SEC Drops Gemini Lawsuit: What It Means for Crypto Regulation [2025]

Last week, something quietly happened that signals a major shift in how the federal government treats cryptocurrency. The Securities and Exchange Commission filed to dismiss its lawsuit against Gemini, the crypto exchange founded by Cameron and Tyler Winklevoss. This isn't just a legal footnote. It's a watershed moment that tells us something profound about regulation, power, and the crypto industry's place in American business right now.

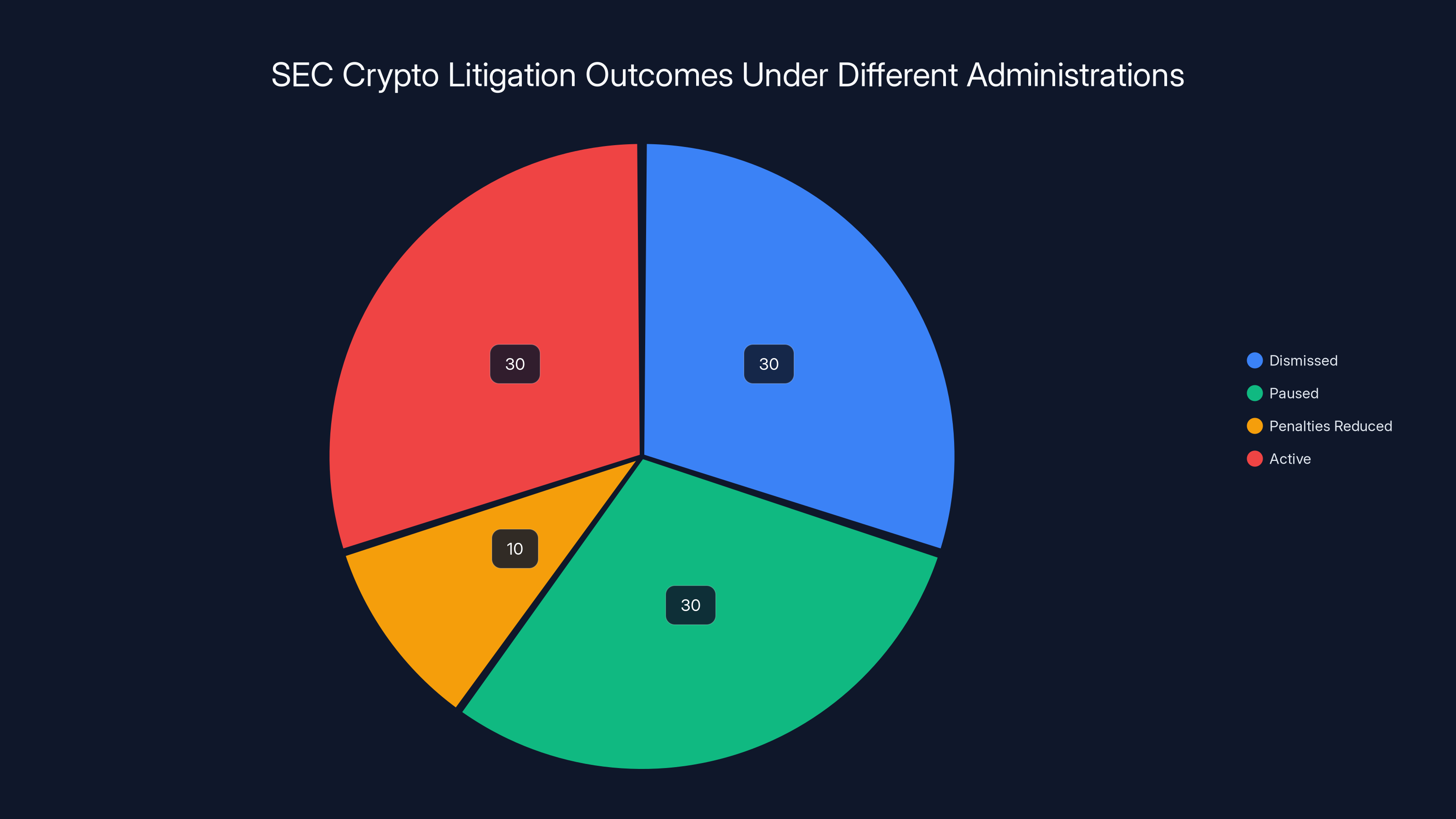

I'll be honest with you straight up: the timing matters here. The Winklevoss twins backed Donald Trump's re-election campaign and his family business ventures. The SEC's move comes just months after Trump took office, when his administration has been noticeably gentler on crypto than its predecessor. In fact, the New York Times reported that the SEC has either dismissed, paused, or reduced penalties in over 60% of crypto lawsuits that were pending when Trump came into office. That's not coincidence. That's a pattern.

But here's the deeper story. The SEC's lawsuit centered on the collapse of Gemini Earn, an investment product that locked customers out of their crypto for 18 months. Some people lost access to hundreds of thousands of dollars. This wasn't a victimless disagreement about regulatory interpretation. Real people got hurt. And yet, the case is now gone.

