The Smartphone Hype Crisis Nobody's Talking About

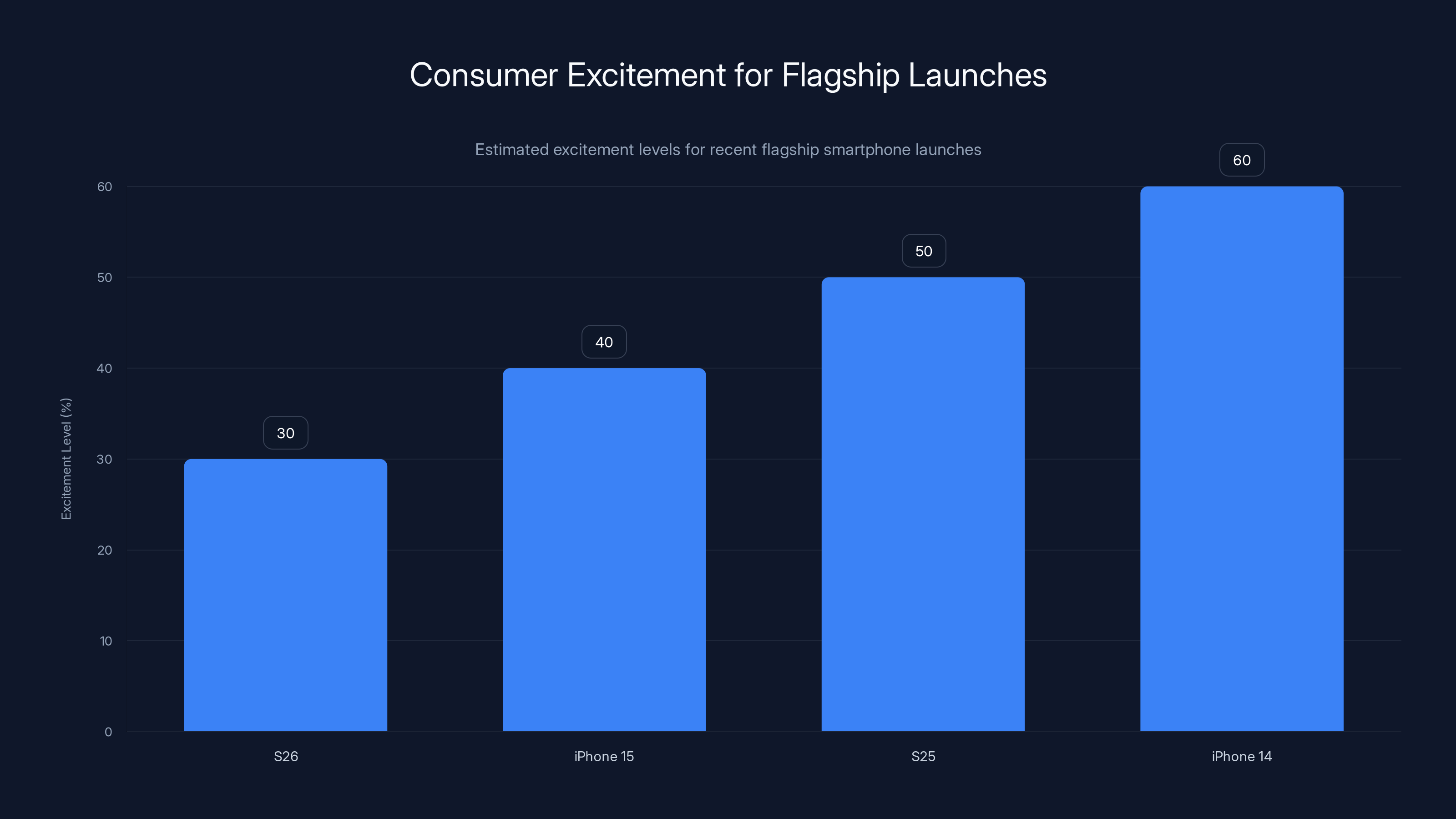

Here's what happened last week: I asked nearly 2,000 tech enthusiasts one simple question—"Are you excited about the Samsung Galaxy S26?" The results were brutal. Seventy percent said no. Not "maybe," not "I'll wait for reviews." Just flat-out no. According to PhoneArena, this lack of excitement is echoed by many consumers.

That's not normal. Galaxy flagships historically launch with anticipation. People line up. Preorders crash servers. Tech blogs explode with hype cycles. But the S26 conversation? It's flat. It's exhausted. It feels like everyone collectively decided they don't actually care anymore.

I'm not spinning this as clickbait. The data reflects something deeper about the smartphone market that manufacturers have been ignoring for three years: people aren't excited about incremental updates anymore. A faster processor. A slightly better camera. Same design, different color. That's not innovation. That's cost-cutting disguised as progression.

Samsung understands this. At least, they should. The company hasn't had a "wow" moment since the Galaxy S20's 100x zoom feature made headlines worldwide. Since then? It's been marginal improvements packaged as breakthroughs. And consumers are exhausted.

The smartphone market isn't broken. Innovation is.

The Smartphone Market Reality Check

Let's talk about what's actually happening in the mobile space, because the narrative you're hearing from manufacturers doesn't match reality.

