Amazon's $1 Billion Returns Settlement: What Customers Need to Know

Last year, something shifted in the e-commerce landscape. Amazon, the company that built an empire on "free, no hassle returns," found itself facing a massive class action lawsuit claiming it had systematically failed to deliver on that promise. The result? A settlement valued at over $1 billion that's now reshaping how the retail giant handles returns and refunds, as reported by The Verge.

This isn't just another corporate fine that gets buried in earnings reports. This settlement directly affects millions of customers who've experienced the frustration of returned items disappearing into the void, refunds that never materialize, or mysterious recharges appearing on their credit cards. If you've ever wondered whether your return actually made it back to Amazon, or worse, if you've been ghosted by the company after shipping something back, you're not alone.

The scale of this settlement tells you everything about how significant the problem was. Amazon is committing

But here's what makes this story more interesting than just another lawsuit payout. The settlement reveals fundamental problems with how one of the world's largest retailers processes something as supposedly simple as returns. It shows the gap between what companies advertise and what they actually deliver. And it raises questions about whether automation, efficiency, and scale have created blind spots that affect millions of people.

Let's dig into what happened, why it matters, and what it means for customers going forward.

TL; DR

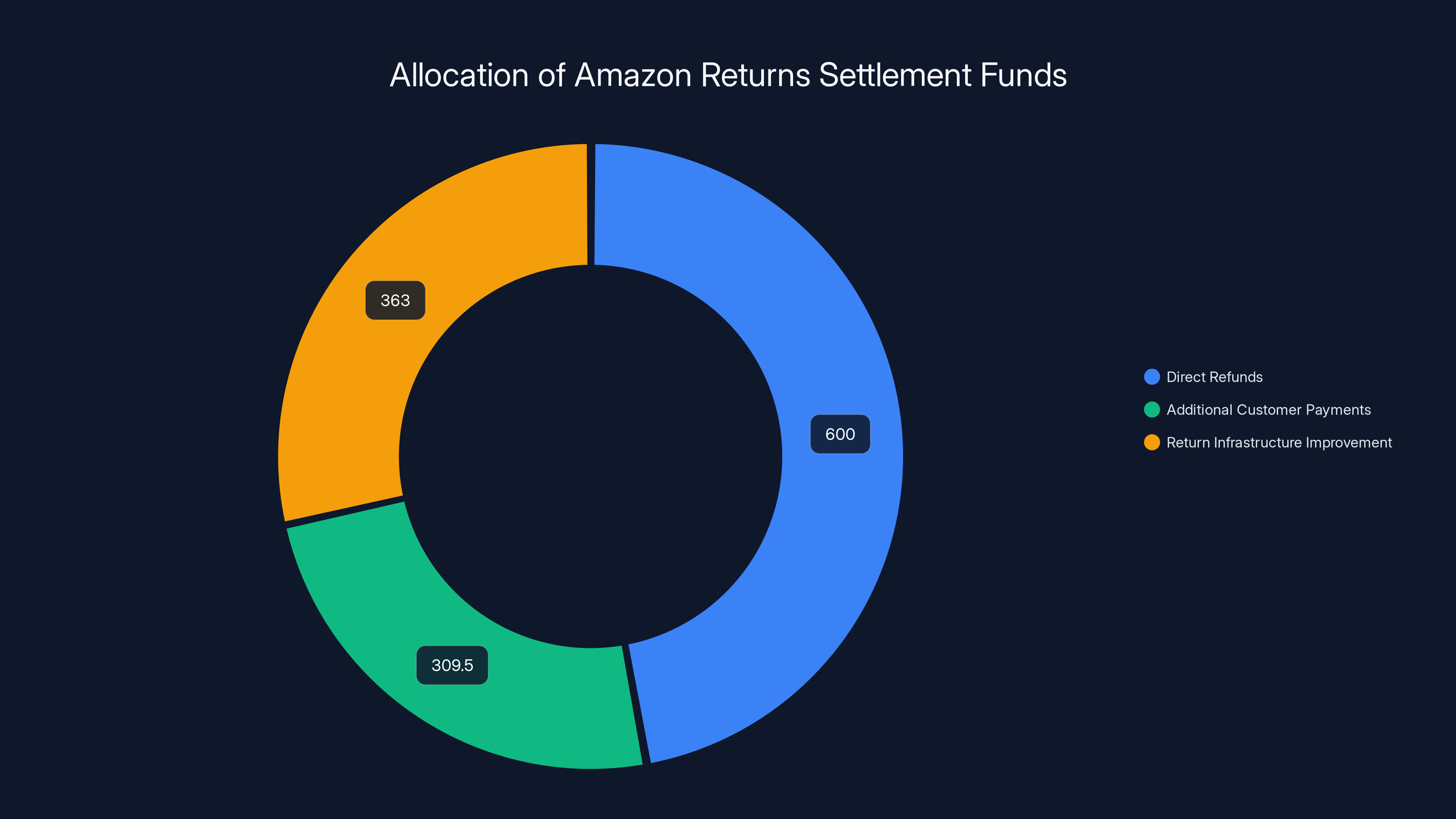

- Amazon faces 909.5 million directly to affected customers plus invest $363 million in fixing its return systems

- Scope of the problem: The lawsuit claims Amazon routinely failed to issue refunds or recharged customers for returned items, despite advertising "free, no hassle returns"

- Who gets paid: Customers who didn't receive refunds for returned items are eligible to file claims, with potential recovery amounts varying

- System improvements coming: Amazon is committing significant resources to overhaul its return detection, processing, and refund issuance infrastructure

- Approval still pending: The settlement awaits final approval from US District Court Judge Jamal Whitehead before payments begin

Estimated data suggests that Amazon's return rate is approximately 30%, which is higher than other major e-commerce platforms. This reflects the company's longstanding 'no hassle returns' policy.

