Google's $32 Billion Wiz Acquisition: What the EU Antitrust Decision Means for Cloud Security

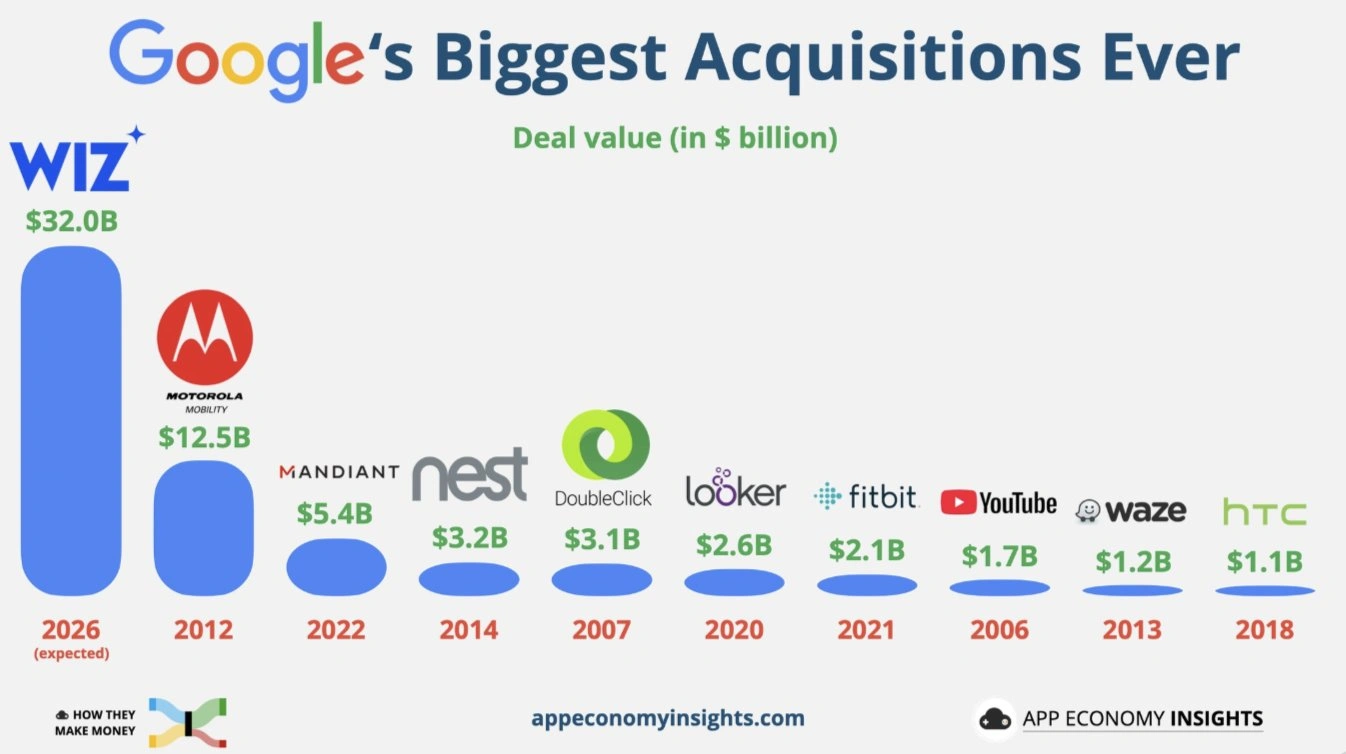

Something massive is happening in the tech world right now, and most people haven't noticed. Google is trying to buy Wiz, a cloud security startup, for $32 billion. That's not just any acquisition. That would be Alphabet's largest deal ever. But there's a problem: European regulators are about to decide whether to let it happen. And they're doing it in the middle of an increasingly hostile regulatory environment toward Big Tech.

This deal matters more than it might seem on the surface. It's not just about one company buying another. It's about consolidation in cloud security, about whether Google gets more powerful, and about what happens when a tech giant tries to expand its reach during a time when regulators globally are tightening the screws. The EU has already proven it's willing to block deals and hit tech companies with massive fines. The question now is whether this acquisition survives that scrutiny.

Here's what's actually happening, why it matters, and what the outcomes could be.

TL; DR

- EU Decision Imminent: European Commission regulators must decide by February 10, 2025 whether to approve, block, or conditionally approve Google's $32 billion acquisition of Wiz.

- Antitrust Concerns: The deal faces scrutiny over potential market consolidation in cloud security, with competitors and regulators worried about reduced competition.

- US Investigation Active: The Department of Justice is conducting its own early-stage antitrust review, adding another layer of uncertainty to the transaction.

