Apple Podcasts Gets a Major Video Upgrade: What It Means for Creators and Listeners

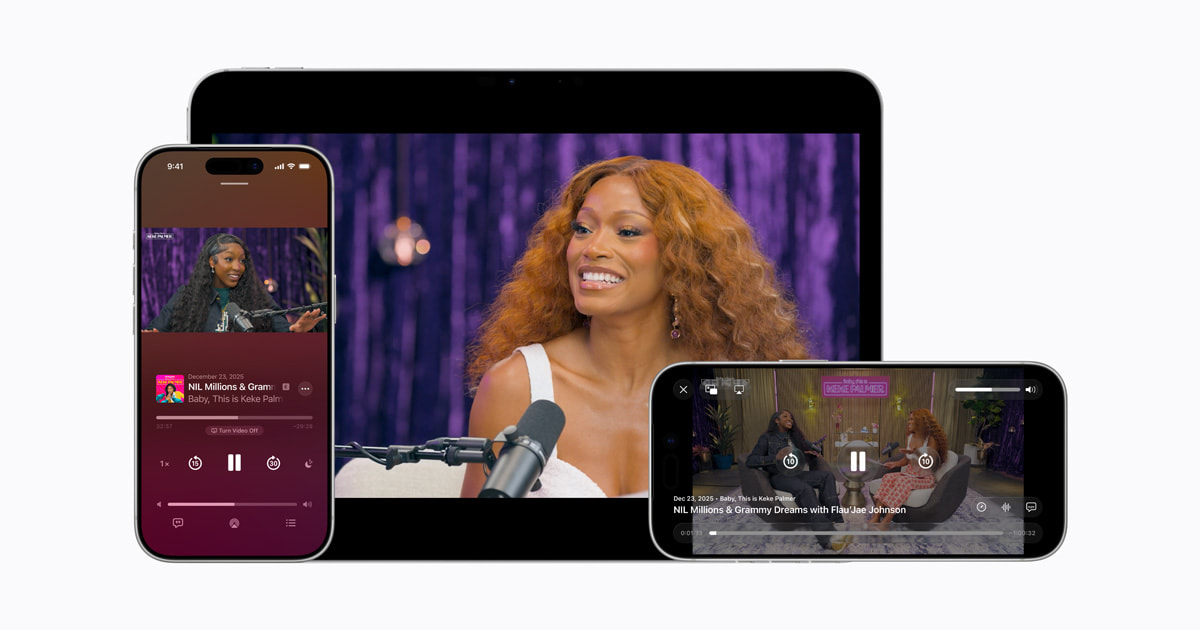

Apple just made a strategic power move in the podcast wars, and it's one of those announcements that feels understated until you realize what's actually happening. The company is rolling out a completely redesigned video podcast experience in its native app starting this spring. No compromise, no half-measures, just a full-featured video watching platform built right into the tool billions of people already use.

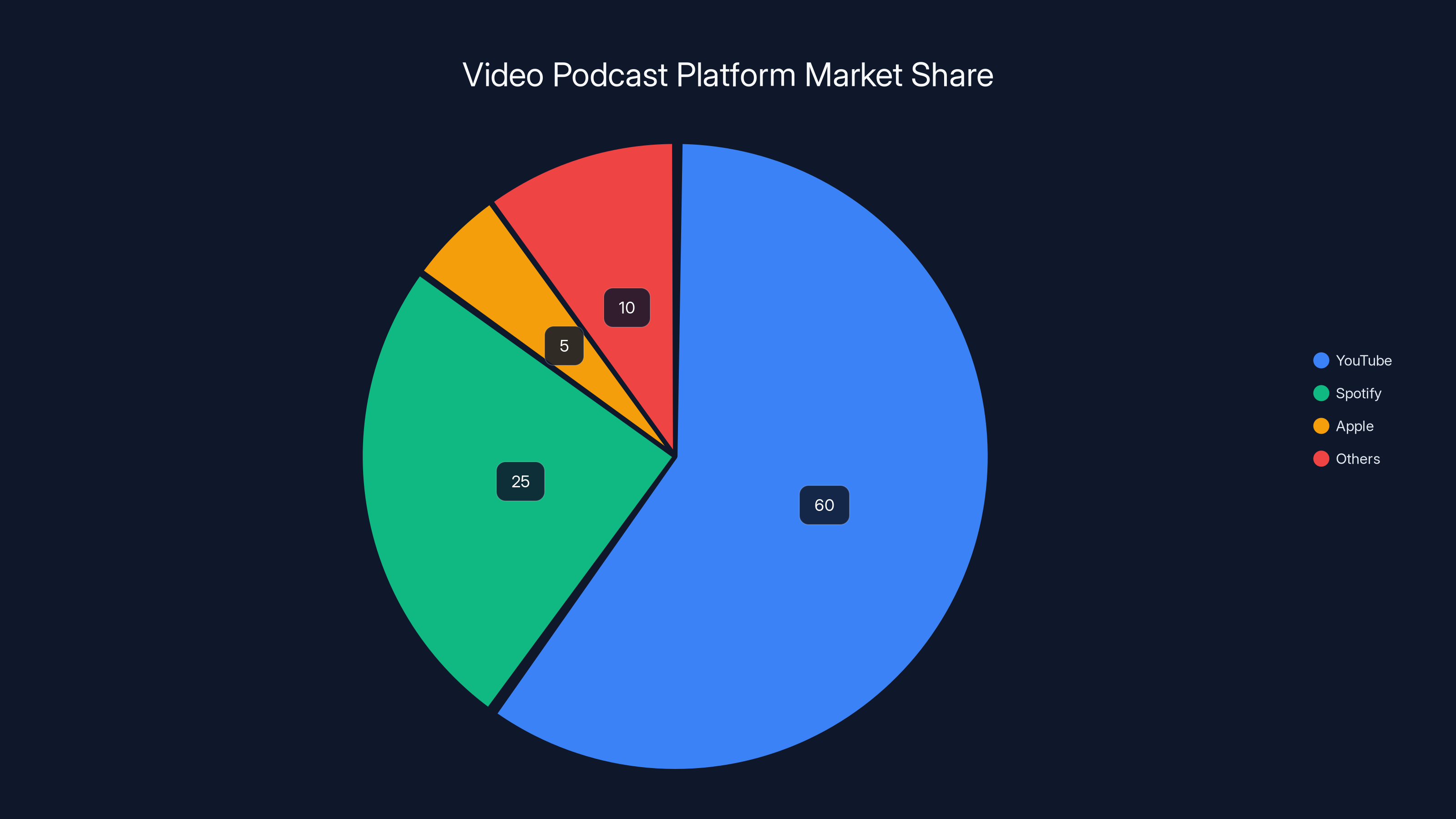

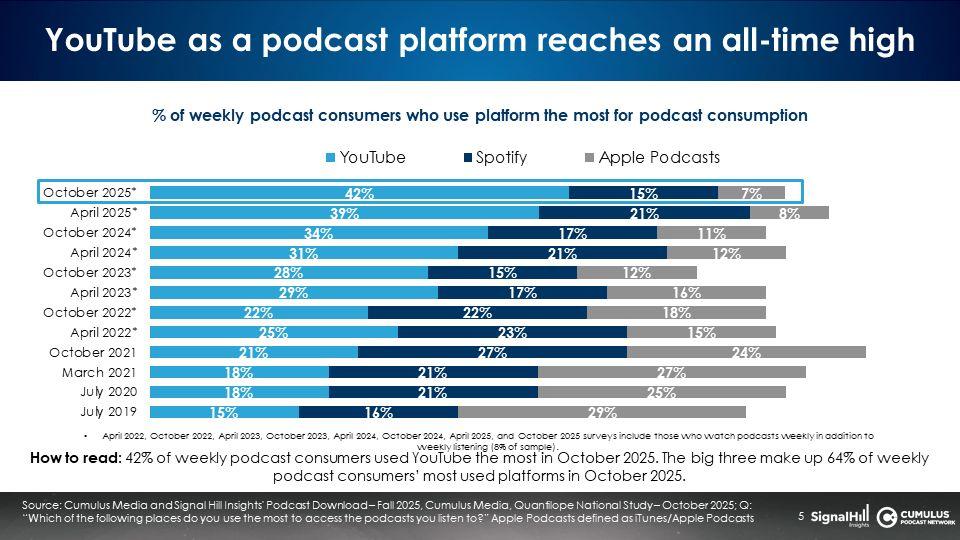

Here's what's wild about this: Apple's been sitting on the podcast market for decades, ever since Eddy Cue and team turned iTunes into the distribution engine that made podcasting actually reach normal people. But they've been passive about video. YouTube grabbed video podcasts. Spotify invested hundreds of millions into the format. Netflix started treating podcasts like prestige content. Meanwhile, Apple was like, "Yeah, people can listen to podcasts." Not anymore.