The Origins of Amazon's Return Promise

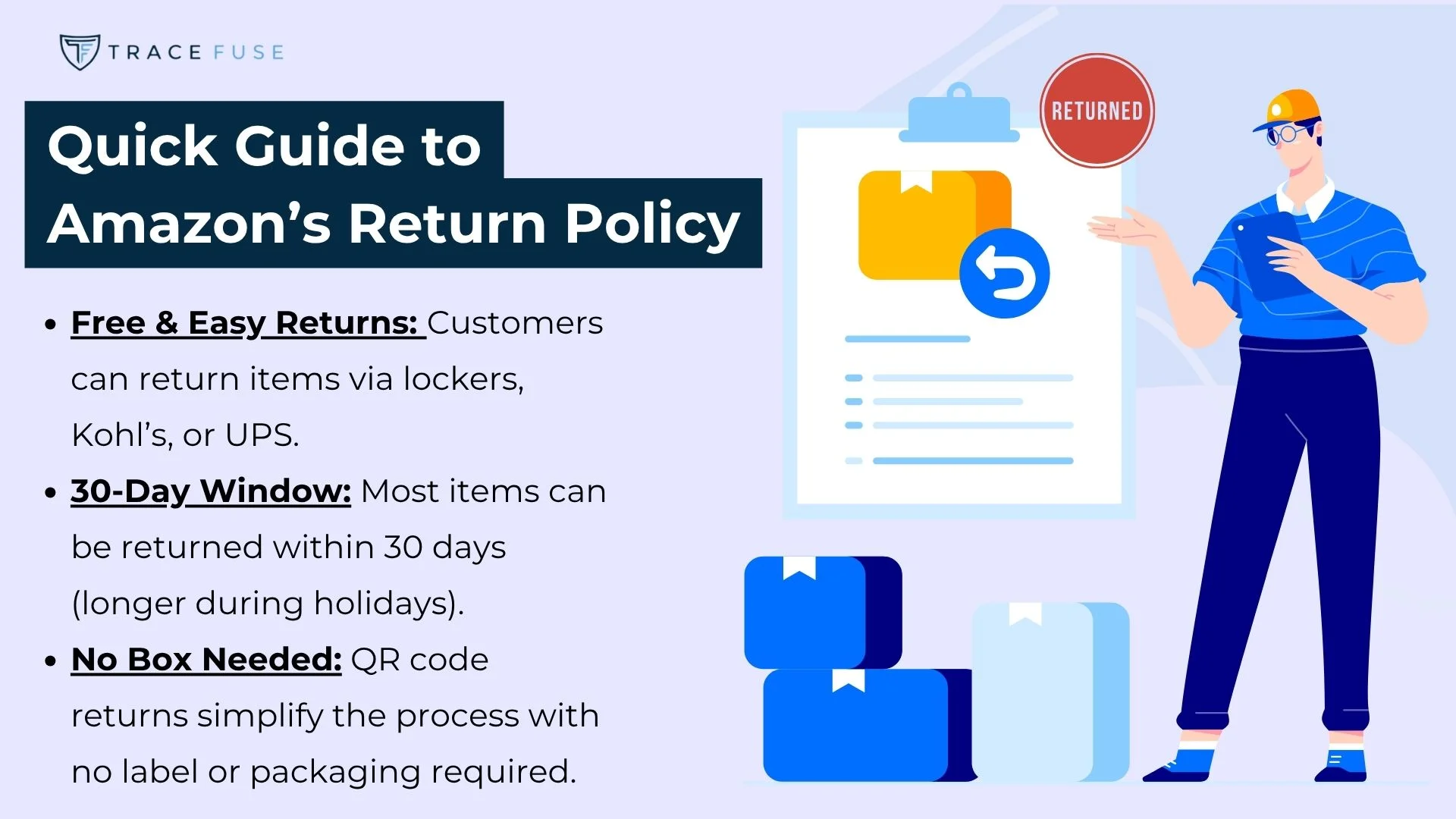

Amazon didn't become the world's largest e-commerce platform by accident. One of the key pillars of its competitive advantage has always been logistics and customer service. The "no hassle returns" policy wasn't just marketing language, it was core to Amazon's identity.

When Jeff Bezos started Amazon in 1994 as an online bookstore, returns were already a contentious issue in retail. Traditional brick-and-mortar stores controlled the return experience. Physical stores made money partly by making returns difficult enough that people wouldn't bother. Amazon's founder saw an opportunity to flip this on its head. If online shopping felt risky because you couldn't touch products before buying, then making returns frictionless was the perfect solution. It removed the biggest barrier to purchase.

For decades, this strategy worked brilliantly. Amazon built a reputation as the customer-friendly alternative. "If you're not happy, send it back. No questions asked." This promise differentiated Amazon from competitors and justified its often-premium pricing. Customers paid slightly more for Amazon because they knew they could return items easily.

But as Amazon scaled from millions of annual orders to hundreds of millions, something changed. The systems that worked for managing thousands of daily returns started to strain under billions. Returns moved from individual handling to automated sorting, scanning, and processing. Somewhere in that automation, the promise started breaking down.

According to the lawsuit filed in 2023, Amazon's advertising claimed "free, no hassle returns," yet the company "fails to issue refunds or re-charges customers who have returned items." The suit alleged that Amazon knew about these failures but didn't disclose them to customers, resulting in "substantial unjustified monetary losses."

This wasn't a brand-new problem when the lawsuit was filed. Frustrated customers had been posting about return issues on Reddit, Twitter, and Amazon's own customer forums for years. But the lawsuit provided the first formal mechanism to quantify the scope and force accountability.

