Introduction: The Expensive Bet That Didn't Pay Off

Peloton made a massive bet last fall. The fitness company launched an entirely new hardware lineup featuring swivel screens, AI-powered coaching, and real-time form correction. Prices were higher than ever before. CEO Peter Stern was betting that loyal Peloton users would line up to upgrade. They didn't.

When Q2 2026 earnings rolled around, the results told the real story. The hardware refresh tanked. Fewer existing subscribers upgraded than expected. Holiday sales, usually Peloton's strongest quarter, fell flat. The stock dropped roughly 20 percent overnight. Even worse, the company announced layoffs cutting 11 percent of the workforce and the CFO was leaving by month's end.

This wasn't just a bad quarter. This was a strategic miscalculation that exposed something fundamental about how Peloton misunderstood its own customer base.

For years, Peloton built its reputation on loyal subscribers who treated their equipment like family heirlooms. These people didn't upgrade gadgets every two years. They rode the same bike, ran on the same tread, and remained committed because the experience worked. They'd invested thousands of dollars and hundreds of hours. So when Peloton announced equipment that would cost even more and required ditching perfectly good hardware, something broke.

The disconnect wasn't about the features. The Peloton IQ system showed real promise. Forty-six percent of users engaged with the new AI features. That's solid adoption for cutting-edge tech. But engagement with features didn't translate to hardware purchases. And that's where Stern's bet fell apart.

This story matters beyond Peloton's quarterly earnings. It reveals a critical tension in premium hardware strategy: the difference between innovation that excites and innovation that alienates. It shows how loyalty, once broken, is expensive to rebuild. And it demonstrates why pricing strategy and customer communication might matter more than raw technology.

Let's dig into what actually happened, why it happened, and what it tells us about the future of fitness hardware and premium consumer electronics.

TL; DR

- The Failed Hardware Refresh: Peloton launched entirely new equipment in October 2025 with swivel screens, AI coaching, and cameras, but fewer existing subscribers upgraded than expected during holiday sales

- Aggressive Pricing Backfired: The new Tread Plus reached $6,695, alongside subscription price hikes, which deterred upgrades from users already invested in older equipment

- No Trade-In Program Hurt: The absence of a trade-in program and DIY upgrade instructions frustrated subscribers who felt squeezed for more money rather than rewarded for loyalty

- Stock Tanked 20%: Weaker-than-expected Q2 2026 earnings triggered significant stock depreciation, leadership changes, and immediate workforce cuts

- New Users Purchased: The silver lining is that sales to completely new Peloton customers met expectations, suggesting the products appeal to fresh buyers but not to existing users

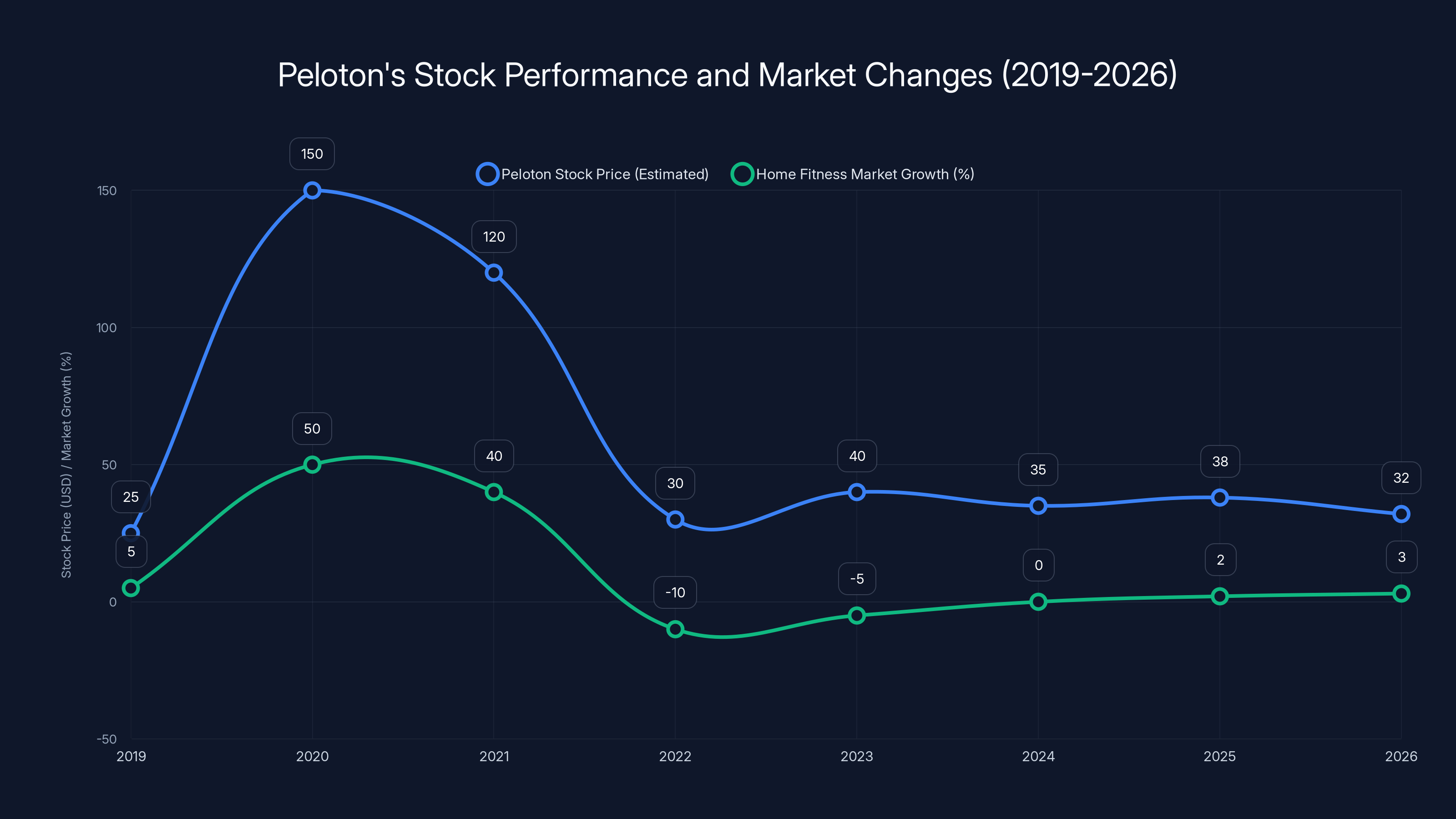

Peloton's stock declined by 20% after Q2 2026 earnings, while revenue fell by 3%. However, 46% of users adopted the new AI coaching features, showing a positive reception among existing subscribers.

The Cross Training Series: What Peloton Actually Built

In October 2025, Peloton launched what it called the Cross Training series. This wasn't a minor upgrade or a single new product. It was a complete reimagining of the company's entire hardware ecosystem.