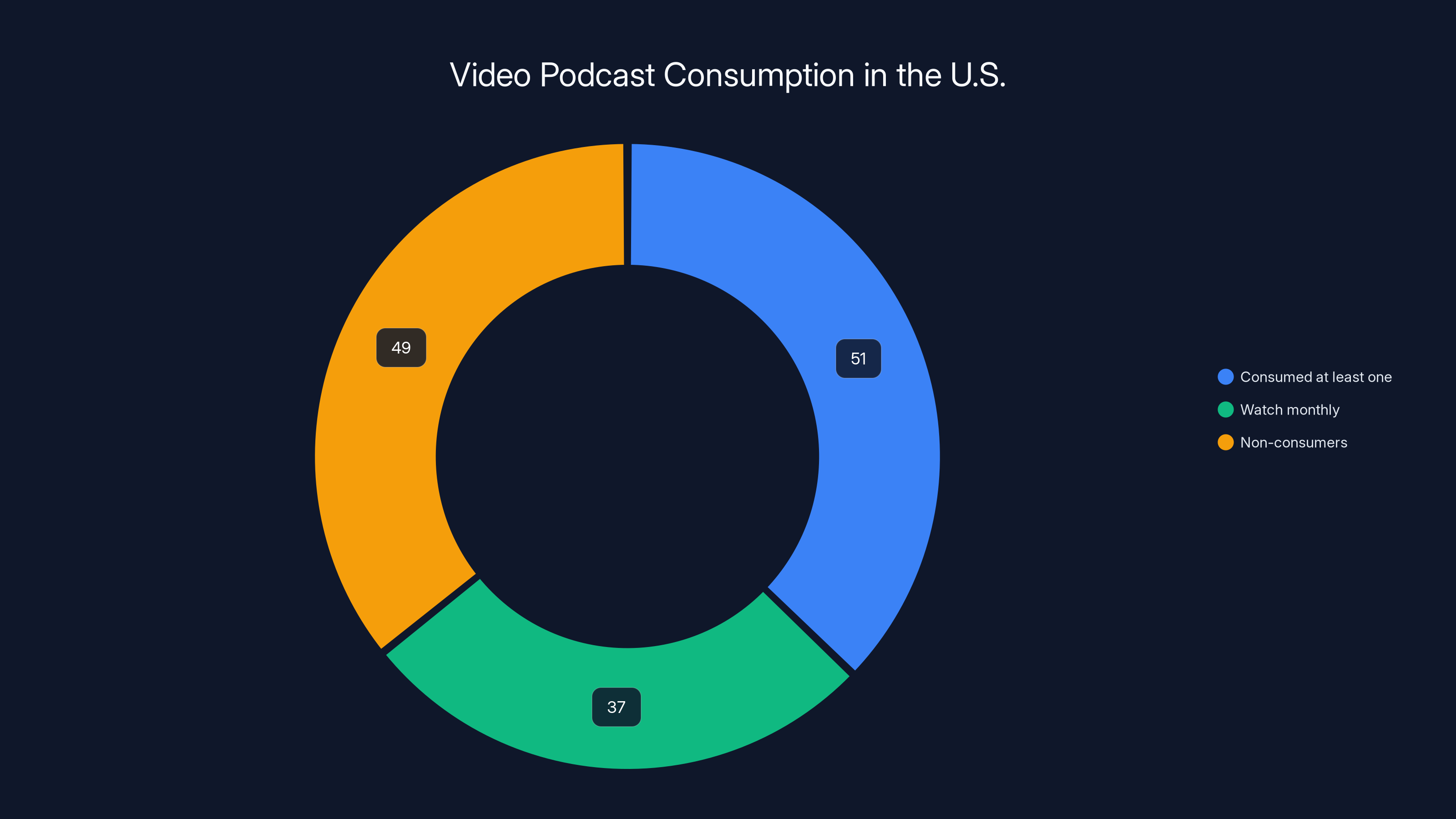

The timing matters. Video podcast consumption hit a tipping point. According to Edison Research, 51% of the U.S. population has now consumed at least one video podcast, and 37% watch them monthly. That's not niche behavior anymore. That's mainstream. YouTube's sitting on over 1 billion monthly active viewers of podcast content. Spotify's got 500,000 video podcasts with nearly 400 million users having watched at least one. Netflix partnered with iHeart Media and Spotify to bring the format into the streaming ecosystem. The market decided video podcasting is the present, not the future.

Apple's move addresses a genuine friction point that creators and listeners have complained about for years. You'd find a podcast you wanted to watch. You'd open Apple Podcasts. It wouldn't work well. You'd switch to YouTube or wherever else the creator uploaded it. Apple watched this happen thousands of times a day and finally decided to fix it.

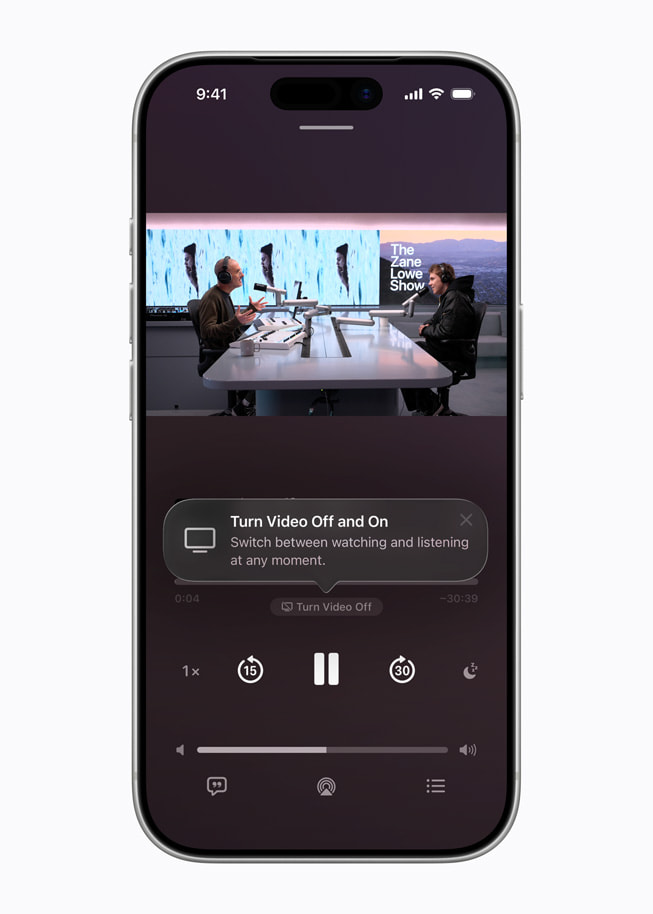

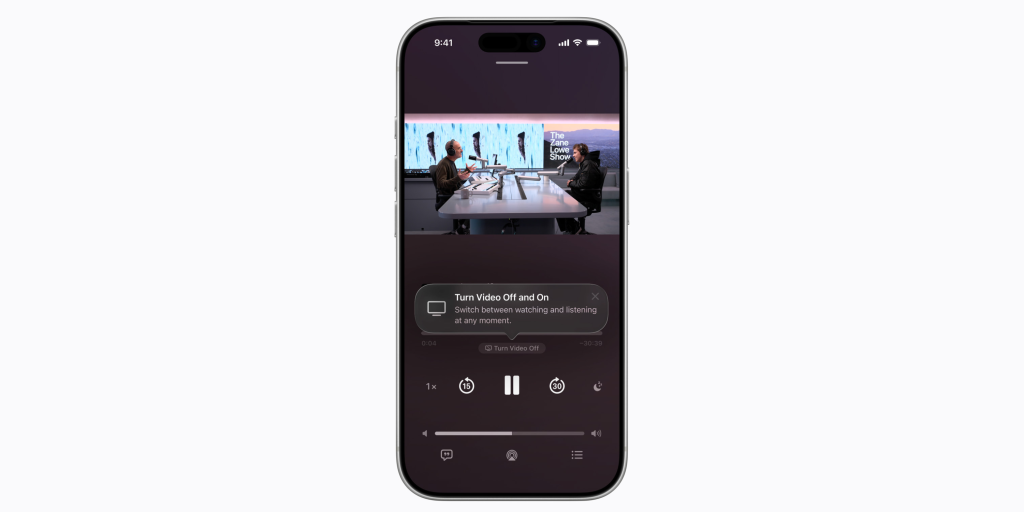

The new video experience includes three specific improvements: seamless switching between video and audio modes without reloading, full-screen horizontal orientation for comfortable viewing, and the ability to download video episodes for offline watching. These aren't revolutionary features individually, but together they solve the actual problems people encounter.

