Spotify's 751M User Milestone: How Wrapped & Free Tier Features Changed the Game

Introduction: The Streaming Giant's Breakthrough Moment

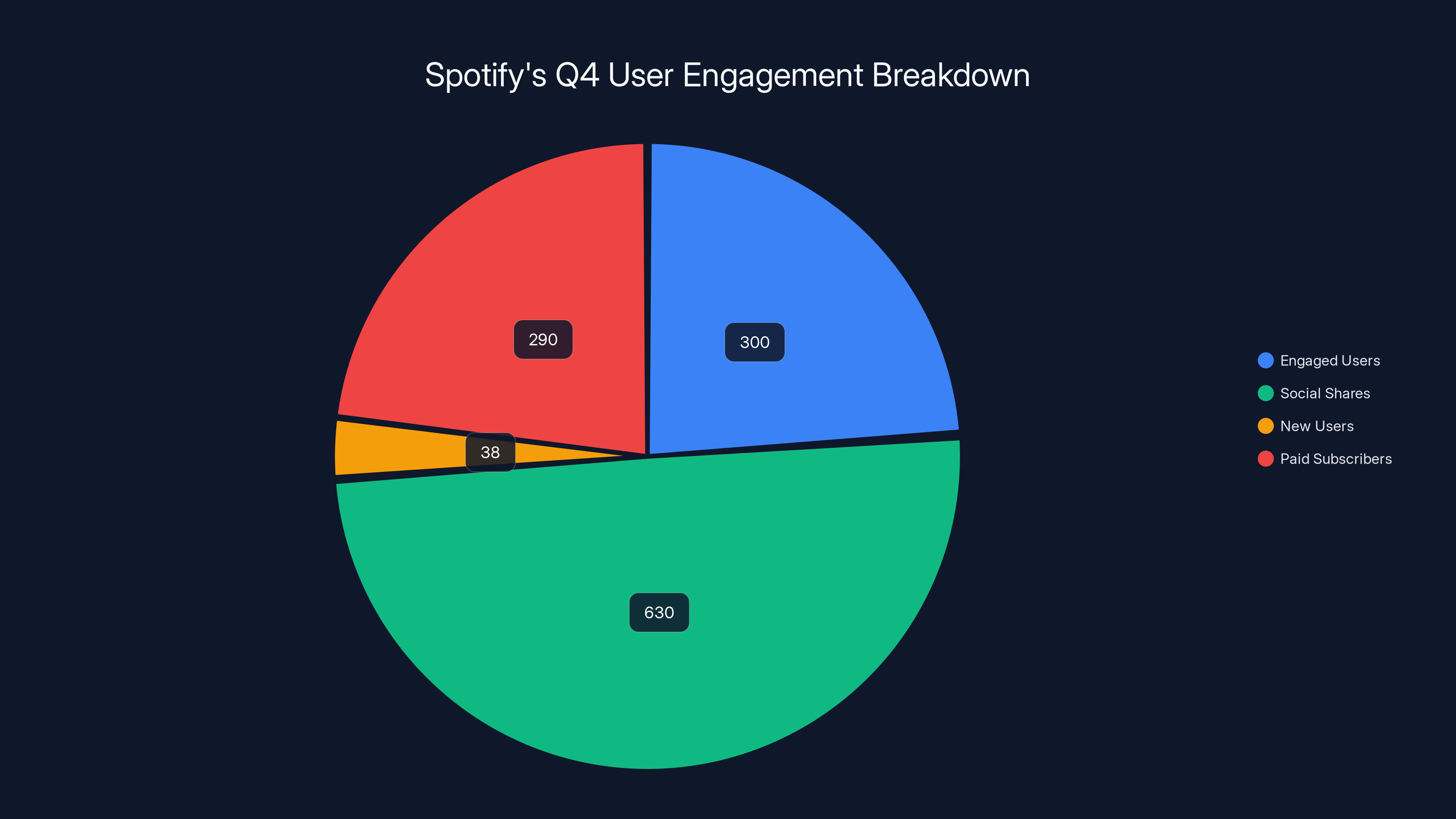

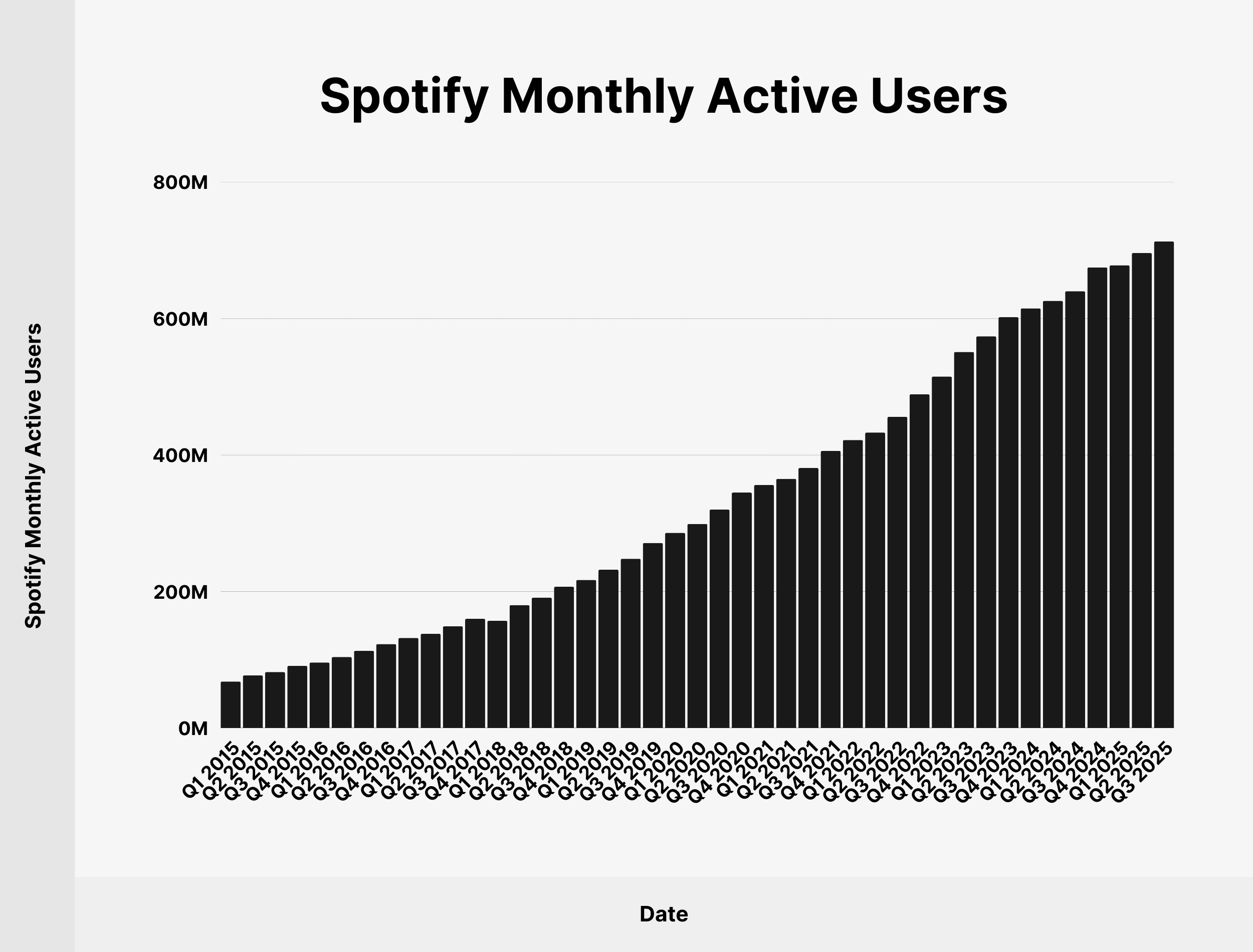

Spotify just hit a milestone that should make every music streaming competitor nervous. The company announced 751 million monthly active users, with 290 million paying subscribers. But the numbers alone don't tell the real story. What matters is how they got there, and more importantly, what their strategy reveals about the future of music streaming.

