Amazon Tariffs Driving Price Increases: What Retailers Face [2025]

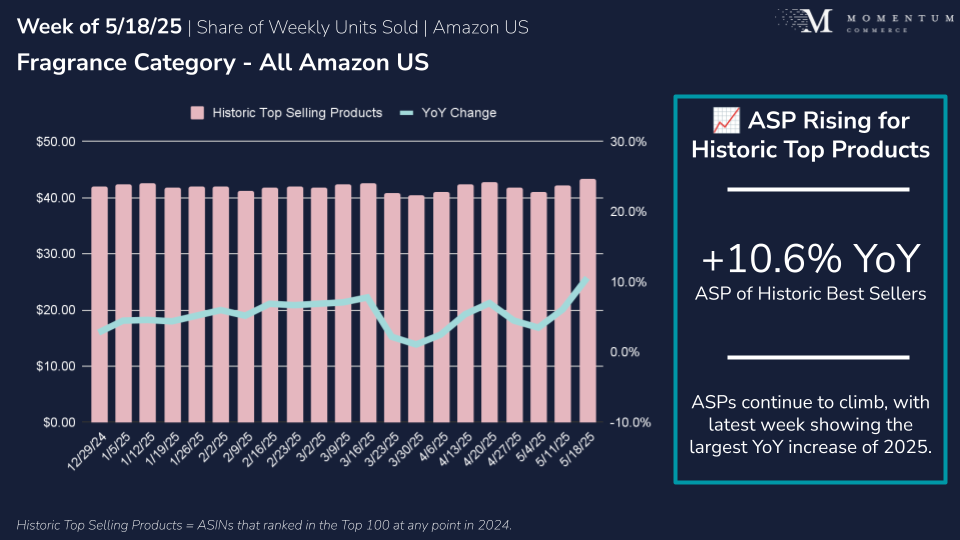

Last month, Amazon CEO Andy Jassy made a statement that sent ripples through retail and e-commerce circles. The tariffs everyone had been bracing for weren't some hypothetical threat anymore. They were starting to hit, and price tags were going up.

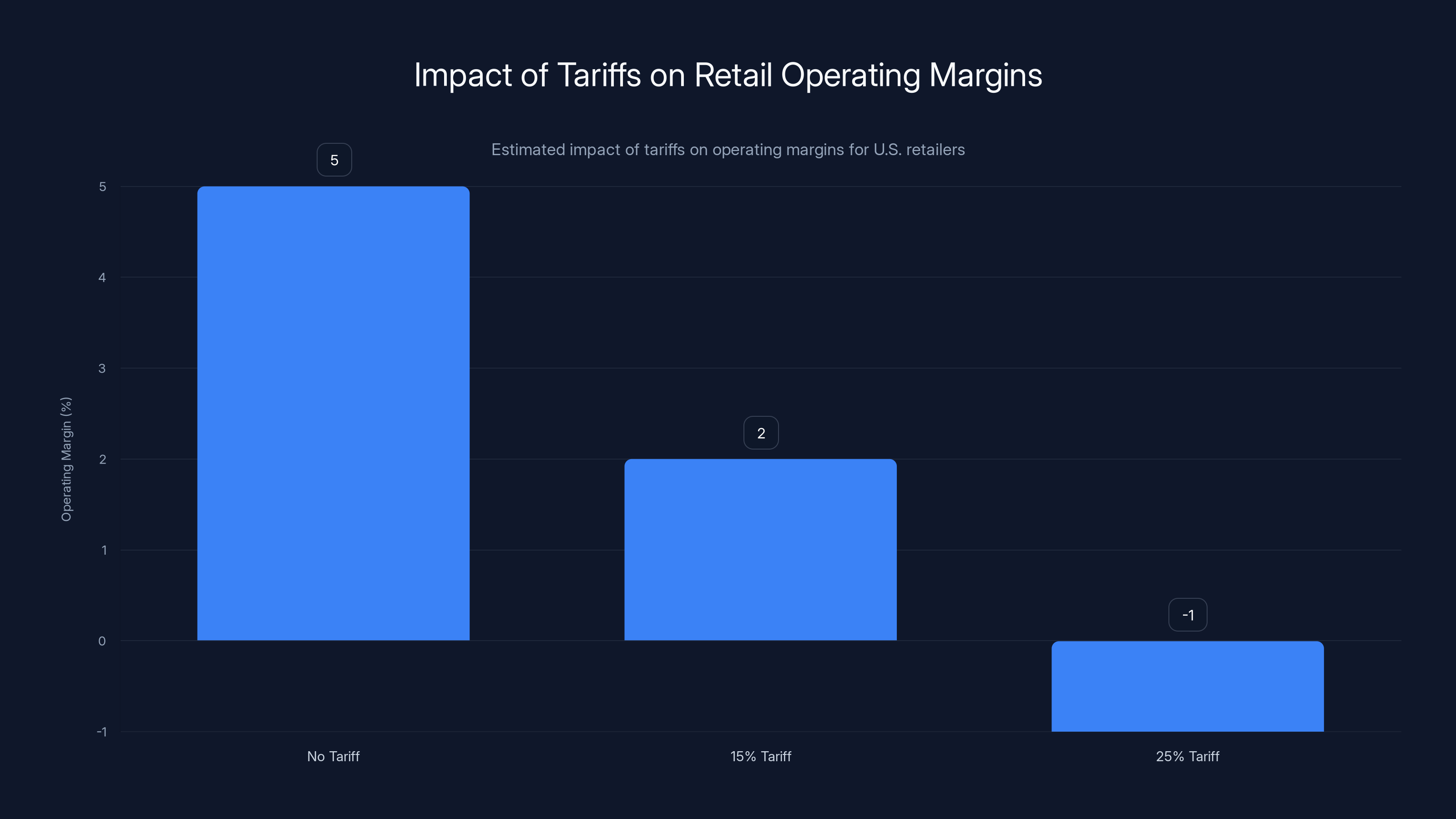

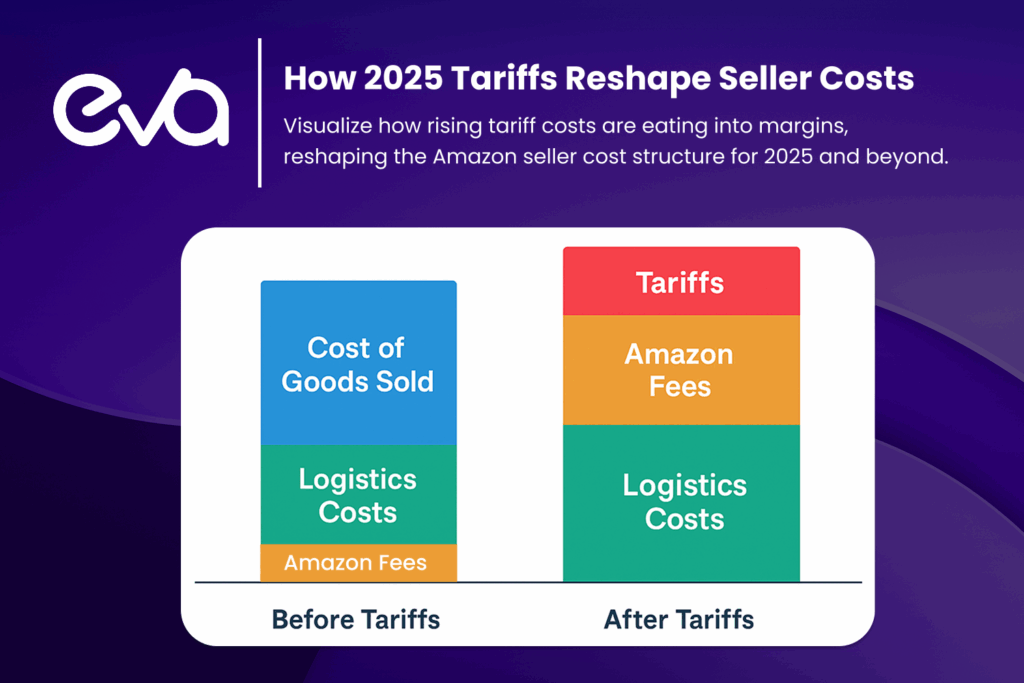

Jassy didn't sugarcoat it on CNBC. Consumers are seeing higher prices. Sellers are passing costs along. The inventory buffer that kept prices artificially low last year has basically evaporated. And here's the part that matters: retail operates on razor-thin margins, usually single digits. When costs jump 10%, there's nowhere to hide.

This isn't just Amazon's problem. It's a wholesale restructuring of how price discovery works across modern commerce. When a company the size of Amazon—which controls roughly 38% of the U.S. e-commerce market—starts signaling price increases, the entire supply chain has to recalibrate.

