Airbnb's AI Revolution: Transforming Travel Search, Discovery, and Customer Support

Airbnb isn't just testing AI features. The company is fundamentally rearchitecting how travelers find homes, plan trips, and get support. CEO Brian Chesky laid out an ambitious vision at the company's fourth-quarter earnings call: an AI-native experience where the platform knows who you are, what you want, and helps you plan before you even know what you're looking for.

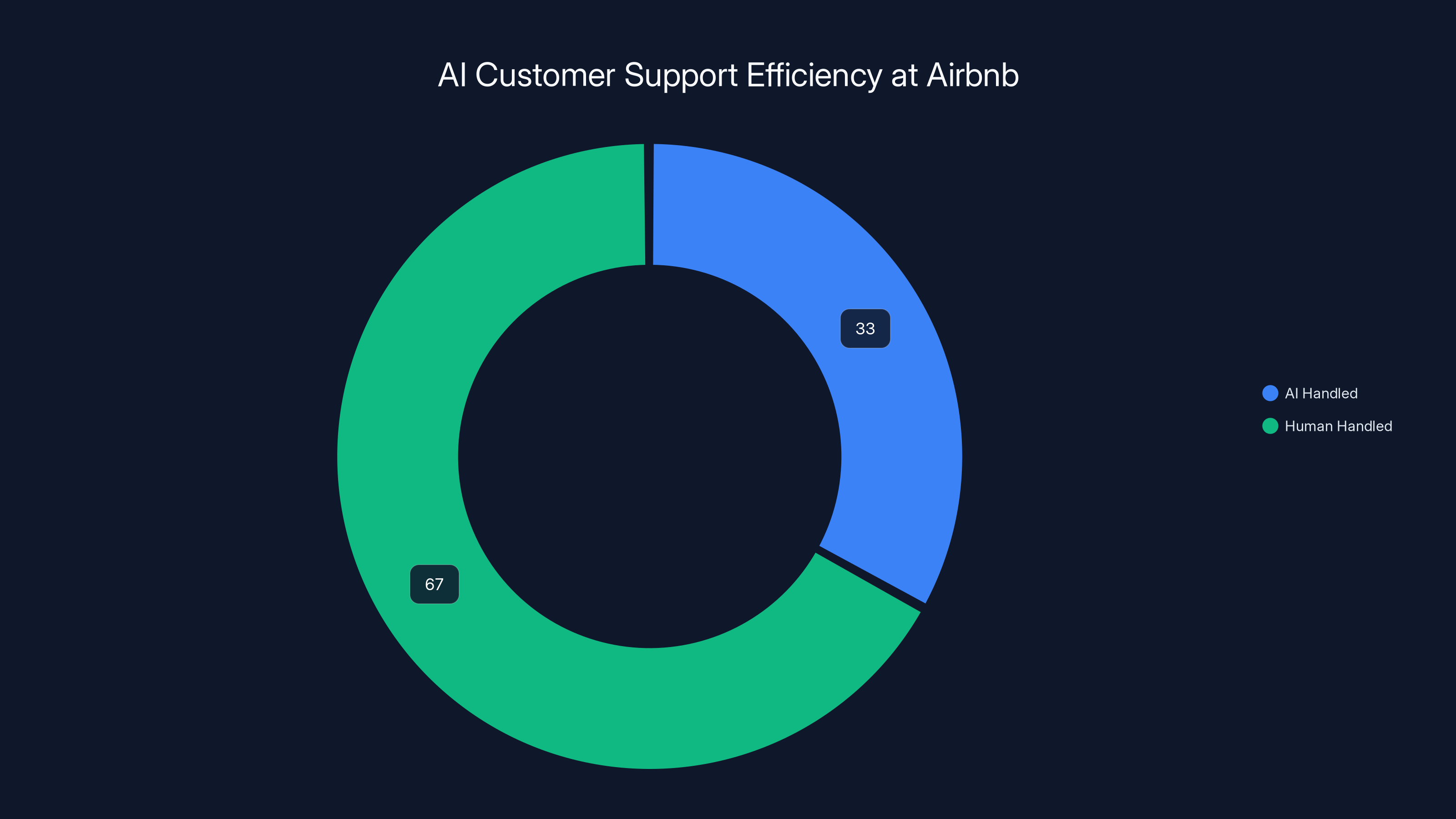

This isn't a minor feature release. This is a pivot toward conversational travel planning, intelligent property recommendations, and AI-powered host management tools. The company is bringing on serious AI talent (its new CTO built Meta's flagship models), deploying AI customer service agents that already handle 33% of support tickets, and planning expansions that could reshape how millions of people book vacations.

But here's what matters: Airbnb isn't just bolting AI onto search results. It's building an entire platform where AI understands your travel history, budget, preferences, and even your unspoken desires. That's a completely different product from what you use today.

Let's break down exactly what's happening, why it matters, and what comes next.

TL; DR

- AI-native platform: Airbnb is building an AI experience that knows guests personally, plans entire trips, and helps hosts manage properties more effectively

- AI search is live now: Natural language search queries are being tested with a small percentage of traffic, with plans to expand significantly

- Customer support transformation: The AI support bot already handles 33% of customer issues without human intervention, expanding to voice and more languages

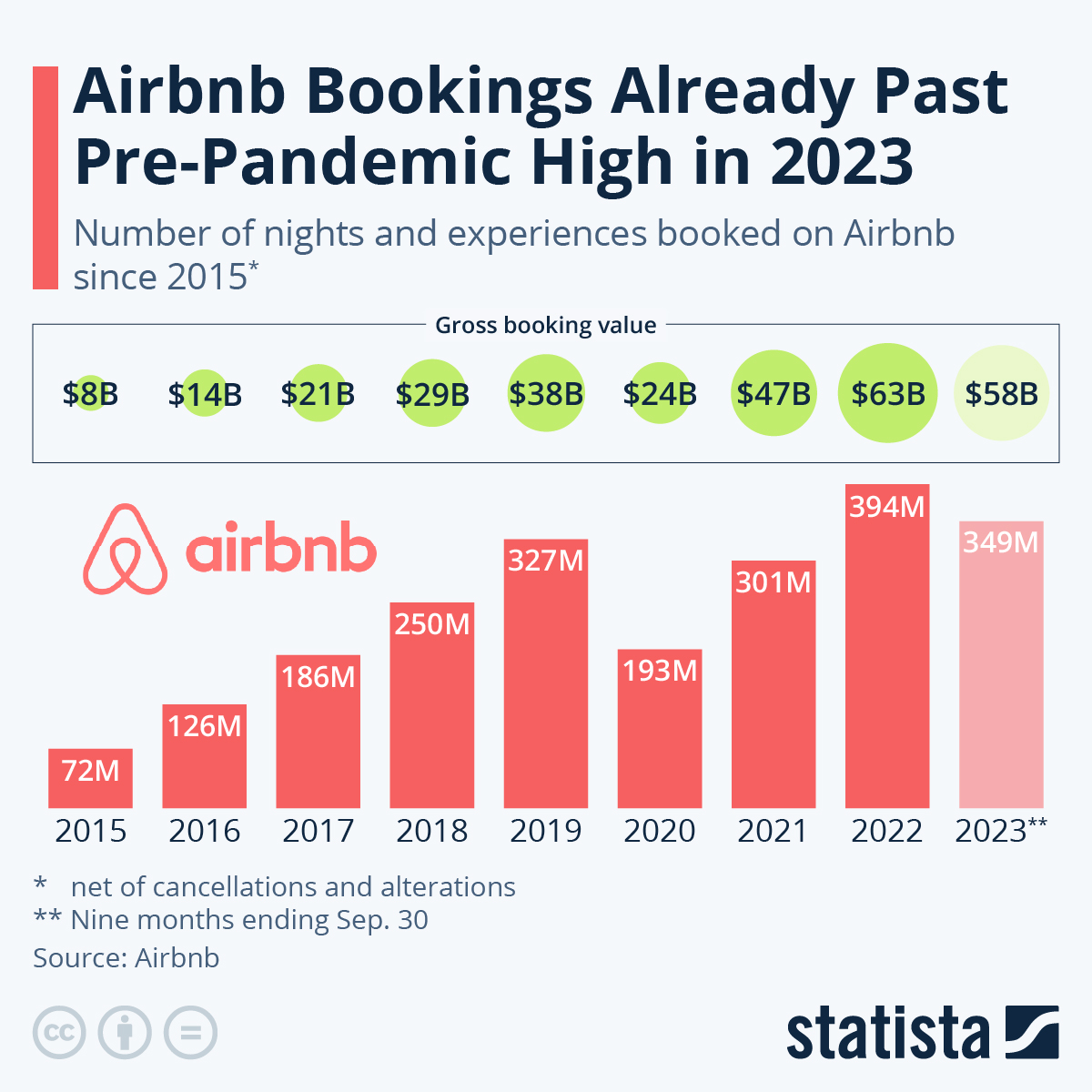

- Revenue impact: Airbnb reported $2.78 billion in Q4 revenue, up 12% year-over-year, validating its business model before AI scaling

