How Apple Became India's Premium Smartphone Powerhouse

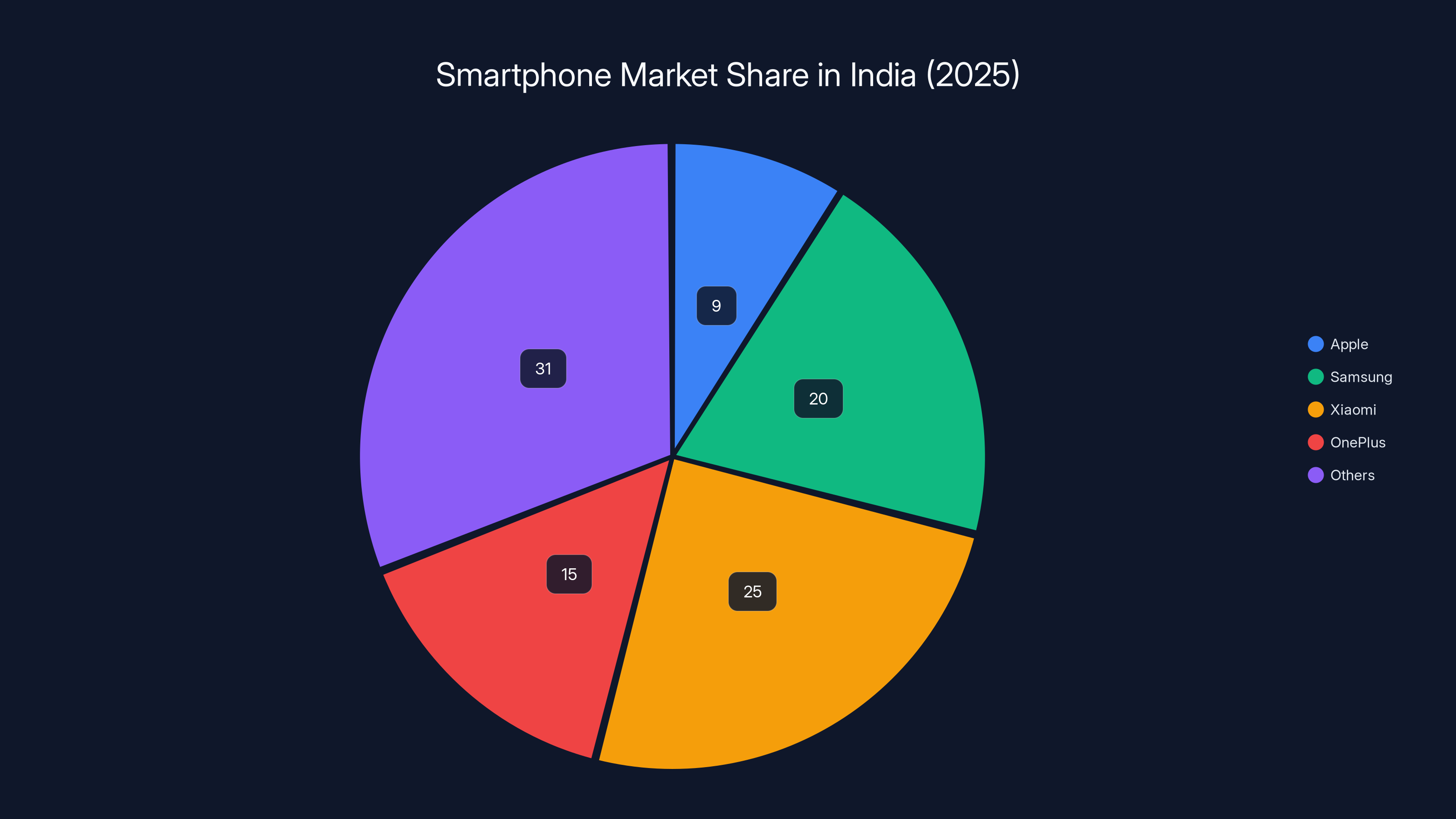

India's smartphone market did something unexpected in 2025. It stopped growing. For the fourth consecutive year, the nation shipped roughly 152 to 153 million devices, remaining essentially flat despite being the world's second-largest market by volume. Yet within this stagnant landscape, one brand managed something remarkable: Apple captured a record 9% market share with approximately 14 million iPhone shipments, up from just 7% the previous year, as noted by Counterpoint Research.

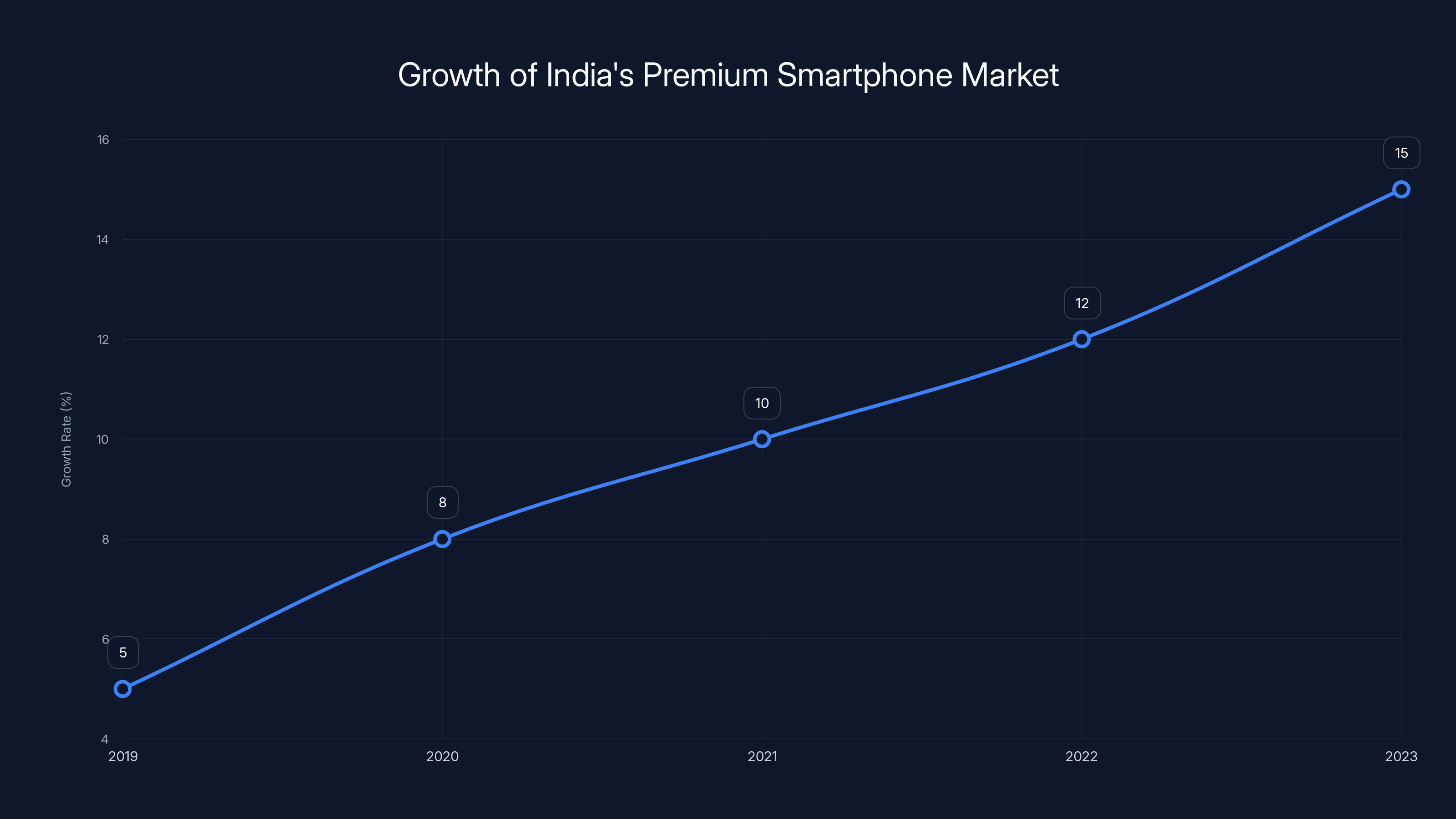

This paradox tells a fascinating story about how markets evolve. While the mass-market smartphone business has ground to a halt, with consumers holding onto their devices longer and fewer feature phone users upgrading to smartphones, an entirely different game is unfolding in the premium segment. Smartphones priced above ₹30,000 (roughly $327 USD) surged 15% year-over-year and now represent 23% of all shipments, according to Omdia. That's the highest proportion ever recorded. Apple isn't just winning in absolute numbers anymore. It's winning the battle that actually matters: the shift toward high-value devices.

