Why Asus Quit Smartphones: The Death of a Phone Maker [2025]

Here's something that would've sounded insane five years ago: Asus is done making phones. Not temporarily. Not "pausing to retool." Actually done, indefinitely.

In January 2025, Asus chairman Jonney Shih confirmed what the tech world had been whispering about for weeks. The company's smartphone business was shutting down. No more Zenfones. No more ROG Phones. No new models in 2026 or beyond. Instead, Asus is pivoting hard into AI servers, robots, and smart glasses, as reported by TweakTown.

On the surface, this looks like just another casualty in the smartphone wars. But it's actually a symptom of something much bigger happening right now in tech. The smartphone market has matured so much that even established players can't make it work anymore. And when Asus gives up, you have to ask: what does that tell us about the future of mobile?

Let me break down exactly what happened, why it happened, and what it means for the rest of us trying to buy a decent phone.

The Official Announcement: What Asus Actually Said

Let's start with the facts. During Asus's 2026 kick-off event in Taiwan, chairman Jonney Shih made the company's position crystal clear. According to reports from the event, Shih stated that "Asus will no longer add new mobile phone models in the future." That's direct. That's final, as detailed by Android Police.

Now, technically Shih also said Asus might release phones again someday if "something changes." But that's corporate speak for "never." When a company commits to an indefinite pause, they're signaling that they see no path forward. They're not saying "maybe in five years." They're saying "we don't see a business case here anymore."

What makes this announcement significant isn't just that Asus is leaving the market. It's the official confirmation after years of Asus acting like the smartphone business still mattered to them. The company had been quiet about its phone plans for months. When rumors leaked in early 2025 that Asus was pulling back on smartphones, the company refused to comment. Now they're spelling it out in front of investors and analysts, as noted by PCMag.

The timing matters too. Asus made this announcement while simultaneously revealing that their AI server business had doubled in 2025. Revenue jumped 26.1 percent overall, mostly driven by AI infrastructure. So Shih wasn't announcing a retreat because of weakness. He was announcing a strategic reallocation of resources to where the real money is, as highlighted by Seeking Alpha.

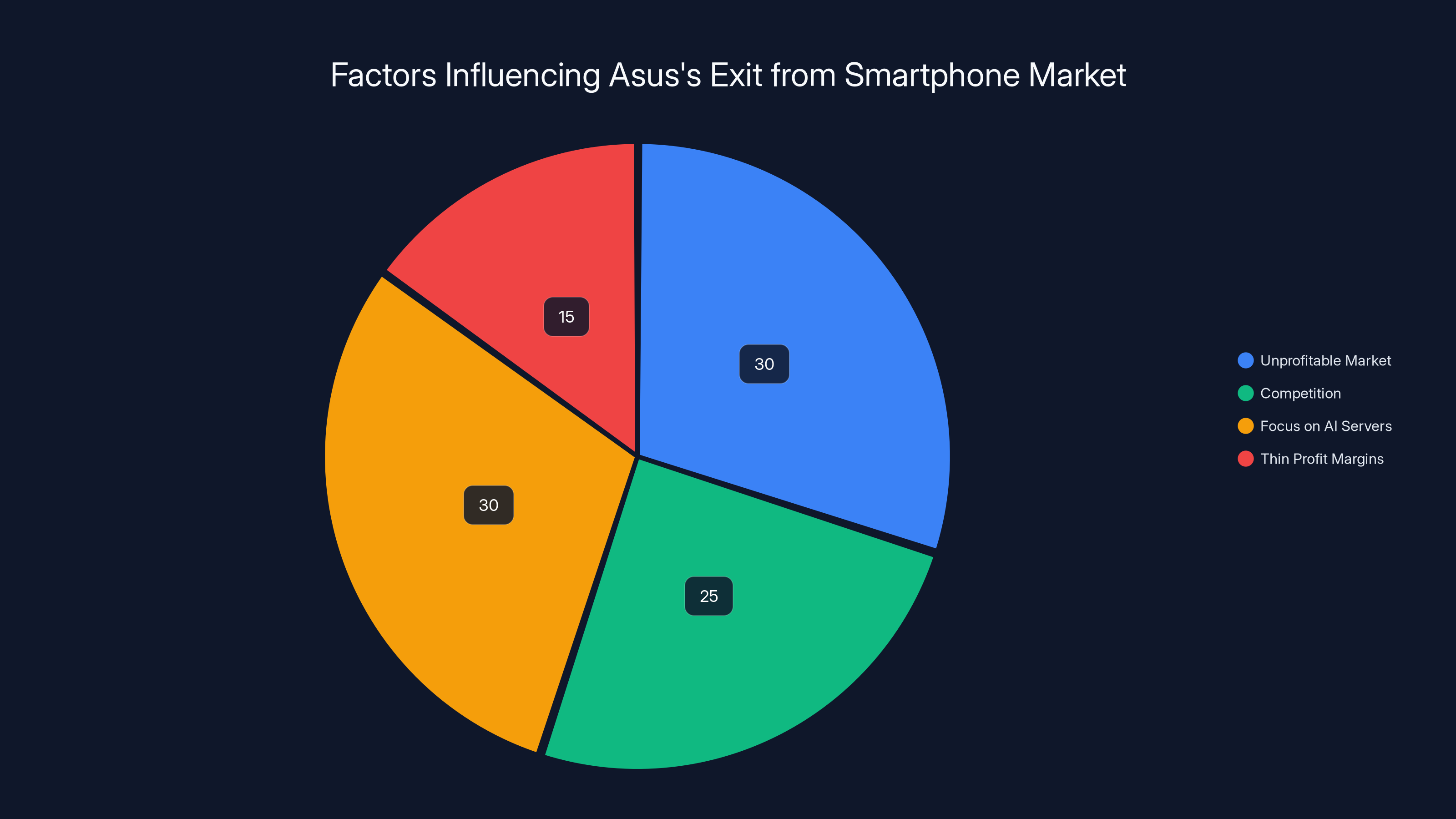

Estimated data shows that unprofitability and strategic focus on AI servers were key reasons for Asus's exit from the smartphone market.

Understanding the Asus Smartphone Legacy

To understand why this matters, you need to know what Asus actually built in the phone market. The company wasn't a rounding error. It was a serious player, at least for a while.

Back in the late 2000s and early 2010s, Asus was everywhere. The company made phones for every possible niche. Want a slider keyboard? Asus had you covered. Interested in a phone with a built-in projector? That existed, and Asus made it, as noted by Android Headlines. They were churning out devices with different form factors, different price points, and different feature sets. During the era when the smartphone market was exploding and diversifying, Asus had space to compete.

The Zenfone line became their volume play. These phones targeted people who wanted something smaller and cheaper than Samsung or Apple's offerings. Asus positioned Zenfones as the thinking person's alternative. Decent hardware. Reasonable prices. They weren't market leaders, but they carved out a respectable niche.

Then there's the ROG Phone line, which is the opposite strategy. ROG Phones are gaming-focused devices built for people willing to pay premium prices for cutting-edge hardware. The most recent ROG Phone 9 Pro starts at $1,200. That's not a typo. A thousand two hundred dollars. For context, that's more than Samsung's most expensive Galaxy devices, as reported by Union Journalism.

ROG Phones came loaded with gaming features that sounded great on spec sheets. Active cooling systems. Multiple USB-C ports. Game controller accessories. Customizable RGB lighting. A headphone jack, which was becoming rare and precious. These phones offered features and specifications that appealed deeply to a specific audience: people who took mobile gaming seriously and had money to spend.