What makes this particularly significant is the technical foundation. Apple's using HTTP Live Streaming technology (HLS), the same standard that powers basically all professional video on the internet. This isn't a quick bolt-on feature. This is enterprise-grade video infrastructure that scales to billions of people. The company's betting serious engineering resources on this.

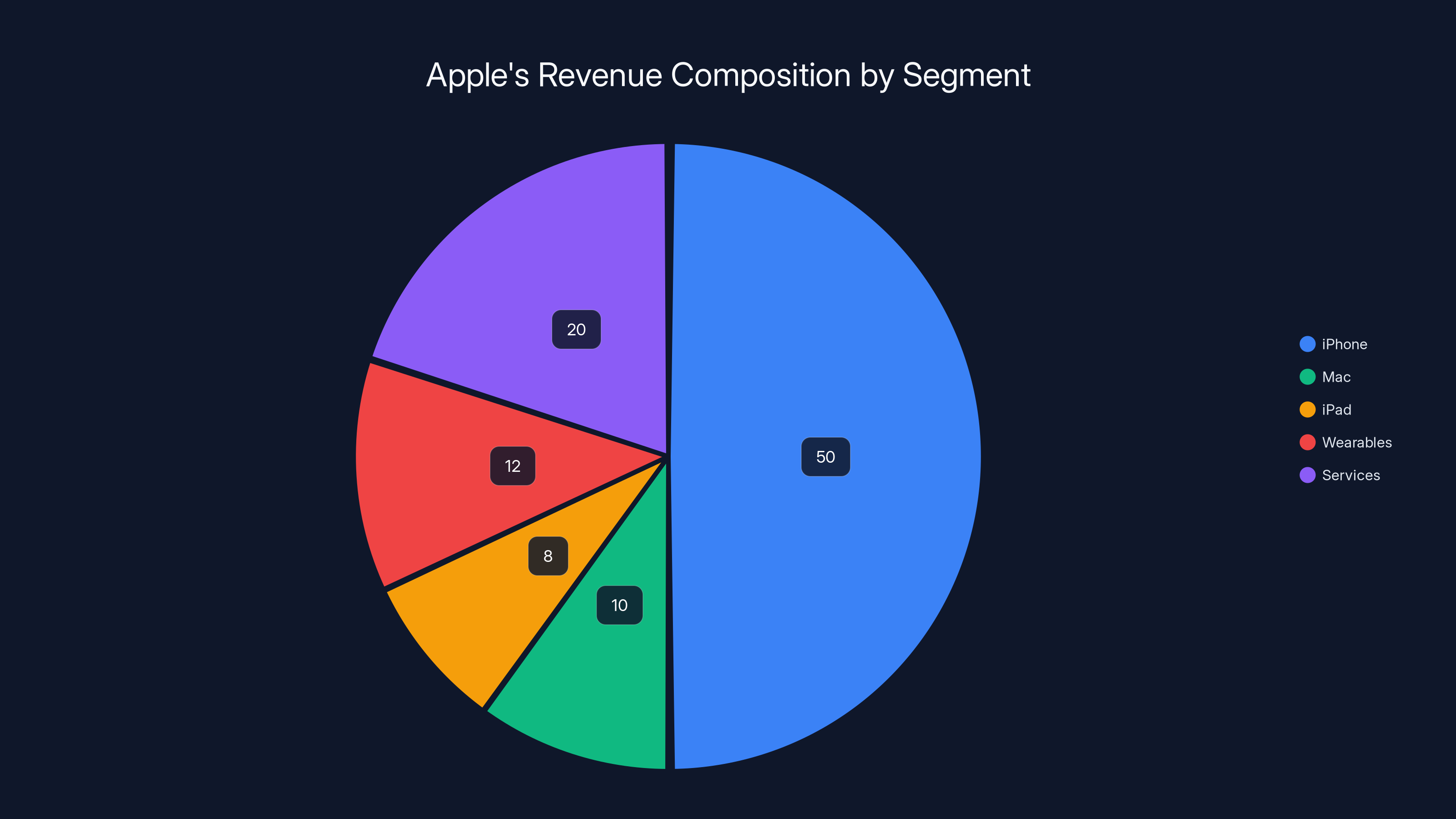

Why now? Why not five years ago? The answer's actually interesting. Apple's services business has become increasingly important to the company's overall revenue. Podcasts sit inside that services ecosystem, and Apple Podcasts subscription is a piece of that. As competition intensified, Apple realized they were losing potential users to better video experiences on competing platforms. A listener who prefers watching their favorite show on YouTube is a listener not opening Apple Podcasts, not potentially upgrading to premium, not engaging with Apple's ecosystem.

This is a compete-or-lose moment, and Apple's not losing.

The Market Reality: Video Podcasting Exploded While Apple Slept

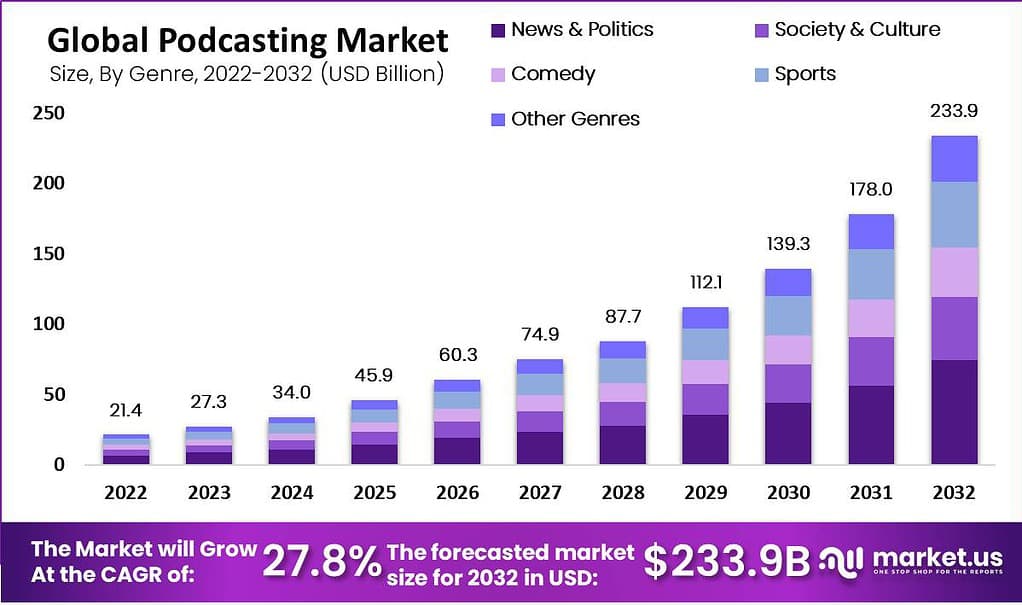

Let's ground this in actual market data because the numbers tell the story of why Apple had to act.

Video podcasting adoption has been accelerating for the past two years in ways that surprised even optimistic analysts. Edison Research's latest survey data shows that video podcast consumption has moved from early-adopter behavior to mainstream participation. The 51% figure for anyone who's consumed a video podcast at least once is the key inflection point. That's not a niche. That's half the country.

The monthly consumption number (37%) is particularly important because it shows sustained engagement, not just trial. People aren't watching one video podcast and stopping. They're coming back. They're building habits. That's how markets transition from experiment to standard.

YouTube's position in this market is dominant but also somewhat accidental. YouTube didn't plan to become the world's largest video podcast platform. They just built a platform that works well for everything, and creators found it useful for podcasts. The platform now has over 1 billion monthly active viewers specifically watching podcast content. That's a massive audience, and it didn't exist five years ago.

Spotify's situation is more intentional and therefore more instructive. The company saw podcasts as a way to differentiate from Apple Music and keep people inside their ecosystem longer. They invested heavily. They signed exclusive deals. They built creator tools. And it worked. Half a million video podcasts on Spotify with 400 million viewers is a meaningful piece of the platform's value. This is exactly what Netflix watched happen, which is why they made their moves into podcasting.

Apple's slice of this market has been surprisingly small despite their massive advantage in distribution. Apple has about 2 billion active devices in circulation. Even if just 30% of those people use the Podcasts app, that's 600 million potential viewers. But poor video experience meant people weren't watching podcasts in the app. They were downloading the audio, or they were switching to YouTube for video versions.

The competitive pressure is real and accelerating. Netflix's entry into podcasts sent a signal: this format matters enough to commit premium platform resources to. When Netflix enters a market, it typically means that market has matured to the point where major players need to have a presence. You can't build a complete entertainment platform without podcasts anymore. You just can't.

