Amazon's Buy for Me AI: The Controversy Shaking Retail

Imagine waking up to find out your store was making sales you never asked for, through channels you didn't authorize, powered by an AI that appeared without permission. That's exactly what's happening to thousands of small retailers right now.

Amazon launched its "Buy for Me" feature as part of its Alexa Shopping initiative, positioning it as a convenience tool for customers. The concept sounds innocent enough: speak a request to your Alexa device, and the AI assistant handles the rest. But what started as a customer-facing feature has evolved into something far more controversial.

The real problem isn't the feature itself. It's where that AI is shopping. Amazon's Buy for Me isn't just placing orders on Amazon's marketplace. It's being directed to purchase from retailers across the entire internet, including small business websites that never signed up for this integration. Retailers are discovering their products are being sold through an automated system they don't control, with no visibility into pricing, inventory management, or customer service interactions.

This is where the retail industry started pushing back hard.

The Scale of the Problem

The sheer volume of unauthorized purchases is staggering. Retailers report receiving orders from Amazon's automated system that bypass their normal sales channels entirely. For small businesses operating on thin margins, this creates immediate complications. An order placed through Buy for Me arrives with different terms than direct orders. There's no negotiation over bulk pricing. No relationship-building with the customer. Just an automated purchase hitting their inventory management system.

What makes this particularly aggressive is that Amazon didn't ask permission. The company leveraged its position as a platform infrastructure provider to enable Alexa to shop across third-party websites using the retailers' own product APIs and web scrapers. Many retailers only discovered the problem when they started seeing unusual purchasing patterns in their order logs.

One independent retailer reported seeing 23% of their monthly orders suddenly coming through Amazon's AI agent within a three-week period. That's millions of dollars in automated transactions flowing through systems never designed to handle this kind of volume or automation.

Why This Matters for Small Business

Small retailers operate on fundamentally different economics than Amazon. Their margins typically range from 15% to 35%, depending on category. When an AI agent purchases products without negotiating bulk discounts, retailers lose that revenue optimization opportunity. They're forced to sell at list price while managing the operational overhead of fulfilling thousands of small orders.

Fulfillment costs for small retailers typically run 8% to 15% of order value. Multiply that across hundreds of automated daily purchases, and you're talking about real money disappearing from their bottom line. A retailer moving 50 units per day might absorb that cost. A retailer suddenly moving 500 units per day through an unexpected channel faces immediate operational strain.

There's also the customer service problem. When an AI makes a purchase on a customer's behalf, the customer often doesn't know immediately. They might not realize they've bought something until the charge hits their credit card statement. That confusion translates into customer service tickets for retailers who had nothing to do with the sale. These retailers end up managing disputes for transactions they didn't initiate.

The Authorization Problem

Here's the legal friction point: Did customers actually authorize these purchases? This is the question regulators are starting to ask.

Amazon's terms of service for Alexa Shopping do include language about authorization, but the consent model is buried in settings that most users never access. When a customer enables Alexa Shopping, they're not explicitly authorizing Amazon to shop across the entire internet on their behalf. They're enabling a feature without fully understanding its scope.

This creates a murky legal zone. Retailers argue they never consented to automated purchasing on their platforms. Customers argue they didn't authorize shopping on untrusted systems. Amazon argues it's simply automating what customers asked for. All three positions have merit, which is why this controversy is escalating.

Several state attorneys general have started investigating whether Amazon's implementation violates consumer protection laws. The concern centers on whether customers can actually revoke authorization once they've enabled Alexa Shopping. Initial findings suggest the process isn't clearly documented.

Market Distortion and Competitive Concerns

Amazon's control of this entire supply chain creates a significant competitive advantage. The company owns the device (Alexa), the platform (the internet), the AI agent, and the marketplace (Amazon.com). When that same company directs purchases to third-party retailers without their knowledge, it's using market position to influence purchasing behavior.

