Introduction: The Biggest AI Alliance Nobody Expected

For months, the tech world watched with bated breath. Which AI company would Apple pick to power the next generation of Siri? Would it be OpenAI, with its Chat GPT dominance? Anthropic, with its focused approach to safety? Or would Apple build everything in-house, as it has done for decades?

Then came the plot twist that surprised almost everyone.

Apple announced it would partner with Google on AI. Not a white-label arrangement. Not a small integration. A full-on, multiyear strategic partnership where Google's Gemini AI models would power the core of Apple Intelligence features, including a completely reimagined Siri coming in 2026.

On the surface, this sounds like two tech giants that compete in search, smartphones, cloud services, and dozens of other markets suddenly deciding to work together. But this deal is far more strategic, more calculated, and more revealing about the state of AI competition than most people realize.

This isn't about Apple surrendering. It's about two established tech behemoths realizing that the AI landscape has fundamentally changed. The newcomers have moved faster. The open-source models keep improving. The costs of developing frontier AI models have become astronomical. And most importantly, the market dynamics are shifting in ways that require traditional tech companies to rethink everything.

Let's break down what this deal actually means, why both companies are making this move, what it reveals about the future of AI competition, and what it could mean for everyone else building AI products.

TL; DR

- Strategic Alliance: Apple partnered with Google to power Siri with Gemini AI models, marking a significant shift from building everything in-house

- Privacy-First Integration: The deal maintains Apple's privacy standards through Private Cloud Compute, meaning data processing happens on Apple's servers

- Market Consolidation: This signals that even the biggest tech companies recognize the need to collaborate on AI rather than compete in isolation

- Competitive Response: The partnership effectively positions Apple and Google as a united front against OpenAI, Anthropic, and open-source alternatives

- User Control: Apple will likely let users opt in to sharing data with Gemini directly, preserving user choice

- Bottom Line: This deal reshapes the AI competitive landscape, suggesting the era of go-it-alone strategies is over

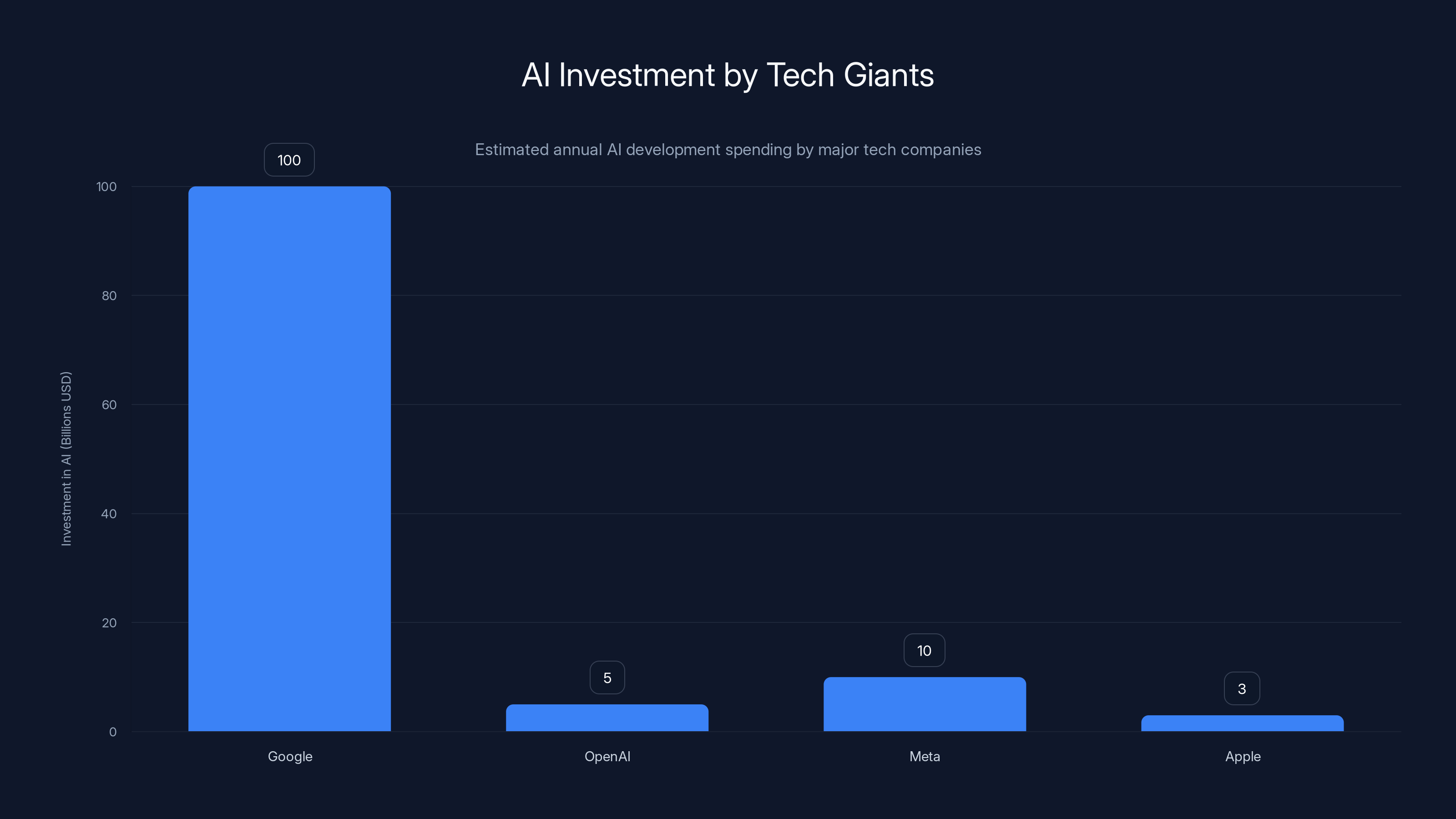

Google leads in AI investment with an estimated $100 billion annually, while Apple invests significantly less, highlighting the strategic need for partnerships like Google's Gemini. Estimated data.

Why Apple Needed Google's Gemini (And Why It Matters)

Apple has never been a company that outsources core technology. The company designs its chips, controls its software stack, and maintains vertical integration as a religion. Steve Jobs famously rejected the idea of licensing out Mac OS. Tim Cook has continued that tradition by ensuring Apple owns most of its supply chain and intellectual property.

But AI changed everything.

Developing frontier AI models isn't like designing an A17 processor or writing operating system code. It requires massive computational infrastructure, enormous datasets, hundreds of researchers, and billions of dollars in annual investment. OpenAI is spending billions annually just training models. Google has committed hundreds of billions to AI infrastructure. Meta is burning billions on AI development.

Apple, despite its cash reserves, faced a choice: spend the next 5-10 years catching up on AI model development while competitors shipped products, or find a strategic partner with cutting-edge models already in market.

