The Freecash Promise That Isn't Real

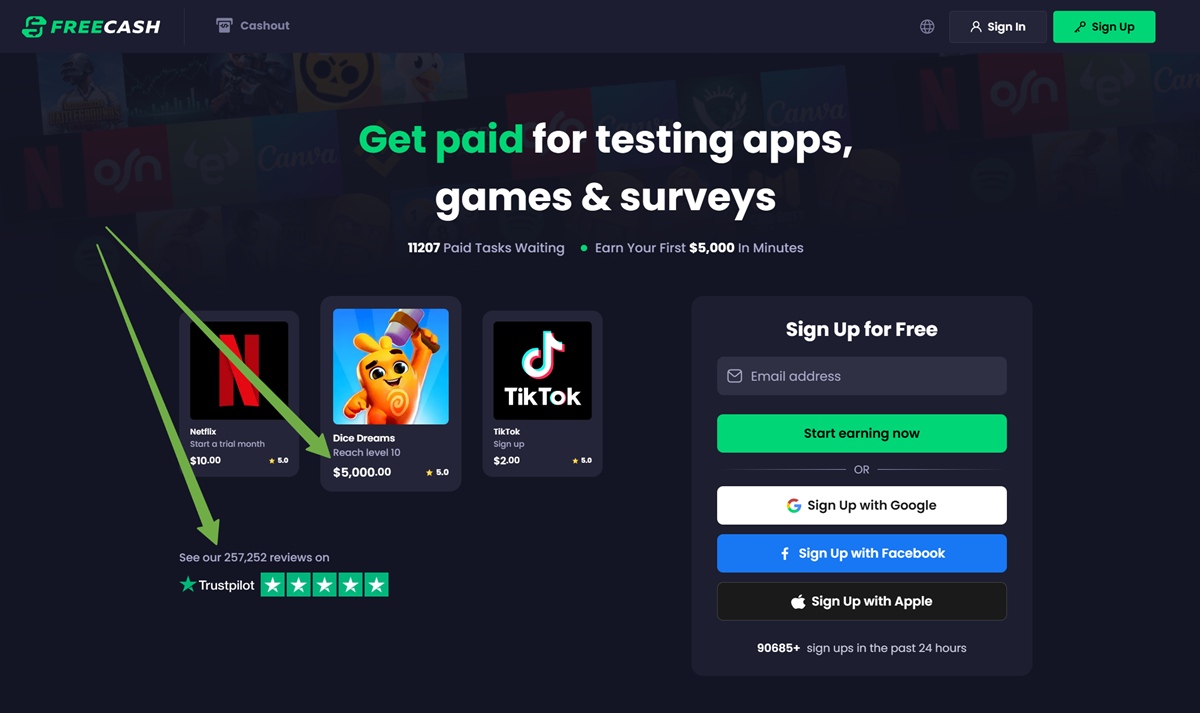

Imagine this: you're scrolling TikTok when an ad pops up. A woman beams at the camera, phone in hand. "Get paid to scroll," the caption reads. "Join thousands earning daily by watching TikTok videos and cashing out instantly." Sounds too good to be true? That's because it is.

Freecash has exploded in popularity during early 2025, rocketing to number two on Apple's free iOS download charts, sitting right between ChatGPT and Google Gemini. That's not coincidence. It's the result of an aggressive marketing blitz across social media, particularly TikTok, where ads promise easy money for doing nothing but what you already do on your phone.

But here's the reality: Freecash doesn't pay you to scroll TikTok. Not even close.

The app's actual business model is far more complicated and considerably less lucrative than the marketing suggests. Instead of rewarding you for passive scrolling, Freecash operates as an advertising platform that matches mobile game developers with potential users. You download games, play them, spend money in them, and maybe earn some cash rewards along the way. The difference between what the ads promise and what the app delivers is so stark that it caught the attention of major platforms and consumer advocates alike.

What started as a curiosity about a trending app turned into a deep dive into deceptive marketing practices, data harvesting, and the murky intersection between social media advertising and misleading claims. The story of Freecash reveals how modern apps exploit aspirational messaging to attract users, only to redirect them toward activities that primarily benefit game publishers and advertisers.

Let's break down exactly what's happening, why consumers should care, and what the app's rise says about digital marketing in 2025.

Understanding Freecash's Business Model

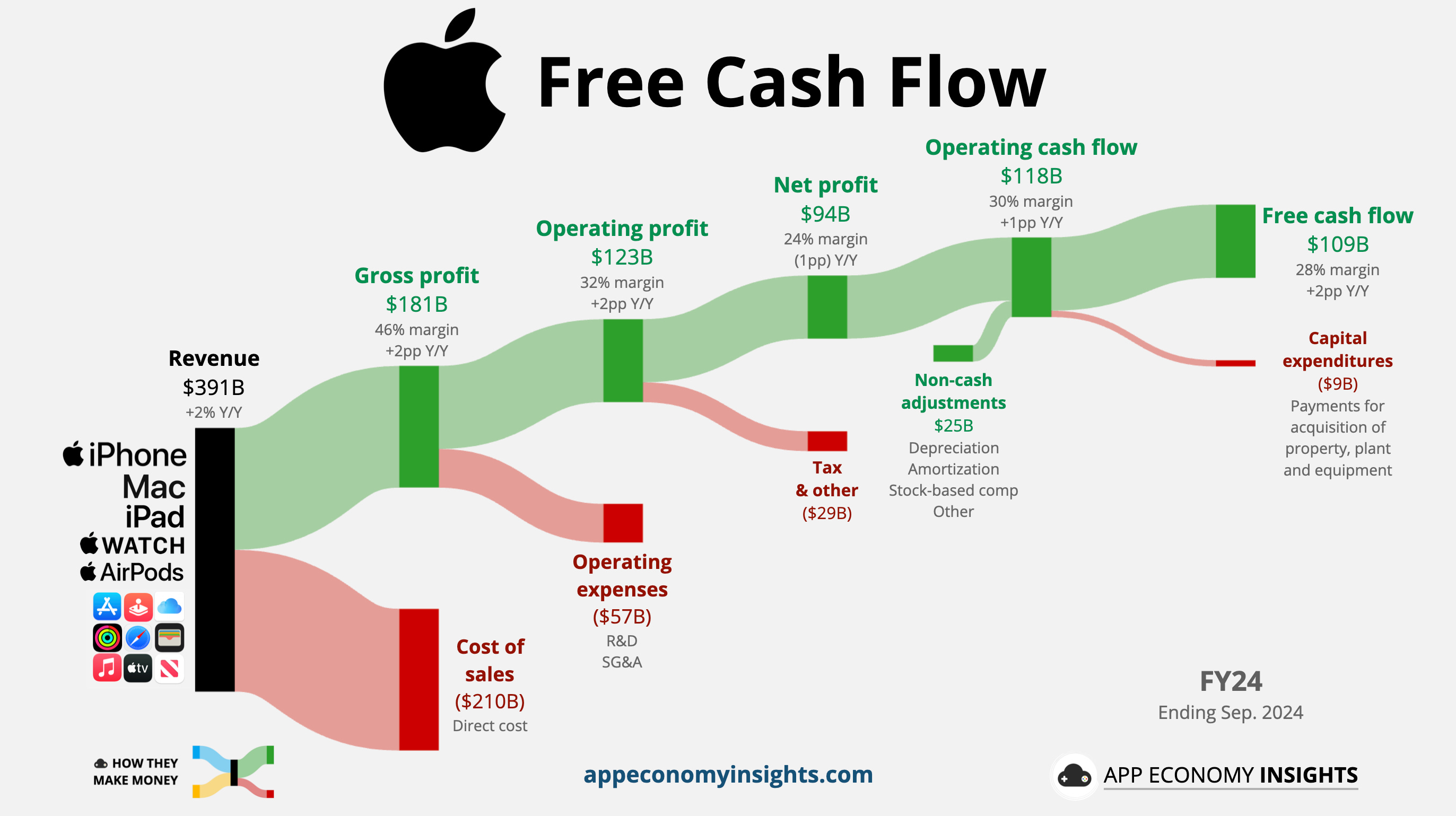

Freecash isn't a direct cash-earning app in the way most users imagine. The company, owned by Berlin-based Almedia, operates a sophisticated matchmaking system between mobile game publishers and potential players. The app's core function is to funnel new users toward specific games, particularly ones that monetize heavily through in-app purchases.