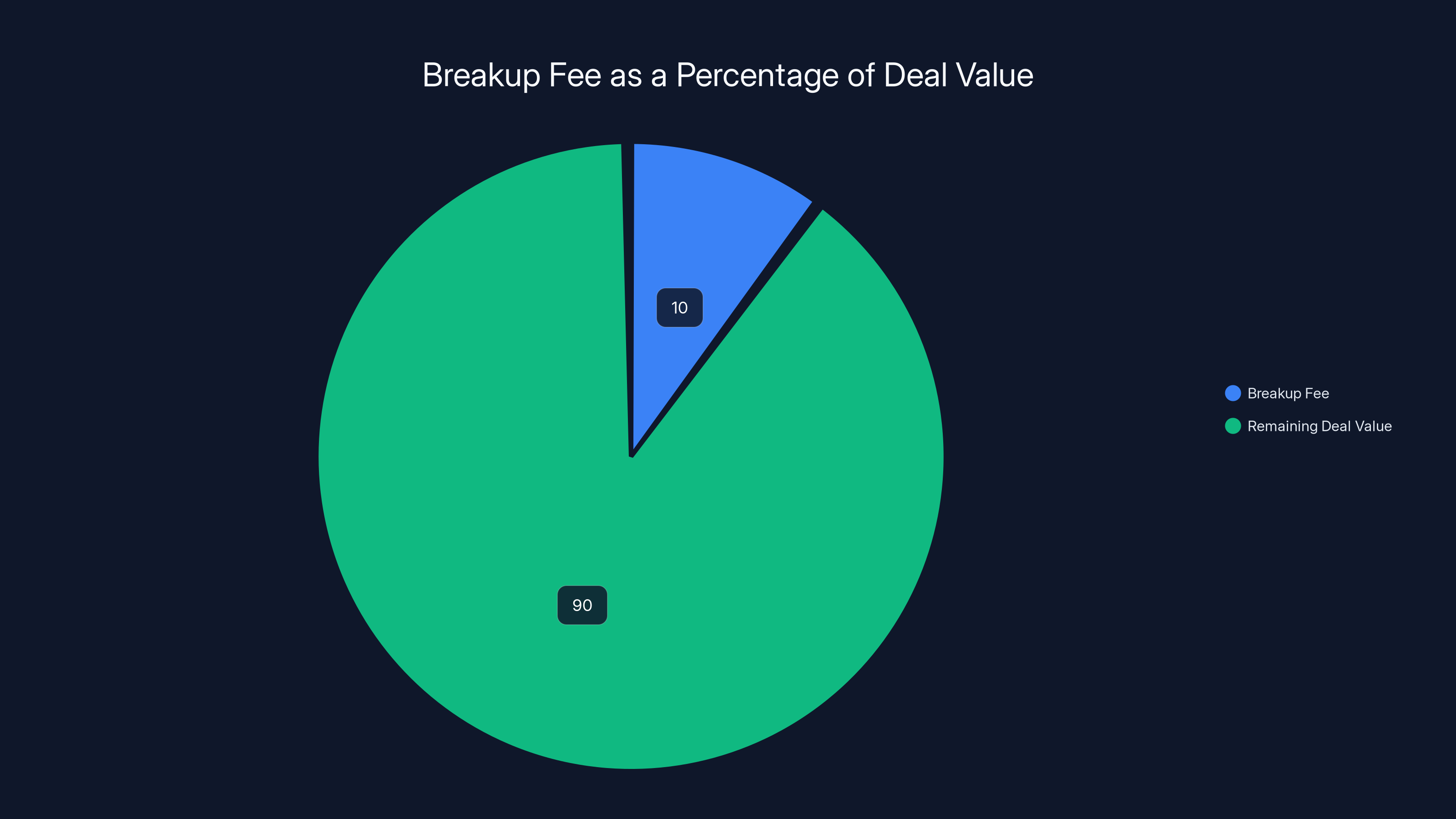

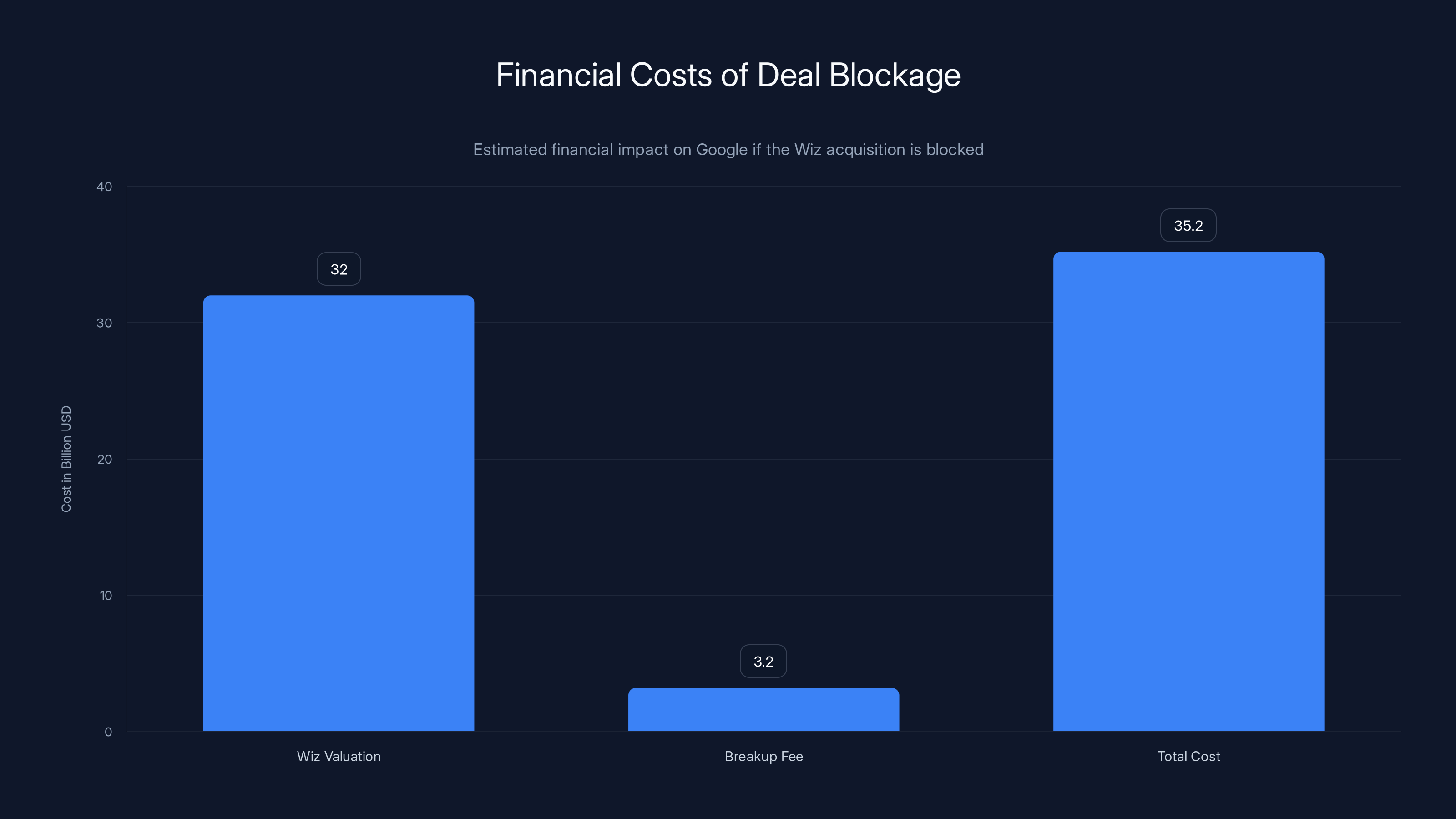

- High Stakes for Google: If blocked, Google owes Wiz a $3.2 billion breakup fee (10% of deal value), representing one of the largest termination costs in tech history.

- Cloud Security Market: The deal would combine Google Cloud's infrastructure with Wiz's expertise in cloud security across multicloud environments (AWS, Azure, Oracle Cloud).

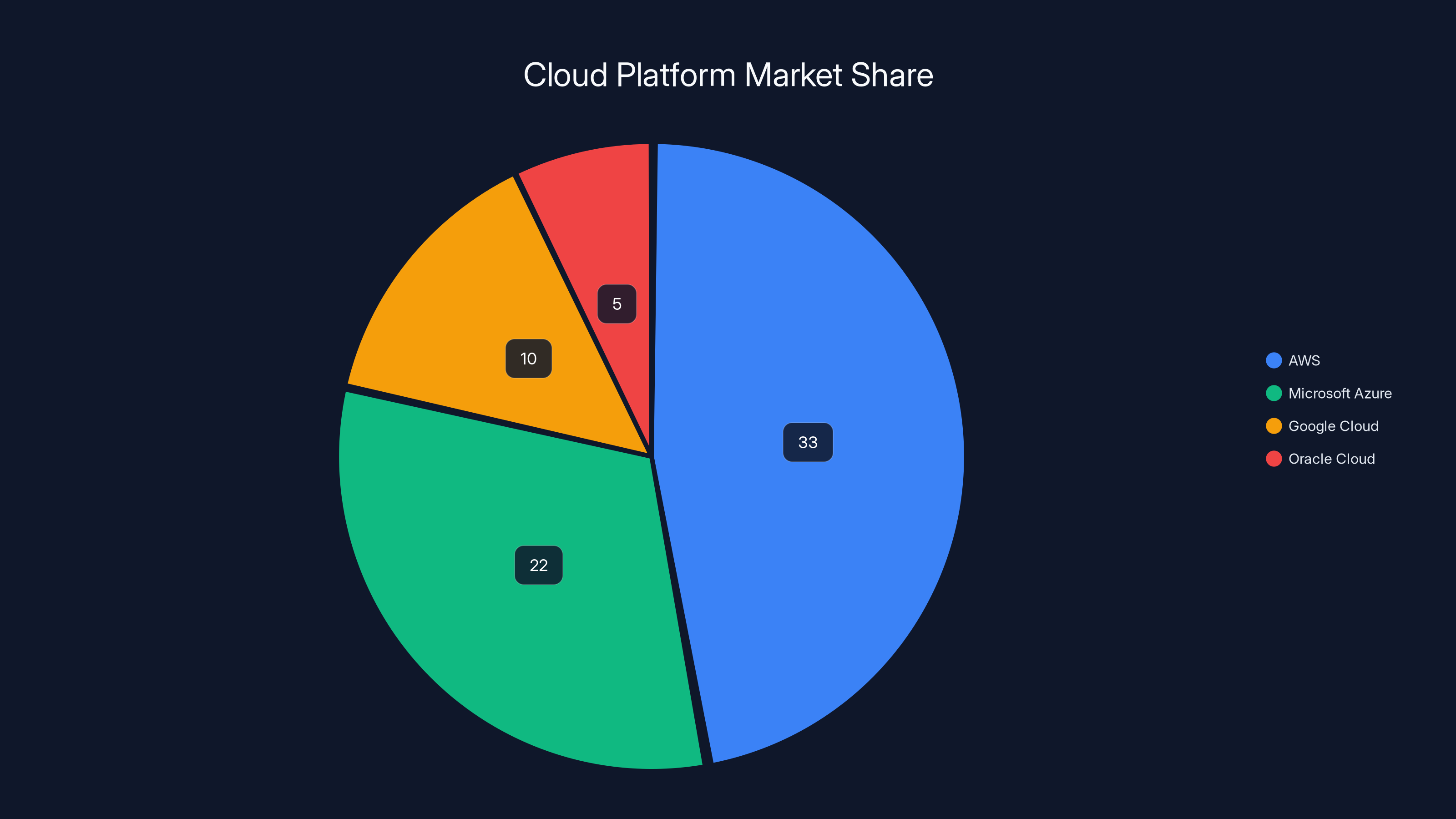

Estimated data shows AWS leading with 33% market share, followed by Microsoft Azure at 22%. Google Cloud holds 10%, highlighting the competitive landscape in which Wiz operates.