So Asus had range. They could sell a mid-range Zenfone to price-conscious buyers and a premium ROG Phone to gaming enthusiasts. The problem wasn't the product lineup. The problem was the market itself.

The Smartphone Market Changed. Asus Didn't Adapt Fast Enough.

Here's the brutal reality about smartphones in 2025: they've become boring. And boring is actually a problem when you're trying to convince people to upgrade every year.

Back when smartphones were young and rapidly improving, you could release a new phone every year and it would feel genuinely better than the last one. Cameras got better. Processors got faster. Screens got brighter and more responsive. Battery life improved. Operating systems added new features. People actually noticed and cared about the differences.

But we've hit a plateau. Think about the phone you own right now. How much better would an upgraded version need to be for you to drop 800 or 1000 dollars on a new one? Probably a lot better than what companies are actually offering.

Screens are already excellent. They're bright, color-accurate, and responsive. Cameras are already incredible. You can shoot photos and videos that rival professional equipment. Processors are already fast enough that apps load instantly. Batteries last long enough for most people to get through a full day. Operating systems are stable and feature-complete.

Where's the innovation? Companies try. They add a new camera sensor. They make the phone 0.2mm thinner. They tweak the color grading algorithm. They add a new computational photography feature that sometimes works. But none of this feels transformative to most users. It feels incremental. And incremental improvements don't justify dropping a thousand dollars.

As a result, people are holding onto their phones longer. A lot longer. The average smartphone replacement cycle has stretched from around 3 years to 4 or even 5 years. That's a massive shift for phone makers. If you used to make 30 percent of your annual revenue from upgrade cycles, and people start upgrading half as often, your business model breaks, as discussed by DigiTimes.

Asus's support and update policies didn't help their case. The company was never known for leading the industry in software support. It was more like the opposite. A Zenfone might get two Android version updates and four years of security patches. The ROG Phone 9 Pro got the same treatment: two OS updates and five years of security patches. Compare that to what Google, Samsung, or Apple offer, and you can see why people don't build loyalty to Asus phones.

When you buy a phone and you know it's going to stop getting meaningful updates in a few years, you're less inclined to keep it. You're more likely to switch to someone else next time. And in a market where people are already upgrading less often, losing loyalty is a death sentence.

