Yahoo's AI-Powered Search Engine: How Scout Changes Search Forever

For years, Yahoo felt like yesterday's news. The search giant that once competed with Google head-to-head had faded into the background, becoming the default search engine on Firefox and little else. But something unexpected is happening now. Yahoo is making a serious play to stay relevant in the age of AI, and it's doing it with something genuinely interesting: an AI-powered "answer engine" called Yahoo Scout.

This isn't just incremental change. Yahoo Scout represents a fundamental shift in how search works. Instead of returning a list of blue links, Scout synthesizes information from across the web, Yahoo's own data, and structured sources to generate direct answers to your questions. It looks at what you're asking, figures out what you actually need, and gives it to you with source citations, interactive elements, and verifiable links.

What makes this moment different from Google's AI Search mode, or the countless other AI tools trying to disrupt search, is that Yahoo is committing to integration. Scout isn't just a standalone tool. Yahoo is embedding it across its entire product ecosystem: Mail, News, Sports, Shopping, and Finance. This is a bet-the-farm move, the kind of thing that only happens when a company realizes it has nothing to lose and everything to gain.

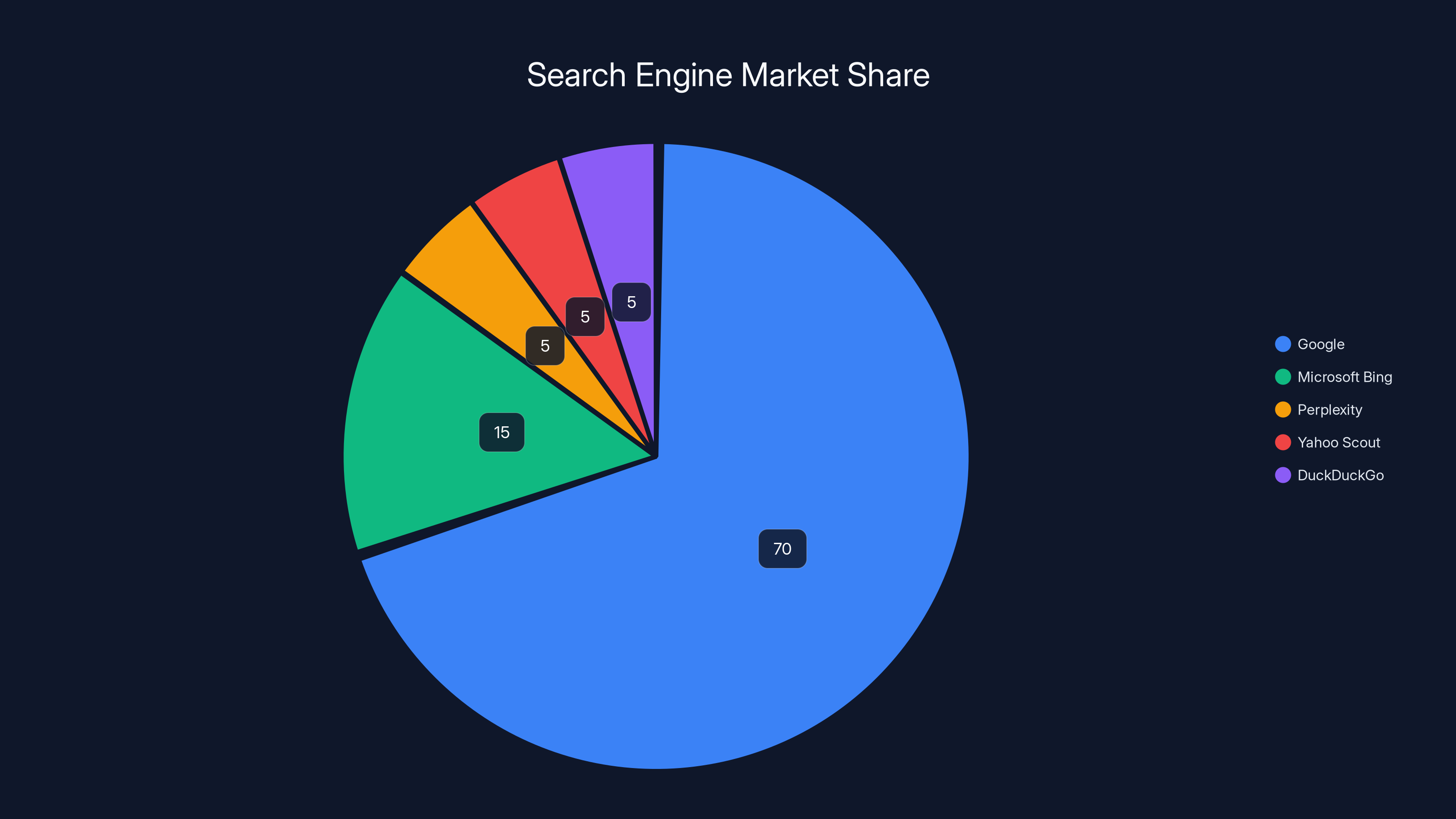

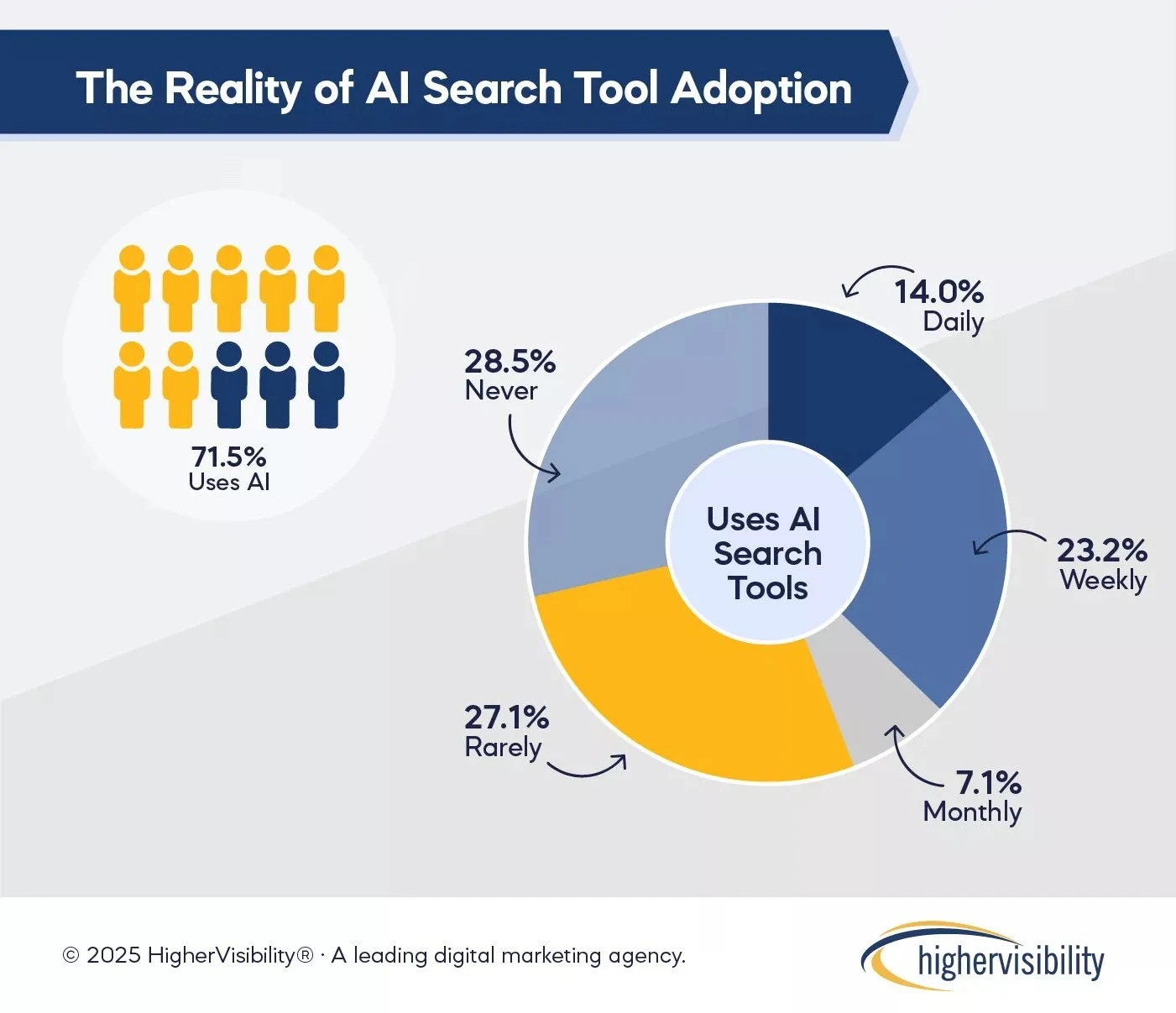

The search landscape has shifted dramatically over the past two years. Chat GPT changed what people expect from AI. Google's search quality has become increasingly questioned, especially as AI-generated content floods the index. Startups like Perplexity have proven that users actually want something different from traditional search results. And now, Yahoo is making its move.

But here's what nobody's talking about yet: this could fundamentally change not just how people search, but how the internet makes money. Search advertising has been the economic engine of the modern web. If Yahoo successfully shifts users away from link-based results to direct answers, the entire ad model breaks. That's why this announcement matters so much more than it seems on the surface.

Over the next 8,000 words, we're going to dissect Yahoo Scout, understand how it works, compare it to the competition, explore its implications for the search market, and figure out whether this actually represents the future of search or just another ambitious bet that won't pay off.

The Evolution of Search: From Links to Answers