But what does this actually mean? For sellers? For shoppers? For anyone trying to understand where prices are heading in 2025? Let's dig into the mechanics, the implications, and what's really going on beneath the headlines.

TL; DR

- Tariffs are hitting consumer prices now: Amazon's inventory buffer from pre-tariff stockpiling has depleted, forcing retailers to pass costs to consumers

- Retail margins can't absorb 10% cost increases: Most retailers operate on 3-5% margins, making price hikes inevitable in some categories

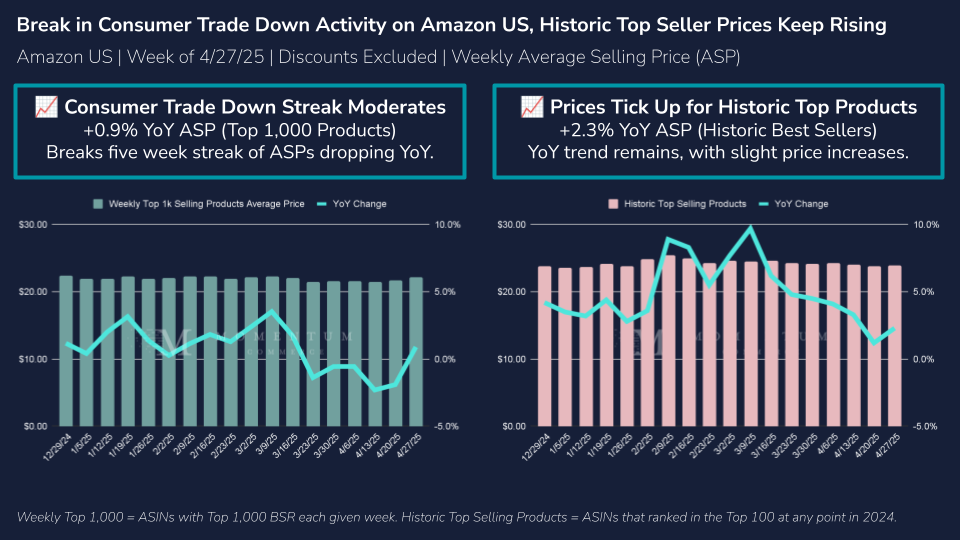

- Consumer behavior is shifting: Shoppers are bargain hunting, trading down to cheaper alternatives, or delaying premium purchases

- Third-party sellers face the biggest squeeze: They have fewer cost-control options than Amazon itself, making price increases more aggressive

- This isn't temporary: Tariff impacts will likely persist through 2025-2026, affecting everything from electronics to apparel to home goods