What actually happened is that New York Attorney General Letitia James reached a settlement with Gemini in 2024, requiring the exchange to return 100% of the crypto assets that customers had loaned through the Earn program. That settlement apparently satisfied the SEC enough to walk away. But the question that should matter to you is simple: does settling a customer restitution case mean the regulatory violations just disappear? Should they?

This article breaks down what the SEC's dismissal actually means. We'll look at why the Earn product failed in the first place, how regulatory enforcement is changing under the new administration, what this signals about the crypto industry's relationship with government, and whether this is good news or a cautionary tale. By the end, you'll understand not just what happened, but why it matters for every investor, every crypto company, and everyone watching to see whether crypto regulation in America is broken, being rewritten, or finally getting its act together.

TL; DR

- SEC dropped its lawsuit against Gemini after the company reached a settlement with New York that returned all customer funds from the failed Earn program

- Political connections matter: The Winklevoss twins backed Trump's campaign, and the administration has reduced penalties in over 60% of pending crypto cases

- Gemini Earn collapsed when lenders refused to fund the program, locking customers out of their crypto for 18 months without clear communication

- Regulatory pattern shifting: The SEC's dismissal reflects a broader trend toward leniency on crypto enforcement, raising questions about the consistency and strength of consumer protections

- Bottom line: This case shows how settlement agreements can close federal cases even when underlying conduct raised serious questions about investor protection

This timeline illustrates the progression of key events related to Gemini Earn, from its launch to the resolution of legal actions. Estimated data.

What Actually Happened to Gemini Earn

To understand why the SEC's dismissal matters, you need to know what Gemini Earn was and why it spectacularly failed.

Gemini Earn was supposed to be simple: you deposit your crypto with Gemini, they lend it out to borrowers, and you earn yield on your deposit. It sounds like putting money in a savings account. You get returns. Gemini makes money on the spread. Everyone wins. Except it didn't work that way.

The program launched and grew fast. People trusted the Winklevoss twins' brand and the promise of passive income from their dormant crypto holdings. Plenty of people had been holding Bitcoin or Ethereum that wasn't being used for anything. Earn offered a way to make that idle capital work. It was genuinely attractive.

But here's what went wrong: the underlying mechanics were fragile. Gemini needed borrowers who wanted to take loans against crypto collateral. As long as those borrowers existed and were profitable for Gemini, the yield payments kept flowing. But the crypto market is volatile and unpredictable. When conditions shifted, those borrowers disappeared.

Specifically, when the crypto market softened and institutional demand for leveraged positions declined, Gemini's lenders stopped being willing to fund the program. The company couldn't keep the product running because the economic model broke. And instead of transparently telling customers what was happening and offering clear exits, Gemini essentially froze the program. Users couldn't withdraw their crypto. For months. Then for over a year. Then for 18 months.

During that time, customers didn't know if they'd ever see their money again. Some people had tens of thousands of dollars locked up. Some had much more. The communication was vague. The timeline kept changing. And Gemini wasn't offering any compensation for the extended lockup. It was a disaster for customer confidence and a textbook example of why crypto financial products need oversight.

That's what triggered the New York Attorney General's lawsuit in 2023. James accused Gemini of defrauding investors by misrepresenting the safety and accessibility of the Earn product. She wasn't wrong. The product did fail. Customers were harmed. The company did mislead users about what would happen if lenders pulled funding.

What makes the New York settlement interesting is that it required full restitution. Every customer got back 100% of their crypto assets. That's actually notable. Gemini could have fought the case, tried to settle for less, or filed bankruptcy. Instead, they paid up. By late 2024, the case was done. Customers were whole. And the SEC, seeing that the state had already enforced the case and customers were already made whole, decided there was nothing left for federal prosecutors to do.

The SEC's logic was straightforward: the harm has been remedied. The state already won. Time to move on. But what got lost in that calculation is whether the underlying conduct that led to the fraud should still matter at the federal level.

The SEC's approach to crypto enforcement shifted significantly, with over 60% of cases being dismissed, paused, or having penalties reduced under the new administration. Estimated data.

The Regulatory Flip: How Crypto Enforcement Changed Overnight

To understand why the SEC's dismissal is significant, you need to know how different this approach is from what we saw just 12 months ago.

Under the Biden administration, the SEC and the broader crypto enforcement apparatus were actively aggressive. Gary Gensler, who led the SEC for the last few years of Biden's term, viewed crypto as an existential regulatory problem. The agency sued Binance. It sued Coinbase. It sued the Winklevoss twins themselves, claiming Gemini was operating without proper registration. It went after lending platforms, staking services, and token launches. The argument was that most crypto products were unregistered securities offerings that should be shut down or heavily regulated.

That approach was controversial within the crypto industry and even among some legal experts who argued that Gensler's interpretation of securities law was too broad. But the intensity was undeniable. The SEC was writing new rules in litigation and pushing boundaries. Whether you agreed with that approach or not, it was clearly an aggressive enforcement posture.

Then Trump took office. One of his first moves was to replace Gensler with a new SEC chair who has a more accommodating view toward crypto. Suddenly, the litigation pressure eased. Cases that were moving forward started stalling. Settlements that looked like they were heading in one direction got renegotiated. And dismissals like Gemini's became common.