The lawsuit potentially affected between 4.5 million and 18 million customers, based on a

How the Return System Failed: The Core Problem

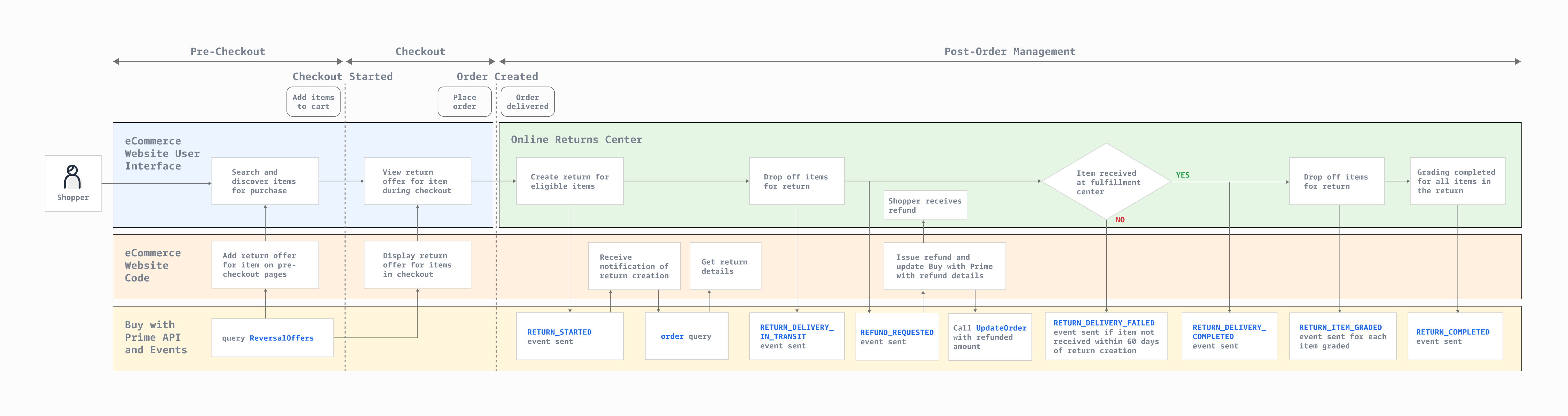

To understand what went wrong, you need to understand how Amazon's return process actually works at scale. It's one thing to send a package back. It's another entirely for that package to be scanned, logged, inventoried, and for a refund to be processed automatically without human intervention.

Amazon's return workflow typically goes like this: customer initiates a return through the website or app. Amazon generates a prepaid return label (usually UPS, Kohl's, or another logistics partner). The customer drops off the package. The package gets transported back to Amazon's fulfillment network. That's where things should get straightforward.

But at the fulfillment center level, packages are processed through a series of automated scanning stations. Barcodes get read. Items get categorized. Inventory gets updated. A determination gets made about whether to refund, restockable items for resale, or liquidate items as damaged goods. If all those steps work correctly, a refund gets issued within the promised timeframe.

The problem? At scale, errors compound. A barcode might not scan cleanly because the label got wet. A package might get lost in the return stream and end up in a temporary holding area. Items might be logged as received but never scanned out of the holding area. The refund logic might execute, but the payment might fail silently without triggering an alert.

What the lawsuit alleged was that these weren't edge cases or random technical failures. Amazon allegedly had systematic gaps where items were returned, customers weren't refunded, and the company didn't flag these failures as problems. In some cases, customers reported being recharged for items that had been returned, as if the system forgot they'd ever sent anything back.

One particularly frustrating scenario customers reported: they'd return an item, see it delivered to the return address, but never receive confirmation that Amazon received it. Then, weeks later, no refund. When they contacted customer service, they were often told the item "wasn't found in the return stream" despite having proof of delivery.

The lawsuit claimed that Amazon was aware of these issues but chose not to invest sufficiently in fixing them. The company knew customers weren't aware their returns had failed to process refunds, which gave Amazon an opportunity to benefit from the mistake (keeping the customer's money while the item got resold).

This isn't a case where Amazon deliberately stole from customers. But it is a case where the company prioritized scaling quickly over ensuring every return was properly tracked and refunded. At a company processing hundreds of millions of returns annually, even a 1% failure rate affects millions of people.

The Lawsuit: Scale and Scope

The class action lawsuit challenging Amazon's return practices was filed in 2023, but it didn't come out of nowhere. It was the culmination of years of customer complaints and growing visibility around the problem.

What makes this lawsuit notable is its size. Class action suits are typically filed against companies for specific, measurable harms. This one alleged that the harm was widespread and systematic. The class definition appears broad: customers who returned items to Amazon, didn't receive refunds, or were recharged for returned items.

Based on the settlement structure, we can estimate the scale of the problem. If the settlement includes

Given that Amazon processes roughly 2 billion orders annually, and return rates in e-commerce typically range from 15-30%, that means Amazon handles 300-600 million returns per year. A failure rate of just 1-3% would create the scale of problems reflected in this settlement.

The lawsuit also highlighted something subtler but important: Amazon's competitive advantage has partly relied on customers not fully understanding their rights around returns. The "no hassle returns" promise is appealing because it's vague. It doesn't specify timeframes, success rates, or what happens if something goes wrong. By the time customers discovered their return had failed, Amazon had already kept the money.

The lawyers for the class action noted that "the monetary relief from the settlement will likely represent a full recovery for every class member, plus interest." This suggests the settlement amount ($909.5 million) is being treated as sufficient to compensate all eligible customers for their losses.