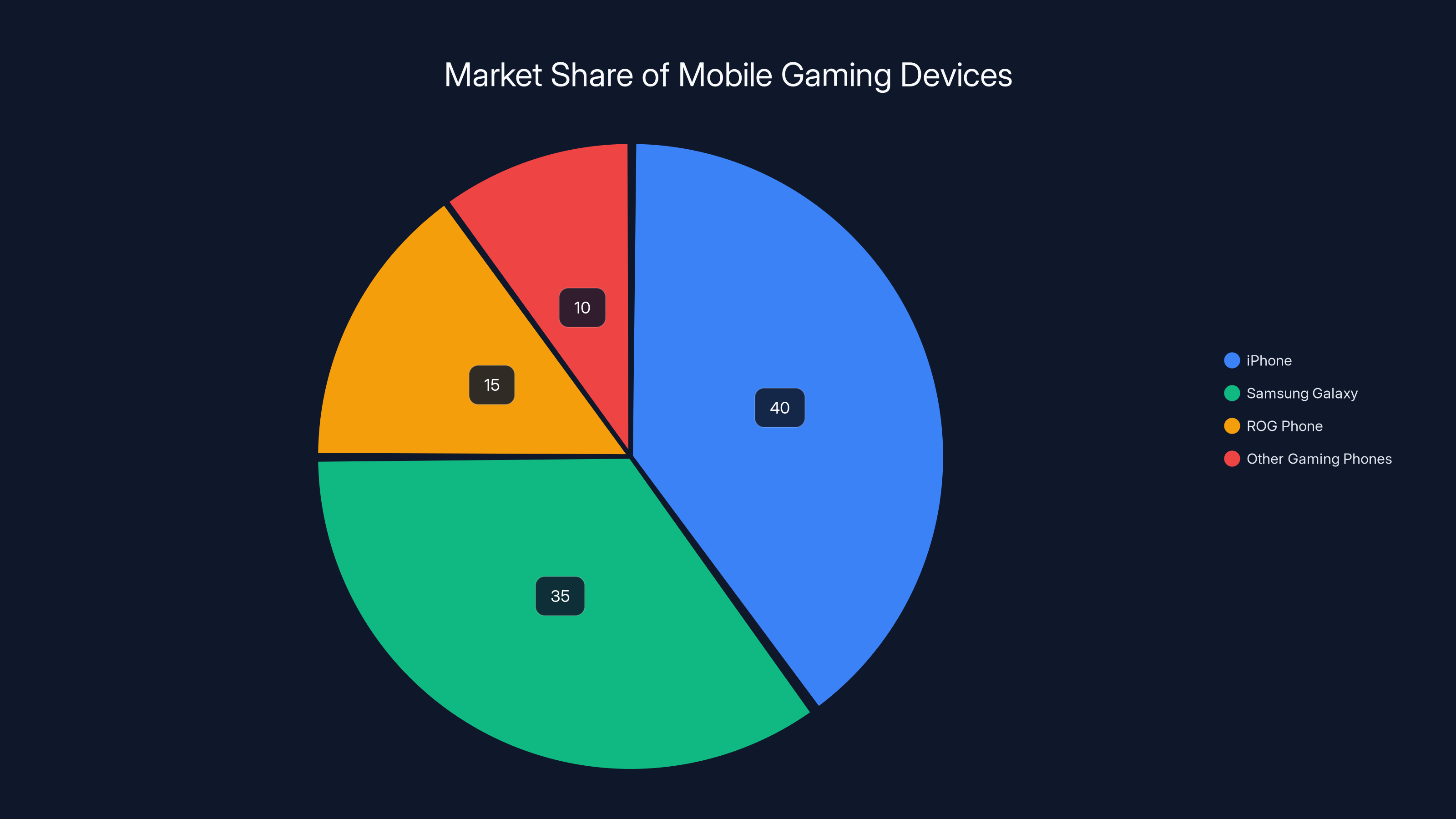

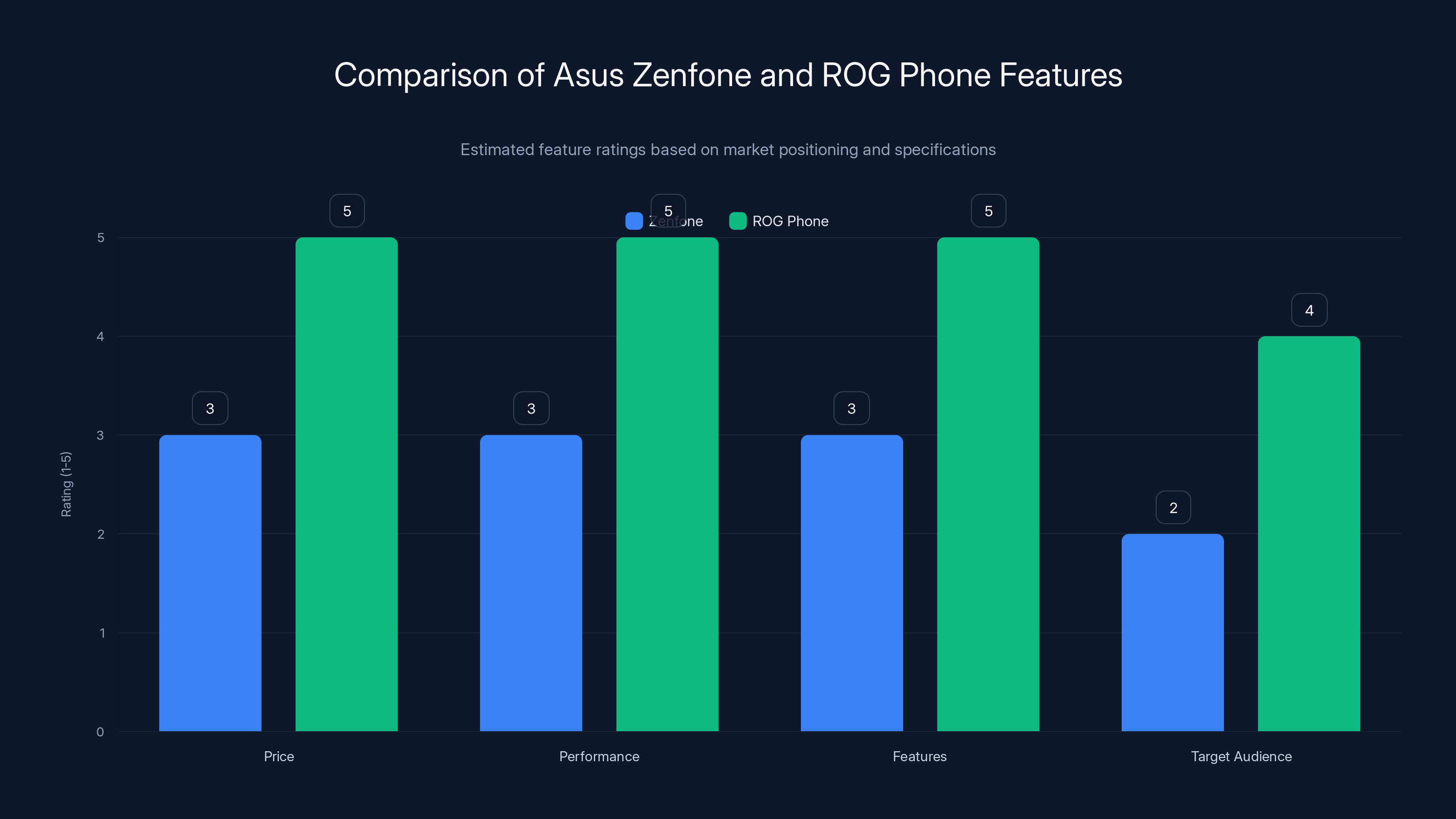

Estimated data shows iPhones and Samsung Galaxy dominate the mobile gaming market, while ROG and other gaming phones capture a smaller niche.

The Rise of Chinese OEMs Changed the Competitive Landscape

Even if Asus had nailed software support and convinced people their phones were worth keeping, they'd still face another massive problem: Chinese competition.

The smartphone market isn't what it was ten years ago. Back then, Samsung and Apple dominated globally, and companies like Asus could carve out regional niches. But Xiaomi, Vivo, One Plus, and Huawei changed everything. These companies figured out how to make phones that are just as good as Samsung or Apple's, for significantly less money. And they're incredibly fast at iterating.

When Xiaomi wants to release a new flagship phone, they can do it. When they want to respond to a competitor's new features, they can roll out updates quickly. They have the manufacturing scale, the supply chain expertise, and the market focus to move fast.

Asus, by comparison, was a company trying to do everything. Computers. Tablets. Networking equipment. Gaming peripherals. Smart home devices. Phones were just one piece of a much bigger portfolio. That meant Asus couldn't allocate the resources to phones that Chinese OEMs could. And it meant whenever Asus took a quarter off from phones to focus on something else, competitors were shipping new devices. By the time Asus came back, the market had moved on.

The result is that in most of the world outside North America, Chinese brands own the market now. Xiaomi, Vivo, OPPO, and others have brand recognition, distribution networks, and customer loyalty that Asus simply doesn't have. In developed markets like the US, Samsung and Apple own the market. Asus was squeezed from both sides, as noted by Android Police.

Asus's Support Problem Was a Fatal Weakness

I want to spend a moment on this because it's crucial to understanding why Asus couldn't sustain its phone business. Asus's software support was consistently behind the market standard.

Let's compare the update promises. Google Pixel phones now come with a promise of at least three years of major OS updates and four years of security updates, with some devices getting more. Samsung Galaxy phones get three to four years of OS updates and five years of security patches. Even One Plus, which started out sketchy on updates, now commits to at least three years of OS updates.

Asus's Zenfone? Two OS updates. Four years of security patches. The ROG Phone 9 Pro? Two OS updates. Five years of security patches.

That matters because software updates aren't just nice-to-have features. They're security patches. They're bug fixes. They're new capabilities. When you stop updating a phone, you're cutting off the device from security improvements. An unpatched phone is a vulnerable phone.

People noticed this. And gradually, they stopped trusting Asus phones. If you're going to spend

This wasn't a product problem. The Zenfone hardware was fine. The ROG Phone hardware was excellent. But the total package, including software support, didn't stack up. And once you fall behind on support, it's nearly impossible to catch up because customers remember.

Why the Market Turned on Premium Gaming Phones

The ROG Phone line is interesting because it represents a specific bet that Asus made: that gaming was becoming mainstream enough to support a premium gaming phone category.

There's logic to that bet. Gaming is huge. Mobile gaming is bigger than console and PC gaming combined in terms of revenue. Tens of millions of people play games on their phones every day. And high-end games like Genshin Impact, Honkai Star Rail, and Call of Duty Mobile can push mobile hardware pretty hard.

So the bet made sense on paper: build a phone specifically optimized for gaming, with the best processor, active cooling, customizable controls, high refresh rate display, and premium build quality. Charge a premium price. Win the gaming phone category.

Here's what went wrong. The gaming phone market turned out to be way smaller than Asus expected.

Most people who want to play demanding games on their phone will just buy the latest iPhone or Samsung Galaxy. These phones are excellent for gaming, and they come with the added benefit of actually being useful for everything else too. You get longevity. You get resale value. You get a rich software ecosystem. A premium gaming phone is only really appealing to people who exclusively care about gaming performance and don't mind sacrificing practicality.

That's a niche market. A profitable niche, maybe, but not enough to sustain a phone division long term. The ROG Phone 9 Pro at $1,200 is cheaper than the most expensive iPhones, but it's not cheaper by much. And if you're spending that much money, most people think "why not just get the iPhone or Galaxy?" They're proven. They hold their value. They're not some gadget that might fall out of favor.

And that's actually the core problem with the gaming phone category. It's always going to feel a bit niche. It's always going to seem risky. Gaming phones are for people who are explicitly willing to make a weird choice in order to get specific features. Most people aren't willing to do that.