For years, music streaming was about raw user acquisition. Get more people to sign up, chase growth at all costs. Spotify did that brilliantly in the 2010s, but something shifted recently. The company stopped chasing vanity metrics and started obsessing over retention, engagement, and what keeps people coming back month after month.

The catalyst? Two things that seem almost mundane on the surface: a yearly recap campaign called Wrapped, and some tweaks to what you can do for free. But these weren't accidents. They represent a fundamental shift in how Spotify thinks about its business, and they're working with remarkable effectiveness.

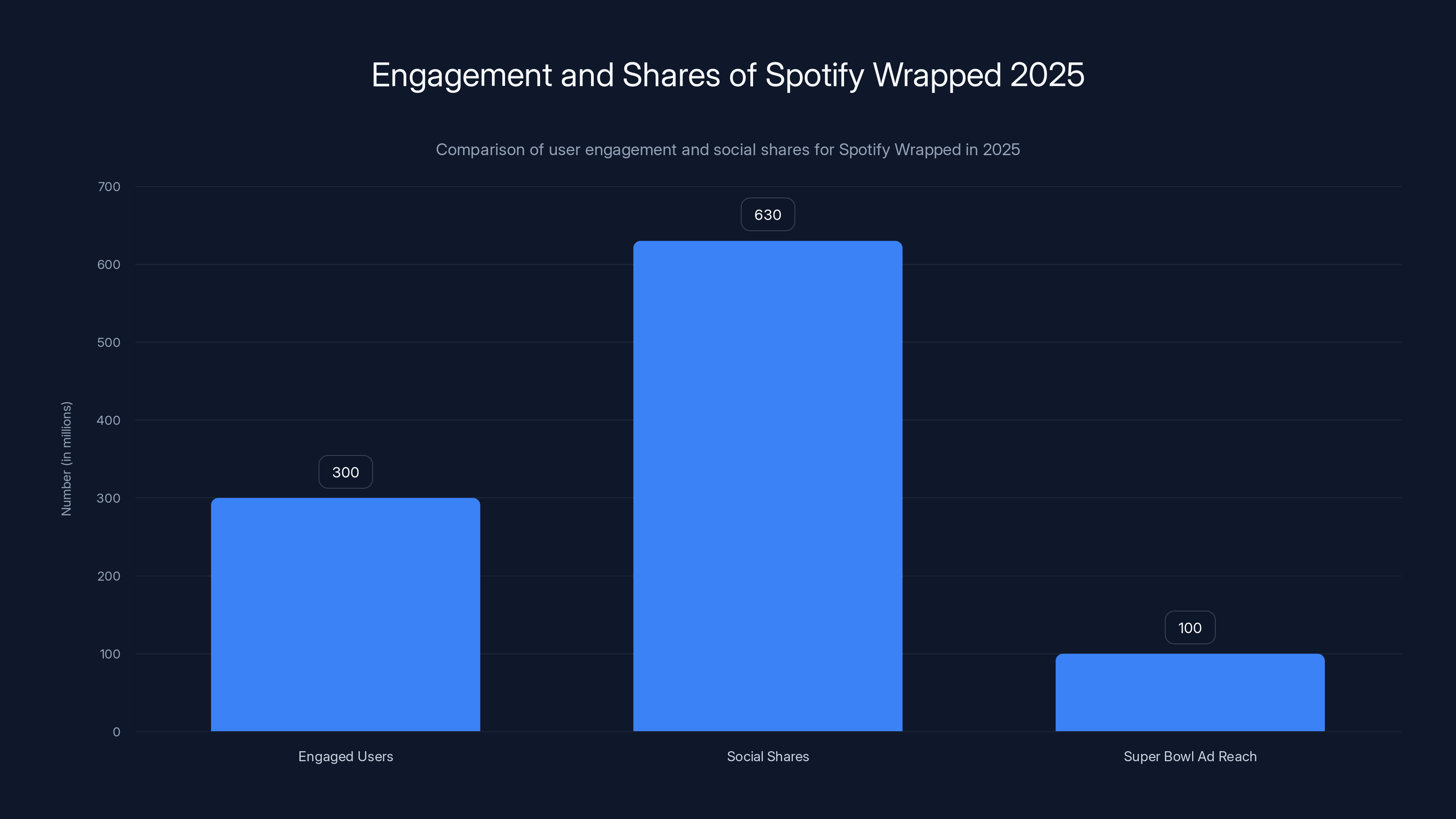

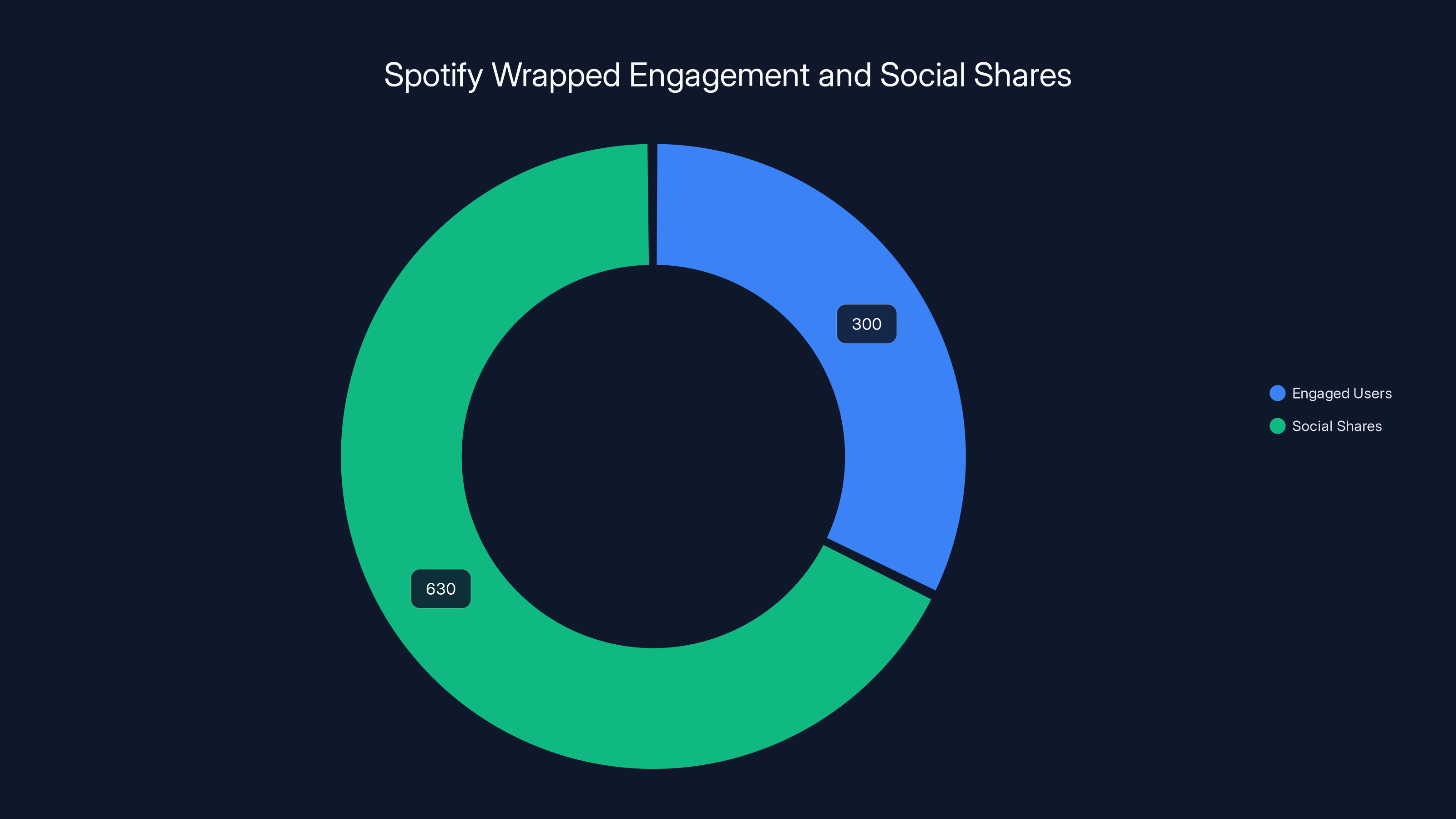

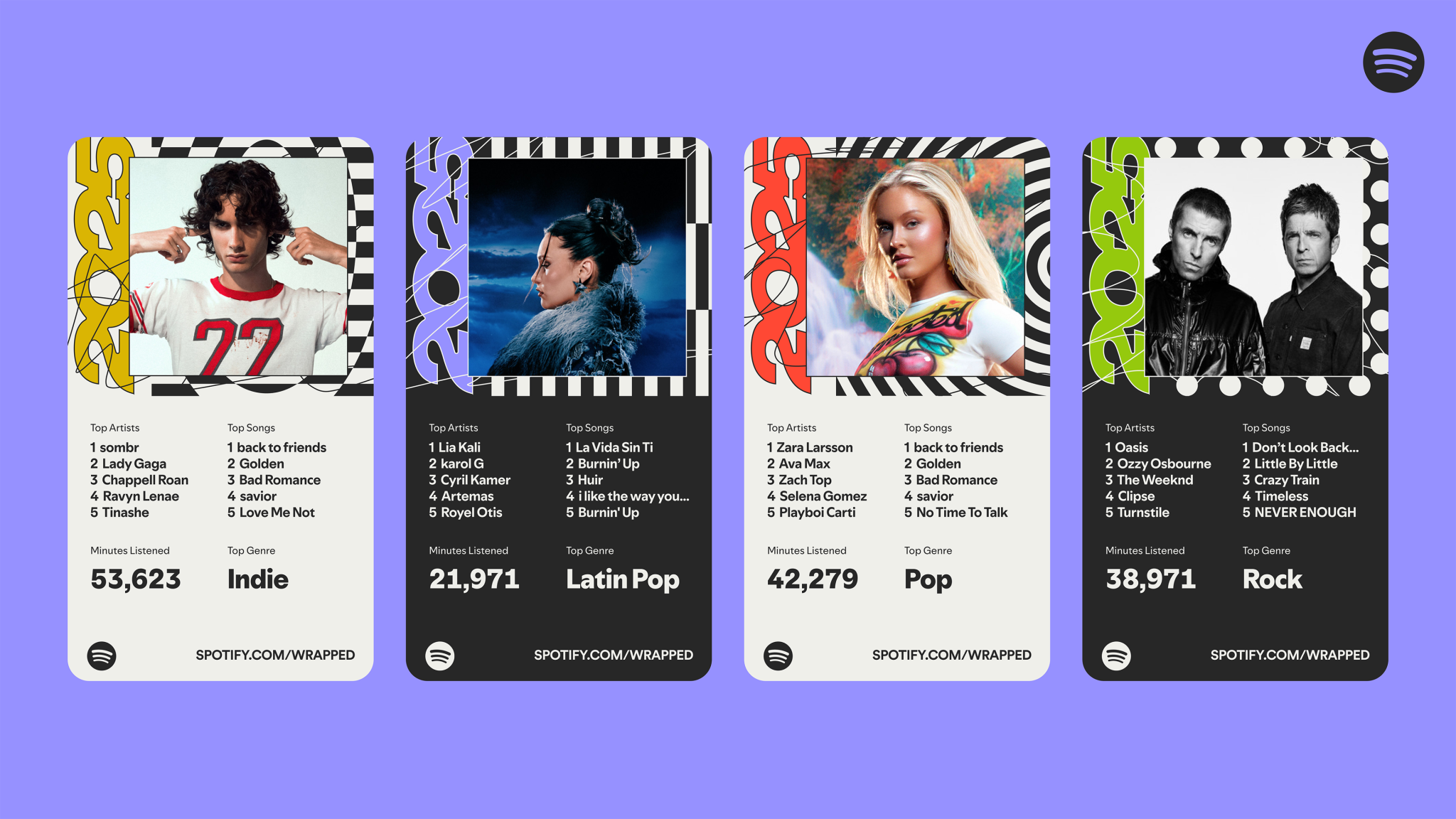

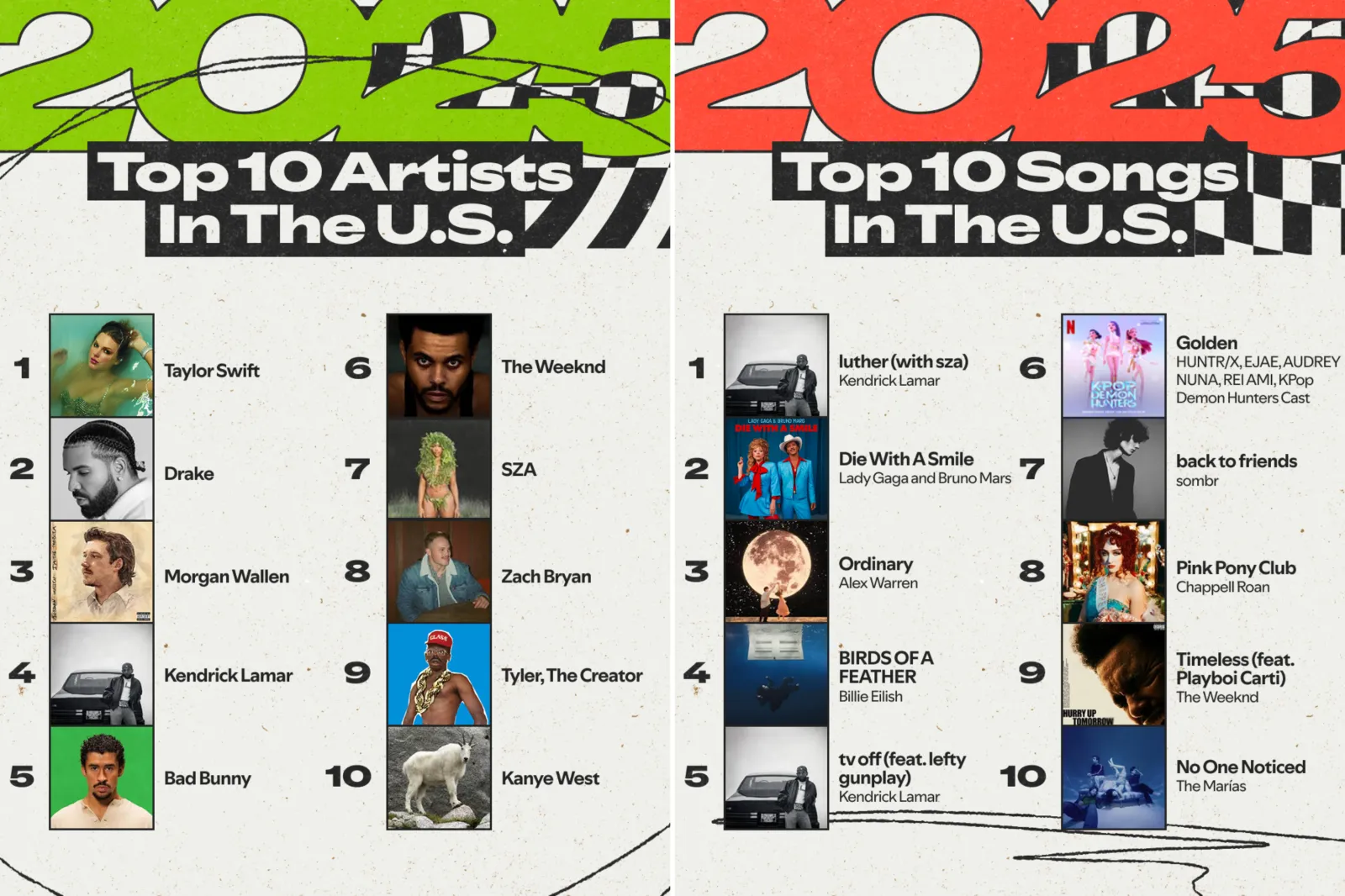

In the fourth quarter alone, Spotify added 38 million new users. That's more than the entire population of Canada joining in a single three-month period. But here's what's even more interesting: 300 million people engaged with Wrapped, and they generated 630 million social media shares across 56 different languages. That's not just user growth. That's cultural relevance. That's people voluntarily marketing Spotify to their friends without Spotify paying for a single ad.