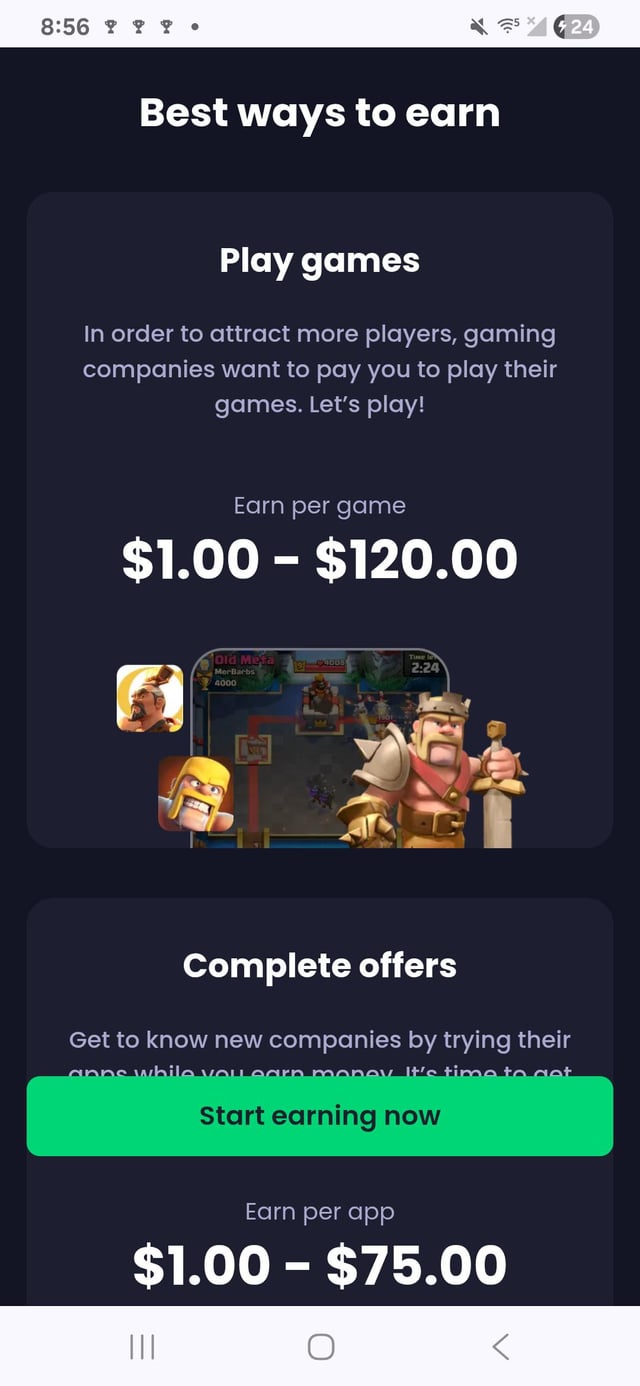

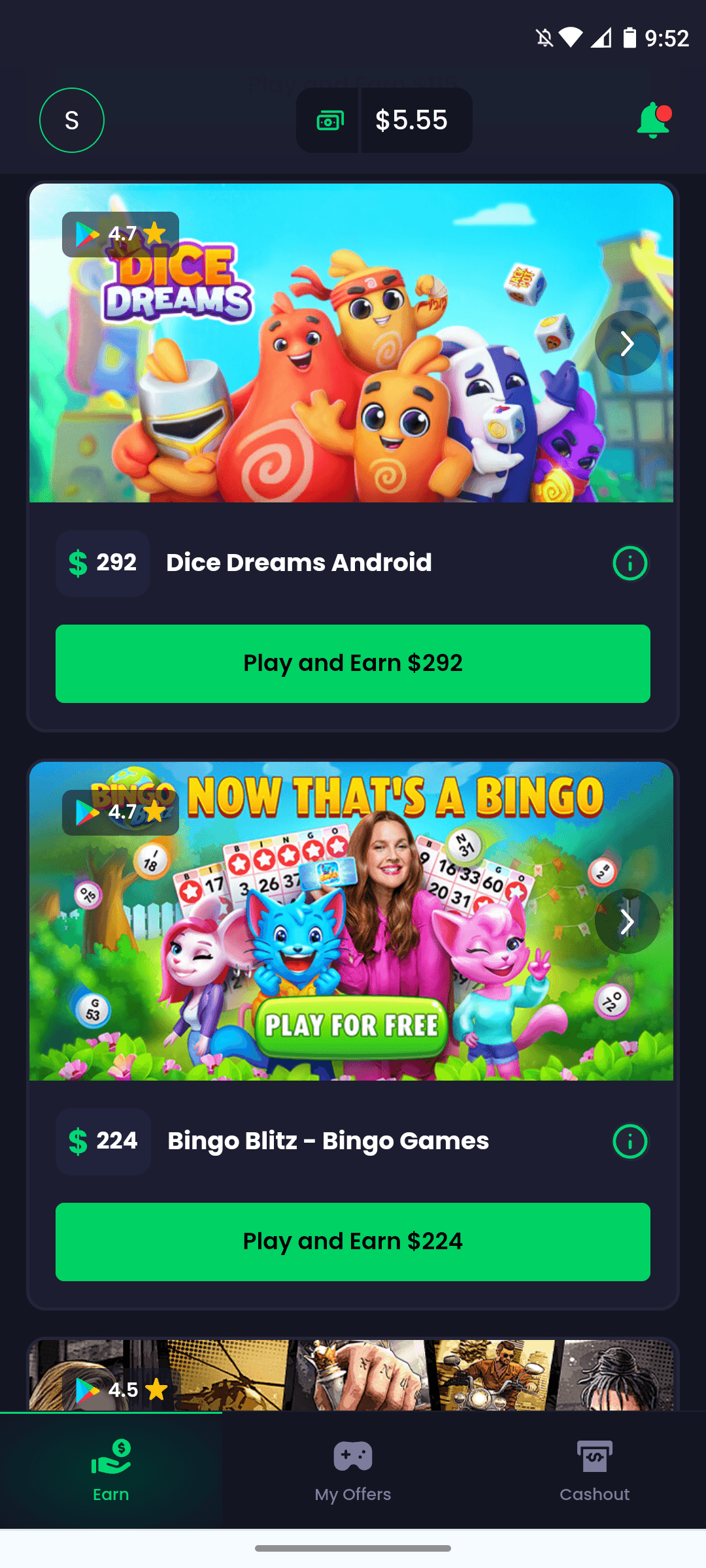

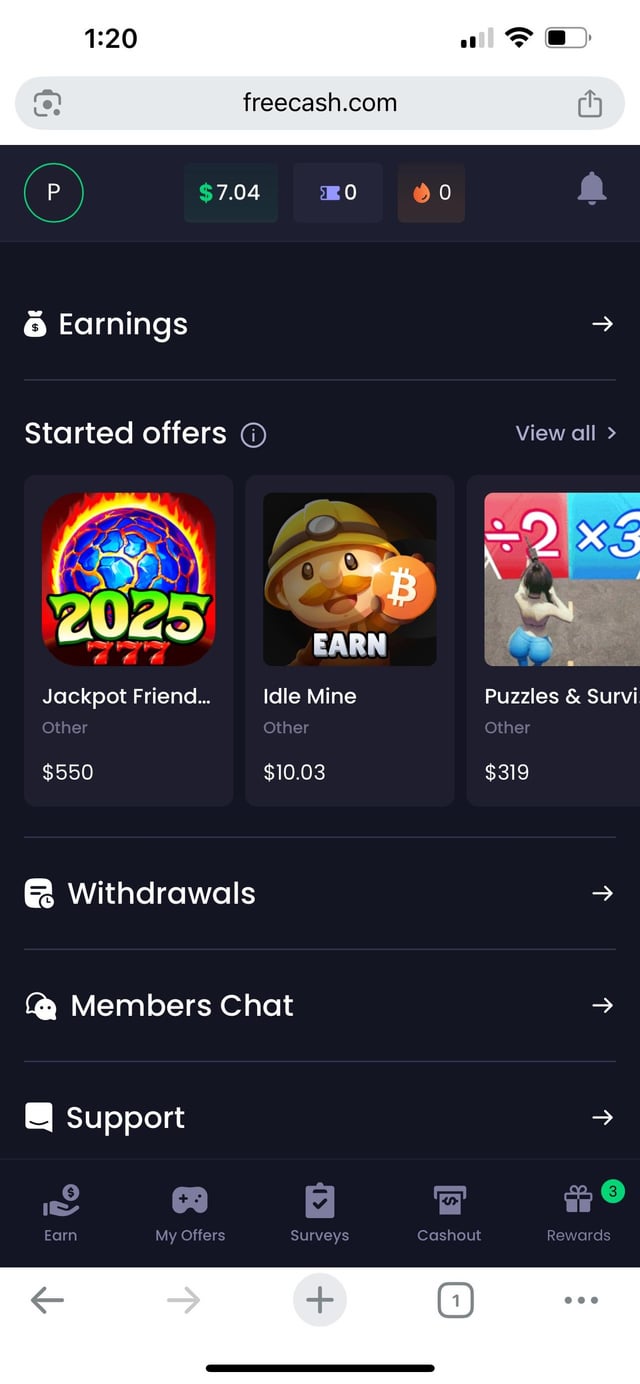

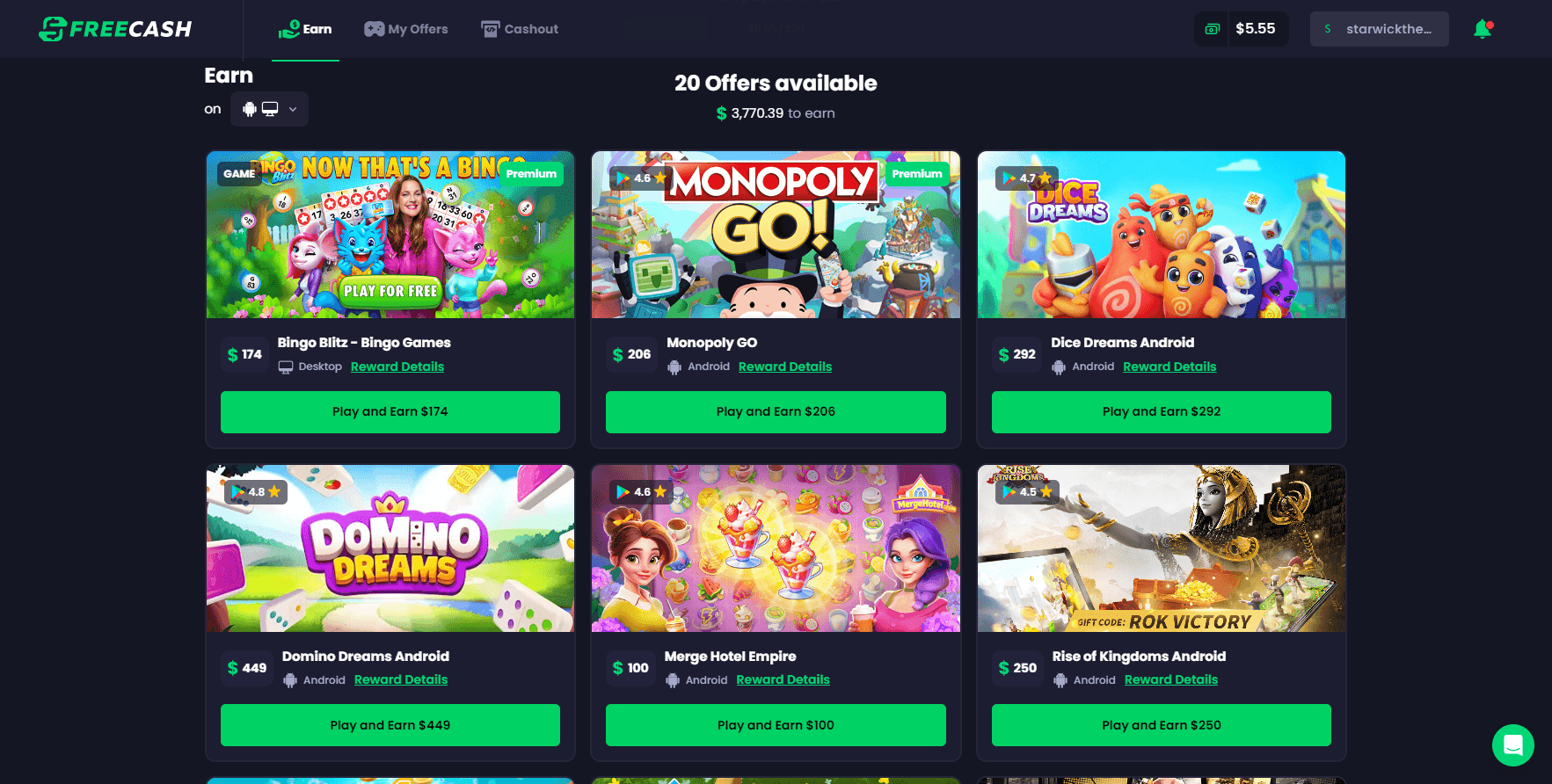

When you first open the app, you're not greeted with options to earn cash by scrolling. Instead, you're immediately directed to download mobile games. The most prominent offerings during early 2025 include titles like Monopoly Go and Disney Solitaire. These aren't random selections. Almedia's CEO, Moritz Holländer, has publicly explained that the company uses sophisticated data matching to determine which games users are most likely to spend money on.

Here's how the psychology works: Almedia believes that users who typically spend money on puzzle games won't generate value for casino-style games. So the platform uses behavioral data to predict your "expected value" to game publishers. If you don't fit their monetization profile, the app won't show you that game. Why? Because disappointing advertisers with low-spending users damages the platform's reputation and profit margins.