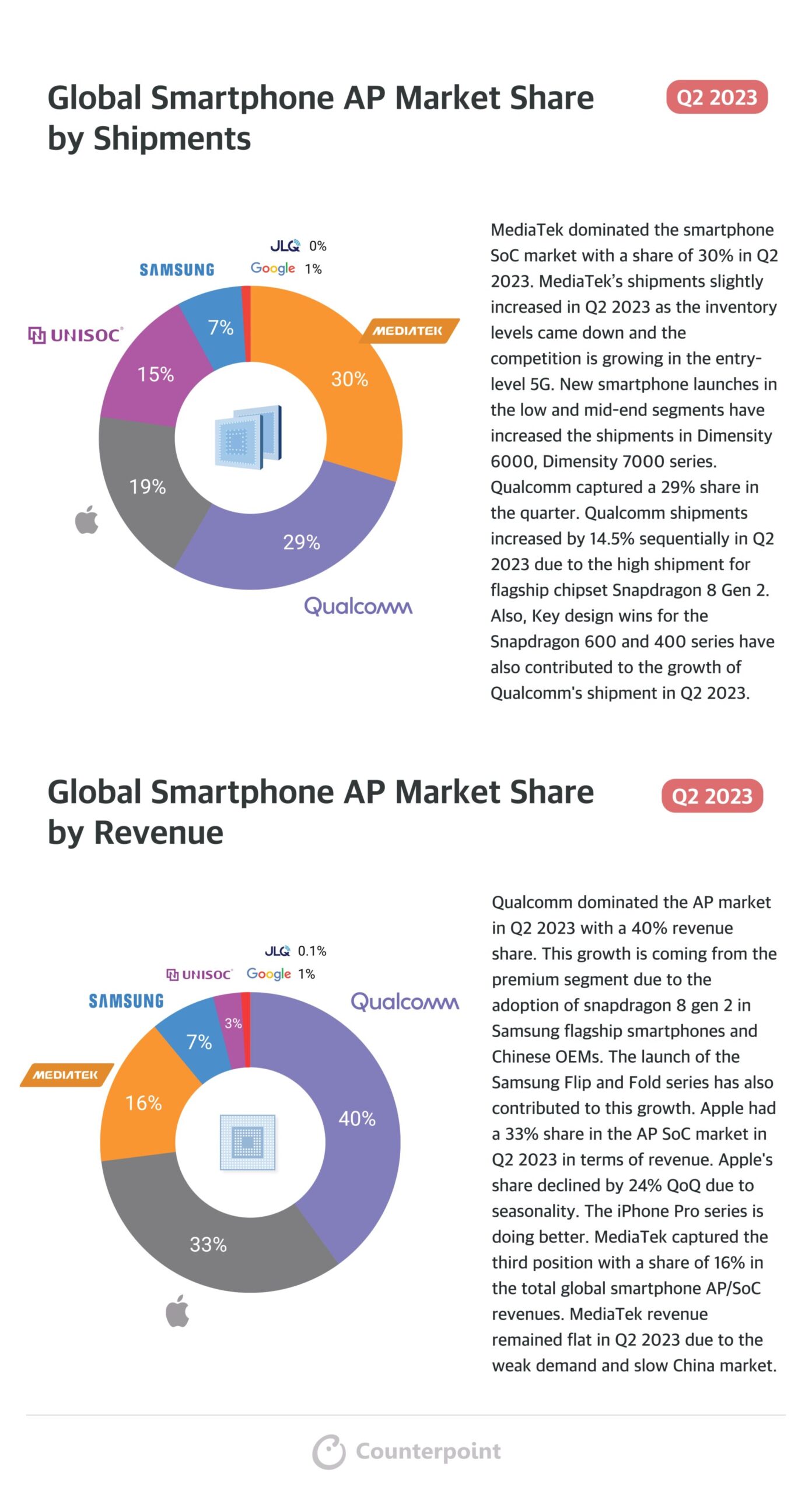

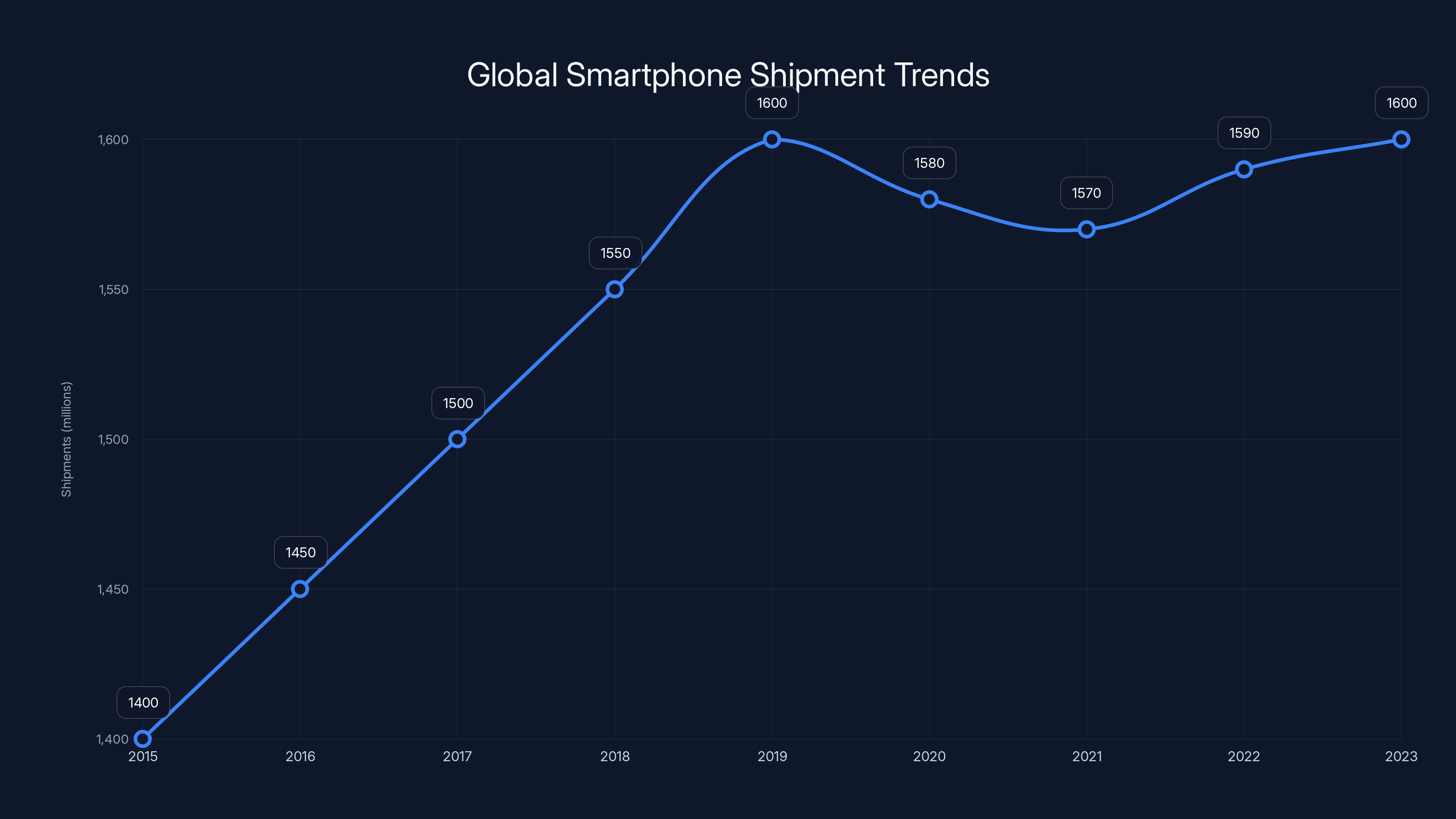

Smartphone sales growth has been nearly flat for five years. According to Omdia, global smartphone shipments haven't exceeded 2019 levels consistently. The average consumer keeps their phone for 3 to 4 years now, up from 2 to 3 years in 2015. That's not enthusiasm. That's acceptance that new phones don't actually solve new problems.

The iPhone 15 launch sparked less media coverage than the iPhone 14. The Galaxy S24 launch wasn't significantly bigger news than the S23. Meanwhile, Google's Pixel lineup has become genuinely interesting to tech enthusiasts—not because of revolutionary hardware, but because of AI integration that actually feels useful in daily life.

But here's the catch: even Google's momentum is fragile. Because AI features wear off fast. You use Google's recording transcription feature three times, it's cool. By month two, it's just infrastructure. It's not a reason to spend $1,200.