There's another critical factor: Siri has become a punchline. The voice assistant that once seemed revolutionary now feels outdated compared to Chat GPT or even Claude. Siri struggles with context, forgets conversation history, can't handle complex multi-step requests, and feels more like a voice-controlled search interface than an intelligent agent.

Apple users have noticed. Customer feedback consistently highlighted Siri's limitations relative to competitors. The solution wasn't just better Siri—it was Siri powered by world-class AI models. And in early 2025, Google's Gemini was one of the best options available.

Google's models weren't just technically capable. They were proven. Millions of users interact with Gemini daily through Google's products. The models handle reasoning, code generation, image understanding, and conversation in ways that matched or exceeded OpenAI's offerings. By partnering with Google, Apple got access to years of training, refinement, and real-world feedback.

But here's what makes this decision shocking: Apple admitted something the company rarely does. It acknowledged that another company's AI was better than what it could build alone, faster than it could build alone, or more cost-effective to license than to build alone.

What Google Gets Out of This (It's More Than Money)

Google paid Apple up to $20 billion annually to be the default search engine. That's roughly half of what some analysts estimate is Google's total annual AI infrastructure spending. So why would Google settle for a Gemini partnership with Apple that probably generates nowhere near that kind of financial return?

The answer reveals why this deal is strategically brilliant for Google: distribution.

Apple has over 2 billion active devices in use worldwide. More importantly, Apple has the ecosystem lock-in that makes those devices incredibly valuable. When you own an iPhone, you don't just use Google services—you're increasingly locked into the Apple ecosystem through iCloud, Apple Music, Apple Pay, and the sheer convenience of the ecosystem.

But here's the thing: most of those devices use Google services. Gmail is still the dominant email platform on iOS. Google Search still dominates search traffic from Apple devices. And now, starting in 2026, Gemini will be the default AI backbone for Siri on hundreds of millions of devices.

For Google, this is a defensive move that happens to be offensive. Google watched Chat GPT reach 100 million users in two months—faster than any platform in history. Google saw its own search dominance potentially threatened by new AI-first interfaces that could bypass search entirely. By embedding Gemini into Apple's Siri, Google ensures that when hundreds of millions of users ask their AI assistant for help, it's Google's AI powering that interaction.

It's not about the direct revenue. It's about staying relevant in the post-search world.

There's another angle: competitive moat. By partnering with Apple, Google makes it harder for OpenAI or Anthropic to secure similar partnerships. If Apple uses Gemini, and Samsung might use Gemini, and Microsoft might deepen its tie-in with Copilot, that leaves fewer major platforms available for competitors. It's a strategic encirclement move.

Google also gains something less tangible but equally valuable: credibility. When Apple endorses Gemini by making it the core AI engine for Siri, it's a massive vote of confidence. It's saying that after careful evaluation, Google's models are best-in-class. That messaging matters for enterprise sales, regulatory discussions, and competitive positioning.

Estimated data suggests that routine integration and antitrust issues are the most likely outcomes, each with a 25-30% chance, reflecting the complex dynamics of AI partnerships.

The Privacy Architecture: Why This Isn't A Data Sellout

The moment many Apple users heard "Google" and "AI" in the same sentence, they had one reaction: privacy concerns.

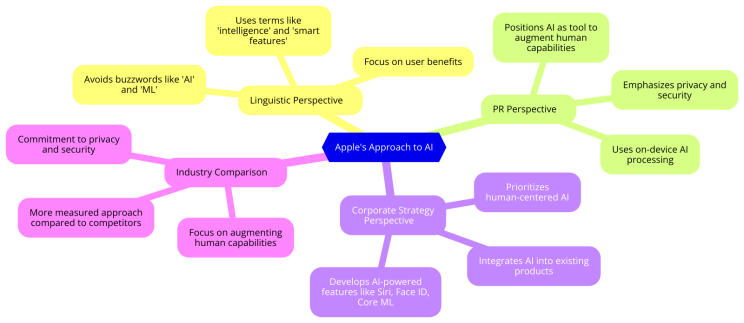

Apple's brand has been built partly on privacy. The company has fought with the FBI over encryption. It's refused to build backdoors. It markets privacy as a core differentiator. The fear was obvious: would Apple hand over user data to Google in exchange for AI capability?

The answer, according to the companies and privacy analysts, is no. Here's how the architecture actually works.

When you use the new AI-powered Siri in 2026, you'll be asked for permission—explicitly asked—before any data gets shared with Google. That's the first privacy guardrail. You control it.

When you do opt in, the request goes to Google, but not in the way you might think. It doesn't route directly from your device to Google's servers. Instead, it goes through Apple's Private Cloud Compute infrastructure. This is a system Apple built specifically for processing sensitive data on its own hardware while using third-party models.

The way it works: your request gets encrypted, sent to Apple's servers, processed there, and then sent to Google's Gemini model. Google sees your request (since it needs to), but Apple maintains control over the infrastructure, the encryption, and the data handling.

Apple's official privacy page details this approach. It's not perfect—Google still sees your requests—but it's far more controlled than if you just asked Siri to send data directly to Google's public API.

This is important because it defines a model that other companies might follow. It says: you can use third-party AI models without giving up control of user data. You can maintain privacy standards while accessing frontier capabilities.

But here's the honest assessment: this still means Google sees your queries. Google learns from them (presumably with anonymization, but privacy is never absolute). And there are legitimate questions about whether users will actually understand what's happening when they opt in.

The Competitive Landscape: Realigning Around AI Giants

This deal doesn't exist in a vacuum. It's part of a much larger reshuffling of the entire tech industry around AI capability.

Consider the landscape before this announcement:

- OpenAI had dominant mindshare with Chat GPT and the most venture capital backing

- Google had the most data, infrastructure, and search leverage, but was considered slower to market

- Anthropic had some of the best researchers and was positioning itself as the "safety-conscious" alternative

- Meta was investing heavily in open-source models

- Microsoft was making huge bets on OpenAI through its Azure integration

- Apple was trying to do everything in-house with limited success

The Apple-Google deal starts to reorganize this landscape. It signals that Apple has chosen a partner. That's significant because Apple's endorsement influences both consumers and enterprise customers.

Now we're seeing potential alignments:

- Google's ecosystem: Google + Apple on consumer devices, Google's enterprise products with Gemini integration, Google's cloud services

- Microsoft's ecosystem: Microsoft + OpenAI through Copilot integration, Azure AI services, enterprise Office integration

- Meta's approach: Investment in open-source models that work across platforms

- Anthropic's position: Differentiated on safety and ethics, but without the massive platform distribution

What this reveals is that the era of AI as a standalone product is ending. Companies now need platform integration, not just better models. A better AI model without distribution is a research project. But Gemini integrated into Siri? That's a product reaching billions of users.

