Introduction: The Supreme Court's Historic Tariff Decision

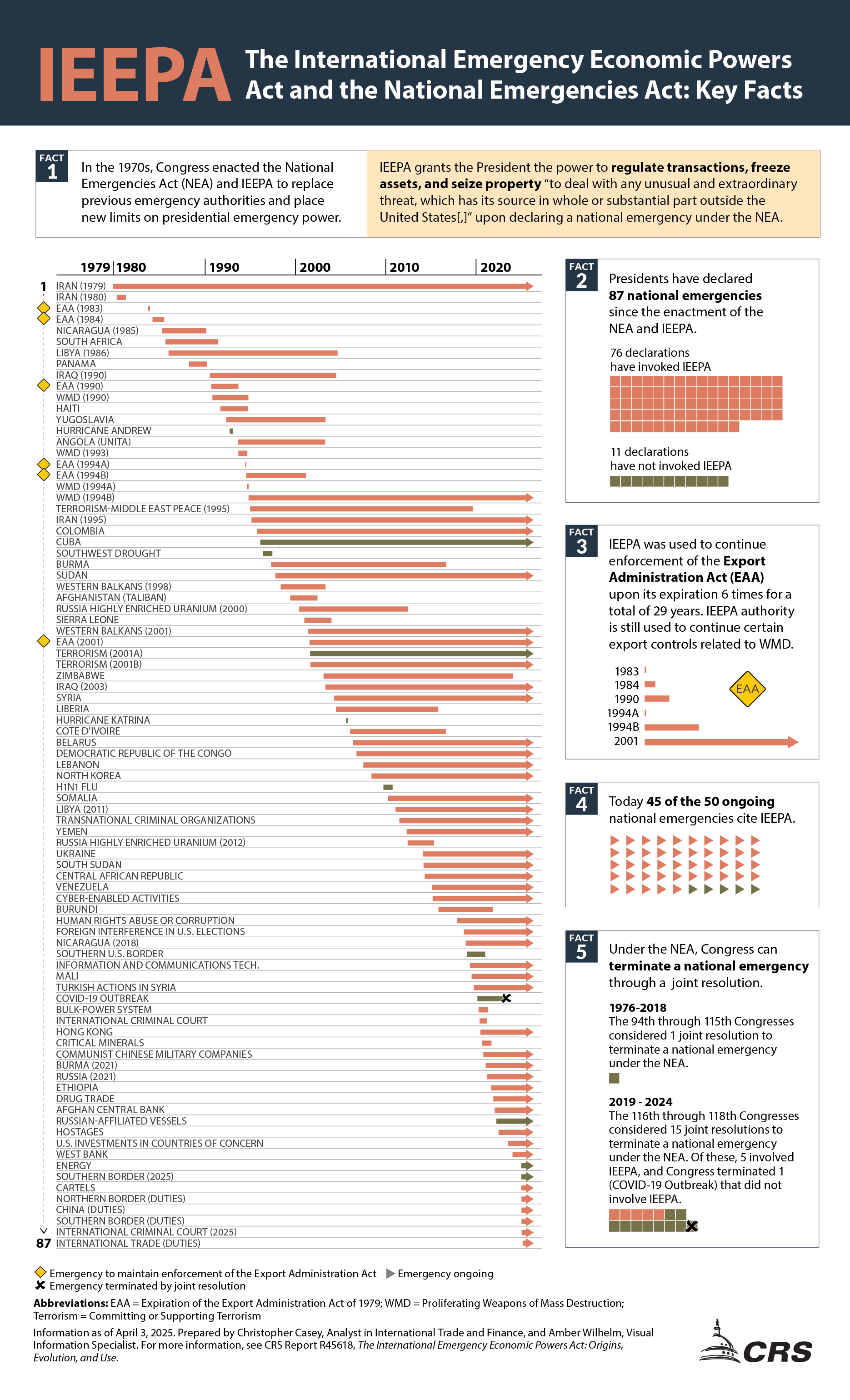

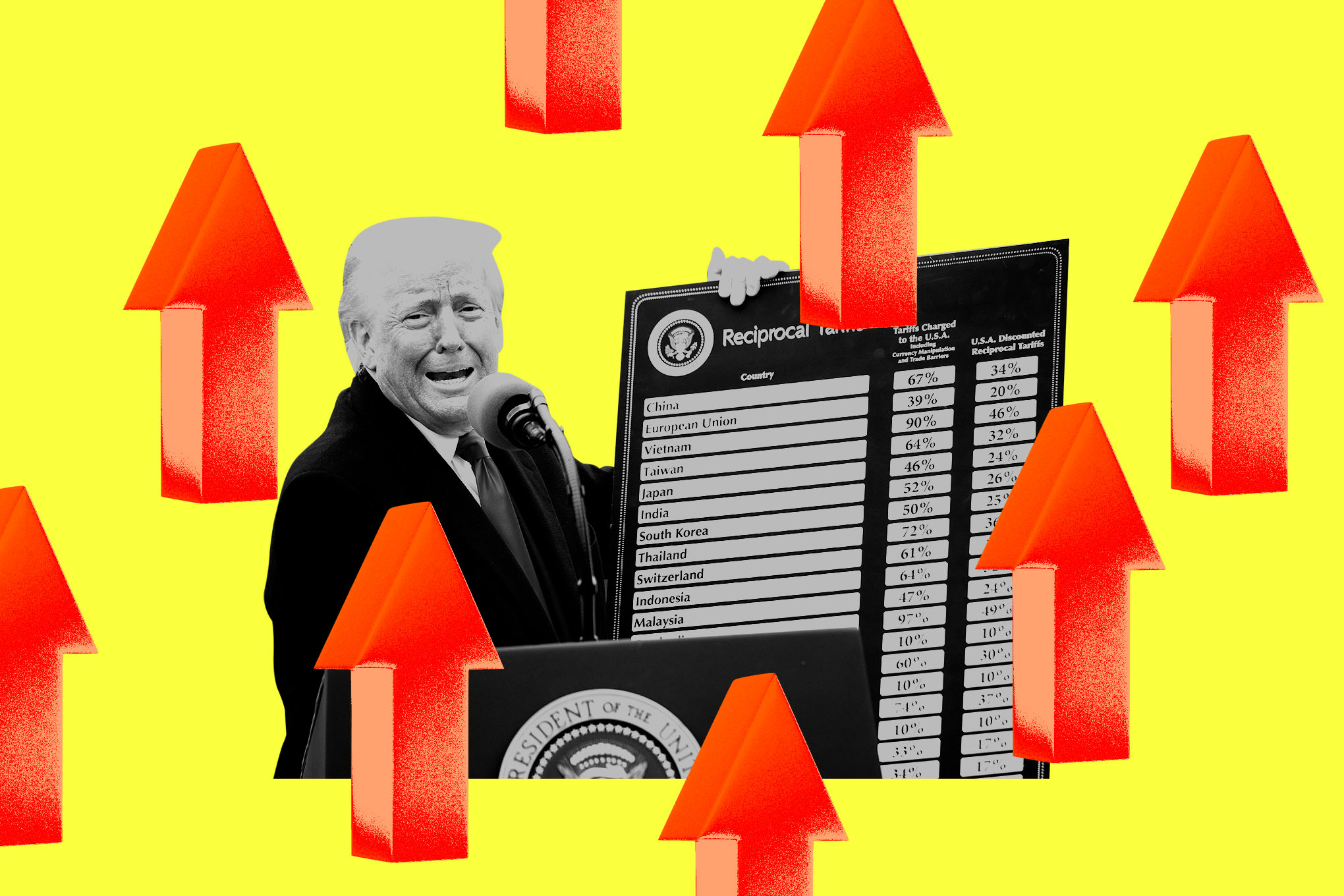

On a Friday in 2025, the Supreme Court did something that shook Washington: it told a sitting president that his tariffs were unconstitutional. The 6-3 decision struck down portions of Donald Trump's aggressive tariff regime, specifically those levied under the International Emergency Economic Powers Act (IEEPA). For the first time in nearly 50 years, a president's attempt to use a national emergency statute to impose trade duties was ruled illegal, as noted by BBC News.