Consumers aren't buying flagship phones anymore because those phones are better. They're buying them because they already paid the carrier lock-in tax and need a device that works. Loyalty is suffering from pure inertia, not satisfaction.

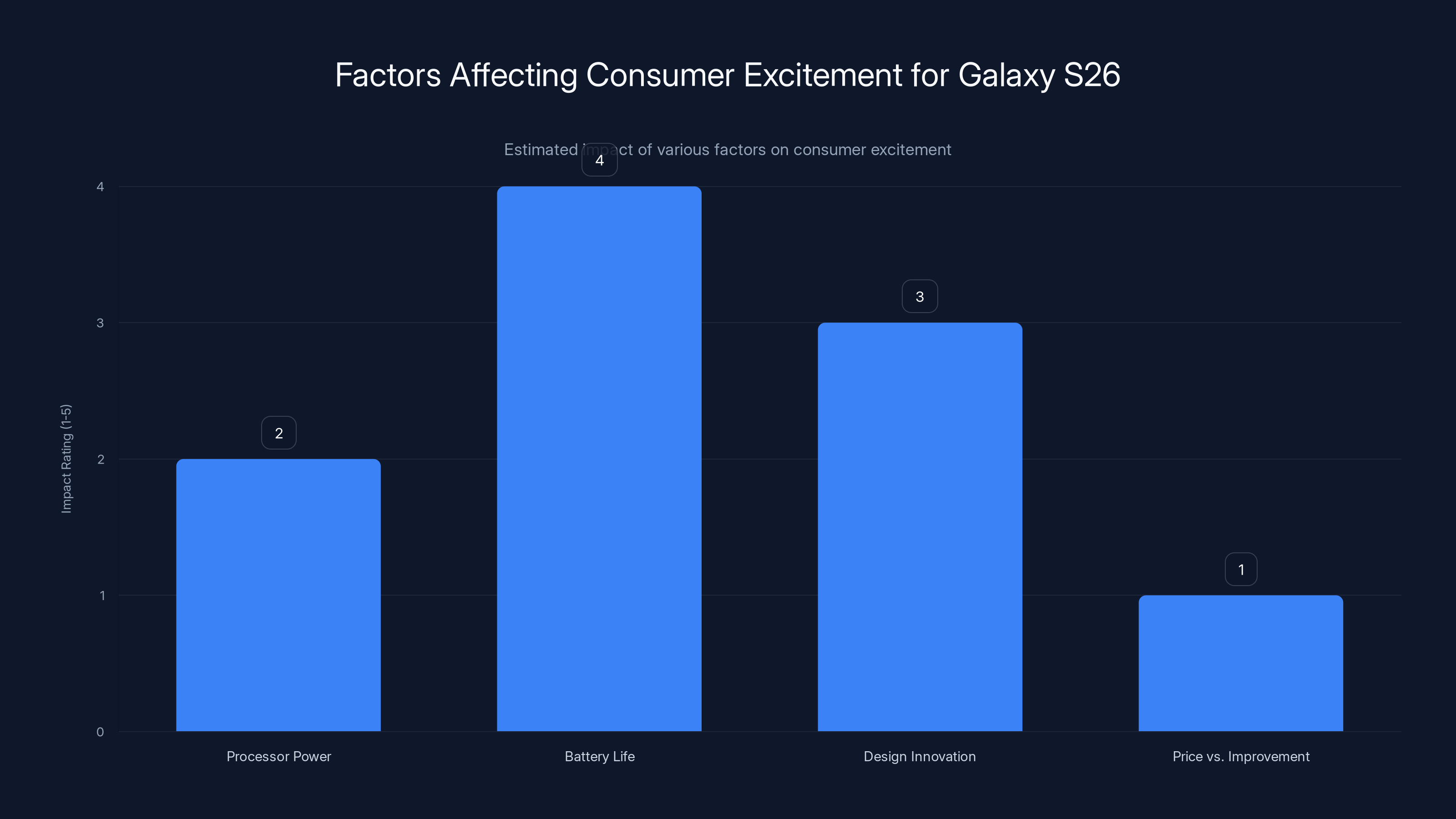

Battery life and design innovation are key areas where consumers feel the Galaxy S26 lacks excitement, despite powerful processors. Estimated data.

Why Iterative Design Kills Excitement

The Galaxy S-series design language peaked at the S22. And I mean that literally—the curved edges, the camera module placement, the overall aesthetic. Samsung understood form at that moment.

Since then? The S23, S24, and presumably the S26 have refined that design rather than evolved it. Same footprint. Same materials. Same color palette with slightly different metallic finishes. The visual difference between an S22 and an S26 is almost imperceptible to most people.