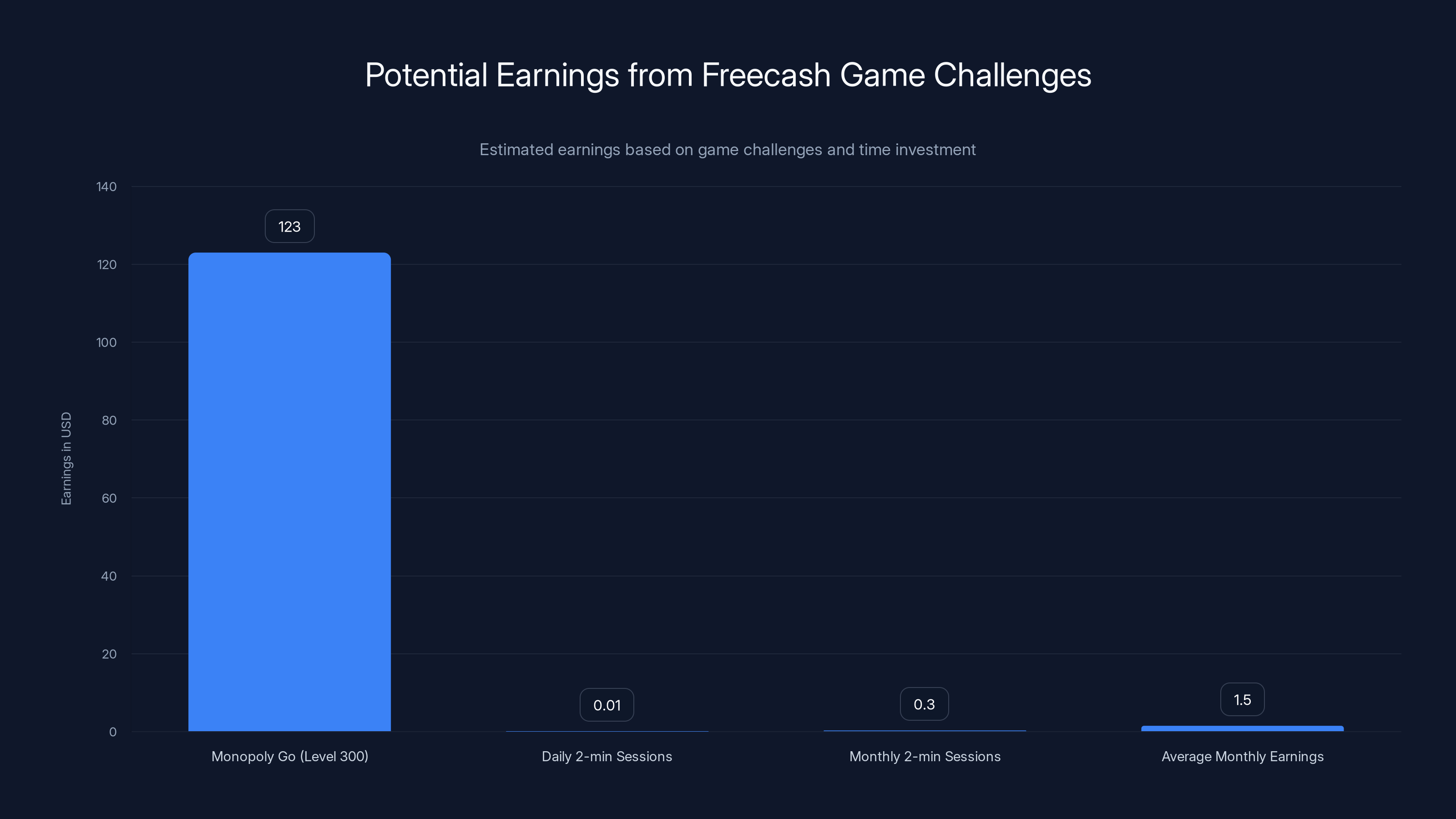

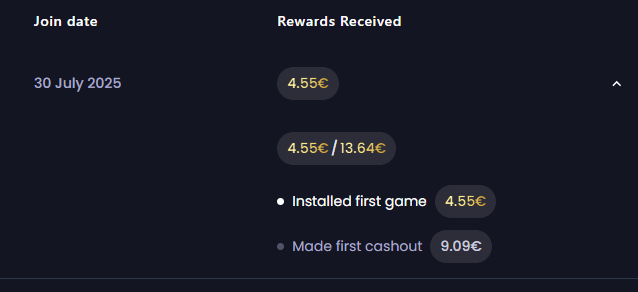

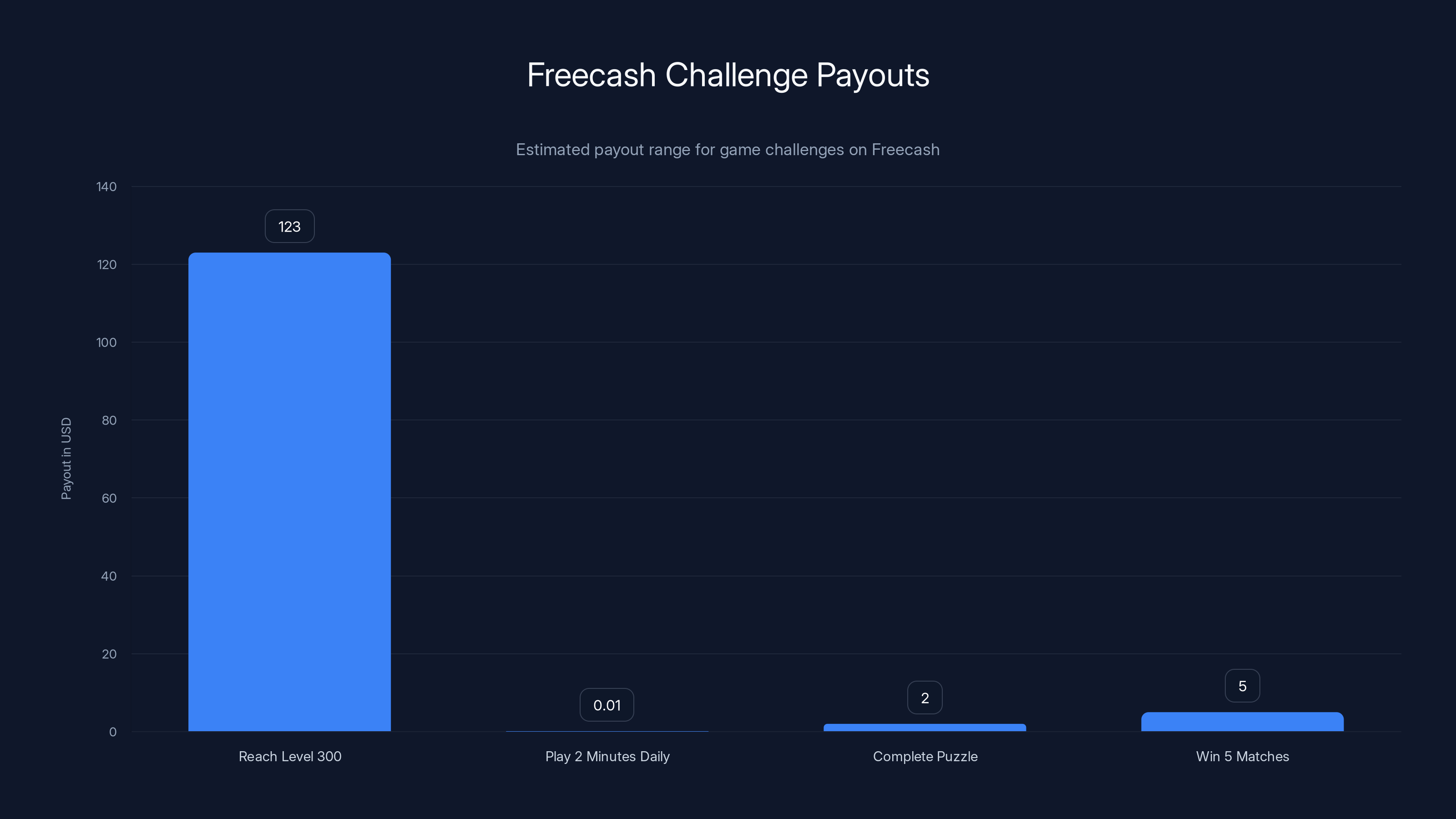

Once you select a game, you see what Freecash calls "challenges." These are time-based objectives with cash rewards attached. Download Monopoly Go, for example, and you might see a challenge like "Reach level 300 in less than three months for

The real revenue driver, though, sits hidden in the design. When you open the Monopoly Go challenge page, Freecash provides a single piece of advice: "Make purchases to reach these faster!" It's not subtle. The app essentially nudges users toward spending real money in games under the guise of "earning" cash from Freecash.

The second time you open the app, a pop-up appears. It offers 33% more rewards if you make your first in-game purchase. This is no accident. Freecash makes money when users purchase virtual currency in games, not when they passively play. The "earnings" are actually game publisher referral commissions, split with users as a carrot to drive monetization.

Freecash's business model is built on a fundamental incentive mismatch: the app benefits when you spend money, not when you earn it. Every reward structure, every notification, and every design choice points toward increasing your spending in the featured games.

Estimated data shows that users can earn between

The TikTok Marketing Campaign That Got Removed

By early January 2025, Freecash had become inescapable on TikTok. Sponsored videos dominated feeds, each more dramatic than the last. One post with over 150,000 likes showed a mother and her young son heading to a store. The caption explained that she could now "buy her son whatever he wants now that I'm paid to watch TikTok."

Other videos featured testimonials from people claiming they were earning substantial daily income just by scrolling. The videos typically showed users holding phones, looking shocked at their earnings, or displaying purchases they'd made with "Freecash money." The messaging was consistent: easy money, instant cashouts, no work required.

There's a problem with this narrative. It's false advertising.

TikTok's advertising policies explicitly forbid ads designed to "scam individuals out of money or personal data" and bar "financial misrepresentation." The Freecash ads violated both. When Wired reached out to TikTok about the deceptive marketing, the platform acknowledged the problem and removed the offending ads.

But here's where things get murky: Freecash's parent company claimed it didn't directly create the misleading ads. Instead, they blamed "third-party affiliate partners." According to Elizaveta Shulyndina, a Freecash spokesperson, the company was "reviewing activity with relevant partners and tightening monitoring."

This claim raises serious questions about accountability. If third-party affiliates can generate deceptive marketing that violates platform policies, who bears responsibility? Consumer advocates point out that this structure may be intentional, allowing the company to distance itself from misleading claims while still benefiting from the influx of new users.

The affiliate opportunity itself reveals another layer. Freecash offers commission payouts to anyone who refers new users through their own marketing. In Freecash's official Discord server, moderators encouraged affiliates to be creative. One moderator, sporting a "FC Staff" badge, told users in January 2025: "You don't even need a huge network tbh. You can buy TikTok/YouTube accounts, use AI, etc. Nowadays, anything is possible."

That statement alone suggests Freecash understood that authentic marketing from genuine users wasn't driving adoption. The company needed volume, and if affiliates needed to purchase accounts or use AI to generate testimonials, Freecash wasn't publicly discouraging it.