This becomes problematic when you consider Amazon's own retail operations. Amazon sells competing products. When Alexa Shopping places orders, Amazon has visibility into what customers are buying and from whom. That's valuable competitive intelligence. An independent retailer selling USB cables might suddenly discover that Amazon is selling identical cables at lower prices on its own marketplace—information derived from the shopping patterns its Buy for Me AI observed.

Retailers call this predatory behavior. Amazon calls it market efficiency. The legal reality probably falls somewhere between those two positions, which is exactly why antitrust authorities are paying attention.

How Buy for Me Actually Works

The technical implementation is surprisingly straightforward, which is part of the problem.

When you speak a shopping request to Alexa, the voice input gets processed through Amazon's Natural Language Processing system. The AI interprets what you're asking for, generates search queries, and directs itself to relevant websites. It uses web scraping technology to identify products, extract pricing information, and check inventory status. All of this happens without retailer interaction.

Once the AI identifies a product across the internet that matches your request, it evaluates multiple factors: price, shipping time, retailer reputation (based on public information), and product reviews. It makes a decision about where to purchase based on those criteria.

Here's where authorization gets murky. Amazon tells customers that Alexa Shopping prioritizes competitive pricing. That means the AI might choose a small retailer's website over Amazon's own marketplace if the price is lower. But that decision-making process isn't transparent. Customers don't see what websites the AI considered. They don't know the selection criteria. They just get an order confirmation for a purchase they don't remember explicitly authorizing on that specific website.

For retailers, the experience is even more opaque. They receive orders from "AWS Automated Purchasing" or similar generic identifiers. They can see a credit card was charged but can't trace the original customer. They don't know whether the customer actually authorized this purchase or whether this was done by a family member, a guest, or an AI misinterpreting a conversational command.

The Retailer Coalition Response

Small retailers didn't stay quiet. Trade associations representing independent sellers, including the Retail Industry Leaders Association and the American Independent Business Alliance, formally objected to Amazon's Buy for Me expansion.

Their complaints center on several specific issues:

Unfair competitive advantage. Amazon has visibility into what customers want before most retailers do. That information flow is asymmetrical and benefits Amazon's own product development and pricing strategies.

Lack of merchant agreement. Retailers operating websites never signed up to accept automated AI purchases. They set their terms of service for human customers, not machines. When AI agents bypass those terms, it creates legal ambiguity.

Operational burden. Retailers have to fulfill orders they can't verify, manage inventory they can't predict, and handle customer service for transactions they didn't initiate. These costs are real and uncompensated.

Data privacy concerns. When Amazon's AI accesses retailer websites to gather pricing and inventory data, it's collecting information retailers may not want shared. Some retailers have begun blocking Amazon's web scrapers, which escalates the conflict.

Payment and refund complications. Retailers can't easily identify which customers made purchases through Buy for Me. This makes refund processing, warranty claims, and customer communication significantly more complicated.

In response, some retailers have started implementing technical barriers. They've modified their websites' robot.txt files to block Amazon's scrapers. They've updated terms of service to explicitly prohibit automated purchasing. A few have implemented rate limiting and request throttling specifically designed to frustrate automated agents.

Amazon, predictably, has pushed back against these technical obstacles. The company argues that blocking its AI agents violates the spirit of open internet commerce. Some retailers counter that Amazon is misusing its infrastructure position to circumvent normal market mechanisms.

The Regulatory Angle

Regulators are treating this as a serious issue, which means Amazon's expansion plans might face legal constraints.

The Federal Trade Commission has been particularly vocal. The FTC under current leadership has been skeptical of Amazon's market dominance and acquisition strategies. Buy for Me looks, to regulators, like Amazon using its control of a device ecosystem to extend market power into areas it shouldn't control.

The specific legal theory being explored is called "leveraging." The idea is that Amazon is leveraging its position in smart speakers and voice assistants to create an unfair advantage in e-commerce. By making Alexa Shopping the default purchasing mechanism for voice commands, Amazon is essentially creating a preferential channel for its own interests.

