Acer Nitro Blaze 11 Cancelled: What Happened to Gaming's Biggest Handheld [2025]

Last January, The Verge sat down with Acer representatives at CES 2025 and held what could have been the most ambitious gaming handheld ever created. The device was massive. Genuinely massive. We're talking about an 11-inch screen—roughly the size of a small tablet—packed into a form factor that looked like someone took a Nintendo Switch and inflated it to absurd proportions.

The Nitro Blaze 11 wasn't just bigger. It was supposed to be a statement. A full-featured gaming device that could compete with laptops for AAA gaming performance while maintaining portability. Acer had plans for smaller variants too—the Blaze 7 and Blaze 8—each targeting different audiences within the expanding handheld gaming market.

Then came the tariffs. And just like that, one of gaming's most audacious hardware bets quietly disappeared.

The Rise of Handheld Gaming Ambition

Understanding why Acer's Nitro Blaze mattered requires context about where the handheld gaming space was in early 2025. The market had fundamentally shifted from what it was just five years prior.

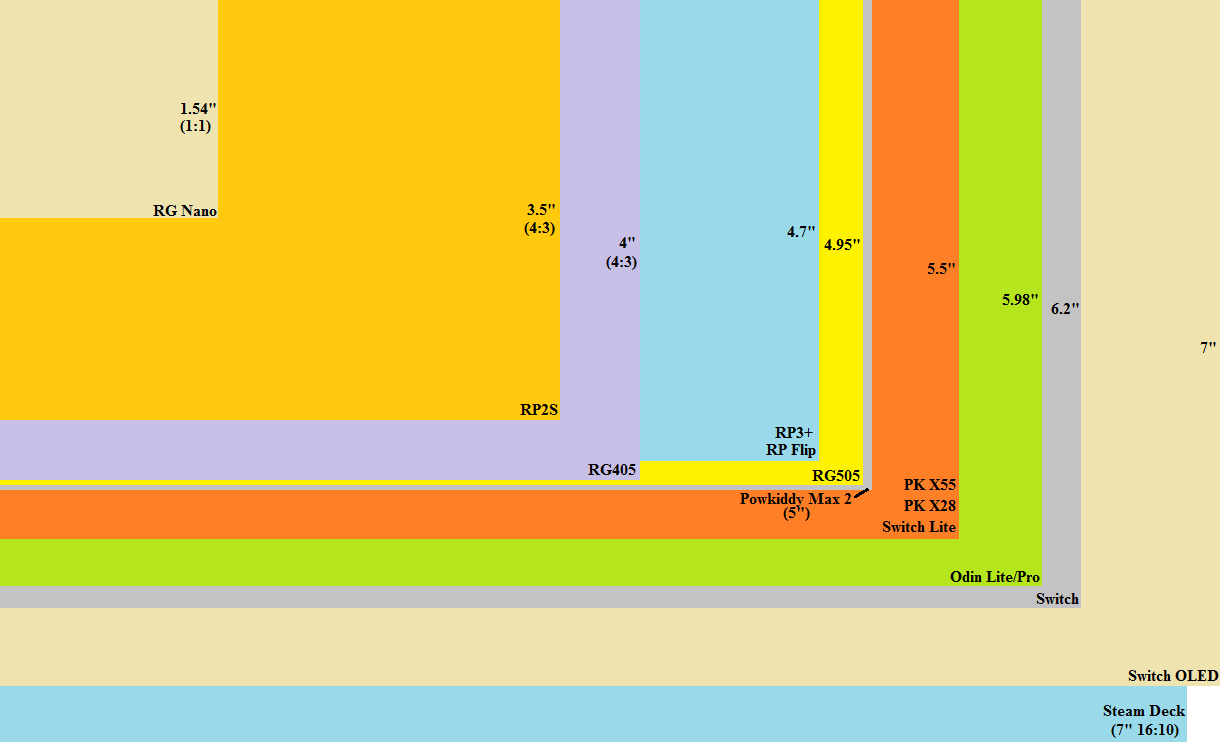

When the Steam Deck launched in December 2021, it was treated as a niche product for PC gamers willing to sacrifice screen size for power. The device started at $399 and featured a 7-inch display. Critics said it was too bulky, the battery life was mediocre, and the library was limited.

Everything changed. Within eighteen months, the Steam Deck had shipped 2 million units. The success wasn't just because the device worked—it was because it proved something fundamental about consumer preferences: people actually wanted to play real games on the go, and they were willing to accept compromises in form factor to do it.