Even after TikTok removed the flagged ads, similar content continued appearing in feeds. This suggests either TikTok's moderation systems lagged behind new variations, or affiliate partners quickly created new accounts and new campaigns to replace the removed ones.

While Monopoly Go offers up to

What Happens When You Actually Download the App

The disconnect between marketing and reality becomes visceral the moment you open Freecash. You're expecting a direct path to cash rewards for scrolling. Instead, you're immediately funneled into a game download experience.

The app's interface prioritizes game downloads above all else. The first screen you see isn't an earnings dashboard. It's a carousel of featured games, presented with the same design language as a legitimate app store. Each game card shows a thumbnail, description, and most importantly, the cash reward associated with completing challenges in that game.

It's a masterclass in dark patterns. Your brain, primed by TikTok ads to expect easy money, sees the game, sees the cash amount, and makes a leap: "I can earn that money by playing this game." Technically true, but practically misleading. You can't earn anything until you download the game, reach specific milestones, and satisfy Freecash's conditions.

I downloaded three games to test the system. Monopoly Go offered the highest payouts. Its challenges ranged from

The smaller rewards are more immediately accessible. You can earn

The app's true intention becomes obvious once you encounter the upsell mechanics. Every game features purchase prompts. Freecash itself prompts you to buy virtual currency in the featured games. That pop-up offering 33% extra rewards for your first in-game purchase? It's designed to lower your resistance to spending. Once you've spent

There's another revelation: each game you download comes with its own privacy policy and terms of service. If you download five games through Freecash, you've just granted access to your personal data to five different publishers and potentially dozens of third-party analytics firms, advertising networks, and data brokers.

Freecash takes a cut of the in-app revenue generated by the users it sends to game publishers. The players get a small percentage as "rewards." Game publishers get the majority. And Freecash's parent company, Almedia, gets the brokerage fee. It's a profitable arrangement for everyone except the user, who invests time and data for minimal compensation.

The Data Harvesting Problem

One of the most concerning aspects of Freecash isn't the misleading earnings claims. It's the massive data collection that occurs in the background.

When you use Freecash, you're not just granting the app permission to track your behavior. You're also exposing yourself to data collection from every game you download, every publisher you interact with, and every third-party vendor integrated into those systems.

Modern mobile games are data vacuums. They collect information about your location, your contacts, your device identifiers, your browsing history, and increasingly, your biometric data. Once that information is collected, it's shared with advertising networks, data brokers, and marketing firms that use it to build detailed profiles of you.

Freecash amplifies this problem because the platform specifically targets users based on their behavior. The matchmaking system analyzing your expected value isn't just using publicly available demographic information. It's analyzing past app usage patterns, spending behavior, and response to specific game genres.

A senior public policy manager at the National Consumers League noted that this kind of structure—where a company claims it's not responsible for misleading marketing created by "third-party partners"—mirrors tactics used by online sports betting platforms to dodge regulatory oversight. The responsibility, consumer advocates argue, ultimately falls on the company offering the service, not the affiliates promoting it.

