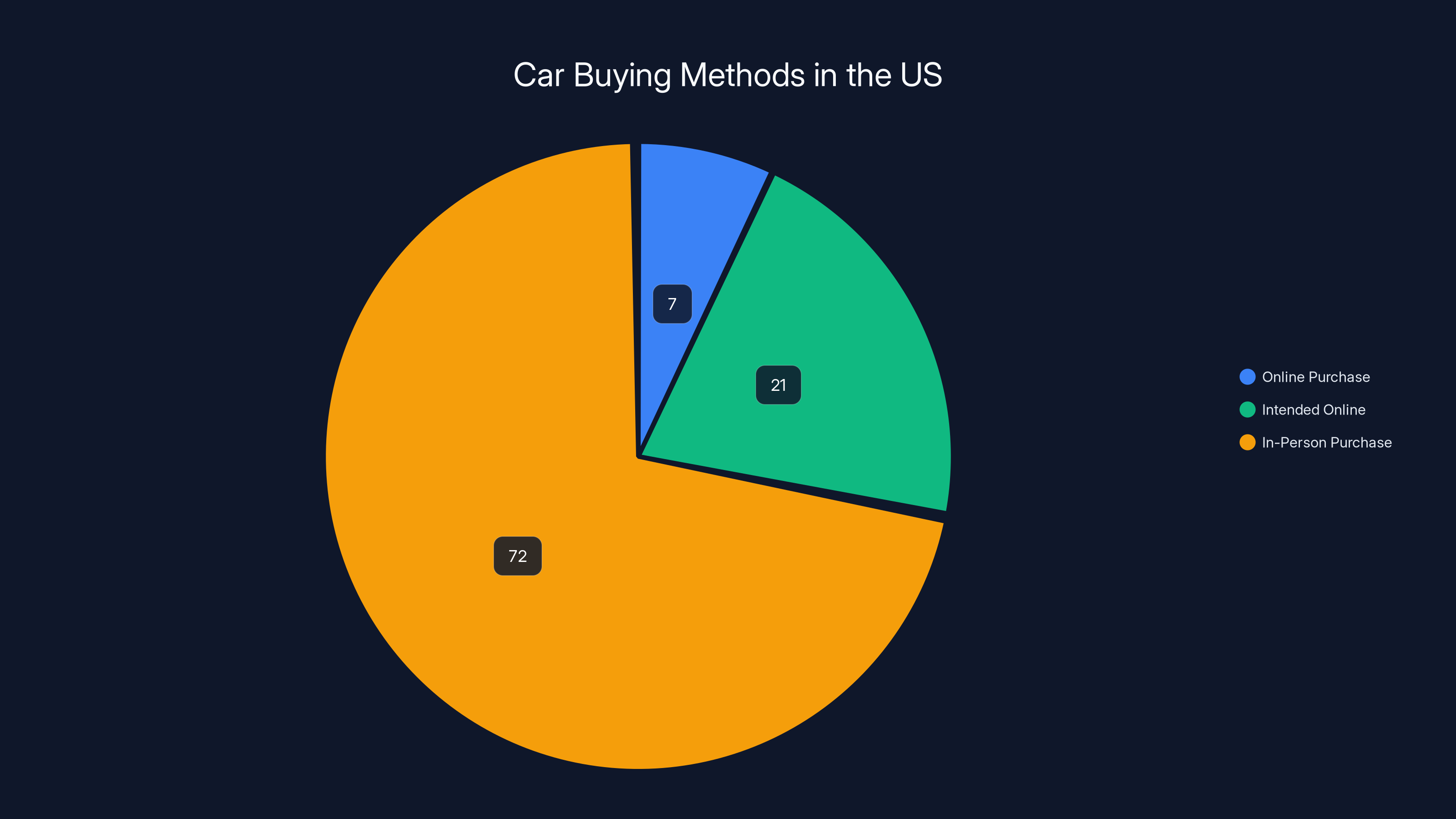

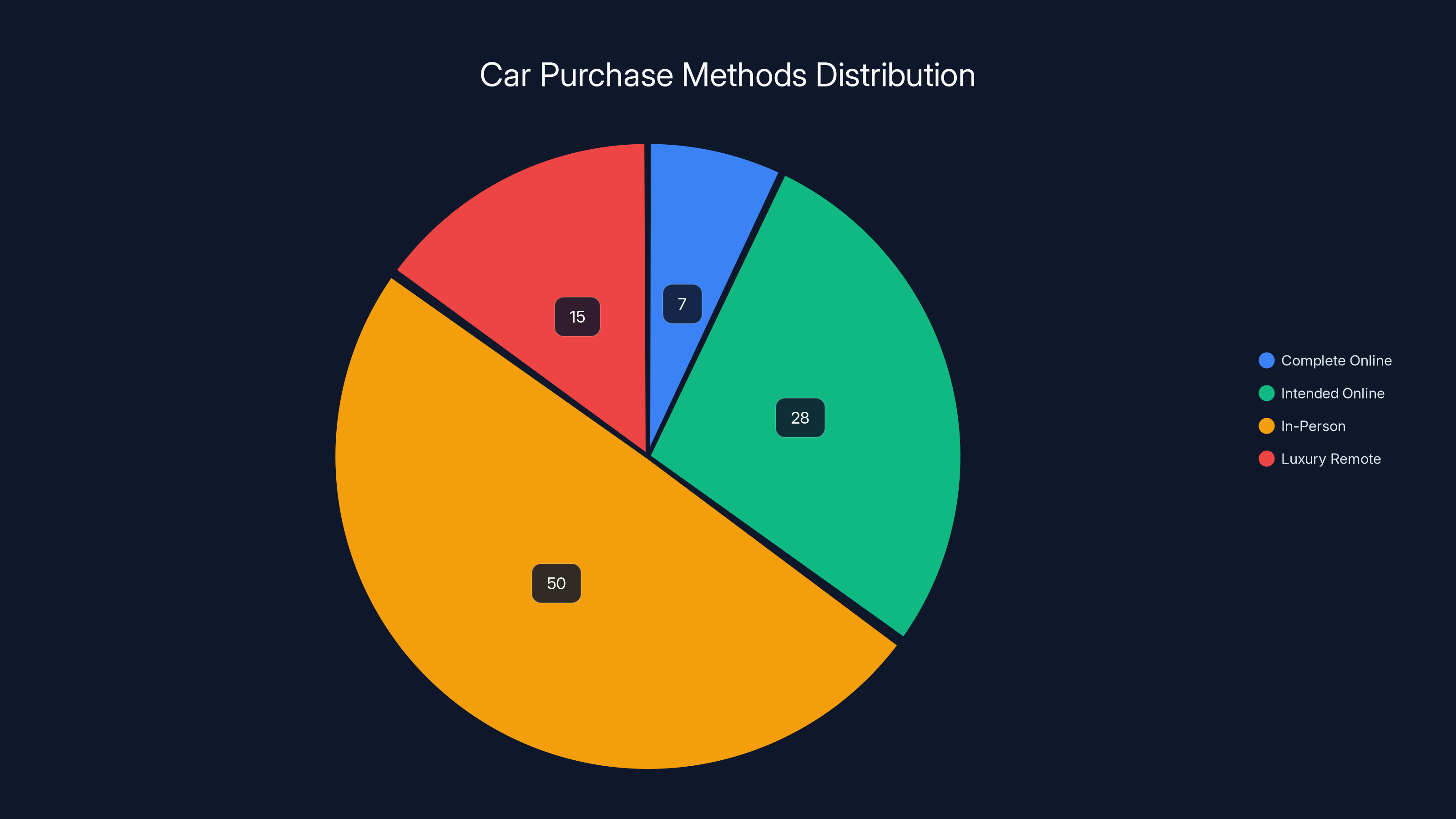

Industry data shows that despite years of investment, hype, and tech infrastructure, only 7 percent of new car buyers in the US actually complete their purchase entirely online. That's it. Seven percent. Meanwhile, more than half of buyers still conduct their entire purchase in person, at a traditional dealership, doing things pretty much the same way their parents did.