Search has gone through three major phases. The first phase was the basic index: you search for something, you get a list of websites that mention your keywords. This is what Alta Vista and early Yahoo did. It worked, mostly, because the internet was small enough that relevance was achievable through simple keyword matching.

Then Google came along with Page Rank, and suddenly search became smarter. Google understood that the best result wasn't necessarily the one with the most keywords, but the one that other websites linked to. This obsession with quality changed everything. Google became so dominant that "Google it" became synonymous with "search for it."

But the internet grew exponentially. Spam evolved. SEO turned from an art into an optimization discipline. And then AI arrived. Suddenly, creating thousands of plausibly-written but low-quality pages became trivial. Search results got worse because the signal-to-noise ratio collapsed. The fundamental assumption that more links equals better quality started failing.

Now we're entering phase three: answer engines. Instead of ranking pages, these systems understand questions and generate answers. They don't just point you to information, they synthesize it. This requires a completely different architecture. You need to understand natural language at a deeper level. You need to access real-time data, not just crawled and indexed pages. You need to evaluate source credibility. You need to know when to say you don't know something.

Yahoo Scout is a bet on phase three. The company is saying: we're not going to compete with Google on page ranking. We're going to compete on understanding what you actually want and giving it to you directly.

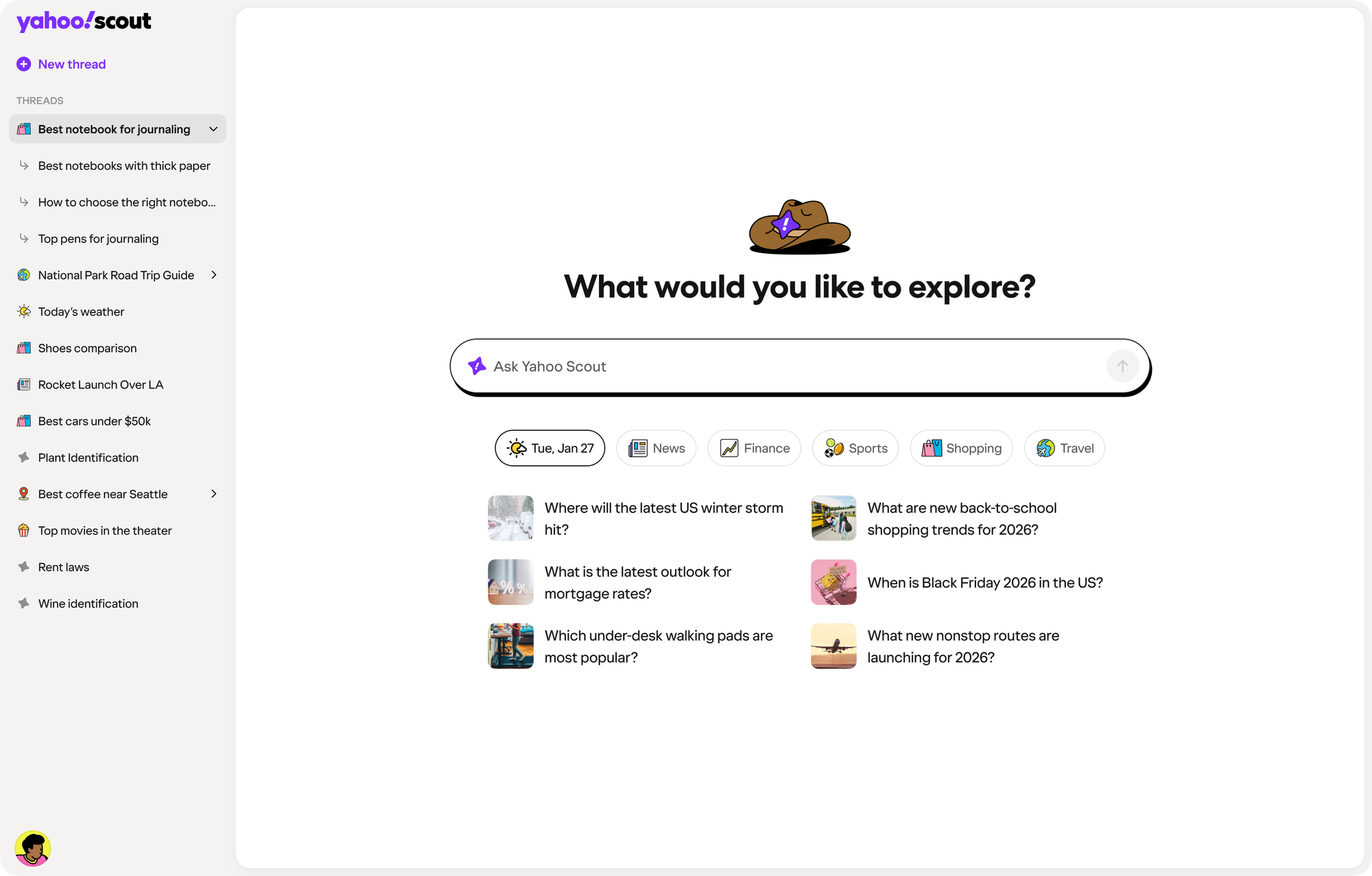

What Yahoo Scout Actually Does

Let's start with what Scout does operationally. You type a question. Scout's Claude-powered backend processes it. The system decides what information it needs: live data, historical context, specific facts, comparative analysis, whatever the question requires. It then synthesizes that information into a coherent answer with source citations, interactive elements like lists and tables, and clickable links to verify claims.

The interface is clean. You see the answer prominently displayed, but you're never cut off from sources. Every claim includes a visible link to where that information came from. This addresses one of the biggest criticisms of AI search: the "hallucination" problem. When an AI generates an answer without showing its work, you have no way to verify it. Scout puts sources front and center.