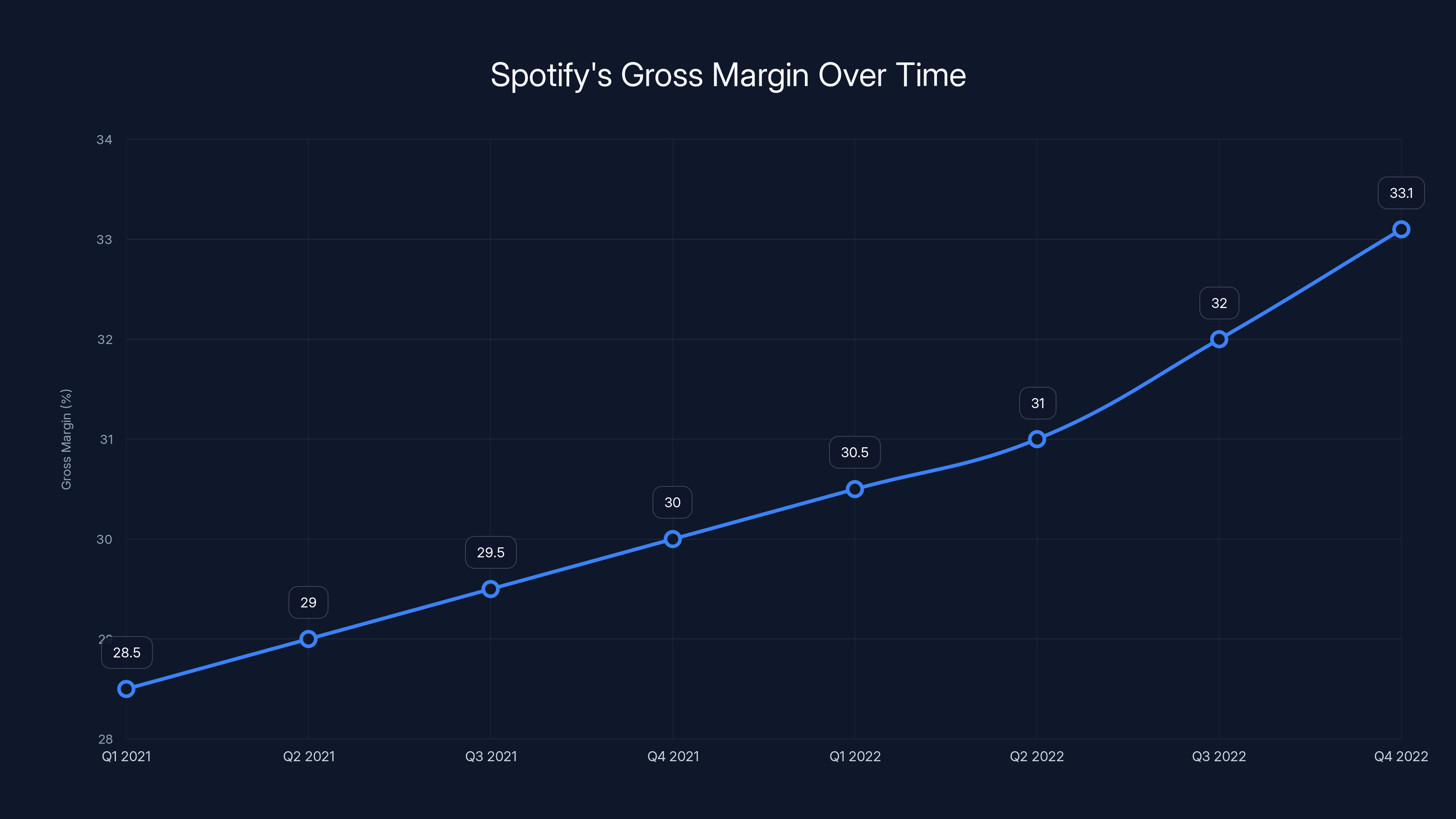

Meanwhile, the company's gross margin hit 33.1 percent, a record high. For a streaming company that spent years bleeding money, this is the payoff of patient, strategic thinking. They're not just bigger. They're more profitable.