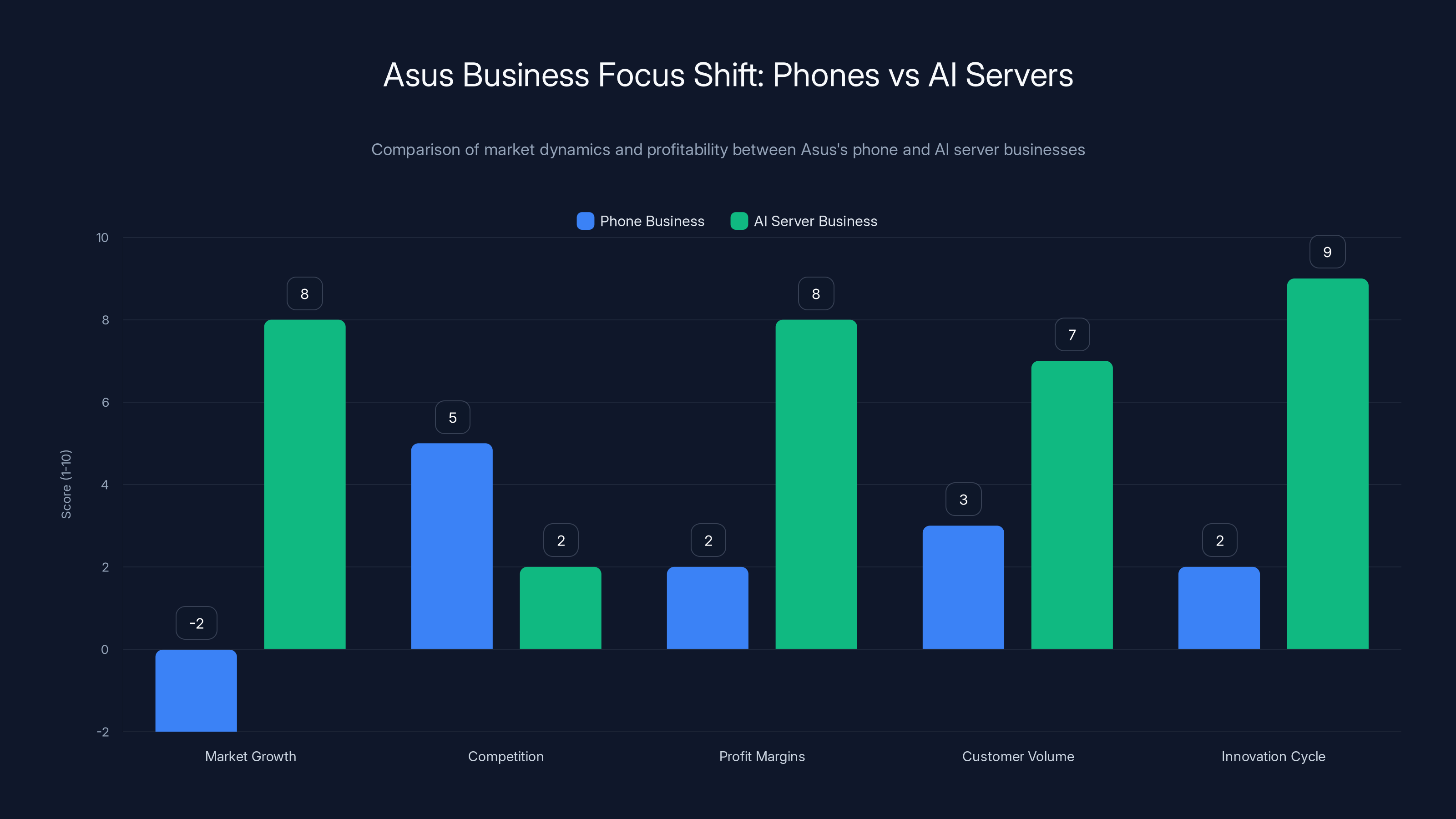

Asus's strategic shift from phones to AI servers is driven by the expanding AI market, higher profit margins, and less competition compared to the stagnating phone industry. Estimated data.

The Broader Trend: Phone Makers Abandoning Ship

Here's the thing that should actually concern you: Asus isn't the first major phone maker to quit, and it won't be the last.

LG Mobile Division was one of the first major casualties. LG was Samsung's rival in South Korea, and globally, LG made competitive phones for a long time. The company was willing to experiment with different form factors and features. They made curved displays before Samsung did. They had quirky things like dual cameras arranged vertically before that became trendy. They were a serious player.

But starting around 2019, LG started losing money on phones. Year after year, the division was in the red. LG kept saying they'd turn it around, that they'd release new phones when they had a good reason. They insisted they weren't exiting the market entirely.

Then in 2021, LG just shut down the mobile division entirely. No more phones. No comeback. Just closure.

Motorola has been in and out of the market multiple times. HTC used to be huge. BlackBerry quit the market after the iPhone crushed demand for physical keyboards. Sony tried for years and eventually became a Japan-focused player. Microsoft tried with Windows Phones and abandoned the idea. Samsung, Apple, and Google still make phones, but Samsung has been cutting back R&D investment in some markets.

The list of phone makers who've quit or significantly scaled back is long. And here's what's important: not a single one of them has ever come back after taking a serious break. Once you're out, you're out. The market moves on. Your brand loses mind share. Your supply chain dissolves. Your partnerships fade. Starting up again would be nearly impossible.

So when Asus says "indefinite hiatus," they're probably lying. Not intentionally, but that's what it will end up being. An indefinite hiatus is just another way of saying "we're exiting the market, but we're being polite about it."

The Real Story: Asus Chose a Better Business

Here's what people sometimes miss about Asus's announcement. It's not just that they're leaving phones because phones are hard. It's that they're leaving phones to focus on something way more profitable: AI infrastructure.

During the same announcement, Asus revealed that their AI server business had doubled in 2025. That's not a small thing. That's not a side project. That's a business that's growing explosively while traditional smartphones are stagnating, as highlighted by TweakTown.

AI servers are business-to-business products. They're expensive. Companies buy them by the rack, not by the unit. The margins are better than consumer phones. The support requirements are different. The software update cycle is totally different. And most importantly, the market is expanding fast while the smartphone market is shrinking.

From Asus's perspective, the decision is obvious. Why would you spend engineering resources on making a better Zenfone when you could be building more AI servers? Why would you invest in phone marketing when you could be investing in enterprise sales?

The math is brutal but simple:

Phone Business: Shrinking market. Intense competition. Tight margins. Customers holding devices longer. Update cycles that don't generate new revenue. Race-to-the-bottom pricing pressure. Slower growth.

AI Server Business: Expanding market. Less competition. Healthy margins. Enterprise customers buying in volume. Rapid innovation cycles. Strong growth.

The choice isn't hard. Asus is a company that exists to make money. As chairman Shih basically said, they're going where the money is. And right now, the money is in AI infrastructure, not smartphones.

This isn't unique to Asus. Companies make strategic decisions based on where they can be profitable. Intel doesn't make smartphones anymore. Qualcomm focuses on chip design and AI. Nvidia abandoned consumer graphics for AI chips and data centers. Every major tech company is reallocating resources toward AI.

Asus is just more honest about it. They're saying "phones aren't working for us, we're pivoting to AI." Other companies are staying quiet while they do the same thing.

What This Means for the Smartphone Market

When Asus quits phones, a lot of people say "so what? Asus phones never mattered anyway." And that's partially true. Asus's market share in global phone sales was never huge. The company was maybe 1-2 percent of the global market at its peak.

But here's what it signals: the smartphone market is consolidating. Every year, fewer companies are making phones. That means less choice for consumers. That means fewer experiments and innovations. That means the companies that remain can raise prices without fear of disruption.

Right now, the global smartphone market is dominated by Apple, Samsung, and Chinese brands like Xiaomi, Vivo, OPPO, and One Plus. Asus was one of the last independent players trying to compete across multiple price tiers. Now they're gone.

The practical impact is this: if you want a phone, your choices are narrowing. You can buy an Apple device if you want iOS. You can buy a Samsung Galaxy if you want a premium Android. You can buy a Chinese brand if you want value. Those are basically your options now. The diversity is gone.

For enthusiast products like the ROG Phone, there's even less options. Asus was one of the few companies making gaming phones seriously. ASUS ROG was known for having the best specs and cooling technology. The next alternative might be One Plus (which has gaming features but isn't dedicated to gaming) or nothing at all.

