Introduction: The Quiet Restructuring That Signals Anthropic's Bold Pivot

Something interesting happened in the upper echelons of Anthropic in late 2024. It wasn't a headline-grabbing funding round or a flashy new product launch. Instead, it was a subtle but deliberate reshuffling of the company's leadership structure that tells you something crucial about where AI development is actually heading right now.

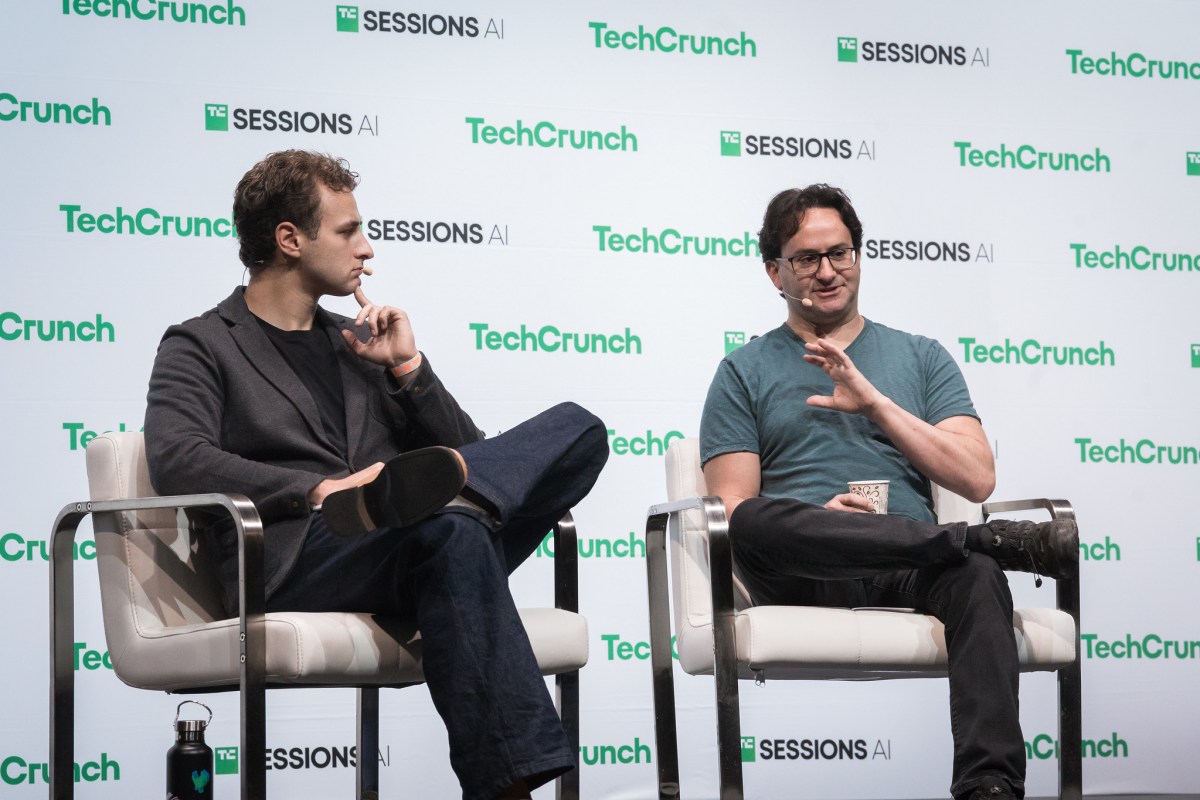

Mike Krieger, the co-founder of Instagram who'd spent two years building Anthropic's product strategy as Chief Product Officer, stepped down from that role. But here's the thing: he didn't leave. Instead, he joined a relatively young internal team called "Labs," which the company had quietly started just months earlier with only two people. His new title? Simply a member of technical staff. On paper, it sounds like a demotion. In reality, it's the opposite.

This reorganization reveals something that most people miss when they're following the AI industry. While everyone's obsessing over which AI company will hit $100 billion in valuation first or whose model is smarter, the real winners are the ones making structural decisions that let them move faster, experiment more freely, and iterate on products that haven't even been imagined yet.

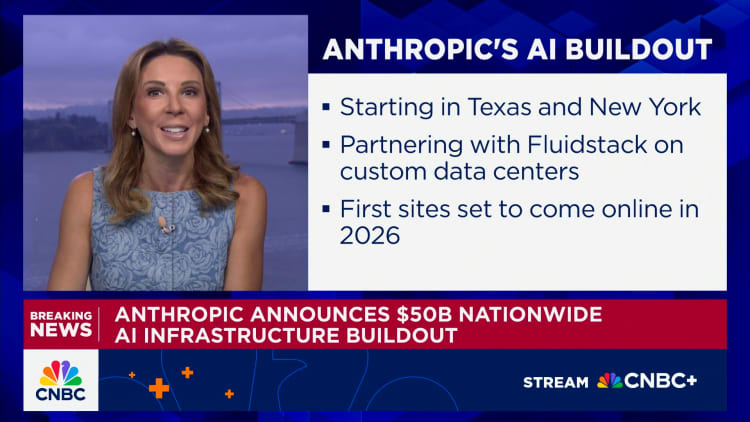

The stakes here are enormous. Anthropic is sitting on a reported

The company's president, Daniela Amodei, said something that's worth unpacking: "The speed of advancement in AI demands a different approach to how we build, how we organize, and where we focus." That's not corporate fluff. That's a direct acknowledgment that the old playbook—where a massive product team slowly iterates on a handful of major products—doesn't work when your underlying technology is improving every quarter.

So what does this reorganization actually mean? Why does Mike Krieger leaving the C-suite to join a small internal team matter for anyone beyond Anthropic shareholders? And what does it tell us about the future of AI product development itself?

That's what we're diving into here.

TL; DR

- Krieger's Shift: Former CPO Mike Krieger moved from Chief Product Officer to co-lead Anthropic's Labs team, signaling a push toward experimental products over incremental scaling

- Labs Expansion: The internal incubator is doubling in size within six months, with a focus on building "experimental products" that leverage cutting-edge Claude capabilities

- Leadership Succession: Ami Vora, previously head of product, takes over as CPO while working with CTO Rahul Patil to scale core products

- Strategic Signal: The restructuring reflects how fast AI capabilities advance relative to product-market fit, requiring agile experimentation

- Industry Context: Moves like this matter because they show how leading AI companies are organizing internally to maintain competitive velocity