The New York Times analysis found that across the SEC's pending crypto litigation, more than 60% of cases have been either dismissed, paused, or had penalties reduced. That's not a random fluctuation. That's a systematic change in enforcement priorities.

Now, there are legitimate arguments on both sides of this shift. One perspective is that the previous administration overstepped its authority. Securities law was written decades before crypto existed. Using that law to prosecute crypto products might have been a stretch. From this view, the new administration's willingness to back off means regulators will actually work with Congress to write clear crypto rules instead of using litigation as a blunt instrument. That's not crazy. Congress probably should write clearer rules.

The other perspective is that this is regulatory capture dressed up as pragmatism. From this view, the crypto industry's political contributions and lobbying have bought them relief from oversight. Customers got their money back in the Gemini case because of the state-level enforcement, not because of the SEC's threat. But if the SEC drops cases, companies lose incentive to treat customer funds with care. Enforcement matters. And if enforcement disappears, fraud proliferates.

The truth is probably somewhere in the middle, but it's worth being clear about what's actually happening: the regulatory environment for crypto is radically different today than it was 18 months ago, and that difference is happening through enforcement decisions, not legislative action. Congress hasn't changed the rules. The SEC has just stopped enforcing them the same way.

Why Political Connections Matter in Crypto Regulation

Let's talk about the elephant in the room: the Winklevoss twins' relationship with Trump.

This isn't a conspiracy theory. This is public fact. Cameron and Tyler Winklevoss donated to Trump's re-election campaign. They've been involved with his business ventures. Their proximity to power is documented and undisputed. And when the SEC suddenly drops a case against their company, it's reasonable to ask whether those connections mattered.

I want to be careful here because correlation isn't causation. The SEC might have dropped the case for purely legal reasons. The fact that customers were made whole by the state settlement is a legitimate basis for federal prosecutors to decide there's nothing left to do. The company might argue they did the right thing by paying customers back, and therefore deserved leniency. These aren't crazy arguments.

But here's what we can say for certain: the crypto industry has successfully made itself a political issue. It's organized. It has money. It has donors. It has lobbying resources. And politicians, including the current administration, view crypto as politically valuable. That political value translates into regulatory leniency. You don't need a smoking gun email to see that happening. The pattern is visible in the data. The timing is suspicious. And the outcomes favor crypto companies and their connected founders.

The Winklevoss twins are an interesting case study here because they're exactly the kind of founders who benefit from this environment. They're wealthy. They're well-connected. They have access to political networks. They can hire the best lawyers. And when enforcement comes, they have the resources to fight back or negotiate from a position of strength. That's very different from the experience of small traders or retail customers who got locked out of Gemini Earn.

This dynamic matters because it suggests that in crypto regulation, your political access might matter as much as your legal merits. That's not how regulation is supposed to work. But it's how it appears to be working right now.

Gemini Earn faced declining operational status due to market volatility and borrower disappearance, leading to a freeze in customer withdrawals. Estimated data based on narrative.

The Collapse of Crypto Lending Platforms: A Broader Context

Gemini Earn didn't exist in isolation. It was part of a broader crypto lending boom that spectacularly failed and took customer money down with it.

