Airbnb's AI Search Revolution: What You Need to Know [2025]

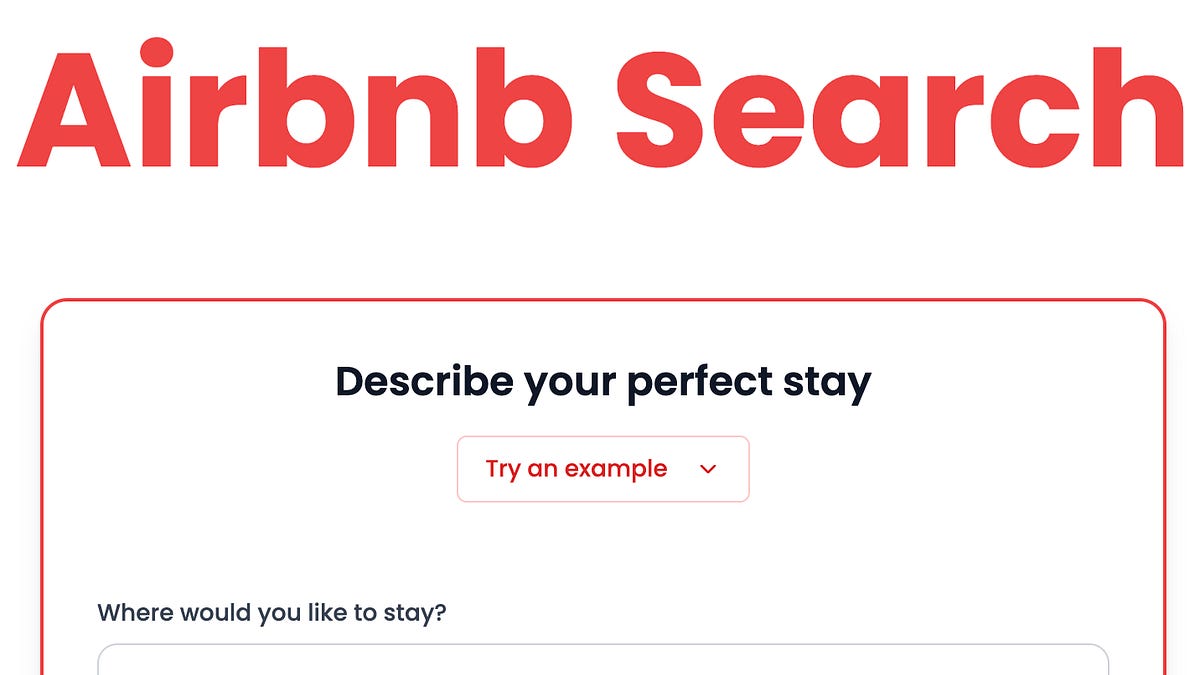

Imagine describing your dream vacation to a friend, and seconds later, getting a curated list of properties that match exactly what you're looking for. No dropdown menus, no filter hunting, no algorithm second-guessing your needs. That's the experience Airbnb wants to create with its new AI-powered search tool.

Last quarter, CEO Brian Chesky announced something that's been quietly reshaping how the company thinks about technology. Airbnb isn't just bolting AI onto its existing search—it's architecting an entirely "AI-native experience" that touches every part of the platform, from guest discovery to host operations to customer support.

The company is currently testing an AI search feature with a limited group of users. According to shareholder communications, this tool lets guests describe what they're looking for in natural language, ask questions about listings and locations, and get smarter recommendations. But here's what makes this different from every other AI feature you've seen lately: this is just the beginning. Airbnb sees AI as foundational infrastructure, not a feature bolted onto the side.

For travelers, this could mean the death of vacation planning frustration. For hosts, it promises better visibility and smarter listing management. For the company, it's a competitive moat against competitors like Booking.com and VRBO. But like any major platform shift, there are questions worth asking: How accurate is the AI? What data is it using? And what does this mean for the future of travel search?

Let's dig into what's actually happening here, why it matters, and what comes next.

TL; DR

- Airbnb is testing AI search: A limited percentage of users can now describe what they want in plain language instead of using traditional filters

- AI-native strategy: The company is building AI into every part of its platform—search, listing management, customer service, and internal operations