The lineup included five new products: The Bike, The Bike Plus, The Tread, The Tread Plus, and The Row Plus. Each one received meaningful hardware redesigns rather than cosmetic refreshes.

The centerpiece of these redesigns was a swivel screen. Peloton added screens that rotated and adjusted to different angles. The idea sounds simple. Riders on the Bike could now transition to strength training classes without awkwardly twisting their necks toward a fixed screen. Runners on the Tread could do floor exercises without dismounting. The Row Plus offered the same flexibility for rowing athletes.

But the physical redesign was just the warm-up. The real innovation came with the hardware specifications themselves. Peloton included built-in cameras on new equipment. These cameras fed into Peloton IQ, a new AI system designed to analyze user form in real-time.

The AI component was genuinely ambitious. The system watched how you moved. It identified form breaks. It suggested corrections mid-workout. It analyzed your strength patterns and generated personalized workout routines based on what it observed about your body and performance level. For riders who've struggled with form feedback from on-screen instructors, this was a meaningful step forward.

Peloton also upgraded the physical comfort layer. New seats were cushier. Equipment included fans for temperature control. These weren't revolutionary additions, but they addressed real pain points that loyal Peloton users had vocalized for years.

The technical specifications were legitimately modern. The screens were larger. The processing power was faster. The integration between hardware and software was tighter than previous generations.

But here's the thing. All of this innovation came at a cost.

The Pricing Problem: Why $6,695 Matters

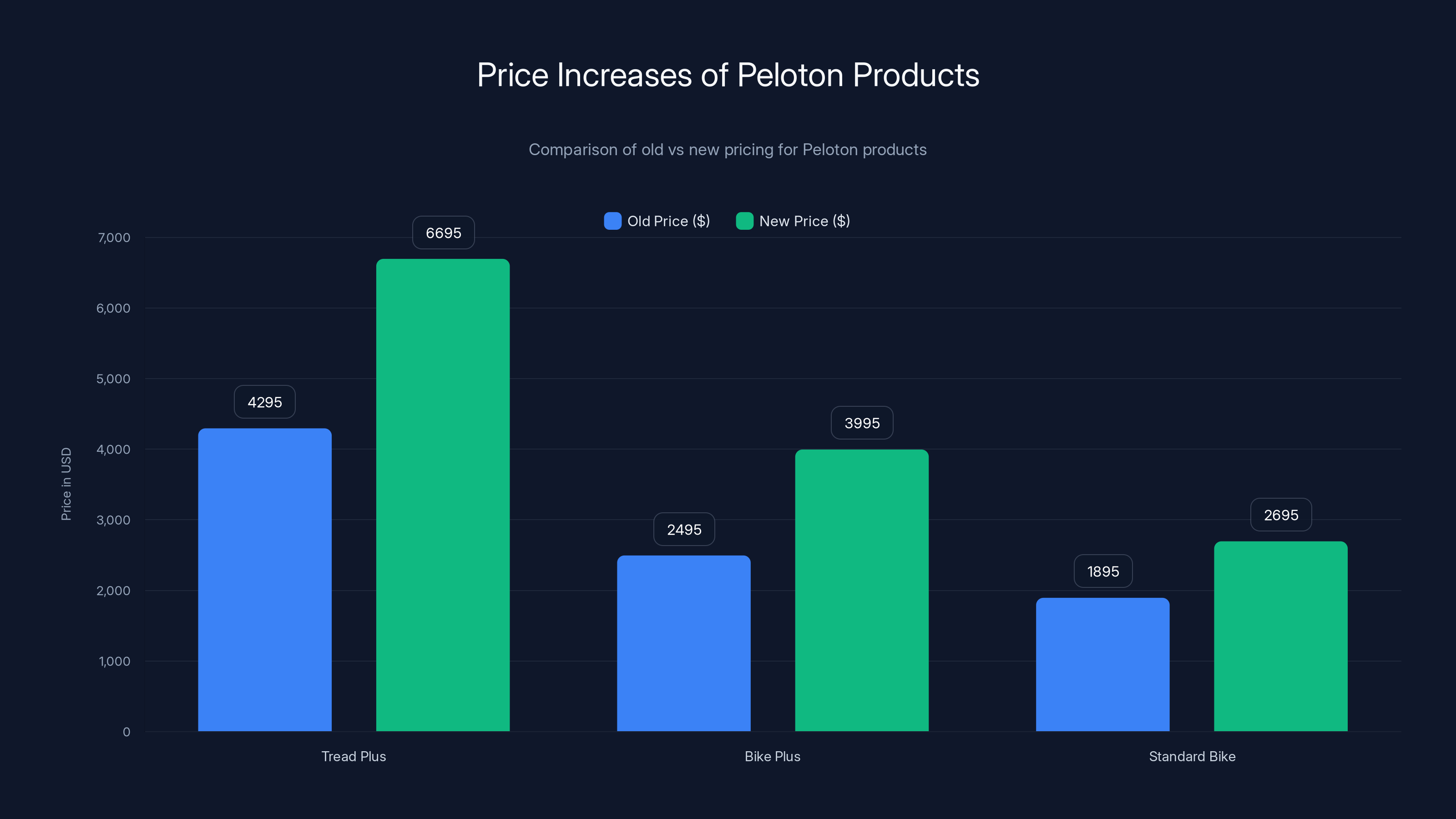

The new Tread Plus cost $6,695. Let that number sit for a moment.

For context, the previous generation Tread Plus started at $4,295. The new model represented a 56 percent price increase. That's not inflation adjustment. That's a significant real-dollar jump.