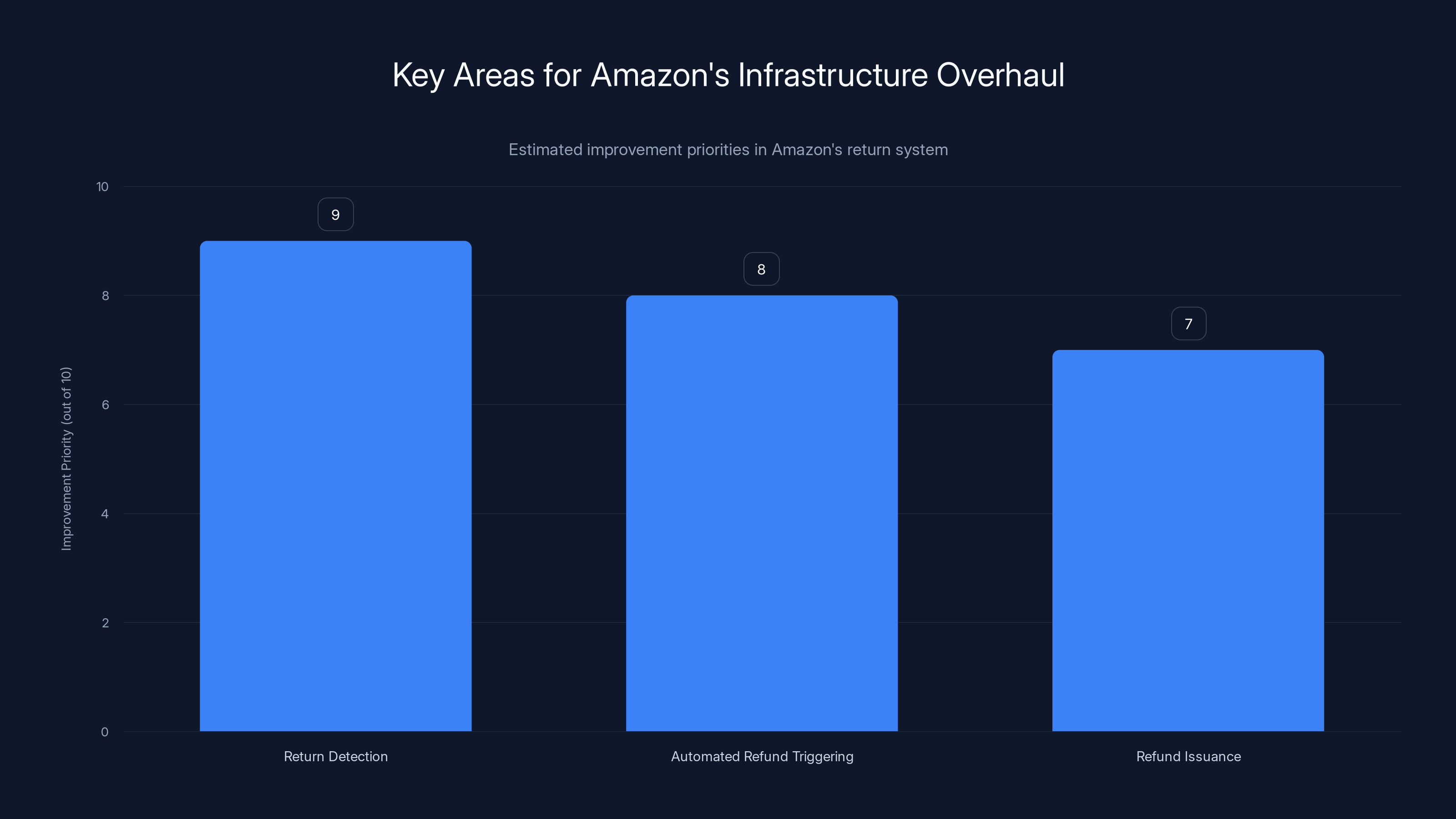

Estimated data suggests that improving return detection and scanning is the highest priority for Amazon's infrastructure overhaul, followed by automated refund triggering and refund issuance.

The Settlement Structure: Understanding the Numbers

When you read "$1 billion settlement," it's important to understand what that actually means. The number is made up of several distinct components, and they do different things.

First, there's the $600 million in direct refunds to customers. This is the clearest piece. Amazon is literally writing checks to people who returned items and didn't get refunded. This money goes directly into customer accounts or original payment methods.

Second, there's the **

Third, there's the **

That's a total of **

Here's the important part: only the first two components actually reach customers. The third component benefits customers indirectly by reducing future return failures, but the money is controlled by Amazon.

To put this in perspective, Amazon's annual revenue is roughly

What Triggers Eligibility: Who Gets Paid?

Not every Amazon customer gets a payment. The settlement has specific eligibility requirements, and that's where things get complicated for customers trying to figure out if they qualify.

Based on the structure of the lawsuit, you're likely eligible if you fall into one of these categories:

Category 1: Refund Never Issued - You returned an item to Amazon, it was received by Amazon (you have tracking or documentation proving delivery), but you never received a refund. This is the most straightforward case. You have clear documentation that the system failed.

Category 2: Partial Refund - You returned an item worth

Category 3: Recharged After Return - You returned an item and received a refund, but then saw the charge appear on your account again days or weeks later. This suggests Amazon's system processed the return twice or failed to properly delink the original charge.

Category 4: Return Delivery Confirmed, Refund Denied - You have proof that Amazon received your return (through carrier tracking or Amazon's own system), but Amazon claimed they couldn't find the item in their return stream. This was a common complaint in the lawsuit.

The tricky part is that claiming eligibility requires documentation. You'll need to provide proof of:

- Your Amazon order number

- Return initiation date and confirmation

- Carrier tracking number showing delivery to Amazon's return address

- Dates you expected and didn't receive refunds

- Documentation of any follow-up with Amazon customer service

If you're missing any of these, you might still be able to claim, but Amazon will be more skeptical. This is why documenting returns properly from the start matters.

Amazon actually began issuing refunds to some customers who complained about missing returns before the formal settlement was finalized. This suggests the company had already identified a pool of customers with legitimate grievances. The settlement just formalizes the compensation for this broader group.