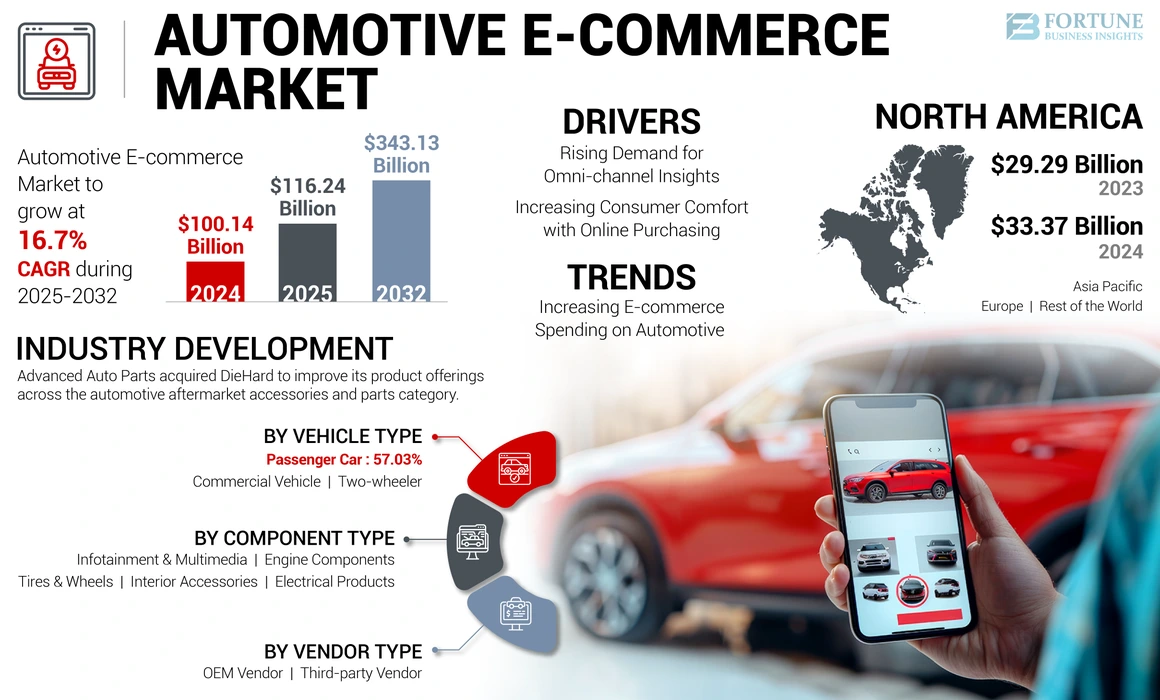

This is wild considering the push. Tesla proved direct-to-consumer sales work. Rivian followed suit. Amazon launched Autos in 2024 with massive resources behind it. Ford and Hyundai started selling certified pre-owned vehicles on Amazon's platform. Hertz built a fully online buying system. Dealerships themselves invested billions in digital infrastructure. Financial institutions rewired backend systems to enable remote transactions. Yet here we are, with consumers still preferring the old way.

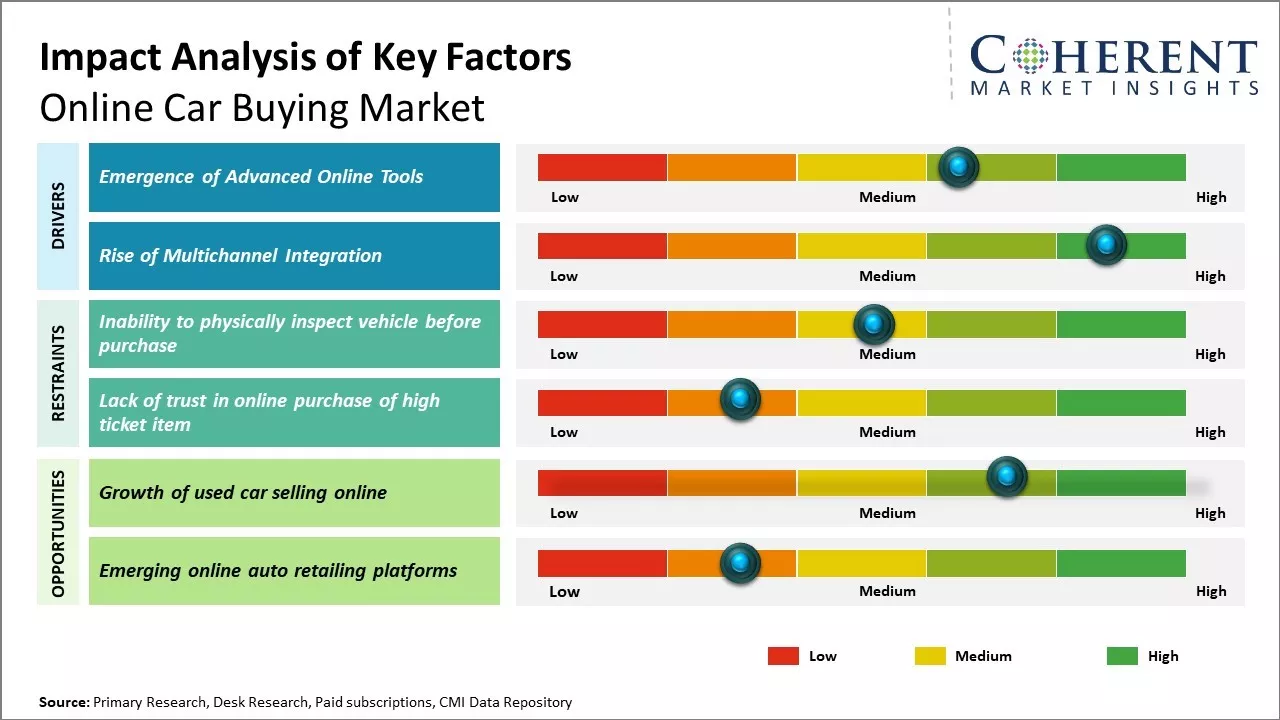

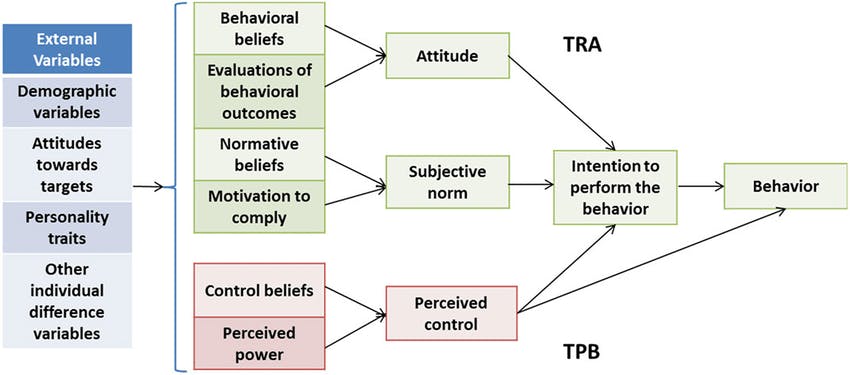

So what's going on? Why hasn't online car buying taken off? The answer isn't simple, and it's not because people are technologically backwards. It's more nuanced than that. It involves psychology, trust, regulation, the economy, and something fundamental about how people make expensive purchases.

Let's dig into why buying a car online remains one of the internet's biggest unfulfilled promises.