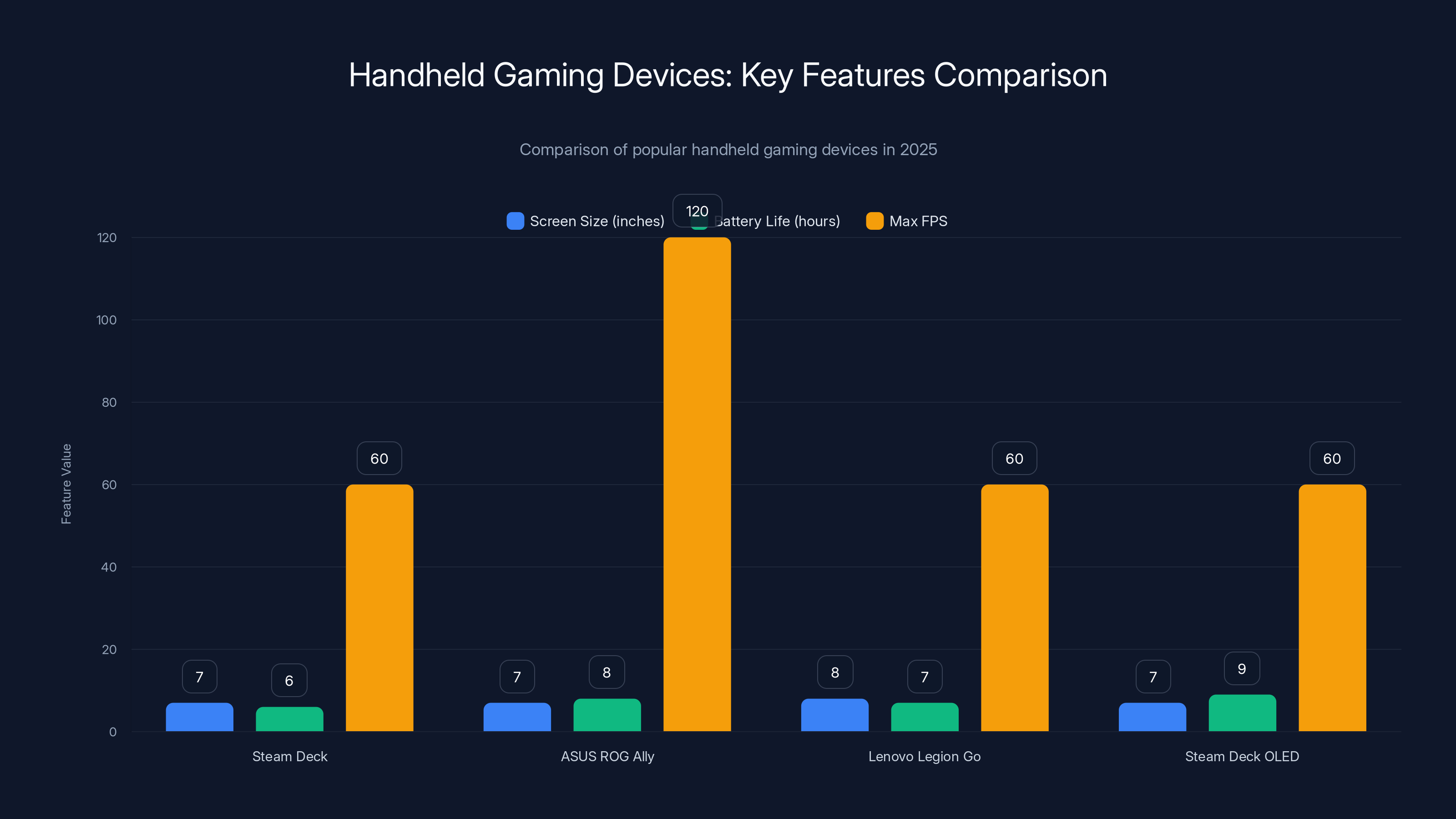

By 2024, the landscape had evolved dramatically. You had the ASUS ROG Ally with its Windows 11 operating system and 120 FPS capability. You had Lenovo's Legion Go with its innovative detachable controllers. You had Valve iterating on the original Steam Deck with the Steam Deck OLED, which featured a 1.6x brighter display and 9-hour battery life.

Into this crowded field, Acer looked at the competitive landscape and made a bold decision: go bigger. Not just slightly bigger. Significantly bigger.

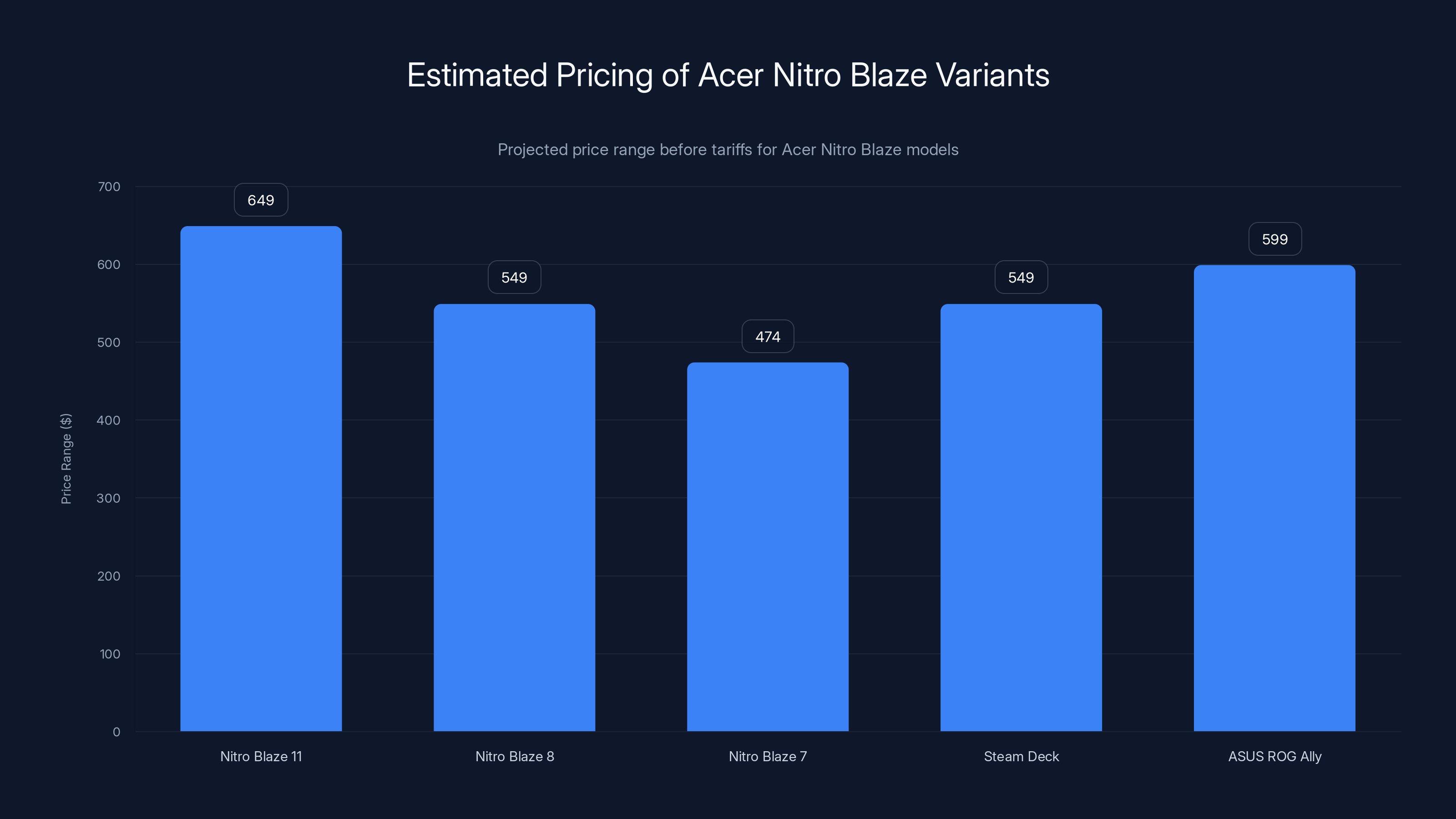

Estimated pricing for the Acer Nitro Blaze models positioned them competitively against the Steam Deck and ASUS ROG Ally, but tariffs would have increased prices by 25-30%.

Why Size Actually Matters

The appeal of an 11-inch gaming handheld isn't immediately obvious. At that screen size, you're basically carrying around a device that's approaching tablet dimensions. The battery drain increases substantially. The weight becomes noticeable. The price point creeps upward.

So why would Acer pursue this?

The answer lies in understanding the actual problem that handheld gamers face. The steam around screen size came down to a fundamental tension: you want your portable device to be actually portable, but you also want the screen large enough to see what's happening on the display without squinting.