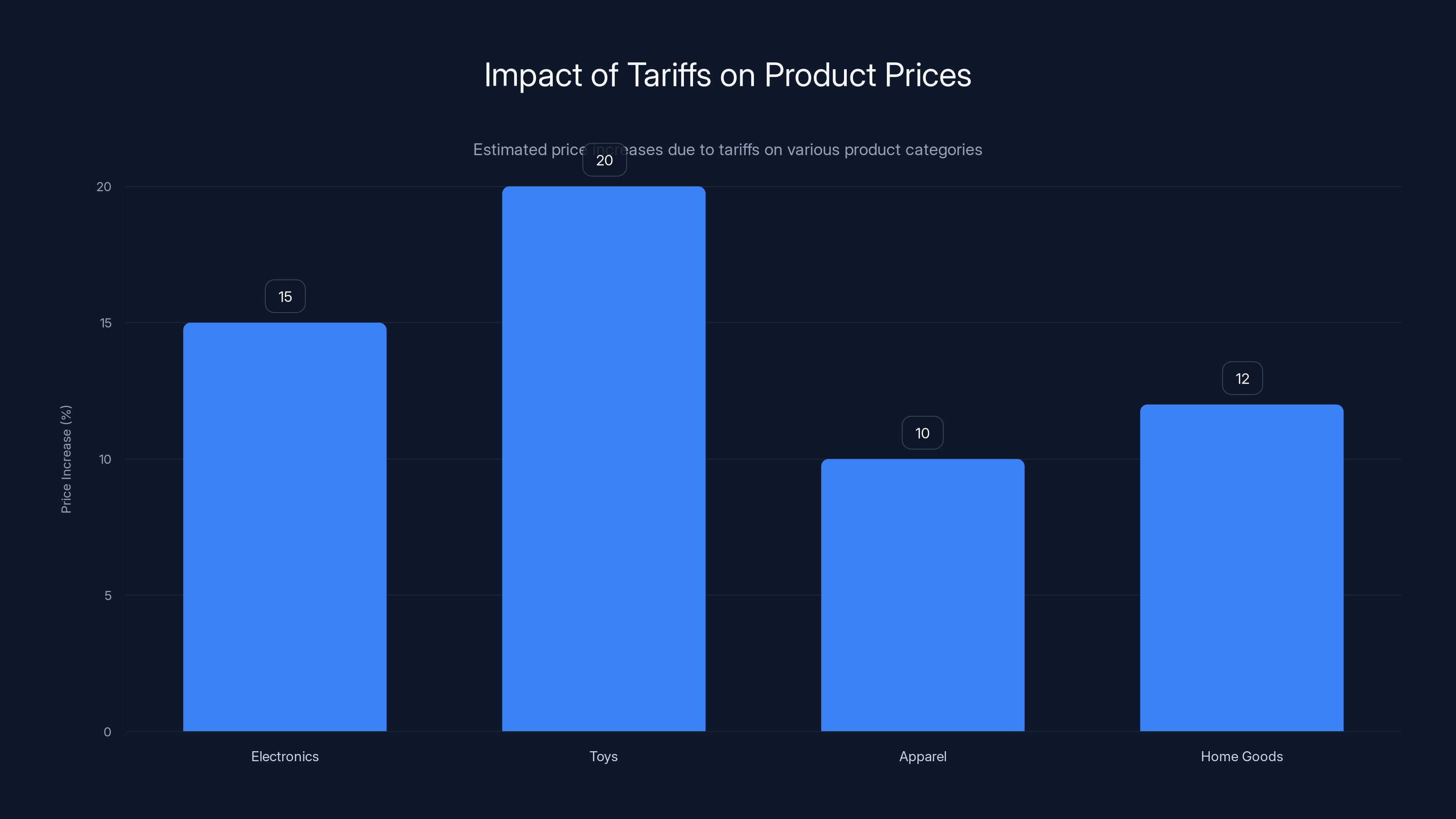

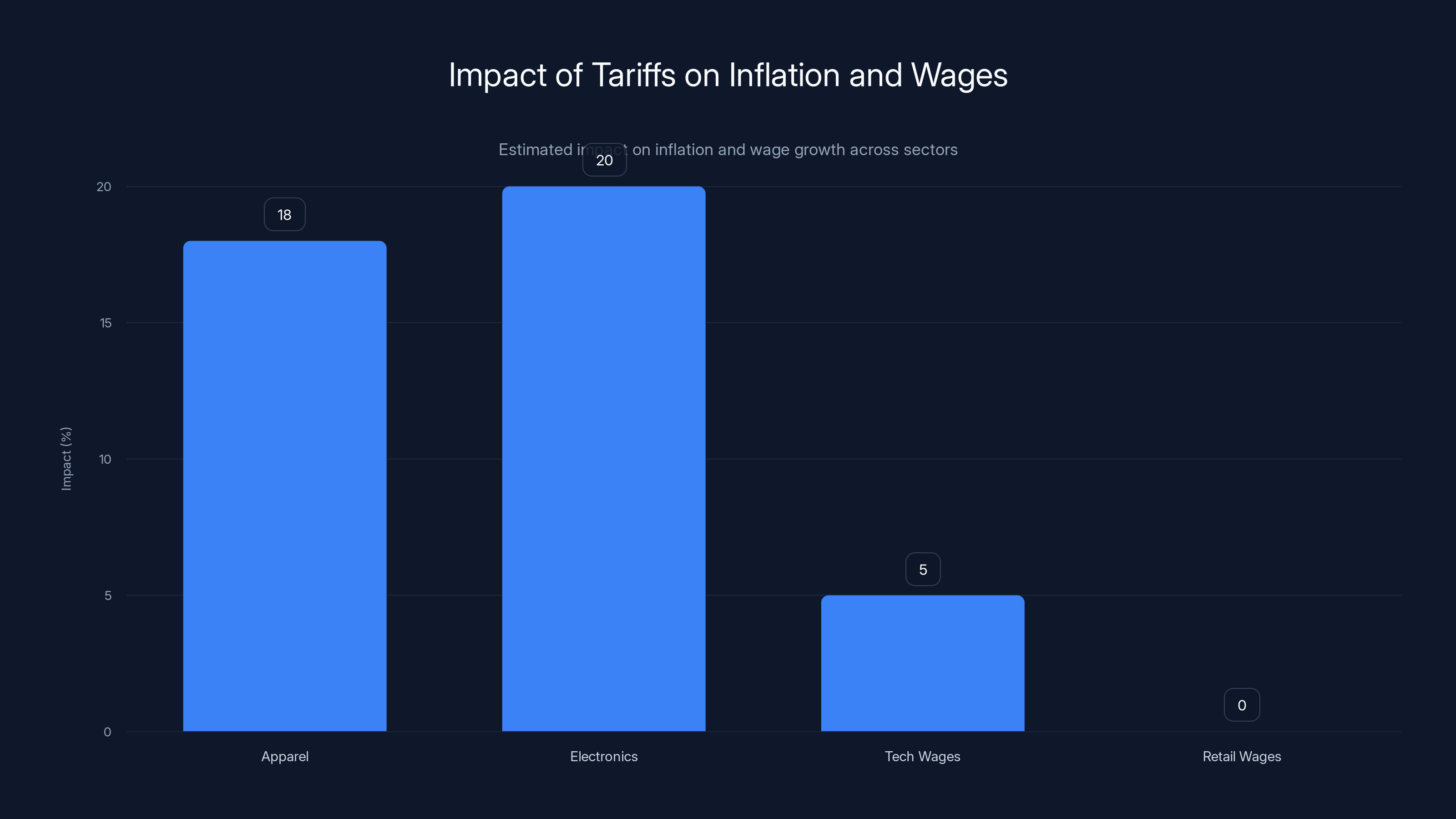

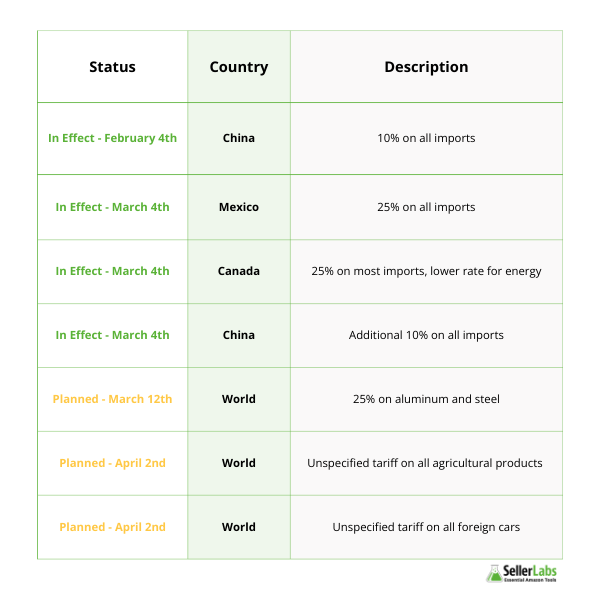

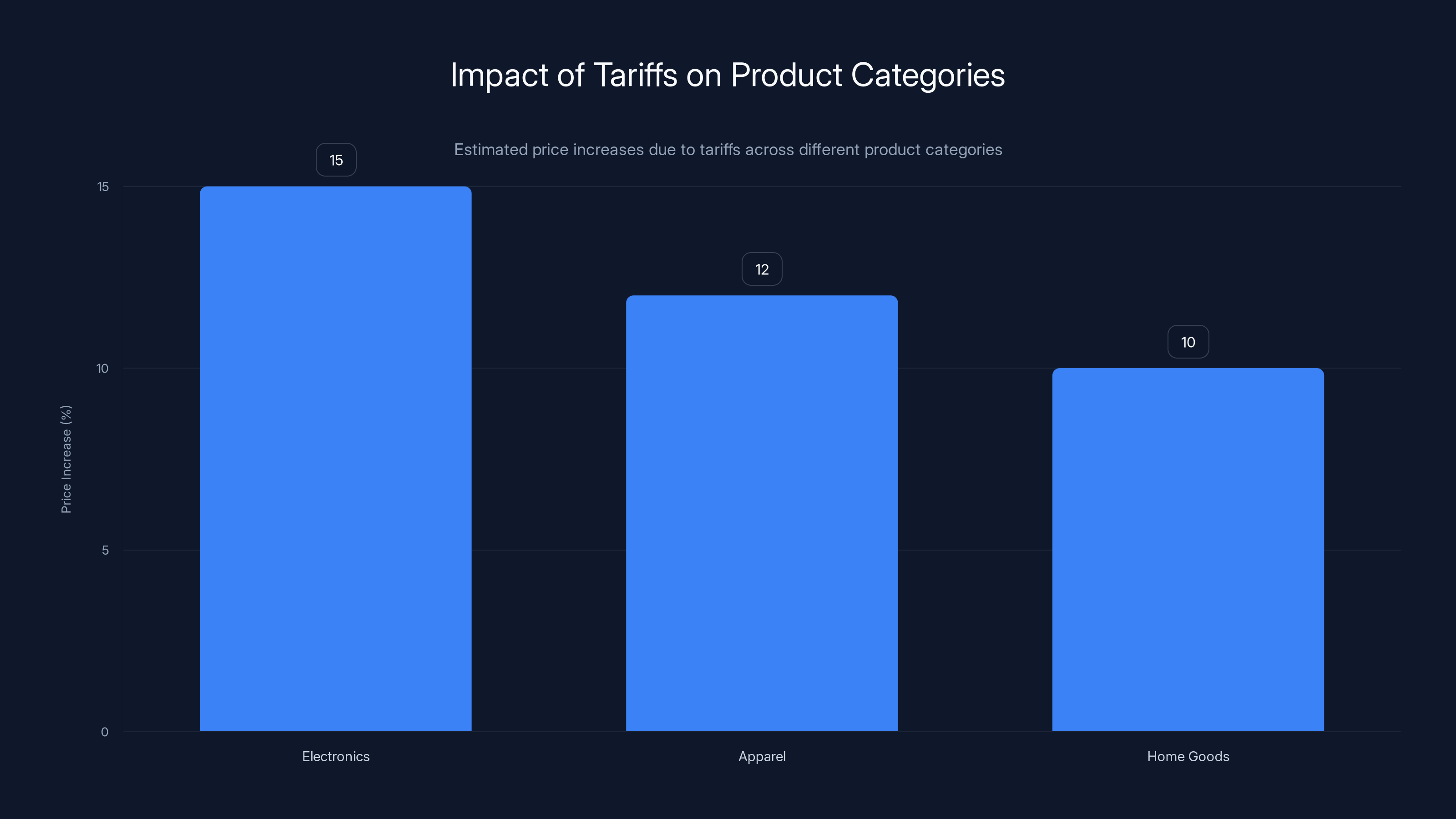

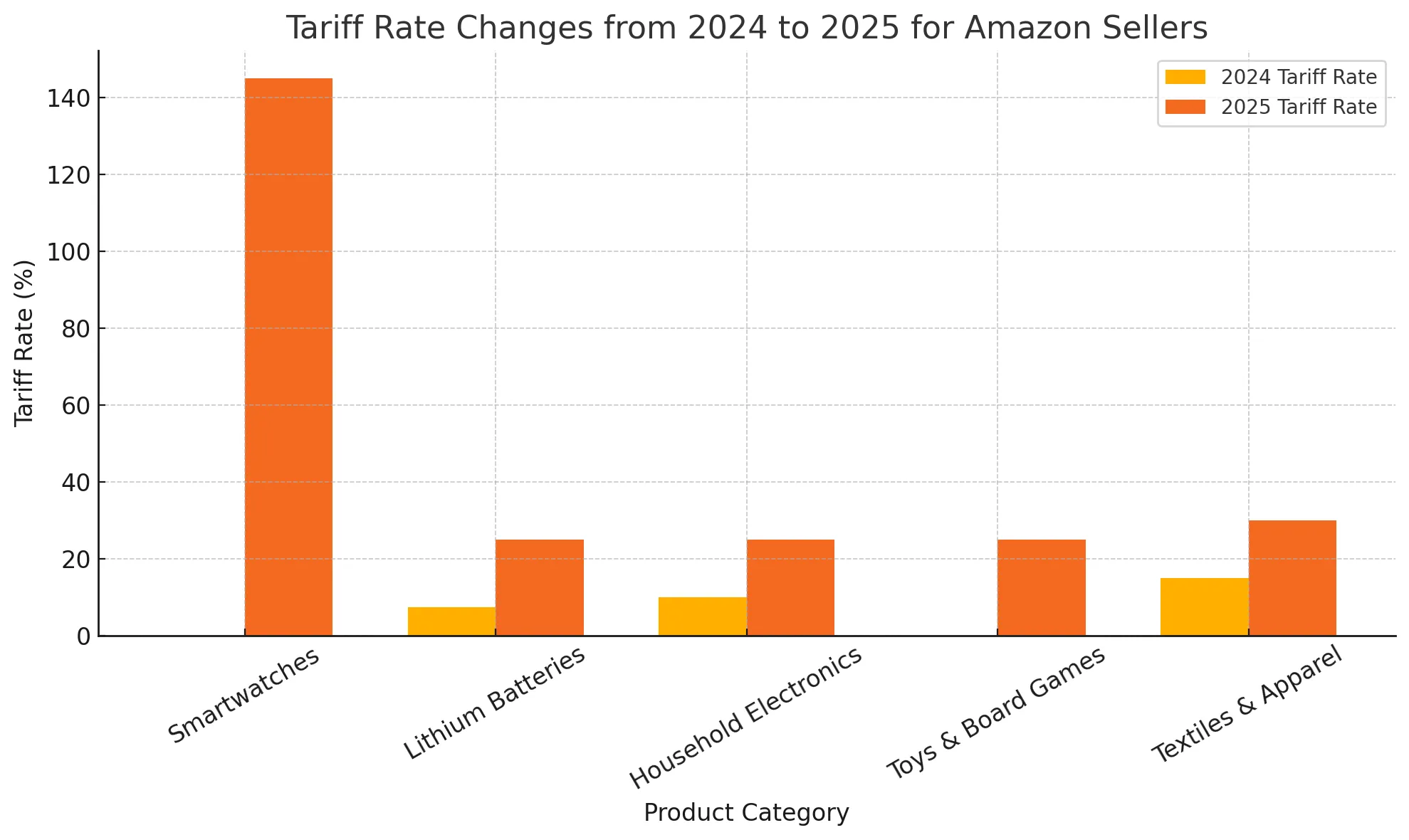

Electronics and toys are experiencing the highest price increases due to tariffs, with estimated increases of 15% and 20% respectively. Estimated data.

Understanding the Tariff Shock: How We Got Here

Tariffs don't work the way people think they do. They're not just a line item on an invoice. They're a cascading disruption that starts upstream and flows downstream through every transaction.

When the Trump administration announced new tariffs on imports from China and other partners, U.S. retailers faced a choice: absorb the costs immediately or try to get ahead of it. Most chose option two. Amazon, Walmart, Target, and thousands of smaller retailers hit the import accelerator in late 2024 and early 2025, racing to stock warehouses before tariffs took effect.

This created a temporary price suppression. Goods sat in warehouses bought cheap, before tariffs landed. Retailers could undercut each other on price because they weren't paying the tariff tax yet. Competition intensified. Margins got squeezed even tighter.

Then that inventory started to clear. Warehouses emptied. Replacement orders came in at higher costs. By late fall, the supply run was mostly depleted. What Jassy said on Tuesday was essentially the bell ringing: "We're out of the cheap stuff. New inventory is expensive. Prices are going up."

Let's break down what this actually looks like economically.

The Math Behind Rising Prices

Retail operates under a brutal mathematical constraint. Here's the formula:

Where COGS is the cost of goods sold.