The system also handles follow-up questions. You're not limited to single searches. You can ask clarifying questions, drill deeper into specific aspects, or shift direction entirely. The context carries forward, so Scout understands what you're building on. This is genuinely useful. Real research and decision-making isn't linear. You start with a question, learn something, realize you need to know something else, and iterate.

What separates Scout from a Chat GPT or Claude conversation is that Scout maintains direct connection to current information. When you ask about stock prices, company news, or weather, Scout isn't working from training data that might be months or years old. It's pulling real-time information. This is the technical moat that makes Yahoo's distribution and data infrastructure valuable.

The Anthropic Partnership: Why Claude Powers Scout

Yahoo didn't build Scout with its own AI model. Instead, it partnered with Anthropic to use Claude. This is a smart choice, and it tells you something important about the current state of AI competition.

Claude has earned a reputation for being thoughtful about accuracy and bias. Anthropic, the company behind Claude, has invested heavily in something called Constitutional AI, which essentially means training Claude with a set of principles and values that constrain how it behaves. This isn't just marketing. The model genuinely seems more careful about admitting uncertainty and avoiding confident false statements.

For a search engine, this matters. People rely on search results for decision-making. If Scout frequently generates plausible-sounding but incorrect answers, it becomes useless fast. Better to be honest about limitations than to be confidently wrong.

The partnership also lets Yahoo avoid the enormous capital requirements of training and operating a custom LLM. The math on building competitive AI models is brutal: billions in compute, specialized engineering talent, ongoing infrastructure costs. By partnering with Anthropic, Yahoo gets access to a world-class model while focusing its resources on integration, distribution, and product experience.

But there's also a strategic element here. Yahoo is essentially saying: we don't need to compete with Open AI or Google on pure model capability. We can compete on distribution, product integration, and user experience. It's a different game, and it might actually be a smarter one.

Scout's Integration Across Yahoo Products

What makes Scout genuinely different from other answer engines is that Yahoo isn't keeping it isolated. Scout is integrating across the entire Yahoo ecosystem. This is where the real value appears.

In Yahoo Mail, Scout generates summaries of important emails. You're not just seeing a subject line and preview anymore, you're getting the key takeaways automatically extracted. This saves time when you're sorting through inboxes. More importantly, it lets you discover what matters without reading everything.

In Yahoo News, Scout provides key takeaways and context for news stories. This is genuinely useful. News sites are often sensationalized. Scout reads the article and extracts the important facts. It can also provide historical context and explain how this story relates to previous developments. This transforms news consumption from passive reading to active understanding.

Yahoo Sports gets game breakdowns powered by Scout. Instead of reading play-by-play summaries, you get analysis of key moments, turning points, and strategic decisions. For sports fans, this is substantial value. You can understand what happened and why without watching every minute.

Yahoo Shopping integrates Scout to provide product recommendations and insights. Scout doesn't just tell you where to buy something, it explains the differences between options, highlights features that matter for your use case, and provides shoppable links. This converts research into action.

Yahoo Finance gets the most sophisticated integration. Scout populates company financials, displays analyst ratings, explains stock movements as they occur, and provides context for market events. For someone trying to make investment decisions, this is transformative. Instead of manually searching for information, you get synthesis and analysis built in.

The strategic genius here is that Yahoo is using Scout to improve retention across every product simultaneously. Users have more reason to stay in Yahoo's ecosystem because every product becomes more useful. This creates a flywheel: more users and engagement means more data to learn from, which makes Scout smarter, which makes products more valuable.