On a 7-inch screen, playing AAA games at 1080p resolution looks good from 18 inches away. But that's not realistic gameplay distance. Players typically hold the device 8-12 inches from their eyes, which means individual UI elements become hard to parse. Text in games becomes nearly illegible. The immersion suffers.

With an 11-inch display, Acer was essentially creating a device where the optimal viewing distance aligned with how people naturally hold gaming devices. Text became readable. UI elements became clickable without relying on muscle memory. The gaming experience felt less cramped.

There was secondary logic too: as game engines improved and screen resolution density plateaued, the biggest differentiator for gaming experiences became processing power and thermals. An 11-inch device gave Acer more interior space for heat dissipation. More room for a larger battery. More room for premium internals without the device becoming impossibly thick.

The Nitro Blaze wasn't just bigger for the sake of being bigger. It represented a different philosophy: optimize for the actual gameplay experience rather than portability compromises.

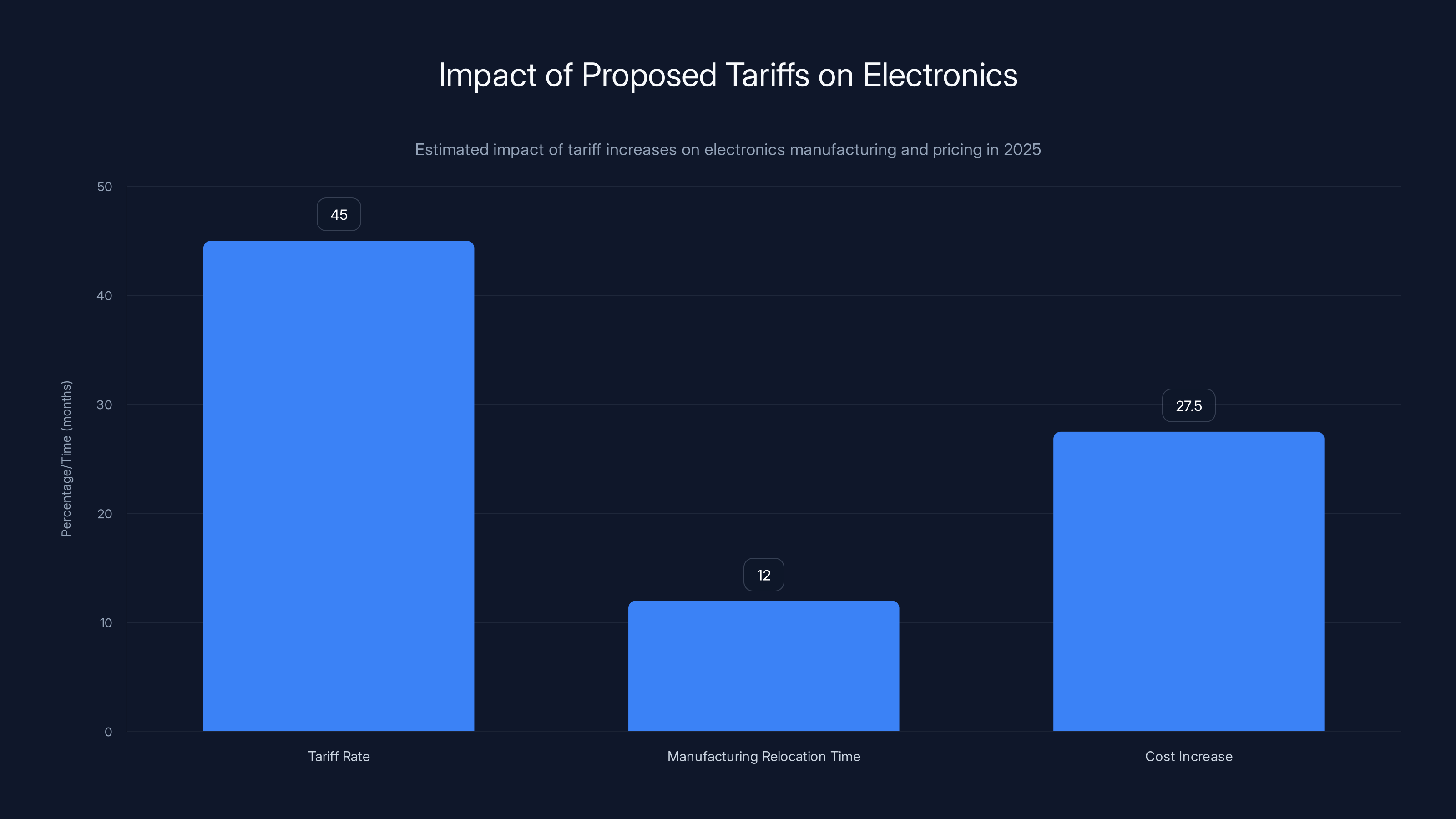

Estimated data shows a 45% average tariff rate, 12 months for relocation, and a 27.5% increase in costs, highlighting the significant challenges faced by electronics manufacturers.