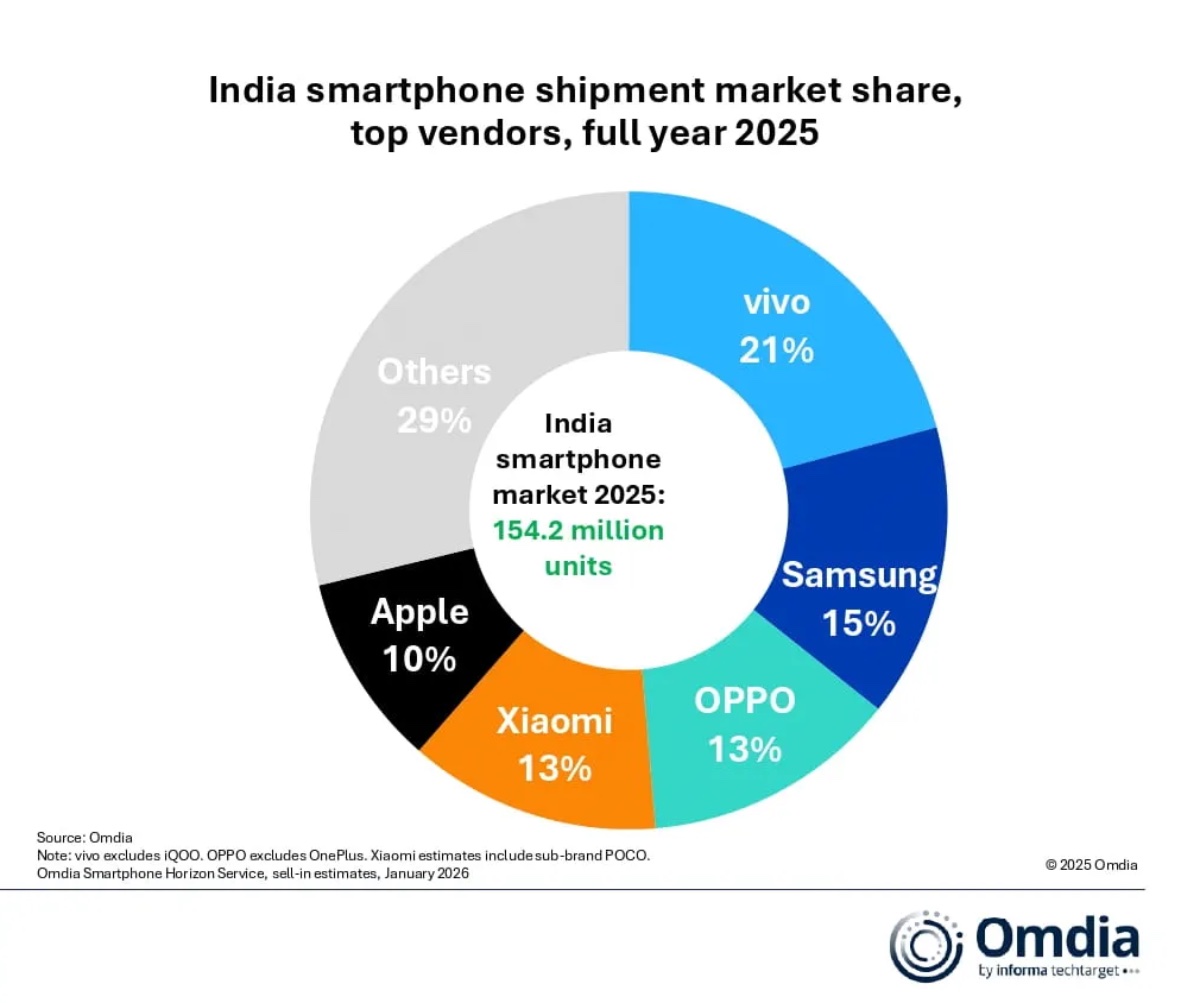

The contrast is stark. By volume, Chinese manufacturer Vivo still dominates with 23% of total shipments, followed by Samsung at 15% and Xiaomi at 13%. Apple doesn't crack the top three when measured purely by unit sales. But that's precisely the point. The smartphone industry's future isn't about who ships the most phones to the masses. It's about who owns the premium tier where actual profits live. Apple understands this better than anyone else in the market.

What's driving this shift? It's not just product quality or brand prestige, though those matter. It's a fundamental economic transition happening across India's middle class. Aspirational consumers who previously bought budget Android phones now want devices that signal status, offer longevity, and integrate with premium services. They're willing to stretch their budgets for something that feels special. Apple's positioned itself perfectly at this intersection of aspiration and capability.

The numbers reveal something deeper than quarterly results. They show how markets stratify. When growth stops in the overall market, the winners are those who successfully move up the value chain. Apple has done exactly that in India, and the implications ripple across the entire smartphone industry.

The Indian Smartphone Market: Stagnation at Scale

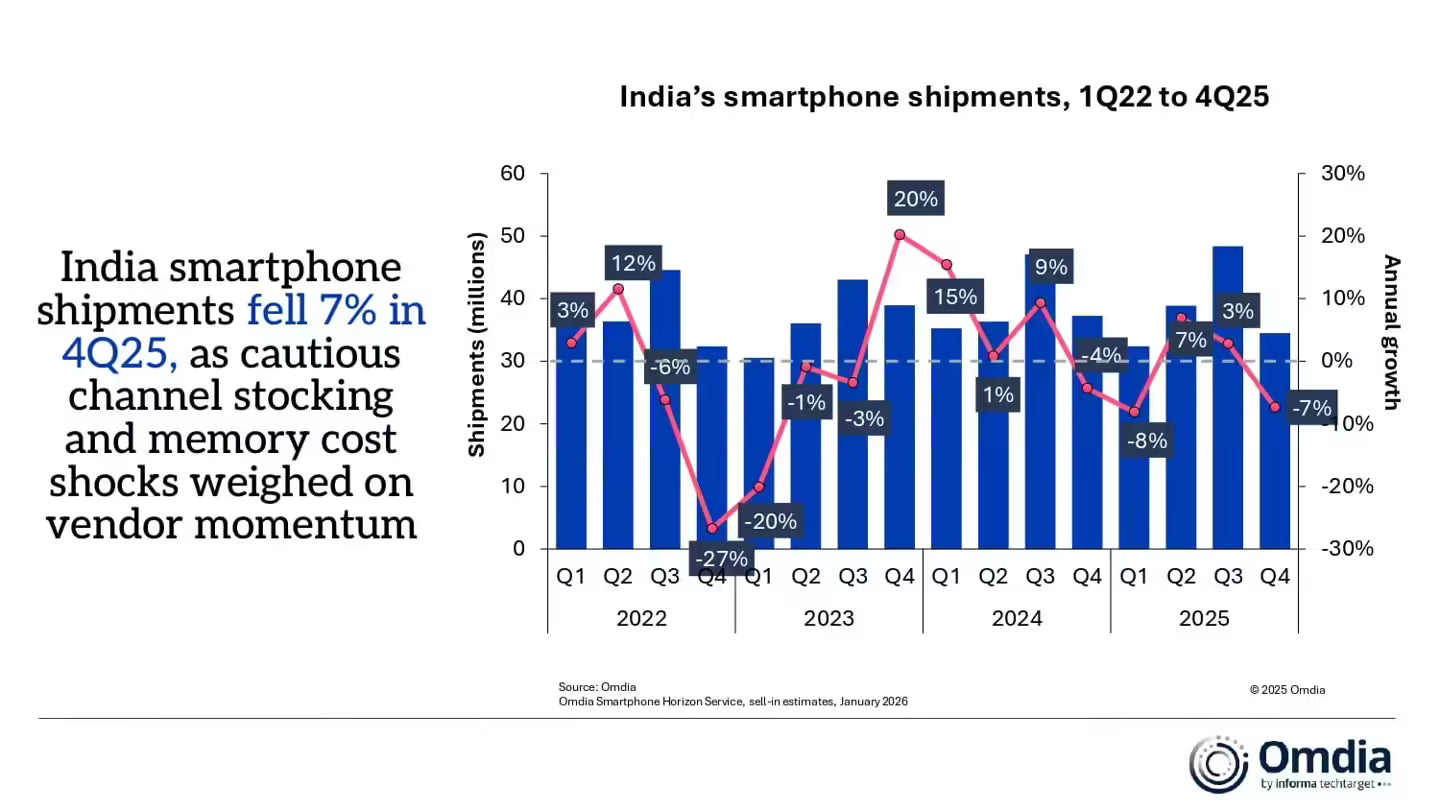

India's smartphone market faced headwinds throughout 2025 that fundamentally reshaped the competitive landscape. The market's fourth consecutive year of flatness wasn't a temporary dip or seasonal slowdown. It represented a structural shift in how consumers behave with mobile devices, as detailed by Counterpoint Research.

Three major factors collided to create this stagnation. First, replacement cycles have stretched dramatically. Consumers who bought smartphones in the 2019-2020 era are now holding onto those devices for 4-5 years instead of the historical 2-3 year replacement cycle. A phone that still performs basic functions simply doesn't create purchasing urgency anymore. These devices handle messaging, social media, payments, and photography adequately, reducing the incentive to upgrade.

Second, the pool of potential first-time smartphone buyers has effectively dried up. India still has users on feature phones, but their numbers are dwindling annually. Converting remaining feature phone users has become increasingly difficult. These users often lack the digital literacy, payment infrastructure access, or financial capacity to jump directly to a modern smartphone experience. The easy growth from feature phone to smartphone upgrades has largely exhausted itself.

Third, the proliferation of refurbished and second-hand devices has fractured the new device market. Consumers can now buy perfectly functional one-year-old premium phones for half the original price. This cannibalization of new phone sales reflects a rational economic choice but undermines manufacturer revenues. A customer buying a refurbished iPhone 15 doesn't generate the same margin as a new iPhone 16 purchaser.

The October through December quarter proved particularly revealing. Despite India's festive season (Diwali and year-end holiday shopping), smartphone shipments actually declined 8-10% year-over-year. This wasn't a surprise to the industry. It confirmed that even the strongest seasonal demand couldn't overcome fundamental market saturation.