Apple's had the assets to compete this whole time. What changed wasn't capability, it was priority. The market finally became big enough that losing it meant something in terms of services revenue and ecosystem lock-in.

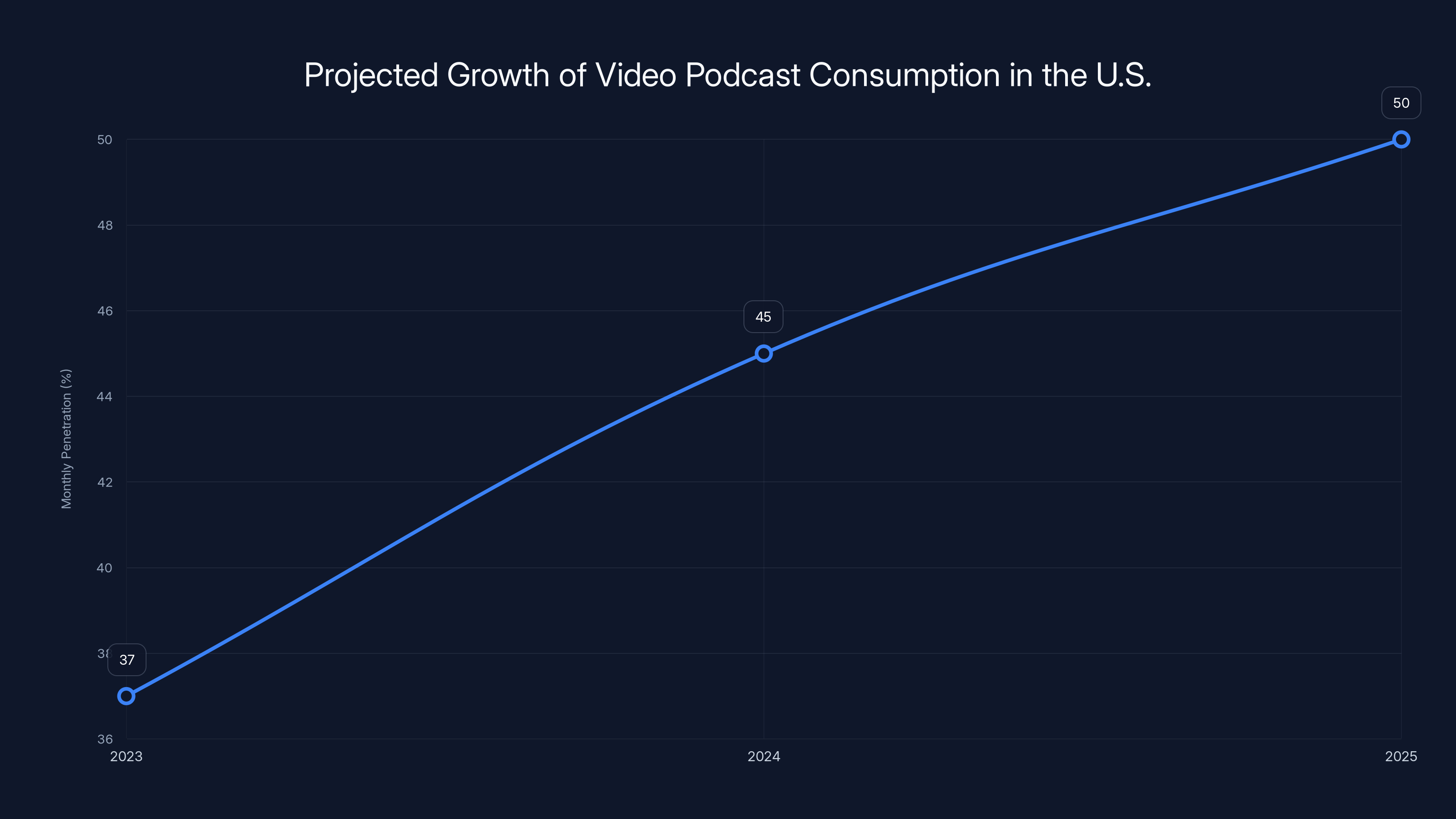

Video podcast consumption is projected to grow from 37% in 2023 to 50% by 2025, indicating a shift towards video as a standard format. Estimated data.

How the New Video Experience Actually Works

The technical implementation matters here because it reveals Apple's confidence in this being a long-term platform feature, not a temporary experiment.

HTTP Live Streaming (HLS) is the backbone of this implementation, and that choice tells you something important. HLS is used by basically every professional streaming service on the internet. Netflix uses it. Amazon Prime uses it. Disney+ uses it. It's the de facto standard for video streaming at scale because it handles variable network conditions, works across different devices, and scales to billions of concurrent viewers.

Why did Apple choose HLS instead of building something proprietary? Because HLS actually works better for the specific use case of podcasts. Podcasts aren't Netflix originals with massive budgets. They're individual creators or small production companies. HLS is simpler for them to implement. It doesn't require special software or expensive encoding infrastructure. Most podcast hosting platforms can already deliver HLS streams because it's become so standard.

The video-to-audio switching feature is the consumer-facing innovation that matters most. Think about current friction: you're watching a video podcast, you get called into a meeting, you want to keep listening while you're walking. Right now, you have to switch apps or use a separate audio track. The new experience lets you tap a button and keep the same episode playing in audio mode without missing anything.

This is a seemingly small thing that's actually a game-changer for daily usage. Podcasts are consumed during transitions: commutes, meals, household chores, exercise. A platform that lets you fluidly move between video and audio mode handles that reality better than any single-format platform.

Offline downloads for video are another practical feature that nobody initially asks for but everyone appreciates once it exists. People download audio podcasts regularly. Commutes in tunnels, flights, areas with no signal, limited data plans, whatever. Being able to download video episodes for offline watching means the platform works for everyone, not just people with unlimited data and perfect signal.

The horizontal viewing mode is basically table stakes at this point. Mobile phones are narrower in portrait than they are in landscape, and video content looks better on wider screens. The fact that this needed to be called out as a feature is kind of sad, but the alternative is worse video watching than YouTube provides, which would mean YouTube remains the default for video podcasts.

Apple's testing approach also matters. The beta release through iOS 26.4, iPadOS 26.4, and visionOS 26.4 means early access for developers and tech-forward users. This gives Apple real-world feedback on streaming reliability, playback issues, and usability problems before the full rollout. It's the responsible approach for a platform feature of this scale.

One thing that's understated in Apple's announcement but important strategically: this puts creators in control of how their content gets packaged and monetized. Creators can choose to upload to Apple Podcasts and benefit from the native app experience. They're not forced to choose between YouTube for video reach and Apple for distribution. They can do both, and the Apple experience is now competitive.

YouTube dominates the video podcasting market with a 60% share, while Spotify holds 25%. Apple's share is minimal at 5%, highlighting its late entry into the market. (Estimated data)

The Competitive Landscape: YouTube, Spotify, and Netflix Fighting for Podcast Dominance

YouTube's position as the dominant video podcast platform is both strong and precarious. Strong because 1 billion monthly active viewers is an absurd number, and YouTube's algorithm is unmatched at surfacing content people want to watch. Precarious because YouTube's relationship with creators is complicated by monetization disputes, copyright complexity, and the fact that podcasts aren't YouTube's core business.

Creators love YouTube's reach and hate YouTube's unpredictable monetization. Some podcasters make excellent money through YouTube's Partner Program. Others hit demonetization issues for saying certain words or discussing controversial topics. The inconsistency drives creators crazy. If Apple Podcasts offers better control to creators, that's a genuine competitive advantage.

Spotify's approach is different because Spotify had everything to prove. The company's not a video platform by nature. Spotify's world is audio. But Spotify realized that podcast listeners were consuming video elsewhere, which meant engagement falling outside their ecosystem. The half-million video podcasts on Spotify with 400 million viewers represents a massive effort to integrate video into what was fundamentally an audio platform.

Spotify's advantages include deep creator relationships from their podcast acquisitions (remember when they bought Gimlet Media and other producers?), a growing advertising network that spans audio and video, and the fact that their user base is already used to finding podcasts in the Spotify app. Switching Apple Podcasts to have equal video capability makes Spotify's video investment less differentiating.

Netflix's entry into podcasts is the most recent and most aggressive. Netflix doesn't do half-measures. They're integrating video podcasts into their main streaming app, giving them the same promotional real estate as their other content, and bundling them with the subscription. This positions podcasts not as an adjacent format but as core entertainment.