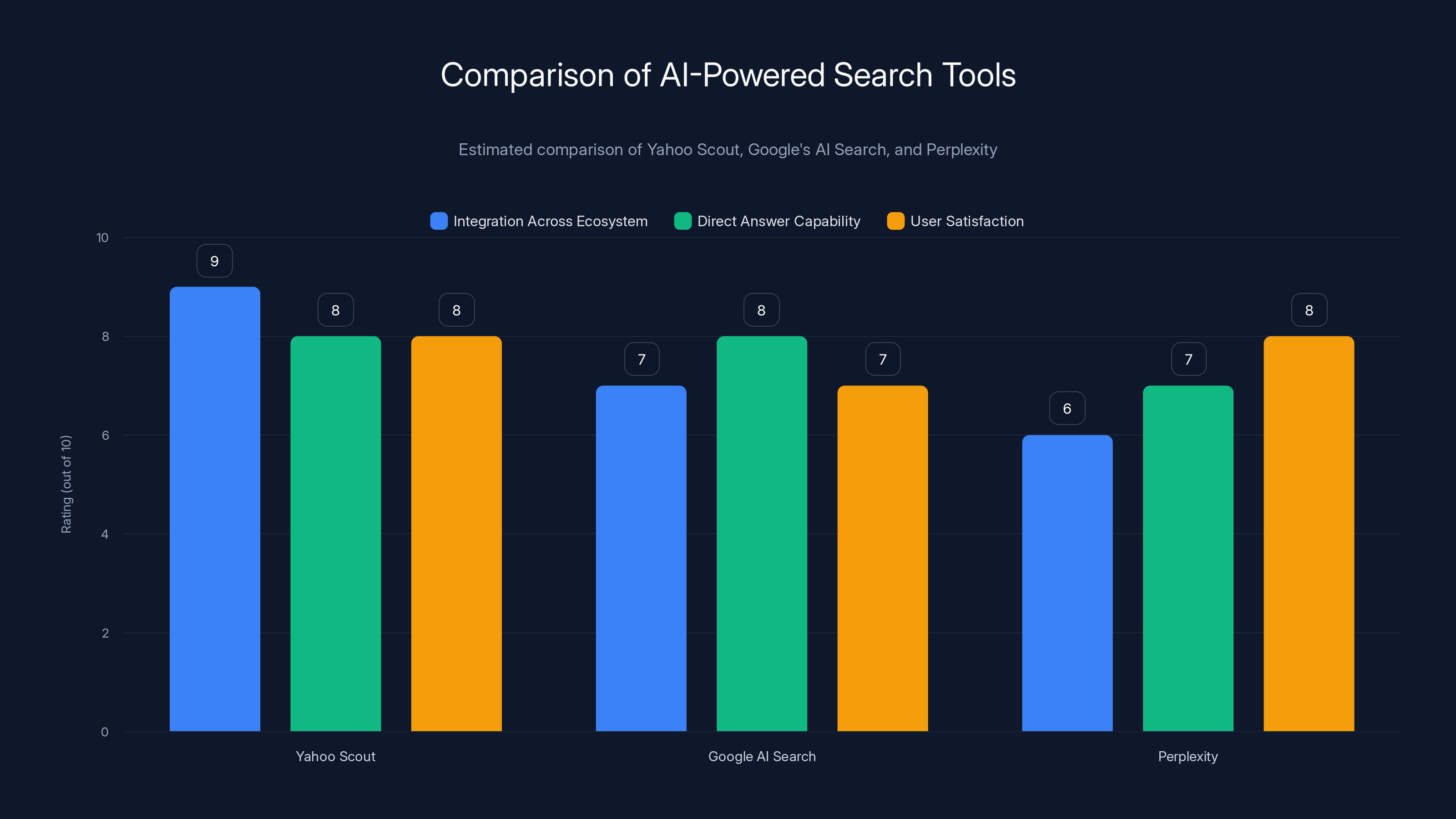

How Scout Compares to Google's AI Search

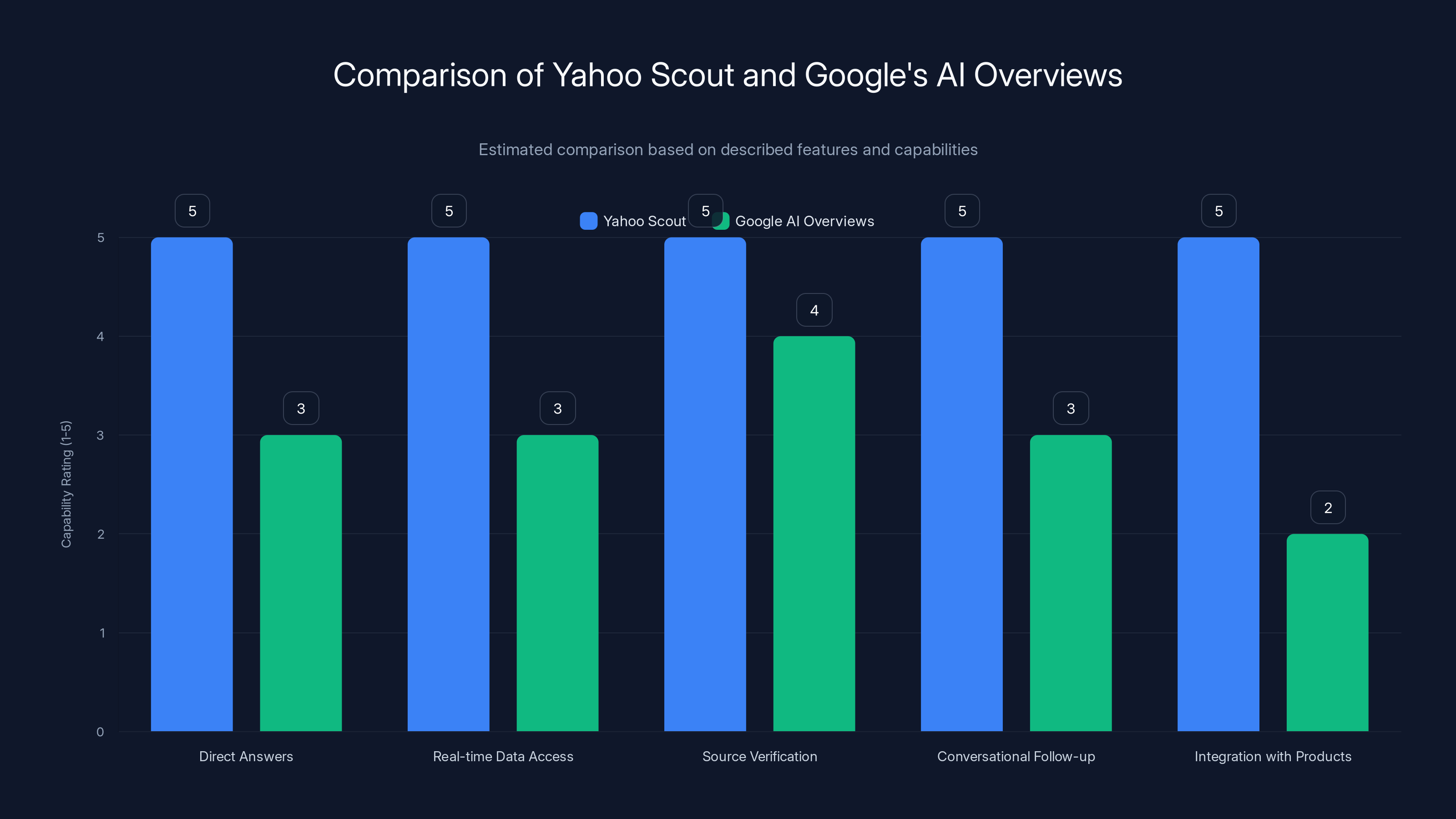

Google released AI Overviews (formerly SGE, or Search Generative Experience) in late 2023 and rolled it out widely through 2024. By now, most US searchers have encountered it. So comparing Scout to Google's offering is inevitable and important.

Google's approach starts with their traditional search results. The AI overview appears at the top, synthesizing information from the ranked results below. This has a major advantage: users can immediately see sources because the results are right there. Google's entire business depends on sending traffic to websites, so they had to preserve that dynamic.

But this approach has a critical weakness. If you ask a question where Google's top results are all mediocre or outdated, the AI overview will be mediocre or outdated. The overview is only as good as the underlying results. Google's ranking algorithm, for all its sophistication, has become increasingly unreliable in the AI age.

Scout works differently. It doesn't rely solely on Google's index. Yahoo has its own data infrastructure. More importantly, it can access real-time information through various APIs and data feeds. When you ask about stock prices, weather, or recent news, Scout isn't synthesizing outdated indexed pages. It's pulling current data.

The user experience differs too. Google's AI overview feels like an add-on to traditional search. Scout positions itself as the primary interface. You're not scanning search results and reading the AI summary. You're reading Scout's answer and diving into sources when you want verification.

Google has massive advantages: better understanding of search intent from years of data, larger index, unmatched distribution. But Google also has massive constraints: they're trying to preserve the ad model that generates $200+ billion in annual revenue. They can't fully commit to answer engines because it would cannibalize their business. Yahoo has no such constraints. Scout can be what it wants to be without defending a legacy business model.

Perplexity and the Rise of Specialized Answer Engines

Before evaluating Scout's chances, we need to understand Perplexity, the answer engine that proved consumers actually wanted something different from Google.

Perplexity launched in 2022 and grew explosively through 2024. The startup reached over 500 million monthly visits without traditional advertising, purely through word-of-mouth and product quality. The core appeal is simple: ask a question, get a direct answer with sources.

Perplexity's model is cleaner than Scout in some ways. It's focused purely on search and answering questions. There's no need to integrate into email, news, or sports. The product does one thing exceptionally well.

But Perplexity also faces scaling challenges. As a startup, it has limited data assets. It relies primarily on publicly available information and APIs. Real-time data access is more constrained. And it has no distribution advantage. Building a search engine requires either achieving massive organic adoption (hard) or integrating into browsers and devices (which Perplexity is attempting, but controlling distribution is difficult).

Scout has distribution baked in. Yahoo's products reach tens of millions of users monthly. These users don't need to choose to use Scout. They encounter it in products they already use. This is an enormous advantage.

But Perplexity has beat Yahoo to something important: cultural momentum. Right now, Perplexity is the trendy answer engine. Developers and early adopters use it. Perplexity feels like the future. Scout, coming from Yahoo, has to overcome decades of accumulated perception that Yahoo is yesterday's company.

The Technical Architecture of Answer Engines

Understanding how Scout actually works requires diving into the technical architecture of answer engines. This isn't just interesting from a technical standpoint. The architecture determines what's possible, what's difficult, and what's fundamentally limiting.

A traditional search engine like Google works like this: user enters keywords, system finds pages containing those keywords, ranker orders them by relevance. The ranker considers thousands of signals: link authority, freshness, user satisfaction metrics, topical relevance, and dozens of proprietary factors.

An answer engine has to work completely differently. Here's the rough flow: user asks a question in natural language, system understands the intent and information needs, system retrieves relevant information from multiple sources (indexed pages, real-time data, proprietary data), system synthesizes that information using an LLM, system formats the answer with source citations and interactive elements.

Each step has challenges. Understanding intent is easy for simple questions but gets complex quickly. "Best Italian restaurants near me" is straightforward. "Why are my investments underperforming the market?" requires understanding multiple concepts and connecting them.

Retrieval is complex because you're not just matching keywords anymore. You need to understand semantic similarity. A question about "software development best practices" should retrieve pages about "coding standards" and "engineering excellence" even if those exact keywords don't appear in your question. This is why large language models are useful here. They understand semantic relationships.

Synthesis is where LLMs shine, but also where they most frequently fail. An LLM can generate plausible-sounding text fluently. But it can hallucinate facts. It can confuse different concepts. It can be confidently wrong. Mitigating this requires careful prompt engineering, source citations, and honest uncertainty quantification. When an AI system says "I'm not sure," that's actually a feature, not a bug.