TL; DR

- Only 7% of buyers complete car purchases entirely online, despite 28% intending to, revealing a massive intention-action gap

- Financing anxiety is the primary blocker, causing buyers to abandon online transactions and visit dealerships in person

- Traditional dealerships still control the market, with 50%+ of transactions happening entirely in-person

- Trust and regulation present structural barriers, including title transfer complexity and consumer protection concerns

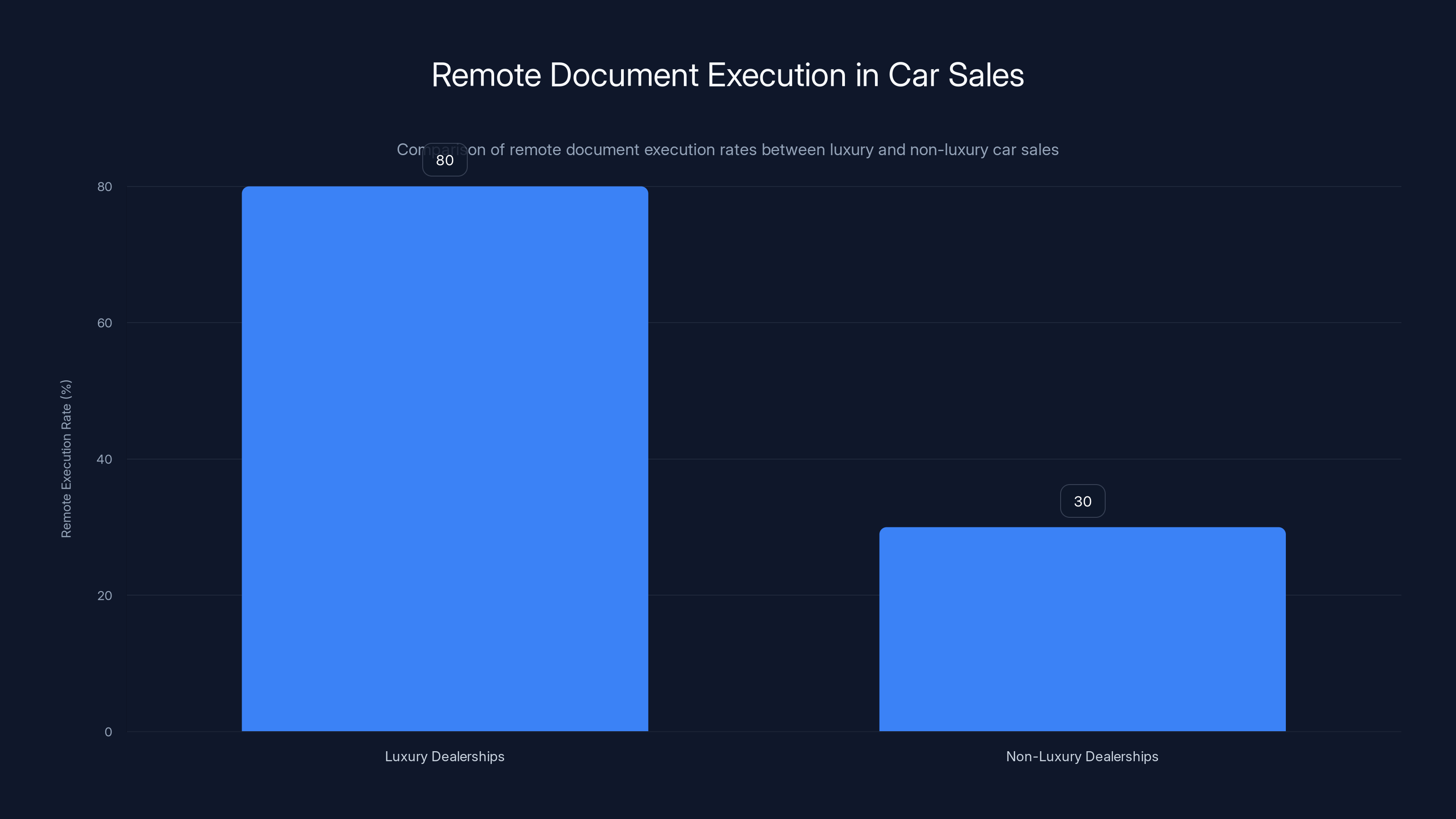

- The luxury segment leads adoption, with 80% of transactions executed remotely at high-end dealerships

Only 7% of new car buyers complete their purchase online, while 28% initially intend to. The majority, 72%, still prefer in-person purchases at traditional dealerships.

The Massive Intention-Action Gap Nobody's Talking About

Here's the most revealing stat: 28 percent of car buyers go into the process thinking they want to buy online. But only 7 percent actually do it. That's a gap of 21 percentage points. That's huge. It means three out of four people who intended to buy online changed their minds somewhere in the process.

This isn't a lack of internet adoption. It's not that people don't know how to use websites. Something about the car-buying experience specifically is triggering people to back out of the online channel.

When you think about it, that intention-action gap tells you almost everything you need to know. It's not a lack of interest in convenience. It's not that people think buying cars online is impossible. It's that something in the execution isn't working.

Cox Automotive, the company that tracks these numbers and also happens to make digital auto sales products, found that buyers overwhelmingly want to complete parts of the process online. Most loved researching inventory online. Many appreciated being able to apply for financing online without walking into a dealership. The problem emerges at specific friction points.

The most telling finding? Over half of car buyers wanted to physically sign paper copies of important documents. Let that sink in. We're in 2025, and more than 50 percent of buyers specifically prefer pen and paper for legal documents, rather than digital signatures. That's not a technology limitation. That's a trust issue.

Then there's this: 86 percent of surveyed buyers said they wanted to see a car in person before finalizing their purchase. That makes sense intuitively. You're spending thirty, forty, fifty thousand dollars. You want to touch it, sit in it, smell that specific car-smell. You want to verify the condition matches the photos. You want to test-drive it.

But here's what's interesting: this doesn't mean the entire purchase has to happen in person. These two things could be separate. You could finalize the deal online, then pick up the car. You could inspect and test-drive it at your convenience, then complete paperwork remotely. But that's not what's happening. Buyers are bundling the entire transaction into one in-person event.

Financing is Where Dreams Die

The biggest reason people abandon online car buying happens at exactly one point: financing.

Erin Lomax, vice president of consumer marketing at Cox Automotive, described this clearly: "They really figured out viewing inventory online. The steps relating to money and financing, that's where the anxiety comes in."

Think about it. You can handle research online. You can compare specifications, read reviews, check inventory across dealers. That's information gathering. Your brain is comfortable doing that on a screen.

But the moment money gets involved, something shifts psychologically. Suddenly you're not just making an informational decision anymore. You're about to commit to a massive financial obligation. You're going to be paying this off for five, six, maybe seven years. The stakes jump significantly.

Online, it all feels abstract. Numbers on a screen. Interest rates, loan terms, APR calculations. You can't see the person explaining it to you. You can't read the room. You can't negotiate if something feels off. And here's the thing: dealership finance managers are good at what they do. They're trained negotiators who can answer questions on the fly, who can offer alternatives, who can build confidence.

When buyers shift from researching online to financing online, they suddenly face a wall of complexity and jargon. They don't know what the terms really mean. They're suspicious they're getting a bad deal. They wonder if they could negotiate better. The anxiety spikes.

So what do they do? They go to the dealership. In person. Where they can talk to a human. Where they can ask questions and get immediate answers. Where they can feel more in control.