Compare that to how the iPhone evolved from the iPhone 6 to the iPhone X. Or how the original Samsung Galaxy S compared to the S10. Those were actual visual transformations that made old phones look dated.

Design refresh cycles are typically 3 to 4 years. We're at year 4 with the curved-edge philosophy. The S26 should look meaningfully different. Instead, leaks suggest a marginally refined version of what came before, as noted by WebProNews.

This matters psychologically. When you hold a new phone in your hand, you need to feel like you're holding something new. The premium flagship market thrives on that perception. Luxury watch makers understand this. High-end fashion understands this. Tech companies keep forgetting it.

The irony? Manufacturing a phone that looks dramatically different is actually cheaper than incremental refinements. You don't need to RE-engineer the chassis as carefully. But Samsung has invested billions in manufacturing optimization for the current form factor. Changing it means absorbing those costs upfront.

So the company does the rational financial thing: squeeze 2% more efficiency from the existing design. Launch it. Call it "innovative." Watch sales decline 8 to 12% year-over-year anyway.

Global smartphone shipments have remained relatively flat since 2019, indicating a saturation in the market. (Estimated data)

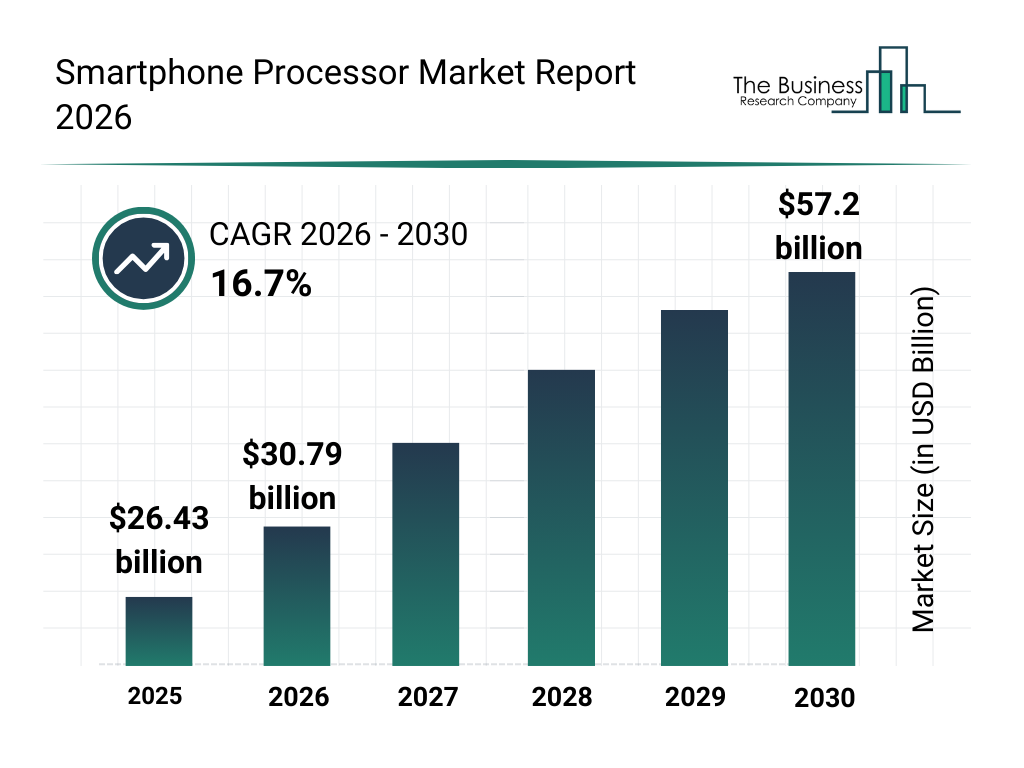

The Processor Plateau Nobody Admits

Smartphone processors crossed the "good enough" threshold around 2020.

The Snapdragon 888 from late 2020 handles everything modern apps require without struggle. Scrolling, gaming, video editing, multitasking—all solved. The Snapdragon 898 improved things slightly. The 8 Gen 1? Even better. The Gen 2, 3, and presumably what will be in the S26? Marginal wins in efficiency and raw compute.

But here's the thing: most users never feel those marginal wins. A person using an iPhone 13 doesn't experience slowdowns in 2025. Someone on a Galaxy S22 isn't frustrated with processor speed. They're frustrated when Instagram's algorithm pushes content they don't want to see. They're frustrated with 6-hour battery life on aging hardware. They're NOT frustrated with processor speed.

Manufacturers tout their latest chips because it's a measurable spec to advertise. 12-core processors. 3.5GHz base clocks. 50% faster ray tracing performance. None of that translates to user experience improvements that justify $1,200 price points.

Meanwhile, battery technology has barely moved. We're still using lithium-ion chemistry invented in the 1990s. Phone manufacturers design thinner devices instead of using extra space for larger batteries. They chase thinness as a design metric even though it makes phones slower to charge and worse for daily use.

That's the inverse of consumer priorities. People would take a phone 2mm thicker with 48-hour battery life over a thin device requiring daily charging. Yet flagship phones are getting thinner.

The Camera Feature Treadmill

Camera specifications have become absurd. Phones have 200-megapixel sensors now. Meanwhile, the limiting factor in computational photography isn't sensor size—it's software algorithm maturity and scene understanding.

Samsung's Galaxy S26 will have a marginally better camera than the S25. More realistic colors. Faster autofocus. Better video stabilization. All incremental. All barely noticeable in real-world use unless you're a photography enthusiast (in which case you own a dedicated camera).

The real innovation in phone cameras happened between 2012 and 2020. That's when computational photography matured. Google's Pixel introduced Night Sight. Apple perfected Smart HDR. These were quantum leaps.

Since 2020, camera improvements have been evolutionary. Better at the margins. Night mode is 8% cleaner. Portrait mode has better edge detection. Video gets slightly more stable.

Yet manufacturers market these as selling points. "Revolutionary new camera system." They're not. They're optimization work. It's necessary engineering, but it's not differentiating.

Here's what would be revolutionary: lossless optical zoom without moving the lens assembly. True periscope optics built into consumer phones the way they are in professional cinema lenses. Advanced computational photography that learns your style and applies it automatically. Phones that understand context and adjust settings intelligently.

