Amazon's 16,000 Layoffs: What It Means for Tech Workers [2025]

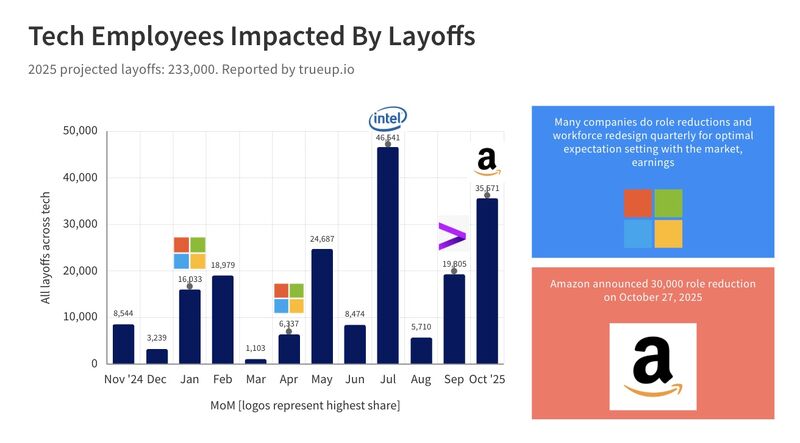

Amazon just announced it's cutting 16,000 jobs. That's not a typo. Sixteen thousand people are losing their positions across the company's various divisions.

But here's the thing that matters: this isn't random. It's not a panicked reaction to market conditions. This is a calculated, strategic move by Amazon to flatten its organizational structure and make room for AI.

In January 2025, Amazon's Senior Vice President Beth Galetti confirmed the layoffs in a company announcement. The news leaked earlier when an internal email labeled "Project Dawn" was accidentally sent to workers. The email, seen by Bloomberg and the BBC, revealed that employees from the US, Canada, and Costa Rica had already been notified.

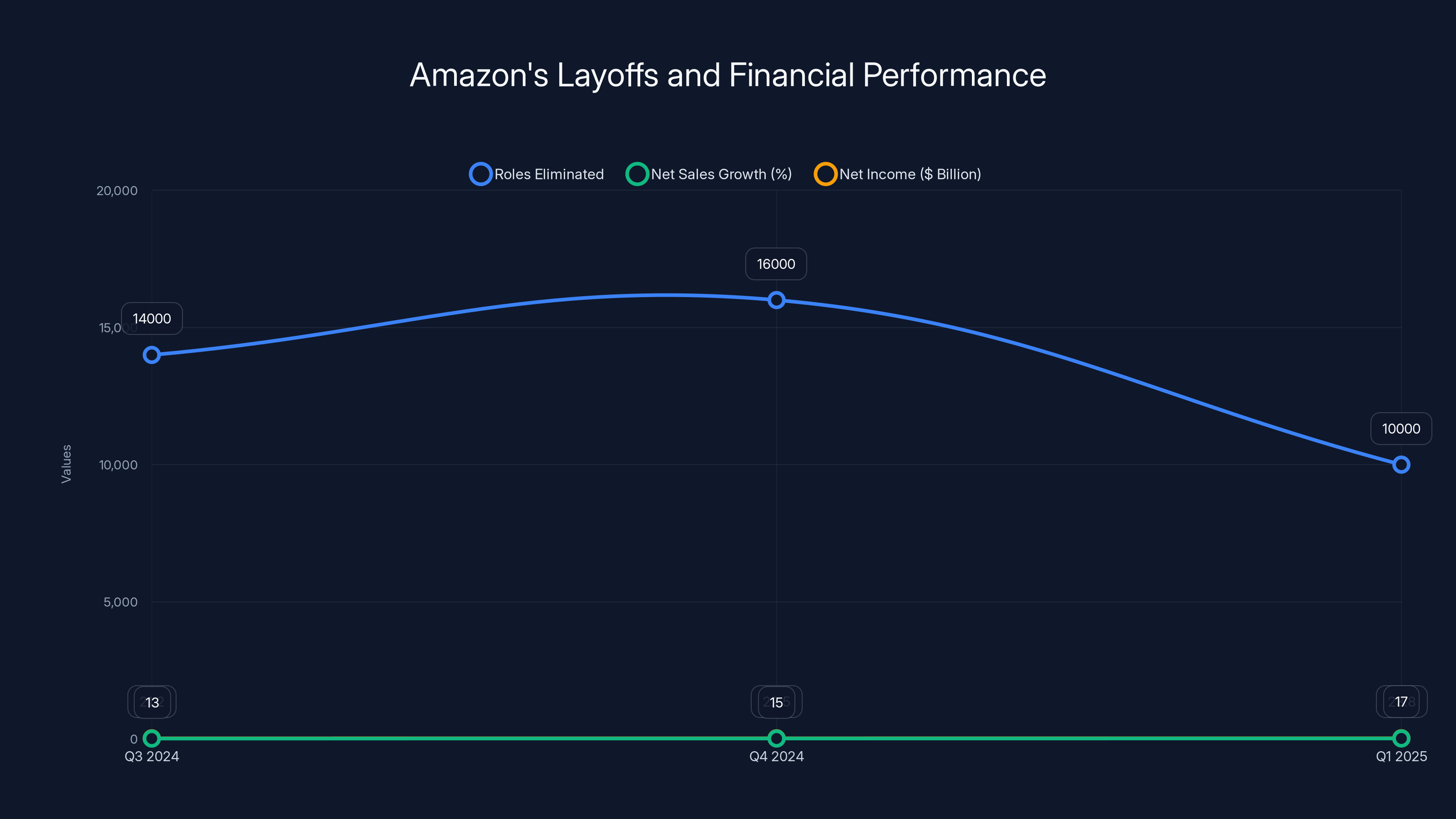

This is the second major workforce reduction in as many months. Back in October 2024, Amazon eliminated 14,000 roles. Add them together, and we're looking at 30,000 people out of work as part of what was originally planned as a broader restructuring initiative.

So why should you care? Because what Amazon does today, the rest of tech follows tomorrow. These layoffs tell us something crucial about where the tech industry is heading, how companies view AI's transformative power, and what the labor market will look like for the next decade.

Let's dig into what's actually happening here, why it matters, and what it means for anyone working in technology.

The Scope and Scale of Amazon's Workforce Reduction

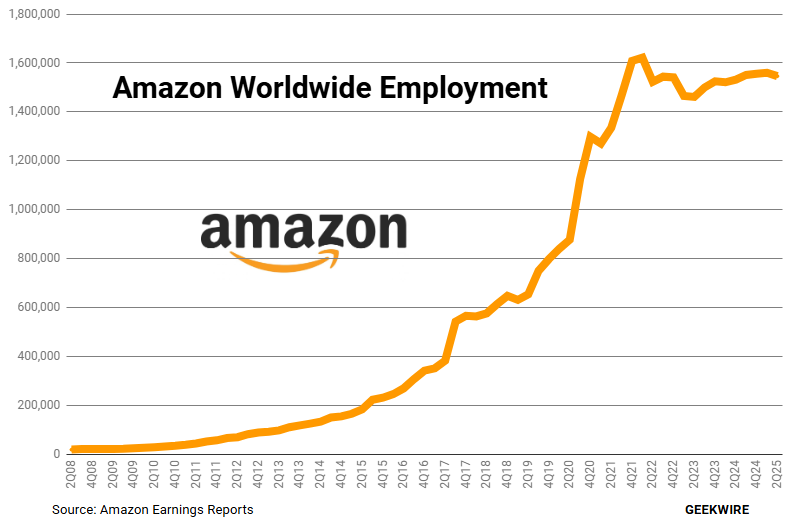

Sixteen thousand employees is a massive number, but context matters. Amazon employed roughly 1.5 million people globally at the end of 2024. That makes this layoff about 1% of the workforce. But that's not how people experience it. For the affected divisions, the impact is severe.