The Bike Plus moved from

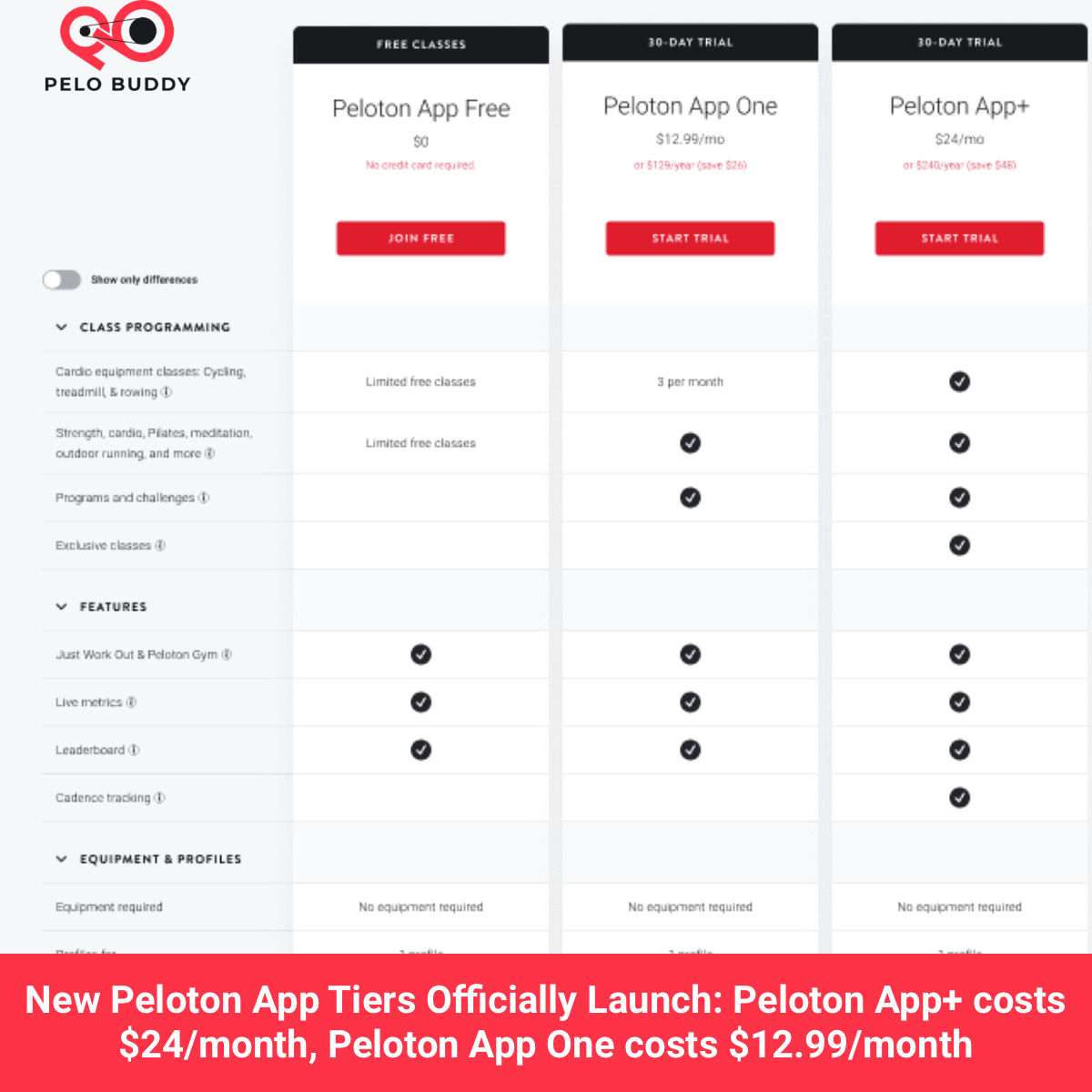

These weren't premium products getting a luxury surcharge. These were already premium products getting more premium.

Simultaneously, Peloton increased subscription pricing. The all-access membership got more expensive. The fitness app subscription got more expensive. From the user perspective, the company wasn't just asking them to replace equipment. It was asking them to pay more to keep using the service they already relied on.

Now, understand that Peloton's core customer base had already made a significant financial commitment. Someone who bought a Tread Plus five years ago dropped

When Peloton suggested they drop another

Sure, the AI feedback sounds nice. But is it worth doubling the cost of entry? The swivel screen sounds convenient. But does it justify 56 percent more money for people who've learned to work around the previous design?

Peloton's pricing strategy assumed a consumer behavior that doesn't match how premium fitness equipment buyers actually behave. They expected people to upgrade like they upgrade smartphones. Every two years, new model, new features, pay up.

But fitness equipment buyers are different. They treat machines as long-term investments. They rationalize purchases by cost-per-use over years, not months. A person who uses a Tread 300 days a year for five years has spent

Peloton's new pricing shows significant increases: Tread Plus by 56%, Bike Plus by 60%, and Standard Bike by 42%. These jumps highlight a strategic shift in pricing, impacting consumer purchase decisions.

The Missing Trade-In Program: A Strategic Oversight

Here's what really frustrated Peloton's core audience: there was no trade-in program.

If Peloton had said, "Trade in your old Tread Plus, get

Instead, Peloton expected people to sell their old equipment secondhand, donate it, or throw it away while paying full freight for the new hardware.

Then something worse happened. Users discovered that Peloton's self-installation kits included instructions for removing the old screens from older equipment. The implication was clear: the screens could be swapped. The hardware was compatible in ways. And yet Peloton wasn't offering that as an upgrade path. They weren't saying, "Buy the new hardware base, upgrade your screen for $800, and keep the rest." They were selling complete new units at complete new prices.

From the user perspective, this felt like price extraction. It felt like Peloton was squeezing more money from people who'd already been loyal customers for years. It felt less like an upgrade path and more like abandonment.

Several loyal users reached out to media outlets to express frustration. They weren't disappointed in the technology. They were disappointed in being treated like wallets to be emptied rather than communities to be rewarded.

This is where Peloton's strategy became tone-deaf. The company had spent years building a cult-like community. People bonded over workouts. They cheered each other on. They invested not just money but emotional energy into the Peloton experience. And when it came time to upgrade, the company communicated that investment didn't matter. Pay the full price or use older equipment.

Why Existing Subscribers Said No

Peloton's CEO Peter Stern tried to frame the upgrade failure as a feature, not a bug. On the Q2 earnings call, he said the installed base of equipment was "quite durable" and "member satisfaction is extremely high." He concluded that these factors contributed to "a longer upgrade cycle than we had anticipated."