Estimated data shows Zappos leading in both return processing speed and success rate, potentially offering a competitive edge over Amazon.

The $363 Million Infrastructure Overhaul: What Amazon is Supposed to Fix

The most important part of this settlement might not be the money being paid out, but the $363 million Amazon is committing to actually fix its return systems. Money paid to customers is compensation for past mistakes. Money spent on infrastructure improvements is supposed to prevent future mistakes.

Based on typical e-commerce operations and the specific failures alleged in the lawsuit, here's what Amazon likely needs to fix:

Return Detection and Scanning - The foundation of any return system is knowing when a return arrives. Amazon needs to ensure that 100% of returns get scanned and logged into the system within 24 hours of arrival at a fulfillment center. Currently, packages apparently slip through this critical first step, sitting in holding areas without getting processed.

Improvement would involve: redundant scanning at multiple points, automatic alerts if a package arrives at the return address but isn't scanned within 4 hours, integration with carrier systems to flag returns before they physically arrive at the fulfillment center.

Automated Refund Triggering - Once a return is detected, the system needs to automatically determine eligibility for a refund and process it. The problem was that items would be received but then stuck in limbo while manual review was supposedly happening.

Improvement would involve: rules-based refund logic that executes within 2 hours of scanning, automatic escalation if the decision takes longer, separate human review queues for legitimate edge cases, with clear timeframes for review.

Refund Issuance and Confirmation - A refund issued to the wrong account or payment method is useless. Amazon needs to ensure that refunds go back to the original payment method and that customers get immediate, clear confirmation.

Improvement would involve: real-time verification of payment method details, automatic retrying if initial refund fails, SMS or email confirmation to customer within 30 minutes of refund processing, dashboard visibility where customers can see their return and refund status at any time.

Recharge Prevention - The most egregious failures were when customers got refunded but then recharged. This suggests duplicate processing or failure to unlink original charges from the return processing system.

Improvement would involve: preventing the same charge from being re-triggered if a return is processed, audit logs that track every financial transaction related to a return, automated alerts if a return and an original charge both appear in the same customer account within 30 days.

Exception Handling and Manual Review - Sometimes returns fail for legitimate reasons (item damaged, never arrived at fulfillment center). There needs to be a process for customers to escalate and get manual review rather than being stuck with an automated system decision.

Improvement would involve: clear appeals process with defined escalation criteria, guaranteed human review within 5 business days, proactive outreach to customers if a return is stuck past a certain date.

The

Broader Implications: What This Says About E-Commerce at Scale

Amazon's return system failure isn't unique to Amazon. It reveals something fundamental about how large-scale e-commerce operations work and where the friction points are.

When a company processes 2 billion orders annually, individual customer service becomes statistically impossible. Amazon can't have a person manually verify every return. The company has to rely on automated systems. But automated systems have failure modes. A barcode that doesn't scan. A package lost in a distribution center. A network timeout that causes a refund request to not execute. All of these happen regularly at Amazon's scale.

The question isn't whether systems fail. It's whether companies build monitoring and exception handling to catch failures and fix them. Amazon apparently didn't invest enough in this. The company prioritized speed and cost efficiency over catching every edge case.

This is a classic problem in large organizations: individual failures are statistically inevitable, but systematic failures (patterns of failures that aren't caught and fixed) are a leadership choice. Amazon chose to accept a higher failure rate in exchange for operational efficiency. The settlement is the cost of that choice.

What's interesting is that this failure mode is almost invisible to most customers. If your return succeeds, you never think about the infrastructure that made it happen. But if you're in the percentage of returns that fail, you suddenly discover that "no hassle returns" is more of an aspiration than a guarantee.

Other large retailers face similar issues but aren't being sued in the same way (yet). Walmart, Target, and others process massive return volumes. Some might be better at it. Some might be worse but haven't been formally challenged in court.

The Amazon settlement sets a precedent: if a company advertises a service level ("no hassle returns") but the actual delivery falls short, it's potentially liable for compensation. Other retailers are probably watching this settlement closely and calculating whether their own return processes would survive similar scrutiny.

The largest portion of Amazon's

The Customer Experience Problem: Beyond the Money

What gets lost in discussions about settlement amounts is the actual customer experience of having a return fail. It's not just about losing $50. It's about the frustration, the time spent trying to resolve it, and the erosion of trust.

Consider a typical scenario: A customer buys a pair of shoes from Amazon for

The customer checks their Amazon order page. It says "Return received and processed." But there's no confirmation of a refund, and their credit card statement doesn't show any refund. So they contact Amazon customer service.

Amazon's support tells them: "Our system shows the item arrived at the return facility but we don't have a record of it being scanned into inventory. We're not sure what happened to it. Please wait 30 days and the refund will be issued if it's still not showing up."

Now the customer has to wait another month with their money gone. And they're wondering: is Amazon lying? Did the return really arrive? Did someone at Amazon mishandle it? Why don't they know?

What actually happened in many cases was that Amazon received the item, it got temporarily logged in the system, but then something broke down (barcode didn't scan, package got stuck in the wrong location, system crash, whatever). The customer was left in the dark because Amazon's system didn't flag the issue as an exception that needed attention.

This experience damages trust in ways that a

But the real recovery would be Amazon so reliably processing returns that customers never have this experience at all. That's what the $363 million infrastructure investment is supposedly for.

Competitive Implications: Does This Change the E-Commerce Landscape?

One interesting angle on this settlement is how it affects Amazon's competitive position. For decades, "no hassle returns" was part of Amazon's competitive moat. Customers trusted Amazon with returns better than they trusted other retailers.

This settlement suggests that trust was partly undeserved. Amazon wasn't better at returns than competitors. Amazon was just bigger and had more successful marketing around the "free returns" message.