Yet within this stagnant overall market, something remarkable is happening. The premium segment above ₹30,000 grew 15% year-over-year, capturing 23% of total shipments, as reported by Omdia. This represents a massive shift in where Indian consumers are concentrating their spending. Instead of upgrading from a feature phone to a budget Android device, or from a budget device to a mid-range device, consumers are now making fewer, bigger purchases. When they do buy, they're buying up.

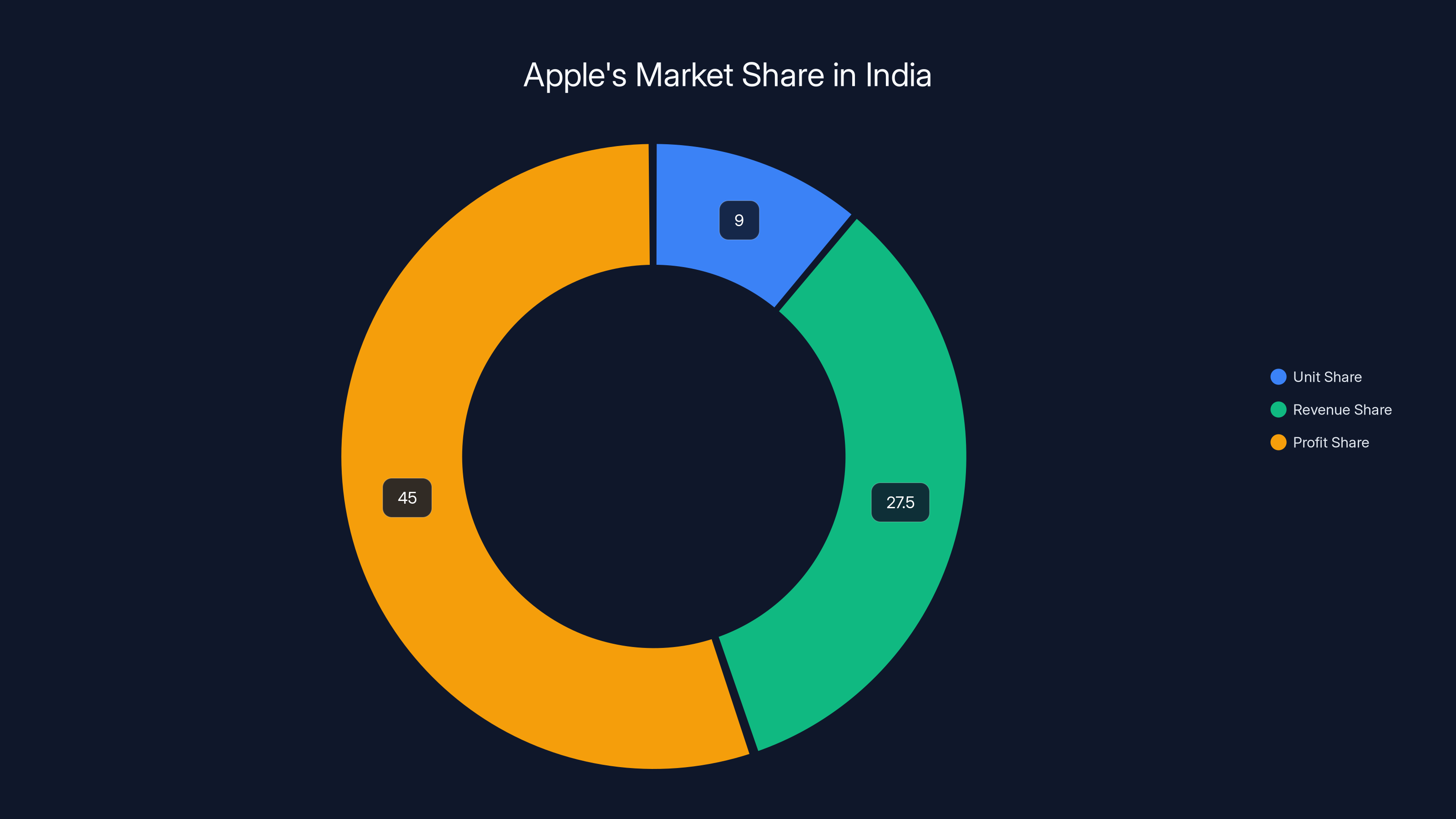

Apple holds a 9% unit share in India but captures a higher revenue share of approximately 25-30% and a profit share of 40-50%, highlighting the premium pricing of iPhones. Estimated data.

Understanding India's Premium Segment Boom

The premium smartphone market in India tells a completely different story than the overall market. While aggregate shipments stagnated, devices priced above ₹30,000 experienced double-digit growth. This 15% year-over-year increase wasn't gradual. It was accelerating, signaling a fundamental reallocation of consumer spending toward high-value devices, as highlighted by Counterpoint Research.

What's driving this premium surge? The answer lies in India's evolving consumer psychology. India's middle class has grown substantially over the past decade, and a significant portion of that middle class has now moved into what we might call the upper-middle-class income bracket. These consumers face a decision: spend incrementally on multiple mid-range devices over a decade, or invest once in a premium device that lasts longer, maintains value, and provides an elevated experience.

Apple's entire market strategy in India hinges on this psychological shift. The company isn't competing on price or volume. It's competing on aspiration and permanence. An iPhone isn't just a phone. For India's aspirational consumers, it's a signal of status, a gateway to premium services, and a long-term investment. The brand carries cultural weight that extends beyond functionality.

Premium devices also offer tangible benefits that justify their price. Better cameras, longer battery life, faster processing, superior build quality, and multi-year software support create a measurable experience gap. For consumers who spend 6-8 hours daily on their phones, these differences compound into genuine value. A premium device feels snappier, captures better memories, and maintains performance longer.

The ecosystem lock-in is another critical factor. Once consumers enter the Apple ecosystem with an iPhone, adding a Mac, iPad, or Apple Watch becomes logical. The seamless integration, continuity features, and cross-device syncing create switching costs that make users less likely to return to Android. This ecosystem advantage is particularly powerful among younger, affluent consumers who are often early adopters of multiple Apple products.

Brand perception amplifies this dynamic. In India, premium brands carry outsized cultural significance. Owning a luxury good isn't just about the product. It's about community membership and social positioning. Apple has masterfully cultivated an image of innovation, premium quality, and aspirational living. For Indian consumers with disposable income, purchasing an iPhone represents more than a rational consumption decision. It's an identity choice.

Market data supports this psychological shift. The premium segment's 23% share of total shipments is the highest ever recorded, indicating that this trend is accelerating. Average selling prices also increased 9% in 2025 and are forecast to rise another 5% in 2026, according to Counterpoint Research. Manufacturers are pushing consumers toward costlier models with more features, and consumers are accepting this shift. The market is voting with its wallet for premium devices.

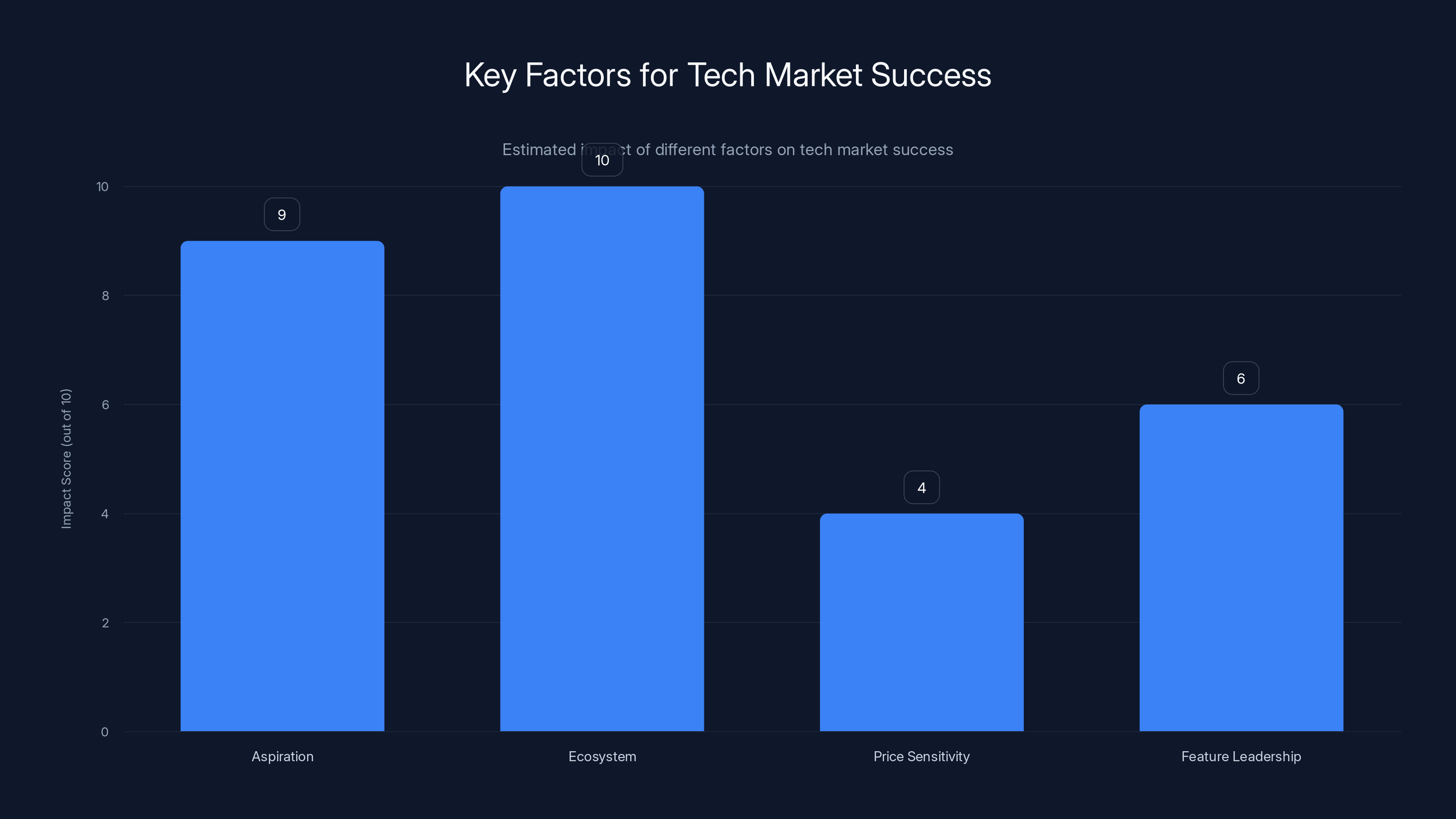

Aspiration and ecosystem integration are key drivers of success in tech markets, outweighing price sensitivity and feature leadership. Estimated data based on industry insights.