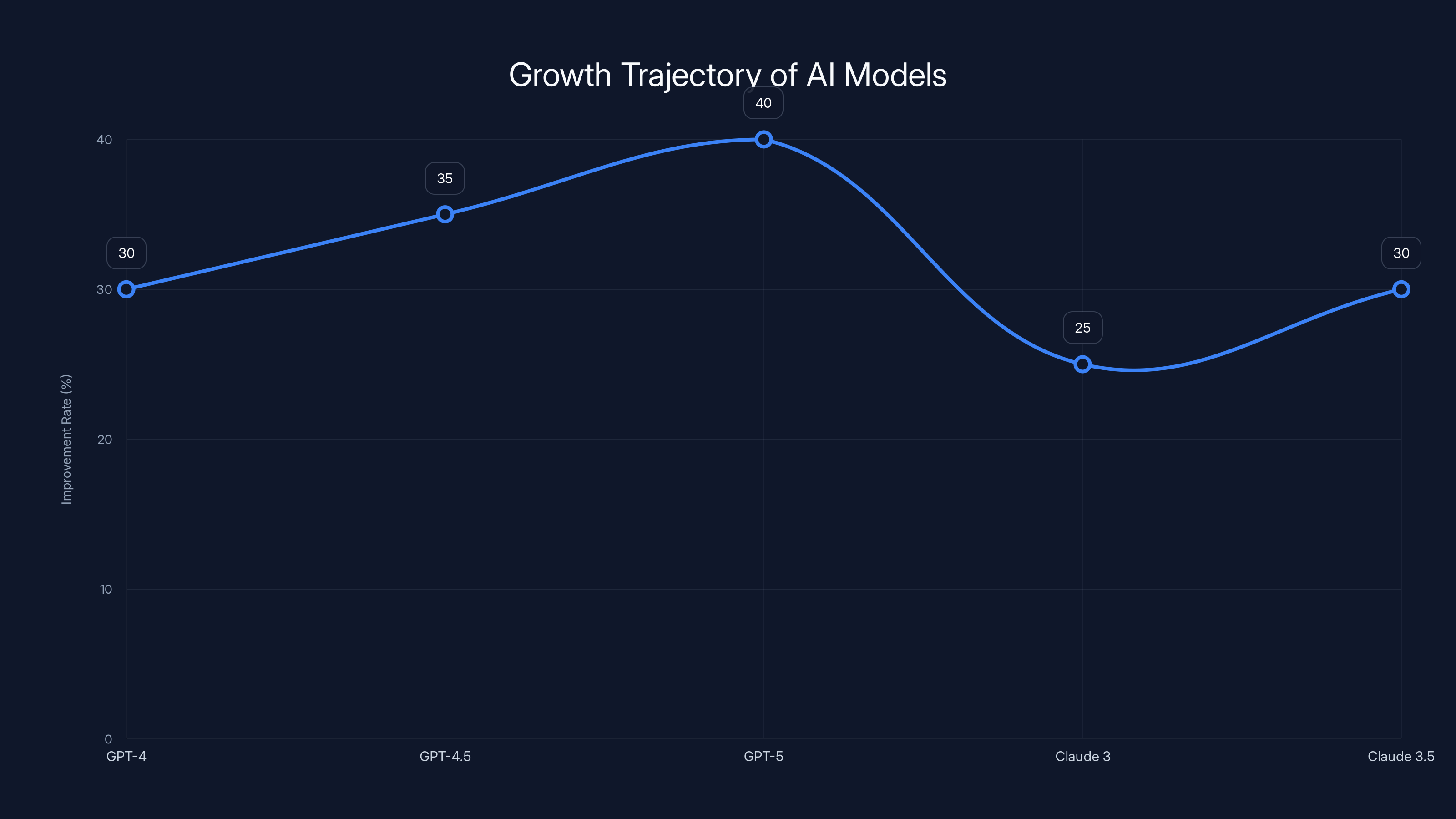

AI models like GPT and Claude are improving rapidly, with each version showing significant enhancements in capabilities. Estimated data illustrates the trend of approximately 30% improvement per version.

Understanding Mike Krieger's Role at Anthropic: From Instagram to AI

When Krieger joined Anthropic in 2022, he brought a specific kind of expertise that's increasingly valuable in AI companies. His track record at Instagram wasn't just building a social network. It was understanding how to take a powerful capability—in Instagram's case, visual sharing—and turn it into something billions of people wanted to use daily. That's product instinct. That's taste.

In the context of Anthropic, Krieger's role as CPO for the last two years meant he was responsible for a critical function: taking Claude, which is genuinely impressive at a technical level, and figuring out which capabilities to expose to users first. What gets prioritized? What gets hidden behind experimental features? How do you position Claude against Open AI's Chat GPT, which had a two-year head start in the market?