The Deal: Google's Biggest Acquisition Ever

Let's start with the basics. Google Cloud announced in March 2025 that it was acquiring Wiz for

Wiz isn't some small startup either. Founded in 2020, the company has grown explosively in the cloud security space. It's raised billions in venture funding and counts some of the world's largest enterprises as customers. The company is worth tens of billions not because of hype but because it actually solves a critical problem: helping organizations understand and manage security risks across their cloud infrastructure.

Why does Google want Wiz so badly? The answer is straightforward. Cloud security is becoming increasingly important, increasingly complex, and increasingly lucrative. As more companies move their workloads to the cloud, they need better ways to protect that infrastructure. Wiz provides visibility and risk management across multiple cloud providers simultaneously. Google Cloud, meanwhile, is competing hard against Amazon Web Services and Microsoft Azure for enterprise customers. Combining these two companies would create a stronger offering.

Google Cloud CEO Thomas Kurian explained the logic in a March 2025 blog post. The idea is that Wiz's products, combined with Google Cloud's infrastructure and AI capabilities, could better handle the growing sophistication of cyberattacks. Kurian framed it as defensive: the threat landscape is changing, attacks are becoming more frequent and severe, and enterprises need better tools to protect themselves.

But here's where it gets interesting. Everyone knew this deal would face regulatory scrutiny. Antitrust regulators worldwide have become increasingly aggressive about blocking acquisitions they believe reduce competition. Google in particular has faced intense scrutiny. So Google and Wiz built the deal with that reality in mind.

Why Regulators Are Concerned About Cloud Consolidation

Antitrust concerns about tech acquisitions typically boil down to a few key questions: Will this deal reduce competition? Will customers have fewer options? Will the combined company have unfair advantages? In the Google-Wiz case, each of these questions becomes relevant.

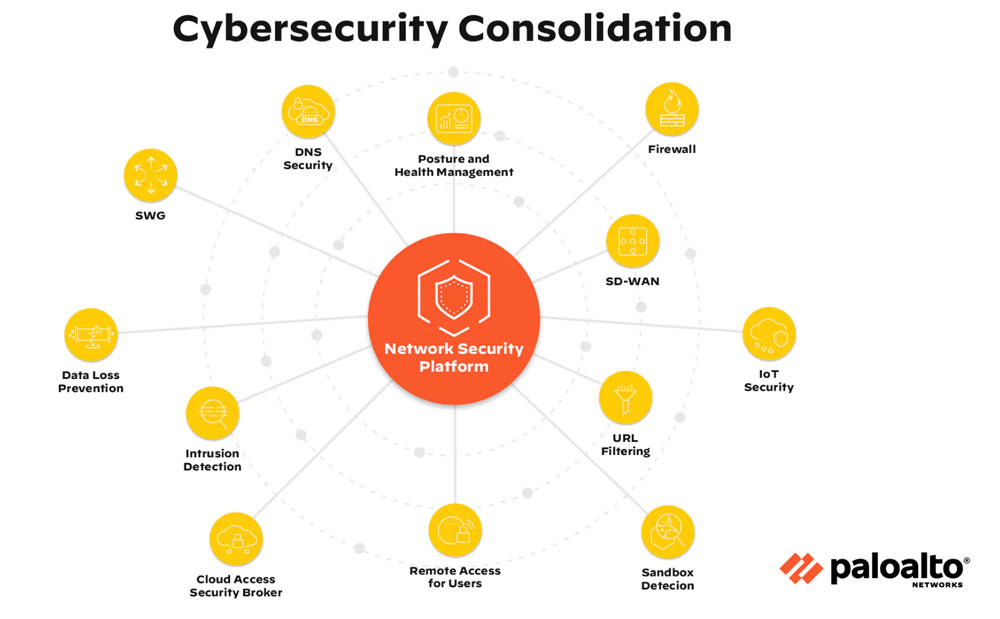

The cloud security market is growing rapidly, but it's also becoming more concentrated. There aren't that many truly independent cloud security platforms. Wiz is one of the rare independent companies that works across all the major cloud platforms (AWS, Microsoft Azure, Google Cloud, and Oracle Cloud). If Google acquires it, Wiz becomes a Google subsidiary. That's a meaningful change in the competitive landscape.

Competitors worry about integration. What if Google starts giving preference to Google Cloud customers? What if Wiz's tool becomes less effective on competing cloud platforms? What if Google uses Wiz's customer data to improve its own cloud offerings while disadvantaging competitors? These aren't conspiracy theories. These are standard competitive concerns that regulators take seriously.

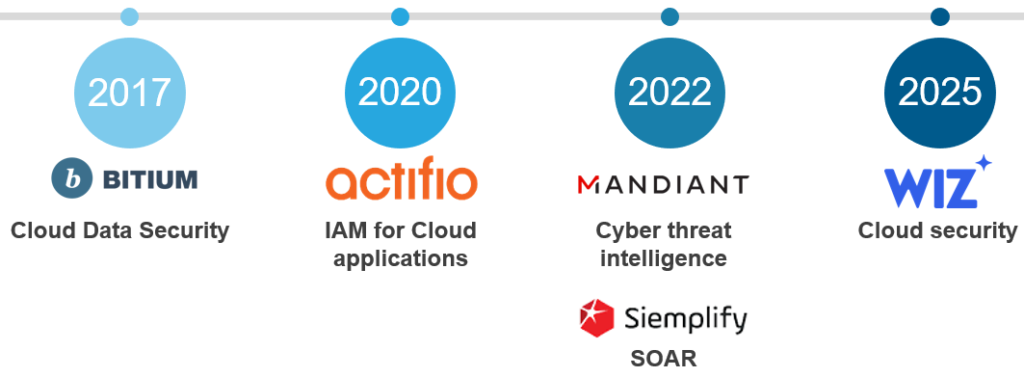

There's also the broader pattern. Google has been on a shopping spree in the cloud space. It's acquired multiple security companies, infrastructure companies, and data companies over the past five years. Each acquisition is relatively small, but together they represent a systematic expansion of Google's cloud capabilities. Regulators worry about death by a thousand cuts: no single deal is massive enough to block, but collectively they reshape the competitive landscape.

The cloud infrastructure market generates hundreds of billions in annual revenue. Security tools and services are one of the fastest-growing segments. If Google consolidates security offerings under its cloud banner, it creates stickiness: customers using Google Cloud's security tools are less likely to switch to AWS or Azure because they'd have to rip out their security infrastructure and rebuild it elsewhere.