Apple's Record Performance: 14 Million iPhones in 2025

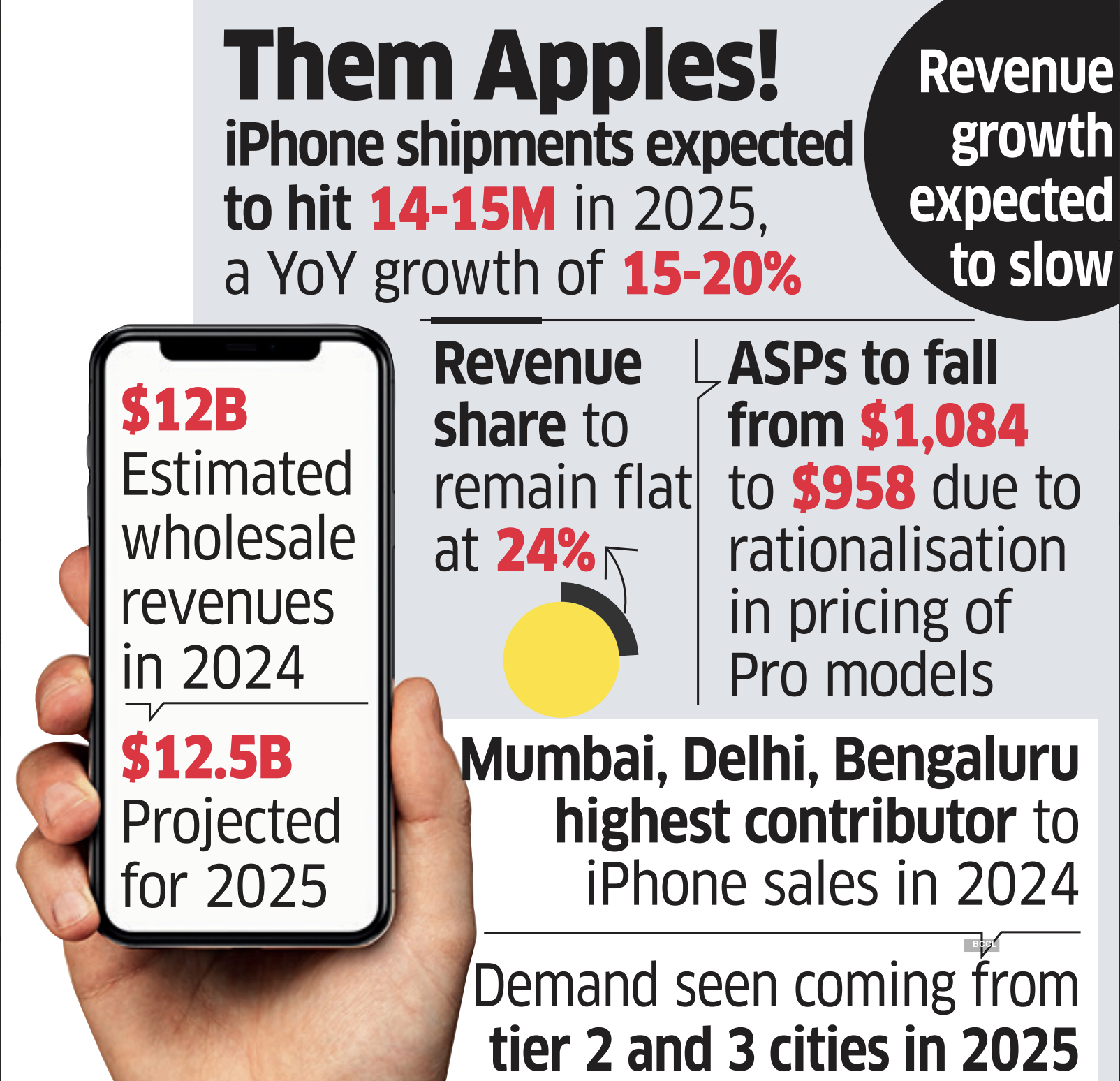

Apple shipped approximately 14 million iPhones into India during 2025, representing a record high for the company in the subcontinent. This figure might seem modest compared to China or the United States, but it's transformative when contextualized within India's market dynamics, as reported by Apple Insider.

These 14 million units translated to 9% market share based on total smartphone shipments, a two-point increase from 7% in 2024. While this places Apple outside the top three manufacturers by volume, it misses the actual narrative. Apple's market share gains occurred precisely while the overall market flatlined. That's not easy to achieve. Growing share in a flat market means you're directly taking customers from competitors who are losing ground.

Where did these customers come from? Primarily from Android manufacturers in the premium segment. Samsung, which held 15% of total market share, likely felt pressure from Apple in the high-end category. Mid-range Android brands like OnePlus also faced competition from older iPhone models at aggressive prices. Apple's strategy of pushing multiple generations into the market simultaneously creates a price ladder that appeals to different consumer segments. Someone who can't afford the iPhone 16 Pro might stretch for an iPhone 15 or iPhone 14, creating a broader appeal than single-generation competitors.

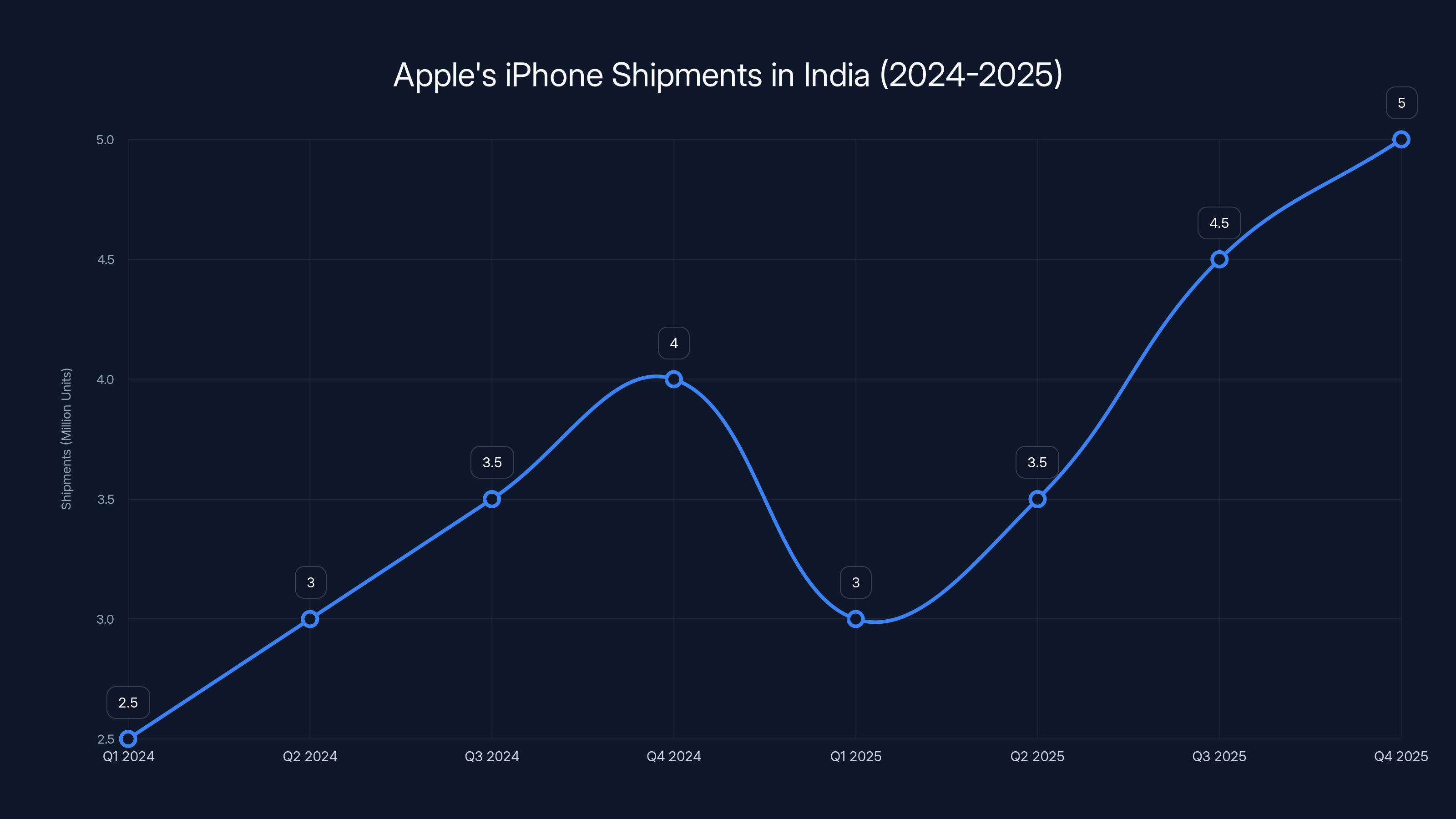

The shipment growth accelerated throughout the year. Apple's Q4 2025 performance likely exceeded Q1 figures substantially, driven by new product launches (the iPhone 17 series launched in September), festive season demand, and improving retail availability. This acceleration suggests momentum entering 2026 that could drive further share gains.