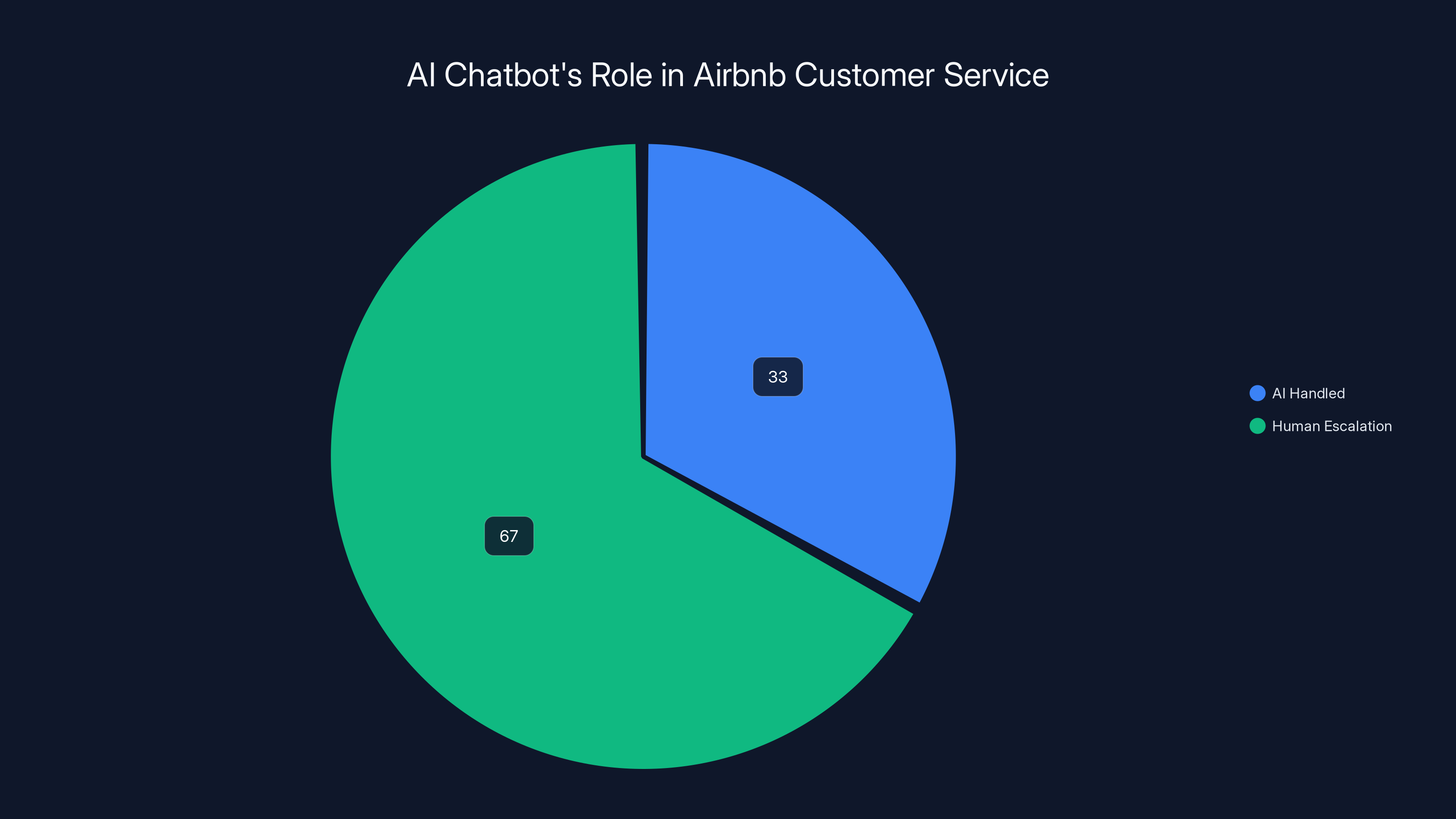

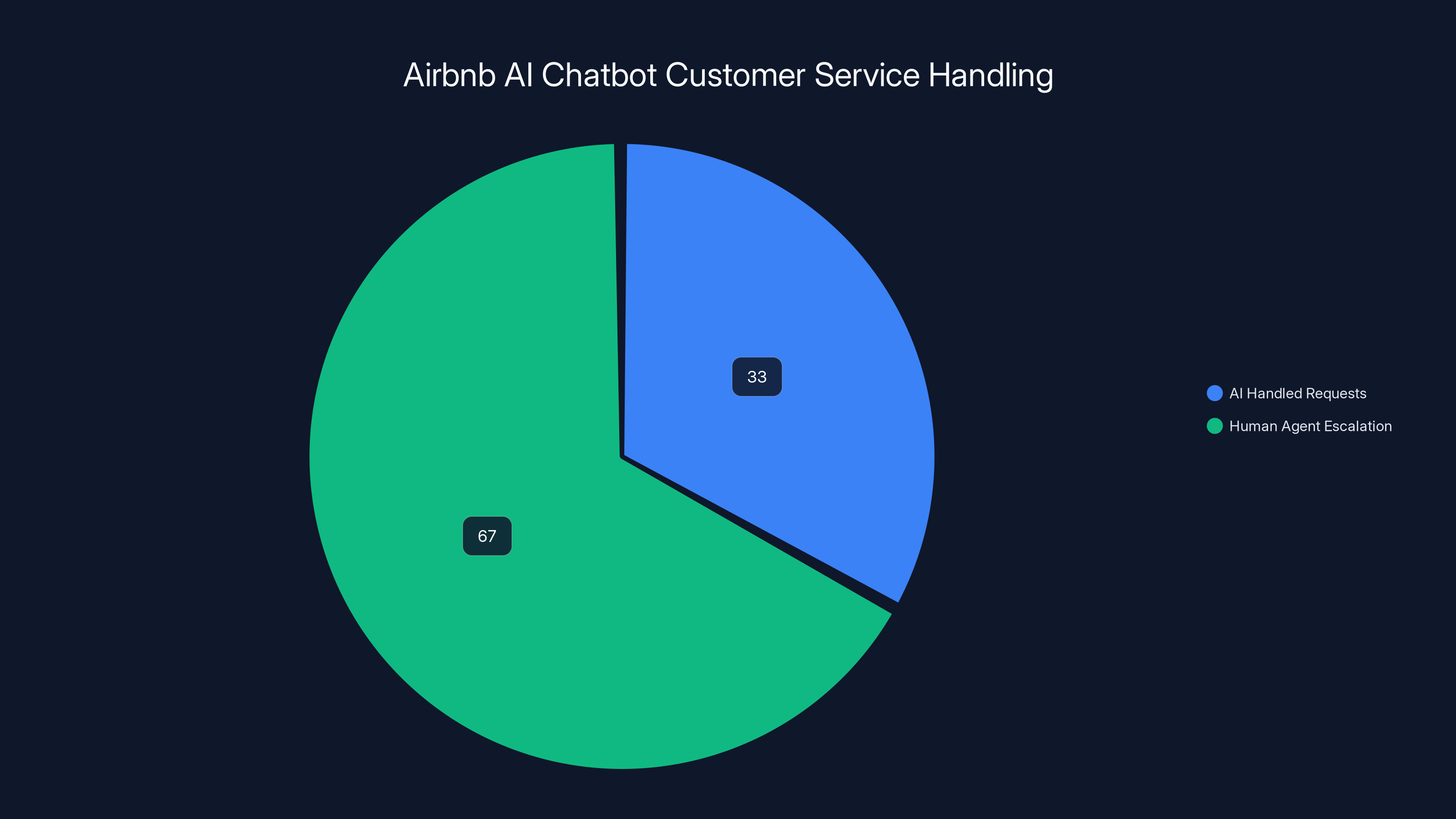

- AI agent already handling customer support: An AI chatbot deployed last year already processes one-third of customer service requests without human intervention

- Expansion plans are aggressive: The company plans to expand AI features globally and increase automation significantly over the next year

- Competition is heating up: Travel platforms are racing to integrate AI search before customers expect it as standard

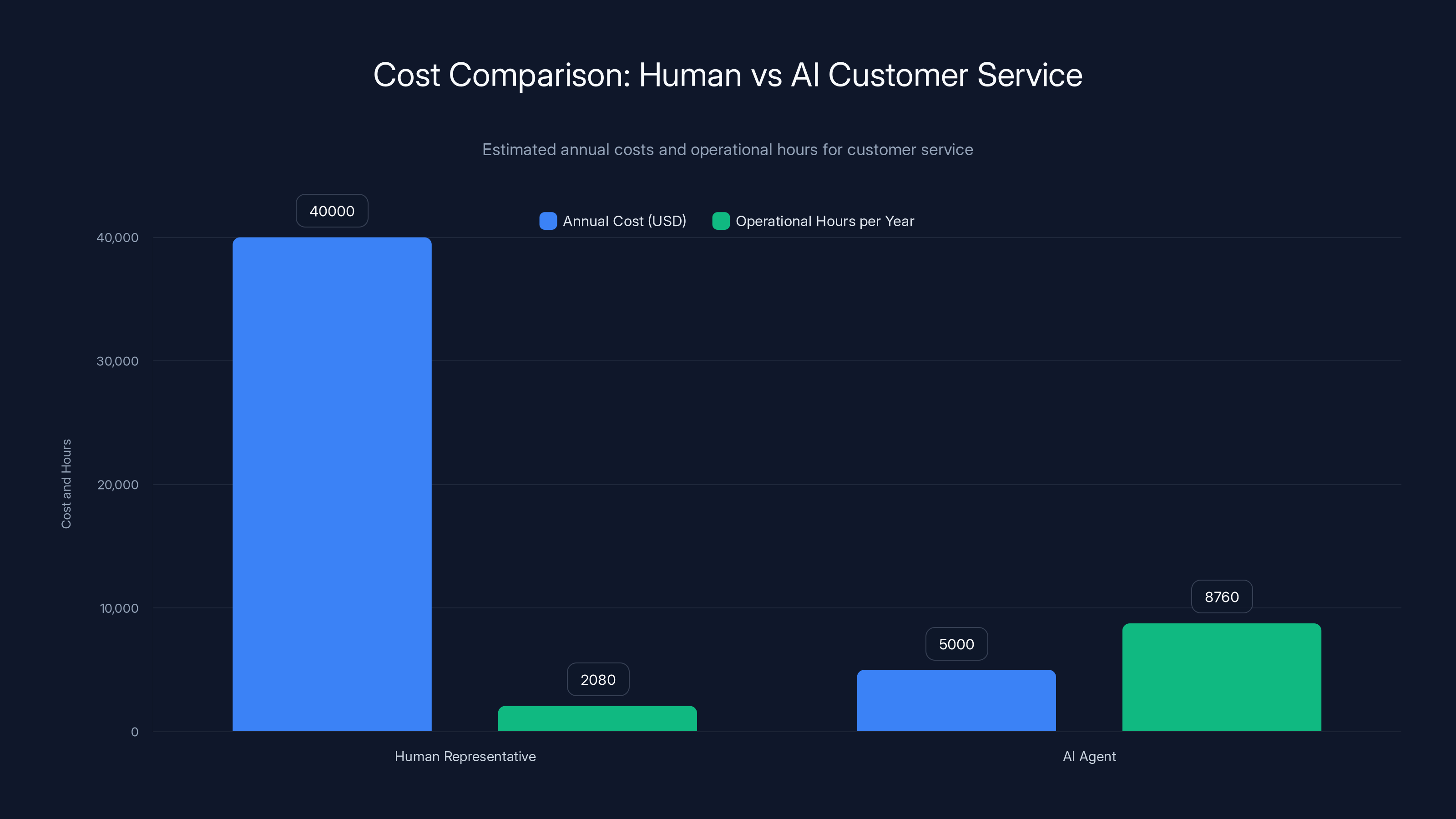

The AI chatbot currently handles approximately one-third of Airbnb's customer service requests, reducing the workload on human agents and leading to significant cost savings. Estimated data.