This is why Anthropic is pursuing partnerships rather than trying to build consumer products directly. It's why OpenAI is expanding its developer platform aggressively. It's why Meta is open-sourcing models instead of gatekeeping them. The game has changed from "who has the best model" to "who controls the platforms where AI gets used."

Apple and Google, despite being competitors in search and cloud, realized they're both bigger winners if they work together on AI than if they compete separately. That's the real significance of this deal.

Why This Matters for the Future of AI

Here's what's really going on beneath the surface of this deal:

We're entering an era where AI capability is becoming table stakes, not a differentiator. When Google and Apple can partner, when Microsoft can rely on OpenAI, when Meta can open-source, it means that frontier AI performance is increasingly commoditized. What matters now is distribution, integration, and user experience.

This changes everything about how AI competition will work.

Five years ago, the question was: "Who has the best large language model?" Companies poured billions into research. Startups raised massive rounds on the promise of better models.

Now the question is: "Whose platform has the best AI experience?" That's fundamentally different. It favors companies with existing user bases, existing infrastructure, and existing trust relationships.

Small AI startups aren't completely out of the game. They can build specialized models for specific domains. They can serve enterprise customers with custom solutions. But they're unlikely to compete on general-purpose AI at the consumer level anymore. The incumbents have too much distribution advantage.

This also means AI development costs will consolidate. Building a competitive frontier model currently costs billions annually. Few companies can sustain that. As models become commoditized, the winners will be companies that can integrate AI effectively into real products and scale them to billions of users. That's Google, Apple, Microsoft, Meta, and maybe Amazon. It's not going to be dozens of competing AI companies.

For users, this could be good or bad. Good because you'll get better AI experiences integrated into the products you already use daily. Bad because the AI industry will be dominated by a handful of companies with massive market power.

For regulators, this deal raises questions about consolidation that will only intensify as the competitive landscape reorganizes around AI integrations.

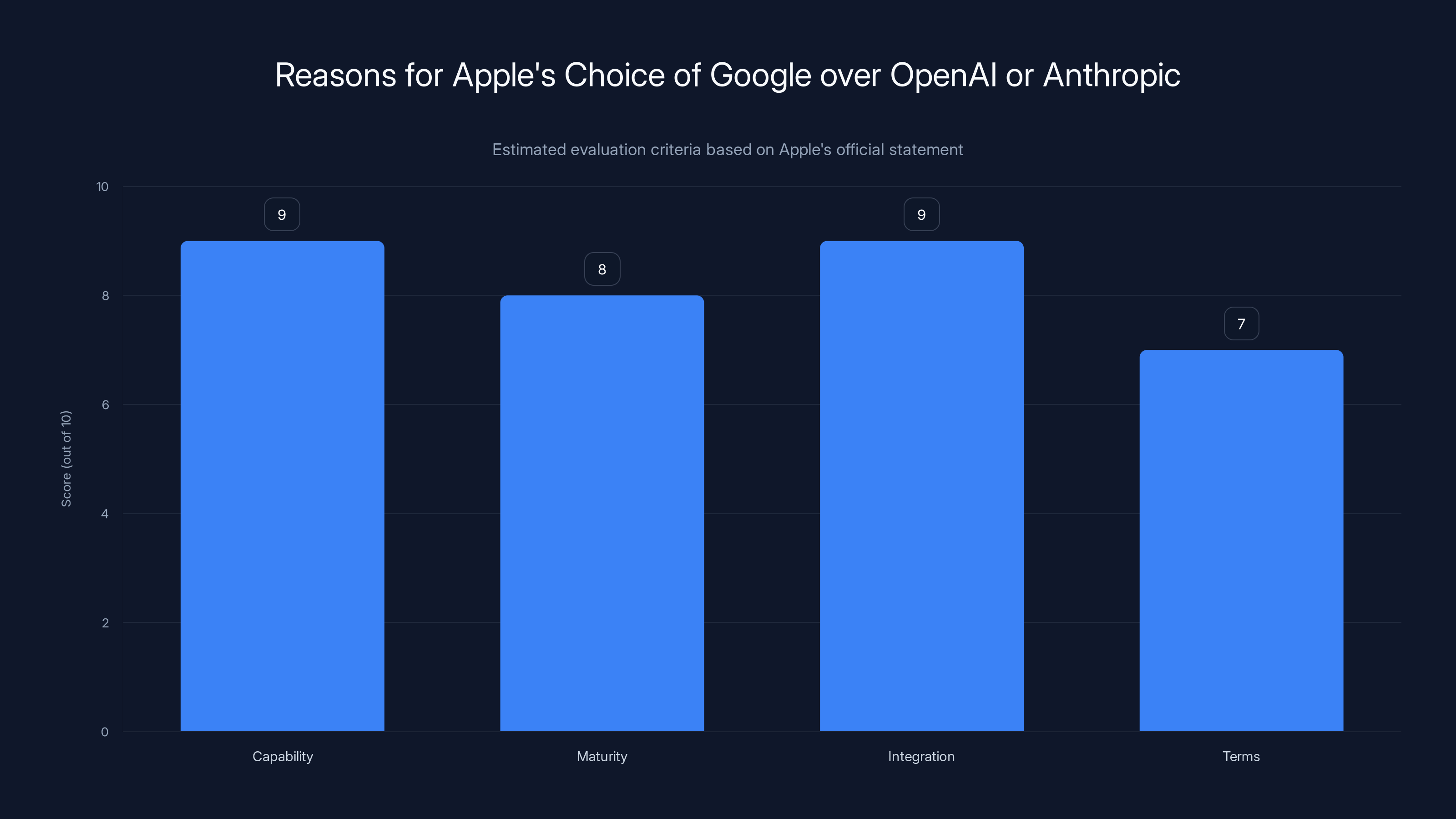

Apple likely chose Google for its superior AI capabilities, maturity, integration with existing infrastructure, and favorable terms. Estimated data based on Apple's statement.

The Search Wars Could Finally Get Interesting

Here's a hidden implication of this deal that most people missed:

Apple gets better AI. That makes Siri better. That makes the iPhone better. And a better iPhone becomes more capable of handling tasks that traditionally would have sent users to Google Search.

Imagine asking Siri: "Find me a good Italian restaurant near my office that has outdoor seating and takes reservations." Five years ago, that would require jumping to Google Search. But with Gemini powering Siri, the answer could come directly from the assistant, pulling from maps, reviews, your location, and your calendar.

Google wins this particular interaction—because Google is providing the AI. But Google also potentially loses search traffic. If Siri can answer questions without the user opening Google Search, that's a lost search impression. Over millions of devices, over billions of interactions, that adds up.

This is why the Apple-Google partnership makes strategic sense: Google would rather own a slice of post-search interactions through Siri than lose them entirely to a competing platform.

But here's where it gets interesting: Apple is building its own foundation models alongside this Google partnership. So Apple will use Gemini for some tasks while using its own models for others. This hybrid approach means Apple maintains independence while getting access to cutting-edge capability when needed.