- Internal AI adoption: 80% of engineers already use AI tools, with plans to reach 100% across the company

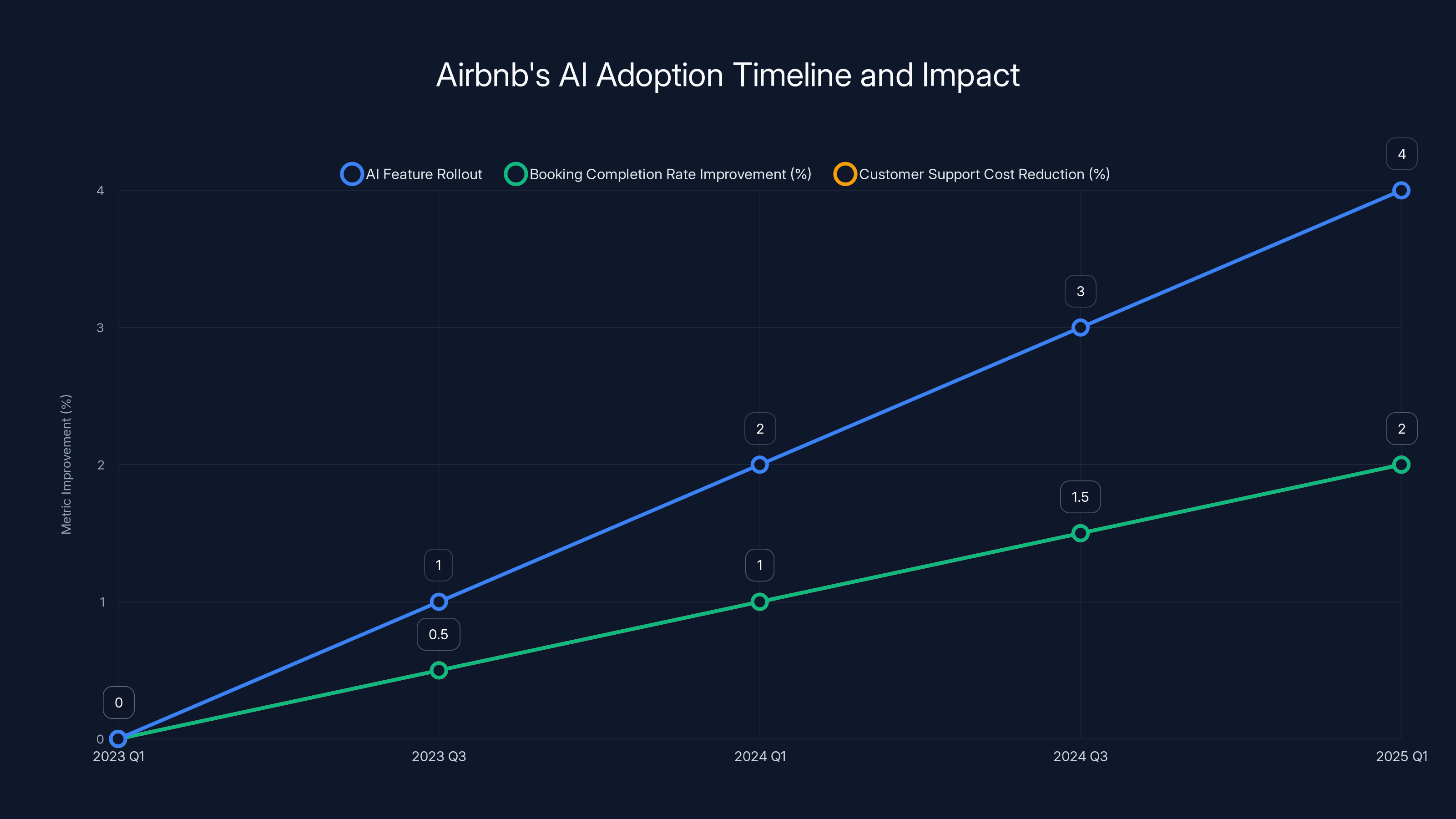

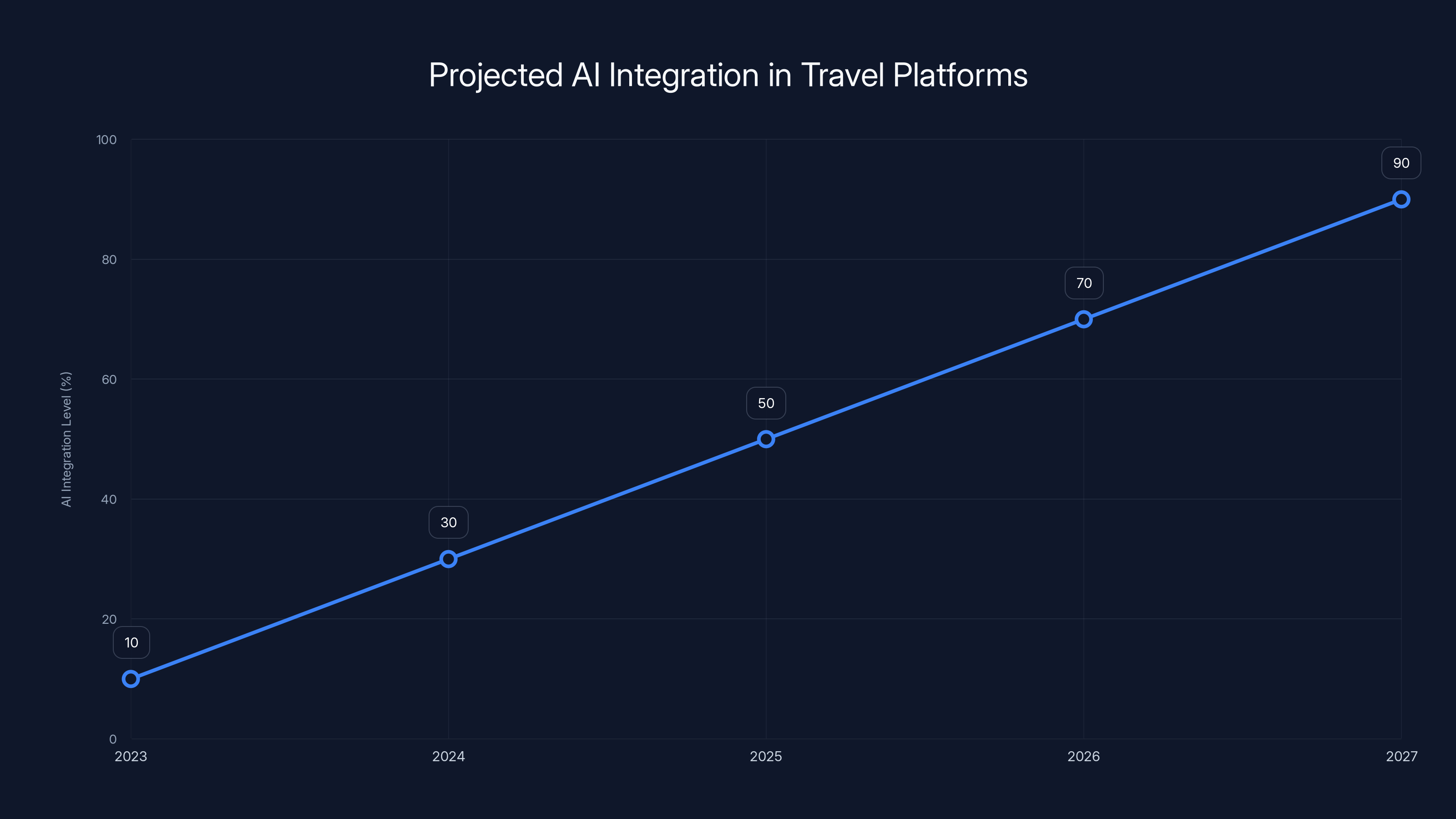

Airbnb's methodical AI adoption from 2023 to 2025 is projected to improve booking completion rates and reduce customer support costs by 2% each, translating to significant revenue gains. Estimated data.