Consumers will adapt. They always do. The market will shift. But something is being lost here, and it's worth acknowledging.

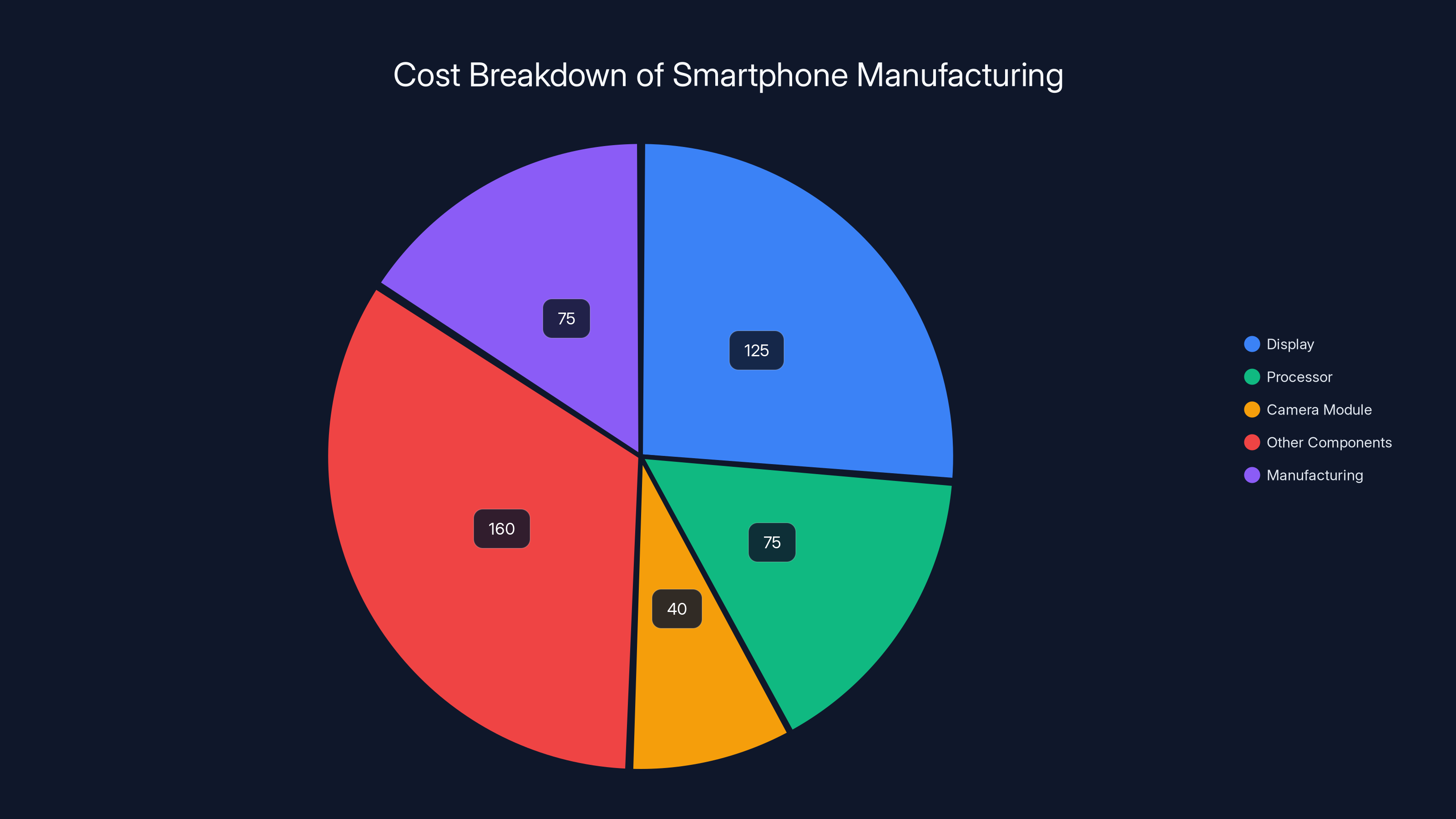

Estimated data shows that display and other components are the largest cost drivers in smartphone manufacturing, contributing significantly to the total cost.

The Software Support Issue Isn't Going Away

One area where Asus's departure has real consequences is software support. When manufacturers quit making phones, they don't immediately abandon their existing customers. But they do tend to deprioritize updates and support for devices that aren't part of an active product line.

Millions of people own Asus phones right now. They own Zenfones and ROG Phones. Those devices are still functioning perfectly fine. The hardware isn't obsolete. The processors are still capable. The cameras still take great pictures. But now their manufacturer has officially abandoned the product line.

That doesn't mean they won't get any more updates. But it does mean they're lower priority. It means security patches might be delayed. It means bug fixes might not happen. It means if there's a critical vulnerability discovered in Android that needs Asus-specific patches, it might take months to get addressed.

Over time, these devices will become increasingly out of date. Eventually, they'll hit a point where they're not supported at all. For some people, that's fine. Their phone will still work. But for others, especially those who rely on their phones for work or important activities, the lack of security updates is actually a real concern.

This is another reason why it's worth caring about Asus leaving the market. It signals the beginning of the end for a product line that millions of people are still using.

Understanding the Zenfone Niche

Before we move on, let's talk specifically about what Asus lost with Zenfones. Because the Zenfone line actually had something going for it that not many competitors offer: reasonable pricing with decent hardware.

The Zenfone was never the cheapest phone. It was never the most feature-filled phone. But it occupied a sweet spot in the market: a phone that was smaller than most competitors, didn't have unnecessary features you'd pay extra for, offered clean software without too much bloatware, and came at a price point that was actually reasonable.

That's surprisingly hard to find. Most phone makers either go for rock-bottom price (compromising on hardware) or premium price (adding features nobody asked for). Asus carved out a middle ground.

The problem was that this middle ground was shrinking. Premium phones were getting cheaper. Budget phones were getting better. The Zenfone's niche got narrower and narrower. Fewer people saw a reason to specifically choose a Zenfone when they could get a Samsung or Xiaomi for similar prices with better software support.

So even though the Zenfone line made sense in theory, it didn't work in practice. By the time Asus decided to quit making them, probably nobody would have missed them.

Why Chinese Phone Makers Thrived While Asus Struggled

There's an interesting asymmetry worth understanding here. Chinese phone makers like Xiaomi, Vivo, OPPO, and One Plus have thrived in the exact market conditions that killed Asus. So what did they do differently?

First, they were all-in on phones from the beginning. These companies didn't have computer divisions or networking divisions to distract them. Phones were their core business. That meant they could invest heavily in phone-specific expertise, supply chains, and R&D.

Second, they understood pricing psychology. These companies would rather sell 50 million phones at a thin margin than 5 million phones at a fat margin. Their business model is built on volume, not premium pricing. That's the opposite of what Asus tried with ROG Phones.

Third, they invested heavily in software quality and updates. One Plus and Xiaomi became known for clean, lightweight software. They also committed to decent update cycles. They understood that software support builds loyalty, and loyalty matters in a market where people are upgrading less often.

Fourth, they were willing to experiment rapidly. One Plus in One Plus flagships. Xiaomi in budget devices. Vivo in camera technology. These companies were willing to take risks and try new things. When something worked, they'd lean into it. When something didn't, they'd kill it fast.

Fifth, they had massive scale and manufacturing expertise. Building phones efficiently is a skill. Chinese manufacturers had been making phones and electronics for decades before they started their own brands. They knew how to optimize production, how to source components cheaply, how to build quality at scale.