The risk Netflix takes is alienating their core film and TV audience if podcasts become too prominent in the app. The opportunity is capturing hundreds of millions of users who might not subscribe to Spotify or YouTube but are already paying for Netflix. If your favorite podcast is available in Netflix with perfect integration and no separate subscription, that's convenient enough to win.

Apple's historical advantage in podcasting comes from distribution control. Two billion devices run Apple operating systems. If you put something useful in the stock app, billions of people can access it with one tap. That's unprecedented reach. But reach doesn't matter if the experience sucks. For years, the Apple Podcasts video experience sucked.

This new rollout closes that gap. When every major platform offers similar video capability, the competition moves to other factors: discovery algorithms, creator tools, monetization fairness, user interface, and cross-platform integration.

Apple's ecosystem advantage becomes relevant again once the video baseline is competitive. An Apple user who can watch podcasts in Apple Podcasts and then see those recommendations surface in Apple Watch, Apple TV, and HomePod has ecosystem benefits that YouTube doesn't provide. That's not an advantage that shows up in this announcement, but it's baked into Apple's strategic thinking.

What This Means for Podcast Creators

Creators are the variable that determines whether any of these platforms actually wins the podcast wars. The platform with the best tools for creators, the fairest monetization, and the largest audience wins. Apple's now in this competitive dynamic where it was previously sidelined.

The first thing creators care about is reach. The broader question is whether moving to video-capable Apple Podcasts actually expands their audience or just distributes the same audience across more formats. This is a critical distinction.

For creators who already have video podcasts, the Apple Podcasts upgrade removes friction. They can upload once and provide video and audio versions without separate uploads to different platforms. That matters operationally. It saves time. It reduces encoding costs. It means creators can update one source and have multiple formats automatically available.

For creators considering adding video to their podcast, Apple Podcasts' upgrade makes that decision easier. They don't have to build their entire video strategy around YouTube or Spotify. They can test video on Apple's platform, see if their audience engages with it, and scale based on actual data rather than guessing.

Monetization is where things get interesting. Apple hasn't detailed the monetization strategy for video podcasts yet. That's a huge question mark. If Apple provides better revenue sharing than YouTube or Spotify, that's a competitive advantage that creators will actually care about. If Apple offers tools to sell subscriptions or premium content directly to listeners through Apple Podcasts, that's meaningful differentiation.

YouTube's monetization through ads is good if you have reach but inconsistent in enforcement. Spotify's approach through their advertising network is less developed for video than for audio. Netflix's approach of bundling podcasts with subscription is great for reach but doesn't give creators direct revenue unless they're producing exclusive content.

Apple's could theoretically build something that's better than all alternatives: video ads, creator subscriptions, direct payments, and exclusive partnerships all in one platform. The fact that they haven't detailed this yet is interesting. Maybe they're still building it. Maybe they're being cautious about over-promising.

One advantage Apple has that's often overlooked: their massive installed base of premium subscribers. Apple One bundles services including Apple Music, Apple TV+, Apple News+, and Apple Arcade into one subscription. If Apple Podcasts becomes a core part of that bundle, suddenly millions of paying subscribers are prime candidates for premium podcast features. This gives Apple a monetization path that YouTube and Spotify can't match.

Creators should treat Apple's announcement as an opportunity to expand their distribution strategy, not as a reason to abandon existing platforms. The optimal strategy remains multi-platform. But the calculus around which platforms matter is shifting. Apple just moved from a secondary distribution channel to a primary one.

Apple Podcasts shows strong potential in audience reach and ease of use, while YouTube leads in creator tools and monetization. Estimated data based on platform capabilities.

The Technical Reality: Why This Matters for Streaming Quality

Understanding the technical foundations helps explain why Apple's implementation might actually be better than what competitors offer, despite them being later to video.

HTTP Live Streaming protocol that Apple's using has advantages that matter at scale. HLS chunks video into segments that are typically 2-10 seconds long. Each segment can be independently encoded at different quality levels. When a viewer's connection is slow, the player automatically requests lower-quality segments. When connection improves, it scales up. This happens seamlessly without pausing or buffering.

This might sound like basic functionality, and it is, but executing it at Apple's scale with their obsession about polish makes a difference. The difference between a streaming experience that works 95% of the time and one that works 99% of the time is the difference between people using your platform and abandoning it for something more reliable.

Apple's also bringing their ecosystem advantages to video streaming. The company controls the entire stack on iOS: the operating system, the hardware, the video player, the network stack. They can optimize at every level. A third-party platform like YouTube is building on top of Android or iOS, working with whatever network conditions exist, managing battery usage constraints, everything. Apple can optimize all of that together.

This is why Apple Video services tend to have better playback quality and battery efficiency than competitors on Apple devices. It's not magic. It's the result of controlling the whole system.

Download-and-watch capability, which Apple's offering, requires different infrastructure than streaming. Downloaded video needs to be encoded in formats that work across the range of devices, stored locally in a way that doesn't eat storage, and managed so it doesn't create problems for the rest of the system. This is technically straightforward but requires thoughtful implementation. Apple's probably overthought this compared to competitors, which means it'll just work.

One technical detail that's easy to overlook but significant: Apple Podcasts uses the same video infrastructure as Apple TV+ and Apple Music. This means video podcast uploads can leverage the same content delivery network, the same encoding facilities, and the same quality assurance processes. For creators, this means better reliability and professional-quality delivery.

Battery efficiency is another consideration that matters on mobile. YouTube's video player is optimized for battery efficiency, but it's still a JavaScript-based web technology on top of the browser on top of the OS. Apple Podcasts' video player can be native code all the way down, which means better battery life for viewers watching on their phones. This might sound like a small thing, but when someone's consuming a three-hour podcast on a commute and worrying about their battery, native implementation matters.

The seamless switching between video and audio mode that Apple's highlighting in their announcement requires specific technical infrastructure. Basically, the app needs to maintain playback state, know the current position in the episode, and smoothly hand off between the video decoder and the audio decoder. YouTube doesn't offer this because YouTube's world is video-first. When you switch to audio on YouTube, you're basically pausing the video and starting a different stream. Apple's built this better.

This is a good example of Apple's tendency to make "customer experience" decisions that require substantial technical investment. The engineering overhead to make that seamless switching work correctly across different phone models, iOS versions, and network conditions is not trivial. But from the user perspective, it's just smooth. That's Apple's trademark move.

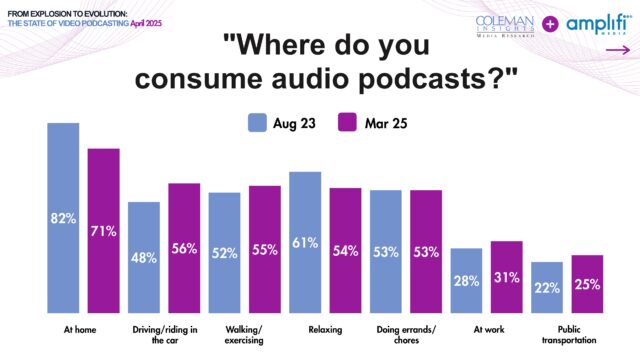

Market Growth and Consumer Adoption Trends

The larger trend here is that podcast consumption is fragmenting across more platforms while simultaneously growing in absolute size. That's unusual. Usually, growth concentrates around one or two winning platforms. But podcasts are different because the barrier to entry is low enough that multiple platforms can serve multiple audiences simultaneously.

Audio podcast consumption is mature and relatively flat. Growth in the podcast market is coming from video and from international markets. As video podcast adoption accelerates, the platforms that offer good video experiences will capture more time and attention.

Edison Research's data on monthly video podcast consumption (37% of U.S. population) is important for projecting where this is heading. If video podcast consumption is at 37% monthly penetration now and growing, we're probably looking at 45-50% within two years. At that point, video podcasts shift from "thing some people do" to "standard format that most people encounter."

This growth benefits all platforms and none of them simultaneously. More people watching video podcasts means bigger audiences for creators and more value created. But that value distribution depends on which platforms people prefer to use. Apple's entry into competitive video podcasting happens at the right time to capture a meaningful piece of that growth.

The market's also seeing interesting segmentation by demographic and content type. News and politics podcasts are driving significant video consumption. Interview shows are almost always video now. Educational podcasts are increasingly adding video components. Comedy podcasts remain split between audio and video depending on the creator's style.

International markets are also important to this story. Video podcasting adoption is different in different regions. In some European markets, video podcast consumption is already above 40%. In Asia, YouTube dominates even more than in the U.S., so platforms there are starting from different competitive baselines. Apple's global rollout means standardized video podcast experience worldwide, which is an advantage in international markets where Apple's device penetration is stronger.