The AI Search Test: What's Actually Happening

Airbnb's AI search feature is currently live for a small percentage of users. This isn't a beta that's been widely publicized or available through an opt-in process. Instead, the company is methodically rolling it out to specific user segments to gather data on how the AI performs in real-world scenarios.

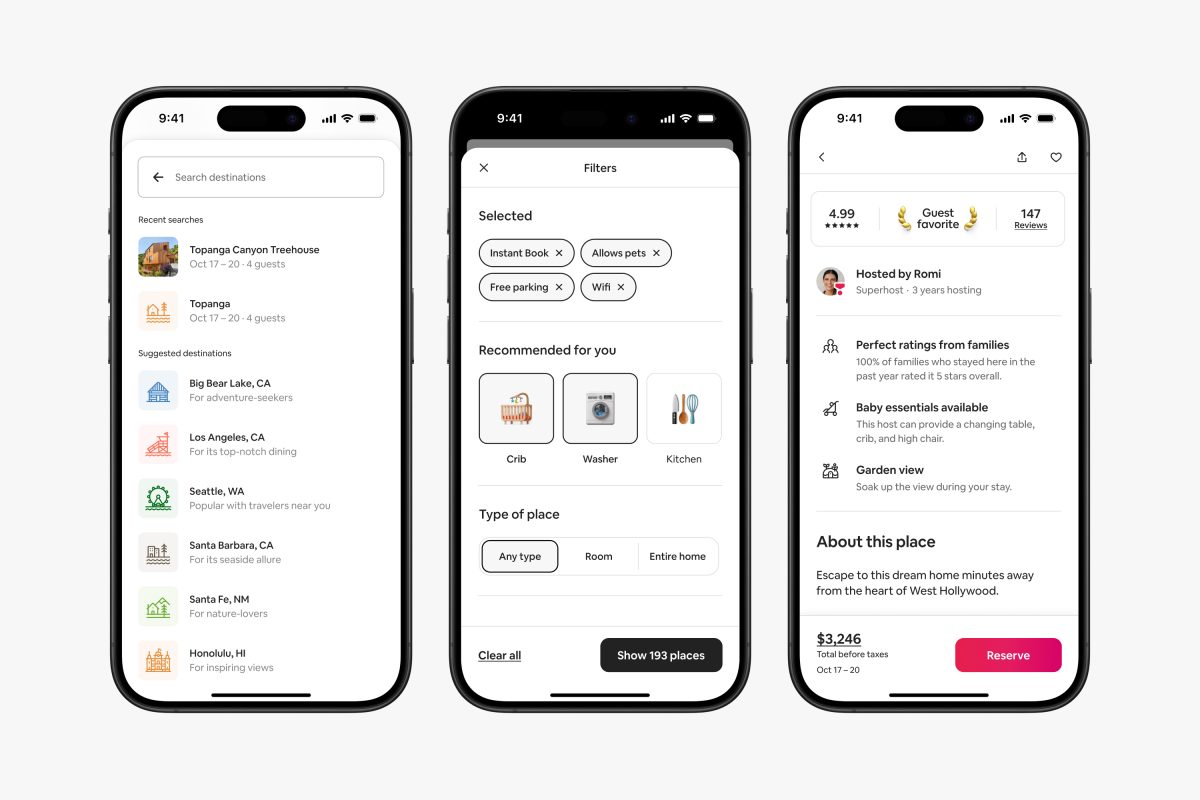

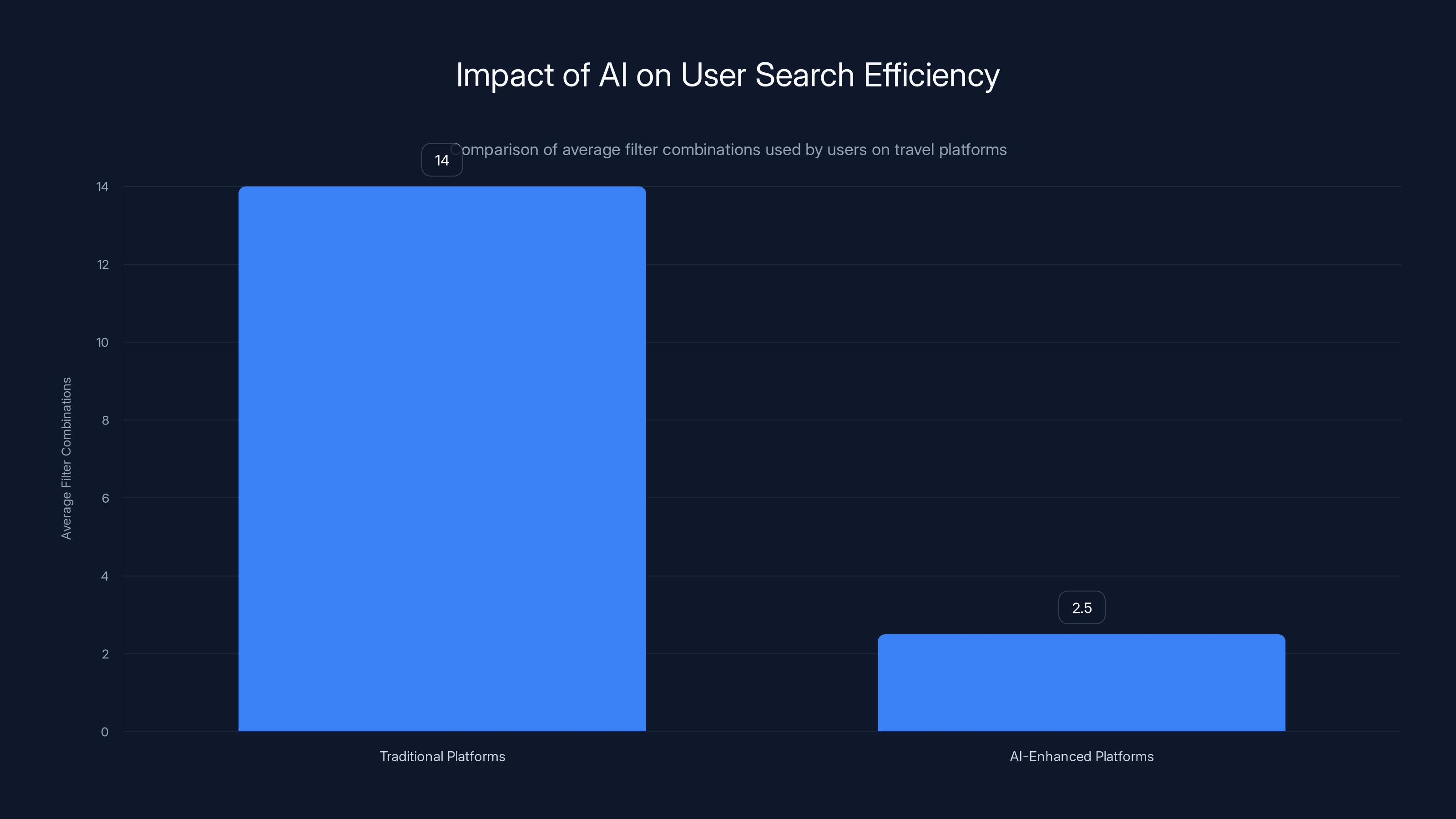

Here's what the tool actually does: instead of clicking through filters for location, dates, price, and amenities, users type what they're looking for in conversational language. "I want a cozy apartment in Brooklyn near a good coffee shop with natural light and a working desk" becomes a query instead of a series of selections. The AI then interprets that request, weighs the different preferences, and returns listings that match.

This isn't just search autocomplete or a smarter filter dropdown. This is a fundamental change in how discovery works. The AI has to understand context, prioritization, and even unstated preferences. If someone says they want to be "near good restaurants," the system needs to know what good means (Michelin-starred? Diverse cuisines? Walkable distance?). That's a much harder problem than traditional search.

The testing phase is critical because it lets Airbnb identify failure modes early. Maybe the AI confidently recommends a place that sounds perfect but is actually above the guest's budget. Maybe it misunderstands "close to transit" and returns listings far from public transportation. These errors compound across millions of users, so the company is being smart about scaling slowly.

What makes this different from Chat GPT-style search tools is the commercial layer underneath. Airbnb isn't just trying to understand what you want—it's trying to match you with listings that will convert to bookings, that have good cancellation policies, that might generate repeat business, and that fit within profitability targets. That's a much more complex optimization problem.