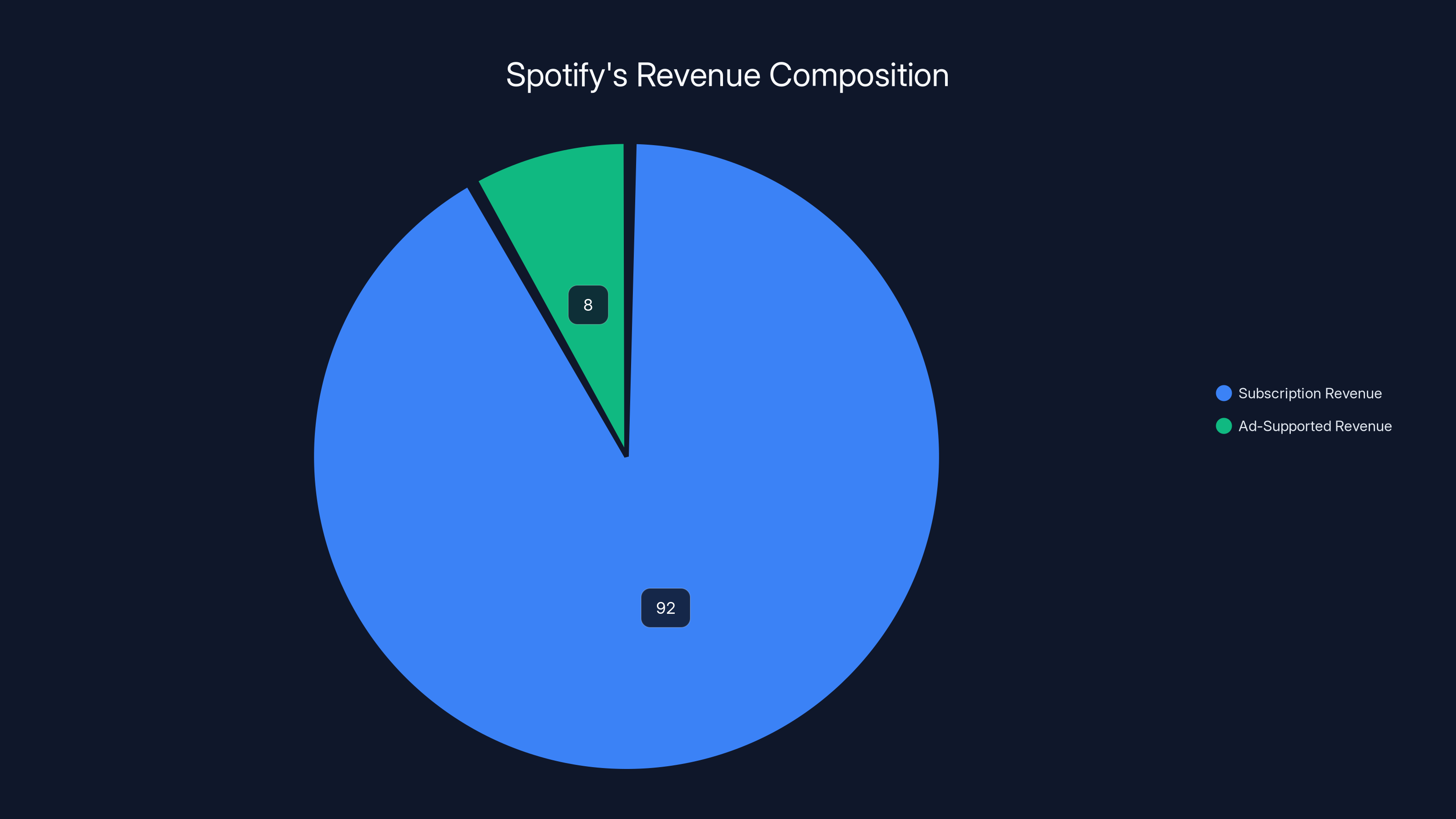

Spotify's revenue climbed to 4.53 billion euros (about 5.39 billion dollars), up 7 percent year-over-year. Subscription revenue grew 8 percent, while the ad-supported business dipped slightly at 4 percent. But here's the thing most people miss: that's by design. Spotify is deliberately prioritizing subscriber growth over ad revenue because subscribers are stickier, more valuable long-term, and harder for competitors to steal.

The company is also navigating a major leadership transition. New co-CEOs Gustav Söderström and Alex Norström took over from co-founder Daniel Ek, and they've inherited a beast of a company that looks nothing like the music streaming service it once was. Spotify now operates in podcasts, audiobooks, video content, and even physical bookstores. They're integrating concert ticketing, exploring AI-generated music recommendations, and experimenting with features that traditional music companies would never have considered.

The question everyone's asking: is this sustainable? Can Wrapped continue to deliver these kinds of engagement numbers? Will free-tier users convert to paid? And most importantly, what does Spotify's playbook tell us about competing in a market dominated by tech giants like Apple, Amazon, and YouTube?

The answers are more nuanced than you'd think, and they reveal something important about consumer psychology, platform strategy, and the economics of entertainment in 2025.

In 2025, 300 million people engaged with Spotify Wrapped, resulting in 630 million social shares, far surpassing the 100 million reach of a typical Super Bowl ad. Estimated data.

TL; DR

- Wrapped's Impact: 300 million engaged users and 630 million social shares drove massive Q4 growth, proving cultural moments matter more than traditional marketing

- Free Tier Evolution: New song-search and selection features on the free tier reduced friction for converting users to paid while maintaining ad revenue

- Profitability Inflection: Gross margin hit a record 33.1%, showing Spotify finally cracked the code on streaming profitability

- User Growth Trajectory: 38 million new users in Q4 alone, with 751 million total monthly actives and 290 million paid subscribers

- Business Diversification: Podcasts, audiobooks, video, and AI features are creating multiple revenue streams beyond core music subscriptions

In 2022, Spotify Wrapped engaged 300 million users and generated 630 million social shares, highlighting its effectiveness as a viral marketing tool. Estimated data.

The Wrapped Phenomenon: Why a Year-End Recap Became Cultural Currency

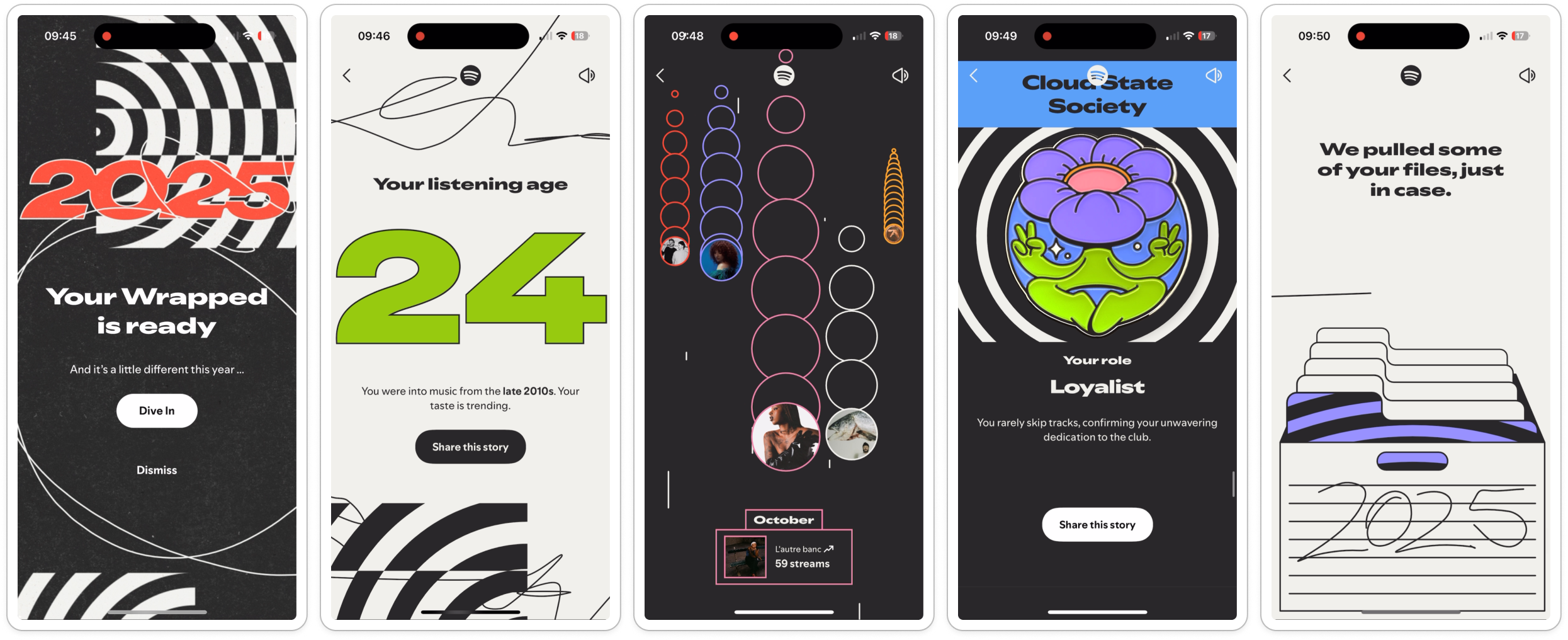

Wrapped started as something simple. In 2016, Spotify created a feature that showed users their listening statistics for the year and shared them on social media. It was clever, but nobody expected it to become the company's single most effective marketing tool.

Fast forward to 2025, and Wrapped is arguably bigger than Spotify itself. People wait for it. They theme their social media posts around it. They share their Wrapped stats like test scores or report cards. Some people's entire personality, at least on social media, revolves around their Wrapped results.

This year, the numbers prove it. Three hundred million people engaged with Wrapped. Let that sink in. That's not 300 million clicks. That's 300 million people who actively interacted with the feature, clicked through their stats, and did something with them. Six hundred and thirty million social shares across 56 languages. That's roughly 2.1 shares per engaged user.

By comparison, major brands spend millions on Super Bowl ads to reach 100 million viewers. Spotify got 630 million shares with Wrapped. The cost per impression is essentially zero because users are voluntarily distributing the content for them.

From a marketing perspective, this is nearly perfect. You've turned your user base into an unpaid sales force. When someone's friend sees their Wrapped stats and thinks "huh, that's a fun feature, maybe I should try Spotify," that's a warm lead generated by a friend's recommendation, which is infinitely more valuable than a cold ad impression.