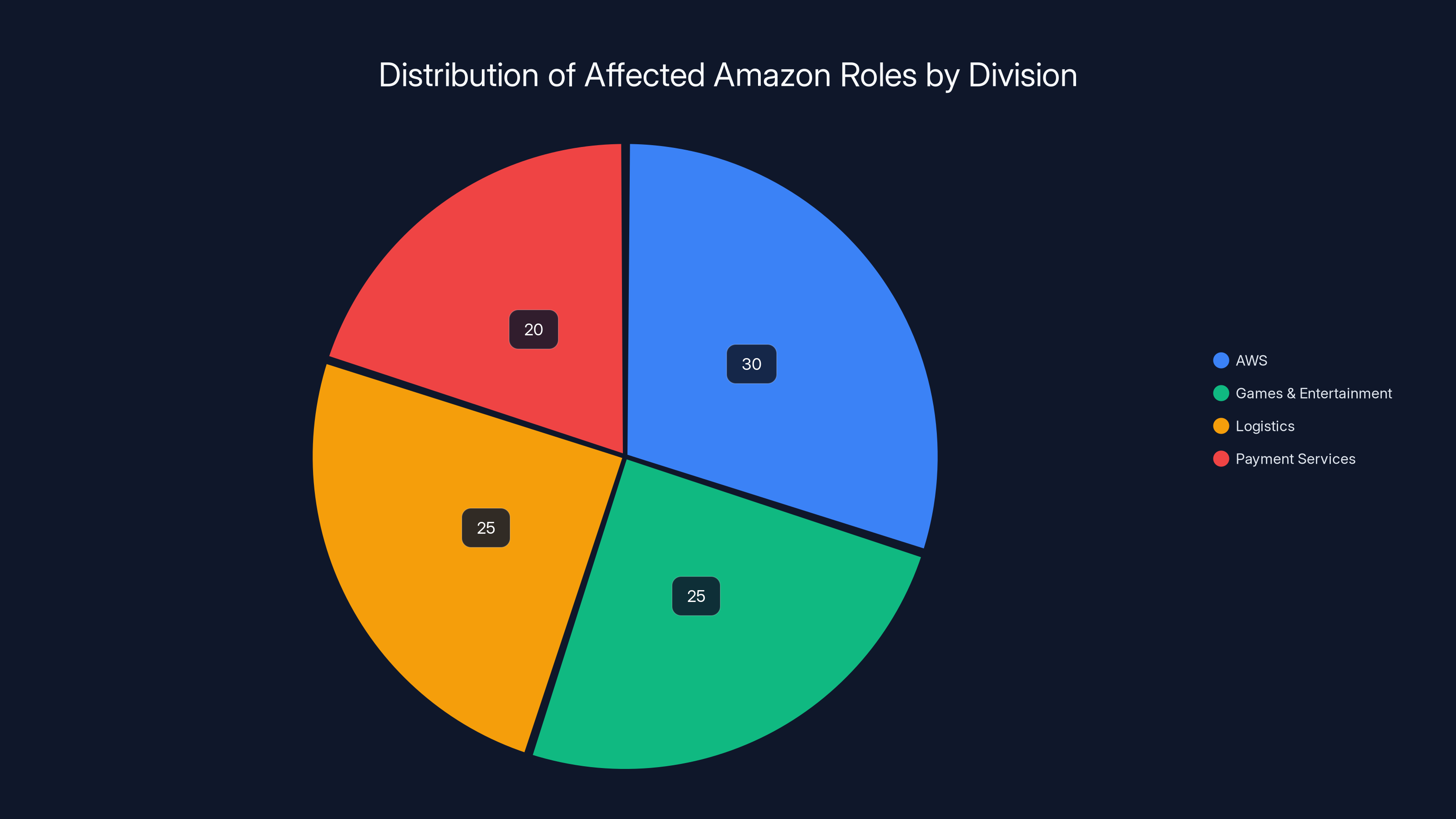

The cuts span Amazon's most important business units. AWS (Amazon Web Services) is affected. Games and entertainment divisions are hit. Logistics operations are being restructured. Payment services are getting trimmed. These aren't peripheral parts of Amazon. These are revenue-generating engines.

What makes this layoff different from typical corporate belt-tightening is the explicit reasoning. Amazon didn't blame external market conditions. It didn't cite a downturn in advertising or e-commerce. Instead, Amazon pointed squarely at artificial intelligence.

"This generation of AI is the most transformative technology we've seen since the Internet, and it's enabling companies to innovate much faster than ever before," Amazon stated in its October announcement. That's not corporate speak. That's a company saying: we need fewer people doing the same amount of work because machines can now do it better.

The layoffs aren't being framed as belt-tightening. They're being framed as organizational optimization. Amazon wants to remove "layers and reduce bureaucracy," as Galetti put it. In corporate language, that means cutting middle management and redundant roles. It means collapsing decision-making chains. It means one person doing what used to take three.

Geographically, the initial wave hit the US hardest, but Canada and Costa Rica are also affected. If Amazon continues with expected additional adjustments, other international offices will likely face cuts too. The company has already indicated it's not done yet.