But here's what you need to understand: this victory for importers and small businesses might be more symbolic than substantive. The ruling didn't eliminate Trump's tariff tools, didn't promise refunds for the billions already collected, and didn't stop the administration from deploying new tariff strategies. Instead, it opened a messy legal and financial situation that could take years to untangle, according to Yale's Budget Lab.

The tariff fight that defined Trump's second term just entered a new, more complicated phase. And unlike a clean Supreme Court victory that ends a debate, this one basically asked: "What happens next?" That question matters to everyone from manufacturing CEOs to Amazon customers, as highlighted by NBC News.

Let's dig into what the Supreme Court actually ruled, why it matters, what businesses are doing about it, and what the real-world implications look like when courts win but the war continues.

TL; DR

- The 6-3 Supreme Court ruling struck down tariffs imposed under the International Emergency Economic Powers Act (IEEPA), saying this 1977 law was never meant to justify trade duties, as detailed by Cato Institute.

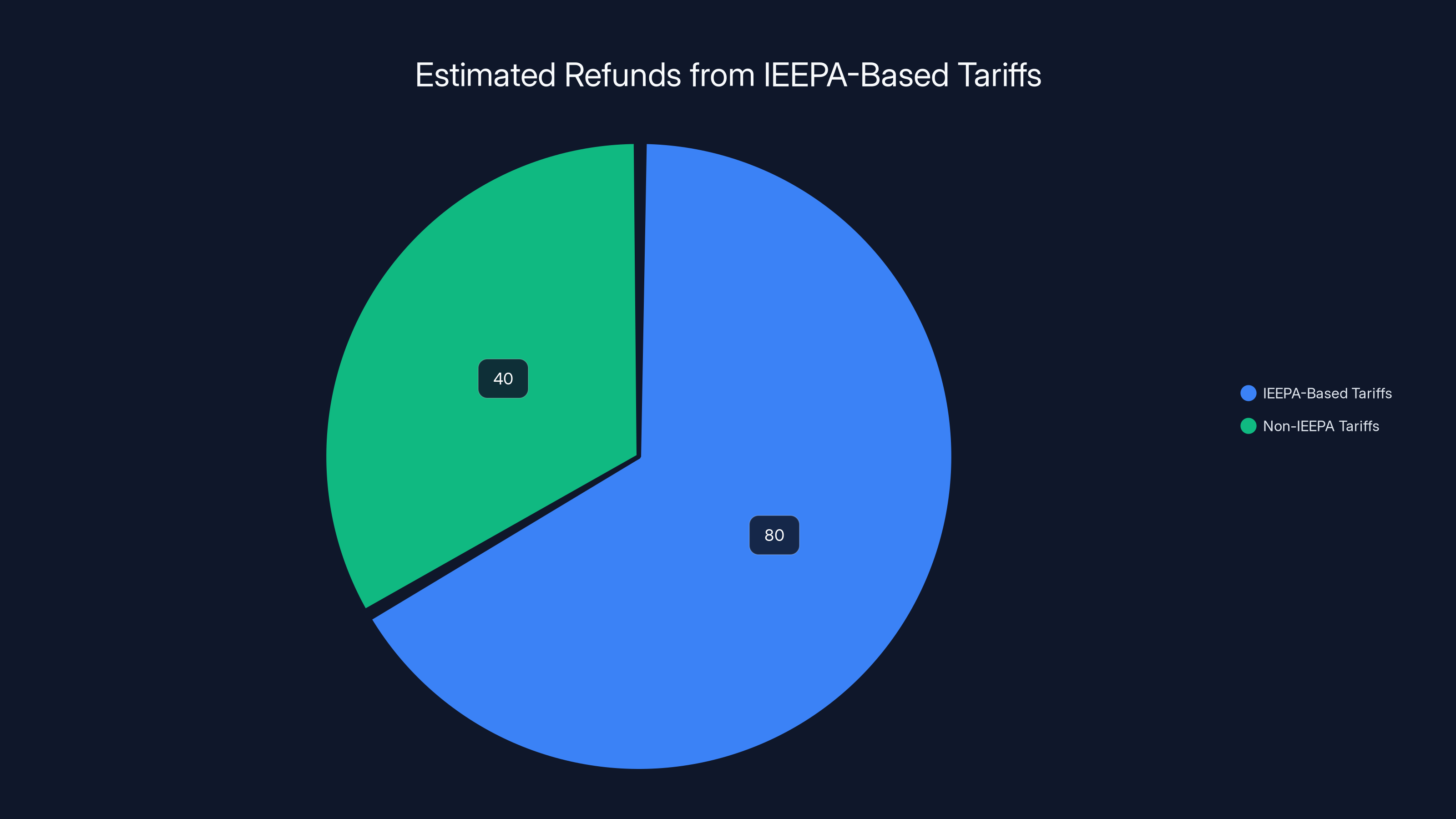

- Tariff refunds remain unclear, but could total roughly $120 billion with no guarantee that small businesses or consumers will actually see that money, according to USA Today.

- The administration is already pivoting, using alternative tariff statutes like Section 122 and Section 301 to impose new duties at a 10% rate, as reported by Time.

- Small businesses won the legal battle but face months or years of bureaucratic processes to recover money unlawfully collected, as noted by NPR.

- The broader tariff environment persists, meaning consumers and importers should expect continued trade friction regardless of this ruling, as discussed by Quartz.

Estimated data suggests

Understanding the International Emergency Economic Powers Act (IEEPA)

The IEEPA sounds like dry legislative language, but it's become the central battleground in Trump's tariff wars. Created in 1977, this law gave presidents the ability to declare a national emergency and freeze assets, restrict transactions, and control trade during genuine crises—think Iranian hostage negotiations or sanctions regimes against hostile nations, as explained by Prismedia.

The law was designed with a specific purpose: limiting presidential emergency powers to situations where the threat came from outside the United States. Congress didn't write it with trade policy in mind. They certainly didn't imagine a president would use it to impose blanket tariffs on Canada, Mexico, and China simultaneously, or apply "reciprocal" tariffs to goods from every country on earth, as highlighted by Peterson Institute for International Economics.

That's exactly what Trump did. His administration argued that protecting domestic manufacturing from foreign competition constituted a national emergency under IEEPA. The legal theory: tariffs are just another tool for controlling economic activity during emergencies.

The problem is like trying to use a fire extinguisher to paint a house. The tool isn't designed for that job, and courts eventually noticed. The Supreme Court's majority said Congress never intended IEEPA to become a tariff authority. If the president wanted broad tariff powers, they'd need to use actual tariff laws—Section 301, Section 232, Section 122—which have specific limits, congressional approval requirements, and defined scopes, as discussed by Council on Foreign Relations.