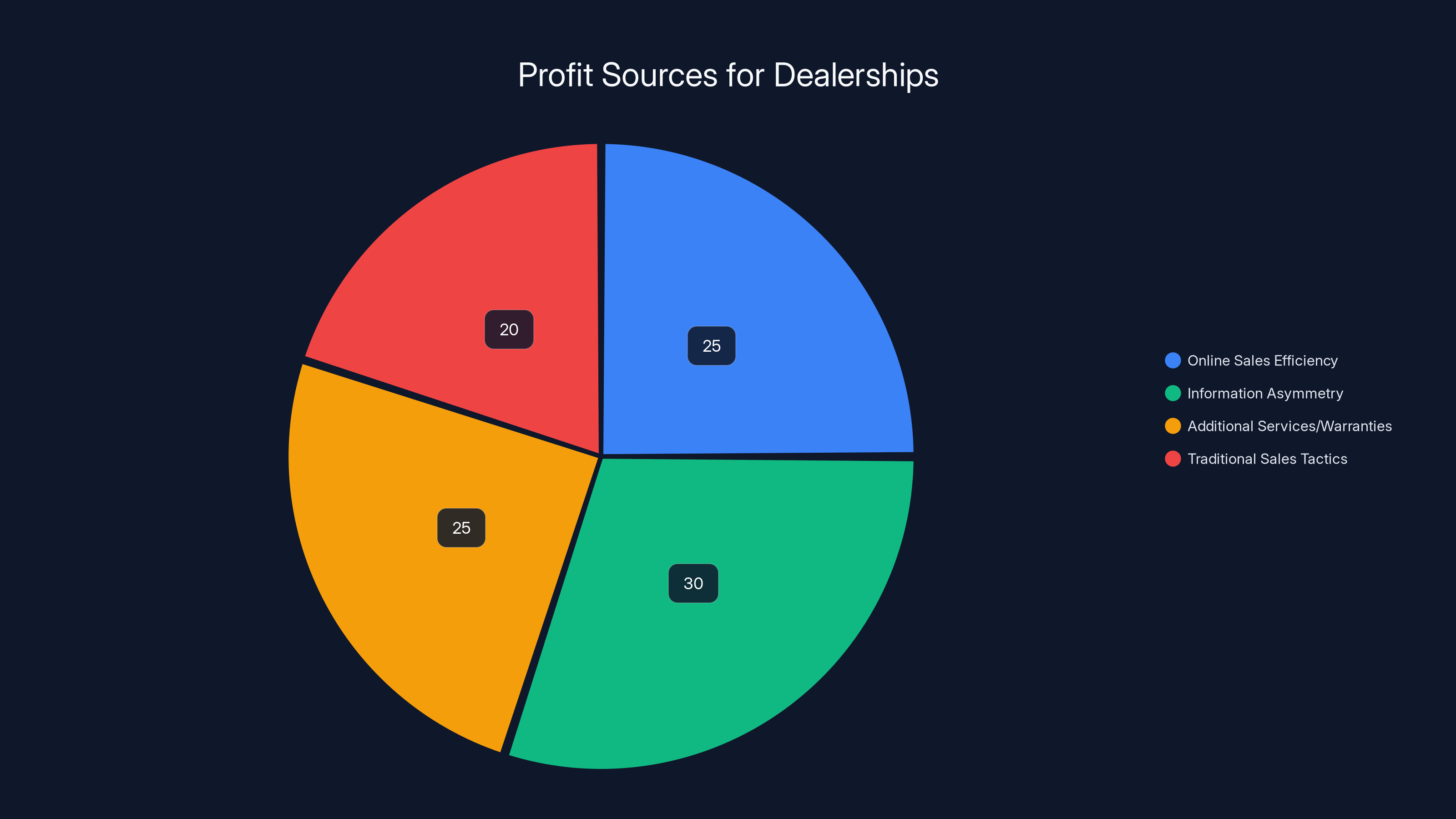

This is also where dealership margin lives. Finance managers typically make profit through add-ons, extended warranties, and favorable loan terms. Dealerships recognize that online financing removes their leverage. So they've been slow to truly adopt it.

But even when dealerships have built online financing capabilities, buyers are still going in person. That tells you the problem isn't the technology. It's the psychology of trust and control when large sums of money are involved.

Luxury dealerships report significantly higher remote document execution rates (80%) compared to non-luxury dealerships (30%). Estimated data.

Why Dealerships Still Control Everything

Traditional dealerships remain the dominant channel for car sales, and they have strong incentives to keep it that way.

For decades, dealerships have been the gatekeepers of car sales in America. That's not accident. It's structured into state franchise laws. Dealerships are protected by regulations that prevent manufacturers from selling directly to consumers in most states. This creates a moat around dealership profitability.

When you're a dealership, going digital is complicated. On one hand, efficiency gains from online transactions mean you spend less time per sale. Your salespeople can handle more transactions. Your back office can process deals faster. Jessie Dosanjh, president of the California Automotive Retailing Group, which owns 20 dealership franchises in the San Francisco Bay Area, said his business actually makes more profit on online sales. Not because customers pay more, but because the transaction is faster and requires less labor.

But there's a catch. Dealerships also make profit through information asymmetry. They know more about pricing than customers do. They can leverage negotiation tactics. They can add services and warranties that customers might not otherwise choose. When you move everything online, you lose those leverage points. Customers can compare pricing instantly. They can see what's available at other dealerships. They know the invoice price. The game becomes more transparent.

So dealerships are in a weird position. They benefit from some online tools (inventory management, customer lead generation, back-office efficiency). But they're threatened by full digitization because it removes their information advantage.

Meanwhile, the dealership experience itself is notoriously adversarial. The sales tactics, the finance manager's pressure to add warranties, the feeling that you're being played against the finance office while they're on their phone with a manager. People hate it. But they're used to it. They know what to expect. There's a rhythm to it, even if they don't like it.

Compare that to the abstract risk of an online transaction. You don't know what you're missing. You can't negotiate. If something goes wrong, who do you call? These unknowns are psychologically heavier than dealing with an annoying but familiar dealership.

Moreover, dealerships have massive distribution advantages. There are around 16,000 dealerships across the US. That's a lot of local presence. Someone in rural Montana can't easily buy online because there might not be a dealership nearby with their desired vehicle. So they go to the one dealership they have access to. The online option isn't actually available in practice.

The Trust Problem Nobody Wants to Admit

Here's something the industry doesn't talk about much: people don't trust online car purchases because they're genuinely higher risk than buying something from Amazon.

When you buy a book online, you know exactly what you're getting. If it's not right, you return it. Easy. Same with electronics, clothes, most things.

But cars are different. The condition of a used car matters enormously. You can see beautiful photos and think you're getting a great deal, then receive a car with hidden damage, transmission problems, or frame issues. You're responsible for that car now. If you discover problems after the purchase, it's your problem.

Dealerships, especially new car dealerships, come with warranties. If something breaks, there's recourse. You can go back to the dealership. They're legally liable. With an online purchase, especially from a private seller or an unfamiliar company, what's your recourse? It depends on state law, the company's policies, and whether they're even solvent when you need them.

Used-car retailers like Carvana and Car Max have tried to address this by offering return windows and extended warranties. But even they've run into problems. Carvana specifically faced reputation damage over quality issues and return hassles. That hurt the entire industry's credibility.

Then there's the regulatory complexity. When you buy a car, you're completing a transaction involving:

- Title transfer (handled by the state DMV)

- Licensing and registration

- Proof of insurance requirements

- Lien documentation if you're financing

- Odometer certification (for used vehicles)

- Various state-specific requirements

Federal law actually prohibits manufacturers from selling direct to consumers in most states (thanks, franchise dealerships lobbying). Some states have recently opened up to direct sales or have carved out exceptions for certain EV manufacturers, but the patchwork is confusing.

When you walk into a dealership, they handle all this. You don't have to think about it. They navigate the regulatory requirements. They know which forms to file with which agency. They manage the logistics.

Online, suddenly you're responsible for understanding your state's specific requirements. Or the company is responsible, which raises questions: are they doing it correctly? Will there be problems later? What if your title doesn't show up in the system?

This regulatory complexity isn't a technology problem. It's a structural problem that requires either aggressive regulatory modernization or for companies to build massive back-office operations to manage state-by-state compliance.

Amazon Autos and the False Start

Amazon Autos launched in 2024 with enormous resources and credibility behind it. This was supposed to be the moment that finally cracked the code. Amazon broke every other industry. E-commerce, cloud computing, grocery delivery. Surely they could break car sales.

Except they haven't. At least not yet.

Amazon's approach is clever: they let you research, compare, and sometimes finance vehicles on their platform, then refer you to local dealerships to complete the purchase. It's a hybrid model. They're not trying to replace dealerships. They're trying to bring dealership transactions to Amazon Prime customers.

On paper, this should work. Amazon has customer trust. They have a massive audience. They have the resources to build great comparison tools. Jessyka Faison, an Amazon spokesperson, said they're "very encouraged by the strong positive response." She also noted that customers often browse Amazon Autos during evening hours when dealers are closed.

That detail is telling. It means people are interested in researching online. They want to browse during their own hours. They want to compare options without pressure. They want information.

But the fact that they're browsing at night suggests they're not completing transactions. They're researching. They're shopping. But when it's time to actually buy, they're probably going into a dealership during business hours.

Amazon also noted that Ford and Hyundai started allowing customers to buy certified pre-owned vehicles directly through the Amazon platform. That's more aggressive than the initial model. You could theoretically complete the purchase on Amazon and pick up the vehicle at a Ford or Hyundai dealership.

Yet adoption hasn't exploded. Why? Probably because people still don't trust a purchase that happens primarily through Amazon for a product that costs fifty grand. They want to inspect it first. They want to test-drive it. They want to do those things before committing to the purchase, not after.

Amazon Autos represents the industry's best effort so far. They have capital, technology, and customer loyalty. If anyone could make online car buying happen, it's them. But so far, it's not accelerating the trend toward digital-only transactions.