The privacy implications extend beyond advertising. Data collected through Freecash and its partner games can be sold, shared with law enforcement, hacked from poorly secured servers, or used for identity theft. The terms of service typically include language allowing companies to share data with "affiliates" and "service providers," which in practice means dozens of unvetted third parties.

That's not paranoia. It's the economic reality of the digital attention economy. Freecash's business model only works if the users it delivers to game publishers are sufficiently valuable. That value comes from behavioral data, not from their likelihood to spend money in games. A user who never spends is still valuable because their data profile is useful to advertisers.

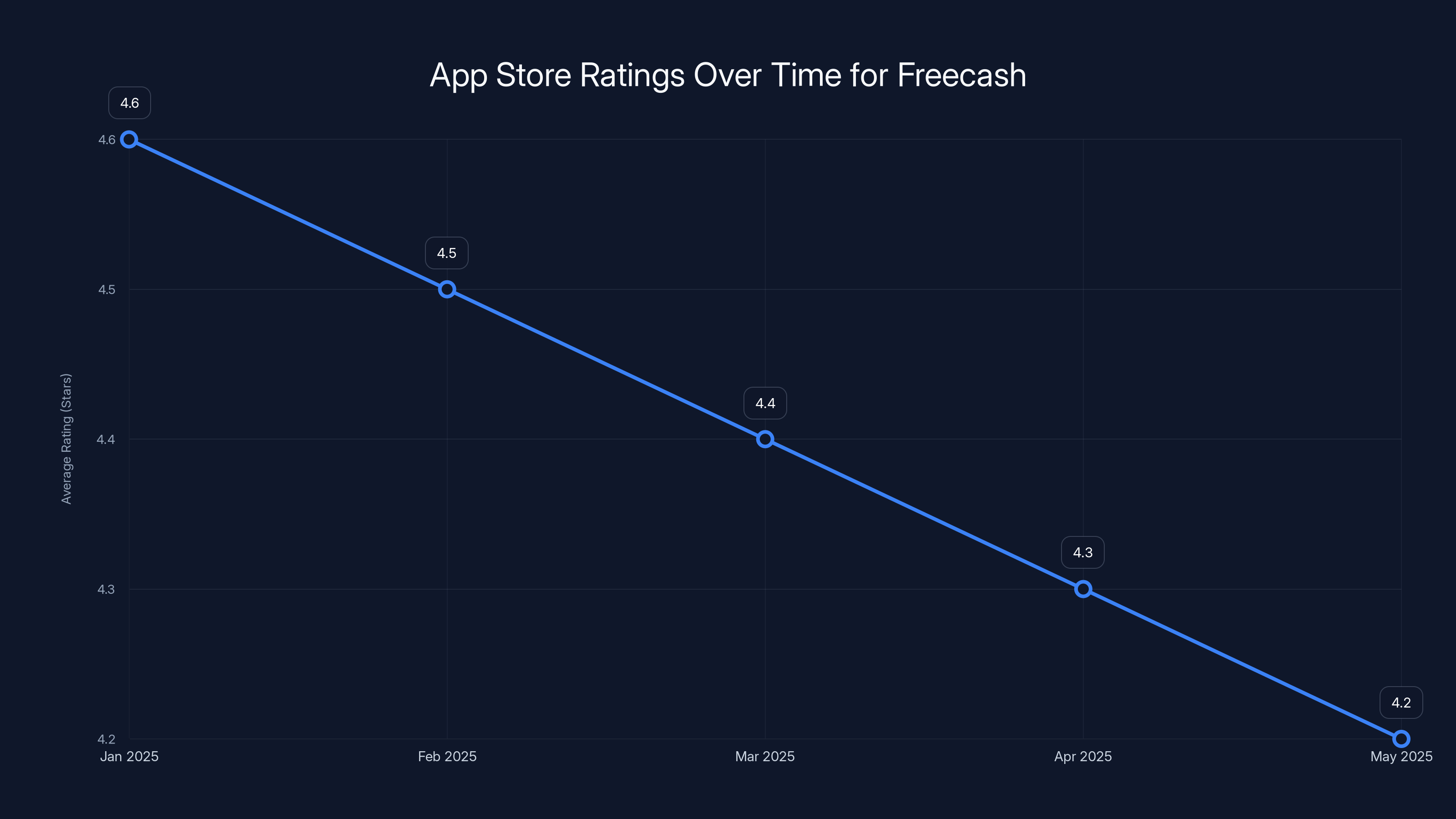

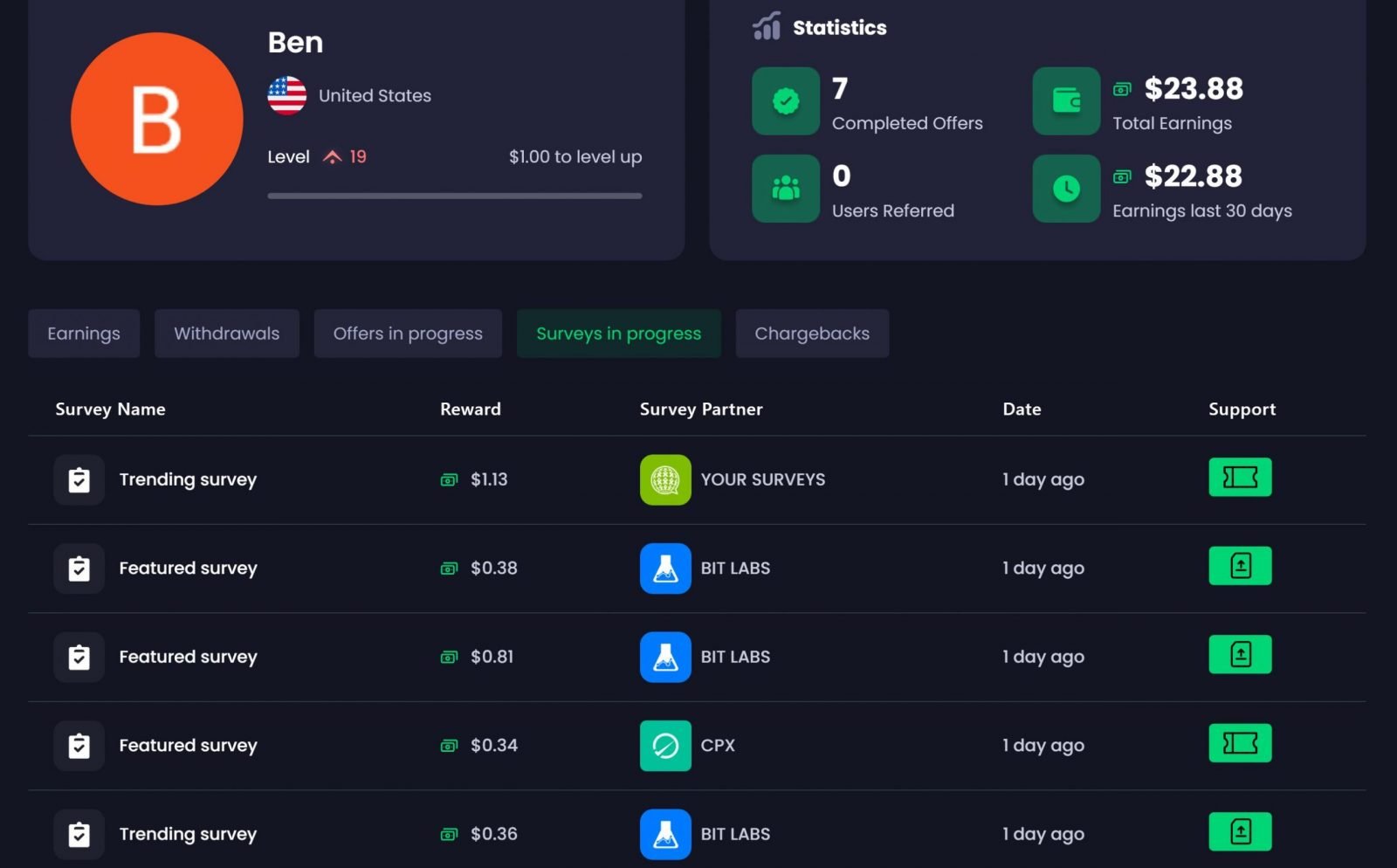

Despite numerous negative reviews citing issues like misleading marketing and withdrawal difficulties, Freecash's average rating remains high due to recent positive reviews. Estimated data.

Comparing Freecash to Legitimate Reward Apps

To understand how misleading Freecash's marketing truly is, it helps to compare it to apps that actually pay for your time and behavior.

Apps like Swagbucks, Survey Junkie, and Branded Surveys operate with similar reward structures, but their marketing is transparent. They don't claim you can earn money by scrolling social media. They're honest: you earn small amounts by completing surveys, watching advertisements, or testing products. The payouts are modest (typically

Freecash's deception isn't just in overstating earnings. It's in fundamentally misrepresenting what the app does. Swagbucks says "earn rewards by answering surveys." Freecash says "earn money scrolling TikTok." One is accurate. The other is false.

Task-based earning apps like Fiverr and Task Rabbit operate differently still. They're marketplaces where you offer services (writing, coding, repair work) and earn actual money from clients. The payouts can be substantial because you're providing genuine value. Freecash provides nothing. It just redirects you toward spending money in games.