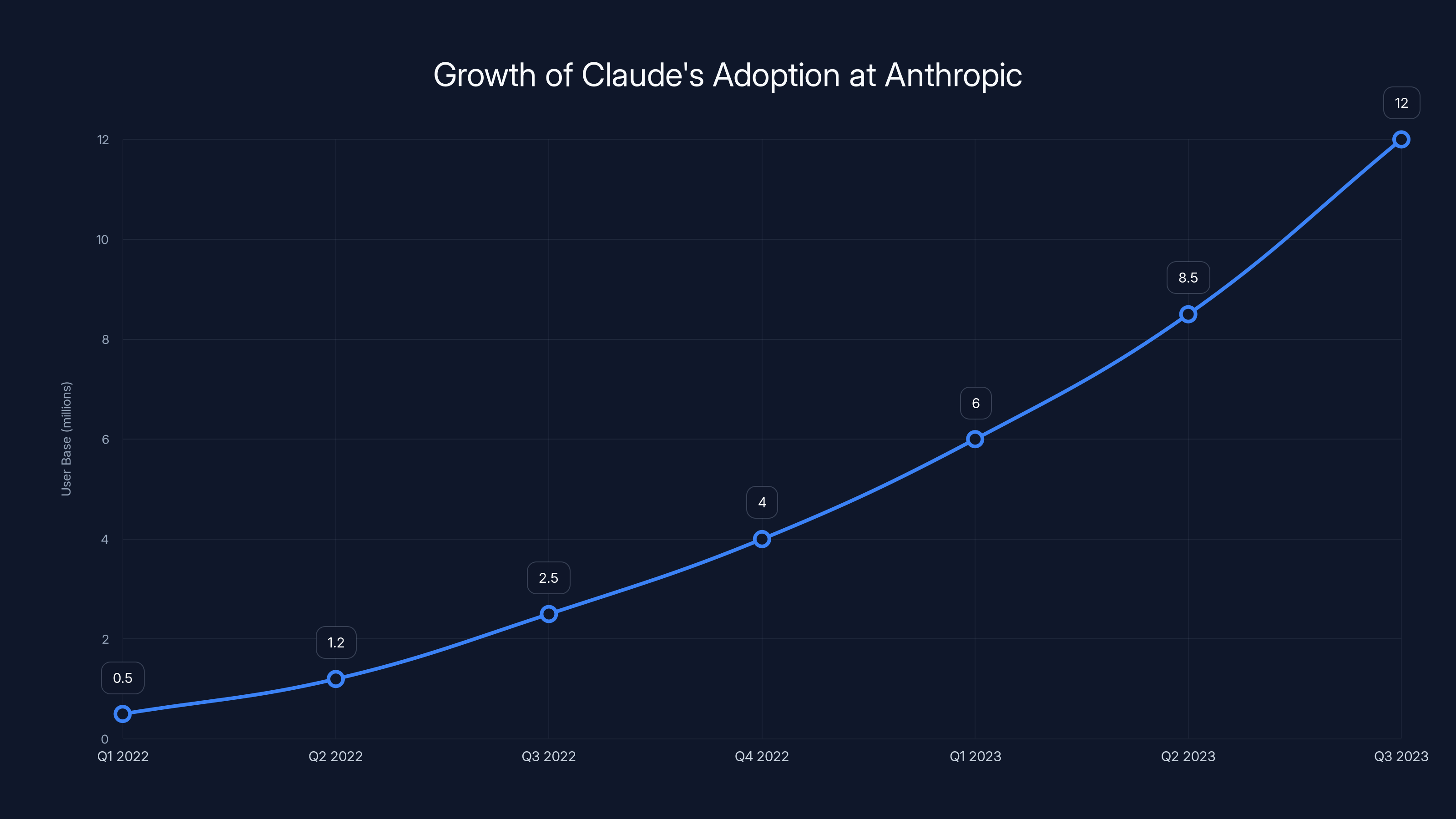

That's not an easy job. By most accounts, Krieger was doing it well. Claude's adoption grew substantially during his tenure. The company expanded its product surface area with web search, image analysis, custom instructions, and increasingly sophisticated multi-modal capabilities. None of that happened accidentally. Those were conscious product decisions.

But here's where the story gets interesting. Being a CPO in a traditional sense means managing tradeoffs. It means saying no to 10 ideas to focus on the three that matter most. It means shipping features on a quarterly roadmap. It means thinking about existing users and existing products.

Labs, by contrast, is explicitly designed to not think about any of that. It's where Krieger gets to work without those constraints. He told The Verge: "I want to be hands-on at the frontier, building products that channel AI toward solving the world's hardest problems." Notice he didn't say "scaling Claude to 100 million users." He said "solving the world's hardest problems." That's a fundamentally different mandate.

The move makes sense for Krieger personally. He's a builder who'd spent enough time in the CPO chair. But institutionally, it signals that Anthropic's leadership believes the next phase of value creation comes from somewhere different than optimizing the existing product.

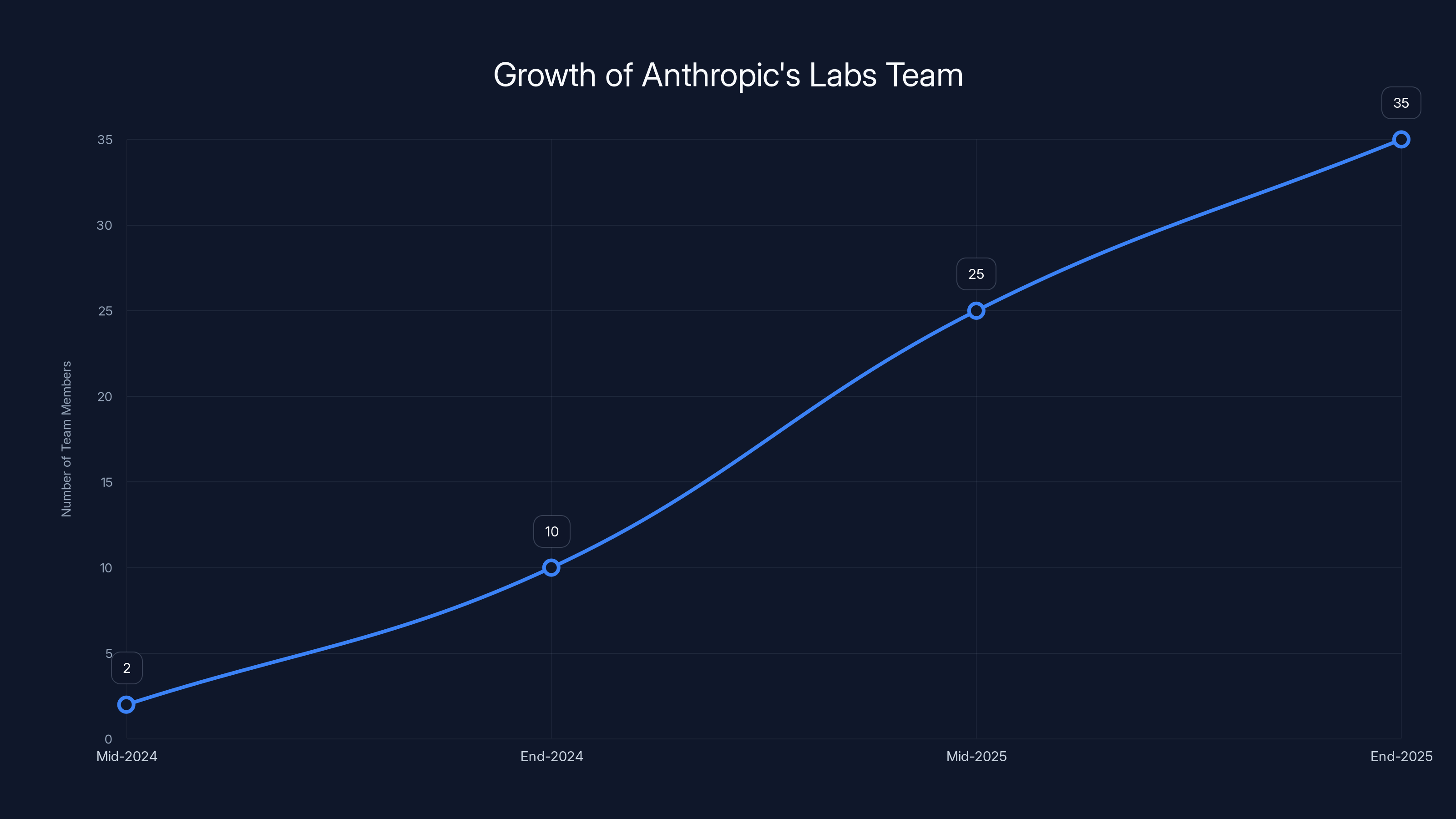

Anthropic's Labs team is projected to grow from 2 members in mid-2024 to around 35 by the end of 2025, indicating a strong focus on innovation and experimental product development. (Estimated data)

What Is Anthropic's Labs Team Actually Doing?

Labs started in mid-2024 with two people. That's not a typo. When Anthropic decided it needed a dedicated space for experimental products, they didn't hire fifty people or launch a massive initiative with a splashy blog post. They started tiny. Two people. That tells you something about how they think about organizational design.

Now, with Krieger joining and the stated goal to double the team within six months, Labs could grow to 30-40 people. Still small relative to the main product organization, but enough to explore multiple product directions in parallel.

So what does an internal incubator do at a company that already has world-class AI capabilities? The obvious answer is: it builds experimental products. But that's vague. What does that actually mean?

Labs is designed to operate under different constraints than the main product team. The main team at Anthropic is responsible for Claude.com, Claude API, and making sure those things work reliably for customers who depend on them. That's a real responsibility. You can't break things. You need uptime. You need security.

Labs doesn't have those constraints, at least not initially. If an experiment fails, the world doesn't end. That freedom matters because it changes how you think about product possibilities. You can take bigger swings. You can try things that might seem crazy if you're optimizing for reliability.