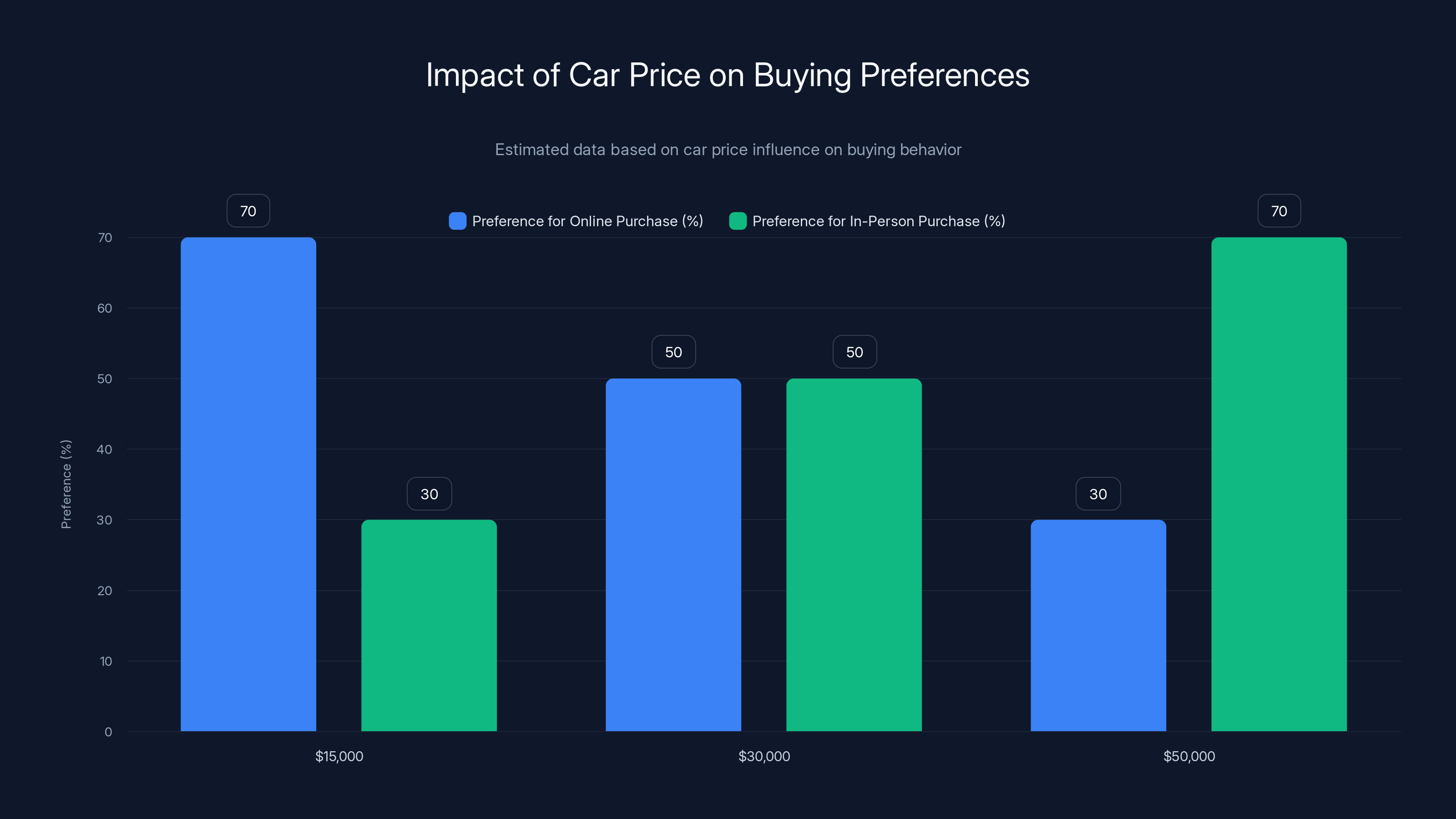

As car prices increase, the preference for in-person purchases rises due to higher perceived risk and the need for reassurance. Estimated data reflects this trend.

The Luxury Segment's Different Game

There's one part of the market where online car buying is actually working: luxury vehicles.

At Dosanjh's Cadillac dealership in Dublin, California, 80 percent of sales documents get executed remotely. That's remarkable. And it's not an outlier. Luxury dealerships across the country report higher rates of remote document execution and digital transaction completion.

Why? Several factors converge.

First, luxury buyers are typically wealthier and more comfortable with digital transactions generally. They're used to high-stakes financial moves happening on their devices. They trust the security and legitimacy of established institutions more readily.

Second, luxury dealerships attract a different customer profile: busy executives, successful entrepreneurs, people with limited free time. Convenience isn't a nice-to-have for them. It's essential. Dosanjh put it perfectly: "People are really busy in the luxury segment. They demand convenience."

Third, luxury vehicles come with higher margins. A dealership can justify investing in premium digital infrastructure, customer service, and process optimization because the economics work. A customer buying a

Fourth, the psychological dynamic is different. When you're buying a luxury vehicle, you're already committing to a premium product and premium service. Remote document execution feels consistent with that premium experience. When you're buying a mid-market car at a franchise dealership, it feels risky and cheap to do it all online.

The luxury segment proves online car buying can work at scale. But it works where customers are already predisposed to embrace digital transactions and where dealerships can afford to optimize for convenience. For the mass market, those conditions don't exist yet.

What Direct-Sales Automakers Got Right (and What They Didn't)

Tesla pioneered direct-to-consumer car sales in the US. No dealerships. No intermediaries. You configure your car online, place an order, and wait for delivery. Rivian followed the same model.

This seemed like it would revolutionize the entire industry. Dealership-free sales eliminate middlemen, reduce costs, and should theoretically make buying easier and more transparent.

But here's what happened: even Tesla and Rivian customers often visit showrooms or service centers before completing purchases. And these companies have run into regulatory battles in multiple states where dealers have lobbied against direct sales. The franchise dealer lobby is powerful.

What direct-sales automakers got right: they proved that you can sell cars entirely online if you control the entire experience. They don't have to work with a dealership network. They don't have the dealership's legacy constraints. They can optimize every step for digital.

What they didn't fix: the psychological barriers remain. Even Tesla buyers sometimes want to see the car in person. Even with a fully digital process, people still have anxiety about large purchases.

Also, both Tesla and Rivian sell premium vehicles. The luxury factor changes the calculus. Compare that to if Tesla were trying to sell a $15,000 economy car entirely online. The adoption curve would probably look very different.

The Price Point Problem

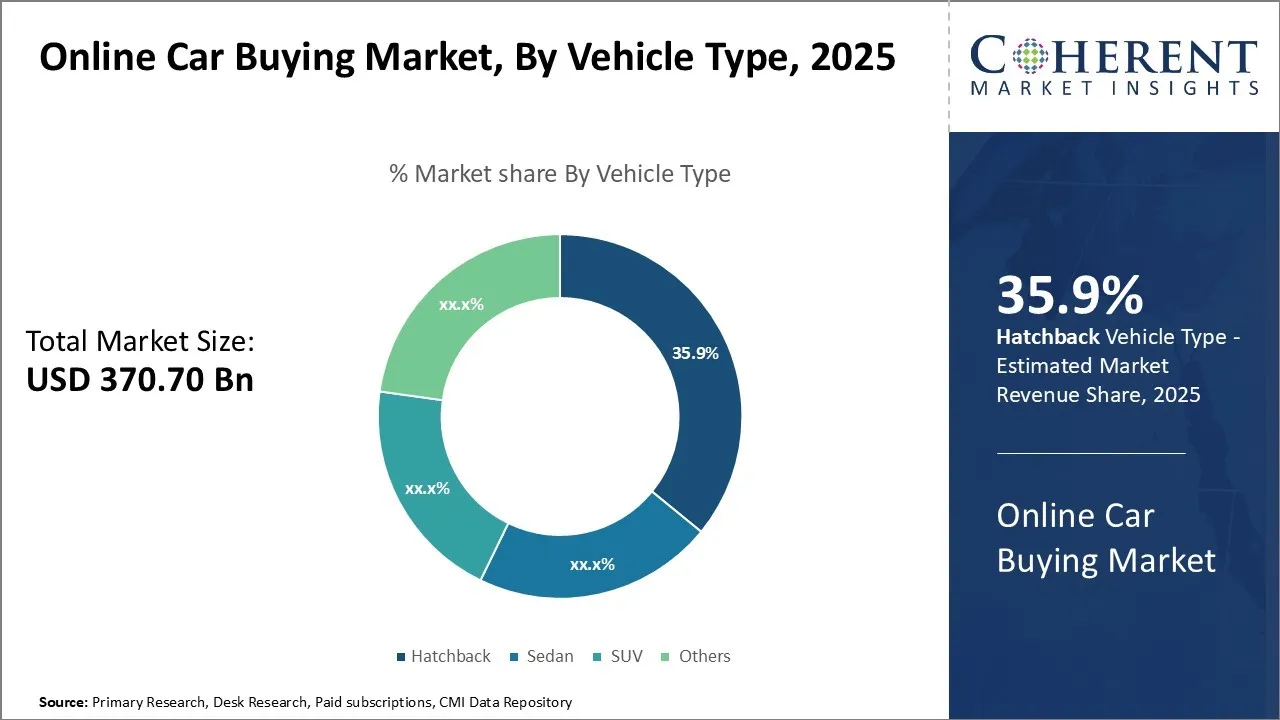

The average new car price surpassed $50,000 in late 2024. That's eye-watering. And it's creating new constraints on online buying.