The subscription model for podcasts is also evolving. YouTube has YouTube Premium. Spotify has free and Premium. Netflix has different subscription tiers. Apple has Apple One and Apple Podcasts+. As these platforms add more premium features to podcasts, listener behavior will shift. Some listeners will pay extra for ad-free content. Some will pay for exclusive access to creators. Some will bundle everything with a services subscription.

This creates opportunities for creators to differentiate. The creator who offers premium video content available only on Apple Podcasts can capture a slice of Apple One subscribers directly. The creator who partners with Netflix gets Netflix's promotional power. The creator who focuses on YouTube gets access to YouTube's 1 billion monthly viewers.

Optimal strategy still involves presence everywhere, but the emphasis shifts based on audience size and audience value. Apple's competitive video experience means Apple Podcasts shifts from optional to essential in that distribution strategy.

51% of the U.S. population has consumed at least one video podcast, with 37% watching monthly, indicating a shift towards mainstream adoption.

The Strategic Importance of This Move for Apple

Apple's services business has become increasingly important to the company's overall revenue and profit. In recent years, services have grown from a rounding error to a meaningful piece of Apple's economics. This means that apps like Apple Podcasts aren't just convenience features; they're revenue drivers and ecosystem hooks.

A user who listens to podcasts regularly is a user who opens Apple Podcasts multiple times per week. That's engagement. That engagement drives brand affinity. That brand affinity makes it harder for the user to leave the Apple ecosystem. This is exactly the kind of sticky user experience that Apple cares about.

The services revenue component is also significant. Apple Podcasts+ (premium subscriptions for podcasts) is currently a small revenue stream, but it's a test of whether Apple can monetize podcasts. If the video upgrade drives podcast engagement higher, that creates a bigger market for premium subscriptions and a stronger case for bundling podcasts into Apple One.

Competitively, Apple's move also sends a signal to Spotify, YouTube, and Netflix that Apple's serious about defending podcasting as a core platform feature. For years, Apple could claim that podcasting was important but didn't put meaningful resources behind the video experience. Now they are. Competitors need to consider whether their podcast initiatives get adequate investment in response.

The timing is also strategic for another reason. Apple's working on spatial computing with Vision Pro. Podcasts are actually interesting content for spatial displays. Imagine watching a podcast in a large virtual screen while you're doing other things, with the podcast automatically following your gaze or hand gestures. Apple's eventually going to make video podcasts work better in Vision Pro than anywhere else, which gives them another unique selling point.

But that's future thinking. Present thinking is that Apple Podcasts was losing video podcast consumption to competitors and needed to fix that immediately. They did.

Apple's also making a bet on HLS becoming more widespread for podcasting. By positioning their infrastructure around an open standard rather than a proprietary technology, they're making it easier for the broader podcast ecosystem to adopt professional video delivery. This benefits everyone and particularly benefits Apple because it becomes the reference implementation of "how to do podcasts right."

The enterprise advantage Apple has is that they can afford to implement podcast video streaming better and more carefully than startups or smaller platforms. This creates a quality bar that's hard for competitors to match without investing significantly.

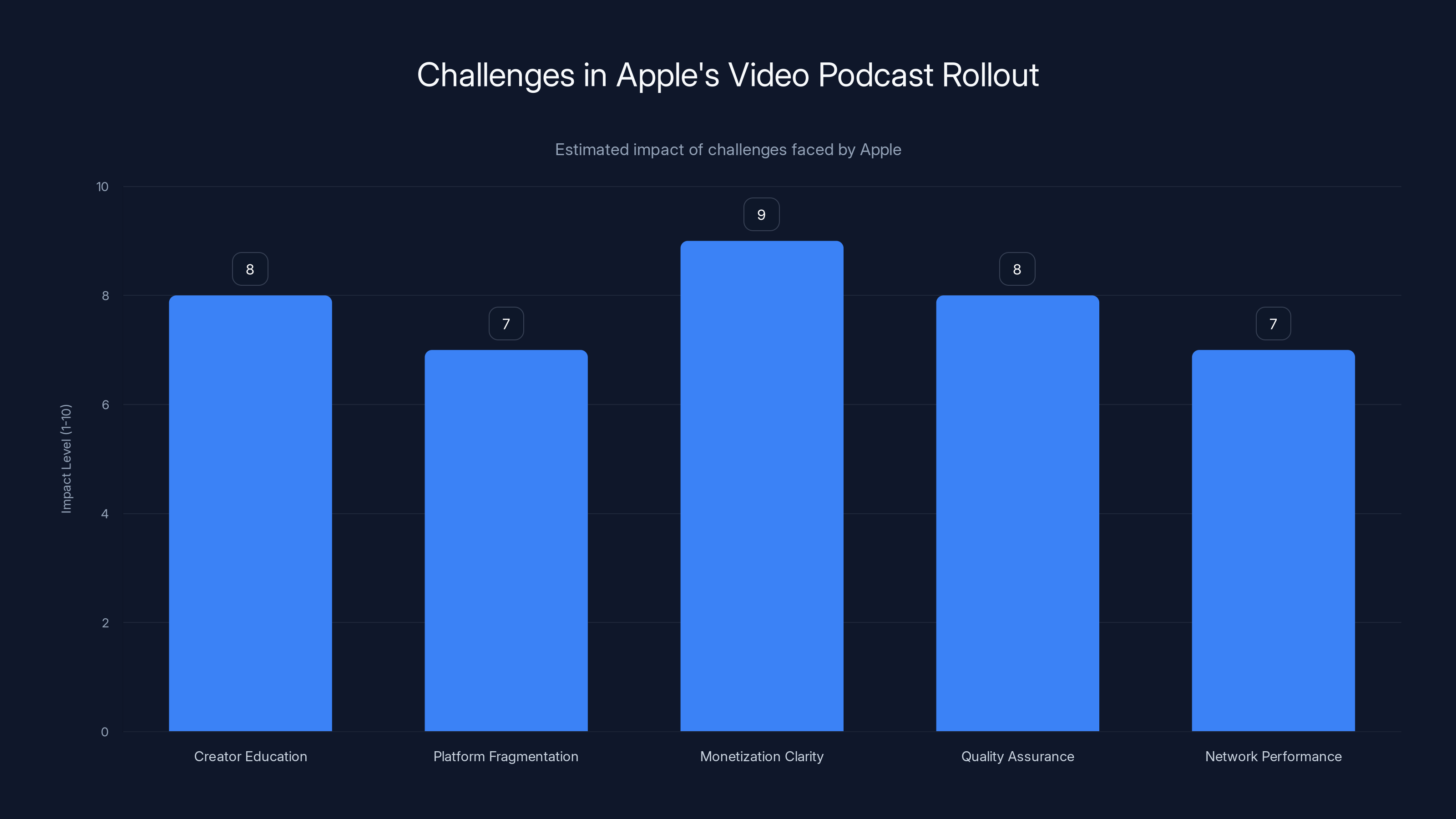

Challenges Apple Faces with This Implementation

No major platform shift is frictionless, and Apple's video podcast rollout has some real challenges that need to be managed.

First, there's the creator education problem. Millions of podcast creators exist. Many of them have no idea how to produce video content. Many don't have cameras or lighting. Many aren't comfortable on camera. Apple's making video podcasting easier to distribute, but they're not making video content creation easier. That's actually outside their sphere of control. Creators have to solve that problem themselves.

The platform fragmentation challenge is real too. Creators now need to think about which platforms get priority, which get secondary content, which get exclusive content. This is the same fragmentation problem that Netflix, Disney+, and HBO+ created, except for podcasts. It's a chooser problem where everyone loses a little bit.

Monetization clarity is another issue. Apple hasn't detailed how video podcast creators will make money. This is not a small thing. If YouTube's Partner Program or Spotify's advertising network offers better revenue share than Apple Podcasts, creators will prioritize those platforms. Apple needs to address this to compete effectively.

There's also the quality assurance problem at scale. YouTube has infrastructure to handle basically any video anyone uploads, and they've optimized for 1 billion viewers. Spotify's built podcast infrastructure but is less experienced with video at scale. Apple Podcasts' current infrastructure is built for audio. Moving to video at the scale of Apple's 500+ million users requires massive infrastructure investment and careful capacity planning. Failures at that scale are public and visible.

Network performance for video is also more complex than for audio. Audio streams at 64-128 kbps. Video streams at 1-5 Mbps depending on quality. That's 20-40x more data. For users in areas with poor networks or on cellular with data limits, that's a real problem. Apple needs to optimize for lower-quality streams aggressively.

Copyright and licensing is another backend complexity that's easy to overlook. Video content has different rights and licensing requirements than audio. If a podcast uses music, clips from movies, or other copyrighted material, the licensing implications are different for video distribution than audio. Apple's probably already thought through this, but it's a complexity that scales with the number of video podcasts on the platform.