Think of it like the difference between managing a commercial airline and running a test pilot program. Different rules, different timelines, different risk tolerances.

The products that Labs explores could go in many directions. They could be entirely new interfaces to Claude. They could be specialized tools for specific verticals. They could be ways to combine Claude with other capabilities—search, images, voice, video. They could fail entirely and teach the company something useful. The point is the optionality.

The Succession Plan: Ami Vora Takes the CPO Chair

When Krieger moved, someone had to backfill his CPO role. That someone is Ami Vora, who was previously Anthropic's "head of product." On the surface, this looks like a standard promotion. In practice, it's more nuanced.

Vora's mandate is different from Krieger's. She's not inheriting a CPO role that's focused on innovation or experimentation. She's inheriting a CPO role that's focused on scaling. The distinction matters.

Specifically, Vora will work closely with Rahul Patil, Anthropic's Chief Technology Officer, to scale products. That's the language Anthropic used in the official statement. Not "develop new products." Not "explore new directions." Scale.

This is the other half of the organizational design. You can't have all innovation and no execution. The Labs team gets the freedom to experiment. Vora gets the responsibility to take things that are working and expand them to more users, more integrations, more reliability.

It's a split brain approach. Creative exploration over here in Labs. Disciplined scaling over there in the main product organization.

Vora coming from a "head of product" role rather than outside the company signals organizational continuity. She knows Anthropic's products intimately. She understands the infrastructure, the team structure, the technical constraints. She can step into the CPO role without a learning curve, which matters when you're trying to execute at speed.

That said, moving someone internally from a strategic role to an operational leadership role is always a bit of a gamble. Vora's strength wasn't necessarily in the day-to-day operational scaling that a CPO needs to manage. But Anthropic clearly believes she has what it takes, and having Patil as a close partner mitigates that risk.

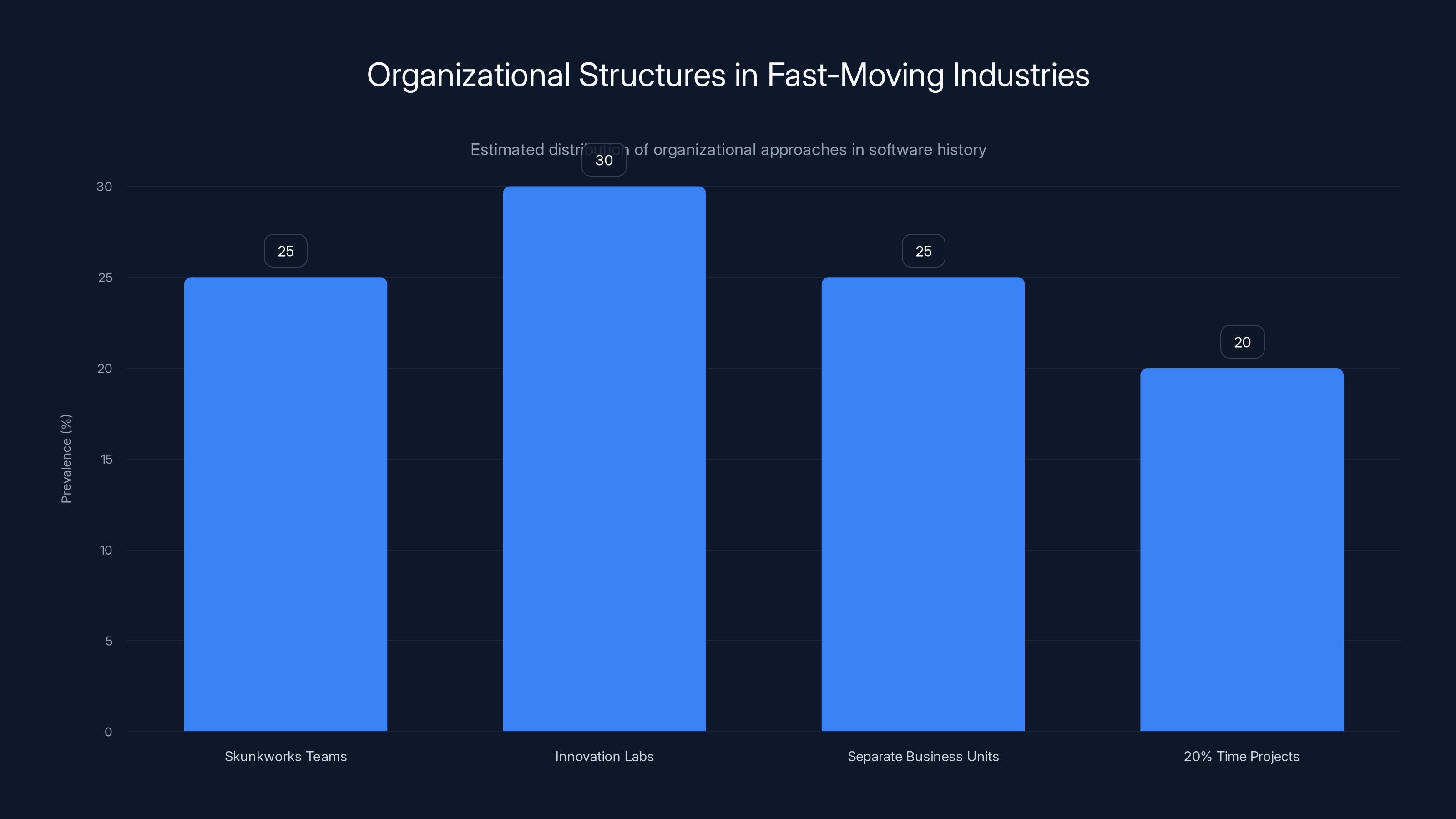

Estimated data shows innovation labs and separate business units are the most prevalent organizational approaches in fast-moving software industries.

Why This Restructuring Matters Right Now

This reorganization didn't happen in a vacuum. It happened in a specific moment in the AI industry, and understanding that context is crucial to understanding why it matters.

Let's be clear about what's happening in the market. Open AI released Chat GPT in November 2022. Within two months, it hit 100 million users. Anthropic's Claude arrived roughly a year later and caught on more slowly but with stronger product-market fit in specific segments (customers who cared about safety, reasoning, and accuracy over flashiness).

But here's the thing: the underlying models are improving faster than product teams can meaningfully differentiate around them. GPT-4 to GPT-4.5 to GPT-5 to whatever comes next. Claude 3 to Claude 3.5 to whatever comes after that. With each version, the capabilities expand. The context window grows. The speed improves. The reasoning deepens.

From a product perspective, that creates a genuine challenge. If you're the CPO at Open AI or Anthropic, what do you actually ship that's new when the underlying model gets 30% better? You can add features, sure, but those feel incremental when the core capability is advancing so quickly.

That's where Labs comes in. It's an organizational answer to that problem. Instead of asking "how do we add features to Claude," Labs asks "what entirely new things become possible when Claude gets this good?" Those are different questions with different answers.

Consider a concrete example. When Claude's vision capabilities first improved, the main product team integrated them into Claude.com and the API. That was product scaling. But what if someone on Labs said, "What if we built a specialized tool for architects that analyzes building plans and suggests structural improvements?" That's a different product. Different interface. Different positioning. Different user base potentially.