The search wars aren't over. They're just moving from "Google Search vs. Bing" to "integrated AI assistants vs. search engines." And this deal shows how that future will probably look: major platforms integrating multiple AI models (their own plus partnerships) to give users the best possible experience.

The Enterprise Implications: B2B AI Just Got Real

When Apple and Google partner on consumer AI, enterprises pay attention.

This deal signals that major tech companies are comfortable outsourcing AI capability to trusted partners. If Apple can use Google's Gemini as the backbone for Siri, then enterprises can use various AI models as the backbone for their products. It removes stigma from the idea of "we don't build our own AI—we integrate the best available."

This matters because most enterprises can't afford to develop frontier AI models. They lack the data, the talent, and the capital. The Apple-Google deal normalizes the idea that outsourcing to specialized AI companies (Google, Anthropic, OpenAI, etc.) is not a weakness—it's a practical business decision that lets you ship better products faster.

For enterprise software companies, this is the blueprint: integrate cutting-edge AI from partners, add industry-specific customization, and deliver value to customers. You don't need to be an AI company to use AI effectively.

It also means we'll see more partnerships like this. Salesforce will deepen its Anthropic integration. SAP might partner with Google or OpenAI. Smaller enterprise software companies will integrate various AI models to compete.

The enterprise AI market isn't about building the best model anymore. It's about building the best integrated experience. And this Apple-Google deal is a masterclass in how to do that at scale.

Antitrust Implications: When Competitors Partner

This deal will inevitably face regulatory scrutiny, particularly in the US and EU where antitrust authorities are already scrutinizing big tech deals.

Here's the regulatory question: When two companies that compete in search, cloud services, and advertising partner on AI, is that competition-enhancing or competition-reducing?

The Apple-Google partnership actually looks like it could be defended as competition-enhancing. Apple doesn't currently have competitive AI. By partnering with Google, Apple can better compete with Microsoft (which has OpenAI), with Amazon (which has AWS AI services), and with the emerging AI-first companies. The partnership allows Apple to offer users better options faster than building alone would allow.

Google's position is similar: by enabling Apple to offer better AI, Google is preventing Apple from building its own AI models and keeping those exclusively for Apple devices. You could argue that a world where Google powers Siri is better for competition than a world where Apple locks users into Apple-built AI.

But there are concerns:

- Search deflection: If Siri (powered by Gemini) answers questions without going to Google Search, Google loses search traffic

- Market power consolidation: Apple and Google together control massive device distribution and data

- Barrier to entry: New AI companies need distribution. By partnering with each other, Apple and Google make it harder for competitors to find platform partnerships

The regulatory narrative will likely depend on how the deal unfolds in practice. If users get better choices and AI capability spreads quickly, regulators might see it as pro-competitive. If it leads to market consolidation that excludes competitors, it could draw scrutiny.

One thing is certain: Google's ongoing antitrust cases will make this partnership relevant to regulatory discussions. Investigators will want to understand whether this is a procompetitive integration or a way to leverage market power.

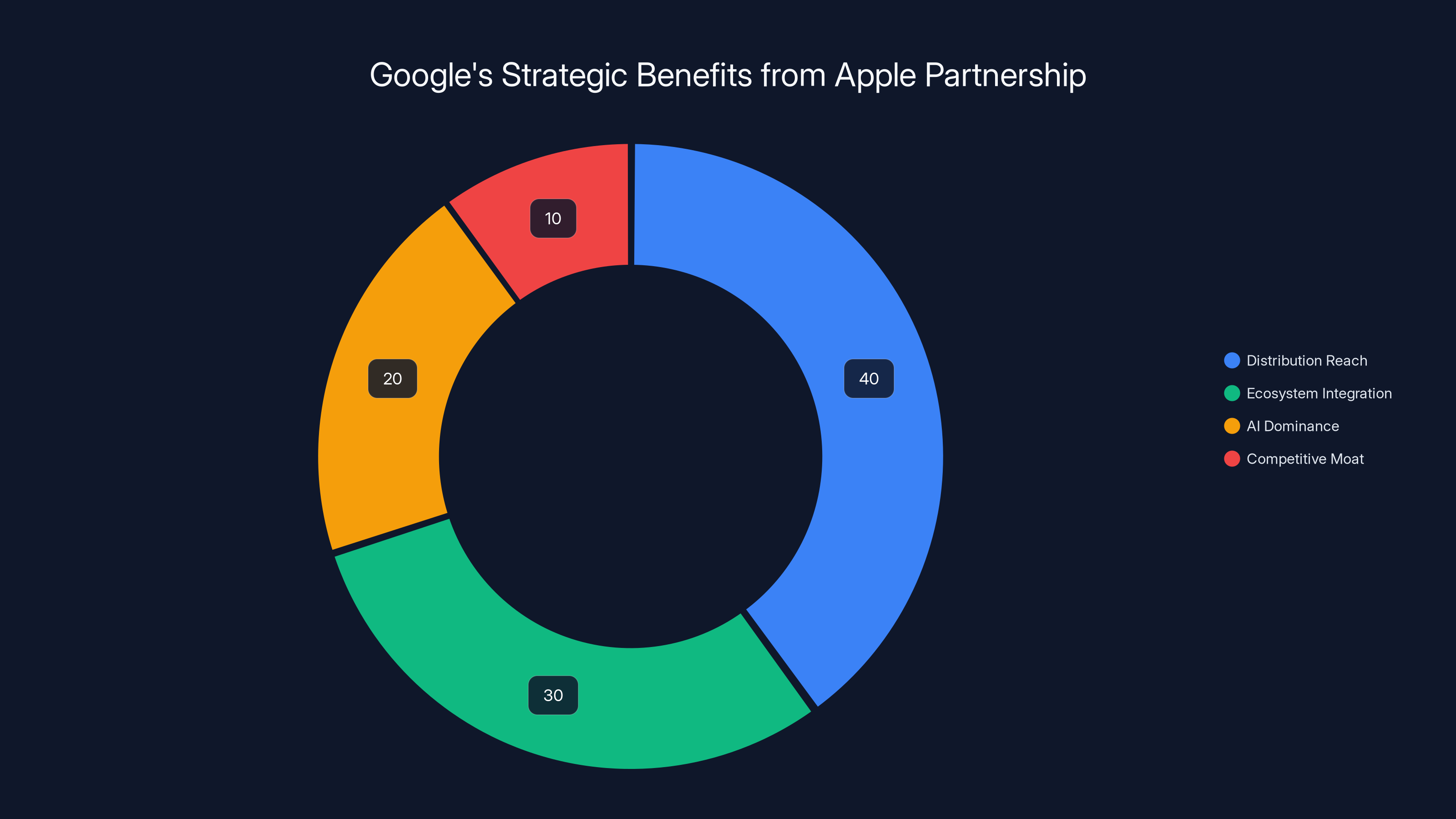

Google's partnership with Apple is primarily about distribution reach (40%) and ecosystem integration (30%), ensuring AI dominance and creating a competitive moat. Estimated data.