Asus, by comparison, was good at computers and gaming peripherals. They were competent at phones. But they weren't obsessed. And in a competitive market, lack of obsession gets you killed.

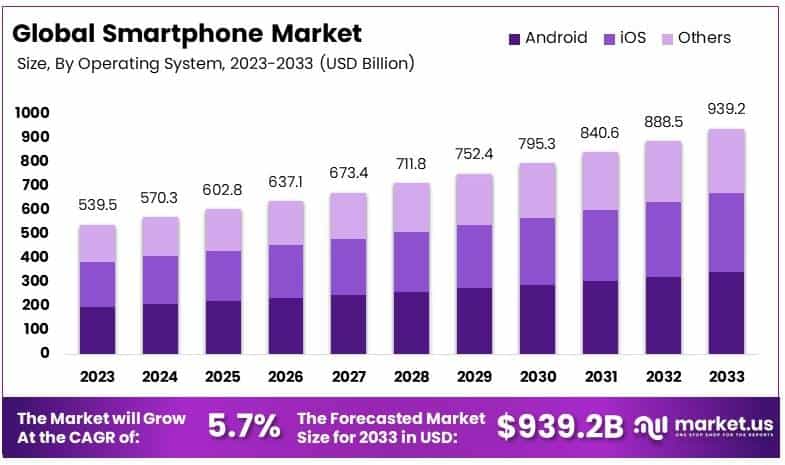

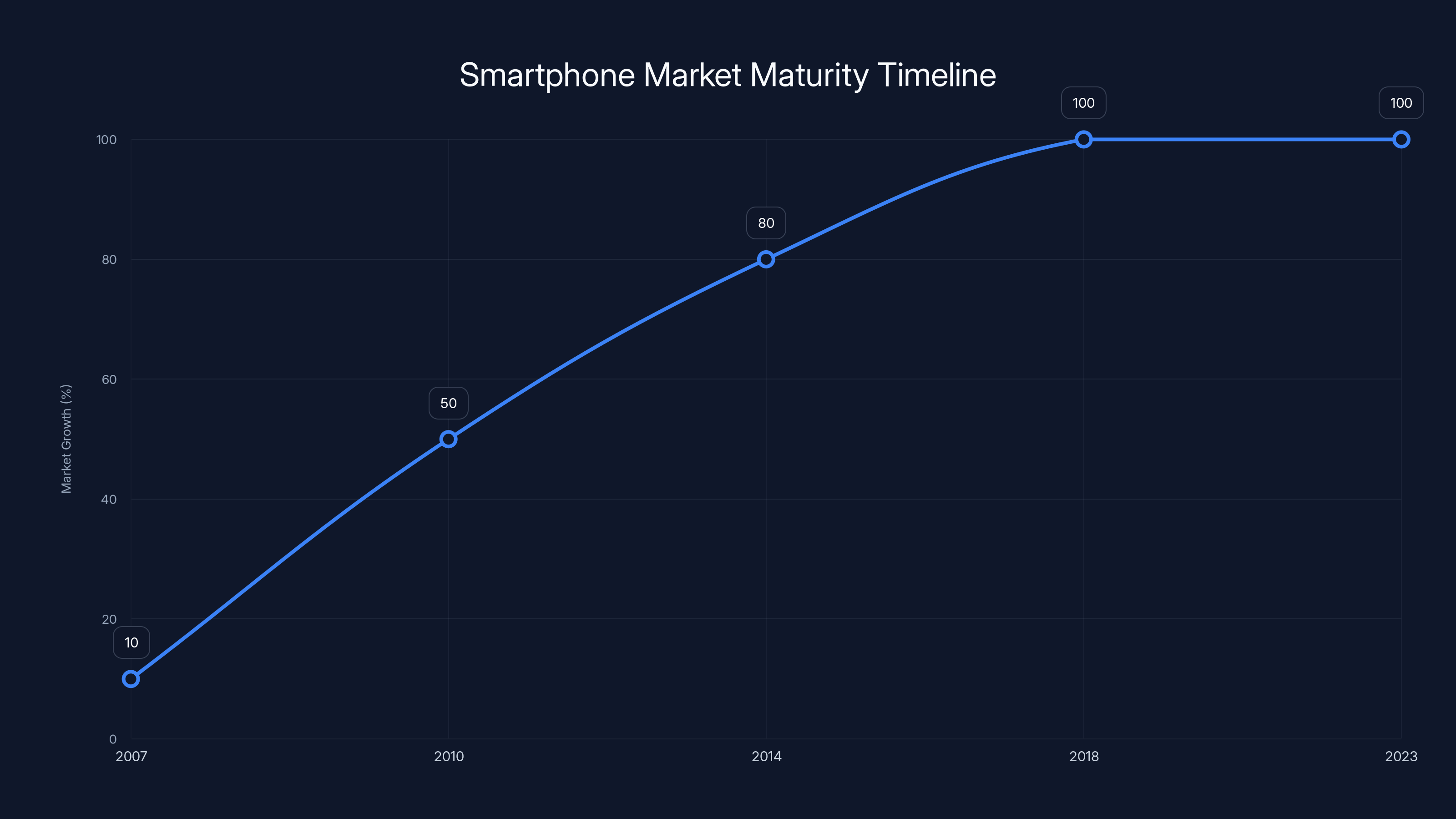

The smartphone market experienced rapid growth from 2007 to 2018, reaching maturity by 2018 where growth plateaued. (Estimated data)

The Economics of Smartphone Manufacturing

Let's zoom out and talk about what's happening economically in the phone market, because that's really what drove Asus's decision.

Making smartphones is brutally difficult from a financial perspective. Here's why.

First, the components are incredibly expensive. The display alone on a modern smartphone might cost

Then you need to actually manufacture the phone. That requires factories, skilled workers, quality control, testing, packaging. The manufacturing cost might add another $50-100.

Now you've spent maybe

But here's the problem: the market is competitive. You can't just charge $600 for a mid-range phone. Samsung, Apple, and Chinese brands have already established price expectations. If you charge too much, people just buy from someone else.

So phone makers are squeezed on both sides. Component costs are high and not really negotiable. Selling prices are constrained by competition. The only way to make money is to sell a ton of phones and capture enough market share to negotiate better prices from component suppliers.

Asus wasn't capturing enough market share. They were a niche player. That meant they were paying standard prices for components while trying to compete in a price war. The economics simply didn't work.

Meanwhile, their AI server business has much better unit economics. You're selling fewer units, but the selling price is much higher. Component costs are lower as a percentage of revenue. And there's less competition, so you have more control over pricing.

From a pure business perspective, Asus made the right call. But it's another reason why the phone market is consolidating. Only the biggest companies with massive scale can afford to compete anymore.

What Happens to Asus Phone Owners Now

If you own an Asus phone right now, here's the practical reality of what Asus's announcement means for you.

In the short term, nothing changes. Your phone will keep working. You'll probably keep getting security updates for a while. The Asus support website will still exist. You can still call customer service if you have problems.

But over time, the support will fade. Asus will deprioritize updates. When critical vulnerabilities are discovered, Asus will patch them slowly. When bugs are reported, Asus might not fix them. Eventually, your device will stop receiving updates altogether.

This might be fine for you. If you use your phone casually and don't care about the latest features, an unsupported phone is just a phone that stops getting new stuff. But if you use your phone for work, or if you handle sensitive information, the lack of security updates becomes a real liability.

Moreover, you're now the owner of a device from a manufacturer that no longer exists as a phone maker. The resale value will tank. If you ever want to sell your Asus phone, you'll find that nobody wants to buy it because they know Asus has exited the market. Why buy last year's Asus phone when you could buy this year's Samsung or Google for the same price?