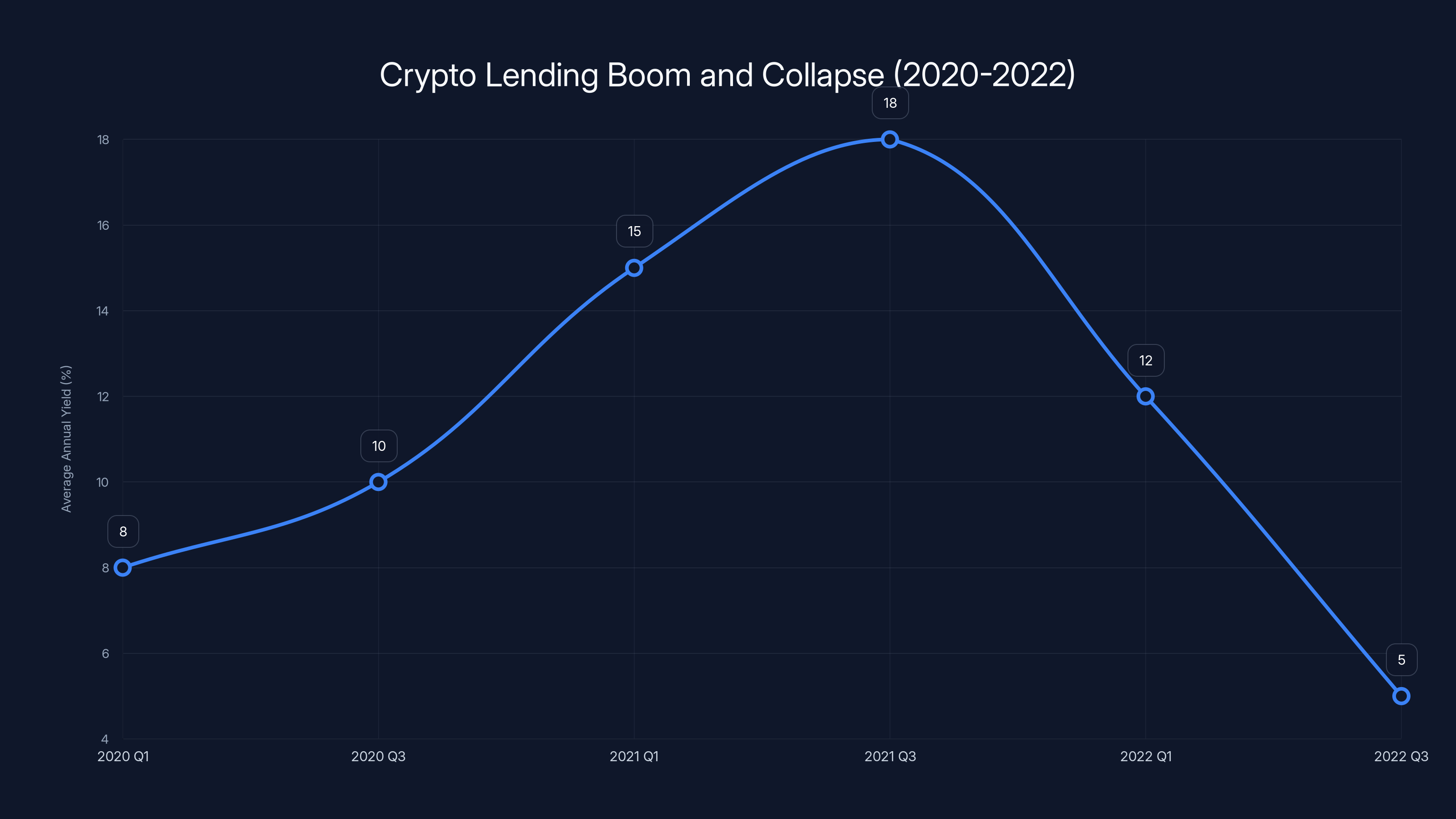

From roughly 2020 to 2022, crypto lending was one of the hottest sectors in the industry. Companies like Block Fi, Celsius, and Voyager Digital offered yields that were almost absurd. You could earn 8%, 10%, even 20% annually on your crypto holdings. That was wildly attractive in an environment where traditional savings accounts paid almost nothing. Retail investors piled in. They deposited Bitcoin, Ethereum, and stablecoins. The companies took those deposits, lent them out, and supposedly paid yields from the interest earned on those loans.

But the business model was broken from the start. Those crazy yields couldn't be sustained. The companies were paying out more than they were earning. They were essentially running Ponzi-like schemes, using new customer deposits to pay old customers' yield. When the market turned and customer deposits stopped growing, the whole thing collapsed.

When it did, billions of dollars in customer crypto disappeared. Celsius bankruptcy proceedings are still ongoing. Block Fi's customers lost money. Voyager had to liquidate. And millions of ordinary people learned the hard way that crypto lending platforms aren't like bank savings accounts. They have no FDIC insurance. They have no federal backstop. When they fail, you lose.

Gemini Earn was different in structure but similar in outcome. It wasn't technically a Ponzi scheme. It was a real product with real borrowers. But when the borrowers disappeared, the yield evaporated and customers got locked out. The end result was the same: people lost access to their money for extended periods, and the company had to be forced by regulators to make them whole.

What's striking about this history is that many of these companies saw crypto lending as a way to differentiate themselves and offer customer value. Gemini, Celsius, Block Fi, and others were all trying to do the same thing: give retail users a way to earn passive income. The problem is that they all misjudged the sustainability of their models. They all underestimated the risks. And they all locked customer money in products that couldn't deliver what was promised.

Regulation matters precisely because of this history. If these companies had been subject to strict risk limits, stress testing, and capital reserves like traditional financial institutions, many of these blowups could have been prevented. But crypto operates in a different regulatory universe. And when things go wrong, customers suffer.

The fact that Gemini's customers ultimately got their money back is actually good. But it's good because of New York enforcement, not because the market worked. That's an important distinction.

What the Settlement Actually Required Gemini to Do

When the New York Attorney General reached a settlement with Gemini in 2024, it wasn't just about returning customer crypto. There were real operational requirements that the company had to meet.