The psychology is interesting too. Wrapped works because it taps into something deeply human: self-reflection and the desire to understand ourselves through data. It also creates a shared cultural moment. Everyone's Wrapped comes out at roughly the same time, so there's a period in early November when the entire internet is comparing listening habits. That FOMO effect drives engagement for people who haven't checked theirs yet.

Spotify learned something crucial from this: sometimes the best marketing isn't marketing at all. It's creating something so interesting or novel that people can't help but share it. That's the difference between paid reach and earned reach, and earned reach scales infinitely better.

The company has started leaning into this insight harder. They've made Wrapped more interactive, added new sharing formats, and integrated it more deeply into the app experience. They've also started experimenting with variations like year-round personalization features and AI-powered insights that keep users engaged beyond just December.

But here's where it gets tricky. Wrapped only happens once a year. It's a peak moment, but it's temporary. The real challenge for Spotify is converting that annual engagement spike into consistent, everyday usage. That's where the rest of their strategy comes in.

The Free Tier Strategy: Making Ad-Supported Users Buy

For years, Spotify's free tier was intentionally crippled. You could listen to music, but with shuffling, ads, lower audio quality, and limitations on skipping. The whole point was to make the free experience so mediocre that you'd pay to upgrade.

But that strategy had a major flaw. It created a ceiling on growth. Sure, you could acquire millions of free users, but if the experience sucked, they'd never convert to paid. Worse, they'd use competitors' free tiers instead, which might actually be better.

Something changed in Spotify's thinking, probably around 2023-2024. Instead of making free worse to make paid look good, they started making free actually usable. The company added the ability to search for and play any song you want on the free tier, not just random shuffles. This single feature reduced the gap between free and paid more than anything they'd done before.

Think about the psychology here. If you're on the free tier and you can play exactly the song you want, what's the reason to upgrade? Before, the answer was obvious: to skip ads and avoid shuffling. Now, the functional gap narrowed significantly. The main reasons to upgrade became: removing ads, better audio quality, offline downloads, and not worrying about when your free trial resets.

But Spotify knows something important from the data. The conversion path from free to paid isn't about feature restrictions. It's about habit formation. If someone uses Spotify every single day, they'll eventually buy it because the friction becomes intolerable. The ads, the shuffle restrictions, the limitations on skipping, they all add up.

So the free tier strategy shifted from punishment to enablement. Give free users just enough to build a habit, then profit from their habit by removing friction through a subscription.

This approach actually increased conversion rates because it made the free tier more valuable. More people use it, more people form habits, and more of those people convert. It's counterintuitive, but it works.

Spotify also understood that free users are valuable for more than just future subscriptions. They're data. When you have 460 million free users (751 million total minus 290 million paid), you're capturing an enormous amount of listening data that trains your recommendation algorithms, tells you what music is popular, and informs your future product decisions.

Free users are also crucial for artist reach. Musicians use Spotify primarily because their songs get heard by millions of people. If Spotify had a tiny free tier, artists would get less exposure, and the platform would be less valuable as a whole. By maintaining a large and functional free tier, Spotify guarantees that artists have an incentive to stay, which means better content, which means better experiences for paid users too.

The ad-supported business is also more important than the headline numbers suggest. Ad revenue dipped 4 percent to 518 million euros, but that's partly because Spotify is shifting resources toward higher-margin subscription growth. The ad business isn't declining in absolute terms. It's being strategically de-prioritized to focus on what matters most: converting paying subscribers.

Spotify's revenue is predominantly driven by subscriptions, comprising 92% of total revenue, highlighting the importance of their paying subscriber base. Estimated data based on trends.

Profitability: The Number That Actually Matters

Gross margin hit 33.1 percent in Q4, up 83 basis points from the prior year. If you're not in the media or streaming business, this might sound like corporate jargon. But for Spotify, it's the holy grail.

For most of Spotify's history, profitability was a theoretical concept. The company spent everything on content rights, infrastructure, and acquisition. They ran at a loss for years. Everyone said streaming would never be profitable, that the unit economics were broken, that Spotify would never make money.

Then something shifted. The company got scale. They negotiated better licensing deals. They built smarter infrastructure. And most importantly, they figured out how to make money from ads and subscriptions simultaneously without eroding the user experience.

That 33.1 percent gross margin means that for every dollar of revenue, Spotify keeps about 33 cents after paying all costs of goods sold. That includes server costs, licensing fees, payment processing, and content delivery. It's not profit (you still have operating expenses), but it's the money available to cover those expenses and eventually become truly profitable.

Why does this matter? Because it proves the business model works. Streaming isn't doomed to be a low-margin commodity business. With the right strategy, smart pricing, and good execution, you can run a streaming company profitably.

This profitability inflection is also why Spotify is so hard to compete with right now. Apple Music, Amazon Music, and YouTube Music can all spend whatever they want because they're subsidies to larger ecosystems. But Spotify can't do that. Spotify has to generate its own returns on investment.

Once you're profitable, you can outspend competitors in ways that look unsustainable to others. You can invest in better recommendations, more sophisticated personalization, exclusive content deals, and international expansion because you're generating the cash to pay for it yourself. That's a different game than when you're burning money to get scale.

The gross margin improvement also came from a strategic bet on podcasts. Earlier years saw significant investment in podcast exclusives and infrastructure. That investment hasn't paid off as a major revenue driver yet, but it's changed the cost structure. Podcasts have lower per-unit licensing costs than music, and as the podcast library grows and subscription conversion improves, those economics get even better.

The Leadership Transition: What Gustav Söderström and Alex Norström Inherit

Gustav Söderström and Alex Norström are now running one of the most complex entertainment platforms in the world. And it's barely recognizable as a music streaming service anymore.

When Daniel Ek founded Spotify, the mission was simple: make music available instantly to anyone who wanted it. Today, Spotify is simultaneously a music platform, a podcast network, an audiobook publisher, a concert ticketing service, a music video platform, a karaoke tool, and an AI-powered recommendation engine.

This complexity is both a strength and a liability. On the strength side, it means Spotify owns the entire audio entertainment experience. You can discover music, listen to podcasts about that music, read about the artist in audiobooks, buy tickets to their concert, and sing along with their song using Spotify Karaoke. That's a comprehensive ecosystem.

On the liability side, it means the company has to execute exceptionally well across multiple domains. A mistake in podcasting doesn't just hurt podcast users. It could hurt music users if resources get diverted or if podcast recommendations push out music recommendations. The complexity creates organizational challenges that can slow down execution and innovation.

Söderström and Norström have already been involved in many of Spotify's biggest strategic bets, so this isn't a surprise leadership change. They've championed the podcast expansion, the audiobook push, and the artist-focused initiatives. But now they own all the consequences.

Their stated priority seems to be consolidating gains rather than making new bets. The company is profitable, growth is strong, and the user base is enormous. The next phase is about operational excellence and deepening engagement rather than radical pivots.

One area where they're definitely leaning in is AI. Spotify's AI DJ feature, AI-generated playlists, and the ability to exclude tracks from recommendations are all moving toward a more personalized experience. That's a bet that the future of music streaming is less about discovering new music and more about perfect curation of the music you already love.

Spotify's Q4 saw significant user engagement with 300 million engaged users and 630 million social shares, alongside 38 million new users and 290 million paid subscribers. Estimated data.