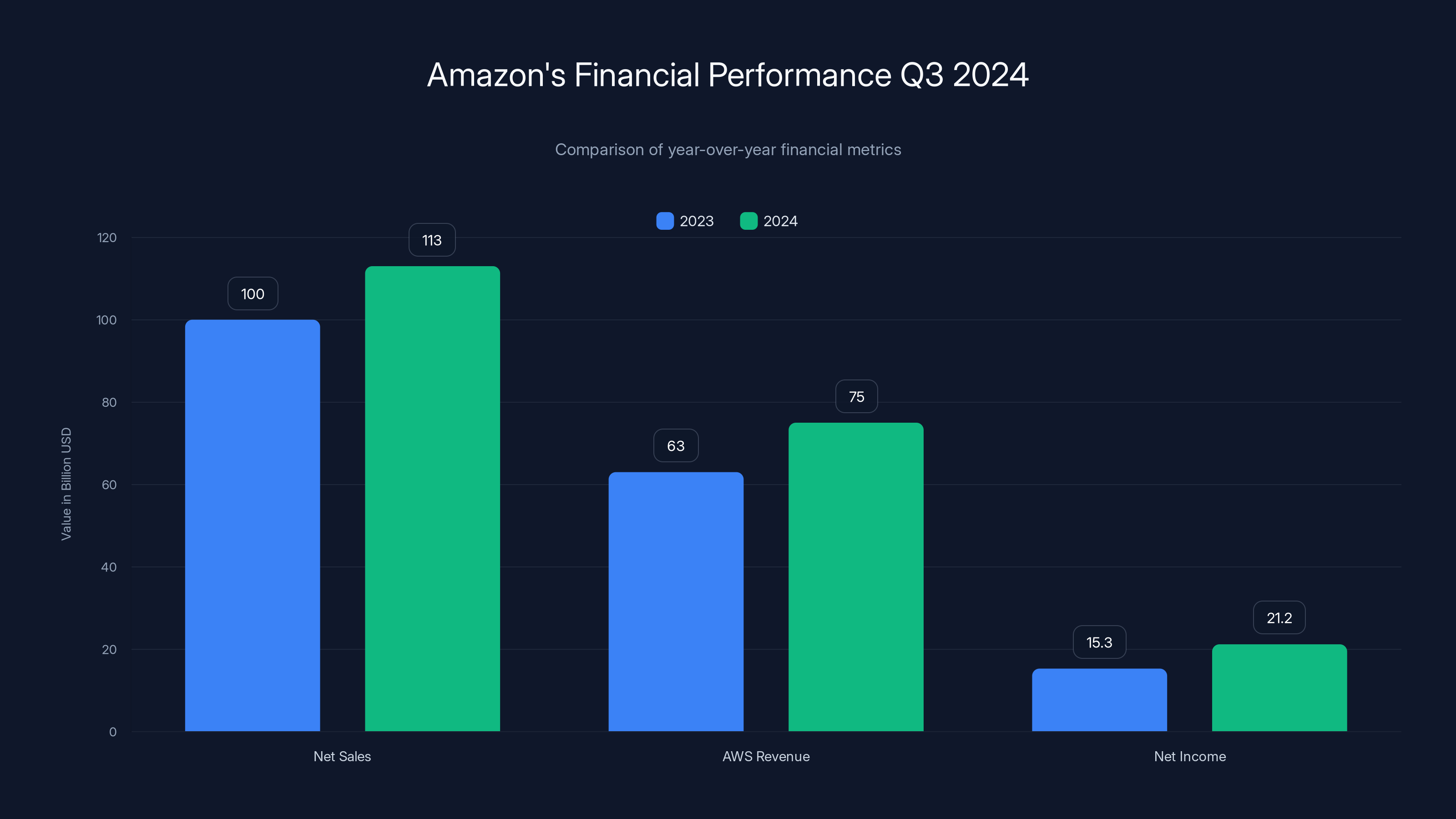

Amazon's financial performance improved significantly in Q3 2024, with net sales up by 13%, AWS revenue up by 19%, and net income increasing to

Why AI Triggered This Restructuring

Let's be direct: Amazon isn't eliminating 16,000 jobs because it wants to be lean. It's eliminating them because AI makes certain roles cheaper to automate.

Consider what's changed in the past 18 months. Large language models went from experimental to production-ready. Code generation tools like Claude and GPT-4 can now write functional software that actually works. Machine learning systems can manage supply chains with minimal human oversight. Computer vision systems can handle quality control. Chatbots can handle customer service inquiries that used to require trained humans.

For a company like Amazon, which operates at insane scale, even small percentage improvements in automation compound into massive savings.

Take AWS as an example. AWS provides cloud computing services to millions of customers. That requires support staff, documentation writers, Dev Ops engineers, systems architects, and technical account managers. Now imagine if 30% of the work that used to require those people can be handled by AI systems. You don't need to eliminate 30% of those roles immediately, but you can stop hiring new ones. You can consolidate teams. You can promote the remaining people and ask them to manage larger workloads with AI assistance.

Amazon's logistics operation tells a similar story. The company has been investing in warehouse automation for years. Robots move packages. Conveyor systems sort items. Barcode readers track inventory. Add AI to that equation, and you can optimize routes in real-time, predict delays, schedule staff more efficiently, and reduce the overhead of human management.

The games division is interesting too. Game development used to require massive teams of artists, level designers, and animators working for months to create assets. AI image generation and procedural generation systems can now produce placeholder assets in minutes. That doesn't eliminate artists, but it does change how many you need on a project.

Here's the uncomfortable truth: this isn't unique to Amazon. Every major tech company is running the same calculation. Microsoft, Google, Meta, Apple, Tesla. They're all asking: how can we use AI to do more with fewer people? The layoffs we're seeing in 2025 are the public manifestation of decisions made in private strategy meetings across the entire tech industry.

Amazon just happened to announce theirs explicitly.

Amazon's layoffs align with their financial growth, indicating strategic workforce reductions. Estimated data suggests continued growth in net sales and income.

The Pattern: This Is Part of a Larger Trend

The January 2025 layoffs didn't happen in a vacuum. Amazon warned about them months earlier.

Back in October 2024, Amazon eliminated 14,000 roles. At the time, leadership indicated that layoffs might continue "every few months." That wasn't idle speculation. That was a preview of what's happening now.

If Amazon's original plan was to eliminate 30,000 roles, and they've now done 14,000 plus 16,000, they've hit that target. But Galetti's language suggests more could be coming. She said Amazon would "make adjustments as appropriate." That's corporate-speak for: we're watching the AI landscape closely, and if we find more automation opportunities, we'll act on them.

What's striking is that these aren't crisis layoffs. Amazon's financial performance didn't warrant them. In Q3 2024, Amazon's net sales grew 13% year-over-year. Net income hit

That distinction matters. When companies lay off workers because they're struggling, it's tragic but temporary. When companies lay off workers because they see a better way to operate, it's a permanent shift.

Industry observers are watching closely. Every other large tech employer will evaluate whether Amazon's approach works. If it does—if Amazon continues to grow revenue and profit while operating with fewer people—you'll see this replicated across the industry.

The timeline is crucial. Q4 2024 and Q1 2025 will be important barometers. If Amazon's operational efficiency improves, if product development accelerates, if customer satisfaction increases, then other companies will conclude that human headcount is expendable. If problems emerge, if quality drops, if innovation slows, then companies will reconsider.

Based on how Amazon operates, I'd bet on the first scenario.

Who's Actually Getting Cut: The Human Impact

Behind every number is a person. Let's talk about that.

The affected employees in the US are getting 90 days to find another internal position. If they succeed, they keep their jobs and their salary. If they don't, they get severance. The package isn't specified in public announcements, but Amazon typically offers 2-6 months of pay plus extended benefits. For higher-level employees, that's a meaningful cushion. For warehouse and support staff, it's less so.

Employees in other countries have different protections. Some countries require minimum severance periods or notice. Some have stronger labor protections. Canada and Costa Rica have different employment laws than the US. The actual severance packages will vary dramatically by location and role.

What's notable is what Amazon didn't offer: relocation packages. They're not saying "move to another Amazon office." They're saying "find another role at Amazon if you can." In a tight labor market, that's different from mandatory relocation. Some people will find internal positions. Many won't.

For those people, 2025 just got complicated. Entry-level engineers can probably land another job. Senior directors can probably find work at another tech company. But what about the people in between? The project managers, the operations specialists, the technical writers? These roles exist everywhere, but they're not always in high demand.

The timing also matters. Layoffs happening in January mean severance spans February and March. That's during tax season, winter, and a time when hiring is often sluggish. Some employees will land softly. Others will face months of job searching.