The Open-Source Wildcard: Why Meta's Approach Matters More Now

While Apple and Google are partnering on proprietary models, Meta is taking the opposite approach. Meta open-sourced its Llama models, allowing anyone to use and build on them.

On the surface, this looks like Meta is losing. If you're a company building AI products, wouldn't you prefer Google's or OpenAI's models? Probably—they're more refined, better supported, and come with liability protection.

But Meta's strategy has a different endpoint. By open-sourcing models, Meta is:

- Building an ecosystem where developers trust Meta models, fine-tune them, and build companies around them

- Avoiding the huge costs of competing on frontier model performance while still maintaining relevant AI technology

- Creating optionality where developers choose Llama, and in doing so, they might integrate other Meta technologies

- Positioning for the long term, where open-source models compete effectively with proprietary ones

The Apple-Google deal actually makes Meta's open-source strategy look smarter. If proprietary models are commoditized through partnerships, then open-source becomes a real alternative. Developers and companies that want to avoid dependency on Google or OpenAI can use Llama-based models.

This is why the future of AI likely includes both: proprietary models bundled into platforms (Apple + Google) and open-source models available for anyone to build on (Meta + others). Companies will choose based on their needs for control, cost, and independence.

How Siri Will Actually Change

Let's get specific about what users will actually experience when this deal rolls out in 2026.

Siri today can do: voice commands, basic searches, weather, reminders, calendar integration, and some device controls. It's functional but limited.

Siri powered by Gemini will likely:

Understand context better: "Hey Siri, send them my availability for next Tuesday." Siri will know who "them" is from the conversation context, will check your calendar, and will compose an email or message. Right now, Siri can't do this reliably.

Handle reasoning tasks: "What meetings do I have coming up with people from the West Coast, and what time would work for all of us?" Current Siri struggles with multi-step reasoning. Gemini-powered Siri will handle this natively.

Generate content: "Write a birthday message for Sarah—make it funny and mention our trip to Colorado last summer." Gemini can generate text. Siri will be able to create content, not just retrieve it.

Handle complex requests: "Find me a new podcast about AI, preferably something technical but not academic, update my reminder about the demo, and show me how many steps I've taken today." Multiple actions, complex filtering, context awareness. Gemini's reasoning should make this feasible.

Integrate across apps: Siri will understand your apps, your data, and your routines more deeply, coordinating across multiple services to accomplish tasks.

However, it will still have limitations:

- Privacy constraints: Without explicit permission, Siri won't access all your data

- Device-first processing: Some simple tasks will still run locally to avoid unnecessary server calls

- Integration dependencies: Features will depend on app support and data availability

The user experience will feel like Siri finally caught up to what Chat GPT made people expect from AI. That's not revolutionary, but it's overdue.

Revenue Models and Monetization: Who Actually Profits?

The financial structure of this deal hasn't been disclosed in detail, and that's interesting.

Apple probably isn't paying Google a huge per-query fee like it pays for search. That would be unsustainable at scale. More likely, the deal involves a combination of:

- Revenue sharing on data Google collects from Gemini-powered Siri interactions

- Long-term commitment to using Gemini in exchange for favorable terms

- Data exchange where Apple shares certain signals with Google in exchange for AI capability

- Infrastructure costs that Google absorbs as the cost of staying relevant on Apple devices

For Apple, the financial math is simple: Gemini-powered Siri makes iPhones more valuable. That drives hardware sales, services revenue, and ecosystem lock-in. The cost of licensing Gemini (whatever it is) is trivial compared to the value it adds to Apple's core business.

For Google, the deal is more about strategic positioning than direct revenue. Gemini integrated into Siri gets exposure to billions of users. That drives Gemini adoption, validates the model against competitors, and keeps Google relevant in the post-search AI world.

Neither company will disclose the actual financial terms, but analysts estimate that Google will receive somewhere between a low single-digit percentage to double-digit percentage of Siri AI interactions' value. For Apple, that's acceptable because the alternative (building Siri alone) costs far more.

This model becomes important because it sets a precedent: AI companies can license models to platforms, and platforms can license models from AI companies, without needing massive per-transaction fees. The ROI is justified by strategic positioning and long-term ecosystem value.