One of those makes Claude more useful. The other creates an entirely new product category. Both are valuable. But they require different organizational structures to explore.

The Competitive Pressure: Why AI Companies Are Restructuring

Anthropic isn't reorganizing in isolation. Every major AI company is grappling with the same organizational challenges right now, just expressing them differently.

Open AI has various research teams working on different problem domains. Google has its labs divisions. Microsoft has its AI divisions. Meta is reorganizing. The pattern is universal: as underlying technology moves fast, companies need organizational structures that can explore possibilities faster than traditional product management can.

The external pressure is real. Apple announced a partnership with Google to use Gemini for its Siri upgrade. Microsoft is integrating GPT-4 into everything. Meta is making noise about AI agents. Startups like Perplexity and others are finding niches that the big players are ignoring.

In that environment, the cost of moving slowly is high. If you wait six months to ship a feature because your traditional product cycle requires it, someone else might have already shipped a competing product that obsoletes your approach.

Anthropic is making an organizational bet that it can maintain velocity by separating the "maintenance and scaling" function (traditional product management) from the "exploration and innovation" function (Labs). Whether that actually works remains to be seen. But the logic is sound given how fast AI capabilities are advancing.

The fundraising context matters too. Anthropic is raising at a $350 billion valuation. That's not being valued for Claude.com being a good Chat GPT alternative. That valuation assumes Anthropic will find product-market fits at scale in multiple categories. Labs is the organizational structure designed to find those fits.

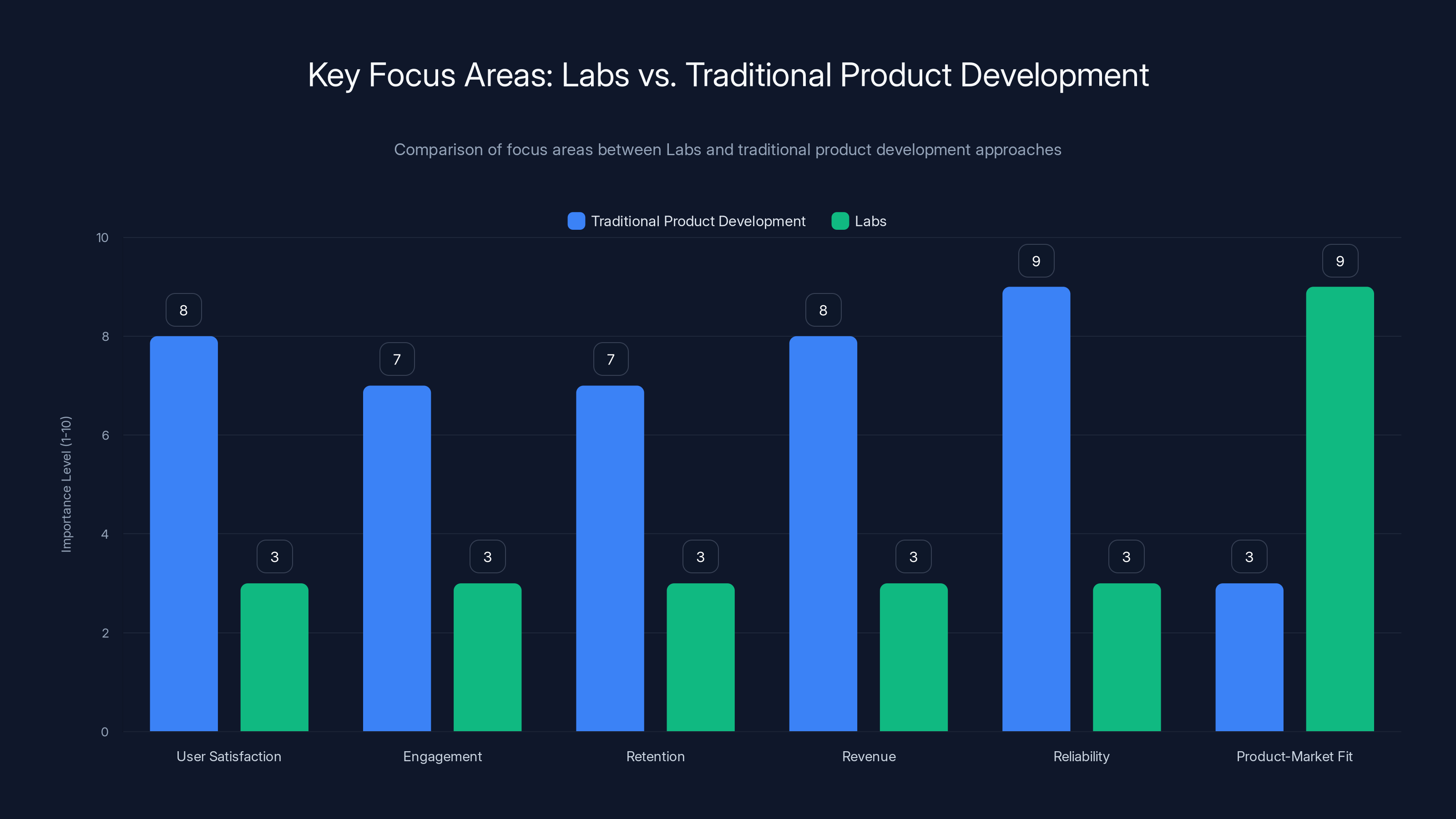

Anthropic's leadership restructuring suggests a significant focus on Labs Innovation (35%), indicating a strategic pivot towards experimental and agile AI development. Estimated data.

How Labs Differs From Traditional Product Development

The fundamental difference between Labs and traditional product management comes down to constraints and incentives.

Traditional product management optimizes for several things simultaneously: user satisfaction, engagement, retention, revenue, reliability. You're managing a complex system with real users who depend on it. Tradeoffs are constant. You ship something, measure its impact, iterate.

Labs optimizes for something simpler: discovering whether a new product idea can achieve product-market fit. It's asking a narrower question with more freedom around constraints. Can we build something that people genuinely want? Does it work? Can it grow?

Notice what Labs isn't optimizing for initially: scale, reliability, monetization, user retention. Those come later, after the experiment proves something worth scaling. That freedom to say "we'll figure that out later" is what Labs buys.

Organizationally, this means Labs probably has different hiring criteria, different deadlines, different success metrics. A Labs team member's job isn't to make Claude 30% better at reasoning. It's to figure out if there's a market for a specialized AI-powered product that didn't exist six months ago.

The downside risk is obvious: some ideas will fail. Some Labs projects will consume resources without producing anything valuable. That's expected and factored into the model. The upside is discovering products that become major business lines. One successful labs project could be worth billions in valuation.

That's the bet Anthropic is making by doubling the Labs team.