Amazon is also being explicit about something important: there won't be surprise layoffs every quarter. Galetti said the company doesn't have plans to announce "broad reductions every few months." But she also said Amazon could "make adjustments as appropriate." So there might be targeted cuts, just not company-wide shock announcements.

That's almost worse in some ways. Employees can't just hunker down and wait for stability. They have to assume the company might trim roles whenever they deem it "appropriate."

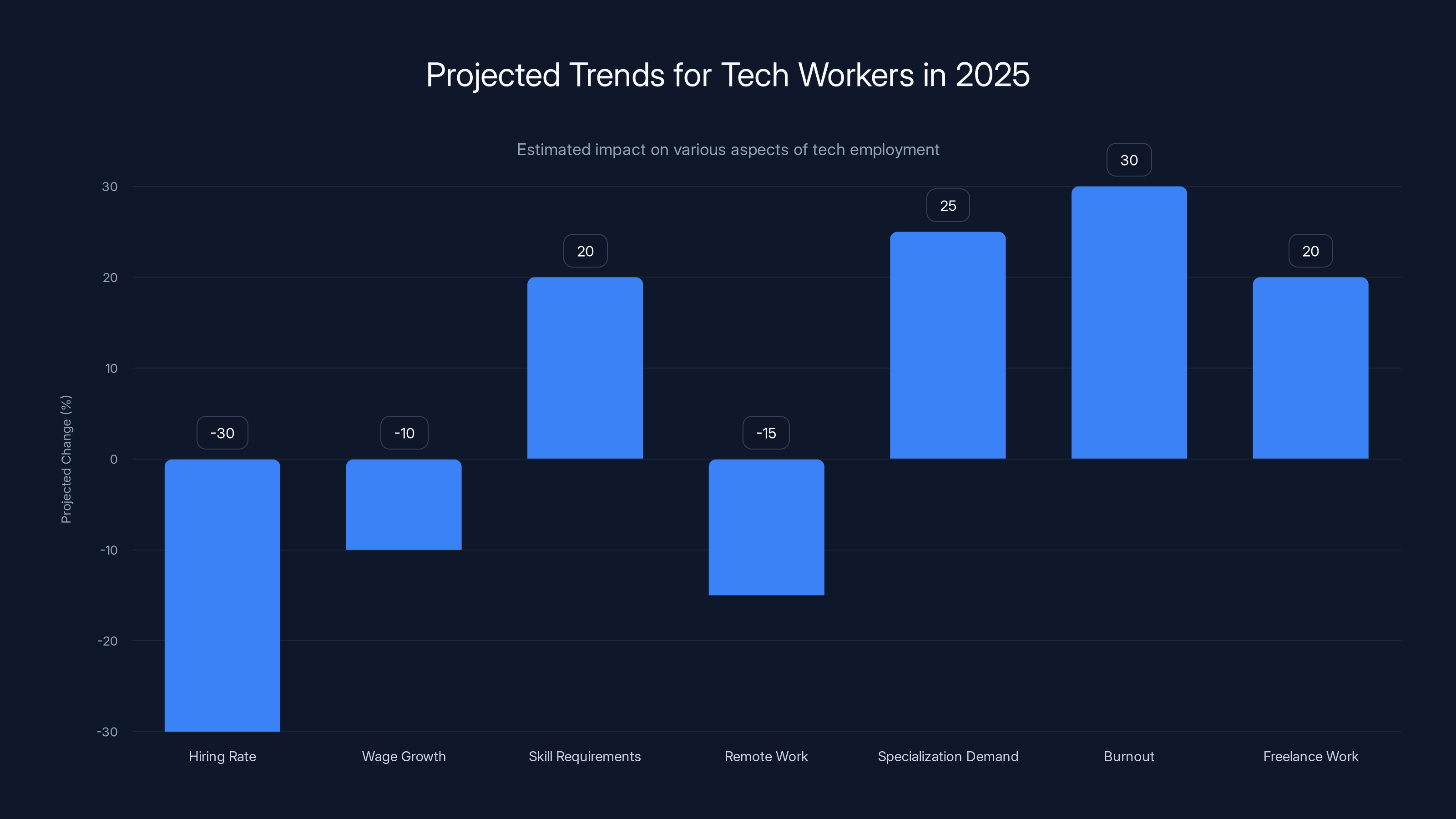

Projected data indicates a significant decrease in hiring and remote work, while skill requirements, specialization demand, burnout, and freelance work are expected to increase. (Estimated data)

Severance, Benefits, and Legal Considerations

The details of Amazon's severance packages are important but sparse. Public announcements mention 90 days to find internal roles and "severance pay" for those who don't find positions. The actual numbers aren't disclosed.

Based on industry norms, here's what severance typically looks like at a company of Amazon's size:

Hourly and warehouse workers: Often get 1-2 weeks per year of service, plus extended health insurance coverage (typically 60-90 days). So someone with 5 years of service might get 5-10 weeks of pay.

Entry-level professional roles: Usually get 1-2 months of severance plus benefits. Someone with 3 years of tenure might get 3-6 months of pay.

Senior roles: Often get 3-6 months of severance, extended healthcare, and sometimes outplacement services. Executive-level people sometimes get 9-12 months.

Amazon hasn't publicly stated whether these layoffs include outplacement services, extended healthcare, or other perks. But given the size of the layoff, it would be surprising if the company didn't offer at least basic support.

There are also tax implications. Severance in the US is taxed as ordinary income. Someone who gets 6 months of severance will have a significant tax bill unless they plan carefully. Most companies that handle large layoffs provide guidance on this.

One thing Amazon is doing right: transparency about the timeline. Employees get 90 days. That's enough time to actually look for jobs, not just update your LinkedIn profile. It's the difference between "you're gone tomorrow" and "you have a quarter to figure this out."

However, the 90-day internal job search creates a weird dynamic. You're still employed, but your division is telling the world you're not wanted. That impacts your internal reputation. People who might mentor you or help you might assume you're on the way out. That can actually make it harder to find an internal position.

The Broader Tech Industry Context

Amazon isn't alone. Let's zoom out.

The tech industry has been in a hiring frenzy since 2020. The pandemic accelerated digital transformation. Companies needed engineers, designers, product managers, and everything else. Tech salaries soared. Stock options multiplied. Equity was flowing.

Then something changed. In late 2022 and early 2023, tech companies started laying off people. Meta eliminated 10,000 employees. Twitter went from 8,000 people to 1,500. Amazon's original October 2024 cuts were the first massive layoff wave in a few months, but they signaled something bigger: the hiring frenzy was over.

But unlike the 2022-2023 wave, which was framed as correction (we hired too many people), the 2024-2025 wave is being framed as optimization (we can do more with fewer people using AI).

That's a crucial distinction. In a correction, companies expect to rehire once growth returns. In an optimization, the expectation is that you've permanently reduced your labor needs.

Look at what other companies are signaling:

Google has been investing heavily in AI. They're talking about using AI to accelerate product development. Their recent hiring has slowed, but large layoffs haven't been announced yet. Expect them to be more surgical in their cuts, targeting specific divisions rather than company-wide reductions.

Microsoft is tied to OpenAI through its partnership. They've been quiet about large-scale layoffs, but they're heavily integrating AI into their products. Expect headcount pressures in specific areas like customer support and data labeling.