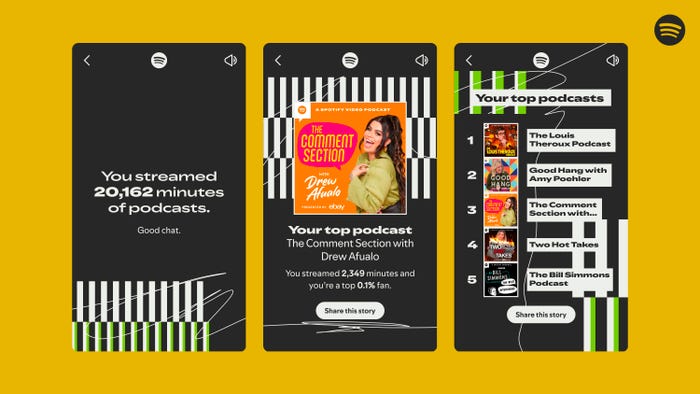

Podcast Strategy: The Bet That Hasn't Fully Paid Off Yet

Spotify spent billions on podcasting. They bought Gimlet Media, Anchor, The Ringer, and invested in exclusive content with everyone from Joe Rogan to Michelle Obama. The strategic logic was sound: audio is audio, podcasts have lower licensing costs than music, and podcast listeners tend to be highly engaged.

But the payoff has been mixed. Podcasts don't drive nearly as much engagement as Spotify hoped. Listeners come for specific shows, not for discovery and exploration like they do with music. And the economics are complicated because exclusive podcast deals require upfront payments that take years to recoup.

That said, podcasts are becoming more important, not less. They provide content that keeps users in the app longer, they create communities around specific creators and topics, and they diversify Spotify's revenue streams beyond music rights negotiations. A user who listens to podcasts for two hours and music for one hour is more engaged than a pure music listener.

The real opportunity with podcasts might be advertising. Music is hard to monetize with ads because users get annoyed, but podcasts are inherently ad-friendly. Listeners expect host-read ads and advertisement integrations as part of the format. If Spotify can build a podcasting advertising business that rivals or exceeds what YouTube does for video, that's enormous.

For now, podcasts are a long-term strategic play that's not moving the needle on quarterly earnings. But that doesn't mean it's failing. Spotify is thinking in years and decades, not quarters.

Video Content: The Latest Frontier

Music videos have been in Spotify for a while now, but the company is pushing harder into full video content. Music videos are straightforward, but the company is also exploring music documentaries, concert footage, and music-related shows.

The logic is the same as podcasts. Audio is how people discover and consume music, but video is how they engage with artists and culture around music. If Spotify can be the platform where you listen to an album, watch a documentary about the artist, listen to a podcast interview with them, and read their biography in an audiobook, they've locked you in completely.

Video also addresses a core weakness: Spotify's UI is pretty minimal and music-focused. There's no real reason to spend hours on the Spotify app just browsing like you might on YouTube or TikTok. Video content changes that by creating a reason to stay in the app and explore.

Spotify's gross margin has steadily increased from 28.5% in Q1 2021 to 33.1% in Q4 2022, indicating improved profitability. Estimated data.

AI Features: Personalization at Scale

Spotify's AI DJ feature has been one of the more interesting experiments. It's an AI voice that introduces songs, makes recommendations, and essentially creates a personalized radio station powered by AI. It's not perfect, but it's interesting enough to keep people engaged.

The goal here is automation of curation. Instead of Spotify's team curating playlists or relying on users to create their own, AI can create infinite personalized playlists on the fly. That scales to billions of users without proportionally increasing costs.

Spotify is also letting users exclude tracks from recommendations. This seems like a small feature, but it's actually important. It means the recommendation engine learns not just from what you play, but from what you explicitly don't want to hear. That creates much more accurate personalization.

These AI features are relatively new, so their impact on engagement and conversion isn't fully clear yet. But they're pointing toward a future where Spotify's value proposition isn't about discovering new music—there are other apps for that—but about perfect personal curation of the music you love.

Pricing Strategy: The Difficult Balance

Spotify has raised prices multiple times in the past few years. In the US and Europe, the company increased subscription prices and introduced higher-tier plans like Spotify Premium Duo and Spotify Premium Family.

This is a classic freemium strategy problem. You want to extract maximum value from customers, but you also don't want to push them away. Spotify's approach has been careful. They've tested pricing increases in specific markets first, monitored churn, and then either stuck with them or rolled back.

The fact that subscription revenue grew 8 percent despite price increases is a strong signal. It means the company has pricing power. People value Spotify enough to pay more for it.

But there's a limit. If Spotify raises prices too high, some users will switch to Apple Music, Amazon Music, or YouTube Music. And some will downgrade to the free tier. So pricing is a careful balancing act.

The company's approach right now seems to be: squeeze current subscribers moderately on price, but pour those resources into new features and expansion that keep them engaged. That's sustainable if the features are good and engagement stays high.

Despite multiple price increases, Spotify's subscription revenue grew by 8%, indicating strong pricing power. Estimated data.

The Competitive Landscape: Why Spotify's Position Is Harder Than It Looks

On the surface, Spotify dominates music streaming. But the competitive pressure is enormous, and it's coming from every direction.

Apple Music has the advantage of iOS integration. Apple can push music recommendations through Siri, show up automatically on every Apple device, and integrate with Apple's ecosystem in ways Spotify can't. Amazon Music bundles with Prime membership. YouTube Music has the world's largest music video library. And Tidal exists if you want lossless audio or want to support artists directly.

Meanwhile, TikTok and Instagram are becoming discovery platforms for music that rival Spotify. Young users discover songs on social media first, then listen on a streaming service. If TikTok ever integrated audio streaming directly (and they're constantly experimenting), Spotify's entire funnel could be disrupted.

Spotify's competitive advantage is fundamentally in personalization and scale. They have the most sophisticated recommendation engine because they have the most listening data. But that advantage only lasts if they keep innovating faster than competitors.

The company's diversification into podcasts, audiobooks, and video is partly defensive. If Apple or Amazon can offer a better bundled experience, Spotify needs to own enough of the audio entertainment pie that switching costs get too high.

The Q1 Outlook: Expectations and Reality

Spotify expects 759 million monthly active users and 293 million paying subscribers in Q1 2025. That's up from 751 million and 290 million in Q4 2024.

Those numbers are solid but not explosive. The company is guiding for continued growth, but at a modest pace. That's a sign Spotify is thinking about sustainability rather than hypergrowth.

The real metric to watch isn't user count. It's net add subscriber conversions and engagement depth. Are more free users converting to paid? Are paid users staying longer? Are they using more features? That's where the real story is.

If Spotify can keep conversion rates stable while growing the free user base, that's a winning formula. They get the data benefits and the ad revenue from free users, plus the conversion upside if engagement stays high.

The Broader Trend: From Growth to Profitability

Spotify's journey mirrors a broader trend in tech. The age of growth-at-any-cost is ending. Investors, regulators, and the market itself are rewarding profitability and sustainability over raw user growth.

That's a major shift for Spotify. The company built its reputation on relentless growth. Now it's building it on the ability to generate returns.

This has implications for how Spotify competes. They're not going to outspend Apple or Amazon on customer acquisition. Instead, they're going to out-execute on product and retention. They're going to build a better experience, keep users engaged longer, and convert them at higher rates.

That's a harder strategy to execute, but it's more durable long-term. When profitability matters more than growth, the company that builds the best product wins. And right now, Spotify's product is really good.

International Growth: The Untapped Opportunity

Spotify's growth in developing markets is still in early innings. The company has massive opportunities in Latin America, Southeast Asia, and Africa where music streaming adoption is accelerating but Spotify's market share is still small.

The localization challenges are significant. You need features that work for regions with lower smartphone penetration, less reliable internet, and different music preferences. Spotify's approach has been to tailor the free tier for these markets and let ad-supported usage drive both engagement and conversion.

International growth is also where Wrapped has the most upside. In markets where Spotify is still new, Wrapped creates a cultural moment that drives trial and word-of-mouth. That's probably why Wrapped was so effective at driving signups in Q4.

Future Outlook: What Comes Next

If the trends continue, Spotify will hit a billion monthly active users within a few years. But the bigger question is what the platform becomes.