For other retailers, this is an opportunity. A company that can genuinely deliver on "every return is processed within 2 business days, 100% success rate" suddenly has a competitive advantage over Amazon. The barrier to this is infrastructure investment and operational discipline, not technology. It's doable.

We're already seeing some retailers emphasizing return speed and reliability more aggressively. Zappos (owned by Amazon actually, but operationally separate) has built its entire brand partly on return confidence. Some direct-to-consumer brands are now highlighting their return policies specifically because they know customers are getting burned by big retailers.

There's also a longer-term implication: as more customers discover that their Amazon returns failed and file claims, the brand perception shifts. Amazon becomes "the company that sometimes doesn't refund returns" rather than "the company with free, no hassle returns." That's not the narrative Amazon wants.

The settlement is partly about fixing the actual system failures. But it's also about managing the perception problem and trying to restore trust before competitors capitalize on it.

The

How to File a Claim: The Practical Steps

If you think you're eligible for compensation from this settlement, you'll need to file a claim. The exact process will be detailed by the settlement administrator once the judge approves the deal, but based on typical class action settlement procedures, here's what to expect:

Step 1: Identify Eligible Returns - Go through your Amazon order history and identify specific returns where you believe a refund failed or was partial. For each one, note the order number, return date, and what happened (refund never appeared, partial refund, recharged later, etc.).

Step 2: Gather Documentation - For each claim, collect:

- Amazon order confirmation

- Return initiation confirmation

- Carrier tracking number showing delivery to return address

- Email or message correspondence with Amazon about the return

- Credit card statements showing the charge and non-refund

- Any customer service tickets you opened about the issue

Step 3: Watch for Settlement Administrator Communications - Once the settlement is approved, the court will appoint a settlement administrator. This company will set up a website, mailing address, and phone number for claim filing. Watch your email and Amazon account for communications about the settlement.

Step 4: File Your Claim - You'll typically have 6-12 months to file. Submit your claim either online, by mail, or by phone. Most settlements now use online filing because it's faster and requires less paper pushing.

Step 5: Provide Documentation - The settlement administrator might ask for additional documentation to verify your claim. Respond promptly and completely. This is where those notes and screenshots matter.

Step 6: Await Determination - The administrator will review your claim and determine if you're eligible. This typically takes 2-4 weeks.

Step 7: Receive Payment - If approved, you'll receive payment via your original payment method, a check, or a prepaid card, depending on how the settlement specifies distribution.

The key point: claim filing is typically free. If someone charges you to help file a claim, it's probably a scam. The settlement administrator handles it at no cost.

Also important: filing a claim doesn't affect your Amazon account or future ability to shop on Amazon. The company can't retaliate or limit your access because you participated in a class action settlement.

The Approval Process: What Still Needs to Happen

Right now, this settlement is still pending. It's not final. US District Court Judge Jamal Whitehead still needs to approve it. This might sound like a formality, but it's not. There are a few things that could still go wrong or change.

The judge will review the settlement to ensure:

Adequacy of the Settlement Amount - Is $909.5 million in customer payments actually sufficient to compensate affected customers? The judge will consider the number of eligible customers, the typical harm per customer, and whether the amount is reasonable. If the number seems too low relative to the alleged harm, the judge might reject it or require it to be increased.

Fairness of the Distribution - Does the allocation of compensation (who gets how much) make sense? Is the system for determining claim amounts transparent and fair? If some customers get

Reasonableness of Attorneys' Fees - Class action lawsuits require lawyers, and they're paid from the settlement. The judge will scrutinize the lawyers' fees to make sure they're not excessive relative to the work done and the benefit provided to the class.

Feasibility of Implementation - Can the settlement actually be administered as described? Are the promised system improvements credible and achievable? If the judge thinks the settlement structure is unworkable, they might reject it or require modifications.

Judge Whitehead will hold a hearing where class members can raise objections. If a significant number of people object, or if the judge has concerns, approval could be delayed or denied. But typically, well-structured settlements with this much money are approved.

Once approved, there's a short window (usually 10-30 days) where additional class members can opt out. After that, the settlement is final and binding.

Amazon's Parallel Settlement with the FTC: The Bigger Picture

Amazon's return settlement is actually part of a larger reckoning with regulators. Around the same time, the company reached a $2.5 billion settlement with the Federal Trade Commission over charges that Amazon tricked millions of people into signing up for Amazon Prime and made cancellation difficult.

These are different issues but they share a theme: Amazon allegedly relied on customer confusion or system design to extract money or keep customers in services they didn't fully understand. The Prime signup issue was about making the option to pay prominent but making the option to cancel obscure. The returns issue is about not fully investigating and fixing a system that failed to deliver on a core promise.

Together, these settlements (roughly $3.5 billion) suggest a pattern of regulatory scrutiny around Amazon's business practices. Federal Trade Commission Chair Lina Khan has been particularly aggressive about going after big tech companies' deceptive practices. Amazon appears to be a priority target.

This puts pressure on Amazon not just to pay settlements but to genuinely change. If Amazon settles the returns issue but then regulators discover the company is committing similar tactics elsewhere, the penalties and reputational damage will be worse next time.

For customers, this is actually positive pressure. It means Amazon might actually invest in the infrastructure improvements rather than just paying settlements and moving on. The FTC is watching.

What This Means Going Forward: The New Normal

Assuming the settlement gets approved, what changes for customers going forward?

Better Visibility - Amazon should be implementing real-time tracking of returns. Customers should be able to see exactly where their return is in the process. Initiated. Picked up. Received. Scanned. Refund issued. This visibility prevents the frustration of not knowing what happened.

Faster Refunds - Amazon should be committing to specific refund timelines. Not "within 30 days." Something like "within 48 hours of receipt." This is achievable with the infrastructure improvements.