Meta already cut 10,000 people in 2023. They're now on a hiring freeze for most divisions while aggressively pursuing AI research. They might avoid major layoffs but just by not replacing people who leave.

Apple has traditionally been leaner than other tech giants. They might not face the same pressure, but their services division (which relies heavily on support and content moderation) could see AI-driven reductions.

Tesla has been aggressively automating for years. Elon Musk has already signaled that AI will replace more workers. Expect continued headcount reductions.

The pattern is clear: companies that can automate fastest will have a competitive advantage. That means companies will double down on AI investment and labor reduction.

Estimated data shows AWS and Games & Entertainment divisions are most impacted by AI-driven layoffs, each accounting for about 25-30% of affected roles.

What This Means for Different Types of Tech Workers

The impact of this shift isn't uniform. Different roles are affected differently.

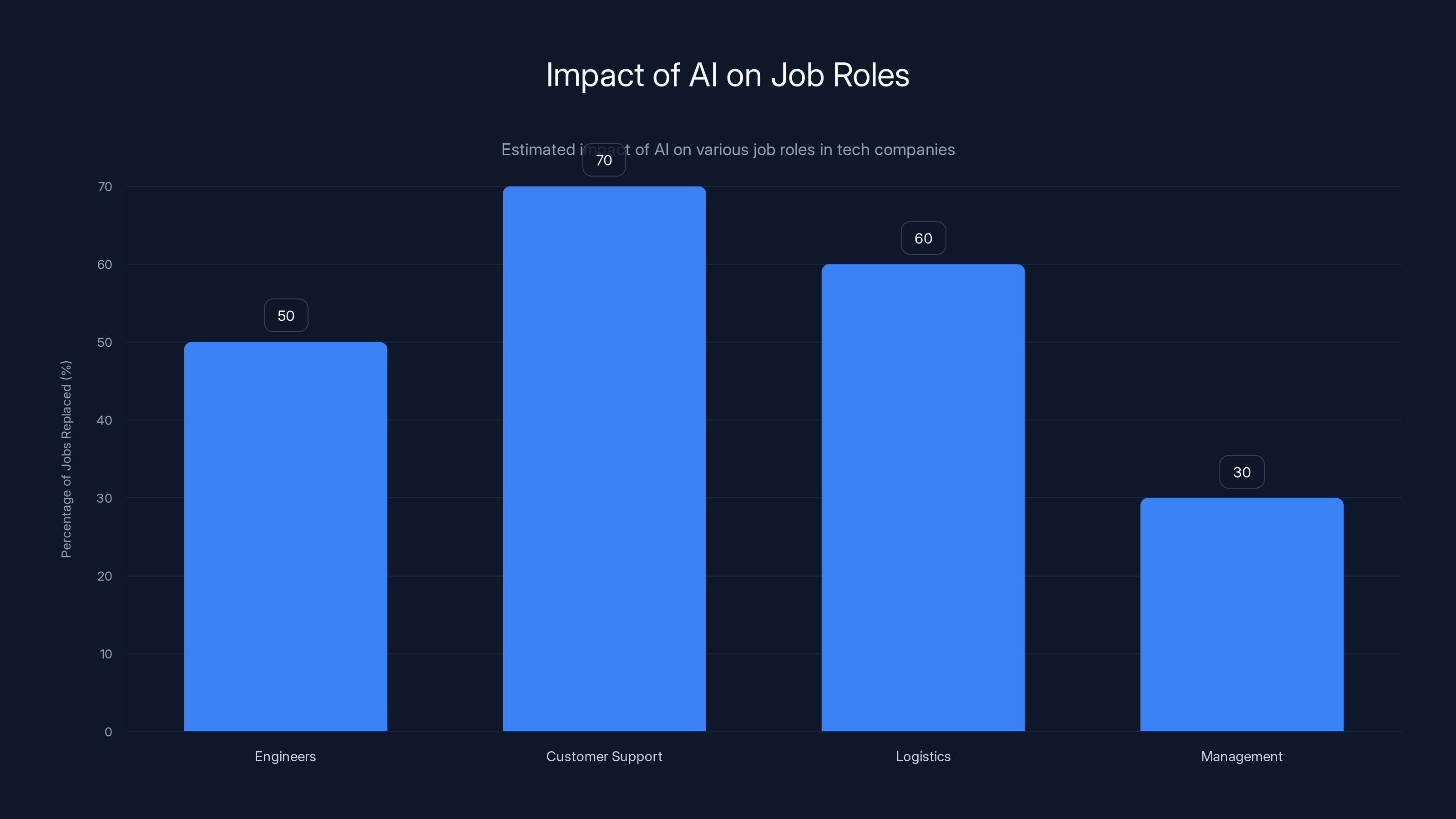

Software Engineers: If you write code, you're in a weird position. AI code generation tools are getting better, but they're not replacing engineers yet. Instead, they're reducing the number of junior engineers companies need. The calculus is simple: one mid-level engineer with AI assistance can do what used to take two junior engineers. Net result: fewer entry-level jobs, same number of mid-level jobs, increased demand for senior engineers who can review AI-generated code.

If you're an experienced engineer, your job is safer but busier. If you're early-career, you need to level up faster than previous generations did.

Data Scientists and ML Engineers: These are the people building the AI systems that replace other people. Demand for these roles is exploding. Amazon's layoffs might eliminate data-adjacent positions (data analysts, business intelligence roles), but they won't eliminate demand for people who actually build AI. If you're specialized here, you're golden.

Product Managers: PMs are interesting because AI could theoretically help with product decisions, but it can't replace the judgment and customer empathy that good PMs bring. However, companies might decide they need fewer PMs. The ratio might shift from 1 PM per 3-4 engineers to 1 PM per 5-6 engineers. It's not elimination, it's consolidation.

Designers and UX Roles: This is a declining category in the short term. AI design tools are getting better. Companies can generate interface mockups automatically. That doesn't mean design is going away, but it means companies need fewer junior designers. Experienced design leaders who can work with AI as a tool are more valuable than ever.

Customer Support and Content Moderation: These roles are hit hardest. Chatbots have gotten legitimately good at handling customer support. Content moderation systems are increasingly automated. If your job involves handling high volumes of routine interactions, that job is at risk.

Sales and Marketing: These are surprisingly resistant to AI disruption (so far). Customer relationships still matter. Sales conversations still require human judgment. But marketing teams might get smaller as AI generates more content and optimizes campaigns automatically.

Operations and Finance: Accounting and financial analysis are being automated. Inventory management is being optimized by AI. General operations work is becoming more efficient. Headcount pressure is real here.

The pattern: roles that are high-volume, routine, and rule-based are getting automated. Roles that require judgment, creativity, and relationship-building are surviving (though possibly with lower headcount).

Here's what's genuinely terrifying: the displaced workers don't automatically move to the high-value roles. Someone doing data entry doesn't automatically become an ML engineer. Someone in customer support doesn't automatically become a PM. The tech industry is creating a structural unemployment problem where certain skills become obsolete faster than workers can retrain.

Amazon's Financial Performance and Why Layoffs Happened Anyway

This is the thing that breaks traditional economic logic: Amazon is printing money right now.