When a purchase costs $50,000 or more, the psychology of risk intensifies. You're not just buying an object. You're making a financial commitment that will affect your life for years. You're probably financing it. You're probably thinking about opportunity cost. You might be anxious about the decision.

Under those circumstances, people become more risk-averse. They want more control. They want more information. They want to verify things for themselves. Digital-only purchases feel risky.

Conversely, if cars were more affordable, online buying might be higher. At

Meanwhile, 62 percent of surveyed car buyers said they think owning or leasing a vehicle is becoming too expensive. That's significant. People are already struggling with car prices. They're probably also more anxious about making a purchase. They're going to be more cautious, not less. That caution manifests as wanting to see the car in person and negotiate in person, rather than trusting an online transaction.

As prices rise, the incentive to optimize the buying process increases. But the psychological barrier also increases. It's a paradox that's pushing adoption in opposite directions simultaneously.

Financing complexity is the leading cause of abandonment in online car purchases, accounting for an estimated 40% of cases. (Estimated data)

The Negotiation Culture Problem

Here's something crucial that rarely gets discussed: American car buying culture is built on negotiation.

When you go into a dealership, you expect to negotiate. You haggle over price. You try to get a better deal. You might trade in your old car and negotiate that separately. You might try to get the dealer to throw in extras.

This negotiation culture has deep roots. It's how dealerships operate. It's how customers expect the process to work. There's even a game quality to it. Some people enjoy the back-and-forth.

Now, here's the problem with moving this online: negotiation requires flexibility and real-time communication. It requires creativity and adaptation from both sides. It's hard to build software that captures the full dynamism of a human negotiation.

Companies like Carvana and Car Max tried to eliminate negotiation altogether. They publish a price, you take it or leave it. That's actually more transparent. But it's also a massive change from the dealership culture. Some customers love it because it removes the need to haggle. But others resent it because they can't negotiate.

Meanwhile, traditional dealerships fought back partly by arguing that they offer negotiation and personalized deals, which online retailers don't. In the luxury segment, this argument resonates. Premium buyers want to feel like they're getting special treatment. They want to negotiate and get a personalized deal.

So online-only car retailers are caught in a bind: if they enable negotiation, they need human staff to conduct it, which defeats the purpose of being online-only. If they don't enable negotiation, they're forcing a different model onto customers who might prefer to haggle.

Dealerships don't have this problem. Negotiation is native to their model. That's another structural advantage they maintain.

Regulatory Fragmentation and Title Transfer Hell

The United States has no national car buying or ownership system. Each state has its own DMV, its own title and registration process, and its own specific requirements.

Buying a car in California involves different paperwork than buying a car in Texas, which involves different paperwork than buying in New York. The forms vary. The timelines vary. Some states accept electronic signatures. Others still require physical signatures. Some states use electronic title systems. Others use paper titles.

This fragmentation is catastrophic for online car buying at scale.

When you buy a car from a local dealership, they navigate this complexity for you. They know their state's specific requirements because they deal with them every single day. They know which forms to file, which agencies to contact, and what problems might arise. They've probably seen every edge case.

When you buy a car online from a national company, that company has to manage 50 different regulatory regimes. That's expensive. It requires massive legal compliance operations. It creates opportunities for errors. If a company gets title transfer wrong in even a few states, it damages their reputation nationwide.

Some states have recognized this problem and begun modernizing their systems. Electronic title transfer, which would make online car buying much easier, is rolling out slowly. But adoption is uneven. A national online car retailer still has to deal with a patchwork of regulations.

Meanwhile, dealerships have lobbied actively to keep these regulations fragmented. Fragmentation creates barriers to entry for online competitors. If buying a car online required navigating a complex regulatory maze in all 50 states, fewer startups would attempt it.

This is a structural problem that's harder to solve than technology. It requires either regulatory modernization or companies investing heavily in legal and compliance infrastructure. Most startups don't have capital for that. Established dealers do. That tilts the playing field toward traditional dealerships.

The Return and Warranty Problem

One of the biggest hidden barriers to online car buying is this: what happens if something goes wrong?

Carvana tried to solve this by offering a 7-day return window. If you don't like the car, you can return it. Sounds great in theory. In practice, it's created enormous problems. Returns are expensive (you have to get the car back to Carvana). Processing returns takes time. And Carvana's execution on returns has been spotty enough that it damaged the company's reputation.

Meanwhile, traditional dealerships have decades of experience handling returns, complaints, and warranty issues. They have established processes. They have local service centers. They have relationships with manufacturers. If something goes wrong with a new car, you go back to the dealership. They'll service it under warranty. It's straightforward.

With online car retailers, the process is murkier. Carvana's issues with returns made this clear. If you're buying from a startup, what's your guarantee they'll still be in business if you need warranty service a few years from now?

For used cars specifically, return policies and warranties are even more complicated. Most used cars are sold as-is. You're buying the vehicle in its current condition. Some dealers offer extended warranties you can purchase, but that's an additional cost and an additional layer of complexity.

When you buy a used car from a local dealership, you might negotiate a warranty as part of the deal. You can argue that you found a problem and want them to fix it. The negotiation is fluid. With an online purchase, everything is predetermined. Here's the warranty. Here are the terms. Take it or leave it.

For risk-averse consumers, that's another reason to prefer a dealership where they can negotiate terms and feel like they have more control.

Despite 28% intending to buy cars online, only 7% complete the purchase online. Traditional dealerships dominate with over 50% in-person transactions, while the luxury segment sees 80% remote transactions. Estimated data.

The Test Drive Imperative

You can't buy a car without test-driving it. This is closer to universal truth than preference.

Consumers need to know how the car feels. Does the steering feel right? How's the acceleration? What's the visibility like? How do the seats feel after 30 minutes? What's the sound system quality? Does it have enough trunk space for your lifestyle?

These are things you cannot evaluate from photos or video. You need to experience them in person.

Some companies have tried to solve this with 360-degree videos or virtual test drives. These help you see the car from different angles. But they don't solve the core problem: you can't sit in it. You can't drive it. You can't feel how it performs on roads you know.

This is such a fundamental requirement that it actually eliminates most pure online-only car buying models. Even Carvana and Car Max, which sell primarily online, recognize that customers want to see the vehicle. Car Max has local lots where customers can visit. Carvana has vending machine-style pickup locations.

So the online-only car selling companies have all converged on a hybrid model: research online, finalize some paperwork online, but ultimately you need to inspect and potentially test-drive the vehicle in person.

For the test drive, you need a location. For the handoff, you need a physical place. This requirement for physical infrastructure is another structural advantage traditional dealerships maintain. They already have lots. They already have facilities. An online startup has to build all this out.

And if you're building out physical locations anyway, you're not really online-only anymore. You're hybrid. You've recreated part of the dealership model. Your advantages over traditional dealerships shrink.

What's Actually Working in Online Car Buying

Despite the headwinds, some aspects of online car buying are genuinely working and worth highlighting.