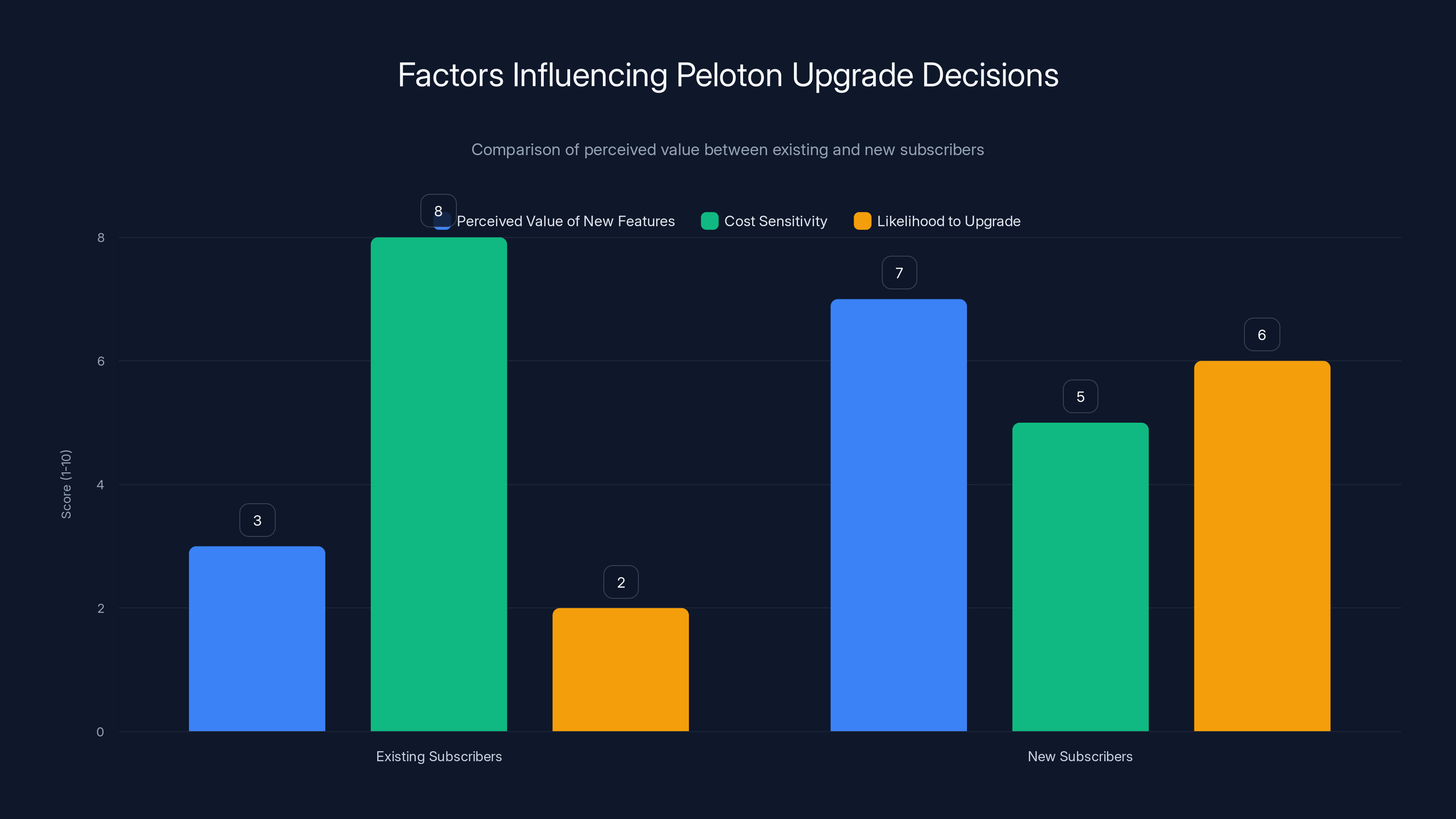

This framing misses the point. It wasn't that existing equipment was too good. It was that new equipment was too expensive relative to the perceived value gain.

Let's break down what actually happened through the lens of rational consumer behavior.

An existing subscriber had to ask themselves: What specific problem does this new hardware solve for me? The old Tread still runs. The old Bike still streams classes. The old equipment still works. What's the pain point?

Peloton's answer was: AI form correction and swivel screens. Reasonable features. But for someone who's been working around a fixed screen for three years, "solving" that problem by spending $4,400 more (56 percent increase) isn't an obvious trade.

Meanwhile, a completely new customer had a different calculation. They'd never owned a Tread before. They weren't comparing the new

This explains why Stern mentioned that "sales to new Peloton users met expectations." New people weren't comparing to what they already owned. They were making a fresh purchasing decision. Some of them saw value in the AI and swivel screen for $6,695. But existing subscribers were comparing the new hardware to their existing hardware, not to nothing, and the comparison didn't favor spending more.

Additionally, churn did occur during the period, despite Stern's claim it was "lower than expected." Some subscribers cancelled. The price hikes, the failed hardware refresh, the sense of being taken for granted rather than appreciated. It all added up.

The AI Features That Actually Worked

Despite the hardware sales disappointment, one part of Peloton's strategy succeeded: the Peloton IQ software.

Forty-six percent of users engaged with the new AI features after rollout. For a brand-new feature category, 46 percent adoption is strong. Not everyone uses it. But close to half of the user base tried it and kept using it.

The engagement suggests the underlying technology worked. Users weren't avoiding AI features because the AI was bad. They were avoiding the hardware upgrade because the price was unjustifiable.

Peloton IQ delivered on the promise of real-time form analysis. The system watches your movement patterns. It identifies issues like asymmetrical strength, poor posture, or compensatory movements. It provides corrections mid-workout. For someone doing heavy strength training, this feedback is genuinely valuable. You can't see your own form from inside your movement. Having an AI system that can is legitimately useful.

The system also generated personalized workout recommendations. Based on observed performance, the AI would suggest which classes to take next, which strength levels would be appropriate, which recovery work might be valuable. This goes beyond the generic recommendation algorithms you see in streaming services. It's actually informed by your movement patterns, not just your watch history.

But here's the critical insight: users could engage with Peloton IQ on their old equipment too. The feature wasn't hardware-exclusive at first. You could use Peloton IQ on some older models. So the success of the software didn't require people to buy new hardware. And most didn't.

This is the cruel irony of Peloton's strategy. The thing that actually worked (AI features) could run on equipment people already owned. The thing that failed (hardware sales) was what Peloton needed to drive revenue.

Existing subscribers perceived lower value in new features and were more cost-sensitive, leading to a lower likelihood to upgrade compared to new subscribers. Estimated data based on narrative insights.

The Loyalty Problem: When Community Doesn't Equal Profit

Peloton built its business on extraordinary loyalty. People didn't just use Peloton. They joined a community. They participated in live classes. They competed on leaderboards with strangers who became friends. They bonded over shared struggle. They celebrated each other's achievements. The company had built something closer to a social movement than a fitness equipment business.

This loyalty was Peloton's greatest asset. It enabled premium pricing. It drove subscription renewals. It created word-of-mouth growth. If you knew someone with a Peloton, you'd heard them talk about it obsessively. That's the power of community-driven businesses.

But loyalty has a shadow side. It comes with expectations. Loyal customers expect loyalty back. They expect to be treated as family, not as market segments to monetize. When they feel taken advantage of, the betrayal runs deeper than with a regular transaction.

Peloton's hardware strategy felt like a betrayal. Here's how it looked from the subscriber perspective: "We've been loyal customers for years. We've paid thousands of dollars. We've built our routines around your platform. And now you're telling us our investment is obsolete? And you want us to pay 56 percent more to stay current? And you won't even offer us a trade-in program? And you secretly hid the fact that screen swaps were possible?"

That's not an upgrade message. That's a "we're extracting as much value as possible" message.

The result was predictable. Loyalty doesn't automatically convert to hardware sales. In fact, for existing customers with existing equipment, loyalty can work against hardware sales because the loyal customer is already happy with what they have.