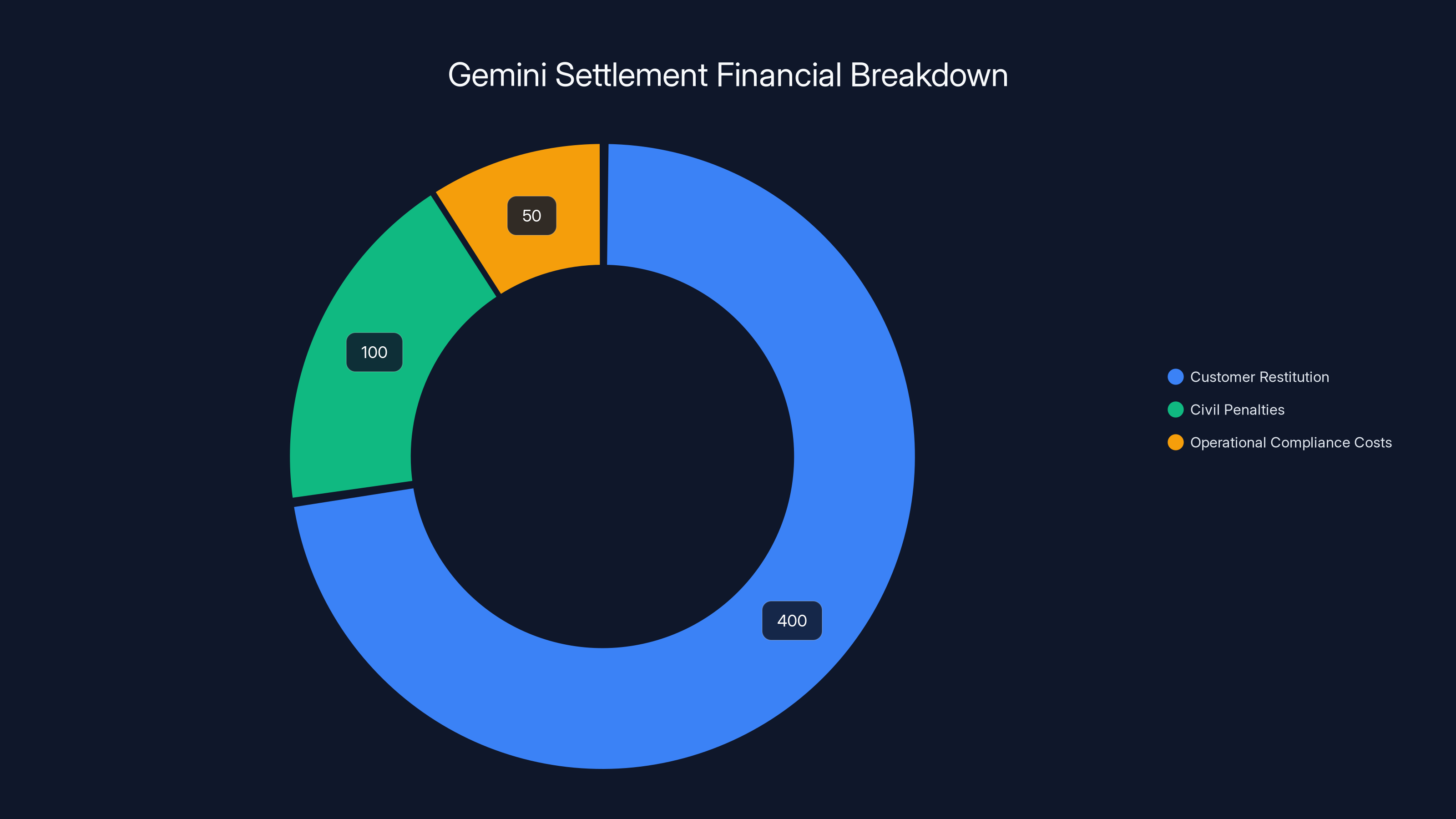

First and most important was the restitution itself. Gemini had to return 100% of the crypto assets that customers had deposited in the Earn program. That's a significant financial obligation. Some reports suggested it was in the hundreds of millions of dollars. Gemini paid it. That matters because it shows that even a well-funded, politically connected company can still be forced to make customers whole when regulators push hard enough.

Second, the settlement included operational restrictions and oversight measures. Gemini has to implement specific compliance protocols around new product launches. The company has to get regulatory approval before offering similar yield-bearing products. There are monitoring requirements and reporting obligations. In other words, the state didn't just take money. It changed how Gemini does business.

Third, the settlement included civil penalties. Gemini paid money to New York as a financial penalty for the violations. Those penalties go to the state, not to customers. But they're significant enough that they create real financial consequences for the company's conduct. When executives and board members see a half-billion-dollar settlement hit their balance sheet, it changes the calculus on future compliance decisions.

What the settlement didn't do is prevent Gemini from continuing to operate. The company is still running as a crypto exchange. The Winklevoss twins are still in charge. The business is still functioning. The settlement modified the company's behavior without destroying it.

That's actually the regulatory equilibrium that you want. Penalties should be strong enough that companies take compliance seriously. But they shouldn't destroy the company or put innocent employees out of work. The New York settlement appears to hit that balance reasonably well.

The question is whether the SEC's subsequent dismissal undermines that balance. If Gemini knows that federal regulators won't follow up on state enforcement, the incentive to comply with those state-level restrictions weakens. The company might lobby to overturn the state requirements. It might drag its feet on implementation. It might interpret the requirements narrowly. Without federal backup, state enforcement can be easier to work around.

Estimated data shows that over 60% of crypto lawsuits were either dismissed, paused, or had reduced penalties under Trump's administration, indicating a significant shift in regulatory approach.

The SEC's Reasoning: Why the Agency Dropped the Case

The SEC's formal reason for dropping the Gemini lawsuit is clear from the joint filing with the company: the underlying harm has been remedied through the state settlement, and there's nothing left for federal prosecutors to accomplish.

That's a legitimate legal argument. Here's the reasoning: the SEC's lawsuit was focused on protecting consumers from fraud and misconduct. New York's enforcement action already did that. Customers got their money back. The company paid penalties. Operational changes were imposed. From a legal standpoint, you could argue that the federal government would just be piling on, pursuing redundant enforcement against a company that's already been sanctioned.