Usability is another consideration. Apple's got a good reputation for interface design, but podcast apps historically haven't been great at video discovery. YouTube works because the algorithm is really good at suggesting the next video you want to watch. Apple Podcasts needs to build similar capability, but for a smaller catalog of content and with less training data. This is solvable but requires investment.

Services now account for an estimated 20% of Apple's revenue, highlighting their growing importance in Apple's ecosystem. Estimated data based on typical segment distribution.

What's Coming Next: The Evolution of Video Podcasting

Looking ahead, the video podcast market is going to evolve in ways that none of these platforms can fully predict or control. But there are some visible trends.

Short-form video podcasts are coming. TikTok and YouTube Shorts have proven that people consume short video in different contexts than long-form content. Podcast creators will eventually create short clips from their episodes optimized for platforms like TikTok, Instagram Reels, and YouTube Shorts. These platforms will become discovery mechanisms that feed back into longer-form viewing on YouTube, Spotify, Apple Podcasts, and Netflix.

Interactivity is another direction. Podcasts are currently passive consumption. But the infrastructure for interactive video exists. Imagine voting in real-time on which topic a podcast discusses next, or asking the host questions that they read and respond to. This is technically feasible and adds engagement. Some platforms will experiment with this.

Live streaming of podcast production is another direction that makes sense. Creators already do this on Twitch and YouTube Live. Podcasts that integrate live streaming as part of their publishing model add immediacy and engagement that recorded content can't match. Apple's infrastructure could support this, but they'd need to build features for it.

Exclusive content partnerships between platforms and creators will accelerate. Netflix's doing this now. Apple will probably do it too. Spotify's already doing it. These partnerships create competitive differentiation but also fragment the audience. Listeners who want to consume all their favorite podcasts might need subscriptions to multiple platforms.

Internationalization is coming. As video podcast consumption grows globally, platforms will need to optimize for different languages, different content preferences, and different viewing contexts. Apple's advantage of having devices in more countries than any other company becomes more relevant.

A/B testing and personalization will become central to podcast platform strategies. YouTube's gotten incredibly good at knowing what video you want to watch next. Spotify's built similar capability for audio. Apple's going to invest heavily in recommendations and personalization for video podcasts. This creates a virtuous cycle where popular creators benefit from better recommendation, which drives more viewers, which makes the recommendation algorithm more effective.

The creator economy around podcasts will also professionalize. Right now, many podcasters operate as individuals or small teams. As video podcasting becomes bigger and more lucrative, we'll see more professional production companies entering the space. This will raise quality standards across the board but will also make it harder for amateurs to compete.

Advertising and sponsorships will evolve too. Podcast advertising is currently dominated by host-read ads and dynamic insertion. As video becomes standard, brands will want to create visual sponsorship integrations that work within the video format. This changes the economics of podcasting and makes sponsorships more valuable but also more complex to produce.

Implications for Users: Better Experience Across the Board

When Apple Podcasts launches its video experience, users benefit immediately and substantially.

The immediate benefit is obvious: better video watching experience. If you prefer the Apple Podcasts app to YouTube, you can watch video podcasts there now. No more switching apps. No more friction. The app you already have works better for the thing you want to do.

The seamless audio/video switching is a real-world benefit for actual usage patterns. You're watching a podcast, someone interrupts you, you tap a button and switch to audio. You're on a subway with spotty service, you tap a button and use downloaded video from earlier. These are features that solve actual problems that people encounter.

Discoverability might improve too. Apple Podcasts' algorithm will eventually learn what video podcast content you like and recommend similar shows. This is currently better on YouTube because of YouTube's 15-year head start on personalization, but Apple will catch up. Better recommendations mean users discover content they actually want to watch.

Privacy is another angle where Apple has advantages. Apple's general reputation is around privacy protection, though that reputation deserves scrutiny. But if you're concerned about video watching being tracked and analyzed across the internet, watching in Apple Podcasts rather than YouTube offers slightly more protection (though Apple still collects viewing data internally).

Battery and data usage should be better on Apple devices. Native implementation of video playback is more efficient than web-based video. Better battery life and lower data usage means people can watch longer, in more contexts, without worrying about running out of battery or hitting data caps.

The ecosystem benefits of being able to share and manage subscriptions within Apple's services ecosystem are also meaningful. If you have Apple One, you get Apple Podcasts+ bundled in. That's value delivered without paying extra. If you use Siri, eventually you'll probably be able to ask Siri to play podcasts. These integrations feel small but accumulate into meaningful convenience.

Apple faces significant challenges in its video podcast rollout, with monetization clarity and creator education being the most impactful. (Estimated data)

The Bigger Picture: Apple's Strategy Across Content and Services

This video podcast move isn't isolated. It's part of a larger strategy where Apple is positioning itself as a comprehensive services platform that does everything reasonably well.

Apple Music competes with Spotify. Apple TV+ competes with Netflix. Apple News+ competes with subscriptions. Apple Podcasts now competitively features video, which means Apple's trying to own your entire entertainment consumption.

The strategy makes sense from Apple's perspective. Users with Apple devices who use Apple services extensively are locked in. Switching to Android becomes harder not because of any single feature but because of the collective friction of losing multiple services. This is ecosystem lock-in at its finest.

For users, this creates both opportunities and constraints. The opportunity is getting everything in one integrated experience with reasonable quality across categories. The constraint is that you're increasingly dependent on one company for your entertainment consumption. If Apple raises prices, you're paying more for everything bundled together. If you disagree with Apple's editorial decisions on what content to promote, you're stuck with it.

Apple's also clearly prioritizing services revenue as the company matures. Hardware sales are still huge but increasingly commoditized. Services attached to hardware are where margins and recurring revenue are. Podcasts are a services play. Video podcasts are attractive because they're higher-engagement content that keeps users inside the ecosystem longer.

The competitive implication is that Spotify, YouTube, and Netflix all need to take podcasts seriously as Apple now does. Spotify's been investing heavily. YouTube's gotten good through scale but hasn't invested developer resources. Netflix just entered. Apple's now committing serious resources. The platforms that don't keep up will cede ground.

For creators, the implication is that platform power is shifting slightly. Apple went from being "the place audio podcasts live" to being "one of the major video podcast platforms." That distributes creator power slightly. Creators have more options, which is generally good, but also more complexity in managing multiple platforms.

Practical Steps for Creators and Listeners

If you create podcasts or listen to them, here's what this Apple Podcasts video update actually means for you.

For creators: First, don't panic about moving your content. You don't need to do anything immediately. The Apple Podcasts video update is backward compatible. Existing audio-only podcasts will continue working fine. But if you're thinking about adding video to your podcast, Apple Podcasts is now a viable primary platform rather than a secondary one.

Start by testing video on your current hosting platform. Most major podcast hosts (Anchor, Buzzsprout, Podbean, Transistor) support video uploads or HLS streaming. Test whether your audience engages with video. Use A/B testing. Some shows see massive engagement boosts with video. Others see minimal difference. Test first.

Once you've confirmed that video works for your show, optimize your video production. This doesn't mean buying expensive equipment. It means lighting your space reasonably, using a decent microphone even though Apple Podcasts handles audio, and framing your shot well. Viewers are forgiving of amateur production if the content is good, but they're less forgiving of dark, quiet, poorly framed videos.

Distribute to multiple platforms from day one. Don't go all-in on Apple Podcasts or YouTube or Spotify. Distribution is free (mostly), so spread your content wide. Let your audience choose where they prefer to watch. Some will choose Apple Podcasts, some YouTube, some Spotify, some Netflix if your content gets picked up. That's fine. Your job is making the content; the platforms' job is distribution.

Monitor where your audience comes from. This is crucial data. If most of your viewers are discovering you on YouTube, invest in YouTube optimization. If most come from Apple Podcasts, make sure your Apple Podcasts presence is optimized. Data-driven decisions beat assumptions.

For listeners: Test the new Apple Podcasts video experience in the beta when it's available. See if it works better than your current video podcast watching platform. If it does, make it your default. If it doesn't, stick with whatever platform you prefer. There's no loyalty benefit to using any particular platform, so choose based on user experience.

Experiment with the audio/video switching feature. This is genuinely useful for commutes and transitions. Having your podcast switch from video when you're stationary to audio when you're moving is convenient.

Try the offline download feature if you're someone who travels or has spotty service. The ability to download video podcasts over Wi-Fi and watch them later is surprisingly valuable.

Don't feel like you need to subscribe to Apple Podcasts+ if you're not already in the Apple ecosystem. The free tier of Apple Podcasts is perfectly functional. Premium subscription is worth it if you follow creators who offer exclusive content, but it's not necessary for most listeners.