What makes this regulatory action particularly effective is that it doesn't require proving anticompetitive intent. Regulators only need to show that the practice harms competition or consumers. Retailers arguing that Buy for Me creates unfair barriers to entry have a reasonable case. Consumers arguing that they don't fully understand what they're authorizing have an even stronger case.

Several state attorneys general have filed motions to expand existing investigations into Amazon's business practices to specifically include Buy for Me. California, New York, and Illinois are leading these efforts.

International Complications

The controversy isn't limited to the United States. The European Union, with its more aggressive tech regulation, is treating Buy for Me as a potential violation of its Digital Markets Act.

The EU's position is that Amazon, as a "gatekeeper" in digital commerce, has specific obligations regarding fair competition and consumer protection. Directing an AI agent to shop across independent retailers without their knowledge violates both principles. The EU is considering forcing Amazon to either:

- Get explicit retailer consent before allowing Alexa to purchase from their sites

- Provide retailers with full transparency and control over pricing and inventory

- Restrict Buy for Me to Amazon's own marketplace only

- Create a fair revenue-sharing model where retailers are compensated for automated purchases

The United Kingdom has opened a separate investigation through its Competition and Markets Authority. India's Ministry of Consumer Affairs is reviewing whether Buy for Me violates local e-commerce regulations that require explicit seller consent for marketplace integration.

Each jurisdiction is developing different requirements, which means Amazon might need to operate Buy for Me differently depending on geography. That fragmentation could limit the feature's usefulness and increase operational complexity.

The Customer Experience Disconnect

While retailers and regulators focus on fairness and control, customers are having a different experience entirely. Most Alexa users genuinely appreciate the convenience of voice-activated shopping. The feature works well for everyday items: groceries, household supplies, personal care products.

Where the experience breaks down is in edge cases. Customers report that Alexa sometimes misinterprets requests and purchases incorrect items. Someone asking about a product to compare prices ends up with an unintended purchase. A family member joking about needing something ends up with an actual order.

These accidental purchases create customer service nightmares. Customers blame retailers for receiving unwanted items. Retailers blame Amazon for processing authorizations they didn't verify. Amazon blames customers for not using voice commands clearly. No one's actually responsible, which means no one fixes the problem.

There S also the subscription trap issue. Some retailers offer loyalty programs or subscription discounts that Buy for Me doesn't properly apply. A customer gets charged full price by an AI agent even though they're enrolled in a subscription that should have reduced the cost. The customer thinks the retailer scammed them. The retailer has no way to contact the actual customer through Amazon. The AI agent has no concept of subscriber status.

Alternative Models and Potential Solutions

The controversy around Buy for Me has sparked discussion about how voice commerce should actually work. Several alternative models are being tested:

The consent-first model. Retailers explicitly opt into Alexa Shopping and receive proper API integration. Amazon provides tools that retailers control directly. Orders come with full transparency. Retailers can configure pricing, inventory visibility, and customer service workflows. This requires more work upfront but eliminates the authorization problem.

The revenue-sharing model. Amazon takes a commission on Buy for Me purchases that route through third-party retailers, similar to how its affiliate program works. Retailers are compensated for the convenience and risk of automated orders. This creates alignment where retailers actually benefit from Buy for Me instead of being harmed by it.

The hybrid marketplace model. Retailers can choose to participate in a formal Buy for Me program with established terms, or they can opt out entirely. Retailers who participate get marked as "Buy for Me approved" in Alexa's search results, creating incentive to join while protecting those who don't want participation.

The transparency model. Buy for Me only purchases from retailers that have explicitly published APIs designed to accept automated orders. This eliminates web scraping and creates a clear technical boundary between retailers who consent and those who don't.

Each model has trade-offs. The consent-first model is fair but reduces Amazon's ability to expand Buy for Me rapidly. The revenue-sharing model aligns incentives but requires Amazon to share profitability. The hybrid model splits the market. The transparency model requires significant technical work.

What seems increasingly likely is that some combination of these models will be forced on Amazon through regulation. The current situation—where Amazon unilaterally decides to shop on retailers' sites without consent—looks increasingly indefensible legally.