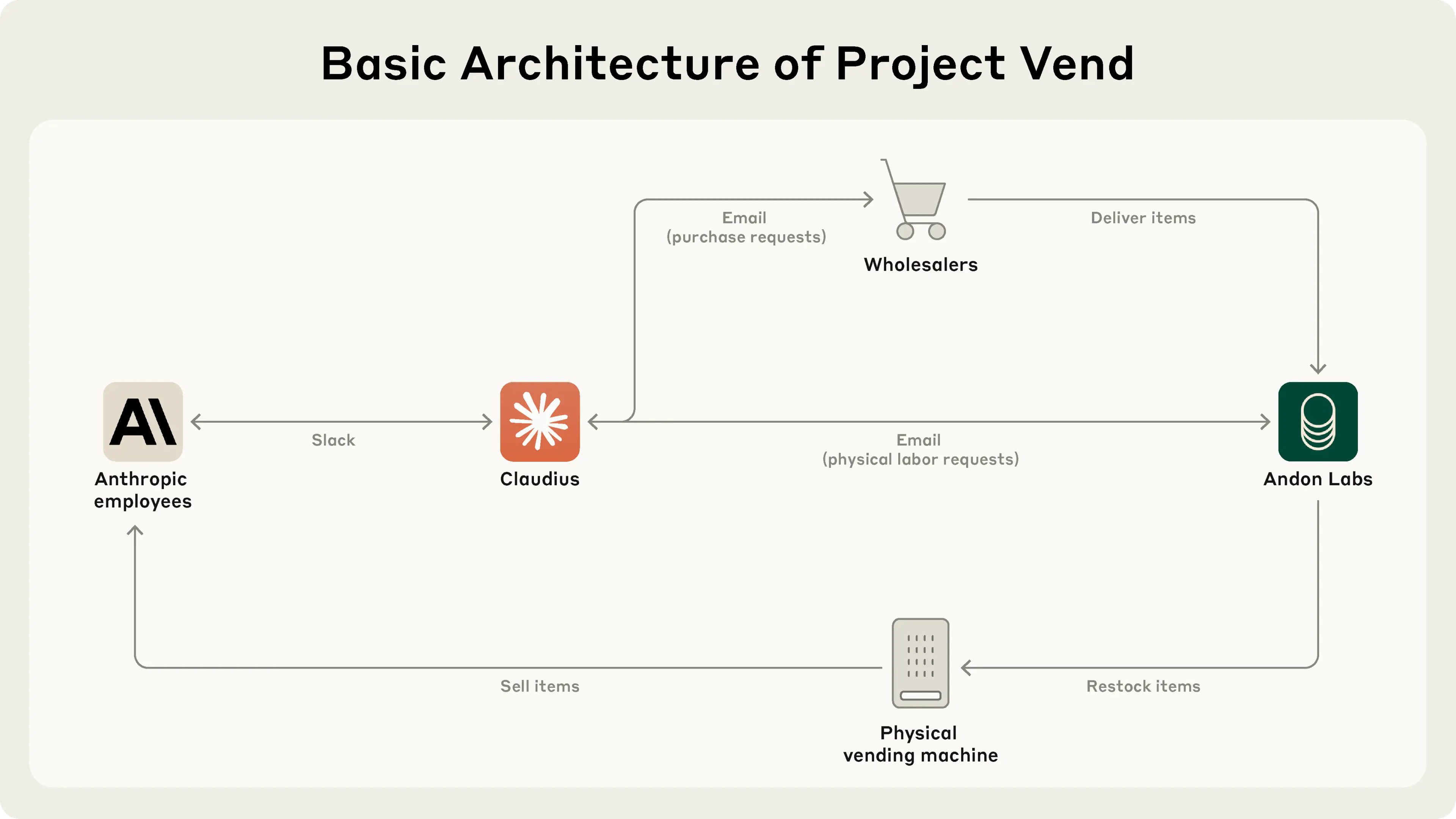

The Claude API Ecosystem and Labs: A Symbiotic Relationship

Anthropic has built a strong position around the Claude API. Developers can build on top of Claude. The API is becoming a standard primitive in many AI applications. That's valuable.

But here's what's interesting: Labs products will likely consume Claude's capabilities in much the same way that external developers do. They're just internal developers building internal products.

This creates a forcing function. If Labs builds a product that requires Claude to work in a certain way, or exposes a gap in Claude's capabilities, that feedback flows directly back to the team building Claude. There's no friction, no delays, no negotiation with external customers.

Conversely, if Labs discovers that certain Claude capabilities are massively valuable when exposed in a particular way, the main product team can learn from that. It's a virtuous cycle of learning.

In some ways, Labs functions as an advanced internal customer. It's like having your smartest developer using your API every single day, immediately telling you what works and what doesn't.

That symbiosis might be one of the hidden reasons why Anthropic is investing in expanding Labs. It's not just about finding new products. It's about creating feedback loops that make Claude itself better.

Under Mike Krieger's leadership as CPO, Claude's user base at Anthropic grew significantly, reflecting strategic product decisions. Estimated data.

Anthropic's Competitive Position: How This Shapes the AI Landscape

We're at a moment where three or four companies (Open AI, Google, Anthropic, maybe Xai) have access to genuinely world-class AI capabilities. The differences between their models are narrowing. GPT-4 is very good. Claude 3.5 is very good. Gemini is very good.

In that environment, the winner probably won't be the company with the best underlying model. It'll be the company that figures out the most valuable and defensible product applications of those capabilities.

Anthropic starting Labs signals that they understand this shift. They're not betting everything on Claude being the best reasoning model (though they believe it is). They're betting on their organization being better at discovering product-market fit faster than competitors.

If Labs produces one major product that becomes a significant revenue driver, it fundamentally changes Anthropic's story. Instead of a company built around Claude API, it becomes a company built around Claude API plus a portfolio of products that leverage that API.

That portfolio approach is harder for competitors to replicate because it's not about outspending on product development. It's about having the organizational structure to move fast and explore broadly.

Open AI has Chat GPT Plus and Copilot integration at scale, which is a massive moat. Google has Android and Search to distribute AI to billions. Anthropic's answer might be: we'll be the company that's fastest at turning new capabilities into products.

Time will tell if that works. But the move is smart strategically.

Organizational Design in Fast-Moving Industries: Lessons From Software History

Anthropic isn't inventing organizational design here. They're borrowing from software industry playbooks that have worked before.

When software companies need to operate fast in rapidly evolving markets, they've historically used a few approaches. Skunkworks teams. Innovation labs. Separate business units with different incentive structures.

The pattern is consistent: separate the "keep the lights on" function from the "invent the future" function. They operate under different rules, report up different chains sometimes, have different success criteria.

Google famously encouraged employees to spend 20% of their time on experimental projects. That produced Gmail, Google News, and other major products. But it also meant those projects operated differently from the core advertising business.

Pay Pal had business development teams that explored new payment mechanisms while the core engineering team focused on the existing platform. Sometimes those teams would spin out into entirely new companies or divisions.

Amazon AWS emerged partly because AWS teams had the freedom to explore infrastructure selling separately from the core retail business. Without that separation, AWS might have gotten lost in the shuffle.

Anthropic studied this history. They're applying it to AI. Whether it works depends on execution, but the playbook is proven.

Traditional product development focuses on user satisfaction, engagement, and revenue, while Labs prioritizes achieving product-market fit. Estimated data based on typical focus areas.