The Long-Term Vision: Where Podcasts Go From Here

The trajectory here is clear. Podcasts are becoming a mainstream entertainment format that rivals traditional television in some metrics. Video podcasts specifically are where growth is happening. Apple's entry into competitive video podcasting is a signal that the platform believes podcasts matter long-term.

The next five years will probably see video podcast consumption grow from 37% monthly penetration to 50%+ in developed markets. Growth will be driven by more video podcast creation, better platform experiences (like what Apple just announced), and increasing legitimacy as a content format.

Podcasts will also become more diverse in format. Scripted shows that are essentially audiobooks with video components. Documentary-style series that blend podcast and short-form video. Interactive experiences that push the boundaries of what "podcast" means.

The creator economy around podcasts will professionalize. Right now, the biggest podcast stars are entrepreneurs, comedians, or media people who started podcasting independently. As podcasting becomes bigger and more lucrative, traditional media companies will invest more heavily. Some independent creators will grow into production companies. Others will be acquired by larger platforms.

Monetization will diversify. Right now, most podcast revenue comes from advertising and sponsorships. That will continue, but we'll see more revenue from subscriptions (both exclusive content subscriptions and platform subscriptions), merchandise, live events, and platform tips.

The platforms will continue to compete, but the competition will normalize. Right now, one of the seven wonders of podcasting is that creators can be on every platform simultaneously. This is unusual in entertainment. Netflix doesn't put content on Disney+. Spotify doesn't let you listen to music on Apple Music. But podcasts are still distributed everywhere. That's an anomaly that will probably normalize as platforms try to differentiate through exclusive content and proprietary features.

But that's speculative. What's concrete is that Apple just moved video podcasting from a nice-to-have feature to a core product focus. That matters for the whole ecosystem. Competitors will respond. Creators will react. Users will benefit from the competition.

That's what happens when a market hits inflection point. Apple's move confirms that podcasting has reached that point.

FAQ

What is video podcasting?

Video podcasting is the format of podcast content that includes visual components alongside audio. This can range from simple screen sharing or graphics during an episode to full production with cameras, lighting, and on-screen talent. Video podcasts are typically 30 minutes to 3 hours long, though the format varies. The core idea is taking the serialized, episodic nature of podcasts and adding video production elements.

How does Apple Podcasts' video experience work?

Apple Podcasts uses HTTP Live Streaming (HLS) technology to deliver video content smoothly across different devices and network conditions. When you open a video episode, you can watch it in full-screen mode or switch to audio-only listening without losing your place. The app also supports downloading video episodes for offline viewing. The seamless switching between video and audio modes is the key innovation—you can be watching, tap a button, and continue listening as audio without any disruption.

What are the benefits of the new Apple Podcasts video experience?

The main benefits are significant improvements in user experience: seamless switching between video and audio without reloading, full-screen horizontal viewing mode for better video watching, and offline download capability for people with limited data. McKinsey research on media consumption shows that viewers appreciate platforms with flexible viewing options. For creators, Apple Podcasts becomes a serious alternative to YouTube or Spotify for video podcast distribution, allowing them to reach Apple's 2 billion active users through a native app experience.

How does this compete with YouTube for podcast viewing?

YouTube currently dominates video podcast viewing with over 1 billion monthly active users on podcast content. Apple's advantage is distribution—2 billion iPhone, iPad, and Mac users already have Apple Podcasts installed. YouTube's advantages include better recommendation algorithms and a 15-year head start optimizing the video platform. Apple's strategy is to make the native app experience good enough that users prefer watching podcasts in Apple Podcasts rather than switching to YouTube, keeping viewers inside the Apple ecosystem.

Will video podcasts on Apple Podcasts be exclusive or also available elsewhere?

Creators can and should distribute video podcasts to multiple platforms simultaneously. The same video podcast can be on Apple Podcasts, YouTube, Spotify, Netflix, and anywhere else the creator chooses. There's no exclusivity requirement. This differs from some streaming strategies where platforms pay for exclusive content, but for podcasts, multi-platform distribution remains the standard approach.

When will the new video experience be available?

The video podcast update will launch broadly in spring 2025, with beta testing available starting in early February 2025 through iOS 26.4, iPadOS 26.4, and visionOS 26.4. Early adopters and developers can test the features before the full rollout, while general users should expect access by April or May 2025 depending on Apple's rollout schedule.

What about monetization for creators on Apple Podcasts?

Apple hasn't yet detailed the specific monetization structure for video podcasts on Apple Podcasts. Currently, Apple Podcasts offers podcast subscriptions (through Apple Podcasts+), but revenue-sharing details for video content specifically are pending. Creators should monitor Apple's announcements as the feature approaches launch. In the meantime, YouTube and Spotify offer established monetization programs (YouTube Partner Program and Spotify's advertising network respectively).

Does offline download work for all video podcasts?

Offline download capability will be available, but specific limitations haven't been detailed. Typically, platforms restrict downloads to certain subscriptions levels or allow limited downloads before requiring deletion. Watch for Apple's specific policies as the feature launches. The main limitation is storage space—video files are much larger than audio files, so downloading many episodes requires significant device storage.

How does video podcasting affect listening experience?

For audio-only listeners, nothing changes. Existing podcasts continue to work exactly as they do now. The new features are additive. Creators can offer both video and audio versions, and listeners can choose which they prefer. Some podcasts will be video-only, but most popular creators will offer both formats to reach the widest possible audience.

What should podcast creators do right now?

If you're already producing video content for your podcast, test uploading to Apple Podcasts once the feature is available. If you're audio-only, monitor audience engagement with video content on platforms like YouTube if you've tried it before. If you haven't tried video yet, research your audience preferences before investing in video production. Continue distributing to multiple platforms rather than focusing exclusively on any single one. Data-driven decisions based on where your actual audience watches is better than assumptions about platform growth.

Final Thoughts: Apple's Bet on the Future of Podcasts

Apple's announcement about video podcasts isn't just about features. It's a strategic decision that video podcasting matters enough to compete seriously, that losing audience to YouTube and Spotify isn't acceptable, and that Apple's services business depends on controlling the entire entertainment experience across audio, video, and everything in between.

For the podcast industry, it's validation that the format has matured. When a company with Apple's resources and standards decides to build world-class products around podcasts, it signals that podcasts aren't a curiosity. They're a core entertainment format that deserves serious investment.

For creators, the entry of Apple as a serious competitor in video podcasting increases options and bargaining power. You're not choosing between YouTube or Spotify anymore. You're choosing among YouTube, Spotify, Apple, Netflix, and others. More choice is generally good, though it also creates more complexity.

For listeners, the immediate benefit is a better experience watching video podcasts on Apple devices. The longer-term benefit is that competition between these platforms will continue driving innovation and improvement.

Apple's timing is strategic but not desperate. They're moving into the market at an inflection point where it matters. Not too early when the market was still small. Not too late when entrenched competitors are unbeatable. Right at the moment when momentum is undeniable and the opportunity is real.

That's how Apple works. They watch markets mature. They let competitors create demand. Then they enter with a product that's better integrated and more polished than alternatives. Sometimes they win. Sometimes they don't. But they always make the market better just by entering.

Video podcasts are about to get that Apple treatment.

Key Takeaways

- Apple Podcasts launches enhanced video experience spring 2025, enabling seamless switching between video and audio playback using HTTP Live Streaming technology

- Video podcast consumption reached 37% monthly penetration in U.S., with YouTube dominating at 1 billion viewers and Spotify at 400 million viewers

- Apple's 2 billion installed device base provides unmatched distribution potential, positioning native app as serious competitor to YouTube and Spotify

- Creators can distribute simultaneously to multiple platforms (YouTube, Spotify, Apple, Netflix) maximizing audience reach without exclusive commitments

- Market consolidation ongoing as Netflix, Spotify, YouTube, and now Apple all invest significantly in professional-grade video podcast infrastructure

Related Articles

- Apple Podcasts Switching to HLS: What It Means for You [2025]

- Spotify's 751M User Milestone: How Wrapped & Free Tier Features Changed the Game [2025]

- Roku's Streaming Bundle Strategy: How It Plans to Drive Profitability in 2026 [2025]

- Why Bezos Abandoned the Washington Post's Newsroom [2025]

- YouTube TV $80 Discount: How to Get It Before 2025 Ends

- Disney+ Dolby Vision Loss in Europe: Patent Battle Explained [2025]

![Apple Podcasts Video Experience: Reshaping Podcast Consumption [2025]](https://tryrunable.com/blog/apple-podcasts-video-experience-reshaping-podcast-consumptio/image-1-1771343046195.jpg)