The company is also gathering feedback on how guests interact with the AI. Do they trust its recommendations? Do they second-guess them by running traditional searches afterward? Do they book based on AI suggestions or does it just help them narrow their options? This telemetry is worth more than the search results themselves, because it teaches the AI what actually matters to humans.

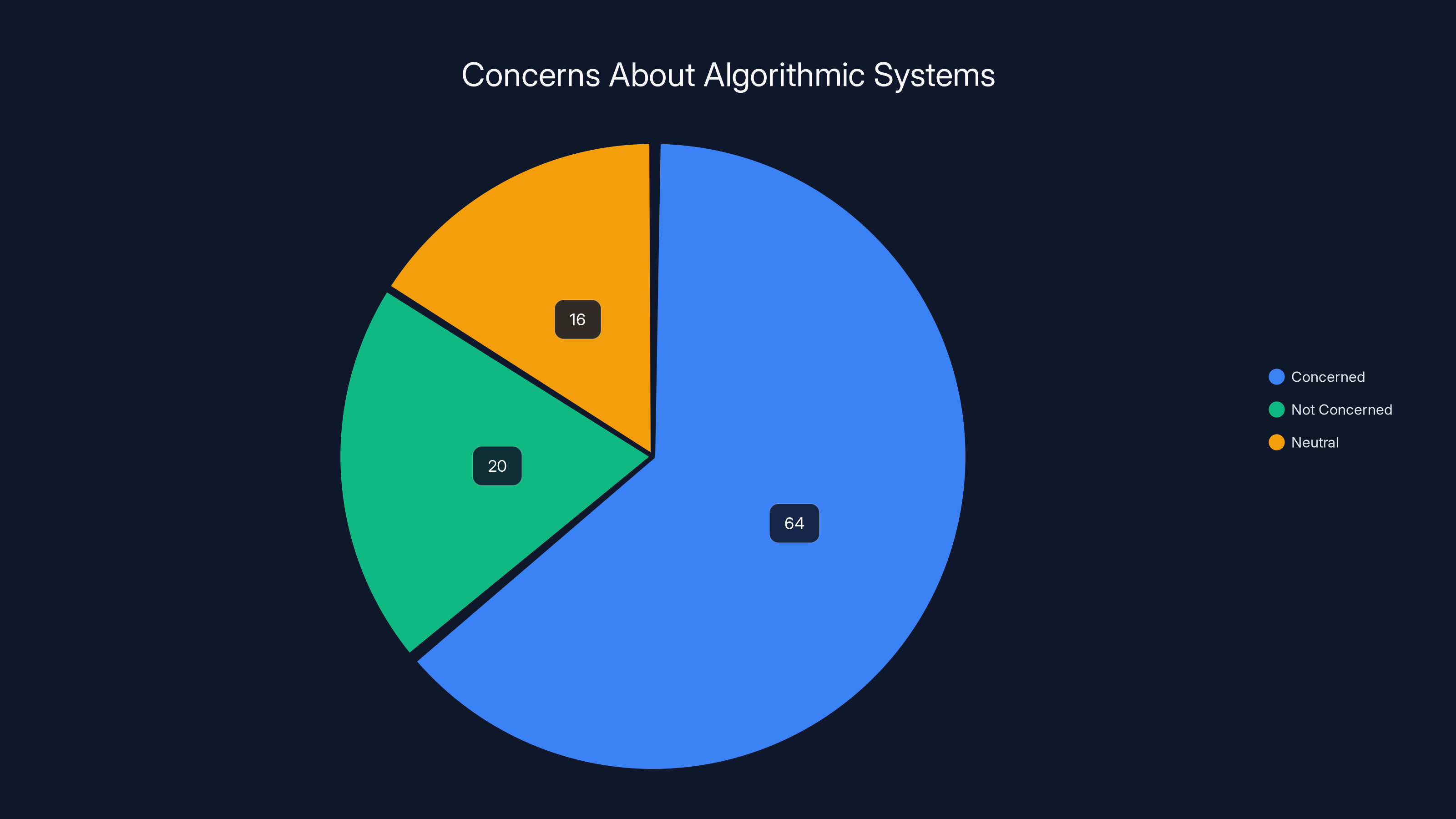

According to a 2024 survey by Pew Research, 64% of Americans expressed concern about algorithmic recommendation systems in marketplaces. This highlights the significant public apprehension towards AI-driven decisions.

Why Airbnb's AI-Native Strategy Matters

Chesky's language about an "AI-native experience" is important. He's not saying Airbnb is adding AI features. He's saying the platform itself is being rewritten with AI as the core architecture.

This distinction matters because it shapes every decision downstream. When you design a platform with AI at the center, you think differently about data structure, feature prioritization, and user experience. Instead of building features and then adding AI to improve them, you build the entire system expecting AI to participate in every transaction.

For Airbnb, this means rethinking how listings are structured and described. Current listings rely heavily on host-written descriptions, which are inconsistent, sometimes misleading, and hard for algorithms to parse. With an AI-native platform, the system might generate standardized descriptions, extract structured metadata automatically, and continuously improve how information is presented based on what guests actually care about.

It also means changing how the company allocates resources. Instead of hiring more customer service representatives, it invests in AI training and infrastructure. Instead of building better search filters, it invests in language understanding. This is a long-term bet that AI will become cheaper and better at these tasks than humans.

There's also a defensive component. Booking.com and other competitors are investing heavily in AI. If Airbnb doesn't move aggressively now, it risks becoming the platform that feels outdated in 18 months. By positioning itself as an AI-native company, Airbnb is signaling to investors, hosts, and guests that it understands where the industry is headed.