What Labs Products Might Look Like: The Product Strategy Angle

It's worth speculating on what Labs might actually build, because it tells you what Anthropic is thinking about.

One possibility: specialized vertical products. A financial analysis tool powered by Claude. A legal research tool. A scientific research assistant. Each would be a distinct product with a different UI, different positioning, different go-to-market strategy. Each would target a specific user base willing to pay for specialized capabilities.

Another possibility: new interaction paradigms. What if instead of a chat interface, you had a long-form collaborative document interface powered by Claude? What if Claude could work as a persistent agent that manages tasks across multiple sessions? What if you could voice-to-voice conversation with Claude through a specialized interface?

A third possibility: integration with other capabilities. Claude plus real-time search. Claude plus image generation. Claude plus code execution. Claude plus external data sources. Each combination creates something meaningfully different from just Claude.

A fourth possibility: enterprise specialized tools. Business intelligence powered by Claude. Customer support agents. Sales automation. Legal document analysis. All of these are being explored in various forms by external developers, but Labs could build first-party, deeply integrated versions.

The point is that Labs has permission to explore in directions that might seem risky or niche from a traditional product perspective. That's the freedom it buys.

The Financial Implications: How Labs Spending Affects Valuation

When Anthropic raises

Doubling the Labs team might mean hiring 15-30 people over six months. That's not trivial cost but it's also not a massive expense compared to model training. The bet Anthropic is making is that investing in Labs now will produce disproportionate returns because these teams will uncover high-value product opportunities.

Investors are clearly comfortable with that bet, given the valuation. They're not funding Anthropic to be a better Claude API alternative. They're funding Anthropic because they believe it will discover and own major product categories that don't exist yet.

Labs isn't a cost center in that financial model. It's a profit center that hasn't generated profits yet. If it produces one product that scales to $100 million in annual revenue, it's easily justified the entire investment.

That's the financial logic powering organizational decisions like this.

Internal Culture Implications: What This Move Signals to Employees

Organizational changes have ripple effects on company culture that often matter more than the formal structure itself.

When Mike Krieger, a senior executive with significant status, voluntarily moves to a smaller, less formal team with a lower title, that sends a signal to everyone below him: status isn't about title, it's about impact. The fact that he did it enthusiastically (by most accounts) makes that signal even stronger.

It tells employees that taking on experimental work, work with unclear outcomes, is valued. It tells them that the company is willing to reorganize to support what they believe in strategically. It tells them that being part of something new and uncertain can be more attractive than climbing a traditional ladder.

That kind of signal matters for recruiting and retention, especially in the AI industry where talented people have options. If Anthropic can position Labs as "the place where we're building the future," it becomes attractive to ambitious builders.

Conversely, it potentially signals to people on the main product team that their role is more operational, less strategic. That could be demoralizing if not managed well. Anthropic's leadership will need to be deliberate about making sure the main product team doesn't feel like they're running the old business while Labs gets to play with the new stuff.

Getting that culture right is probably just as important as getting the organizational structure right.

Execution Risk: Why This Could Fail

Organizational design is only one piece of the puzzle. Execution is everything.

There are several ways this could go wrong. First, Labs could simply fail to discover anything valuable. The team could spend six months exploring ideas that don't have markets. That happens. It's expected sometimes, but if it happens consistently, the whole model falls apart.

Second, the separation between Labs and the main product team could create friction. If Labs products need something from the core Claude team and can't get it, they stall. If the main product team feels like they're supporting Labs' experiments while running the business themselves, morale suffers.

Third, Labs could succeed at finding cool ideas but fail at shipping them successfully to users. Discovering that something is interesting is different from discovering that something has product-market fit. Labs might nail the first and stumble on the second.

Fourth, the market timing could be off. Even if Labs discovers something valuable, it might not be valuable at the specific moment the team builds it. Being a year too early is almost the same as being a year too late in AI markets.

Fifth, competitive pressure could undermine the thesis. If Open AI or Google ship similar products faster, Labs discoveries become less valuable. Speed matters in AI right now.

The Krieger move mitigates some of this risk because he's a proven operator with good instincts. But execution risk is real.

The Broader Trend: How All AI Companies Are Reorganizing

Anthropic isn't unique in making this move. Every successful tech company dealing with rapid capability advancement is experimenting with similar organizational structures.

Open AI has various specialized teams working on agents, multimodal capabilities, and other emerging areas. Google reorganized its AI divisions to be more experimental. Microsoft created specialized groups. Meta is restructuring continuously.

The pattern is universal: decouple the innovation function from the execution function. Let innovation teams operate under different rules. Let execution teams optimize for reliability and scale.

This trend will likely continue because the underlying condition that creates it—rapid capability advancement outpacing product development—isn't going away. If anything, it'll accelerate.

For the AI industry, this means we should expect more experimental products, more rapid pivots, more portfolio approaches rather than single-product bets. Companies will try more things. Some will fail. Some will become major business lines.

For users, this probably means more choice and more specialized AI products rather than consolidation around a few general platforms. Instead of everyone using Chat GPT, you might use Chat GPT for some things, a specialized financial analysis tool for other things, a coding assistant for another, etc.

Organizational design affects industry structure. Anthropic's move is a small signal about how that structure is shifting.

Looking Ahead: What Success Would Look Like for Labs

Imagine it's two years from now. Anthropic's Labs team has expanded to 50 people. They've explored 20 different product directions. Five of them showed real promise. Two of them have paying customers. One of them is scaling meaningfully and contributing to Anthropic's revenue.

That would constitute success. Not all Labs projects need to succeed. Most should fail, actually, because that means you're taking real swings. But if at least one project becomes a material business line, Labs justified its existence and expansion.

The bar for Labs success isn't the same as the bar for the main product team. Labs is measured on discovery and experimentation. The main product team is measured on execution and scale. Both matter. Both have different success criteria.

For the AI industry more broadly, successful Labs-style teams signal that organizational design matters as much as technical capability. It signals that the next phase of AI value creation isn't just about better models, it's about better products and better organizational structures to find those products.

That's a meaningful signal about the direction the industry is heading.

The Broader Strategic Implications for AI Product Development

Zoom out and think about what this restructuring means for how AI products get built in 2025 and beyond.

For the last few years, the dominant pattern was: build a really good base model, wrap a nice interface around it, release it, iterate on features based on user feedback. Open AI essentially perfected this playbook with Chat GPT.

But that playbook has limits. At some point, adding features to your main product has diminishing returns. The real value is in discovering entirely new product categories.

Anthropic is betting that the next phase requires a different approach. Not a feature team. An exploration team. Not optimization. Discovery.

If that bet pays off, you'll see more companies copy the playbook. You'll see more labs, more separate experimental divisions, more tolerance for failure as a necessary part of finding new product-market fits.

Conversely, if Labs fails to produce anything meaningful despite Anthropic's significant investment, it might signal that organizational structure isn't the constraint. Maybe the constraint is just that product-market fit for new AI applications is genuinely hard, and organizational design doesn't solve hard problems.