What made this record possible? Apple executed a multi-pronged strategy that addressed previous market constraints. Product portfolio diversity increased significantly. The iPhone 16 lineup included more options at more price points, allowing consumers at different income levels to find an iPhone that fit their budget. The base iPhone 16 became more accessible, while the Pro models served affluent consumers willing to spend ₹150,000+ ($1,800+ USD).

Production and availability improved dramatically. Apple expanded manufacturing in India through partnerships with Foxconn and Wistron, reducing supply constraints that had historically limited iPhone availability. For several years, iPhones were difficult to find outside major cities. By 2025, they were available across more retail channels. This distribution expansion was crucial for converting latent demand into actual sales.

Pricing strategy also adapted to market realities. While iPhones remain premium, Apple introduced more competitive pricing at launch and maintained price discipline through the product cycle. The company didn't compete on discounts, but it offered more value at each price point, making the premium feel justified.

Apple's Strategic Investments in India's Market Infrastructure

Apple's record performance in India didn't happen by accident. It reflected years of deliberate investment in market infrastructure, local manufacturing, retail presence, and service capabilities. The company treated India not as a secondary market but as a core strategic priority alongside China and the United States.

Retail expansion symbolized this commitment visually. In January 2026, Apple opened its fifth physical store in India, this one in Noida near Delhi. This might sound like a small number for a market of 1.4 billion people, but it represented a carefully phased expansion strategy. Each store serves as both a sales channel and a brand experience center. Walking into an Apple Store shapes consumer perception in ways that online purchases never can.

More importantly, Apple wasn't relying solely on flagship stores. The company systematically expanded partnerships with authorized resellers and telecom operators. Devices became available at Reliance, Airtel, and other major carriers. This "last-mile" distribution strategy brought iPhones to smaller cities and towns where dedicated Apple Stores made no economic sense. A customer in Jaipur or Nagpur could now walk into a local mobile shop and buy an iPhone rather than traveling to a major metro center.

Local manufacturing represented an even more significant investment. Apple's decision to produce iPhones in India addressed three critical challenges simultaneously. First, it reduced import tariffs and duties that had previously made iPhones significantly more expensive than regional competitors. Made-in-India iPhones could be priced more competitively. Second, it improved supply chain resilience by diversifying production away from China at a time of geopolitical uncertainty. Third, it signaled long-term commitment to the Indian market, building credibility with consumers and policymakers alike.

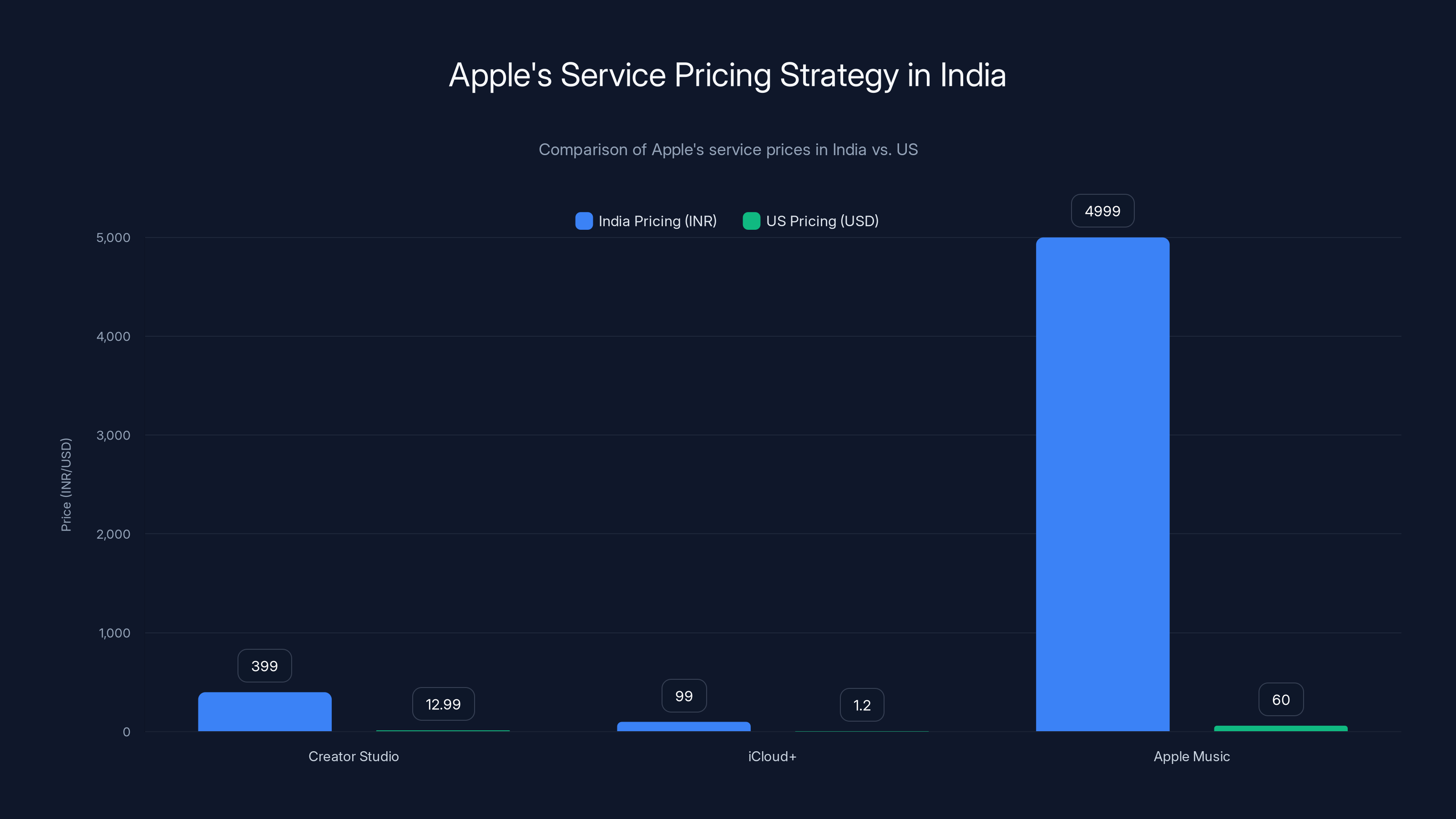

Services localization received substantial investment as well. Apple expanded its Apple Care network, trained local technicians, and established service centers across major cities. Consumers became more confident purchasing iPhones knowing that support was available locally. The company also introduced Apple Creator Studio, a subscription bundle of creative apps priced at just ₹399 monthly (

The services strategy extended beyond technical support. Apple invested in partnerships with financial institutions to offer installment payment options, making expensive iPhones accessible to middle-class consumers without large upfront capital. Zero-interest EMI schemes became available through major banks, effectively reducing the psychological barrier to purchase. A ₹80,000 iPhone became a ₹6,500 monthly commitment for 12 months, transforming affordability perceptions.

Digital infrastructure improvements also mattered. Apple Maps integration with Indian mapping services, regional language support, and localized content recommendations made the iOS experience feel authentically Indian rather than globally generic. The company understood that premiumness in India means respecting local culture and language while maintaining global standards.

Apple holds a 9% market share in India, highlighting its focus on premium segments. Despite a smaller unit share, Apple captures a significant portion of revenue and profit, emphasizing the value of premium market positioning. Estimated data.

Why the Premium Segment Is the Market's Future

The smartphone industry's next decade will be defined not by total unit growth but by value concentration. India's 2025 market dynamics foreshadow a global trend: the mass market for budget smartphones is maturing and fragmenting, while the premium segment is where innovation, profit, and brand loyalty live.

This shift reflects economic maturity. Mature markets naturally stratify. Some consumers buy smartphones purely for functional needs and spend minimally. Others view smartphones as lifestyle products and spend lavishly. India's market is transitioning from a single-tier market (where most consumers bought budget Android phones) to a multi-tier market with distinct segments.

Budget segment pressures will intensify. Manufacturers competing on price alone face margin compression and commoditization. A ₹10,000-₹15,000 smartphone market controlled by Chinese brands offers minimal profitability. Vivo, Xiaomi, and Redmi have optimized manufacturing and supply chains, but they're competing primarily on price and specifications. Profit per unit is razor-thin, and brand loyalty is minimal. Consumers switch brands monthly based on discount availability.

Mid-range segment vulnerability emerges from both directions. Budget phones improve capabilities yearly while maintaining low prices, narrowing the feature gap. Premium phones drop in price through older generations, creating competition from above. The mid-range becomes squeezed, with fewer defensible positions. This explains why OnePlus, which once dominated the segment, has struggled to maintain relevance.