For most retailers, this looks like 3-5% operating margin. That's it. For every

Now, tariffs add roughly 15-25% to the cost of goods depending on the category and product origin. On a

If you're a retailer with a 5% margin operating at scale, you have three levers:

Option 1: Absorb the cost. Your

Option 2: Raise prices. You pass the cost to consumers. Your margin stays intact, but your competitive position suffers. Customers might switch to competitors. Your volume drops. Revenue per unit goes up, but total revenue might fall.

Option 3: Cut costs elsewhere. Reduce marketing spend, automate faster, consolidate warehouses, lay off staff. This takes months or years and has limits. Most retailers are already ruthlessly efficient.

Most choose option two, with a bit of option three mixed in. Prices go up. That's what Jassy was saying.

Why Amazon Has More Flexibility Than Everyone Else

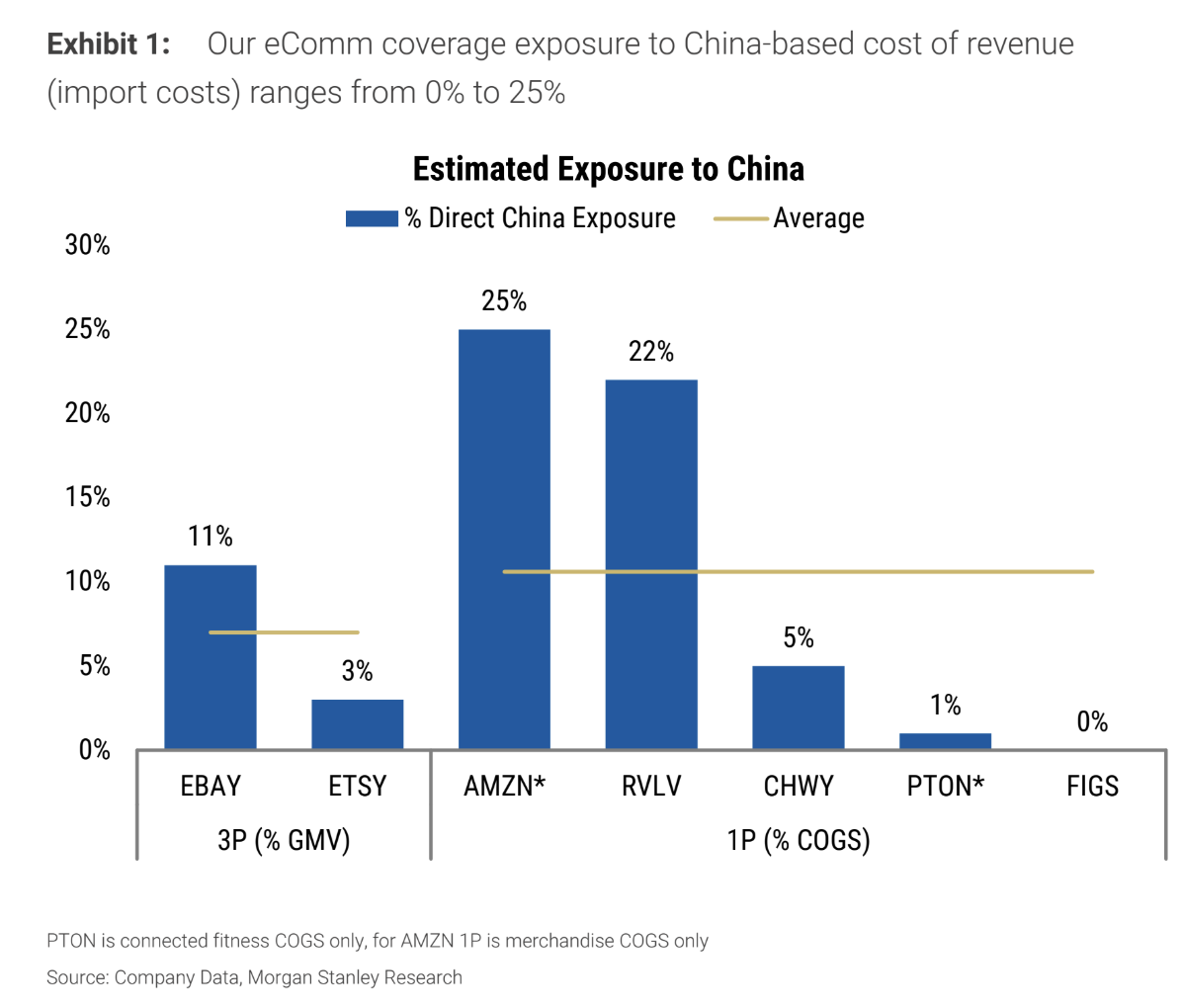

Here's the thing about Amazon that most people miss: they're not primarily a retailer. They're a platform with a retail division bolted on. This matters because their margin structure is completely different.

Amazon's first-party retail margins are indeed thin. But Amazon Web Services (AWS) generates 24% operating margins at scale. That's not retail—that's software business territory. When Amazon wants to absorb tariff costs on goods to maintain market share, they can. They're literally using cloud computing profits to subsidize consumer prices.

Walmart is similar in structure—they have advertising and data businesses providing margin relief. But smaller retailers and third-party sellers on Amazon's platform? They don't have this luxury. They're pure retail operators. They live or die by their unit economics.