But I'd bet on Labs working out, at least in part. Anthropic's leadership has been thoughtful about most decisions. They're applying proven playbooks. And they're starting with talented people, including Krieger, who know how to build products.

Whether that's enough to overcome execution risk and competitive pressure? That's the question investors are betting on.

FAQ

What exactly is Anthropic's Labs team?

Labs is an internal incubator division at Anthropic that started in mid-2024 with two people and is expanding to 30-40 people in 2025. It's designed to explore and build experimental products that leverage Claude's capabilities in new ways, separate from the main product team that scales existing offerings. The team operates under different constraints and success metrics than traditional product management, with more freedom to take risks and explore unconventional directions.

Why did Mike Krieger move from Chief Product Officer to Labs?

Krieger shifted from the CPO role to co-lead Labs because he wanted to get back into "builder mode" and work hands-on at the frontier of AI capabilities. While the CPO role requires managing tradeoffs and optimizing existing products, the Labs role lets him explore entirely new product possibilities without those constraints. His move signals that Anthropic believes the next phase of value creation comes from discovering new products rather than incrementally improving existing ones.

How does Labs differ from Anthropic's main product team?

The main product team focuses on scaling Claude through Claude.com and the Claude API, optimizing for reliability, user satisfaction, and revenue. Labs operates with different priorities: discovering new products and finding product-market fit for experimental ideas. Labs teams have more freedom to fail, longer timelines for validation, and don't need to worry initially about reliability or monetization. Once a Labs product proves successful, it might transition to the main team for scaling.

Who took over Mike Krieger's CPO responsibilities?

Ami Vora, who was previously Anthropic's head of product, was promoted to Chief Product Officer. She works closely with CTO Rahul Patil to scale existing products. Vora's mandate is different from Krieger's: focused on execution and scaling rather than exploration and experimentation. This split approach lets the company simultaneously explore new directions (Labs) and optimize existing products (main team).

Why would Anthropic invest in Labs when they could just focus on scaling Claude?

The underlying AI capabilities are advancing faster than product teams can meaningfully differentiate around them. Every version of Claude gets better, but that improvement doesn't automatically translate to new product opportunities or user value. Labs is designed to discover what becomes possible when Claude's capabilities advance, rather than just adding incremental features to existing products. One successful Labs product could become a multi-billion-dollar business line, justifying the entire investment.

What kind of products might Labs actually build?

Potential Labs projects could include specialized vertical products like financial analysis tools or legal research assistants, new interaction paradigms like voice interfaces or persistent agents, integration of Claude with other capabilities like search and image generation, or enterprise tools for business intelligence and customer support. The range of possibilities is intentionally broad because Labs is designed to explore, not execute a predetermined roadmap.

How does this organizational change affect Anthropic's competitive position?

By separating innovation from execution, Anthropic positions itself to discover and own product categories faster than competitors who keep everything in traditional product teams. If Labs succeeds, it creates multiple revenue streams and makes Anthropic harder to compete against because competitors would need not just better models but also better organizational structures for discovery. The move signals confidence that organizational design is a defensible competitive advantage.

Is this organizational model risky?

Yes, but in controlled ways. Labs projects might fail to discover anything valuable, or succeed at discovery but fail at execution. There's also execution risk—Labs teams need to actually ship things. Separation between Labs and the main team could create friction. But these risks are intentional and expected; the model only works if some projects fail. The real risk is if Labs consistently fails to discover anything worthwhile, which would suggest the model doesn't work for Anthropic specifically.

How common is this organizational approach in tech?

Very. Google created Google X for moonshot projects. Pay Pal had separate business development teams. Amazon AWS emerged from a separate organizational structure. Intel, Microsoft, and others have all used labs divisions when facing rapid technical change. Anthropic is applying a playbook that works in other industries to AI product development. The approach is proven; execution is the variable.

What does this mean for the future of AI product development?

It suggests that the next phase of AI won't be dominated by whoever has the best models, but by whoever has both the best models and the best organizational structures for discovering product-market fit. Expect more companies to adopt labs-style structures, more experimental products, more portfolio approaches rather than single-product bets. The industry is shifting from feature development toward product discovery at the organizational level.

Conclusion: Organizational Design as Competitive Advantage

When you strip away the industry jargon, what Anthropic is really doing is saying: "The way we need to build products in an era of rapidly advancing AI is different from how we've built them before."

That's a profound statement. Most companies don't reorganize unless they're forced to by external pressure. Anthropic is reorganizing proactively, while still strong, because their leadership understands that the window for organizational change is now.

Mike Krieger moving to Labs isn't a minor personnel move. It's a signal that Anthropic is betting on discovery over optimization, on exploration over execution, on new products over better versions of existing products. It's saying that maintaining competitive velocity in AI requires structural changes, not just talent and capital.

Will it work? That depends on execution. Labs needs to actually discover products worth scaling. The team needs to execute well. The separation needs to be managed carefully to avoid friction. All of that is genuinely hard.

But the strategic logic is sound. And if Anthropic pulls it off, it'll likely inspire competitors to reorganize similarly. You'll start seeing more labs, more experimental divisions, more organizational tolerance for failure as a necessary condition for finding breakthrough products.

The real competition in AI might not be between different models anymore. It might be between different organizational approaches to turning those models into products people want to use. Anthropic just made a bet that theirs will win.

Time will tell if that bet was smart. But at minimum, it's a signal worth paying attention to for anyone trying to understand how the AI industry actually works beyond the headline-grabbing model releases and funding rounds.

The unsexy stuff—organizational design, reporting structures, incentive alignment—turns out to matter more than most people think. Anthropic just proved it by moving a respected executive to a smaller role in a smaller team. That's the kind of decision that looks crazy until you understand the strategic thinking behind it.

Key Takeaways

- Anthropic restructured its C-suite by moving CPO Mike Krieger to co-lead Labs, signaling that innovation takes priority over traditional product scaling

- Labs is expanding from 2 people to 30-40 in six months, indicating serious organizational investment in experimental product development

- The restructuring reflects a strategic bet that the next phase of AI value creation comes from discovering new products, not incrementally improving existing ones

- Organizational design is becoming a competitive advantage—companies that separate innovation from execution can move faster than those with traditional product structures

- This move likely signals a broader industry trend: expect more AI companies to adopt labs-style divisions as model capabilities continue advancing faster than product development

Related Articles

- AI Music Flooding Spotify: Why Users Lost Trust in Discover Weekly [2025]

- Pebble's Comeback: Why Eric Migicovsky Says His New Company Isn't a Startup [2025]

- Claude Cowork: Complete Guide to AI Agent Collaboration [2025]

- Apple's Siri Powers Up With Google Gemini AI Partnership [2025]

- Meta Appoints Dina Powell McCormick as President and Vice Chairman [2025]

- AI PCs Are Reshaping Enterprise Work: Here's What You Need to Know [2025]

![Anthropic's Strategic C-Suite Shake-Up: What the Labs Expansion Means [2025]](https://tryrunable.com/blog/anthropic-s-strategic-c-suite-shake-up-what-the-labs-expansi/image-1-1768336595072.jpg)