The Three-Device Strategy

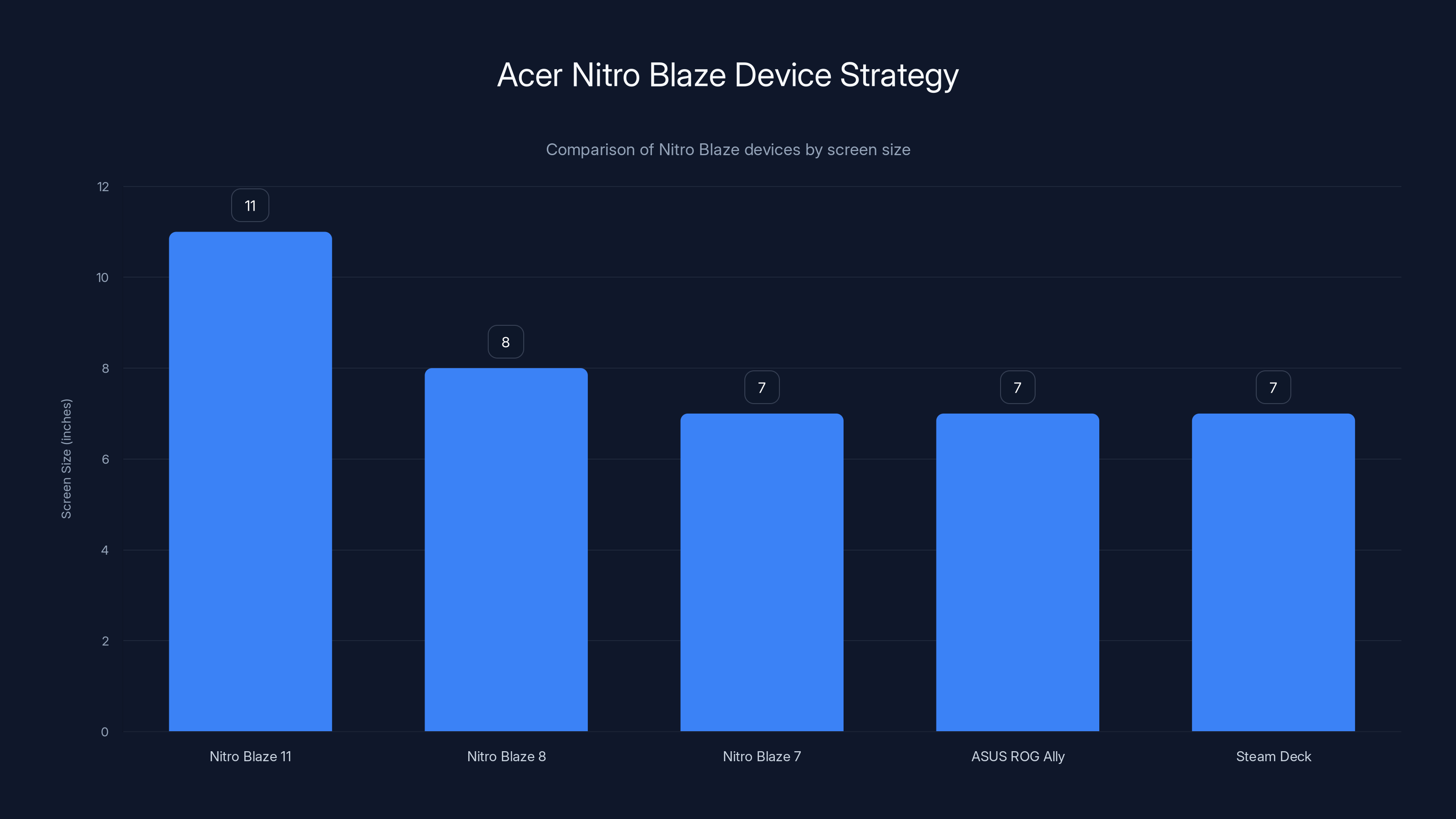

Acer wasn't planning a single device. The Nitro Blaze lineup was supposed to launch as a tiered product family.

The flagship Nitro Blaze 11 would serve high-end consumers willing to carry a larger device for optimal gaming. It was targeted at players who used handhelds primarily at home, in offices, or during long travel sessions where a backpack was already being used.

The mid-tier Nitro Blaze 8 would occupy the middle ground between existing competitors and the flagship. At 8 inches, it would be noticeably larger than Steam Deck but more portable than the 11-inch variant. This was positioning directly against the ASUS ROG Ally's 7-inch display.

The entry-level Nitro Blaze 7 would compete directly with Steam Deck, but with Acer's engineering and potentially different internal specifications or pricing.

This three-pronged approach made strategic sense. It allowed Acer to test different screen sizes, power targets, and price points simultaneously. It gave retail partners inventory options. It meant that even if one variant underperformed, the others could succeed.

A Q2 2025 launch timeline was set. That gave Acer roughly 4-5 months from CES announcement to market availability. For a gaming handheld with custom engineering, that's an aggressive timeline, but not impossible. Companies routinely compress timelines for product launches.

Then the political landscape shifted.

The Tariff Bomb

In late January 2025, US administration officials began signaling plans for aggressive tariff increases on products manufactured in China. The proposed rates ranged from 25% to 60% on imported goods across multiple product categories, with particular focus on consumer electronics.

For electronics manufacturers, tariffs don't just affect the final price to consumers. They create cascading complications throughout the supply chain:

Manufacturing Location Constraints: If your device is manufactured in China (as most were), you suddenly face a choice: eat the tariff costs and accept reduced margins, or increase the price to consumers and risk competitiveness.

Supply Chain Restructuring: Many manufacturers don't have alternative manufacturing locations immediately available. Setting up production in India, Vietnam, Mexico, or other tariff-advantaged countries takes time. You need to negotiate contracts with manufacturers, qualify new production facilities, re-engineer supply chains, and validate quality standards.

Time Compression: Even if alternative manufacturing is theoretically possible, the timeline is problematic. Establishing new manufacturing partnerships takes 6-18 months under normal circumstances. During a tariff crisis, when every tech company is simultaneously trying to relocate production, timelines stretch even further.

Financial Viability: The Nitro Blaze was positioned as a premium device competing with Steam Deck and ROG Ally. If tariffs increased the cost of goods sold by 25-30%, you'd need to increase retail price by similar amounts just to maintain margin. But market research likely showed that demand would crater at those price levels.

Acer did the calculation and concluded that launching the Nitro Blaze into a tariff environment made no financial sense.