So if you're an Asus phone owner, the lesson is this: you're on your own now. Not immediately, but eventually. You're holding a device with an expiration date that got pushed forward a few years.

That might not bother you. But it's a cost of buying from a smaller phone maker. You're betting that the company will stay in the market and keep supporting your device. When that bet doesn't pay out, you're stuck.

The Broader Implications for Consumer Choice

Let's zoom out and think about what Asus's exit means for the broader tech industry.

Every year, more companies abandon the smartphone market. Every year, more consumers find that their choices are narrowing. This is the opposite of what we'd want in a competitive market. Ideally, you'd have dozens of phone makers competing, each trying different strategies and features.

Instead, we're consolidating around a handful of brands. Apple, Samsung, and Chinese manufacturers own the market. Everyone else is either exiting or becoming irrelevant.

This consolidation has consequences:

-

Less innovation: When there are fewer competitors, there's less pressure to innovate. Phone makers can release incremental upgrades and call them revolutions. There's nobody pushing them to do better because there's nowhere else for customers to go.

-

Higher prices: With less competition, phone makers can charge more. The market is less price-competitive when you have fewer choices. You'll see prices stay high even as component costs fall.

-

Less experimentation: Niche phone designs become impossible. Gaming phones, small phones, affordable flagships with great software. These niches exist because of companies like Asus. When Asus exits, those niches disappear.

-

Slower innovation: This might seem counterintuitive, but consolidation actually slows innovation. When you have fewer competitors, you have less pressure to innovate. You also have more reason to milk existing designs. Samsung would rather sell Galaxy S25 in 47 variants than take a risk on a radical new design.

-

Software fragmentation: With fewer manufacturers, you get less experimentation with Android customization. This is actually good for software consistency, but bad for innovation in what phones can do. Every phone is starting to feel the same.

These aren't catastrophic consequences. Phones still work great. People still have choices. But we're seeing a slow erosion of the competitive market that made smartphones what they are today.

The ROG Phone line excels in performance and features, targeting high-end gaming enthusiasts, while Zenfone offers balanced features at a lower price point for budget-conscious consumers. Estimated data based on market positioning.

How the Smartphone Market Became Mature

To understand why this is happening, you need to understand that the smartphone market has gone through a classic technology adoption lifecycle.

When smartphones were brand new (2007-2010), there was massive innovation and rapid improvement. The first iPhones had tiny screens and slow processors compared to today. Early Android phones were experimental and weird. Phone makers were constantly trying new things because everything was new. There was room for dozens of different approaches.

Then the market entered the growth phase (2010-2018). Smartphones became mainstream. Every year brought new features and better performance. People upgraded regularly because each new phone was meaningfully better. During this phase, multiple companies could compete because the market was expanding fast enough for everyone to make money.

Now we're in the mature phase (2018-present). Smartphones are good enough. Innovation is incremental. Upgrade cycles are slower. The market isn't growing; it's just replacing old devices with new ones. In a mature market, only the biggest, most efficient players can compete profitably.

This is what every technology eventually faces. Personal computers went through the same thing. Televisions went through the same thing. Automobiles went through the same thing. When a technology matures, competition consolidates.

Asus's exit is just another data point in this inevitable process. It's not surprising. It's actually the expected outcome.

The Role of AI in Reshaping Tech Priorities

One more thing worth understanding: the reason Asus is leaving phones isn't just that phones are hard to sell. It's that AI infrastructure is incredibly lucrative right now.

AI is reshaping tech spending priorities across the industry. Companies are moving resources away from consumer products and toward AI infrastructure. GPUs, AI chips, data center equipment, AI software. This is where growth is happening. This is where profit is possible.

Asus's announcement is partly about phones being a bad business. But it's also partly about AI being a great business. The company isn't struggling financially; they're just reallocating resources to where returns are higher.

This is happening everywhere. Major tech companies are cutting consumer product lines to invest in AI. Teams are being reorg'd to focus on AI. Budget is being moved from proven products to speculative AI projects.

For Asus, this means phones became the product line to sacrifice. It's a strategic choice based on financial analysis. The company sees AI infrastructure as the future and phones as the past.

Whether that's correct remains to be seen. But it's the calculation that led to this decision.

What Could Have Saved Asus's Phone Business

Let's imagine an alternate timeline where Asus didn't quit phones. What would they have needed to do differently?

First, they would have needed a unique value proposition that nobody else could replicate. The Zenfone's "smaller and cheaper" positioning wasn't unique enough. If Asus had committed to something specific, like "the best software support in the industry" or "phones built for privacy," that might have given them a defensible position.

Second, they would have needed to invest heavily in software quality and updates. This is non-negotiable. Consumers care about getting updates. If Asus had committed to four years of OS updates and five years of security patches, they'd have been competitive. Instead, they lagged. That decision alone probably cost them significant market share.

Third, they would have needed to pick a single market and dominate it. Instead of trying to be everything to everyone, Asus should have said "we're the best phone maker in Japan" or "we're the best gaming phone maker" and focused all resources on winning that specific battle.

Fourth, they would have needed to be willing to lose money for several years to build market share and brand loyalty. That's not realistic for a public company with shareholders. But it's what Chinese competitors were willing to do. Xiaomi, OPPO, and others lost money for years to build their brands. Asus wasn't willing to do that.

Fifth, they would have needed to accept lower profit margins and higher volume. Asus wanted to maintain the profit margins of a premium brand while competing with budget brands. That math doesn't work.

There's no single thing that would have saved Asus's phone business. It would have required a complete strategic overhaul, years of investment, and willingness to accept lower profits. For a company focused on AI infrastructure, that wasn't going to happen.

The Future of Smartphone Market Consolidation

If Asus is exiting, who's next? Which other phone makers might follow?

Motorola is still making phones, but they're not independent anymore. They're owned by Lenovo, a Chinese company. Motorola functions as a sub-brand. It's not really a competitor in the traditional sense.

HTC is still technically making phones, but they've become irrelevant. Their market share is nearly zero. They're basically a zombie company at this point.

One Plus is still independent and still making phones, but they're in a weird position. They're owned by BBK Electronics, which also owns Vivo and Oppo. So they're kind of independent but not really.

Sony still makes phones, but only in Japan. Globally, Sony has given up on phones.

Nokia used to be a phone maker, then they exited entirely, now there are Nokia-branded phones made by HMD Global. But these are licensing deals, not actual Nokia phones.

The reality is that the list of independent phone makers is getting very short. Apple, Samsung, Google, and Chinese brands. That's basically it.

I don't think many more major phone makers will exit in the next couple of years. The market has stabilized somewhat. But I also think we've reached the point where only the biggest, most resourceful companies can compete in phones. That era of Asus, HTC, Sony, and LG all making phones is over. It's not coming back.

Why Smartphones Matter Less Than They Used To

Here's one more perspective that's worth considering: smartphones are becoming less important as a technology category.

I know that sounds weird because everybody uses smartphones. But from a business perspective, phones are mattering less.

Ten years ago, smartphones were cutting-edge technology. Phone makers were racing to push the boundaries of what was possible. Phone innovation was visible and exciting. A new iPhone or Galaxy was an event.

Now, smartphones are mature technology. They're reliable. They're good enough. Most people don't care about the differences between phones anymore. The differences are so small that they don't matter in daily use.

Meanwhile, new categories have emerged as more interesting and more lucrative. AI. Wearables. VR. Smart home. Autonomous vehicles. Cloud computing. For ambitious tech companies, phones represent the past, not the future.