EU Antitrust Enforcement: A Pattern of Aggressive Oversight

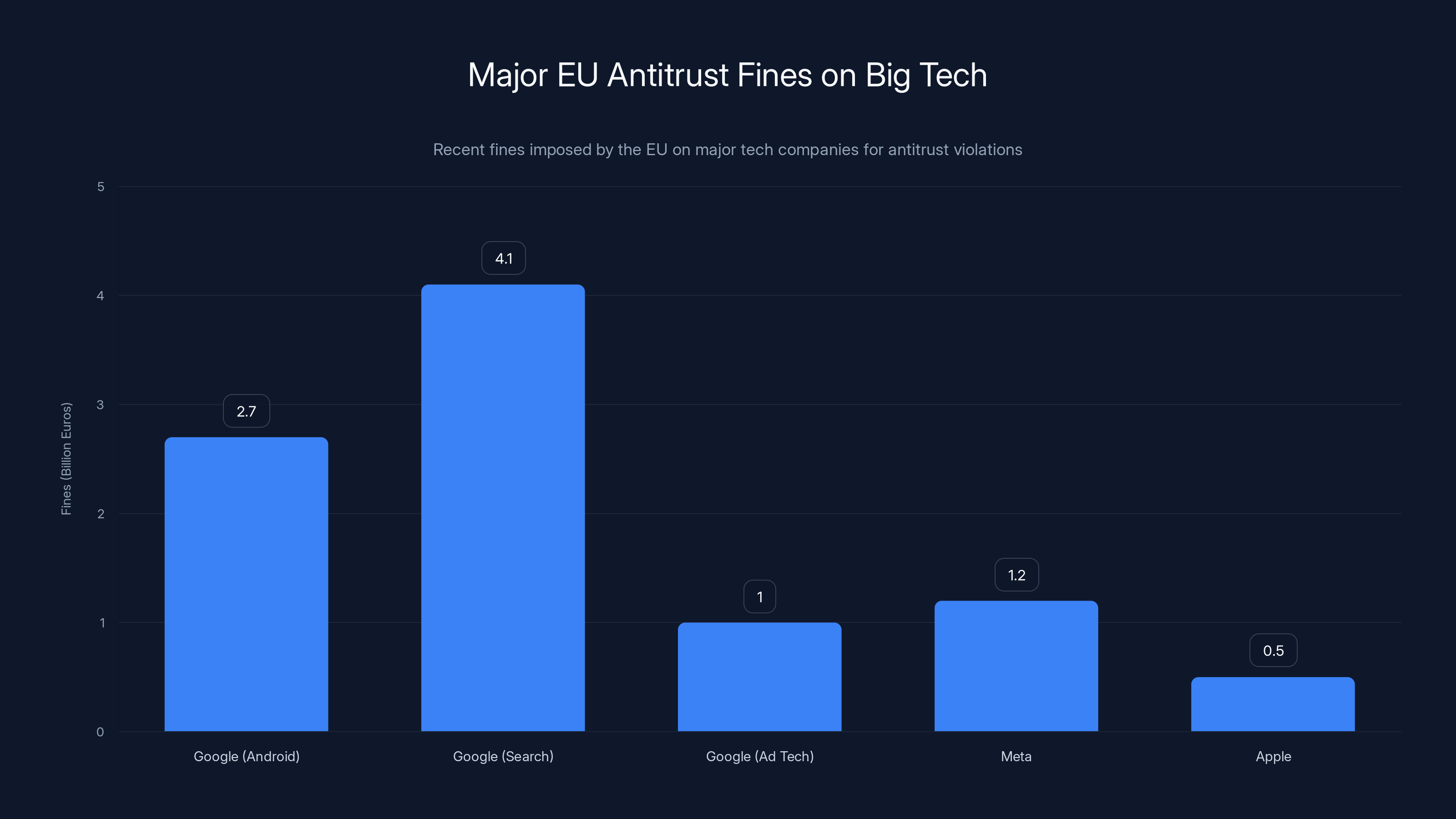

Understanding the EU's likely approach to this deal requires understanding recent EU antitrust enforcement. The European Commission, led by enforcement officials, has fundamentally changed how it approaches Big Tech. In recent years, it's blocked or nearly blocked multiple major tech acquisitions and has fined tech companies tens of billions of euros.

Consider the context. The EU blocked Microsoft's acquisition of Activision Blizzard in 2023 (actually, the UK did, but the EU was also investigating). The EU has been investigating Meta's acquisition of Instagram and WhatsApp. The EU forced Apple to open up its App Store. It fined Google

The pattern is clear: the EU regulatory environment has shifted. There's no assumption that a deal is acceptable. The burden is on the acquirer to prove that the deal doesn't harm competition. That's a heavy burden, especially for a company like Google, which is already under scrutiny for various monopolistic practices.

Google has actually been found guilty of holding an illegal monopoly in online search and in parts of the ad tech market by US courts. That's not ancient history. That's recent. So EU regulators reviewing this deal have recent evidence that Google has engaged in anticompetitive behavior. That makes them more skeptical of arguments that Google won't use Wiz anticompetitively.

The Multicloud Commitment: Google's Attempt to Address Concerns

Google and Wiz both knew this deal would face regulatory scrutiny, so they tried to address the most obvious concern: that Google would make Wiz less effective on competing cloud platforms or would disadvantage non-Google Cloud customers.

Assaf Rappaport, Wiz's co-founder and CEO, made an explicit commitment. He stated that Wiz would remain a multicloud platform. The product would continue supporting AWS, Microsoft Azure, and Oracle Cloud with the same level of functionality and support as Google Cloud. This wasn't a casual comment. It was a deliberate, public statement designed to reassure customers and regulators.

Kurian echoed this in his blog post, stating: "We both also believe Wiz needs to remain a multicloud platform, so that across any cloud, we will continue to be a leading platform." This language is important. Google is explicitly committing to keeping Wiz as a multicloud tool.

But here's the reality check. These are promises made before the acquisition closes. Once Google owns Wiz, those promises become harder to enforce. What stops Google from gradually deprioritizing development on competing platforms? What stops them from pricing Wiz differently for AWS users versus Google Cloud users? What stops them from integrating Wiz more tightly with Google Cloud over time?

These aren't hypothetical concerns. Tech companies routinely use acquired products in ways that favor their own platforms. Facebook integrated WhatsApp's backend into Facebook's infrastructure, despite promises to keep them separate. Microsoft integrated Activision's games more tightly into Xbox Game Pass than they initially suggested.

Regulators know this history. So even though Google and Wiz are making multicloud promises, regulators are likely to question whether those promises are sufficient or whether behavioral commitments would be adequate enforcement mechanisms.

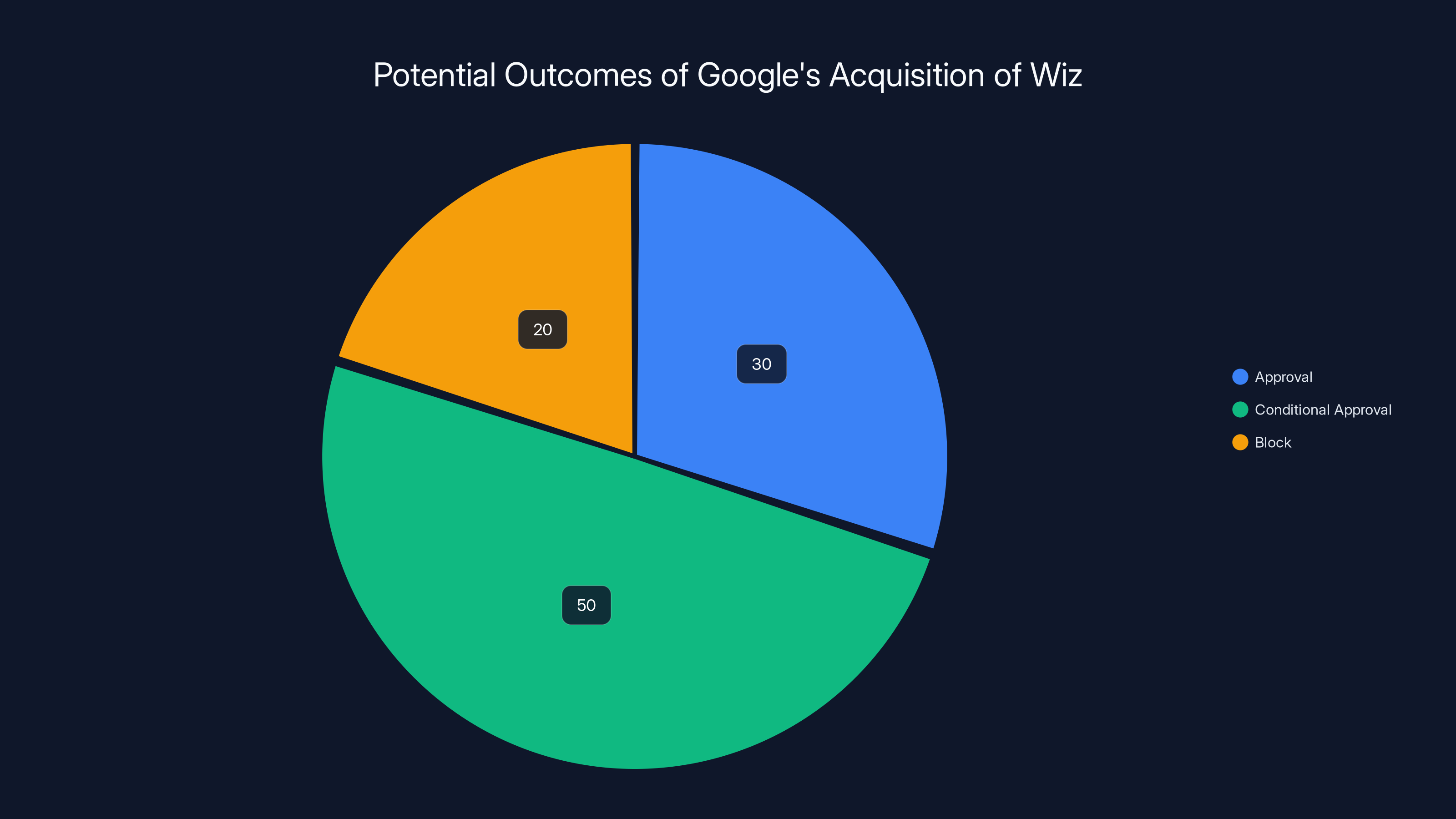

Estimated data suggests a higher likelihood of conditional approval for Google's acquisition of Wiz, reflecting typical regulatory caution in large tech deals.