Premium segment dynamics are inverted. Apple, Samsung, and other premium players enjoy pricing power, customer loyalty, and profitability. Consumers in this tier make deliberate choices based on brand, ecosystem integration, and experience rather than price alone. They upgrade less frequently but spend significantly more per transaction. A consumer buying an iPhone 16 Pro Max at ₹150,000 is fundamentally different from one buying a Redmi Note at ₹20,000. The motivations, willingness to pay, and lifetime value diverge dramatically.

Ecosystem advantages magnify in the premium segment. Apple's ecosystem (iPhone, Mac, iPad, Watch, AirPods) creates switching costs that lock in customers for years. Android's fragmented ecosystem (hundreds of manufacturers with different implementations) offers no equivalent lock-in. This ecosystem moat is becoming the primary competitive advantage.

Innovation clusters around premium devices. Foldable screens, advanced cameras, AI capabilities, and computational photography appear first in premium devices. These features eventually trickle down, but premium consumers enjoy years of exclusive capabilities. This innovation leadership reinforces brand prestige and justifies premium pricing.

Think about the mathematics. Suppose a manufacturer sells 1 million budget phones at ₹15,000 each (₹300 million gross revenue) and 1 million premium phones at ₹100,000 each (₹100 billion gross revenue). The premium phones represent 0.1% of unit volume but 25% of revenue and probably 70% of profit. This explains why Apple, despite 9% market share by volume, captures outsized profitability in India.

India's premium growth trajectory suggests this concentration will accelerate. Economist projections forecast 5% average selling price increases annually through 2026-2027, driven entirely by premium device adoption. The overall market might grow 0-2% by units, but by value it grows 5-7%. Manufacturers not positioned in the premium segment face headwinds that no amount of cost optimization can overcome.

Apple CEO Tim Cook's "All-Time Revenue Record" Claim

Tim Cook's statement during Apple's October 2025 earnings call deserves deeper examination. He announced that Apple had set an "all-time revenue record in India," a claim more nuanced than simple iPhone shipment growth might suggest.

Revenue and units tell different stories. If iPhones shipments were 14 million units (let's estimate average selling price of ₹75,000, or roughly

Services growth is particularly important. India's digital economy is exploding, with increasing subscription adoption. Apple Music, Apple TV+, and iCloud+ penetration in India remains low relative to developed markets, offering massive expansion potential. A consumer purchasing an iPhone often adds 1-2 services subscriptions, creating recurring revenue. This services revenue compounds significantly over time, turning a one-time device purchase into years of recurring payments.

Wearables represent another growth vector. Apple Watch adoption in India historically lagged the United States, but aspiration for premium wearables is rising. A consumer buying an iPhone 16 at ₹80,000 might add an Apple Watch at ₹30,000, creating $1,100+ in total transaction value. This ecosystem upsell strategy significantly exceeds the device purchase.

Cook's emphasis on "active install base reaching all-time highs" indicates that Apple cares less about quarterly iPhone sales than about the cumulative user base engaging with services and ecosystem products. A larger install base means larger recurring revenue potential, which drives company valuation more than any single quarter's iPhone shipments.

The "quarterly record for upgraders" claim is equally important. Upgraders are existing iOS users buying new iPhones, not Android converts. This indicates ecosystem strength and demonstrates that iPhone buyers aren't one-time purchasers. They're in a cycle of regular upgrades, creating predictable revenue streams. If 30-40% of iPhone shipments came from existing users upgrading, that's dramatically more profitable than converting Android users, who might leave for a cheaper competitor next cycle.

Cook's emphasis on India reflects strategic reality. China is increasingly hostile to Apple, imposing restrictions and favoring domestic champions like Huawei. The United States is mature and saturated. India represents Apple's most important growth market for the next decade. Statements about India performance carry outsized weight in investor discussions.

The premium smartphone segment in India has seen accelerating growth, reaching a 15% increase in 2023, indicating a shift in consumer spending towards high-value devices. Estimated data.

Market Challenges Ahead: Why 2026 Might Be Tougher

Apple's 2025 success masks underlying challenges that could constrain growth in 2026. Counterpoint Research's forecast of a 2% market decline in 2026 reflects real headwinds that no manufacturer has successfully overcome.

Memory price inflation represents a technical but critical challenge. NAND flash and DRAM prices are rising due to supply constraints in the semiconductor industry. Phones use significant quantities of both memory types. As manufacturing costs increase, phone makers face uncomfortable choices: absorb the cost reduction in margins, pass it to consumers through higher prices, or cut specifications to maintain margins.

Apple could theoretically absorb cost increases, but it's unlikely to do so significantly in India. The company operates on roughly 45% gross margins in iPhone products globally. A 10-15% increase in component costs would cut margins to 38-40%, which shareholders would find unacceptable. Instead, Apple might raise prices modestly (₹2,000-₹5,000 increases) on iPhone models, potentially dampening demand in price-sensitive segments.

Cashback and promotional intensity will likely decrease. Brands use cashback offers and discounts during the festive season and promotional events to drive volume. As margins compress from higher costs, brands will cut these promotions to protect profitability. Consumers conditioned to expect ₹5,000-₹10,000 discounts on flagship phones might face ₹2,000-₹3,000 in 2026. This tighter promotional environment could suppress upgrade cycles among cost-conscious premium consumers.

Competitor responses pose another threat. Samsung, which still holds 15% market share, has formidable resources and brand recognition. The Korean manufacturer could launch more competitive pricing or introduce unique features (perhaps better display technology or battery life) that appeal to Indian consumers. Xiaomi and OnePlus might also sharpen their competitive positioning.

The refurbished device market continues fragmenting new device demand. As phones last longer and depreciation curves shift, older iPhones enter the second-hand market at increasingly attractive prices. A consumer might buy a refurbished iPhone 15 for ₹50,000 instead of a new iPhone 16 at ₹80,000. Apple doesn't directly compete in refurbished devices, creating a leakage effect where customers who might have bought new devices instead purchase used.

Consumer sentiment around frequent upgrades is shifting. Environmental consciousness, financial prudence, and genuine satisfaction with current devices are making consumers more selective about upgrades. A customer with an iPhone 14 in working condition faces strong headwinds to justify upgrading to iPhone 16. The improvements (faster processor, slightly better camera) might not justify ₹60,000+ expenditure when the current phone meets everyday needs.

Economic headwinds could also emerge. India's inflation, currency volatility (rupee weakness), and potential interest rate increases would affect consumer purchasing power. Premium smartphone purchases are often discretionary. In tighter economic times, some consumers delay upgrades or choose less expensive alternatives.

Despite these challenges, Apple's position remains relatively strong. The company has pricing power in the premium segment that protects it from competition. Premium consumers, once acquired, tend to remain loyal. The ecosystem moat continues strengthening. If Apple maintains market discipline, resists price-cutting temptations, and continues investing in local infrastructure, the company can sustain share gains even in a declining overall market.

The Broader Smartphone Industry Impact

Apple's India performance reverberates across the entire smartphone industry, signaling trends that manufacturers worldwide should heed. The market is stratifying faster than many executives anticipated.

Android manufacturers face an uncomfortable reality. No single Android brand has created an ecosystem equivalent to Apple's. Users switch between Samsung, OnePlus, Xiaomi freely, using them as substitutes rather than complements. This lack of lock-in forces Android makers into constant competition on price and specifications, racing toward the bottom. Apple, by contrast, operates in a league where price competition barely exists because switching costs are high.

China-centric manufacturers (Xiaomi, Vivo, Oppo) have succeeded globally through aggressive pricing and rapid innovation at low price points. But this strategy hits fundamental limits in mature, premium-conscious markets like India. To compete with Apple in the premium segment, these manufacturers would need to build ecosystems, invest in services, and create brand prestige. This requires 5-10 years of sustained investment with uncertain returns. Most Chinese manufacturers will instead double down on budget and mid-range segments, ceding the premium market to Apple and Samsung.

Samsung occupies an awkward middle position. The company has strong brand recognition, a diverse product lineup, and ecosystem capabilities (through Tizen and Galaxy ecosystem). But Samsung has never effectively matched Apple's premium prestige or ecosystem integration. Moreover, Samsung competes across all segments simultaneously, creating internal cannibalization. A high-end Samsung Galaxy device competes with its own mid-range offerings, forcing the company into complex pricing strategies.

Manufacturers without ecosystem strategies face existential questions. Once a consumer enters the Apple ecosystem (buying an iPhone and perhaps an iPad or Mac), they're unlikely to switch to Android. Manufacturers can compete for the initial device, but they'll lose that customer permanently for follow-on purchases and services. Over time, this compounding effect creates an irreversible market structure where ecosystems dominate.

India's market should have been a place where Android manufacturers dominated permanently. Budget-conscious consumers, Android's traditional strength, defined the market for years. But economic growth and rising aspirations changed the game. Middle-class consumers who saved to buy a ₹40,000 device demanded something special, and Apple delivered prestige, reliability, and ecosystem integration. Now, as this segment grows and becomes India's mainstream, Apple's advantages compound.

The industry is effectively bifurcating. Premium players (Apple, Samsung, increasingly Google with Pixel) will focus on high-margin devices, services, and ecosystem integration. Volume players (Xiaomi, Oppo, Vivo) will optimize for cost and market share in budget and mid-range segments, accepting slim margins. The middle tier—OnePlus, Nothing, and similar brands—struggles to find defensible positions.

This bifurcation has profound implications for innovation. Premium manufacturers invest heavily in R&D because high margins fund exploration. Budget manufacturers optimize existing technology for cost reduction. Midrange manufacturers lack resources for meaningful innovation, so they copy features from both directions. Over a 5-10 year timespan, innovation concentrates at the premium end, widening capability gaps and reinforcing ecosystem advantages.