Why Airbnb Waited This Long on AI (And Why It Matters)

Airbnb's cautious approach to AI has been frustrating for some analysts. The company watched competitors and other platforms embrace generative AI models throughout 2023 and 2024. Yet Airbnb held back, releasing features incrementally rather than rushing an "AI-first" redesign.

That patience was intentional. Here's the thing: Airbnb has constraints that other platforms don't. When you're building AI for travel bookings, mistakes are expensive. A mismatched property recommendation could mean a ruined vacation. A chatbot that confidently gives wrong cancellation policy information could trigger refund disputes. Bad AI recommendations could destroy host trust if guests consistently show up expecting something different from what was listed.

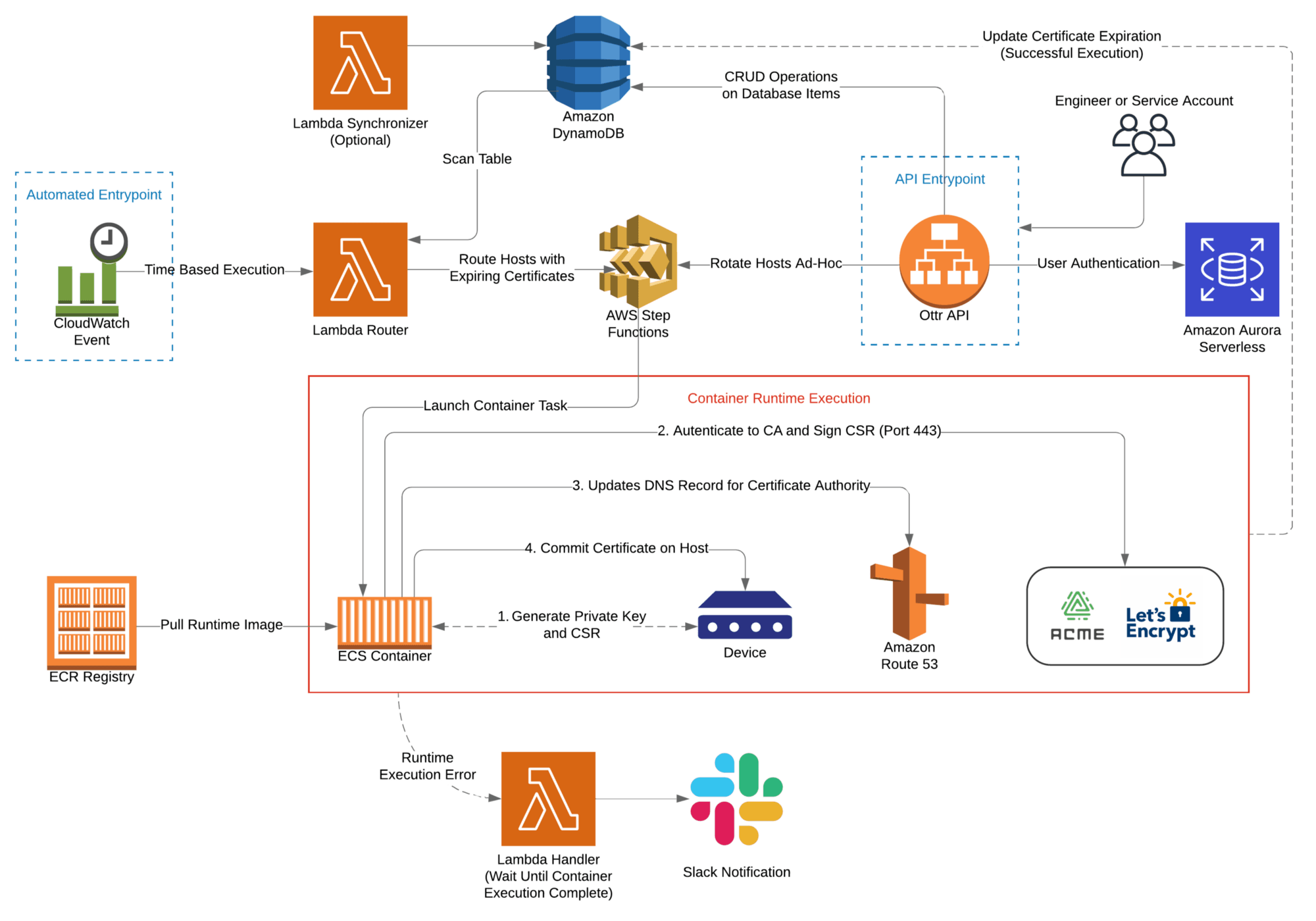

So Airbnb spent time building infrastructure. The company accumulated identity data, review histories, booking patterns, and guest preferences across millions of transactions. It deployed an LLM-powered customer service bot first in controlled markets. It tested personalization features quietly. It hired seriously: the new CTO, Ahmad Al-Dahle, previously worked on Meta's Llama models—one of the most capable open-source language models in the world.

Now the company is confident enough to accelerate. But this acceleration isn't reckless. It's methodical. And that's why it matters.

The business case is straightforward: AI-powered search drives higher engagement. Smarter property recommendations increase booking completion rates. AI customer support reduces operational costs while improving response times. For a company at Airbnb's scale, even 2% improvement in these metrics translates to hundreds of millions in incremental revenue.

But there's a secondary play here too. Airbnb isn't just improving consumer experience. It's building tools for hosts. That's the real unlock. A host who can ask an AI agent for insights about their pricing, competitive analysis, or automated guest communication is less likely to switch to a competitor. Sticky platforms win. AI tooling makes the platform stickier.