The music streaming wars are increasingly a platform wars. Apple wants Spotify to be just another app on iOS. Amazon wants it to be a feature of Prime. YouTube wants it to be secondary to their video platform. And Spotify wants to be the center of your audio entertainment universe.

That battle will play out over the next few years. Spotify's advantage is focus. It's an audio-first company making decisions for audio users. That's harder to replicate than it sounds.

The company's diversification into podcasts, audiobooks, and video is about building that audio entertainment universe. They're not trying to compete with Netflix or YouTube on video. They're trying to be the place where all your audio entertainment lives, with video as a complement.

If they execute on that vision, Spotify becomes incredibly sticky. You listen to music, discover a podcast, read about the topic in an audiobook, and watch a documentary. Switching platforms becomes impossible because you'd lose access to your entire entertainment ecosystem.

But that vision is also complex to execute, and there are a lot of ways it could fail. Execution risk is the real story here.

The Bottom Line: A Streaming Platform Hitting Its Stride

Spotify's 751 million users represent something more important than just scale. They represent a company that figured out the fundamental economics of streaming, found ways to keep people engaged, and built a moat through product excellence and ecosystem lock-in.

Wrapped proved that cultural moments matter more than traditional marketing. The free tier proved that restriction kills growth while enablement drives it. And profitability proved that streaming can be a real business, not just a venture-backed growth story.

The company's transition to new leadership, expansion into adjacent audio formats, and investment in AI personalization all point toward a company thinking about the next decade, not the next quarter.

There are risks. Competitors have advantages Spotify doesn't. Regulatory pressure around music licensing continues. And the audio market could fragment in ways that hurt Spotify's scale advantages.

But right now, Spotify is executing at a level that's hard to match. They're winning because they understand their users, understand the medium, and understand how to build products people actually use every single day.

That's not just impressive growth. That's a durable competitive advantage.

FAQ

What is Spotify Wrapped and why is it so effective?

Spotify Wrapped is an annual feature released in early November that compiles your listening statistics for the year and presents them in shareable graphics and videos. It's effective because it creates a cultural moment that encourages voluntary social sharing. Three hundred million people engaged with Wrapped last year, generating 630 million social shares, turning Spotify's entire user base into unpaid marketing ambassadors.

How does Spotify's free tier work and how does it drive paid conversions?

Spotify's free tier lets users search for and play any song they want, with the trade-offs being advertisements, audio quality limitations, and offline listening restrictions. The strategy is to make the free experience functional enough to build daily habits, then profit from those habits by offering premium features that remove friction. Users who develop strong daily habits are more likely to convert to paid because the accumulated friction of ads and limitations becomes intolerable.

What does a 33.1% gross margin mean for Spotify's business?

Gross margin is the percentage of revenue left after paying the direct costs of running the platform. A 33.1% gross margin means Spotify keeps roughly 33 cents from every dollar of revenue after paying licensing fees, server costs, and content delivery. This proves the streaming business model is fundamentally profitable, not just a way to burn venture capital. It also gives Spotify cash flow to invest in features, international expansion, and new products.

Why did Spotify invest billions in podcasts if they're not a major revenue driver?

Podcasts are a long-term strategic bet for Spotify. They diversify the platform beyond music, create new advertising opportunities, increase time spent in the app, and reduce dependence on music licensing agreements. While podcasts haven't become a major revenue driver yet, they're building the foundation for a more diversified audio entertainment platform that's harder for competitors to disrupt.

How does Spotify compete against Apple Music and Amazon Music when both have much larger parent companies?

Spotify competes through focus and execution. Apple Music and Amazon Music can spend unlimited capital because they're subsidies to larger ecosystems, but Spotify has to generate its own returns. This forces the company to be more disciplined about product decisions and more innovative about monetization. Spotify wins by building a better recommendation engine, creating a more engaging user experience, and investing in features that keep users coming back every single day.

What's the difference between Spotify's subscription and ad-supported revenue models?

Subscription revenue comes from users paying monthly for a premium experience without ads and with additional features like offline listening. Ad-supported revenue comes from free-tier users who agree to listen to advertisements. Subscription revenue is higher margin and stickier (users pay monthly), but ad revenue provides scale and engagement data. Spotify needs both: subscription revenue for profitability and free users for growth and data that trains recommendation algorithms.

Is Spotify going to reach a billion monthly users soon?

Based on current growth rates, Spotify will likely reach a billion monthly active users within three to five years. The company is guiding for 759 million users in Q1 2025, which is roughly 8 million users per quarter. However, growth might accelerate in some regions and decelerate in mature markets. The bigger question isn't whether Spotify will hit a billion users, but whether those users become more engaged and more profitable once it does.

Conclusion: Why This Matters Beyond the Numbers

Spotify hitting 751 million monthly active users is impressive on its surface, but the real significance runs much deeper. The company proved something that seemed impossible just a few years ago: that you can run a music streaming business profitably while still growing.

Every tech investor and analyst spent years saying streaming was broken. The licensing agreements were too expensive, the competition from tech giants was insurmountable, and the economics just didn't work. Spotify proved them all wrong.

More importantly, Spotify proved that product excellence, user understanding, and strategic focus compound into competitive advantages that are genuinely hard to replicate. Apple Music has the advantage of iOS integration, but Spotify has better recommendations. Amazon Music has Prime membership bundling, but Spotify has better engagement. TikTok has discovery, but Spotify has depth.

The Wrapped campaign is the perfect example of this. It's not a complicated feature. It's not particularly expensive to build or maintain. But it works because it's built on a deep understanding of what users actually want: to feel understood, to reflect on their own behavior, and to share that reflection with their community.

Similarly, the free tier changes weren't about restriction or punishment. They were about understanding that you catch more users with a functional free tier than a crippled one, because functional free tiers convert at higher rates over time.

This is the kind of thinking that separates companies that grow because they throw money at problems from companies that grow because they're solving the right problems.

Spotify's new leadership team is inheriting a company at an inflection point. The growth is strong. The profitability is real. The product is differentiated. The user base is enormous. The question now is whether they can maintain that momentum while diversifying the business into podcasts, audiobooks, and video.

That's harder than just optimizing for music streaming, but it's also where the real opportunity is. The company that owns all of audio entertainment, not just music, wins the next decade. That's what Spotify is trying to build.

The 751 million users aren't the destination. They're the platform. Everything comes next.

Key Takeaways

- Spotify's Wrapped campaign reached 300 million engaged users and generated 630 million social shares, making voluntary user advocacy the company's most powerful marketing tool

- Strategic free-tier improvements (on-demand song selection) increased conversion to paid while maintaining ad revenue, proving restriction kills growth

- Gross margin hit a record 33.1%, proving streaming is a genuinely profitable business model, not just a venture-backed growth experiment

- Spotify expects 759 million users and 293 million paid subscribers in Q1 2025, showing acceleration from the previous quarter's 751 million and 290 million

- Podcast expansion, audiobook integration, and AI personalization create multiple revenue streams and ecosystem lock-in that competitors find nearly impossible to replicate

Related Articles

- Spotify Hits 750M Users: Growth Drivers Behind the Numbers [2025]

- YouTube TV $80 Discount: How to Get It Before 2025 Ends

- Spotify's About the Song Feature: What You Need to Know [2025]

- YouTube's $60B Revenue Dominance: Inside Google's Subscription Strategy [2025]

- Crunchyroll Price Hikes: Inside Sony's Anime Streaming Strategy [2025]

- Prime Video's The Wrecking Crew: How Amazon Toned Down Violence [2025]

![Spotify's 751M User Milestone: How Wrapped & Free Tier Features Changed the Game [2025]](https://tryrunable.com/blog/spotify-s-751m-user-milestone-how-wrapped-free-tier-features/image-1-1770734169145.png)