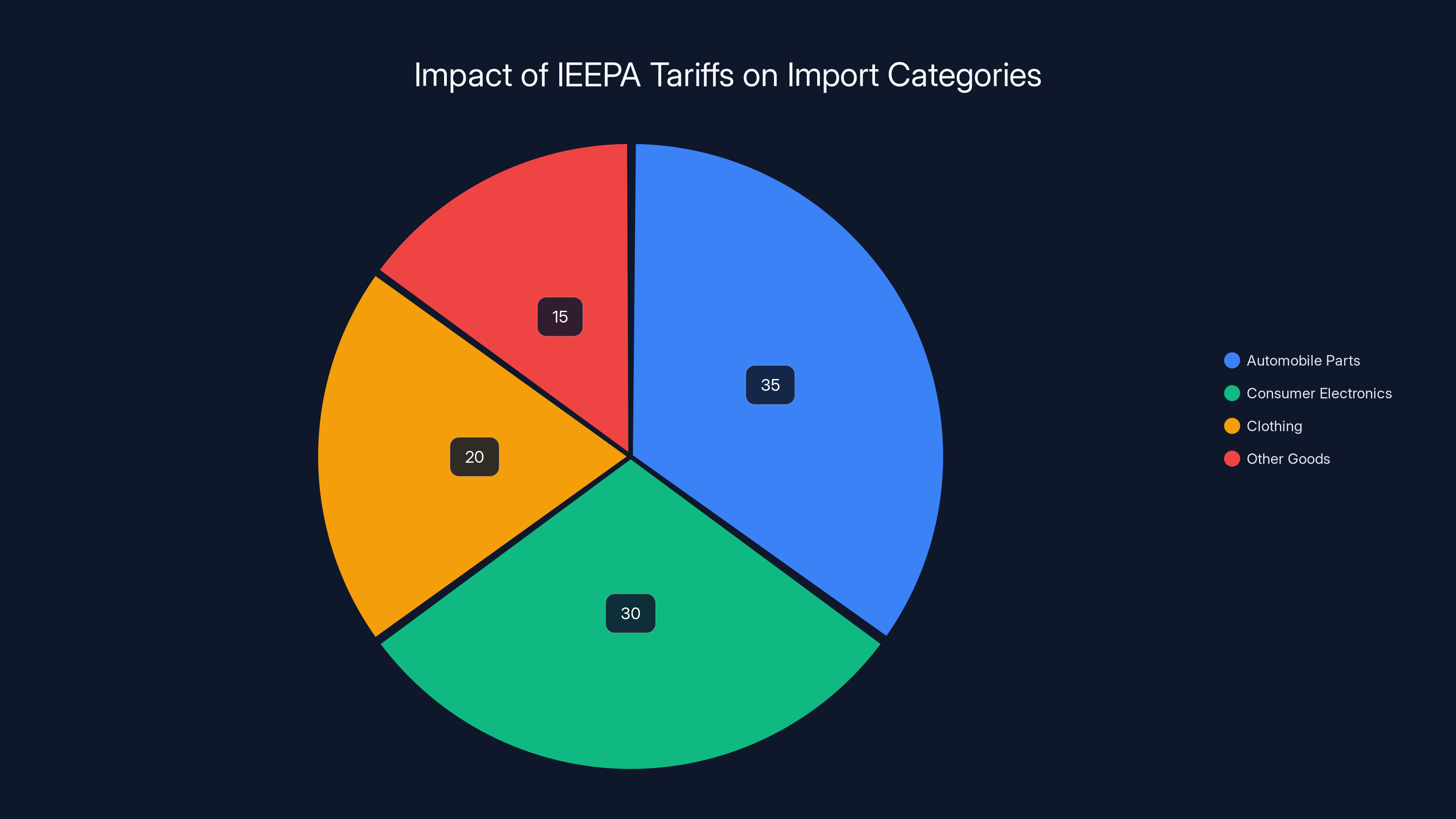

This matters because IEEPA tariffs affected roughly **

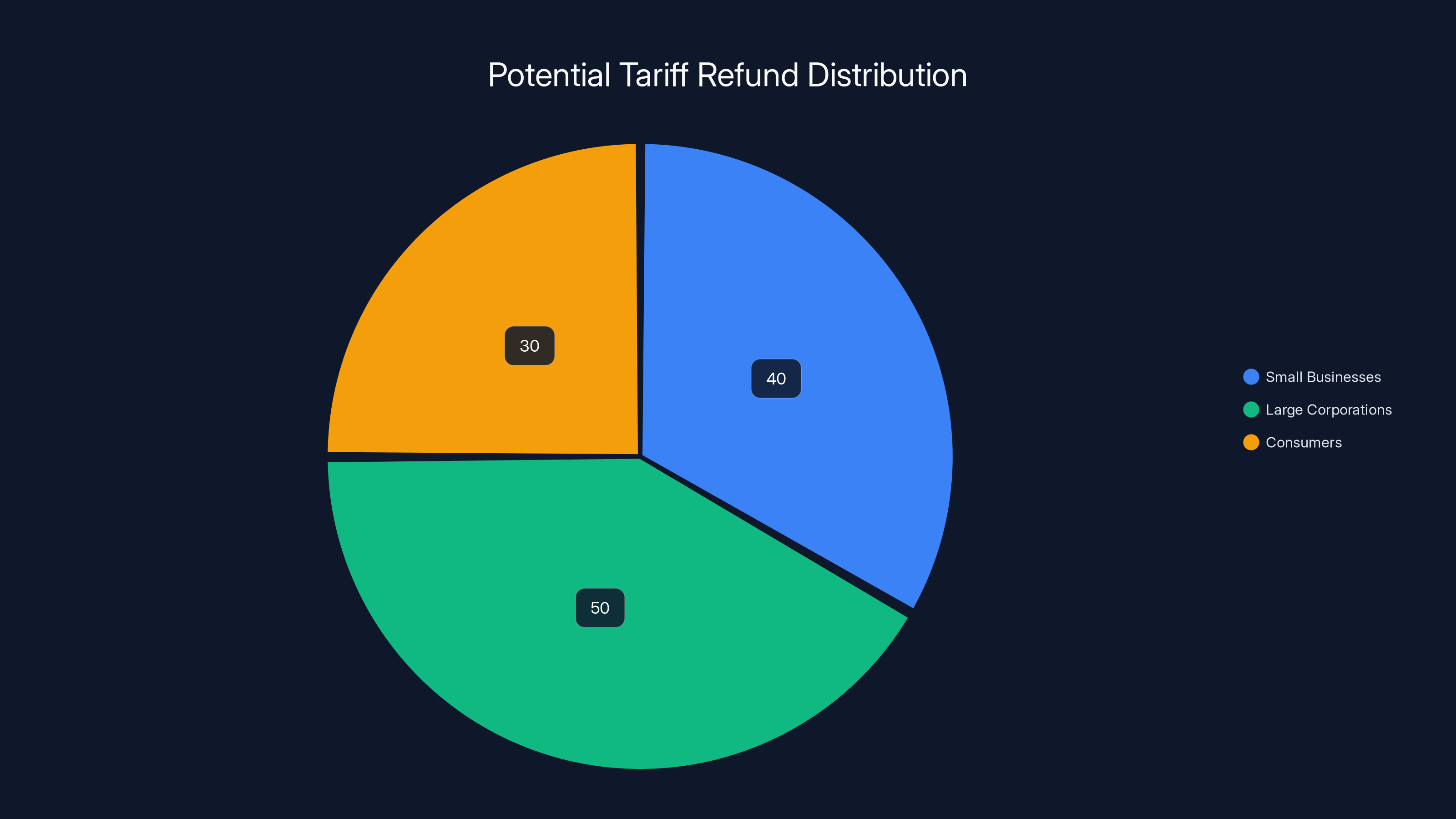

Estimated data: Small businesses and large corporations are expected to receive the majority of the $120 billion in tariff refunds, with consumers seeing a smaller share.

The Supreme Court's 6-3 Ruling: What the Majority Said

The Supreme Court's majority opinion didn't mince words. The justices looked at the statutory text of IEEPA and concluded the law is about foreign threats to national security and the economy, not about leveling the playing field with trading partners or protecting domestic industries from competition, as reported by CNBC.

The key language in the ruling focused on IEEPA's limiting language: "any authority or powers conferred upon the President by this Act shall be exercised only in such manner as is consistent with the purposes of this Act." Those purposes, the Court said, relate to foreign threats coming from outside the country. Trade protection isn't listed among them.