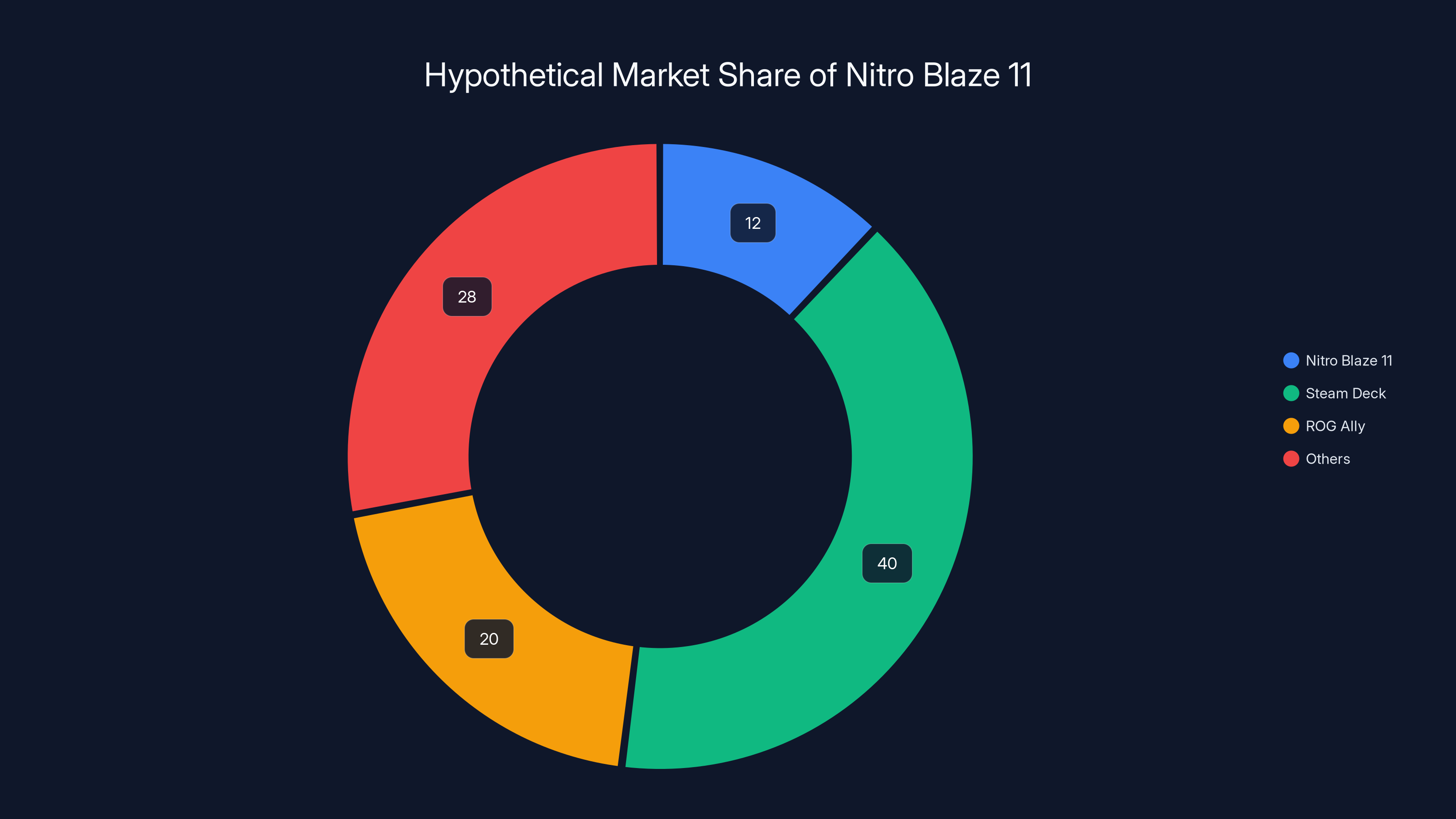

Estimated data suggests Nitro Blaze 11 could have captured 8-15% of the handheld gaming market, positioning it as a strong competitor against Steam Deck and ROG Ally.

What Lisa Emard Actually Said

When reporting broke about the Nitro Blaze's delayed launch, few journalists pursued the story directly with Acer. The Verge's Antonio G. Di Benedetto did exactly that at CES 2026, tracking down Lisa Emard of Acer America Corporation.

Emard's response was telling and honest:

"When we announced those products it was just ahead of the tariffs situation. We wound up just focusing on our core products, on laptops, because we needed to find manufacturing options outside of China. We don't have any imminent plans to offer them."

This statement reveals several important realities about how hardware companies actually operate:

First: The tariff timing was brutal. CES happens in early January. The first major tariff announcements happened weeks later. Acer had committed to these products before the policy uncertainty solidified into actual policy.

Second: Acer prioritized laptops. This wasn't a decision to kill handheld gaming entirely—it was a resource allocation choice. Acer's core business is laptops. Handhelds are new territory. When facing supply chain crisis, you protect your existing revenue streams first.

Third: "Finding manufacturing options outside of China" is expensive and time-consuming. It requires capital investment, facility validation, and supply chain reconstruction. For a product category that's still experimental for Acer, that investment may not have justified itself.

Fourth: "No imminent plans" is corporate-speak for "probably not happening." In tech, "imminent" typically means 2-4 quarters. The fact that Acer explicitly said there are no imminent plans suggests this product is effectively shelved indefinitely.

The Handheld Market's Real Winners

While Acer shelved the Nitro Blaze, the handheld gaming market didn't stall. Instead, it consolidated around existing players who already had supply chains established before tariffs hit.

Valve released the Steam Deck OLED in October 2024, right before tariff uncertainty became acute. The device sold out consistently and became the dominant premium handheld on the market. Valve's advantage: they already had manufacturing relationships and supply agreements locked in place.

ASUS continued iterating on the ROG Ally, releasing updated versions with improved internals and better battery life. ASUS had the same advantage: existing manufacturing infrastructure that could absorb tariff costs or relocate more efficiently than newcomers.

Nintendo maintained dominance in the casual handheld space with the Switch OLED, and later with rumors of Switch 2 hardware. Nintendo's manufacturing footprint is global and diversified, making them less vulnerable to single-country tariff policies.

What didn't happen: new entrants. The tariff environment created barriers to entry. Smaller companies and new players got squeezed out. Large incumbents with existing supply chains could weather the storm. New companies trying to launch their first major hardware product? Dead in the water.

Acer's Nitro Blaze became a casualty of this dynamic. Not because the product was bad. Not because consumer demand didn't exist. But because the timing created an impossible business case.

The ASUS ROG Ally stands out with its 120 FPS capability, while the Steam Deck OLED offers the best battery life at 9 hours. Estimated data for comparison.

The Technical Specifications Acer Never Published

One of the most frustrating aspects of the Nitro Blaze's cancellation is that Acer never publicly released detailed specifications. The company showed working hardware at CES 2025, but withheld detailed technical information.

What we know from hands-on impressions:

Display Technology: The 11-inch variant featured what appeared to be a 1440p LCD panel with 120 Hz refresh rate. This was significantly higher than the Steam Deck's 800p, 90 Hz display. The pixel density worked out to approximately 200 PPI, which is competitive with mid-range tablets.

Processor Rumors: Given that Acer announced the device in early 2025, the processor was likely based on either Qualcomm's Snapdragon platform or AMD's custom architecture. The Snapdragon X series (available in Windows handheld devices) would have been the logical choice, offering performance competitive with ROG Ally.

Thermal Management: The larger form factor implied more sophisticated cooling. The device included what appeared to be dual ventilation fans and an internal vapor chamber design for heat dissipation. This would have enabled sustained performance without throttling.

Battery Capacity: The size of the device suggested a battery between 40,000-50,000 mAh, roughly 2-3x larger than Steam Deck. This would theoretically enable 8-12 hour gameplay sessions.

Acer also planned docking solutions, peripheral controllers, and an SDK for developers to optimize games for the larger screen. The company was building an ecosystem, not just a device.

None of this ever shipped. None of it ever will.

Market Timing and the CES Effect

CES has a special role in the tech industry. It's where companies announce ambitions, test market reactions, and set expectations for the year ahead. The showcase can make a product famous. It can also create expectations that hardware realities can't meet.