This creates a perverse incentive structure. The largest retailers can afford to hold prices steady and squeeze margins for a period. Everyone else has to raise prices immediately. This actually consolidates market share toward the biggest players—Amazon, Walmart, Target—and makes it harder for smaller competitors.

So when Jassy says "you don't have endless options," he's partially talking about Amazon too. But Amazon has more options than almost anyone else.

Estimated data shows that tariffs significantly reduce operating margins for retailers, potentially turning profits into losses under high tariff scenarios.

How Tariffs Actually Flow Through Supply Chains

Tariffs are strange because they're not transparent costs. They hide in the supply chain, and their impact depends entirely on who owns what piece of the chain.

The Import Picture

About 40% of U.S. consumer goods imports come from China. Electronics, apparel, furniture, toys—anything with "Made in China" on it. When tariffs hit, these items get more expensive at the port of entry.

A container of smartphones that cost

Manufacturers have a choice: absorb it or pass it along. Most pass it along. They raise their wholesale prices to distributors. Distributors raise their prices to retailers. Retailers raise prices to consumers. By the time the cost reaches your shopping cart, it's gotten amplified by each entity's need to maintain margin.

Where It Gets Weird: Contract Timing

Supply chain contracts matter enormously here. Some retailers locked in prices with manufacturers months ago. Their invoices still reflect pre-tariff economics. Other retailers have contracts that refresh quarterly or monthly. Those folks are getting hammered immediately.

Target, for instance, has different contract terms with different suppliers. Their Nike shipments might be locked in at old prices for six more months. But their private-label athletic wear manufactured overseas? That's probably already facing tariff premiums on new orders.

This creates price inconsistency across categories and brands. You'll see some items stay flat while others jump 15-20%. It's not random—it's a function of when contracts renew and where manufacturing happens.

The De Facto Devaluation

Here's something economists keep talking about that consumers experience but don't always articulate: tariffs are effectively a devaluation of your purchasing power. It's not that your

This is economically different from inflation, which affects everything broadly. Tariffs affect imports specifically, which means they distort relative prices. Domestically made goods become relatively cheaper. Import-heavy categories become relatively more expensive. Consumers respond by substituting—buying more domestic goods, buying cheaper import alternatives, or buying less.

Jassy noted this: shoppers are trading down. They're moving from premium brands to store brands. They're bargain hunting more aggressively. This is rational behavior in response to tariff-driven price signals.

The Third-Party Seller Problem

Amazon's platform hosts roughly 2 million third-party sellers. These are small business operators, distributors, resellers, and manufacturers selling directly to consumers through Amazon's marketplace.

These sellers are getting crushed right now.

Why? Because they don't have Amazon's leverage or diversified profit streams. They're dependent entirely on the margin between wholesale cost and selling price. When wholesale costs go up 15-20% from tariffs, they face an immediate decision: lose money or raise prices.

Most third-party sellers are raising prices. This is why you're seeing price inconsistency across Amazon's marketplace. Some products have jumped 20-30% in the past two months. Others are flat. The difference is almost always whether the seller is a large corporation with supply chain hedging or a small seller with zero leverage.

Amazon itself is in an interesting position here. They could lower the take rate (the percentage commission they charge sellers) to provide relief. They're not doing that. Instead, they're letting sellers bear the full weight while maintaining or increasing commission rates. This makes Amazon's first-party business more competitive against their own platform sellers—which is a classic antitrust concern, but that's a different article.

The Liquidation Question

When prices rise rapidly, inventory that was profitable at old prices becomes unprofitable at new prices. Some sellers will need to liquidate stock at a loss just to free up cash flow. This creates opportunities for liquidation marketplaces like Facebook Marketplace, local discount stores, and clearance outlets.

This is deflationary locally but doesn't change the fundamental dynamic. The margin pressure is real, and it's here to stay.

Estimated data shows that 40% of consumers are trading down, 30% are delaying purchases, and another 30% are increasing price sensitivity in response to price hikes.

Consumer Response Patterns

Jassy mentioned consumer resilience, but he buried the lede a bit. What he meant was: consumers are responding rationally to price increases by adjusting behavior.

Let's look at what's actually happening in consumer data.

Trading Down in Real Time

When prices rise, consumers don't all accept it. They shop around. They switch brands. They move from premium to mid-market to budget. This is the most predictable economic response imaginable.

In apparel, we're seeing movement from national brands toward private label. In electronics, from flagship brands toward secondary Chinese brands that many consumers have never heard of. In home goods, from aspirational to functional.

This is economically efficient—prices rise, consumers respond by choosing lower-cost options—but it's devastating for mid-market brands that rely on consumer loyalty. Budget brands and ultra-premium brands do okay. The middle gets compressed.

The "Put It Off" Strategy

Some consumers aren't trading down. They're just not buying. Premium discretionary purchases—new laptops, furniture, appliances—are getting delayed. Consumers are asking: "Do I really need this now, or can I wait six months?"

If they can wait and tariffs drop or stabilize, they save money. If they can't wait, they buy. But this uncertainty is making purchasing decisions more elastic. People are less willing to impulse buy or upgrade unnecessarily.

This puts pressure on retailers in categories where replacement cycles are discretionary: consumer electronics, home furnishings, sporting goods. Categories where replacement is mandatory—groceries, personal care, basic clothing—are more resilient.

Increased Price Sensitivity

The third pattern is simple: consumers are shopping more aggressively for deals. They're using price comparison tools more. They're checking multiple retailers before buying. They're willing to wait for sales.

This compounds margin pressure on retailers. Not only are prices rising, but consumers are also becoming less willing to pay full retail. The combination is brutal for inventory management. Retailers are caught between raising prices and maintaining volume.

What Happens to Different Product Categories

Tariffs don't affect all categories equally. Some sectors are getting hit much harder than others.

Electronics: Severe Impact

Electronics are getting hammered. Smartphones, laptops, tablets, smart home devices—most of this stuff is made in China or Taiwan. Tariffs are adding 15-25% to landed costs.

For a

This is compounded by the fact that electronics move quickly. Inventory turns over in weeks or months. Old supply chains clear fast. New tariff-inclusive supply chains take effect immediately.

We're probably going to see electronics prices settle 12-18% higher by mid-2025 as pre-tariff inventory completely clears.

Apparel: Significant Impact

About 90% of U.S. apparel is imported. Tariffs are adding 15-20% to clothing costs. But here's where it gets interesting: apparel is price-elastic. Consumers will substitute and shop around aggressively.

What we're seeing is premium brands holding prices but selling less volume. Budget brands raising prices more modestly. Private label (Walmart's Great Value, Target's Cat & Jack, etc.) raising prices but staying competitive.

For apparel retailers, this is a volume game. Lower margins but more volume through the door. We're seeing this at Walmart especially, where private label has become the default choice for price-conscious shoppers.

Home Goods: Moderate to Severe

Furniture, bedding, cookware, decor—lots of this comes from China. Tariffs are adding costs, but home goods are less price-elastic than apparel. Consumers replace furniture less frequently, so they're more willing to absorb price increases if quality is maintained.

Expect 8-15% price increases in home goods categories over the next 6 months. Some categories like outdoor furniture and décor will see larger jumps because they're more import-dependent.

Groceries: Minimal Direct Impact

Here's the good news: most food is domestically sourced or sourced from tariff-exempt countries (Canada, Mexico via USMCA). Grocery prices aren't facing direct tariff pressure.

The indirect impact exists—packaging, equipment, ingredients from China—but it's muted. Expect 1-3% price increases in grocery from tariff spillovers, mostly in international specialty items and certain packaged goods.

Toys: Severe Impact

Almost all toys are made in China. Tariffs of 15-20% are standard. Retailers are eating some cost to stay competitive during holiday seasons, but come January, prices will adjust significantly upward. Expect 15-25% price increases on toys and games by spring 2025.

Estimated data shows apparel and electronics experiencing significant inflation (15-20%), while tech wages rise modestly (5%) and retail wages stagnate (0%).

How Amazon Specifically Is Navigating This

Amazon is in a unique position because they're both a retailer and a platform. Jassy's comments reveal their strategy.

First-Party Price Strategy

On goods that Amazon owns and sells directly (first-party), they're trying to keep prices as low as possible. Why? Because low prices on first-party goods drive traffic to the platform. Higher traffic means more third-party sales opportunities. More marketplace volume means more commission revenue.

So Amazon can afford to take narrower margins on first-party goods to drive platform volume. They're leveraging AWS profits to subsidize retail competitiveness.

But even Amazon has limits. Jassy explicitly said they can't absorb 10% cost increases indefinitely. So we're seeing selective price increases on first-party goods, particularly in high-tariff categories like electronics.