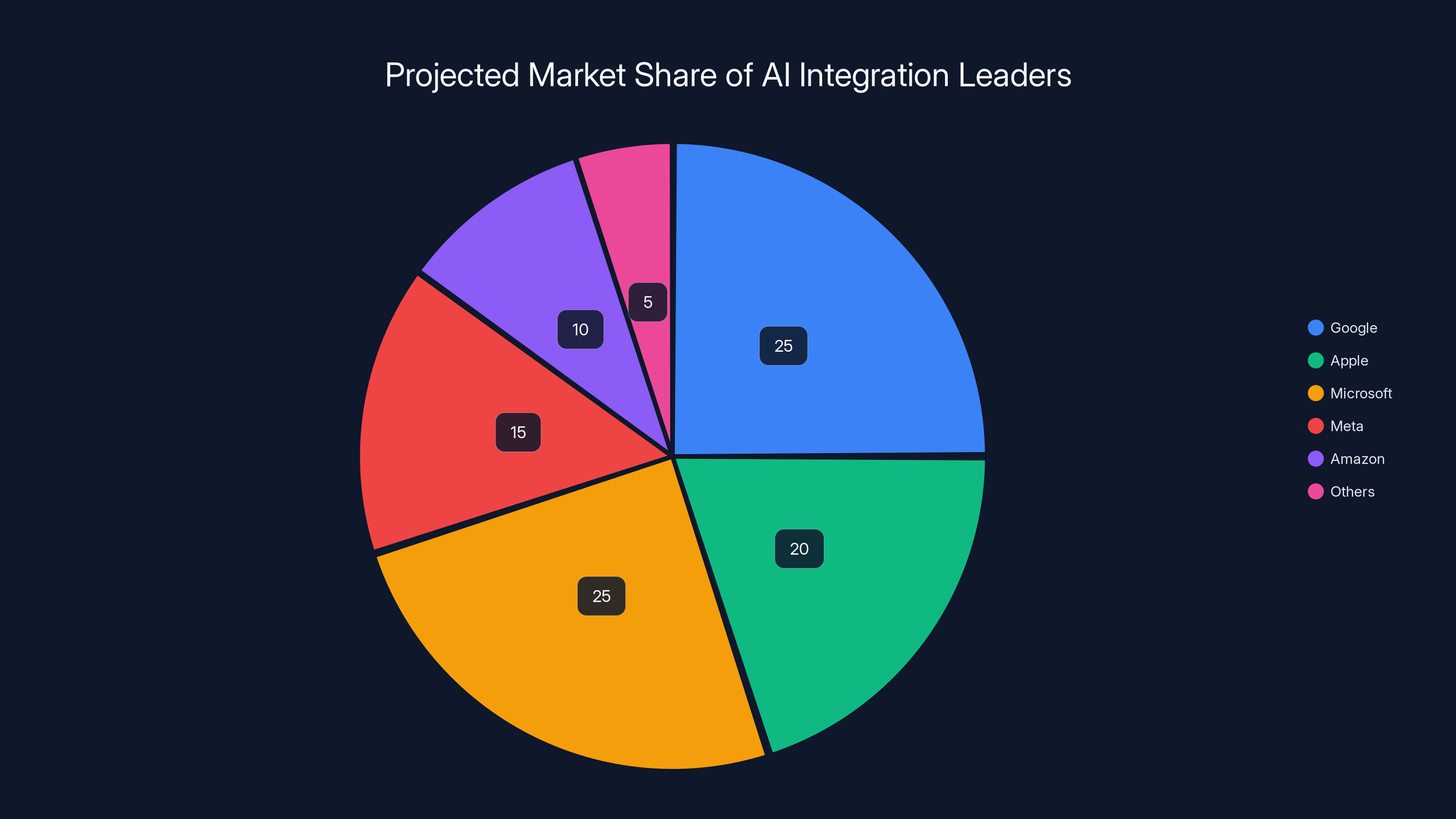

Estimated data suggests that Google, Apple, Microsoft, Meta, and Amazon will dominate AI integration, collectively holding 95% of the market. This reflects their existing infrastructure and user base advantages.

Competitive Responses: What OpenAI and Anthropic Need to Do

When Apple chose Google over OpenAI, it wasn't a subtle signal. It meant that Google's Gemini was considered as capable or more capable than OpenAI's models for this particular use case.

For OpenAI, this creates urgency. The company has dominated mindshare with Chat GPT, but that doesn't translate to platform integration. OpenAI needs partnerships with major platforms to compete with Google's embedded Gemini.

OpenAI will likely pursue deals with:

- Microsoft: Already deep partnership, but potentially expanding Copilot integration across more devices

- Samsung: Potentially replacing or augmenting Samsung's existing AI assistant

- Automotive: Integration into car interfaces and dashboards

- Enterprise software: Deeper Copilot integration across Microsoft Office and third-party enterprise platforms

For Anthropic, the challenge is tougher. Anthropic is smaller, newer, and doesn't have the distribution platform that Google or OpenAI have. But Anthropic has something else: the reputation for safety and thoughtful AI design.

Anthropic will likely pursue:

- Enterprise partnerships: Focused on companies that value safety and ethics

- Developer platforms: Integration into developer tools where safety is a key requirement

- Regulatory relationships: Building credibility with governments and regulators

- Specialized domains: Healthcare, legal, finance—where safety and accuracy matter most

The Apple-Google deal accelerates the consolidation of AI around major platforms. But it also shows that specialized companies can still compete by focusing on specific strengths (safety for Anthropic, reasoning for OpenAI, integration for Google).

Privacy vs. Capability: The Core Tension

Here's the uncomfortable truth about this deal:

To get better AI in Siri, you have to share more data with Google. That's not bad—it's just the economics of AI. Better models require more context. More context requires more data.

Apple has positioned Private Cloud Compute as the solution: you get better AI without giving up privacy. But that's true only if you trust Apple's implementation, only if you trust Google not to misuse data, and only if Google actually deletes the data after processing.

Google will claim: "We don't store your Siri queries indefinitely." But Google has been caught in the past using voice data and search data for purposes beyond what users expected. Privacy-conscious communities will remain skeptical.

The real question: Is better AI worth the privacy trade-off?

For most users: probably yes. A better Siri is a tangible benefit. The privacy cost is abstract and hard to measure.

For privacy-conscious users: no. They'll disable Gemini features and use offline Siri capabilities.

For regulators: this is the fundamental question underlying their scrutiny. When major platforms integrate with AI providers, how much data sharing is acceptable? Where's the line between competitive integration and invasive data practices?

Apple and Google have built their answer into the architecture. Whether regulators and users accept it remains to be seen.

The Broader Shift: From Competition to Coopetition

In the 1990s and 2000s, tech companies competed intensely and kept secrets. Microsoft fought Google. Google fought Apple. Apple fought Microsoft. The idea of deep partnership between competitors would have been unthinkable.

But the economics of AI have forced a shift. Here's why:

Training costs are too high: Developing frontier AI models costs billions annually. Few companies can sustain that indefinitely. Partnership spreads the cost and risk.

Capability gaps are real: Google's Gemini is genuinely better for certain tasks than Apple would build alone. Apple has accepted that reality and chosen partnership over paralysis.

Distribution is the differentiator: Having the best model doesn't matter if nobody uses it. Having mediocre models distributed across billions of devices matters more. That favors partnerships between AI companies and platform companies.

Speed matters: Partnerships let companies move faster than building everything in-house. For Apple, partnering with Google means Siri improvements in 2026 instead of 2028 or 2029.

The Apple-Google deal exemplifies this shift toward coopetition: cooperative where it makes sense (AI capability), competitive where it still matters (hardware, ecosystem, search, advertising).

This coopetition model will likely define the next era of tech competition. Companies will partner on AI because it's too expensive and complex to compete on everything. They'll compete on the platforms that integrate AI because that's where they create value for users.