The US DOJ Investigation: A Parallel Threat

Google isn't just facing EU scrutiny. The US Department of Justice is conducting its own antitrust review. This is actually a significant complication for Google because the regulatory environment is different on both sides of the Atlantic.

The US review is in its early stages, which means it's still a question mark. The DOJ could approve it with conditions, approve it outright, or challenge it. This creates real uncertainty. Even if the EU approves the deal, a DOJ challenge would prevent it from closing. Conversely, if the DOJ approves but the EU blocks, the deal is dead anyway.

The DOJ's approach to tech acquisitions has been more permissive than the EU's historically, but that's been changing. Under the Biden administration, antitrust enforcement became more aggressive across the board. There's been a clear shift toward more skepticism about acquisitions that consolidate market share.

Google's recent antitrust losses in the US courts are relevant here too. Last year, a federal judge found Google guilty of holding an illegal monopoly in search and in search advertising. That finding makes the DOJ more likely to be skeptical of Google's arguments that Wiz acquisition wouldn't harm competition. If Google is already acting monopolistically in one market, why should regulators trust that it won't do the same in cloud security?

The early-stage review could take months. That creates a hanging sword over the deal. Even if EU regulators approve, Google and Wiz can't close if the DOJ is likely to challenge.

Market Impact: What Consolidation Means for Cloud Security

Beyond the regulatory mechanics, there's the actual market question: does this consolidation matter for customers and competition? The answer is yes, probably significantly.

Cloud security is currently in a competitive phase. There are multiple independent vendors competing aggressively on product quality and innovation. Prices are competitive. Customers have genuine choices. If Google acquires Wiz and integrates it into its cloud platform, that changes the competitive dynamic.

Smaller security vendors would face a tougher environment. Why would an enterprise buy a different cloud security tool when they can get integrated cloud security from one of the three major cloud providers? That's the consolidation risk. Over time, the market could shift from point solutions (specialized tools for specific security problems) toward integrated platform solutions (where security is built into the cloud platform).

That's not inherently bad. Integrated solutions have benefits. They're easier to deploy, they integrate well, and they leverage the cloud provider's native APIs and infrastructure. But it does reduce competition. Customers have fewer independent choices.

For security innovation, this also matters. The most interesting security innovations in recent years have come from nimble independent companies, not from cloud providers. If Wiz becomes a Google subsidiary, that changes its incentives and structure. It's less likely to take risks or innovate in ways that compete with Google's other products.

The Breakup Fee: A $3.2 Billion Contingency

Here's a detail that illustrates how seriously Google takes the regulatory risk. Google agreed to pay Wiz a $3.2 billion breakup fee if the deal doesn't close. That's 10% of the deal value. It's enormous.

Why would Google agree to such a large breakup fee? Because Wiz's investors demanded it. They wanted reassurance that Google wouldn't walk away from the deal if regulators got tough. A billion-dollar fee is expensive enough that Google would be incentivized to fight harder for the deal.

But here's what the breakup fee tells you: Google knows this deal faces real regulatory risk. It's not offering a $3.2 billion fee because it thinks regulators will rubber-stamp the deal. It's offering it because regulators might block it, and Google wants to show good faith to Wiz's investors.

For Wiz, the fee is actually a decent outcome insurance policy. If regulators block the deal, Wiz walks away with $3.2 billion, which it can use to fund growth independently. That's not nothing. It's real money that de-risks the acquisition for Wiz's backers.

EU Timeline: February 10 Decision Point

The European Commission has set February 10, 2025, as the decision deadline. That's the date by which regulators must issue a formal decision. But what does that decision actually look like?

EU antitrust reviews typically end in one of three ways. First, the Commission can issue a statement of objections (basically saying "we think you're breaking antitrust law"), which triggers a more formal investigation that can drag on for months. Second, they can approve the deal with behavioral or structural commitments (like requiring Google to maintain Wiz as independent or to maintain interoperability). Third, they can simply block the deal.

Given the timeline and the level of scrutiny, February 10 seems designed to trigger either a commitment-based approval or a further investigation. An outright block seems less likely on that timeline, though it's possible.

If EU regulators issue a statement of objections, that extends the process significantly. Google would then have time to respond, regulators would investigate further, and the entire process could drag into 2026. That uncertainty is costly for Google and Wiz. Both companies would prefer clarity.

Precedent: Recent Major Tech Acquisitions

To predict what might happen, it helps to look at how EU regulators treated similar deals. The closest precedent is probably the Broadcom-Qualcomm attempted acquisition in 2018, which the EU blocked. That deal also raised consolidation concerns in a critical tech market. Regulators worried that combining the two companies would reduce competition in smartphone components.

Another precedent is the proposed Microsoft-Activision deal, which faced intense scrutiny in multiple jurisdictions. UK regulators blocked it on concerns about gaming consolidation. The EU investigated but ultimately allowed it with some conditions.

The pattern from these cases suggests that EU regulators are more likely to either block a deal or approve it with significant commitments, rather than approving it unconditionally. A flat approval of the Google-Wiz deal seems unlikely. A block is possible. Approval with conditions (like structural separation, pricing controls, or interoperability requirements) seems most probable.

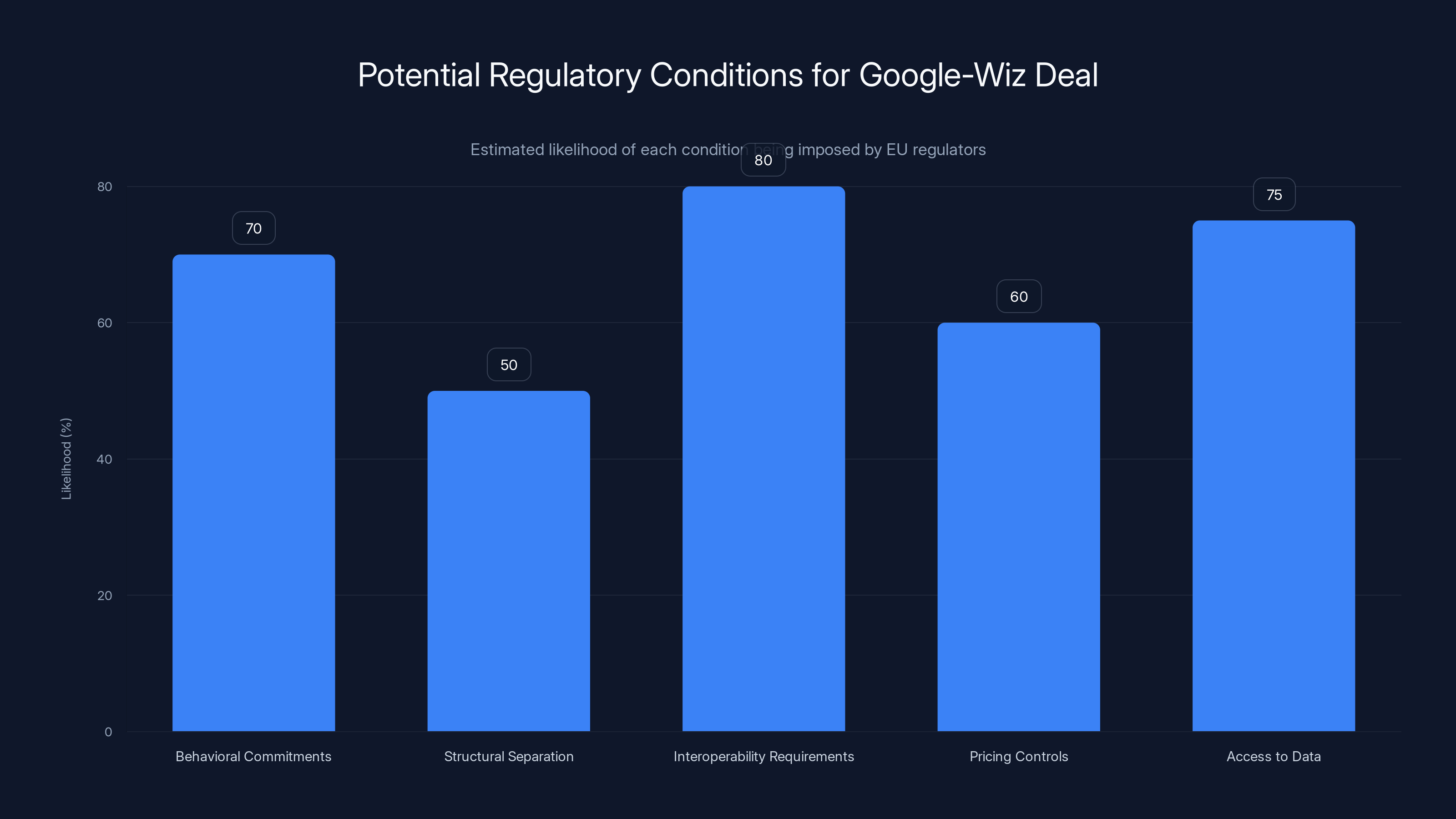

Interoperability requirements and access to data restrictions are the most likely conditions to be imposed, with estimated likelihoods of 80% and 75% respectively. Estimated data.