This is important because it's not the Court saying tariffs are unconstitutional. It's saying this particular president used the wrong law. The ruling distinguishes between tariffs imposed under IEEPA (illegal) and tariffs imposed under other statutes with actual tariff authority (still legal).

The majority also emphasized that the IEEPA contains safeguards Congress designed to prevent emergency overreach. The president must declare an actual emergency. The emergency must be linked to foreign threats. Congress gets periodic oversight. When a president ignores these safeguards and stretches the law's language beyond recognition, courts have a responsibility to push back, as highlighted by Whalesbook.

In essence, the Court said: "We trust Congress to write tariff laws when it wants to. We trust presidents to follow those laws. We don't trust presidents to rewrite their own powers using unrelated emergency statutes."

Justice Kavanaugh's Dissent: The Refund Problem He Identified

Justice Brett Kavanaugh wrote a dissent that's becoming the most practically important part of the ruling. He disagreed with the majority on whether IEEPA authorized the tariffs, but his dissent focused on a question the majority opinion didn't directly address: what happens to all the money already collected?

Kavanaugh noted that if these tariffs were illegal, the US Treasury probably has to refund them. That's a legal principle called "restitution for unlawful government actions." But here's where it gets messy: refunding $120 billion involves massive administrative challenges, as discussed by Cato Institute.

Who gets the refund? The importer who paid the tariff? But importers often passed those costs to retailers, who passed them to consumers. Do consumers somehow get refunds for higher prices? The Kavanaugh dissent described this process as "a mess," which is probably the most accurate legal language ever used in a Supreme Court opinion.

The practical reality is that most refund requests will go to importers and distributors—companies that have records of what they paid. Consumers who paid higher prices at stores won't see refunds because there's no mechanism to track or reimburse millions of individual purchases.

Kavanaugh also suggested that the refund determination process could take months or years. The government would need to verify each tariff payment, match it to the IEEPA-imposed duties, calculate the refund amount, and process it through federal channels. Every step involves paperwork and potential disputes, as noted by NPR.

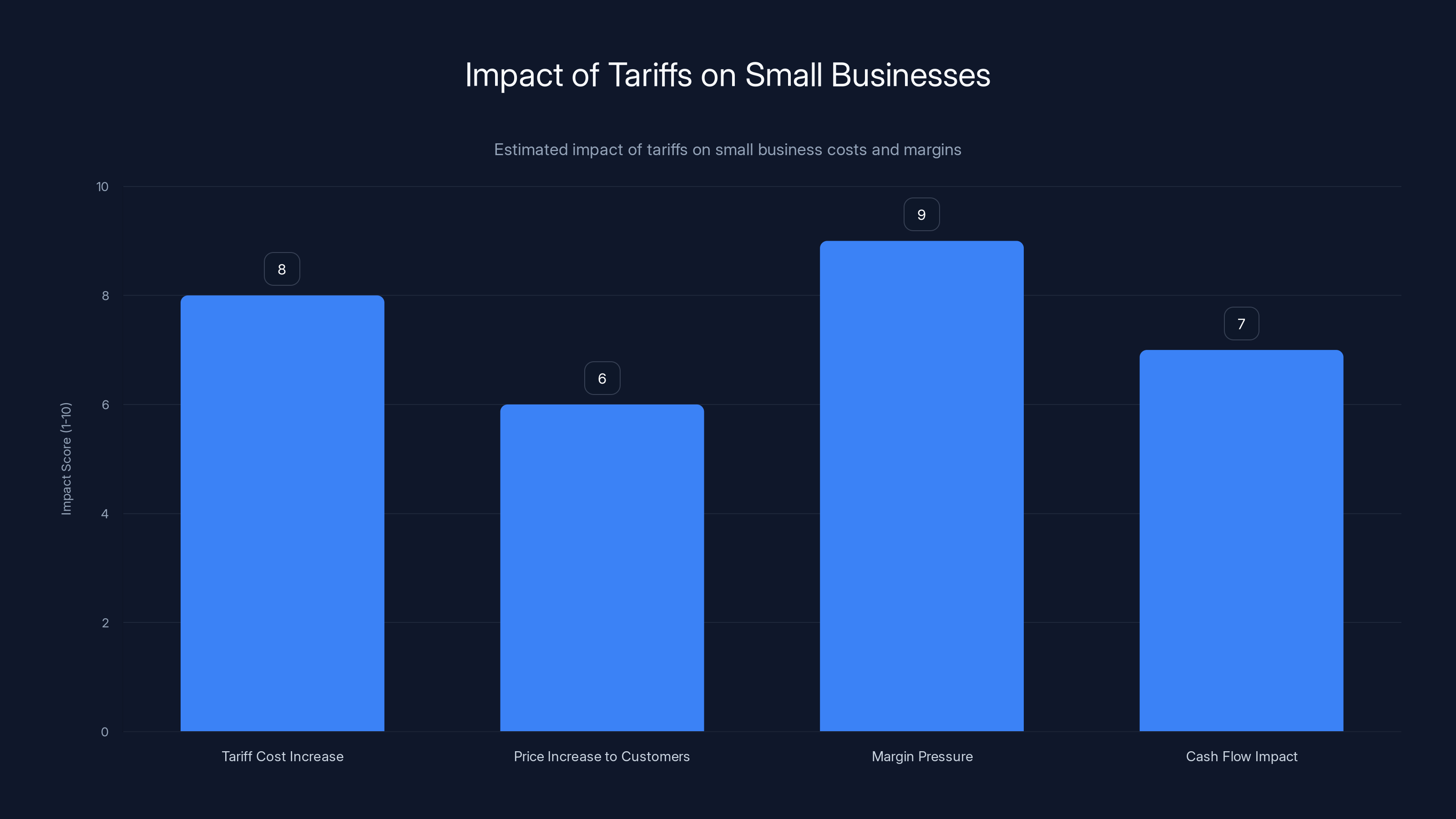

Estimated data shows that tariff cost increases significantly impact small businesses, especially in terms of margin pressure and cash flow challenges.

The Reality of Refunds: Will Businesses Actually Get Money Back?

Here's where theory meets reality, and things get complicated. The Supreme Court ruling declares the tariffs illegal, but it doesn't automatically trigger refunds. Instead, it creates a legal pathway for refunds that the government now has to navigate, as explained by Reuters.

The National Retail Federation called for "a seamless process to refund the tariffs to U. S. importers," which is retail-speak for "the government needs to make this easy." But government refund processes are rarely seamless. They typically require applications, verification, documentation, and appeals.

Small businesses are particularly concerned. A coalition called "We Pay the Tariffs," representing hundreds of small manufacturers and importers, issued a statement that captured the frustration: "A legal victory is meaningless without actual relief for the businesses that paid these tariffs. Small businesses cannot afford to wait months or years while bureaucratic delays play out," as highlighted by Prismedia.

The estimated $120 billion in potential refunds assumes the government processes every claim quickly and fairly. In practice, expect:

- Application requirements: Companies will need to prove they paid specific tariffs on specific dates

- Documentation demands: Import records, receipts, customs declarations all need to be assembled

- Verification delays: Government agencies will need to cross-reference payment records

- Dispute resolution: Some companies will disagree with refund amounts and pursue appeals

- Timeline uncertainty: Months to settle straightforward cases, years for complex disputes

The Court of International Trade will likely oversee this process, which means refund disputes become litigation. That's expensive for small businesses that can't afford legal fees, as noted by NBC News.

Alternative Tariff Strategies: What the Trump Administration Is Doing Instead

The Supreme Court ruling eliminated one tool from Trump's tariff toolkit, but he's got several others. In fact, at his press briefing immediately after the ruling, Trump signaled he'd move on to different legal authorities—and he made good on that promise, as reported by Council on Foreign Relations.