Apple's strategic pricing in India offers significantly lower prices compared to the US, making premium services more accessible to Indian consumers. Estimated data.

Apple's Service Strategy and Ecosystem Expansion in India

Apple's smartphone success would prove ephemeral without parallel success in services and ecosystem products. The company clearly understands this, which explains recent investments in services localization and ecosystem expansion in India.

Apple Creator Studio, launched in January 2026 at ₹399 monthly, exemplifies this strategy. The bundle includes Final Cut Pro, Logic Pro, and other creative tools. At less than

Services pricing in India reflects sophisticated market segmentation. Apple understands that Indian consumers value premium quality but operate under different income constraints than Western consumers. Rather than offering identical products at identical prices globally, Apple segments pricing. A ₹99/month iCloud+ plan (

Apple's financial services expansion supports ecosystem growth. In partnership with Indian banks, Apple offers Zero-interest EMI (equated monthly installments) on iPhone purchases, transforming the purchase into a monthly expense rather than a lump-sum decision. This psychological shift is remarkably powerful. A ₹80,000 purchase becomes 12 payments of ₹6,666. Suddenly, the iPhone becomes more affordable than people initially thought, expanding the addressable market significantly.

Apple TV+ has struggled globally, but in India, localization offers opportunity. The service lacks compelling Indian content relative to Netflix or Amazon Prime Video, but strategic Indian productions could change this. Investing in Indian directors, producers, and writers to create locally relevant content would increase appeal. Given India's massive creative talent pool and low production costs, this represents a rational investment.

The App Store, while mature in developed markets, still has explosive growth potential in India. As smartphone penetration increases and digital payments infrastructure improves, App Store transaction volume should accelerate. Every purchase generates 30% revenue for Apple. With over 14 million active iPhones in India and high app engagement, the App Store could generate $500 million+ in annual revenue within 5 years.

Fitness+, HomeKit, and Apple Books represent additional ecosystem expansion vectors. But the strategic priority is services adoption among the 14 million iPhone users. Each additional service subscription increases customer lifetime value, lock-in, and switching costs. An iPhone buyer also using Apple Music, iCloud+, and Apple TV+ is dramatically less likely to switch to Android than someone using only the device.

Competitive Responses and Alternative Premium Strategies

Samsung and other manufacturers clearly recognize Apple's premium-segment advantage. Their responses reveal how differently they approach this challenge.

Samsung's Galaxy Z series (foldable phones) represents an innovation-led response. By introducing unique form factors unavailable on iPhones, Samsung attempts to differentiate beyond specification metrics. A Galaxy Z Fold appeals to consumers wanting something genuinely different from traditional smartphones. In India, the Z Fold starts at roughly ₹150,000, targeting ultra-premium consumers willing to experiment. The problem: most consumers view foldables as novelties rather than necessities. Samsung has sold millions of foldables globally, but they remain a tiny percentage of total premium sales.

Google's Pixel strategy emphasizes computational photography and AI capabilities rather than raw specifications. Pixel phones, available in India at ₹90,000-₹150,000, compete with iPhones through unique software capabilities and ecosystem integration (Android-native integration with Google services). Pixel has gained traction among photographers and Android enthusiasts, but brand recognition remains lower than Apple or Samsung in India.

OnePlus and Nothing have attempted to carve out positions through design philosophy. OnePlus emphasizes "flagship killer" positioning—premium specifications at lower prices than Apple or Samsung. Nothing emphasizes design innovation with transparent back panels and unique aesthetics. Both strategies work to some degree, but they lack the ecosystem defensibility that Apple enjoys. A consumer choosing a Nothing phone based on design might leave for something else when the next cycle begins.

Vivo, Oppo, and Xiaomi premium lines attempt to compete through feature density. Ultra-high megapixel cameras, fast charging, large batteries, and advanced displays appeal to specification-focused consumers. But features commoditize quickly. Once all flagship phones offer 200+ megapixel cameras, battery longevity measured in days, and displays indistinguishable from OLED to human eyes, feature differentiation erodes. Apple's secret is that it doesn't compete primarily on features. It competes on experience, ecosystem, and brand prestige—dimensions that resist commoditization.

The fundamental issue all competitors face: competing with Apple requires building something Apple doesn't offer. But Apple owns the premium prestige, ecosystem integration, and brand perception in ways that take decades to challenge. Competitors can win on price (positioning below Apple), unique features (foldables, extreme specs), or ecosystem strength (if they build one). But directly competing with Apple at the same price point with similar positioning is nearly impossible. The brand moat is simply too strong.

This explains why Samsung remains the only manufacturer with meaningful premium share—it's the only one with near-equivalent brand prestige and ecosystem integration. Everyone else occupies a different space, competing on differentiation rather than direct confrontation.

Apple's iPhone shipments in India grew significantly in 2025, with a notable acceleration in Q4 due to new product launches and festive demand. Estimated data.

India's Smartphone Market Outlook Through 2026-2027

Counterpoint's 2% market decline forecast for 2026 reflects structural realities that extend beyond single-year fluctuations. Understanding this trajectory helps clarify where Apple and competitors are headed.

The replacement cycle math is straightforward. If the average smartphone replacement cycle is 4.5 years and the market shipped evenly over this period, market maturity would suggest stable shipments around 34 million units annually (152-153 million divided by 4.5 years). Current shipments already exceed this equilibrium, suggesting continued modest decline as market maturation progresses.

Memory price inflation creates additional headwinds. Semiconductor supply constraints are expected to persist through 2026 Q2-Q3, maintaining elevated component costs. Manufacturers will likely absorb some cost increases in margins, but consumers will also face price increases of 3-5% on average. This moderate price increase, combined with economic factors, typically suppresses unit demand by 1-2%.

Average selling price growth of 5% forecast for 2026 (following 9% growth in 2025) indicates continued premiumization. The premium segment will probably grow another 10-15% despite overall market decline, capturing 26-28% of shipments. This means the budget and mid-range segments are declining 8-15% annually, a significant shift in market structure.

Apple's position in this trajectory appears secure, possibly improving. If the company maintains its premium segment share and that segment grows 12%, Apple's volume could reach 15-16 million units in 2026. Even modest market share gains could push this higher. The question isn't whether Apple grows, but by how much.

Samsung will probably see premium segment stability or modest growth, partially offset by declining share in budget and mid-range segments. The company's largest vulnerability is in the mid-range segment, where it competes with Chinese manufacturers and pure-play Android brands.

Chinese manufacturers face compression from both directions. They dominate budget segments facing 8-12% annual volume decline. Even if they maintain share, volume declines hit their topline revenue. They also compete with used devices that have become dramatically more available as premiumization accelerates.

Smartphones purchased in 2021-2023 are now entering the refurbished market. A barely-used iPhone 13 Pro available for ₹60,000 captures demand that might have purchased a new mid-range phone. Similarly, a 2022 Samsung Galaxy S22 at ₹40,000 competes with the ₹50,000 budget segment. This refurbished influx will probably reduce new device demand further, particularly in budget and mid-range segments.

Long-term, India's market likely stabilizes around 120-130 million units annually by 2028-2029. This represents a mature market with replacement cycles extending to 5+ years and minimal new-user growth. At that equilibrium, premiumization will concentrate revenues among fewer brands, all earning profits on premium segments. The mass-market smartphone business becomes a volume game with minimal profitability.

Key Lessons for Tech Executives and Investors

Apple's India performance offers broader lessons applicable beyond smartphones. The company's success demonstrates timeless principles about how markets evolve and where sustainable competitive advantages live.

Lesson 1: Aspiration Trumps Price at Scale

India's growth narrative centered on affordability—making smartphones cheap enough for hundreds of millions to buy. That story was true through 2020. But as purchasing power increased, consumers didn't want cheap phones. They wanted aspiration. Apple understood this shift before most competitors, positioning the iPhone as an aspirational device rather than trying to compete on value. When enough consumers earn ₹800,000+ annually ($9,600+ USD), they don't optimize for ₹15,000 phones. They optimize for prestige.

For executives: Monitor when your market transitions from price-sensitive to prestige-sensitive. The inflection point represents opportunity for brands positioned at the top of the market.

Lesson 2: Ecosystem Creates Moats That Features Cannot

Apple doesn't dominate because iPhones have the best cameras or fastest processors (though they're competitive). Apple dominates because iPhone users live in an ecosystem where iPhone, Mac, iPad, Watch, and services interoperate seamlessly. This lock-in is worth billions in customer lifetime value. Competitors with better features but fragmented ecosystems consistently lose to Apple's integrated approach.

For executives: Single products lose to ecosystems. If your strategy relies on feature leadership, you'll win short-term battles and lose the long-term war. Build ecosystems that make switching costly.

Lesson 3: Market Stagnation Reveals True Competitive Advantage

Fast-growing markets mask competitive weaknesses. In India's explosive growth years (2015-2020), dozens of phone makers thrived because rising tide lifted all boats. Stagnation reveals who has real advantages. Apple's 2% share gain in a flat market proves this more convincingly than 50% unit growth would in an expanding market. When growth stops, only the strongest brands with the most valuable customers survive.

For executives: Your competitive position is only truly tested in flat or declining markets. Growth hides weaknesses. Use this moment to honestly assess whether you'd win in a stagnant market.