The AI Chatbot That's Already Working

Before the AI search tool, Airbnb deployed an AI chatbot for customer service. This isn't a flashy feature that went viral on social media. It's a behind-the-scenes operational tool that's quietly handling millions of customer interactions.

According to TechCrunch, the chatbot already handles about one-third of customer service requests without escalating to human agents. That's significant because customer service is expensive, and even small percentages of automation translate to millions of dollars in annual savings.

Currently, the AI agent is available only to users in North America. This is a key detail, because it suggests Airbnb is being cautious about deploying AI across different languages, cultural contexts, and regulatory environments. Handling customer service requests in English is different from handling them in German, Mandarin, or Arabic. The company is learning, iterating, and preparing to expand.

Chesky mentioned during the earnings call that the AI agent would handle "significantly more" customer requests by this time next year, and that it would roll out globally. In practice, this probably means the company will continue improving the AI on the North American dataset, then adapt it for other regions using similar approaches.

What's interesting about the chatbot's current performance is that it's not trying to solve every problem. The AI handles common issues: cancellation questions, refund status, listing clarifications, booking modifications. For complex cases—disputes, hosts with legitimate concerns, unusual circumstances—the system escalates to humans. This is a smart approach because it focuses AI on what it's actually good at while preserving human judgment for edge cases.

The financial impact of this automation is worth understanding. If Airbnb reduced customer service costs by just 10% using AI, that's roughly $30-50 million in annual savings based on typical support spending. That's not the motivation, but it's the outcome. And over time, the AI gets better, faster, and cheaper to operate.

Airbnb's AI chatbot currently handles approximately 33% of customer service requests autonomously in North America, reducing the load on human agents.

How AI Search Will Change Guest Experience

The shift from filter-based search to AI-powered natural language search fundamentally changes how travelers interact with Airbnb. Let's think through a specific scenario.

Today, if you're planning a family trip to Portland, you click filters: entire home, 4+ bedrooms, under $400/night, proximity to downtown, has a kitchen, pet-friendly, free cancellation. You get 47 results. You look at the first 12, read reviews, check photos, and maybe bookmark 3-4 options. The process takes 30-45 minutes.

With AI search, you type: "We're a family of 6 visiting Portland with our dog for Thanksgiving. We want to cook together and explore downtown on foot. Budget is $400/night and we need flexibility because family stuff always changes." The AI understands this is a multi-day stay (Thanksgiving context), that walkability matters, that the kitchen is important (cooking together), that cancellation flexibility is critical, and that pets are a dealbreaker. It returns 8-12 results that actually fit these criteria.

The difference isn't just fewer clicks. It's that the AI understands intent and trade-offs. If a perfect property is

But here's where it gets complex: the AI is also optimizing for Airbnb's business. If a listing has a higher cancellation rate, the AI might show it lower in results. If a host has excellent ratings, it might be boosted. If a property has higher margins for the platform, it might get promoted. The AI isn't just optimizing for the guest—it's optimizing for multiple objectives simultaneously.

This raises an important question about transparency. If you ask for a family-friendly apartment and the AI recommends one that's owned by a host the platform wants to promote, how would you know? The answer, from past examples in tech, is usually "you wouldn't." That's why regulatory oversight of recommendation systems is becoming increasingly important.

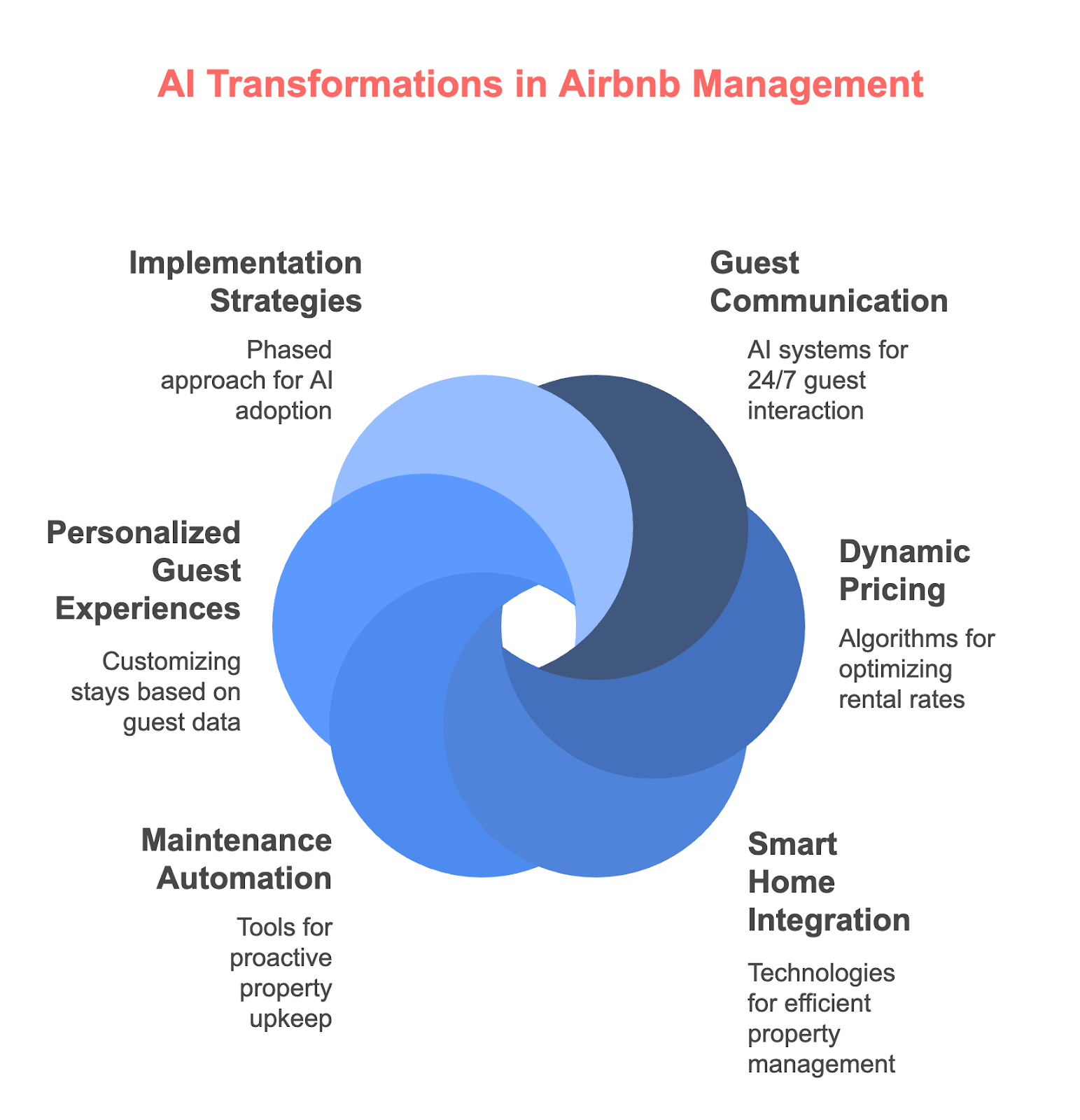

The Expansion to Host Operations

Airbnb isn't stopping at guest search. The company also plans to use AI to help hosts manage their listings more effectively. This is actually where some of the most significant value could emerge.

Hosting on Airbnb involves dozens of tasks: writing compelling descriptions, taking quality photos, setting competitive pricing, managing availability calendars, responding to inquiries, processing check-ins, handling maintenance issues, and managing guest relationships. Most of these tasks are done manually by hosts, many of whom are not professional property managers.