Google's Recent Antitrust Troubles

Context matters. Google isn't coming into this review with a clean reputation. The company has been found guilty of anticompetitive behavior in multiple markets. US federal courts recently found that Google illegally monopolized search and parts of the ad tech market. The EU has fined Google repeatedly for antitrust violations.

This history changes the dynamic. Google can't just assert that it won't use Wiz anticompetitively. Regulators have evidence that Google has used past acquisitions and market power anticompetitively. So the burden on Google is higher. It needs to convince skeptical regulators that this time will be different.

One argument Google could make is that Wiz is a complementary business, not a competitive threat. Wiz sells security products. Google Cloud sells compute and storage. In theory, combining them doesn't reduce competition in either market because they're not competing head-to-head.

But that argument has weaknesses. Cloud security is increasingly becoming part of the cloud platform's core offering. AWS has built extensive security tools into its platform. Microsoft has integrated security into Azure. If Google acquires Wiz and integrates it into Google Cloud, it's combining a competitor in cloud security (Wiz) with a player in cloud infrastructure (Google Cloud). That consolidation reduces competition in cloud security.

Industry Response: Competitors and Customers Weigh In

It's worth noting that competitors have been vocal about concerns with this deal. Smaller cloud security vendors and even some of Google's major cloud customers have expressed concerns to regulators. AWS and Microsoft are unlikely to be thrilled about Google acquiring one of the most respected independent cloud security vendors.

Customers have been more mixed. Enterprise cloud users appreciate Wiz's independence and multicloud approach. Some have expressed concerns about what happens if Google owns it. Others have suggested they'd be fine with the acquisition as long as Wiz remains multicloud.

Security researchers and industry analysts have been split. Some think the combination makes sense and could lead to better integrated security. Others worry about consolidation and reduced competition.

Regulators will listen to these stakeholders but won't be bound by them. The regulatory question isn't whether customers want the deal or competitors dislike it. The question is whether the deal violates antitrust law or policy.

What Regulatory Approval Might Look Like

If the EU approves this deal, it would almost certainly come with conditions. These conditions might include:

-

Behavioral Commitments: Google commits to keeping Wiz independent and multicloud. These are enforceable through fines if violated, but they're hard to verify and easy to circumvent over time.

-

Structural Separation: Google agrees to keep Wiz as a separately operated subsidiary with its own CEO, board, and operating independence. This makes it harder for Google to use Wiz anticompetitively, but it also reduces the synergies that make the acquisition valuable to Google.

-

Interoperability Requirements: Google guarantees that Wiz will integrate equally well with AWS, Azure, and Oracle Cloud as with Google Cloud. This requires ongoing compliance monitoring.

-

Pricing Controls: Google agrees not to price Wiz differently based on whether customers use Google Cloud. This prevents predatory pricing practices.

-

Access to Data: Restrictions on how Google can use Wiz customer data to improve its own cloud offerings. This prevents Google from using one subsidiary's market insights to harm competitors.

Any of these conditions would be designed to mitigate the anticompetitive concerns while allowing the deal to proceed.

What Regulatory Rejection Might Look Like

If the EU decides to block the deal, the reasoning would focus on consolidation concerns. The argument would be that cloud security is a distinct market where Wiz is a significant independent player. By acquiring Wiz, Google reduces competition in that market. The multicloud commitments are insufficient to address this because they're hard to enforce and easy to circumvent.

A block would also consider the broader context: Google's pattern of acquisitions in cloud infrastructure, Google's antitrust history, and the strategic importance of cloud security to cloud platforms. The EU would argue that allowing this acquisition contributes to consolidation that ultimately harms competition and consumers.

A block would be surprising because EU regulators sometimes approve acquisitions with conditions rather than rejecting them outright. But it's not impossible. If the EU decides that behavioral commitments are insufficiently protective, it might prefer to block the deal rather than attempt enforcement.

The Global Antitrust Environment

This deal doesn't exist in isolation. It's part of a broader shift in how regulators worldwide approach Big Tech acquisitions. In the US, the FTC and DOJ have become more aggressive. In the EU, that aggression was already established. In the UK, regulators blocked the Microsoft-Activision deal. In China, regulators have increasingly restricted tech acquisitions.

The momentum globally is toward greater skepticism about tech acquisitions. That suggests that if this deal faces any real competitive concerns (and it does), regulators have the tools and willingness to block it or heavily condition it.

Google, as one of the most scrutinized tech companies globally, faces this skepticism more intensely than most. What might be approved for another company might be rejected for Google based on its antitrust history.

The $3.2 billion breakup fee represents 10% of the total deal value, highlighting the significant regulatory risk Google anticipates.

Financial Impact and Timing

From a financial perspective, the $32 billion price tag reflects Wiz's value to Google, but it also reflects Wiz's standalone value. If this deal is blocked, Wiz remains a valuable, independent company. Its customers won't disappear. Its technology won't evaporate. The startup would likely seek alternative strategic options or return to independent growth.

For Google, a blocked deal would be expensive in two ways. First, it loses the strategic benefits of the acquisition. Second, it pays the

But delay is also expensive. Every month the deal remains uncertain creates operational challenges for both companies. Employees at both organizations are uncertain about their futures. Customers worry about whether service will change. Investors fret about timing and execution.

The February 10 deadline provides some clarity on European timing, but if regulators issue a statement of objections, the process extends significantly. That could push the resolution into mid-2025 or beyond.

Implications for Future Tech Consolidation

How regulators decide on this deal will have ripple effects. If they approve it with heavy conditions, future tech deals will be structured with similar conditions from the start. If they block it, companies will be more cautious about proposing large acquisitions in consolidating markets.

This deal might become a watershed moment. It's large enough, strategic enough, and scrutinized enough to potentially reshape how regulators approach tech M&A. If the EU approves it despite consolidation concerns, it signals that the threshold for blocking is quite high. If the EU blocks it, it signals that cloud infrastructure consolidation is a regulatory red line.

What Happens If Regulators Disagree?

Here's a complication: the EU and US regulatory systems operate independently. It's possible that one approves the deal while the other blocks it. If the EU approves but the DOJ challenges, Google faces a choice: fight the DOJ challenge, settle with conditions, or withdraw the deal. The cost-benefit calculation changes if you're fighting multiple regulators.

Conversely, if the US approves but the EU blocks, the deal is dead. Google won't close a deal that's blocked in one of its major markets.

Most likely, regulators will coordinate informally. They already communicate about major deals. If one jurisdiction signals a block, others often follow.

The Broader Context: Google's Cloud Ambitions

Google Cloud is trying to compete with AWS and Microsoft Azure in a market where the latter two have substantial leads. AWS dominates infrastructure cloud services with roughly a 32% market share. Azure has around 23%. Google Cloud has roughly 10-11%. Google has been trying to narrow that gap through a combination of product improvements, price competition, and strategic acquisitions.

The Wiz acquisition is part of that strategy. Security is one of the major decision factors for enterprise cloud adoption. If Google can offer integrated, best-in-class cloud security, it becomes more competitive against AWS and Azure.