Third-Party Commission Structure

Here's where it gets interesting from an antitrust perspective: Amazon's take rate for third-party sellers is roughly 15-45% depending on category. They're not lowering this to help sellers deal with tariff impacts.

This means if a seller's costs go up 15%, their effective take-home margin doesn't just shrink by 15%. It shrinks by more because the margin was already narrow. A seller with a 10% pre-tariff margin seeing a 15% cost increase would drop to a negative margin (before Amazon's commission). This forces aggressive price increases or inventory liquidation.

Amazon benefits because first-party sellers can now compete more aggressively on price (with AWS-subsidized margins) while third-party sellers are forced to raise prices or exit. Market consolidation accelerates toward Amazon's first-party business.

Logistics and Fulfillment Costs

Amazon's Fulfillment by Amazon (FBA) fees are also relevant here. When costs rise, Amazon doesn't typically drop FBA fees immediately. Sellers face both tariff impacts AND unchanged fulfillment costs. This is another squeeze point.

Sellers who use Fulfillment by Merchant (FBM) have more flexibility, but they bear higher operational costs and customer service risk. It's an unfavorable tradeoff.

The Broader Economic Implications

This isn't just about higher prices at checkout. Tariff pass-through has systemic implications.

Inflation Dynamics

Tariffs are inflationary for specific goods but might not show up as broad inflation because they're selective. Core inflation could stay moderate while apparel and electronics inflation spike. This creates a two-tier economy where some shoppers barely notice price changes while others see 15-20% increases in their most-purchased categories.

For the Fed's inflation calculations, this is messy. Headline inflation might rise noticeably while core inflation stays tame. This could influence policy decisions.

Wage Pressure

When consumers feel poorer (because goods cost more), they put pressure on employers for higher wages. Retailers facing lower traffic due to reduced consumer spending might push back on wage growth. This creates wage stagnation pressures in retail, even as other sectors raise wages.

We could see a bifurcation where tech and finance workers see rising wages while retail workers see wage stagnation despite inflation in their spending categories. This widens inequality.

Supply Chain Restructuring

Companies are already exploring alternatives: moving production to Vietnam, India, Indonesia, Thailand. Others are nearshoring to Mexico. Some are reshoring to the U.S.

This takes time—months to years—but tariffs are accelerating these shifts. The competitive advantage of Chinese manufacturing is eroding when tariffs add 20% to costs. Eventually, alternative sourcing makes sense.

This could be deflationary long-term (once production comes online), but it's inflationary near-term (transition costs).

Retail Consolidation

Small retailers and sellers with thin margins are the most vulnerable. They'll either exit or get acquired by larger players with better margin profiles. This accelerates retail consolidation toward mega-retailers like Amazon and Walmart.

This has implications for competition, local economies, and consumer choice. Fewer retailers generally means less price competition, though online markets offset this somewhat.

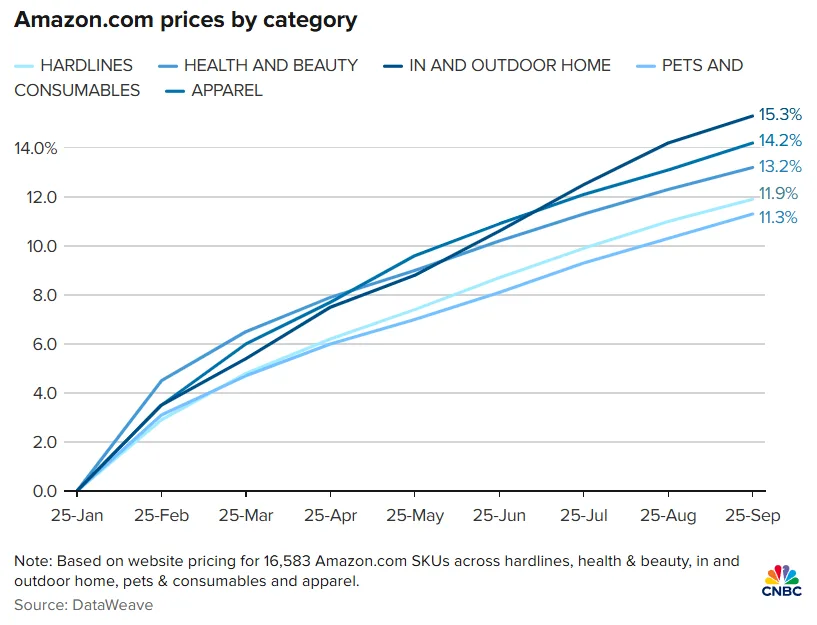

Estimated data shows electronics experiencing the highest price increase at 15%, followed by apparel at 12%, and home goods at 10% due to tariffs.

What Sellers Need to Do Right Now

If you're a retailer or third-party seller, sitting idle isn't an option. Here's what you need to do.

Audit Your Supply Chain Immediately

Map out exactly where your inventory comes from. Which suppliers? Which countries? Which products have tariff exposure?

For each product, calculate:

- Current cost of goods

- Tariff cost as a percentage

- Current margin

- Margin after tariff (if passed through)

- Margin after tariff (if absorbed)

This gives you a clear picture of which products are viable and which aren't under tariff economics.

Communicate Early

If you're going to raise prices, do it now rather than later. Give customers advance notice. Explain the reason. Show the math if possible.

Customers are more forgiving of tariff-driven price increases than inflation-driven ones. They understand trade policy causes input costs to rise. They'll accept price increases if explained.

Waiting six months and then suddenly jumping prices looks like opportunistic gouging. Front-loading the increase looks like honest adaptation.

Negotiate With Suppliers

Your suppliers are also dealing with tariff impacts. But they might have more flexibility than you think. If you commit to volume or longer contract terms, you might lock in prices that are more favorable than spot market rates.

This requires negotiation skills and relationships, but it's worth pursuing. Even a 5% reduction in tariff impact through supplier negotiation dramatically improves your margin situation.

Explore Sourcing Alternatives

For products currently sourced from China, start researching alternatives: Vietnam, India, Indonesia, Mexico. Lead times are longer, volumes might be smaller, and quality might be different. But prices could be 10-15% lower after tariffs because these countries don't face the same tariff rates (or don't face them yet).

This requires upfront investment and testing, but it hedges your tariff exposure.

Optimize Product Mix

Focus inventory investment on products with healthier margins post-tariff. If a product that was 15% margin is now 2% margin, reduce investment. Shift toward products where margins are still defensible.

This sounds obvious, but most retailers are slow to adjust product mix because of sunk costs in existing inventory and shelf space agreements.

Prepare for Deflation

Tariffs are cyclical. Political winds shift. If tariffs drop in 2026, prices won't immediately fall. But there will be a period of deflation where inventory purchased at high tariff prices sits alongside cheaper replacement inventory. This creates forced markdowns and margin pressure.

Plan for this now by managing inventory turns aggressively. Don't over-invest in tariff-expensive goods. Keep inventory lean so you can adapt if tariff policy changes.

The Political and Policy Dimension

Understanding tariff impacts requires understanding the policy dynamics driving them.

Why Tariffs Now?

The Trump administration's tariff strategy is multifaceted: reduce U.S. trade deficits, boost domestic manufacturing, increase government revenue, and assert geopolitical leverage with China.

From an economic standpoint, tariffs do raise government revenue and they can protect domestic industries. But they also raise consumer prices and create supply chain chaos. The tradeoff is real.

Retailers are caught in the middle. They're not policy makers. They're adapting to policy.

Will They Stick?

Tariff policy is uncertain. Will tariffs stay at current levels? Will they escalate? Will they be repealed?

This uncertainty itself is a cost. Retailers can't plan long-term if policy is unpredictable. Some are holding inventory in foreign warehouses, waiting for policy clarity before importing. Others are aggressively pushing inventory through channels before tariff rates potentially change.

This policy uncertainty is almost as damaging as the tariffs themselves.

Revenue Generation

The U.S. government collected roughly $80 billion in tariff revenue in 2024. That's real money that offset some deficit spending. If tariffs drop, that revenue disappears and gets replaced by income or other taxes. This creates political pressure to maintain tariffs even if they're economically inefficient.

Politics matter here as much as economics.