Proactive Problem Resolution - Instead of customers having to contact support to discover a return failed, Amazon should proactively notify customers if there's an issue. "We received your return but it arrived damaged. Here's what happens next." This eliminates the black hole experience.

Clear Communication About Non-Refundable Items - One cause of return frustration is customers not understanding which items are returnable and under what conditions. Better upfront communication prevents disputes later.

Customer Service Training - Return-related issues are often about customer service interactions. A customer service representative who can actually access your return's status in real time and provide accurate information would eliminate a lot of frustration.

The settlement also sets a precedent that other retailers are watching. If Walmart, Target, and others face similar lawsuits, they'll know that settlements are expensive. That might motivate them to actually fix their return systems rather than accepting failure rates as a cost of doing business.

For Amazon specifically, the settlement is partly about compliance but also about rebuilding the trust brand narrative. The company needs to move from "we got sued for poor returns" to "we've completely overhauled our returns system and now it's industry-leading."

That's an achievable goal if the $363 million infrastructure investment is real and well-executed.

The Broader Consumer Protection Angle

What's notable about this settlement is that it happened at all. For decades, large companies could operate with poor return systems and customers would just absorb the losses. You didn't get your refund, and there was little you could do about it. The company was too big to negotiate with, and individual lawsuits weren't economical.

Class actions changed that. They made it possible for a group of scattered customers to collectively demand accountability. A single customer losing

Regulatory agencies have also become more aggressive about these issues. The FTC under Lina Khan seems to have a philosophy that companies should be held accountable not just for overt fraud but for deceptive practices where the deception is embedded in how systems work.

For consumers, this creates an environment where companies are more likely to face consequences for broken practices. For companies, it creates an incentive to actually invest in reliable systems rather than just maximizing short-term profit.

The Amazon settlements suggest that era is changing. Companies that rely on consumer confusion or system failures to extract value are going to face legal and regulatory blowback. The cost of fixing these practices is becoming lower than the cost of getting caught.

Skepticism and Limitations: What This Settlement Doesn't Address

It's worth being honest about the limitations of this settlement.

First, Amazon still hasn't admitted wrongdoing. The company settled "without admitting wrongdoing," which is legal language for "we're paying but we're not saying we did anything wrong." In reality, the settlement is an implicit admission that the system failed, but from a legal perspective, Amazon maintains innocence. This allows the company to avoid additional liability in other contexts.

Second, the $363 million infrastructure commitment is vague. We don't know specifically what Amazon is building. The company could spend that money on modest improvements and still be within the spirit of the agreement. Or the company could invest heavily and genuinely fix the problems. We'll only know when the improvements go live.

Third, monitoring and accountability is unclear. Who verifies that Amazon actually spent the $363 million? How do customers know if the new systems work? There should be public reporting on return success rates, but it's not clear if this is mandated by the settlement.

Fourth, the settlement only addresses specific past failures. If Amazon's return system develops new failure modes in the future, this settlement doesn't prevent that. The company would face future lawsuits but past settlements wouldn't help.

Fifth, the settlement assumes that customers will actually file claims. If claim filing is difficult or inconvenient, many eligible customers might not get their compensation. Settlement administrators try to make filing easy, but there's still a gap between "eligible for payment" and "actually receives payment."

Despite these limitations, the settlement is still significant. It's a billion-dollar acknowledgment that Amazon's system failed, it provides direct compensation to affected customers, and it creates financial incentive for Amazon to actually improve its infrastructure.

The real test will be whether the improvements Amazon makes actually prevent these failures going forward. That's not something we'll know for a couple of years once the new systems are fully deployed.

Expert Opinions and Industry Perspective

The return system failures alleged in this lawsuit aren't surprising to people who work in supply chain management or logistics. Industry experts have long noted that returns are the hardest part of e-commerce to scale.

A forward shipment (customer buying something and getting it delivered) is relatively straightforward. The package moves from warehouse to customer. One direction, predictable flow.

A return (customer sending something back and getting refunded) is messier. The package might come from anywhere, through multiple carriers, and needs to arrive back at one of dozens of fulfillment centers. Then it needs to be checked, logged, categorized, and processed. If anything goes wrong at any step, the whole chain breaks.

Retailers have been warning about this complexity for years. In supply chain conferences, executives talk about "reverse logistics" as their most challenging operational problem. Amazon's settlement proves why. At scale, you can't manage complexity through manual process and exceptions. You need robust systems that catch and fix problems automatically.

The $363 million investment makes sense from this perspective. Amazon isn't just fixing a broken system. The company is reimagining how to manage returns at massive scale.

Some supply chain experts believe this will actually make Amazon more competitive long-term. Once the new systems are deployed and working, Amazon's return process will likely be genuinely superior to competitors. But the cost of getting there is a billion-dollar settlement and several years of operational overhaul.

Timeline and What to Watch

Here's the likely timeline going forward:

Q1-Q2 2025: Judge Whitehead holds a hearing on the settlement. If approved, a settlement administrator is appointed.

Q2-Q3 2025: Settlement administrator sets up claim filing process. Customers receive notifications (via email if possible, via mail otherwise) about their right to claim compensation.

Q3 2025 - Q2 2026: Claim filing period (typically 6-12 months). Customers submit claims with documentation.

Q3 2026: Claims review and determination. Settlement administrator verifies eligible customers and determines compensation amounts.

Q4 2026 - Q1 2027: Distribution of payments. Customers receive refunds or compensation.

2026-2027: Amazon's return system improvements go live. New scanning infrastructure, refund automation, customer visibility dashboards deployed across fulfillment centers.

2027 onwards: Evaluation period. FTC and potentially Amazon's settlement monitor track whether return failures actually decrease. If the new systems work, return success rates should approach 99%+.