For Acer, announcing the Nitro Blaze at CES 2025 was both brilliant marketing and a calculated risk. The company knew that handheld gaming was hot. The company knew that larger-screen devices occupied an underserved market niche. The company wanted to position itself as innovative and ambitious.

What Acer didn't anticipate was the policy environment shifting just weeks after the announcement. In a normal market, the January announcement would have generated buzz, reviews would have gone out in Q2 (launch quarter), sales momentum would have built, and by Q4 we'd see whether the product succeeded or failed.

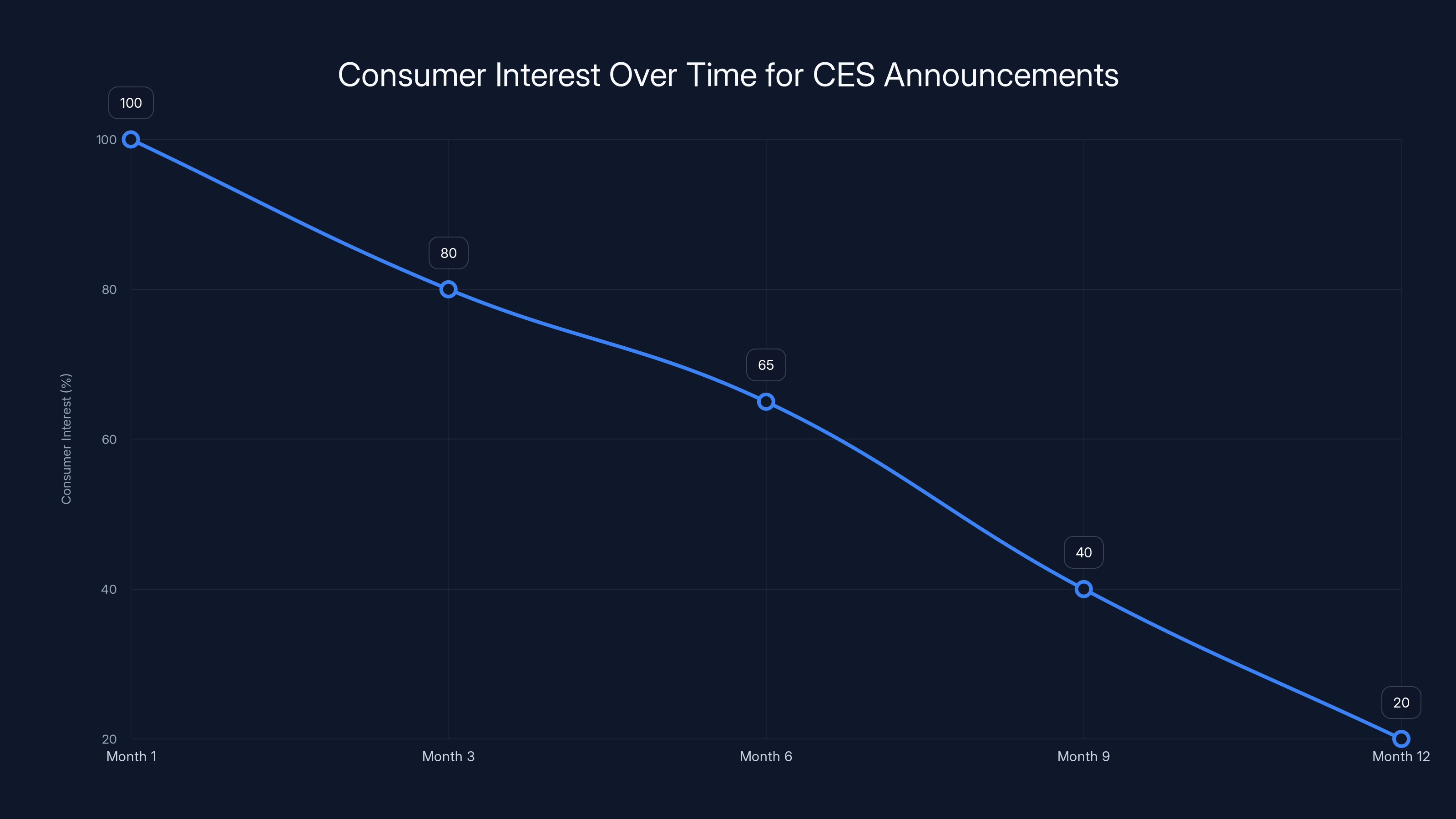

Instead, the announcement became orphaned. The product entered a state of indefinite limbo. The marketing momentum dissipated. Consumer interest, which was real in early 2025, shifted to other devices.

This timing problem is unique to hardware in a way that software isn't. When a software company announces a feature and delays it, consumers stay interested—the feature remains relevant. When a hardware company announces a device and delays it, people buy alternatives. The market doesn't wait.

Acer's decision to shelve the Nitro Blaze indefinitely was probably the only rational choice, but it demonstrates a broader truth: product announcements and market conditions need to align. When they don't, even ambitious hardware projects die.

The Nitro Blaze lineup offers a range of screen sizes, with the flagship model at 11 inches, providing options for different user preferences and competitive positioning against ASUS ROG Ally and Steam Deck.

What Acer Learned About the Handheld Market

Despite the cancellation, the Nitro Blaze mattered. It proved that Acer was serious about gaming, even in categories outside their traditional laptop business. The company developed relationships with component suppliers, testing houses, and potential retail partners.

The device showed up in gaming publications and tech press. Journalists held the hardware, tested the build quality, and reported positive impressions. The concept wasn't flawed—the execution environment was.

For Acer, the lesson likely involved several insights:

First: Handheld gaming is viable as a business, but the market is dominated by entrenched players with manufacturing advantages. Breaking in requires either a significant technological leap or acceptable timing with supply chain stability.

Second: Screen size expansion is a viable product strategy. Gaming community feedback was positive about the larger form factor. If Acer ever resurrects handheld products, expect larger screens to remain part of the roadmap.

Third: Policy risk needs to be factored into hardware product timelines. Acer's planners probably now include "tariff impact analysis" as a standard part of go/no-go decisions.

Fourth: Gaming product lines need robust ecosystems. The Nitro Blaze wasn't just hardware—it included software SDK work, developer relationships, and peripheral planning. Rebuilding that infrastructure requires significant time and capital.

The Broader Gaming Hardware Landscape

The Nitro Blaze's cancellation is one data point in a larger story about gaming hardware consolidation.

In 2024-2025, the narrative in gaming hardware shifted from "everybody is making handhelds" to "only established companies are making handhelds." Smaller players like GPD and Anbernic continued making niche products for enthusiasts, but new major manufacturers entering the space basically stopped.

The same dynamic played out in gaming laptops. Brands like MSI, ASUS, and Lenovo dominated. New entrants struggled. Supply chain complexity and tariff exposure created barriers to entry that couldn't be overcome by new companies.