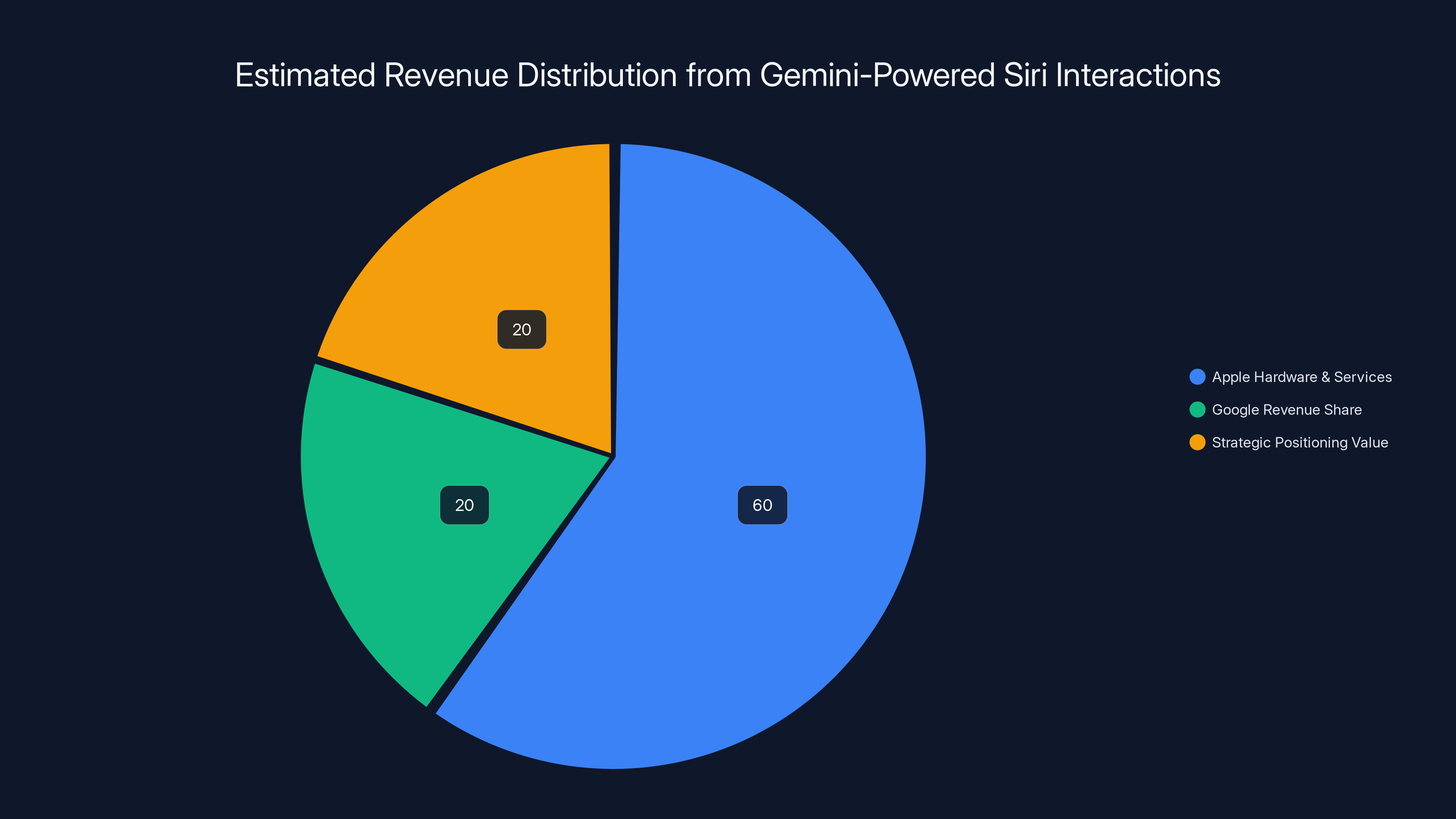

Estimated data suggests Apple benefits primarily through increased hardware and services revenue, while Google gains from revenue sharing and strategic positioning. (Estimated data)

What This Deal Means for You

If you're an Apple user: expect a dramatically better Siri in 2026. It will be more capable, more conversational, and more helpful. You'll also get the choice to opt in to Gemini features or rely on on-device processing for some tasks. Your privacy trade-offs will be more transparent, though the underlying data flows will remain complex.

If you're a Google user: you're already using Gemini-powered features in Google Assistant, Google Search, and Google's other products. This deal means Gemini will be available on Apple devices, potentially improving your overall Google experience when you switch between platforms.

If you're building AI products: this deal shows that partnerships beat building alone when scale matters. You don't need to compete on frontier model capability if you can integrate the best available models into your product and add your own domain expertise and user experience on top.

If you care about privacy: this deal shows that major tech companies are willing to put privacy-protective infrastructure in place (Private Cloud Compute), but those systems require trust and verification. The privacy-capability tradeoff exists, and you'll need to decide what settings work for you.

If you're an investor: this deal demonstrates that AI company valuations will increasingly be determined by platform integration opportunities, not just model capability. Companies that control distribution (Apple, Google, Microsoft) will be able to negotiate favorable terms with AI companies that control capability (OpenAI, Anthropic, or in this case, Google itself).

The Antecedent: Understanding the Apple-Google Search Deal

To really understand the Apple-Google Gemini deal, you need context on their previous relationship.

For nearly two decades, Apple and Google have had a partnership where Google pays Apple to be the default search engine in Safari. That arrangement is worth up to $20 billion annually to Apple.

Why would Apple, a company fiercely protective of its brand and control, allow another company's search engine to be the default? Because the alternative—building Apple's own search engine—would cost far more than $20 billion annually and would likely produce an inferior product.

The search deal shows that Apple has pragmatically partnered with Google for decades when the economics made sense. The Gemini deal is cut from the same cloth: Apple recognizes that Google's AI is too good to build alone, Google recognizes that Apple's distribution is too valuable to ignore, and both benefit from the partnership.

The difference is scope. The search deal was narrow: search queries. The Gemini deal is broad: AI-powered experiences across Siri and Apple Intelligence. But the logic is identical.

Understanding this historical context explains why the Gemini deal makes sense to both companies and why it likely won't be their last partnership. Apple and Google have learned that on certain technical challenges, partnership beats competition.

Future Scenarios: Where This Goes From Here

Scenario 1: The deal works brilliantly. Siri becomes the most capable voice assistant. Apple and Google deepen the partnership, expanding Gemini integration beyond Siri into other Apple Intelligence features. Other platforms follow suit. By 2028, major platforms are standardized on partnerships with AI providers rather than building AI in-house. The competitive landscape becomes: Microsoft + OpenAI vs. Apple + Google vs. Meta (open-source) vs. Amazon.

Scenario 2: The deal faces privacy backlash. Users and regulators raise concerns about data sharing. Apple is forced to implement stronger restrictions or disable Gemini features in certain markets. Google's position on Apple devices remains limited. Both companies' AI growth plans slow down. The deal becomes a case study in how hard it is to do partnerships at scale in the privacy-conscious era.

Scenario 3: The deal creates antitrust problems. Regulators view Apple-Google cooperation as market consolidation that harms competition. The deal gets restructured or partially unwound. Google is forced to license Gemini more openly to other platforms, reducing Apple's competitive advantage. Microsoft or Amazon strike similar deals with Anthropic or OpenAI.

Scenario 4: The deal becomes routine. By 2027, every major platform has announced AI partnerships. The story stops being news because it becomes the standard practice. The real competition shifts to: whose partnerships are best, whose AI is most integrated, whose user experience is most seamless. Model capability becomes secondary to platform integration.

Most likely: a combination of these. The deal works in some regions and faces friction in others. Apple and Google deepen the partnership strategically while managing regulatory and privacy concerns. Other players respond with their own partnerships, accelerating industry consolidation around a few major platforms.

FAQ

What exactly is Apple getting from Google in this deal?

Apple is licensing Google's Gemini AI models to power Siri and future Apple Intelligence features. Specifically, Apple gets access to Google's frontier AI capability—the underlying models that power Gemini's reasoning, language understanding, and generation abilities. Rather than building these capabilities from scratch, Apple integrates Gemini into Siri's architecture, with data processing happening on Apple's Private Cloud Compute servers. This allows Apple to provide users with significantly more capable AI assistant features without spending years and billions developing competitive models independently.