Instead, we get sensor recycling with slightly modified software filters.

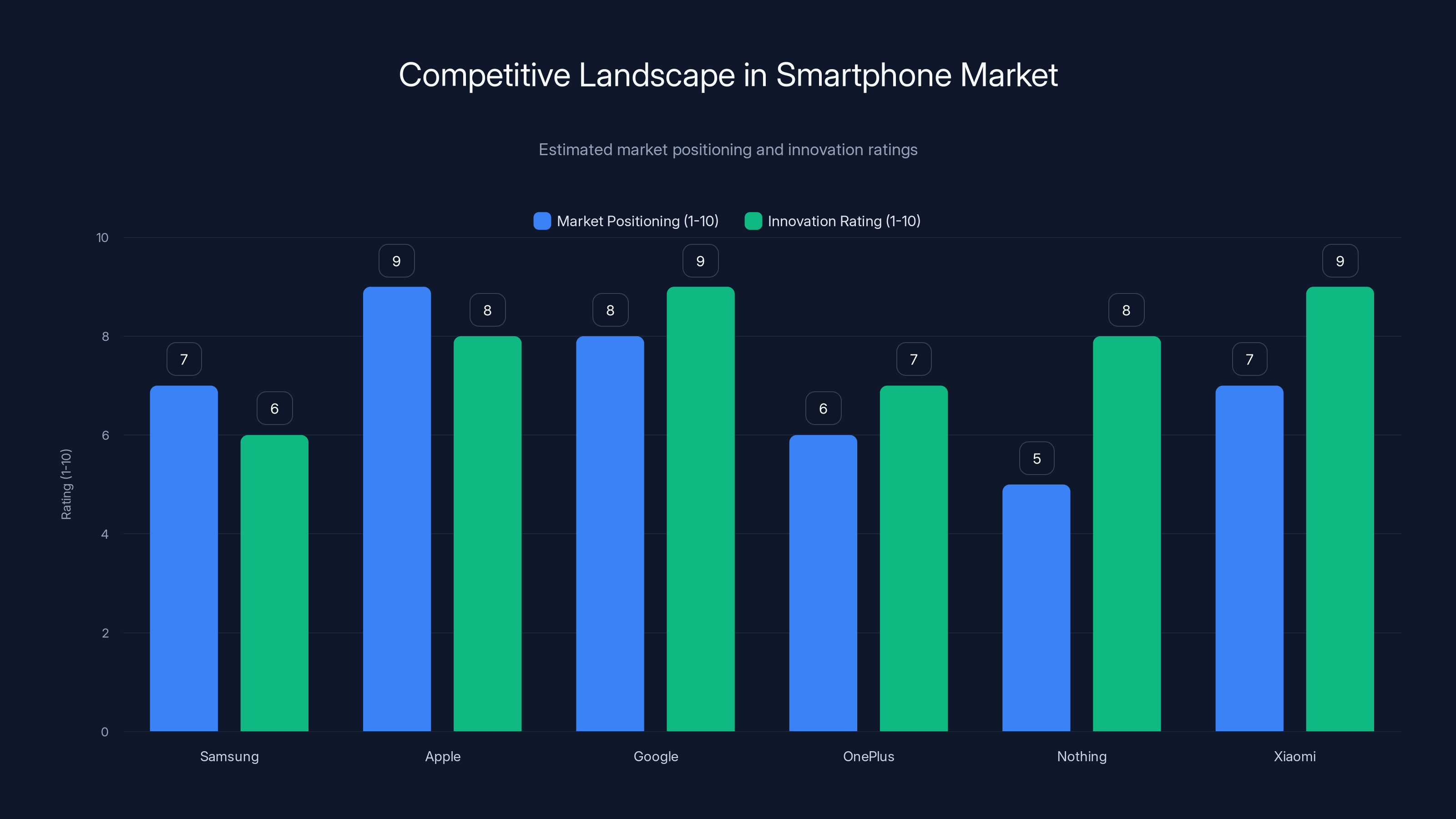

Apple leads in market positioning due to brand loyalty, while Google and Xiaomi excel in innovation. Samsung's split focus impacts its competitive edge. Estimated data.

The Missing Killer Feature Category

When the original iPhone launched, it had capacitive touch. Game-changing. Revolutionary. It defined the next decade of mobile design.

When Samsung introduced the S Pen to phones, it created a category nobody asked for but proved genuinely useful for a specific audience.

When Apple added Face ID, it changed how security worked across the entire industry.

The S26 doesn't have a clear killer feature on the horizon. AI capabilities? Google's doing that better. Folding phones? Samsung already mastered that with the Galaxy Z Fold. Battery life? Still mediocre.

There's a feature category that would actually matter: true passive authentication. Not facial recognition. Not fingerprints. Something that recognizes you constantly, passively, without interaction. Behavioral biometrics. Gait recognition. Voice modulation analysis. A phone that knows it's you 99% of the time without requiring action.

That would change how phones work. You could make security seamless. Payments would be one tap. Device switching would be instant. It would eliminate the friction of modern authentication.

But that requires integration of specialized hardware, sophisticated ML models, and privacy infrastructure. That requires innovation, not iteration. And innovation carries risk.

Manufacturers choose the safe path: another processor bump. Another camera algorithm tweak. Another year of the same phone.

Why Premium Pricing Compounds the Problem

The Galaxy S26 will cost approximately

At that price, consumers expect meaningful innovation. They expect breakthroughs. They expect something that justifies carrying a $1,000+ computer in their pocket.

Instead, they get 3 to 5% performance improvements, minor camera refinements, and similar battery life. The value proposition is broken.

Here's the math: if you amortize the S26 cost over a 4-year usage period, that's

Consumers understand this calculus intuitively. That's why the "maybe next year" mentality dominates flagship markets. Because next year, the S25 will be discounted 25 to 40%. And the S26 will offer marginal improvements not worth paying full price for.