What emerged was a three-tier market:

Tier 1: Market Leaders (Steam, ASUS ROG, Nintendo): These companies had established supply chains, brand recognition, and capital reserves to absorb tariff costs. They thrived during the tariff environment because competitors were forced out.

Tier 2: Premium Specialists (smaller brands with loyal audiences): These companies found niches and served them well. They charged premium prices and maintained healthy margins despite tariff exposure.

Tier 3: New Entrants: Almost completely eliminated. The barriers were too high. The capital requirements were too steep. The timing was too risky.

Acer, as a Tier 1-adjacent company (huge in laptops, but new to gaming handhelds), fell into a gap. They were too large to ignore policy risk, too new to gaming handhelds to justify the capital expenditure, and not established enough in the handheld space to have the supply chain advantages of Steam or ASUS.

Consumer interest in products announced at CES typically declines by 65% within 6-9 months if not launched, highlighting the critical timing for market entry. (Estimated data)

The Road Not Taken: Hypothetical Success

What if the Nitro Blaze had launched on schedule in Q2 2025? What if tariffs had been delayed or never implemented?

Historically speaking, the device likely would have competed well. Gaming journalism coverage was positive. Consumer interest was real. The larger screen size addressed a legitimate pain point in the market.

Launching at a

With proper marketing and retail support, the device could have captured 8-15% of the handheld gaming market in its first year. That would have translated to somewhere between 200,000-500,000 units sold.

Would that have been successful? Absolutely. Those numbers are profitable for a brand like Acer. It justifies the R&D investment and establishes the brand in a new category.

But success was never the problem. Feasibility during a tariff crisis was. And under those conditions, the device simply couldn't succeed at a competitive price point.

Handheld Gaming's Future After Nitro Blaze

Looking forward, the cancellation of the Nitro Blaze offers insights into where handheld gaming is heading.

Screen sizes will likely stabilize around 7-8.5 inches for standard handhelds. This represents the sweet spot between portability and visibility. Larger variants will remain niche products for enthusiasts willing to sacrifice portability.

Processing power will continue increasing, but at a measured pace. The gap between handheld and console/PC gaming continues narrowing. Within 3-5 years, the difference becomes largely academic—handhelds will handle AAA games at competitive frame rates.

Ecosystem lock-in becomes the differentiator. The device hardware matters less than the software, store, and community. Steam's dominance comes from Proton compatibility and the game library, not superior hardware. ASUS succeeds because of integration with Windows and ROG ecosystem services.

Supply chain resilience becomes a market factor. Companies with diversified manufacturing will gain competitive advantage. Companies dependent on single-country manufacturing face ongoing risk.

New entrants will be institutional: Expect Apple or Samsung to eventually enter with integrated ecosystems, not standalone devices. Expect established console makers like Sony to eventually launch Play Station handheld devices. Expect Microsoft to integrate Xbox services more deeply into handheld gaming. Independent companies breaking into the market becomes increasingly unlikely.

The Human Cost of Cancellation

Behind the Nitro Blaze cancellation were engineers, designers, project managers, and product specialists who invested real work into the device. People who believed in the project. People who planned product launches. People who sold the concept to leadership.

Then one policy announcement and the project was shelved. No public announcement of cancellation. No formal press release. Just silence.

This is the reality of hardware development. Products get killed. Sometimes for good reasons (lack of demand, technical infeasibility). Sometimes for bad reasons (politics, policy changes, executive whims). Often, the actual reason is buried and wrapped in corporate language.

Acer's situation was actually one of the honest versions. At least company representatives acknowledged the real reason (tariffs and supply chain restructuring) when asked directly.

For many other products that disappear, we never get even that level of transparency. We just assume they failed in the market, when often they were killed before they reached the market.

Lessons for Other Hardware Companies

The Nitro Blaze cancellation offers several lessons for other companies considering entry into competitive hardware categories:

Lesson One: Time Your Announcements: Don't announce hardware if your supply chain is vulnerable. Wait until manufacturing is locked in, tariff environment is clear, and launch timelines are certain. CES hype isn't worth a cancelled product.

Lesson Two: Protect Core Business First: If you're diversifying into new categories, ensure they don't cannibalize resources from your profitable businesses. Acer's decision to prioritize laptops (where they're established) over handhelds (where they're new) made sense.

Lesson Three: Build Ecosystem Early: Don't launch hardware without a software/service ecosystem ready. Acer had SDK work planned, but it wasn't complete when the product got shelved. Have all pieces ready before announcement.

Lesson Four: Establish Manufacturing Relationships Early: Before announcing, lock down manufacturing partnerships. Don't assume you can find alternate suppliers easily. The supply chain is your bottleneck, not the engineering.

Lesson Five: Have a Pivot Plan: What if tariffs hit and your supply chain became unviable? Did you have a plan B? Acer did (focus on laptops)—make sure you do too.

The Future of Acer's Gaming Ambitions

Does the Nitro Blaze cancellation mean Acer is abandoning gaming? Almost certainly not. The company continues investing in gaming laptops through the Nitro brand. The company invests in gaming displays and peripherals. Gaming is part of Acer's future.

What changes is the category focus. Acer may eventually return to handheld gaming, but likely only after:

- Supply chain diversification makes the business case work

- Manufacturing relationships are established outside China

- Policy uncertainty around tariffs stabilizes

- The handheld gaming market matures and consolidates further

When Acer does return to handhelds, expect a different approach. The Nitro Blaze was ambitious and bold. The next attempt will probably be more cautious, more focused on a specific niche, and supported by deeper ecosystem integration.

Or, alternatively, Acer may have learned that handheld gaming is a tough category requiring long-term commitment that the company isn't willing to make. Gaming laptops are Acer's strength. That's where resources flow.

Why This Story Matters Beyond Gaming Hardware

The Nitro Blaze cancellation is important because it illustrates how policy and hardware development intersect. Most tech coverage focuses on announcements, specifications, and consumer reactions. The business reality—supply chains, tariffs, manufacturing relationships—remains invisible.

But that's where products live or die. A well-engineered device with weak supply chains won't make it to market. A mediocre device with strong supply chains will. Policy environments shape product portfolios more than engineering does.

As tariff policy continues evolving, expect more announcements followed by quiet cancellations. Expect supply chains to concentrate among larger, more resilient companies. Expect new product categories to become harder to enter.

The Nitro Blaze was a casualty of this larger trend. It won't be the last.

What We Learned From Holding the Hardware

For the journalists and reviewers who actually held the Nitro Blaze at CES 2025, the device left an impression. Reports consistently mentioned build quality, screen quality, and thoughtful industrial design. The device felt premium, not like a prototype.