The distinction matters because it shapes user expectations. When someone downloads Freecash expecting to earn money for passive activity, and then discovers they need to spend money to unlock those earnings, they feel deceived. Because they are.

Legitimate reward apps also typically have lower barriers to entry and faster payouts. Swagbucks doesn't require you to download multiple apps and play games for hours. You can start earning within minutes. Freecash artificially extends the process, each step designed to deepen your engagement with the platform and the games it promotes.

Red Flags in App Store Ratings and Reviews

Freecash's App Store presence tells an interesting story if you look closely.

During early 2025, the app boasted high ratings (typically 4.5+ stars), which seems to contradict the numerous complaints users voiced. Digging into specific reviews reveals a pattern. Many one-star reviews cite identical complaints: misleading marketing, difficulty earning promised amounts, pressure to spend money, and difficulty withdrawing funds.

One-star reviewers frequently mention waiting weeks for promised withdrawals or discovering that their earnings were forfeited because they didn't meet specific conditions. These aren't isolated complaints. They're consistent patterns across thousands of reviews.

Yet the overall rating remains high. How? Higher-rated reviews often come from recent downloads or from people who earned small amounts (

Freecash may also employ review manipulation tactics. Studies of app stores have documented instances where companies pay for positive reviews, use fake accounts to boost ratings, or compensate users for leaving positive reviews. While there's no direct evidence that Freecash does this, the pattern of recent positive reviews combined with older negative reviews matches the profile of manipulated ratings.

Prospective users reading reviews often scroll past the oldest, most detailed criticisms and see the recent, brief positive reviews first. This algorithmic bias favors apps with time-gated reward structures, where most users feel positive about their experience in the first two weeks before reality sets in.

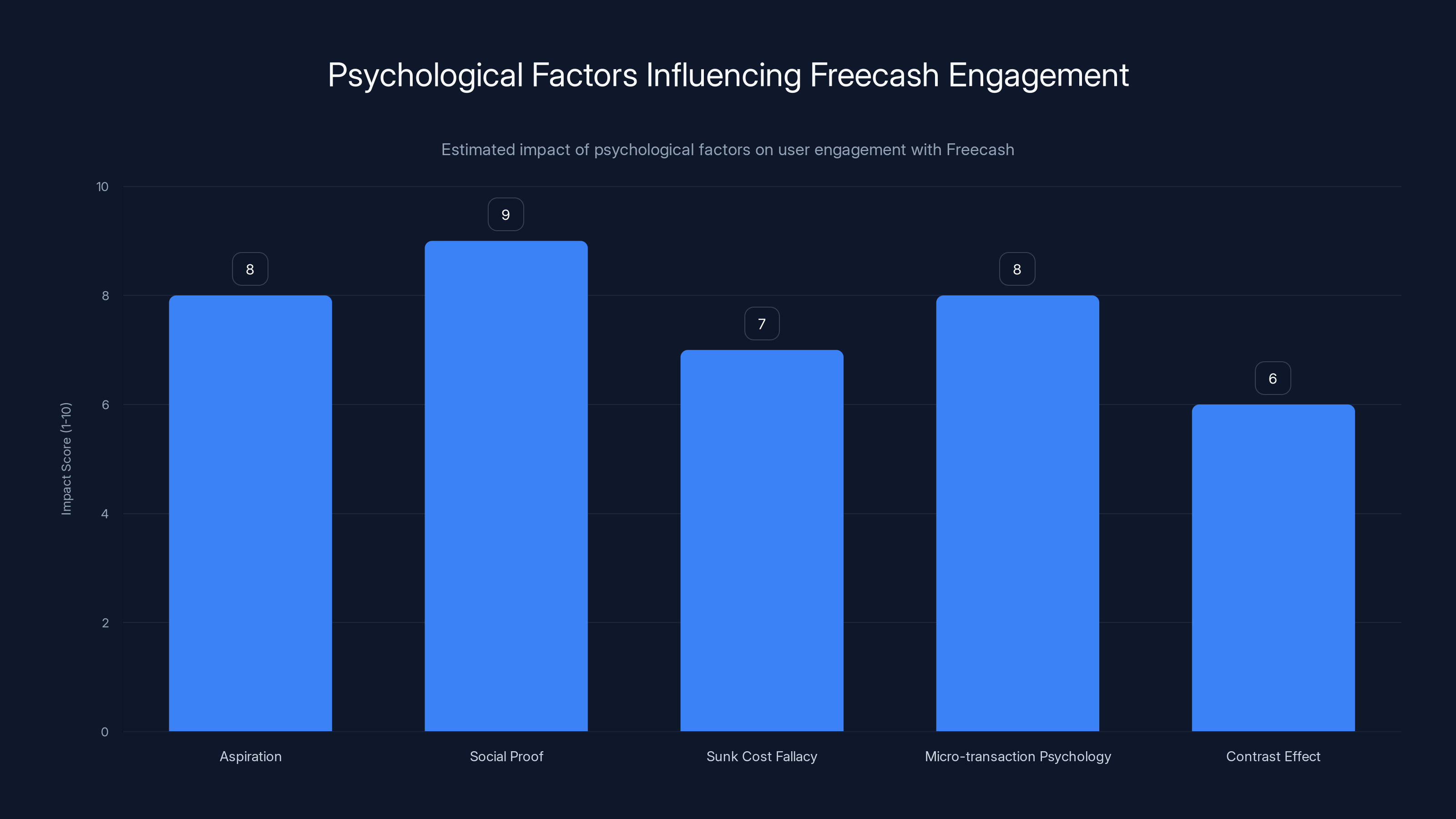

Social proof and aspiration are the most influential psychological factors driving engagement with Freecash, followed closely by micro-transaction psychology. (Estimated data)

The Regulatory Response and Consumer Advocacy

Freecash's rise hasn't gone unnoticed by regulators and consumer advocates. TikTok's removal of deceptive ads was one form of response. But that's far from comprehensive.

Consumer protection agencies in various states have begun scrutinizing reward apps that make unsubstantiated earnings claims. The Federal Trade Commission has authority to challenge misleading advertising, though enforcement often requires patterns of documented complaints before action is taken.

The challenge is that companies like Freecash use affiliate structures precisely to create distance from deceptive marketing. When a third-party marketer creates a false ad, Freecash can claim it lacked knowledge and oversight. By the time the company "tightens monitoring," thousands of new users have already downloaded the app.

Consumer advocates point out that this is backwards. Companies should be responsible for ensuring all marketing associated with their services is accurate, regardless of who creates it. The current structure incentivizes negligence.

Some states have started regulating the claims that apps can make about earnings potential. California, in particular, has been aggressive about challenging apps that promise money without clear disclosure of actual earnings potential. But these regulations are state-by-state, and enforcement is slow.

What's particularly troubling is that younger users, who are more likely to use TikTok, are more vulnerable to these tactics. Minors downloading Freecash to try earning money could inadvertently expose themselves to extensive data collection and persuasive spending mechanics.

How Affiliate Marketing Enables the Deception

Freecash's affiliate program is the key to understanding how the misleading marketing happened and why the company claims plausible deniability.

The app offers commissions to anyone who refers new users. That's standard in marketing. But Freecash's affiliate payouts appear generous enough that they incentivize aggressive promotion. The exact commission structure isn't public, but given the influx of TikTok ads, the payouts are likely substantial.

This creates a perverse incentive structure. Affiliate marketers earn more money by getting users to download the app than Freecash itself earns from most individual users (at least in the short term). So affiliates have every reason to make the most exaggerated claims possible, up to and including false statements about how the app works.

To make matters worse, low barriers to entry mean anyone can become an affiliate. You don't need business experience, marketing expertise, or a preexisting audience. You can buy TikTok accounts (as the Discord moderator suggested), use AI to generate testimonial videos, and rapidly scale a promotional campaign.

Freecash benefits from this arrangement without directly conducting the deceptive marketing. If the FTC investigates, the company can point to affiliate partners as the source of misleading claims. If TikTok removes ads, new affiliates create replacements. The system is designed to be resilient to enforcement.

This isn't unique to Freecash. Many apps, from financial services to diet products, use affiliate networks to generate deceptive marketing at arm's length. But the sheer scale of Freecash's affiliate operation and its focus on social media means millions of people are encountering false claims.