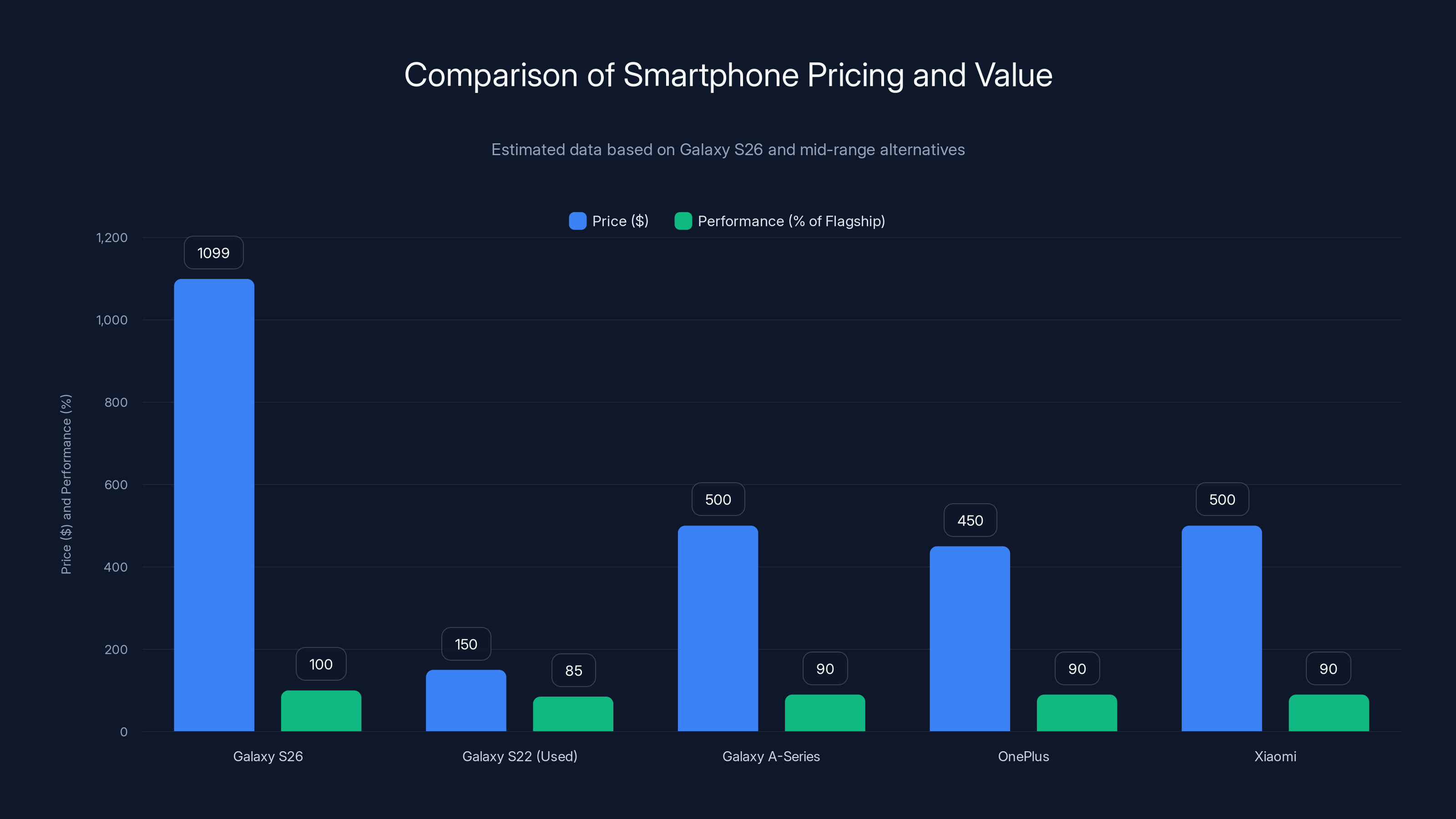

Meanwhile, mid-range phones have stolen the value narrative. The Galaxy A-series phones cost

Samsung knows this. So the company keeps prices high anyway, betting on brand loyalty and carrier subsidies. But subsidies are weakening as carriers compete on plans rather than device discounts.

The economic model is cracking.

Estimated data shows declining consumer excitement for recent flagship launches, with only 30% excited about the S26. This reflects a broader trend of diminishing returns in new smartphone features.

The Software Stagnation Nobody Mentions

Android has been essentially stable since version 10. iOS hasn't fundamentally changed since iOS 13. Both operating systems are mature, stable, and heavily optimized.

Since then, updates have been incremental. New widgets. Slightly reorganized settings. Different notification handling. Better integration with wearables. All nice. None transformative.

What would be transformative: a mobile OS that fundamentally rethinks how humans interact with devices. Spatial computing like Vision Pro? That's interesting, but it's a separate device category. Ambient computing that surfaces relevant information without active interaction? That's been "coming soon" for five years.

Instead, manufacturers spend engineering resources on polish. Smoother animations. Faster app launches by 200ms. That's optimization territory, not innovation.

The reason? Platform lock-in is already complete. iOS users aren't switching to Android. Android users aren't switching to iOS. The switching cost is psychological, financial, and practical. So both Google and Apple optimize for the installed base rather than taking risks on new paradigms.

This benefits enterprise software but murders consumer excitement. Because mature platforms don't inspire wonder. They deliver consistency.

Consumer Expectations Have Shifted Dramatically

Survey data reveals something crucial: consumers aren't upgrading phones to get better phones anymore. They're upgrading because their current phone is slowing down, aging, or damaged.

That's a maintenance purchasing behavior, not an excitement behavior. You buy new tires for your car because the old ones wear out, not because you're thrilled about tires.

Smartphones crossed that threshold around 2021. The market shifted from "what's new" to "what breaks." That's a maturity signal in product categories.

Manufacturers respond by extending software support (Apple's five years, Samsung's now four years) and designing for longevity. But extending support also means fewer upgrade cycles. If your phone gets updates for four years, you're less motivated to buy a new one after two.

It's a strategic contradiction: manufacturers want long product lifespans (good for brand loyalty and environmental PR) but also need high upgrade frequency (good for revenue). Both aren't compatible.

Samsung chose to optimize for both by making phones that feel stale after two years despite still functioning perfectly. Batteries degrade. Software optimizations lag behind. The camera loses appeal when every new photo looks familiar. Nothing breaks. You just feel like you're using old tech.