Q3 2024 financial results (the most recent available): Net sales up 13% year-over-year. AWS revenue up 19% year-over-year. Net income hit

So why cut 16,000 people?

Because profitability and headcount optimization are different things.

Amazon is profitable despite its massive headcount. The question leadership is asking is: could we be more profitable with fewer people? And the answer is almost certainly yes.

Think about operational efficiency. Every person on payroll costs money: salary, benefits, equipment, office space, management overhead. Every person also represents a constraint on decision-making speed. More people means more meetings, more bureaucracy, more layers of approval.

AI removes both constraints. A system running in the cloud costs a fraction of an employee's salary and works 24/7 without vacation or sick days. Decision-making gets faster because there are fewer layers.

From Amazon's perspective, especially AWS's perspective, this math is obvious. AWS is already incredibly profitable at $75 billion+ in annual revenue. What if they could squeeze another 5-10% profit margin by optimizing headcount? That's billions of dollars in additional profit.

For shareholders, that's fantastic. For employees, that's terrifying.

The layoffs are happening because Amazon is successful, not despite it. A struggling company might cut to survive. A thriving company cuts to optimize.

This has a secondary effect: the layoffs actually support Amazon's stock price and earnings reports. When the company reports Q1 2025 results, the headcount reduction will help margins look better. Lower headcount + same or higher revenue = higher profit per employee, which investors love.

Amazon's CFO and leadership team are explicitly betting that they can maintain or increase revenue with fewer people. If they're right, the stock goes up. If they're wrong, they have a problem. But the incentive structure is totally aligned with trying.

Estimated data shows AWS and Logistics as the most impacted divisions, each accounting for about 25-30% of the layoffs. Estimated data.

How Project Dawn Got Leaked and What It Reveals

One of the most interesting details is how the news broke: an internal email and calendar invite for "Project Dawn" were sent out early to thousands of workers.

The email came from Colleen Aubrey, SVP of AWS. It was supposed to coordinate internal notifications. Instead, it gave the world an inside look at how Amazon manages sensitive information.

The codename "Project Dawn" is revealing. Amazon didn't call it "Project Restructure" or "Project Optimization." They called it "Project Dawn," implying something new is beginning. It's the dawn of the AI era at Amazon. It's poetic, actually.

The fact that the email made it to Bloomberg and the BBC before the official announcement tells you something about information control at large companies: it's impossible. Thousands of people see sensitive information. One person leaks it. That's just how it works now.

What's notable is that Amazon didn't overreact to the leak. They didn't try to bury the story or deny it. Instead, Galetti published an official announcement a few hours later. That's actually smart crisis management. Get ahead of it. Control the narrative. Move on.

The email itself, as reported, was respectful. Aubrey acknowledged that "changes like this are hard on everyone." She noted the decisions were "difficult and made thoughtfully." That's not how most companies handle layoffs (they usually try to spin it as positive). Amazon's tone was realistic.

What we don't know: how many people received the leaked email? Was it intended to go to all workers or just managers? What other communications were in the system? Typically, companies prepare for layoffs with HR discussions, legal reviews, and communication planning that spans weeks. This leak just accelerated the calendar a bit.

Severance Packages and What Employees Should Know

Let's get practical. If you're an Amazon employee affected by this, or you're worried you might be, here's what you should know.

The 90-day internal job search clock: You have three months to find another position at Amazon. Use it strategically. During this time, you're still an Amazon employee. You still have your job. You still get paid. Use this time to actually interview at other companies too, not just Amazon.

Severance negotiations: Most companies offer a base severance package, but there's often room to negotiate, especially if you've been at the company a long time or if you're in a specialized role. If you feel you deserve more, ask.

Healthcare continuation: Typically, severance includes extended healthcare coverage. If your job provides health insurance, you need to understand when that ends and what your options are. COBRA lets you continue health insurance for 18 months, but you'll pay the full premium. Factor that into your financial planning.

Unemployment benefits: Once you're officially laid off, you'll be eligible for unemployment insurance. This varies by state, but it's typically 50-60% of your previous salary for 6 months. It helps but doesn't fully replace income.

Stock options and RSUs: If you have restricted stock units (RSUs) or stock options, the treatment matters. Generally, vested options are yours to keep. Unvested options are forfeited. Vested RSUs are paid out (usually immediately). Unvested RSUs are lost. This can be significant depending on your tenure and stock price.

Signing bonuses and clawbacks: Some severance agreements include clawbacks of recent bonuses or require you to repay signing bonuses. Read your agreement carefully.

Non-compete clauses: If you signed a non-compete, layoff sometimes affects its enforceability. Amazon is generally reasonable about this, but understand your restrictions before taking a new job in a competing company.

Outplacement services: Large companies often provide these when doing significant layoffs. It usually means a service that helps with resume writing, interview prep, and job searching. It's often provided for 3-6 months. Use it if offered.

Estimated data suggests significant AI impact on customer support and logistics roles, with potential replacement rates of 70% and 60% respectively.

The AI Angle: Why This Matters Right Now

The timing of these layoffs is important. It's not 2020. It's not when AI was still mostly a research topic. It's 2025, when AI is actually shipping in products.

Amazon uses AI throughout its operations:

AWS services: Amazon offers AI/ML services to customers. They've got Amazon Bedrock for foundation models, SageMaker for machine learning, and various AI features. These services make Amazon money directly, but they also inform the company's own AI strategy.

Alexa: Amazon's voice assistant has been using AI for years. That's another place where Amazon is learning what works and what doesn't.

Logistics and supply chain: Amazon's supply chain is legendarily optimized. AI routing, demand forecasting, and inventory management are core to how they operate. These systems get better every year and require fewer humans to maintain.

AWS itself: The actual AWS team is probably the most impacted by this. They're building AI infrastructure for customers, which means they're learning the best ways to use AI internally. They're dogfooding their own products.

What Amazon probably discovered: AI can handle 20-30% of the work that currently happens in these divisions. That doesn't mean replacing workers one-to-one with AI. It means restructuring teams so one senior person manages more work with AI assistance.

Other companies are learning similar lessons. Sundar Pichai at Google has talked about using AI to make engineering teams more productive. Satya Nadella at Microsoft is pushing AI throughout the company. Zuckerberg at Meta is betting the company on AI.

The pattern is clear: companies are betting that AI productivity gains will exceed the wage increases they'd otherwise need to pay. So they're reorganizing around that bet.

For workers, this is existentially different from previous technological shifts. During the industrial revolution, machines replaced manual labor, but new jobs were created. During the digital revolution, automation replaced clerical work, but new technical jobs were created.

With AI, it's not clear what new jobs get created to offset the losses. That's the scary part.

What Amazon Could Have Done Differently

Here's a thought experiment: how else could Amazon have approached this?

They could have done a hiring freeze instead of layoffs: Rather than cutting 16,000 people, Amazon could have said "no new hires for 2025" and achieved similar headcount reduction through attrition over time. That would have been less traumatic but slower. Given Amazon's urgency about AI, they probably felt speed was important.

They could have offered transfer programs to growing divisions: Instead of just a 90-day internal job search, Amazon could have explicitly moved people from shrinking divisions (games) to growing ones (cloud, AI). That would have been more expensive but potentially better for retention of good people.