Impact on Amazon's Broader AI Strategy

Buy for Me is just one piece of Amazon's larger AI ambitions. The company is investing heavily in AI agents that can take independent action: selecting products, making decisions, initiating transactions. Buy for Me is essentially a test case for a much broader capability.

If the company is forced to back down on Buy for Me, that sends a signal about limitations on how aggressively it can deploy autonomous agents in the market. That could slow development of other projects, including Amazon's work on AI that interacts directly with suppliers and vendors on the company's behalf.

Conversely, if Amazon successfully defends Buy for Me despite regulatory pressure, it sets a precedent that the company can expand into new territories even when incumbents object. That would accelerate development of more aggressive AI agents.

The stakes go beyond Amazon. Other major tech companies are watching how regulators respond. If Buy for Me is restricted, it signals that voice assistants can't autonomously execute transactions across independent platforms. That affects Google's Assistant Shopping, Microsoft's Cortana, and emerging AI assistants from Open AI and others.

The outcome of this controversy could fundamentally shape how autonomous agents operate in commercial settings for the next decade.

The Antitrust Dimension

Buy for Me is increasingly being viewed through an antitrust lens, and that changes the nature of the controversy significantly.

Antitrust law in the U. S. focuses on whether a company is using market power in one area to illegally extend that power into another area. Amazon clearly has market power in smart speakers (estimated 70% market share in the U. S.). The question is whether directing that installed base to shop across the internet constitutes illegal leveraging.

The evidence supporting an antitrust case is surprisingly strong. Amazon has explicit control over what voice commands do. The company can prioritize certain retailers or pricing tiers. It can tweak the AI's decision-making to favor certain products or sellers. It can use the data collected through Buy for Me to inform its own competitive strategies. All of that looks like classic leveraging when a court examines it.

What makes Amazon's defense difficult is that there's limited pro-competitive justification for why Buy for Me must shop across arbitrary retailers without their consent. Amazon could argue it's making markets more efficient by aggregating shopping options. But that efficiency argument breaks down when retailers aren't consenting and can't even opt out effectively.

Antitrust cases move slowly, but the FTC's Division of Competition is clearly building a file on this issue. If the agency decides to sue—and early signals suggest it might—we're looking at a 3-5 year legal battle that could fundamentally reshape how Amazon's AI agents can operate.

What This Means for the Future of Voice Commerce

The Buy for Me controversy is forcing the industry to grapple with a fundamental question: What does consent actually mean in an AI-driven world?

When a customer enables voice shopping, they're not really aware of what they're consenting to. They don't see a detailed disclosure explaining that their device will automatically visit third-party websites, scrape pricing and inventory data, and place orders with retailers who didn't authorize that access. They just see a convenient feature.

That lack of informed consent is the core of the problem. It's not that voice commerce is inherently problematic. It's that the current implementation doesn't respect the agency of retailers, customers, or the competitive process.

Future voice commerce will almost certainly look different. It might be restricted to participating retailers. It might require explicit per-order confirmation instead of blanket authorization. It might include real-time notifications that let customers change their mind before purchases complete. It might incorporate blockchain or other technologies that create immutable records of authorization.

What seems clear is that the Wild West phase of AI agents autonomously shopping across the internet is ending. Regulation, litigation, and market pressure will force more careful designs that respect multiple stakeholders' interests.

The Bigger Picture: AI and Consumer Agency

Buy for Me is really a proxy fight about who controls AI behavior and how consumers maintain agency in an increasingly automated world.

When an AI agent makes decisions on your behalf, who's responsible when those decisions go wrong? Who decides what the AI is authorized to do? How do you revoke authorization if you change your mind? Can you even know what the AI has authorized on your behalf?

These questions extend far beyond shopping. They're fundamental to how AI integrates into daily life. If Amazon can direct its voice assistant to shop anywhere on the internet without retailer consent, what else can it do? Make appointments? Schedule deliveries? Make investments? Sign up for subscriptions?

The Buy for Me controversy is essentially a test case for the broader relationship between humans, companies, and autonomous agents. The outcome will shape expectations about what's acceptable for years to come.