The Competitive Pressure

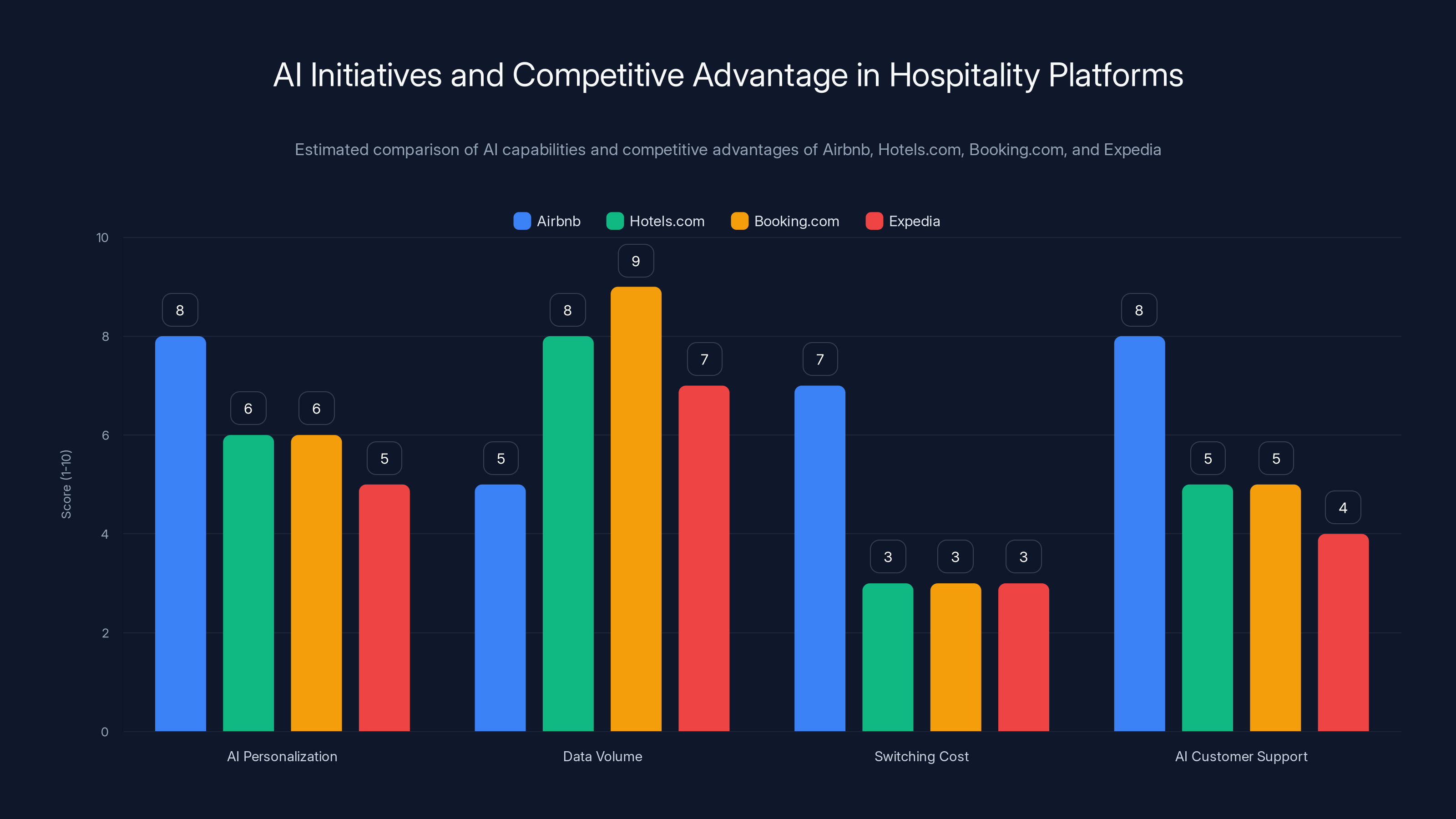

Airbnb's cautious approach made sense in early 2023. But by late 2024 and into 2025, waiting became a liability. Hotels.com integrated AI search. Booking.com deployed AI-powered recommendations. Google's Travel tools got smarter with generative AI. Even boutique platforms started offering AI concierge features.

Delaying further would be strategic malpractice. Guests are now expecting AI-powered search on travel platforms. They want conversational interfaces. They want agents that understand their preferences. Airbnb staying quiet while competitors shipped felt increasingly risky.

Chesky's announcement signals: we're catching up, and we're doing it at scale. That's the message.

AI improvements could generate an estimated

Understanding Airbnb's AI-Native Experience Architecture

When Chesky talks about an "AI-native experience," he's describing something more ambitious than a search bar with a chatbot. Let's decode what this actually means.

Traditionally, Airbnb works like this: you enter search parameters (location, dates, price), the algorithm returns results, you browse, read reviews, and book. It's linear. You control the inputs, the system returns matching outputs.

An AI-native approach flips this. Instead of you feeding parameters to Airbnb, Airbnb feeds suggestions to you based on patterns in your data. Here's how it works in practice:

Step 1: Continuous Learning. The system ingests your behavior constantly. Did you book a luxury apartment in Barcelona in March 2024? That's stored. Did you filter for properties with pools? Noted. Did you read reviews mentioning "vibrant nightlife" before booking? Catalogued. Did you leave feedback praising a clean kitchen? Remembered. Over time, the system doesn't just know what you've booked—it knows why.

Step 2: Predictive Personalization. When you open the app next time, the AI doesn't ask you where you want to go. It suggests three properties based on your historical patterns, time of year, and emerging trends in destinations similar to places you've visited. Maybe you visited beach towns every summer for the last three years. That summer, before you book anything, you're already seeing curated beach property recommendations.

Step 3: Trip Planning Beyond Booking. This is the part that's genuinely new. Once you've tentatively selected a property, the AI helps you plan the entire trip. It suggests experiences near your rental based on your interests. It recommends restaurants matching your past dining preferences. It identifies transportation from the airport. It estimates duration of activities based on how other guests with similar profiles have spent their time. Some of this functionality is built-in; some delegates to AI agents that integrate with other services.

Step 4: Proactive Support. The system anticipates problems. Two days before your check-in, the AI has reviewed your booking, the property's historical issues, and your preferences. If there's risk (weather, local events), it alerts you. If you'll need something specific (crib, wheelchair accessibility confirmation), it prompts the host. If the property matches a discount you qualify for that you haven't claimed, it notifies you. Friction is reduced before it happens.

This architecture requires massive amounts of training data, sophisticated ranking models, and real-time inference. That's why the infrastructure investment took so long. Building this requires:

- Identity graph: Connecting user behavior across devices, sessions, and time

- Property embeddings: Converting complex property attributes into vectors that capture subtle preferences

- Collaborative filtering at scale: Processing billions of interactions to find patterns

- Real-time personalization: Serving fresh recommendations within milliseconds

- Safety guardrails: Ensuring recommendations don't violate community standards or legal requirements

Airbnb has all of this now. That's why the acceleration is credible.