There's precedent for this approach. When state and federal authorities are investigating the same conduct, there's a tradition of coordinating to avoid duplication. If the state goes first and achieves meaningful enforcement outcomes, the feds sometimes step back. It's not illegal. It's not necessarily wrong. It's just deference to state authority and recognition that the goal (protecting consumers and punishing misconduct) has already been achieved.

But there's a counterargument worth considering. Federal law and state law aren't the same. The SEC's lawsuit was grounded in federal securities law, specifically around the registration and regulation of investment products. New York's lawsuit was grounded in consumer protection and fraud law. These are overlapping but distinct legal theories. You could argue that dismissing the federal case means the federal violations simply disappear from the record, even though they occurred.

Moreover, dismissals send signals. When companies see that federal regulators step back once state enforcement happens, they learn that they can potentially negotiate with states knowing that federal pressure will ultimately ease. That changes the negotiating dynamics. A company facing both state and federal enforcement is in a much weaker position than one facing just state enforcement. If the company knows the feds will step back once the state settles, the company has more negotiating leverage with the state.

The SEC's approach also raises a broader question about regulatory consistency. If the SEC drops cases against well-connected companies while pursuing cases against smaller or less politically influential crypto businesses, that's a form of inequitable enforcement. Justice should be blind to political connections. Regulatory enforcement should be consistent regardless of who funds whose campaign.

How This Compares to Enforcement Against Other Crypto Companies

The Gemini dismissal doesn't exist in a vacuum. It's part of a broader pattern of how the new administration is handling crypto enforcement.

Consider what happened with Coinbase. Under the previous administration, the SEC was actively litigating against Coinbase over staking and lending products. Those cases were moving forward. But after the political transition, Coinbase reached a settlement with regulators that was much more favorable than early indications suggested was likely. The company agreed to restrict certain products, but the federal enforcement pressure eased.

Or look at Binance. The company faced massive enforcement pressure from federal prosecutors and regulators. But in the new regulatory environment, that pressure has eased. Cases are being paused. Settlement discussions that were going nowhere suddenly have new momentum.

And then there's the broader category of crypto lending platforms. The SEC and other agencies could have pursued systematic enforcement against every platform that offered yield products that weren't properly registered. But enforcement has been selective and now appears to be winding down.

The pattern suggests that what changed isn't the law or the underlying conduct. It's the political will to enforce. And that political will is clearly conditional on your political connections.

Coinbase's CEO, Brian Armstrong, has been very public about supporting crypto-friendly policies and politicians. Binance, while controversial, still has resources and political reach. Gemini, founded by the Winklevoss twins, has direct access to the current administration through campaign donations and personal relationships. These companies are getting leniency. Smaller, less well-connected crypto companies don't have the same advantage.

That's not how regulation should work. Regulatory agencies should be independent and consistent. They shouldn't favor well-connected companies over others. But that's not what's happening in crypto regulation right now.

The chart illustrates the rise and fall of average annual yields offered by crypto lending platforms from 2020 to 2022. Yields peaked in 2021 before collapsing in 2022 as the market conditions worsened. (Estimated data)

What This Means for Consumer Protection and Crypto Safety

Here's the question that matters most: does the SEC's dismissal of the Gemini case make crypto safer or less safe for regular people?

The honest answer is that it's probably bad for consumer protection in the long run, even if customers made out okay in the Gemini situation specifically.

Remember that Gemini Earn customers only got their money back because of the state settlement. Without that enforcement action, there's a real possibility Gemini would have tried to negotiate smaller restitution or drag out the process indefinitely. The state-level pressure forced the company to do the right thing. But that kind of pressure works better when companies know that federal authorities are also watching and willing to act.

When federal enforcement disappears, companies know that state-level regulators can only go so far. They can sue in New York or California or Texas, but they can't shut down a company's federal operations or impose federal penalties. The leverage shifts in favor of the companies.

Moreover, the dismissal sends a message to other crypto companies: if you get in trouble, you can negotiate with the states and expect federal enforcement to eventually back off. That reduces the overall deterrent effect of regulation. Companies take less care preventing fraud if they know the consequences won't include federal action.

There's also the question of what counts as adequate consumer protection. In traditional finance, companies operating at Gemini's scale and handling customer funds at that magnitude would be subject to strict federal oversight. They'd have regulatory examiners. They'd be required to hold certain amounts of capital in reserve. They'd face stress testing. There would be continuous federal supervision.

Gemini operates with almost none of that. And under the current regulatory approach, that's unlikely to change. The company will continue handling billions of dollars in customer crypto with minimal federal oversight. That's not safe. It's a recipe for the next Gemini Earn-type disaster.

The crypto industry will argue that this lighter regulatory touch is actually better for innovation and consumer choice. And there's something to that. Overregulation can stifle new products and business models. If the SEC had been able to completely ban yield products, Gemini Earn never would have existed. Customers never would have had that option. Some would argue that's bad because it limits choices, even if some choices end badly.

But the question isn't whether regulation should exist. It's what kind of regulation protects consumers while allowing legitimate innovation. The current approach in crypto is too light. Companies are taking risks with customer funds without adequate safeguards. That's not consumer protection. That's just hoping things work out until they don't.