If you had a return that failed, you should watch for official communications about the settlement. Don't click on suspicious links claiming to help you file—the settlement administrator's official process will be free.

The Bottom Line: What This Settlement Means

Amazon's $1 billion (plus infrastructure investment) settlement is significant because it acknowledges what millions of customers have experienced: the company's "no hassle returns" promise broke down at scale.

It's not that Amazon intentionally stole from customers. It's that the company chose optimization over reliability. For years, Amazon accepted a certain percentage of returns would fail, because fixing every failure would cost more money and slow down operations. The settlement is what that choice costs.

For customers, it means potential compensation if your return was one of those that failed. It also means pressure on Amazon to actually fix the underlying infrastructure so future returns work reliably.

For the e-commerce industry, it means a precedent that systems failures have consequences. Other large retailers are watching and calculating whether their return systems would survive similar scrutiny.

The real outcome won't be known for a couple of years, once Amazon's new systems are fully deployed and we can see whether return failure rates actually decline. If they do, Amazon will have genuinely improved its business and customer experience. If they don't, this settlement will be just a fine, and the underlying problems will persist.

For now, if you're Amazon's customer and you're returning an item, document everything. Take photos of barcodes. Keep tracking numbers. Screenshot confirmation emails. Do this partly because it protects you if a return fails (you have documentation for a claim). But also do it because it creates accountability. Companies are more likely to fix broken systems when they can't hide the failures.

Amazon's billion-dollar settlement is evidence that those failures add up. The question now is whether the company will actually invest in preventing them going forward.

FAQ

What exactly is the Amazon returns settlement?

Amazon has agreed to pay over

Who is eligible to receive settlement compensation?

You're likely eligible if you returned an item to Amazon but didn't receive a refund, received a partial refund, were recharged for a returned item, or had Amazon claim they couldn't locate your return despite proof of delivery. Eligibility typically requires documentation showing the return was initiated and tracking information proving delivery to Amazon's return address.

How do I file a claim for the settlement?

Once the settlement receives final court approval, a settlement administrator will be appointed. They'll set up a website, phone number, and mailing address for claim filing. Watch your email and Amazon account for official notifications. Claim filing is completely free and typically lasts 6-12 months. You'll need to provide your Amazon order number, return date, and documentation of the refund failure.

How much money will each customer get?

The amount depends on how many eligible claims are filed and the value of each return. Since the settlement is structured around making "full recovery for every class member plus interest," the exact per-customer amount won't be known until the settlement administrator calculates the total number of eligible claimants. It could range from $10 to several hundred dollars depending on your return value.

Will filing a claim affect my Amazon account?

No. Filing a claim in a class action settlement is a legal right that companies cannot retaliate against. Amazon cannot limit your account access, reduce seller ratings, or penalize you in any way for participating in the settlement. This is explicitly protected by law.

When will the settlement be approved and when can I expect payment?

As of early 2025, the settlement is pending approval from Judge Jamal Whitehead. Once approved (likely in Q1 or Q2 of 2025), the claims filing period will open. Most class action settlements complete payment distribution within 12-18 months after claim filing closes, so expect payment sometime in late 2026 or early 2027 for claims filed in 2025.

What is Amazon's $363 million infrastructure commitment?

Amazon has committed to investing $363 million to improve its return and refund processing systems. This money is supposed to go toward better return scanning, automated refund decisions, real-time customer visibility, duplicate charge prevention, and improved customer service training. This isn't money paid to customers but rather invested in preventing future return failures.

Is this settlement final or can it be appealed?

The settlement is not final until Judge Whitehead approves it. Even after approval, there's typically a 10-30 day window where customers can object or opt out. Once that window closes, the settlement becomes binding. Amazon cannot appeal a final settlement that it agreed to, though customers technically can object before finalization.

What about Amazon's $2.5 billion FTC settlement for Prime signup issues?

That's a separate settlement with the Federal Trade Commission regarding allegations that Amazon made Prime signup easy but cancellation difficult. That settlement is administered differently and has its own claim process. Both settlements are significant but address different practices.

How do I know if an online service claiming to help me file is legitimate?

The official settlement process is completely free. Any service charging money to help you file a claim is likely a scam. The settlement administrator's official website and communications will be linked from the court's website once approved. Be cautious of any unsolicited emails or texts claiming to represent the settlement.

Ready to claim your refund if you're eligible? Keep an eye on your email for official settlement notifications. Document your Amazon returns now while the details are still fresh.

Key Takeaways

- Amazon will pay 600M refunds +363M to infrastructure overhaul

- The lawsuit claims Amazon systematically failed to process returns despite advertising 'no hassle returns,' suggesting millions of customers experienced missing refunds

- Eligible customers can file claims for compensation with documentation of their failed returns, with claims filing expected to open mid-2025

- The settlement sets precedent that e-commerce companies are liable for system failures that prevent advertised services, pressuring competitors to improve reliability

- Amazon's parallel $2.5B FTC settlement for Prime signup deception suggests pattern of regulatory scrutiny requiring genuine operational changes, not just payouts

Related Articles

- Google's $68M Voice Assistant Privacy Settlement [2025]

- Trump Mobile FTC Investigation: False Advertising Claims & Political Pressure [2025]

- Verizon Boston TV Blackout: Why the Rare Refund Matters [2025]

- SEC Drops Gemini Lawsuit: What It Means for Crypto Regulation [2025]

- The 3 Biggest Lies Robot Vacuum Brands Are Telling You [2025]

- Freecash App: How Misleading Marketing Dupes Users [2025]

![Amazon's $1 Billion Returns Settlement: What Customers Need to Know [2025]](https://tryrunable.com/blog/amazon-s-1-billion-returns-settlement-what-customers-need-to/image-1-1769526727570.jpg)