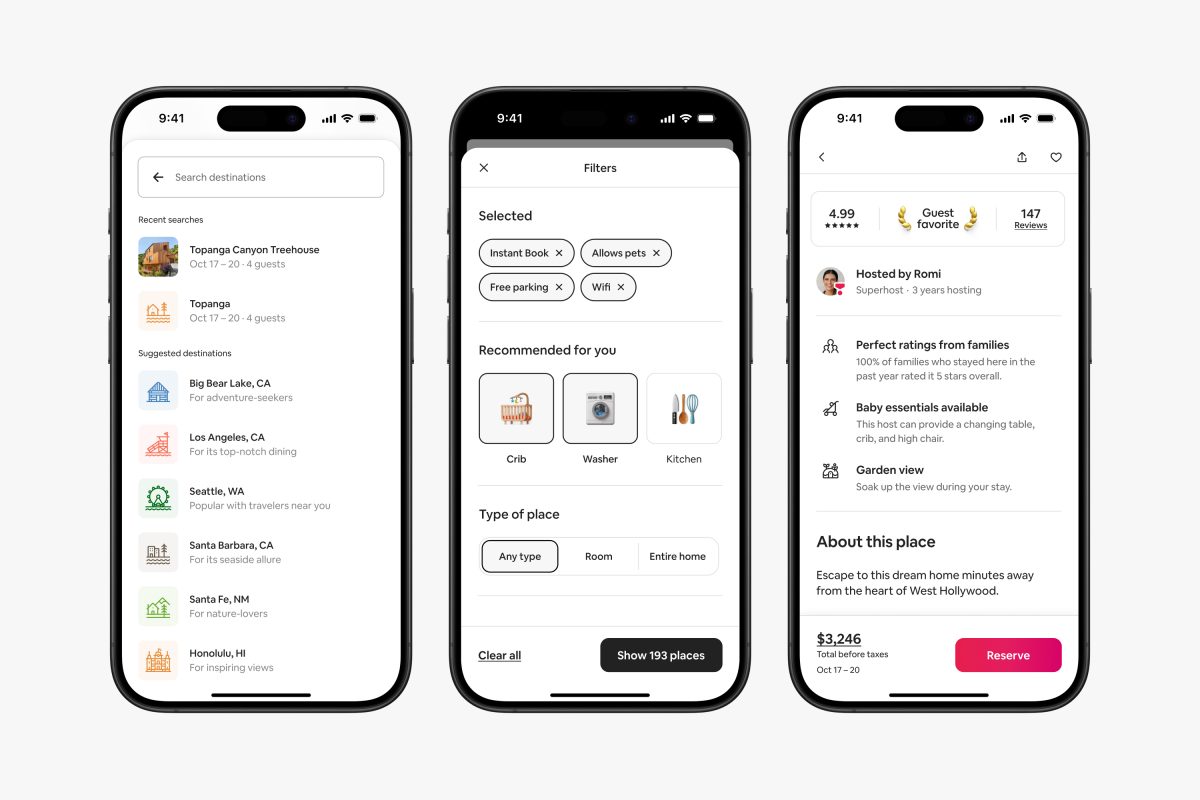

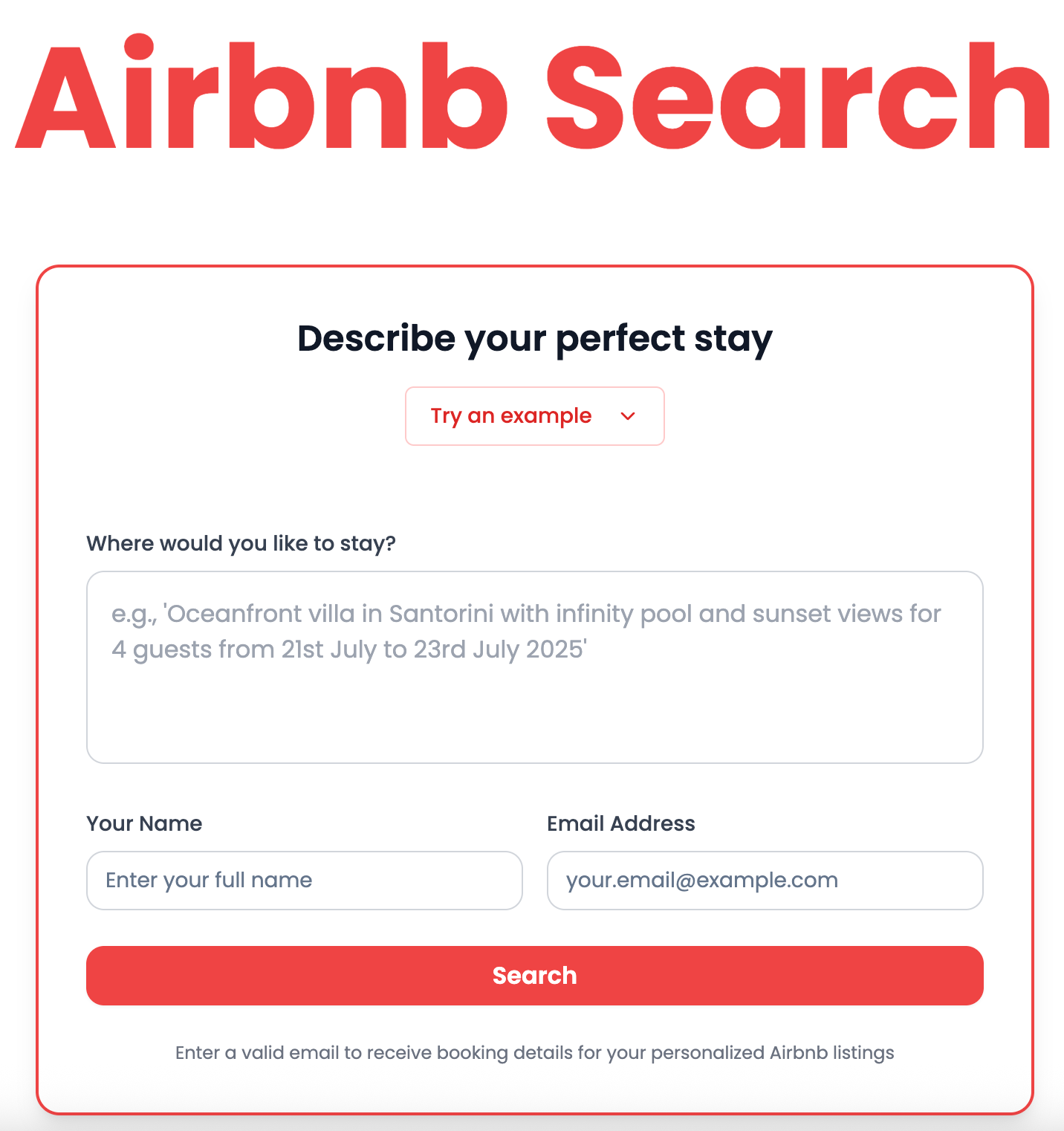

The AI Search Revolution: Conversational Queries Transform Browsing

Airbnb's new AI search feature is the headline product. And it's genuinely different from traditional search interfaces.

Here's how it works: Instead of entering a location like "Barcelona" and dates like "March 2025," you can type or say conversational queries. Examples from early testing include:

- "I want a cozy apartment near the beach with a rooftop where I can work and it has good internet"

- "Find me a property that fits three people, allows dogs, and is close to hiking trails"

- "Show me something quiet and charming in a neighborhood with good coffee shops"

The system parses these queries using language models, extracts intent and constraints, and returns matching properties. But crucially, it's not just keyword matching. The AI understands nuance. "Cozy" means different things to different people. "Good internet" maps to specific speed thresholds. "Quiet neighborhood" weights away from party areas and high foot traffic.

This is harder than it sounds. Property data is messy. Reviews use different vocabularies. Exact Wi Fi speeds aren't always documented. Neighborhoods have subjective vibes. The AI has to infer from review text what properties actually deliver on these soft attributes.

How It Differs from Existing Search

Traditional search works like this: you input parameters, the system filters inventory, algorithms rank results, you see a grid of properties. It's structured, predictable, and requires you to articulate exactly what you want.

AI search is different:

It understands implicit preferences. If you say "something charming," the system doesn't just look for the word "charming" in listings. It maps that to properties that past guests with similar profiles have rated highly, with specific attributes like exposed brick, vintage furniture, or unique architectural details.

It handles ambiguity. You don't have to know exact dates. "Spring break timing" works. You don't need a price range. "Budget-friendly for Europe standards" works. The system infers.

It suggests before you complete your query. As you type "I want a place near the beach," the system is already predicting you'll care about sunset views, water temperature, and beach crowd density. It can proactively ask clarifying questions.

It provides context in results. Instead of showing property cards in a grid, results can be narrative. "This Barcelona apartment is a 15-minute walk from the beach you asked about. Guests love the balcony for morning coffee. Wi Fi is 150 Mbps, which should handle streaming. Dogs are welcome. The neighborhood is quiet after 9 PM."

This is a fundamentally different product. And Airbnb is testing it with a small percentage of traffic right now, not because it doesn't work, but because scaling this requires careful observation of failure modes.

The Monetization Question (And Chesky's Honesty)

Analysts immediately asked: will Airbnb insert paid listings into AI search results? Will hosts be able to pay for prominence in these conversational results?

Chesky's answer was refreshingly honest: not yet, and only after getting the experience right. Specifically: "AI search is live to a very small percentage of traffic right now. We are doing a lot of experimentation. Over time, we are gonna be experimenting with making AI search more conversational, integrating it into more than the trip, and, eventually, we will be looking at sponsor listings as a result of that."

Translate that: they're running experimentation. They're learning what works. Eventually, yes, there will be ads. But the company learned from Google's ad-laden search interface and Facebook's engagement-over-quality problem. Jamming ads into a conversational experience degrades it immediately. Users can tell when results are ranked by payment rather than relevance.

So Airbnb's approach is: prove the relevance first, figure out monetization second. This is smart. A worse-performing search that makes slightly more money per transaction is worse than a better-performing search that makes less. Guests stop using bad search products.

Airbnb's AI support bot efficiently handles 33% of customer inquiries, reducing the need for human intervention and potentially lowering operational costs. Estimated data.

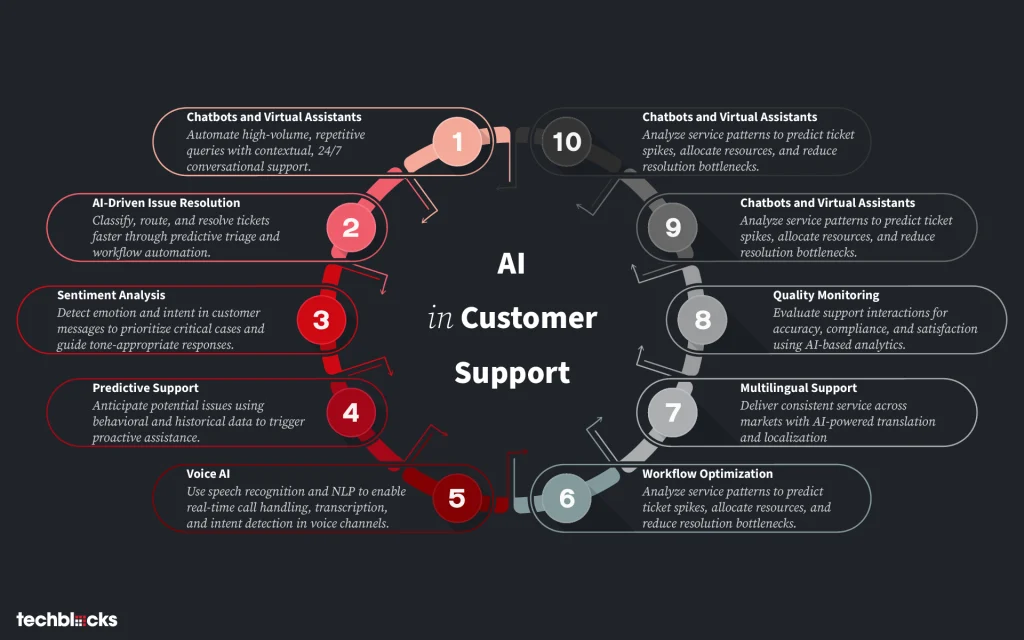

AI Customer Support: From Chat Bots to Voice Agents

Airbnb's customer support transformation is happening faster and at larger scale than almost any platform attempt at AI automation.

The numbers are striking: the AI support bot launched in North America last year now handles 33% of customer problems without human intervention. That's one of every three support tickets resolved entirely by AI.