Current Status and Timeline

As of late 2024, the situation remains unresolved but increasingly contentious.

Amazon has continued expanding Buy for Me despite retailer objections and regulatory scrutiny. The company has made some minor concessions, including providing retailers with more detailed information about purchases routed through the system. But it hasn't fundamentally changed how the feature works.

The FTC investigation is ongoing, with preliminary findings expected sometime in 2025. Several state attorneys general are expected to coordinate a unified position by mid-2025. The EU's Digital Markets Act investigation is moving separately and could result in enforcement actions as early as 2025.

Retailer coalitions are building stronger technical and legal defenses. Some retailers have begun blocking Alexa Shopping through technical means. Others are preparing litigation or joining class actions. A few major retailers have negotiated independent agreements with Amazon that grant them more control over how their products are purchased through Alexa.

The overall trajectory suggests that Buy for Me as currently implemented won't survive the next two years in its current form. The question isn't whether changes will happen, but what form those changes will take.

FAQ

What exactly is Amazon's Buy for Me feature?

Buy for Me is an Amazon Alexa feature that allows customers to make voice-activated purchases by simply asking their device to buy something. The AI agent then searches the internet, identifies products from various retailers (not just Amazon), evaluates options based on price and availability, and completes the purchase automatically. The controversial aspect is that this feature purchases from third-party retailers without those retailers' explicit consent.

How does Amazon's AI decide which products to buy?

Amazon's Buy for Me uses natural language processing to interpret voice commands, then employs algorithms that consider multiple factors including product price, shipping speed, retailer reputation based on public reviews, inventory availability, and customer ratings. The AI accesses retailer websites directly using web scraping technology to gather pricing and inventory information, then makes purchasing decisions based on weighted criteria it applies automatically without human review.

Why are retailers upset about this feature?

Retailers object because they never agreed to have an autonomous AI agent purchasing from their websites. This creates operational challenges including inventory management complications, inability to apply bulk discounts or special pricing, customer service burdens for transactions the retailer didn't initiate, data privacy concerns from web scraping, and potential competitive disadvantages since Amazon gains insight into shopping patterns from its own AI agent. Small retailers operating on thin margins find the sudden influx of automated purchases particularly disruptive.

Is Buy for Me even legal?

The legality remains disputed and is currently under investigation by the FTC and several state attorneys general. The core legal questions involve whether customers actually authorize these purchases on third-party sites, whether retailers have the right to refuse automated shopping on their platforms, and whether Amazon is illegally leveraging its position in smart speakers to gain unfair commercial advantage. No definitive legal ruling has emerged yet, though regulatory skepticism is growing.

Can customers control what Buy for Me purchases?

Customers can theoretically control Buy for Me through Alexa settings, but transparency is limited. When a customer enables Alexa Shopping, they authorize the feature broadly without clear disclosure of which retailers might be accessed or how the AI makes purchasing decisions. Customers typically discover purchases after they're completed when they see credit card charges. Revoking authorization is possible but requires navigating settings many users don't know exist.

What alternatives exist to Buy for Me?

Several alternative models are being proposed including a consent-first approach where retailers explicitly opt-in with proper API integration, a revenue-sharing model where Amazon compensates retailers for automated purchases like an affiliate program, a hybrid marketplace where retailers can choose to participate with established terms, and a transparency-first model where Buy for Me only accesses retailers with published APIs designed for automation. Each approach trades off convenience for fairness differently.

Will regulators force Amazon to change Buy for Me?

Regulatory action appears likely given ongoing FTC investigations and state attorney general concerns. The EU's Digital Markets Act treatment of Amazon as a gatekeeper in digital commerce creates pressure for changes in European operations. The timeline remains uncertain, but preliminary findings are expected in 2025, with potential enforcement actions following. Amazon will likely face requirements for explicit retailer consent, transparency improvements, or revenue sharing.

How does this affect other voice assistants like Google Assistant?