The administration quickly announced Section 122 tariffs at a 10% rate, effective almost immediately. Section 122 is a completely different law that gives the president power to impose tariffs to protect national defense-related industries. It's not as broad as IEEPA, but it's real and it has actual statutory authority.

Section 122 tariffs are limited. The statute specifies they can last 150 days without congressional approval. But 150 days buys time. Trump can use that window to pursue additional tariff actions under Section 301 (retaliatory tariffs against unfair trading practices) and Section 232 (tariffs on national security grounds for specific products like steel and aluminum), as noted by BBC News.

These alternative approaches matter because they were already working before the Supreme Court ruling. Steel and aluminum tariffs imposed under Section 232 were never challenged successfully because that statute has clear language authorizing them. Section 301 tariffs on China have been in place for years.

So from a practical standpoint, Trump's tariff regime continues, just under different legal authorities. The Supreme Court didn't end tariffs. It just forced the administration to use the correct legal authorities, as highlighted by Peterson Institute for International Economics.

Estimated data shows that automobile parts and consumer electronics were the most affected by IEEPA tariffs, representing a significant portion of the $300 billion in annual imports.

The Steel and Aluminum Question: Why Some Tariffs Weren't Affected

One of the cleaner parts of the Supreme Court ruling is what it didn't affect: steel and aluminum tariffs. These were imposed under Section 232, a completely different law from IEEPA. Section 232 explicitly authorizes the president to impose tariffs on products deemed essential to national defense, as discussed by Cato Institute.

The statutory language is broad enough that courts have generally upheld Section 232 tariffs, even though "national defense" was stretched pretty far. Is aluminum inherently a national security issue? Debatable. Has the president stretched that interpretation? Absolutely. But the statute gives him that authority.

Similarly, industry-specific tariffs that weren't based on IEEPA remain in place. This means the tariff landscape is fragmented:

- IEEPA tariffs: Ruled illegal, subject to refund claims

- Section 232 tariffs: Still legal, still in effect

- Section 301 tariffs: Still legal, still in effect

- Section 122 tariffs: Recently deployed at 10% rate, still legal

- Reciprocal tariffs under IEEPA: The legal status is murkier, but the Supreme Court's reasoning likely applies here too

Importers and small businesses benefit from the IEEPA ruling but face continued tariff pressures from these other authorities, as noted by NPR.

Impact on Small Businesses: Winners and Losers

Small businesses were early and vocal opponents of Trump's tariffs. Companies relying on imported components or parts faced margin pressures as tariff costs increased. Many couldn't absorb those costs without raising prices, which risked losing customers, as highlighted by USA Today.

The Supreme Court ruling is symbolically important to this constituency. It validates their legal arguments and suggests courts do have a role in constraining tariff overreach. But the practical relief is another story.

For a small manufacturing company that imported

- Filing a formal refund claim with documentation

- Waiting for government verification

- Potentially appealing if the government disputes the amount

- Receiving a refund possibly 6-18 months later

That's capital tied up for over a year. For small businesses with thin margins and cash flow challenges, that's not just inconvenient—it's a business problem, as discussed by Whalesbook.

Small importers also can't easily pass tariff costs to larger retailers. When Walmart demands a 3% price reduction but tariffs increase costs by 5%, small suppliers absorb the difference. The Supreme Court ruling helps, but it doesn't immediately improve margins or cash flow.

The real question is whether the administration's pivot to alternative tariff authorities changes the calculus. If Section 122 and other tariffs stay in place for extended periods, small businesses remain under pressure regardless of the IEEPA ruling, as noted by CNBC.

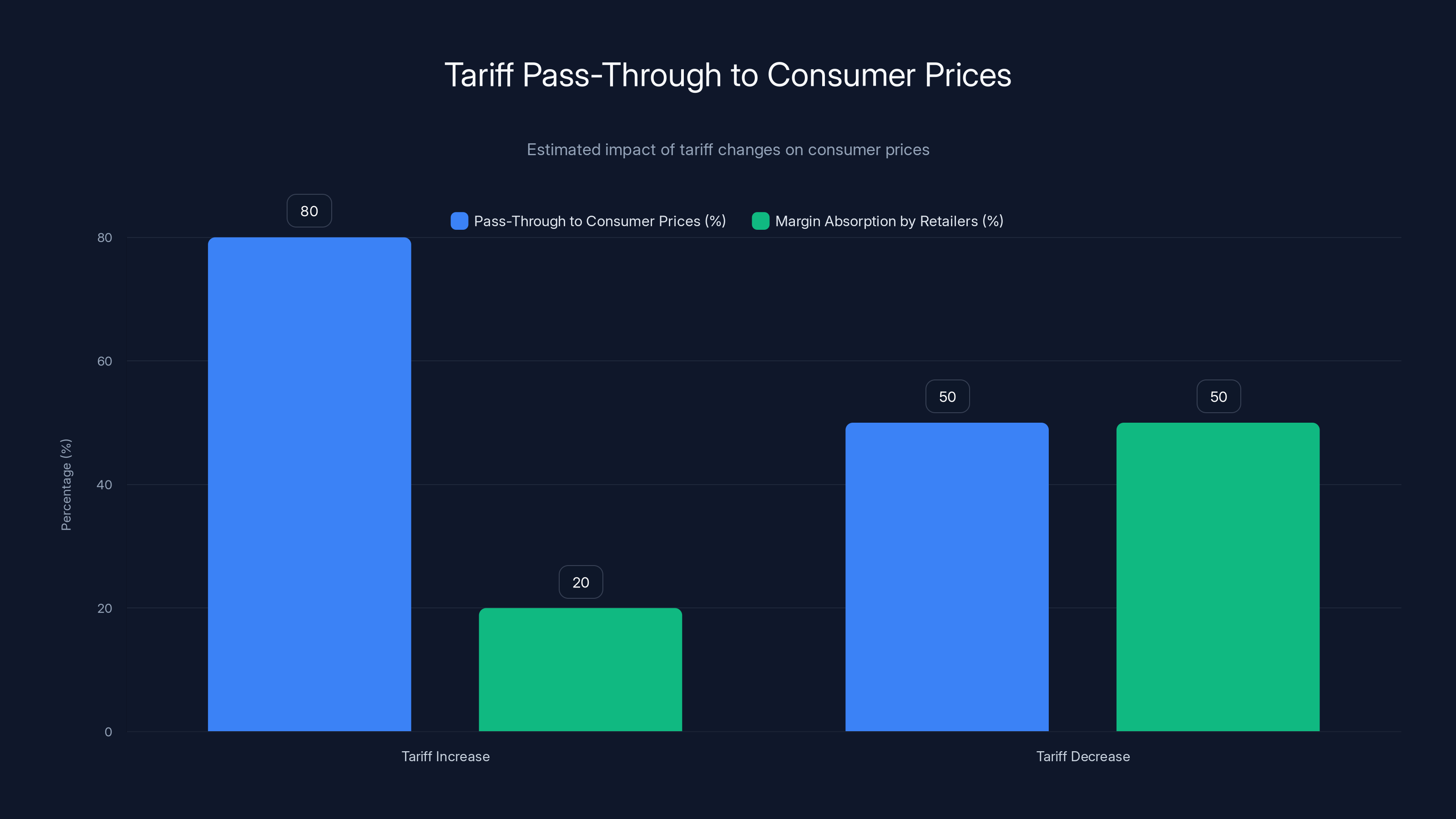

Tariff increases quickly pass through to consumer prices with about 80% impact, while decreases see only 50% pass-through, with the remainder absorbed by retailers. Estimated data.

Consumer Impact: Will Prices Come Down?

Here's the hard truth: most consumers won't see the IEEPA tariff refunds. They'll probably get benefits from lower import prices if those tariffs disappear, but the supply chain from tariff reduction to lower retail prices isn't automatic, as explained by BBC News.