Think about what that means operationally. If Airbnb handles, say, 300,000 customer support inquiries per month in North America, that's 99,000 tickets monthly that don't require paying humans to respond to. At loaded labor costs (salary, benefits, systems), that's easily millions of dollars in monthly operational savings.

But more importantly, it's faster for customers. An AI agent responding to "What's your cancellation policy?" in under 10 seconds is better than waiting for a human to respond tomorrow. For guests stressed about a trip gone wrong, immediate help beats a good help desk.

The Expansion Plans

Chesky outlined three major expansions for AI support:

1. Voice support. Currently, the AI handles chat. But Chesky said "A year from now, if we are successful, significantly more than 30% of tickets will be handled by a custom service agent... AI customer service will not only be chat, it will be voice." This means you'll call Airbnb's support number, reach an AI agent, and have a natural conversation about your issue.

Voice is harder than chat. Accents vary. Background noise interferes. People ramble. Phone calls have rhythms that text doesn't. But it's also more natural for many people, especially older users or those describing complex problems.

2. Multilingual support. Airbnb operates in 191 countries. Customer support is currently available in far fewer languages. The AI can scale that instantly. Once you train a model on support conversations in one language and have examples in other languages, you can adapt the model to new languages relatively cheaply.

Chesky said the goal is coverage "in all the languages where we have live agents." That's dozens of languages. Deploying human support in that many languages is economically impossible. AI makes it feasible.

3. Proactive problem solving. The current AI handles incoming tickets reactively—you message asking for help, the bot responds. The next phase is predictive. If a guest messages asking about a check-in time and the property can't accommodate early check-in, the AI proactively offers alternatives. If there's a pattern of guests complaining about a specific property issue (bad Wi Fi, noisy location), the AI alerts the host before more guests arrive.

Why This Matters Beyond Efficiency

Yes, reducing the need for customer support staff is economically attractive to Airbnb. But there's a deeper play.

Customer support quality is a competitive differentiator in the travel space. Users choose platforms partly based on how well they're treated when things go wrong. Airbnb's historical advantage over Booking.com and Expedia has been responsiveness and nuance. Humans understood context.

Modern AI changes that equation. An AI agent that understands your entire booking history, your communication preferences, previous issues you've faced, and your current emotional state can often outperform a tired support person who's fielding their 200th inquiry of the day.

Airbnb is betting on this. And the 33% resolution rate suggests the bet is paying off.

The CTO Effect: Ahmad Al-Dahle and Meta's Llama Architecture

Chesky specifically mentioned Airbnb's new CTO, Ahmad Al-Dahle, who previously worked on Meta's Llama models. This hire deserves attention because it signals where Airbnb's AI strategy is going.

Llama isn't just a model. It's a philosophy. Meta released Llama as open-source, which was strategically brilliant. It meant developers worldwide weren't locked into proprietary vendors. Instead of choosing between GPT-4 or Claude, you could fine-tune and deploy Llama yourself.

For Airbnb, having someone who built Llama means:

Custom model fine-tuning is on the roadmap. The company isn't betting entirely on APIs to Open AI or Anthropic. It's likely training specialized models for travel use cases. A model trained specifically on travel conversations, property descriptions, and guest-host dynamics will outperform general-purpose models.

Cost optimization is a priority. Llama models are smaller and cheaper to run than GPT-4. As Airbnb scales AI across hundreds of millions of users, cost per inference matters enormously. Smaller, specialized models deployed at the edge (on your phone) are cheaper than always calling an API.

Open-source strategy aligns with culture. Meta's commitment to open-source LLMs suggests Airbnb might contribute to the ecosystem, compete on execution rather than model exclusivity, and build partnerships with other companies using the same models.

This hire is significant because it positions Airbnb as a builder, not just a consumer of AI APIs. That distinction matters for long-term competitive advantage.

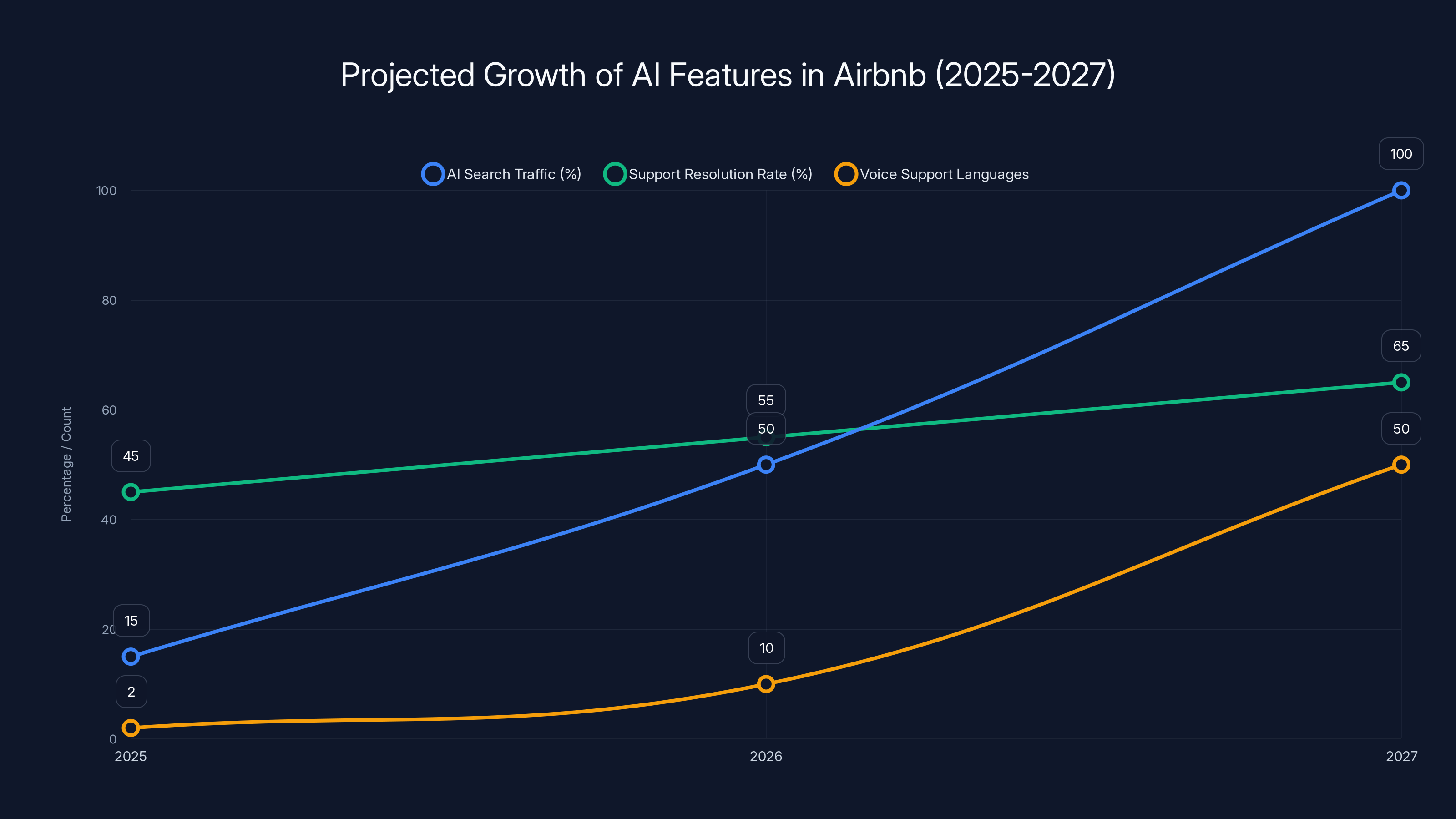

Estimated data shows a rapid increase in AI integration in travel platforms, with significant adoption expected by 2027.

The Data Advantage: Identity, Reviews, and Behavioral Patterns

Airbnb has a moat that most companies can't replicate: travel and accommodation data at scale.

Consider what Airbnb knows:

- Your travel history: Every place you've visited, when, for how long, who you traveled with

- Your preferences revealed through searches: What you filter for, what you ignore, what you click

- Your stated preferences: Your profile data, communication style, photos you share

- Your decision making: Which properties you viewed but didn't book, and why (reviews you read before deciding against it)

- Your satisfaction: Ratings you left, reviews you wrote, follow-up behaviors

- Your behavior post-arrival: How long you stayed, if you reached out to hosts, if you contacted support

- Network effects: Information about people you travel with, your travel companions' preferences

Most of this data is anonymized and aggregated, but it's extraordinarily rich. A competing platform, even with machine learning expertise, doesn't have 15 years of accumulated guest preference data.