How does the privacy work if Google's AI is powering Siri?

When you use Gemini-powered Siri features, your request gets encrypted and sent to Apple's Private Cloud Compute infrastructure first, not directly to Google. Apple's servers handle the request, send only what's necessary to Google's Gemini models, and receive the response. Users must explicitly opt in to sharing data with Gemini, maintaining control over their privacy settings. However, Google does see your requests since it processes them—this isn't zero-knowledge encryption. Apple's privacy architecture documentation details this flow. The system is designed to be more private than sharing data directly with Google, but it's not completely anonymous.

Why did Apple choose Google over OpenAI or Anthropic?

Apple's official statement emphasized that Google's technology "provides the most capable foundation" after careful evaluation. Practically, this likely means Gemini matched or exceeded OpenAI's capabilities for Apple's specific use cases, was more mature and proven in production environments, integrated better with Apple's existing infrastructure, or offered better terms. Additionally, Google and Apple already have a long-standing partnership for search, so integrating another Google product followed a familiar pattern. OpenAI and Anthropic are strong companies, but Google's combination of capability, scale, and existing relationship made it the preferred choice.

Will this deal make Siri actually good?

Siri powered by Gemini will be dramatically better than current Siri—significantly more capable at understanding context, handling multi-step requests, generating content, and reasoning through complex tasks. However, "actually good" is subjective. The new Siri will likely compete effectively with Google Assistant and will exceed current capabilities by wide margins. Whether it matches Chat GPT's conversational ability or achieves the flexibility of advanced assistants depends on implementation. The experience will vary based on task type: some requests will be handled locally on your device, others will go to Gemini. For most users, this will feel like a major improvement, though power users might still find limitations.

What does Google get out of this deal if they're not getting paid $20 billion per year?

Google gets distribution to hundreds of millions of Apple devices, validation of Gemini as a competitive AI model, and positioning in a post-search world where AI assistants are primary interfaces rather than search being the dominant pattern. Google also prevents Apple from building its own AI and locking it exclusively to Apple devices. Additionally, Google collects data from Gemini-powered Siri interactions that feeds back into improving Gemini's models. The deal is financially modest compared to search, but strategically valuable—it's about staying relevant as the AI landscape evolves, not about maximizing short-term revenue.

Could this deal face antitrust challenges?

Yes, the deal will likely face regulatory scrutiny, particularly from the US Department of Justice and EU regulators already investigating both companies. The main questions: Does this partnership reduce competition in AI services? Does it unfairly advantage Google by embedding Gemini into hundreds of millions of devices? Does it create barriers for competing AI companies like OpenAI or Anthropic? Regulators will likely examine whether the deal is pro-competitive (helping Apple compete better) or anti-competitive (consolidating market power). Apple's argument will be that partnership enables them to compete with Microsoft + OpenAI. Google's argument will be that this spreads AI benefits to more users. The regulatory outcome will depend on how authorities evaluate these claims.

What happens to the existing Apple search deal with Google?

The existing arrangement where Google pays Apple up to $20 billion annually to be the default search engine remains unchanged. That deal is distinct from the Gemini partnership—the search deal is about search queries, while the Gemini deal is about general-purpose AI. Both deals reflect Apple's pragmatic approach to partnering with Google when it makes economic sense. However, if Gemini-powered Siri starts answering questions without sending users to Google Search, that could eventually reduce search traffic from Apple devices, which would change the dynamics of both partnerships over time.

Conclusion: The New AI Economy

The Apple-Google Gemini deal is a watershed moment for AI development, but not in the way many people expected. It's not about Apple surrendering to Google or Google defeating OpenAI. It's about the entire tech industry reorganizing around a new reality: frontier AI capability is expensive, complex, and increasingly shared.

The era of go-it-alone AI development is ending. The companies that will win are those that can integrate best AI—whether built in-house or licensed—into products that reach billions of users. Apple and Google just showed how this works.

This deal will likely accelerate consolidation around a few major platforms, each backed by proprietary AI capability or open-source alternatives. Microsoft has OpenAI. Google now has both its own Gemini and a partnership with Apple. Amazon has AWS AI. Meta has open-source Llama. The competitive game has shifted from individual models to integrated ecosystems.

For users, this means better AI experiences in the products you already use. For developers, this means you have strategic options beyond building your own models. For startups, this means the path to AI success likely involves specialization, partnership, or focusing on specific domains where you can compete despite big-tech entrenchment.

The Apple-Google deal proves that in the AI era, pragmatism beats purism. Neither company built everything themselves. Both recognized that partnership was faster, cheaper, and ultimately more likely to deliver value to users.

That's the lesson: In competitive markets, coopetition often beats pure competition. When the stakes are high and the technology is complex, working together beats trying to do everything alone.

Watch for more deals like this. Because this is just the beginning.

Key Takeaways for Implementation

If you're managing a tech company or building products in the AI era, here are the concrete takeaways:

1. Partnership beats building alone on non-core capabilities. Apple excels at hardware, OS design, and ecosystem. AI model development isn't where Apple has historical advantage. Partnering with Google is smarter than attempting in-house development.

2. Distribution is increasingly valuable. Google's Gemini is only valuable to Apple if it reaches users at scale. The partnership only works because Apple has billions of devices. If you have distribution, you have leverage for partnerships.

3. Privacy architecture is table stakes. Apple's Private Cloud Compute isn't an optional feature—it's necessary to protect the brand and maintain user trust. Any AI partnership needs privacy-first architecture, not privacy as an afterthought.

4. Coopetition is practical strategy. You can compete fiercely in some areas while cooperating in others. Apple and Google do both. The companies that master this balance will outperform those that try to compete on everything.

5. Speed of integration matters more than speed of model development. Apple didn't wait for Siri AI to be perfect. It partnered for capability and integrated as fast as possible. In fast-moving markets, being first to integrate beats being first to innovate.

6. Regulatory navigation is critical. Partnerships between major competitors will face antitrust scrutiny. You need to understand the regulatory environment and be prepared to defend the deal's pro-competitive benefits.

The Apple-Google deal is a masterclass in pragmatic strategy for the AI era. Watch it, learn from it, and adapt its principles to your own competitive environment.

Related Articles

- Apple Adopts Google Gemini for Siri AI: What It Means [2025]

- Apple's Siri Powers Up With Google Gemini AI Partnership [2025]

- Apple & Google's Gemini Partnership: The Future of AI Siri [2025]

- xAI's $20B Series E: What It Means for AI Competition [2025]

- Amazon's Alexa+ Comes to the Web: Everything You Need to Know [2025]

![Apple and Google's Gemini Deal: What It Means for AI Competition [2025]](https://tryrunable.com/blog/apple-and-google-s-gemini-deal-what-it-means-for-ai-competit/image-1-1768317138449.gif)