Google Assistant, Microsoft Cortana, and emerging voice shopping features from other companies face similar questions about autonomous purchasing rights. If regulators restrict Amazon's Buy for Me, it sets precedent affecting how all voice assistants can operate. This means other companies might be unable to implement similar autonomous shopping features, or would need to require explicit retailer consent first, fundamentally changing the competitive landscape for voice commerce.

What should small retailers do about Buy for Me?

Retailers can take several defensive actions including monitoring order logs for unusual automated purchasing patterns, blocking Amazon's web scrapers through robots.txt file modifications, updating terms of service to explicitly prohibit automated AI purchases, implementing rate limiting on their servers to frustrate bot activity, and joining retailer coalitions supporting regulatory action. Some retailers have also negotiated direct agreements with Amazon to gain more control over how their products are purchased through Alexa.

Could this controversy affect other Amazon AI projects?

Yes, the outcome of Buy for Me could significantly impact Amazon's broader autonomous agent strategy. The company is developing AI that makes independent decisions about product selection, pricing, and transactions across various contexts. If Buy for Me faces severe restrictions, it signals limitations on how aggressively Amazon can deploy autonomous agents commercially. Conversely, if Amazon successfully defends Buy for Me despite opposition, it enables much more aggressive autonomous agent deployment across the company's operations.