That's intentional. It's also why excitement is dying.

The Galaxy S26 is priced at a premium with minor performance gains over previous models. Mid-range phones offer 90% of flagship performance at half the price. Estimated data.

The Foldable Phone Gamble That Partially Paid Off

One bright spot in Samsung's innovation narrative is the Galaxy Z series. Foldable phones started as concept vehicles in 2019. Now they're a legitimate product category with multiple manufacturers competing.

The Galaxy Z Fold has genuine usefulness that justifies premium pricing. You get a small phone and a tablet in one device. That's real added value, not spec-sheet inflation.

But foldables still represent a niche market. They're 5 to 8% of Samsung's phone sales. The primary volume comes from the S-series and A-series lines, which compete on traditional metrics: processor speed, camera megapixels, screen brightness.

Here's the tension: foldables prove Samsung can innovate when forced to. The engineering challenges of folding displays, managing durability, optimizing software for form factors—these required genuine creativity.

Yet the S26 doesn't apply those lessons. Because the S-series is where profit lives. It's the revenue engine. Foldables are prestige products that build brand image but not scale.

If Samsung wanted to save the S26's hype crisis, they'd fold some of that foldable innovation back into the flagship line. New form factors. Different screen aspect ratios. Modular camera systems. Physical design breakthroughs that make people say "I've never seen a phone like that."

Instead, expect the S26 to be the S25 in an S26 body.

What Consumers Actually Want (And Don't Know How to Ask For)

When you push consumers hard enough, interesting patterns emerge in what they're actually looking for.

Battery life dominates every complaint. Not eight-hour battery life. Actual multi-day battery life. The ability to use your phone for 48 hours on one charge. That's not technically difficult—it's a physics problem solved by bigger batteries and lower-power displays. Samsung could ship an S26 with 7-day battery life if it allocated chassis space to batteries instead of thinness.

Thermal management matters more than clock speed. Phones throttle under sustained workload. Gaming for two hours? Your S25 slows down 20 to 30%. That ruins the experience. Better thermal engineering (liquid cooling, intelligent workload distribution) would improve daily usability more than a 5% processor speed bump.

Haptic feedback quality is underrated. iPhones have superior haptic engines to most Android phones. That subtle vibration when you tap a button, click a button, or receive notification matters psychologically. It makes interactions feel more precise and intentional. It's a premium feature that costs $20 more to implement.

Proper shade and color accuracy matter for a specific audience. Phone screens are calibrated for vibrancy, not accuracy. A screen calibrated to Rec.709 color space would look less exciting in the store but better for content creation. That's a features for professionals that never ships on consumer devices.

Ultimate repairability would be genuinely innovative. Not the theatrical "right to repair" stuff. Actual design-for-serviceability. Swappable batteries that don't require disassembly. Modular camera units. Storage expansion via SD card. The ability to fix your phone without specialized equipment.

None of these are hard. They're all profitable innovations that enhance user experience. Yet flagship phones systematically eliminate them to hit thinness targets and increase lock-in to manufacturer services.

The Competitive Landscape That's Making It Worse

Samsung doesn't compete alone anymore. The iPhone dominates the premium market with brand loyalty that's historically hard to crack. Google Pixel has carved out an AI-first positioning that's gaining traction. OnePlus, Nothing, and other insurgent brands are stealing the "power user" segment.

Meanwhile, mid-range phones are the actual growth story. The Galaxy A-series, Pixel 7a/8a, and phones from Xiaomi and Motorola are where volume growth exists.

In a fragmented market, Samsung's strategy should be to reposition the S-series as the ultra-premium, aspirational product. Make it actually different. Justify the $1,200 price through innovation, not through marketing claims.

Instead, Samsung is treating the S-series as the core volume driver and the Z-series as prestige. That splits resources and focus. The S26 won't get the design revolution it needs because Samsung's betting on stable revenue, not innovation.

Meanwhile, Nothing is shipping phones with translucent backs and actual design personality. Xiaomi is pushing the envelope on zoom optics. OnePlus is keeping pricing reasonable while delivering flagship performance. These companies are capturing the "skeptical enthusiast" demographic that Samsung used to own.

The competitive vacuum Samsung is creating is being filled by companies that took bigger risks.

Why The Market Research Data Tells A Brutal Story

When surveys show 70% of consumers unexcited about a flagship launch, that's not noise. That's signal. That means the hype generation infrastructure isn't working anymore.

Manufacturers have historically driven excitement through three mechanisms: design reveals, feature announcements, and exclusive pre-release access to media. All three generate coverage, speculation, and anticipation.

The S26 faces two problems in that infrastructure: design is known (it'll look like the S25), features are leaked (incremental), and media skepticism is high (because every flagship launch disappointed expectations last year).

The media narrative has shifted from "what's new" to "is this worth upgrading for." That's a dangerous shift for Samsung because the honest answer is increasingly "no, not really."

When the iPhone 12 launched, the story was 5G and faster processing. When the iPhone 13 launched, it was improved cameras and battery life. Both narratives had some substance.

When the iPhone 15 launched, the story was USB-C. A connector change. Not a feature. A compliance update forced by EU regulation. And it still generated headlines because there was literally nothing else to announce.

The S26 faces the same narrative poverty. It'll have a marginally better processor, slightly better cameras, possibly slightly better battery (unlikely). That's not sufficient for a $1,200 device in 2025.

Research firms are noting this openly now. Gartner, IDC, and Counterpoint Intelligence are all reporting mature market dynamics, declining upgrade frequency, and shifting consumer priorities toward durability and repairability over raw specifications.

Samsung can't advertise away that research. It's published. It's credible. Journalists reference it. Consumers read it.

What Samsung Actually Needs To Do

The company isn't doomed. It has resources, manufacturing expertise, and brand equity. But it needs to fundamentally rethink the S-series strategy.

Option one: Make the S26 genuinely different. New form factor. Truly revolutionary design. Actual innovations (like a passive authentication system or eight-day battery life). Price it at $1,300 and position it for early adopters. Cannibalize the Z-Fold user base if necessary. Build a new category around it.