Formatting matters more than it seems. A direct answer to a simple factual question can be a sentence. A complex topic needs structure: headings, bullet points, tables, comparative analysis. Scout's interface seems to handle this reasonably well, with structured lists and tables, but I haven't tested every possible query type.

The Real-Time Data Advantage

Here's something that separates answer engines more significantly than most people realize: real-time data access.

When you ask Google about the current stock price of a company, Google can show you current data because it has integrations with financial data providers. But this integration happened after the fact. Google built stock price display specifically because it's a common query.

Answer engines face a choice: generate answers based on indexed, potentially outdated information, or integrate real-time data access for specific query types. This is technically complex and expensive. Every data source you integrate requires maintaining the integration, handling API failures, and ensuring data quality.

Yahoo has massive advantages here. Yahoo Finance is a major product with deep access to financial data. Yahoo News has relationships with content providers and APIs. These aren't freely available to competitors. When Scout pulls stock data, analyst ratings, and financial metrics, it's using infrastructure that costs enormous resources to build and maintain.

Perplexity has some real-time data access but not at Yahoo's level. This shows up in quality gaps. Ask an answer engine about a stock, a recent news event, or weather, and you'll see differences in how current and comprehensive the responses are.

The real-time advantage matters more than it might initially seem because search behavior concentrates on exactly these kinds of queries. A huge percentage of searches are about information that changes: stock prices, weather, news, sports scores, traffic. If Scout handles these categories better than competitors, it wins a disproportionate share of searches.

User Experience and Interface Design

Product design matters enormously in search. Google famously kept their homepage minimal when competitors were cluttering theirs with portals and widgets. That simplicity became iconic.

Scout's interface is clean. The answer appears prominently. Sources are visible. There's space for interactive elements like tables and lists. From descriptions, it seems well-designed, though nothing revolutionary.

But interface design for answer engines faces a specific challenge: balancing comprehensiveness with readability. A traditional search result can be sparse: title, URL, two-line description. That's easy to scan. An answer needs to be substantive but not overwhelming. Show too much, and you lose the benefit of synthesis. Show too little, and the answer feels incomplete.

Scout seems to strike a reasonable middle ground. It shows enough information to be useful but includes source links so you can dive deeper. This is smart because it acknowledges that some users will want additional context, and some will just want the answer.

The follow-up question feature is important from a UX standpoint. Real research is iterative. You learn something, then want to know something related, then discover you need background context. Supporting this conversational flow makes Scout more natural to use than traditional search, which treats every query as isolated.

The Advertising Challenge: Search's Economic Engine

Here's the uncomfortable truth that everyone in search avoids discussing: answer engines might be better for users but worse for the internet's economic model.

Search generates roughly

When search returns results as a ranked list, advertiser-supported content gets discovered. You search for "best laptop under $1000," Google shows you a bunch of results, you click on some, you see ads and affiliate links, someone makes money.

When an answer engine synthesizes an answer directly, that discovery path is interrupted. You get the information you want without necessarily visiting the content creators who gathered and analyzed it. This is better for users but worse for the publisher ecosystem.

Google has managed this tension by keeping links prominent in their AI overviews. But as answer engines become better and more satisfying without leaving the search interface, this tension increases.

Yahoo's Scout, by integrating into Yahoo products like Finance and Shopping, actually has a different model. Yahoo Finance makes money through financial services deals, not just ads. Yahoo Shopping has affiliate revenue. These products benefit from Scout because it drives engagement within their walled gardens.

But Scout's pure search function faces the same economic challenge. If Scout becomes the primary way people search and they never click through to external websites, who benefits? Essentially, Yahoo. The broader internet ecosystem loses.

This isn't necessarily a reason to avoid using Scout, but it's worth understanding the long-term incentive structures. A world where the majority of searches happen inside proprietary answer engines is a world that concentrates control over information access. That might not be bad for users, but it's a shift in how the internet's infrastructure works.

Privacy, Personalization, and Data

Yahoo's history with privacy and user data is complicated. The company has been involved in various data sales and controversies. Scout's launch introduces questions about data collection and personalization.

The Scout system described doesn't seem to require extensive personalization to work well. Even a generic answer to "what's a good ergonomic keyboard" is useful regardless of who's asking. But Yahoo could potentially improve Scout by making answers more personalized: factoring in your location, your previous searches, your product browsing history, your financial portfolio.

This raises privacy questions immediately. How much of this personalization data is collected? Is it separate from other Yahoo tracking? Can you opt out?

These questions aren't unique to Scout. Google personalizes search results extensively based on your history. Microsoft personalizes Bing results. But Scout is new enough that users should think carefully about what they're comfortable sharing.

From a technical standpoint, personalization is harder in answer engines than in traditional search. An LLM generating text is less transparent about why it made specific choices. If an answer is personalized, you might not realize it, and source bias becomes possible. A system that understands you're researching a particular stock might unconsciously emphasize positive information about it. This isn't malicious, but it's a risk.

Yahoo probably won't be transparent about how much personalization Scout does. But users should assume it's significant and adjust their expectations accordingly. For fact-based queries, this matters less. For subjective or comparative queries, be aware that answers might be filtered through your profile.

Competitive Responses and Market Dynamics

How will competitors respond to Scout? This is the most important question for figuring out whether Scout actually matters.

Google will respond with improved AI Overviews. They have to. The company can't allow competitors to significantly improve on their core product. Expect to see better synthesis, more interactive elements, and tighter integration with real-time data across Google properties. Google has the resources and distribution to iterate quickly.

Microsoft is interesting because they've already bet heavily on AI through Open AI and Copilot integration in Bing. Bing can improve its answer engine through better LLM capabilities, tighter integration with the Microsoft ecosystem, and hardware advantages through Windows and Edge. Bing is deeply integrated into Windows search, giving them similar distribution advantage to Yahoo.

Perplexity will continue improving their product and try to build distribution partnerships. They might integrate into browsers, mobile devices, or third-party applications. But as a startup, they can't match the resources of Google, Microsoft, or Yahoo.

Smaller competitors will get squeezed. Specialized search engines for research, code, or specific domains might survive, but general-purpose search will consolidate around platforms with distribution and data moats.

The most likely scenario is that we end up with three or four major answer engines, each integrated into a different ecosystem: Google has search and Android, Microsoft has Windows and Office, Yahoo has their product suite and their partnerships, and maybe one of Perplexity or a new competitor becomes the "scrappy challenger" option.

Implementation Challenges and Limitations

Scout is ambitious, and ambition always encounters friction. Let's be honest about what's hard here.

LLMs are expensive to operate at scale. Every query that goes through Claude costs money. Yahoo needs to figure out how to offer Scout without breaking their unit economics. This might mean limiting how much Scout is available, caching common answers, or optimizing prompt efficiency. As Scout scales, efficiency matters more and more.

Accuracy is hard. Synthesizing information from multiple sources is harder than ranking pages. When an LLM hallucinates or makes subtle errors, it's a worse failure than returning a bad ranked list. Users trust answer engines more than search results, so accuracy expectations are higher.

Legal liability is a real consideration. If Scout gives bad financial advice and someone loses money, or health advice and someone gets hurt, there's potential liability. Yahoo probably has extensive disclaimers, but liability still exists.

Integration complexity is substantial. Scout needs to integrate cleanly into different products, each with different user needs and interfaces. Getting the integration right across Mail, News, Sports, Shopping, and Finance is a multi-year effort.

Source quality and coverage is ongoing. Scout is only as good as the data it can access. For some topics, available information is sparse or poor quality. Scout can't magic up better sources.

These challenges are real, but none are insurmountable. Yahoo has the resources and distribution to work through them.

The Broader Shift in Information Access

Scout is part of something larger: a shift in how we access information. For decades, the primary model was: search, discover links, click through, read. The internet was a distributed collection of websites connected by hyperlinks.