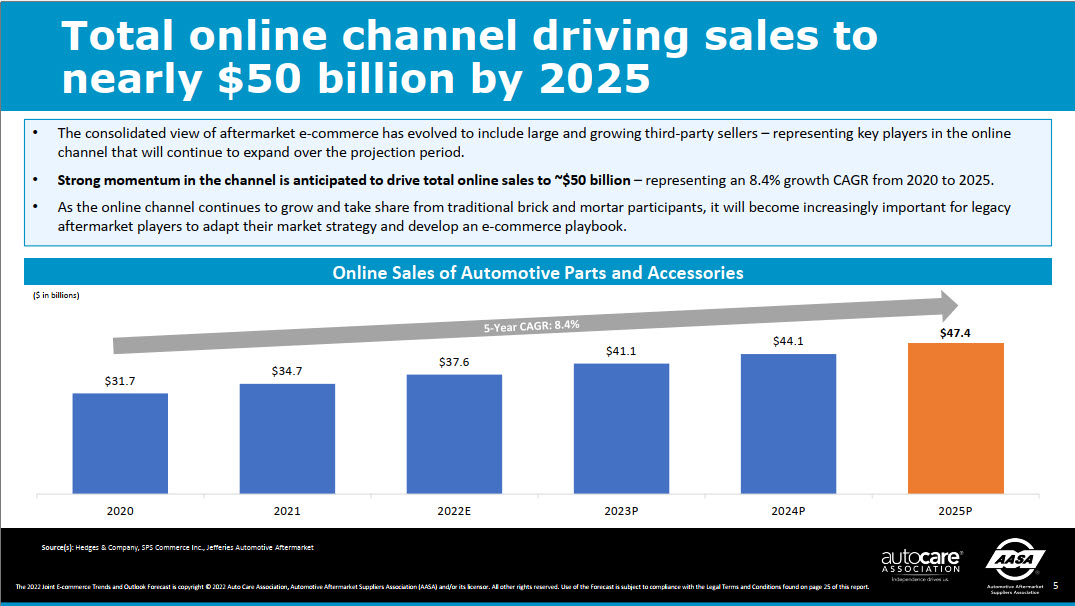

Research and comparison are now heavily online. Customers start online. They look at inventories, read reviews, check prices across multiple dealerships. This is a massive change from even 10 years ago. Dealerships recognize this and have adapted by building better online inventory tools, comparison features, and information transparency.

Financing pre-approval is happening online. You can go to a dealership website, enter financial information, and get pre-approved for a loan without walking in. This is genuinely useful. It removes some of the mystery from financing and lets you shop with knowledge of what you can afford.

Trade-in appraisals can happen online or through quick in-person inspections. You can get estimates for your current vehicle's value without a lengthy dealer negotiation. Several sites make this relatively straightforward.

After-market services are moving online. Extended warranties, service plans, gap insurance, and other add-ons can now be quoted and purchased with less hassle.

So the system is becoming more digital. Just not in the way the industry initially expected. It's not that the entire transaction is moving online. Instead, specific components of the process are moving online, and people are becoming more comfortable completing parts of the purchase digitally.

The dealership isn't being eliminated. It's being integrated into a larger online ecosystem.

The Coming EV Disruption (Maybe)

Electric vehicles are supposed to disrupt car buying. Here's the theory: EV buyers are different. They're tech-forward. They're comfortable with digital interfaces. They might be more receptive to online buying.

Ford CEO Jim Farley explicitly said Ford needs to adopt Tesla's direct sales model and move to "100 percent online" for EV sales. That suggests the auto industry sees EV buyers as different and more amenable to digital purchasing.

But there's a catch. EV pricing is volatile. Battery costs are falling, but unpredictably. Used EV values are uncertain because we don't have years of long-term ownership data. When things are uncertain, people want to evaluate in person. They want to drive the car. They want to feel confident.

Also, EV buying involves education. Most people still don't understand how EVs work, what the real driving range is, how charging works, or what the total cost of ownership looks like. You need someone to explain this. Digital educational content helps, but a conversation with a knowledgeable person is even better.

Dealerships recognize this. They're hiring EV specialists. They're training staff to explain EV technology to customers. They're creating demo areas where customers can experience EVs.

So even as EVs disrupt the market, the basic structure of car buying might persist: research online, get pre-approved online, talk to a specialist online or in person, but ultimately verify the vehicle in person and complete paperwork with human support.

Dealerships derive profit from various sources, with information asymmetry and online sales efficiency being significant contributors. Estimated data.

The Psychology of Big Purchases

Here's something fundamental that technology companies sometimes miss: buying a car is not the same as buying a book or even a laptop.

A car is possibly the second-most expensive purchase most people make in their lives, after a house. It's something you'll use multiple times per day. It affects your daily experience. It's tied to identity and status in subtle ways.

When stakes are that high, psychology takes over. People become more risk-averse. They want more information. They want to verify things for themselves. They want human interaction. They want to feel like they have control and agency.

Digital transactions can optimize for efficiency and information transparency. But they struggle with the emotional and psychological aspects of high-stakes decisions.

A dealership, at its best, provides reassurance. A human who can answer questions, who can explain warranties, who can troubleshoot concerns, and who is physically present and accountable. That's psychologically powerful when stakes are high.

Online, everything is mediated through interfaces. You're not sure if you're talking to a human or a chatbot. You can't read tone of voice or body language. You can't build rapport. If something goes wrong, it's unclear who you should contact or whether they'll actually help.

For high-stakes purchases, humans still win on psychological comfort, even when digital is objectively more efficient.

What It Would Take to Actually Fix This

If the auto industry wanted to push online car buying adoption significantly, what would it take?

First, regulatory modernization. Streamlining title transfer across states. Creating standardized processes. Accepting electronic signatures and digital documentation everywhere. This would lower the friction and risk significantly.

Second, decoupling the inspection and test drive from the purchase. Let people buy online, then schedule in-person inspection and test drive after the transaction. Or vice versa: inspect and test drive, then complete purchase online. Give customers the option to sequence these differently.

Third, transparency on financing. Most dealerships keep financing complexity deliberately opaque. If financing were transparent, if terms were standardized, if APRs were clearly explained, people would have less anxiety doing it online.

Fourth, establishing truly confident warranty and return policies. Carvana's issues suggest this is harder than it sounds. But a company that could definitively solve the "what if something goes wrong" question would have huge advantages.

Fifth, expanding test drive and inspection options. Mobile inspection services, partnerships with local mechanics, logistics networks that let people inspect vehicles near their home. Anything that removes the requirement to visit a physical dealership lot.

Sixth, cultural shift. We need people to become more comfortable with digital-only transactions for large purchases. That's a long-term thing. Each generation gets more comfortable with digital. Eventually, online buying will probably be the default. But we're not there yet.

Lastly, meaningful cost savings. If buying online saved you $5,000, that would matter. But if it just shifts the hassle around without saving money, people won't prioritize it. Companies need to pass through enough of the cost savings to make online buying genuinely attractive.

None of these are impossible. But they require coordinated effort across an industry that has fragmented incentives.

What the Numbers Actually Mean

That 7 percent figure is real and significant. But it's also not the whole story.

If we broaden the definition of "online car buying" to include things like financing pre-approval, trade-in evaluation, and other digital components, the percentage goes up substantially. Most new car purchases now involve online research and digital tools.

But the core transaction, the moment of purchase commitment, still happens in-person for 93 percent of buyers. That's the real insight.

What does that tell us? That technology is flowing into car buying, but the fundamental structure persists. People are comfortable with online components. They're not comfortable with going fully digital for the entire process.

This is probably the stable equilibrium. A hybrid model where you can research and compare online, get financing approved online, and handle paperwork digitally. But you still visit a dealership to inspect the vehicle, test-drive it, and complete the transaction in person.

Dealerships will continue to evolve. They'll get better at digital. They'll reduce the annoying aspects of the experience. But the idea of buying a car entirely online, sight-unseen, probably won't become the norm anytime soon.

The Dealership Isn't Dead (Yet)

There's a temptation to predict that dealerships will disappear. That online car buying will eventually take over entirely. That the old dealership model is in death throes.

Probably not.

Dealerships have structural advantages that are hard to overcome. They have physical presence. They have local expertise. They have customer relationships built over years. They have regulatory protection through franchise laws. They have the legal and logistical infrastructure to handle title transfer and registration.

Meanwhile, every company that's tried to disrupt car selling has run into the same walls. The regulatory maze. The need for physical locations. The test-drive requirement. The financing complexity. The need for customer service.

Tesla proved you can sell cars without dealerships if you control the entire experience and have massive resources. But even Tesla hasn't completely eliminated the dealership experience. You still visit service centers. And dealers have lobbied successfully to limit Tesla's expansion in many states.