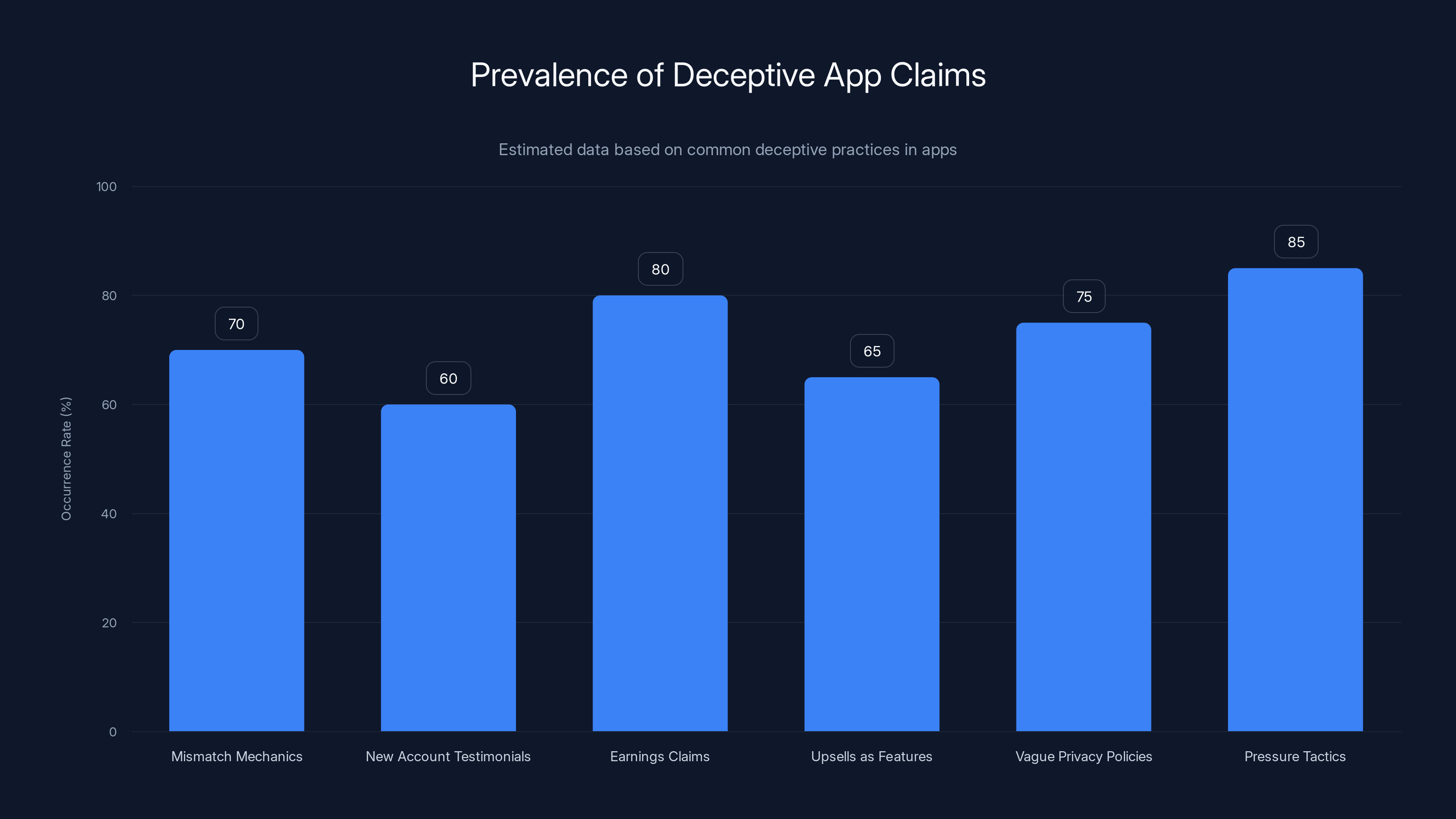

Estimated data shows that pressure tactics and exaggerated earnings claims are the most common deceptive practices in apps. Estimated data.

The Psychology Behind Why People Fall For It

Freecash's marketing success isn't due to the claims being subtle or sophisticated. It's actually due to psychological factors that make people vulnerable to exaggerated earnings promises.

First, there's aspiration. Many people would genuinely like to earn extra money with minimal effort. It's not irrational. Remote work, passive income, and financial flexibility are real goals. Freecash taps into that desire directly.

Second, there's social proof. When you see testimonials from people claiming to earn money, your brain doesn't automatically flag them as fake. TikTok's algorithm amplifies videos with high engagement. The Freecash videos with 150,000+ likes create the impression that thousands of people are already earning, so you should too.

Third, there's the sunk cost fallacy. Once you download Freecash and the games it promotes, you've invested time and attention. Even if the earnings are disappointingly small, you feel compelled to continue engaging because you've already made an investment.

Fourth, there's micro-transaction psychology. The smallest rewards (

Finally, there's the contrast effect. If you see a challenge offering

Freecash's design weaponizes all these psychological principles. It's not accident. The app was built by people who understand behavioral economics and have structured every interaction to maximize engagement and spending.

Common Scenarios Users Face

Using Freecash for several weeks reveals patterns in how the app frustrates users and nudges them toward spending.

The Unattainable Challenge: You see a challenge offering

The Withdrawal Delay: You accumulate $5 in rewards and attempt to withdraw. The app requires you to wait 7 to 10 days. During the wait, you continue using the app, see more games, and download another. By the time your withdrawal processes, you've already accumulated additional reward earnings, creating a sense of progress that encourages continued engagement.

The Forfeited Balance: You take a week off from the app. When you return, you discover that unused rewards from certain challenges have expired. The app doesn't clearly state this expiration upfront. You lost money you thought you were earning.

The Spending Trap: You spend $1 on virtual currency in a game through Freecash. Suddenly, you become eligible for a different game that has higher-value challenges. Your spending history is now visible to the platform's matching algorithm, which now prioritizes showing you games with aggressive monetization. You've flagged yourself as a potential spender.

These aren't glitches. They're features. Each scenario is designed to either generate frustration that leads to spending or to create habit loops that deepen engagement.

Freecash offers a wide range of payouts for completing game challenges, from micro-payouts to substantial rewards for more demanding tasks. Estimated data.

Comparing Earnings Promises to Actual Payouts

Let's do the math on what Freecash actually pays versus what ads claim.

The marketing suggests users can "earn daily" and "cash out instantly." The reality is starkly different. A dedicated user who plays 2 hours daily across multiple games might earn

Let's say you spend one hour daily on Freecash for a month. That's 30 hours of gameplay. Across all accessible challenges, you might accumulate

Compare that to minimum wage in most US states, which ranges from

But the advertising claims aren't modest. They show people allegedly earning "hundreds daily." If you actually did earn

The math behind why these claims exist is interesting. For a tiny fraction of users who spend significant money in the featured games, the platforms do become profitable. Someone who spends

What Happens to Your Data After Download

Downloading Freecash doesn't just expose you to deceptive earnings claims. It initiates a cascade of data collection that continues long after you might stop using the app.

When you install Freecash, you grant it permissions to access your device identifiers, IP address, and potentially your location. These are tracked and shared with Almedia's matching algorithms.

Each game you download comes with its own privacy policy and analytics integrations. Monopoly Go, for example, tracks extensive behavioral data and shares it with its parent company and various third-party vendors. Disney Solitaire does the same. By downloading five games through Freecash, you've exposed your data to dozens of companies.

That data doesn't disappear when you delete the apps. It's been logged on company servers, backed up, and potentially sold to data brokers. If you ever used a credit card to purchase virtual currency, your financial data is now associated with your user profile across multiple systems.

There's also a concerning behavioral angle. Game publishers can now see that you were referred by Freecash. They can infer that you're someone susceptible to reward-based persuasion. That profile is valuable. Years from now, if a new game is released with aggressive monetization, you might be targeted with promotional offers specifically designed to exploit your behavioral history.

Your data becomes an asset in a complex system of retargeting and behavioral targeting that extends far beyond Freecash itself.

Platform Accountability and the Affiliate Marketing Loophole

TikTok's removal of Freecash ads demonstrates that platforms can enforce their policies against deceptive marketing. But it also reveals a fundamental weakness in how social media regulates advertising.

Affiliate marketing creates a gap in accountability. TikTok can remove ads, but if Freecash's business model depends on affiliate commissions, the platform has limited incentive to aggressively police its partners. The affiliates are motivated to generate results quickly. They're not employees subject to company policies. They're independent contractors chasing commissions.

Consumer advocates argue that this structure is fundamentally flawed. If a company profits from misleading advertising, it's responsible for that advertising, regardless of whether it directly created the ads. Yet current FTC enforcement often treats the affiliate and the company as separate entities.

There's also a lag problem. TikTok can remove deceptive ads, but by the time they do, thousands of people have already downloaded Freecash. New affiliate accounts create replacement ads. It's a game of whack-a-mole that platform moderation teams can't win.

The solution, some consumer advocates suggest, is stronger regulation of apps that make earnings claims. Requiring disclosure of actual average earnings, median time investment, and the percentage of users who earn nothing would make apps like Freecash harder to market deceptively. But such regulations don't yet exist on a comprehensive scale.

Alternatives to Freecash That Actually Pay

If you're interested in earning money through apps, there are more legitimate options, each with different tradeoffs.

Survey Apps (Swagbucks, Survey Junkie): These pay

Task Marketplace Apps (Fiverr, Task Rabbit): If you have skills (writing, coding, design, repairs), you can offer services and earn real money based on your work quality. Payouts can range from

Content Creation Platforms (YouTube, TikTok): If you're willing to create original content, these platforms offer ad revenue sharing and sponsorship opportunities. Earnings are highly variable but can be substantial with a large audience.