When tariffs increase, prices rise pretty quickly. Retailers and distributors need revenue, so they pass costs through. But when tariffs decrease, price reductions often lag. Retailers absorb the margin improvement rather than immediately cutting prices.

This is a documented phenomenon in economics. Tariff increases have "fast pass-through" to consumer prices, while tariff decreases have "slow pass-through." Some economists estimate that maybe 50-60% of tariff savings reach consumers as lower prices, while the rest accrues to importers, distributors, and retailers as margin improvements, as noted by Reuters.

Additionally, consumers bear the cost of tariffs they never see directly. If you buy electronics, clothing, furniture, or auto parts that were subject to IEEPA tariffs, you've been paying more. The Supreme Court ruling might eventually reduce those prices, but there's no mechanism to refund consumers for the extra amounts they already paid.

The consumer benefit from the ruling is therefore mostly forward-looking. Future purchases might be cheaper. Past purchases? That money is gone, as highlighted by NBC News.

The Court of International Trade's Role: Where Real Disputes Get Resolved

The Supreme Court made the ruling, but the Court of International Trade will sort out the practical consequences. This specialized court handles tariff disputes, import classifications, and trade law issues. It's not well-known outside trade circles, but it's where the rubber meets the road, as discussed by Prismedia.

The Court of International Trade will likely oversee:

- Refund claim disputes: Companies arguing the government undercounted their tariff payments

- Tariff classification challenges: Goods whose IEEPA status is ambiguous

- Timeline and process rules: How quickly refunds must be processed

- Appeals and escalations: The legal infrastructure for refund disagreements

Monika Gorman, a former Biden administration manufacturing official now at Crowell Global Advisors, noted that the refund process could take months to sort out. The Court of International Trade isn't known for rapid decisions. Complex trade disputes regularly take 18-24 months to resolve, as highlighted by Cato Institute.

For small businesses, this timeline is problematic. They can't afford extended litigation to recover money the government unlawfully collected. They need clear procedures and fast processing.

The court's role also extends to future tariff disputes. If the administration tries to impose new tariffs under different statutes, companies will challenge them in the Court of International Trade. Expect a steady stream of litigation over the coming years, as noted by BBC News.

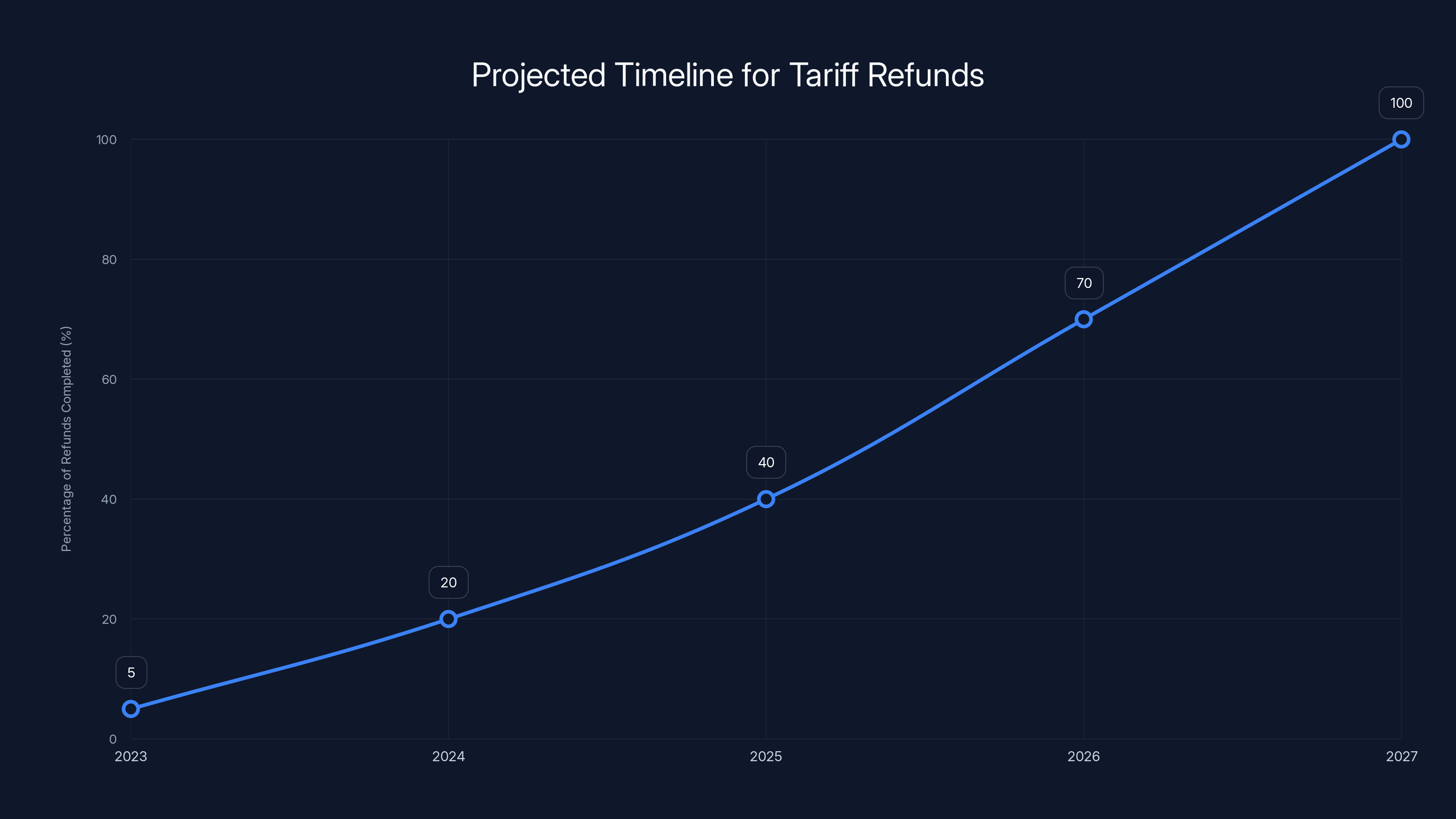

Estimated data suggests that it could take until 2027 for substantial tariff refunds to reach importers, highlighting the complexity of the refund process.

The De Minimis Exemption: One Specific Casualty

One of the cleaner parts of Trump's IEEPA tariff strategy was eliminating the de minimis exemption. This exemption previously allowed packages under $800 to enter the US duty-free. It was designed to reduce customs processing costs for low-value items, as explained by Whalesbook.

Eliminating it meant that now, a $50 package from a foreign retailer gets hit with tariffs. For online shoppers ordering from international sites, this became a visible tariff cost at checkout.

The Supreme Court ruling likely invalidates this de minimis elimination since it was justified under IEEPA. That means packages under $800 should once again enter duty-free, benefiting online shoppers who buy from international retailers.

However, the administration has signaled it might reinstate the de minimis elimination under different legal authority if possible. The challenge is finding a statute that actually authorizes it. Most tariff laws don't explicitly address de minimis thresholds.

This specific fight illustrates the broader dynamic: the Supreme Court ruled on one authority, but the administration continues searching for alternative authorities to achieve similar outcomes, as noted by Council on Foreign Relations.

Reciprocal Tariffs: The Murkier Status

Trump also imposed "reciprocal" tariffs—duties that purported to match the tariff rates other countries imposed on US exports. The theory was fairness: if Mexico taxes American corn at 15%, then American corn from Mexico gets taxed at 15%, as discussed by NPR.

It's an appealing concept in theory. In practice, reciprocal tariffs are complicated because countries have different tariff rates on different products, and comparing them directly is like measuring apples against oranges tariff schedules.

The IEEPA authorization for reciprocal tariffs is even more legally questionable than the blanket tariffs. The statute says nothing about reciprocity. It's a concept Trump introduced. The Supreme Court's reasoning—that IEEPA isn't a tariff statute—probably applies here too, though the Court didn't specifically rule on reciprocal tariffs.