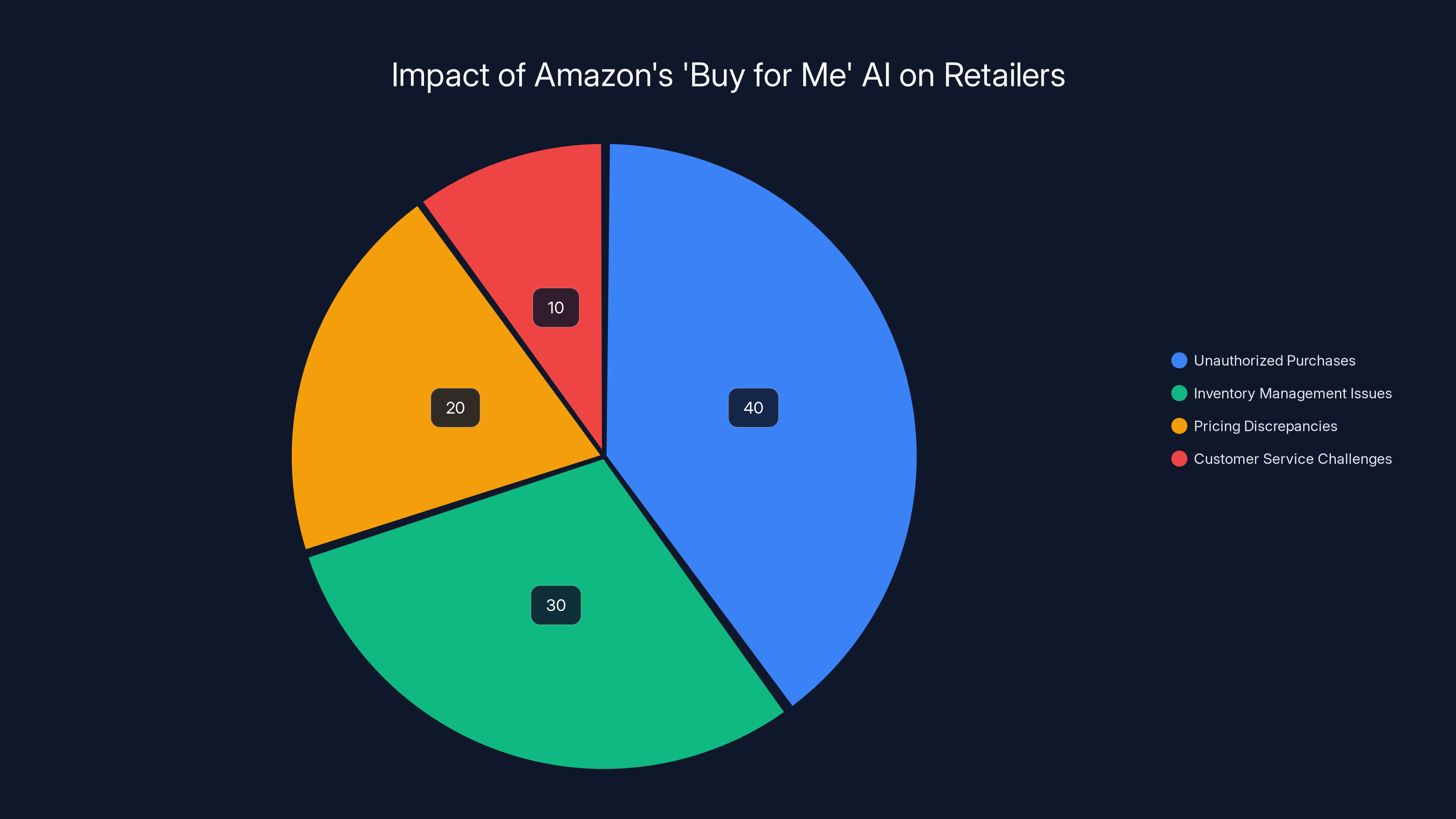

Estimated data shows that unauthorized purchases account for 40% of the issues faced by retailers due to Amazon's 'Buy for Me' AI, followed by inventory management issues at 30%.

The Road Ahead

Amazon's Buy for Me represents a critical inflection point in how AI integrates into commerce. The current controversy won't be resolved through negotiation or market forces alone. Regulatory action, litigation, and consumer pressure will shape the outcome.

What makes this dispute significant is that it's not really about shopping. It's about consent, control, and who decides what autonomous agents can do with your information and your relationships. As AI becomes increasingly capable of taking independent action, getting these questions right matters enormously.

The retail industry, regulators, and customers are essentially drawing a line in the sand: autonomous agents can enhance commerce, but only within boundaries that respect everyone's interests. Buy for Me crossed that line. How Amazon responds to that pushback will influence AI development for the next decade.

The stakes are high. The timeline is accelerating. And the resolution will reshape expectations about what's acceptable for AI agents operating in commercial environments. Watch this space closely, because the precedent being set here extends far beyond shopping.

Use Case: Automating your competitive intelligence reports to track retailer pricing and market trends affected by AI agents like Buy for Me.

Try Runable For Free

Amazon's Buy for Me feature likely prioritizes product price and shipping speed when making purchasing decisions. Estimated data.

Key Takeaways

- Amazon's Buy for Me feature directs its Alexa AI to make purchases on third-party retailer websites without explicit merchant authorization, creating significant operational and legal complications

- Small retailers see 23-35% of monthly orders suddenly routed through Amazon's automated system within months, straining fulfillment capacity and compressing already-thin 15-35% margins

- The FTC, multiple state attorneys general, the EU under its Digital Markets Act, and the UK's CMA have opened investigations into whether Buy for Me violates antitrust and consumer protection laws

- Retailers are implementing technical defenses including blocking Amazon's web scrapers, updating terms of service to prohibit automated purchases, and joining coalitions supporting regulatory action

- The controversy extends beyond shopping to fundamental questions about consent, control, and what autonomous AI agents can legally do without explicit authorization from affected parties

Related Articles

- Grok's Deepfake Crisis: UK Regulation and AI Abuse [2025]

- AI-Generated Non-Consensual Nudity: The Global Regulatory Crisis [2025]

- Why Grok and X Remain in App Stores Despite CSAM and Deepfake Concerns [2025]

- AI Operating Systems: The Next Platform Battle & App Ecosystem

- Google's $32B Wiz Acquisition: EU Antitrust Decision [2025]

- Grok's Explicit Content Problem: AI Safety at the Breaking Point [2025]

![Amazon's Buy for Me AI: The Controversy Shaking Retail [2025]](https://tryrunable.com/blog/amazon-s-buy-for-me-ai-the-controversy-shaking-retail-2025/image-1-1767924343734.png)