Gemini's Path Forward: IPO and Expansion

One last thing worth noting: the SEC's dismissal clears a major hurdle for Gemini's plans to go public.

The company filed to go public in recent months, which means it would need to produce financial statements, risk disclosures, and regulatory compliance documentation. An ongoing federal lawsuit would complicate that process significantly. Investors want clean cap tables and clear regulatory status. A lawsuit would create uncertainty.

With the lawsuit dismissed, Gemini's path to IPO becomes cleaner. The company can go to public markets without that legal overhang. It can market itself as a compliant, regulated exchange. The stock offering could be attractive to mainstream investors who were previously wary of crypto. That's probably good for Gemini's shareholders, including the Winklevoss twins. It's probably good for crypto adoption if a well-known exchange can access public capital markets. But it raises another question: should a company that just settled a massive consumer protection violation be able to go public in the near term?

In traditional finance, you'd expect some period of probation. After a company pays millions in settlements for consumer fraud, regulators keep a close eye before approving anything else. But in crypto, the settlement is already happening and the path forward is already clear. Regulatory consistency matters. And crypto doesn't have it.

Estimated data shows the majority of Gemini's financial obligations were towards customer restitution, highlighting the settlement's focus on making customers whole.

The Bigger Shift: Crypto Regulation Under New Administration

The Gemini case is one data point in a much larger trend. The entire relationship between crypto and federal regulation is shifting.

We're seeing movement toward crypto-friendly appointments in key regulatory positions. We're seeing new executive orders designed to streamline crypto regulation rather than restrict it. We're seeing signals that the administration might support crypto industry requests, including a possible federal crypto banking framework that would let crypto companies operate with less regulatory burden than banks currently face.

Some of this is probably good. The previous regulatory regime was antagonistic toward crypto. It was probably too strict in some areas. A more balanced approach could encourage legitimate innovation while still protecting consumers. That would be an improvement.

But "more balanced" shouldn't mean "lighter enforcement." It should mean enforcement that's consistent, predictable, and applied equally regardless of political connections. Right now, we're not seeing that. We're seeing selective enforcement that favors connected companies. That's not balance. That's capture.

The danger is that we end up with a crypto regulatory regime that's lighter than traditional finance but not actually protective of consumers. You could have a system where crypto companies have fewer restrictions than banks but also have less oversight and less safety. That's a bad outcome for retail users.

We need crypto regulation that's clear, consistent, and user-protective. We probably don't need crypto regulation that's as strict as the previous administration was pushing. But we definitely don't need what we're getting now, which is selective leniency based on political connections.

Key Takeaways and What Comes Next

Let's zoom out and think about what we've learned.

The SEC's dismissal of the Gemini lawsuit represents a fundamental shift in how federal regulators are approaching crypto enforcement. Where there was pressure, there's now leniency. Where there were lawsuits, there's now accommodation. That shift is driven partly by political change, partly by legitimate questions about whether the previous approach overstepped, and partly by crypto industry political influence.

Gemini Earn was a real product failure that caused real harm to real customers. The fact that customers were ultimately made whole is good. But it happened because of state-level enforcement, not because federal regulators were successfully pursuing the case. Federal dismissal doesn't erase the underlying problems. It just means those problems won't be addressed at the federal level.

The pattern across the crypto industry is clear: well-connected companies are getting lighter enforcement. Smaller or less connected companies don't have the same advantages. That inequity is corrosive to the long-term health of crypto as an asset class. If people believe the system is rigged, they won't trust it. And if they don't trust it, adoption stalls.

Moving forward, watch for three things. First, see whether Gemini actually implements the operational changes required by the New York settlement or whether the company interprets them narrowly. Second, watch whether other state attorneys general continue to pursue crypto enforcement or whether they also step back in the face of federal leniency. Third, watch whether Congress actually writes clear crypto rules or whether we continue operating in this ambiguous space where enforcement is the only rule-setting mechanism.

Crypto regulation needs to mature. That means clear laws, consistent enforcement, and protection for consumers without unnecessary restrictions on innovation. The Gemini dismissal moves us in the wrong direction on the enforcement consistency piece. Until that gets fixed, crypto will remain a space where political connections matter more than legal merits.

FAQ

What was Gemini Earn and why did it fail?

Gemini Earn was an investment product that allowed customers to deposit their cryptocurrency with Gemini, which would then lend it out to borrowers and pay customers yield on their deposits. The product failed because Gemini's business model depended on a steady supply of borrowers willing to take loans against crypto collateral. When market conditions shifted and those borrowers disappeared, Gemini couldn't sustain the product. The company froze the program and locked customers out of their funds for over 18 months, which triggered enforcement action from the New York Attorney General and led to the SEC lawsuit.

Why did the SEC drop its lawsuit against Gemini?

The SEC dropped its lawsuit because New York reached a settlement with Gemini that required the company to return 100% of customer crypto assets, pay penalties, and implement operational changes. The federal agency concluded that the underlying harm had been remedied through state enforcement and that pursuing a separate federal case would be redundant. The SEC's reasoning was that once customers were made whole and the company paid penalties, there was no additional consumer protection benefit to continuing federal litigation.