This supports the theory that the cancellation wasn't about the product being flawed. It was about business conditions becoming impossible. A bad product gets cancelled quietly. A good product that can't be manufactured profitably due to tariffs gets shelved indefinitely.

The Nitro Blaze proved that Acer could design world-class gaming hardware. The company just proved it won't be allowed to bring it to market under current conditions.

The Bigger Picture: Tariff Impact on Tech

The Nitro Blaze is one visible casualty of US tariff policy. But the broader impact is distributed across thousands of products and companies that never reach the level of CES announcement publicity.

How many products were cancelled before announcement due to tariff impact? Hundreds, probably. How many companies decided not to enter new markets because tariff exposure was too high? Dozens. How much innovation was shelved because business cases didn't work under new policy conditions?

That's the invisible cost of trade policy. It shows up as cancelled handheld gaming devices, but the real cost is in innovation not attempted, products not developed, and companies not started.

Acer's transparency about the reason (even when directly asked) is actually unusual in this space. Most companies either never announce ambitious products that tariffs will kill, or they announce and then go silent.

Final Thoughts: The Nitro Blaze That Could Have Been

The 11-inch Nitro Blaze gaming handheld represented ambition. It represented a company looking at an emerging market and saying, "What if we went bigger?"

The answer turned out to be irrelevant. Not because "bigger" was wrong. Not because the market didn't want it. But because the conditions for getting it to market successfully simply didn't exist.

In another timeline—one where tariffs were delayed, or announced earlier so Acer could plan accordingly, or simply never happened—the Nitro Blaze might be sitting in consumer hands right now. It might be finding success. It might be establishing Acer as a serious player in gaming handhelds.

Instead, it's shelved. Probably permanently. The engineers moved to other projects. The peripheral partnerships dissolved. The marketing plans were archived. The retail relationships were redirected to laptop products.

The device served one purpose before it even launched: it proved that large-screen gaming handhelds were technically feasible and market-interesting. That knowledge might eventually become useful if Acer returns to the category under better conditions.

But for now, the Nitro Blaze is a ghost product. A what-if. A reminder that market conditions matter more than hardware quality. And a cautionary tale for companies announcing ambitious products in uncertain times.

If you're thinking about buying a gaming handheld in 2025-2026, the Acer Nitro Blaze simply isn't an option. And that's a shame, because by all accounts, it would have been a genuinely interesting alternative to existing devices.

FAQ

What was the Acer Nitro Blaze 11?

The Acer Nitro Blaze 11 was an announced but never-released gaming handheld featuring an 11-inch display, making it significantly larger than competitors like the Steam Deck and ASUS ROG Ally. Acer planned three variants (7-inch, 8-inch, and 11-inch) positioned as premium gaming devices with advanced specs, targeted for Q2 2025 launch. The device was showcased at CES 2025 with positive hands-on impressions from tech journalists before being indefinitely shelved.

Why did Acer cancel the Nitro Blaze?

According to Acer representatives, the announcement happened just before US tariff policy became uncertain in late January 2025. When tariffs were implemented (ranging from 25-60% on Chinese-manufactured electronics), the business case for the product became unviable. The company needed to redirect resources to finding alternative manufacturing outside China, a complex process that would have required the product to launch at significantly higher prices. Rather than proceed under these conditions, Acer shelved the project indefinitely to focus on established business lines like laptops.

How much would the Nitro Blaze have cost?

Acer never officially announced pricing, but industry estimates based on internal component specs and competitive positioning suggested a price range of

What screen size was the Nitro Blaze?

Acer planned three screen sizes: the Nitro Blaze 11 featured an 11-inch display (significantly larger than standard gaming handhelds), the Blaze 8 had an 8-inch screen, and the Blaze 7 carried a 7-inch display. The 11-inch variant was the most ambitious, featuring a 1440p resolution with 120 Hz refresh rate, providing superior visual clarity compared to competing devices.

Will Acer ever release a gaming handheld?

Acer has not completely ruled out future handheld gaming products, but company representatives stated they have "no imminent plans" to offer them. Realistically, such a product would only happen after supply chain diversification is complete, tariff environments stabilize, and the gaming handheld market reaches greater maturity. Don't expect announcements in the near term.

How does the Nitro Blaze compare to Steam Deck and ROG Ally?

The Nitro Blaze occupied a unique position with its larger 11-inch display compared to Steam Deck's 7-inch and ROG Ally's 7-inch screens. Specs were competitive with ROG Ally (suggesting similar performance), while the bigger screen provided advantages for UI readability and immersion. However, at estimated price points ($600+), it would have been more expensive than both alternatives, requiring consumers to value the larger form factor enough to justify the premium.

What does the Nitro Blaze cancellation mean for handheld gaming?

The cancellation illustrates that handheld gaming hardware development is increasingly concentrated among established companies with robust supply chains. New entrants or brands new to the category face barriers from tariffs, supply chain complexity, and market consolidation. The market likely won't see many new major handheld gaming entrants until policy stabilizes and manufacturing relationships diversify away from single-country dependence.

Key Takeaways

- Acer's Nitro Blaze 11 represented an ambitious gaming handheld with an 11-inch screen, significantly larger than competitors like Steam Deck and ROG Ally

- The device was announced at CES 2025 with Q2 launch target but was shelved indefinitely when US tariff policy created supply chain complications

- Lisa Emard of Acer America stated: 'We wound up just focusing on our core products, on laptops, because we needed to find manufacturing options outside of China'

- Tariffs ranging 25-60% on Chinese-manufactured electronics made the business case unviable, forcing either significant price increases or unacceptable margin compression

- The cancellation illustrates how policy risk and supply chain complexity create barriers to entry in hardware categories, favoring established companies with diversified manufacturing

Related Articles

- AMD at CES 2026: Lisa Su's AI Revolution & Ryzen Announcements [2026]

- MSI Crosshair 16 Max HX: Thinner Chassis, Stronger Specs [2026]

- Intel Core Ultra Series 3 Panther Lake at CES 2026 [Complete Guide]

- NVIDIA RTX 3060 Comeback: Why 2021 GPUs Return to Fight AI Shortage [2025]

- CES 2026 Day 1: The 11 Best Tech Gadgets Revealed [2025]

- Apple Vision Pro: Why This $3,500 Headset is Actually Dying [2025]

![Acer Nitro Blaze 11 Cancelled: What Happened to Gaming's Biggest Handheld [2025]](https://tryrunable.com/blog/acer-nitro-blaze-11-cancelled-what-happened-to-gaming-s-bigg/image-1-1767656890374.jpg)