Expect litigation over reciprocal tariffs to continue. Companies will challenge them, the government will defend them under alternative statutes, and courts will work through the legal questions. This uncertainty makes planning difficult for importers, as noted by Cato Institute.

Industry Perspectives: Manufacturing, Retail, and Logistics

Different industries have different stakes in the tariff situation. Manufacturers that rely on imported inputs celebrate the Supreme Court ruling but remain anxious about future tariffs. Retailers worry about supply chain costs and price pressures. Logistics companies see opportunity in the complexity, as highlighted by Peterson Institute for International Economics.

Manufacturing sector: Companies that assemble products in the US using imported parts were devastated by IEEPA tariffs. Higher input costs meant either absorbing lower margins or raising prices. The Supreme Court ruling provides relief, but uncertainty about Section 122 and other tariffs creates continued planning challenges, as noted by Council on Foreign Relations.

Retail sector: Major retailers like Walmart and Target absorb some tariff costs but pass others to suppliers and consumers. The ruling helps manage costs, but tariffs under alternative statutes remain problematic. The National Retail Federation has been clear: they want a stable, predictable tariff environment, not a series of legal battles, as discussed by NBC News.

Logistics and customs brokerage: Tariff complexity creates business opportunities. Every new tariff authority, every refund dispute, every classification appeal generates work for customs brokers, tariff consultants, and logistics professionals. The industry is booming partly because tariffs have become more complicated, as highlighted by USA Today.

Agricultural sector: Farming regions that export to China were hit hard by Section 301 tariffs (not affected by the Supreme Court ruling). While IEEPA relief helps some agricultural imports, the broader tariff environment remains difficult, as noted by BBC News.

The Political Context: Trump's Tariff Authority and Congressional Dynamics

Trump views tariffs as central to his economic policy. They're not incidental. He ran on protectionism, he built tariffs into his first-term agenda, and he's continued the approach in his second term, as discussed by Prismedia.

From Trump's perspective, the Supreme Court didn't tell him to stop using tariffs. It told him to use the correct legal authorities. And the correct authorities exist. Congress gave presidents tariff power through Section 301, Section 232, Section 122, and other statutes. The Supreme Court just said: "Use those laws, not IEEPA."

This is why Trump's statement after the ruling emphasized that he'd continue pursuing tariffs through alternative mechanisms. He wasn't backing down. He was pivoting, as noted by Council on Foreign Relations.

From Congress's perspective, there's division. Some representatives want to reclaim tariff authority from the executive branch. Others support presidential tariff flexibility for trade negotiations. The court ruling highlights this debate: Should Congress explicitly constrain executive tariff power, or does the current statutory framework provide sufficient limits?

Republicans are largely unified around Trump's tariff approach, even if they disagree on specific rates. Democrats oppose the tariffs but lack the votes to override a veto.

Likely congressional developments include attempts to clarify tariff statutes, establish refund procedures, or constrain emergency authorities more explicitly. But with Republicans controlling Congress, significant changes seem unlikely in the short term, as highlighted by NPR.

Refund Mechanics: How the Government Will (Probably) Process Claims

The refund process will likely work something like this, based on how the government typically handles similar situations:

Phase 1: Notice and Documentation (Weeks 1-4) The government announces refund procedures and deadlines. Companies submit claims with documentation proving they paid specific tariffs on specific dates.

Phase 2: Initial Review (Weeks 5-12) Customs authorities cross-reference payment records with the government's tariff collection data. They verify the tariff category and the amount claimed.

Phase 3: Assessment (Weeks 13-24) The government determines refund amounts based on verified claims. Companies that disagree with assessments file disputes.

Phase 4: Dispute Resolution (Months 6-18) The Court of International Trade hears disputes. Some get resolved quickly, others take over a year.

Phase 5: Disbursement (Months 12-24+) The government issues refund checks or electronic transfers to verified claimants.

This timeline suggests that a company paying tariffs in January 2025 might not see a refund until late 2026 or early 2027. That's capital tied up for nearly two years, as noted by Cato Institute.

Companies should document everything now: tariff payment dates, amounts, categories, and the goods covered. Customs brokers and accountants should flag all IEEPA-related duties so refund claims don't get lost in the administrative shuffle, as highlighted by BBC News.

Long-term Implications: What the Ruling Means for Trade Policy

The Supreme Court's decision establishes a precedent that presidents can't reuse emergency statutes for purposes they weren't designed for. That matters beyond tariffs. Future presidents can't invoke IEEPA to regulate things Congress didn't authorize through that statute, as discussed by Prismedia.

But the ruling also reveals how much tariff authority Congress has already delegated to the executive branch. Presidents have extensive Section 301, Section 232, and other authorities. They can impose substantial tariffs without violating law.

Long-term implications include:

- Congress might clarify tariff statutes: Defining what counts as a legitimate trade offense under Section 301, or what products qualify as defense-related under Section 232

- Trade policy might become more litigious: Companies will challenge tariffs in court more frequently, creating uncertainty

- Tariff authority might shift: Future presidents could ask Congress for new tariff authorities or expanded powers

- International trade relationships remain strained: Regardless of the Supreme Court ruling, other countries are imposing retaliatory tariffs and negotiating hard

The ruling isn't the end of American tariff policy. It's just a boundary marker on how far presidents can stretch existing authorities, as noted by NPR.

Timeline: Key Dates and Developments

Understanding the tariff saga requires tracking key dates:

- 2025 (early): Trump announces IEEPA tariffs on Canada, Mexico, China, and reciprocal tariffs globally

- 2025 (spring): Multiple companies and business groups challenge tariffs in court

- 2025 (mid-year): Supreme Court hears arguments on whether IEEPA authorizes tariffs

- 2025 (late spring/early summer): Supreme Court rules 6-3 that IEEPA tariffs are illegal

- 2025 (immediate aftermath): Trump announces Section 122 tariffs and signals continued tariff actions under alternative authorities

- 2025-2026 (ongoing): Court of International Trade processes refund claims and hears disputes

- 2026-2027 (projected): Refunds slowly disbursed to verified claimants

This timeline shows why small businesses remain frustrated. The Supreme Court victory in mid-2025 doesn't translate to refunds until 2026 or 2027. Meanwhile, new tariffs imposed under different statutes create ongoing pressures, as highlighted by Cato Institute.

What Businesses Should Do Now

For companies affected by tariffs, the Supreme Court ruling creates immediate action items:

Documentation: Compile all tariff payment records, customs declarations, and import data. Digital copies organized by tariff category make refund claims easier.

Legal review: Work with customs brokers or tariff counsel to identify all IEEPA-related duties paid and estimate potential refunds. Get ahead of the refund process rather than scrambling later.

Refund planning: Don't count on refunds as near-term revenue. Assume 18-24 month timelines. Plan cash flow and working capital accordingly.

Future tariff monitoring: Track new tariff announcements and alternative authorities. Section 122, Section 301, and Section 232 tariffs will continue. Adjust supply chain strategies accordingly.

Supplier relationships: Communicate with importers and distributors about tariff situations. Tariff relief on finished goods might not extend to components. Verify your entire supply chain's tariff exposure.

Advocacy: Join industry associations pushing for clear refund procedures and tariff policy clarity. The National Retail Federation, small business groups, and trade associations are leading these efforts.

FAQ

What is the International Emergency Economic Powers Act (IEEPA)?

The IEEPA is a 1977 law that authorizes the president to declare a national emergency and control economic activity during foreign threats. It was designed for situations like sanctions regimes or terrorist financing restrictions, not for trade policy. Trump's administration stretched the law far beyond its original purpose by using it to impose tariffs on imports, which the Supreme Court ruled was illegal, as explained by BBC News.