Revenue Results: The Numbers Don't Lie

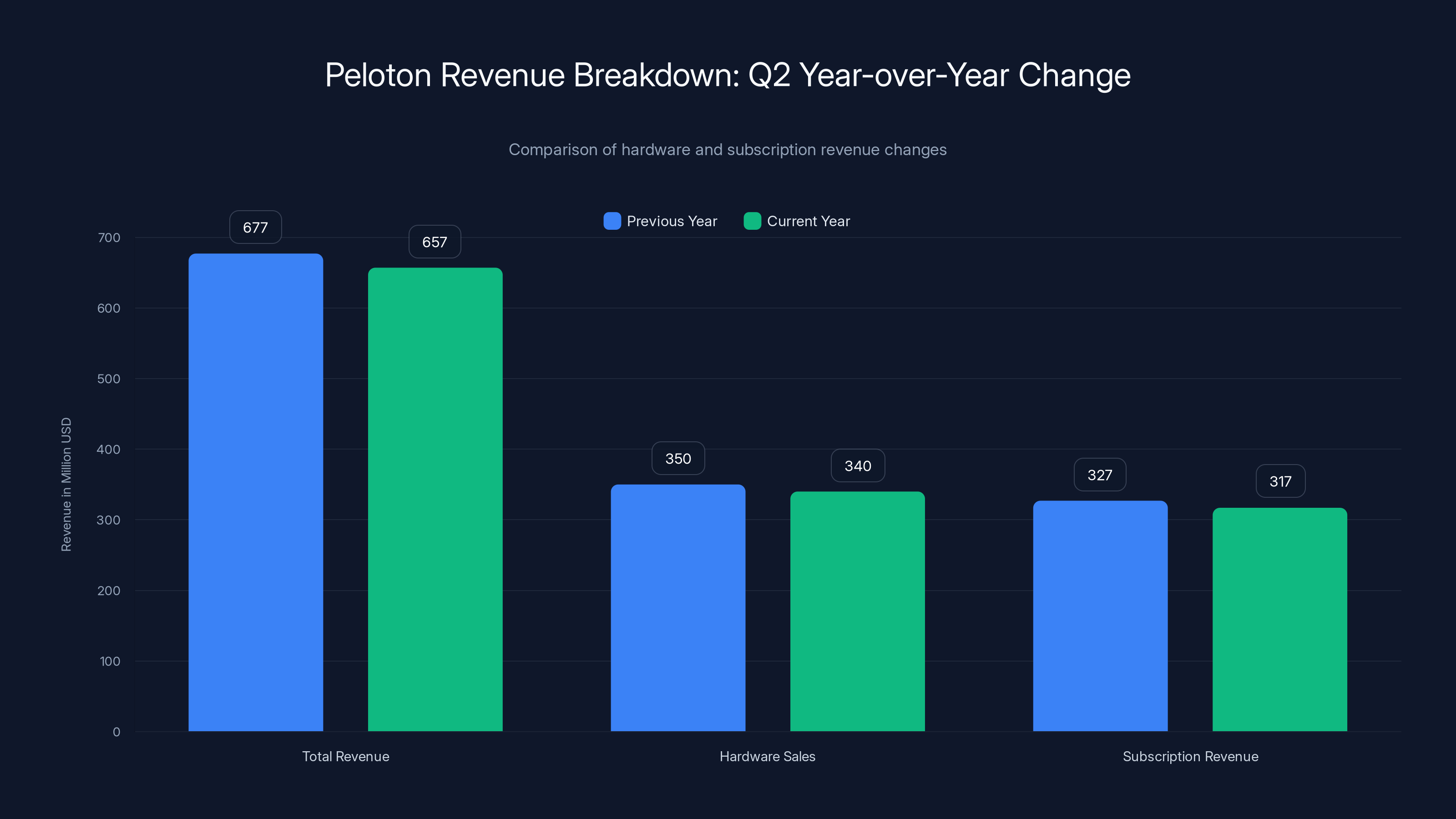

The earnings call results were brutal. Total revenue fell three percent year-over-year to $657 million. Both hardware and subscription sales fell short of targets.

Think about that context. This was Q2, which includes the holiday season. The holiday season is when fitness equipment companies make the bulk of their annual revenue. People resolve to get fit. They buy equipment as gifts. They justify the expense as a New Year's investment. If Peloton couldn't drive sales during the holiday season despite an entirely new hardware lineup with cutting-edge AI features, the strategy failed catastrophically.

Three percent year-over-year decline in total revenue might not sound dramatic. But it's decline, not growth. In a consumer electronics and fitness equipment space, you're supposed to grow. You're launching new products. You should be capturing market share. If you're just shrinking, something's deeply wrong.

Subscription revenue specifically fell short. This matters because subscriptions are supposed to be the business model's foundation. Hardware is cyclical and competitive. Subscriptions are recurring and defensible. If hardware sales are weak, subscriptions should be your buffer. But subscriptions also declined, which means people weren't even keeping their existing equipment and maintaining subscriptions. Some were leaving altogether.

The hardware sales miss was expected at this point, but the subscription decline was the signal that the hardware strategy didn't just fail to drive upgrades. It actively damaged the core business.

CEO Peter Stern's Positioning: Is Peloton a Fitness Company?

During the earnings call, CEO Peter Stern made an interesting rhetorical move. He tried to reframe what Peloton actually is.

"Peloton isn't a fitness company any more but a wellness one," he said.

This pivot is telling. When your core strategy fails, you rebrand the strategy itself. Instead of admitting the hardware refresh didn't work, Stern suggested the whole company was evolving beyond fitness into wellness.

The wellness frame opened a new strategy. Rather than competing on equipment specs and performance tracking, Peloton would compete on holistic wellness. That meant partnerships with lifestyle brands like Respin. That meant expanding menopause-specific content. That meant doubling down on strength training content specifically because of connections to GLP-1 medications and muscle loss concerns.

These aren't bad moves. They're actually thoughtful in recognizing where consumer attention is shifting. People who take GLP-1 drugs for weight loss do lose muscle. Addressing that gap through strength training content is smart. Recognizing that menopause affects millions of people and represents an underserved market is smart. Building partnerships with lifestyle brands makes sense.

But the pivot also signals something: the hardware-centric strategy failed, and Peloton is now trying a different approach. If the Cross Training hardware refresh had succeeded, Stern wouldn't need to suddenly reframe the entire company as "wellness, not fitness."

Stern ended the earnings call by urging analysts and investors to try pilates and kettlebell classes. It's a charming moment. It's also a CEO trying to change the subject away from disappointing earnings and failed strategy.

New customers perceive the

The Layoffs: 11 Percent of Engineering and Enterprise Teams Gone

Just a few months before the disappointing Q2 earnings announcement, Peloton cut 11 percent of its workforce. The layoffs focused on engineering and enterprise divisions.