What did Gemini have to do to settle with New York?

Gemini's settlement with New York required the company to return all customer crypto assets from the Earn program, pay substantial civil penalties to the state, and implement compliance protocols for future product launches. The company now needs regulatory approval before offering similar yield-bearing products and must meet specific monitoring and reporting obligations. These operational restrictions are designed to prevent similar product failures from occurring in the future.

How is crypto regulation changing under the new administration?

The SEC and other federal regulators have adopted a more accommodating stance toward crypto companies. The New York Times reported that over 60% of pending crypto litigation has been either dismissed, paused, or had penalties reduced. This represents a significant shift from the previous administration's approach, which was more aggressive in enforcement. The pattern suggests the new administration is prioritizing working with Congress to write clear crypto rules rather than using litigation to regulate the industry.

Why does it matter that the Winklevoss twins backed Trump?

The Winklevoss twins' political donations and business relationships with the Trump administration create a perception that their company received favorable treatment through regulatory leniency. While correlation doesn't prove causation, the pattern of more favorable treatment for politically connected crypto companies versus less connected ones raises concerns about whether regulatory enforcement is being applied consistently and equitably. Regulatory agencies should operate independently regardless of which politicians companies support.

Is it good or bad for crypto consumers that enforcement is lighter?

There are arguments on both sides. Lighter enforcement could encourage innovation and reduce unnecessary regulatory burdens that stifled crypto development. However, it may also reduce consumer protection by giving companies less incentive to implement strong safeguards and compliance procedures. The ideal approach would be clear rules and consistent enforcement that protects consumers while allowing legitimate innovation, rather than selective leniency based on political connections.

Could the Gemini Earn collapse have been prevented with stronger regulation?

Probably yes. If Gemini had been subject to the kind of federal oversight that traditional financial institutions face, including capital reserve requirements, stress testing, and continuous regulatory examination, the company would likely have either avoided launching Earn with an unsustainable business model or would have been forced to shut it down before customer funds were locked up for 18 months. Strong regulation doesn't prevent all failures, but it can prevent foreseeable ones that result from companies taking excessive risks with customer assets.

What does Gemini's planned IPO mean for crypto regulation?

Gemini's planned initial public offering suggests the company believes regulatory uncertainty has been resolved and that investors will be comfortable with its compliance posture going forward. A successful IPO would give Gemini access to public capital markets and mainstream investor confidence. However, the proximity of the IPO to settlement of major enforcement actions raises questions about whether enough time has passed to demonstrate sustained compliance or whether public investors are getting adequate information about the company's regulatory history.

What should retail crypto investors learn from Gemini Earn?

The key lesson is that yield-bearing crypto products are risky and should be approached with extreme caution. When a platform offers returns that seem unusually high (like the 8-20% yields offered by various lending platforms), that's a warning sign that the business model may not be sustainable. Before depositing crypto with any lending platform, check the company's regulatory history, read independent audits of their loan books, and understand exactly how they're generating returns. If you can't clearly understand how the platform makes money, it's probably too risky.

The Crypto Regulation Landscape is Shifting, But Not Toward Clarity

What we're watching play out with Gemini is a fascinating and troubling moment in crypto's relationship with American government. For years, crypto operated in a regulatory vacuum. Then the previous administration tried to aggressively regulate crypto through enforcement actions. Now we're in a third phase where federal enforcement is easing but clear rules still don't exist.

That's an unstable equilibrium. Companies don't want vague regulation because it creates uncertainty. Consumers don't want weak regulation because it creates risk. Regulators shouldn't want selective enforcement because it creates the appearance of capture.

What we need is Congress to actually write clear crypto rules. Define what is and isn't a security. Set up proper regulatory frameworks for exchanges, lending platforms, and custodians. Establish consumer protections. Create a path to compliance for legitimate businesses. That's hard work and it requires Congress to actually engage with the technical details of crypto. But it's the only way out of this cycle.

Until that happens, cases like Gemini will continue to define crypto regulation. And cases defined by enforcement actions are cases defined by power, connections, and politics. That's not a regulatory system. That's just chaos with consequences.

For retail users and investors, the lesson is clear: crypto remains a high-risk space where regulatory protections are minimal and political connections matter. Proceed carefully, diversify heavily, and never risk money you can't afford to lose on any single crypto asset or platform. The government isn't consistently protecting you. You have to protect yourself.

Related Articles

- Trump Mobile FTC Investigation: False Advertising Claims & Political Pressure [2025]

- NYSE's 24/7 Tokenized Trading Platform: The Future of Markets [2025]

- The 3 Biggest Lies Robot Vacuum Brands Are Telling You [2025]

- Freecash App: How Misleading Marketing Dupes Users [2025]

- Smart Device End-of-Life Disclosure: Why Laws Matter [2025]

- FCC Equal-Time Rule & Late-Night Talk Shows Explained [2025]

![SEC Drops Gemini Lawsuit: What It Means for Crypto Regulation [2025]](https://tryrunable.com/blog/sec-drops-gemini-lawsuit-what-it-means-for-crypto-regulation/image-1-1769279760555.jpg)