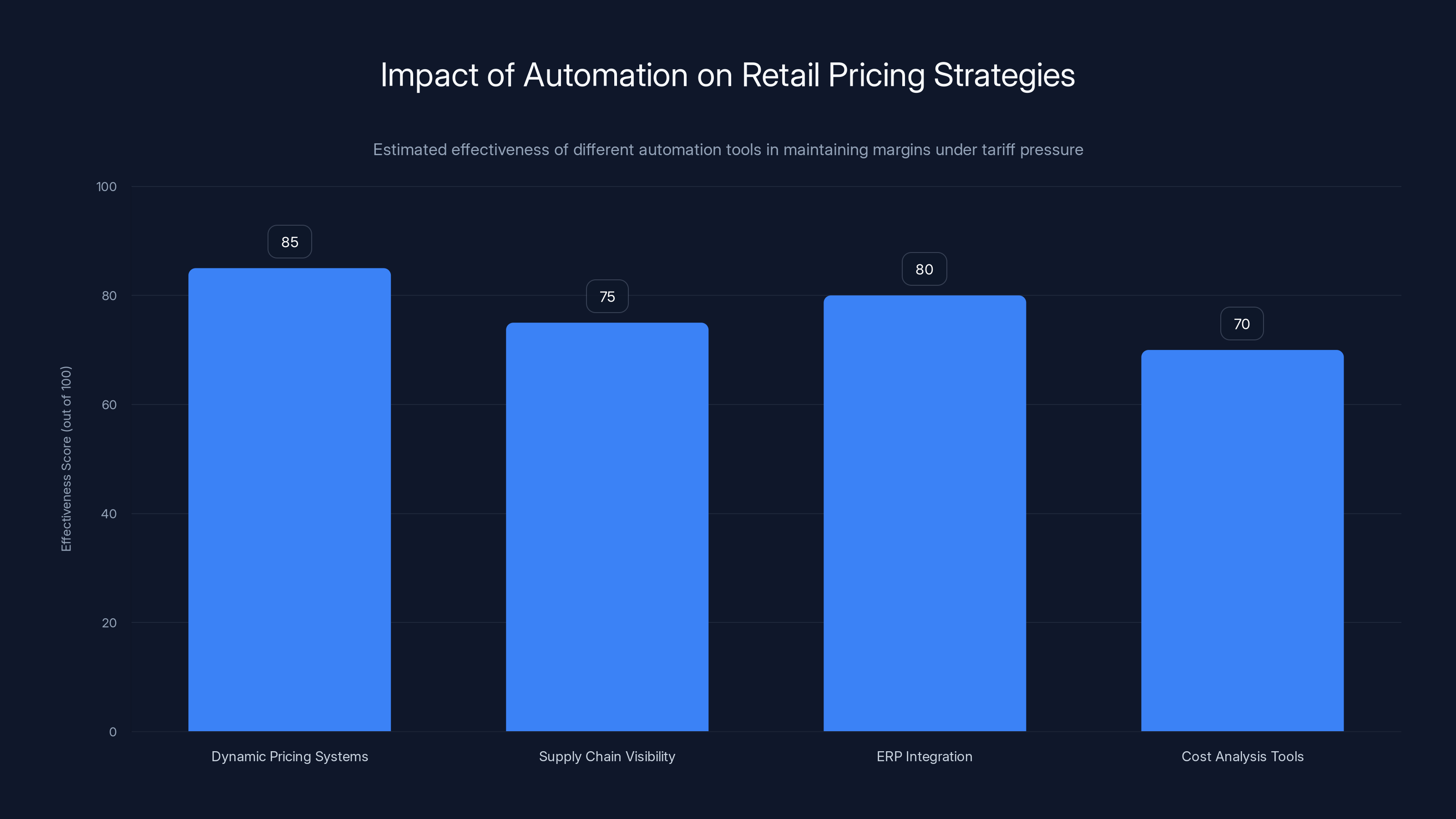

Dynamic pricing systems are estimated to be the most effective tool for maintaining margins under tariff pressure, with an effectiveness score of 85. Estimated data.

What Consumers Should Expect

If you're shopping, here's what to anticipate over the next 12 months.

Categories Facing Price Increases

- Electronics: Expect 12-18% increases by mid-2025

- Apparel: Expect 8-12% increases, with budget brands absorbing less

- Home goods: Expect 8-15% increases

- Toys: Expect 15-25% increases

- Appliances: Expect 10-15% increases

- Furniture: Expect 12-18% increases

- Automotive parts: Expect 8-12% increases

- Groceries: Expect 1-3% increases from indirect impacts

Timing Considerations

Prices will adjust unevenly. Some retailers will raise prices immediately. Others will take months. Categories with rapid inventory turnover (electronics, apparel) will see faster price adjustments. Categories with slower turnover (furniture, appliances) will see delayed adjustments as old inventory clears.

If you're going to buy something, timing matters. Electronic devices purchased in the next 2-3 months might still have pre-tariff pricing reflected in some channels. By summer 2025, expect full tariff pass-through.

Where to Shop

Mega-retailers like Walmart and Target are better positioned to absorb tariff costs than smaller retailers. They have more negotiating power with suppliers and more diversified profit streams.

Private label brands are becoming more competitive relative to national brands. Store brands at Walmart, Target, Costco are raising prices less aggressively than name brands because they're willing to sacrifice margin to maintain volume.

Automation and Technology Solutions

Here's where it gets interesting for retailers and sellers looking to maintain margins under tariff pressure: automation and technology can help.

Dynamic Pricing Systems

Retailers can now implement AI-driven dynamic pricing that adjusts prices in real-time based on costs, demand, competition, and inventory levels. This allows retailers to maintain margin targets without broad price hikes. Items with lower tariff exposure might stay flat while high-tariff items adjust.

Platforms that automate pricing based on cost structures can help retailers navigate tariff uncertainty more efficiently. This is different from surge pricing—it's cost-responsive pricing that protects margins.

For businesses looking to automate workflows and integrate real-time data into pricing decisions, solutions like Runable enable teams to build custom workflows that pull cost data from suppliers, calculate margin impacts, and generate pricing reports automatically. This turns tariff response from a manual, quarterly process into a real-time, data-driven system.

Use Case: Automatically generating daily pricing recommendations across your product catalog by integrating supplier costs, current tariff rates, and competitor pricing into a unified dashboard.

Try Runable For FreeSupply Chain Visibility

Retailers are investing heavily in supply chain visibility tools that track inventory, costs, and tariff exposure in real-time. Better visibility means faster adaptation to cost changes.

Tools that integrate with ERP systems and provide real-time cost analysis are becoming essential. They help retailers avoid over-buying tariff-exposed inventory and identify cost-saving opportunities.

Inventory Optimization

AI-driven inventory management is helping retailers reduce excess stock while maintaining availability. This is crucial under tariff pressure because excess inventory becomes a liability.

Optimization tools use historical demand, seasonal patterns, and current cost structures to recommend optimal inventory levels. This reduces holding costs and forces faster turnover of tariff-exposed goods.

Looking Forward: 2025 and Beyond

Where does this go from here?

Short-term (Next 6 Months)

Expect accelerating price increases as pre-tariff inventory fully depletes. Most visible increases will be in electronics and toys. Consumer backlash will be moderate but growing. Retailers will start tweaking product mix in response to margin pressures.

Third-party sellers will continue struggling. Some will exit the market. Others will shift to private label or lower-tariff-exposed products.

Medium-term (6-12 Months)

Production alternatives outside China become more viable. Companies that invested in Vietnam, India, or Mexico operations will start seeing payoff as tariff-free goods enter supply chains.

Price increases plateau as cost pass-through completes. Consumer behavior adapts to new price levels. Bargain hunting remains elevated, but shoppers accept new price baselines.

Retail consolidation accelerates as smaller players struggle with margin pressure.

Long-term (12+ Months)

The outcome depends entirely on tariff policy. If tariffs persist, we see structural reshoring and supply chain restructuring away from China. If tariffs drop, we see deflation in tariff-exposed categories as alternative sourcing expands.

Either way, the current period is one of transition. Supply chains that were optimized for Chinese manufacturing and zero tariffs are being re-optimized for a higher-tariff world.

This takes time, but change is accelerating.

The Bigger Picture: Why This Matters

Jassy's comment about price increases isn't interesting just because retail is important. It's interesting because retail is the visible symptom of a fundamental shift in how global trade is organized.

For decades, the logic was: find the lowest-cost manufacturing source globally, import it tariff-free or low-tariff, and compete on price. This drove massive deflation in consumer goods. Your

Tariffs are reversing this logic. Manufacturing costs and logistics costs are rising again as tariff rates increase the effective cost of imports.

Over time, this might actually be inflationary, or it might incentivize domestic manufacturing and cause deflation through re-shoring. But in the near term, it's painful. Consumers pay more. Retailers struggle with margins. Supply chains must reconfigure.

Jassy's comments are essentially saying: "This isn't hypothetical anymore. We're living in the new regime. Prices are going up. Adapt."

That's the real message.