Cashback Apps (Rakuten, Ibotta): These pay you a percentage back on purchases you were going to make anyway. Earnings are modest (

Gig Work Apps (DoorDash, Uber): These pay per task (delivery, ride) based on time and distance. Earnings depend heavily on your location and the number of tasks you complete, but can range from

None of these are get-rich-quick schemes. But they're transparent about what they pay and what they require. If an app's marketing doesn't match its reality, that's a red flag.

The Bigger Picture: App Ecosystem Deception

Freecash isn't an isolated case. Its success reflects a broader pattern of misleading app marketing that's become normalized in the mobile ecosystem.

Apps that claim extraordinary weight loss results, dating apps that show artificially attractive profiles, gaming apps that promise substantial earnings, productivity apps that overstate time-saving potential, all operate in similar ways. They make exaggerated claims in ads, show selected testimonials that represent rare outcomes, and rely on the fact that many users won't bother to scrutinize the claims.

The mobile app ecosystem is less regulated than other advertising mediums. A TV commercial making false health claims would face regulatory action from the FTC or FDA. A newspaper ad with misrepresentations could result in legal action. But app store ads operate in a gray area where enforcement is inconsistent and slow.

That's changing, slowly. States like California are beginning to regulate how apps can market earnings potential. The FTC has started investigating specific apps for deceptive claims. But the pace of enforcement is glacial compared to the speed of app innovation and marketing evolution.

Freecash's success in early 2025 suggests that the app ecosystem still rewards aggressive marketing regardless of veracity. Companies can spend massive sums promoting exaggerated claims, absorb the modest fines if regulations catch up, and still profit handsomely. For many apps, deceptive marketing is just a cost of doing business.

How to Spot Deceptive App Claims

Protecting yourself against apps like Freecash requires skepticism and an understanding of how to evaluate marketing claims.

Red Flag 1: The Promise Doesn't Match the Mechanics. Freecash claims you can earn money scrolling TikTok. But the app doesn't actually access your TikTok account and doesn't track your TikTok scrolling. If the app's mechanics don't match the advertising claim, that's deception.

Red Flag 2: Testimonials from New Accounts. If the app being promoted by accounts created in the last week or accounts with no other content, those are likely paid promoters or fake accounts.

Red Flag 3: Earnings Claims Without Context. An app claiming you can "earn $100 daily" without explaining the time required, the percentage of users who achieve that, or the conditions attached is making an exaggerated claim. Real apps state average earnings and typical time investment.

Red Flag 4: Upsells Disguised as Normal Features. If using the app requires you to spend money to unlock the promised earnings, that's not an earnings app. That's a spending app dressed up as earning.

Red Flag 5: Vague Privacy Policies. If an app isn't clear about what data it collects and who it shares that data with, assume the worst. You're probably the product being sold to advertisers.

Red Flag 6: Pressure to Act Quickly. "Limited time offer" and "only X spots left" are classic pressure tactics. Legitimate apps don't create artificial scarcity around their service.

If an app exhibits any of these red flags, it's worth moving on to alternatives that operate more transparently.

The Future of Reward App Regulation

As of early 2025, there's no comprehensive federal regulation of how apps can market earnings potential. But trends suggest that's changing.

Several states are considering or have implemented regulations requiring apps that make earnings claims to disclose actual average earnings, the percentage of users earning nothing, and typical time investment. These disclosures would make apps like Freecash much harder to market deceptively.

Social media platforms are also tightening their rules. TikTok, Instagram, and others have strengthened policies against ads making unsupported financial claims. YouTube has similar restrictions. The enforcement is improving, though it's still inconsistent.

The FTC has signaled that it's prioritizing deceptive app marketing. Multiple investigations into apps making false earnings claims have been initiated, and the agency has been more aggressive about enforcement actions.

Long-term, we might see a future where apps are required to clearly state that they don't provide earnings equivalent to wages, that spending money is required to unlock promised rewards, and that substantial data collection occurs. That transparency would fundamentally change the economics of apps like Freecash.

In the meantime, users are their own best defense. Skepticism, research, and reading detailed reviews from users who've spent significant time with the app can reveal reality beneath the marketing.

FAQ

What is Freecash and how does it actually work?

Freecash is a mobile app owned by Berlin-based company Almedia that functions as an advertising platform matching game developers with potential users. Instead of paying users to scroll TikTok as advertised, the app directs users to download mobile games, complete challenges within those games, and earn small rewards. The app profits by taking a commission from in-game spending that the users generate while playing the featured games.

Why are Freecash's marketing claims misleading?

Freecash advertises that users can "earn money scrolling TikTok" and "join thousands earning daily by watching TikTok videos." However, the app doesn't actually access your TikTok account, doesn't reward you for scrolling, and doesn't provide passive income from watching videos. These claims directly contradict how the app actually functions, making the advertising deceptive by definition.

How much money can you actually earn with Freecash?

Most dedicated users earn

Why does Freecash encourage in-app purchases if it pays rewards?

Freecash's actual revenue comes from commissions paid by game publishers when users spend money in their games. The "rewards" users receive are a tiny fraction of that in-game spending. The app is designed to nudge users toward making purchases (through suggested tips, bonus reward offers, and time-limited challenges) because that's when the app becomes profitable. The rewards are incentives to get you to spend, not genuine earnings.

What data does Freecash collect and where does it go?

Freecash collects your device identifiers, IP address, location data, and behavior patterns to match you with games likely to generate in-app spending. Each game you download also collects extensive data through its own analytics systems. This data is shared with advertising networks, data brokers, and potentially sold or used for behavioral targeting. Your data profile becomes an asset that follows you across multiple companies and advertising systems.

How is Freecash able to claim third-party affiliates created deceptive ads?

Freecash operates an affiliate marketing program that pays commissions to anyone who refers new users. The company claims it didn't directly create the false "earn money scrolling TikTok" ads, instead blaming third-party affiliates. However, consumer advocates argue this structure allows the company to profit from deceptive marketing while maintaining plausible deniability about responsibility for those false claims.

Did TikTok actually remove Freecash ads for violating policies?

Yes. After Wired reported on the misleading Freecash ads, TikTok confirmed the ads violated its policies against "scamming individuals out of money" and "financial misrepresentation," and removed them. However, new affiliate-created ads promoting Freecash continued appearing in feeds shortly after, suggesting the removal was a temporary setback rather than a comprehensive solution.

What are legitimate alternatives to Freecash for earning money?

Legitimate earning apps include survey platforms (Swagbucks, Survey Junkie) paying

What red flags indicate an app is making deceptive earnings claims?

Red flags include claims that don't match the app's mechanics (promising TikTok scrolling rewards when the app doesn't access TikTok), testimonials from brand-new accounts, earnings claims without time context or percentage of users achieving them, features that require spending money to unlock rewards, vague privacy policies, and high-pressure tactics like "limited time offers." Apps making legitimate earnings claims are typically transparent about all of these factors.

Is there government regulation protecting consumers from apps like Freecash?

As of 2025, federal regulation is limited, though evolving. Several states are implementing rules requiring earnings claims to be accompanied by average earnings disclosures and percentage-of-users data. The FTC has been more aggressive about investigating deceptive app marketing, and social media platforms have strengthened policies against financial misrepresentation. However, enforcement remains inconsistent, and companies often use affiliate structures to sidestep accountability.

Why did Freecash become so popular so quickly in 2025?

Freecash benefited from aggressive affiliate marketing on TikTok that made exaggerated claims about earnings potential. The platform's matchmaking algorithm between games and users created a seamless experience for downloading multiple games quickly. The combination of misleading advertising, design patterns that create habit loops, and the broad appeal of earning extra money created rapid adoption. TikTok's algorithm amplified the promotional content, further accelerating growth despite the misleading claims.

Key Takeaways

- Freecash claims users can earn money scrolling TikTok, but actually directs users to download games and make in-app purchases instead

- The app's business model profits from in-game spending, not user earnings, creating a fundamental incentive mismatch with what's advertised

- Users typically earn 2 per hour (85%+ less than minimum wage) despite marketing claims of substantial daily income

- Freecash uses affiliate marketing to create distance from deceptive ads while still profiting from the misleading claims

- Downloading games through the app exposes users to extensive data collection shared with multiple third-party analytics and advertising firms

- The app employs dark design patterns like habit-forming notifications, bonus offers for purchases, and time-limited challenges to nudge spending

- TikTok removed deceptive Freecash ads but similar content continues appearing through new affiliate accounts created specifically for promotion

- Legitimate earning alternatives like survey apps and task marketplaces are transparent about earnings and don't require spending money

Related Articles

- TikTok's US Deal Finalized: What the ByteDance Divestment Means [2025]

- Smart Device End-of-Life Disclosure: Why Laws Matter [2025]

- ICE Agents Doxing Themselves on LinkedIn: Privacy Crisis [2025]

- Under Armour Cyberattack 2025: What 7M Users Need to Know [Guide]

- Why We're Nostalgic for 2016: The Internet Before AI Slop [2025]

- FTC Meta Monopoly Appeal: What's Really at Stake [2025]

![Freecash App: How Misleading Marketing Dupes Users [2025]](https://tryrunable.com/blog/freecash-app-how-misleading-marketing-dupes-users-2025/image-1-1769172116516.jpg)