When a company like Asus looks at its future, phones aren't where they see growth. Phones aren't where they see innovation. Phones aren't where they see the opportunity to build something remarkable.

So it makes sense that Asus abandoned phones to focus on AI. They're not alone. Every major tech company is reallocating resources the same way. It's not specific to Asus or phones or the market conditions we've discussed.

It's part of a larger shift where smartphones have gone from being the future of computing to being a mature, commoditized product. That's actually fine. Mature products serve their purpose. But it means the era of intense smartphone competition is probably over.

Conclusion: What Asus's Exit Teaches Us

When Asus quit making phones, it wasn't because they failed at building good devices. The Zenfone was solid. The ROG Phone was exceptional. The problem was that Asus was trying to compete in a market that had become hostile to their business model.

Smartphones have matured. People aren't upgrading as often. The upgrade cycle has stretched from three years to four or five. That's a fundamental change that makes phone manufacturing less profitable.

Meanwhile, Chinese competitors have captured the value in the smartphone market by optimizing for volume and efficiency. American and Taiwanese phone makers can't compete on those dimensions. Samsung and Apple survive because they have loyal customers willing to pay premium prices and because their brands are too valuable to abandon.

Asus didn't have that. They had good products in a shrinking market. Eventually, the math stops working, and that's what happened.

The bigger lesson is that smartphone market consolidation is real and probably irreversible. We're unlikely to see dozens of phone makers competing in the future. We're going to have Apple, Samsung, a handful of Chinese brands, and nobody else. Consumers will adapt. People will still have decent phone choices. But the diversity that characterized the 2010s is gone.

For people buying phones today, that means understanding that your choices are limited and will get more limited over time. It means choosing a phone from a manufacturer that's committed to the long term. It means being skeptical of niche products from companies that might exit suddenly.

For the tech industry broadly, Asus's exit is a confirmation that the smartphone era of rapid innovation and intense competition is ending. The next big things are AI, robotics, autonomous systems, and new computing paradigms. Phones will keep improving incrementally, but they're not where the exciting technology work happens anymore.

Asus was right to look at that landscape and make a strategic decision. Staying in phones would have meant slowly declining relevance. Pivoting to AI infrastructure means competing in a growth market with fewer competitors and better margins.

That's not a failure. That's actually smart business decision-making.

FAQ

Why did Asus completely stop making smartphones?

Asus stopped making smartphones because the market had become unprofitable for them. Smartphones have matured into a commoditized product with slower upgrade cycles, intense competition from Chinese manufacturers like Xiaomi and Vivo, and thin profit margins. Simultaneously, Asus's AI server business doubled in 2025, generating significantly better returns. Chairman Jonney Shih made a strategic decision to reallocate resources from a struggling consumer market to a booming enterprise market, as detailed by TweakTown.

Will Asus ever make phones again?

Asus stated they might release phones again in the future if something changes, but this is essentially a polite way of saying no. Historically, when major phone makers take a break from phones, they never successfully return. LG Mobile is the prime example: they said they'd return when they had a good reason, then permanently shut down five years later. Once a company exits the market, regaining market share, rebuilding supply chains, and reestablishing brand loyalty becomes nearly impossible, as noted by PCMag.

What happens to existing Asus phone owners?

Existing Asus phone owners will continue receiving software updates for a while, but support will gradually decline over time. Asus phones like the Zenfone and ROG Phone will eventually stop receiving security updates and Android version upgrades. The devices themselves will remain functional, but the lack of support becomes a liability for security-conscious users. Resale value will also decrease significantly since there's no active product line anymore.

Why was the ROG Phone so expensive if it wasn't successful?

The ROG Phone was expensive because Asus positioned it as a premium gaming device with cutting-edge components, active cooling systems, and specialized gaming features. The market for such a niche product turned out to be much smaller than Asus anticipated. Most consumers willing to spend $1,200 on a phone would rather buy an iPhone or Samsung Galaxy, which offer better overall value, longer software support, and broader functionality beyond gaming.

How did Chinese phone makers succeed where Asus failed?

Chinese manufacturers like Xiaomi, Vivo, OPPO, and One Plus succeeded by being completely focused on phones as their core business. They optimized for high volume and low margins rather than premium pricing. They also invested heavily in software quality, competitive update cycles, rapid experimentation, and efficient manufacturing. They were willing to operate at thin profit margins while building market share and brand loyalty, something established players like Asus couldn't justify to shareholders.

Is the smartphone market really consolidating?

Yes, absolutely. The smartphone market has consolidated dramatically. Ten years ago, dozens of companies made phones. Today, the market is dominated by Apple, Samsung, and Chinese brands. Companies like Asus, HTC, LG, Sony, and Motorola have all exited or become irrelevant. This consolidation reflects the smartphone market moving from a growth phase with room for multiple competitors to a mature phase where only the largest, most efficient players can compete profitably.

Why don't phones improve as fast anymore?

Smartphones have matured as a technology. Displays are already excellent. Cameras are already exceptional. Processors are already fast enough for any real-world task. Battery life is adequate. Operating systems are stable and feature-complete. There simply aren't major innovations to build anymore. This lack of meaningful improvement is why people hold onto phones longer, which reduces upgrade cycles and makes the business less profitable for phone makers.

What is Asus focusing on instead of phones?

Asus is focusing on AI infrastructure, particularly AI servers, which saw their revenue double in 2025. The company is also exploring AI robots and smart glasses. AI infrastructure represents a high-growth market with fewer competitors and better margins than smartphones. Unlike phones, AI infrastructure is in an early growth phase where innovation is still happening rapidly and companies can charge premium prices.

How does software support affect phone manufacturer viability?

Software support is crucial because it directly impacts customer loyalty and device longevity. Manufacturers that commit to longer update cycles build customer trust and create repeat buyers. Asus's two-year OS update commitment was significantly behind competitors like Samsung, Google, and One Plus, which offered four years or more. This inferior support policy directly contributed to customers choosing other brands and Asus's declining market share.

What does Asus's exit mean for smartphone consumers?

Asus's exit represents the end of an era with multiple competing phone makers. Consumers now have fewer choices, coming down to primarily Apple, Samsung, and Chinese brands. This consolidation reduces innovation, experimental designs, and niche products. There's less pressure on remaining competitors to innovate or maintain low prices. The smartphone market is becoming more predictable but less diverse.

Key Takeaways

- Asus quit smartphone manufacturing indefinitely to focus on AI infrastructure, which doubled in revenue during 2025

- Smartphone market maturity with extended replacement cycles (3 years to 4.7 years) fundamentally broke traditional phone maker business models

- Asus faced impossible competitive positioning: squeezed by Apple and Samsung premium segments while outcompeted by Chinese manufacturers on value

- Software update policy failures (2-year OS updates vs. 4-5 year competitors) directly eroded customer loyalty and market competitiveness

- Market consolidation is irreversible: LG and other previous exiters never returned, signaling Asus's indefinite hiatus is likely permanent

- Chinese manufacturers succeeded where Asus failed through complete business focus on phones, willingness to accept thin margins, and superior software support

- Smartphone manufacturing economics require $300-400+ component costs, making profitability dependent on massive scale only largest manufacturers can achieve

- Phone market consolidation now leaves only Apple, Samsung, and Chinese brands viable, with fewer choices and less innovation pressure on competitors

![Why Asus Quit Smartphones: The Death of a Phone Maker [2025]](https://tryrunable.com/blog/why-asus-quit-smartphones-the-death-of-a-phone-maker-2025/image-1-1768847842125.jpg)