FAQ

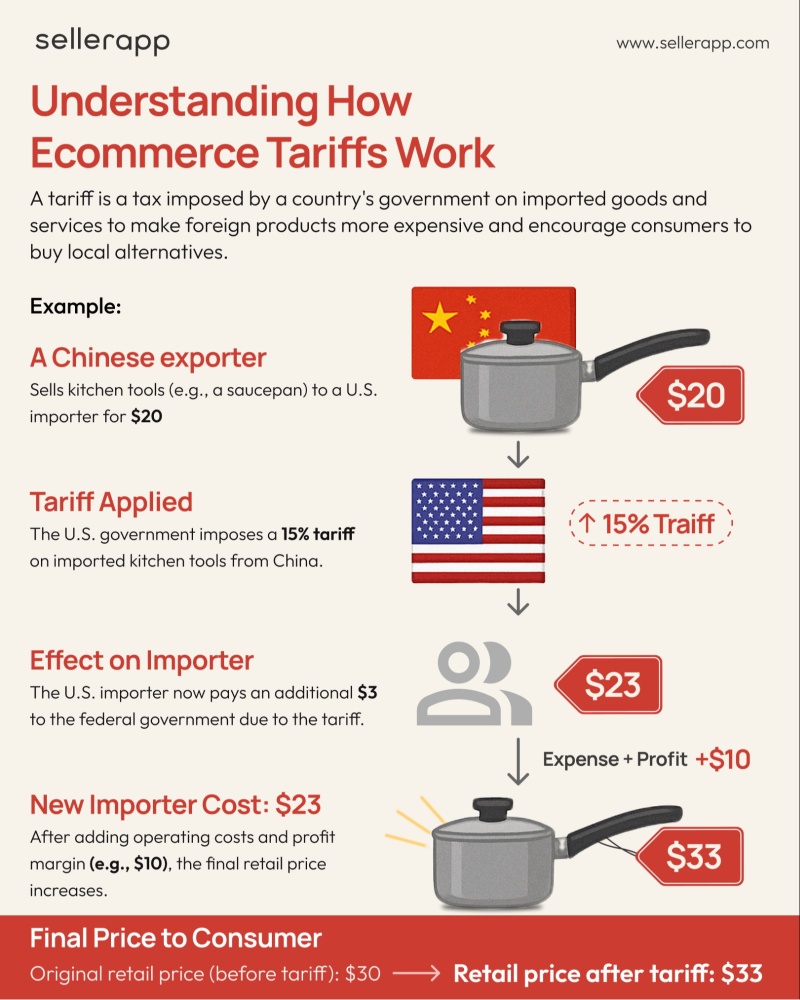

What exactly are tariffs and how do they affect prices?

Tariffs are taxes on imported goods. When the U.S. government places a 15% tariff on imported electronics, it means the import cost of a

Why hasn't Amazon kept prices flat despite tariffs?

Amazon initially absorbed tariff costs using pre-tariff inventory purchased before tariffs took effect. But that inventory has now depleted. New replacement inventory costs more due to tariffs, so Amazon must choose between absorbing the costs (which erodes margins beyond sustainability) or raising prices. Retail operates on 3-5% margins, and a 10-15% increase in import costs cannot be absorbed indefinitely without destroying profitability.

Which products are being hit hardest by tariffs?

Electronics, apparel, toys, and home goods are facing the largest price increases because they're primarily manufactured in China and other countries subject to tariffs. Electronics are seeing 12-18% increases, toys 15-25%, apparel 8-12%, and home goods 8-15%. Domestically produced goods like groceries and some manufactured items face minimal direct tariff impact.

How do tariffs affect small retailers versus large retailers like Amazon?

Large retailers like Amazon have diversified profit streams (AWS, advertising) that allow them to absorb tariff costs and maintain competitive pricing. Small retailers and third-party sellers operate on pure retail margins with no other revenue sources. This means tariffs force small retailers to raise prices immediately or see margins vanish, effectively consolidating market share toward large retailers.

Are these price increases permanent?

Tariff-driven price increases depend on whether tariff policy persists. If tariffs remain in place, prices will stabilize at new higher levels as supply chains adjust. If tariffs drop, we could see deflation in affected categories as inventory purchased at high prices becomes obsolete. The uncertainty itself is as problematic as the tariffs, making long-term planning difficult for retailers.

What should consumers do to minimize the impact of tariff-driven price increases?

Consumers should buy essential electronics and high-tariff items now while some pre-tariff inventory remains, as prices will likely increase over the next 6 months. Shift toward private label and budget brands in apparel and home goods, where tariff pass-through is less aggressive. Delay non-essential purchases like furniture and luxury goods if possible, as these categories are experiencing significant price pressure.

How are third-party sellers on Amazon coping with tariff impacts?

Third-party sellers face immediate margin compression with no AWS subsidies to offset costs. Most are raising prices 15-20% on tariff-exposed products or liquidating inventory at losses. Some are exploring alternative sourcing from Vietnam, India, or Mexico. Others are simply exiting categories or entire platforms. Amazon's commission structure isn't adjusting to help sellers, which creates additional competitive pressure.

Will tariffs cause a major economic recession?

Unlikely in the near term. Tariffs are inflationary for specific categories but not broad-based inflation. Consumer spending has momentum, and the labor market remains strong. However, sustained tariffs that significantly raise consumer prices could eventually dampen spending and economic growth. The impact will become clearer over 12-24 months as tariff effects fully cascade through supply chains.

Can companies avoid tariffs by sourcing from different countries?

Yes, but it takes time. Companies are already exploring Vietnam, India, Indonesia, and Mexico as alternative sourcing destinations. These countries either don't face tariffs or face lower rates than China. However, establishing new supply chains requires 6-18 months and involves setup costs, quality control risks, and minimum order quantities. Eventually, alternative sourcing will reduce tariff impacts, but the transition period is painful.

How is retail margin pressure affecting wages and employment?

Retailers facing tariff-driven margin compression are reducing hiring, slowing wage growth, and potentially laying off staff. Wages in retail are stagnating despite inflation in consumer prices, creating a wage-price squeeze. Technology and automation investments are accelerating as retailers try to reduce labor costs to offset tariff impacts. This could lead to job losses in lower-skilled retail roles over the next 12-24 months.

Conclusion

Andy Jassy's statement about rising prices isn't just a commentary on current retail conditions. It's a signal that the global trade regime that's dominated for the past three decades is undergoing a fundamental transformation.

For decades, consumers benefited from supply chain optimization that ruthlessly pursued the lowest-cost manufacturing, usually in China. Tariffs are reversing that calculus. When import costs rise 15-20%, the economics of Chinese manufacturing change. Alternative sourcing becomes viable. Domestic production becomes competitive. Supply chains begin to reconfigure.

In the short term, this means higher prices. Consumers will pay more for electronics, apparel, furniture, and most manufactured goods. Third-party sellers will struggle with margins. Retailers will consolidate. Wage growth in retail will stagnate.

In the medium term, supply chains adjust. Companies invest in alternative sourcing and domestic production. Prices stabilize at new higher levels. Consumers adapt purchasing behavior.

In the long term, the outcome depends on policy. If tariffs stick, we get structural supply chain changes and probably higher baseline prices but potentially more resilient domestic manufacturing. If tariffs drop, we see deflation in affected categories and a return to the pre-tariff regime.

Right now, we're in the transition period. It's uncomfortable. Prices are rising. Margins are shrinking. Supply chains are confused. But this is necessary to reach a new equilibrium.

Jassy's comments acknowledge this reality. Amazon is trying to hold prices down, but they can't hold them forever. At some point, costs force prices up.

The question isn't whether prices will rise. They already are. The question is how fast they'll rise, how consumers will adapt, and whether supply chains can reconfigure quickly enough to stabilize at a new, slightly-less-chaotic equilibrium.

Watch the next 6-12 months closely. That's when we'll see if this is a temporary tariff shock or a permanent shift in how global manufacturing and retail work.

Key Takeaways

- Tariffs of 15-20% are forcing retailers to choose between margin erosion or price increases, with most choosing price increases

- Third-party sellers face 8-10% margin compression while large retailers like Amazon can absorb costs using diversified profits

- Electronics, toys, and apparel are seeing 10-25% price increases as pre-tariff inventory depletes over next 6 months

- Consumers are responding by trading down to budget brands and delaying discretionary purchases, pressuring retail volume

- Supply chain reconfiguration to Vietnam, Mexico, and India will take 6-18 months but eventually reduces tariff exposure

![Amazon Tariffs Driving Price Increases: What Retailers Face [2025]](https://tryrunable.com/blog/amazon-tariffs-driving-price-increases-what-retailers-face-2/image-1-1768939682971.jpg)