Chesky explicitly called this out: "We plan to tap the AI expertise of its new CTO... to use its trove of identity and review data to make the app more useful." That trove is the differentiator. The AI models are increasingly available. The data isn't.

This creates a competitive moat that strengthens over time. As Airbnb gets better at predicting what guests want, conversion rates improve. Better conversion rates mean more bookings. More bookings mean more data. More data means better predictions. It's a flywheel.

New entrants can't easily replicate this. You can license language models. You can hire ML engineers. You can't buy 15 years of travel preference data from millions of users.

Internal AI Adoption: Engineering at Scale

Airbnb currently has 80% of engineers using AI tools. The goal is 100%.

This seems like an internal detail, but it's strategically important. Companies that nail internal AI adoption move faster. Engineers using Git Hub Copilot write code 30-40% faster. Engineers using AI-powered debugging tools find issues more efficiently. Teams using AI for documentation reduce onboarding time.

For Airbnb, that's compound velocity. If 500 engineers move 35% faster, that's equivalent to hiring 175 additional engineers. The cost difference is negligible (subscription to tools plus compute), but the impact is massive.

The fact that it's "only" 80% now means there's friction somewhere. Maybe some teams haven't found the right tools. Maybe some skeptical engineers are holding out. Maybe legacy projects aren't set up for AI integration. The goal of 100% is realistically achievable with training, incentives, and better tools.

This also signals internal philosophy. Companies that push AI adoption internally are betting on AI for everything, not just external products. It suggests Airbnb sees AI as a productivity multiplier across the entire operation.

Airbnb leads in AI personalization and customer support due to exclusive listings and early AI adoption. Competitors have more data but face commoditization. (Estimated data)

The Financial Picture: Q4 Revenue and AI Investment Trade-offs

Airbnb reported $2.78 billion in Q4 revenue, up 12% year-over-year. That's solid growth for a mature company at scale. It's the financial foundation that justifies AI investment.

Here's the business math: if Airbnb books

Meanwhile, AI customer support handling 33% of tickets versus 0% is probably worth $50-150 million annually in operational savings (depending on assumptions about support volume and labor costs).

The ROI on the AI infrastructure investment ($50-200 million in engineering, compute, and infrastructure) pays back in roughly 3-5 quarters. That's why the investment is accelerating.

Search vs. Discovery: Two Different Problems

Chesky mentioned both "search" and "discovery." These are different products solving different problems, and it's worth distinguishing them.

Search is what you do when you know what you want. You're looking for "3-bedroom apartment in Barcelona, June 2025." The goal is to find that thing fast and efficiently.

Discovery is what you do when you don't know what you want. You have time, budget, and openness, but no specific destination. Discovery is inspiration. "Show me somewhere I've never been that I'll love."

Traditional Airbnb excelled at search. The filters are efficient. You get results quickly. But discovery was weak. The "Explore" section was generic. It wasn't personalized.

AI changes this. An AI discovery experience shows you places that match your style, your travel rhythm, your hidden preferences—things you didn't articulate but would love when you see them.

Discover features are high-value for Airbnb because they drive bookings in slower seasons and less obvious destinations. A guest who discovers Barcelona through AI recommendations might book in July when prices are higher and the market is crowded. But a guest who discovers Lisbon (or a smaller Portuguese town) through discovery might book in shoulder season when inventory is available and pricing is more flexible.

From a revenue perspective, discovery increases addressable market. The more destinations you make appealing, the more bookings you capture across the calendar year.

AI features in Airbnb are projected to grow significantly by 2027, with AI search becoming fully integrated and voice support expanding globally. (Estimated data)

Challenges Ahead: Hallucination, Liability, and User Trust

Airbnb's AI rollout will face three major challenges.

Challenge 1: Hallucination and false confidence. Language models sometimes confidently state falsehoods. If an AI support agent says "Your cancellation deadline is 24 hours before check-in" when it's actually 48 hours, that's a problem. It's a liability problem. It's a trust problem.

Airbnb mitigates this by having AI agents trained on their actual policy documents and connected to live data systems. The bot doesn't generate answers from the model's training data—it looks up answers in real systems and regenerates explanations. But this architecture is more complex and slower.

The support team has already figured out how to make this work (33% resolution rate suggests good reliability). But scaling to voice and more languages means retraining on more languages and handling more complex scenarios. That increases hallucination risk.

Challenge 2: Property mismatch liability. If an AI search result recommends a property and the guest arrives to find it's not what they expected, who's liable? Is it the property owner? The platform? The AI? Current law is ambiguous.

Airbnb's protection is that AI recommendations are just that—recommendations. The guest still reads reviews and sees photos before booking. But if the AI strongly implied something and the property delivered differently, disputes will happen.

Challenge 3: Host gaming and manipulation. Once hosts understand that AI is ranking their properties, some will try to game it. They'll over-optimize descriptions for the model. They'll buy fake positive reviews. They'll manipulate photos. Some will succeed for a while.

Airbnb has systems to detect this, but it's an arms race. As the AI gets smarter at predicting which properties are high-quality, bad actors get smarter at faking quality signals.

These challenges are real, but they're not deal-breakers. They're management issues that scale with resources. Airbnb has the resources.

Competitive Response: Hotels, Booking, Expedia

Traditional hospitality won't stand still. Hotels.com, Booking.com, and Expedia have AI initiatives of their own.

But there's an asymmetry: those platforms are marketplaces connecting guests to third-party properties, most of which are hotels and listed on multiple platforms. Airbnb is different—many properties are exclusively Airbnb. That means Airbnb's AI can be more personalized and more confident in recommendations because the properties don't compete on other platforms.

Hotels.com and Booking.com have more hotel data (more listings), but the data is more commoditized. Every hotel lists on multiple platforms. For hotels, the switching cost is low. For Airbnb properties, the switching cost is high (it's easier to be on Airbnb than to separately manage inventory on Booking.com).

So Airbnb's competitive moat is real. But the window to maintain it is narrow. In 18-24 months, competing platforms will have deployed similar AI features. The question is execution. Who has the better training data? Better models? Better UX for AI-powered search?

Airbnb's early-mover advantage in customer support (33% already handled) is significant. Building trust in AI support takes time. Users need to have good experiences repeatedly before they trust the AI. Airbnb is building that trust now. Competitors will catch up, but they'll start from behind.

The Three-Year Outlook: What's Actually Coming

Extrapolating from what Chesky said, here's the likely roadmap:

Year 1 (2025): AI search expands to 10-20% of traffic. Voice support pilots in US and UK. Support resolution rate climbs to 40-50%. Personalized discovery recommendations launch more broadly.

Year 2 (2026): AI search becomes default for new users. Voice support expands to 10 languages. Support resolution rate reaches 50-60%. Host tools for AI-powered pricing and communications launch. First experiments with sponsored listings in AI results begin (cautiously).

Year 3 (2027): AI search is fully integrated into the core product. Voice support available globally. Support resolution rate plateaus at 60-70% (some issues need humans). Sponsored listings become a meaningful ad revenue channel ($100 million+ annually). Custom Airbnb LLM fine-tuned for travel is deployed at scale.

The limiting factor isn't capability—it's user trust. Users have to believe that AI is recommending properties because they're good, not because they're lucrative. That requires months of good experiences. Airbnb is building that slowly and carefully.

Why This Matters Beyond Airbnb

Airbnb's AI strategy signals something broader: AI isn't a separate product layer anymore. It's infrastructure.

Five years ago, AI was an add-on feature. "Now with AI." Today, it's foundational. Airbnb's entire platform is being rearchitected around AI assumptions. Search. Discovery. Support. Operations. Everything.

That's where other platforms are heading. Once you start using AI for one part of your product, you realize you need to use it everywhere. The alternative is inconsistency and inefficiency.

For users, this means travel platforms are becoming smarter, more personalized, and more helpful. For companies, it means AI talent and infrastructure investment are existential. You either upgrade your platform with AI or get outcompeted.

Airbnb's announcement isn't revolutionary. But it's a signal that the AI transition is moving from "experimental" to "business-critical."

Best Practices from Airbnb's Approach

If you're building AI into your product, Airbnb offers a masterclass in execution:

1. Start with support, not search. Customer support is lower-risk. Mistakes are less costly. Users expect some failures from support AI. Getting this right first builds confidence.

2. Use your data advantages relentlessly. Airbnb leaned hard into its review and identity data. Don't try to compete on AI models if you don't have proprietary data. Compete on how you use your data.