Layoffs before disappointing earnings are a corporate timing issue. If you're cutting staff in January or February and then reporting disappointing results in March or April, it suggests leadership knew the strategy was struggling and was trying to preempt profit warnings with cost cuts.

The focus on engineering layoffs is particularly notable. If Peloton is supposed to be advancing AI technology and innovating hardware, why cut engineering staff? The answer is probably efficiency. The company built for growth that didn't materialize. It needed to rightsize costs. But cutting engineering suggests Peloton isn't betting heavily on hardware innovation moving forward. If the next-generation hardware failed to drive upgrades, why keep a large engineering team?

The enterprise layoffs suggest something else: the B2B fitness strategy didn't work either. Peloton has been trying to sell equipment to corporate gyms, hotels, and fitness studios. Those sales haven't been strong enough to justify the staff investment.

Between the hardware sales miss, the subscription decline, the sudden CEO reframing of the entire company mission, and the layoffs, it's clear Peloton is in strategic repositioning mode. The original hardware bet didn't work. The company needs a new strategy. And that strategy starts with cheaper operations and a different positioning.

Chief Financial Officer Departure: Leadership Instability

On top of everything else, Peloton announced that CFO Liz Coddington would be leaving at the end of March.

CFO departures during periods of disappointing earnings and strategic challenges often signal deeper dysfunction. Either the CFO is being pushed out because leadership is scapegoating the finance team for earnings misses, or the CFO is leaving voluntarily because they disagree with the direction the company is headed.

Either way, it's not a good sign. Companies in growth mode don't lose CFO continuity. Companies in crisis or transition do.

The combination of CEO strategy pivots, CFO departures, engineering layoffs, and earnings misses creates a picture of a company that's lost confidence in its own strategy and is trying to rebuild.

Why New Customers Bought but Existing Customers Didn't

Stern noted that sales to completely new Peloton users met expectations. This is the one bright spot in the earnings. The new hardware sold well to people who'd never owned Peloton equipment before.

This distinction matters because it reveals the core problem: pricing perception is relative.

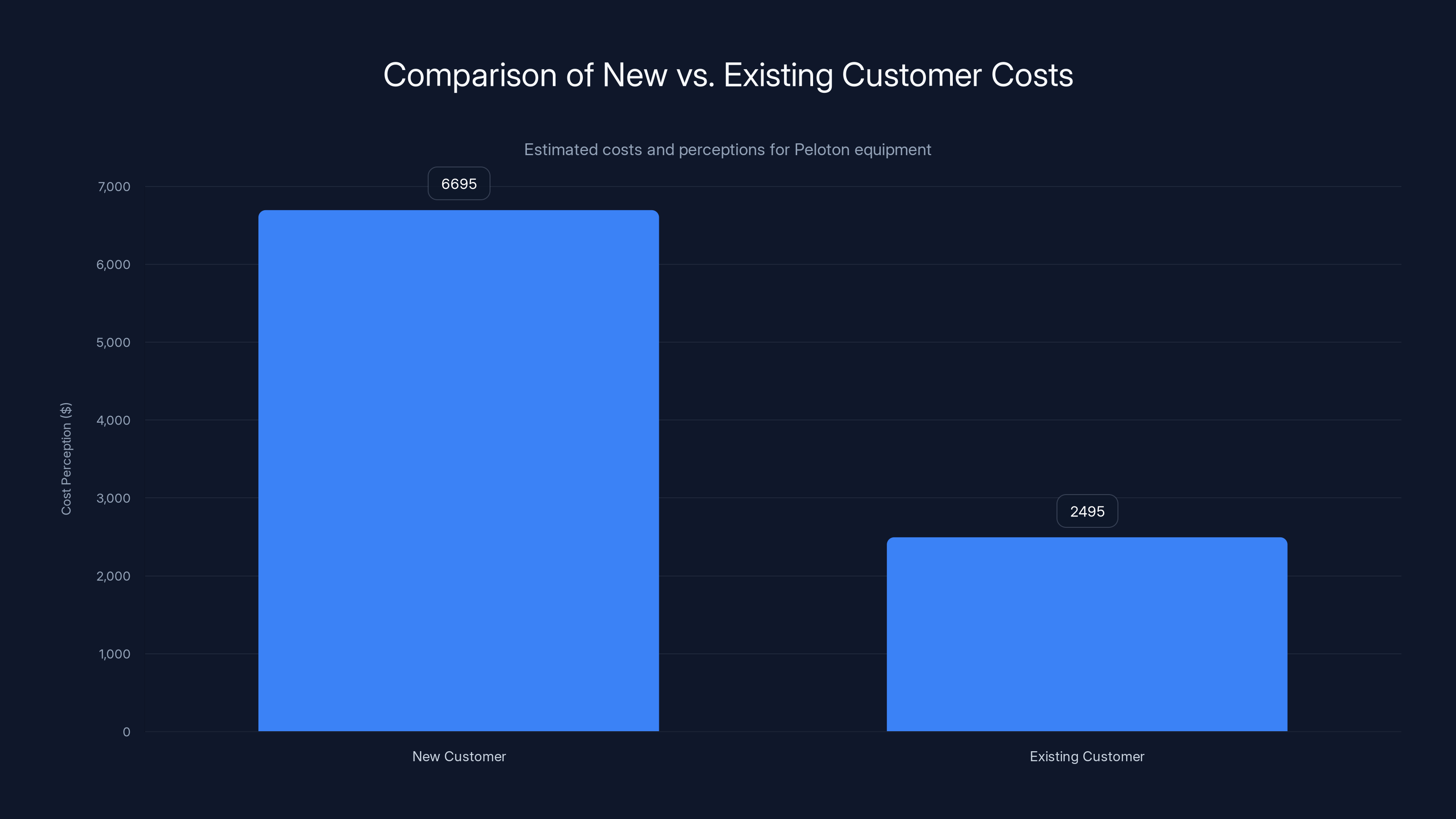

For a new customer,

New customers are also getting the newest features. They're not comparing new hardware to old hardware they already own. They're comparing new hardware to no hardware.

But for existing customers, the psychology is completely different. They've already made the investment. They're not comparing to boutique fitness alternatives. They're comparing the new hardware to equipment that's already paid off. The existing equipment has a sunk cost of

This is why the sales mix matters so much. If Peloton could only sell new hardware to new customers and not upgrade hardware to existing customers, the business model breaks down. Existing customers are the predictable base. New customer acquisition is the variable. Building your strategy around converting existing customers to new hardware is more predictable than building it around new customer acquisition.

But that's exactly what didn't happen.

Peloton's stock price peaked during the pandemic but crashed post-2021 as the home fitness market growth slowed. Estimated data shows continued market challenges.

The Cross-Training Product Strategy Failure

The Cross Training series was supposed to be expansive. It wasn't just new Bikes and Treads. It included a Row Plus. The idea was that subscribers would buy different categories of equipment, not just replace what they had.