But regulators view the same strategy differently. From their perspective, if Google uses acquisitions to fill product gaps and become more competitive against AWS and Azure, that's fine. But if Google uses acquisitions to reduce competition and prevent other companies from competing with Google Cloud, that's antitrust violation.

The Wiz deal sits at the borderline between these two scenarios. It's genuinely strategic for Google Cloud's competitive position. But it also consolidates an important independent player in cloud security.

The Security Argument: Legitimate Value Creation

It's worth taking seriously Google's actual argument for why this acquisition makes sense. Cloud security threats are real, growing, and increasingly sophisticated. The organizations managing these threats are struggling to keep up. Better, more integrated security tools could genuinely reduce the risk that enterprises face.

Wiz's cloud-native approach to security is genuinely innovative. The company has built tools that help enterprises understand their security posture across multiple cloud platforms. Combining Wiz's expertise with Google Cloud's infrastructure and AI capabilities could produce genuinely better products.

This isn't just corporate synergy language. There's real potential value creation here. The question for regulators is whether that value creation justifies the competitive consolidation that results from the acquisition.

The EU has imposed significant fines on major tech companies, with Google facing the largest penalties, highlighting the aggressive antitrust enforcement approach. Estimated data for Apple's fine.

Regulatory Precedent in Digital Markets

The EU's approach to digital market regulation has shifted dramatically in recent years. The Digital Markets Act, which took effect in 2024, establishes a framework for regulating large tech platforms. Google is designated as a gatekeeper under that act.

Being a designated gatekeeper carries obligations and restrictions. Google has to maintain interoperability with competitors, can't self-prefer its own services, and faces various restrictions on data usage. The Wiz acquisition would need to be compatible with these obligations.

If regulators approve the deal, they'd likely add specific conditions ensuring that Google's gatekeeper obligations apply to the integrated Wiz product. This would reinforce the multicloud commitments and prevent predatory behavior.

The February 10 Timeline Explained

Why February 10 specifically? EU antitrust investigations typically have timeline requirements. Once a company notifies regulators of an acquisition, there's usually a Phase I investigation period (roughly 25 working days) to determine if the deal raises serious competitive concerns.

If regulators decide during Phase I that there are serious concerns, they can extend the investigation to a Phase II (more formal, longer investigation) or issue remedies that address the concerns. If they decide there aren't serious concerns, they can clear the deal.

February 10 likely represents the end of Phase I or the date by which Phase I must be extended to Phase II. It's the regulatory checkpoint where the Commission makes a preliminary decision about the deal's competitive impact.

Expert Analysis: What Analysts Are Saying

Tech industry analysts and antitrust experts have varied views on the likely outcome. Some believe the EU is likely to approve the deal with conditions, citing the strategic logic of cloud security consolidation and the difficulty of defining harm in integration scenarios.

Others believe the EU is likely to block the deal, citing the consolidation concerns, Google's recent antitrust history, and the EU's demonstrated willingness to block large tech acquisitions when competitive concerns exist.

Most analysts agree that an outright approval without conditions is unlikely. The consolidation concerns are too obvious and the regulatory environment too skeptical for that.

Most also agree that if the deal is blocked, the reasoning will focus on the principle that independent innovation in cloud security should be preserved, even if integration might produce short-term efficiency gains.

Customer Perspective: Enterprise Cloud Adoption

From the enterprise customer perspective, the acquisition creates both opportunities and risks. Opportunities include better integrated security that's easier to deploy and manage. Risks include reduced competition, potential price increases post-acquisition, and concerns about vendor lock-in.

Large enterprises with multi-cloud strategies are particularly concerned. They've deliberately spread workloads across AWS, Azure, and Google Cloud to reduce vendor lock-in risk. If Wiz becomes Google-exclusive or primarily optimized for Google Cloud, that reduces the value of multi-cloud strategies.

This customer concern is real input for regulators. If customers are worried about reduced choice and increased lock-in, that's evidence of competitive harm.

The Role of Digital Services Act Compliance

EU regulators also care about compliance with the Digital Services Act, which regulates large online platforms. Google is designated as a "very large online platform" under that law. That designation imposes various operational requirements and restrictions.

One concern with the Wiz acquisition is whether it creates conflicts with these requirements. For example, if Google starts preferring Wiz's security tools in Google Cloud while disadvantaging competitor security tools, that could violate Digital Services Act requirements for fair treatment of competing providers.

This is a newer regulatory framework that wasn't relevant to acquisitions five years ago. It adds another layer of scrutiny to the Wiz deal.

The potential blockage of the Wiz acquisition could cost Google a total of

What Happens to Wiz's Employees?

One factor worth considering is the impact on Wiz's workforce. The company currently operates as an independent organization with its own culture, leadership, and strategic direction. If acquired by Google, it would become a subsidiary within a much larger organization.

For Wiz employees, this could be either positive (access to Google's resources, stability, ability to hire from Google's network) or negative (loss of startup independence, change in company culture, potential for reorganization). Regulators don't explicitly consider employment impacts, but they do care about innovation and competitive vigor. If an acquisition reduces Wiz's ability to innovate independently or drives away talented employees, that's a competitive harm.

Investment Implications: What Venture Capitalists Think

Venture capitalists who invested in Wiz have a direct financial interest in this deal closing. A $32 billion valuation represents a successful exit for their investments. A blocked deal would likely trigger a down-round or return to independent growth with a lower valuation.

That said, VCs also understand regulatory risk. Many investments in mature startups now include assumptions about regulatory approval odds. Wiz's investors presumably built in contingency plans if the deal doesn't close, including the $3.2 billion breakup fee and potential alternative strategic options.

The Negotiation Dynamics

It's worth noting that Google and Wiz have already had to negotiate with regulators to some extent. The specific terms around multicloud commitments and the structure of the deal likely reflect regulatory feedback during preliminary discussions.

Both companies have incentive to address obvious regulatory concerns preemptively. Adding conditions to the deal structure now is better than having regulators impose them later or block the deal entirely.

This negotiation dynamic means the deal we might see approved (if it is approved) could look different from the original terms. Additional structural separations or behavioral commitments might be added to satisfy regulators.

Long-Term Strategic Implications

If the deal closes, it reshapes the cloud security landscape. Cloud platforms become more integrated security vendors. Independent security point solutions have to compete more aggressively. Some independent vendors might exit the market or sell to other platforms.

If the deal is blocked, the cloud security market remains more fragmented. Wiz continues as an independent vendor. Innovation in multicloud security continues from an independent perspective. Other cloud platforms remain free to acquire different security vendors.

From a competition perspective, these outcomes have different implications for long-term innovation and customer choice.

Regulatory Economics: The Cost of Review

One often-overlooked aspect of this deal is the cost of regulatory review itself. Both companies are spending significant resources on regulatory compliance, legal review, and antitrust analysis. These costs come on top of the deal price.

For Google, regulatory costs might reach hundreds of millions when you include legal fees, outside experts, consulting, and internal resources. For Wiz, the burden is proportionally larger (it's a smaller company), though Google is likely covering some costs.

These regulatory review costs are a real drag on deal economics and a reason why companies sometimes choose to walk away or renegotiate rather than continuing to pursue approvals.

The Role of Lobbying and Public Affairs

Both Google and Wiz are likely engaging in active regulatory affairs and lobbying around this deal. They're presenting their cases to regulators, responding to information requests, and trying to build support for approval.

Competitors are likely doing the opposite, presenting concerns to regulators and trying to build a case for rejection or heavy conditions.

Regulators insist they make decisions based on law and economics, not lobbying. But lobbying does affect the information available to regulators and the framing of issues. A well-executed regulatory affairs campaign can influence outcomes at the margins.

Alternative Outcomes: Conditional Approval Scenarios

Let's think through what conditional approval might actually look like. A realistic scenario might include:

- Wiz operates as a separate Google subsidiary for at least 7-10 years

- Wiz maintains multicloud functionality equal across all platforms

- Google commits to equivalent product support and pricing across clouds

- Wiz's management team remains independent with decision-making authority

- Regular compliance monitoring and audit rights for regulators

- Restrictions on sharing customer data between Wiz and other Google Cloud divisions

- Commitment to maintain Wiz's multicloud commitment in any future sale or restructuring

These conditions would address the most obvious competitive concerns while allowing the deal to proceed. They're similar to conditions imposed on other major tech acquisitions.