They could have offered sabbaticals or reduced schedules: Instead of all-or-nothing (find a job or get laid off), Amazon could have offered 6-month sabbaticals or part-time options. That gives people breathing room to retrain or find work without immediately terminating employment.

They could have been more gradual: Instead of two consecutive quarters of massive layoffs, Amazon could have spread this over a longer period. That would have been less shocking and allowed better planning.

They could have invested in retraining: Amazon could have committed resources to help displaced workers transition to new roles or industries. This is expensive but shows goodwill and builds long-term community trust.

Amazon did none of these things. Instead, they chose the most efficient path: announce, execute, move on. That's consistent with Amazon's culture (pragmatic, aggressive, data-driven) but probably not optimal for worker welfare.

It's worth noting that Amazon isn't uniquely harsh here. This is fairly standard for large tech companies. But standard doesn't mean good.

Comparisons to Previous Layoff Waves

Let's put this in historical context.

2022-2023 layoff wave: When Meta cut 10,000 people, it was framed as overexpansion correction. They'd hired too much during the pandemic. The assumption was they'd hire again once growth returned. Reality: they're still not back to pre-layoff levels.

The current wave: It's explicitly framed as optimization driven by AI. This isn't about correcting mistakes. It's about structural change.

That's the key difference. Previous layoffs were temporary corrections. This layoff is a permanent shift in how companies will operate.

Other comparisons:

Bank layoffs in 2023: When banks started laying off thousands, it was in response to rising interest rates and reduced trading volume. Those layoffs came from necessity. Amazon's layoffs come from opportunity.

Twitter/X implosion: Elon Musk cut Twitter's headcount from 8,000 to 1,500 in weeks. It was chaotic, brutal, and many people argue it damaged the platform. Amazon's approach is slower, more systematic, and probably more sustainable as a result.

Microsoft cuts in 2023: Microsoft laid off 10,000 people but framed it as focusing on AI. They were actually ahead of the curve here. Amazon is following the same script but at larger scale.

The current layoff wave is more systematic and intentional than previous ones. Companies have had time to plan. They're explicit about the AI connection. They're doing it from positions of strength, not weakness.

That's actually more concerning. It means this is the new normal, not a temporary adjustment.

The Ripple Effects: Vendors, Partners, and the Broader Ecosystem

When Amazon cuts 16,000 people, it doesn't just affect those people. It affects entire vendor ecosystems.

Consider cloud infrastructure vendors. Amazon's AWS is massive. When AWS operations are streamlined, they might reduce vendor contracts. Managed service providers who sold consulting services to Amazon might suddenly have less business. Software companies that sold tools to Amazon might see their relationship become a transactional commodity.

Consider staffing agencies and recruiters. When Amazon stops hiring, recruiters lose commissions. Staffing agencies that specialized in AWS hiring lose revenue. Some of these firms will have to downsize too.

Consider real estate. Amazon has office space all over the world. Fewer employees might mean renegotiating leases, consolidating offices, or subletting space. That affects office landlords in major cities.

Consider the supplier network. Amazon's logistics network is massive. Service contractors who support logistics might see reduced work. Trucking companies, warehouse operators, and logistics software providers could all be affected.

Consider the tech ecosystem broadly. When one of the world's largest tech companies signals that headcount reduction is good business, other companies pay attention. This gives cover to other companies considering similar moves. Companies that might have hesitated now see a clear industry trend.

The ripple effects are measured in hundreds of thousands of people, not just the 16,000 at Amazon. That matters.

What 2025 Will Look Like for Tech Workers

Let's be honest about what the next 12 months will bring.

Hiring will slow dramatically: Companies are going to observe Amazon's results closely. If it goes well, hiring will contract further. Even companies not doing layoffs will reduce hiring.

Wages might stagnate: For years, tech salaries kept going up because companies were competing for talent. With less hiring, that pressure goes away. Salary growth will slow. Some roles might see actual reductions.

Skill requirements will increase: Every remaining role will require more skills. Junior positions will become scarcer. Seniority and specialization will command premiums.

Geography will matter more: Remote work will decrease. Most companies will push people back to offices. People in major tech hubs (SF, Seattle, NYC, Boston) will have better job prospects. People in smaller cities will have fewer options.

Specialization will pay: Generalists will have harder times. Specialists (AI, infosec, infrastructure, etc.) will have better prospects.

Burnout will increase: For people who stay employed, workload will increase. Fewer people doing the same work means harder work. That'll burn people out faster.

Freelance and contract work will grow: As companies reduce headcount, some work will shift to contractors. If you're considering freelancing, 2025 might be a reasonable time to try it.

Retraining will be critical: If your current role is under pressure, you need to learn something new. That might be AI skills, might be a different specialization, might be a different industry entirely.

None of this is surprising. But the pace is accelerating. The shift from the stable job market of 2019-2022 to the volatile market of 2025 is happening faster than most people adjusted.

Long-Term Implications: The Future of Corporate Employment

Zoom out from Amazon and the tech industry. What does this tell us about the future of employment?

Permanent employment is becoming less stable: The promise of a long-term career at a single company is gone. Even at successful, profitable companies, headcount reductions are now considered normal optimization. That changes the social contract.

Companies are optimizing for flexibility: Fewer full-time employees means more contract workers, more cloud services, more outsourcing. Companies are moving toward being platform orchestrators rather than employers.

Skills are more important than tenure: A 10-year employee isn't automatically secure. A 2-year employee with rare skills might be. The era of "just be a solid employee and you're fine" is ending.

AI productivity gains are real but unequally distributed: Some workers will get AI assistance and become massively more productive. Others will be replaced entirely. The distribution is unequal.

Unemployment might increase even as economies grow: This is the scenario economists worry about. Economic growth doesn't require hiring if companies can do more with fewer people using AI. That could create structural unemployment where growth coexists with joblessness.

Income inequality might worsen: Jobs that can't be automated will either be very high-skill or very low-wage. The middle-skill jobs that built the middle class are vulnerable. That could widen inequality.

Retraining infrastructure needs to improve: If large portions of the workforce need to retrain regularly, we need better systems for doing that. Current options (bootcamps, online courses) are limited and expensive.

Amazon's layoffs aren't just corporate news. They're a signal about structural economic shifts.

How to Prepare If You Work in Tech

Here's practical advice if you're concerned about your job security in this environment.

Skill diversification: Don't bet on one skill or technology. Learn AI tools. Learn adjacent skills. Build relationships across functions. The more valuable you are in different contexts, the safer you are.

Network actively: Your personal network is more valuable than ever. Stay in touch with former colleagues. Go to conferences. Be helpful to others. When you need a job, your network is your best resource.

Document your impact: Keep a record of what you accomplish. Metrics, outcomes, problems solved. If you need to find a job quickly, having this ready is invaluable.

Financial resilience: Build a 6-12 month emergency fund. Tech salaries can be high, but spending keeps pace. Having reserves gives you options.

Explore your market value: Periodically interview at other companies. Not to leave, just to understand your actual market value. You might be worth more than you think. You might be vulnerable in ways you don't realize.

Consider your next move: If you're worried about your current company, start planning your next move now while employed. It's easier to find a job while employed than while job-hunting.