Answer engines change this to: ask, get direct answer, optionally verify sources. The internet becomes more like a knowledge base that you query, less like a collection of documents you browse.

This shift has implications for how information is created and consumed. Content creators need to think about whether their work will be visible when an answer engine synthesizes answers. News outlets need to think about whether traffic from answer engines justifies the information they provide.

For users, the shift is mostly positive. Getting answers directly is more efficient than finding and reading pages. But there's a cost: less serendipitous discovery, less exposure to diverse perspectives, less understanding of how information is gathered and validated.

Scout accelerates this shift. By integrating answer capabilities into Yahoo's products, Scout makes information synthesis the default experience for many people. This is important because defaults matter enormously in user behavior.

Timeline and Rollout Strategy

Scout is launching in beta now. This means it's available but not fully polished. There will be bugs, unexpected behaviors, edge cases where the system fails. Beta is where Yahoo learns what works and what doesn't.

Rollout strategy will determine how quickly Scout impacts the search market. If Yahoo makes Scout the default within Yahoo.com, it reaches millions of people immediately. If they keep it as an optional feature, adoption takes longer.

Historically, Yahoo has been cautious about major changes. But search is an area where they have nothing to lose. Being bold makes sense.

Expect Scout to be fully integrated into Yahoo's main products within 6-12 months. Broader distribution partnerships (potentially integrating Scout into other browsers or devices) will take longer, probably 12-24 months.

The timeline for Scout becoming a major competitor to Google is probably 2-3 years. By then, most competitive gaps will be addressed, Scout will have stabilized, and adoption patterns will be clear.

The Future: What Scout Could Become

Looking forward, Scout could evolve in several directions.

More personalization is likely. Yahoo could train custom models specific to different domains: financial queries, shopping queries, health queries. Each model would be optimized for accuracy in its domain.

Action-oriented features are possible. Instead of just answering questions, Scout could suggest actions. Planning a trip? Scout could draft an itinerary. Researching a purchase? Scout could add items to a cart. This gets more ambitious, but it's technically feasible.

Community integration could happen. Yahoo could incorporate user-generated content and reviews into Scout's answers, similar to how Google integrated user ratings and reviews.

AI-to-AI interaction might emerge. As AI becomes more prevalent, Scout might interact with other AI systems to gather information or validate answers. This is speculative, but it's a logical extension of the technology.

Beyond Scout specifically, the broader implications are significant. If answer engines become the dominant way people search, the internet's architecture changes. Distribution shifts from individual websites to aggregated platforms. Business models shift from traffic-based to engagement-based. Content strategy shifts from optimization for discovery to optimization for synthesis.

Risks and Worst-Case Scenarios

Not everything about Scout's rise would be positive. Let's consider some risk scenarios.

Central point of failure: If Scout becomes the primary way millions of people get information, Scout's errors become systemic. A bug that causes Scout to provide wrong answers to financial questions affects millions of decisions.

Information ecosystem collapse: If answer engines significantly reduce traffic to content creators, media companies and publishers struggle to survive. This could reduce quality journalism and analysis.

Consolidation of control: Information access concentrating in a few platforms (Google, Microsoft, Yahoo) means those companies control what information people see. This increases the risk of censorship or manipulation.

Economic lock-in: Once users are comfortable getting answers from one system, switching costs increase. This reduces competition and innovation in search.

These risks are real, but they're not unique to Scout. They apply to any dominant search engine. The question is whether Scout adds to these risks or is a natural evolution that happens regardless.

Recommendations and Conclusions

For users: Scout is worth trying. It's a clean interface, reasonably accurate, and genuinely useful for many types of queries. But don't use it exclusively. Verify important answers by reading sources. Be aware that your interactions are tracked and potentially used for personalization.

For content creators: Monitor how Scout treats your content. If your content is being synthesized without proper attribution, you might need to optimize for answer engines instead of traditional search. This is a shifting landscape, but awareness is the first step.

For the broader technology ecosystem: Scout represents a maturation of AI technology. Answer engines are now real, competitive products. The shift from traditional search to answer engines is underway and will accelerate.

Yahoo Scout is not a guaranteed success. The company faces well-resourced competitors and inherits decades of skepticism. But Scout has real advantages: distribution, data assets, integration capabilities, and a company with nothing to lose by being bold.

The search market is entering a new phase. Whatever happens with Scout specifically, the future of search is answer engines, not link lists. Users prefer getting direct answers. Companies prefer engaged users over links clicked. This shift is inevitable.

Scout is simply one manifestation of that inevitable shift, and it's perhaps a more credible manifestation than we might expect from yesterday's Yahoo.

TL; DR

- Yahoo Scout is an AI-powered answer engine powered by Claude that synthesizes web information and Yahoo's data to directly answer user questions instead of returning link lists

- Scout integrates across Yahoo products including Mail, News, Sports, Shopping, and Finance, creating a flywheel effect that improves engagement and retention across the ecosystem

- Real-time data access is a major advantage over competitors like Perplexity and even Google, especially for stock prices, news, weather, and financial information

- The economic model faces challenges because answer engines reduce traffic to external websites, threatening the ad-supported publisher ecosystem that has powered the internet

- Competition will intensify rapidly with Google improving AI Overviews, Microsoft leveraging Open AI partnership, and Perplexity continuing to build distribution partnerships

Yahoo Scout is estimated to have strong integration across its ecosystem, potentially giving it an edge over competitors. Estimated data based on current trends.

FAQ

What is Yahoo Scout?

Yahoo Scout is an AI-powered answer engine launched in beta that uses Anthropic's Claude model to synthesize information from the web and Yahoo's proprietary data sources to provide direct answers to user questions. Unlike traditional search engines that return ranked links, Scout generates comprehensive answers with source citations, interactive elements like tables and lists, and visible source links for verification.

How does Yahoo Scout work?

Scout accepts natural language questions, uses AI to understand user intent and information needs, retrieves relevant information from multiple sources including indexed pages and real-time data feeds, synthesizes that information using Claude's language capabilities, and formats the answer with source attribution and interactive elements. The system supports follow-up questions, maintaining context across multiple queries in a conversation.

What are the benefits of Yahoo Scout over traditional search?

Benefits include receiving direct answers without manually scanning multiple link results, built-in source verification through visible citations, real-time data access for current information like stock prices and news, support for conversational follow-up questions, and integration with Yahoo products that provide relevant context based on the domain (finance, shopping, news, etc.).

How is Scout different from Google's AI Overviews?

Google's AI overviews synthesize information from Google's ranked search results, which means they're only as good as the underlying results. Scout has independent access to real-time data through Yahoo's infrastructure and financial/news partnerships, allowing more current and comprehensive answers. Scout also positions itself as the primary search interface rather than an addition to ranked results.

Why did Yahoo choose Anthropic's Claude instead of building its own AI model?

Partnering with Claude allows Yahoo to access a world-class language model while avoiding the massive capital expenditure, infrastructure costs, and specialized engineering talent required to train and operate a custom LLM. Claude's focus on accuracy and honesty about limitations also aligns well with search requirements where confident false answers are worse than admitting uncertainty.

What products will Scout integrate into?

Scout is integrating across Yahoo's entire product ecosystem including Yahoo Mail (email summaries), Yahoo News (article summaries and context), Yahoo Sports (game analysis), Yahoo Shopping (product recommendations and comparisons), and Yahoo Finance (company financials, analyst ratings, stock explanations). Each integration is tailored to the specific use case of that product.

How does Scout handle privacy and personalization?

Scout can potentially personalize answers based on user location, search history, browsing behavior, and other profile data, though specific practices aren't fully transparent. Users should assume significant personalization occurs and adjust expectations accordingly, especially for subjective or comparative queries that might be filtered through personal profiles.

Will Scout reduce traffic to content creators and publishers?