The more realistic future is a hybrid market. Some people will buy online from Carvana or Car Max or Amazon Autos. Some will buy from dealers who've improved their online experience. Some will buy directly from manufacturers for EVs where that's legal. But the vast majority will probably continue doing what they're doing now: research online, negotiate at a dealership, buy mostly in person.

That's not an exciting prediction. But it's probably the accurate one.

Lessons for Other Industries

Car buying's resistance to online disruption teaches us something valuable about digital transformation more broadly.

Not every industry will move online just because the technology exists. Some purchases are fundamentally high-stakes. Some require human verification and trust-building. Some are regulated in ways that create structural barriers. Some are tied to cultural practices that change slowly.

The companies that successfully disrupt these industries won't just build better digital tools. They'll solve the trust problem. They'll navigate the regulatory maze. They'll create offline infrastructure where needed. They'll integrate digital and physical experiences.

Pure digital disruption rarely works for high-stakes transactions. Hybrid models that combine digital efficiency with human touchpoints are more likely to succeed. That's the lesson of car buying and probably many other industries too.

Where We Go From Here

Car buying will keep evolving. More digital tools will emerge. Regulatory barriers will gradually fall. New companies will try new approaches.

But the core dynamic probably won't shift dramatically. People will want to see cars in person. They'll want to drive them. They'll want human interaction during financing. They'll want someone to hold accountable if something goes wrong.

Those are human needs, not technology problems. Technology can make the process more efficient. It can increase transparency. It can reduce friction. But it can't eliminate the fundamental human requirement for trust and control during expensive purchases.

The auto industry's push toward online car buying was based on the assumption that convenience and efficiency would win. But buying a car isn't like buying anything else. The stakes are too high. The emotions are too strong. The need for verification is too fundamental.

So here we are, at 7 percent. And we'll probably stay here, or climb slowly, until the underlying psychology of expensive purchases fundamentally shifts. That might happen eventually. Or it might not. But it won't happen just because better technology exists. There has to be a shift in how people think about trust, risk, and control during high-stakes transactions.

Until then, dealerships will adapt. They'll get less awful. They'll offer better digital options. They'll meet customers halfway. And most people will probably keep walking into a dealership to buy a car, even though they could do it online.

That's not a failure of technology. It's just how humans work.

FAQ

Why isn't online car buying more popular if the technology exists?

The barrier isn't technology. It's psychology and trust. Buying a car costs

What percentage of car buyers actually complete their purchase online?

Only 7 percent of new car buyers in the US complete their entire purchase online, despite 28 percent initially intending to. This massive intention-action gap reveals that people abandon online car buying at specific friction points, particularly during financing. More than half of car buyers still conduct their entire purchase entirely in person at traditional dealerships.

Why do people abandon online car buying during the financing stage?

Financing is where emotional and financial anxiety peaks. Online financing feels abstract and risky. Buyers can't ask real-time questions or negotiate terms directly. They worry they're getting a bad deal. A human finance manager at a dealership can provide reassurance, explain complex terms, and offer alternatives. This human element significantly reduces psychological anxiety during the most financially consequential part of the transaction.

Do luxury car buyers complete purchases online more often?

Yes. At luxury dealerships, 80 percent or more of sales documents are executed remotely. Luxury buyers typically have higher comfort with digital transactions, value convenience more highly, and have the resources to trust remote purchases. Dealerships can also afford premium digital infrastructure for this segment. The economics and psychology of luxury purchasing are fundamentally different from mass-market car buying.

What's preventing Amazon Autos from accelerating online car buying?

Amazon Autos launched in 2024 with massive resources and credibility, but adoption has remained limited. The platform still requires buyers to visit local dealerships to inspect, test-drive, and finalize purchases. Even though Amazon Autos provides research and comparison tools, buyers still need to see the vehicle in person before committing. This requirement for physical interaction limits Amazon's ability to create a fully digital experience.

How does title transfer complexity block online car buying?

The US has no unified car sales system. Each state has different DMV requirements, registration processes, and title transfer procedures. Some states accept electronic signatures. Others require physical signatures. Some use digital titles. Others use paper. This regulatory fragmentation creates enormous complexity for national online retailers. Dealerships handle this complexity easily because they operate locally. Online companies must navigate 50 different systems, which is expensive and error-prone.

Will electric vehicles change online car buying adoption?

Probably not dramatically. While EV buyers tend to be more tech-forward, they also need education about how EVs work, charging infrastructure, and total cost of ownership. Used EV values are uncertain. Pricing is volatile. When purchasing uncertainty is high, people want to see the vehicle in person and talk to specialists. Ford and other automakers are betting that EV buyers will embrace direct sales, but evidence so far suggests hybrid models (digital plus in-person) will dominate.

What would be required to significantly increase online car buying?

Multiple coordinated changes would help: regulatory modernization to standardize title transfer, transparent financing with clear APR presentation, strong warranty and return policies, decoupling inspection/test-drive from purchase transactions, expanded mobile inspection services, and cultural shifts as younger generations become more comfortable with digital-only transactions. Additionally, meaningful cost savings from online buying would incentivize adoption. However, the fundamental psychological preference for human interaction during expensive purchases may remain structurally limiting.

Conclusion

So we're back to where we started: only 7 percent of car buyers complete their purchases online. After years of industry investment, tech advancement, and dedicated companies trying to disrupt the market, the needle has barely moved.

This isn't a failure of effort or innovation. Companies like Amazon, Tesla, Carvana, and hundreds of others have invested billions trying to move car buying online. Dealerships have modernized their technology significantly. Payment processors have rebuilt backend systems. Regulatory frameworks have evolved in some states.

But the fundamental reality persists: most people don't want to buy cars entirely online.

That's not because they're backwards or technologically uncomfortable. It's because buying a car is different from buying anything else. It's too expensive. Too personal. Too tied to daily life and experience. Too risky to complete sight-unseen.

When stakes are that high, humans default to wanting verification, human interaction, and control. Technology can optimize the process, but it can't eliminate the psychological need for trust-building during expensive purchases.

What we're probably seeing, instead of a complete digital transformation, is a gradual shift toward hybrid models. Research online, financing partially online, paperwork increasingly digital, but always with some in-person component for inspection, test-drive, and closure.

Traditional dealerships aren't going anywhere. They're adapting. They're becoming more digital where it makes sense. They're less adversarial than they used to be. They're improving their customer experience. But the core model persists.

And for most car buyers, that's probably fine. The dealership experience has gotten better. The information is more transparent. The process is less mysterious. It's not perfect. But it's increasingly functional.

Maybe in another decade, online car buying will be more common. Maybe generational shifts will normalize digital transactions for large purchases. Maybe regulatory modernization will reduce complexity. Maybe trust in digital processes will improve.

But right now, at 7 percent, online car buying is an exception, not the norm. And it's probably going to stay that way for a while.

That's not a tech story. It's a human story. And humans are proving, once again, that when it really matters, they want to deal with other humans.

Key Takeaways

- Only 7% of US car buyers complete purchases entirely online despite 28% intending to, revealing a massive intention-action gap driven by psychological anxiety

- Financing complexity and trust issues cause buyers to abandon online transactions and visit dealerships in person

- Regulatory fragmentation across 50 states and title transfer requirements create structural barriers that technology alone cannot solve

- Luxury dealerships achieve 80%+ remote document execution, proving online buying works when buyers value convenience and dealerships invest in digital infrastructure

- The requirement to inspect, test-drive, and verify cars in person remains fundamental to consumer confidence at high price points

Related Articles

- Google Assistant Broken on Android Auto: Gemini Rollout Delays Explained [2025]

- Chevrolet Bolt EUV Returns 2027: LFP Battery, 262 Miles, 150kW Fast Charging [2025]

- Kia EV2: The Compact EV That's Shaking Up Europe [2025]

- Solid-State Batteries: The EV Revolution Finally Here [2025]

- Ford's AI Assistant Revolution: What's Coming to Your Car in 2027 [2025]

- Sony Honda's Afeela 1 EV: Why It Feels Outdated at CES 2026 [Review]

![Why Online Car Buying Still Isn't Happening [2025]](https://tryrunable.com/blog/why-online-car-buying-still-isn-t-happening-2025/image-1-1768736157851.jpg)