Lesson 4: Localization Isn't Cosmetic—It's Strategic

Apple could have offered identical products at identical prices globally. Instead, it localized pricing (Creator Studio at 66% discount), payment options (EMI financing), retail strategies (partner channels beyond flagship stores), and services. This localization effort consumed resources but unlocked market access. The company treated India not as a small country to extract from, but as a diverse market requiring distinct strategies.

For executives: Localization creates defensibility. Competitors can copy technology more easily than they can copy market understanding and local relationships built over years.

Lesson 5: Profitability Concentrates in Premium Tiers

Vivo ships more phones than Apple in India. Yet Apple likely captures 3-4x Vivo's profit. Unit volume is deceiving. Profitability in smartphones concentrates in the premium segment where customers are less price-sensitive and ecosystem lock-in is stronger. Competing in the volume game is probably a losing strategy unless you're the absolute cost leader (like some Chinese manufacturers). Premium positioning offers better risk-adjusted returns.

For executives: Market share is a vanity metric. Profit share matters. Would you rather be the #1 manufacturer by units with 2% margins, or #5 by units with 30% margins? Strategy should optimize for valuable customers, not volume.

FAQ

What does "9% market share" mean if Apple is outside the top three manufacturers by volume?

Market share can be measured in units (shipments) or value (revenue). Apple's 9% refers to unit share, meaning 9 out of every 100 phones sold in India are iPhones. However, premium phones represent a disproportionate share of revenue and profit. Apple captures roughly 25-30% of revenue despite 9% unit share because iPhones cost 3-5x more than average Android phones. By profitability, Apple's share is likely 40-50%. This disconnect between unit share and profit share is crucial for understanding smartphone industry economics.

Why did the overall Indian smartphone market remain flat when so many countries were experiencing growth?

India's market flatlined due to three factors: extended replacement cycles (consumers keeping phones 4-5 years instead of 2-3 years), depletion of the feature-phone-to-smartphone upgrade pool, and cannibalization from the refurbished device market. Additionally, while absolute buying power increased for the middle class, not all of this translated to new smartphone purchases. Some affluent consumers bought higher-end devices instead of upgrading yearly. The market reached saturation in some segments, particularly budget and mid-range phones, while the premium segment continued growing. Overall, these headwinds created net flatness despite growth in premium segments.

How does Apple's ecosystem create switching costs that prevent customers from returning to Android?

Apple's ecosystem works through integration across devices and services. An iPhone user might also have a Mac, iPad, and Apple Watch. These devices sync data effortlessly through iCloud, share clipboard content, enable universal clipboard, and integrate Handoff functionality (starting work on iPhone, continuing on Mac). Services like Apple Music, iCloud+, and subscriptions are tied to the Apple ID. The more products and services a customer uses, the harder switching becomes. Moving to Android requires abandoning all this integration, losing years of data, and starting fresh. This friction is worth hundreds of dollars in switching costs, making users willing to pay premium prices for new iPhones rather than try cheaper Android alternatives. Competitors haven't replicated this ecosystem integration at equivalent depth.

Why is Apple's Creator Studio priced at ₹399 monthly when it costs $12.99 in the United States?

Apple adjusts pricing based on purchasing power parity. India's per capita income is roughly 1/15th of the United States. Charging

What does the "15% growth" in premium smartphones mean for average consumers?

Premium smartphones, defined as devices above ₹30,000 ($327 USD), grew 15% year-over-year while the overall market was flat. This means manufacturers and retailers shipped 15% more premium phones in 2025 than in 2024, while total phone shipments stayed constant. This indicates that consumers are reallocating spending toward higher-priced devices. In practical terms, if you're a smartphone buyer, you're more likely to see premium phones in stores, see more advertising for premium phones, and encounter friends buying premium phones. The market is shifting toward a norm where the "good" smartphone costs ₹60,000-80,000 rather than ₹25,000-35,000.

Could Apple's record performance in India be driven simply by new users entering the market rather than Android switchers?

Unlikely. India's smartphone penetration is already 50%+ among population but much higher among the affluent consumers (income >₹800,000 annually) who buy premium phones. New-to-smartphone users are mostly buying budget phones, not ₹80,000 iPhones. Apple's growth primarily comes from two sources: existing Android users trading up to iPhones as they enter premium income tiers, and existing iPhone users upgrading to new models. The company's emphasis on "quarterly record for upgraders" confirms that upgrade volume from existing iOS users is accelerating, meaning repeat purchases, not entirely new users, drive growth.

What could prevent Apple from continuing its market share gains in India?

Several risks threaten continued growth: rising component costs forcing Apple to raise prices just as middle-class affordability begins to plateau; competitor innovations (Samsung's foldables, Google's Pixel AI capabilities) that appeal to specific consumer segments; economic slowdown reducing disposable income for discretionary purchases; aggressive market share gains by Samsung or another competitor in premium segments; and increasing competition from Chinese brands in the premium tier as Xiaomi, Oppo, and Vivo develop stronger brand positioning. Additionally, the refurbished iPhone market could cannibalize new iPhone sales if older models are available at steep discounts. Finally, regulatory risks exist—India has occasionally favored domestic tech champions, potentially creating unfavorable conditions for Apple.

Why should investors care about Apple's performance in a single country like India?

India represents Apple's most important growth market through 2030. China, historically Apple's second-largest market, faces geopolitical uncertainty and rising competition from Huawei. The United States is mature and saturated. India has 1.4 billion people with rapidly rising disposable income, digital payment infrastructure improving yearly, and an aspirational middle class that views premium brands favorably. Growing iPhone shipments in India by 5-10% annually for a decade adds billions in revenue and potentially trillions in services revenue. Moreover, India's trajectory indicates where global markets will head. Understanding Apple's India strategy provides insight into how companies can thrive in maturing smartphone markets. Investors who understand India understand Apple's long-term trajectory.

Conclusion: Market Stratification and the Future of Smartphones

Apple's record 14 million iPhone shipments and 9% market share in India during 2025 tells a story about how technology markets evolve. It's not primarily a story about iPhones becoming better or cheaper. It's a story about markets maturing, bifurcating, and concentrating value among brands offering ecosystem integration, aspiration, and long-term reliability.

The Indian smartphone market's flatness shouldn't be interpreted as stagnation. It's actually market maturation, which manifests differently than growth. A mature market doesn't expand total units; it consolidates around increasingly valuable customers. This consolidation favors premium brands with strong ecosystems and erodes the economics of volume-focused manufacturers.

For Apple, India represents the company's clearest opportunity for the next decade. The United States is approaching saturation. China grows hostile. India remains massive and aspirational. Apple has positioned itself precisely where India's market is heading—toward premium devices, services, and ecosystem integration. The company's investments in local manufacturing, retail expansion, services localization, and financing options represent a masterclass in understanding how to win in emerging premium markets.

For competitors, Apple's India success should be sobering. No Android manufacturer has created ecosystem equivalent to Apple's. Competing on price is a losing game in premium segments. Competing on features brings temporary advantage before features commoditize. Sustainable advantage requires ecosystem depth, and building equivalent ecosystems requires 5-10 years of sustained investment with uncertain returns.

For investors, Apple's India story validates a fundamental thesis: premium market segments offer superior returns. Apple's 9% unit share but 25-30% revenue share, and probably 40%+ profit share, demonstrates that volume is deceiving. The company willing to concentrate on premium customers, accept lower units, and invest in ecosystem depth will outperform volume competitors by orders of magnitude over time.

Looking forward, expect India's smartphone market to remain flat through 2026-2027, with the premium segment growing 10-15% annually. Apple will likely maintain or slightly increase market share, reaching 15-16 million units by 2027. The company's services ecosystem will expand, with App Store revenue and subscription adoption accelerating. Samsung will maintain presence in premium segments but face pressure from Apple and Google. Chinese manufacturers will increasingly focus on budget and mid-range segments with thin margins.

The bigger lesson extends beyond smartphones. As markets mature globally, stratification happens everywhere. Companies must choose: compete for volume at low margins, or focus on premium customers at high margins. Apple made this choice years ago and is reaping the benefits. Other tech companies making similar decisions will prosper. Those still fighting volume wars in maturing markets will struggle.

India's 2025 market dynamics offer a preview of global smartphone markets in 2030. By that point, unit volumes worldwide will probably stabilize around current levels. Growth will come from average selling price increases driven by premiumization. Brands with strong premium positions will thrive. Volume players will face margin compression. The smartphone market, so dynamic and growth-oriented for the past 15 years, enters a new era of maturity and consolidation.

Apple's record Indian performance isn't an anomaly. It's a signal of industry transformation ahead.

Key Takeaways

- Apple achieved 14 million iPhone shipments (9% market share) in India 2025, the highest ever, while overall smartphone market remained flat

- Premium smartphone segment (₹30,000+) grew 15% YoY and now represents 23% of total shipments, indicating market stratification favoring high-value devices

- Apple's 9% unit share generates 27-30% of total market revenue, proving that profit concentration is far more important than volume leadership

- Ecosystem lock-in creates defensible competitive advantages that pure hardware innovation cannot overcome, explaining Apple's durability against feature-focused competitors

- India's market trajectory signals how global smartphone markets will evolve: overall flatness with premium premiumization, favoring brands with integrated ecosystems over volume players

- Extended replacement cycles (4.5 years vs 2-3 years historically) and refurbished device cannibalization are primary drivers of overall market stagnation despite economic growth

![Apple iPhone India Record 2025: Why Premium Smartphones Are Winning [2026]](https://tryrunable.com/blog/apple-iphone-india-record-2025-why-premium-smartphones-are-w/image-1-1769233032707.jpg)