Learn AI: This is obvious but important. Whatever your role, understanding AI, using AI tools, and thinking about AI-implications is becoming essential knowledge.

Evaluate your company's health: How is your company approaching AI? Are they investing aggressively or cautiously? Are they hiring or cutting? Are they profitable or struggling? These signals matter.

Build leverage: The more irreplaceable you are, the more secure your job. That might mean deep expertise, client relationships, or institutional knowledge. Actively build these things.

FAQ

What exactly triggered Amazon's decision to cut 16,000 jobs?

Amazon explicitly cited AI as the primary reason. The company stated that "this generation of AI is the most transformative technology we've seen since the Internet" and used that to justify organizational restructuring. Specifically, Amazon aimed to remove bureaucratic layers and reduce redundancy now that AI systems can handle many tasks that previously required human workers. The layoffs are part of a broader effort to flatten the organization and improve decision-making speed.

Are these layoffs unique to Amazon or part of a larger industry trend?

These layoffs are part of a broader pattern across the technology industry, though Amazon's scale makes them notable. Other major tech companies like Google, Microsoft, Meta, and Apple are also reducing headcount or slowing hiring in response to AI capabilities. What distinguishes 2025 layoffs from 2022-2023 waves is that they're explicitly framed as optimization driven by AI rather than correction for over-hiring. This suggests the changes are permanent rather than temporary.

How much severance will affected Amazon employees receive?

Amazon hasn't publicly disclosed specific severance amounts, but they announced affected US employees get 90 days to find another internal role. Those who don't find positions will receive severance pay, though the exact amount isn't specified. Based on industry norms for large tech companies, severance typically ranges from 1-6 months of salary depending on tenure and role level, plus extended health insurance coverage.

What types of Amazon roles are most affected by these layoffs?

The layoffs span multiple divisions including AWS (cloud services), games and entertainment, logistics, and payment services. Roles most affected tend to be those that involve routine decision-making, support functions, and positions that can be partially automated by AI systems. Technical roles like software engineers are safer than customer support, data entry, and operations positions. Senior technical and leadership positions have better retention prospects than junior or entry-level roles.

Will Amazon continue laying off workers throughout 2025?

Amazon's leadership has explicitly stated they don't plan "broad reductions every few months," but they reserve the right to "make adjustments as appropriate." This suggests no company-wide surprise layoffs are planned, but targeted cuts by division are possible. Companies typically assess results quarterly and adjust strategy accordingly, so more cuts could happen if management sees fit.

How should tech workers prepare for potential job loss in this environment?

Workers should build a 6-12 month emergency fund, diversify their skills (particularly in AI), maintain an active professional network, and regularly assess their market value by interviewing at other companies. Documentation of achievements with metrics is valuable for job searches. Consider building depth in specialized areas that are hard to automate while also learning complementary skills that make you more valuable when AI is introduced to your role.

What does this mean for the broader tech job market in 2025?

Expect slower hiring across the industry, wage growth to stagnate, and a shift toward valuing specialized skills over generalist experience. Entry-level positions will become scarcer as companies focus on efficiency. Remote work options may decrease, and geographic location will matter more for job availability. Freelancing and contract work will likely grow as companies shift away from full-time headcount.

Is the tech industry entering a recession?

No. Amazon and other tech companies are still highly profitable and growing revenue. These layoffs happen despite financial health, not because of financial stress. Companies are optimizing for better margins, not struggling to survive. This distinction matters because it signals a permanent shift in how companies operate, not a temporary correction.

Can Amazon employees challenge their layoffs or negotiate better severance?

Unless employment law in your jurisdiction provides specific protections, layoffs in the US are generally at will. However, severance packages often include room for negotiation, particularly for senior employees or those with specialized expertise. Employees should consult employment attorneys if they believe they've experienced wrongful termination. Some states have stronger employment protections than others.

How will Amazon's supply chain and vendor ecosystem be affected?

Vendors, contractors, and service providers who rely on Amazon business may experience reduced contracts and commissions. Real estate and office space providers might face renegotiation of leases. Staffing agencies and recruiters lose hiring opportunities. Managed service providers and consulting firms that sold services to Amazon may need to shift focus to other clients.

Conclusion: The New Reality

Amazon's announcement of 16,000 layoffs isn't just a company story. It's a signal about where the entire economy is heading.

For years, economists and technologists promised that AI would create new jobs even as it destroyed old ones. Maybe that's still true. But the timeline matters. If AI replaces jobs faster than new ones are created, we have a structural unemployment problem. If income flows to people who own AI systems rather than people who work alongside them, we have an inequality problem.

Amazon's behavior suggests the company believes AI productivity gains are real and achievable now. They're betting that one engineer with AI assistance can do what two could do before. They're betting that AWS doesn't need all those customer success people if chatbots can handle 70% of questions. They're betting that logistics operations can be run by fewer humans with better AI systems.

They might be right. The financial markets certainly think so. Amazon's stock will probably be fine regardless of whether these layoffs create problems. Shareholders win. Employees lose.

For workers, this is a critical moment. The old playbook (get a good education, land a job at a good company, work hard for 30 years) doesn't work anymore. The new playbook requires constant learning, aggressive networking, and willingness to change careers every few years.

It's not a fun reality. But it's the reality we're living in.

The question isn't whether this will happen to your industry. The question is when. Amazon is just first. Others will follow. If you work in an industry that produces knowledge, analysis, content, or services, your turn is coming.

The only real defense is to become the kind of person who can't easily be replaced by either AI or offshore workers. That means developing judgment, relationships, and specialized expertise. It means continuously learning. It means being adaptable.

Amazon didn't want to lay off 16,000 people. Well, actually, they probably did. But the point is they could have if they thought it made business sense. And increasingly, companies think it does. That's the new normal we have to navigate.

Key Takeaways

- Amazon's 16,000 layoff follows October's 14,000-person cut, totaling 30,000 jobs eliminated in two months

- AI is the explicit driver: Amazon positioned restructuring as necessary response to AI's transformative capabilities

- Layoffs happening despite financial health: Q3 2024 showed 13% revenue growth and $21.2B net income

- Tech industry pattern: AI-driven restructuring is becoming standard across Big Tech, not unique to Amazon

- Entry-level and operations roles face highest risk; specialized AI skills and senior roles most secure

- 90-day internal job search given to US employees; severance packages not fully disclosed but follow industry norms

- Structural economic shift: This signals permanent change in employment model, not temporary correction

- Tech workers need continuous retraining, active networking, and diversified skills to maintain job security in 2025

Related Articles

- Pinterest Lays Off 15% for AI: What This Means for Tech [2025]

- Anthropic's Claude Cowork: The AI Agent That Actually Works [2025]

- Pinterest Layoffs 15% Staff Redirect Resources AI [2025]

- AI Agents: Why Sales Team Quality Predicts Deployment Success [2025]

- Voice-Activated Task Management: AI Productivity Tools [2025]

- Why AI ROI Remains Elusive: The 80% Gap Between Investment and Results [2025]

![Amazon's 16,000 Layoffs: What It Means for Tech Workers [2025]](https://tryrunable.com/blog/amazon-s-16-000-layoffs-what-it-means-for-tech-workers-2025/image-1-1769604494241.jpg)