AI can help with several of these. It can auto-generate listing descriptions from photos and host inputs. It can suggest pricing based on comparable listings, seasonality, and demand. It can draft responses to common guest questions. It can identify which listings have high cancellation rates and why. It can even analyze reviews to detect patterns ("guests mention the wifi is slow," "the shower pressure is weak") and suggest improvements.

This might sound like incremental improvement, but the cumulative effect is substantial. A host who spends 5 hours per week on administrative tasks could cut that to 2 hours with AI assistance. That's 150 hours per year recovered. For someone with multiple properties, that's the difference between being able to manage 5 properties or managing 10 properties.

Airbnb benefits because better-managed listings get better reviews, higher occupancy rates, and better guest experiences. That drives booking conversion, repeat bookings, and positive reviews. The platform becomes more valuable to guests, which attracts more guests, which allows hosts to raise prices, which attracts more hosts. The network effects compound.

But there's a hidden tension here. If AI makes it easier to be a host, more people become hosts. That increases supply. Increased supply can put downward pressure on prices. Ironically, AI tools that help hosts be more efficient might eventually hurt their earning potential if competition increases faster than demand.

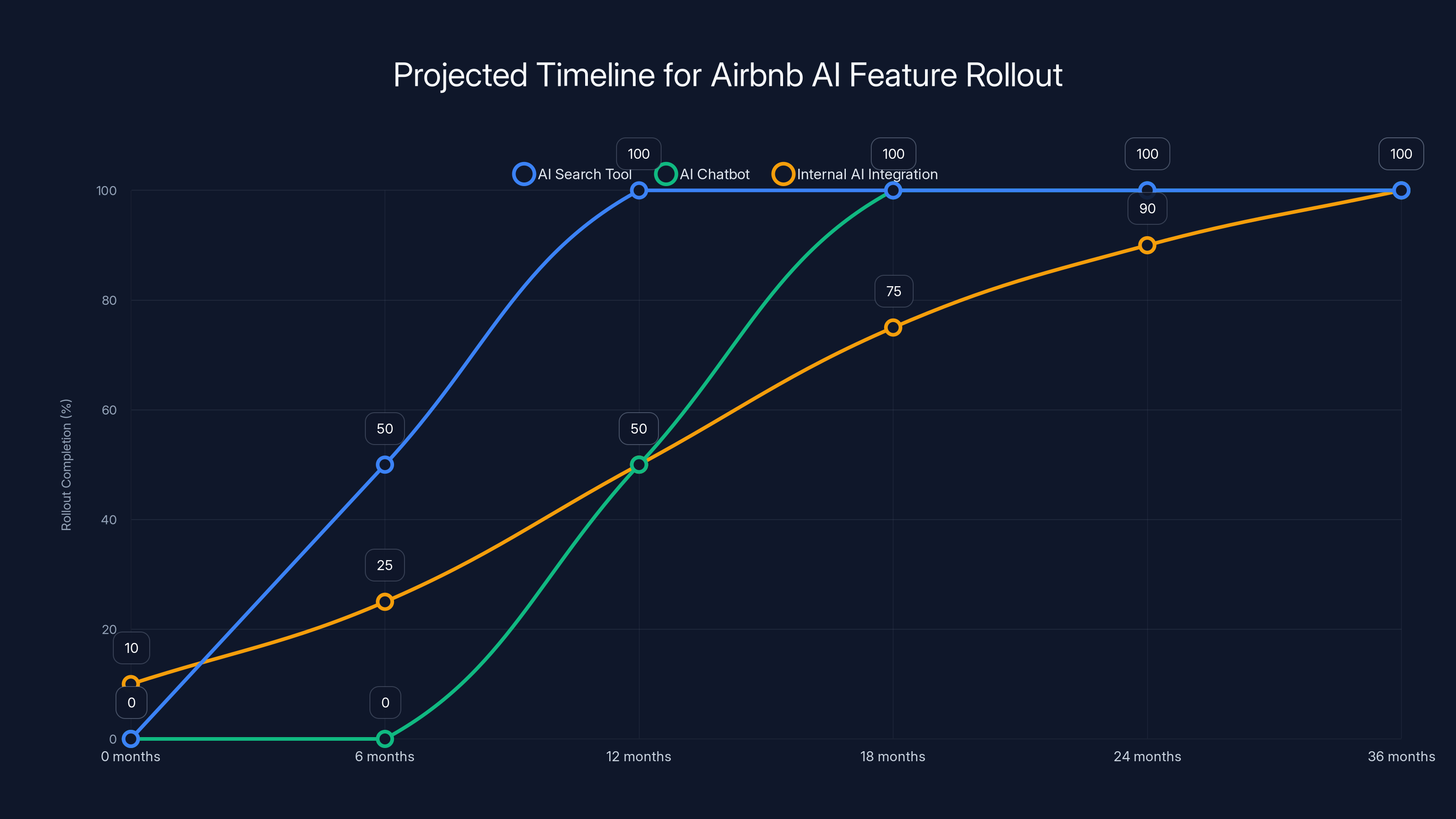

Estimated data shows that Airbnb's AI search tool could be fully rolled out within 12 months, the AI chatbot globally within 18 months, and internal AI integration reaching full maturity in 2-3 years.

Competitive Pressure and Industry Response

Airbnb isn't the only platform investing in AI-powered search and discovery. Booking.com, owned by Booking Holdings, has been integrating AI features across its platform. Expedia is investing in AI recommendations. Trip Advisor is experimenting with AI-powered itinerary planning.

The competitive pressure is real. If Booking.com's AI search is demonstrably better at matching travelers with properties, guests will start preferring Booking.com. If Expedia's interface feels more intuitive with AI assistance, travelers will spend more time there. These aren't winner-take-all markets—multiple platforms can coexist—but market share shifts happen faster in digital businesses than in traditional hospitality.

For travelers, this competition is good. It means platforms are racing to improve the experience. For hosts, it means more tools and more automation. But for employment in customer service and basic property management, the pressure is downward. As AI handles more tasks, fewer humans are needed.

The interesting question is whether Airbnb's AI-native approach gives it a structural advantage. The company has been investing in AI for several years now. It has enormous amounts of listing data, guest behavior data, and transaction data. It has the resources to hire top AI talent. Smaller platforms might struggle to compete on these dimensions.

But scale is also a liability. Airbnb has to be careful about bias in its AI systems. If the algorithm inadvertently discriminates against listings owned by minority hosts, or against guests with certain preferences, the PR and regulatory fallout could be massive. Larger platforms are under more scrutiny. Smaller competitors might be able to move faster with less concern for these issues, at least initially.

Data, Privacy, and the Transparency Question

Here's something that doesn't get talked about enough: building AI systems requires enormous amounts of data. Airbnb's AI is trained on millions of guest reviews, host descriptions, booking patterns, cancellation histories, and interaction logs.

None of this is surprising in the abstract. But think about what that means concretely. The AI has learned patterns from your past searches, your booking history, your reviews you left, and probably your communication with other users. It's using that to predict what you want.

Is your data shared with third parties? The privacy policies probably say something like "we may share data with service providers who help us improve our platform." In practice, that often means AI training data is shipped to companies that specialize in model training and optimization.

Airbnb isn't alone here. Every major platform does this. But the trade-off is worth being explicit about: you get a better, more personalized experience. In exchange, your behavior becomes training data for increasingly sophisticated AI systems.

The good news is that regulation is catching up. The EU's AI Act requires transparency about high-risk AI systems. The FTC is investigating how tech companies deploy AI. Users are becoming more skeptical of algorithmic recommendations.