Timeline Forward: Beyond February 10

Even if EU regulators issue a decision on February 10, the deal might not close immediately. A clearance decision typically requires regulatory sign-off in all relevant jurisdictions. The US DOJ review would still need to conclude. Closing conditions would need to be satisfied.

If the EU approves with conditions, those conditions would need to be documented and agreed to by all parties. That's a negotiation process that could take weeks.

If the EU issues a statement of objections (indicating serious concerns), the process extends significantly. Google would then have time to respond, regulators would investigate further, and the entire timeline extends into mid-2025 or beyond.

If the EU blocks the deal, that's relatively final, though Google could theoretically appeal or propose a restructured deal. But an appeal would take additional months and might not succeed.

The Precedent for AI and Cloud Integration

One additional context worth mentioning is that cloud security acquisition is happening in the era of AI-powered security. Google is trying to position itself as an AI-native cloud platform. Wiz has been building AI capabilities into its security platform.

The acquisition also represents consolidation of AI capabilities. Google combining with Wiz means less independent AI-powered security innovation in the market. That's a consideration for regulators thinking about long-term competitive dynamics.

Conclusion: A High-Stakes Deal in a Hostile Regulatory Environment

The Google-Wiz acquisition is a massive, strategically important deal that sits squarely in the regulators' crosshairs. It raises genuine competitive concerns about consolidation in cloud security, even though it also creates potential benefits through better-integrated products.

The EU must decide by February 10 whether to clear, conditionally clear, or block the deal. The US must also reach a decision. Both regulators are operating in an environment where they've recently demonstrated willingness to block large tech deals and impose significant conditions on acquisitions.

Google's recent antitrust history works against it. The company can't just assert that it won't behave anticompetitively; regulators have evidence that it has. That shifts the burden and makes approval more challenging.

Most likely, if the deal proceeds, it will be with significant conditions. Pure approval seems unlikely. Pure block is possible but might surprise some observers given the deal's strategic logic.

The outcome will matter beyond this deal. It will set precedent for how regulators treat large tech acquisitions in consolidating markets. It will signal whether consolidation around major platforms is acceptable or whether regulators will intervene to preserve independent innovation.

For customers, this deal represents a potential shift toward more integrated but possibly less competitive cloud security platforms. For investors in Wiz, it represents a major liquidity event assuming regulators allow it to close. For Google Cloud's competitive position, it could be a transformative acquisition, assuming it survives regulatory scrutiny.

The February 10 date will be important, but it might not be the final chapter in this story. This deal could still face extended review, significant conditions, or outright rejection. The regulatory environment for large tech acquisitions has fundamentally changed, and this deal will test the new boundaries.

FAQ

What is the Google-Wiz acquisition?

Google has agreed to acquire Wiz, a cloud security company, for $32 billion in what would be Alphabet's largest acquisition ever. The deal combines Google Cloud's infrastructure and AI capabilities with Wiz's expertise in cloud security across multiple platforms including AWS, Microsoft Azure, Google Cloud, and Oracle Cloud. Wiz helps enterprises understand and manage security risks across their multicloud environments.

When will the EU make a decision on the Google-Wiz acquisition?

European Commission antitrust regulators must issue a formal decision by February 10, 2025, according to regulatory timelines established when the deal was notified. This date marks the end of the Phase I investigation period where regulators determine whether serious competitive concerns exist. Regulators could issue clearance, clearance with conditions, or a statement of objections indicating more formal investigation is needed.

Why is this acquisition facing antitrust scrutiny?

Regulators are concerned about consolidation in the cloud security market. Wiz is one of the few truly independent cloud security vendors that works equally well across all major cloud platforms. If Google acquires Wiz, it reduces competitive choice in cloud security. Regulators worry Google might integrate Wiz preferentially with Google Cloud, making it less effective on competing platforms, or use Wiz's customer data to improve its own competing offerings.

What are the competitive concerns with Google owning Wiz?

The primary concern is that cloud security could become less competitive if major cloud platforms own their security tools. Competitors worry that Google might integrate Wiz more tightly with Google Cloud than with AWS or Azure, creating lock-in effects. There's also concern that Google could use Wiz customer data to improve its own competing cloud security tools while disadvantaging independent vendors. Additionally, consolidation might reduce innovation since independent startups have driven cloud security innovation in recent years.

What is Google committing to if it acquires Wiz?

Both Google and Wiz have publicly committed that Wiz will remain a multicloud platform supporting AWS, Microsoft Azure, Google Cloud, and Oracle Cloud equally. CEO Thomas Kurian stated that Google believes Wiz needs to remain multicloud and continue being a leading platform across all clouds. Wiz co-founder Assaf Rappaport made similar commitments. However, these are pre-acquisition promises that could be difficult to enforce post-acquisition. Regulators are evaluating whether behavioral commitments are sufficient or whether structural conditions are necessary.

Is the US Department of Justice also reviewing this deal?

Yes, the DOJ is conducting an early-stage antitrust review of the acquisition. The US review is parallel to the EU review but operates independently. It's possible that one jurisdiction could approve while another blocks or conditions the deal. If the DOJ challenges the deal while the EU approves it, Google would have to decide whether to fight the DOJ challenge, settle with conditions, or withdraw the deal entirely. Most likely, the agencies will coordinate informally on their decisions.

What happens if regulators block the acquisition?

If the deal is blocked, Google owes Wiz a

What would conditional approval of the acquisition look like?

Conditional approval might include structural requirements like Wiz operating as an independent Google subsidiary for a set period, behavioral commitments to maintain equal product functionality across all cloud platforms, restrictions on data sharing between Wiz and other Google divisions, pricing commitments preventing preferential treatment of Google Cloud customers, and ongoing regulatory monitoring and audit rights. These conditions would address competitive concerns while allowing the deal to proceed and create synergies.

How does Google's recent antitrust history affect this deal?

Google's situation is complicated by its recent antitrust losses. A federal judge found Google guilty of holding an illegal monopoly in online search and in search advertising markets. The EU has fined Google multiple times for antitrust violations. This history makes EU and US regulators more skeptical of Google's promises not to behave anticompetitively with Wiz. Instead of taking Google's word about maintaining multicloud commitments, regulators will likely demand structural or behavioral conditions to enforce those commitments.

What is the timeline for deal closure if approved?

Even with EU approval on February 10, closing could take additional months. The deal must also clear the US DOJ review. If conditions are imposed, parties must negotiate and finalize those terms. If the EU issues a statement of objections indicating serious concerns, the investigation extends into Phase II, potentially pushing resolution into mid-2025 or beyond. Regulatory timelines are rarely predictable and often extend longer than initially expected.

What does this acquisition mean for cloud security customers?

If the deal closes without significant conditions, cloud security customers might see better-integrated products combining Wiz's expertise with Google Cloud's infrastructure. However, they also face potential risks including reduced competition, possible price increases post-acquisition, and concerns about vendor lock-in if Wiz becomes primarily optimized for Google Cloud. Multi-cloud customers are particularly concerned about reduced choice and independence. Regulatory conditions could mitigate these risks by requiring equal functionality across all cloud platforms.

Key Takeaways

- EU antitrust regulators must decide on Google's $32 billion Wiz acquisition by February 10, 2025, with significant implications for cloud security market consolidation.

- The deal raises genuine competitive concerns about reducing independent cloud security vendors and potential lock-in effects, though it also creates benefits through integrated products.

- Google's recent antitrust losses in search and ad tech markets increase regulatory skepticism, shifting burden to Google to prove the deal won't harm competition.

- Both Google and Wiz have committed to keeping Wiz as a multicloud platform, but these behavioral promises are difficult to enforce post-acquisition.

- Most likely outcome is conditional approval with structural or behavioral requirements, though outright block is possible given hostile regulatory environment for large tech deals.

Related Articles

- Meta's $2B Manus Acquisition and Chinese Regulatory Concerns [2025]

- Data Sovereignty for SMEs: Control, Compliance, and Resilience [2025]

- AI Factories: The Enterprise Foundation for Scale [2025]

- Supply Chain, AI & Cloud Failures in 2025: Critical Lessons

- The TikTok US Deal Explained: Who Owns It Now, What Changes [2025]

- How Big Tech Surrendered to Trump's Trade War [2025]

![Google's $32B Wiz Acquisition: EU Antitrust Decision [2025]](https://tryrunable.com/blog/google-s-32b-wiz-acquisition-eu-antitrust-decision-2025/image-1-1767897434005.jpg)