3. Expand carefully into monetization. Airbnb is not rushing to put ads in AI search. It's proving relevance first, monetization second. That's smart.

4. Make the AI invisible when possible. The best AI features feel like magic, not AI. Users should notice the benefit (better recommendations), not the mechanism (neural networks).

5. Invest in infrastructure before scaling features. Airbnb spent time building systems that support AI at scale before rolling out to millions. That meant initial slowness but eventual reliability.

The Broader Context: AI Adoption in Consumer Platforms

Airbnb is not alone. Every major consumer platform is doing this. Door Dash is using AI for delivery route optimization and restaurant recommendations. Netflix is using AI for personalization and content discovery. Spotify is using AI for playlist generation and music discovery.

What's different about Airbnb is the scope. The company is retrofitting AI into literally every part of the product. That's ambitious.

It's also necessary. Consumer platforms in 2025 are expected to be intelligent, personalized, and adaptive. Users who are accustomed to Netflix's discovery feel frustrated by generic travel search. Platforms that don't adapt will lose engagement.

Airbnb's approach—cautious deployment, careful measurement, gradual expansion—is the playbook for doing this right. Platforms that rush (deploying untested AI features) or delay (hoping to avoid the investment) will regret it.

FAQ

What does "AI-native experience" mean in the context of Airbnb?

An AI-native experience means the platform is fundamentally built around AI decision-making rather than traditional search filters. Instead of you entering parameters (location, dates, budget) and the algorithm returning results, the system proactively learns from your history, behavior, and preferences—then suggests properties, entire trips, and solutions before you explicitly ask. The AI knows you and anticipates needs, which is different from a traditional platform that responds to your explicit queries.

How does Airbnb's AI search differ from traditional search?

Traditional search requires you to input specific parameters like location and dates, and it returns matching properties. AI search accepts conversational queries like "I want a cozy apartment near the beach with good Wi Fi," and the system extracts intent from natural language, understands nuanced attributes like "cozy" and "good Wi Fi," and returns properties that match those soft requirements. It can also proactively ask clarifying questions and refine results through conversation rather than requiring you to navigate filters manually.

Why is it significant that Ahmad Al-Dahle (who built Meta's Llama) joined as CTO?

It signals that Airbnb is planning to fine-tune and customize language models specifically for travel use cases rather than relying entirely on APIs from Open AI or Anthropic. Someone who built Llama brings expertise in custom model optimization, cost reduction through smaller models, and open-source AI strategy. This positions Airbnb to deploy more efficient, specialized AI models across its platform at scale, reducing infrastructure costs and potentially offering faster inference.

What's the business case for AI customer support if it costs money to build and maintain?

The ROI is compelling. Airbnb's AI support bot already handles 33% of customer inquiries without human intervention. Assuming 300,000+ support tickets monthly in North America alone, that's roughly 99,000 automated responses that would otherwise require hiring support staff. At fully loaded labor costs (salary, benefits, systems), that's millions in monthly operational savings. Additionally, faster response times (AI responds instantly versus hours or days for human support) increase customer satisfaction and reduce churn, which indirectly increases customer lifetime value.

Will Airbnb insert ads into AI search results?

Chesky stated that monetization through sponsored listings is planned eventually, but only after the AI search experience is proven and optimized for relevance. The company is explicitly prioritizing user experience and accuracy before introducing ads. The reasoning is sound: a search product compromised by ads degrades quality, which hurts engagement. Better to establish a high-quality, high-engagement product first, then carefully integrate monetization without degrading the experience. The timeline is at least 1-2 years out.

How does Airbnb use review and identity data to improve AI recommendations?

Airbnb accumulates rich data about every guest and property interaction: guest profiles, search and browsing behavior, booking history, reviews written (both guest-to-host and host-to-guest), ratings, post-arrival feedback, and even follow-up support interactions. This creates a detailed map of guest preferences and property characteristics. AI models trained on this data can predict which guests will be satisfied with which properties based on subtle patterns (e.g., guests who book quiet properties and left positive reviews mentioning "peaceful" will likely prefer other quiet properties, even if they don't explicitly request it). This collaborative filtering, enhanced with behavioral signals, generates highly personalized recommendations that generic travel platforms can't replicate.

What's the timeline for voice support and multilingual AI support?

According to Chesky, within approximately one year, the company expects voice support to be available for customer inquiries, with AI handling "significantly more than 30%" of tickets via voice. Multilingual expansion is concurrent, with the goal of supporting all languages in which Airbnb currently operates live support (currently dozens of languages). The timeline suggests pilots in primary markets (US, UK) by mid-2025, followed by gradual rollout globally through 2026.

How does internal engineer adoption of AI tools relate to product innovation?

When developers use AI coding assistants (like Git Hub Copilot), they write code faster, deploy features more quickly, and reduce routine debugging time. For Airbnb, achieving 100% AI tool adoption across engineers means the company can ship features roughly 30-40% faster than competitors who haven't achieved similar adoption. This translates to competitive advantage in rapid AI product iteration. Additionally, engineers using AI daily develop better intuitions about AI capabilities and limitations, which informs better product design. Internal adoption is thus a leading indicator of product innovation velocity.

Conclusion: Airbnb's AI Transition Is About Platform Transformation

Airbnb isn't rolling out a Chat GPT feature. It's fundamentally rearchitecting how people discover, book, and manage accommodations. The company is moving from a traditional marketplace with search filters to an AI-native platform where the system knows you, anticipates your needs, and guides your entire trip.

This transition will take 2-3 years to fully materialize. Right now, Airbnb is in the infrastructure and capability-building phase. AI search is limited to a small percentage of traffic. Voice support is piloting. Host tools are nascent. But the direction is clear.

The competitive implications are significant. Platforms without similar AI investment will feel increasingly dated. A traditional search interface feels clunky when you're used to conversational queries. A support system that makes you wait hours for a human feels frustrating when AI can resolve your issue in 30 seconds.

Airbnb's advantage is data and execution velocity. The company has 15 years of accumulated travel preference data that competitors don't have. It has the infrastructure, talent, and capital to move fast. It has a CTO who built the models that others are licensing.

But advantages narrow quickly in tech. Within 18-24 months, competitors will have deployed comparable AI features. What matters then is execution consistency. Did the AI improve the product or degrade it? Do users trust the recommendations or feel manipulated? Can the company maintain quality as it scales?

Based on Airbnb's careful approach so far—prioritizing user experience, building support infrastructure first, proving reliability—the company is positioned to do this well. That's not guaranteed, but it's plausible.

The travel industry in 2027 will be fundamentally different from 2025. AI will be embedded in search, discovery, support, pricing, and operations. Platforms that navigate that transition effectively will increase market share. Platforms that stumble will lose relevance. Airbnb's roadmap suggests the company is thinking several years ahead and building accordingly.

For travelers, this means better experiences ahead. For Airbnb, it means a stronger moat and better unit economics. For competitors, it means the clock is ticking to match Airbnb's pace or differentiate in some other way.

The AI revolution in travel accommodation isn't coming. It's already here. Airbnb just explained its version.

Key Takeaways

- Airbnb is fundamentally rearchitecting around AI as core infrastructure, not as a secondary feature, moving from traditional search filters to AI-native personalization

- AI customer support already resolves 33% of tickets without human intervention; voice and multilingual expansion could reach 50-65% automation by 2027

- Conversational search accepts natural language queries instead of requiring explicit parameters, understanding nuanced preferences like 'cozy' and 'good WiFi' implicitly

- Airbnb's 15-year accumulation of guest behavior and property data creates an unreplicable competitive moat that competing platforms cannot quickly duplicate

- The company is prioritizing user experience and relevance before monetizing AI search through sponsored listings, a disciplined approach that strengthens long-term quality

Related Articles

- Uber Eats AI Cart Assistant: How AI Is Transforming Grocery Shopping [2025]

- Agentic AI and Unified Commerce in Ecommerce [2026]

- The AI Deployment Gap: Why Surface-Level Integration Is Costing You [2025]

- Google Search AI Overviews with Gemini 3: Follow-Up Chats Explained [2025]

- Google AI Overviews Follow-Up Questions: What Changed [2025]

- Yahoo's AI-Powered Search Engine: How Scout Changes Search Forever [2025]

![Airbnb's AI Revolution: Search, Discovery & Support [2025]](https://tryrunable.com/blog/airbnb-s-ai-revolution-search-discovery-support-2025/image-1-1771038435286.jpg)