How did Trump use IEEPA to impose tariffs?

Trump's administration claimed that foreign competition and trade deficits constituted a "national emergency" and invoked IEEPA to impose tariffs. The strategy included blanket tariffs on Canada, Mexico, and China, "reciprocal" tariffs on goods from every country, and elimination of the de minimis exemption that previously allowed low-value packages to enter duty-free. The Supreme Court found that IEEPA simply doesn't authorize tariffs, regardless of whether an emergency exists, as noted by Prismedia.

Why did the Supreme Court rule 6-3 that the tariffs were illegal?

The Supreme Court's majority looked at the actual language of IEEPA and concluded the law addresses foreign threats to national security and the economy, not trade competition or commerce policy. The statute doesn't grant tariff authority. Presidents must use actual tariff laws for that purpose. Congress delegated some tariff authority to the executive branch through Section 301, Section 232, and other statutes, but IEEPA isn't one of them. The Court essentially said the administration used the wrong tool for the job, as highlighted by Cato Institute.

How much money in refunds might be involved?

Estimates suggest the government collected approximately $120 billion in tariffs under IEEPA. However, not all of that is automatically refundable. The refund amount depends on which specific tariffs courts determine were IEEPA-based and therefore illegal. Some tariffs imposed under alternative authorities like Section 232 remain legal. Small businesses and importers will need to document their specific tariff payments and file refund claims, which could take months or years to process, as reported by Reuters.

Will consumers get refunds for higher prices they paid due to tariffs?

Probably not directly. Most refunds will go to importers and distributors who can document their tariff payments through customs records. Consumers who paid higher retail prices due to tariffs have no way to claim refunds without knowing exactly which products included tariff costs. However, consumers may benefit from lower future prices if tariff reductions are passed through the supply chain, though that reduction typically lags behind tariff changes by several months, as noted by NBC News.

What alternative tariff authorities is Trump using now?

The administration is deploying Section 122 tariffs at a 10% rate immediately. Section 122 addresses trade impacts on national defense industries and is limited to 150 days without additional congressional action. The administration is also continuing Section 301 tariffs (retaliatory measures against unfair trading practices) and Section 232 tariffs (national security grounds). These alternative authorities have actual statutory language supporting them, which makes them harder to challenge in court than the IEEPA approach, as explained by Council on Foreign Relations.

Will steel and aluminum tariffs be affected by the Supreme Court ruling?

No. Steel and aluminum tariffs were imposed under Section 232, a completely different law that explicitly authorizes the president to impose tariffs on products deemed essential to national defense. The Supreme Court ruling only applies to IEEPA-based tariffs. Section 232 tariffs remain legal and in effect unless Congress or future litigation specifically challenges them, as noted by Cato Institute.

How long will the refund process take?

Based on typical government refund timelines, companies can expect 6-18 months before receiving refunds, assuming straightforward cases with clear documentation. Complex disputes could take 2-3 years. The Court of International Trade will oversee the process, and its cases typically move slowly. Small businesses should document everything and file refund claims promptly rather than waiting for the government to initiate contact, as highlighted by Prismedia.

What should businesses do immediately after this ruling?

Companies should compile complete tariff payment records, work with customs brokers to identify all IEEPA-related duties, document the tariff categories and payment dates, estimate potential refunds conservatively, and file refund claims when government procedures are announced. Don't assume refunds will be quick or automatic. Plan cash flow around extended timelines, monitor new tariff announcements under alternative authorities, and communicate with suppliers about ongoing tariff exposure. Consider joining industry associations advocating for clear refund procedures, as noted by NBC News.

Is the tariff situation finally resolved?

No. The Supreme Court ruled on one legal authority (IEEPA), but the administration has multiple other authorities available. The ruling doesn't eliminate tariffs or prevent the administration from pursuing aggressive trade policies. It just means those policies must be justified under statutes Congress designed for that purpose. Expect ongoing legal challenges to alternative tariffs, continued refund disputes, and years of uncertainty as the government processes claims and companies adapt to new tariff regimes, as explained by Council on Foreign Relations.

What does this mean for the broader trade environment?

The Supreme Court ruling validates the principle that presidents can't reinterpret emergency statutes beyond their original purpose. But it doesn't constrain the substantial tariff authority Congress has already delegated to the executive branch. Trade policy will likely remain contentious, with companies challenging tariffs and the government defending them under different legal authorities. International trade relationships will continue facing pressures regardless of the Supreme Court decision. The overall tariff environment is expected to remain elevated for the foreseeable future, even with the IEEPA ruling, as noted by NPR.

Conclusion: The Victory That Doesn't Fully Resolve the Fight

The Supreme Court ruled decisively that Trump's IEEPA tariffs violated the law. It was a clear 6-3 victory for importers, small businesses, and everyone opposing the tariff overreach. But victories in court sometimes reveal how complicated implementation can be, as discussed by Cato Institute.

The ruling confirms an important principle: presidents can't stretch emergency statutes beyond Congress's intent. IEEPA isn't a tariff law. The Court respected the statute's text and purpose. That matters for the rule of law and constitutional boundaries on executive power.

But here's the reality check. Trump still has tariff authority under Section 301, Section 232, Section 122, and other statutes. The Supreme Court didn't eliminate those authorities. It just forced the administration to use the correct ones. And the administration is already doing exactly that, as noted by Council on Foreign Relations.

Small businesses won the legal battle but face bureaucratic messiness in pursuing actual relief. The $120 billion in potential refunds requires documentation, verification, disputes, and litigation. Companies with resources can navigate this. Companies without lawyers and accountants will struggle. The process could easily take until 2027 before substantial refunds actually reach importers, as highlighted by Prismedia.

Consumers won't see this relief directly. They'll benefit from lower future prices if tariffs decline and those reductions get passed through supply chains. But past overpayments on tariffs are gone. There's no mechanism to refund millions of individual purchases, as explained by NBC News.

The tariff situation moves forward, not backward. There's no scenario where tariffs completely disappear based on this ruling. Trump's philosophy on trade protectionism remains unchanged. He views tariffs as tools for negotiation and economic policy. The Supreme Court just told him to use different legal tools.

What comes next involves the Court of International Trade sorting out refunds, companies filing claims and disputing outcomes, the administration deploying new tariffs under alternative authorities, and businesses adapting to continued uncertainty. The Supreme Court provided clarity on one legal question but opened new questions about implementation, as noted by Cato Institute.

For importers and small businesses, this ruling is meaningful but incomplete. It validates their arguments and creates a pathway toward refunds. But the path is bureaucratic, slow, and offers no guarantees. They won the battle. The war continues under different rules, as highlighted by Prismedia.

Key Takeaways

- The Supreme Court ruled 6-3 that Trump's IEEPA tariffs were illegal, but this doesn't eliminate tariff authority or immediately provide relief

- Estimated $120 billion in refunds could take 18-24 months to process, requiring extensive documentation from importers and small businesses

- The administration is already deploying alternative tariff authorities like Section 122 at 10%, meaning the tariff environment persists

- Most consumers won't see direct refunds for higher prices they paid, though future prices may decrease if tariffs are reduced

- Small businesses won a legal victory but face continued tariff pressures and bureaucratic complexity in recovering money

Related Articles

- Supreme Court Rules Trump's Tariffs Illegal: What This $175B Decision Means [2025]

- Amazon Tariffs Driving Price Increases: What Retailers Face [2025]

- How Trump's Tariffs Are Creeping Into Amazon Prices [2025]

- US Government 25% Tariff on AI Chip Exports to China [2025]

- How Big Tech Surrendered to Trump's Trade War [2025]

![Supreme Court Rules Trump's Tariffs Illegal: What's Next [2025]](https://tryrunable.com/blog/supreme-court-rules-trump-s-tariffs-illegal-what-s-next-2025/image-1-1771621772479.jpg)