Airbnb will have to navigate these concerns. The company will probably adopt transparency measures—explaining why a specific listing was recommended, allowing users to opt out of certain AI features, being explicit about how data is used. Not because it wants to, but because regulatory pressure and user expectations will eventually demand it.

AI agents significantly reduce operational costs and increase service hours, offering a compelling economic advantage over human representatives. Estimated data.

Timeline and Rollout Strategy

Airbnb is being strategic about how it rolls out these features. The company isn't launching everything at once. Instead, it's testing with limited user groups, gathering feedback, iterating, and then expanding.

The AI search tool is currently in testing phase. The company hasn't announced a public launch date, but based on how these things typically work, you can expect it to become available to all users within 6-12 months. The company will probably announce it as a major feature update, market it heavily, and position it as something that makes travel planning "easier" and "more intuitive."

The AI chatbot will expand geographically. It's currently in North America. The company plans to roll it out to Europe, Asia, and other regions. This will take time because each region requires different language training, cultural adaptation, and regulatory compliance. You can probably expect the global chatbot rollout to happen over the next 12-18 months.

Beyond these specific features, Airbnb is building AI into internal operations. The company is using AI to optimize pricing algorithms, predict cancellation rates, recommend hosts to do renovations, identify fraud, and improve internal processes. These changes don't get announced to users, but they're happening continuously.

The longer-term vision seems to be that within 2-3 years, AI will be so deeply integrated into Airbnb's operations that most interactions between guests, hosts, and the platform will involve some AI component. It won't feel like you're talking to an AI—it'll just feel like the platform is unusually smart.

What This Means for the Travel Industry

Airbnb's push into AI isn't an isolated event. It's part of a broader shift in how the travel industry operates. Hotels are deploying AI concierges. Airlines are using AI to predict passenger behavior and optimize pricing. Travel agencies are using AI to create personalized itineraries.

The industry is being reorganized around data and algorithms. The platforms with the best data and the most sophisticated algorithms will have an advantage. That favors incumbents like Airbnb, Booking, and Expedia, who have accumulated massive amounts of historical data.

But it also creates opportunities for startups that can apply AI to specific niches. A startup that uses AI to match backpackers with fellow travelers. A company that uses AI to find the best local experiences in a city. A tool that uses AI to optimize travel logistics for digital nomads. These don't threaten the giant platforms directly, but they nibble at the margins.

The real disruption might come from a different direction. What if AI becomes so good at planning travel that people stop using traditional booking platforms entirely? What if you just tell an AI agent "I want to spend 10 days in Italy with my partner, we like food and architecture, our budget is $4000, we hate crowds," and the AI books flights, hotels, restaurants, and creates an itinerary? That's not a radical sci-fi scenario—that's probably 18-24 months away from being viable.

When that happens, the value proposition of traditional travel platforms changes. They become infrastructure that AI agents use to fulfill requests, rather than interfaces that humans navigate. That's still valuable, but it's less valuable than being the interface itself.

Airbnb's AI-native strategy is partly a bet that it will successfully transition to this future. Instead of being the company that hosts book travel, it becomes the company that provides the data and infrastructure that AI agents use to book travel.

AI-enhanced platforms like Airbnb's AI-native strategy could significantly reduce the average number of filter combinations from 14 to approximately 2-3, improving user search efficiency. (Estimated data)

Challenges and Potential Failure Points

Not everything is going to go smoothly. Let's talk about the real risks.

Data quality and bias: AI is only as good as the data it learns from. If Airbnb's training data has biases—maybe certain neighborhoods are underrepresented, maybe certain host demographics get systematically lower reviews—those biases get baked into the AI. The company will have to continuously audit its systems for this, and it's harder than you'd think.

User expectations vs. reality: People love the idea of "just describe what you want and the AI figures it out." But in practice, AI sometimes confidently returns bad recommendations. A traveler might book based on an AI suggestion and end up disappointed. Bad experiences with AI can be more frustrating than bad experiences with traditional tools because the failure feels mysterious.

Competitive responses: Once AI search becomes standard, it stops being a differentiator. All the major platforms will have similar tools. The winner won't be whoever moved first—it'll be whoever executed best. Airbnb's first-mover advantage only lasts until Booking.com builds something comparable.

Regulation: Governments are increasingly skeptical of algorithmic recommendation systems, especially when they affect prices or limit consumer choice. Airbnb might face regulatory pressure to be more transparent about how its AI works, to allow users to opt out, or to ensure fair treatment across different user demographics.

Host resistance: Some hosts might feel like they're being replaced or disadvantaged by AI. If an AI system systematically recommends certain properties over others, hosts whose properties get buried might feel screwed. This could lead to pushback, boycotts, or hosts moving to competing platforms.

Model degradation: There's a phenomenon called "model collapse" where AI systems trained on AI-generated content gradually degrade in quality. As Airbnb's AI generates descriptions, reviews summaries, and other content, those AI-generated texts might end up in the training data for the next version of the model. Over multiple generations, this can degrade quality. The company will have to carefully manage what data it uses for training.

What Gets Built Next

Based on the direction Airbnb is heading, here's what you can probably expect in the next 12-24 months.

Predictive features for guests: The AI will anticipate what you might search for next. If you searched for beach destinations, the platform might proactively suggest coastal properties that match your past preferences. This is already being done by other platforms, but Airbnb will likely implement it more aggressively.

Dynamic pricing for hosts: AI will recommend real-time pricing adjustments based on demand, competing listings, and local events. This could mean a host's nightly rate changes weekly or even daily based on AI analysis.

Itinerary planning: Airbnb could build AI features that suggest activities, restaurants, and experiences around where you're staying. This gets it into competition with services like Google Travel and traditional tourism platforms.

Proactive problem solving: The AI will try to prevent issues before they happen. If a guest's flight is delayed and they're going to miss check-in, the AI alerts the host and the guest, and suggests solutions. If a host's listing has poor reviews mentioning specific issues, the AI suggests actions to fix them.

Community features powered by AI: The platform could use AI to identify guests who have similar interests and suggest they connect. This creates network effects—people who've met through Airbnb might choose Airbnb for future trips because they're building a network.

The Broader Context: Why Tech Companies Are Betting on AI

Understanding Airbnb's AI push requires understanding why every major tech company is suddenly obsessed with AI. It's not just because AI is trendy. It's because AI can handle specific classes of problems that humans are expensive at and inconsistent about.

Customer service is a perfect example. A human customer service representative costs $30-50K/year. They work 8 hours a day, 5 days a week. They get tired, they have bad days, they have different levels of expertise. An AI agent costs thousands of dollars to build and train, but then costs pennies to operate, works 24/7, and gives consistent responses.

The economics are compelling for any platform with scale. Airbnb handles millions of customer inquiries per year. If AI can reduce that load by 50%, that's potentially millions of dollars in savings.

But it's not just about cost reduction. AI also enables capabilities that humans can't provide at scale. A human can't personalize the search experience for 100 million users simultaneously. An AI can.

This is why you're seeing AI pushed into every corner of every platform. It's not conspiracy or hype. It's economically rational for these companies. The question isn't whether companies will invest in AI. The question is how fast they can deploy it and how well they can manage the risks.

The User Perspective: What You Should Know

If you're an Airbnb user, you might be wondering whether these changes will improve or worsen your experience.

The optimistic case: AI search works as intended, you get better recommendations faster, you spend less time looking for properties, and you find places you actually want to stay. The platform becomes more convenient and more useful.