Potentially yes. By providing answers directly without requiring users to click through to source websites, Scout could reduce discovery traffic for publishers and content creators who depend on search traffic for monetization. This represents a fundamental shift in the internet's economic model as it moves from traffic-based to engagement-based revenue.

How accurate is Scout for different types of queries?

Scout performs well for factual questions with available sources, real-time queries using Yahoo's data feeds, and comparative analysis where synthesis of multiple sources adds value. It's less reliable for highly subjective topics, niche information with limited coverage, and queries requiring specialized domain expertise. Users should verify answers, especially for important decisions.

What are the main risks or limitations of answer engines like Scout?

Key limitations include expensive operation costs due to LLM inference, potential hallucinations or factual errors in synthesized answers, legal liability when answers influence user decisions, reliance on source quality (Scout can't improve information that isn't available), and integration complexity across multiple products with different user needs and interfaces.

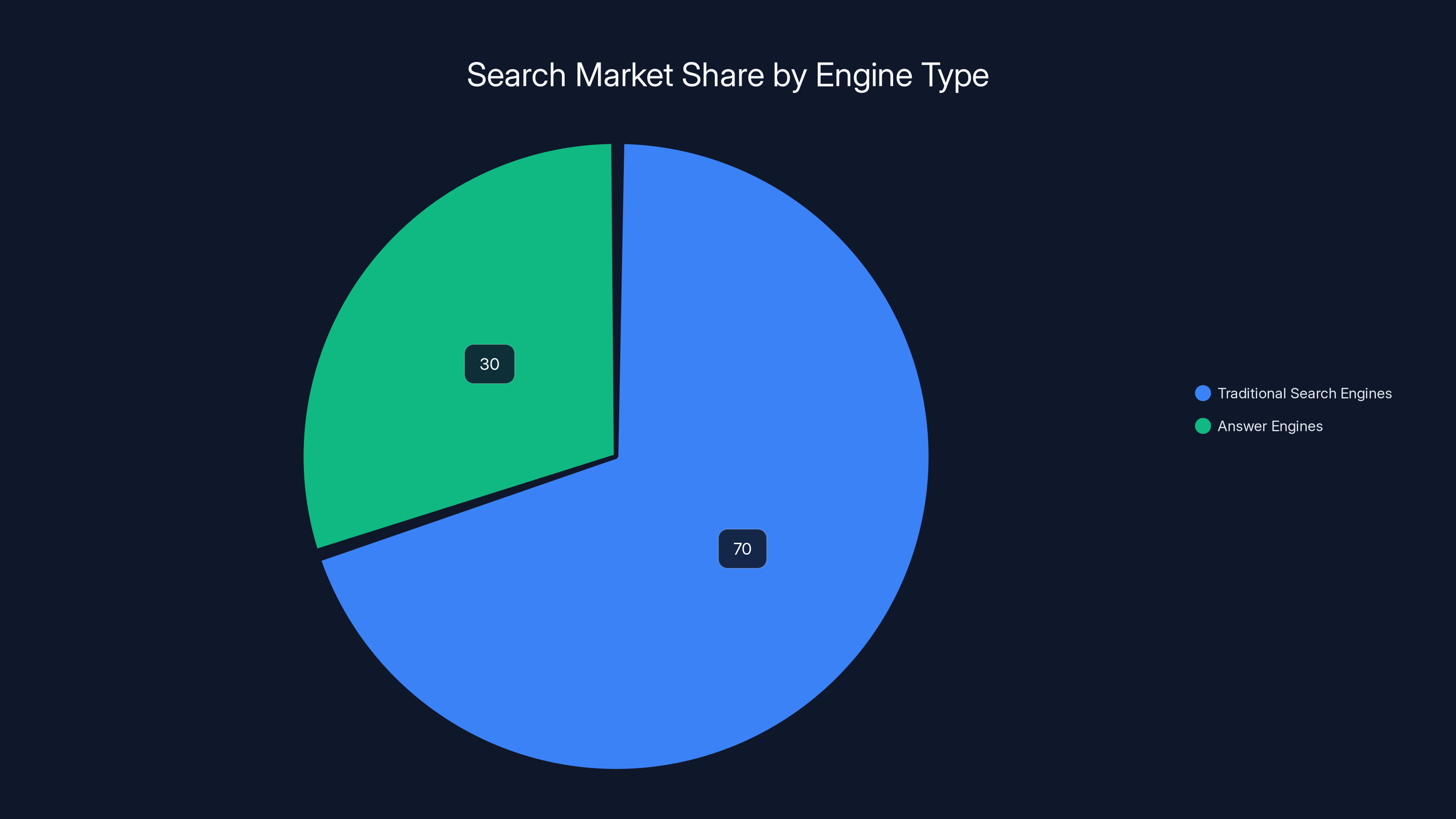

Google dominates the global search advertising market with an estimated 70% share, while Yahoo and Bing each hold about 10%. Estimated data.

The Competitive Landscape

The search and answer engine market is becoming increasingly competitive as multiple platforms recognize the opportunity to shift from link-based to synthesis-based search. Here's how the major players are positioning themselves.

Google dominates with over 90% search market share, but this dominance has vulnerabilities. AI-generated content has degraded search quality, user satisfaction metrics have declined, and competitors have proven consumers want direct answers. Google's AI Overviews represent their response, but they face constraints from needing to preserve their advertising business model.

Microsoft has invested heavily through Open AI, integrating GPT-4 into Bing and their products. Bing's answer engine capabilities are competitive, and Copilot integration across Windows and Office provides distribution. Microsoft's advantage is a fully integrated ecosystem where answer capabilities support productivity features.

Perplexity has achieved remarkable adoption for a startup, reaching hundreds of millions of visits through product quality alone. The company focuses purely on search, giving them singular clarity of purpose. However, they lack the distribution advantages and proprietary data assets of established platforms.

Yahoo's Scout enters this market with unique advantages: integrated distribution through multiple high-traffic products, proprietary financial and news data, affiliate and services revenue models that don't depend on ads, and a company with nothing to lose from disrupting traditional search.

Smaller competitors like Duck Duck Go focus on privacy rather than AI capabilities, finding a niche among privacy-conscious users but lacking the resources to compete on answer quality.

Implementation Lessons from Early Adopters

Companies testing answer engines in their products are discovering several important lessons.

First, users want sources. Skepticism of AI is high enough that direct answers without visible sources get immediate pushback. Every claim needs a link to verify. This has forced answer engine designers to put sources front and center rather than hidden in footnotes.

Second, accuracy matters exponentially more than coverage. A system that gets 90% of queries right and admits uncertainty on 10% beats a system that returns incorrect answers for 5% of queries. Users trust that admitted limitations more than they trust confident errors.

Third, integration requires care. Shoving answer capabilities into existing products creates an awkward experience if not thoughtfully designed. Yahoo's approach of tailoring Scout to each product's specific needs (game analysis for Sports, financial metrics for Finance) is smarter than generic integration.

Fourth, real-time data is table stakes for many query types. Systems limited to indexed, potentially outdated information lose credibility for time-sensitive queries. This is where Yahoo's infrastructure advantages become substantial.

Fifth, conversational flow matters. Users don't search in isolation. They ask a question, learn something, realize they need more information, adjust their query. Supporting this conversation is more important than optimizing for individual queries.

Google continues to dominate the search engine market, but competitors like Microsoft Bing and Yahoo Scout are gaining traction with unique features and integrations. (Estimated data)

Market Size and Opportunity

The addressable market for search and answer engines is enormous. Global search generates around $200 billion in annual advertising revenue. Beyond advertising, information access has massive value across e-commerce, financial services, news, and other sectors.

Answer engines increase engagement metrics within platforms because users spend more time in the search or product interface rather than clicking out to external websites. This engagement is monetizable through improved ad targeting, affiliate commissions, and subscription services.