Option two: Reduce the S-series to mid-range pricing. Deliver flagship performance at

Option three: Extend the S-series lifecycle. Instead of yearly launches, move to 18-month cycles. Use that extra time to develop real innovations. Announce once. Build anticipation. Deliver substantially. This kills the marketing treadmill but improves substance.

Option four: Pivot entirely. Make the S-series the "normal phone" and create a new ultra-premium line above it. Something with form factor experiments, extreme pricing ($1,500+), and genuine innovation targets. Let the S26 compete on practicality instead of excitement.

The company won't choose option one because it's the most expensive. It'll probably default to incremental option three (extended timelines) while internally justifying it as "listening to consumers."

That's the safe play. It's also the path to slow irrelevance.

The Broader Industry Implications

The S26 hype crisis isn't just Samsung's problem. It's an industry signal.

Apple faces the same challenge with the iPhone. Google faces it with the Pixel. OnePlus faces it with every new iteration. The smartphone market has matured past excitement cycles.

This opens opportunity for companies willing to genuinely innovate. Foldables, rollable phones, different aspect ratios, new materials—these could spark interest if marketed around actual utility rather than specifications.

But it also suggests a consolidation phase coming. If consumers only upgrade when their phone breaks, and phones last 4+ years now, the market will shrink. Fewer phones sold annually. Higher price points to maintain revenue. More aggressive retention through services (subscriptions, extended warranties, manufacturer financing).

Manufacturers will start competing on ecosystem lock-in rather than hardware innovation. Apple already won that war. Samsung is fighting it with One UI and Galaxy ecosystem services. Google is trying to compete through AI services integration.

The innovation, paradoxically, will move from hardware to software and services. That's less exciting but more profitable. It's also why you see aggressive push toward AI features in every flagship announcement now.

But AI features are even faster to commoditize than hardware specs. Every phone will have generative AI capabilities within 18 months. The competitive advantage will evaporate immediately.

The S26 is entering a market where hardware innovation is costly, software innovation is temporary, and consumer excitement is a luxury good that manufacturers can't reliably generate anymore.

That's actually healthy for consumers. It means companies will focus on durability, repairability, and long-term support instead of forcing upgrades. It means prices might stabilize or decline in real terms.

But it's terrifying for manufacturers betting on perpetual growth. Welcome to mature market dynamics.

FAQ

Why are consumers not excited about the Galaxy S26?

Consumers show low excitement for the S26 because smartphone innovation has plateaued. Processors are powerful enough for all practical uses, battery life remains unchanged, and design is iterative rather than revolutionary. When a $1,200 flagship offers only 3-5% improvements over the previous model, the value proposition for upgrading disappears.

What innovation would actually make the S26 worth buying?

Meaningful innovations include multi-day battery life through larger capacity (not thinner design), passive biometric authentication without user interaction, revolutionary new form factors beyond current designs, or genuine advances in thermal management. These would address actual user frustrations rather than marginal spec improvements.

How long do smartphone upgrades actually need to be?

Smartphones reach functional obsolescence much slower than they did historically. A phone from 2022 still receives security updates and handles modern apps without struggle. Users keep phones for 3-4 years on average now, driven by practical longevity rather than excitement-based upgrades.

Why do manufacturers keep releasing yearly phones if people don't want them?

Manufacturers maintain yearly release cycles for marketing momentum, market segment coverage, and revenue stability. Reducing frequency would disrupt marketing infrastructure and quarterly earnings expectations. Even when yearly innovations are marginal, the marketing ecosystem (carrier promotions, media coverage, trade-in programs) drives sales without requiring genuine consumer excitement.

Could mid-range phones make flagships irrelevant?

Mid-range phones already captured the value-conscious market and are growing faster than flagships. However, flagships retain premium brand perception, superior cameras, and exclusive features. The market will likely bifurcate: mid-range phones for practical users, flagships for brand loyalty and early adopters, with the gap between them widening.

What would force the industry to genuinely innovate?

Competition from adjacent categories (AI devices, augmented reality, spatial computing) would force innovation. Alternatively, a radically different approach (like sustainable manufacturing with lifetime repairability) from an insurgent brand could reset expectations. Currently, locked-in markets and network effects prevent disruption.

Is the Galaxy S26 worth waiting for?

Based on historical release patterns, waiting for the S25 or S24 at discounted pricing offers better value. Flagship phones reach maximum discount 6-12 months after launch, making used or clearance models excellent options. Unless the S26 announces genuinely revolutionary features before launch, upgrading to a previous generation offers superior economics.

How does the S26 compare to the iPhone 16 or Pixel 9?

All three flagship lines offer comparable performance and features with marginal differentiation. The iPhone 16 has better optimization and longer software support. The Pixel 9 has superior AI integration. The Galaxy S26 has design refinement and broader feature parity. Choice comes down to ecosystem preference rather than objective capability differences.

Key Takeaways

- Seventy percent of consumers express low excitement for the Galaxy S26, reflecting broader smartphone market saturation and fatigue with iterative upgrades

- Smartphone processors, cameras, and design have reached a plateau where incremental improvements no longer justify premium $1,200 price points for most users

- Consumers now keep phones for 3-4 years on average, driven by practical longevity rather than excitement, fundamentally changing upgrade economics

- Mid-range smartphones deliver 80-90% of flagship performance at 50% of the cost, making premium models increasingly difficult to justify from value perspective

- Samsung's inability to deliver design innovation comparable to its foldable Z-series suggests strategic prioritization of profit stability over breakthrough advancement

Related Articles

- Samsung Galaxy Z TriFold Sold Out: What It Means for Galaxy S26 [2025]

- Why Loyalty Is Dead in Silicon Valley's AI Wars [2025]

- Samsung Galaxy S26 Launch Date and Expected Discounts [2025]

- Should You Wait for Galaxy S26? Why Skipping S25 Makes Sense [2025]

- Inside Moltbook: The AI-Only Social Network Where Reality Blurs [2025]

- Samsung Galaxy Unpacked 2026: S26 Launch Guide [2025]

![Why Samsung's Galaxy S26 Faces Massive Hype Crisis [2025]](https://tryrunable.com/blog/why-samsung-s-galaxy-s26-faces-massive-hype-crisis-2025/image-1-1770345338770.jpg)