The pessimistic case: AI recommendations are optimized for Airbnb's revenue, not your satisfaction. You get steered toward higher-margin properties. You see less diversity in recommendations. Your data is used in ways you didn't authorize. The platform feels less like a marketplace and more like a sales algorithm.

The truth is probably somewhere in between. AI search will probably improve the experience for some users while creating new frustrations for others. The best approach is to stay aware of how recommendations work, to cross-check AI suggestions against manual search results, and to opt out of data sharing when possible.

For hosts, the dynamics are different. AI tools that help you manage your property are probably good. AI pricing optimization is probably good if you're trying to maximize revenue. But if AI systematically disadvantages your property in the search algorithm, that's a problem. You'll want to monitor whether your bookings change and whether the platform gives you transparency into how it's ranking you.

FAQ

What exactly is Airbnb's AI search tool, and how does it differ from traditional search?

Airbnb's AI search lets users describe what they're looking for in natural language instead of using filters. Rather than selecting specific criteria like location, price, and amenities, you can type something like "I want a cozy cabin near mountains with a fireplace" and the AI interprets your request to find matching properties. This differs from traditional search because it understands context and intent, making recommendations based on what matters to you rather than just matching individual criteria.

When will Airbnb's AI search be available to all users?

Airbnb hasn't announced a specific public launch date for the AI search feature. The company is currently testing it with a small percentage of users to gather feedback and improve the system. Based on typical rollout patterns for major platform features, you can expect broader availability within 6-12 months, though this timeline could change depending on testing results and regulatory considerations.

How does Airbnb's AI chatbot help with customer service?

Airbnb deployed an AI chatbot that handles common customer service requests like refund status inquiries, cancellation questions, listing clarifications, and booking modifications. Currently available in North America, the chatbot already handles approximately one-third of customer service requests without requiring human intervention. For complex issues or disputes, the system escalates to human agents who can provide more nuanced support.

What data does Airbnb's AI use to make recommendations?

Airbnb's AI is trained on millions of data points including guest reviews, host descriptions, booking patterns, cancellation histories, search behavior, and user interactions. This data helps the system understand preferences, predict what guests might want, and match them with suitable properties. The company collects this data through normal platform operations and uses it to continuously improve its AI systems.

Could Airbnb's AI search disadvantage certain hosts or properties?

Yes, there's potential for AI systems to inadvertently favor certain properties or host profiles over others. If training data contains biases—such as certain neighborhoods being underrepresented or particular demographics receiving systematically lower reviews—these biases can influence recommendations. Additionally, the AI might optimize for Airbnb's business interests alongside user preferences, potentially affecting which listings are promoted in search results.

How is Airbnb preparing to expand these AI features globally?

Airbnb is expanding its AI features region by region, starting with North America and progressively moving to other markets. The company is tailoring AI systems for different languages, cultural contexts, and regulatory environments. The AI chatbot rollout to Europe, Asia, and other regions is expected to occur over the next 12-18 months as the company adapts its systems for local requirements.

What's the difference between Airbnb's "AI-native experience" and simply adding AI features?

An AI-native platform is built from the ground up with AI as a core component, not as an afterthought. This means all decisions about data structure, feature design, and user experience assume AI will participate in every interaction. Instead of building a traditional platform and adding AI on top, Airbnb is rearchitecting the entire platform so AI is fundamental to how it operates, from search to operations to customer service.

How will Airbnb's AI investment affect pricing for travelers and hosts?

AI could affect pricing in multiple ways. For guests, better recommendations might reduce time spent searching, potentially leading to faster bookings. For hosts, AI pricing optimization tools will suggest real-time rate adjustments based on demand and competition, which could increase revenue but also increase supply competition. The overall impact on prices will depend on how demand changes as the platform becomes easier to use and how AI-driven supply adjustments play out.

What are the privacy and transparency concerns with Airbnb's AI systems?

Key concerns include data collection for AI training, algorithmic bias in recommendations, lack of transparency about how AI ranks properties, and whether users truly understand how their data is used. Regulatory frameworks like the EU's AI Act are beginning to address these issues by requiring greater transparency and fairness in AI systems. Airbnb will likely need to adopt measures like explaining why specific listings are recommended and allowing users to understand and control how their data is used.

How does Airbnb's AI strategy compare to competitors like Booking.com and Expedia?

All major travel platforms are investing in AI, but Airbnb's "AI-native" positioning suggests a more comprehensive integration across the entire platform. Booking.com and Expedia are also deploying AI search and recommendations, creating competitive pressure across the industry. The winner likely won't be whoever moved first, but whoever executes most effectively and builds the most sophisticated AI systems with the best data and least bias.

What This Means Going Forward

Airbnb's push into AI represents a fundamental shift in how the company operates and how it wants users to interact with its platform. It's not a single feature launch. It's a strategic bet that AI will become increasingly central to how people discover, book, and manage travel.

For travelers, this could mean a significantly improved booking experience, assuming the AI works well and stays transparent about its recommendations. Less time spent searching for the perfect place, more time spent actually traveling.

For hosts, it could mean better tools to manage properties, but also increased competition and pressure to optimize their listings for AI algorithms. The winners will be hosts who adapt quickest to these new dynamics.

For Airbnb as a company, it's a play for long-term competitiveness. Companies that successfully integrate AI across their operations tend to become more valuable than competitors who bolt AI features onto traditional platforms. The structural advantages compound over time.

But there are real risks. AI systems can be biased, opaque, and sometimes completely wrong. Regulatory pressure is increasing. User expectations might not align with AI capabilities. And as AI becomes more prevalent across all platforms, the differentiation value diminishes.

The next 12-24 months will be crucial. How well Airbnb executes on these AI features will determine whether this positioning becomes a sustainable competitive advantage or just another platform feature that everyone eventually copies. The testing phase matters. The execution matters. And managing the inevitable failures and controversies will matter even more.

One thing's certain: the way you search for and book travel is about to change. Whether that change is positive depends on how transparently Airbnb implements these systems and whether the company prioritizes user experience alongside business optimization. Based on history, we should probably expect a mix of both, with users getting better recommendations in some scenarios and subtle steering toward higher-margin properties in others.

Pay attention to how your recommendations change over the coming months. Notice if search feels more intuitive or if you're getting steered toward specific properties. The transition to AI-native experiences is happening whether we're paying close attention or not. The least we can do is notice.

Key Takeaways

- Airbnb is testing AI-powered search that lets users describe what they want in natural language instead of using traditional filters

- The company is building an "AI-native experience" where AI participates in every part of the platform from discovery to operations

- An AI chatbot is already handling one-third of customer service requests in North America with plans for global expansion

- Competitive pressure from Booking.com and Expedia means all major travel platforms are racing to deploy superior AI systems

- Data privacy, algorithmic bias, and regulatory oversight present significant challenges to Airbnb's AI rollout strategy

Related Articles

- Airbnb's AI Revolution: Search, Discovery & Support [2025]

- Why OpenAI Retired GPT-4o: What It Means for Users [2025]

- 7 Biggest Tech News Stories This Week: Claude Crushes ChatGPT, Galaxy S26 Teasers [2025]

- Meta's 'Dear Algo' Feature: How Threads Turned User Complaints Into Official Features [2025]

- OpenAI's Greg Brockman's $25M Trump Donation: AI Politics [2025]

- How Spotify's Top Developers Stopped Coding: The AI Revolution [2025]

![Airbnb's AI Search Revolution: What You Need to Know [2025]](https://tryrunable.com/blog/airbnb-s-ai-search-revolution-what-you-need-to-know-2025/image-1-1771103168944.jpg)