Stern mentioned that existing Peloton users did buy new categories of hardware. Bike owners bought treadmills. That part worked. But it worked at lower volumes than expected.

The cross-training strategy assumes that after investing

For people committed to just cycling or just running, cross-training is less compelling. For people who have limited space, adding a second piece of expensive equipment is impractical. For people who were already stretching their budgets on their first Peloton, the idea of buying a second major piece of equipment at premium prices isn't realistic.

The cross-training strategy made assumptions about customer behavior and financial capacity that didn't match reality.

The Hardware Durability Problem: Features, Not Obsolescence

One of the legitimate challenges Peloton faces is that its older hardware actually works really well. The Bikes and Treads from 2020, 2021, 2022 haven't become obsolete. They still deliver classes. They still track metrics. They still motivate.

This is good news for customers. It's bad news for equipment manufacturers trying to drive upgrade cycles.

In consumer electronics like phones and laptops, obsolescence is faster. Software updates slow things down. New apps demand more processing power. Battery degradation is real. A five-year-old phone legitimately struggles with modern software.

But a five-year-old Peloton Tread doesn't struggle to run classes. The screen still displays video. The software still connects to the internet. The mechanical components still function.

This durability is actually a competitive advantage for Peloton in the long term, but it's a disadvantage for driving upgrade cycles in the short term. Peloton built such good equipment that it lasts longer than the upgrade cycle the company needs.

This is why the AI features were supposed to be the upgrade driver. Not hardware replacement, but software that made the old hardware feel new again. If Peloton IQ had been exclusive to new hardware, it would have forced upgrades. But by making it available on some older equipment, Peloton solved the problem of making classes more engaging without requiring hardware purchases.

That decision was probably right for customer satisfaction but wrong for revenue.

Market Context: Fitness Tech Post-Peloton IPO Crash

Peloton's Q2 2026 miss has to be contextualized within the broader fitness tech landscape. The company went public in late 2019 at the height of pandemic-driven fitness equipment demand. The stock soared. Competitors emerged. Expectations were extraordinary.

But the pandemic ended. People returned to gyms. The home fitness boom softened. Peloton's stock crashed. The company lost $2.2 billion in a single quarter in early 2022. Multiple CEO changes followed. The company went private again, then public again. It's been chaos.

In this context, the Q2 2026 miss is consistent with a company still struggling to find stable footing in a post-pandemic fitness equipment market. The hardware refresh was supposed to be the turning point. A new CEO, new products, new strategy, new growth. Instead, it failed.

This matters because it suggests the fitness equipment market has fundamentally changed. The easy growth of 2020-2021 is gone. Going back to growth requires not just new features but a fundamentally better value proposition. Peloton offered features without fixing the price problem.

Peloton's total revenue fell by 3% year-over-year to $657 million, with declines in both hardware and subscription revenues, indicating a strategic failure despite new product launches. Estimated data used for hardware and subscription breakdown.

Subscriber Sentiment: The Unspoken Betrayal

When loyal customers reach out to press outlets to express frustration with a company they've invested thousands into, it's not about the product anymore. It's about feeling valued.

The silent message Peloton sent with its Cross Training series pricing and lack of trade-in support was: "We appreciate your loyalty enough to expect you to pay even more for equipment you might not need." That's not the message you want to send to people who've been part of your community.

Loyalty-driven businesses like Peloton depend on a psychological contract. Customers commit money and attention. The company commits to respecting that commitment. When the company breaks that contract to extract more money, the relationship deteriorates faster than with transactional relationships.

A person who uses hotel chains or restaurant chains doesn't expect loyalty to be reciprocated. They're comfortable with transactional relationships. But a person in a Peloton community expects something deeper. They expect to be valued. They expect to be considered. When they're not, the betrayal cuts deep.

The Fitness Tech Competitive Landscape

Peloton isn't the only company competing in connected fitness. Apple has fitness classes integrated into Apple TV+. Companies like Beachbody own digital fitness platforms. Traditional gyms have added digital components. Even Lululemon bought Mirror and tried to build a connected fitness platform.

The competitive landscape changed while Peloton was dealing with internal chaos. New players entered. Existing players adapted. Digital fitness became less unique and more commoditized.

In this environment, Peloton's strategy of premium hardware with exclusive AI features is tougher. If people can get strong fitness content from Apple for $10 per month, or free from YouTube, or from their local gym membership, then Peloton hardware needs to justify premium pricing relative to these alternatives, not just relative to having no hardware.

The

Strategic Lessons: What Peloton's Hardware Failure Teaches

The Peloton hardware failure offers several critical lessons for premium hardware companies.

First, loyalty doesn't automatically convert to upgrade sales. The relationship between customer loyalty and hardware sales isn't linear. People who love your existing product might be the hardest people to convince to buy a new version, because they're already satisfied.

Second, price increases need to be justified relative to the customer's reference point, not just relative to historical costs. A 56 percent price increase might be justified by manufacturing costs and component prices. But it's not justified from the customer's perspective if their existing equipment still works.

Third, trade-in programs aren't just customer service. They're strategic. They signal that you respect the existing investment. They make the upgrade math easier. They dramatically increase upgrade rates for premium goods.

Fourth, new features don't drive hardware sales if the customer can access new features on old hardware. Peloton IQ should have been exclusive to new hardware from day one. By making it partially available on older equipment, the company removed the upgrade driver while still creating the costs to develop the feature.

Fifth, community-driven businesses need to think about community impact when making pricing decisions. Loyal customers are the most sensitive to price increases because they feel the company is taking advantage of their loyalty. New customers are less sensitive because they have no history with the company.

The Path Forward: Repositioning as Wellness

Peloton's shift toward wellness positioning is probably the right move given the hardware strategy failure. Instead of competing on equipment specs and performance, the company can compete on lifestyle integration.

This means leaning into content that addresses real wellness concerns. Menopause-specific workouts matter because menopause is under-addressed by fitness companies. Strength training positioning tied to GLP-1 medication effects matters because that's where real consumer demand is.

It means partnerships with complementary lifestyle brands. If you're a Peloton subscriber interested in menopause wellness, partnering with a meditation app or supplement company or hormone health platform creates value beyond just fitness classes.

It means recognizing that Peloton isn't just competing for workout time anymore. It's competing for wellness attention. That's a different competitive landscape with different competitors and different success metrics.

The irony is that this is probably the more sustainable strategy than the hardware refresh. Hardware is competitive and cyclical. Wellness content is differentiated and defensible. If Peloton can position itself as the wellness platform for specific underserved demographics, it has a clearer path to growth than trying to convince people to repeatedly upgrade expensive equipment.

FAQ

Why did Peloton's new hardware fail to drive subscriber upgrades?