Yahoo's opportunity is significant but requires execution. If Scout captures even 10% of Yahoo search traffic, that represents millions of users. If Scout becomes the default on Yahoo.com and in other Yahoo products, adoption scales rapidly.

The key metric to watch is whether answer engines increase or decrease time spent in search. If answer engines satisfy users faster, they'll search more often (more queries, more touchpoints for monetization). If answer engines make search unnecessary, the market shrinks.

Early evidence suggests the former. When search becomes more useful, people do more searching. Perplexity's rapid growth suggests they're expanding the search market rather than just capturing share from Google.

Technical Feasibility and Scalability

Technically, Scout appears feasible based on available information about architecture. The hard problems (natural language understanding, source synthesis, real-time data access) have been solved by companies like Google, Microsoft, and Perplexity. Scout doesn't need to invent new technology.

The challenges are operational: scaling Claude inference to handle millions of concurrent queries, maintaining latency under 2-3 seconds (the acceptable search response time), handling edge cases and edge failures, optimizing costs.

Yahoo can solve these problems. They have substantial infrastructure, experience running search-scale systems, and the financial resources to invest. The question isn't whether they can build it technically; it's whether they'll do it well enough to compete.

Scalability challenges include API cost management (each Claude query costs money), cache optimization (many queries have common elements that can be cached), and load distribution across infrastructure. These are well-understood problems in cloud computing.

The more interesting technical question is how Scout will improve over time. Will Yahoo train custom models for specific domains? Will they develop better source ranking algorithms? Will they integrate user feedback to improve answer quality? These improvements determine whether Scout stays competitive as competitors improve.

Yahoo Scout offers superior capabilities in direct answers, real-time data access, and integration with Yahoo products compared to Google's AI Overviews. (Estimated data)

Strategic Implications for the Broader Internet

Scout's success or failure has implications beyond just search market share. It affects how the internet is organized, how information flows, and how companies create value.

If answer engines become dominant, the importance of individual websites decreases relative to integrated platforms. A blog post has value not as a destination but as a source for synthesis. This changes incentives for content creation. Niche blogs optimized for long-tail search might lose viability if traffic comes from answer engines rather than direct search links.

For news organizations, the impact could be severe or beneficial depending on how answer engines cite sources. If Scout drives traffic to news articles while attributing content correctly, it's positive. If Scout summarizes news without adequate source visibility, traffic and revenue drop significantly.

For e-commerce, answer engines become powerful. Scout integrated into Yahoo Shopping makes product discovery easier, potentially benefiting both Yahoo and merchants. This could shift e-commerce search from Google Shopping to Yahoo and other platforms.

For financial information and trading, answer engines create opportunities for brokerages and financial data providers to integrate more deeply with search. Yahoo Finance gains value; independent financial websites lose search traffic.

The long-term implication is consolidation. Platforms with distribution and data assets become more powerful. The decentralized web becomes slightly more centralized. This isn't necessarily bad for users, but it's a significant structural change.

Predictions and Future State of Search

Based on current trends, here's what search likely looks like in 5 years:

Answer engines are the dominant search interface, not link lists. Most searches return direct answers rather than blue links. Traditional search results become secondary, used when answer engines don't satisfy.

Three or four major answer engines control the market: Google maintains dominance despite not having built the best product, simply because of distribution; Microsoft builds the second major platform through Windows, Office, and Copilot integration; Yahoo potentially becomes viable again through Scout and product integration; one challenger (possibly Perplexity or a new entrant) captures early adopter and privacy-conscious users.

Specialized answer engines emerge for specific domains: research, code, medical information, legal information. These maintain independence through domain expertise that generalist engines don't match.

SEO shifts from optimization for ranking to optimization for synthesis. Content creators need to make their information easily extractable, well-structured, and clearly attributed. Writing style shifts from click-baiting headlines to clear explanations.

Advertising evolves from search ads (ads within search results) to answer ads (sponsored answers or paid placements within answer summaries). This is harder to implement ethically but potentially more valuable because engagement is higher.

User behavior changes as search becomes more productive. People search more often because search is more useful. Research tasks that were previously complex become simple. Information access democratizes further.

These predictions assume answer engine technology matures and remains competitive. The wild card is whether new AI breakthroughs enable qualitatively different search experiences that we can't currently imagine.

Estimated data suggests that while traditional search engines still hold a larger market share, answer engines are rapidly gaining traction, accounting for approximately 30% of the market.

Conclusion: The Search Market Has Shifted

Yahoo Scout's announcement signals that the shift from traditional search to answer engines is real and accelerating. This isn't speculative or far-future. It's happening now, with multiple platforms investing heavily.

The search market's fundamental economics are changing. For decades, search was about ranking authority. Page Rank and link analysis determined relevance. Google built a dominant position on being slightly better at this than competitors.

Answer engines change the competition to something else: accuracy, clarity, comprehensiveness, source verification, real-time data access, and user experience. These are different capabilities. Companies good at traditional search aren't automatically good at answer engines.

This opening is why Yahoo has a chance. The company's decades of search experience aren't directly applicable to answer engines. Scout doesn't need to be better at Page Rank; it needs to be better at synthesis, integration, and real-time data.

Scout won't become the dominant answer engine. Google's distribution is too powerful, and Microsoft's ecosystem integration is too deep. But Scout could become viable and profitable, especially if it captures specific use cases (financial search, shopping search, news search) better than competitors.

The broader implication is that the internet's search and discovery layer is being rebuilt. We're in the middle of this transition, so outcomes are still uncertain. But the direction is clear: from links to answers, from ranking to synthesis, from distributed websites to integrated platforms.

Yahoo Scout is one piece of this larger shift. Whether Scout succeeds or fails, the shift itself is inevitable.

Users should experiment with Scout and decide whether it works better than their current search habits. Content creators should pay attention to how their information is being synthesized and consider optimizing for answer engines. Investors should recognize that search market dynamics are genuinely disrupting, creating opportunities and risks across the ecosystem.

For Yahoo specifically, Scout represents a bet-the-company pivot. The company has nothing to lose and everything to gain by succeeding. That desperation to succeed might actually be an advantage. Yahoo can be bold and take risks that more established companies can't. Whether that boldness translates into product quality and market success remains to be seen.

But the search market has shifted. Answer engines are real. Scout is here. The next chapter of internet search has begun.

Key Takeaways

- Yahoo Scout represents a fundamental shift from link-based to answer-based search, synthesizing information directly using Claude AI

- Scout's integration across Yahoo's entire product ecosystem (Mail, News, Finance, Shopping, Sports) creates distribution advantages competitors lack

- Real-time data access through Yahoo's infrastructure gives Scout advantages over Perplexity and even Google for time-sensitive queries like stocks and news

- The economic implications are massive: answer engines reduce traffic to external websites, disrupting the ad-supported publisher model that powers the internet

- Answer engines are becoming the dominant search interface across multiple platforms, with Google, Microsoft, and Yahoo all investing heavily in this paradigm shift

Related Articles

- Claude AI Workspace: Control Slack, Figma, Asana Without Tab Switching [2025]

- Google Photos AI Video Generation: Text Prompts & Creative Control [2025]

- Claude MCP Apps Integration: How AI Meets Slack, Figma & Canva [2025]

- Google Photos Me Meme: AI-Powered Meme Generator [2025]

- Thinking Machines Lab Exodus: OpenAI's Talent War & AI Industry Implications

- Anthropic's Strategic C-Suite Shake-Up: What the Labs Expansion Means [2025]

![Yahoo's AI-Powered Search Engine: How Scout Changes Search Forever [2025]](https://tryrunable.com/blog/yahoo-s-ai-powered-search-engine-how-scout-changes-search-fo/image-1-1769535547707.png)