Peloton's hardware refresh failed because existing subscribers had no financial incentive to upgrade. The new Tread Plus cost

How much did Peloton stock decline after the Q2 2026 earnings announcement?

Peloton's stock fell approximately 20 percent on the morning of the Q2 2026 earnings announcement. This dramatic drop reflected investor disappointment that the company's flagship hardware refresh—meant to drive growth and justify premium pricing—failed to convert existing subscribers into upgrading customers. The earnings also revealed that total revenue declined 3 percent year-over-year to $657 million, with both hardware and subscription sales missing targets.

What was successful about Peloton's strategy in Q2 2026?

Despite the hardware sales disappointment, Peloton IQ—the company's new AI coaching system—showed genuine adoption success with 46 percent of users engaging with the features after rollout. The system's real-time form correction and AI-generated workout recommendations provided legitimate value. Additionally, sales to completely new Peloton customers met expectations, suggesting the products appeal strongly to first-time buyers who weren't comparing new hardware against existing investments.

Why didn't Peloton offer a trade-in program for older equipment?

Peloton did not publicly announce a formal trade-in program, which frustrated loyal subscribers. The lack of a trade-in option meant existing customers faced the full price of new hardware while disposing of perfectly functional equipment. This strategic decision likely maximized short-term revenue per transaction but damaged customer goodwill and reduced upgrade rates significantly. Users discovered that hardware components were compatible enough for screen swaps, raising questions about why the company didn't offer modular upgrade paths.

What does Peloton's shift toward "wellness" positioning mean for the company's future?

Peloton's repositioning from a fitness company to a wellness company signals a strategic pivot away from hardware-centric growth toward content and community-based differentiation. This includes expanding menopause-specific wellness content, partnering with lifestyle brands, and doubling down on strength training as a market segment. This approach acknowledges that hardware is cyclical and competitive, while wellness content is more defensible and can address underserved demographic segments with specific health needs.

What happened to Peloton's leadership team after the earnings miss?

Peloton announced significant leadership changes following disappointing Q2 2026 results. CFO Liz Coddington was set to leave by the end of March, signaling internal instability during a critical period. Additionally, the company cut 11 percent of its workforce, with layoffs focused on engineering and enterprise divisions. These changes, combined with CEO Peter Stern's recent strategy pivots, suggested the company was entering a restructuring phase and repositioning its long-term strategy away from hardware-driven growth.

How did the price increase affect Peloton's market competitiveness?

The 56 percent price increase for the Tread Plus made Peloton equipment significantly more expensive relative to competitors like Nordic Track and traditional gym memberships, which increased from

Why did subscription revenue decline despite the hardware refresh?

Subscription revenue declined because the failed hardware strategy not only failed to convert existing customers but also damaged overall customer sentiment. Some subscribers cancelled rather than accept price increases and the perception of being undervalued. The absence of a trade-in program and the marketing misstep of revealing DIY screen-swap instructions frustrated the community. This erosion of goodwill turned what should have been a growth opportunity into a revenue headwind across both hardware and subscription segments.

Conclusion: When Innovation Costs More Than Customer Loyalty

Peloton's Q2 2026 earnings miss is a masterclass in how not to execute a hardware refresh strategy. The company invested billions into new products, AI features, and marketing. The products themselves worked. The AI features drove engagement. But the strategy failed because it ignored the economics of loyal customer upgrading behavior.

The central mistake was assuming that loyalty plus innovation equals purchase. Peloton assumed that customers who loved the old equipment would automatically want the new equipment. Instead, satisfied customers with paid-off equipment have zero motivation to upgrade unless the value proposition overwhelms their cost-benefit analysis. A 56 percent price increase doesn't overwhelm anything except customer patience.

The second mistake was the missing trade-in program. In premium consumer electronics, trade-in programs aren't just customer service gestures. They're admission that you understand the upgrade calculus. They're recognition that existing investment matters. They're the bridge between loyalty and sales.

The third mistake was making Peloton IQ partially available on older equipment. The one feature that truly justified hardware replacement should have been new-hardware exclusive. By making it partially available on existing devices, Peloton gave customers the innovation without forcing them to buy new hardware. That's good customer service but catastrophic revenue strategy.

The fourth mistake was underestimating how much people value the option to use what they already have. Hardware durability can be a competitive advantage or a competitive disadvantage depending on how you position it. Peloton built equipment so well that it didn't need replacement. Then tried to force replacement anyway. That's the opposite of how premium brands work.

Fifth, the company forgot that in community-driven businesses, loyalty is a two-way street. When companies signal they're taking advantage of loyalty rather than respecting it, the relationship deteriorates faster than in transactional businesses. Peloton taught long-term customers that they couldn't be taken for granted. But then took them for granted.

The path forward for Peloton probably doesn't include another hardware refresh anytime soon. The wellness positioning and content-focused strategy is smarter. But rebuilding the goodwill that the failed hardware strategy damaged will take years.

The lesson for other companies? Loyalty is an asset that can evaporate quickly if you treat it as something to exploit. Premium customers expect premium treatment. That doesn't mean discounts. It means respect for their existing investment. It means upgrade paths that feel like rewards, not punishments. It means recognizing that sometimes the hardest customers to sell to are the ones who already love your product.

Peloton learned this lesson the hard way, with a 20 percent stock drop and eleven percent workforce cuts to show for it.

Key Takeaways

- Peloton's hardware refresh launched October 2025 with Tread Plus priced at 4,295 model—but fewer existing subscribers upgraded than expected

- The absence of a trade-in program frustrated loyal customers who felt extracted from rather than appreciated, fundamentally damaging community goodwill and loyalty

- Q2 2026 revenue fell 3% year-over-year to $657M with both hardware and subscription sales missing targets, causing stock to drop 20% and triggering leadership changes

- Peloton IQ achieved 46% user engagement showing AI features worked, but making the software partially available on older equipment eliminated the hardware upgrade driver

- New customer sales met expectations while existing subscriber upgrades collapsed, revealing the core mistake: loyal customers with working equipment have no financial incentive to upgrade at premium prices

Related Articles

- YouTube Blocking Background Playback on Mobile Browsers [2025]

- Crunchyroll Price Hikes: Inside Sony's Anime Streaming Strategy [2025]

- Crunchyroll Price Hike 2025: What Changed & Why Anime Fans Matter [2025]

- Amazfit Smartwatches Get Two Game-Changing Features [2025]

- Garmin Connect Gear Tracking: The Hidden Feature Runners Love [2025]

- Meta's VR Fitness Reckoning: Why Supernatural's Shutdown Matters [2025]

![Why Peloton's $6,695 Treadmill Gamble Failed to Win Over Subscribers [2026]](https://tryrunable.com/blog/why-peloton-s-6-695-treadmill-gamble-failed-to-win-over-subs/image-1-1770309515549.jpg)